Thesis

American companies spend an average of ~$4K and 42 days filling open positions, costing employers upwards of $1 trillion in talent management expenses annually as of 2019. The average turnover rate for wage-earning workers in the US was around 47% in 2023, but financially stressed workers are twice as likely to look for a new job. One source of financial stress comes from how companies normally process their cash flow. Most firms balance operating expenses on a two- to four-week schedule, meaning employees typically receive their paycheck every two or four weeks.

This means that American wage-earning workers, who earned a median wage of just $220 per day in 2023, cannot always access their earned wages when they may need them. As a result, almost half of Gen Z and Millennial workers in 2022 were living paycheck to paycheck and worrying they wouldn’t be able to cover their expenses from one pay period to the next. Facing this predicament, some draw down their account balances, which risks overdrafts and low balance fees. Others may tap high-interest lending, such as credit cards (20% APR). In 2023, an estimated 12 million Americans will borrow against their future paycheck through payday lenders (400%–600% APR).

DailyPay is an “earned wage access,” or EWA provider. Rather than extending credit against a worker’s paycheck, DailyPay charges workers a small fee to access their earned wages whenever they need them. This payment flexibility reduces the financial stress experienced by workers while helping employers attract and retain talent and reduce their costs on sourcing and training replacements. With its low transfer fees and simple integrations with major HR management software providers, such as Workday and Oracle, DailyPay has become a meaningful leader in EWA payment volume.

Founding Story

DailyPay was founded by Jason Lee (former CEO) and Rob Law (former CTO) in 2015. Shortly before founding DailyPay, Lee visited a restaurant chain owned by a friend. Surprised that he couldn’t order food from the restaurant through a popular New York City online food delivery app, he asked his friend why this wasn’t possible.

In the discussion that followed, Lee learned that restaurants dealt with inconsistencies in pay schedules, payroll, and payments that created problems for the business. He was also aware that many Americans live paycheck to paycheck with little savings to draw on. This led him to decide on an idea for a company that could help remedy these problems. Having previously spent two decades on Wall Street, Lee partnered with Rob Law, the founding engineer at ReferralExchange, to launch DailyPay with the idea that “American workers shouldn’t have to wait until payday to use, spend and save money they’ve already earned.”

In 2022, UK-based neobank Chime offered to buy DailyPay for $2 billion. But when the company’s board rejected this deal, Lee and Law left DailyPay. In June 2022, Lee was replaced as CEO by Kevin Coop, who formerly led Dun & Bradstreet’s North American operations. Since leaving DailyPay, former founders Lee and Law continued working on wage access and founded Salt Labs.

Product

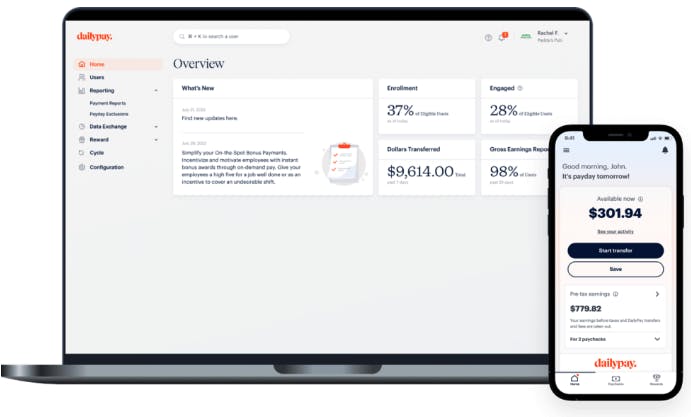

DailyPay

Source: DailyPay

DailyPay’s primary product is a web-based platform and smartphone app that allows workers to collect unpaid wages before their scheduled pay period, a service commonly known as “earned wage access” (EWA). Employers partnering with DailyPay can make use of DailyPay’s 180+ payroll or timekeeping integrations to their existing workforce management software.

Workers elect when to transfer funds to the account of their choice — instantly for a small, ATM-like fee, or in 1-3 business days for free. Workers can transfer their earned wages up to five times each day or up to $1K. The employee interacts with DailyPay via a digital wallet that functions as a “financial wellness” tool to improve access to funds and incentivize savings. Formerly known as PayEx, the digital wallet integrates directly into the employer’s existing payroll system and can be customized by each employer.

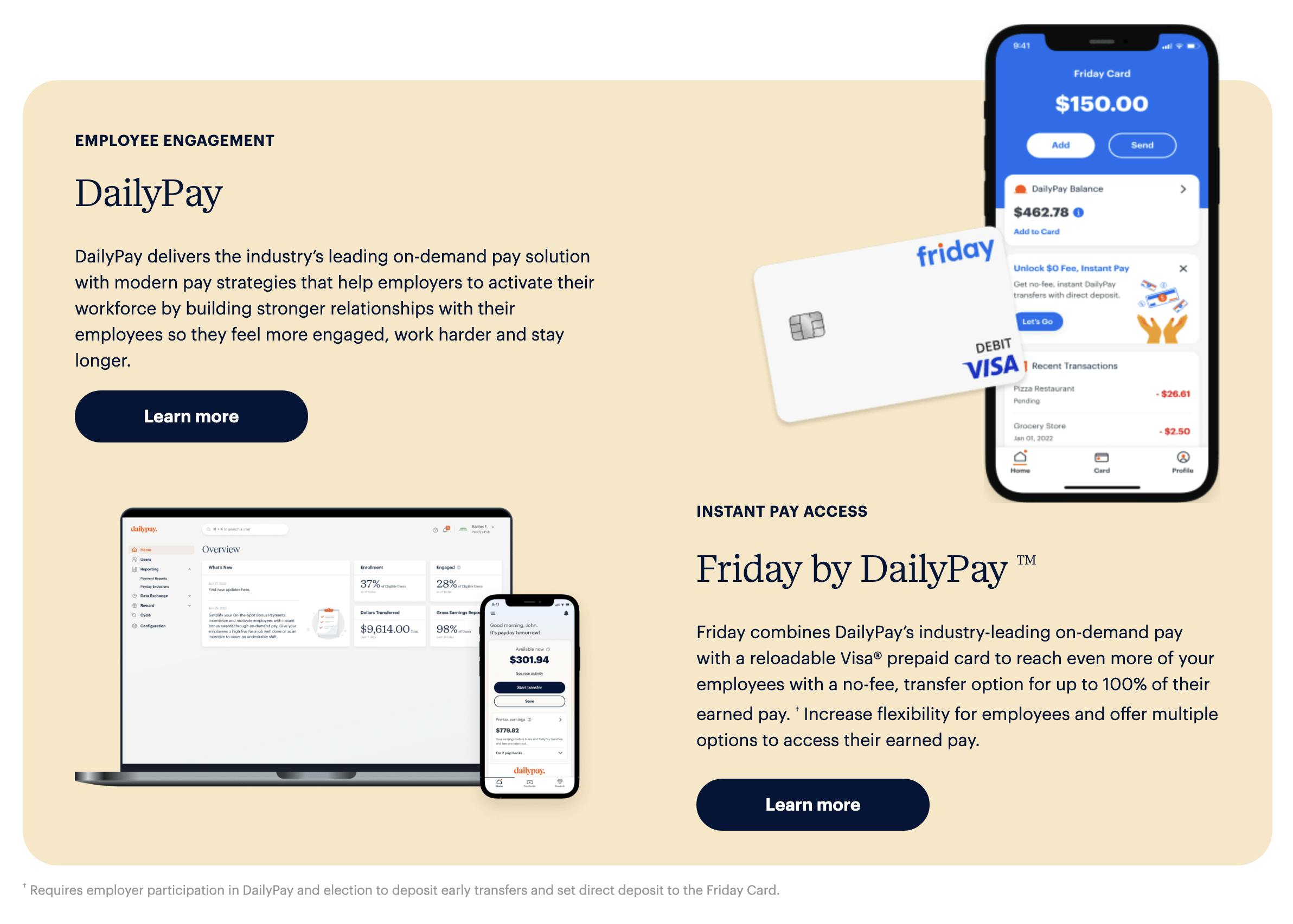

Friday by DailyPay

Source: DailyPay

Because DailyPay is used by workers who may not have access to a bank account, the company offers an in-app account to collect earned wage transfers called Friday. Workers can elect to transfer their wages to this Visa-branded, prepaid debit card, meaning they don’t need to open their own bank accounts. DailyPay waives the fees for earned wage transfers to a Friday account and instead earns interchange fees on each transaction with the Friday card (i.e., the fee merchants pay when consumers swipe their debit and credit cards).

Reward by DailyPay

DailyPay’s Reward feature allows employers to send instant, cash-based rewards to employees, akin to a small bonus, along with a personalized message. It also allows for campaigns that automatically award employees who hit certain metrics. Citing studies that claim 52.5% of employees want immediate recognition from their managers, DailyPay therefore offers an alternative to payroll adjustments or gift cards, both of which are manual and not easily scalable. Gift cards can be awarded instantly, but are typically limited in their use. Payroll adjustments offer a record of rewards or bonuses granted, but cannot be intuitively accessed by employees. DailyPay’s digital Reward platform aims to motivate employees while keeping a reliable record for employers.

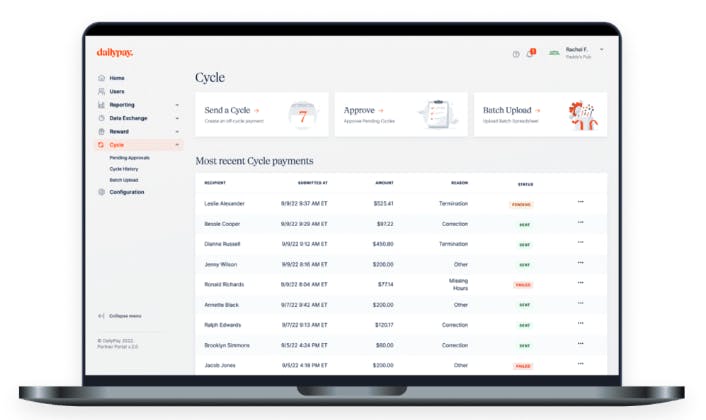

Cycle

DailyPay’s other employer-facing product is a paperless payroll process called Cycle. Expanding its in-app human capital management (HCM) capabilities, the service covers common payroll events, such as termination pay and payroll reconciliation with missing hours or other corrections.

Source: DailyPay

Market

Customer

DailyPay’s primary customers are employers of wage-based workers, such as the owner of a hotel or restaurant franchise. DailyPay integrates with the employer’s existing HCM provider, such as Viventium, Workday, or Oracle, to offer earned wage access. It also offers white-label payroll and timekeeping applications for employers, who can choose which DailyPay integrations to include in their system. The company also offers integrations with financial institutions, enabling EWA solutions such as PNC Bank’s EarnedIt product.

DailyPay does not offer direct-to-consumer wage access; instead, it works through employers, which means the company can expand vertically by targeting brands, landing franchise arrangements, and expanding to other franchise owners. Notable customers of DailyPay as of November 2023 include Kroger, Adecco, Six Flags, Dollar Tree, and HCA Healthcare.

Source: DailyPay

Partnerships with HCM providers have allowed DailyPay to expand horizontally across many industries, including healthcare, retail, restaurants, hospitality, supermarkets, call centers, and manufacturing.

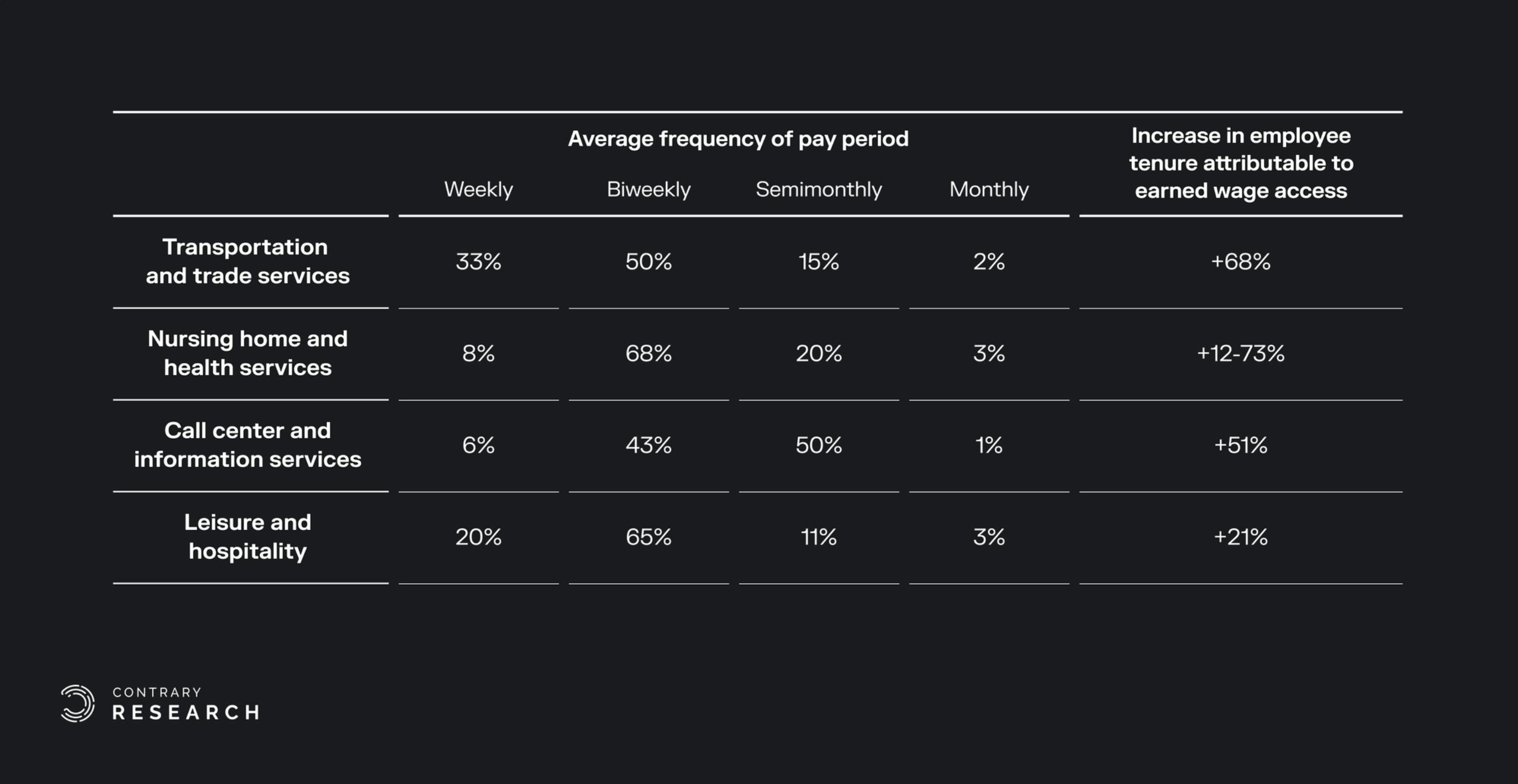

Source: Bureau of Labor Statistics; DailyPay; Contrary Research

Market Size

DailyPay hopes to provide a cheaper, more flexible alternative to payday lenders, who offer employees liquidity between paychecks but charge high interest rates, which can trap workers in unsustainable debt. The global payday loan market was estimated at $32.5 billion in 2020, with the US market claiming roughly $5 billion of this in 2021. In 2022, the Consumer Financial Protection Bureau (CFPB) estimated that 12 million Americans would reach out to payday lenders to cover recurring costs such as utilities or mortgage payments, with some paying APRs up to 400%.

Besides payday lenders, many employees use credit cards to access funds between paychecks (and sometimes to pay off higher-interest payday loans). With average interest rates around 20%, the CFPB estimates that US consumers pay $120 billion annually in credit card interest and fees, presumably higher for the 40-60% of Americans living paycheck to paycheck. EWA providers as a whole processed an estimated $9.5 billion in 2020 and raised $1.1 billion in debt and equity funding in 2021.

DailyPay targets vertical expansion in industries that can see turnover rates as high as 100%, such as fast food, retail, and call centers, while also expanding horizontally, among lower compensation employees and entry-level workers. A DailyPay-commissioned study found that 62% of employees who had access to DailyPay chose to access their earned wages every pay period or every other pay period. An estimated 77% of earned wage access users elected to receive their payments instantly as of 2021.

Source: ADP

DailyPay aims to reduce costs to employers by reducing turnover and estimates that replacing an employee can cost $4K per worker. The company also claims that increased employee satisfaction will not only save on HR costs but also improve productivity, claiming that companies with unhappy employees are 21% less profitable, and disengaged employees can cost U.S. employers up to $550 billion per year.

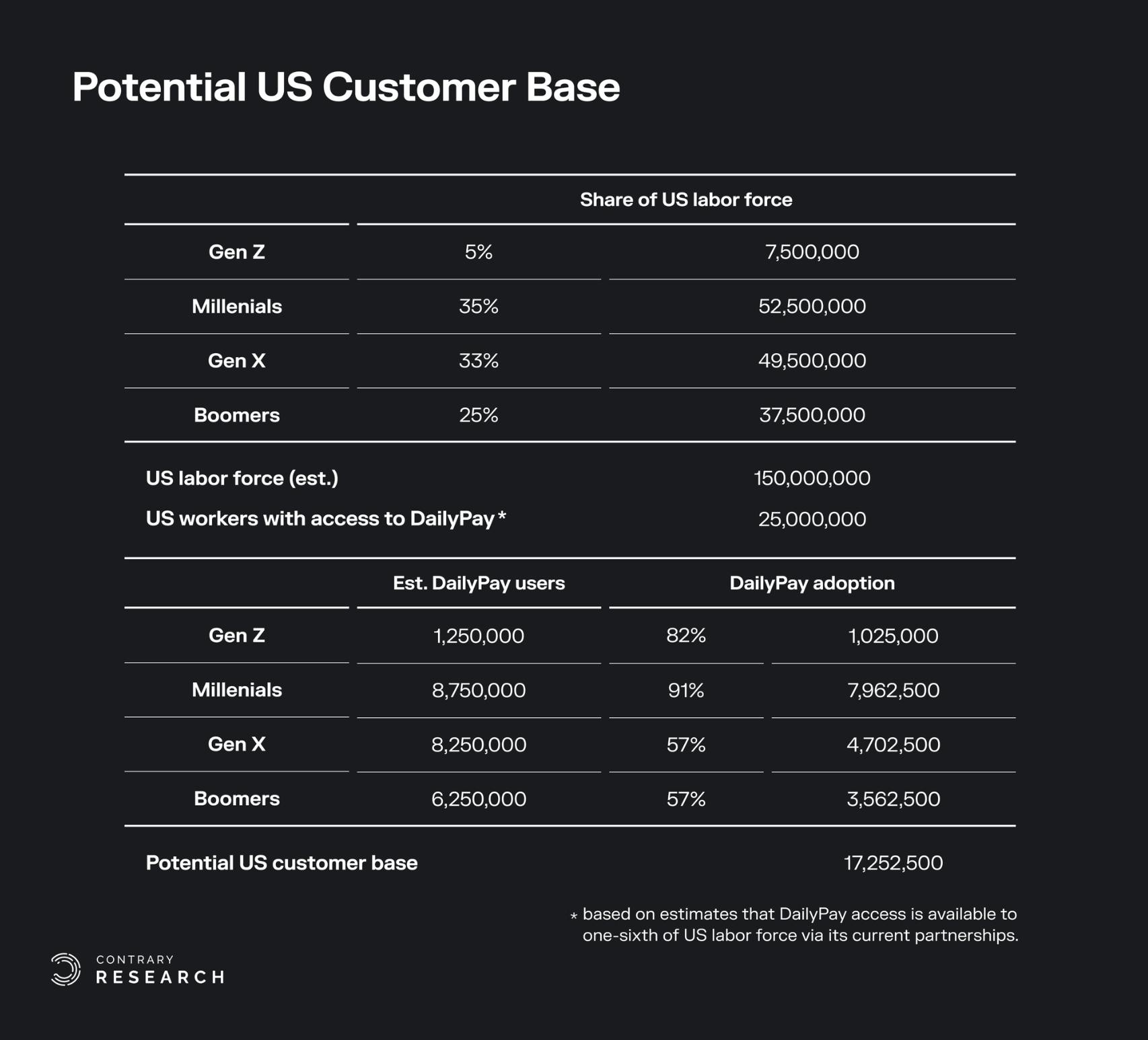

DailyPay’s horizontal partnerships with HCM providers mean that one in six American workers now have potential access to DailyPay if their employer chooses to integrate it through their existing HCM. If employed Americans number around 150 million, this would indicate a potential addressable market of 25 million US workers. However, by DailyPay’s own statistics, younger workers are more likely to adopt and use earned wage access services than older generations, putting this figure closer to 17.2 million US workers. Rob Nardelli, DailyPay’s head of business development, said in April 2023 that the company covered just 3% of the market, suggesting it has room to grow.

Sources: Bureau of Labor Statistics, LiveCareer, DailyPay, Fiserv, Contrary Research

Competition

Instant Financial

Instant Financial was founded in 2015. Like DailyPay, it also hopes to replace paychecks and direct deposits to increase employee satisfaction and retention. Unlike DailyPay or Wagestream, Instant Financial doesn’t charge employees for its services. Instead, it earns revenue from the interchange fees collected when employees use related spending cards.

Besides Instant Pay, the company’s basic earned wage access tool, Instant also offers capabilities for collecting and distributing tips to workers. Unique among EWA providers, Instant specifically targets delivery truck drivers, offering simple travel reimbursement. In 2021, there were roughly 1.6 million delivery truck drivers earning a median of $36K per year, and the field appears to be growing. The Georgia-based company has raised a total of $28 million in funding as of November 2023.

Payactiv

Payactiv was founded in 2011. It offers EWA, a digital wallet, a spending card for employees, and a payroll card for employers. Employees benefit from financial planning tools backed by AI and machine learning, helping them save, budget, and efficiently manage their wages. Like Instant Financial, Payactiv also offers tips and travel reimbursement capabilities.

Payactiv charges $0.99 for next-day transfers and $1.99 for instant transfers, as well as a $1.99 fee for an ATM-like cash “pickup” service, available at Walmart (the company used to charge a $1.00 “access fee” on the day the user accessed the platform, but waived this in 2022). As of 2019, over 380K of Walmart’s 1.4 million employees used Payactiv. Payactiv has processed over $1 billion for 650K users, claiming to have saved workers over $120 million in overdraft and interest fees. Founded three years before DailyPay, Payactiv has raised $133.7 million in funding as of November 2023. Its $100 million Series C in August 2020 valued the company at over $500 million.

ZayZoon

Canada’s ZayZoon, founded in 2014, charges employees $5.00 per pay period to access their wages, up to $200 in a pay period. Like DailyPay, employers can choose to cover this charge or transfer their wages to a ZayZoon-branded Visa card, which eliminates the $5.00 fee since ZayZoon earns interchange instead.

The company has had some success with its ZayZoon Boost, a service that pays a bit more than the workers’ earned wages if the worker elects to receive wages in the form of gift cards for gas, groceries, or retail. ZayZoon claims 3K business partners, including Sonic, McDonald’s, Domino’s, and Hilton. Zayzoon has raised a total of $75 million in funding as of November 2023, having raised a $34.5 million Series B in September 2023.

Wagestream

Based in London and founded in 2018, Wagestream lets employees tap a portion of their income any given month for a small, flat fee ($2.99 per instant transaction) or for free for next-day payments. Employers pay Wagestream between $0.50 cents $2 per employee for its service; they also have the option to cover the employee’s fees, but only 15% do. Wagestream has been active in the UK, Ireland, Spain, Canada, and Australia and entered the US market in June 2022, which it sees as its biggest growth market.

As of 2022, Wagestream reported partnerships with 100 US employers covering 300K workers. Globally it has 300 employers covering 1 million workers. Wagestream bills itself as a “financial wellbeing app” and differentiates itself with an optional employee savings account paying 5% interest, but the CEO reported that only about a third of its customers paid for this option as of 2022. Wagestream benefits from a social purpose corporate charter and has raised $258 million in debt and equity, but hasn’t disclosed its valuation.

Rain

Like DailyPay, Rain, which was founded in 2019, integrates with employers’ payroll systems to offer EWA, charging employees around $3.00 per transfer. Since its launch, Rain distributed over $150 million in wage advances to employees at McDonald's, Applebee’s, Taco Bell, Marriott, and Hilton by March 2023. For context, EWA providers collectively processed an estimated $9.5 billion in 2020 alone. Rain has raised $128.6 million in total funding, with a $116 million Series B ($66 million in equity and $50 million in debt) that valued the company at $250 million.

Business Model

Earned wage access providers integrate with human capital management (HCM) platforms (e.g., Workday), and many also provide employees access through a pay card or neobank, generating revenue through a combination of fees on wage withdrawals and interchange on card purchases. Some EWA companies advance pay to employees directly, usually charging interest on advances.

DailyPay integrates with HCM providers and generates revenue off of transaction fees. After paying for the initial integration, there is no cost to employers. Instead, DailyPay charges employees a “small ATM-like fee” of $3.49 for immediate transfers, with a free option for 1-3 business day transfers. This per-transaction fee model contrasts with some of DailyPay’s competitors, such as Even, who charge employees a subscription fee for regular pay access. DailyPay also earns interchange off of its Friday debit card and waives the earned wage transfer fee if employees transfer to this card.

Traction

Through its partnerships with major HCM providers, DailyPay’s product covered 500K workers as of 2020, which had increased to 2 million employees by November 2023. In addition to its numerous brand partnerships, DailyPay has engaged PNC Bank and TD Bank, further expanding the share of the US population with access to its earned wage access tools. Payments are processed through The Clearing House (TCH) network in the US, and DailyPay was the network’s second-largest user behind PayPal as of April 2023.

One of DailyPay’s selling points is improving workers’ financial well-being by offering an alternative to expensive wage access. DailyPay claims that 95% of users who were previously reliant on payday loans either stopped using payday loans or reduced use after DailyPay, with the majority (88%) attributing this change to DailyPay’s features, saving them an estimated $624—$930 each.

The company commissioned a survey in 2022 that found its services increased quality of work by 19% and improved productivity 3x. Meanwhile, 67% of employees say DailyPay helps them reduce financial stress, and another 77% say it helps them save money by avoiding costly alternatives such as payday lending. Among employers, 96% of those who offer on-demand pay say it helps them attract talent, while 52% of employees say their opinion of their employer improved after using DailyPay.

Valuation

DailyPay raised a $175 million Series D led by Carrick Capital Partners in May 2021 which accompanied a raise of $325 million in debt funding for a total of $500 million. The company has raised a combined total of $1.1 billion in debt and equity funding as of November 2023. DailyPay reportedly refused a $2 billion offer from UK-based fintech, Chime, in 2022.

Key Opportunities

Partnerships

Based on DailyPay’s existing partnerships, an estimated one-sixth of Americans have potential access to the company’s earned wage access tools. DailyPay’s horizontal integration, which allows the provider to tap any of the industries covered by its HCM partners, means it could address a much larger market than, for example, its direct-to-consumer competitors. In 2022, 82% of surveyed employers with greater than 1K employees who did not already offer EWA said they were interested in adopting it, suggesting DailyPay has room to grow within its addressable market.

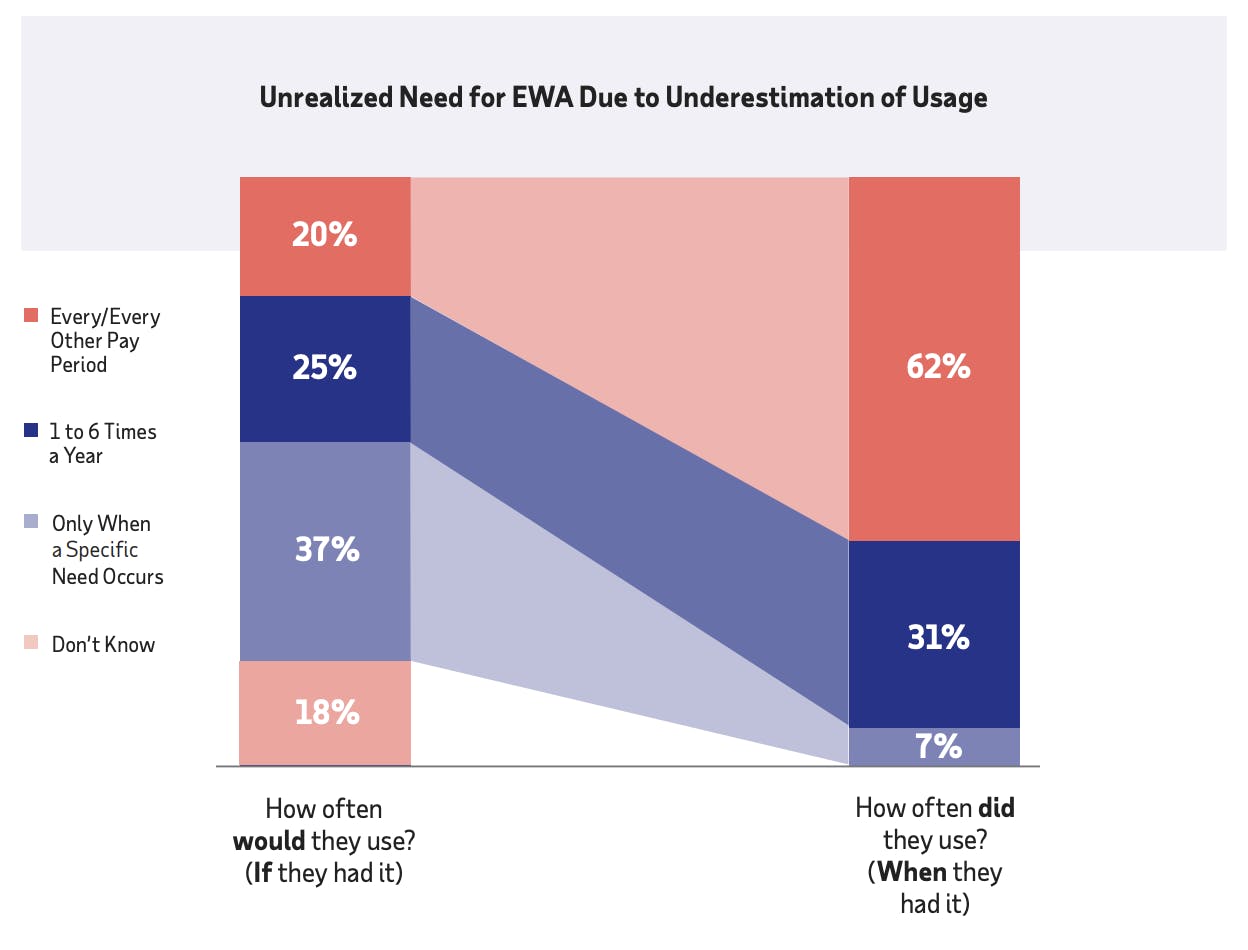

Volume Advantage

DailyPay was the “global leader” in EWA volume as of April 2023 and the second largest user of the TCH payments network, with its employee transfers claiming one in 10 real-time payments. This is partly reflected by statistics suggesting the actual rates of EWA use exceed the expectations of interested users. According to a 2022 survey, 37% of employees who do not have access to EWA estimated they would request an early payment only when a specific need occurred and only 20% suggested they might use it every pay period or every other pay period. Yet in practice, the majority of employees (62%) who have access to EWA indicated they request early access every or every other pay period, and only 7% indicated that they used EWA only when a specific need occurred.

Acquisition by Neobank

As EWA providers compete with expanded, low-cost service offerings, these platforms — some of them complete with debit cards and savings accounts — have begun to resemble digital neobanks. However, it is more likely that a bank or neobank would purchase an EWA provider for its on-demand pay functionality than EWAs successfully completing this transition. The increase in on-demand payments also increases the incentive for smaller banks to tap into TCH capabilities since it offers another revenue stream for banks. On the other hand, if demand for EWA increases enough, it’s possible that employers may start making faster payments directly to employees, foregoing intermediaries like DailyPay.

Key Risks

Limits to Adoption

Despite DailyPay’s purported benefits, integrating its capabilities into a company’s existing processes involves startup and maintenance costs that may limit the adoption it expects among its major brand partnerships. For example, a 2022 study found that roughly 60% of millennials claim they would prioritize a job offer with earned wage access, but the same survey indicated that many employers were concerned about compliance, cost, and implementation.

Specifically, earned wage access requires implementation, upgrading maintenance support, employee support and education, and usage fees (for instance, covering employees’ transfer costs, if applicable). Besides these hard costs, there are support costs for HR and IT, as well as potential regulatory and compliance costs, since wage and hour laws may vary widely by state. These hurdles may place a limit on the number of companies willing to adopt EWA.

Crowded Market

EWA is a crowded market, with little differentiation among competitors on price or service, and more competitors continue to enter and offer lower pricing New entrants competing on access pricing may make transfer fee revenue less reliable. The result may be a race for expanded services as each EWA provider attempts comprehensive neobanking, resembling such players as Alipay in China or N26 in Europe.

Regulatory Risks

Protecting workers is a regulatory priority for state legislatures and the Consumer Financial Protection Bureau (CFPB) in Washington, DC. Regulators are more likely to scrutinize those companies that cater directly to employees, whereas DailyPay and its major competitors work through employers, and therefore operate under the so-called wage-assignment laws. For instance, the US Government Accountability Office recommended the CFPB clarify whether earned wage access counts as “credit” under the Truth in Lending Act, and under what conditions. If EWA providers are found to be ”credit providers,” that would make the service subject to closer oversight and stricter rules.

A separate but related concern is that earned wage access leads workers to spend more and actually corrupts their financial well-being. Earnin, which extends advances more credit-like than DailyPay’s EWA model, settled a lawsuit in March 2021 that accused the company of causing more than 250K workers to incur the overdraft and other fees that it promised to help them avoid. DailyPay could be at risk for something similar.

Summary

DailyPay is an earned wage access provider that allows workers in a range of industries to access their pay more frequently than their currently scheduled paychecks, which are usually distributed once or twice a month. Accessing these funds as needed may improve workers’ overall financial well-being, thereby improving their productivity and satisfaction with their employer. Employers may find it easier to attract and retain employees if they can access their wages as needed.

These concerns are important to DailyPay’s primary customers, who are wage-earning service workers. For the 40-60% of workers living paycheck to paycheck, just $100 fewer in savings can make families more likely to pursue predatory lending and forgo utility bill payments, one 2020 study showed; an estimated one in five families in the US has less than two weeks of liquid savings. A report from the Economic Policy Institute found that, as of June 2022, 14% of gig workers in the US earned less than the federal minimum wage and that 26% earned less than $10 per hour.

DailyPay reports that 48% of employees say they are more motivated to remain with their current employer because they offer on-demand pay. The company also claims that employees who can track their hours and earnings in real time, and who have instant access to their earned pay, are more motivated and productive at work. There is increased regulatory scrutiny over EWA providers, but its fees provide a fair, less expensive to predatory payday loans or paycheck cash advances. DailyPay’s market advantage, as well as its large partnerships with major brands and financial institutions, positions it well in a growing but highly competitive market.