Thesis

Community plays a critical role in organizations across industries in that they help people form relationships, feel supported, and work towards common goals. A strong community can also enable customer acquisition, streamline support, and provide product insights. For example, successful companies like Twilio, Atlassian, and Stripe depend on their developer communities to strengthen their platforms, GitHub relies on its open-source community, and Figma and Notion invest heavily in fostering community to inspire ideas, gather feedback and support their users.

Because of this, companies are hiring more community professionals, increasing the resources they allocate toward their communities, and finding new ways to measure ROI. They’re also tapping into a growing tech stack of tools designed to make the whole process easier to manage. The way software is built, evaluated, and adopted by companies has shifted. Companies are increasingly influenced by their communities of users who provide feedback across engagement channels.

Community management is about engaging customers across digital channels to increase brand loyalty and grow connections with the audience. Building and managing communities is specialized, time-consuming work. Success depends on knowing where, when, and how to invest time and energy for maximum impact. The dynamic, networked nature of communities makes it difficult to understand what is happening in communities and have up-to-date context.

Common Room provides unified intelligence across companies’ communities, providing real-time insight to inform action. With Common Room’s reporting and engagement capabilities, teams can engage their community at the right time with the right message without the manual work, saving time to focus on high-impact projects. As the market continues to shift towards community-led acquisition, the role of community professionals is evolving in terms of business impact and value. Common Room allows companies to quantify their contributions to the business through metrics. It marries community engagement with product usage and CRM data to help companies extract the full value out of their communities.

Founding Story

Common Room was founded in 2020 by Linda Lian, Francis Luu, Viraj Mody, and Tom Kleinpeter. Prior to founding Common Room, CEO Linda Lian spent time at Morgan Stanley, and a mobile security startup Lookout, before joining the investing team at Madrona Venture Group. From there, her interest in open source software led her to the AWS team at Amazon. Co-founder Francis Luu spent a decade as a product designer at Facebook, and Viraj Mody had led engineering teams at Convoy and Dropbox and was a founding engineer at Audiogalaxy, which was acquired by Dropbox. Tom Kleinpeter had been an engineer at Dropbox for seven years.

When working as an early-stage VC, Lian dove deep into open source and discovered how the building and distribution of software was changing. From there, she dove into working with open source products on the AWS product marketing team at Amazon. In order to keep up with the dynamic needs of the AWS developer community, she glued workarounds together to collect insights. She also managed a crowded Slack channel where developers often got lost in the noise, and sales engineers couldn't keep up as they tried to manage a massive community with a simple Google Sheet. Understanding the growing necessity to cultivate a community around the company’s software, she tried to drive growth using a community-led playbook, but found that the tooling was lacking across analytics, customer support, outcome reporting, and organizing the community.

These experiences led her to the idea for Common Room, and the company was founded in February 2020. Originally conceptualized as a “slack-forum baby to rule them all,” she built a community of founders in the B2B SaaS world who helped her realize that they needed a way to tie together all the applications where their community already existed, not just another application. She found her co-founders through cold outreach on LinkedIn. She first brought Francis Luu on board, followed by Viraj Mody and Tom Kleinpeter.

Product

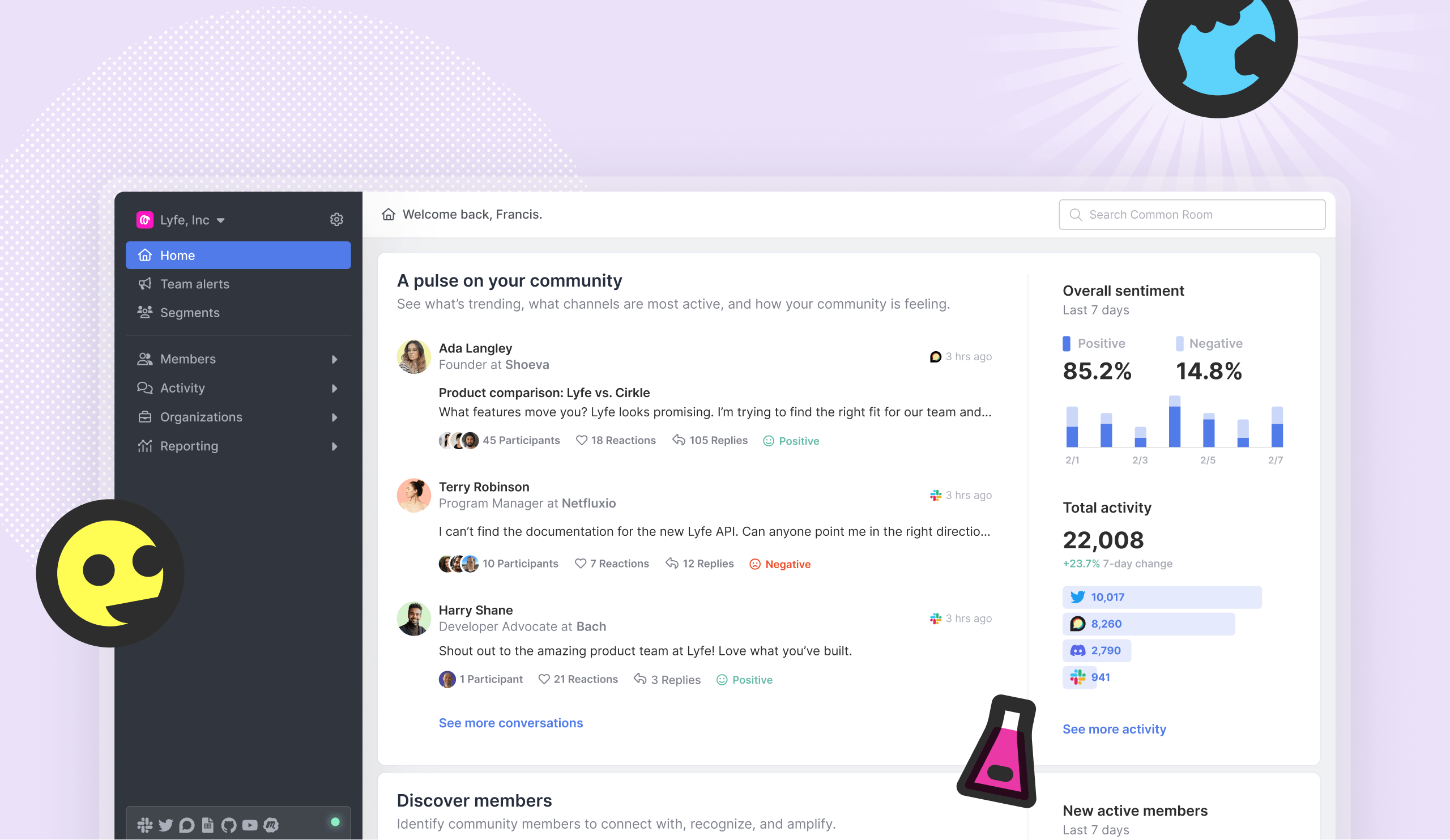

With Common Room, community managers get a holistic view of a community member’s activity, sentiment, and engagement across all sources. They can stay on top of the most important things happening in their community through alerts around specific metrics in different channels.

With sentiment analysis on activities and members, community managers can quickly catch and mitigate negative sentiment and track trends or spikes in positive sentiment to proactively engage with their community. Users can find, share, and triage product feedback and questions with relevant teams. Common Room lets them identify the most impactful community members and connect with their community at scale without losing the human touch.

Source: Common Room

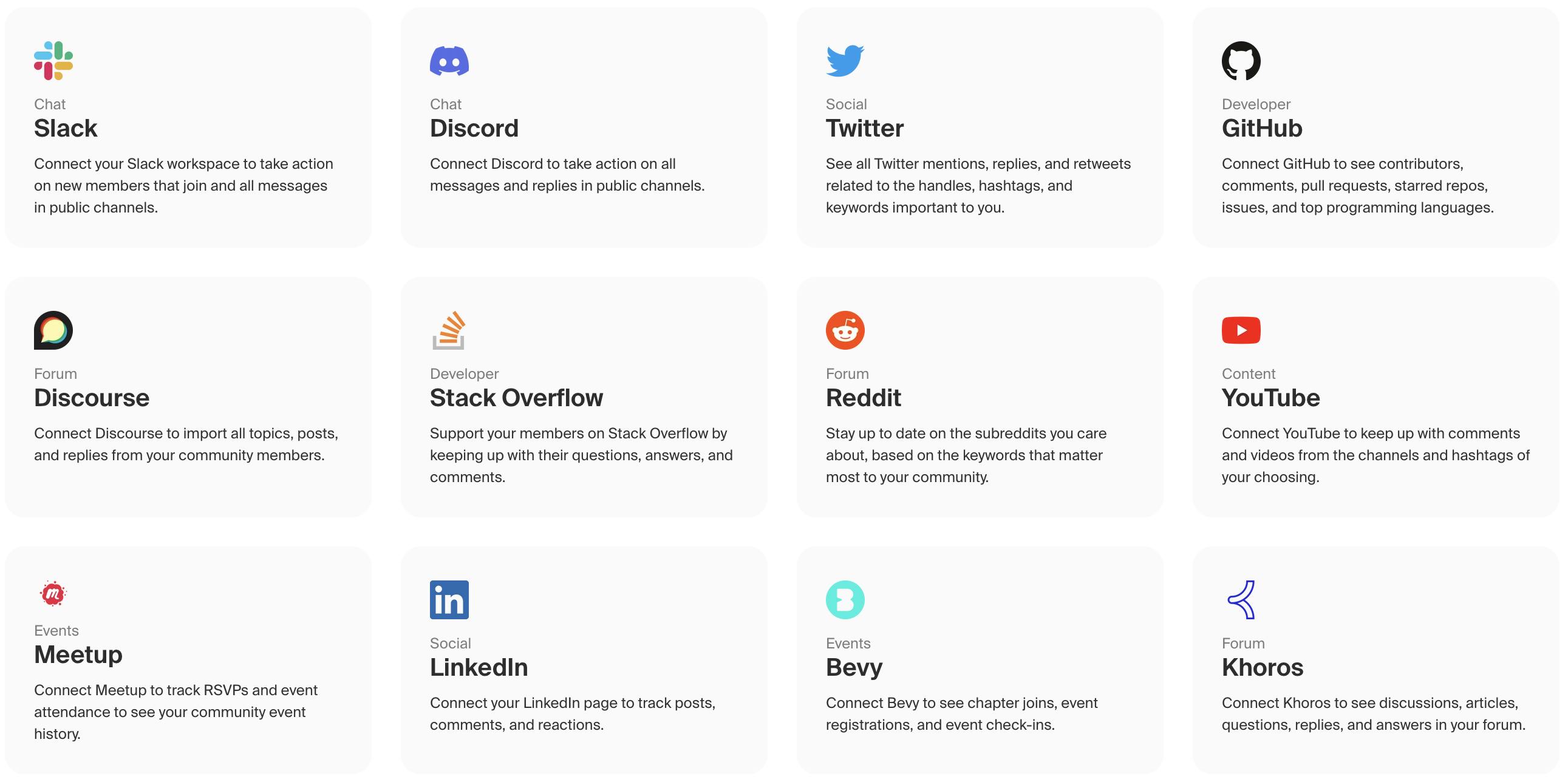

Integrations

Common Room’s integrations lie at the core of its product. The fastest way to add community members to Common Room is by using integrations. In addition to all the platforms that community members interact on, like Slack, Discord, or Discourse, Common Room connects bidirectionally with CRMs like Salesforce and HubSpot to enable cross-team interactions and provide deeper user context. The primary use case with CRM integrations is to identify community-qualified leads and send their information to the sales team.

Source: Common Room

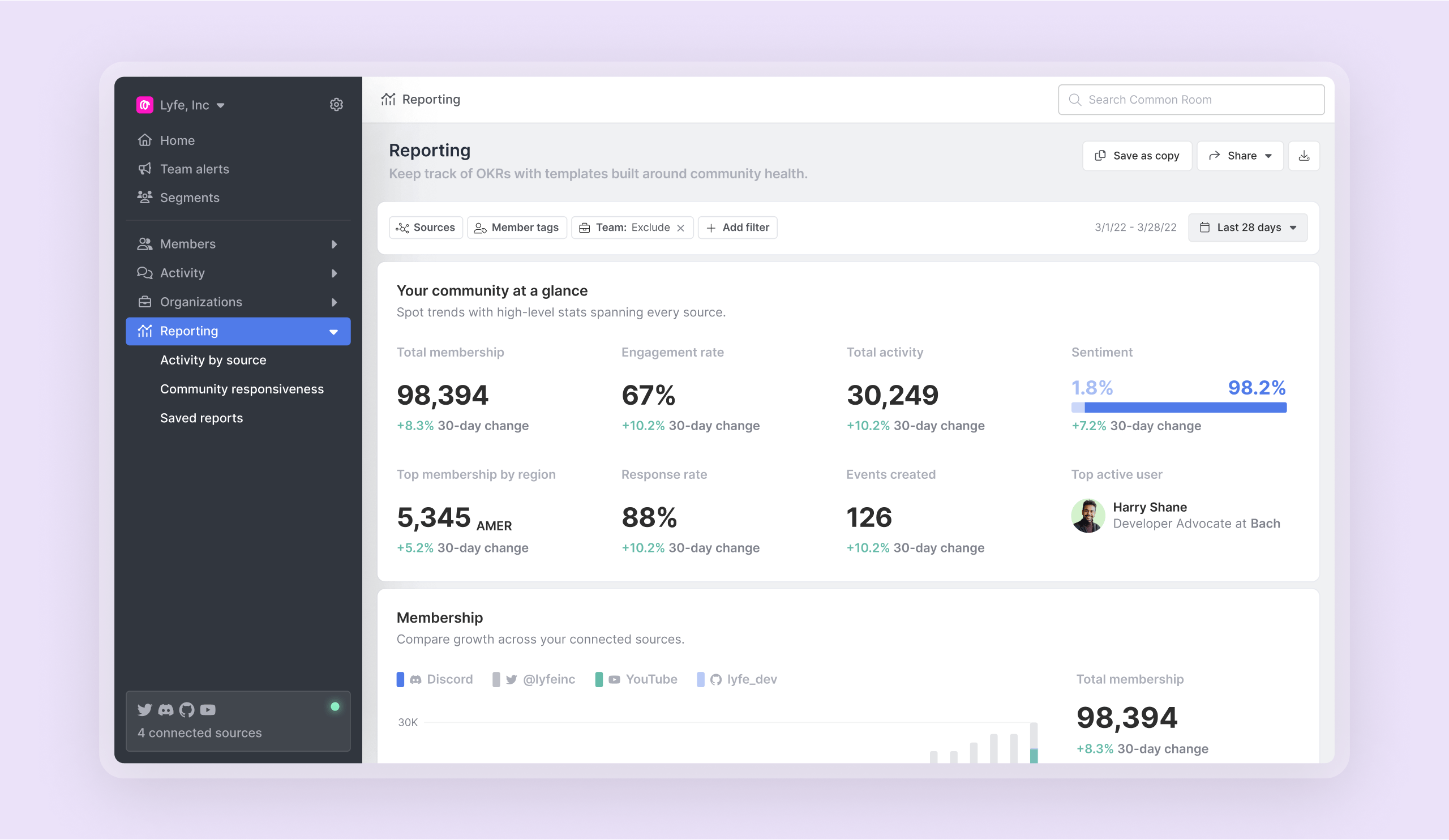

Reporting

Common Room helps businesses measure the impact and health of their communities by tracking metrics such as total membership, total engagement rate, total active members, total activity, activity by channel, top membership by region, response rate, and most active members. It also surfaces the most salient topics in a community in addition to responsiveness and engagement metrics. Summaries of reporting data can be easily saved and shared with stakeholders.

Source: Common Room

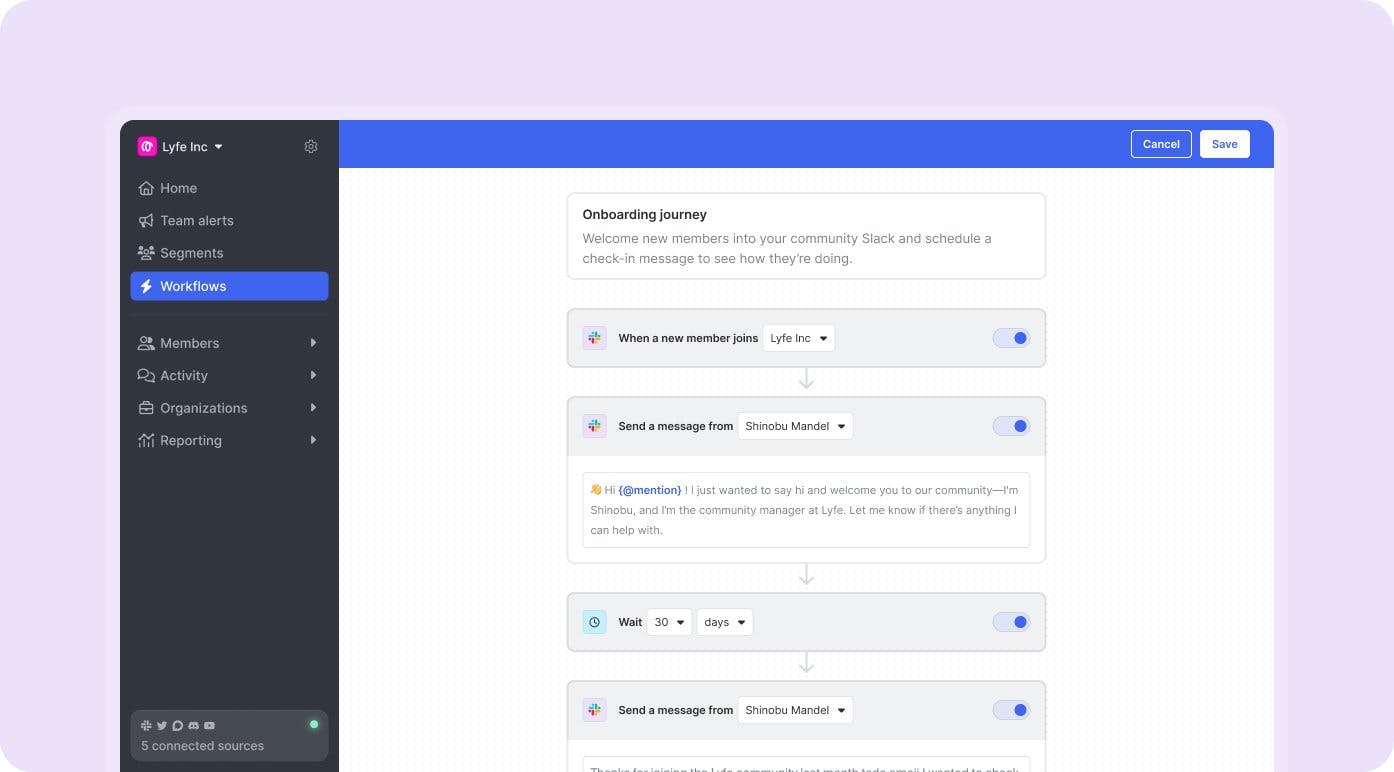

Workflows

To help managers take action on generated insights, Common Room provides pre-built automated workflows for tasks like onboarding, re-engagement, surveys, standardized messaging, and more. Each workflow includes a combination of a Trigger (which defines what kicks off a workflow), Actions (defining what happens in the workflow), and Conditions (additional filters or criteria must be met to proceed within a workflow).

Source: Common Room

Security and Compliance

Common Room works with external partners to audit security architecture and controls independently. It follows the GDPR and CCPA regulations and provides a programmatic integration to remove all personally identifiable information. It also supports single sign-on, role-based access control, and multiple identity providers such as Okta and Microsoft Azure Active Directory.

Market

Customer

Common Room serves companies that value community engagement and community-led growth. Its customers include Asana, Figma, Atlassian, Webflow, and Airtable. Common Room can be used for different functions in an organization. Developer Relations teams can find product champions, gather product feedback, surface community-generated content, and find members to collaborate with. Sales & Marketing teams can identify community-led opportunities, enhance lead scoring with community activity data, identify new champions to improve targeting and identify new potential prospects. Finally, community teams can use the product to get a 360-degree view of a member’s activity, sentiment, and engagement across all sources.

Market Size

The global online community marketing software market is expected to garner $2.8 billion by the end of 2032. The market was valued at $1.5 billion in 2021.

As one data point, Insight Partners surveyed its portfolio of over 400 software companies in May 2022. It found that 25% of their companies had adopted community-led growth motions at the time of the survey, and 55% were planning to test in 2023. The same survey indicated that 73% of Insight’s portfolio companies had established community budgets for people, tools, and programs, with companies spending an average of 9% of their marketing budget on community.

In 2021, software companies generated $547.2 billion in revenue, a number expected to grow to $872.7 billion by 2028. Software companies typically spend 13.10% of their revenue on marketing. If Insight’s portfolio can be taken as a representative sample of the industry as a whole with 9% of marketing budgets going towards community, then the community industry’s TAM can be estimated at around $6.5 billion, expected to grow to $10.3 billion by 2028. From February 2020 to September 2022, marketing grew as a percentage of companies budgets from 11.3% to 13.8%. As marketing budgets increase, budget allocations toward community could increase, which would expand Common Room's addressable market size.

Competition

Orbit - Orbit is a community growth platform offering a product similar to Common Room with a different user interface. The company has raised $22.7 million since it was founded in 2019, with Coatue leading its $15 million Series A in 2021. Its acquisition of Hoopy, a developer relations consultancy, brought more specialized DevRel expertise to the company.

Commsor - Commsor provides a community operating system which allows companies to tie their community ecosystem together to measure and drive impact. Meetsy, which enables communities and internal teams to facilitate meaningful one-to-one connections, is another Commsor offering. The company also combines software, community services, and education to give organizations the integrated solution they need to become community-led. It was founded in 2019 and raised a $50 million Series B at a $450 million valuation in March 2022, bringing its total funding to $66 million.

Circle - Circle is a community platform that brings together the creators' discussions, memberships, and content. It was founded in 2019 and has raised $30 million in funding. Circle had over 4K paying communities, with paid subscriptions averaging $40 to $400 per month in 2021.

Zendesk - This public customer support and CRM company offers Zendesk Gather, a community forum platform that gives customers a space to connect over its products and tools for helping managers recognize important members and generate analytics.

Hivebrite - Hivebrite is an all-in-one community management platform that helps clients build brand engagement. It is a flexible standalone platform rather than integrating across multiple channels. It raised a $20 million Series A led by Insight Partners in 2020, bringing its total funding to $23 million. In the same year, Hivebrite announced it had processed over $3 million in payments and delivered more than 30 million emails to its customers, with over 100K people attending events organized through the platform in 2020.

Khoros - Khoros is a customer engagement platform that turns siloed knowledge into enterprise value and customers into contributors. It was founded in 2008 and raised $138 million in funding. It is now owned by the private equity firm Vista Equity.

Traction

Common Room's early customers included companies like Figma, Asana, and Confluent. Notable customers listed on Common Room’s website as of March 2023 include Atlassian, Confluent, dbt Labs, Grafana, Webflow, Hubspot, and Coda.

Source: Common Room

Valuation

In April 2021, Common Room raised a $32.3 million Series B funding round led by Greylock at a $300 million valuation. Index Ventures and 01 Advisors participated. Other backers include a slew of angel investors, including Etsy CEO Josh Silverman, former Twitter CEO Dick Costolo, and former Axiom CEO Elena Donio.

Key Opportunities

Rise of Community Teams

Community teams are often a sub-group within larger marketing teams. In 2021, only 15% of companies reported having a dedicated community department. That figure jumped to 22% in 2022. Because they are often siloed, community teams lack the autonomy to plug in with teams across the enterprises they serve fully. Among companies with community teams, only 39% of other teams participated in their community often, and 48% participated infrequently. As community teams move out of department silos, they’ll be more capable of engaging other aspects of the business. Common Room, which marries data relevant to community, sales, and product teams, has the potential to increase its value as organizations continue to change their approach to community.

Resilience to Economic Headwinds

Though it may seem counterintuitive, an economic downturn could provide a meaningful growth opportunity for Common Room since building a robust community may become increasingly attractive in a recession. In any economic climate, community-led growth adopters enjoy lower acquisition and customer service costs along with increased member retention and LTV due to the powerful network effects of the community; these benefits become especially alluring in a cost-cutting environment. On the other hand, the budget for marketing is often the first to go during a downturn, and the community budgets embedded within them may shrink proportionally.

Key Risks

Graduation Risk

While a mature company is more likely to have an established community than a newer one, a company’s dependence on its community to generate leads diminishes with scale. One of Common Room’s central value propositions is its ability to fuse a company’s community with its CRM, but this could prove less useful as a company grows. It might be the case that at a certain point, the value of community and Common Room stop increasing one-to-one. If Common Room’s lineup of high-growth enterprise customers approach this point, they could turn to other tools that meet their specific needs better.

Summary

Most great companies have a community, but many haven’t unlocked their communities’ potential. This has given rise to the early days of the community-focused SaaS vertical, which Common Room hopes to lead by building infrastructure to support community-led growth. However, venture-backed companies like Orbit and Commsor have found traction with directly competing product offerings. Whether Common Room can gain and retain its market share will be a function of its ability to differentiate in an increasingly saturated market.

*One or more Contrary affiliates have invested in one or more customers of Common Room, including Replit, which is included in one of the graphics above.