Thesis

Radiology plays a crucial role in modern medicine, using medical imaging to diagnose diseases, guide treatment, and determine clinical care for patients during the early stages of disease detection. The global market for medical imaging in 2023 was $39.8 billion, growing at a 4.9% CAGR through 2030. Within this market, point-of-care (POC) medical imaging is emerging as what many consider a paradigm shift in healthcare delivery, patient comfort, and the immediacy of treatment decisions. POC medical imaging consists of technology that allows medical imaging to be performed at the patient’s bedside or convenient location.

Medical imaging growth is being driven by several key factors taking place across healthcare including an aging population, the rising incident rate of noncommunicable diseases, and a shortage of radiologists. This growing population exacerbates the volume of scans required in the typical course of care. From 2020 to 2023, the global proportion of adults above 65 increased from 9% to 10%. In the US, medical imaging utilization among older adults doubled between 2000 and 2016 across computed tomography (CT) and magnetic resonance imaging (MRI). Meanwhile, ultrasound scans grew by 50%.

In addition, the rising volume of noncommunicable diseases merits more of these scans. Noncommunicable diseases, or chronic diseases, kill 41 million people annually, accounting for 74% of global deaths in 2023. The noncommunicable disease percentage of the total global disease burden has increased from 49.2% in 2000 to 61.6% in 2023. Approximately 80% of noncommunicable diseases are preventable and can be managed through detection, screening, and treatment, often involving radiological modalities such as CT, MRI, and ultrasound scans.

Even as the demand for medical scans has grown, there has been a decrease in the number of qualified radiologists who can conduct and interpret those scans. The workload for radiologists has increased. From 1999 to 2010, the number of images requiring interpretation per minute per radiologist increased from 2.9 to 16.1. Despite this, the number of diagnostic radiologists in the US fell by 2.4% with a 7.2% decrease in first-year radiologist residents and fellows from 2016 to 2021. In particular, low and middle-income countries (LMICs), have an estimated 3.2 billion people who lack access to basic imaging, even though X-rays and ultrasounds could address 70% to 80% of illnesses as of July 2023. POC devices such as ultrasounds have positively impacted over 60% of patients in these regions as of July 2023.

Despite the shortage in radiologists, the technology behind imaging has continued to progress. Advances in artificial intelligence, the adaptation of existing devices, the miniaturization of hardware components, the collection of multimodal data, self-running diagnostic machines, and the transmission of health information are all contributing to the growth in medical imaging as of 2023. These advances have enabled the development of smaller devices, improved access, and improved decision-making.

That’s where OXOS Medical comes in. OXOS Medical is positioned to take advantage of the growing demand for point-of-care diagnostic imaging and the increasing adoption of radiology technology. The company's portable X-ray device captures static and dynamic X-ray images, aiming to address the limitations of expensive, predominantly stationary, and complex X-ray technologies that require technician expertise.

By utilizing smaller spot sizes (focal points on an X-ray) and producing less scatter (background fog on an X-ray image) than traditional X-ray machines, OXOS Medical aims to enhance portability, safety, and image quality. The company also supports the development and deployment of AI algorithms for image interpretation, providing training data for new algorithms and uploading approved algorithms to OXOS Medical devices for diagnostic use. OXOS Medical's mission is to expand access to radiographic diagnostics at the point of need, aiming to change how healthcare is delivered.

Founding Story

OXOS Medical was founded in May 2016 by Dr. Gregory Kolovich (Chief Medical Officer) and Evan Ruff (CEO), both Georgia Institute of Technology engineering alumni.

Kolovich, a Harvard-trained, board-certified orthopedic surgeon with a background in electrical engineering, identified the need for improved X-ray technology during his fellowship at Massachusetts General Hospital from 2014 to 2015. Kolovich became frustrated with the existing X-ray devices available and found that traditional 800-pound CR technology cumbersome, inefficient, and lacking in image quality, particularly in his specialty in reconstructive hand surgery.

Ruff’s background was as a serial entrepreneur with experience building several technology companies. Before OXOS, Ruff also held leadership positions at multiple startups and consulting firms. He holds a bachelor's degree in computer engineering and an MBA from the Georgia Institute of Technology.

Together, they developed Micro C in 2016, a small-scale X-ray device specifically designed for use on hands, feet, and elbows. This first product aimed to improve ergonomics, increase workflow speed, enhance image quality, and reduce radiation exposure, all while bringing POC radiology to urgent care centers and primary care offices.

As of August 2024, Kolovich leads the OXOS medical advisory board and manages all clinical user needs and research. He continues to practice as an orthopedic hand and microsurgeon in Savannah, Georgia, and has served as president of the Georgia Society for Surgery of the Hand since 2018. Ruff drives business and engineering functions at OXOS Medical as of August 2024.

Product

OXOS Medical develops a wireless, portable X-ray device that aims to enable radiographic diagnostics to be administered anywhere and anytime.

MC2

Source: OXOS Medical

The MC2 is the core product offering for OXOS Medical as of August 2024. The product is a portable, handheld, X-ray device that has been in development since November 2021. The MC2 is the successor to the company's previous product. Incorporating feedback from Micro C users, the MC2 was designed to enhance the capabilities and user experience of portable X-ray imaging. It features four distinct modes: Radiography, Dynamic Digital Radiography (DDR), Fluoroscopy, and Photography. The system combines AI and computer vision to autonomously self-calibrate and capture sharp images at low radiation levels.

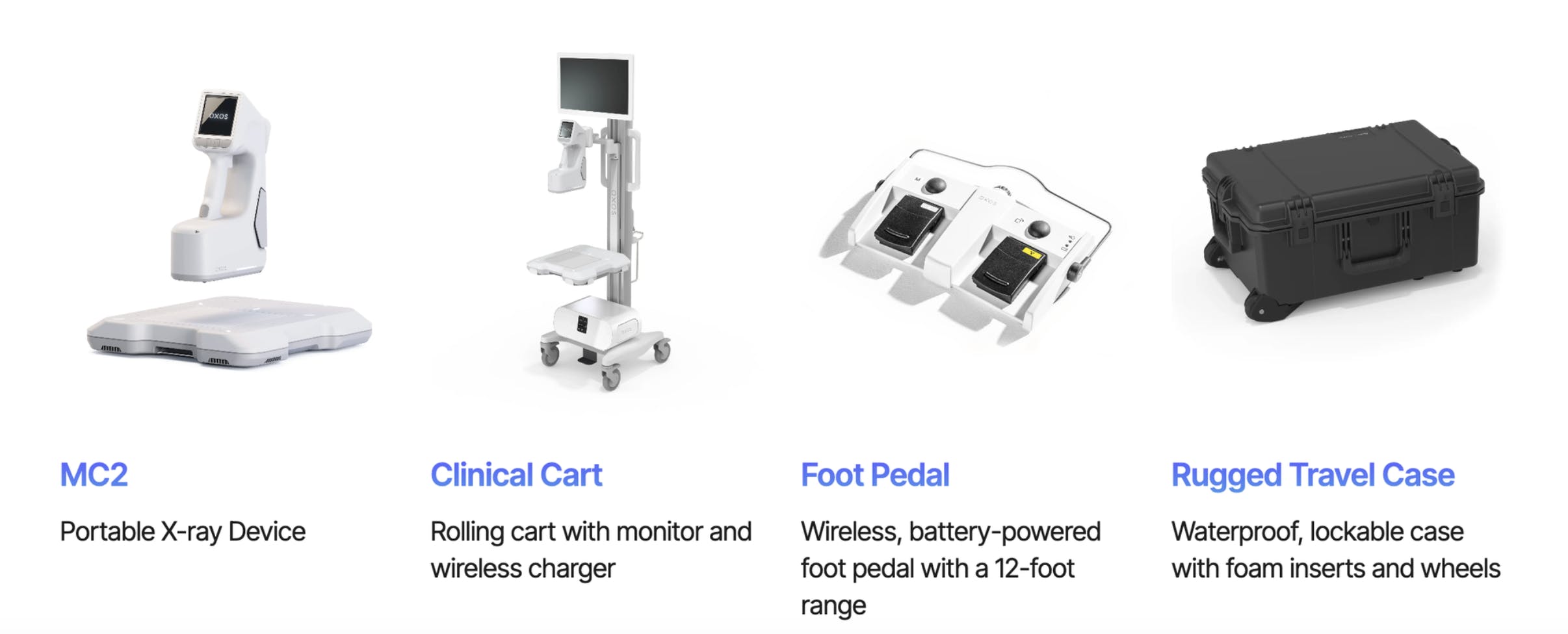

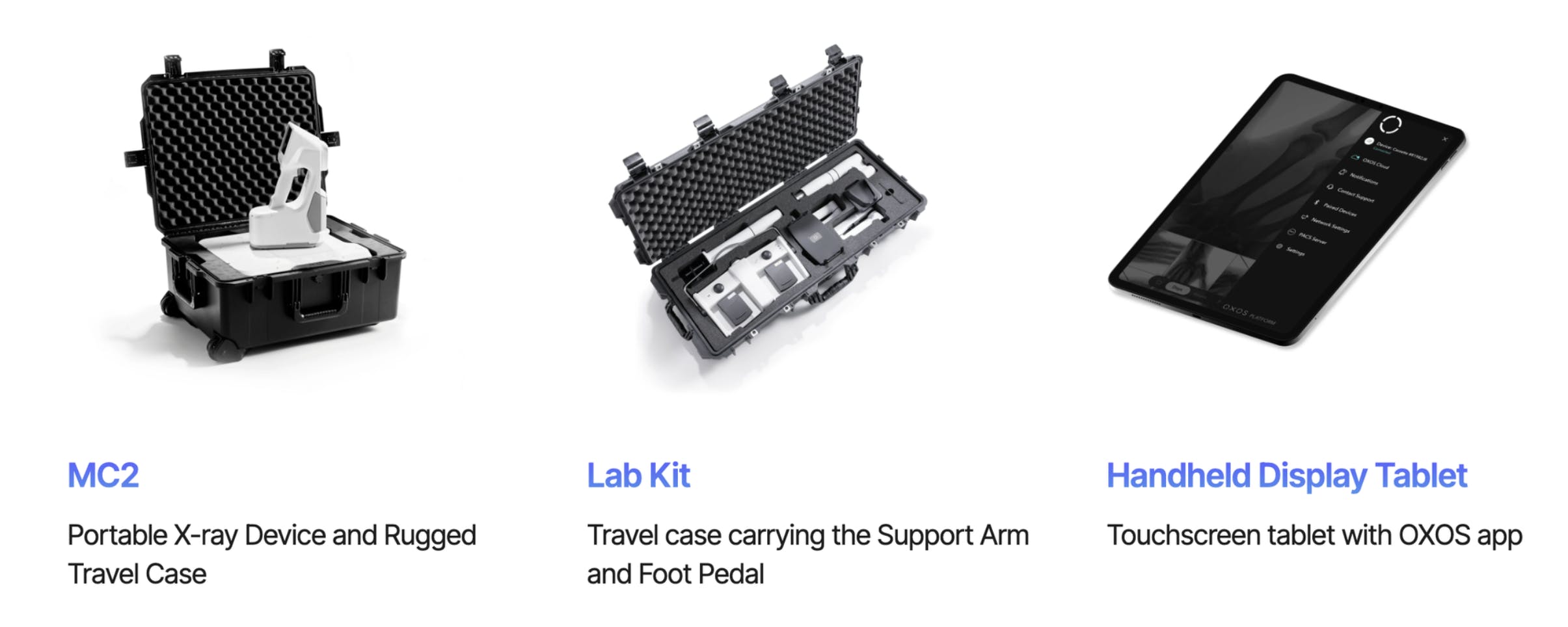

In addition to the standard MC2 portable X-ray device, OXOS Medical offers three specialized variants tailored to specific healthcare settings and applications:

The MC2 Clinic is designed for use in clinical settings such as hospitals, urgent care centers, and medical practices. This product aims to provide an all-in-one solution for point-of-care imaging. MC2 Clinic includes a clinical cart with a wireless charger and monitor, a foot pedal with a 12-foot range, and a rugged travel case.

Source: OXOS Medical

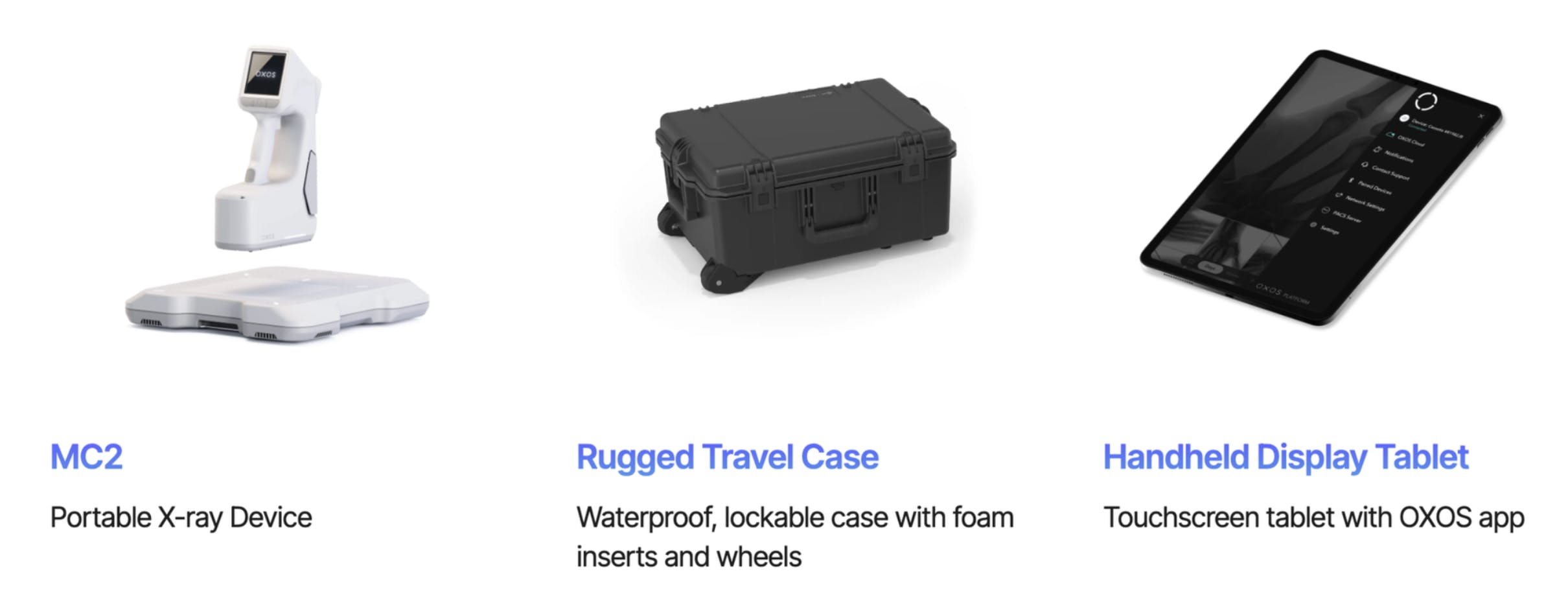

The MC2 Go is built for mobile and remote healthcare applications. This product is the most portable solution because it’s designed to be easily transported and deployed in various settings, such as ambulances, disaster response teams, military operations, and global health initiatives. The MC2 Go features a rugged travel case, a handheld display tablet that connects to the OXOS app, and wireless connectivity, allowing healthcare professionals to capture high-quality X-ray images even in challenging environments.

Source: OXOS Medical

The MC2 Lab is tailored for medical education and laboratory applications. The MC2 Lab features a lab kit that includes a travel case, pivoting support arm, and foot pedal that can be assembled quickly and stored. The product also includes a handheld display tablet that connects to the OXOS app.

Source: OXOS Medical

The MC2 has gained recognition for its design, winning the 2023 Red Dot Design Award and Fast Company's 2023 World Changing Ideas Award in the Health category. As of August 2024, MC2 is awaiting FDA clearance and is not yet available for sale.

Previous Products

Micro C

OXOS Medical’s first revenue-generating product was a portable X-ray machine, the Micro C, designed to enhance point-of-care imaging. The lightweight, portable emitter allowed healthcare providers to conduct imaging at or near the patient's residence, primary care offices, or at the incident site. This capability eliminated the need to send patients to external facilities, reducing the time associated with waiting, booking appointments, and travel.

As a handheld fluoroscope, the Micro C converted radiation into real-time static and dynamic fluoroscopic images of the human skeleton. Fluoroscopic imaging provides high-quality pictures and videos of surgical anatomy and pathology. This type of imaging is particularly useful during diagnostic procedures and surgeries where observing the motion of organs or instruments is crucial. The small emitter size enables surgeons and healthcare providers to bring the X-ray source directly to the target for precise imaging. The Micro C emitter weighed seven pounds, compared to 1.1K pounds for a traditional C Arm, 485 pounds for a Mini C arm, and 16 pounds for a portable C arm.

Source: OXOS Medical

The Micro C showed improved resolution and reduced radiation compared to traditional C arms, Mini C arms, and Portable Mini C arms. Higher-resolution images can improve diagnostic accuracy, better visualize pathologies such as calcifications in tissue or hairline fractures, and improve treatment planning. These images also reduce the likelihood of needing repeat scans, saving time, reducing patient discomfort, and lowering radiation exposure. These improvements were possible because the Micro C used a smaller spot size, a patented rolling collimator, and reduced scatter.

The Micro C also utilized the in-house developed AiLARA System to automate the implementation of the "As Low As Reasonably Achievable" (ALARA) principle. AiLARA uses a machine-learning algorithm to automatically determine optimal X-ray settings based on anatomy thickness and distance from the X-ray source and detector. This results in clinically relevant images with minimal radiation exposure.

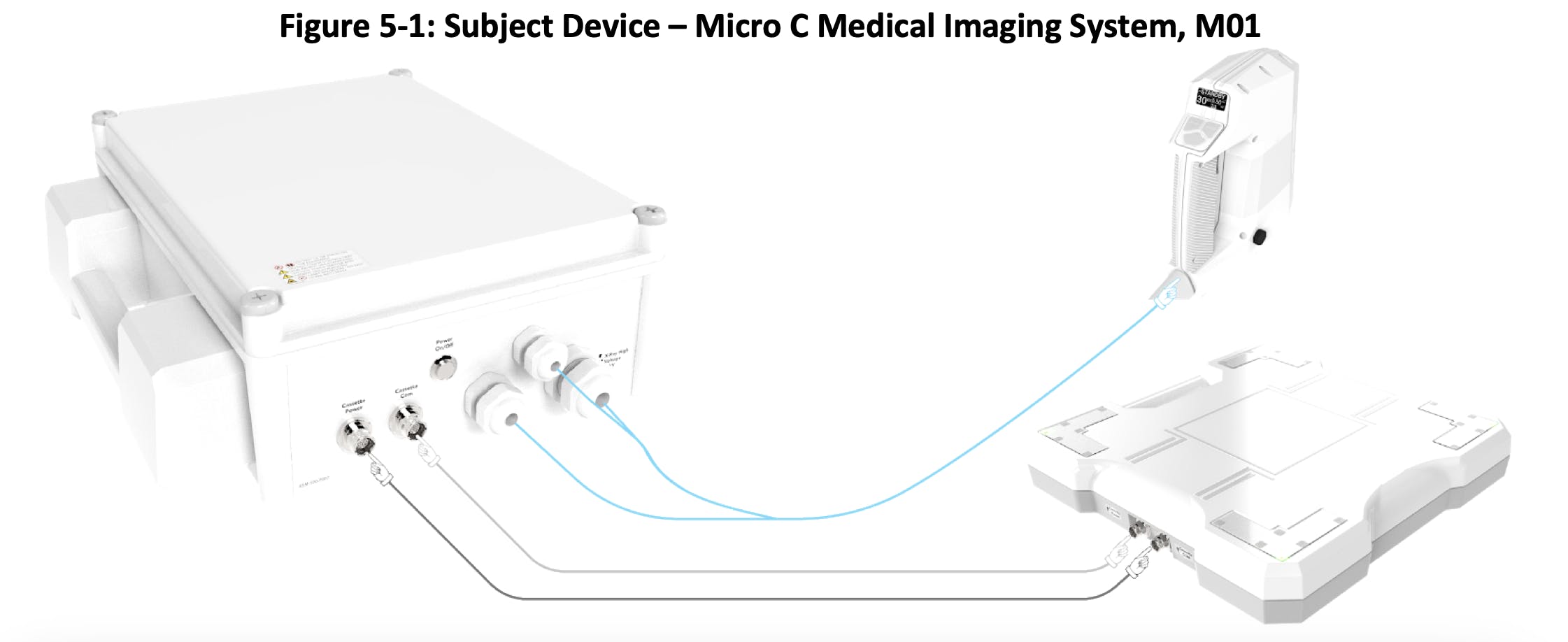

The Micro C consisted of three primary subsystems: the Emitter, Cassette, and Control Unit.

The emitter includes the operator control panel, an X-ray tube, and a computer vision camera, designed for handheld operation and precise positioning.

The cassette contains the X-ray detector, which collects X-ray energy and provides a digital representation to the control unit for display. It also has status and IR lights to assist in positioning the X-ray field.

The control unit houses the high-voltage generator, computing power, monitor and keyboard inputs, and other necessary electronics.

These subsystems worked in conjunction with a DICOM (Digital Imaging and Communications in Medicine) monitor, keyboard, and mouse, powered by a mains power outlet. In the image below, the control unit is on the left, the emitter is on the top right, and the cassette is on the bottom right.

Source: U.S. Food & Drug Administration

The device utilized a computer vision positioning system that allowed the emitter to be positioned above the patient's anatomy and aligned with the cassette, ensuring accurate imaging.

Additionally, the Micro C device is designed to integrate with existing medical systems. It is DICOM compatible, facilitating seamless connection with Picture Archiving and Communication System servers for image transmission. The device integrated with patient data and health information through a worklist, ensuring streamlined workflow and data management. The product was compatible with major Electronic Medical Records systems such as Epic, Cerner, and Athena. Furthermore, the device was Fast Healthcare Interoperability Resources compatible, enabling capabilities for capturing, sending, and billing directly from the device.

The Micro C had limitations as well. While effective for imaging smaller limbs, it lacked the power for imaging larger bones in larger individuals, such as professional athletes. Additionally, it cannot replace radiographic systems that offer variable tube currents and voltages for optimizing image quality and radiation exposure across different exam types.

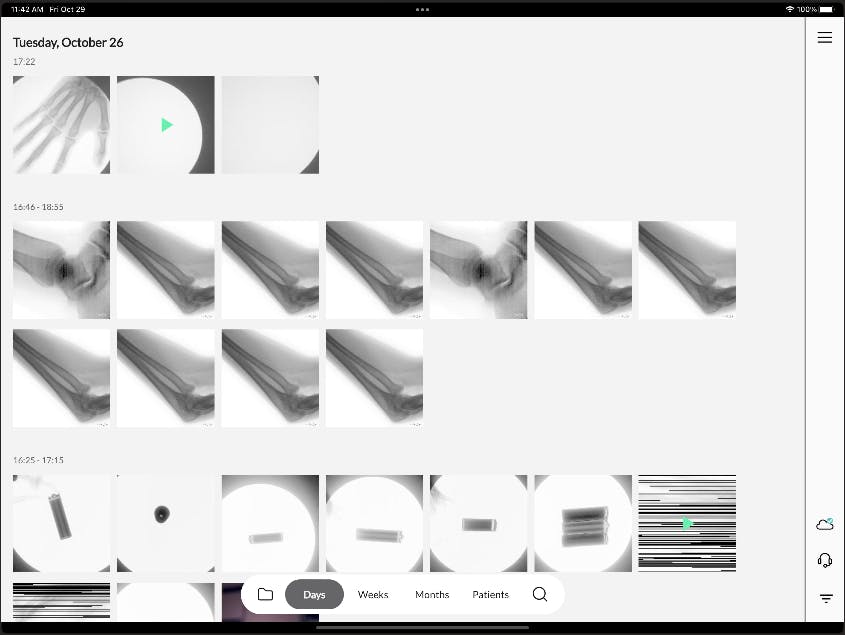

OXOS Cloud Platform

The OXOS Cloud Platform, which was launched in 2022, was a cloud-based integration and archival system that securely stores all radiographic studies and dynamic X-ray captures. The HIPAA-compliant platform included a nationwide teleradiology service that provides rapid study interpretation. Images captured by the Micro C were instantly accessible to medical practitioners through the platform across desktops, tablets, and web interfaces.

Source: OXOS Platform App

Third-party AI algorithms integrated with the Micro C could be deployed directly at the point of care, delivering diagnostics to patients and providers. The platform supported detailed metadata, including positioning information and depth metrics, which can be used to train new algorithms. OXOS collaborated with partners to achieve FDA approval and CE clearance ensuring algorithms were safely deployed on OXOS devices.

OXOS devices utilized API wrappers to send DICOM studies to installed AI containers, enabling offline and real-time analysis. This architecture allowed publishers to manage and iterate effectively while providing access to advanced algorithms. For example, OXOS partnered with accredited service providers to enhance teleradiology capabilities, allowing providers to offer imaging services and teleradiologists to access new streams of reads with a one-click "Send to Teleradiology" function. OXOS also managed integration, billing, and routing, allowing teleradiology providers to focus on patient care.

Market

Customer

For its initial Micro C product, OXOS Medical claimed as of 2020 to have served three tiers of customers for its portable X-ray devices.

The first tier consists of customers looking to directly replace traditional C Arms. C-arms are medical imaging devices that are comprised of an X-ray generator and detector, connected by a C-shaped arm. The C-arms market size in the US was ~$900 million in 2022 and is projected to grow to $1.3 billion by 2030 at a CAGR of 4.6%.

The second tier comprises customers seeking a portable device for urgent radiological imaging needs. As of April 2023, these have included orthopedic providers spanning urgent care clinics, military departments like the US Department of Veterans Affairs, sports organizations like the NFL, medical educators, imaging centers, and biological labs.

The third tier targets the AI-enabled radiology market, which includes settings like home health, rural medicine, retirement homes, and elder care facilities where medical professionals may not be readily available. OXOS Medical's AI algorithms aim to enable precise clinical decision-making at the point of care, improving patient outcomes and healthcare efficiency in underserved communities and remote locations.

Similar to the Micro C, MC2 is designed to serve a wide range of customers across various healthcare settings and applications.

The MC2 Clinic targets customers in clinical settings such as hospitals, urgent care centers, orthopedic practices, and other medical facilities. These customers require an all-in-one POC imaging solution that integrates with their existing workflows and systems, aiming to enable quick and accurate diagnosis of conditions like fractures, dislocations, and foreign body detection.

The MC2 Go caters to customers in mobile and remote healthcare applications, including ambulance services, airports, disaster response teams, military operations, and global health initiatives. These customers typically need a compact and lightweight device that can be easily transported and deployed in challenging environments, providing high-quality X-ray imaging capabilities even in off-grid locations.

The MC2 Lab was designed for medical education and lab environments. Researchers and scientists can assemble the MC2 quickly and transport it easily.

In addition to these use cases, OXOS Medical highlights several other customer segments that can benefit from the MC2 device. These include sports medicine professionals who require dynamic imaging capabilities and portability for on-site imaging at sporting events and training facilities, as well as healthcare providers in mobile health units and global health organizations seeking to improve access to diagnostic services in remote or underserved areas.

For example, OXOS Medical has supported multiple initiatives that are helping provide global access to affordable radiology, including medical mission trips to Central America and Africa with organizations such as USAID, the Luke Commission, and the Helping Hands charity.

Market Size

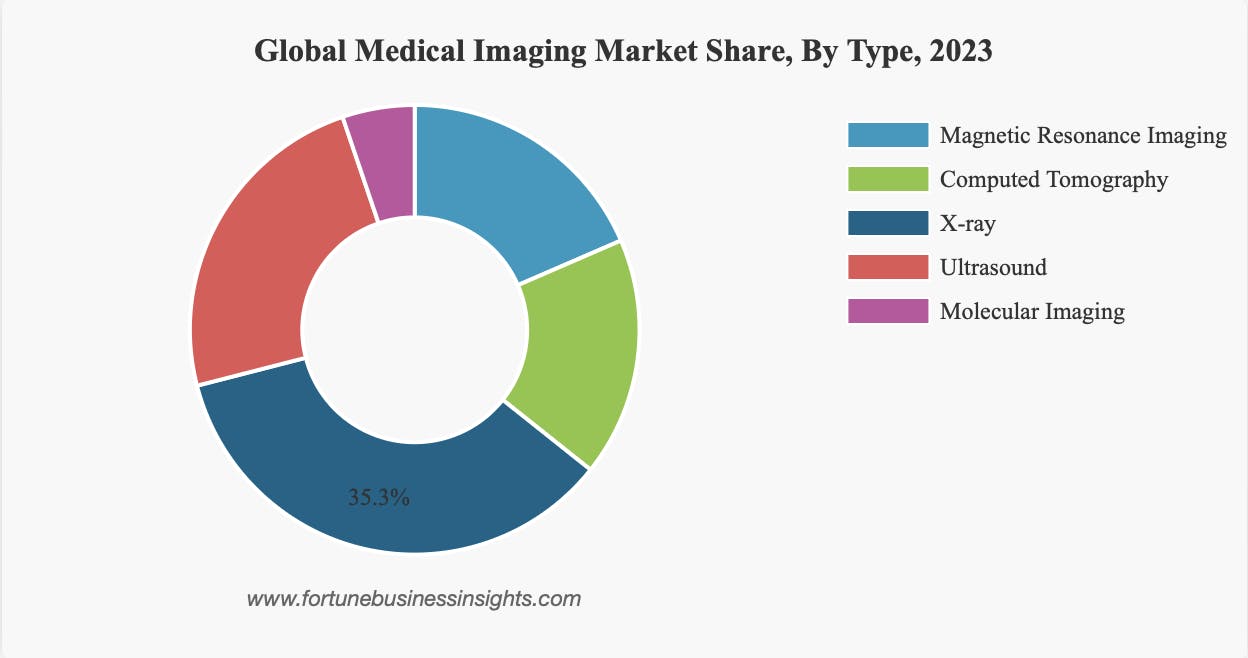

The global medical imaging market was valued at $39.8 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. Factors driving this growth include product innovations, the development of point-of-care medical imaging equipment, and the integration of AI technologies. These advancements are expected to improve diagnostic accuracy and efficiency, crucial for managing the healthcare demands of aging populations worldwide. In 2022, the US medical imaging market was valued at $10.6 billion. In 2023, within the global medical imaging market, X-ray imaging accounted for 35.3% of total market share.

Source: Fortune Business Insights

OXOS Medical more categorically falls into the global point-of-care diagnostics market, which was valued at $1.2 billion in 2022 and was projected to grow at a CAGR of 4.3% from 2023 to 2030. The US point-of-care diagnostics market was valued at $333.1 million in 2023 and is expected to reach $425.2 million by 2030 at a CAGR of 3.6%. The global market's growth is driven by an aging population, increasing incidence of diseases, adoption of POC imaging devices, and technological advancements.

Competition

Direct Competitors

KA Imaging: KA Imaging, founded in 2015, is a Canadian company that claims it has developed the world's first portable dual energy subtraction X-ray detector. The company's flagship product, Reveal, received FDA 510(K) clearance in June 2020 and Health Canada clearance in September 2020. In 2020, KA Imaging raised a $1 million debt financing round, led by FedDev Ontario. The company raised a total of $11.4 million in funding as of August 2024. In March 2024, the company indicated it was hoping to close a $25 million funding round to support commercialization efforts and develop AI technology, though as of August 2024 that round hadn’t been announced. The company reported a 4x increase in revenue in 2023 compared to 2022 and a 38% growth in headcount in 2023.

Unlike traditional radiology solutions, KA Imaging's patented SpectralDR technology captures digital radiography, bone images, and soft tissue images in a single shot, positioning it uniquely in the point-of-care radiology market. More than 10 hospitals in the US are using SpectralDR technology.

KA Imaging offers five medical products: Reveal Mobi Pro, Reveal Mobi Lite, Reveal Portable Package, Reveal 35C X-ray Detector, and Sight. Particularly, Reveal 35C specializes in showing bone and soft tissue without motion artifacts. KA Imaging use cases primarily focus on producing front and lateral views of the lungs and bones to visualize pneumonia, fractures, and masses, while OXOS Medical is primarily used for conducting dynamic and static scans of bones from the hip to the toes and from the shoulder to the fingertips.

Turner Imaging Systems: Turner Imaging Systems, founded in 2016 and a subsidiary of Turner Innovations, develops the Smart-C, which is a battery-powered, hand-transportable mini C-arm. The company raised $1.4 million in total funding from investors including Mountain Pacific Partners, Cavendish Impact Capital, and RadNet. Key customers include sports teams like the LA Dodgers, LA Rams, and BYU Football team and various surgical and clinical settings. In 2022, the company was awarded a contract to develop a dual-use X-ray imaging device for the US Air Force.

The Smart-C is used for similar use cases to OXOS Medical's devices, primarily to capture images on limbs, extremities, or shoulders, including orthopedics, and emergency medicine. However, the Smart-C arm weighs 16 pounds, which is heavier than OXOS Medical's Micro C product, which weighs seven pounds. As of August 2024, the company has not reported integrations with AI algorithms and cloud accessibility, unlike OXOS Medical. In 2021, the Smart-C received the CE mark, which allows the product to be distributed through the EU and UK. As of 2024, OXOS Medical was planning to apply for the CE mark to gain entry into Europe and other regions.

MinXray: MinXray, founded in 1967, is a global manufacturer of portable X-ray generators serving medical, veterinary, and military use cases. MinXRay's medical imaging products include Impact Wireless, CMDR Tethered System, and CMDR Wireless System, all featuring battery-powered digital radiography capabilities. MinXray further expanded its suite of portable X-ray equipment to include a handheld ultrasound scanner. MinXRay has partnered with national distributors like Maven Imaging and Dicom Solutions. MinXRay also partnered with the Diagnostic Ultra-portable X-ray for Space program where it successfully obtained medical diagnostic radiographic images in zero-gravity conditions with its impact digital radiography system. MinXRay's Impact Wireless is similar in weight to OXOS Medical's Micro C device. While MinXRay and OXOS Medical overlap in their target customer groups, OXOS Medical leverages cloud and AI offerings.

Orthoscan: Orthoscan, founded in 2002, offers three product lines as of August 2024: TAU, Mobile DI, and Ziehm Solo FD The Mobile DI C-arm is the most portable solution, weighing 35 pounds, and is suitable for extremity imaging (hands, feet, etc.) and various clinical applications.

Orthoscan was acquired by ATON GmbH in 2011. Atom GmbH is owned by the Helmig Family, a German private investment company that holds majority equity in companies in the fields of medical technology, mining technology, aviation, and engineering. Atom GmbH also owns Ziehm Imaging Group, a German technology leader in full-size mobile C-arms.

While Orthoscan has an international presence and a network of distributors like Block Imaging, Soma Tech Intl, and Quest Imaging Solutions, OXOS Medical differs by leveraging cloud and AI offerings.

Hologic: Founded in 1985, Hologic is a public medical device manufacturer with a focus on breast and skeletal health, diagnostic solutions, gynecological surgical solutions, and skeletal health. Hologic's InSight FD mini C-arm offers customizable imaging options such as high-resolution modes and low-radiation modes and is used to perform minimally invasive surgical procedures on extremities. InSight FD is built with a flat, rotating detector to improve surgical area positioning and a C-arm with a 120-degree range of motion.

Of the four segments it operates in, Hologic makes the least revenue from its skeletal health segment, reporting $133.4 million in revenues for 2023 and an operating income of $12.6 million in this segment. Hologic considers its primary competitors in the skeletal health segment to be GE Healthcare and Orthoscan.

Hologic has an international presence and network of distributors like Soma Tech Intl and Quest Imaging Solutions. As of August 2024, Hologic does not describe any AI or cloud options associated with its mini C-arm, unlike OXOS Medical.

Distributors

Medical device distributors offer a wide selection of mobile and portable X-ray systems as well. They are typically only distributors, but enable buyers to view a catalog of devices in one place. As a result, these are adjacent competitors to OXOS Medical. While distributors may sell competitive products, they could also potentially sell products on behalf of OXOS Medical. These companies offer the advantage of centralization, efficiency, and variety for customers looking to buy X-ray systems compared to individually browsing company sites.

Maven Imaging: Founded in 2014, Maven Imaging is an X-ray equipment distributor that sells a variety of radiological imaging equipment, including mobile and portable X-ray systems. It provides three-wheeled, rolling mobile systems and handheld portable systems. Prices for its products range from $8K to over $100K, depending on features, brand, and quality. Examples of brands it distributes include FUJI, CareView, and MinXRay.

Soma Tech Intl: Founded in 1992, Soma Tech Intl is a medical device distributor, offering a variety of devices across industries including heart-lung machines, imaging tables, incubators, and EKG machines. Soma Tech Intl offers new, demo, and refurbished devices and charges up to 50% below original equipment manufacturer prices. As of August 2024, Soma Tech Intl sells 14 Mini C-arm devices manufactured solely by GE Healthcare, Hologic, and Orthoscan.

Pacific Healthcare Imaging: Founded in 2011, Pacific Healthcare Imaging is a medical device distributor specializing in C-arms and other types of medical imaging. It offers new and refurbished C-arms along with C-arms for rent or lease. As of August 2024, Pacific Healthcare Imaging offers 13 compact or mini C-arms. Brands offered by Pacific Healthcare Imaging include Ziehm, Hologic, OrthoScan, and Siemens.

Traditional C Arm Manufacturers

The industry standard for X-ray imaging is the traditional C-arm. The arm allows for movement to produce images of the target anatomy from different angles. While traditional large C-arms offer high generator power, long-exposure imaging, and flexibility in the angles, they are heavy, lack portability, and are expensive. Mobile C-arms can often handle the most common types of imaging cases, are less expensive, and are easily portable.

Many industry leaders have versions of a mobile C-arm available. Despite their name, these mobile arms remain heavy compared to the portable X-ray devices, weighing 607.6 pounds on average. These mobile arms are often wheeled and transported within an imaging center or hospital, rather than moved offsite or used at the point of care. OXOS Medical’s portable X-ray device capitalizes on size, weight, and reductions in radiation while producing high-quality images at a similarly fast pace. The primary advantage of C-arms compared to the Micro C is that C-arms are better equipped to capture larger bones and more complex imaging angles due to the size of the arm and the automated positioning system.

GE Healthcare: Founded in 1892, GE Healthcare is a multinational manufacturer in the medical imaging sector and has a range of X-ray equipment. GE Healthcare went public in January 2023 with a $27.5 billion market capitalization but is now valued at $38.6 billion as of August 2024. The company offers a portable X-ray imaging device, the AMX Navigate. This device can be wheeled and has a telescoping column which removes lift force in moving and positioning the emitter. The device also features an on-device AI solution for detecting and triaging critical conditions, checking the quality of the image, and reprocessing images.

Siemens Healthineers: Founded in 1847, Siemens Healthineers is a multinational medical technology company. The company manufactures X-ray equipment as part of its medical imaging portfolio. It went public in March 2018 with a $28 billion market capitalization and is now valued at $57.8 billion as of August 2024. Siemens does not offer hand-held X-ray devices.

Philips Healthcare: Founded in 1891, Philips Healthcare is a subsidiary of Philips, a multinational conglomerate corporation that manufactures a wide range of items. Its parent organization Philips went public in 1912 with a $3.3 billion market capitalization. Philips Healthcare offers a wide variety of medical devices, including medical imaging. Philips produces four mobile C-arms: Zenition 30, Zenition 50, Zenition 70, and Zenition 90 motorized. These C-arms are much larger than the portable C-arms developed by OXOS Medical’s direct competitors.

Business Model

As of August 2024, OXOS Medical has not publicly disclosed the cost of production and price of its device and software solutions. In 2023, CEO Evan Ruff stated that the company aspired to reduce the price of its detector from $20K to $2K. According to Maven Imaging, a hospital equipment supplier based in California, portable X-rays typically cost $5K to $60K, while traditional stationary systems cost $35K to $200K+.

OXOS Medical generates revenue from the direct sale of Micro C. Large medical device companies are reported to have profit margins between 20% and 30%. A competitor to OXOS Medical, Turner Imaging Systems, launched a C-arm subscription plan in 2022, where customers can receive a SMART-C mini C-arm for a nominal monthly charge with a 12-month commitment.

Additionally, OXOS Medical may also generate revenue from the use of AI algorithms embedded within Micro C. Similar features are sold as a SaaS offering in addition to physical device sales by incumbent competitors like Siemens and GE Healthcare.

Traction

In 2021, OXOS Medical received FDA 510(K) clearance for radiographic imaging and DDR of the distal extremity in adults and children. Following this approval, OXOS Medical produced 50 devices, which were all sold within the first year. The company has been granted eight patents and has applied for an additional 10 patents in the imaging systems and methods category.

OXOS Medical was a finalist in the US Army xTechSearch competition in 2021 and 2022, receiving $120K in non-dilutive funding in 2021. The company has developed a cooperative research and development agreement with the Department of Veterans Affairs (VA), one of the largest health systems in the US, to deploy its imaging solutions across multiple care settings, particularly in the VA's 1K community-based outpatient centers.

Globally, OXOS Medical has supported medical missions in Central America and Africa in collaboration with USAID, the Luke Commission, and Helping Hands charity to provide imaging services to underserved communities. In the sports sector, the Jacksonville Jaguars and Georgia Bulldogs have integrated the OXOS Micro C into their medical protocols for sideline scans and quick diagnostics during games.

Valuation

In April 2023, OXOS Medical closed a $23 million Series A round at an undisclosed valuation led by Parkway Venture Capital and Intel Capital. Gregg Hill, co-founder and managing partner at Parkway Venture Capital, and Eric King, Investment Director at Intel Capital, joined the OXOS Medical board of directors. OXOS Medical planned to use the funding to accelerate product innovation and expand availability globally. Prior, Musha Ventures led their $4.4 million seed round in 2021. As of August 2024, the company has raised a total of $41.7 million in funding.

Key Opportunities

Increased Demand for POC Diagnostic Imaging

As of July 2023, the global demand for diagnostic imaging services was expected to normalize back to pre-COVID-19 levels, driven by an aging population, advances in imaging technology, and a shift toward preventative care. The aging global population is contributing to an increase in age-related diseases, necessitating frequent and advanced imaging diagnostics. Advances in imaging technologies and the shift towards preventative care further stimulates demand for diagnostic solutions, increasing the size of the addressable market for OXOS Medical.

As demand for diagnostic imaging services increases, demand for POC imaging services has also shown growth. For example, the POC medical imaging market is projected to grow at a CAGR of 4.3% between 2023 and 2030. POC radiology enables imaging procedures to be conducted closer to the patient, reducing time to diagnosis and improving patient outcomes. During the COVID-19 pandemic in 2020, POC radiology, including modalities like chest ultrasounds, has proven crucial in emergency and critical care settings. In low and middle-income countries (LMICs), where access to centralized radiology services is limited as of July 2023, POC imaging models are pivotal in providing timely diagnosis and management of prevalent non-communicable diseases. OXOS Medical is well-positioned to take advantage of this trend with its focus on portable, point-of-care suitable medical devices.

Shortage of Radiologists

As of July 2024, the US was experiencing a radiologist shortage, despite the increased need for diagnostic radiologists as of 2023. As of March 2024, more than 1.4K physician positions were posted on the ACR job board. However, despite medical students' interest in radiology, Congress limits the number of fundable resident positions it supports. Consequently, training additional residents annually will require healthcare systems to self-fund positions.

To cope with this shortage, systems have started implementing AI services to reduce radiology burdens and allow radiologists to take on more cases. OXOS Medical's Micro C, which utilized computer vision and AI algorithms for precise image positioning and analysis, allowed non-specialist healthcare providers to perform imaging tasks and receive image interpretation, potentially addressing the gap caused by the radiologist shortage.

Increased AI Adoption in Radiology

AI integration into radiology practices is reshaping diagnostic capabilities and efficiency. The global AI in medical imaging market was estimated to be almost $1 billion in 2023 and is estimated to reach $11.8 billion by 2033, with a projected CAGR of 28.2% from 2024 to 2033.

As of October 2022, 521 AI-enabled medical devices received FDA approval, where 86% of the total were for radiology and cardiology devices. AI enhances diagnostic accuracy, improves patient outcomes, and reduces downstream costs for healthcare systems. Overcoming challenges such as data volume and quality remains crucial. OXOS Medical's imaging dataset is positioned to support effective training and refinement of third-party AI models.

Key Risks

Global Regulation Differences

The medical device industry is subject to stringent regulatory requirements imposed by regulatory bodies such as the FDA in the US and equivalent agencies in other regions. While OXOS Medical has received FDA 510(K) clearance for its Micro-C device, it is awaiting FDA 510(K) clearance for its MC2. Other manufacturers have acquired the CE mark for distribution in Europe and the UK or have experience in international markets, allowing them a first-mover advantage in these markets.

High Development & Scaling Costs

The challenge of economies of scale is common for hardware companies like OXOS Medical. The high initial production cost, which can be up to $30 million, can hinder expansion, along with warranty and repair costs. To remain competitive, companies must continue to invest in research and development while potentially remaining unprofitable for years. Once devices receive FDA approval and are ready for market, collaborating with distributors can lead to reduced operating margins. Additionally, marketing the product can be a significant expense for the company.

Summary

The point-of-care imaging market is positioned for significant growth, driven by an aging population and an increasing emphasis on diagnostic and preventative imaging. The integration of AI is expected to further expand the market size for diagnostic imaging, particularly given the shortage of radiologists. OXOS Medical is positioned to capitalize on the growth of AI-enabled point-of-care imaging sectors with its portable, lightweight products.

The company’s first product, Micro C, aims to offer safe and clear imaging, integrations with third-party AI algorithms, and access to teleradiologists for image interpretation. OXOS Medical is awaiting FDA approval for its new, portable X-ray device, MC2. Along with FDA clearance, OXOS Medical faces high development and scaling costs, which could potentially influence its growth and future revenue potential.