Thesis

Global payments revenue is expected to reach $3.3 trillion by 2031. By bringing commerce online, the COVID-19 pandemic accelerated growth in digital payments. Global cashless payments are projected to grow by 80% from 2020 to 2025, with the fastest growth expected in the Asia-Pacific region, followed by Africa. This growth is reshaping payment systems on both the front and back ends. Payments companies are rethinking their payment strategy, with a lot of them choosing to layer on additional services like payroll, issuing, lending, and insurance, among others.

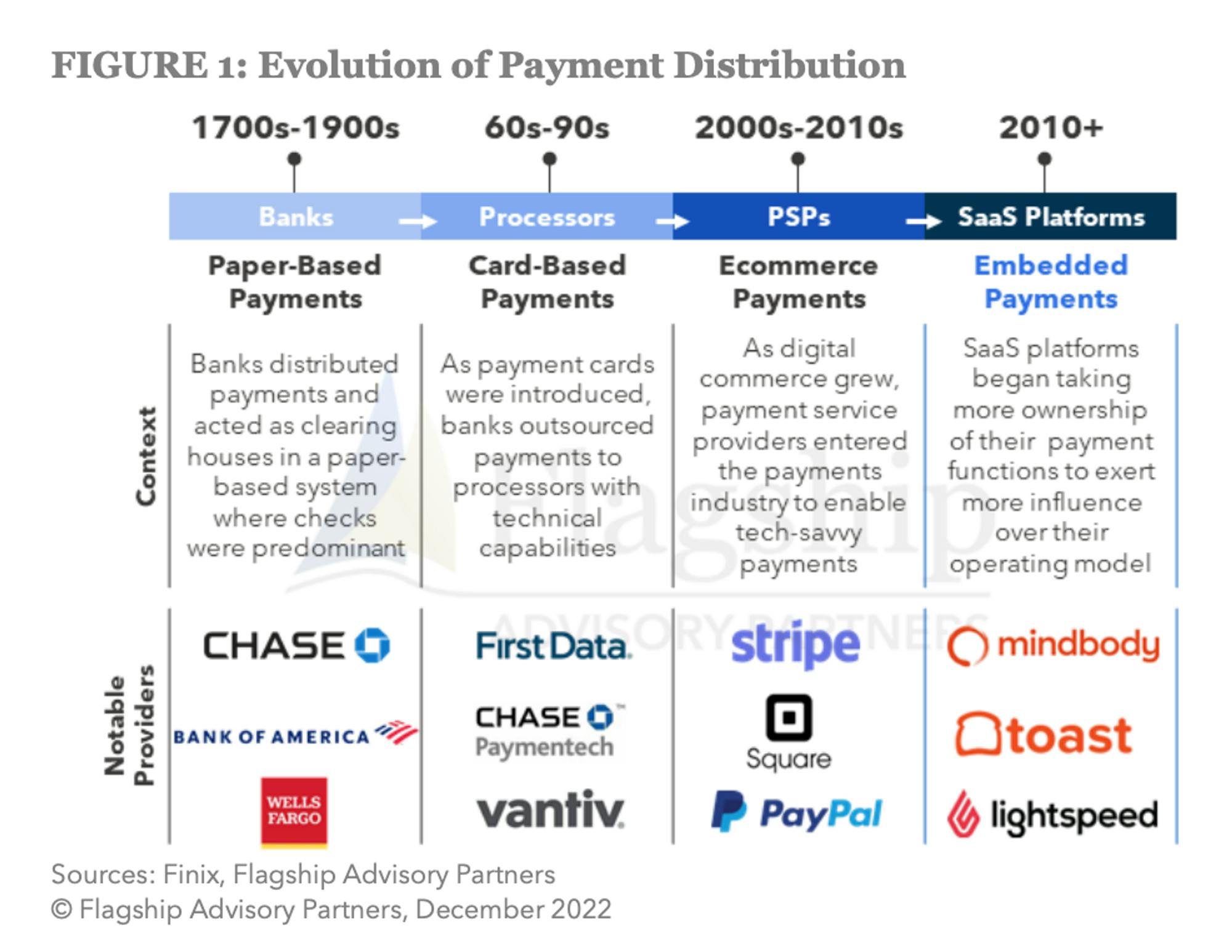

The transition from analog to digital and from banks to technology companies has created a tailwind for a large set of tech-enabled players. One of the most evident within these broad trends is the growth of integrated payments. Many software companies are leveraging their prominent and data-rich relationship with merchants to take over the payments acceptance function. As a result, software vendors are expected to represent $154 billion or 54% of North American payment revenue by 2027, and software companies are integrating payments into their core value proposition across sectors. By embedding payment capabilities into their core offerings and owning more of the transaction, they’re able to capture more value while also providing a more seamless experience to customers.

Source: Flagship Advisory Partners

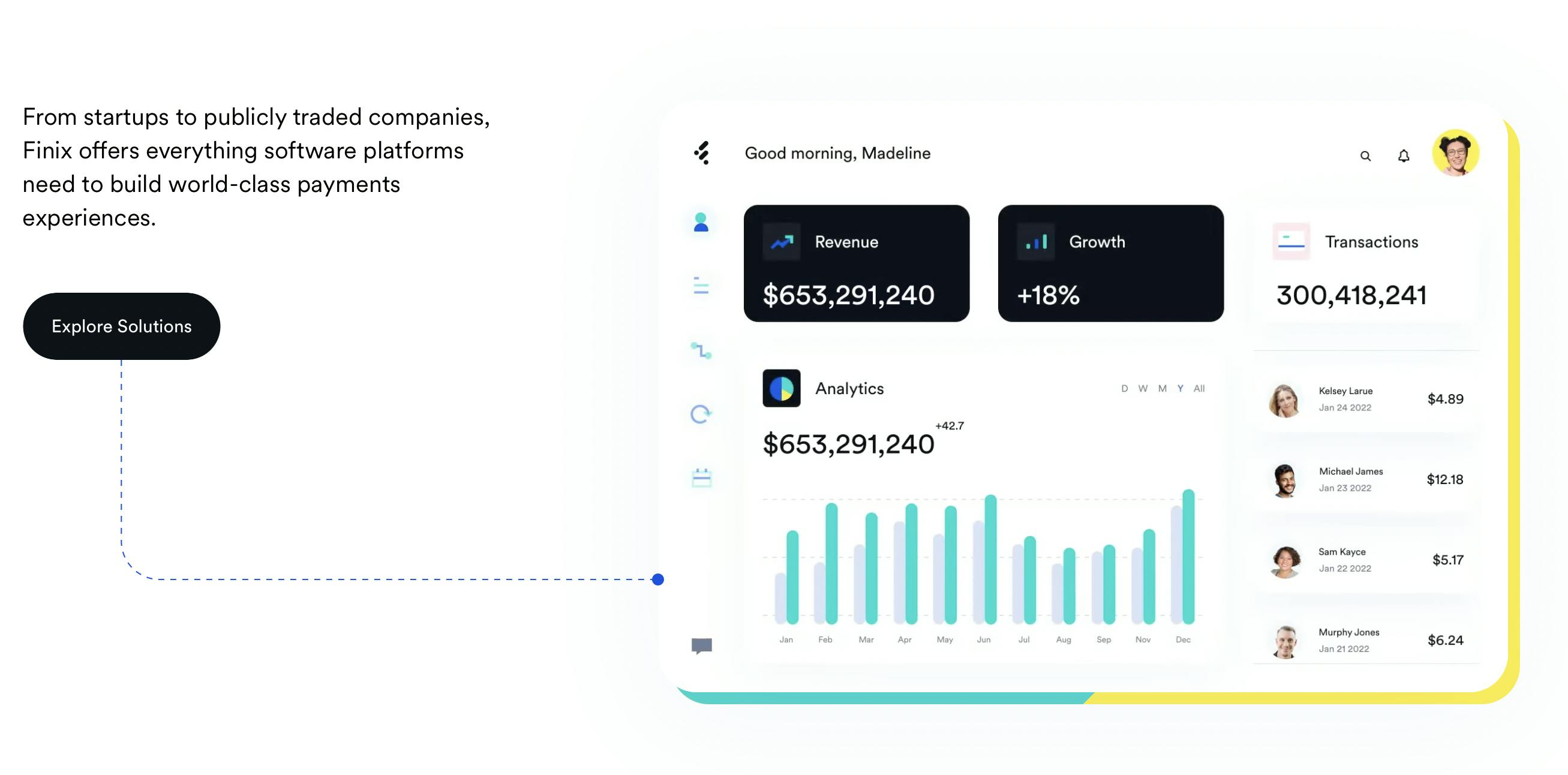

Finix is a payment infrastructure platform that gives businesses an alternative way to own, manage, and monetize their entire payments experience without the expense of building an in-house system from scratch and seeks to lower barriers to entry through developer-friendly API integration. SaaS, marketplace, and ecommerce platforms use the Finix API and dashboard to accept payments quickly and eliminate manual workflows. Bringing payments in-house has the potential benefits of increase revenue, reduce costs, build a better customer experience, and enhance retention.

Founding Story

Finix was founded in 2015 by Richie Serna (CEO) and Sean Donovan. Serna studied political science at Harvard. After graduating he started his career in management consulting but left at age 25 to move to San Francisco and learn software engineering. Before starting Finix, he worked as a software engineer at Balanced, the first payments API for marketplaces. Sean Donovan, meanwhile, co-founded BeanStalk Technologies, a routing intelligence platform for online card payments, prior to co-founding Finix. He had also previously served as the COO of North America for Klarna and also worked at Vantiv (now WorldPay) as VP of PayFac & Integrated Partners, an integrated payments channel, for 14 years.

When he had been at Balanced, Serna recognized a major gap in the market for companies that wanted to monetize their payments but needed more time and resources to do so. In 2015, Balanced closed down and migrated its customers to Stripe. During this transition, he realized that the company’s fastest-growing customers were vertical SaaS companies. When the exit to Stripe was announced, a few vertical SaaS companies started reaching out to Serna and his team with offers to come in-house to build the payments technology for them. As a result, Serna realized that if someone was willing to pay them for those services, then there was an opportunity in the market to help businesses stand up their own payment businesses and help them turn a historical cost center into a profit center. That’s how Finix was born.

Product

Source: Finix

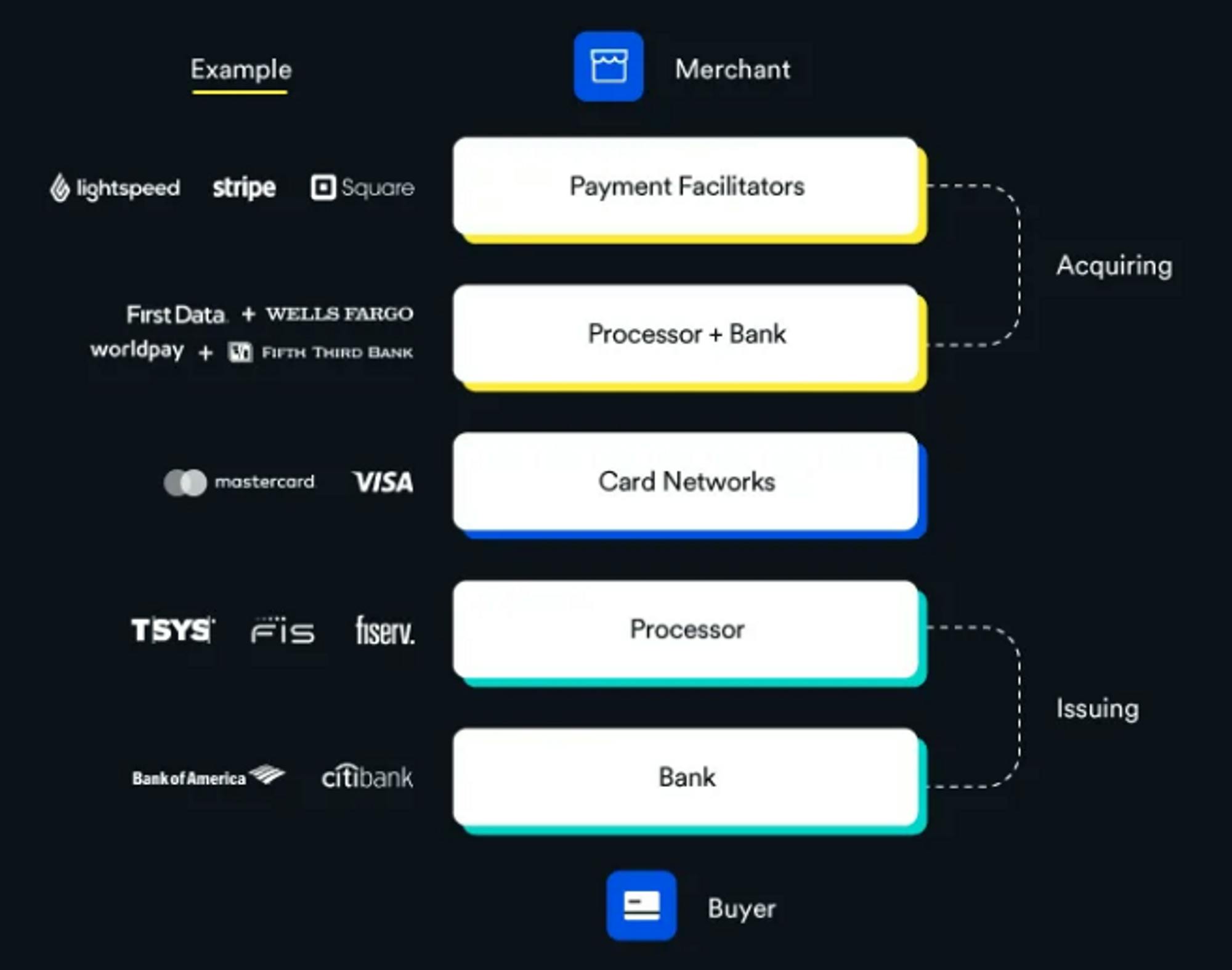

Payment facilitation players like Stripe and Square sit on top of merchant banks like Wells Fargo and acquiring processors like Fiserv. Finix enables companies to become payment facilitators and provides the software infrastructure to access the underlying legacy financial infrastructure.

Finix therefore serves as a replacement for third-party facilitators. It makes banks and processor technology available through RESTful APIs and services for payment facilitation and takes care of underwriting, reconciliation, dispute management, and more. The platform also offers functionalities including payout schedules, payout tracking, fee collection, failed transfer management, accruing settlements, settlement approval, and subscription billing.

Finix additionally provides multiple ways to onboard merchants for SaaS platforms. It offers APIs to allow merchants to build their own custom, self-hosted forms and prebuilt hosted forms. Its managed merchant underwriting allows platforms to run white-labeled checks using their API-driven underwriting engine. Sub-merchant management capabilities help platforms’ sub-merchants remain compliant with Payment Card Industry (PCI), tax reporting, and sanctions screening obligations. Companies can customize their onboarding experience through the onboarding API, set up a verification process, and handle onboarding rejections. Its pricing configurations (including interchange-plus pricing) allow platforms to exercise greater control over processing fees for their sub-merchants.

Customers can manage their payments through the Finix Dashboard or the Finix API. White labeling allows merchants to customize the dashboard to include logos, colors, and a subdomain of choice. On the dashboard, merchants can configure notifications, manage onboarding forms, schedule payouts, handle disputes, process refunds, and generate reports.

Its reporting capabilities give platforms granular transparency and visibility into what’s happening on their platform. Reports generated include net profit, transactions (gateway, payout, and interchange), transactions settled, consolidated fees, settlement merchant, fee profile, settlement application, settlement processor, daily merchant chargeback, historical merchant chargeback, and failed funding instructions. Finix is a PCI DSS Level 1, SoC1, and SoC2 compliant company. Vulnerability scanning and penetration testing are conducted regularly by an Approved Scanning Vendor.

Market

Customers

Finix serves software platforms including both startups and publicly traded companies. It also works with vertical SaaS platforms, marketplaces, and ecommerce platforms. As of May 2022, the platform supported more than 12K merchants across the US. Customers include Pay Theory, Passport, Archy, Club Essential, Sublime, Invii, Kabbage, Cargas, Revvable, Beyond, and foreUP.

Market size

By 2021, the global payment industry revenues had recovered from the impact of the COVID-19 pandemic and grew by 11% to reach $2.1 trillion. Industry revenues are expected to continue growing for the next five years to exceed $3 trillion by 2026. In addition, the payment facilitator market is expected to reach $15 billion in payments revenue by 2025. As technology advances, businesses are opting to use modern PayFacs that provide a single solution that incorporates several functionalities.

Source: CardKnox

Traction

In May 2022, Finix claimed that billions of dollars in total payments volume (TPV) flow through its system each year and that its TPV had more than doubled from 2020 to 2021. The company supports over 12K active small businesses each month. In 2020, Finix’s revenue was estimated to be $17.8 million.

Competition

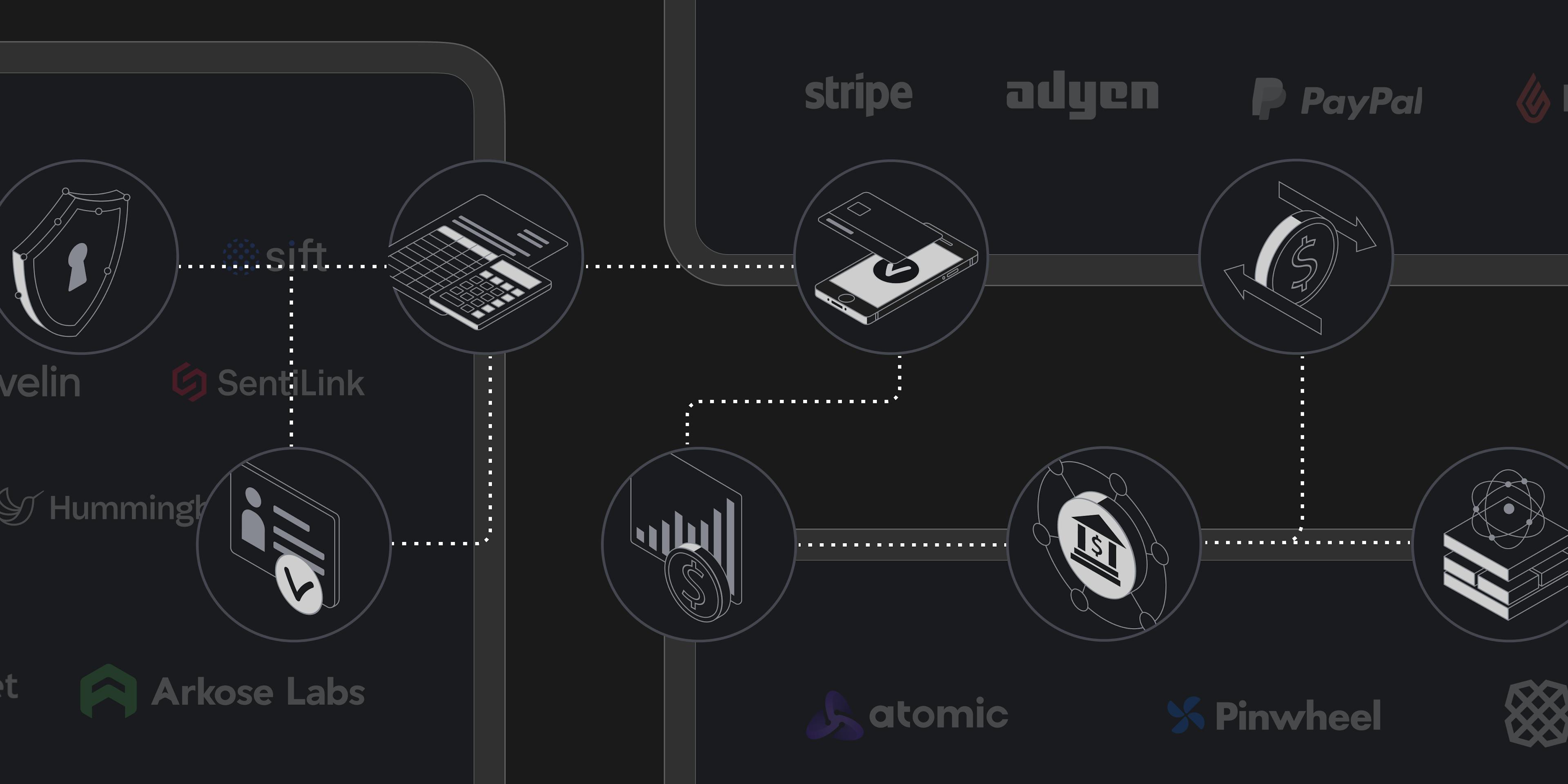

Key players in the payment processing space include payment facilitators, acquiring banks, payment processors, issuing banks, card networks, and issuing processors. Some firms play in more than one area of the payment processing ecosystem. The global payment facilitator market is growing fast, with the number of players expected to increase to 4.2K by 2025.

Source: Finix

Stripe: Stripe is a payment processing platform founded in 2010 and has raised over $2 billion in funding. Stripe competes with Finix on payment facilitation. Stripe offers an already-assembled solution to its users that makes it easy to use. Finix creates API building blocks from which users can choose and offers flexibility. According to Serna, Finix’s infrastructure is “an open system and open architecture that is modular and configurable,” while Stripe’s “continues to double down on that vendor lock-in so it can continue to close their system and architecture.” Finix specifically mentions Stripe as one of its main competitors.

Stax - Stax is a provider of payment technology solutions. It was founded in 2014 and has raised $263 million in funding. It enables software companies with the tools they need to process payments. The Stax API allows developers to create custom, on-brand payment experiences and tailor solutions to each business and platform’s needs. Like Finix, vertical SaaS companies work with Stax to combine the monetization of payments with the control and security of their own infrastructure.

Paystand - Paystand is a payments company founded in 2013. It has raised $98 million in funding as of March 2023. Its branded payments platform allows companies to create a payments engine that drives new revenue, automates complex payment flows, and enhances their software product offerings.

WorldPay: A global payment processing company founded in 1989 and acquired by Fidelity National Information Services (FIS) for $43 billion in 2019. The company provides solutions that allow platforms, businesses, and enterprises to take payments, make payments, and manage payments. It also provides data-driven insights, risk control, and operations optimization. The company competes with Finix on payment facilitation and API integration. Wordplay for Platforms offers embedded payments and professional services. Its parent company acquired Payrix, a player in embedded payments for vertical software businesses, in 2021.

Square: Square is a payments platform with integrated, omnichannel solutions aimed at small and medium businesses that allow them to sell online, manage inventory, and accept credit card payments. It also provides hardware POS systems for brick-and-mortar businesses and online enterprises.

Business Model

As of March 2023, there is limited information publicly available about Finix's revenue model. Ex-Chief Growth Officer Jareau Wadé has stated that Finix charges its customers a monthly licensing fee plus certain usage fees (i.e., a few cents to tokenize a card or onboard a merchant). The company, however, does not take a percentage of its clients' transaction volume.

Valuation

Finix doesn't publicly disclose its valuations during fundraising rounds, but it has raised over $126 million in total funding. Investors include American Express Ventures, Bain Capital Ventures, Homebrew, Inspired Capital, Lightspeed Venture Partners, and Visa.

In February 2020, Finix closed $35 million in Series B funding led by Sequoia and with the participation of new investors Activant Capital and Inspired Capital. However, Sequoia revoked its investor rights a month after the round closed, citing a conflict of interest with its Stripe holding since Stripe is a Finix competitor. In August of the same year, the company extended its Series B financing with a $30 million investment. This round was led by Lightspeed Venture Partners and American Express Ventures.

Key Opportunities

Payments as a Strategic Asset

Businesses have made payment a key part of the customer experience and are increasingly demanding scalable, secure, and flexible payment processing systems. Small businesses may be content with using third parties to facilitate and process payments. However, as they grow, they may prefer to bring payments in-house to enable them to own the customer relationship and enhance customer experience. In the long run, it's also cost-effective to process payments in-house. In November 2020, Finix CEO Richie Serna stated that he expected a huge number of software companies to generate the largest share of their revenue from fintech and other payment-related services in the near future. If that prediction proves accurate, it should provide a significant tailwind for Finix’s business.

Geographical and Vertical Expansion

In 2023 Finix operates in the US, but there are opportunities to expand to other regions around the globe. The demand for payment infrastructure solutions is increasing as more and more customers embrace digital payments. Finix can customize its offerings to serve a greater range of industries and verticals. The global SaaS market was valued at $215 billion in 2021 and is expected to reach $883.3 billion by 2029. Within this, particular areas of opportunity include the government cloud market, which projected to reach $71.2 billion by 2027 after having reached $27.6 billion in 2021, or healthcare where SaaS adoption is growing at a rate of 17.8% per year and where healthcare cloud computing is expected to reach $89.4 billion by 2027, or the school management system market which will reach $41.3 billion in value by 2028.

Key Risks

Liability for Merchants

PayFacs assume all risks associated with merchants. They have to put systems in place to avoid excessive chargebacks, identify suspicious activities, prevent fraud, and comply with KYC requirements when onboarding sub-merchants.

Regulation

Finix is required to abide by KYC/AML laws, which call on businesses to confirm the legitimacy of their clients. This may involve gathering and validating private data, like name, address, and occupation. Failure to adhere to KYC standards may lead to huge fines or reputational damage.

Data Security

Due to the sensitive nature of the data Finix handles in its capacity as a payment system provider, the company is susceptible to data security threats. These dangers include illegal access to customer data, data breaches, account takeovers, and identity theft involving payment cards. Finix is obligated to guarantee that all client data is encrypted and maintained securely to thwart access from unauthorized parties. Finix must also ensure that no customer information is disclosed without user permission and that all information is periodically checked for suspicious behavior.

Summary

Finix is a payments infrastructure platform with the mission to create an accessible financial services ecosystem by building a fast, easy, and cheap global operating system for fintech. Besides providing developer integration tools, the company also focuses on streamlining payment operations like reconciliation and settlement. Bringing payments in-house gives businesses more control over their processes, allows them to own customer relationships, and provides opportunities to build additional product features on top of the payment experience. Finix doesn't take basis points from the customers' transaction volumes, with the intent of allowing merchants to offer lower prices while maintaining higher margins.