Thesis

Design is increasingly becoming a driver of business and product strategy in organizations of all kinds. As of 2023, 79% of business leaders actively involved in app or website design expected better design processes to have a significant benefit to end customers. However, 58% of them reported encountering barriers such as a lack of alignment, siloed teams, and lengthy development cycles during the digital product design process.

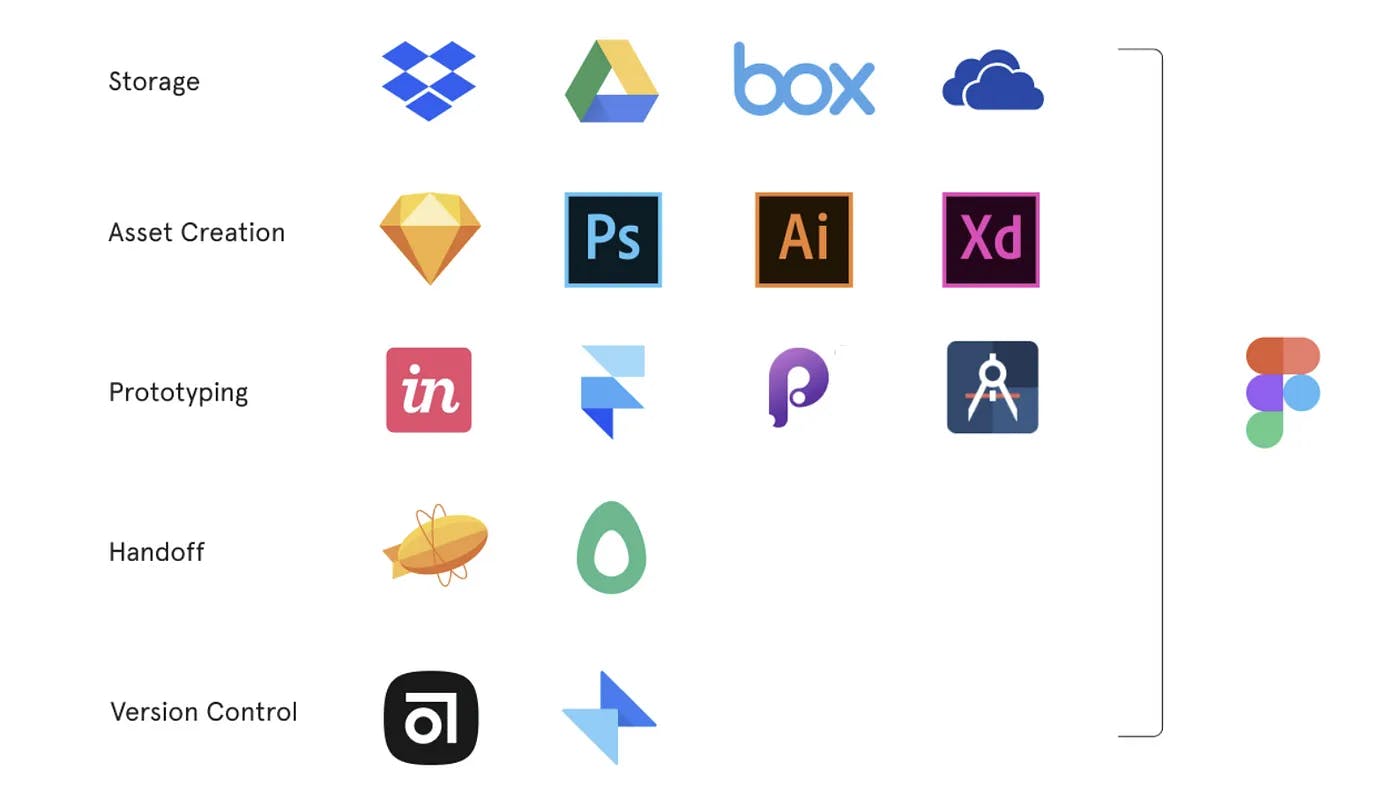

The evolution of digital design in the 2010s was influenced by the advent of mobile devices. Early options for user interface design included Adobe Photoshop, a legacy raster graphics editor. However, this proved to be inefficient because, unlike print graphics, digital graphics need to be displayed on screens of varying sizes. While the advent of software like Sketch marked a new era of design tool innovation in 2010, designers in this period still had to use an array of tools to handle individual parts to create a UI flow, such as prototyping, version control, and developer handoff. Since they were desktop-based, these tools were not conducive to collaboration.

Figma is a cloud-based design tool that offers collaborative features, facilitating real-time work on user interface designs. It provides a variety of tools for creating UI flows, wireframes, and interactive prototypes, with support for vector graphics and responsive design principles. Figma's cross-platform compatibility makes it accessible across different operating systems, including Windows, macOS, and Linux. As of October 2025, Figma’s customers include notable companies like Airbnb, Microsoft, and Netflix.

Founding Story

Figma was founded in 2012 by Dylan Field (CEO) and Evan Wallace. The two met at Brown University, where Field was studying computer science and Wallace was his friend and TA. Field interned at LinkedIn in 2010 and Flipboard in 2011 and 2012, working on data analysis, product design, and software engineering projects. He also led Brown’s Computer Science Department Undergraduate Group. Wallace had prior engineering experience at Pixar and Microsoft.

Field applied for and received the Thiel Fellowship in 2012. Despite a lack of mechanical engineering background, the original idea with which he applied was for a drone company. Field stated in his application that:

“The prospect of using UAVs in civilian settings faces three limiting factors: software, battery life and the FAA…I am going to change the world by creating better software for UAVs. After I finish at Flipboard, I will cofound a company with the smartest programmer I know and work on this problem.”

In 2011, a JavaScript API called WebQL was launched, which made it possible to render high-performance 2D and 3D graphics in a web browser. Wallace, who had previously worked on building and programming drones, convinced Field to move away from the plan and work on WebQL-related products instead. According to Field, the primary reasons that Wallace used to convince him to move away from drones included the fact hardware involved long debug cycles, that drones were a space with regulatory risk, and that many drone product ideas implied potential violations of privacy.

The duo therefore pivoted to the idea of having real-time graphics in a browser, which was inspired by a 3D demo of a ball floating in water that Wallace had built previously. Field and Wallace extended the idea and experimented with building a “Photoshop in the browser”, incorporating tools such as poisson blending, image cutting, and a photo editor into a consumer application. In this initial period, the team received a negative response from an investor in a potential seed round who passed due to a perceived lack of focus, telling them, “I just don’t think you know what you’re doing yet.”

In response, the team decided to focus on interface design, removing other features such as animation, photo editing, and 3D design from the product scope. They coalesced around a new vision which remains Figma’s focus: “to make design accessible to all”. Since graphic processing capability had become possible on the web, Figma chose to build a web-based product. In 2013, Field and Wallace raised a $3.9 million seed round led by Index Ventures. They used this round to grow the team to 18 employees, at which point they raised a $14 million Series A led by Greylock Partners. Figma launched a closed beta product in 2015 after this Series A, and then publicly released its flagship design editor product in 2016.

To attract users, Figma initially focused on individual designers, trying to get them on board for side projects even before they incorporated the software into their daily work. The product was initially free, only adding a paid tier two years after its launch. As Claire Butler, Figma’s first marketing hire, put it:

“If folks weren’t ready to use Figma full-time in their day job, they could use Figma for free for a side project. You could use the tool in a lower-stakes way and come back to Figma repeatedly over time.”

Figma then held customer discovery chats, gathered feedback, and demoed with potential customers. Coda was the company’s first major enterprise customer.

Product

Figma Design

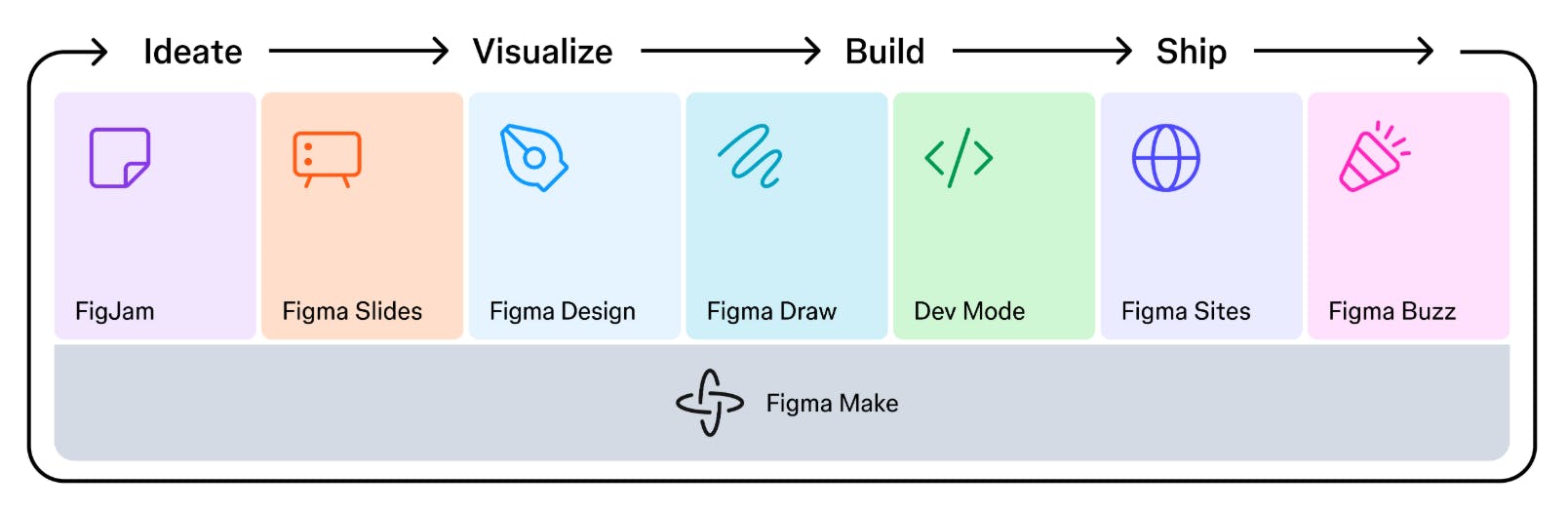

Figma Design remains the core of Figma’s product suite, serving as the foundation for its broader ecosystem, which now includes FigJam, Dev Mode, Sites, Make, Buzz, and Draw. Figma Design enables users to create, prototype, and iterate on designs in real time within a web browser, unlike traditional design software that works offline and lacks multiuser collaboration. Figma provides solutions for multiple product development tasks such as design, prototyping, developer mode, and design systems.

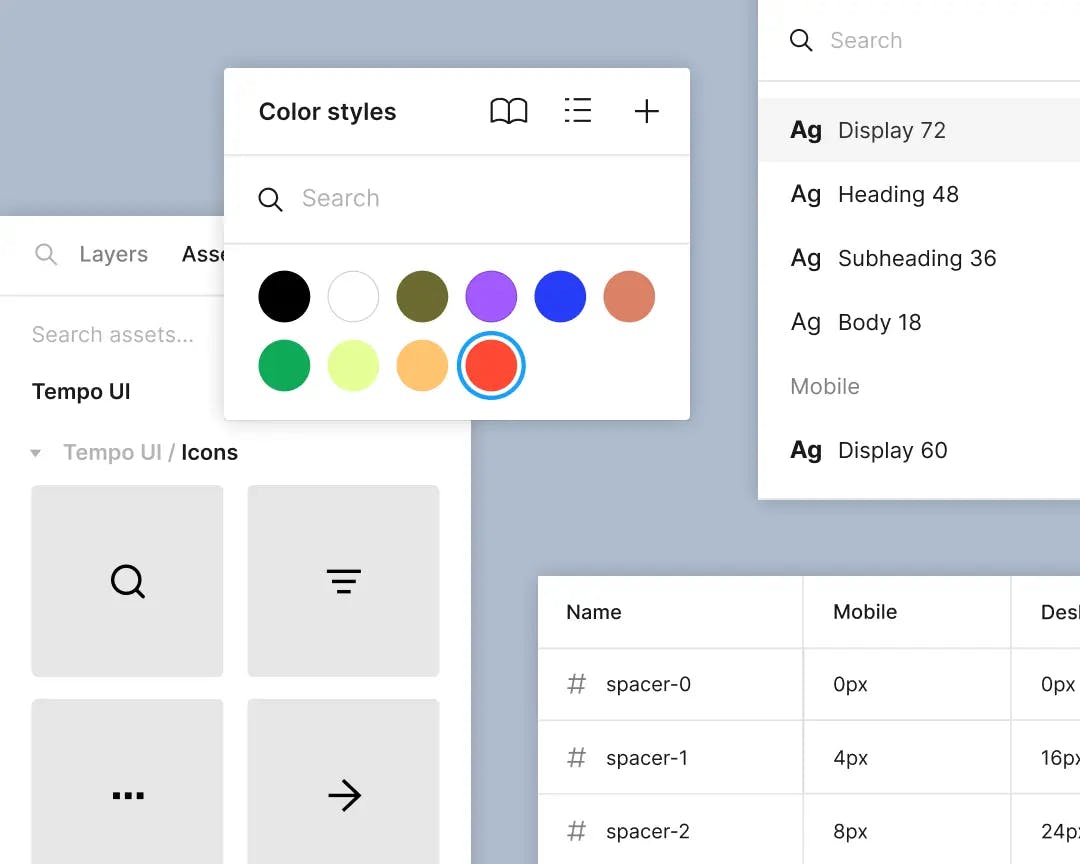

Source: Figma

Design: Figma supports creating high-fidelity mockups. Its design tool includes pre-loaded frames, or individual design panes, which serve as the basic building block for designs. These frames can then contain other frames and sections, allowing users to create complex designs while retaining coherence. Figma’s design tool also offers intelligent alignment of components through auto-layout.

Source: Figma

Like branching in code development tools, Figma also offers the ability to branch from a main design and add updates to the main design through merging. Like its other design tool competitors, Figma also offers a vector drawing tool. Users can switch between different views, such as desktop, tablet, and mobile, to ensure that their designs are responsive and optimized for various screen sizes. Figma also allows users to “Spotlight” themselves, allowing other collaborators on the file to follow each movement they make on a canvas, including things like zooming in or switching pages.

In 2025, Figma expanded its design capabilities with AI-powered image editing, including batch background removal, resolution enhancement, and model selection between Gemini 2.0 Flash and GPT Image 1. It also introduced layout improvements such as grid variables, reflow behavior, and object swapping, along with accessibility updates like keyboard canvas navigation and improved screen reader support.

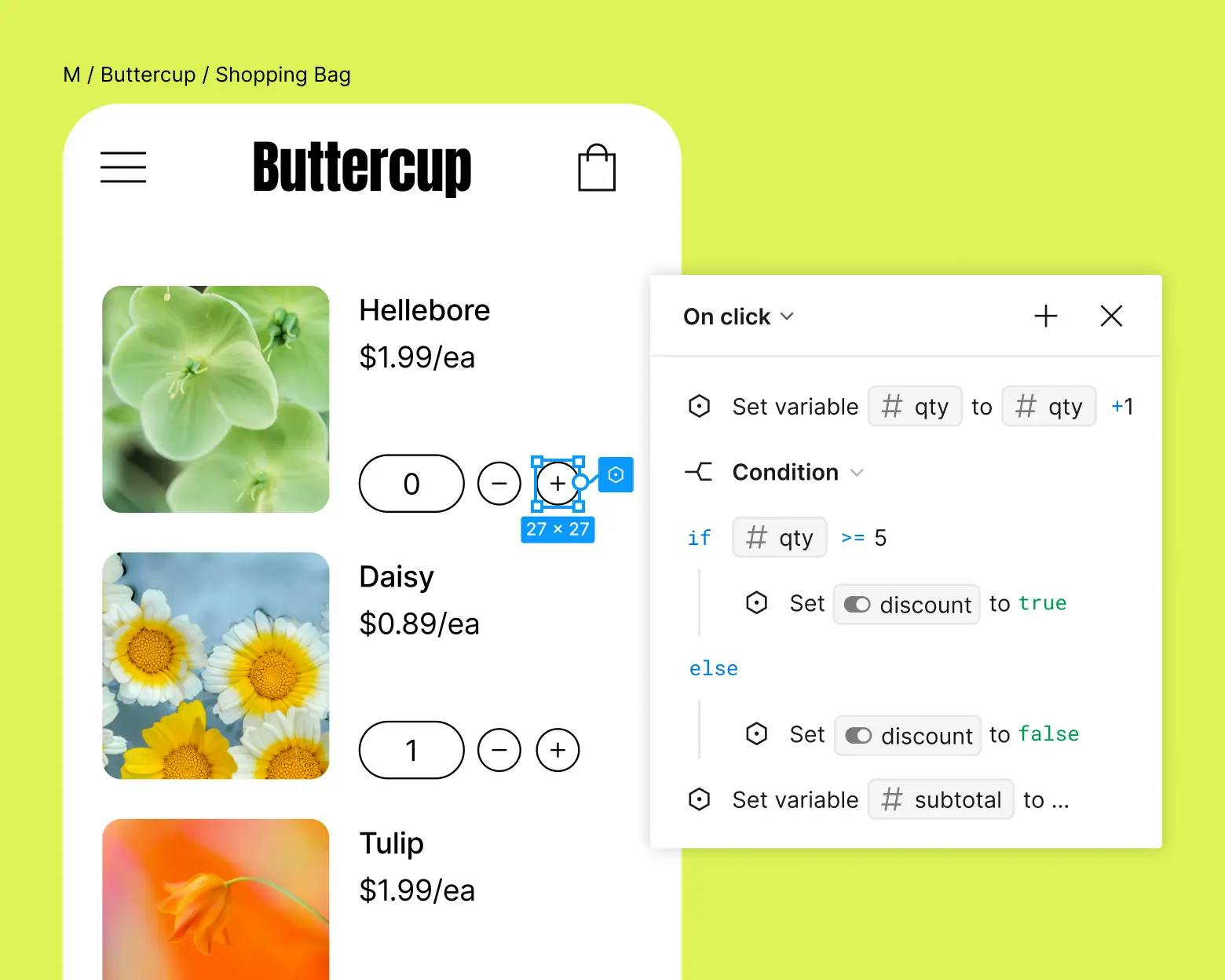

Prototyping: Users can create multiple user flows by adding connections between any two frames. They can define the trigger, such as hover, scroll, click, or double-click, at which the interaction flow is supposed to start and move to the next screen. No-code prototyping allows users to visualize interactive flows by letting them preview and play prototypes. Users can also add advanced prototyping features like conditional logic, smart animation, and dynamic layers.

Source: Figma

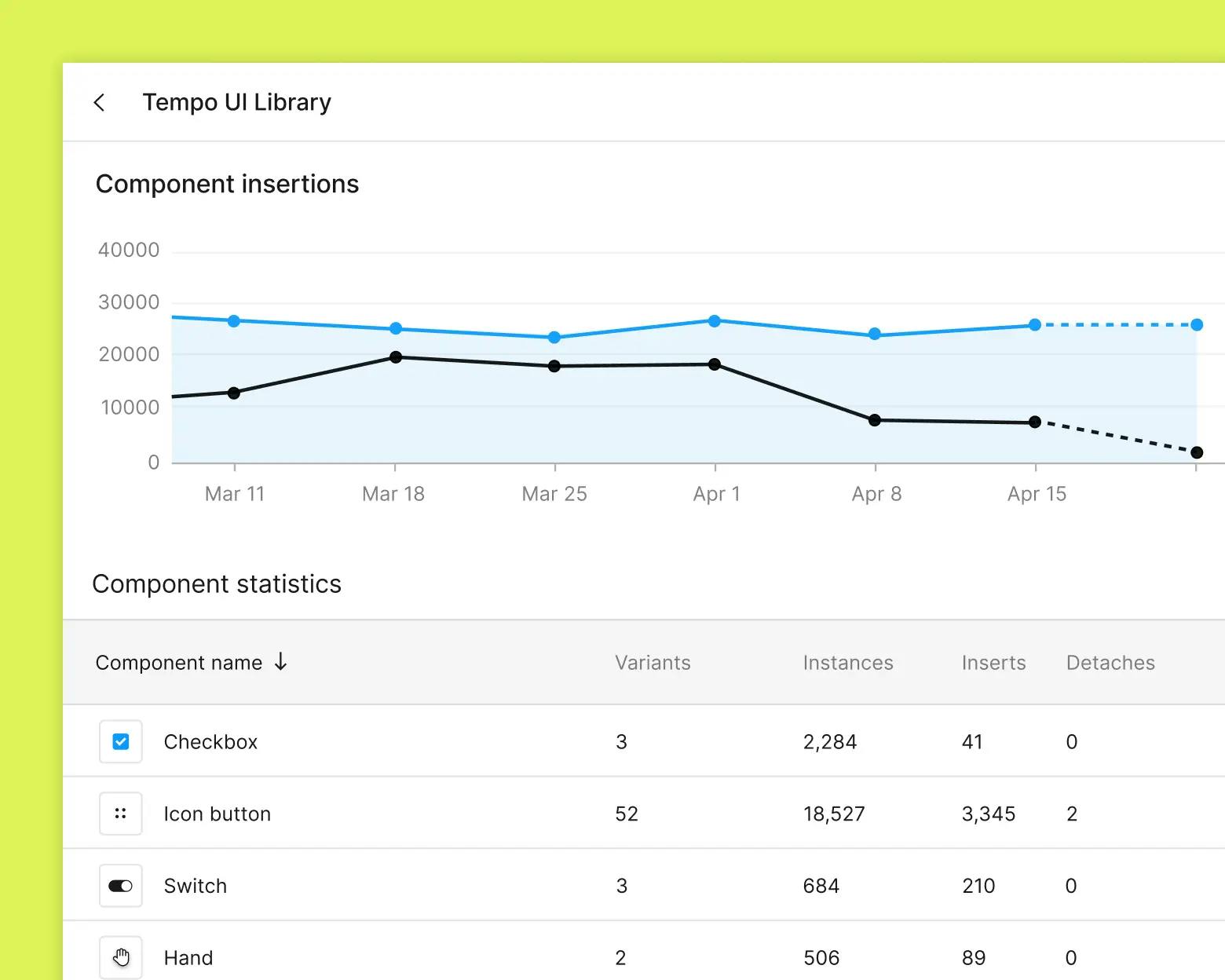

Design Systems: Teams can maintain consistency by publishing assets in shared libraries. Figma variables enable easier adaptation across product themes and screen sizes, while components, such as buttons and icons, can be reused and customized as variants. Figma’s analytics tools track the frequency of component and variant usage. To improve usability when navigating large design systems, hover-tooltips were also introduced for truncated variable and style names.

Source: Figma

Dev Mode

In 2023, Figma launched Dev Mode, a new interface to help developers take design from handoff to implementation as quickly as possible. Dev Mode is an option within a Figma file that allows developers to inspect specs and styles without impacting the design file. Designers can generate code snippets, assets, and specifications directly from their designs, streamlining the handoff process from design to development. A VSCode extension allows developers to inspect Figma files, receive notifications, and use the integrated text editor. Additional tools include a component playground to test properties in a sandbox, section status tags to see which screens are ready for handoff, and version comparison to track design changes.

In 2025, Figma introduced the Model Context Protocol (MCP) server in beta, allowing AI agents such as Copilot or Claude to access design data directly. Dev Mode also added interactive inspection tools to test designs across responsive breakpoints and variable modes, as well as the ability to create MCP rules for customizing AI agent outputs. These updates further streamline developer workflows and enhance AI-assisted implementation.

Figma can also be integrated with Jira, GitHub, and Storybook to improve team workflows. Figma Design remains accessible across platforms, including its web and desktop apps, while the mobile app only allows users to view boards and comments.

FigJam

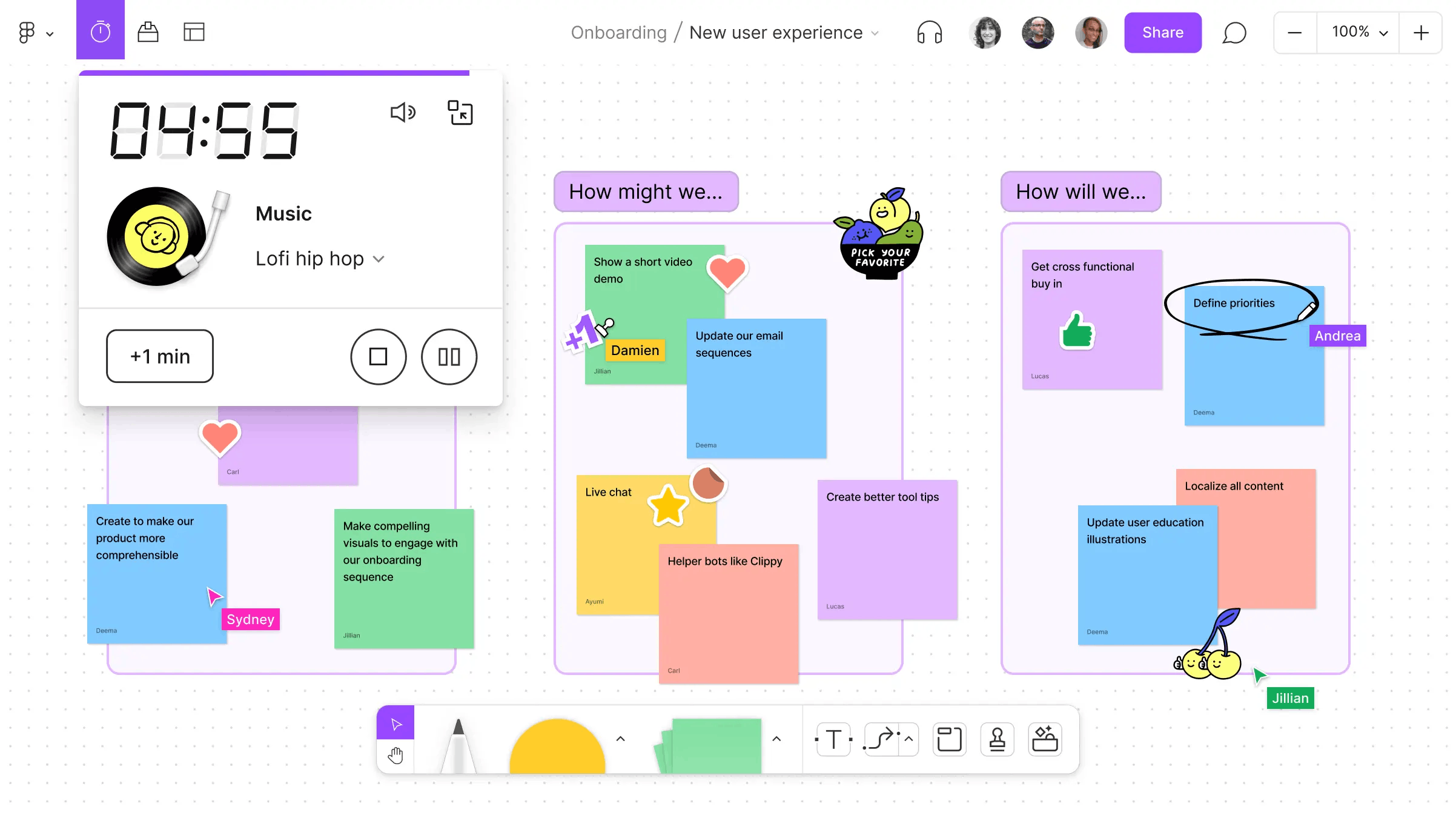

FigJam is an online collaborative whiteboarding platform designed to enhance remote collaboration and ideation processes within teams. Launched in 2021, FigJam offers a virtual workspace where teams can visualize ideas, discuss strategies, and create diagrams in real time. The product serves designers, developers, project managers, educators, and other professionals.

Source: Figma

Users can interact through audio calls, comments, voiceovers for asynchronous communication, and workflow widgets. FigJam supports reactions with stickers and stamps. Like Figma Design, FigJam allows users to ‘Spotlight’ themselves, allowing other collaborators on the file to follow them.

FigJam is accessible via browser and through the Figma Design app on desktop and mobile devices. For iPads, it is accessible either through the Figma Design app or as a standalone application.

In 2023, FigJam AI launched in open beta, enabling users to summarize, sort, and generate templates for flowcharts, icebreakers, meetings, and brainstorming sessions based on written prompts. Templates include project kickoff, team meetings, flowchart, customer journey map, standup, retrospective, roadmap review, and project timeline.

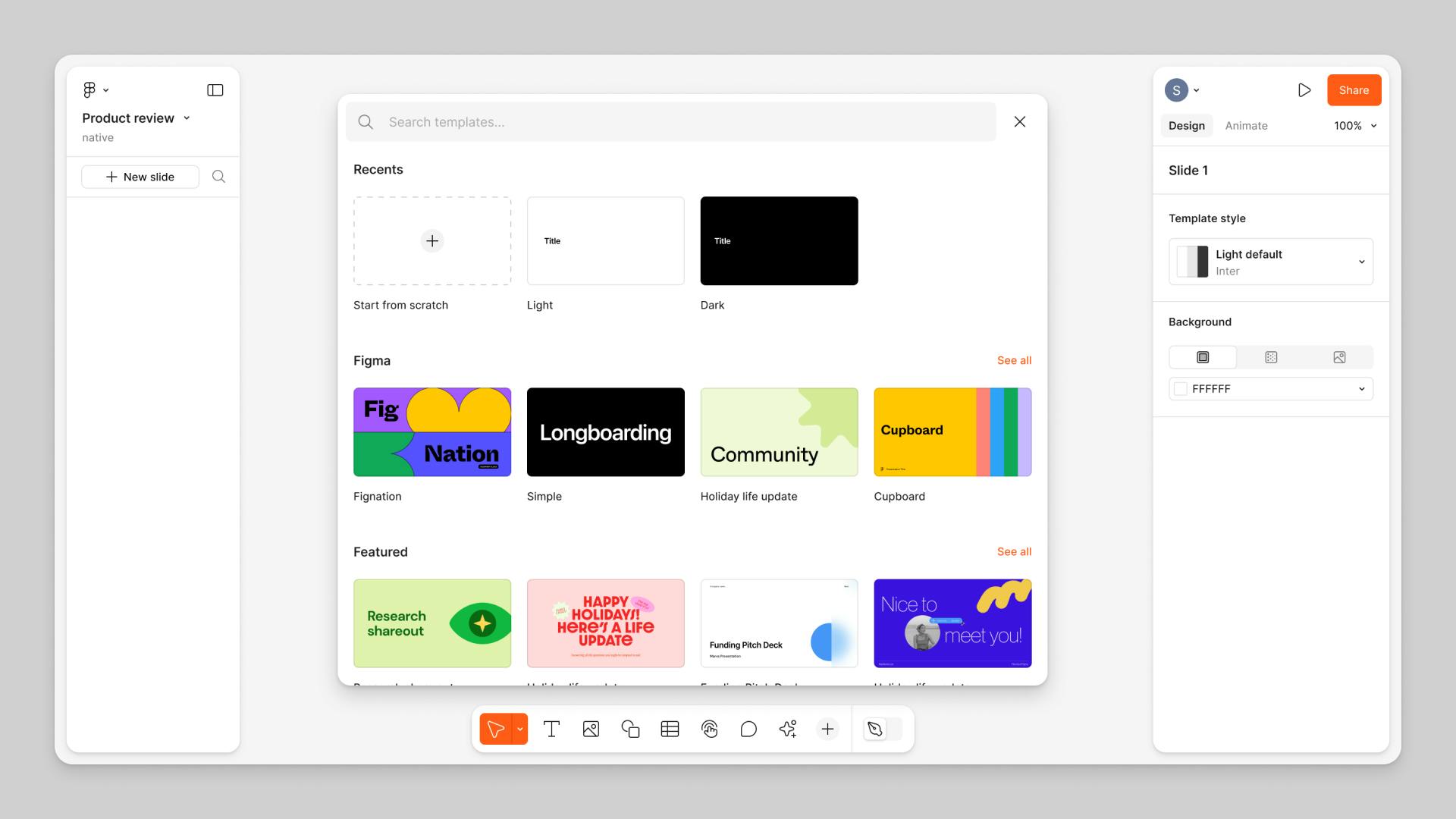

Figma Slides

Figma Slides was announced during Figma’s annual conference, Config, in June 2024 and entered open beta the same month. Slides extends Figma’s collaborative design platform to presentations, allowing teams to create slide decks together. Designers and non-designers can work in real time, using features like grid view to organize content, embedded prototypes, and audience polls.

Slides gives users access to Figma’s design tools, including Auto Layout, custom fonts, and shared asset libraries. AI features can help adjust tone, shorten text, or translate slides. Presenters can combine slides from different templates to keep decks consistent and on-brand, while co-presenting tools make live handoffs smoother.

Source: Figma

Slides rapidly evolved in response to demand from Figma’s large user base, who previously created millions of presentations each year by repurposing Figma design files. Initially free in open beta, paid plans began rolling out in early 2025.

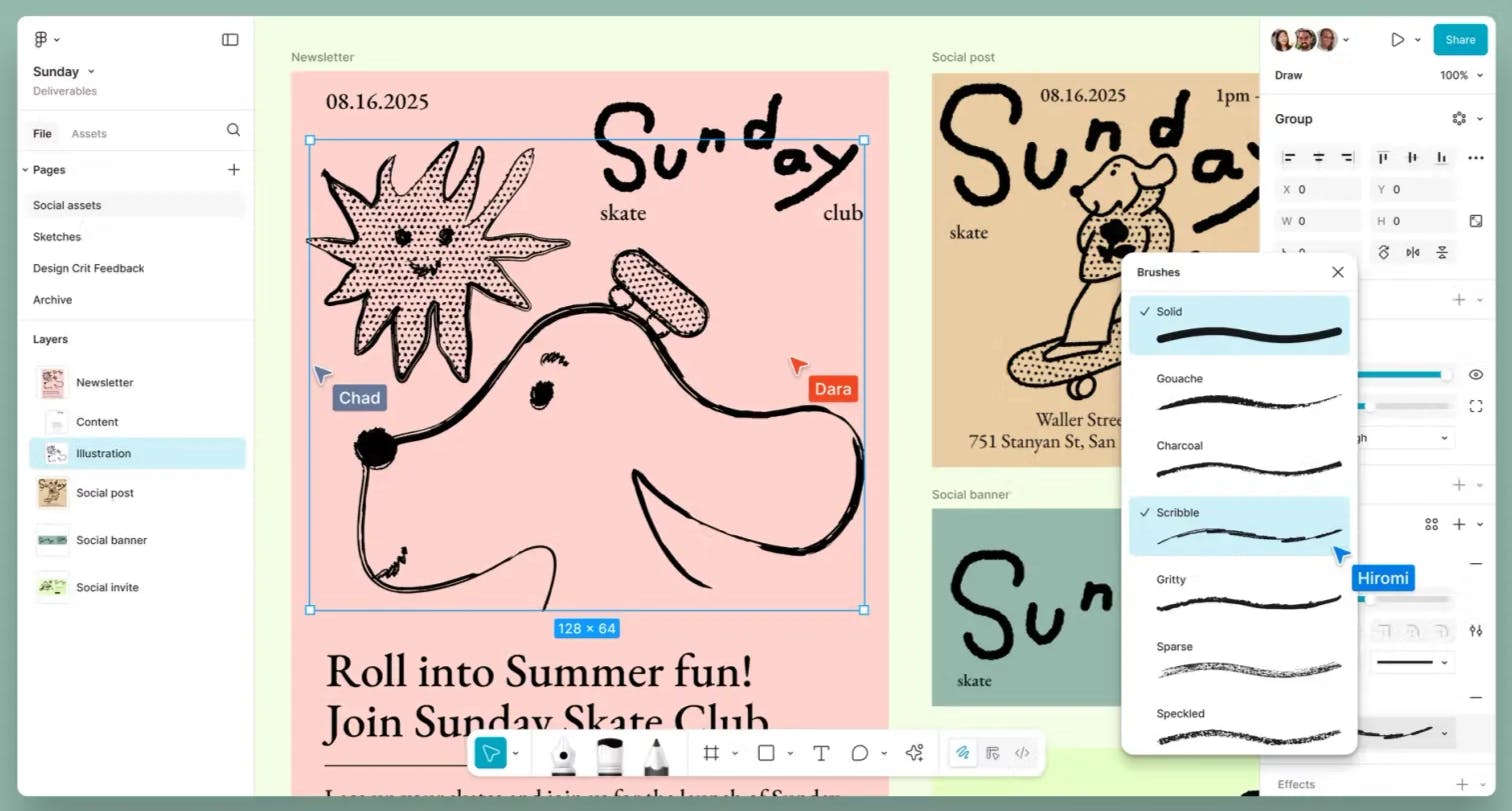

Figma Draw

At Config 2025 in May 2025, Figma unveiled Figma Draw, a vector illustration tool within Figma Design which expands the platform’s creative capabilities. Draw offers a focused illustration workspace with a streamlined toolbar for Pen, Brush, and Pencil tools, a Layers panel with thumbnail previews, and a Properties panel that lets users fine-tune strokes, fills, and effects.

Source: Figma

The tool includes enhanced vector editing features such as dynamic and variable-width strokes, as well as advanced texture fills like noise and progressive blur, allowing for more nuanced and organic illustrations. By integrating illustration directly into the Figma environment, Draw enables designers to create visual assets without switching to external software, while maintaining the ability to collaborate in real time with team members.

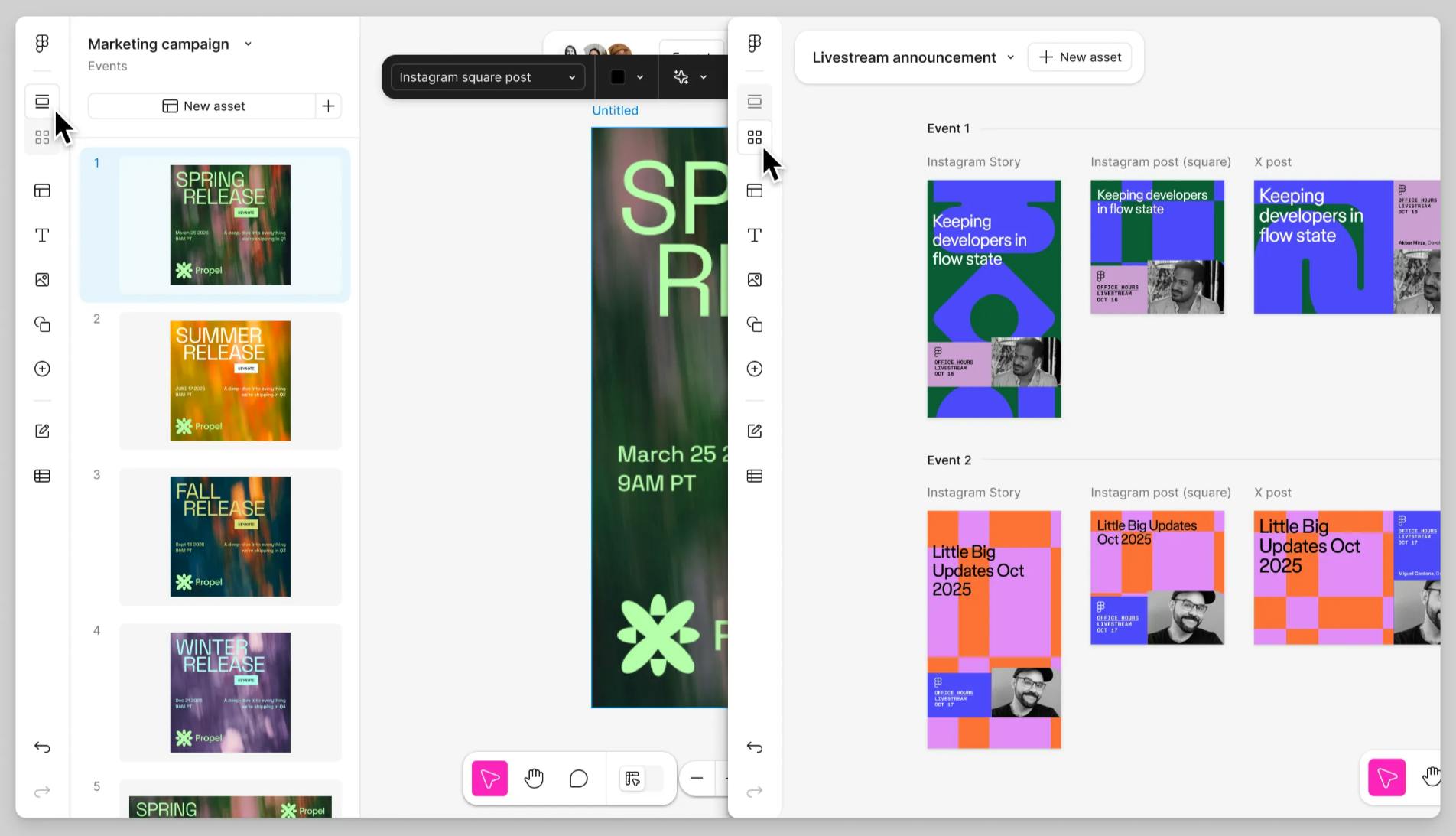

Figma Buzz

Figma introduced Figma Buzz, a dedicated workspace for creating and managing marketing and brand assets, at Config 2025. While Figma has long been used for product design, Buzz is tailored to teams producing content like social graphics, event materials, promotions, and even internal communications. The tool provides templates, brand kits, and AI, making it easier for marketers and brand designers to stay consistent while working alongside product teams.

Source: Figma

In August 2025, Buzz launched in beta, with initial access focused on marketing and creative departments of enterprise accounts. Teams can build brand libraries directly within Buzz, ensuring fonts, colors, and logos stay synchronized across campaigns. Figma also integrated Buzz with publishing pipelines, allowing assets to be exported in optimized formats for social media platforms like Instagram without having to leave the app.

Buzz's collaborative layer mirrors Figma's core platform, enabling real-time co-editing, contextual feedback, and revision tracking, and eliminating the need for juggling multiple file formats or relying on external review tools.

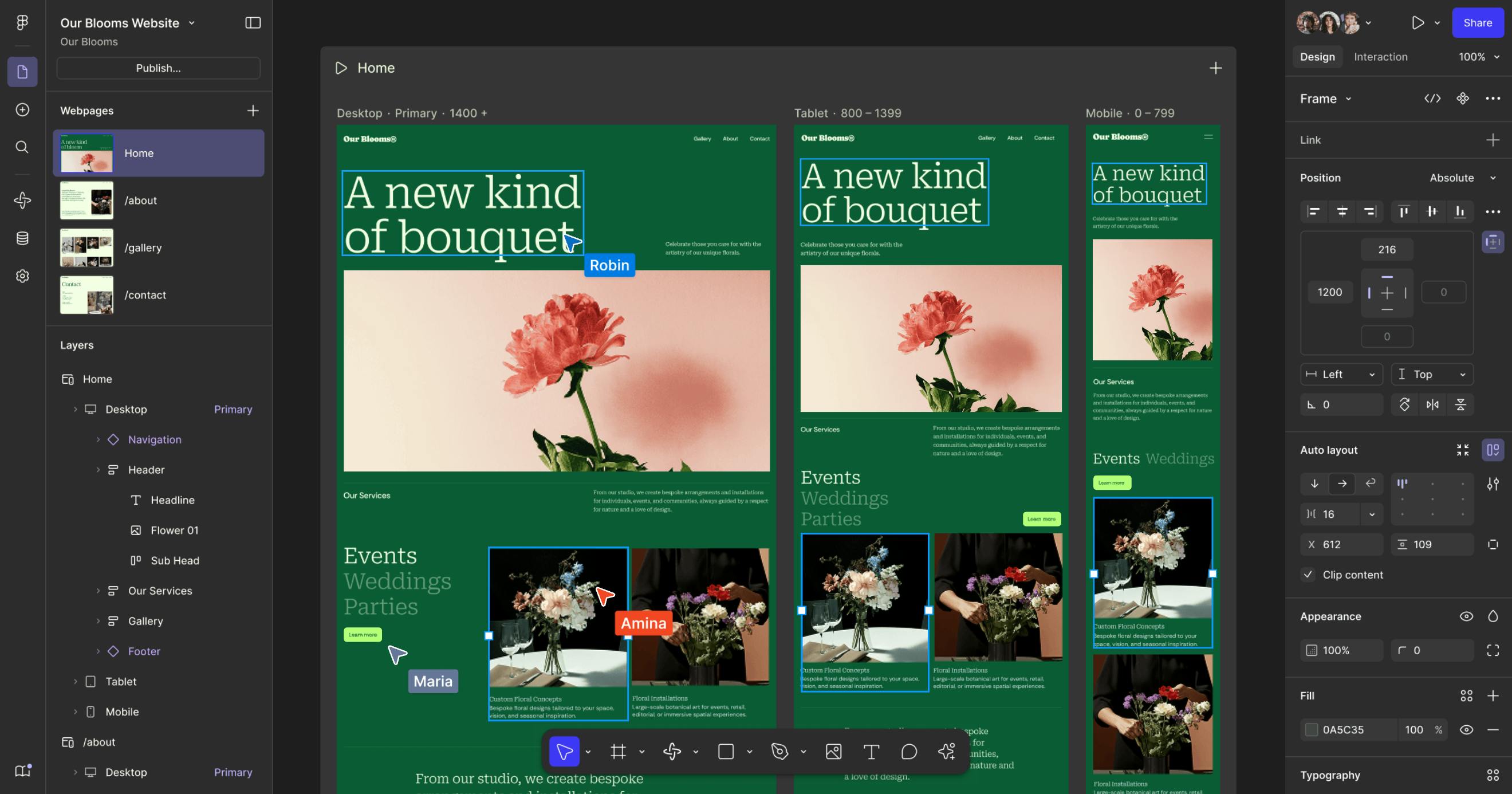

Figma Sites

At Config 2025, Figma Sites was unveiled, a new product that extends the platform’s workflow from design into live website publishing. The tool allows designers to convert Figma files directly into fully responsive websites without requiring third-party builders or custom code. Users can publish interactive prototypes as production-ready sites, complete with animations, responsive breakpoints, and object states. This reduces the need for design-to-development handoff, effectively closing the gap between visual design and deployment.

Source: Figma

Sites builds on Figma’s collaborative design foundation, allowing teams to reuse existing components and styles to maintain brand consistency across published pages. Designers can preview how sites adapt across different screen sizes and modes, while developers and marketers gain the ability to publish updates instantly. Figma also announced that a lightweight CMS layer will be added, giving non-designers the ability to manage content within published pages without breaking the design system. As of October 2025, Figma Sites is still in beta.

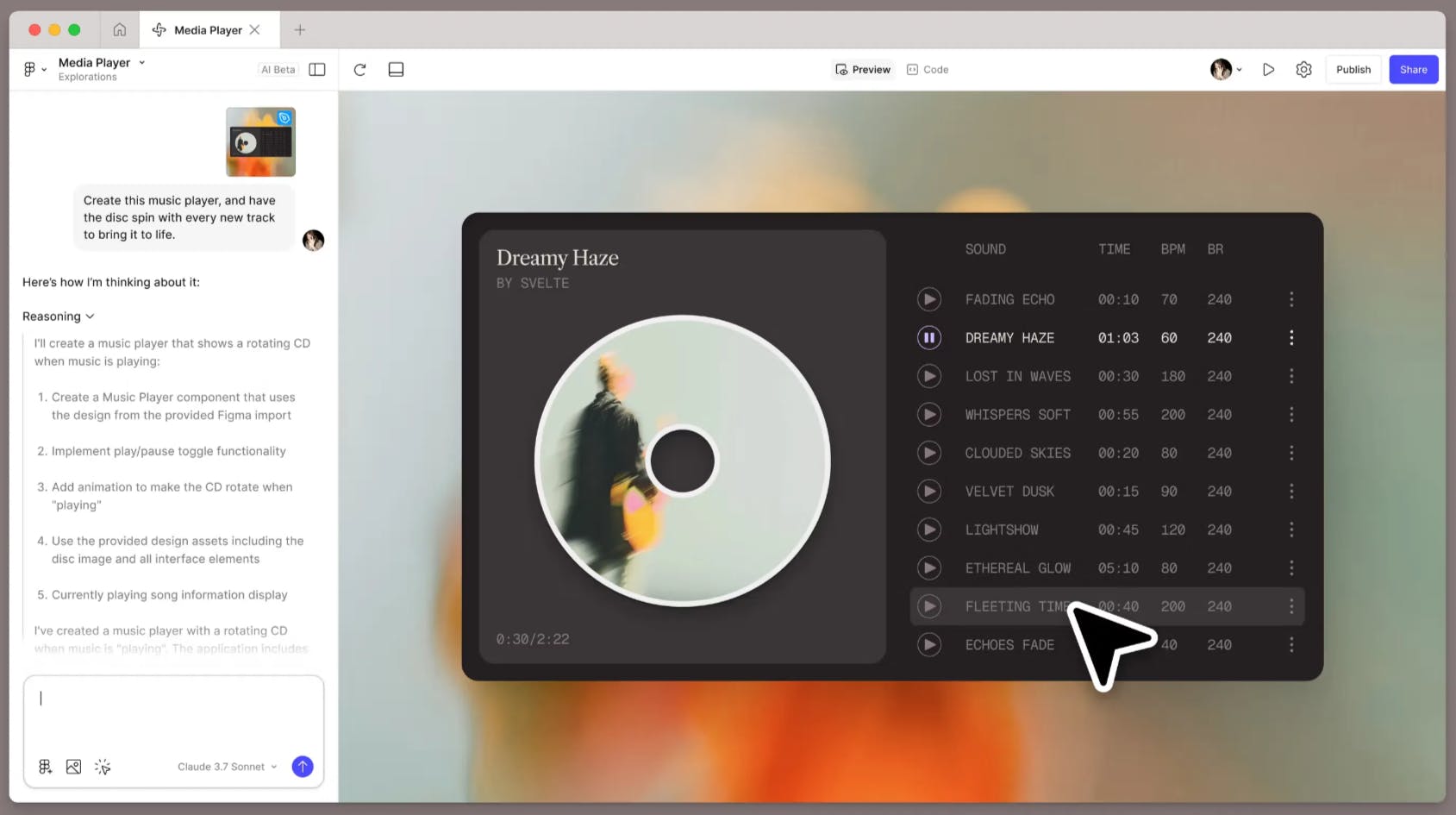

Figma Make

At Config 2025, Figma introduced Figma Make, an AI-driven tool that turns text prompts or design files into interactive prototypes and functional apps without requiring code. Users can begin by typing a description or by uploading a Figma design as a reference. Make then generates a live, editable UI powered by Anthropic’s Claude 3.7 model, giving designers the ability to quickly move from concept to working prototype.

Source: Figma

In July 2025, Figma expanded Make’s availability by moving it out of beta and offering it across all subscription tiers. To manage usage, the company introduced an AI credit system. Full Seat users received unlimited publishing rights for the apps generated, while users on View, Collab, Dev, and Starter seats could experiment in personal drafts. Publishing remained reserved for Full Seat accounts.

Make also incorporates visual context into design generation. Designers can pair a prompt with an image or Figma file to influence the app’s layout and styling. Output can be refined through follow-up AI prompts, manual design edits, or inline code changes for more control. Once complete, projects can be published as web apps directly from Figma, streamlining the process of testing and sharing interactive designs.

Market

Customer

Before products that offered collaborative design software on a browser came onto the market, designers would need to use multiple tools from ideation to creation to handoff. This created inefficient feedback loops because designers would often be siloed from a constantly iterative process.

Source: Craft Ventures

When Figma was gearing up for its beta launch in 2015, it started tapping into the community of designers to demo the product. Field, along with his first business hire, conducted informal interviews with designers, and the product was iterated upon with the goal of keeping “the individual designer in mind”.

The company followed a bottom-up SaaS go-to-market approach. By offering a free version first, designers could use it for a side project in a lower-stakes environment and eventually become repeat customers and advocate for its use in their day jobs, leading to business adoption. Along with product designers, initial target customers also included typographers, illustrators, and iconographers.

When the company initially introduced a paid tier, it limited the number of people who could collaborate in the free tier. The company soon realized, however, that “we weren’t enabling people to experience the magic moment of multiplayer collaboration” and so adjusted their strategy by allowing free members to collaborate with an unlimited number of people, while limiting the number of files allowed. This supported its bottom-up strategy of targeting individual users to become eventual advocates for business customers.

Figma reported having 13 million active users as of three months ended March 2025, including 95% of the Fortune 500. Over this same period, Figma noted almost 85% of its weekly active users were outside the United States, despite these users making up only 53% of total revenue. Figma users are overwhelmingly young (nearly 60% under the age of 35 as of October 2025). Their customer base is fairly diverse, with their top ten customers making up less than 10% of revenue.

Notable customers of Figma include Microsoft, Stripe, Netflix, The New York Times, Slack, Zoom, Airbnb, Dropbox, Duolingo, GitHub, Peloton, Datadog, Mizuho, Pentagram, Anthropic, Uber, JetBlue, and LinkedIn.

Source: Figma

Market Size

Figma’s design platform operates in the global UI and UX design software market, which was valued at $10.5 billion in 2022, and was expected as of August 2025 to reach a market value of $25.4 billion by 2033. Figma itself estimates a total addressable market of $33 billion within the global workforce engaged in software design space as of July 2025.

FigJam, meanwhile, operates in the broader category of collaborative design tools or online whiteboarding platforms. Productivity management software was valued at $54.6 billion in 2023 and was expected to reach $150.6 billion by 2032, growing at a CAGR of 13.5%. The collaborative whiteboard software market in particular was projected to reach $2.6 billion in 2024 and to grow at a CAGR of 20.8% between 2024-2029.

Competition

Canva

Canva is a collaborative graphic design platform launched in 2012. The company offers simplified tools to create designs, including social media content, videos, gifs, posters, websites, and multimedia presentations. Canva is designed to be the “visual suite for everyone,” requiring little to no experience in design to use. It offers thousands of templates and resources to teach individuals who have never designed anything how to create high-quality graphics. Figma is geared toward professional designers who need advanced collaboration tools, whereas Canva targets non-designers who need to design simple graphics. Like Figma, Canva has been making strides in developing AI tools, with it now supporting every stage of the creative process.

As of October 2025, Canva has raised $2.5 billion in total funding. In September 2021, Canva raised $200 million at a $40 billion valuation, led by T. Rowe Price, and has received funding from investors Sequoia Capital, Bessemer Venture Partners, General Catalyst, Shasta Ventures, 500 Global, and Founders Fund. In April 2022, in response to a fall in public company valuations, Franklin Templeton cut the carrying value of its shares in Canva by one-third, reducing Canva’s valuation to approximately $37 billion. As of October 2025, Canva had a total valuation of $42 billion.

Sketch

Sketch was founded in 2010. It is a vector graphics application that designers use to create UI and UX flows for mobile applications and websites. It raised a $20 million Series A in September 2021 at an undisclosed valuation led by Benchmark, which accounted for its total funding to date. The company had a partnership with Apple that Sketch ended in 2015, removing the Sketch app from the App Store and allowing users to download it directly. The Sketch app was made available on the App Store again in 2023. As of 2024, Sketch has more than 1 million users, with notable clients including Netflix, Google, Boeing, Target, Epic Games, Motorola, and Porsche.

Both Sketch and Figma offer similar functionalities for creating digital interfaces. Unlike Figma, which operates on a cloud-based collaborative platform, Sketch is primarily a desktop-native application. Sketch users need an Apple computer running macOS to create and design files in the Sketch application, with the web app only offering view, inspect, and download features.

Adobe XD

Adobe XD, which has now been discontinued by Adobe, was a design and prototyping tool developed by Adobe Systems, initially released in 2016. Adobe XD was deeply integrated with other Adobe Creative Cloud applications, such as Photoshop and Illustrator, offering workflow integration for designers already entrenched in the Adobe ecosystem. As part of other products offered by Adobe bundled in a Creative Cloud suite, Adobe XD does not offer a free tier.

The software generated $17 million in ARR in 2022; however, Adobe XD was no longer available as a standalone application through Adobe’s Creative Cloud app launcher as of June 2023. Given that Figma and Adobe XD offer similar design tools to customers, this indicates that after being acquired by Adobe, Figma would replace Adobe XD. After Adobe’s deal to acquire Figma for $20 billion collapsed in December 2023 under regulatory pressure, Adobe announced plans to discontinue XD.

Framer

Framer is a design tool that provides a visual interface for designing UI components and screens, as well as a code editor for adding logic and interactivity using JavaScript. In 2022, Framer evolved from being a prototyping platform to a no-code web design platform, allowing it to expand its customer base to marketers and non-technical users. While Figma Sites enables no-code web publishing, its feature set and production capabilities remain limited compared to Framer, which continues to offer more comprehensive tools, stronger SEO, professional templates, and advanced web performance for serious or scalable website projects.

Framer was founded in 2013 and raised a $27 million Series C in September 2023 at an undisclosed valuation, led by Meritech Capital Partners. As of October 2025, the company has raised a total of $161 million. The company reported revenues of more than $10 million in September 2023. As of October 2025, Framer customers include Dribbble, Superhuman, Miro, and Perplexity.

Miro

Miro is a collaborative whiteboarding platform that was founded in 2011. Miro offers a virtual space for brainstorming, ideation, and visual collaboration to users across industries like engineering, marketing, and IT. Miro is a direct competitor of FigJam, with both products offering similar whiteboarding features. Miro offers greater integrations with other productivity tools like JIRA, Slack, and Zoom compared to FigJam. FigJam offers integration with Figma’s design tool, which lets users transition between ideation and design.

The company raised a $400 million Series C in January 2022 at a valuation of $17.5 billion, led by ICONIQ. As of October 2025, the company has raised a total of $476.3 million. The company’s customer base includes more than 90 million users and 250K companies, as of October 2025. Notable customers include HP, Accenture, Cisco, and Deloitte.

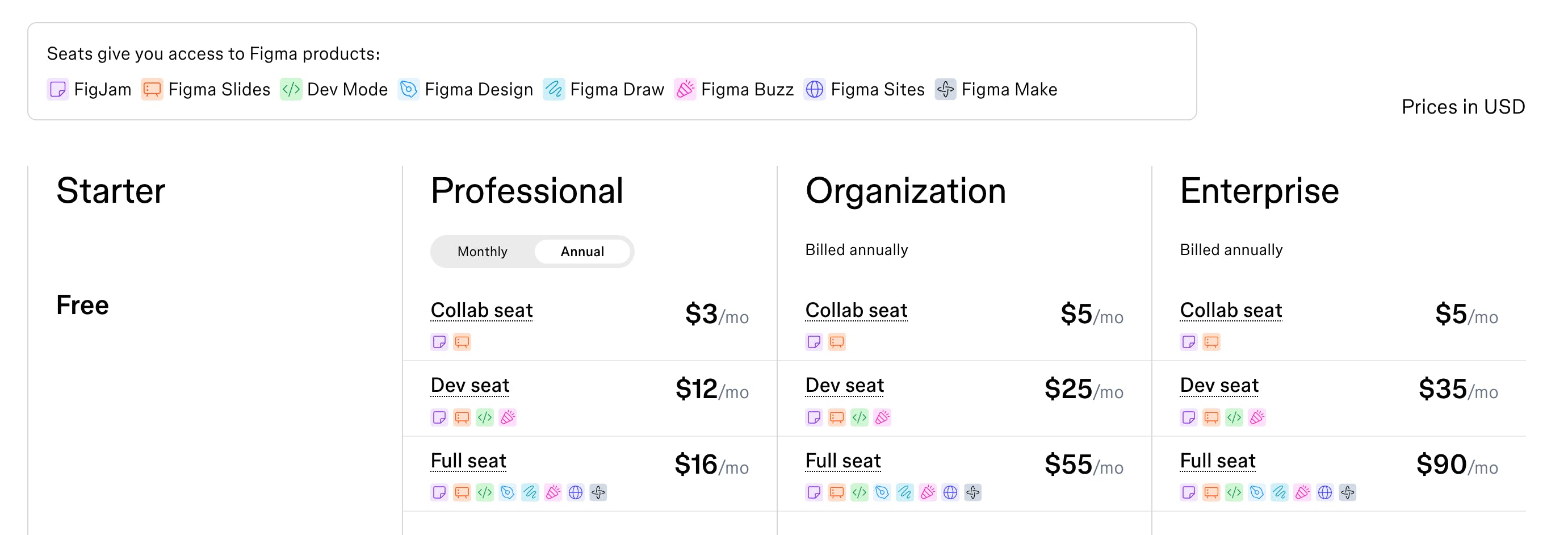

Business Model

Figma operates on a SaaS subscription model built around per-seat billing. The platform offers a free plan to attract and onboard new users, but the majority of its revenue comes from tiered subscription plans that scale with team size and collaboration needs. Figma is free for students and educators.

The products within Figma’s suite are bundled together, with access determined by subscription tier and seat type. Figma provides three primary paid tiers: Professional, Organization, and Enterprise, which add progressively more administrative features, security controls, and analytics. Billing is based on the number of active paid seats, with admins managing upgrades, assignments, and prorated changes to keep costs predictable.

Source: Figma

The platform offers four types of seats, each designed for different roles within a company. Full seats are the most expensive and give users full editing and collaboration rights across all products, ideal for designers and team leads. Dev seats are built for developers, with access to developer tools, file inspection, and collaboration in FigJam and Slides. Collab seats are for cross-functional team members who contribute to whiteboards or presentations but do not need to edit design files. View seats are free and allow stakeholders or external partners to look at files without editing.

Looking ahead, Figma is preparing to launch a Content seat, which will grant access to Figma Buzz, Figma Sites CMS, Figma Slides, and FigJam, broadening its appeal to content and marketing teams.

In addition to subscriptions, Figma makes money through its Community marketplace, where users can share or sell plugins, templates, and widgets. Figma takes a 15% cut of paid sales, which both adds revenue and supports a stronger ecosystem. Through connected projects, the platform also offers options for freelancers and agencies to collaborate with clients without needing extra paid seats.

Traction

Figma’s market share in UI design tools grew from 7% in 2017 to 90% by 2023, driven by its product-led growth model and community adoption. In 2023, the company generated $505 million in revenue at a 50% year-over-year growth rate.

By 2024, revenue had increased to $749 million, with LTM revenue reaching $821 million as of Q1 2025. Quarterly revenue for the first quarter of 2025 came in at $228.2 million, representing ~46% year-over-year growth, and with projections that the business will cross $1 billion in annual revenue in 2025. Figma reported a net loss of $732 million in 2024, driven in part by stock-related and IPO preparation expenses, but recorded a net income of $44.9 million in Q1 2025.

The platform now counts 13 million monthly active users and is used by 95% of the Fortune 500. As of March 2025, Figma employs 1,646 people worldwide, up from 1,300 in late 2023. Figma was the primary choice of software for 75% of product designers in 2023, while 40% used FigJam as their primary digital whiteboarding tool. According to UX Tools’ 2023 survey, Figma’s tools consistently rank among the most popular across UI design, prototyping, digital whiteboarding, and design systems.

Valuation

In April 2020, the company raised a $50 million Series D led by Andreessen Horowitz at a $2 billion valuation. By June 2021, Figma had quintupled in size, closing a $200 million Series E at a $10 billion valuation, with investors including Durable Capital Partners and Morgan Stanley.

In September 2022, Adobe announced plans to acquire Figma for $20 billion, but the deal collapsed in December 2023 after pushback from European regulators. Britain’s Competition and Market Authority declared that the acquisition typified anti-competitive behavior and that with the acquisition, Adobe would “eliminate competition for product design, image editing and illustration software”. As part of the termination, Figma received a $1 billion breakup payout. The company’s internal valuation fell to around $10 billion in January 2024, roughly half of Adobe’s offer.

In July 2025, Figma went public on the NYSE under the ticker FIG. Shares were priced at $33, giving the company a $19.3 billion market capitalization. Investor demand was overwhelming: the stock opened at $85 and closed at $115.50 on its first day of trading, marking a 250% gain and pushing the company’s valuation to nearly $70 billion. This made Figma’s IPO one of the most successful and closely watched debuts of the decade.

Key Opportunities

Freemium Funnel to Enterprise Growth

Figma has built a wide entry funnel through its free Starter plan and dedicated offerings for students and educators, which lower adoption barriers and expand awareness. As of March 2025, the platform had more than 13 million monthly active users across free and paid tiers. This broad base creates a consistent pipeline for monetization as users transition from individual use cases into more complex team workflows.

In both 2024 and the first quarter of 2025, about 70% of new Organization and Enterprise customers included at least one user who had previously subscribed to a Professional plan. This pattern reflects a land-and-expand motion in which initial individual adoption scales into broader team-level standardization. The dynamic represents a key opportunity for Figma to increase revenue through systematic plan upgrades.

Growth in Collaborative Design Platforms

The broader collaboration software market has accelerated with the persistence of hybrid and remote work. Within this context, Figma’s market share has risen to more than 40% among design collaboration tools. Its product-led growth approach has been a consistent engine, where individual or small-team adoption transitions into larger enterprise contracts. Although 85% of users are outside the United States, international markets account for only 53% of revenue, suggesting a gap between usage and monetization.

Figma’s multiplayer architecture and viral onboarding are central to this model. Retention rates remain strong, with gross retention of 96% for accounts paying over $10,000 annually. These metrics indicate that once organizations commit to the platform, churn is limited. The key levers for continued expansion are twofold: deeper penetration of enterprise accounts through upselling and a more systematic approach to international monetization, where usage is high but revenue capture lags behind.

Key Risks

Pricing Model

Figma’s Dev Mode pricing has been difficult for smaller companies to justify, given that the tool still offers very basic features to a developer. While Figma offers developer-oriented functionalities to make the interface hand-offs more efficient, it is still a design-centric tool. With the introduction of Dev Mode and other developer-oriented tools, Figma may be trying to move focus from designers to developers. Amongst community discussion boards, users have complained about the Dev Mode licensing rules.

To counteract this, the company could look into creating differently priced tiers for developers or offering Dev Mode as a plugin. With Dev Mode and FigJam, Figma is becoming a multi-product platform, which complicates billing flows substantially. It needs to figure out how it wants to market and sell its evolving product suite.

Regulatory Roadblocks

Regulatory pressure makes it difficult to consolidate software products and companies with different functionalities to build an end-to-end product. The pushback can cause a decline in venture investment into design and prototyping software and slow down innovation in existing products. This was demonstrated, for example, by Adobe first suspending and then permanently sunsetting its in-house Figma competitor, AdobeXD, after the acquisition deal was announced.

Because Figma is public as of October 2025, it is less likely to be acquired and more likely to pursue the purchase of smaller companies that may strengthen its offering. As of October 2025, Figma has acquired four companies and invested in three.

Summary

Figma’s cloud-based platform supports real-time collaboration across design, whiteboarding, and development. Founded by Dylan Field and Evan Wallace, the company initially focused on individual designers before expanding into the enterprise market. By 2024, it reported more than 4 million users, and surveys indicated that about three-quarters of product designers viewed it as their primary UI design software.

Adobe announced plans to acquire Figma for $20 billion in 2022, but regulators in Europe blocked the deal in December 2023. Following the cancellation, Figma’s internal valuation was reset to $10 billion in early 2024. The company continued to expand its product offering, adding AI features to its FigJam tool and introducing Dev Mode to increase adoption among developers.

In July 2025, Figma went public on the New York Stock Exchange at $33 per share. Strong investor demand drove the stock to close at $115.50 on its first day of trading, raising the company’s market capitalization to nearly $68 billion. The debut was one of the strongest for a U.S. tech company in recent years, reflecting renewed investor appetite for high-growth software firms and positioning Figma among the most valuable design platforms globally.