Thesis

Cities were originally built for walking or horses as the major modes of transportation. The mass production of automobiles in the US saw the number of automobiles in the US explode from 8K to 2 million between 1900 and 1915. Cars quickly became the dominant mode of transport. Urban planning changed to accommodate this shift. Within cities, roads were no longer built to accommodate bikers or pedestrians except as an afterthought. As a result, the average American spends around an hour per day sitting in a car, which means Americans spend a collective 93 billion hours driving each year. American commuters have continued to prefer cars over public transit, with only 3.1% using public transit in 2022, down from 5% in 2019.

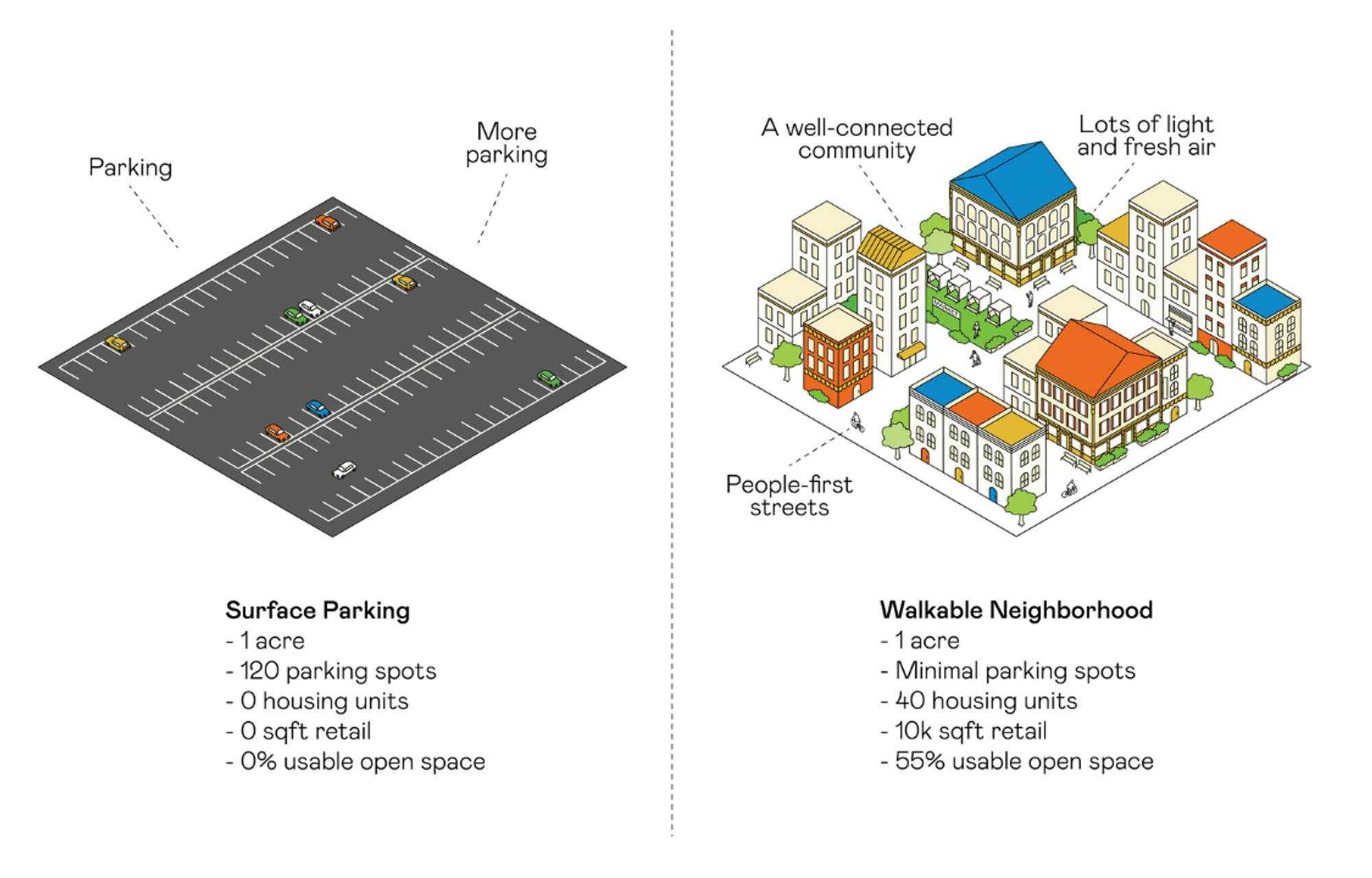

One key reason for this is the legacy of America’s 20th-century car-centric planning, which left few viable public transit options outside of dense urban areas. Across the nation, 45% of Americans have no access to public transportation. Cities — places that are relatively more walkable — have also been designed to favor cars. As much as 50-60% of downtown land areas in the US are dedicated to cars, including right-of-ways and parking. In fact, 22% of land in US cities is, on average, taken up by parking alone. Car-centric design has not only meant that walkable communities are uncommon in the US but also that the roads are often unsafe for pedestrians. In 2022, pedestrian deaths hit a 40-year high.

Another reason for American’s reliance on cars is that existing walkable cities are unaffordable for most people. Renters pay a 41% premium for walkability, while homebuyers pay 35%. The most walkable cities include New York, Boston, San Francisco, and Seattle - all of which fall in the top 20 most expensive cities to live in as of 2024. These high costs are driven by the lack of housing in urban areas combined with high demand to live in those areas, making ‘walkability’ dependent on one’s ability to pay. This also means that walkable communities have often been inaccessible to low- and moderate-income people. Culdesac refers to this shortage as ‘missing middle housing,’ which describes the lack of medium-density residential buildings in North America.

Despite the lack of viable alternatives, demand remains for a different vision of how American cities could look; 79% of Americans desire to live in walkable, pedestrian-focused communities as of 2023 and 78% of these people are willing to pay more to live in them. What’s missing is the initiative to supply that demand.

Culdesac is a real estate developer and property management company that was founded with the goal of reimagining American cities to be built for people, not cars. In 2023, Culdesac opened its first neighborhood project in Tempe, Arizona, launching the first car-free neighborhood built from scratch in the United States. Tempe, a suburb in the Phoenix metropolitan area, is known for its desert climate and as the home of Arizona State University. By 2025, it aims to complete the site and house 1K people. Culdesac envisions new neighborhoods designed around mobility that respond to the challenges of congestion, loneliness, traffic fatalities, and global warming.

Founding Story

Culdesac was founded in 2018 by Ryan Johnson (CEO) and Jeff Berens (COO). The two co-founders were roommates at the University of Arizona where they both studied economics and international studies. While in high school, Johnson had worked with his grandfather, a train engineer, to build a website for the first light rail in Phoenix. This was his first exposure to the transportation industry. He was able to visit 60 countries during his time at university due to a scholarship he received, and during his travels, he was inspired by the combination of walkability and great public transportation he observed in international cities.

Prior to founding Culdesac, Johnson was on the founding team of residential real estate company Opendoor and served as VP of Operations. While collecting customer feedback at Opendoor, Johnson noticed users repeatedly asking for “cute neighborhoods” which emphasized proximity, thoughtful architecture, and community. He then reunited with Berens, who had been working for McKinsey in its public and social sector practice, and the two decided to start Culdesac.

The two Arizona natives moved operations from San Francisco to Tempe because of its more favorable regulatory environment, proximity to a population center, and climate. Tempe, a Phoenix suburb with a degree of bike friendliness, embraced Culdesac and permitted them to build apartments without parking spots (illegal in most areas) as long as residents signed contracts to live car-free or not park in surrounding areas. Culdesac participated in the summer 2018 batch of Y Combinator.

Product

Culdesac Tempe, the company’s first location, is a 17-acre neighborhood built to fit 1K people by 2025. By the time of its completion, it will consist of 17 acres of land, 44K square feet of retail and amenities, 761 apartments, and over two miles of bike and footpaths. Open community space accounts for 55% of the location’s land, including parks, courtyards, retail locations, restaurants, co-working spaces, and more. A coffee shop, main park, and pool will also be added. The neighborhood is meant to satisfy everyday needs and contains 3x more green spaces than a typical development of comparable size.

As of January 2024, around a hundred people were reported to be living at the Tempe location, with 60 additional units to be opened in 2024. The complex includes both two and three-bedroom floor plans. The apartments are organized into pods, each with a courtyard that serves as the outdoor living room for residents with BBQ grills, fire pits, and hammocks.

There is also a coffee shop, restaurant, co-working space, market, and other retail space in the neighborhood. The idea is to reach “gentle density,” or a ratio of 40 units per acre while allotting significant space to parks and other green spaces. The lead architect and designer, Daniel Parolek, refers to the effect as “fabric buildings.” Apartments come in multiple sizes and prices: studios from $1.3K, one-bedroom units from $1.4K, two-bedrooms from $2.1K, and three-bedrooms from $2.9K.

As of 2024, Culdesac Tempe apartments came with four to six weeks of free rent, a complimentary Valley Metro Pass of over $750 per year value, and a free electric bike of over $1K value. Apartments are lease-only to help move residents in quickly, but future Culdesac neighborhoods may include the option to buy apartments. Residents instead have an “Extend Your Home On Demand” program that enables them to extend their contracts on an as-needed basis through a Culdesac app.

Source: Opticos Design

Given that Culdesac’s mission is to build cities for people, not cars, Culdesac Tempe’s design for modern mobility is one of its key features. Culdesac Tempe does not have residential parking for residents and residents must sign a contract that they will not park a car within a quarter mile of the neighborhood. In exchange, each resident receives $3K per year in mobility benefits, which enable access to multiple forms of transportation.

The neighborhood is located by a light rail station that connects residents to downtown Phoenix, downtown Tempe, and the airport. There are on-site Bird rental electric scooters, over 1K bike racks, full-service e-bike shops, and even biking classes. For the occasions when residents need a car, they can access 15% off all Lyft rides, free and discounted Waymo rides, and an on-site EV carshare service that starts at $5 per hour.

Source: CityNerd

Another feature is its climate-resilient design. Culdesac Tempe buildings are clustered together to maximize shade and create narrow walkways for strolling. The streets are built with pavers instead of traditional asphalt since they reflect less heat and allow rainwater to pass through, protecting against both rising temperatures in the American Southwest and flooding. These strategic urban design and eco-conscious design choices are motivated by Culdesac’s commitment to deliver comfort and a high quality of life to residents.

Source: Congress For New Urbanism

Culdesac Tempe offers multifunctional neighborhoods that serve diverse needs. A car-free neighborhood is supposed to be safer, quieter, and more walkable. Main walkways are built to be wide enough to provide access to emergency service vehicles when needed, which can get to where they need to go with more efficiency because of the lack of congestion. There is also a pool and dog park on site, as well as courtyards and other shared spaces.

Spaces for walking and biking are thought to facilitate more encounters and community engagement and social interaction than driving, supporting residents to overcome feelings of loneliness and isolation. Limited car use means residents are estimated to emit 50% less transportation-related carbon dioxide than those in neighboring communities, providing health benefits such as cleaner air. Culdesac believes its neighborhoods are the solution to people living happier and healthier lives.

Source: Culdesac

Market

Customer

Culdesac neighborhoods are not marketed to any specific demographic, but certain groups have tended to align well with the walkable neighborhood mission. Culdesac has historically seen demand from two demographics in particular:

Young professionals: Professionals looking for an urban experience without having to pay high rent prices, especially those with remote jobs and without families, have found Culdesac’s carless community attractive. Born between 1981 and 1996, 85% of millennials have expressed a desire to live in more walkable areas as of 2023.

The Silent Generation: With its youngest members in their mid-70s, the Silent Generation was born between 1928 and 1945. For some in this group, part of Culdesac’s appeal is that it offers an alternative to retirement villages. As of 2023, around 56% of people in this demographic want to live in walkable neighborhoods, and Arizona has a large and increasing elderly population.

The shared characteristics of those looking to join Culdesac have been a desire to live in a place with a strong sense of community, care for the environment, and interest in cutting down on living costs.

Market Size

While car-free cities exist in the US, many are private, far from society, or relatively expensive. Additionally, none were made with the same vision as Culdesac, which is built to allow residents to meet their daily needs without the use of a car.

As of 2023, 79% of Americans want to live in walkable neighborhoods, but an estimated 7% live in one — representing a large gap in the market between supply and demand. Walkable neighborhoods cover less than 0.1% of US land, and Culdesac believes the market is therefore quite open. The premiums paid by homeowners and renters living in large, metropolitan areas indicate the potential for value capture for an offering like Culdesac’s.

After Tempe, Culdesac plans to break ground in at least five new locations: Denver, Washington, Dallas, Atlanta, and Raleigh, North Carolina. All locations (besides Raleigh, North Carolina) are close to rail lines, but each will be 3x larger than the Tempe location. CEO Ryan Johnson hopes to build neighborhoods for 10K residents and eventually build a full car-free city.

The total value of US residential real estate was $47.5 trillion at the end of 2023. Although it’s unlikely to capture a substantial amount of this in the near term, if Culdesac is able to successfully scale, considering the degree of reported demand for walkable neighborhoods it may one day be able to address a substantial portion of the US residential real estate market.

Competition

From Culdesac’s perspective, if walkable mini-cities see success early on, municipalities and cities without such neighborhoods may openly welcome more in the future. If more cities join, new infrastructure will be built for bikes, pedestrians, and public transit instead of cars, benefitting Culdesac residents and preparing land for additional neighborhoods. Ryan Johnson believes there is no supply shortage for land to build these communities, and as such, “competing” startup cities or carless communities may initially be positive-sum competitors.

Bleutech Park, located outside Las Vegas, is building a “$7.5 billion energy-efficient mini-city” with “net-zero buildings, artificial intelligence, robotics, and renewable energy sources.” The project is focused on achieving net-zero carbon emissions and occupies a large 210-acre plot of land secured in 2019. In 2021, it secured a partnership with Siemens Advanta, an IoT consultancy that will help develop a master plan for the city infrastructure.

Source: Sunday World

On Roatán in Honduras, Próspera broke ground on a sustainable, car-free development in 2020, taking advantage of a Honduran law that allows corporations to set up special economic zones with their own governance system. By 2025, Próspera seeks to house 10K residents, appealing mostly to Honduran professionals and remote workers. To join the community, Hondurans would pay a $260 membership fee while foreigners would pay $1.3K, and sign a social contract that obtains an agreement from residents that they would abide by Próspera governance systems.

In the Mediterranean, a company named Bluebook Cities aims to stand up as an “internet-native” city that is backed by Peter Thiel. This city is part of a project called Praxis, an online community that eventually aims to build an autonomous state for 10K people with a decentralized crypto economy. The founders, Dryden Brown and Charlie Callinan, set up Praxis according to the perspective that existing cities lack shared values. As of 2024, over 2K people and 146 companies had joined the city. Praxis raised a $15 million Series A in 2022 led by Paradigm Capital, with Alameda Research, Robot Ventures, and Apollo Projects.

Finally, in Saudi Arabia, a car-free linear smart city funded by Crown Prince Mohammed bin Salman has been under construction, though with setbacks. Called the Line, the city is a $1.5 trillion development project that had initial ambitions to cover a 170 km stretch of desert land and house 1.5 million people by 2030. However, budget overages and frequent turnover of staff has led to the scale-down of the project, which is now expected to be 2.4 km long and house 300K people by 2030. The Line is part of the Crown Prince’s wider Neom project to diversify the oil-dependent economy and build an industrial city built on the most recent advanced technologies.

Business Model

Culdesac Tempe launched in November 2023 with over 50 residents. As of July 2024, there were 225 residents on site. Each resident pays monthly rent. Apartments come in multiple sizes and prices: studios from $1.3K, one-bedroom units from $1.4K, two-bedroom units from $2.1K, and three-bedroom units from $2.9K.

Discounted transportation and access to local businesses are key features of the offering to live in Tempe. Culdesac has partners across mobility companies. This includes Lyft, Bird, Envoy, Lectric Bikes, Archer’s Bikes, and Valley Metro Rail, which together provide a mobility package of up to $3K per year in value to residents. Its partners also include restaurants like Cocina Chiwas. While the full leasing price of these spaces is not disclosed, it is noted that 30% of all retail and light industrial spaces are offered at an affordable rate for small businesses.

In October 2020, Culdesac had planned to scale its business by expanding its offering to other locations, including Denver, Washington, Dallas, Atlanta, and Raleigh, North Carolina. As of December 2023, the company had discussed progress on plans to expand to Mesa and Atlanta but was no longer commenting on any other expansion plans. It opened pre-sales for an Atlanta location listed on its website starting in August 2024, which it describes as “Brand-new one-bedroom townhomes for sale starting in the $190Ks”.

Culdesac’s stated goal has been to target locations that were reachable from a central business district, proximate to existing transit, and offered a favorable regulatory environment that enables car-free development.

While the basic concepts underlying the design choices at Tempe will be carried forward to other projects, just how car-light these new projects can be will depend on regulations and accessibility to regional rail lines. These different neighborhoods are expected to operate as franchises under the Culdesac brand. Culdesac will serve as the developer and property manager of all projects, using venture capital, debt, and equity to finance projects. For example, Culdesac Tempe was supported by $17 million in venture capital from Khosla Ventures, Zigg Capital, and Initialized Capital and partnered with real estate investment firm, Encore Capital, to raise $170 million in equity needed for construction.

Down the line, Culdesac is also interested in building larger projects. In April 2024, Culdesac signed a memorandum of understanding with Mesa, a city in Arizona less than a 13-minute train ride away from Tempe, to build 1K new residential units on 25 acres of land. In July 2024, Tempe received a $16 million federal grant to expand its streetcar from Tempe to Mesa, creating an opportunity to expand its footprint via interconnected and larger projects.

Traction

Source: LinkedIn

Culdesac Tempe has been increasing its occupancy, with 225 residents and 13 local businesses as of July 2024. It has also been moving into new markets and new locations, such as downtown Mesa and Atlanta. As Culdesac Tempe continues to grow and demonstrate the financial payoff of such projects, it will likely become easier to propose further projects and generate wider developer interest.

As of 2023, John Zimmer, co-founder of Lyft, and Megan Meyer Toolson, President of Opendoor, had joined Culdesac’s board. They joined Evan Moore, who had previously served as VP of Product at Opendoor.

Valuation

In January 2022, Culdesac raised a $30 million Series A from Khosla Ventures to increase hiring and continue progress on Culdesac Tempe. Other notable investors across Culdesac’s funding rounds include Founders Fund, LENx (Lennar's venture investing arm), Byers Capital, Zigg Capital, Initialized Capital, and Bessemer Venture Partners. As of September 2024, the company had raised a total of $40 million in funding.

Key Opportunities

Partnerships with Local Governments

As people move to more walkable cities, they are likely to favor cities with reliable public transit. Culdesac can open new markets and secure favorable real estate for walkable neighborhoods by building relationships with local governments. If Culdesac Tempe successfully attracts additional residents, other cities may be interested in partnering with Culdesac to build their own walkable neighborhoods.

Through such municipal partnerships, Culdesac may gain access to various resources, such as funding, grants, and technical assistance, to help them build and maintain their car-free neighborhood. Local governments could also provide regulatory support to Culdesac by creating favorable zoning and land use policies that support car-free neighborhoods and sustainable transportation options.

Positive Branding for Walkable Cities

Most walkable neighborhoods are too expensive for the average American. As of January 2023, there were only six markets, primarily in older cities with established walkable neighborhoods, where it was found that living in walkable urban places was more affordable than car-centric suburban areas. These markets included Baltimore, Cincinnati, Cleveland, Detroit, St. Louis, and Philadelphia. However, these cities have experienced significant economic challenges, including job loss and gun violence, making them largely unattractive for many people including Culdesac’s target customers.

Federal Investments in Infrastructure

The Biden Administration passed the Bipartisan Infrastructure Law in 2021, with plans to invest $550 billion in new transportation and infrastructure up until 2026. $286 billion has been set aside for improving surface transportation networks while $76 billion has been dedicated to clean energy-related initiatives including EV infrastructure. As of January 2023, 40% of the total BIL clean-energy funding had been launched.

These public investments will improve public transportation across America, opening up new potential sites where Culdesac could build in the future and creating momentum for improved mobility in line with Culdesac’s company goals. In fact, Tempe received a $16 million federal grant in July 2024 to extend its local streetcar service, which will run by Tempe Culdesac and expand transportation options for residents.

Key Risks

Return-to-Office

As the COVID-19 pandemic work-from-home mandates end, workers may be forced back to large cities where many companies are headquartered. The supply of remote job offerings has been decreasing, with 91% of Fortune 100 employees subject to be fully in-office or hybrid. In a series of 2023 surveys, nearly 90% of workers want to work in a flexible or remote environment, but 50% of leaders are demanding employees start coming into the office again, indicating that the daily commute will remain a part of US life. Culdesac’s value proposition depends on buying land where people can work and live without a car, but those types of land purchases are not practical in areas like San Francisco and New York. Culdesac's addressable market may decrease if even more employers require employees to return to the office.

Consumer Interest

While consumer desire for sustainability seems strong, the argument continues over whether consumers are willing to make life changes to achieve more sustainable outcomes. Culdesac claims that 52% of Americans want to live in walkable cities but don’t due to uncontrollable factors like high costs. But the high friction imposed by significant life changes like moving may also contribute.

A car-free lifestyle may also remain a tough sell to the American consumer — J.H. Crawford, Author of Carfee Cities, said, “If you propose [living car-free] to the average American, the response is: if you take my car away from me, I will die.” During the pandemic, surveys showed a housing shift to large homes in remote areas with space to build at lower costs. Culdesac is proposing a new way of life, which it believes is better, but which may have arrived before a critical mass of demand emerges.

Regulatory & Funding Hurdles

Culdesac requires large amounts of real estate capital from investors and special permission from cities to build neighborhoods. Culdesac Tempe raised $200 million in real estate capital to finance the project. Continuous growth in its occupancy is essential as future investors base investment decisions on the ROI from Culdesac Tempe.

From a regulatory perspective, most big cities have laws requiring apartments to provide some pre-determined ratio of residential parking spaces to residents before approving the project. In Tempe, Culdesac was granted special permission to remove all parking from blueprints, agreeing that no residents would park near the neighborhood. Other cities may not grant such permission, complicating plans for Culdesac. For example, its project in Atlanta may require a parking deck and on-street parking to be a car-light development rather than a car-free one. Regulatory challenges pose a key obstacle to scaling Culdesac’s model, but the company’s regulatory prowess may also prove to be a competitive advantage in the long run. The fact that Culdesac Tempe’s model is not directly replicable due to these local regulatory hurdles may also delay development timelines.

Summary

Culdesac is operating in a largely untouched market with few competitors. It launched Culdesac Tempe, the first car-free neighborhood in the US in 2023, and has plans to expand into new markets and sites including Mesa and Atlanta. The Culdesac team believes that living car-free provides a higher quality of life than many Americans already desire. Future success is largely dependent on whether this bears out once the product has hit the market and whether enough Americans are truly willing to get rid of their personal vehicles in exchange for the potential of a stronger community, less environmental impact, and reduced traffic.