Thesis

The growth of hybrid and remote work arrangements, accelerated by the COVID-19 pandemic and shown to have enduring effects post-pandemic, has created a pronounced demand for tools that facilitate effective collaboration among geographically dispersed teams. Despite a renewed push for return-to-office policies, building occupancy in the New York metro barely broke 40% as of August 2023. A traditional five-day in-office work week, once the universal standard, seems unlikely to return for office workers. A hybrid model looks likely to supplant this and become the new normal.

These shifts have necessitated a new class of collaborative software, as traditional in-person methods of performing project planning, brainstorming, and diagramming on a physical whiteboard, or in a co-located meeting room, are not directly translatable to a virtual environment. Such activities, referred to by Deloitte as “high-touch collaboration,” are challenging for organizations with a hybrid or remote workforce. There are specific challenges that come with this style of collaboration, such as the need for real-time, visually engaging tools to capture complex ideas, processes, or data flows that were previously managed using physical whiteboards or flipcharts.

In an August 2020 survey of 12K remote employees, for example, 75% stated they were able to maintain or improve their productivity on individual tasks, but only 51% reported they were able to do so for collaborative tasks. Collaboration was cited as one of the primary reasons for companies announcing required time off (RTO) policies, with a May 2022 survey of 150 US CEOs expressing concerns with productivity and engagement. In the new normal of hybrid work, where team members will often be collaborating remotely, there is a clear need for software tools that effectively foster engagement and productivity in high-touch collaboration activities.

Lucid Software is tackling the unique challenges presented by the modern, dispersed workforce through its suite of visual collaboration tools. Lucid’s software tools allow teams to create, collaborate on, and understand a wide range of dynamic, visual documents in real time. These range from brainstorms and strategic plans to diagrams and flowcharts. These tools can be used to bridge the gap between remote and in-person team members. Lucid's suite of products is positioned to serve the growing need for collaborative software that enables visual, real-time interaction, facilitating efficient and effective work in the hybrid workspace.

Founding Story

Lucid was founded in 2010 by Karl Sun (Board Chair) and Ben Dilts (CTO). While studying at Brigham Young University, Dilts joined Zane Benefits, a health tech company, as its third member for a summer job in 2006 and was tasked with building its technology. He stayed there for approximately four years, developing the technology and team.

In 2008, Dilts identified a pressing need for efficient diagramming tools while working on new healthcare products at Zane Benefits. The team had only two costly licenses for Microsoft Visio, forcing them to waste time emailing large files, printing them, and making manual edits. Dilts believed a collaborative, cloud-based diagramming tool could solve this issue. Though Google Docs existed, he found that no equivalent tool was available for diagrams and flowcharts that met workplace standards.

Unable to find a suitable solution, Dilts took the initiative to build one himself. He began working on the project in the summer of 2008, dedicating 30-plus hours weekly during nights and weekends on top of his full-time job. By December of that year, he had a "mostly-working-most-of-the-time" prototype of Lucidchart. Within the first 10 days after launching, the product gained thousands of free users and garnered attention from popular blogs, including LifeHacker.

Source: Lucid

Recognizing he had tapped into an unmet need, Dilts decided to take the project more seriously. In 2009, he left his job at Zane Benefits, returned to BYU to finish his degree, and began assembling a team to build on the technology he had initiated. While looking for angel investment, he crossed paths with Sun, a former Google executive. Sun had been with Google since 2002, serving as its Head of Patents as well as leading Google’s business development efforts in China. Later, he led the company’s green tech investment arm.

After relocating to Utah for his wife's teaching job at BYU Law, Sun was scouting opportunities in the local tech community. Meeting Dilts as a potential investor, Sun was immediately impressed with the Lucidchart prototype Dilts had built and how it compared favorably with what he had witnessed inside Google. He not only wrote a check but also joined Lucid as its CEO in early 2010, filling the business and operations role within the fledgling company. Around the same time, in October 2010 Lucid made its first business hire, a former Bain Consultant, Dave Grow.

The company began in Dilts's living room near BYU, later moving to a rented basement. Initial funding came primarily from Sun’s network, amounting to approximately $200K. The early days were lean, with Dilts barely covering his rent and Sun drawing no salary. Struggling to find local investors who understood the software business model, the team turned to Silicon Valley. Within a few months, they successfully closed a more substantial investment round.

The funds secured in this round provided the runway needed for scaling the product and growing the team. This financing also facilitated the transition from Lucidchart to a full-fledged enterprise solution. Initially launching as a freemium product, this approach allowed Lucid to acquire users at scale without direct enterprise engagement. Over time, patterns in user growth provided actionable insights into which companies they could target for more formal partnerships. In 2012, this strategy bore fruit when Lucid signed Pearson as its first enterprise customer, marking the beginning of Lucid’s growth.

In the fall of 2020, Lucid launched Lucidspark, a cloud-based virtual whiteboard, in response to the rise of remote work after the onset of the COVID-19 pandemic. This new product was intended to address the challenge of cross-team collaboration and aimed to allow teams to come together in a common space to brainstorm, ideate, and work, whether together or remote. The company also launched a third product, Lucidscale, in the fall of 2021, as a cloud visualization solution to help organizations see, understand, and optimize their cloud environment.

In April 2022, Lucid announced that Karl Sun would be stepping back into the role of Board Chair, and Dave Grow, who had been serving as the company’s COO since 2016 and President since 2017, would take Sun’s place as Lucid’s CEO.

Product

Lucid offers three visual collaboration tools designed to improve communication, collaboration, and understanding within teams and organizations. The company’s Visual Collaboration Suite includes Lucidchart and Lucidspark, while Lucidscale addresses a specific need for a more focused audience. Each serves a distinct need in the collaborative tool ecosystem. All of Lucid’s products are cloud-based and can be run from a web browser.

Lucidchart

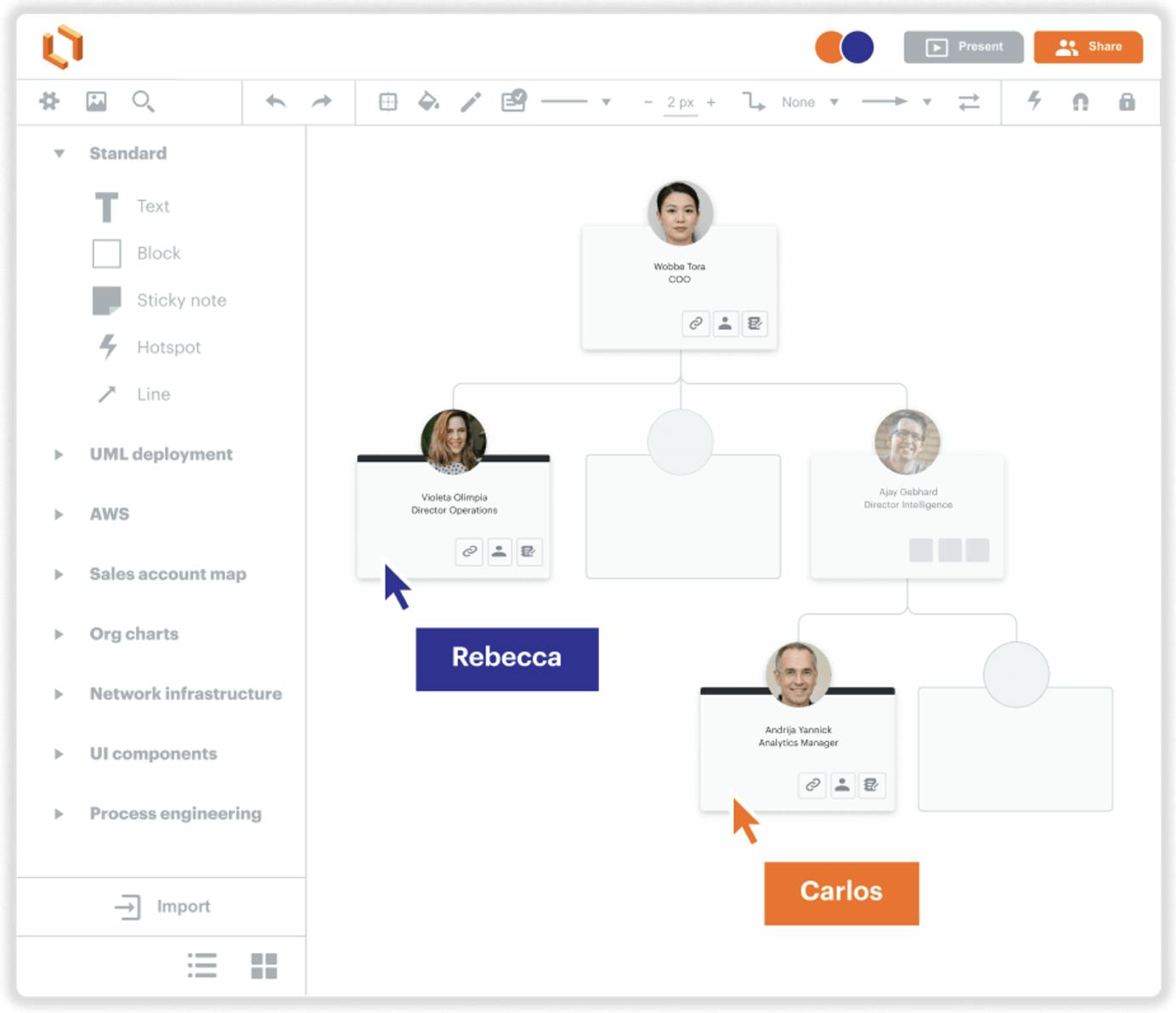

Lucidchart, Lucid’s flagship product, is a cloud-based tool that lets users create and collaborate on charts and diagrams in real time. The platform offers drag-and-drop functionality, industry-specific templates, real-time collaborative editing, and integrations with popular applications like Google Workspace, Microsoft Office, Slack, and Salesforce. Users can construct a variety of visuals including flowcharts, organizational charts, UML diagrams, and mind maps, serving multiple business functions from project management to software engineering.

Source: Lucid

Lucidchart also provides advanced features like conditional formatting and data import, allowing users to create more interactive and data-driven diagrams. Additionally, Lucidchart can dynamically link to live data from external sources, ensuring that diagrams are always up-to-date and reflective of current information.

The product also has many intelligent features, including interoperability with large language models. This includes an AI Prompt Flow extension that allows users to build and experiment with prompts in existing workflows, as well as a ChatGPT Plugin that enables users to utilize ChatGPT+ to build a base diagram that can be edited and modified within Lucidchart.

Lucidspark

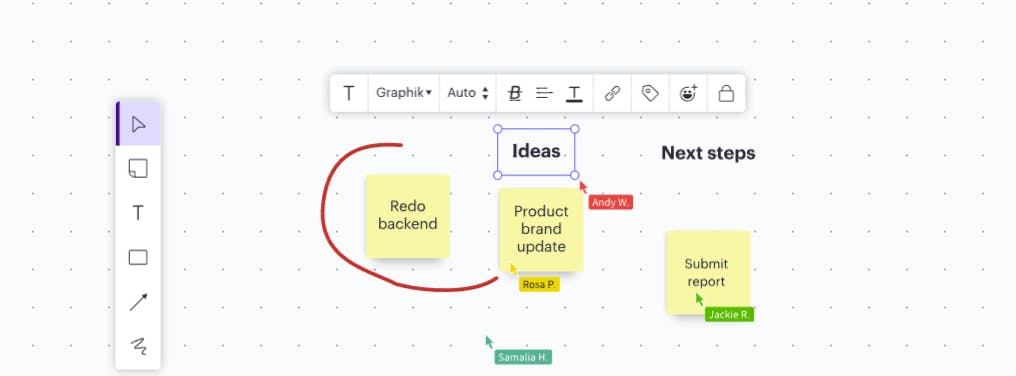

Lucidspark is a digital whiteboarding tool that provides a canvas for brainstorming, planning, and analysis. Users can collaborate in real-time on the canvas, dropping text, images, sticky notes, and other forms of rich media onto the canvas while seeing what other users are doing. Lucidspark provides pre-made templates and various drawing tools, including sticky notes and free-hand drawing, and also includes collaborative functions like voting and tagging functionalities.

Source: Lucid

Other collaboration features include timed brainstorming and review sessions. Like many of Lucid’s products, whiteboards created in Lucidspark can be connected with popular enterprise tools like Slack, Microsoft Teams, and Jira, and includes a native integration with Lucidchart. Users can also integrate AI into their brainstorms and workflows using a Collaborative AI tool, which helps teams generate, sort, and summarize ideas.

Lucidscale

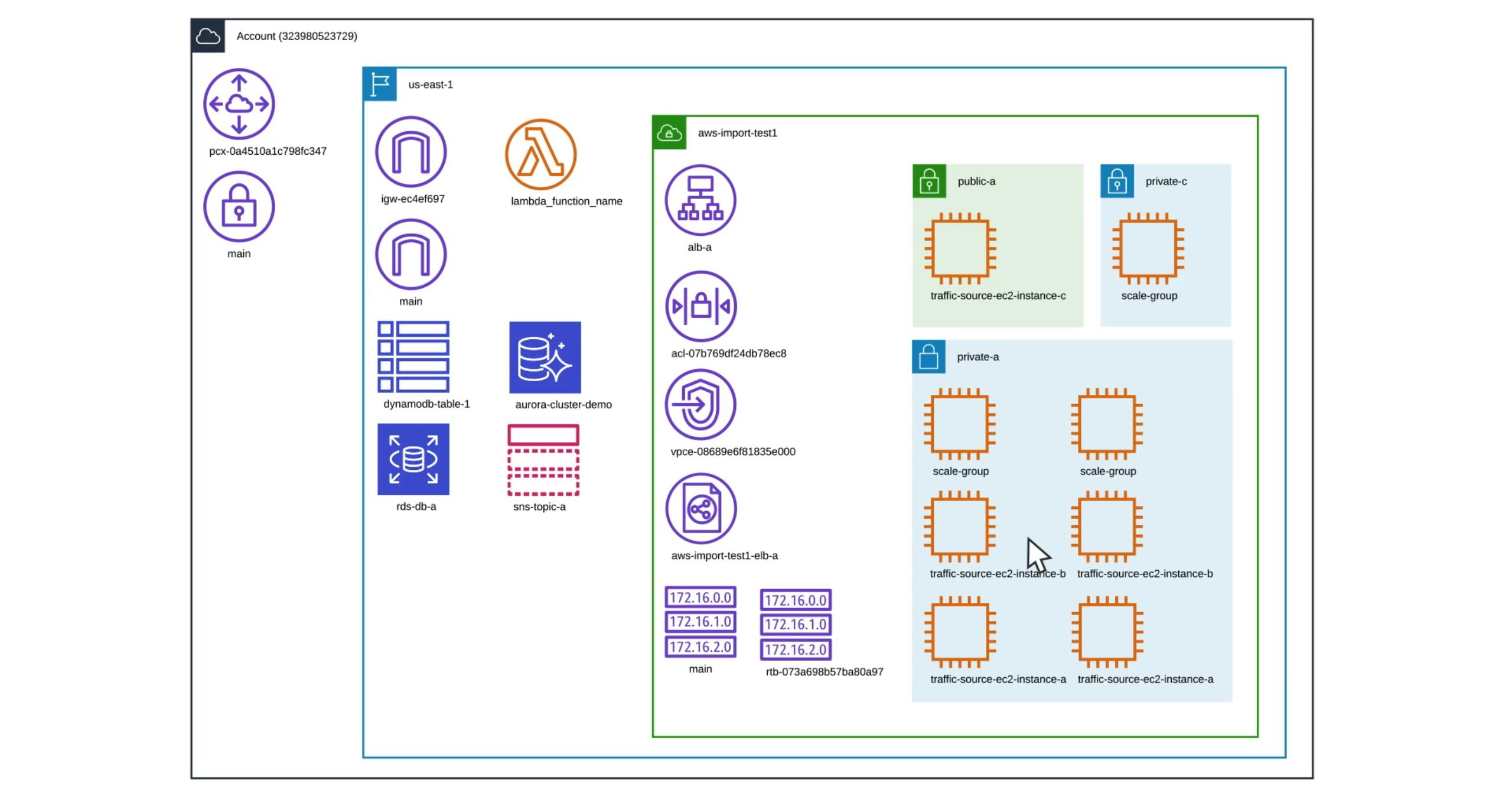

Lucidscale is a cloud visualization tool designed to help companies map and understand their cloud infrastructure. The tool automatically inventories and diagrams cloud resources, offering a real-time view of an organization's cloud environment. Companies can use Lucidscale to visualize their cloud architecture to ensure that existing cloud infrastructure, like instance sizes, regions, and availability zones match the needs of the organization.

Source: Lucid

In addition to visualization, Lucidscale provides features that enable users to automate the documentation of cloud architecture into a central wiki or repository. Documentation generated by Lucidscale can be used for compliance reporting and auditing use cases to assist organizations in adhering to industry standards and regulations. Key integrations provided by Lucidscale include dynamic, real-time updates with major cloud providers like AWS, Azure, and GCP, and documentation export integrations with Confluence.

Market

Customer

Lucid's customer base includes corporate teams and individual users across a range of industries like technology, finance, healthcare, and education. It has also expanded to target the public sector with its FedRAMP authorization which took place in September 2023.

The primary users of Lucidspark and Lucidchart are often project managers, business analysts, and IT professionals who require tools that allow them to both engage and collaborate with others visually, whether that be for retrospectives and sprint planning, or for diagramming and process mapping. These users value the ability to create specific visual records, like flowcharts, network diagrams, and org charts that help visualize complex information and systems, and the ability to collaborate in real time.

For Lucidscale, the ideal customer profile skews toward DevOps teams, cloud architects, and IT managers in organizations with substantial cloud infrastructure. These professionals use Lucidscale for real-time cloud environment visualization and compliance reporting.

Market Size

Lucid’s suite of products addresses two primary, targeted markets: the diagramming software market and the collaborative whiteboard software market. Both are specific segments of the overall team collaboration software market, valued at $17.1 billion in 2021 and projected to grow to $40.8 billion by 2028.

The diagramming software market that Lucid’s flagship product, Lucidchart, addresses, was valued at $700 million in 2021 and is expected to grow at a CAGR of 9.4% to reach approximately $1.3 billion by 2028. The collaborative whiteboard market, of relevance to Lucidspark, was valued at $2.1 billion in 2021 by Mordor Intelligence, with an expected 17.8% CAGR through 2038 to reach $4.9 billion. Key drivers across these markets include the shift to remote and hybrid work resulting in an increasing demand for collaboration tools.

Competition

Miro

Miro, founded in 2011, focuses on online collaborative whiteboarding, offering a product that competes with Lucidspark. With a range of features including infinite canvas, pre-built templates, and real-time collaboration, Miro has gained significant traction with over 60 million users worldwide. The platform has found a niche in remote work settings, agile development, and design thinking, with clients ranging from startups to Fortune 500 companies. Miro raised $400 million in a Series C funding round in January 2022, led by ICONIQ Capital. While Miro doesn't directly compete with Lucidchart, its feature set and focus on collaborative brainstorming make it a direct competitor to Lucidspark.

Through Google Workspace offerings like Google Drawings and Google Jamboard, Google at one time presented potential competitors to both Lucidchart and Lucidspark. Google Drawings offers basic diagramming tools integrated into its ubiquitous Google Drive ecosystem. Google Jamboard was geared toward interactive whiteboarding, offering real-time collaboration much like Lucidspark.

However, in September 2023, Google announced that it would be shutting down Jamboard, after receiving feedback from Workspace customers that other whiteboarding solutions like Lucidspark and Miro worked better. To help users impacted by the shutdown transition, Google stated that:

“We are integrating whiteboard tools such as FigJam, Lucidspark, and Miro across Google Workspace so you can include them when collaborating in Meet, sharing content in Drive, or scheduling in Calendar.”

Microsoft

With its Visio flowchart software, Microsoft and its Microsoft 365 suite represent a direct competitor to Lucid’s product offerings. As part of the Microsoft Office suite, Visio benefits from direct integration with popular tools like PowerPoint and Excel. Aimed at both technical and business users, Visio offers a range of templates and robust features that satisfy diverse diagramming needs.

Microsoft also competes indirectly with Lucidspark through its Whiteboard application, which enables real-time collaboration and brainstorming, albeit in a more simplified, less feature-rich way. Microsoft's extensive enterprise customer base and integration capabilities give it a distinct advantage, especially for businesses already operating within the Microsoft ecosystem.

Diagrams.net

Founded as Draw.io in 2000 and later rebranded to Diagrams.net, this platform is a diagramming tool that provides a straightforward and cost-effective alternative to Lucidchart. Diagrams.net supports various file formats, including Lucidchart's, and offers essential features for diagramming for free. Diagrams.net’s mission statement to “provide free, high-quality diagramming software for everyone” has made it popular among budget-conscious users and organizations. The tool has been integrated with a wide range of third-party services, including popular platforms like Confluence and Jira, making it versatile for users accustomed to Atlassian products.

Business Model

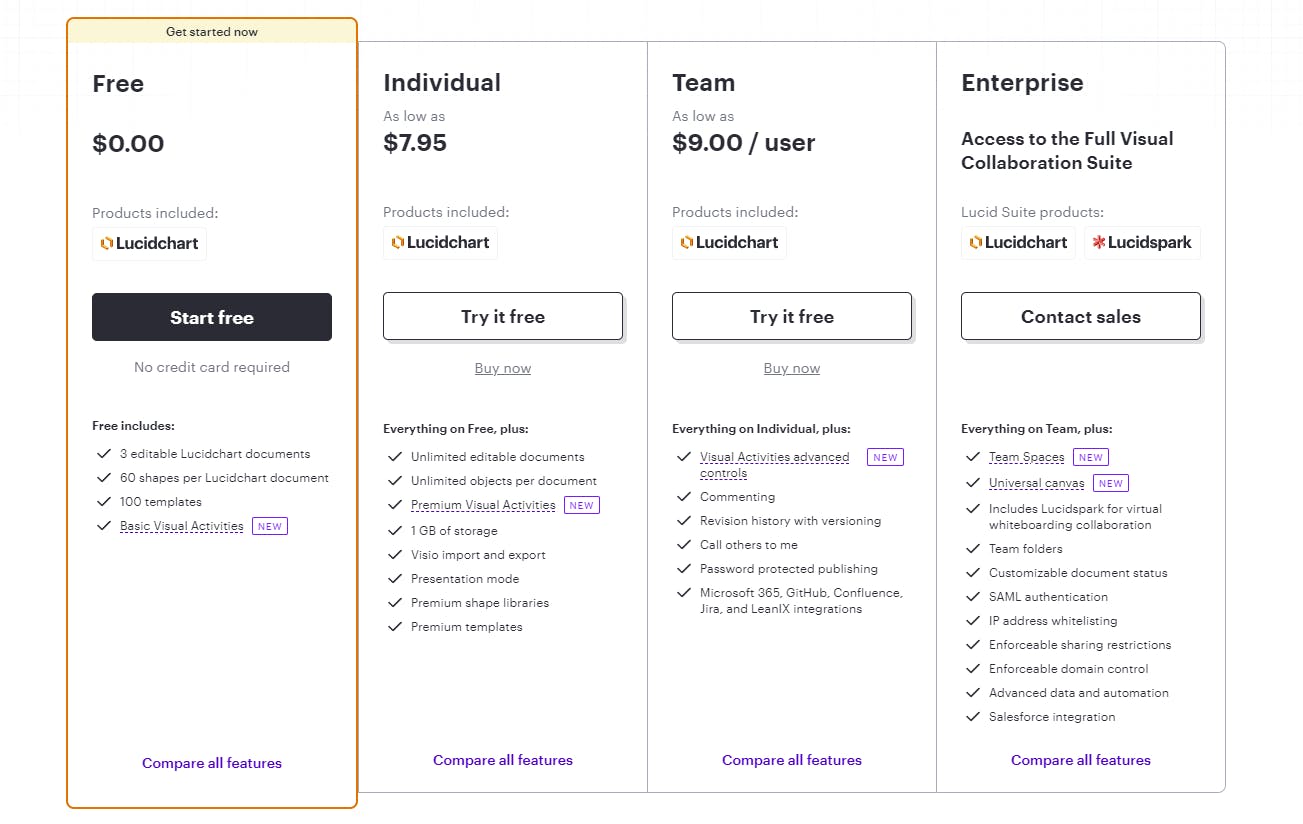

Lucid operates a tiered subscription-based model that caters to both individual professionals and enterprise-level clients. The company offers different plans for each of its products, namely Lucidchart, Lucidspark, and Lucidscale. As of November 2023, pricing and features include four tiers:

Free, for occasional users who only need a basic diagram and flowchart-creating tool, comes with restrictions including only 3 editable documents and only 60 objects per document.

Individual ($7.95/month) is targeted at solo professionals. Lifts restrictions on the number of documents and objects in documents provides Microsoft Visio import and export, and enables shape libraries and templates.

Team ($9/user/month) is intended for small to mid-sized teams. Adds commenting features, revision history, password protection, and integrations with enterprise tools like Microsoft Office, Github, and Jira.

Enterprise, for large organizations with more advanced needs, pricing is custom and not publicly disclosed. Provides the richest set of features including document sharing restrictions, SAML authentication, and team workspaces.

Source: Lucid

Lucidspark shares similar pricing to Lucidchart, offering a free plan with significant restrictions, an individual plan for $7.95 monthly that lifts restrictions, a $9 per user per month team plan that introduces versioning and rich collaborative features, and an enterprise plan with advanced organizational controls. In addition to the previously mentioned standalone Lucidspark pricing, customers have the option to bundle both Lucidchart and Lucidspark, which provides a 25% discount to both the individual and team plans, and both Lucidchart and Lucidspark are also combined together for enterprise licenses.

Lucidchart and Lucidspark have pricing models that cater to both casual and professional users. In contrast, Lucidscale is aimed squarely at the enterprise market. Individual and team plans for Lucidscale include either Creator or Explorer licenses, where Creators can generate visualizations and modify them, whereas Explorers can interact with existing visualizations and metadata.

Individual ($2K/year) includes 1 creator license and enables the automatic visualization of AWS, Azure, or GCP cloud environments.

Team ($2K/creator license/year, $400/explorer license/year) requires at least two licenses and introduces access control mechanisms for importing, exporting, and sharing data with individuals and applications.

Traction

Since its inception, Lucid has seen consistent growth, driven largely by the widespread adoption of its flagship product, Lucidchart. In its September 2016 Series B, Lucid stated it had more than 8 million users. Less than two years later, this number increased to 10 million in a May 2018 podcast with Dave Grow (then President and COO). In April 2020, Lucid stated this number had grown to over 20 million users across 180 countries worldwide.

As of November 2023, the company claims that more than 70 million users use Lucid’s products. Notably, the company stated in June 2021 that 99% of Fortune 500 companies use Lucid products, with notable names including Google, Amazon, Starbucks, Stripe, Volkswagen, and Audi.

Source: Lucid

Valuation

In June 2021, Lucid announced a $500 million secondary investment that valued the company at $3 billion, which included Tiger Global, Alkeon Capital, and STEADFAST Capital Ventures as new investors.

Prior to this, its $52 million Series D in April 2020 was led by ICONIQ Capital. Lucid stated that it passed $100 million in ARR during its Series D in April 2020. At the time, Lucid declined to share its valuation but stated it was worth in excess of $1 billion. In Lucid’s June 2021 secondary investment raise, the company claimed to have grown bookings “over 100% from the prior year.” Assuming that the stated growth directly translates to an increase in ARR, $200 million in ARR at a $3 billion valuation would value the company at a 15x revenue multiple.

Key Opportunities

Generative AI

In May 2023, Lucid began to leverage generative AI to add to its product functionality when it announced the beta release of Collaborative AI to its platform. It followed up on this in October 2023 when it announced enhancements to the Visual Collaboration Suite’s AI features, drawing from feedback from its beta launch. The company now allows users to integrate AI into their brainstorms and workflows.

It also expanded interoperability with LLMs with an AI Prompt Flow extension, which allows users to build and experiment with existing Lucidchart workflows using AI prompts. In addition, it added a ChatGPT plugin to help automatically create Lucidchart diagrams based on prompts, which can then be edited within Lucidchart.

Continuing to leverage generative AI could potentially enhance Lucid's value proposition in the diagramming and visual workspace market. By distinguishing itself as a leader in AI-driven diagramming solutions, Lucid could carve out a new niche, while offering existing customers more value to increase user retention and lifetime value.

Vertical-Specific Solutions

Lucid’s development of Lucidscale represents a foray into vertical-specific solutions, with the initial focus on cloud architecture. To grow Lucid’s addressable customer base, this approach of developing vertical-specific solutions can be replicated across other industries that require specialized features or compliance standards. For instance, a HIPAA-compliant version could serve healthcare sectors, while a supply chain mapping tool could be invaluable for manufacturing.

Just as Lucidscale offers specific functionalities to cloud architects, industry-specific tools could be created for areas such as finance, where compliance with regulations like SOX is crucial. By diversifying its offerings in this manner, Lucid can expand its addressable market and introduce pricing differentiation for specialized features. Moreover, developing industry-specific capabilities as add-ons could create upselling opportunities and potentially increase ARPU for existing customers.

Education Sector Focus

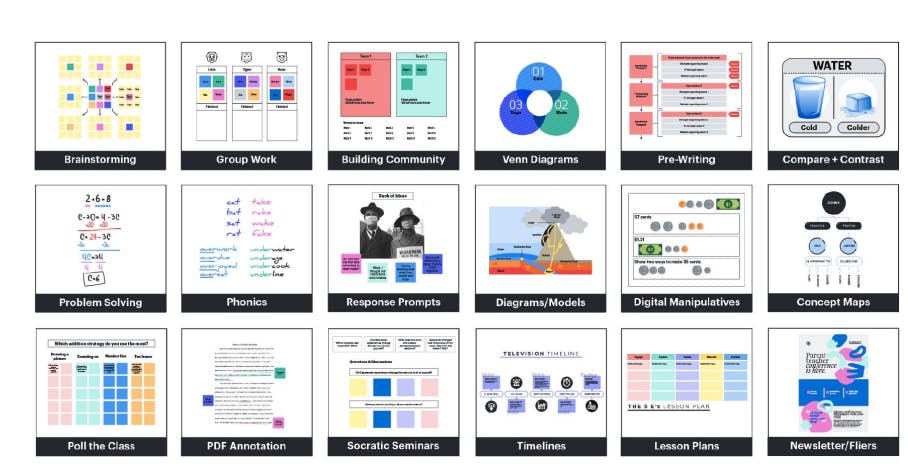

Doubling down on targeting the education sector presents a substantial opportunity for Lucid to grow product adoption with younger consumers. While Lucidchart is already used for various applications like flowchart creation and process mapping, its potential as an educational tool can be expanded upon.

According to a report the company shared with Contrary Research in November 2023, Lucid has already created templates and features specifically designed for educational settings, including lesson plans, “Socratic seminars”, concept maps, and others, as part of its “Lucid for education” initiative targeted at both K-12 and higher ed.

Source: Lucid

Other companies like Google have successfully executed a similar playbook with Google for Education, providing a suite of productivity tools specifically designed for classroom use. Google Workspace for Education reached 120 million users. While Lucid has a dedicated page for education customers, the company counts only 10 million education users, indicating there is significant room for growth when compared to Google’s reach, although the company works with Google as a partner and offers various integrations from Google in its education products.

Key Risks

Macroeconomic Downturn

In the wake of the macroeconomic downturn starting in 2022, enterprises are tightening their budgets, causing a slowdown in SaaS growth. This presents a risk to Lucid, which relies heavily on enterprise customers for recurring revenue. As companies look to cut costs, they may choose to downgrade their subscriptions, opt for cheaper alternatives, or completely discontinue usage of non-essential software tools — especially in light of studies showing that 49% of software installed by enterprises goes unused by employees.

Zylo’s 2023 SaaS Management Index Report, for example, identified team collaboration and project management were two of the top three areas of redundancy in SaaS spend that enterprises should look to cut spending on. In a strained macroeconomic climate, specialty SaaS products like the ones Lucid develops are at risk of reduced enterprise spending and contract renewals.

Rapidly Evolving Market

The market for visual collaboration software is becoming increasingly crowded, with the relatively frequent emergence of new competitors and the existence of incumbents with platforms like Microsoft. Lucid Software needs to continue to innovate and differentiate its products to maintain its competitive edge. As the market for visual collaboration software is competitive and constantly evolving, Lucid needs to continue to adapt to new trends, as it did with generative AI, to stay ahead of the curve.

Summary

Lucid operates in the visual collaboration and diagramming space, aiming to simplify complex processes and information. Its products have found traction among a range of casual and professional users, from students to software developers, to create flowcharts, wireframes, and organizational charts, among other diagram types. However, Lucid faces considerable competitive pressures from larger, more diversified SaaS platforms. Companies like Microsoft and Google have integrated or are capable of integrating diagramming and workflow functionalities into their broader suite of office and productivity tools. These larger platforms have the advantage of established customer bases, bundled service offerings, and extensive resources for R&D, potentially overshadowing Lucid's specialized focus.

Lucid's expansion into other areas, like Lucidspark for virtual brainstorming, might diversify its product offering and generate additional revenue streams. But these areas also expose Lucid to competition from specialized platforms in virtual whiteboarding. To secure its position, Lucid needs to continue to innovate, possibly through more advanced features or integrations that make it indispensable within specific workflows. The company's continued growth will depend on its ability to fend off competition, either by deepening its product capabilities or through strategic partnerships that enhance its distribution and value proposition.