Thesis

In 2022 in the US alone, there were 18 separate weather and climate disaster events that were responsible for more than $1 billion in damages. Weather-related natural disasters are increasing in frequency and total damage. 2022 ranked as the third most costly year on record when it came to property damage from natural disasters, with more than $165 billion in damage. One consequence of this mass property damage due to natural disasters has been to further exacerbate an existing supply-side housing shortage across the US.

Lack of adequate housing supply was an increasing issue in the US in 2023. The shortage was caused by a housing construction slowdown over the preceding decade, paired with a surge in home buying due to the exceptionally low interest rates of a mortgage during the COVID-19 pandemic. As of the start of 2023, the US had a shortage of 6.5 million single-family homes. Additionally, building a home is also a long process that takes on average 9-18 months to complete from the start of construction. This doesn’t even take into account the lengthy pre-construction process which includes finding and purchasing land, designing the home, and the initial permitting processes. After natural disasters, local builders are often overwhelmed with demand, leaving people on multi-year waitlists to even begin the building process.

Homebound is a tech-enabled custom homebuilder that seeks to make building the perfect home simple, transparent, and human. It manages the entire building process for homeowners, from insurance negotiation and architecture to permitting, construction, and move-in. Homebound uses easy-to-use technology to make the building process simple and efficient, and it partners with local builders and architects to build the homes themselves. The company was originally focused on providing construction and project management services for homeowners who were rebuilding or renovating their homes after disasters such as wildfires, floods, hurricanes, and other catastrophic events, but has since expanded to serve home buyers in general.

Founding Story

Homebound was founded in 2018 by Nikki Pechet (CEO) and Jack Abraham in the aftermath of the devastating Tubbs Fire in Northern California in October 2017. Pechet’s home just escaped the fires, but she watched as her neighbors and thousands of others lost their homes. Abraham was one of those affected. His home, along with over 5.6K buildings, burned down in Napa and Sonoma counties.

With only around 400 homes being built per year in the area at the time, the scale of the destruction and the slow pace of recovery underscored the need for a more efficient approach to home construction. Pechet knew something had to be done to help others get their homes rebuilt.

Homebound was born out of the founding team’s desire to help those who had lost their homes, and this problem hit close to home as it was happening in both co-founders’ literal backyards. As Pechet recalled in a 2022 interview:

“I was running all of go-to-market on both sides of the Thumbtack marketplace, which is the largest local services marketplace in the country, and I could not figure out how to help… That’s when Jack said to me, ‘We have got to build something better.’”

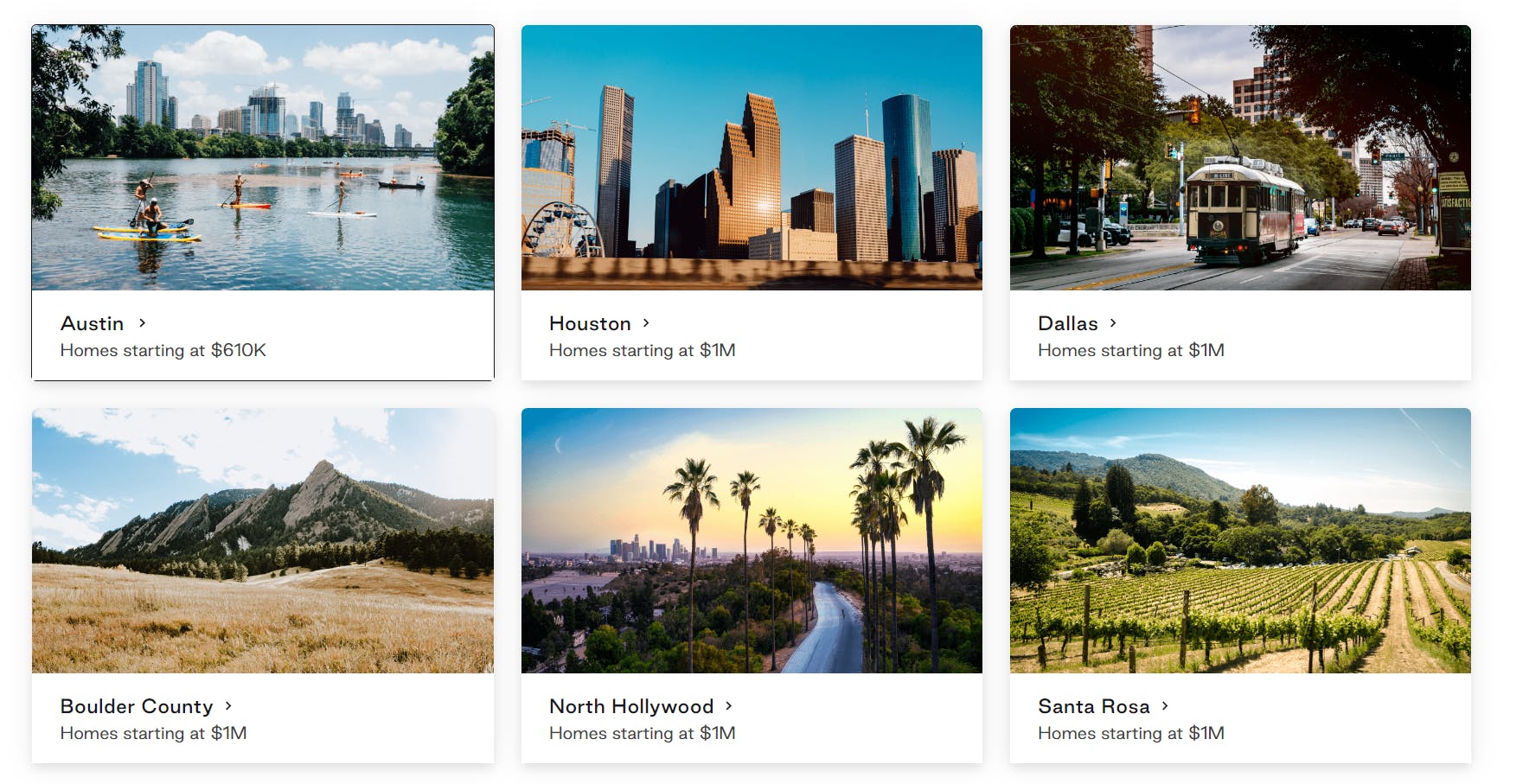

Having started with natural disasters in 2018, Homebound realized that its digital general contracting and “personalized” homebuilding services could be applied to non-disaster use cases as well — especially in regions where there was a major shortage of inventory. In 2021, Homebound expanded to Austin, Texas, its first non-disaster market. In 2023, with the help of an experienced leadership team Homebound is an active builder in six markets, including Austin, Houston, Dallas, Boulder County, North Hollywood, and Santa Rosa.

Product

Homebound’s core offering is a technology platform that simplifies and streamlines the home-building process, combined with a network of fully vetted and qualified trade partners who create and build homes. Homebound has expanded into the home buying and selling market segments as well.

Homebound provides customers with an end-to-end platform for building their homes. The platform includes 3D renderings and digital walkthroughs for homeowners before and after construction. Progress can be tracked in real time on budget, schedule, documents, and other essential building updates.

Additionally, all communication happens within the platform, providing customers with direct access to their Homebound point of contact. This point of contact is what Homebound refers to as a project manager, who acts as the customer’s liaison and sole point of contact in coordinating the entire build process. They utilize Homebound’s proprietary project management software to manage their projects, which can be up to 45 in number at a time.

Source: Homebound

Personalized Building

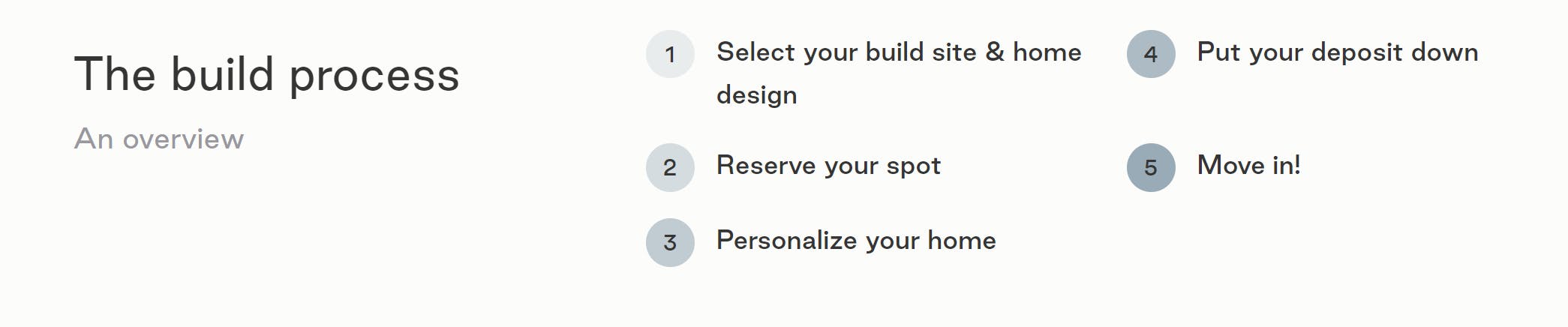

From the customer’s perspective, Homebound breaks up the build process into the following five steps:

Source: Homebound

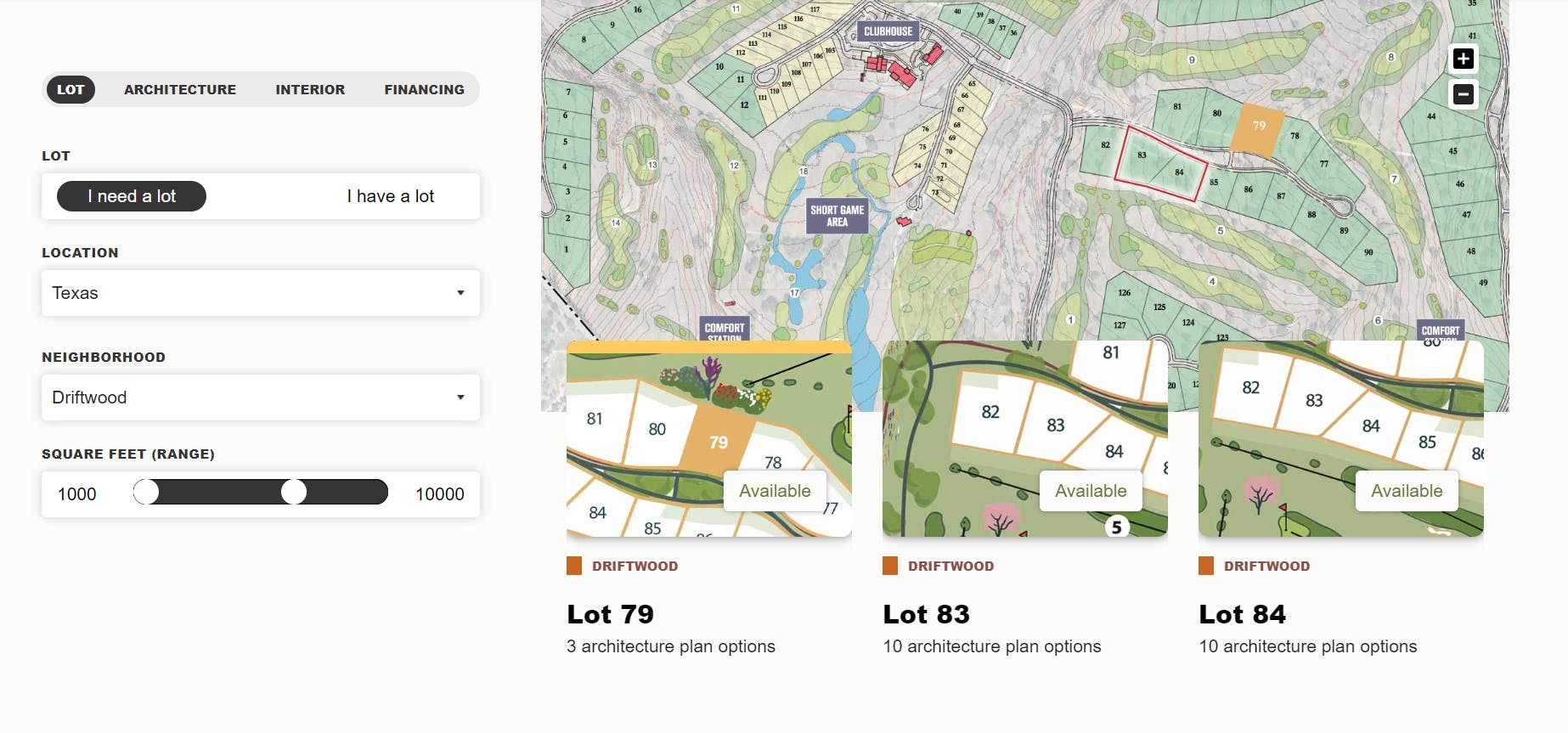

1a. A customer selects a build site, which can either be their own plot of land or one that Homebound helps source.

Source: Homebound

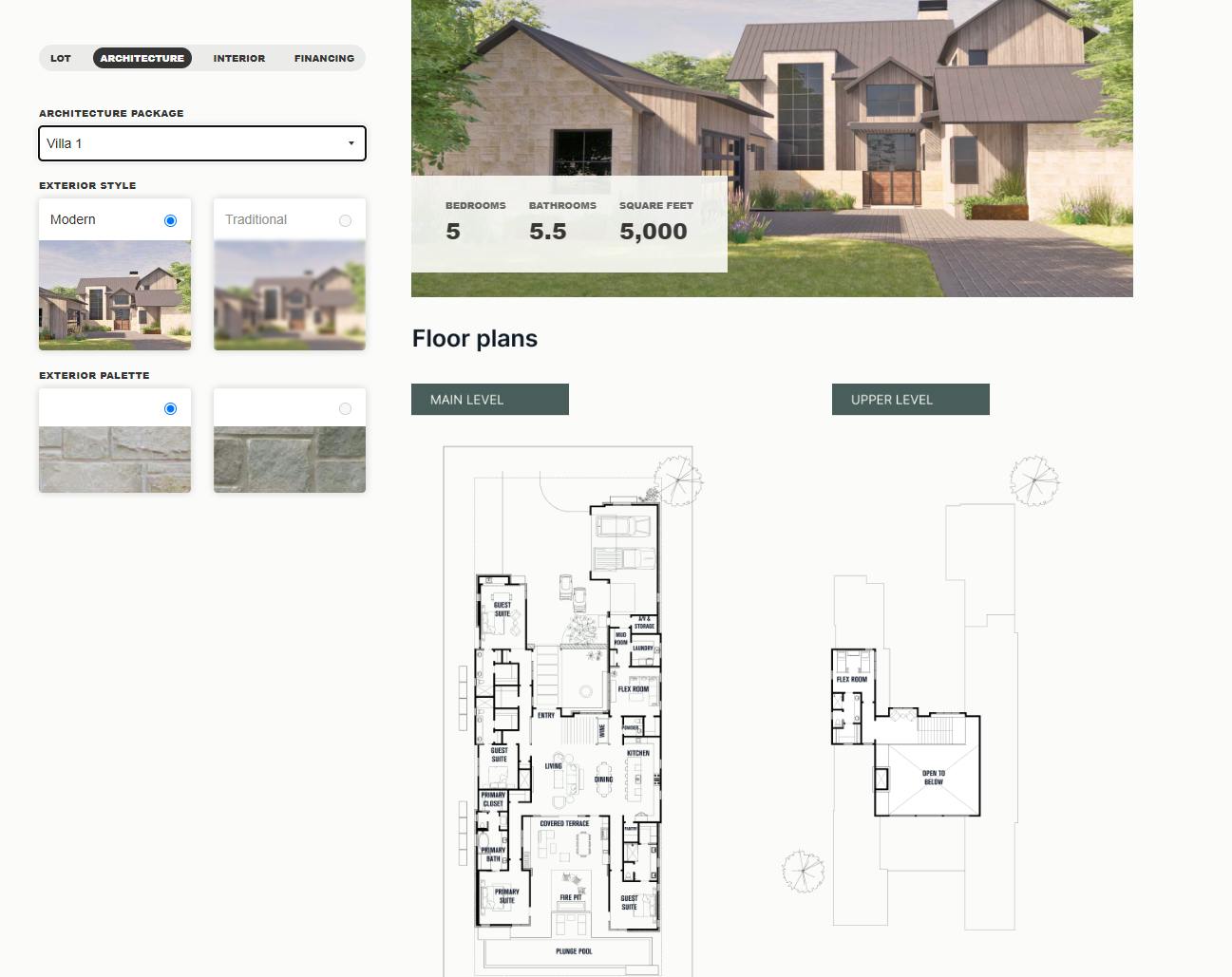

1b. Home Design: If customers have their own architecture plans and are ready to start construction, Homebound estimators can start the process while exploring interior style options. Additionally, if a customer is building on a Homebound lot, Homebound has curated architecture plans designed specifically for the lot with the ability to have it customized. Also, Homebound has more than 20 pre-existing architecture plans that are ready to build and that can also be customized.

Source: Homebound

2. Once a spot is reserved, the customer has two weeks to make a decision on whether to move forward with the build or not.

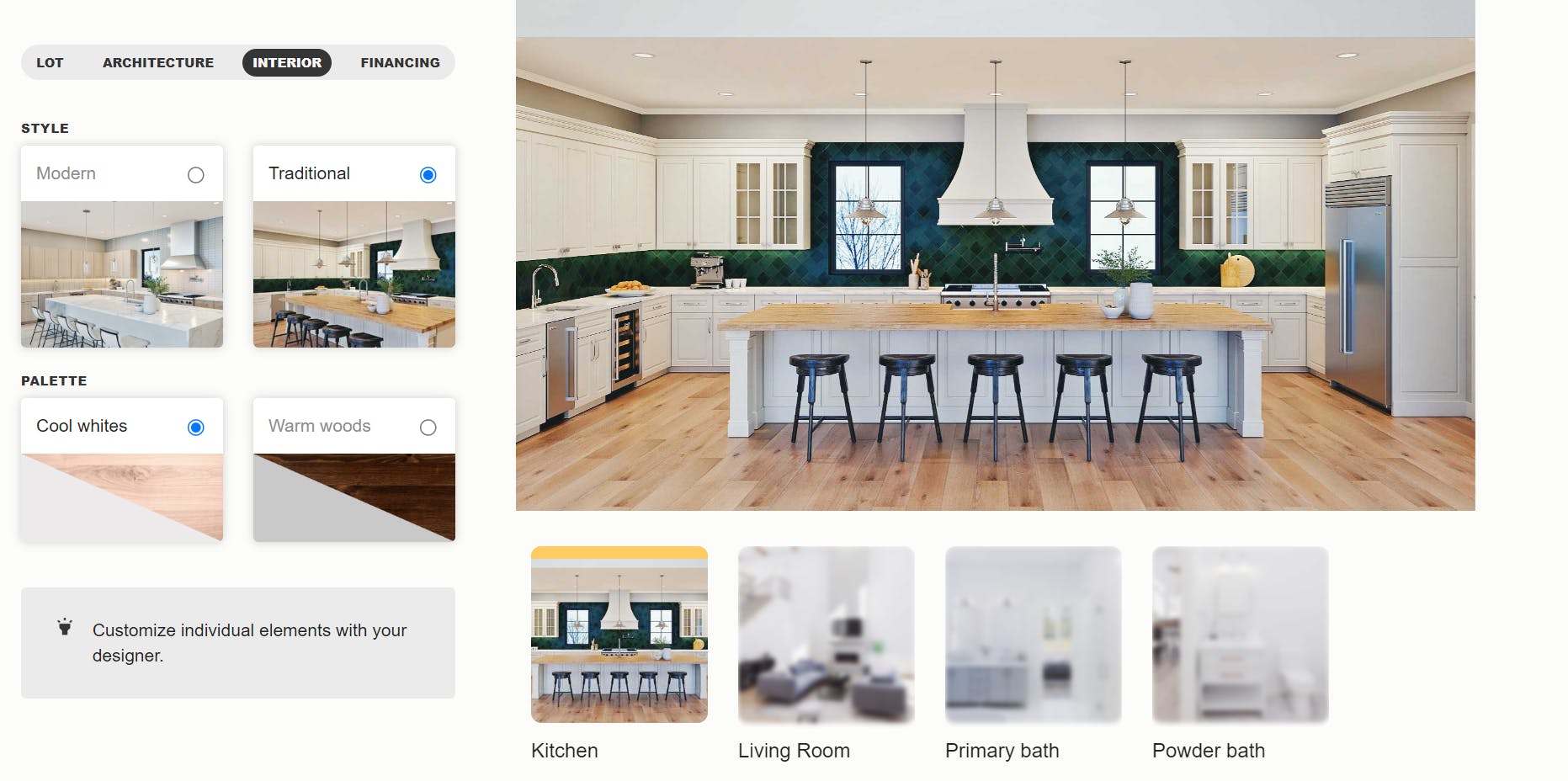

3. After the decision is made, while awaiting financing options, the customer is able to customize the interior.

Source: Homebound

4. Once financing and customization is completed, the customer puts a deposit down and construction breaks ground. Homebound claims to be 10% faster during this construction phase than the average home builder.

5. After construction, which can take between 9-18 months, the customer can move into their newly built home.

Finished Homes

Through Homebound’s website, customers can also shop for move-in ready homes. There are homes also listed as “Coming Soon” which are nearly complete projects that can be reserved ahead of completion. Homes with customization allow buyers to choose finishes and features that suit their preferences.

Source: Homebound

In a survey of 268 national buyers and 272 national builders, Homebound found that most consumers (93% of buyers and 84% of builders) are open to buying a home in the construction phase and/or buying a newly completed home. The opportunity to build and sell completed homes has had an impact on the company’s product prioritization. The finished, for-sale-homes business line has become the focal point of the company's website as of July 2023.

Source: Homebound

Property and Home Purchasing Program

In 2021, with Homebound’s expansion to Austin, Texas, the company realized that it would need to acquire properties that it could turn into for-sale homes. This expansion to land ownership was not a priority until the company broadened its focus away from natural disasters.

Source: Homebound

Additional Support

Homebound offers the following ancillary product offerings to complement its core initiatives.

A financing engine. Homebound offers construction financing for customers engaging in a build. Typically, customers come with a standard mortgage, but Homebound also has a network of preferred lenders it can introduce clients to.

A suite of pricing products that includes home valuation, market identification, and lot acquisition products. Homebound’s home valuation products are built on automated valuation models (AVMs) and Home Price Appreciation (HPA) models that accurately measure home values and accurately predict future home values, respectively. The market and lot acquisition products are powered by scoring, propensity, and risk models to identify the most attractive properties for Homebound to acquire and develop.

A custom design catalog that is a byproduct of decades of design-build experience which has allowed Homebound to optimize dimensions and sizing of spaces, programming and functionality, construction methods and materials, and aesthetics. Homebound’s catalog enables the use of higher quality materials and detailed designs at a price point below that of a typical custom-built home.

Market

Customer

Homebound began serving individuals and families who lost their homes in the 2017 wildfires in Northern California. The customers of Homebound’s rebuild services are those who lost their homes in recent natural disasters. Many of them have no intention of leaving and want to minimize the complexity and variables of the rebuild process while minimizing time to completion.

Homebound has grown to now serve anyone who wants to build, buy, or sell a home in select cities across the US. As of May 2023, Homebound services customers in Austin, Houston, Dallas, Boulder County, North Hollywood, and Santa Rosa. Although geographically concentrated in select areas, the typical Homebound customer shares many of the same core characteristics. They are most often wealthy individuals or families who are able to spend $1 million or more on a home as their primary residence.

Market Size

The home builders industry in the US is a $124 billion market. CEO Nikki Prechet believes Homebound can help triple this market size by making the industry more accessible. The thesis on the expansion of the market is that more customers deciding between buying and building will choose the latter if it is made easier and cheaper. As pricing parity between the two options occurs and time to build decreases, Homebound is betting that more people will choose to build new, personalized homes rather than buying old homes and renovating. The average cost to build a house, according to a July 2022 report, was $449K vs. $414K to buy a house.

Competition

Homebound has two main groups of competitors: large residential home builders and online services for buying and selling homes.

Large Residential Homebuilders

Pulte Group is a home construction company founded in 1950 that builds homes in the United States. During the first quarter of 2023, gross orders totaled ~9k homes. A public company, its annual revenue in 2022 was $16.2 billion, and its market cap as of July 2023 was $18.8 billion.

Lennar Corporation, founded in Miami in 1954, is a home construction company that builds affordable, move-up, and active adult homes. In 2023, Lennar expects to deliver between 12K-13.5K homes, with an average selling price of around $450K. It is a public corporation with a market cap of $40.6 billion as of July 2023.

D.R. Horton is a home construction company founded in 1978 that operates through more than 50 divisions in more than two dozen states. During the first quarter of fiscal 2023, the company sold 694 homes. It’s a public company with a market cap of $43.5 billion as of July 2023.

Online Home Buying/Selling Platforms

Opendoor, founded in 2018, offers home selling and buying services through its digital platform. In 2022, Opendoor did $15.6 billion in revenue. Opendoor is a public company with a market cap of $2.9 billion as of July 2023.

Redfin is a real estate brokerage company founded in 2004 that provides services for buying and selling homes in the US. In 2022, Redfin did $2.3 billion in revenue. It is a public company that had a $1.7 billion market cap as of July 2023.

Zillow is a real estate marketplace company that generates revenue by selling advertising on its website. Zillow spun off its iBuying unit in November 2021. However, it still acts as a potential alternative avenue for customers to purchase homes. Zillow did nearly $2 billion in 2022 revenue and is a public company with a market cap of $12.5 billion as of July 2023. Despite being a competitor, Homebound is listed as a builder on the Zillow platform.

Business Model

Homebound takes a per project fee that is based on the spread of what the customer pays for the build vs. the projects cost. Homebound does not disclose the fee percentage, other than that it is somewhere between 10-30% range. Typically, general contractors make a spread of 10-25% of a given project, if they are not using a cost plus model which falls within a similar 10-20% range.

Homebound is able to have a high degree of certainty about its builds which allows it to create fixed price contracts when providing the scope of work for customers. This is because it has a set design catalog that it is able to budget and scope accurately for. Homebound claims that what most builders will build for $800-$1K per square foot, Homebound can build for $600. Homebound’s typical home price falls within the $500K-$1.5 million price range.

Traction

Homebound’s revenue in the year after its founding, 2019, was estimated to be $10 million. Assuming, at the high end, a 25% take rate and an average home cost of $1 million, that means somewhere around 40 homes were built by Homebound in the first year alone.

As of 2023, Homebound has built 500+ homes across 6 cities. Based on the above assumptions, Homebound could potentially have somewhere between $100 million to $125 million in lifetime revenue.

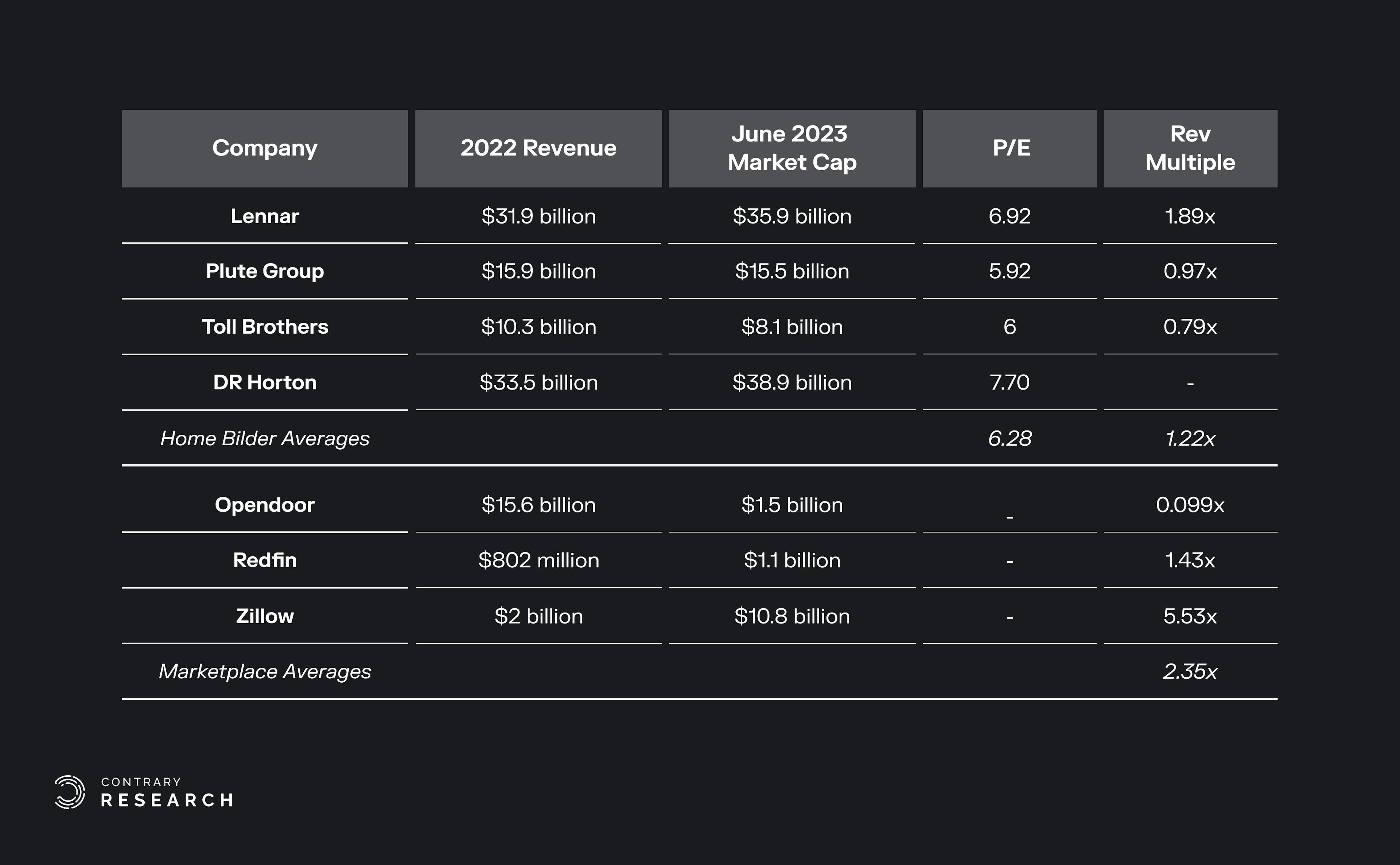

Valuation

Homebound’s last known equity financing round was a $75 million Series C led by Khosla Ventures in Februrary 2022, bringing its total funding to $128.4 million. Other notable investors include Google Ventures and Thrive Capital. Homebound declined to reveal any revenue growth metrics or its valuation.

To consider the public market comparisons, as of June 2023, the largest traditional homebuilders are trading at a revenue multiple of 1.2x where as tech-enabled residential real estate marketplaces are trading at an average of 2.4x revenue.

Source: Contrary Research

Key Opportunities

Home Building Gaining Market Share from Buying

The housing shortage has left potential homebuyers frustrated and discouraged in the typical home-buying experience. Many have turned to building as a solution to their frustrations. In 2022, the US saw the fastest growth since 2006 in new home construction. This provides an opportunity for Homebound, which will have a larger TAM if more customers see building as a viable alternative to buying.

Proprietary Data

Homebound tracks hundreds of data points per project. Having access to the breadth and depth of property and building data provides a unique vantage point that allows Homebound to optimize layouts and designs The opportunity to further templatize the design process and lean into personalization over full customization may allow for more effective material sourcing, favorable buying terms from suppliers, more efficient labor allocation, and more benefits. Its proprietary data also helps power Homebound’s AI/ML platform which helps it identify markets to expand to.

Global Expansion

Housing shortages and natural disasters are not unique to the U.S. From 1960 to 2015, Europe’s population rose by 25% to half a billion, yet the rate of new homebuilding halved. Before the COVID-19 pandemic, rising rents and housing shortages were already a growing issue in Europe, but in the 2020s, issues like the pandemic, war, inflation, and high energy and construction costs have exacerbated the problem, which may make it an expansion target for Homebound.

Key Risks

Scalability

Large builders have been dominant because of their ability to scale across local markets. By producing large volume of homes in local markets, builders are able to get favorable terms on labor, subcontracting rates, cost of materials, and even some elements of the land assembly and entitlement process. This poses two problems for any new entrant into the home building market: 1) a new entrant like Homebound will need enough volume of projects at a given time to be competitive in terms of price in a given market 2) in order to scale nationally, such an entrant needs to build out each local market individually.

Natural Disaster Impact on Homeownership

Although no longer the core focus of Homebound, areas with a high risk of natural disasters have had a harder time keeping residents and attracting new ones. A 2021 survey from Realtor.com found that 78% of homebuyers consider natural disasters when deciding where to purchase a home. In 2023, some of the largest insurance companies are no longer underwriting property and casualty insurance in at-risk areas across the US. This may negatively impact some of Homebound’s initial markets.

Summary

Homebound, founded in 2018 after the devastating Tubbs Fire, is a tech-enabled custom homebuilder which may help address the housing shortage in the US. It simplifies the home-building process through a platform that manages everything from insurance negotiation to move-in. Originally focused on post-disaster rebuilding, it expanded to serve home buyers in general. With over 500 homes built across six markets, Homebound has seen significant growth since its early days. Its proprietary data enables optimized designs and material sourcing. While the US market shows promise, global expansion, and scalability remain crucial opportunities for the company's continued growth.