Thesis

Technology is increasingly reshaping both professional and amateur sports. In 2020, venture capitalists invested an estimated $1.4 billion into sports technology startups, a figure that rose to nearly $10 billion by 2024. This expansion has been driven by startups developing data-driven solutions that help athletes and coaches monitor performance, prevent injury, and optimize training workloads. These tools are transforming sports from a largely intuition-based field into one governed by measurable data, feedback loops, and remote collaboration.

The global sports technology market was valued at $22.5 billion in November 2025 and is projected to grow at a CAGR of 20.8% through 2034, potentially reaching $65.9 billion. Growth is being driven by the widespread integration of AI, wearables, and computer-vision technologies into sport, which serve to enhance performance analysis, fan engagement, and athlete safety across every level of competition.

On the consumer side, the fitness industry continues to show significant growth. A growing public interest in health and wellness is evident in the increasing popularity of gym memberships and physical activities such as running. In the United States, for instance, gym memberships hit an all-time high of 72.9 million in 2023, up from 64.2 million in 2019. As of November 2025, nearly one-third of Americans engaged with fitness centers or digital workout platforms regularly, and the number of U.S. fitness-based businesses stood at 115K in 2023, up 29% from 88.9K fitness companies in 2013.

Running, in particular, has experienced a cultural and commercial renaissance since 2020. Approximately 50 million Americans, or 15% of the US population, participated in some form of running or jogging in 2024, up from 11.3% in 2010. Global marathon participation is also reaching record levels, with a 14.6% year-over-year increase in the number of reported finishers from 2024 to 2025. In September 2025, nearly 1.1 million applicants entered the lottery for the 2026 London marathon, nearly double 2023’s (at the time) 578K record. Importantly, the lottery applications had a nearly 50/50 male-female split, with a third of entrants aged 18-29.

The UK alone added some 349K new runners in the year 2024, an increase almost entirely driven by Gen-Z women. This “third running boom,” accelerated by remote work, wellness culture, and social media, has made running both fashionable and communal. Specifically, Gen-Z’s preference for experiences over nightlife, along with increased mental-health awareness and reduced alcohol consumption, has made running a new form of social connection. As fitness activities generally become more prevalent in daily life, so does the desire to connect and build community with others who have similar exercise habits.

Strava is a platform for athletes and fitness enthusiasts. It provides a fitness tracking tool that doubles as a sports and fitness-focused social network, empowering users to record and share their workouts, connect with others, and engage in friendly competition. Athletes and fitness enthusiasts can track various activities like running, cycling, swimming, and more while analyzing detailed performance data to monitor their own progress and set new personal goals. Strava's user interface and features have made it popular among those seeking motivation, accountability, and a sense of community in their fitness journey. Strava offered 50 different sport categories for tracking fitness as of March 2025, indicating its aim to appeal to a broad range of fitness enthusiasts.

Founding Story

Strava was founded in 2009 by Michael Horvath (former CEO) and Mark Gainey (Chairman), two former Harvard crew teammates who first met in the late 1980s. Their connection began in the boathouse, where Horvath served as the captain of the lightweight crew rowing team in his junior year and where Gainey, two years younger, joined the team after a running injury forced him to switch sports. The pair bonded through the shared training cycles, competitive intensity, and the tight-knit culture of the Harvard rowing program.

Gainey’s early life foreshadowed both his athletic adaptability and his comfort in various competitive environments. Raised in Reno, Nevada, he grew up involved in skiing and soccer, encouraged in an active lifestyle by his parents. At Harvard, Gainey studied fine arts and graduated in 1990. He then moved into investing, working at TA Associates from 1991 to 1995 with a focus on investing in the technology and business sectors. Meanwhile, Horvath graduated with an A.B. in economics from Harvard in 1988 and then pursued a PhD in economics at Northwestern University from 1991 to 1994. Upon his graduation in 1995, Horvath moved west to pursue a teaching career as an assistant professor of economics at Stanford University.

Even while pursuing different careers in investing and academia, respectively, Horvath and Gainey stayed in close contact. Once Horvath moved to Palo Alto, they met regularly in his Stanford office, which was one of the only places with a stable internet connection at a time when dial-up was still standard. These frequent meetings led them to reminisce about how much they missed the accountability, camaraderie, and competitive motivation of their college rowing days. As Horvath said of their ideation process during this time:

“In 1994-95 we were dreaming up, ‘What could we do with the internet?’ It’s this new thing in our lives. And we said, you know, it’s kind of funny, but we really miss walking to Leavitt and Peirce and seeing what the workout would be, who would be working out with us. What if we could create that sort of feeling using the Internet?”

This longing led them to conceptualize a digital space that would serve as a "virtual locker room” of sorts. They pictured it as an online community where athletes could connect, compete, and celebrate their achievements, irrespective of their physical locations. Unfortunately, the idea proved too early for the available technology of the time. GPS devices were still sparse, smartphones did not yet exist, and the internet still lacked the infrastructure required to upload and analyze outdoor activity data.

In the interim, they co-founded Kana Communications, a customer email service software company. They started Kana after talking with multiple sports analytics groups and realizing that many businesses struggled to answer their customer emails. In just four short years, the company rode the highs of the dot-com bubble, eventually going public in 1999 and briefly achieving a multi-billion dollar valuation.

Both Horvath and Gainey left Kana in the early 2000s, which left them ready to jump into the startup world again. Nearly a decade after their first “virtual locker room idea”, the conditions finally aligned to try again. By the mid-2000s, GPS-enabled cycling computers were common, smartphones were beginning to spread, and social platforms like Facebook and Twitter were starting to normalize the sharing of personal activity online. Athletes were already posting mileage totals, race updates, and gear preferences to their social feeds, creating early signals that a dedicated athletic community platform might resonate. Horvath and Gainey, after years of working in enterprise software, were also finally ready to build a product that aligned more closely with their own passion for endurance sports.

In 2006, a key final technical puzzle piece fell into place. Horvath met software developer and endurance athlete Davis Kitchel, who had independently been interested in using his own GPS data to discover training insights. Kitchel’s early experiments in using code to ingest his training data provided exactly the kind of technical foundation that the long-delayed “virtual locker room” concept required. In 2007 and 2008, Horvath and Gainey both began working with Kitchel to develop the foundation of the platform that would become Strava. Their MVP was initially just a leaderboard that tracked the efforts of a few athletes across a couple of Vermont and California cycling segments. Of the initial excitement that they saw from the cycling athletes, Horvath said:

“They were doing things like calling in sick to work so they could go ride their bikes [and challenge the segment leaderboard]. We’re like, ‘Hmm, maybe this has got legs.’ And so that’s where, by the end of 2008, we had enough proof points that this [idea] was different… [and] we were going to really put our energy and our money behind this”

Strava officially launched in 2009 as a web-based platform for cyclists to upload rides, analyze performance, and compare results with others. The name "Strava" is derived from the Swedish word for "strive," reflecting the founders' vision of creating a platform centered around pursuing athletic excellence. Although cycling was the first sport supported, the founders always intended Strava to be a home for athletes across various disciplines.

The initial team reflected both technical depth and genuine passion for endurance sports. Along with Horvath, Gainey, and Kitchel, the early founding group included engineers Mark Shaw and Chris Donahue, as well as Pelle Sommansson. Many of the platform’s most iconic features emerged directly from the group’s own athletic habits. Kitchel, for example, conceived of segment leaderboards after recalling an unofficial hill-climb competition from a local group ride he participated in the late 1990s.

As Strava grew, Horvath and Gainey alternated leadership roles while guiding the company through several major transitions. Horvath served as CEO from 2009 to 2013. He then stepped down for family reasons, and Gainey assumed the role while Horvath became president and chairman. Horvath then returned as CEO in 2019 and remained in the position until again announcing a second departure in 2023. In January 2024, Strava appointed Michael Martin as its new CEO. Martin brought senior leadership experience from YouTube, Nike, and Disney, while also becoming the first non-founder to run the company. Around this time, Strava also added two new executives: Matt Salazar as Chief Product Officer, previously at Epic Games and Nike, and Rob Terrell as Chief Technology Officer, previously the CTO of Zynga.

Product

Strava is a platform intended to help athletes and fitness enthusiasts track their workouts, find new jogging routes and exercise regimens, connect and compete with other athletes, and publish their training with titles, captions, and photos.

Core Activity Tracking

Source: Strava

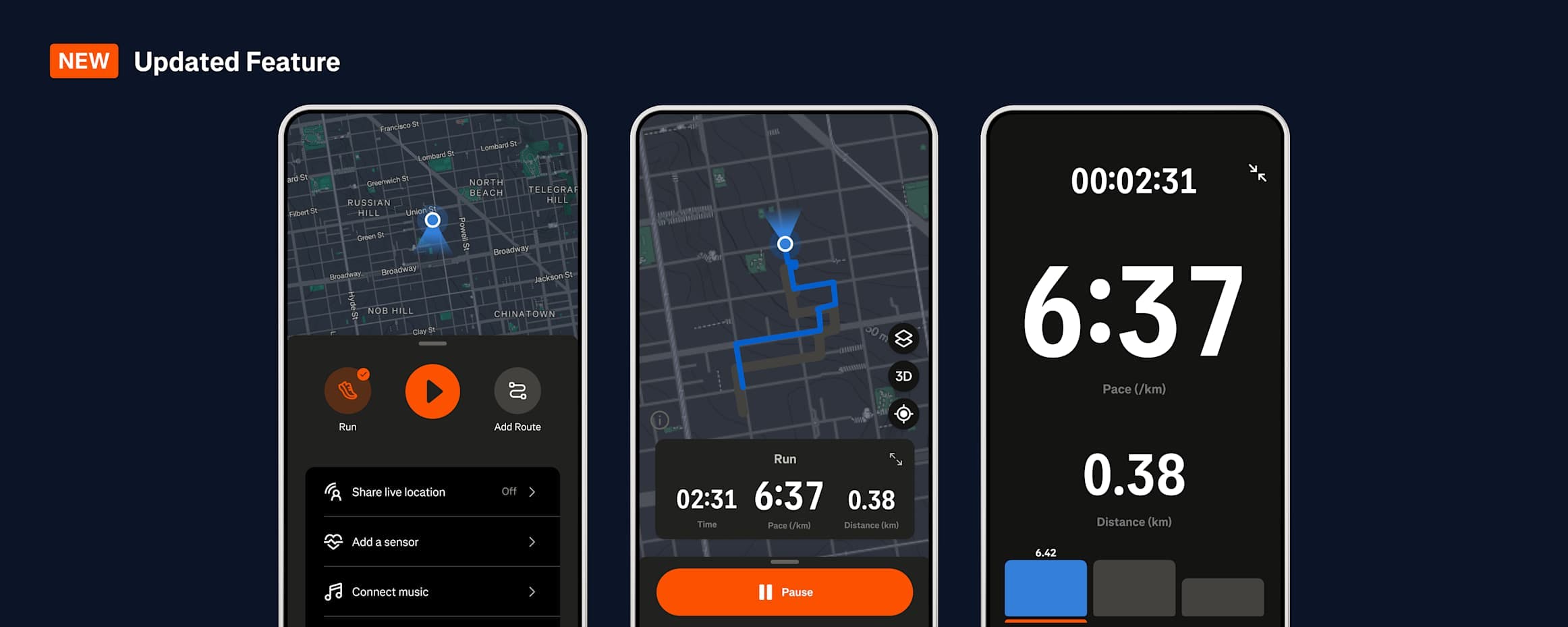

Strava's core feature is activity tracking for running, cycling, swimming, and other sports. Users can record activities using GPS devices like a Garmin or an Apple Watch. Users can also manually enter workouts. The app then displays maps and statistics from the activity, like duration, pace, calories, and elevation. In 2025, Strava revamped its mobile “Record” interface to be more dynamic: on-device recording now shows map and live stats on one screen, streamlining activity tracking. Once recorded, Strava then analyzes the activity data to provide detailed performance metrics, personal records, and segment leaderboards, which show which athlete has the best time performance along a predetermined route.

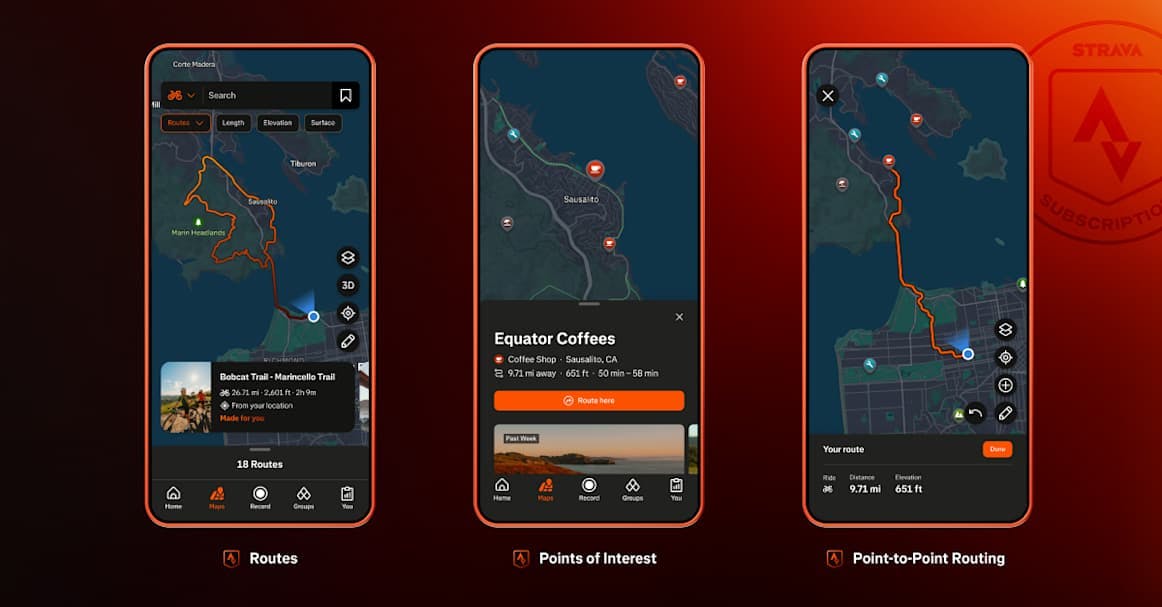

Route Planning

Source: Strava

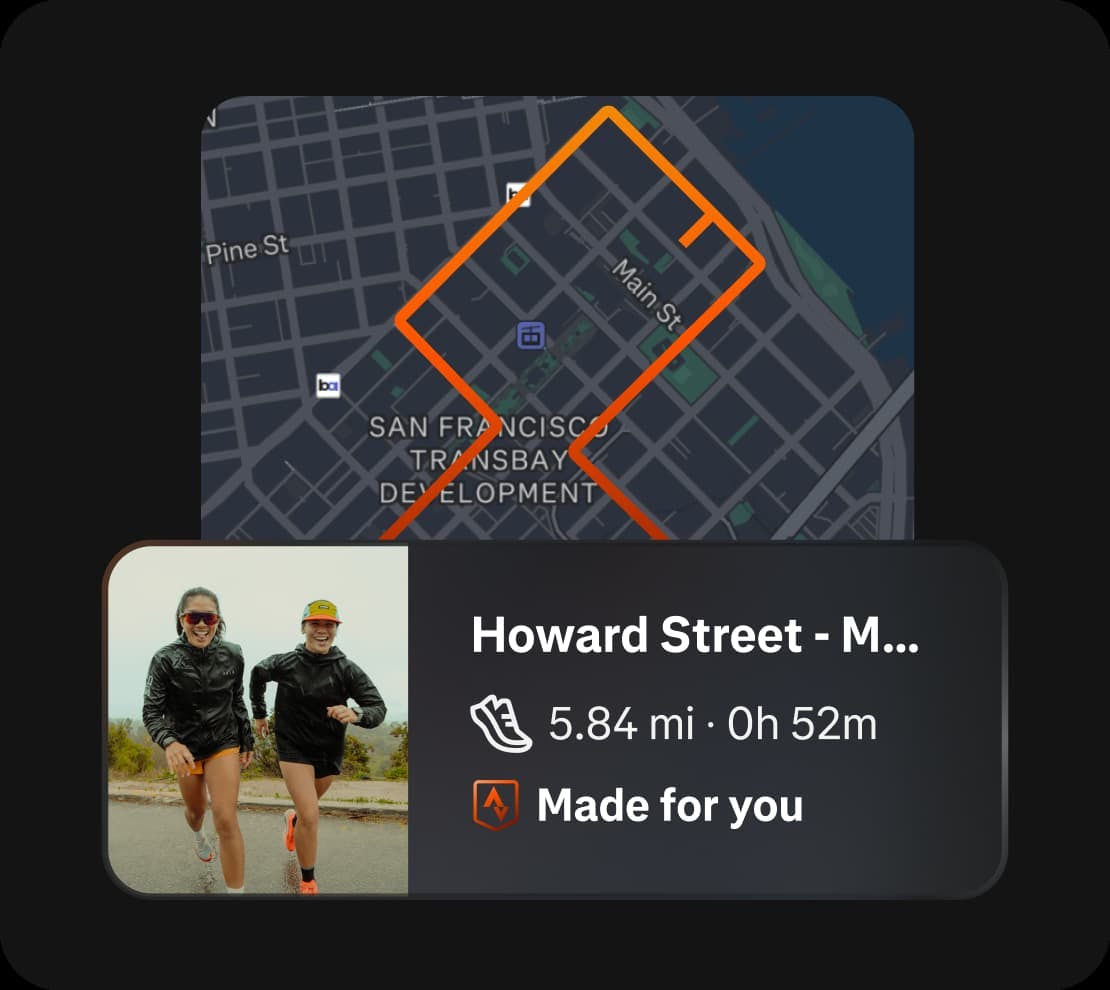

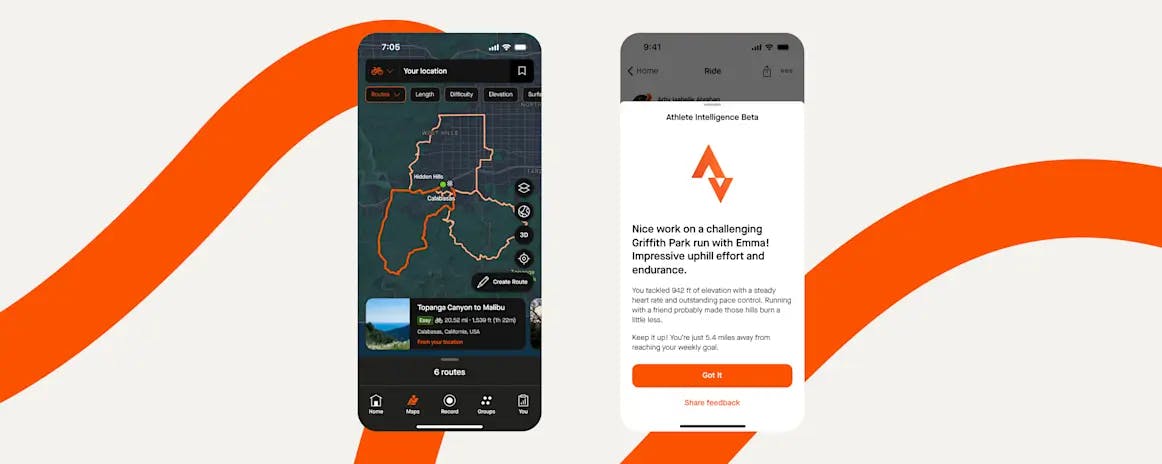

Strava provides a database of road and trail routes crowdsourced from eight billion logged activities. Athletes can discover popular routes, plan new ones, and access recent photos showing current trail conditions. Subscribers can generate routes anywhere using an AI-powered system that draws on Strava’s Global Heatmap, allowing users to “run, ride, or walk like locals wherever they go” by following popular paths.

Source: Strava

In May 2025, Strava introduced “tappable points of interest” (cafes, restrooms, scenic overlooks) on its mobile map, allowing athletes to tap any such point of interest to get information or create a route to or through that location. Then, in July 2025, Strava introduced a point-to-point routing feature, allowing users to drop a pin and go to a specific point on the map using the most efficient route based on their activity type.

Strava also provides a web-based Route Builder to allow users to map activities with greater flexibility. In August 2023, Strava added millions of recent community photos to the route planner, allowing users to see up-to-date pictures of trails while building a route. In August 2025, the route builder was then enhanced to let users slide along a pre-planned route to display elevation, distance, and surface type. Users can then add, move, or remove waypoints in the map for fine-tuned planning. It even allows switching sport types mid-route (e.g., from road to gravel cycling) for multi-discipline activities.

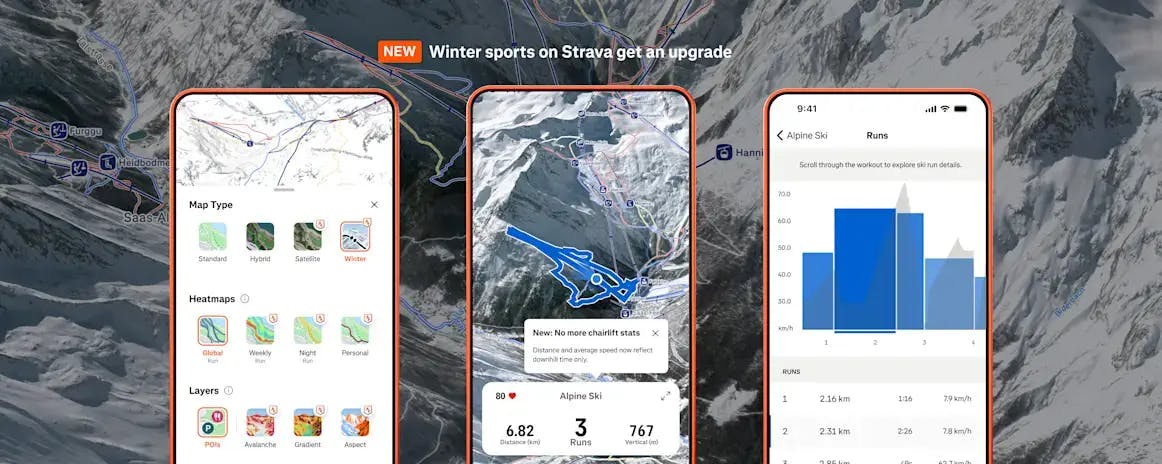

Source: Strava

In November 2025, Strava announced a new set of upgrades for mapping winter sports. New snowboarding/skiing features let users track their downhill runs in real time (i.e., count of runs, total vert, average speed) while excluding time spent on the chairlift for accurate pace and distance stats. Subscribers can then use specialized winter map layers to plan ski routes and even see lift stations or named ski runs on the map.

Source: Strava

For all activity types, Strava provides an “Activity Flyover” feature that generates a 3D aerial overview, complete with overlaid stats and shareable highlights to social media.

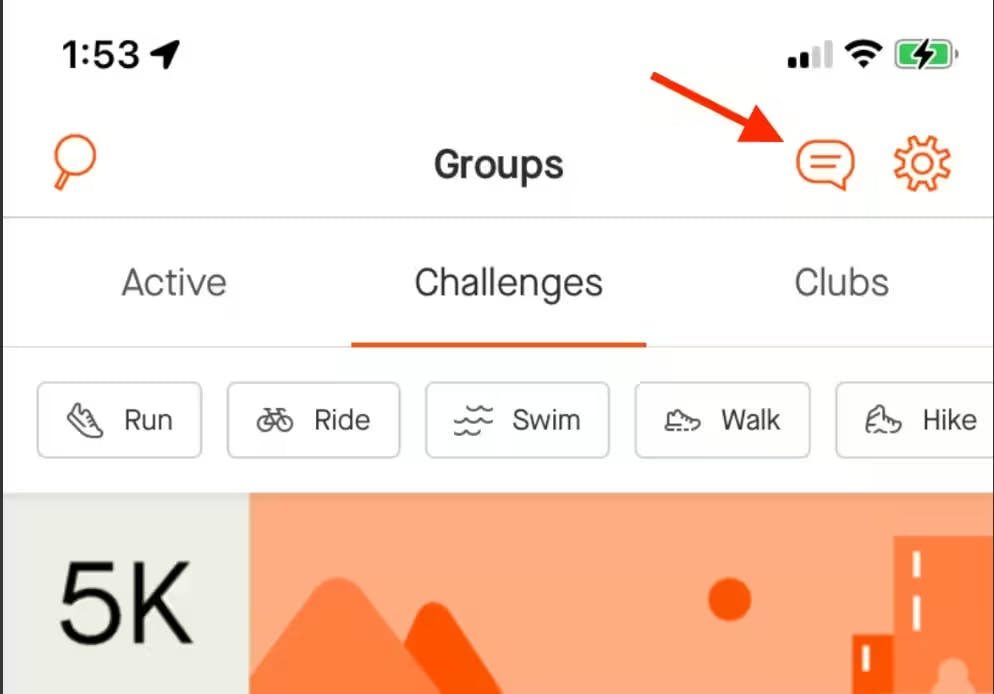

Social Features

Source: Strava

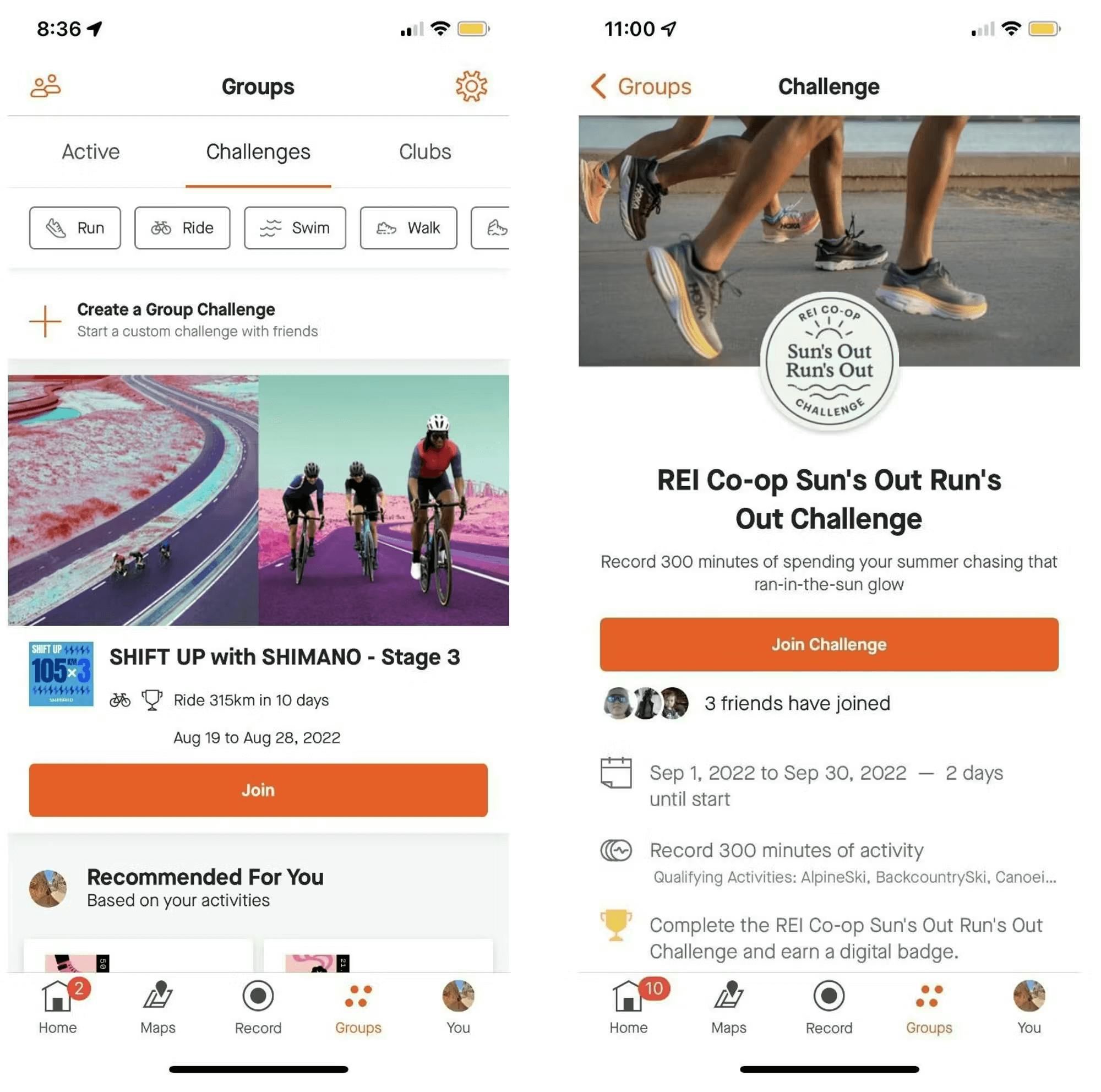

Beyond just tracking, Strava functions as a social network for athletes. Users can follow friends, join clubs, share photos and stories, and give “kudos” (likes) on each other’s activities, which appear in a social media-style feed. Athletes can create or join Clubs and Groups to organize local activity-based teams and set group goals. Strava also runs challenges (monthly distance/elevation goals) and sponsored events where users can earn badges or prizes for completing specific targets.

In December 2023, Strava added a new built-in messaging feature that allows users to chat one-on-one or in groups and easily share activities and routes. Privacy controls require users to opt in and choose whether anyone or only existing followers can message them. The goal of the messaging feature is to reduce context switching between other apps when planning group fitness activities. As Strava's chief business officer, Zipporah Allen, noted in the December 2023 press release:

“The magic of Strava is in that connection and belonging that people feel, and so messaging is really the next iteration of what that feels like.”

Source: Strava

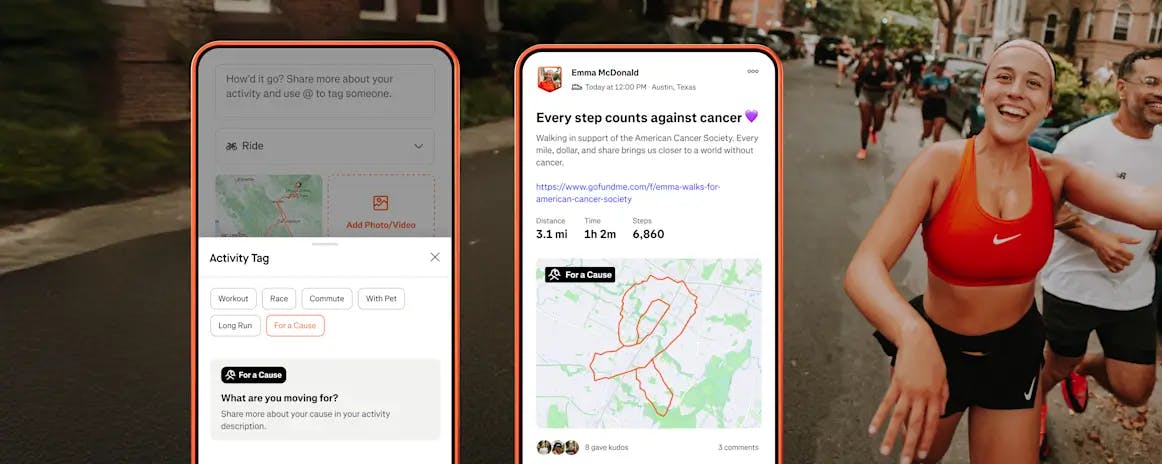

Strava is also increasingly tying fitness to community-based causes. In November 2025, Strava introduced a “For a Cause” activity tag in partnership with GoFundMe. Athletes can start or link a GoFundMe fundraiser and then tag any workout with that cause. When they upload the activity, the Strava post then highlights the charity or fundraiser link in the description. For example, athletes can dedicate a run to cancer research or hunger relief groups, and then invite their Strava network to support it.

Athlete Intelligence and Personalized Training

Source: Strava

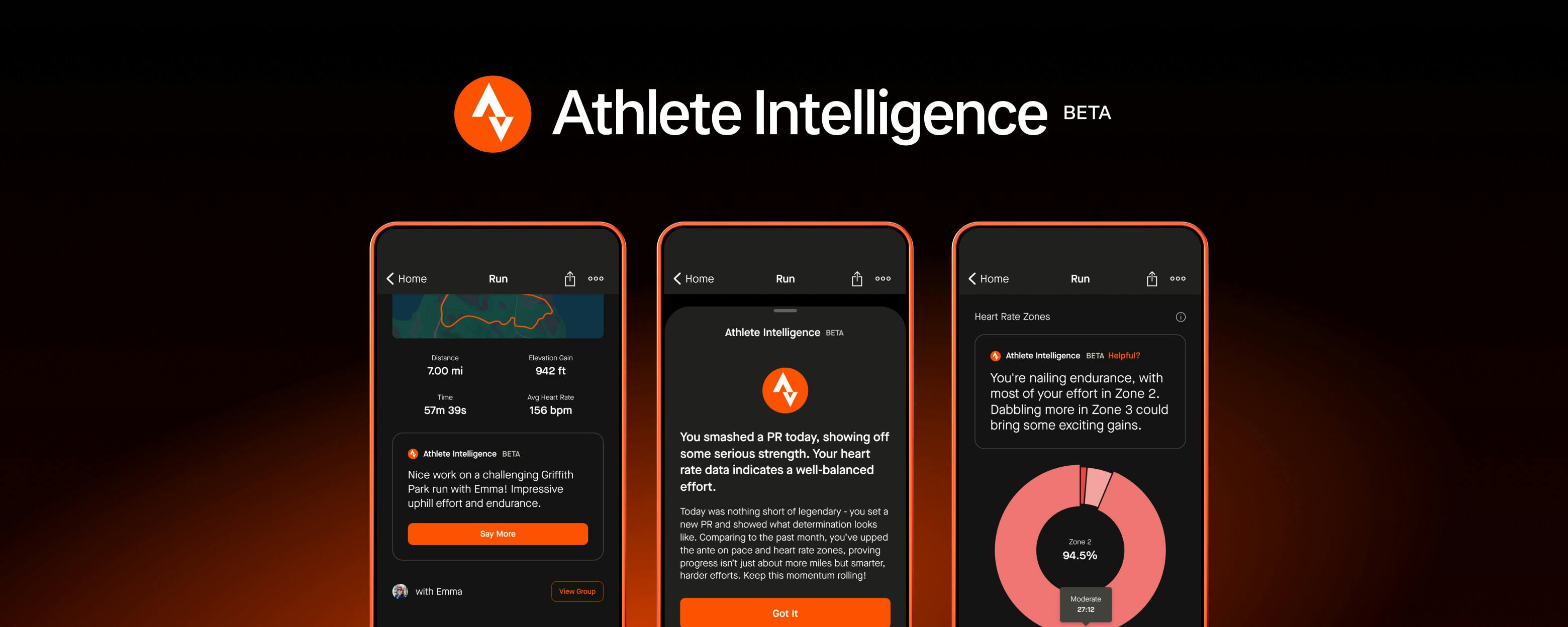

Strava is heavily expanding its personalized training ecosystem through AI and targeted acquisitions. In October 2024, Strava introduced Athlete Intelligence in beta, a feature that uses machine learning to turn an athlete’s entire training history into simple summaries of milestones, performance trends, and goal recommendations. The intent is to allow each subscriber to understand their own fitness development without requiring them to interpret raw data.

Source: Strava

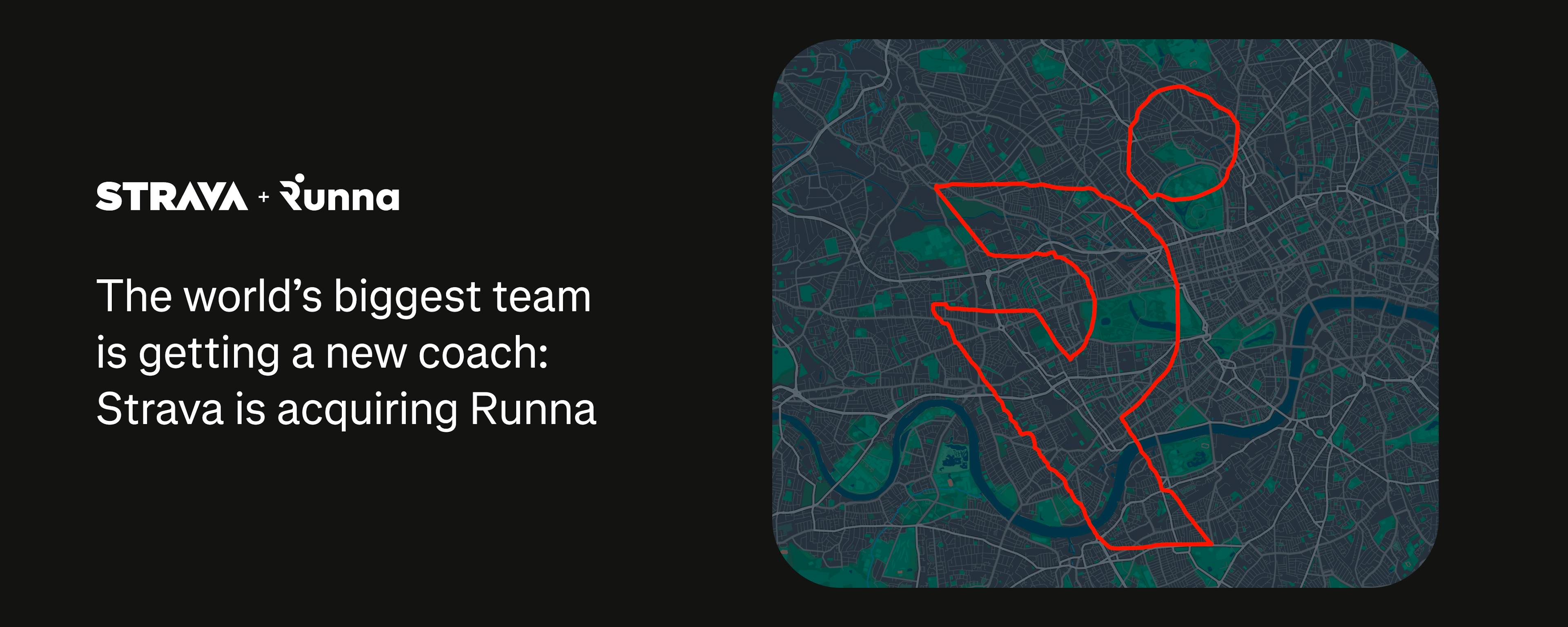

Strava has further strengthened each of these performance coaching capabilities in 2025 by acquiring Breakaway (May 2025) and Runna (April 2025), two coaching apps focused on cycling and running, respectively. Breakaway’s native technology helps to power features such as Power Skills, which highlight a cyclist’s all-time personal records across different power intervals, and Training Zones, which show how much time an athlete has spent in a specific pace and heart rate. Runners can get access to Strava’s premium features as well as Runna-based coaching by virtue of a new Strava and Runna subscription bundle that was announced in July 2025.

Integrations

Source: Strava

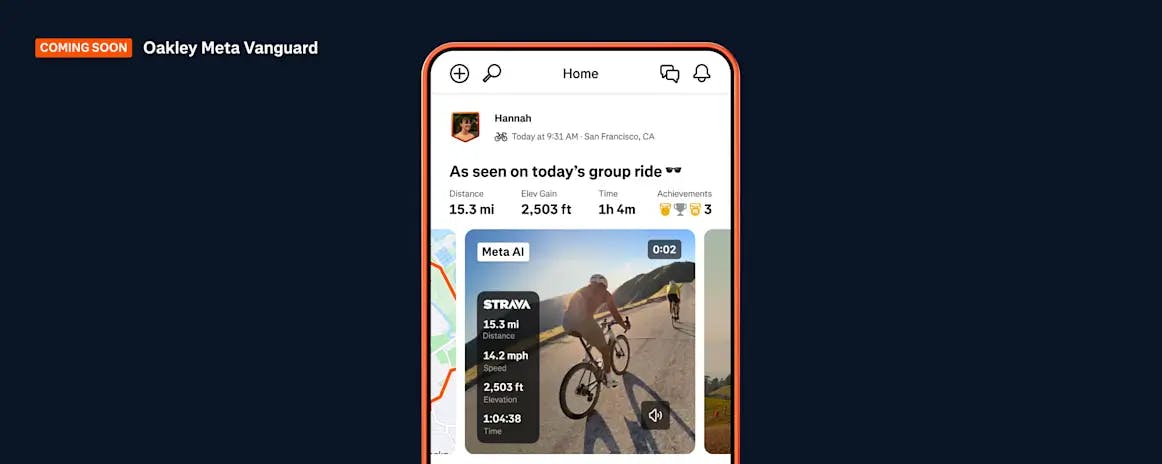

Strava’s platform connects with a wide range of devices and services that enhance the overall workout recording experience. Notable among these integrations was Strava’s announced partnership with Oakley to support the Meta Vanguard augmented reality glasses. The integration allows athletes to graphically overlay their performance metrics onto videos and photos that were captured by the glasses.

Market

Customer

The ideal customer profile for Strava is an active, tech-savvy individual who is passionate about sports and fitness. Strava users are typically avid runners, cyclists, and outdoor enthusiasts who enjoy tracking their activities, setting goals, and connecting with like-minded individuals. Strava's target audience tends to be motivated by challenges, competitions, and community engagement. Strava’s customers can range from amateur fitness enthusiasts to professional athletes such as Eliud Kipchoge, the world record holder in the marathon, and INEOS Grenadiers, a professional cycling team.

The platform provides a social networking aspect where users can connect with friends, join clubs, and participate in challenges, which appeals to those seeking camaraderie and motivation in their fitness journey. Strava also targets fitness enthusiasts interested in improving their performance and achieving personal goals by leveraging the app's data-driven insights and training features.

While running and cycling are the most popular activities among Strava users, they also engage in a wide range of other sports, such as swimming, hiking, and skiing. Strava's customer base is large and varied, with over 100 million registered users globally as of 2023. Strava has a high percentage of millennials using the app. Out of all cyclists using Strava, 47% are millennials, 29% are Gen X, 17% are Gen Z, and 7% are Boomers as of 2023.

In addition to individual athletes, Strava serves businesses and organizations looking to engage with the fitness community. The Strava Metro platform provides anonymized data insights to help cities and urban planners make informed decisions about infrastructure and transportation. Companies like Salomon, REI, and Sweaty Betty have leveraged Strava's advertising and partnership opportunities to reach their target audiences, increase sales, or build communities.

Market Size

Strava operates in the $8.5 billion global fitness app market, which is expected to grow to $28.7 billion by 2029 at a 27.5% CAGR. The market is driven by an increasing number of health-conscious people, the adoption of technology such as smartphones and the internet, and the growing usage of fitness apps where people, especially those suffering from chronic diseases, can track health metrics.

In 2024, an estimated 26.4% of US adults met the guidelines for aerobic physical activity and muscle-strengthening activity during their leisure time. In 2021, Michael Horvath, Strava’s former CEO, said the company believed 700 million people worldwide “wake up every day wanting to be active” and could benefit from using Strava.

Competition

Wearables

Garmin Connect: Garmin Connect is a digital fitness platform that offers personalized coaching, training plans, and analytics tools for athletes. Founded in 1989, Garmin provides fitness tracking solutions, primarily specializing in GPS technology and wearable technology for a variety of activities, indoor and outdoor. The company had a market cap of $41.1 billion as of January 2026. Garmin Connect does not share public information on the number of users or activities tracked, but Garmin was estimated to account for 9% of the smartwatch market in the United States as of December 2023.

Compared to Strava, Garmin Connect offers more advanced training and coaching features, providing personalized plans, recovery advice, and insights based on users' fitness levels and goals. Meanwhile, Strava provides better social features, making it easy for users to connect with friends, join clubs, and participate in challenges. Both apps provide data analysis, but Garmin Connect offers more in-depth insights when used with compatible devices. Strava has more integrations with third-party services, while Garmin Connect is more limited in this aspect. While Garmin Connect appeals to users who prioritize coaching and in-depth data analysis, Strava caters to users who value community and connectivity.

Google Fitbit: Fitbit, founded in 2007, is in the wearable fitness device market. The company offers a range of fitness trackers and smartwatches that monitor users' activity, sleep, and heart rate. Fitbit was acquired by Google in January 2021 for $2.1 billion. In March 2024, Fitbit was then rebranded under Google (Google Fitbit), integrating into Google’s native devices like the Google Pixel watch. Fitbit's primary focus is on activity and health tracking for users who use the company’s wearable devices, while Strava emphasizes GPS tracking and performance analysis for outdoor activities. In August 2024, Fitbit partnered with Strava to sync Fitbit activities, making it a Strava partner as well as a competitor.

Apple Fitness: Launched in 2015, Apple Fitness is the built-in and default fitness tracking app for Apple Watch and iPhone users. It provides an overview of users' daily activity, including step count, calories burned, and exercise minutes. In 2020, Apple expanded its offerings with the launch of Apple Fitness+, a subscription-based fitness service that provides guided video workouts across various disciplines, including running, cycling, and strength training.

Apple Fitness leverages the ecosystem of Apple devices and services, making it a convenient choice for users already invested in the Apple ecosystem. Apple Fitness offers personalized recommendations based on user data and emphasizes studio-style workouts led by professional trainers. In contrast, Strava emphasizes its user-generated content, such as sharing activities, photos, and achievements on social media, and caters primarily to outdoor activities like running and cycling.

Fitness and Health Apps

Runkeeper: In 2016, Asics acquired Runkeeper, a fitness tracking app, for $85 million to integrate software into its offerings and leverage Runkeeper's 34 million users for cross-promotion of its products. Despite the acquisition, Runkeeper, which was founded in 2008, has maintained its autonomy and continues to operate independently. Runkeeper lacks the social aspects that make Strava a "Facebook for runners". While Runkeeper has some social features, such as the ability to share runs and join challenges, it does not have the same level of social interaction as Strava, which allows users to give kudos, comment on each other's activities, and compete on segment leaderboards.

Nike Run Club: Founded in 2012 by its parent company, Nike, Nike Run Club (NRC) is a digital fitness app that offers features to augment the traditional running experience and a virtual community to share runs. Nike had a market cap of $98.1 billion as of January 2026. One of the unique features that NRC offers is its guided runs feature, where users are led through a run distance by a coach on an audio track who offers tips and encouragement during the run. Additionally, the app also offers free training plans that can help users reach their running goals, ranging from a 5K to a marathon. While Strava also offers training plans for running, they are limited to users with a pro subscription.

MyFitnessPal: Founded in 2005, MyFitnessPal is a mobile app and website that helps users track their diet and exercise. The company was acquired by Under Armour in 2015 for $475 million and then sold for $345 million in 2020 to investment firm Francisco Partners. MyFitnessPal focuses on calorie counting and nutrition tracking, which differentiates it from Strava's primary emphasis on activity tracking and community building. However, both apps aim to help users achieve their fitness goals and maintain a healthy lifestyle.

MapMyFitness: MapMyFitness, founded in 2007, provides a suite of fitness-tracking apps, including MapMyRun, MapMyRide, MapMyWalk, and MapMyHike. The company was acquired by Under Armour in 2013 for $150 million. MapMyFitness apps offer features similar to Strava, such as GPS tracking, route mapping, and community. However, Strava has more features, including segments and leaderboards, which foster competition within the community.

Business Model

Tiered Subscriptions

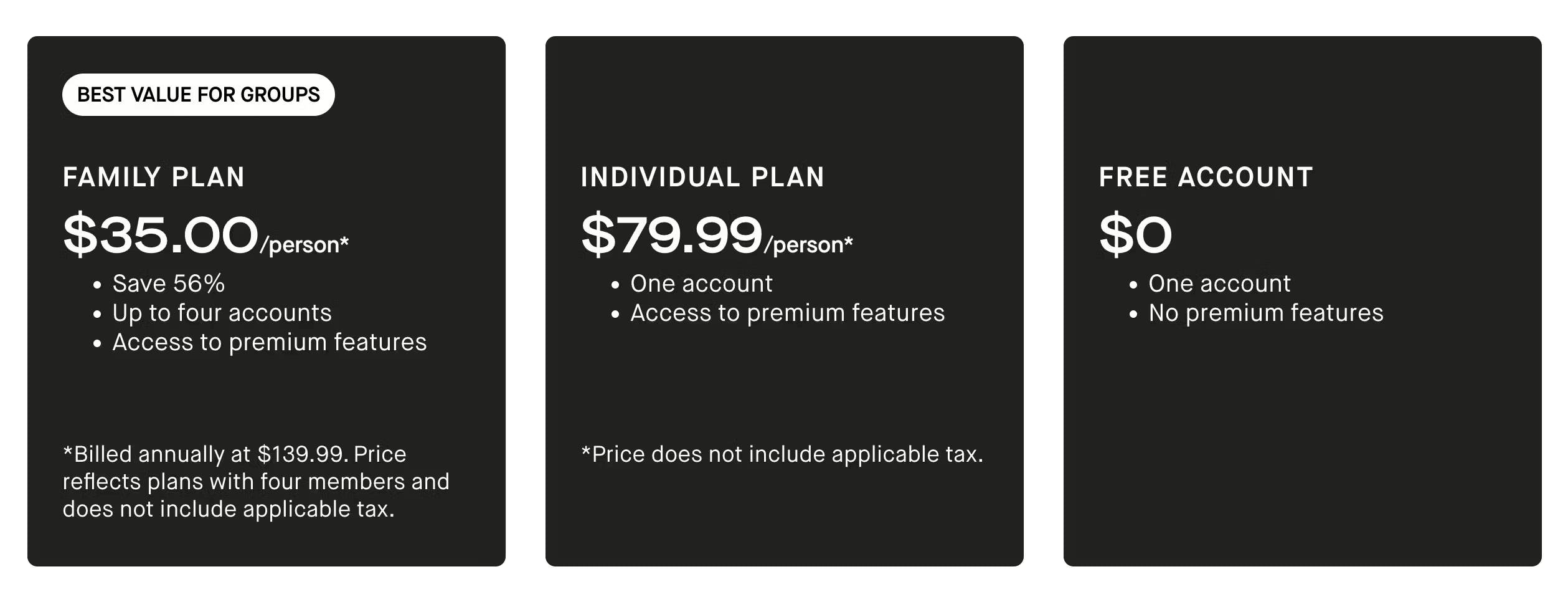

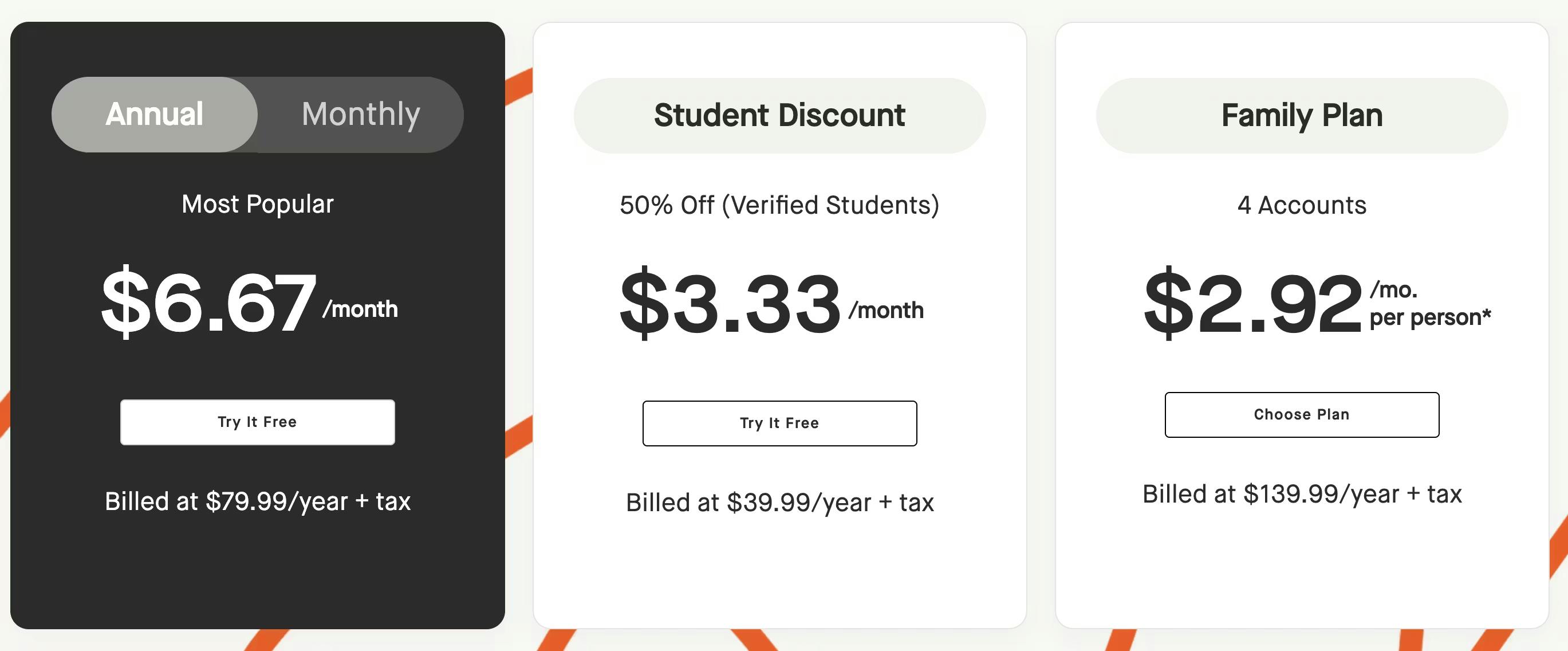

Source: Strava

Strava’s “freemium” model allows users to use the app for free with limited capabilities or purchase a “premium” subscription with enhanced features. As the company grew, it dialed back some free components and turned them into premium capabilities (i.e., segment searching, leaderboard viewing, and ride matching). However, Strava users can access several core features for free, including activity recording, social network access, safety tools, and lifetime personal record tracking.

For $79.99/year or $6.67/month with the individual plan, users can access additional features such as group challenges with friends, competition on segment leaderboards, route building and sharing, advanced activity analysis, custom goal setting, and "best efforts over time".

In July 2024, Strava announced its newest pricing offering: the family plan. Starting at $139.99/year, four users, i.e., friends or family, can jointly purchase a plan to access premium features at a discounted rate.

Source: Strava

Strava also provides a student plan that starts at $3.33/month or $39.99/year, which is a 50% discount from the individual plan and shares the same features.

Strava Metro

While most of Strava’s revenue comes from subscription users, Strava Metro, and sponsored challenges have also become revenue drivers. Strava Metro allows governments and agencies to buy Strava data to understand cycling and running patterns. The data can help them create better urban spaces for bikers and pedestrians.

Recent case studies have shown that Strava Metro data can guide the placement of bike-share stations and counters, as well as inform active transportation planning. By leveraging the insights gained from Strava users' activity data, cities can make data-driven decisions to improve cycling infrastructure and encourage active transportation. As of January 2026, Strava Metro had partnered with over 3.7K organizations worldwide, demonstrating its potential to transform urban mobility and create more sustainable, bike-friendly cities.

Strava Challenges

Source: Strava

Strava Challenges are like advertisements. They allow companies to promote their brand but don’t appear as conventional ads. Companies pay $30K-$200K to sponsor challenges. These sponsored challenges serve as a “motivational influence” with organic interaction rather than the “disruption” of traditional advertisements. For example, Adidas offered a Strava badge and commitment to a plastic waste cleanup project based on completing its Adidas x Parley Run For The Oceans challenge.

When a user’s friend opts to join a challenge, it appears in the feed of their followers, alongside everyone’s activities. Branded challenges introduce companies to Strava users and allow them to market their brands and products. Many challenges give users prizes, helping bring more customers to Strava Challenge Sponsors. Prizes can include discounts or free offerings with certain purchases.

Traction

Strava has experienced significant growth and traction. The company reported over 180 million registered users globally as of November 2025, a 327% increase from 55 million at the end of 2020. In May 2025, CEO Mike Martin also noted that the company was on track to hit $500 million in annual recurring revenue soon.

User engagement on the platform has also increased, with 40 million activities uploaded per week in 2023, an 86% increase from 21.5 million per week in 2020. According to Strava's 2023 report, 77% of Gen Z athletes reported feeling more motivated to exercise after seeing their friends' or family's activities on the platform.

Valuation

Strava raised an undisclosed funding round in May 2025 (including some debt financing) led by Sequoia Capital, valuing Strava at $2.2 billion. This marked an uptick from its previous Series F round in November 2020, when Strava raised $110 million (led by TCV and Sequoia) at a roughly $1.5 billion valuation. In total, Strava has now secured over $228.5 million in venture funding across all rounds. Other notable Strava investors include Sigma Partners, Dragoneer Investment, Jackson Square, Madrone Capital, and Go4It Capital. In January 2026, it was reported that Strava had confidentially filed for IPO “in recent weeks”.

Key Opportunities

Partnerships and Integrations

Strava has established strategic partnerships with various brands, races, competitions, and high-profile athletes to enhance user experience and engagement. The company's partnerships with relevant brands such as Red Bull, Adidas, and Le Col Giro provide unique challenges and rewards for Strava users. Additionally, Strava's collaborations with major races and competitions, including the Virgin Money London Marathon, TCS New York City Marathon, and NYRR Virtual Race, allow athletes to participate in virtual events and connect with the global running community. Some of these athletes are professionals like pro runner Hillary Allen or pro cyclist Cory Williams, who are encouraged to use Strava to grow their following and inspire other athletes.

Strava's partnership with the Tour de France and the Tour de France Femmes provides athletes with the opportunity to share more information during the races and offers fans greater visibility into the events. This collaboration brings the races to life for cycling enthusiasts worldwide by creating a storytelling hub for cyclists. The Tour de France Femmes is set to become the world's largest and most competitive women's race. Strava's public support of women in sports and other female-athlete-focused companies could foster a community of women eager to compete, especially in the male-dominated fitness world.

In March 2024, Strava announced new platform integrations with ŌURA and Open, allowing athletes to bring their passive health scores, such as recovery and sleep, and progressive health practices, like meditation and mindfulness, together for a holistic approach to training and well-being. This integration enables users to understand how their daily activities contribute to their overall health and performance. For example, a long run can be improved by an Open breathwork and meditation, or a hike can be fueled by a strong Readiness Score from Oura.

In February 2024, Strava partnered with Fi, the connected dog collar and health platform, to celebrate Walk Your Dog Day. This partnership allows athletes to seamlessly integrate their active lives with their dogs and share their experiences with their communities on Strava.

Furthermore, as of September 2023, Strava's partnership with Nike has enabled Nike Members from Nike Run Club and Nike Training Club to sync their workouts with Strava and share them with their Strava communities. This integration expands the reach of both platforms and encourages users to engage with a larger fitness community. Later, in November 2025 Strava partnered with GoFundMe to launch a new “For a Cause” feature that allows athletes to tag activities in support of charitable fundraisers. This integration allows athletes to tag activities in support of charitable fundraisers

Network Effects and Gamification

Strava’s use of gamification elements, such as leaderboards, challenges, personal records, and badges, fosters a sense of community and competition among users. The company’s focus on community engagement as a driver tends to separate it from traditional fitness tracking apps. The unique gamification elements encourage users to engage with others on the app to expand its user base. Passionate community users have created a marketplace of shirts and mugs to canonize the phrase “if it’s not on Strava, it never happened”. As the former CEO of Strava (from 2017 to 2019), James Quarles explained: “Community is our core. People say they don’t download Strava, they join Strava”.

That community looks to be increasingly driven by social connection rather than raw performance alone. According to Strava’s 2024 Year in Sport report, “making social connections” was the number one motivator for users to stay active, outpacing both health and performance goals. Global running club participation jumped some 59% in 2024 alone, reflecting a broader cultural shift at work. In the midst of what many professionals have termed a loneliness epidemic, Gen Z and younger millennials are turning to fitness as one of the preferred means of meeting others, forming friendships, and even dating. In 2024, nearly 1 in 5 Gen Z went on a date with someone they met through exercise, and they were four times more likely to prefer meeting people at a workout than at the bar.

Strava is well-positioned to capitalize on this trend. As younger generations increasingly embrace so-called sober curiosity and shift their social lives away from alcohol-centric spaces, apps that help to facilitate real-world, wellness-oriented connections will stand to gain ground.

Device Compatibility

With many compatible devices, Strava’s synergy with equipment makers will likely continue to be a valuable avenue. For example, over 50 million Peloton activities were uploaded to the app as of 2021, and Strava saw similar popularity among Zwift users. As a result, Strava has the potential to become the de facto social and competitive network for fitness. The company could seek to improve integration from more apps (i.e., Equinox+, Lululemon Mirror), equipment, and wearables, and offer more social network components (i.e., direct messaging). Individuals use several apps and platforms, and Strava may want to consolidate users from other applications to continue leading the market.

Device Compatibility

One of Strava’s greatest advantages as a company is its exceptionally broad device and platform compatibility. The platform syncs with virtually any GPS watch, fitness tracker, or workout app. This proves especially helpful for the scores of multi-discipline athletes training using an array of data trackers. Runners rely on GPS watches for outdoor miles, cyclists log indoor sessions on smart trainers, and many supplement training with apps for strength, yoga, and mobility. Strava’s strategy is to unify all of these data sources into a single social and analytics picture where the entire training picture lives.

As Strava continues to expand its integrations, it strengthens its position at what the company calls the “nucleus of [an athlete’s] active life”. This central position is hard for competitors to replicate because it is reinforced by powerful network effects: new devices and fitness platforms often need to support Strava to gain credibility with the millions of athletes who already log their activities there. The more tools that plug into Strava, the more indispensible the platform becomes as a central store of fitness data specific to the athlete.

Strava’s unified dataset also enables product experiences that siloed ecosystems struggle to match. Its global heatmap, area-specific route recommendations, and long-term performance insights are all powered by billions of aggregated data points that rely on the breadth and depth of activity uploads across the platform. As of January 2024, more than 40 million activities are uploaded to Strava every week from a variety of separate data sources.

Key Risks

Data and Privacy Concerns

After landing in hot water for inadvertently exposing the location of US military bases in 2018, Strava eliminated mid-workout and live tracking features. The company subsequently placed a bigger emphasis on privacy, like hiding an activity’s start and end points, making private profiles, hiding profile pictures from non-friends, and hiding entire activities. The GPS component works well for fostering community, but some athletes experienced privacy breaches by individuals who found their locations from the app. In 2023, a former Russian military officer was reportedly tracked and killed with help from his open Strava profile, while in 2025, a report revealed that the Swedish prime minister’s bodyguards had unwittingly shared his private addresses and travel routes through Strava uploads. If Strava continues to have data and privacy concerns it could severely limit its long-term potential.

Monetization

Users have expressed concerns that the company may begin selling their data to find new revenue, though the company has committed not to sell user data except in the case of Strava Metro as of August 2024. Since there are over 100 million active Strava users who opt for the free version as of August 2024, it’s unclear how many of the athletes would be willing to pay for the premium offering.

Strava’s subscription-based model provides a steady stream of predictable revenue. However, this model has also led to criticism from users who feel the company is nickel-and-diming them by revoking previously free features and turning them into premium perks. For example, features such as route planning, leaderboards, and performance analysis are only available to premium subscribers as of June 2023. In 2022, Strava’s “Year in Sport” feature, which provides a summary of a user’s activity for the year, was added as a premium feature, a move that led to some user frustration. Athletes currently enjoy the ad-free nature of the platform, but Strava may add an ad-supported tier as it starts to focus more on monetizing a large cohort of free-tier users.

Reliance on Third-Party Integrations

Strava’s clash with Garmin exposed the platform’s dependence on third-party integrations. In October 2025, Strava filed a lawsuit against Garmin, alleging patent infringement tied to Garmin Connect’s use of segment-based performance tracking and heatmap-style visualization (core Strava features). The lawsuit followed weeks of mounting tensions over Garmin’s new API policy requiring branded attribution on all synced activities, with threats to cut off Strava API access to Garmin if compliance wasn’t met by November. Strava viewed this requirement as undue “blatant advertising” and responded with the lawsuit as well as posting a public grievance on Reddit. Just three weeks later, however, Strava backed down and voluntarily withdrew the suit with no settlement gained, signaling that Strava effectively conceded to Garmin’s attribution demands.

Although the legal battle was short-lived, a crucial 15-year partnership with Garmin may have been permanently damaged. Garmin is Strava’s single most important hardware partner, with some estimates suggesting that nearly 70% of all Strava activities are sourced from Garmin hardware devices. As one analyst noted, if Garmin severed all data integrations with Strava, it could “almost immediately” spell the end of Strava. While a total disconnect was narrowly averted, Garmin has since been strengthening its relationship with certain core Strava competitors (for example, rolling out new integrations with Komoot). The entire episode has also highlighted the potential fragility of Strava’s core hardware partnerships. Given how Garmin accounts for such a large share of device-linked activity uploads on Strava, any future disruption in API access or collaboration could materially affect Strava’s functionality, community engagement rates, and user retention.

Summary

Between its broad addressable market and minimal direct competition, Strava is well-positioned among community-oriented fitness apps. Though many other companies overlap with Strava’s business, none directly compete with Strava’s entire offering. Strava unifies all athletes on a single app, syncs with hundreds of devices, offers over 40 sports, and promotes competition and community engagement between users of all skill levels.