Thesis

Mental health and employee well-being are increasingly critical issues in the modern workforce. In 2023, 21% of adults in America were reported to experience a mental illness, equivalent to over 50 million people. This prevalence extends to the workplace, where 47% of employees in the US and Canada indicated they were struggling or suffering in 2023. In 2022, this resulted in estimated annual losses of nearly $48 billion due to reduced productivity and unplanned absences. The shift to remote and hybrid work has exacerbated these issues, making employee engagement and mental health support more urgent for companies.

The demand for effective mental health solutions and professional development services is rising. Companies are expanding their investment in employee well-being and development programs to address these challenges. The global e-learning market, valued at $316.2 billion in 2023, is expected to grow to $661.6 billion by 2032. Similarly, the global coaching market is projected to increase from $2.4 billion in 2023 to $10 billion by 2034. These growing markets represent a significant opportunity for companies that can offer comprehensive, scalable solutions for learning and development (L&D) and mental health.

That’s where BetterUp comes in. BetterUp describes itself as a "human transformation platform," focused on combining virtual coaching with behavioral science, analytics, and evidence-based methodologies. BetterUp aims to help individuals and organizations achieve peak performance and mental resilience. Its offerings include personalized coaching, structured programs, and robust analytics tools designed to provide actionable insights. BetterUp's comprehensive approach, which integrates mental health support with professional development, sets it apart in a competitive market.

Founding Story

Alexi Robichaux (CEO) and Eduardo Medina (COO) co-founded BetterUp in 2013. The origins can be traced much earlier, however, to two interests that Robichaux developed in high school: coding and coaching. As a freshman in high school in England, he and his brother taught themselves how to program and build websites. After moving to the US, Robichaux and a friend started an after-school club that offered peer-to-peer coaching on what they referred to at the time as “life skills.” He also built a website for what would become Youth Leadership America (YLA). Robichaux explains:

“[YLA] just ignited in me this passion for this whole world of helping people realize their potential and the power of coaching and mentorship and practice.”

In 2010, Robichaux was pursuing his first interest in Silicon Valley as a Product Manager for a Series B software company called Socialcast. When it was acquired a year later by VMWare, Robichaux became a 25-year-old executive, overseeing product development and engaging in regular meetings with the CEO and board of VMware. He was feeling over-tasked and under-skilled and, after 18 months, was burned out and ready for something different.

Taking a break, Robichaux tried everything from therapy to life coaching, executive coaching, the Landmark Forum, and even walking the Camino de Santiago in Spain. Throughout this, he made an important realization of what he was looking for: the juxtaposition of evidence-based, clinical expertise with the business context of an executive coach. During this time, Robichaux and his friend Medina were still coaching and mentoring high school students with YLA. Combining what he now knew he needed on a personal level with what they were providing to the students, BetterUp was born in 2013.

From the early days, the company’s top priority wasn't necessarily making money, but rather providing a much-needed service to those in need. They were not interested in selling the company to another organization; the goal was to create impact and bring about positive change in the world, and they believed that retaining control over the business was essential to achieving this vision.

In recent years, BetterUp has added several prominent individuals to its leadership team. In 2021, the Duke of Sussex, Prince Harry, joined BetterUp as its inaugural Chief Impact Officer. Dr. Adam Grant, Wharton organizational psychologist and 5x New York Times bestselling author, has served on BetterUp’s Science Board since 2018 and in 2022, was appointed Chairman of BetterUp’s Center for Purpose and Performance.

Product

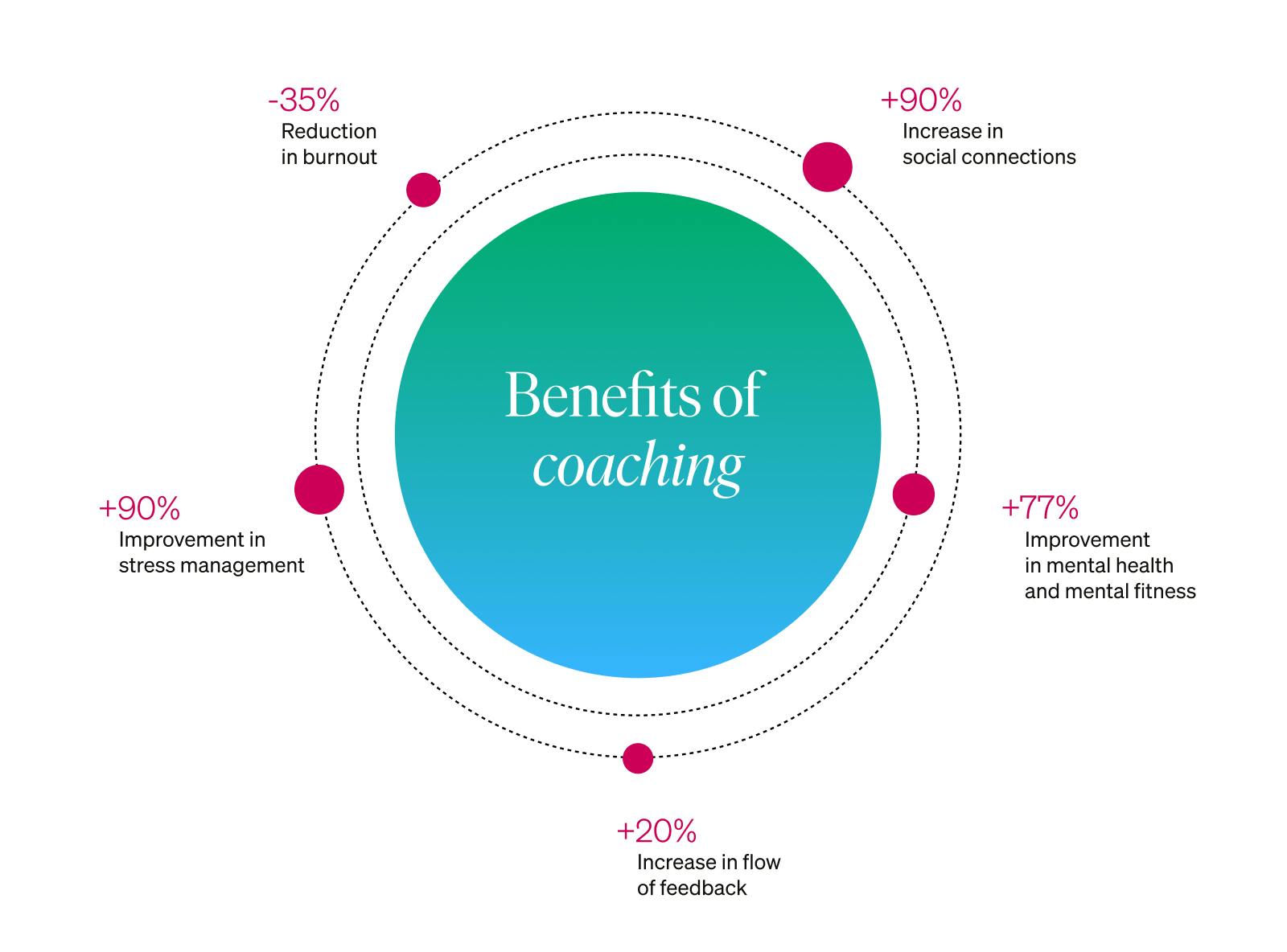

BetterUp’s core service is virtual professional coaching. Coaching is a process where an individual works with a trained professional for their betterment — developing self-awareness, identifying strengths and weaknesses, setting goals, and building skills and behaviors. BetterUp offers coaching services for both individuals and enterprises, along with a research lab and AI tools.

Source: BetterUp

BetterUp For Business

BetterUp’s Human Transformation Platform supports enterprises of all sizes in developing their workforces with the aim of improving performance. The company works with its clients to create a coaching plan that aligns with its goals and is comprised of different products, which include BetterUp Lead, BetterUp Care, and BetterUp Manage. These services are designed to be layered together to work at scale for the entire organization.

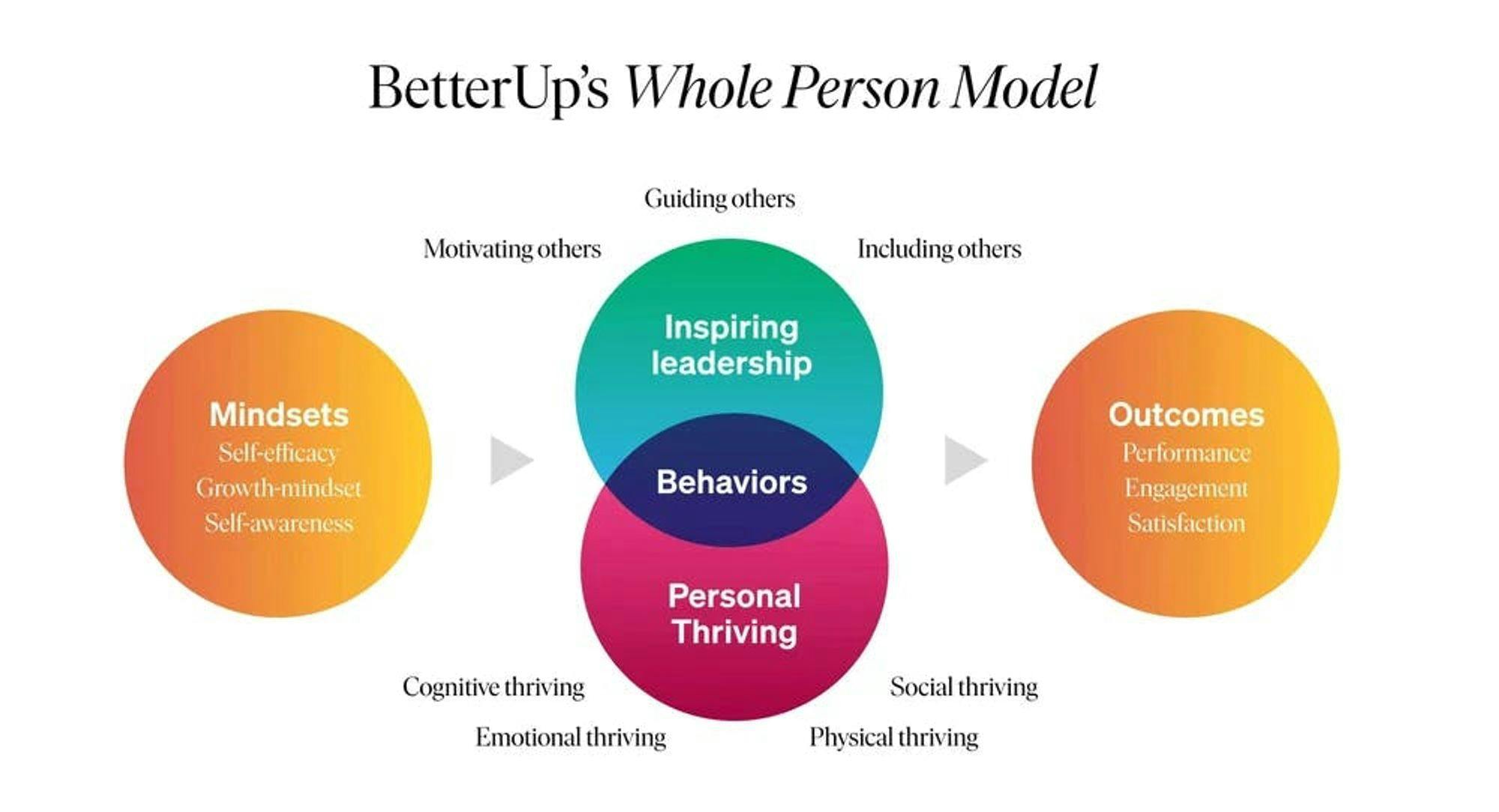

Many traditional leadership approaches focus on improving one or a couple of aspects of an employee’s day-to-day work. BetterUp developed what it calls a ”Whole Person Model” (WPM), which was intended to be a comprehensive approach to measuring and evaluating employees. The WPM measures the mindsets and behaviors that lead to peak performance, enhanced well-being, and a strong company culture. The WPM helps employers identify behaviors to improve, tracks employee growth over time, and provides insights to leaders to help them better understand ways to drive change in their organizations.

BetterUp employs the WPM in both of its core product offerings: Lead and Care. These programs are rooted in BetterUp's coaching essentials while emphasizing distinct outcomes. Lead is designed to develop leaders within an organization, while Care aims to foster mental resilience among employees.

Source: BetterUp

BetterUp Lead

BetterUp Lead is a leadership development service with the purpose of creating leaders who drive impact. It involves 1:1 coaching, personalized assessments, and AI-powered digital learning to help employees develop leadership capabilities. As of July 2024, BetterUp has 4K ICF-certified coaches who are matched with users and work with them to build skills such as public speaking and effective communication. For those facing unique challenges like sleep or nutrition, BetterUp offers specialist coaching.

The coaching and content are supported by data-driven tools designed to lead to what BetterUp claims are “measurable, actionable insights.” For example, its People Analytics Dashboard (PAD) outlines growth and behavior changes. BetterUp also collaborates with teams to develop Quarterly Business Reviews (QBRs) that measure Lead’s influence on key metrics.

BetterUp Care

BetterUp Care centers on resilience and well-being coaching and targets a broader audience of employees at every level of the company. According to the company, the ROI of Care is a 146% increase in productivity, a 63% reduction in involuntary attrition, and a 135% increase in resilience. Like BetterUp Lead, Care users are given a custom plan and coach matches, as well as live workshops with peers.

BetterUp Manage

BetterUp Manage combines the science of coaching with AI tools with the intent of offering support to managers. The company has taken insights from over 3 million coaching sessions to identify the skills managers need to be effective and built a platform where managers can learn them. Manage’s approach combines personal assessments, video, AI-powered interventions, 1:1 coaching, and group coaching.

BetterUp For Individuals

For individuals, BetterUp offers one-on-one, custom coaching to help them accelerate their personal and professional growth. Users are matched with a coach who fits their needs and can then schedule one to four video sessions a month, along with unlimited messaging. Its network includes over 4K certified coaches across 30 industries and 70 time zones. The typical coach has an average of 12 years of management experience and 45% have held VP-level leadership positions or higher.

BetterUp primarily offers life, career, and communication coaching to individuals. Life coaching is focused on improving resilience, life satisfaction, balance, and purpose. Career coaching uses industry-specific expertise to support users in advancing their careers. BetterUp Labs’ tracking has claimed its career coaching can increase productivity, job satisfaction, and goal attainment. BetterUp’s communication coaches attempt to help individuals express themselves effectively — improving public speaking skills, developing executive presence, and mastering negotiation techniques. Its communication coaching has helped users see an 80% increase in social connection and a 56% increase in relationship building.

BetterUp Research

In 2018, BetterUp Labs was launched as a behavioral research lab that aims to foster collaboration among business, academia, and science. The lab comprises over 40 PhDs specializing in organizational psychology, behavioral neuroscience, social psychology, and other related fields. Through partnerships with universities such as UC Berkeley, the University of Pennsylvania, Princeton, Dartmouth, Johns Hopkins, and Harvard Business School, the lab has published peer-reviewed academic articles on topics like mental health, workforce well-being, leadership, and more. As of July 2024, BetterUp has invested over $20 million in research.

In 2022, BetterUp introduced The Center for Purpose and Performance led by Adam Grant. The center facilitates discussions with leading practitioners, funds interdisciplinary research, and leverages scientific insights to further enhance the tools used by BetterUp.

Market

Customer

When Robichaux and Medina initially launched BetterUp, their intention was to provide consumers, primarily college students and employees, with the support and coaching they needed to reach their goals. From there, BetterUp expanded its offerings to enterprises and now serves both markets.

Enterprise investment in learning and development is increasing in the US and is likely to only continue to do so as rapidly evolving technologies require new skills and processes. Traditional corporate L&D investment happened primarily in-house, often led by HR teams. However, this system was ineffective, with one study finding that 75% of managers across 50 organizations were dissatisfied with their company’s L&D efforts in 2019. Many internal training teams lack real-world and industry-specific expertise, treat L&D as another to-do, and aren’t optimized for information retention. BetterUp is attempting to solve these problems with outsourced, domain-specific expertise as well as a data-backed approach that assigns L&D investments to measurable business outcomes.

As of July 2024, its partnerships included restaurant chains like Chipotle, utility companies like Chevron, and tech companies like Twilio. In July 2023, BetterUp announced a partnership and integration with Microsoft Viva, the employee experience platform. In 2020, BetterUp worked with the city of Santa Monica to provide leadership coaching to its employees. In September 2023, BetterUp was awarded a contract with the US Air Force to provide over 1.5K airmen and guardians with coaching in a $99 million contract. Other notable customers include Google, WarnerMedia, DeliveryHero, and John Muir Health.

Market Size

The global e-learning market was valued at $316.2 billion in 2023 and is expected to grow to $661.6 billion by 2032, representing a CAGR of 8.6%. The global coaching market was worth $2.4 billion in 2023 and is projected to hit $2.7 billion by 2024 and $10 billion by 2034 at a CAGR of 13.9%. Companies are also investing capital into the coaching and overall betterment of their employees; the global corporate training market was valued at $361.5 billion in 2023 and is expected to reach $805.6 billion by 2035 at a CAGR of 7%. In 2023, one source found that 63% of companies were intending to increase their investment in training over the course of 12 months.

BetterUp’s product also addresses an audience to provide solutions outside traditional coaching and training by including preventative solutions for mental health. In April 2024, one study estimated the economic cost of mental illness in the US at $282 billion annually, which comprises 1.7% of the country’s aggregate consumption. Another study from 2022 estimated that poor mental health costs $47.6 billion in lost productivity and unplanned absences.

Competition

BetterUp stands out in the competitive landscape of the learning and development industry by integrating both coaching and mental health support. While many players in the market focus on either coaching for L&D training or mental health individually, there are few who combine these components together in a comprehensive approach.

L&D-Focused Coaching Solutions

CoachHub: CoachHub, founded in 2018 in Berlin, has raised $333.5 million in funding from investors like SoftBank Vision Fund and Sofina who led the company’s Series C round in 2022. CoachHub offers 1:1 coaching primarily for performance, well-being, organizational transformation, and executive coaching. It caters to traditional industries such as manufacturing, retail, logistics, education, healthcare, and finance & business services. CoachHub is the closest competitor to BetterUp, offering a wide range of coaching services to both consumer and enterprise customers, but doesn’t have the same focus that BetterUp places on mental health.

Torch: Torch was founded in 2017 and has raised a total of $87.8 million as of July 2024 from investors such as Norwest Venture Partners and 137 Ventures. Torch focuses exclusively on coaching and mentoring for B2B partners with customers such as Allstate, Reddit, and Twitch, among others. Torch's mentors are not certified coaches but experienced volunteers who want to share their knowledge with others.

Hone: Hone, founded in 2018, has raised $52.4 million as of July 2024 from 3L Capital, NextGen Venture Partners, Slack Fund, and others. Hone offers solutions for employee learning and development through online courses, training programs, and group coaching. Like Torch, it caters to enterprises, including Calendly, Indeed, Zoom, and Mixpanel. Where BetterUp aims to improve the “whole person”, Hone’s approach targets skill building and improvement, particularly across leadership, communication, and inclusion.

GrowthSpace: GrowthSpace, founded in 2018, has raised $44 million as of July 2024, including from Microsoft’s venture fund M12. It offers 1:1 coaching and mentoring, team coaching, cohort-based workshops, and internal mentoring programs. Similar to Hone, GrowthSpace is a skill development platform that solely targets enterprises. It caters to more specific segments within a business compared to BetterUp, including high-potential talent, organization leadership, DEI initiatives, and teams.

Leland:* Leland, founded in 2021, has raised $5.1 million from Contrary, Peterson Ventures, and others. It is a coaching marketplace with coaches across 50+ categories in the career, education, and test spaces. It offers 1:1 coaching, asynchronous content courses, and cohort-based classes. Leland markets directly to consumers and is outcome-centric, differing from BetterUp on both accounts.

Employee Mental Support

Lyra Health: Lyra, founded in 2015, has raised $910.1 million as of July 2024, including a $235 million Series F round in 2022 that valued the company at $5.6 billion. Notable investors include Dragoneer Investment Group, Coatue, and Salesforce Ventures. Unlike BetterUp, Lyra focuses exclusively on mental health services, providing coaching, blended care therapy, medication management, and preventative care solutions. It aims to provide mental health support to employees in various forms, such as in-person treatments, video sessions, live messaging, and self-led exercises. Lyra primarily targets companies with enterprise partners such as Zoom, Morgan Stanley, Starbucks, Salesforce, and Lululemon.

Talkspace: Founded in 2012, Talkspace went public via a SPAC in 2021 with a valuation of $1.4 billion. As of July 2024, its market cap stands at $364.7 million. Talkspace offers various online therapy solutions for individuals, couples, teens, the LGBTQIA+ community, and veterans, as well as medication management and unlimited messaging. Talkspace has tailored solutions for businesses that include 1:1 therapy, psychiatry, medication support, and self-paced programs. It focuses on helping employers increase employee well-being, productivity, culture, and retention. Similar to Lyra, Talkspace is a therapy-forward product and does not offer career or skill-based coaching.

Spring Health: Spring Health, founded in 2016, has raised $366.5 million in total funding as of July 2024 and was valued at $2.5 billion in April 2023. Spring Health is a comprehensive mental health solution for employers and health plans. It offers digital support, meditation exercises, coaching, therapy, medication, and more. Users take a survey and are then given a custom care plan and Care Navigator for ongoing support. Spring Health works with companies to provide mental health services to improve business results, specifically aiming to improve business results like absenteeism and lost productivity.

Headspace: Headspace, a meditation platform founded in 2010, and Ginger, an on-demand mental health platform founded in 2011, merged in 2021 to form Headspace Health at a valuation of $3 billion. Before the merger, Ginger had raised $222.4 million from investors like Blackstone Group, Khosla Ventures, Bessemer Venture Partners, and Kaiser Permanente ****Ventures. Headspace has raised $320.9 million from Blisce, Spectrum Equity, TCG, and others as of July 2024. With the merger, under Headspace’s brand, the joint company began offering mental healthcare services to employers, consultants, and health plans. It provides 1:1 mental health coaching, therapy, psychiatry, and self-guided care to clients like Sephora, Mattel, Booking.com, and Western Union.

Business Model

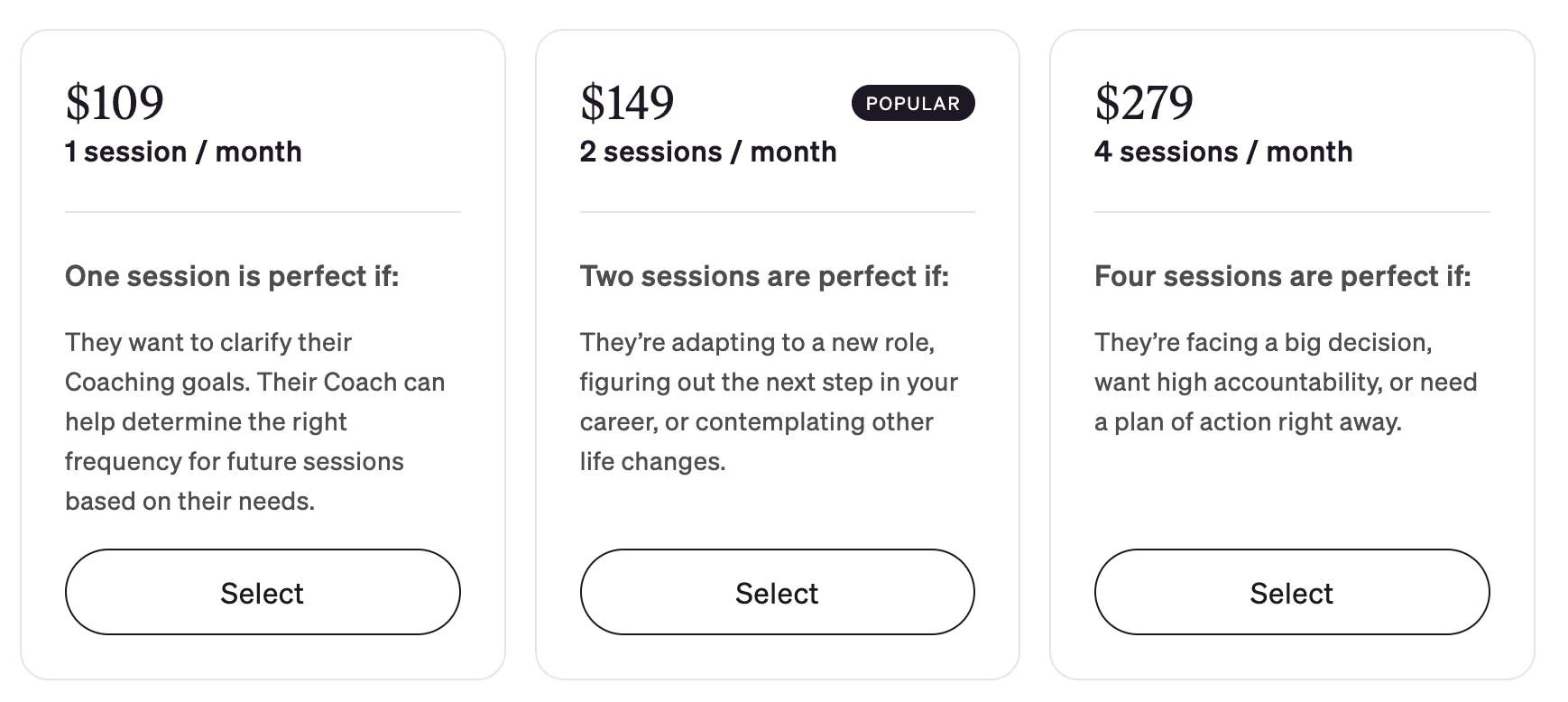

Source: BetterUp

BetterUp operates on a SaaS model that includes monthly subscription fees for access to their virtual coaching services, content, and other resources. Individuals can subscribe to BetterUp on a monthly, biannual, or annual basis, choosing plans that include one, two, or four coaching sessions per month. Monthly fees start at $109 for one session, $149 for two sessions, and $279 for four sessions as of July 2024.

For enterprises, BetterUp offers a more comprehensive service, reported to start at $499 per user per month. This allows companies to provide their employees with personal and professional development opportunities as a perk or part of an internal development program. BetterUp's value proposition extends beyond mere matchmaking between clients and coaches. The company has developed and continues to innovate on coaching methods, providing structured programming and analytics to companies. This positions BetterUp as a platform rather than a traditional marketplace.

While BetterUp charges on a subscription basis, similar to traditional marketplaces, it has lower gross margins because it compensates its coaches for every session they complete. According to the company, coaches' fees range from $50 to $250 per hour. However, in April 2022, several coaches within the BetterUp ecosystem issued complaints about pay.

BetterUp has expanded its distribution through partnerships with platforms like Salesforce and Walmart — BetterUp Sales Performance is listed on the Salesforce AppExchange and "BetterUp for Caregivers" is available exclusively to Walmart users. This strategy allows other businesses to incorporate BetterUp's coaching services into their products, benefiting from BetterUp's interface and network of professional coaches. These partnerships also serve as a top-of-funnel to drive additional revenue for BetterUp.

Traction

In 2022, BetterUp was estimated by one unverified source to have reached $175 million in revenue. It doubled in revenue from 2020 to 2021 as more aspects of life went remote, but then fell to 40% year-over-year from 2021 to 2022. As of the company’s Series E in 2021, BetterUp had grown its customer base by 80%, recorded a net revenue retention of over 170%, and served more than 380 enterprise businesses with a company headcount of over 500. Also in 2021, BetterUp acquired two software companies, Motive and Impraise.

Motive leverages ML and NLP models to extract precise and actionable insights from multichannel data, uncovering valuable information about people's experiences. With its proprietary technology that accurately detects emotions in language, Emotion API Motive enables organizations to cultivate empathy on a large scale. Motive may be able to add value to BetterUp by helping capture employee and customer experiences from a human perspective.

Impraise, on the other hand, brings experience in developing software that empowers managers to effectively understand and nurture their teams. Its data-driven and analytical approach to fostering engaged and high-performing teams could enhance BetterUp's ability to expand and thrive in the EMEA region.

In August 2023, BetterUp announced a layoff of 16% of its employee base, representing 100+ people.

Valuation

BetterUp has raised $570 million over seven financing rounds. In October 2021, the company raised a Series E of $300 million at a $4.7 billion valuation. The round was led by Wellington Management, ICONIQ Growth, and Lightspeed Venture Partners with participation from existing investors and customers of BetterUp, Salesforce Ventures, and Mubadala Investment Company. Other investors included Sapphire Ventures, Morningside Group, SV Angel, and PLUS Capital. Prior to this, in February of 2021, BetterUp raised a $125 million Series D at a $1.7 billion valuation, which means that BetterUp’s valuation more than doubled over the course of 2021.

Key Opportunities

Market Penetration

One survey in 2023 found that the civil construction industry lacks training and resources in addressing and promoting mental health, with less than a third of respondents believing their employers offered effective means of mental health improvement. This could represent a dynamic that exists in several industries which BetterUp could expand to address.

By tailoring their offerings to meet the specific needs of these markets, BetterUp could attract new customers and expand its user base. This includes developing localized content and services that resonate with industry and regional nuances. Additionally, focusing on industries such as construction, manufacturing, retail, and education, where employee development and mental health support are emerging priorities, can open up new revenue streams and enhance the company's market share.

AI Product Innovation

By leveraging advancements in AI and machine learning, BetterUp could enhance its personalized coaching services, providing more accurate and effective support to users. Additionally, AI tools have the potential to significantly reduce the expensive costs associated with coaching, democratizing access to career and mental health support. AI tools can also be made available 24/7, unlike human-centered coaching.

Many existing coaching companies have already started deploying AI coaching tools. For example, CoachHub launched AIMY, an AI coaching companion, in May 2024. Kajabi, a platform where experts and creators can build and run their own courses, released an AI creator hub in 2023.

Growing Awareness of Mental Health

As awareness grows, more individuals and organizations recognize the importance of mental health support, driving demand for services like BetterUp’s. One research report found that 62% of Gen Z employees marked mental health services as a very or extremely important benefit, compared to 56% of millennials and 46% of Gen X. Engaging in public awareness campaigns, partnering with mental health advocacy groups, and contributing to policy discussions can further enhance BetterUp's reputation and attract new users.

This growing recognition is also leading to increased investment in mental health solutions by enterprises, expanding BetterUp's market potential. To illustrate, a survey by PwC in 2022 found that 64% of employers had already implemented or had a plan in place to implement an expansion of mental health benefits.

Partnership Expansion

BetterUp currently partners with a number of companies and organizations through different integrations and joint projects. However, the ecosystem for mental health and L&D is vast, and there are more opportunities to collaborate that could help with distribution and potentially expand their business model. For example, BetterUp could partner with insurance companies in the US that could provide their clients with access to BetterUp's coaching services as a way to improve their mental health and well-being. This could help BetterUp reach a wider audience and make its services more affordable.

Key Risks

Crowded Market

The market for digital coaching, encompassing both performance (L&D) and mental health, is highly competitive with numerous players. Affordable, scalable online video platforms and the rise of AI have made it easier for companies to enter this space and offer both synchronous and asynchronous coaching services. While BetterUp stands out by incorporating advanced analytics, data components, and thought leadership, it faces the risk of increased competition. There are also verticalized coaching players that will compete against BetterUp’s more generalist offerings — for example, MBA coaching or executive coaching. As other companies adopt similar approaches, more affordable alternatives may gain prominence in the market.

Profitability & Future Funding

BetterUp's business model, which involves taking a cut from fees paid out to coaches, could lead to lower gross margins and pose challenges in the current funding climate. As a late-stage growth company, BetterUp has successfully raised significant amounts of money in the private markets. However, depending on its burn rate and revenues, it may require additional capital to sustain their growth trajectory. In such a scenario, BetterUp might face the possibility of a lower valuation or reduced growth compared to their initial expectations.

Lack of Certified Coaches

The coaching industry may face challenges in meeting the increasing demand generated by online coaching, considering a shortage of certified coaches. According to the International Coaching Foundation (ICF), there were almost 50K certified coaches globally in 2023 and 196K licensed psychologist jobs in the United States in 2022. With only about 250K professionals available to cater to a potential market of ~150 million workers in the US, the existing numbers appear insufficient. This scarcity poses a risk to the industry's growth and scalability and to BetterUp, in particular, which only employs certified coaches. In theory, every employee could benefit from coaching, but given the current number of coaches, the industry cannot adequately meet the potential demand. Companies like Torch address this difficulty by using volunteer mentors and experts, rather than solely ICF-certified coaches.

Summary

BetterUp operates within a growing market for mental health and professional coaching, leveraging a SaaS model to provide virtual coaching services to both individuals and enterprises. The company's offerings include personalized coaching, structured programs, and analytics tools aimed at enhancing employee performance and health. It has three primary offerings — Lead, Manage, and Care — which concentrate on leadership development, enabling managers, and employee resilience, respectively, to foster a comprehensive approach to organizational growth and employee well-being. Though there is much competition, BetterUp is a well-known player in the expanding market for digital coaching and mental health services with its “whole person” model and technology partnerships.

*Contrary is an investor in Leland through one or more affiliates.