Thesis

Since 2003, identity theft has increased by 584%, with some estimates indicating payments fraud will reach $400 billion by 2032. The issue of fraud has become especially relevant in the early 2020s as the COVID-19 pandemic led to accelerated adoption in fintech, online gaming, and ecommerce. In 2021, the Federal Trade Commission (FTC) reported that consumers filed 2.8 million fraud reports – a 70% increase from the previous year. As one consultant working in identity and fraud put it, the COVID-19 pandemic was “a big playground for fraudsters.” Underscoring the issue, in March 2023, the Biden Administration announced a $1.6 billion “pandemic anti-fraud proposal”.

Combatting fraud effectively can be difficult, especially for businesses operating in highly regulated industries like fintech or government services. On the one hand, customers want to be able to access their accounts and information quickly and easily; over 65% of customers in 2023 expect an exceptional digital experience. On the other hand, organizations need to protect customer data from unauthorized access. To strike a balance between convenience and security, firms must invest in robust security measures that protect customer data without adding friction to the customer journey.

The average user has ~130 different accounts. While this makes user identity security more complex, it also provides a clearer digital footprint to understand different users. Unlike legacy solutions, newer platforms rely on automation and APIs to leverage machine learning to learn from feedback. This enables these platforms to improve over time, reducing cases such as a good user having to undergo a lengthy verification process due to suspected fraud. With digital behavior only becoming more pervasive, the global market for identity verification solutions is expected to increase by 4x from $8.5 billion in 2021 to $34 billion by 2030.

Socure is a digital identity verification and management platform providing predictive analytics to understand user behavior and potential threats. The platform works across a variety of industries, such as financial services, ecommerce, and online gaming. Consumers who frequently use online services have likely unknowingly used a platform like Socure when creating a new online account or purchase. Socure was one of the early users of machine learning to manage user identities. As of June 2023, Socure’s database contains 8 billion records and over 600 million rows of user data. In March 2023, the company considered itself the “largest private company in the identity verification fraud market globally.”

Founding Story

Source: Business Wire

Socure was founded in 2012 in New York by Johnny Ayers (CEO) and Sunil Madhu (ex-CEO). Prior to Socure, Ayers was a Senior Consultant at IBM and COO at a startup while Madhu was the founder of a bootstrapped company who also had two decades of experience as an IT Architect.

The pair started Socure with the idea to “create the future of identity verification and fraud prediction [with the wealth of] the Internet.” Ayers has described how Socure’s approach differs significantly from that of legacy solution providers because traditional solutions are primarily focused on single channels of identity verification, such as email, as well as still relying on manual processes.

While Socure struggled to gain traction in the early years, the company eventually grew to double-digit millions in revenue by 2019, at which point Madhu left the company to start a new business. Between February 2018 and December 2020, 5x CEO Tom Thimot stepped in to lead the company, seeing aggregate revenue growth of 688% during his tenure. As the company grew, so did its offerings, which expanded from multi-channel identity verification to KYC, fraud detection, and more. In 2021, Ayers became CEO.

Over time, Socure’s mission has evolved from providing fraud detection and identity verification solutions to focused a broader fraud prevention platform. The company also has a number of executives that have contributed to the company’s growth, including Pablo Abreu (Chief Product Officer), who past employees describe as “one of the sharpest minds in the industry as far as modeling and AI.” Other executives who joined the company later include Chad Kalmes (CISO), who Socure hired in April 2022, having previously held director roles at Twilio and Optimizely. As of June 2023, the company has remote teams in both the United States and Chennai, India.

Product

Source: Socure

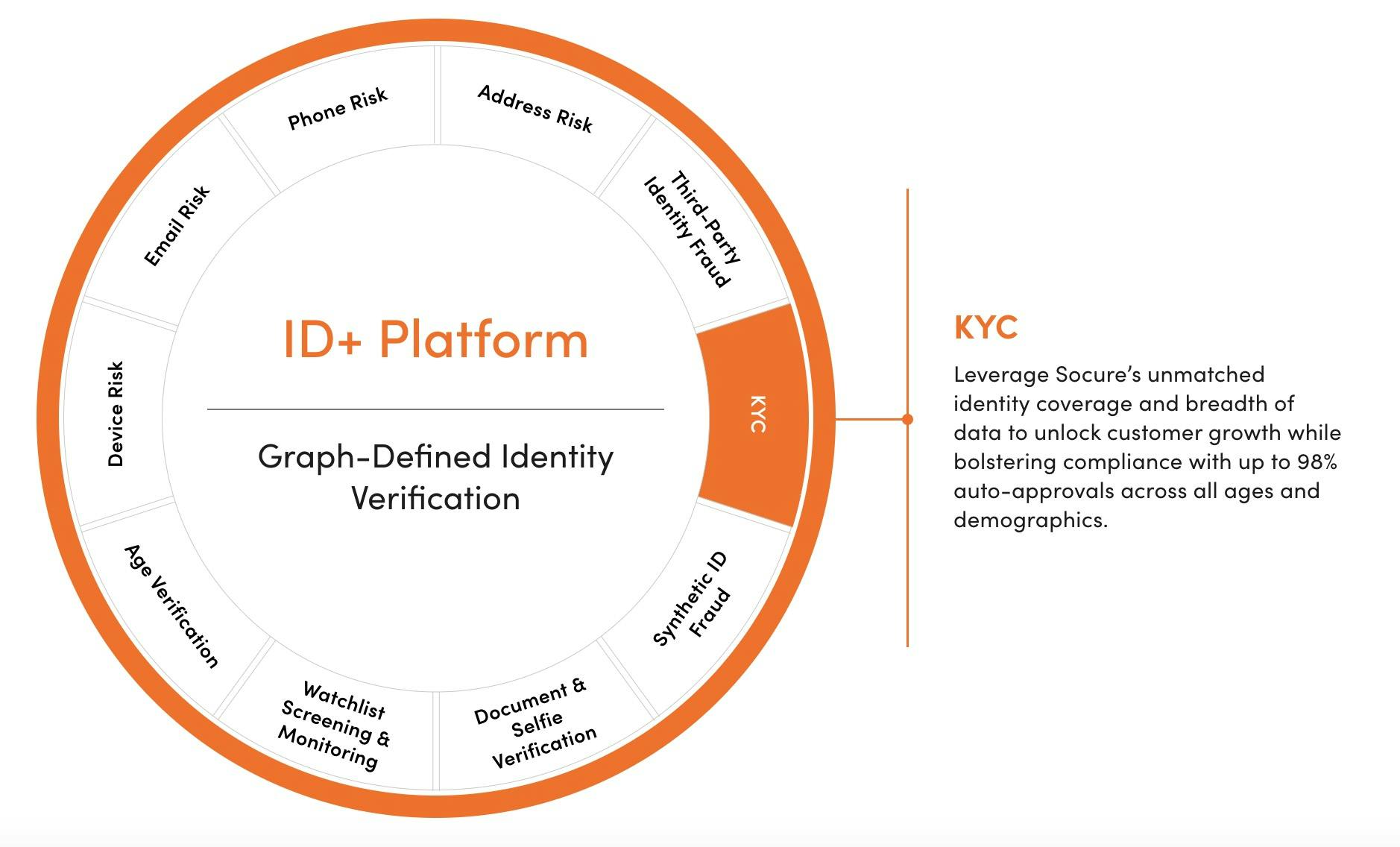

Socure’s core product offering is the ID+ Platform, which is comprised of several core features that together provide predictive solutions for identity verification and fraud prediction. Socure does this through Graph-Defined Identity Verification, an approach to identity verification that gets a comprehensive picture of every user in real-time using multiple trusted data sources.

Compared to its competitors and legacy solutions, Socure is considered to be better at detecting fraud with its graph analytics combined with machine learning models, enabling the platform to recognize attacks that would be difficult for humans to detect. The platform’s individual features utilize AI/ML in an attempt to continuously learn on a proprietary network of online/offline data populated with billions of predictions and outcomes.

All of Socure’s products can be accessed through one API, with use cases spanning from onboarding to transactions. As CEO Ayers remarked in a 2021 interview, Socure’s ID+ Platform provides a single solution for all identity verification needs, eliminating the need for “patchworking and frankensteining all these different companies together.”

Fraud Risk Detection & Prediction

Socure’s fraud & risk suite is comprised of seven features that allow customers to streamline their risk program and reduce fraud losses:

Sigma Identity Fraud: This feature analyzes several dimensions of consumer identity—name, email, phone, address, date of birth, social security number (SSN), IP address, device, velocity, network, and behavioral intelligence—to detect identity fraud across a consumer’s digital footprint. Companies’ main identity verification-related concerns are customer-approval friction due to false positives (e.g. when a legitimate user does not pass an identity check). Sigma Identity Fraud is able to capture identity fraud in the riskiest 3% of applicants 85-90% of the time, while still reducing false positives by >13x, driving customer approval rates by 30-60%. Socure’s Sigma Identity Fraud is trained on a model with over 600 million rows of feedback data, which continues to grow over time.

Sigma Synthetic Fraud: Synthetic identity fraud occurs when someone uses a combination of real and fake personal information, such as a stolen SSN and a fake name, to commit identity fraud. As early as 2016, synthetic fraud accounted for 20% of total credit losses for US lenders. Socure’s synthetic fraud solution uses advanced models built on fraud investigation best practices to draw upon public records and device intelligence to create a comprehensive profile and predictive fraud score associated with each user. Sigma Synthetic Fraud is “trained to think like a fraudster” and is learning from feedback data so that it can detect synthetic identity fraud as it happens.

Sigma Device: Customers using mobile devices to transact and communicate are typically unaware of the potential malicious actors potentially using VPNs, virtual infrastructure, and mobile emulators to conduct device fraud. Socure’s Sigma Device binds a device to an identity and uses device intelligence to assess the risk of fraud at account opening, account maintenance, and online transactions. Using AI/ML, Sigma Device can detect fraudulent log-ins and password changes while avoiding additional friction for users.

Phone RiskScore: Phone RiskScore uses 87+ phone data sources to assess the risk of fraud associated with a phone number, including how often the phone number has been ported, length of subscriber tenure, IP phone number, and line type. Socure continuously runs these assessments for its clients, whether during account registration, one-time passcodes, or digital goods delivery. For any given phone number, Phone RiskScore returns a score between 0 to 1, with a higher score indicating a higher risk of fraud.

Address RiskScore: Similar to Phone RiskScore, Address RiskScore takes into account 40+ factors related to addresses like address age, suspended mail activity, and proximity to high-crime areas, to generate a score between 0 to 1 indicating the riskiness of an address.

Email RiskScore: Socure provides a risk-scoring system for email addresses. Malicious actors often use fake, stolen, or invalid emails to conduct fraud, and Socure’s platform factors in 60+ email-specific features like domain mismatches and unusual string patterns to provide a holistic view of every email’s status.

Portfolio Scrub: In 2022, 62% of US financial institutions experienced an increase in financial crime. With large portfolios of data to manage, high-risk profiles and crimes, like money laundering, can easily fall through the cracks of any financial organization. Socure’s Portfolio Scrub feature uses AI/ML and third-party fraud expertise to identify risks in computer accounts and support clients in developing better mitigation strategies. Companies can use Portfolio Scrub for a variety of applications, such as uncovering identities used by money mules, bolstering KYC processes, and identifying risks in newly acquired portfolios.

Compliance

In identifying and mitigating risk, companies must also maintain continuous compliance with regulatory mandates, especially those in highly regulated industries like financial services and gaming. Socure provides a suite of compliance tools that helps companies maintain approval processes while staying compliant with ever-changing regulations.

KYC: Socure KYC is a cloud-based identity verification feature that uses a variety of data sources, including public records, social media, and device intelligence, to provide complete digital identity matching. Socure provides a 98% auto-approval rate through complete birth matching, SSN matching, address standardization, and name matching capabilities (can detect name permutations like ‘Elizabeth’ vs. ‘Beth’). Additionally, Socure uses patented AI/ML to provide vast coverage of population segments (i.e. Gen Z, thin-file, etc.) and automate processes like matching data records over time. After verifying a match, Socure is able to utilize synergies with its identity verification features to determine whether the identity is good or fraudulent. Companies can access all their KYC needs through a single insights and analytics dashboards. As of June 2023, Socure’s KYC solution possesses the most accurate address matching in the US, with over 99.5% coverage—more than the USPS, or Google.

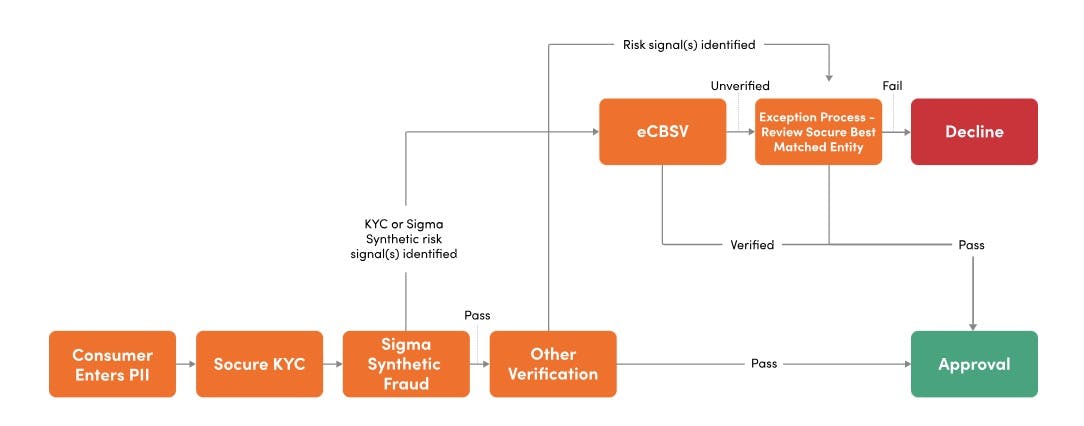

eCBSV: Socure’s Electronic Consent Based Social Security Number Verification service (eCBSV) verifies user information against the Social Security Administration’s (SSA) government database of SSNs, names, and birth dates. This KYC solution provides additional customer clarity to help companies make confident decisions when interacting with higher-risk consumers, such as Gen Z, millennial, credit invisible, thin-file, and other hard-to-verify customers. On average, eCBSV allows companies to verify 6-8% more populations. Socure eCBSV is fully integrated within the company’s general KYC solution.

Source: Socure

Global Watchlist Screening & Monitoring: Socure also provides solutions for watchlist screening, or the process of checking individuals against government and international watchlists to prevent criminal activities. Using ML and proprietary data sources, Socure helps companies avoid compliance penalties by monitoring global watchlists and providing alerts in real-time. Socure covers watchlists such as Politically Exposed Persons (Tiers 1-4), OFAC SDN and consolidated lists, and state owned entities data.

Identity Document Verification (DocV)

Socure’s predictive document verification (DocV) solution digitally verifies thousands of global identity document types from 180+ countries. The feature works through a multi-step identity assessment involving advanced image capture, ID classification and cross checks, forensic checks for ID verification, and fraud risk detection. Unlike competing document verification tools, Socure only needs a single selfie image to complete the verification process. Additionally, by using premium NIST PAD Level-2 liveness detection and enhanced biometrics, Socure detects and prevents spoofing attacks with 99.5% accuracy. Companies can implement DocV for a variety of use cases, such as decreasing spoofing attacks, reducing friction for customers during security checks, and getting a more holistic customer view.

In June 2023, Socure announced the acquisition of Berbix, an identity and document verification company, for $70 million. Socure indicated that its platform had already previously integrated with Berbix as part of its predictive document verification product. However, Socure CEO Johnny Ayers indicated that the market was increasingly looking for well-integrated best-in-class solutions:

“We are finding repeatedly that there is a need for best-in-class active and passive — documentary and non-documentary — identity verification and fraud controls to solve very complex fraud and customer acquisition challenges.”

Account Intelligence

Socure Account Intelligence instantly verifies bank account status and ownership prior to ACH payment transactions or funds disbursement. Unlike other account intelligence solutions, Socure delivers results in real time and with the highest account coverage rate (~90% account status coverage and ~60% account ownership coverage). Moreover, only the customer name, bank account number, and routing number are needed for Account Intelligence to work. Socure is also a preferred partner of Nacha, the ACH governing body.

The feature is primarily suited for customers that often deal with ACH payments (such as for bank account funding, government benefits, bill payments, etc.) and can be used for anything from new account funding to bill payments and payroll direct deposit. One 2021 study found that checks and ACH debits were the payment methods most impacted by fraud activity—a sign that Socure’s Account Intelligence feature is in demand.

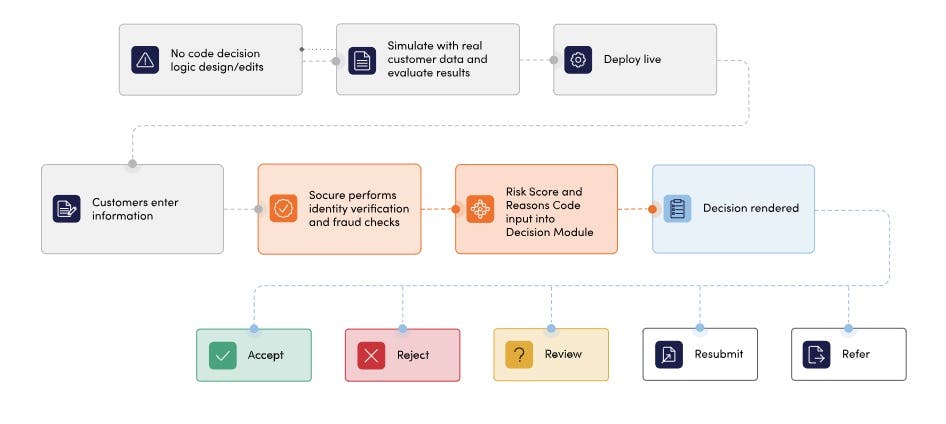

Decisioning

Socure also provides a no-code decision logic platform that enables companies to simulate, optimize, and automate their decision-making while remaining fully compliant. Teams can use the drag-and-drop decision module to implement complex automation sequences and then later on see the impact of changes either through simulations or deployment. Applicable use cases include automating onboarding processes and streamlining regulatory audit reporting.

Source: Socure

Market

Customer

Source: Socure

Socure’s customer profile consists of companies of all sizes that engage in digital-first account opening, as well as customer interactions that are primarily conducted online. Socure sells into a variety of industries including financial services, online gaming, telehealth providers, government agencies, buy-now-pay-later (BNPL), and ecommerce marketplaces. In recent years, the COVID-19 pandemic increased Socure’s customer profile as companies across many other industries adopted digital processes either out of necessity (i.e. remote payroll) or new opportunities (i.e. digital commerce). This shift prompted greater demand for products like Socure from new customers, and existing Socure customers doubling down on the number of Socure features. Speaking on the pandemic’s effect on Socure in November 2021, Socure CEO Johnny Ayers described how he saw “five to seven years of digital transformation get jammed into a 12-month period.”

As one Head of Risk at an international fintech remarked, Socure’s “bread and butter” is modeling, having “excelled in taking input data, broadening it based on their much larger data sources base and then modeling on that much larger data set” to provide “highly predictive” results. Socure has been able to demonstrate that its product is “3% better than others” in aspects such as false positive reduction, an improvement that can translate to $80 million of new customer value for one client. This focus on data contrasts that of legacy solutions, which take a more qualitative approach to detecting fraud.

Moreover, the continuous promise of more accurate results over time makes Socure a long-term investment for clients, evident by the near-zero churn rate Socure has seen. Long-time customers of Socure have reported improvement in model accuracy over the years, primarily due to new clients bringing unique data about end-user interactions that is fed right back into Socure’s models. The previously mentioned Head of Risk has found Socure hard to replace given how embedded its products have become in processes like customer onboarding and transactional monitoring. Similarly, a Director of Product Management at a financial advisory firm believes that, compared to other options, Socure offers the “best chances of maintaining the conversion rates among our good customers.”

Currently, Socure is trusted by 1.7K+ customers, including 4 of the top 5 banks, 250+ of the largest fintechs, 6 of the top 10 credit card issuers, and 3 of the top MSBs.

Market Size

According to one study, the global identity verification market size was valued at $8.5 billion in 2021 and is predicted to reach $34 billion by 2030, increasing at a CAGR of 16.7% from 2022 to 2030. These figures line up with Socure’s own market sizing analysis, which valued the identity assurance market at $30 billion in 2022.

This high expected growth rate can be attributed to a surge in online interactions. As the world becomes more digital, more companies will need fraud and identity verification solutions. In an analysis of 79.8 billion digital transactions conducted throughout 2022, one study found that the global digital fraud rate increased 20% year-over-year. And as of June 2023, 89% of all companies have a digital-first strategy or are planning to adopt one. Moreover, industries where Socure sells into most are expected to experience significant growth in the coming years, with fintech revenues expected to grow sixfold by 2030 to $1.5 trillion and ecommerce to grow by ~30% to $8.1 trillion by 2026. Finally, President Biden’s $1.6 trillion pandemic anti-fraud proposal in March 2023 signals a greater emphasis on combatting fraud going forward that will not only increase Socure’s business in the government services industry but across businesses of all sizes who may find security products increasingly necessary.

Competition

Within the broader fraud detection space, Socure primarily competes with other all-in-one companies that leverage AI to deliver a suite of capabilities associated with identity and fraud authentication. While point solutions exist (such as email risk management), companies are increasingly optimizing for vendor reduction and subscribing to one-stop-shop solutions such as Socure. Additionally, newer players have centered their offerings around advanced machine learning models to drive precision and efficiency—a shift that incumbents have been slow to adopt. As to what differentiates the different players within the space, Socure CEO Johnny Ayers describes how companies are competing on the ability to open more accounts for “good” players; helping a client open 3-5% more customer accounts without reducing fraud could potentially lead to $80 million of new customer value.

Jumio

Jumio is an identity verification company that provides photo and ID scanning and validation products for mobile and web interactions. Companies can integrate Jumio’s core KYX Platform or individual features using one API that automates identity verification while maintaining compliance. Compared to its competitors, Jumio’s product is more centered around the document verification phase of risk management and offers less integrated features for detecting fraud throughout other stages of the customer lifecycle. The company was founded in 2010 and has raised $205..4 million to date. As of August 2023, it last raised $150 million from Great Hill Partners in 2021.

Persona

Persona is another identity verification platform that was founded in 2018. Like other players, Persona offers a variety of tools including KYC, KYB (know your business), and age verification, through a customizable, mix-and-match business model. However, one key differentiator is that instead of drawing on its own database of information, Persona aggregates data from different databases, like that of LexisNexis, allowing clients to jump between different pools of data to achieve more accurate results. The company has raised a total of $217.5 million, and as of August 2023, it last raised a $150 million Series C led by Founders Fund in 2021.

Feedzai

Feedzai is a risk management platform that uses AI and advanced machine learning models to prevent, detect, and remediate fraud risk for its clients. Similar to its competitors, Feedzai offers API-based omnichannel fraud detection, KYC, and transaction monitoring solutions. However, the company differentiates by focusing on the financial services market, where it has been able to capture significant demand from mid-sized financial institutions like Santander and Standard Chartered. The company was founded in 2009 and has raised $277.5 million as of August 2023 from investors like KKR and Citi Ventures.

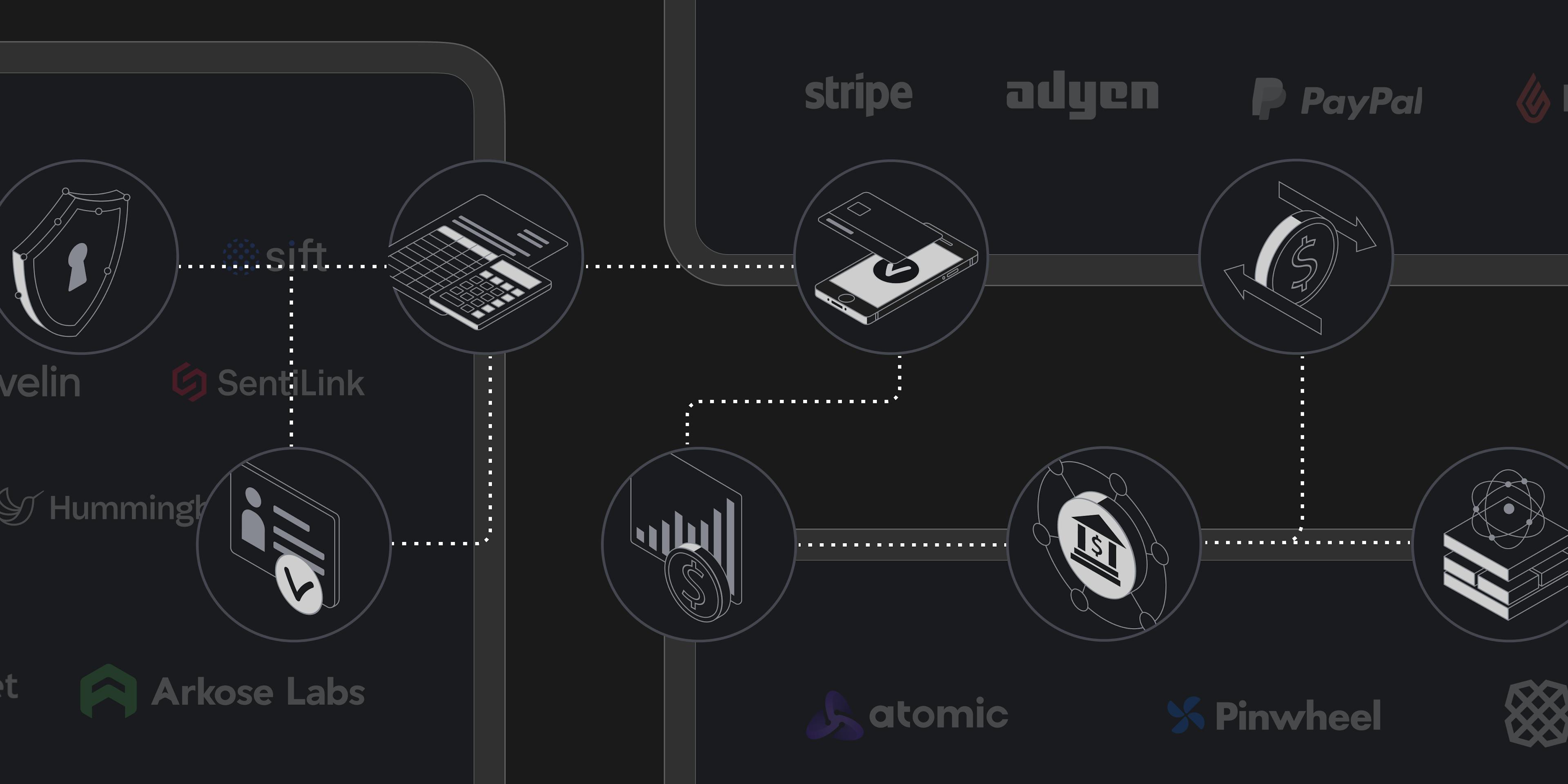

Sift

Sift is a platform that uses a global network of data to detect fraud and increase positive user experience for fintech, ecommerce, and retail companies. Like Socure, the company draws upon AI and proprietary models to deliver fraud insights to its clients. But Sift additionally offers features such as dispute management and content fraud that is unique to its industry focus. Founded in 2011, the company has raised $156.5 million to date with involvement from notable investors like Insight Partners and Union Square Ventures.

IBM

IBM is an American multinational technology corporation which operates in over 175 countries and provides a suite of technology services and software assisting companies across all business workflows. The company is an incumbent competitor to Socure, with a built-out suite of security and identity tools that include Guardium (data encryption and management), QRadar (AI threat detection), and Trusteer (customer authentication). Compared to other players in the space, IBM is much larger in scale (345K employees) and provides greater product depth through the ability to integrate with other product suites (i.e. supply chain and DevOps) and AI tools like IBM Watson. Additionally, the company provides services globally, while Socure only currently operates in the United States. IBM was founded in 1911 and IPO’ed in 1915.

LexisNexis

LexisNexis is an incumbent competitor that uses public and private data, as well as proprietary analytics technology, to provide risk management solutions across different industries including financial services and government. Compared to Socure, LexisNexis has access to a larger dataset and offers dozens more fraud and identity solutions unique to different industries and business processes. LexisNexis has been able to expand these offerings by acquiring point solutions such as ThreatMetrix (threat intelligence) and Emailage (email fraud detection). However, LexisNexis lacks the flexibility and automation capabilities offered by Socure and its universal API. The company was founded in 1970, with its suite of risk solutions originating out of a $3.6 billion acquisition in 2008.

IDology (GBG)

IDology is another incumbent and global provider of identity verification, document authentication, and fraud management solutions. Similar to Socure, IDology functions as a plug-and-play platform solution, comprised of individual features like identity verification, KYC/AML regulatory compliance, and fraud management. IDology was founded in 2003 and was acquired in 2019 by UK-based GBG for $300 million. Subsequently, IDology has been able to realize synergies with other GBG companies including Acuant, a provider of both software and hardware solutions for identity verification.

Prove

Prove is another all-in-one identity management platform providing solutions like onboarding to multi-factor authentication. Prove differentiates from its competitors through its many partnerships which are listed on its API marketplace. Additionally, while the company sells to a variety of industries, its features are catered toward mobile customer interactions. Prove was founded in 2008 and has raised a total of $202.9 million from investors including Apax Digital and American Express Ventures.

Business Model

Socure operates on a flexible, client-specific pricing model. Customers pay on a per API-call basis (i.e. for a transaction or a customer onboarding) and can either pay for all of the products within the ID+ Platform or a mix of individual features, which each function as a standalone offering as well. Regardless of the offering, all Socure products are accessible via a single API powering the ID+ platform.

Although Socure is software-focused and mainly iterates on features, the company still incurs significant long-term costs, mostly in the form of running its models. As these databases are expected to continue growing over time with more customers and feedback data, these data costs may impact the company’s road to profitability, which Socure CEO Johnny Ayers described as a priority in a January 2023 letter to employees.

Traction

Prior to 2020, Socure had achieved annual revenues in the double-digit millions. However, from 2020 onward, Socure has experienced notably stronger growth by capitalizing on increased digitization from COVID-19. Over the course of 2021 the company raised two rounds of financing, and Socure CEO Johnny Ayers reported that Socure achieved 221% year-over-year customer growth, 500% year-over-year increase in bookings, and five consecutive quarters of record year-over-year revenue growth. In 2021, the company also experienced a 600% year-over-year increase in customer acquisition in the online gaming market and maintained a churn of negative 160%, meaning that customers were more likely to spend more money on Socure every year. Customers who gradually replace point solutions with Socure’s suite of products benefit from the increased efficiency that comes with having an end-to-end solution.

In March 2023, Ayers told TechCrunch that they had tripled their customer base in the past two years and developed more relationships with top banks and financial institutions. Around this time, the company also partnered with financial institution Alacriti and was added to the State Risk and Authorization Management Program’s (StateRAMP) Progressing Product List, signaling significant strides into both the financial and government services markets.

According to Socure’s website, the company works with 4 of the top 5 banks, 250+ of the largest fintechs, 6 of the top 10 credit card issuers, and 3 of the top MSBs as of June 2023. Commenting on his company and how far it has come, Socure CEO Johnny Ayers considered Socure to be the “largest private company in the identity verification fraud market globally.” In March 2023, Ayers indicated the company had intentions to make several potential acquisitions, after announcing a new $95 million credit facility. In June 2023, Socure announced the acquisition of Berbix for $70 million. At the same time, Ayers also indicated that over the course of 2022 the company had grown revenue by 50%.

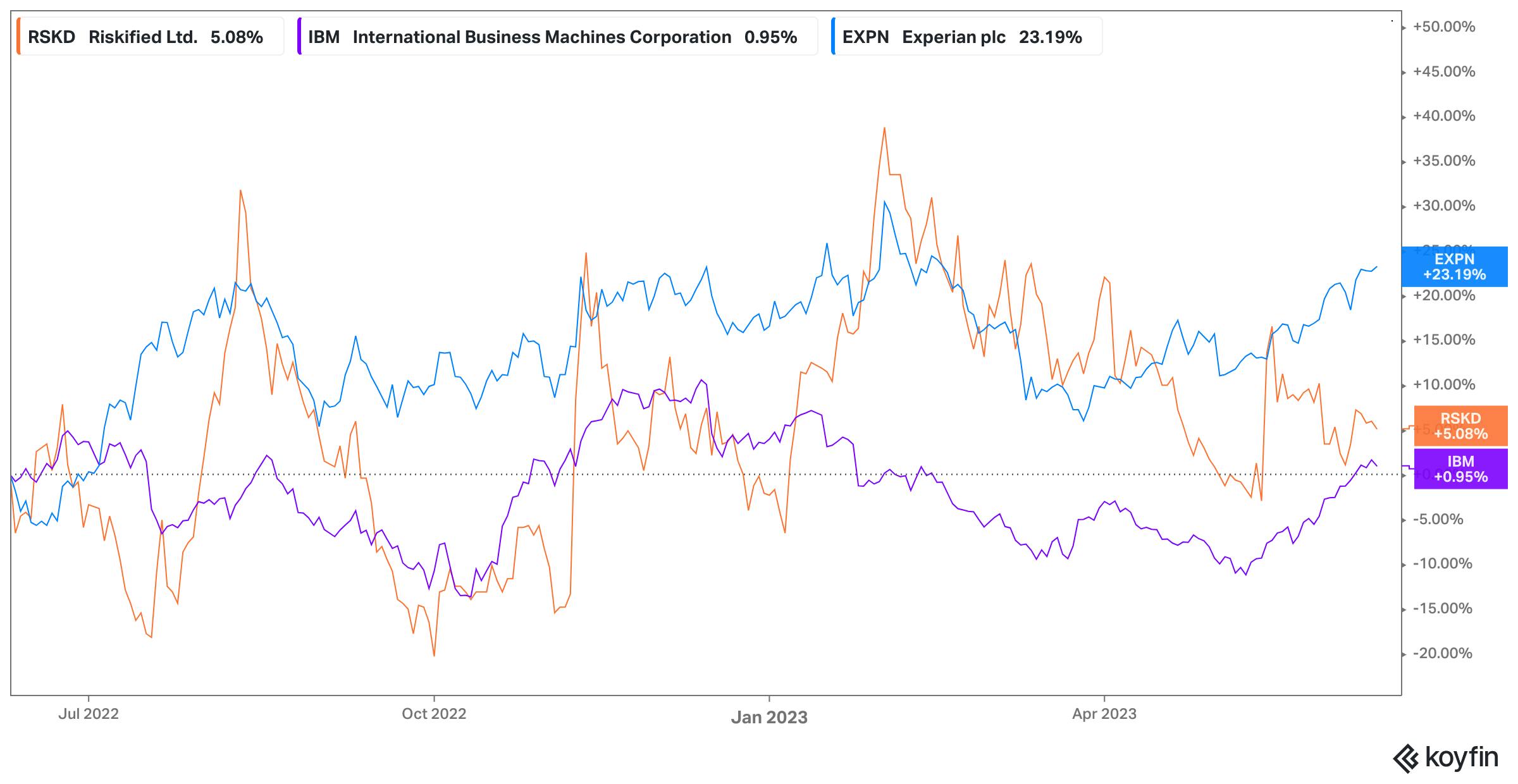

Valuation

Socure raised a $450 million Series E, led by Accel and T. Rowe Price, in November 2021 at a $4.5 billion valuation. Other investors that participated include Bain Capital Ventures, Tiger Global, Scale Venture Partners, and Sorenson Ventures. This round came only months after Socure’s $100 million Series D in March 2021, which valued the company at $1.3 billion. As of August 2023, the company has raised $741.9 million to date.

After Socure’s round of funding in 2021, CEO Ayers stated that the company “will certainly come to market here in the not-too-distant future” and was aiming for 2023 as a tentative IPO date. The only publicly announced news related to financing since then was a $95 million credit facility with J.P. Morgan, Silicon Valley Bank, and KeyBanc Capital Markets, which Socure closed in March 2023. In an interview with TechCrunch, Ayers stated that the credit loan was motivated by favorable rates and could “significantly strengthen the balance sheet and put [Socure] in a really good position to be offensive.”

Source: Koyfin

Key Opportunities

Increased Demand for Security

In March 2023, President Joe Biden announced a $1.6 trillion anti-fraud proposal targeting synthetic fraud and identity theft catalyzed by COVID-induced digitization. As many companies shifted their business model or operations to remote during COVID-19, digital fraud increased by 70% in 2021. David Mattei, a senior analyst at Aite-Novarica Group, describes how “The use of document identification and verification solutions to verify a user’s identity is growing due to the surge in online, digital interactions.” Companies across all industries—especially those that are just now digitizing—are all liable to attacks and are increasingly recognizing the importance of purchasing identity verification solutions.

In 2021, the digital shift helped Socure grow from ~350 customers to nearly 1K in the span of 7 months. Increased caution towards fraud going forward could present even more opportunities for Socure to reach new industries and regions.

Continued Model Improvement

The core of Socure’s platform is comprised of proprietary machine learning models trained on a database containing more than 8 billion records, tied to over 1 billion confirmed good and bad identities. Since massive quantities of data are critical to improving the accuracy of Socure’s features, the company has developed a process for continuous improvement using feedback data from its broad range of clients representing multiple industries. This provides an incentive for customers to stick with the platform, as more data increases the chances that the platform can detect new attacks. One Head of Risk Management observed how Socure’s model accuracy has visibly improved over the years due to the company bringing on clients of different industries and sizes.

Back in 2021, CEO Ayers stated how Socure was already “heading down on being the first to verify 100% of good identities and perfectly classify identity fraud.” In May 2023, Socure reported that it had reached a 99% onboarding rate for mainstream populations. If Socure continues to increase the precision of its features, the company could realize significant growth across both new and existing audiences.

Growth in Fintech

Due to the high potential for fraud and strict industry regulations, financial institutions represent a sizable portion of Socure’s customer base. In recent years, fintech has continuously increased its share of the global financial services market, with banking fintechs expected to constitute almost 25% of all banking activity by 2030. Digital payments transaction volume is also expected to grow at an 11.8% CAGR between 2023-2027, reaching $14.8 trillion by 2027.

Socure has already made multiple strides to capture the growing fintech market. The company is not only the Preferred Partner of Nacha in the categories of Risk & Fraud Prevention and Compliance, but it is actively helping the ACH governing body with strategic solutions to the ACH network as well. In April 2023, Socure also partnered with Alacriti, a fintech company specializing in instant payments, to deliver third-party and synthetic identity fraud prevention. As fintech continues to grow, Socure could establish itself as the leading provider for companies within the space.

Growth in Gen Z Consumers

As of June 2023, Socure claims an onboarding rate of 93% for 18-25 year olds and 70% for 18 year-olds opening their first account (at least 30% higher than competitors). Verifying the identity of Gen Z consumers is becoming more crucial as the cohort represents the largest demographic in industries such as gaming and is a strong driver of financial products like custodial accounts and BNPL. According to Bank of America Research, the Gen Z demographic born between 1996-2012 earns $7 trillion, with this number expected to grow to $17 trillion by 2025 and $33 trillion by 2030.

In May 2023, Socure announced a new enhanced KYC solution allowing it to provide greater accuracy when vetting high-risk customers. When asked about the reasoning behind the feature update, Socure CEO Johnny Ayers remarked how attracting Gen Z consumers is “key to the longevity and growth” of Socure’s clients. Continuing to target this growing audience will enable Socure to ride the tailwinds brought upon by the next generations of consumers.

Key Risks

Increased Fraud Sophistication

While the increased presence of fraud has catalyzed new demand for Socure, the company must be wary of newer, more advanced attacks if it wants to continue capitalizing off of the trend of digitization. For example, 49 million customers fell victim to identity fraud in 2020, and one study found that over 70% of SSNs have already been leaked, suggesting that businesses can no longer verify identity using only SSN. When asked about the advancement of fraud in a 2021 interview, Ayers said:

“As data breaches continue to grow, more data becomes available, and attacks are getting more and more sophisticated. As folks provide real-time funds availability and real-time money, the target on their back becomes very big, because it’s very lucrative to steal the correct amount of money that’s available across the web and I think there’s this near-term enterprise problem in probably three to five years.”

With bots that can perform hundreds of account takeovers in seconds and the existence of deepfake software, fraudsters are more sophisticated than ever before. While Socure’s adaptable machine learning may catch many of these attacks, the company must continue to fine-tune its models and remain agile in order to keep its clients’ data secure.

Regional Limitations

Up until 2022, Socure only operated within the United States. In October 2022, Socure announced plans to expand internationally into Canada, the United Kingdom, and Europe. However, international expansion has been a common pain point for identity verification solutions in the past, as companies often do not experience the same initial traction as in their home market and end up playing catch-up compared to other providers. This is because different countries have different sets of regulations (e.g. GDPR) and data sources stored in different locations, meaning that platforms often have to manually build out entirely new frameworks to provide the same KYC and fraud detection functionalities. For Socure, these limitations could create friction for its clients looking to expand their business into new regions, who may then be forced to partner with different regional providers in order to onboard customers or perform compliance checks across borders.

Reputation Risk

Within the identity and fraud management spaces, a single mistake, data breach, or scandal can severely damage a firm's reputation. With Socure handling billions of data points — many of which are personally identifiable information such as SSNs and addresses — the potential implications of a mishap are even greater. While Socure has no public history of the above, the company must continue to ensure that its clients’ data is safe and protected in order to maintain client trust and further expand its business.

Summary

As people continue to grow their digital footprint, fraud will become increasingly common and hard to detect. Point solutions and manual identity verification solutions are no longer enough to protect company data from bad actors, and AI-driven tools like Socure are becoming the main line of defense. While Socure’s competition continues to increase, the company has the potential to solidify itself as the leader in the space if it continues to improve the accuracy of its models and prioritize a frictionless end-user experience. The key questions that still remain are whether Socure can keep up with rapidly advancing fraud and find the same success as it has in the United States across different regions around the world.