Thesis

In the realm of life sciences research, the need for efficient data management and collaboration has surged alongside advancements in modern science. As of 2024, the volume of biotech data was doubling every seven months. This rapid expansion in scientific data requires robust, scalable solutions for storage, analysis, and sharing. But despite R&D spend of $300 billion in life sciences during 2023, teams struggle to use data at scale due to manual data silos and broken data lineage.

Life sciences companies have historically lagged behind other industries in their digital maturity. As these companies transition to more data-oriented operations, they struggle to scale their R&D solutions. Teams struggle to use data at scale due to these structural issues with their data. In the mid-2010s, new techniques like CRISPR, gene therapy, and cell therapy shifted from academic to professional labs. These next-generation therapies involved working with biomolecules more complex than small-molecule drugs, exacerbating the need for purpose-built software.

Benchling offers a cloud-based platform for life sciences R&D with digital tools to standardize data from lab work across an organization. Benchling’s goal is to streamline administrative tasks and improve R&D workflows by digitizing processing like tracking lab notebooks and inventory. With this standardized central source of data, Benchling offers a new level of collaboration for research teams. The platform serves researchers ranging from academics to enterprise R&D labs. As the demand for seamless, data-driven research solutions continues to grow, Benchling’s cloud infrastructure provides a solution that aligns with the evolving needs of modern scientific research.

Founding Story

Sajith Wickramasekara (CEO) and Ashu Singhal (President) founded Benchling in 2012. They met at MIT in their freshman year.

Wickramasekara grew up staying after school in his high school computer lab, as well as working in biology wet labs. Though he considered a career in medicine, Wickramasekara chose to study computer science at MIT. He continued to explore his interest by working in research labs.

From working in both fields, he noticed a contrast between software and biology. Wickramasekara saw the tools for building modern software were getting better and better. But when it came to his lab work, he saw the limitations of using physical notebooks and Excel spreadsheets. He saw an opportunity to build software that could streamline lab work collaboration and administration. With this in mind, he took a leave of absence from MIT to found Benchling in 2012.

After founding Benchling, Wickramasekara recruited a team with biology and software backgrounds. Many of the engineers on the team came from companies, such as Google, Meta, and Palantir, but their research experience spanned genetics, neuroscience, and synthetic biology. The team was focused on tackling the opportunity between software and biology. The company joined YC in Spring 2012.

Product

In the early days, Benchling focused on academic labs and improving processes around tracking and sharing experimental design tasks. Benchling began as a usable tool that academics would adopt into their research process and set itself up in the long term as a system of record. Benchling’s software aggregates data that is typically siloed across institutions, allowing a form of version control of life sciences similar to Github.

Benchling expanded beyond digital notebooks and began offering DNA editing and analysis. It has expanded to serve other R&D markets, like RNA Therapeutics and Early Development. This continuous focus on easy-to-use products and deeper and deeper sophistication of its product enabled Benchling to expand from academia into drug development and industrial biotechnology.

One key network effect that increases the value of Benchling has similarities to GitHub. Joshua Elkington, an investor at a life science-focused investment firm, Axial Partners, explains the similarity this way:

“Biologists upload their designs and experimental instructions (i.e. cloning, gene editing). For Github, software engineers share their code. However, Benchling takes this another step further… by allowing biologists to edit their “code” within their product. Whereas Github was mainly about sharing in an [text editor] environment, Benchling enables sharing designs and operating on them because there was little viable competition for both at the time of founding.”

The more researchers can build on the collaborative work of everyone involved, the more effective the process becomes. Given that every aspect of the process (other than execution) is recorded automatically, it increases the speed and efficiency of each experiment.

As of 2024, Benchling has built out products for specific types of processes within life sciences.

Benchling Bioresearch

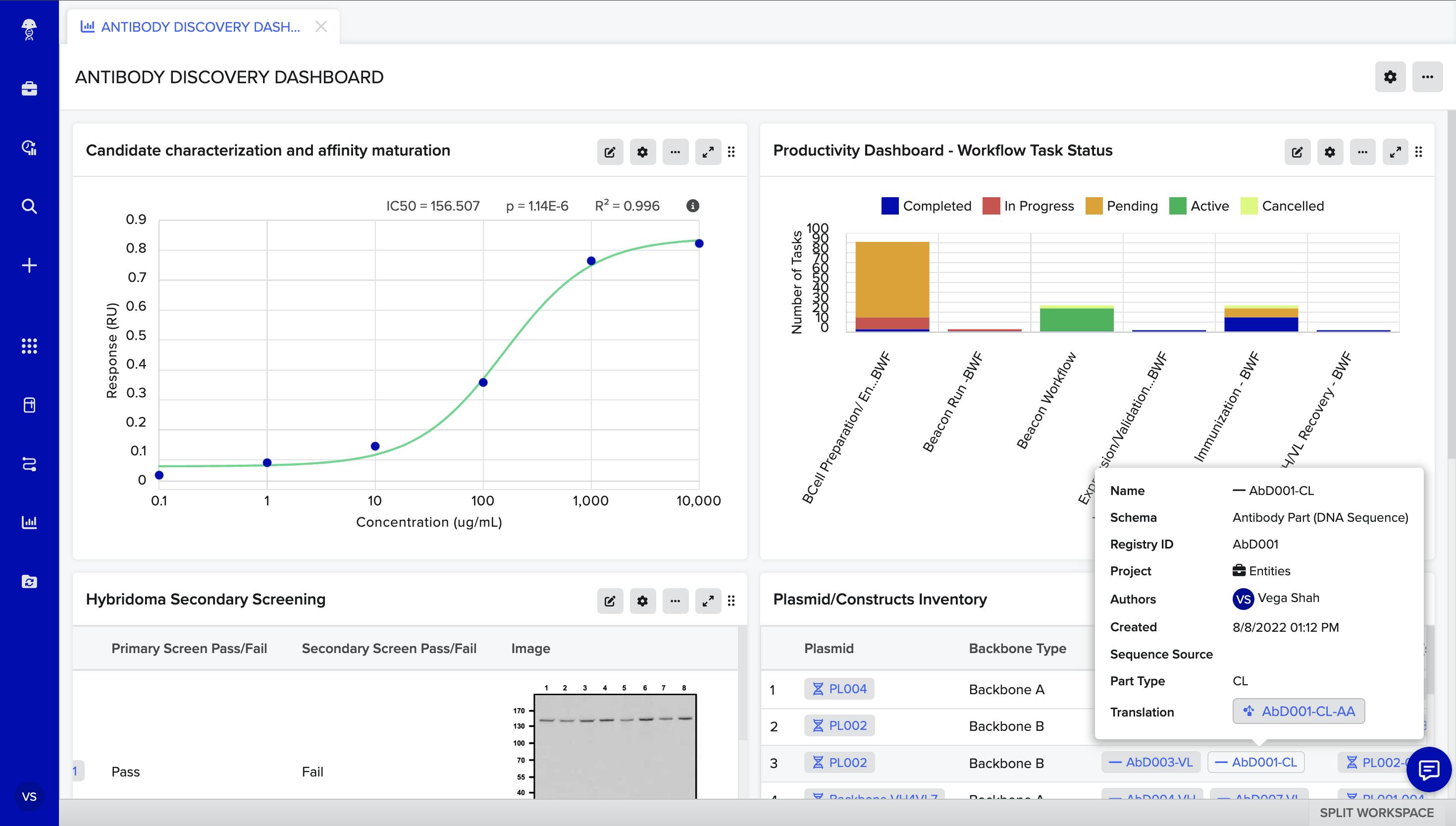

Source: Benchling

Benchling Bioresearch provides research teams a shared space to manage their experiments, biomolecules, workflows, and results. Teams can work together in real time to capture experimental details and create templates to standardize data. They can leverage templates to aid biomolecule design, as well as keep track of their inventory of samples and equipment within the electronic lab notebook. The platform can streamline the workflow of design and development of biomolecules. One scientist at Gilead claims the company now spends 63% less time on administrative tasks thanks to Benchling’s platform.

Benchling Bioprocess

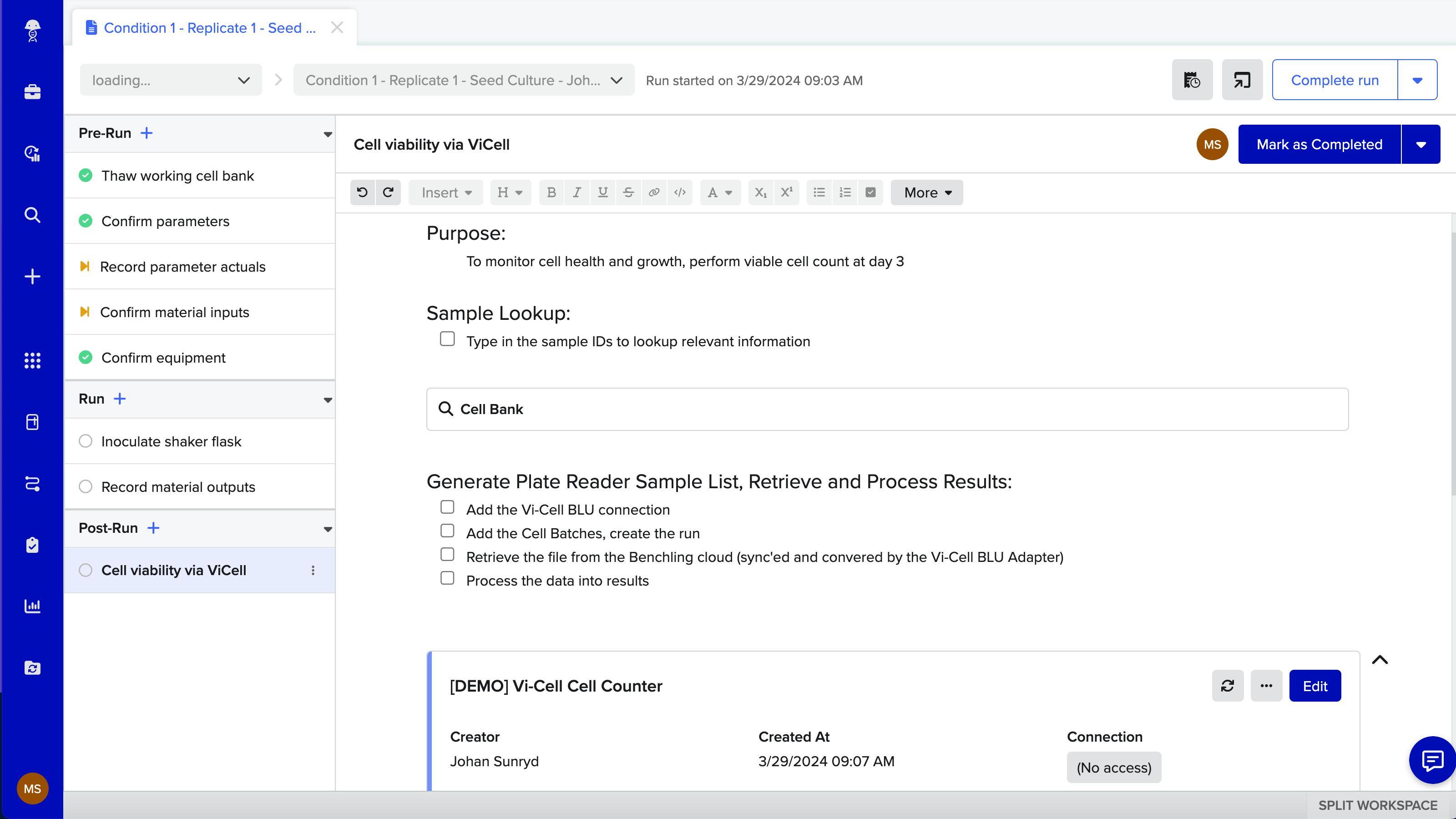

Source: Benchling

Benchling Bioprocess enables high-throughput process development in manufacturing. Released in 2024, the platform caters to biopharmaceutical R&D teams that design and execute processes such as cell line development.

The collaborative nature of the product enables teams to more efficiently access structured data throughout a particular process. This enables teams to more easily move a research process into manufacturing, or react more quickly to quality and regulatory inquiries. The solution supports use cases in process development with a drag-and-drop interface for recipe design, flexible experiment planning, and dynamically populated batch execution. The platform also visualizes process data and integrates with out-of-the-box connectors.

Source: Benchling

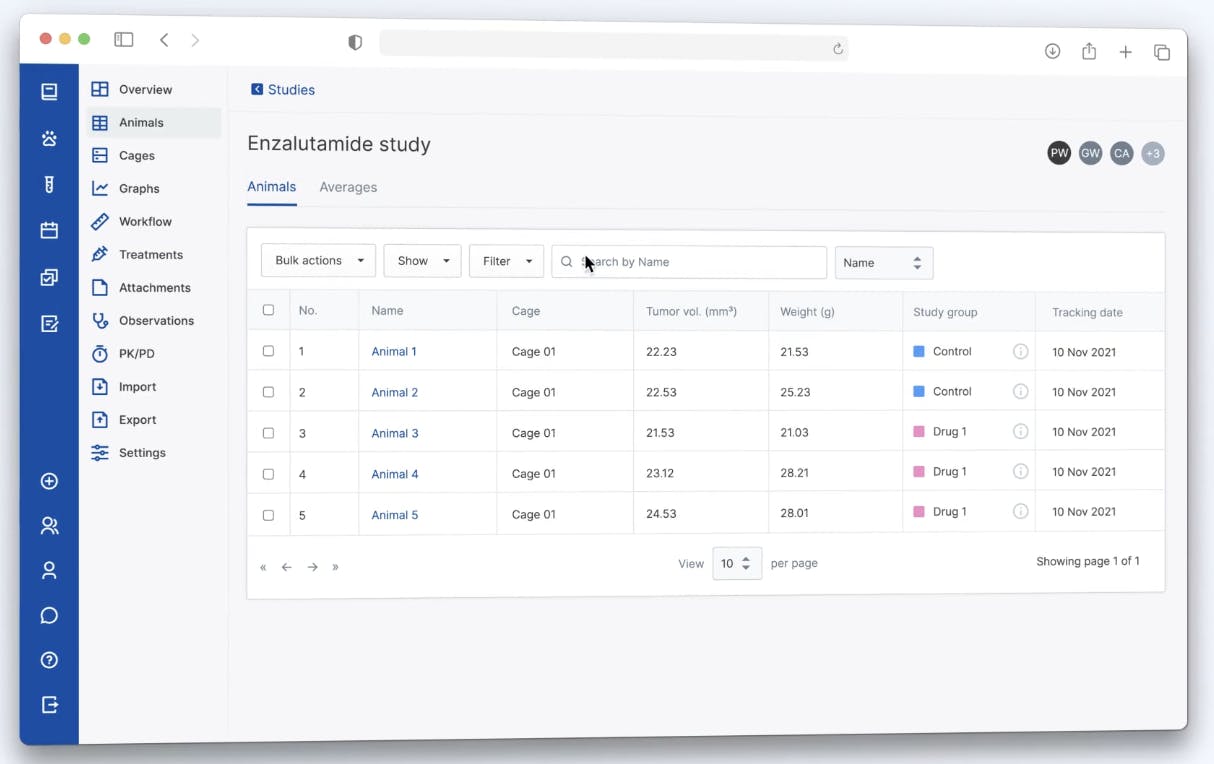

Benchling In Vivo

Source: Benchling

Benchling In Vivo easily integrates with the Benchling R&D cloud to connect upstream R&D to downstream in vivo studies. Companies that manage in vivo studies with living organisms can easily consolidate their experiments on one platform. They can initiate their studies faster with reusable templates, capture study data by integrating instruments into the platform, and generate real-time analytics.

In vivo studies can be particularly complex because they typically involve animals. Benchling’s product also enables “configurable alert thresholds for body weight loss or experimental endpoints to identify any potential animal welfare issues.”

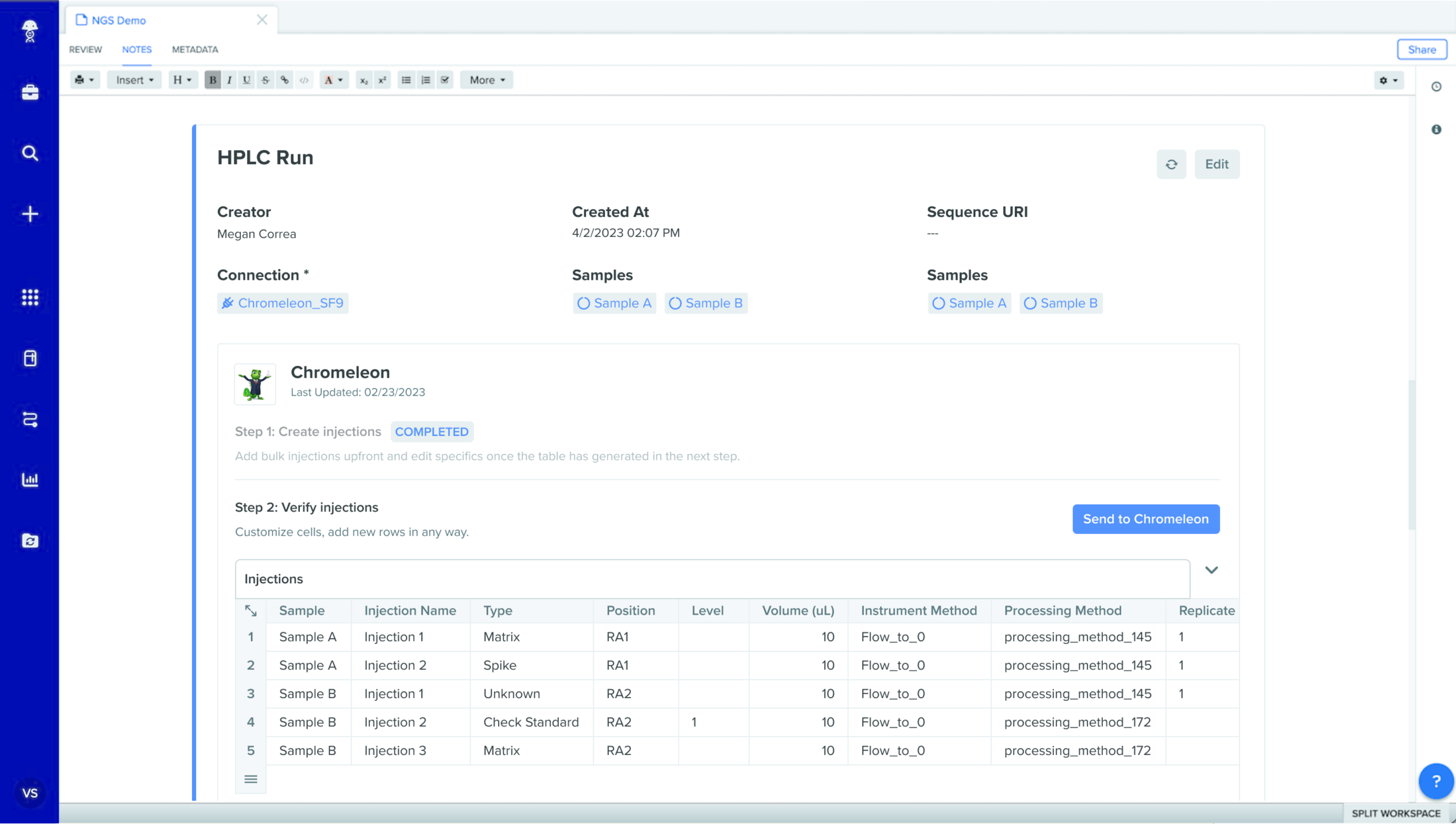

Benchling Connect

Source: Benchling

Benchling Connect is a platform for analyzing lab instruments and systems in one place. R&D teams automate manual data collection to save time and consolidate experimental data to prevent data silos. Benchling Connect integrates with lab instruments, standardizes and enriches the raw metadata, and unifies the data across laboratory PCs. Additionally, the platform stores structured data, like entity metadata and workflow tasks, in data warehouses. This data management enables context-driven searchability and AI/ML analytics.

Market

Customer

Benchling’s customer base ranges from small academic labs to enterprise R&D labs. Historically, scientists used handwritten notes and spreadsheets to track their experiments, but neither is conducive to collaboration, especially with external researchers. Data would be scattered across handwritten notes, spreadsheets, and emails, and aggregating information across multiple experiments would be difficult. Scientists would spend a significant amount of time to manage their siloed data. Although teams have moved to Laboratory Inventory Management Systems (LIMS), these solutions prove to be difficult to configure and implement due to the diverse nature of R&D workflows.

In the beginning, Benchling let academic labs use its products for free in order to receive early customer feedback and iterate its software. An early trend was that academic users would then bring Benchling to the next startup or enterprise they joined. As of 2022, one in four biotech startups that went public in the previous two years was built on Benchling. In 2021, Benchling drew from its early success with research to support early development use cases. By becoming a trusted tool among academics, Benchling expanded into a broader set of fields, such as biopharmaceuticals, industrial biotech, and cell therapy.

Benchling’s largest customer sector continues to be pharmaceutical companies, but it has seen growth within the fields of agriculture, food, materials, and chemicals. In 2021, 43% of its new revenue came from the top 50 life sciences companies in the world. As of September 2024, some of Benchling’s customers include AstraZeneca, Neoplants, Cambrium, ElevateBio, and others.

Market Size

The bioinformatics market was estimated to be $18.7 billion in 2024, growing at a CAGR of 13.6%, and is expected to reach $35.5 billion by 2028. The demand for data management, data extraction, and other software tools is driving the growth of bioinformatics. The potential for tools like CRISPR to increase investment in biotech R&D creates an even more poignant need for Benchling’s product.

In particular, the increased potential of breakthroughs in biotechnology could drive meaningful economic impacts that would expand the potential of a product like Benchling. One report in 2021 estimated that the industry would have a $2 to $4 trillion per year of direct economic impact over the next twenty years. That impact increases revenue potential for Benchling’s customers and subsequently makes the demand for Benchling’s product even more meaningful.

Competition

Technology Specialists

LabWare: LabWare was founded in 1987 and has a wide suite of products such as its Laboratory Information Management System (LIMS) and Electronic Laboratory Notebook (ELN). While Benchling is willing to serve everything from small labs to Fortune 500 companies, a number of its customers are small businesses (e.g. 62% of customer reviews on G2 are small businesses). Alternatively, LabWare is more focused on the mid-market, with 45% of its customer reviews coming from that segment. In March 2022, LabWare acquired CompassRed, a data analytics platform, to broaden its capabilities in not just storing data, but enabling customers to leverage it.

Genemod: Genemod is a cloud-based workspace collaboration platform for biopharma R&D teams which was founded in 2018. The company raised a $4.5 million seed round in 2023. Customers include AstraZeneca, Bristol-Myers, and Merck. Genemod focuses on collaboration, with live document editing, inventory tracking, and equipment scheduling. It also offers GeneMod AI, which generates scientific insights based on specific research questions. Based on customer comparisons, GeneMod’s LIMS feature set is much less robust than Benchling’s as of September 2024.

LabVantage Solutions: LabVantage, founded in 1981, helps customers run their labs more efficiently by automating their tasks and integrating across instruments and systems. Over 800 companies use LabVantage, such as Moderna Therapeutics, Pfizer, NYU Langone Health, and NeoGeonomics Laboratories. LabVantage started as Laboratory MicroSystems and has changed hands a number of times, first being acquired in 1990 by Instron and then being sold to Axiom Systems in 1997, when the company was renamed to LabVantage. By 2005, the company had moved most of its development work to a group of employees in India.

Labguru: Labguru is a cloud-based ELN platform that manages laboratory data and inventory. The platform spans the entire workflow from ELN to inventory to sample management. Labguru’s products were used by 120K scientists worldwide as of April 2024. It was founded in 2007, and acquired by Battery Ventures in 2024 and merged with Titian Software, a sample management platform founded in 1999.

Legacy Life Science Companies

Thermo Fisher Scientific: Thermo Fisher Scientific was founded in 1956, with an annual revenue of more than $42 billion in 2023. The company has its own LIMS platform focused on laboratory operations and data accuracy. In addition, Thermo Fisher has partnered with Labguru to distribute its ELN module alongside Thermo Fisher’s LIMS product. It provides complete workflow solutions from analytical instruments to laboratory equipment and software.

Differentiation

Established players benefit from deep customer relationships and a broad portfolio of products. However, they are less flexible to adapt to the evolving needs of biotech R&D. Compared to other startups, Benchling has been able to differentiate itself through its freemium model and emphasis on integrations. Its platform combines multiple functionalities, such as an Electronic Lab Notebooks, a Molecular Biology Suite, and a developer platform to offer as much flexibility as possible to the researcher.

Business Model

Benchling uses a freemium SaaS model. It targets academics with a free tier and offers paid tiers for industry researchers. The company’s free tier encourages users to try Benchling’s software, lowering customer acquisition costs. When more labs use Benchling, more users will contribute data points to Benchling and enrich the platform. Benchling is then able to offer better insights into lab best practices and product usage, thereby increasing the pace of product improvements in its suite of tools. By continuing to launch new products, Benchling will give customers more reasons to transition to a paid tier.

Benchling for Startups also offers the product at a reduced cost to early-stage life sciences research companies, starting at $15K per year. Benchling Enterprise offers complete access to all of Benchling’s tools. Enterprise plans can reach $1 million or more for very large organizations.

Traction

In November 2021, the company announced over 200K scientists at more than 7,000 academic and research institutions use their products, having grown ~400% over the course of 5 years. Across user reviews, Benchling’s products are highly regarded with a 4.5/5 rating on G2, near the top of its peers in the LIMS and Electronic Lab Notebook categories.

Sources: Techcrunch (2016), Techcrunch (2018), Techcrunch (2019), Benchling

In April 2021, Benchling also announced its ARR had seen triple-digit growth for the fourth year in a row. The number of researchers using Benchling grew more slowly than ARR, likely indicating that Benchling is upselling existing customers to more effectively drive monetization through expansion, even though it is not adding net new researchers as quickly. In November 2021, Benchling indicated that the company had “a 169% dollar-based net expansion rate.”

As of late 2021, Benchling was indicating interest in going public via IPO or direct listing in 2022 before market conditions turned less favorable in mid-2022. As of of May 2024, some unverified estimates indicated Benchling had hit an ARR of $210 million growing 27% YoY, with 1.2K customers, representing an average contract value of $175k per customer.

In April 2023, Benchling laid off 74 employees, which represented 9% of its staff. As of September 2024, it is headquartered in San Francisco, California with four office locations globally.

Valuation

In November 2021, Benchling raised a $100 million Series F at a $6 billion pre-money valuation. As of September 2024, the company had raised a total of $411 million through nine funding rounds. Based on secondary markets, Benchling’s valuation was estimated at $2.4 billion as of September 2024.

One comparable company to Benchling in terms of potential eventual outcomes is Veeva, a vertical software platform for life sciences across R&D, quality control, and commercialization. Veeva went public in 2013 with a similar financial profile at $130 million of revenue, albeit faster growth, growing 111% YoY. As of September 2024, Veeva had $2.5 billion in revenue, growing 15.3% YoY, and trading at a 12.1x EV/LTM revenue multiple.

Benchling’s September 2024 valuation of $2.4 billion in secondary markets represents a comparable multiple; 11.4x the revenue estimate of $210 million in May 2024.

Key Opportunities

Life Sciences Community

Benchling has a dedicated academic community thanks to its freemium model and initial focus, with over 200K scientists at more than 7K institutions. In biology, collaboration is crucial for research, as large companies will provide funding to small biotech startups, and academic institutions will partner with large companies. In 2023, Benchling launched an online community as a forum for scientists, IT professionals, and admins. Users use the Community to share in-person meetups, swap best practices, and share product ideas. The Benchling Community is a key opportunity to build trust with customers, and enable scientific collaboration.

When a lab uses Benchling for an extended period of time to collaborate internally and with other labs, switching costs go up. Using a different product would make collaboration with other labs more difficult and limit a lab's ability to continue using the data in Benchling effectively. Benchling can leverage its free tier to keep labs on its platform and continue to see value from its products.

AI-Driven Biotechnology

The rise of machine learning has the potential to accelerate biotech research and product development. Drug discovery is a historically inefficient process that aims to generate as many quality drug candidates as possible. There are nearly 270 companies in the AI-driven drug discovery industry as of 2022, with the goal of identifying the most promising compounds at every stage of the value chain. By 2025, the pharmaceutical industry is estimated to spend $3 billion on AI-driven drug discovery. As of 2023, Benchling supports drug discovery use cases. Due to the high compute and data needs of an AI-drug discovery workload, Benchling can leverage its background in consolidating data sources in the cloud to cater to their needs.

Key Risks

Regulatory Compliance

The life sciences is a heavily regulated industry, as companies must stay compliant with FDA, HIPAA, and HHS standards. Benchling has achieved SOC 2 Type 2 Security, as well as met industry standards and privacy regulations. At the same time, security standards for life sciences data are evolving, especially for AI or machine learning use cases. As Benchling grows the number of third-party integrations it supports, it must ensure that it stays compliant and ensures data integrity within the cloud.

Selling to Mainstream Customers

Benchling’s focus on academia established them as a key player in the space, but the seeming slow in total users from 2019 to 2022 may suggest more difficulty moving into larger enterprise R&D labs. While those larger organizations are easier to monetize given their larger budgets, they have harder sales cycles and more robust requirements for an application. Benchling’s ability to move up-market will be critical in maintaining long-term growth.

Summary

Life sciences research is dealing with greater volumes and complexity of biological data, accelerating the need for efficient data management. However, teams struggle to use data at scale due to manual data silos and broken data lineage. Benchling is replacing pen-and-paper lab notebooks and collaboration techniques within the biotech sector. Its cloud-based approach offers a unified platform that integrates experimental data, automates workflows, and facilitates real-time collaboration, thereby reducing inefficiencies and enhancing research productivity. The company’s freemium model has led to adoption across academic labs. Since then, it has demonstrated success in breaking into corporate R&D labs. As the demand for seamless, data-driven research solutions continues to evolve, Benchling will need to continue to provide a solution that aligns with the needs of modern scientific research.