Thesis

As of 2024, global data generation has reached 403 million terabytes per day, with projections estimating total creation will exceed 394 zettabytes annually by 2028. This growth, fueled by increased digitization, Internet of Things (IoT) proliferation, and AI integration, has placed growing pressure on businesses to derive insights from large volumes of data in real time. While the global data analytics market is expected to reach $190 billion by 2028 at an 11.1% CAGR, many organizations continue to rely on legacy business intelligence (BI) systems that lack the speed, scalability, and accessibility needed to support modern workflows.

Traditional BI tools present multiple friction points. Many rely on predefined dashboards and static reports that require manual updates, delaying critical insights. Access to these tools often requires SQL or coding experience, making them less usable for non-technical stakeholders. In many organizations, data remains siloed across platforms and departments, which leads to inconsistent reporting and duplicative effort. These legacy systems also carry significant maintenance and licensing costs, further limiting their scalability as data volumes grow.

In response, organizations are adopting self-service BI tools to reduce reliance on technical teams and empower more employees to work directly with data. The global self-service analytics market, valued at $6.7 billion in 2024, is projected to grow to $26.5 billion by 2032 at a CAGR of 18.7%. This shift supports broader goals around data democratization and operational agility, making insights accessible to more stakeholders while reducing delays tied to centralized data teams. Modern BI platforms increasingly incorporate AI-powered features to automate complex queries, generate insights, and support faster decision-making at scale.

This is where ThoughtSpot comes in. As organizations adopt self-service analytics to reduce dependency on centralized data teams, ThoughtSpot offers a platform designed to address specific limitations of traditional business intelligence tools. These limitations often include restricted access for non-technical users, slow query response times, and a reliance on IT or data specialists to generate reports. ThoughtSpot’s platform allows users to query data using natural language and integrates with modern cloud data stacks. Its architecture supports faster performance and broader accessibility, enabling teams to conduct analysis more independently. As a result, it serves as a tool that aligns with the broader movement toward decentralized and on-demand data use within organizations.

Founding Story

Source: ThoughtSpot

ThoughtSpot was founded in 2012 by Ajeet Singh (Executive Chairman of the Board, former CEO) and Amit Prakash (CTO), two engineers who came from different corners of the enterprise technology world but shared a similar frustration: in most organizations, the people responsible for making business decisions had limited access to their own data. Despite improvements in computing infrastructure and data collection, business users still depended heavily on analysts to run reports, often waiting days or even weeks for answers.

Singh’s path to entrepreneurship was shaped by a combination of consulting, product leadership, and startup experience. He began his career in management consulting before joining Honeywell’s India office, where he developed Honeywell Zing, an OnStar-style system for business jets. The success of that initiative led Singh to transfer to the U.S. in 2006 to help launch the product internationally. In 2007, he joined Oracle’s Database Group in Silicon Valley, where he worked with leading enterprise software engineers, but found that the scale and legacy of the organization limited his ability to drive product innovation. Seeking a faster-paced environment, he moved to Aster Data Systems as Head of Product Management, where he worked alongside his former college roommate from the Indian Institute of Technology (IIT), Dheeraj Pandey.

At Aster Data, Singh saw how companies were beginning to accumulate large volumes of business data but lacked effective tools to make it usable across the organization. Most companies relied on traditional business intelligence (BI) software, which required specialized technical knowledge and produced static reports that were difficult to update. As a result, line-of-business teams remained heavily dependent on IT to access even basic performance metrics.

This experience at Aster Data, combined with his earlier frustrations at Oracle, where product innovation was slow and layered with bureaucracy, motivated Singh to build a company of his own. He recognized that building within a startup environment offered greater opportunity to implement bold product ideas with speed and focus. In 2009, Singh partnered with Pandey and fellow technologist Mohit Aron to co-found Nutanix. While the specific product direction emerged after market research, their initial intent was clear: simplify the complex and fragmented enterprise IT infrastructure landscape.

Meanwhile, Amit Prakash had built his career designing large-scale data systems and analytics infrastructure. He began as a software engineer at Microsoft, working on distributed computing platforms. One of his early projects involved building a spam-resistant version of PageRank—the algorithm behind Google Search—focused on improving the relevance and reliability of web results at scale.

Prakash later joined Google in 2007, where he became a tech lead on the AdSense Analytics team. His group developed machine learning algorithms and statistical models that optimized the revenue performance of Google’s ad-serving platform. Working inside an organization that could deliver real-time insights to millions of users, Prakash became interested in why the same level of responsiveness and accessibility did not exist in the enterprise context. In most companies, accessing basic business data required long lead times and the involvement of multiple teams. Despite advances in data collection and storage, analytics remained confined to specialists.

In 2012, Singh and Prakash met for the first time at a Starbucks near Google’s Mountain View campus. What began as a casual coffee meeting turned into a series of regular conversations. Over the course of several weeks, the two compared notes on what they had seen at their respective companies — Singh from the product and infrastructure side, and Prakash from the large-scale analytics and algorithmic side. They concluded that enterprise BI remained overly dependent on technical teams and that the next wave of innovation in data would require removing those barriers altogether.

As they began outlining the company’s foundation, Singh and Prakash started assembling a founding team. They recruited several early engineers who had experience building large-scale systems at major tech firms, including Shashank Gupta, Vijay Ganesan, Sanjay Agrawal, Priyendra Deshwal, and Abhishek Rai. Collectively, the group brought technical experience from companies like Google, Amazon, Facebook, Microsoft, and Oracle. Many had backgrounds in core infrastructure, distributed systems, and AI, and understood both the technical and practical challenges involved in delivering fast, reliable analytics at scale. “A large cofounding team can be a problem,” says Singh. “But we know when to defer to each other, and when we do disagree, we do it with respect.”

Singh took on the responsibility of building out the broader team. In the early days of ThoughtSpot, he personally interviewed more than 100 candidates, many of them at the same Starbucks where the initial idea was conceived. He focused less on credentials and more on motivation, asking each prospective hire the same question: “What inspires you?” If they expressed a desire to build something from the ground up, to work collaboratively, and to make a lasting impact, they were invited to join. Today, ThoughtSpot has nine office locations across the globe and close to 800 employees.

As the company matured, it expanded its executive team to support broader functions beyond engineering. Brad Roberts joined as Chief Financial Officer, overseeing financial planning and capital strategy. Jeff Depa became Chief Revenue Officer, taking responsibility for global sales and revenue operations. Cindi Howson, who had previously led BI strategy at Gartner, was brought on as Chief Data and AI Strategy Officer to help shape the company’s direction in an increasingly AI-driven analytics landscape. Micheline Nijmeh joined as Chief Marketing Officer to lead go-to-market strategy and brand development, while Ahmed Quadri came on board as Chief Customer Officer, focusing on post-sale engagement and long-term client success.

In 2024, ThoughtSpot made a significant leadership transition with the appointment of Ketan Karkhanis as new CEO. Karkhanis had previously held executive roles at Salesforce, where he worked on cloud analytics and enterprise software products. His background in cloud-native architecture and AI-powered tooling aligned with ThoughtSpot’s evolving focus on modern analytics delivery. Singh transitioned into the role of Executive Chairman, where he continues to play an active role in the company’s long-term strategic planning and vision.

Product

ThoughtSpot’s product suite consists of three core offerings: ThoughtSpot Analytics, ThoughtSpot Embedded, and Analyst Studio. These are accompanied by additional product features including Spotter, AI-Augmented Dashboards, Augmented Insights, and Actionable Analytics. The platform is designed to support both technical and non-technical users across a range of use cases, including self-service analytics, embedded BI, and workflow integration. ThoughtSpot’s products integrate with major cloud data platforms such as Snowflake, Databricks, and Google BigQuery, and are used across industries for querying, visualizing, and operationalizing data.

ThoughtSpot Analytics

Source: ThoughtSpot

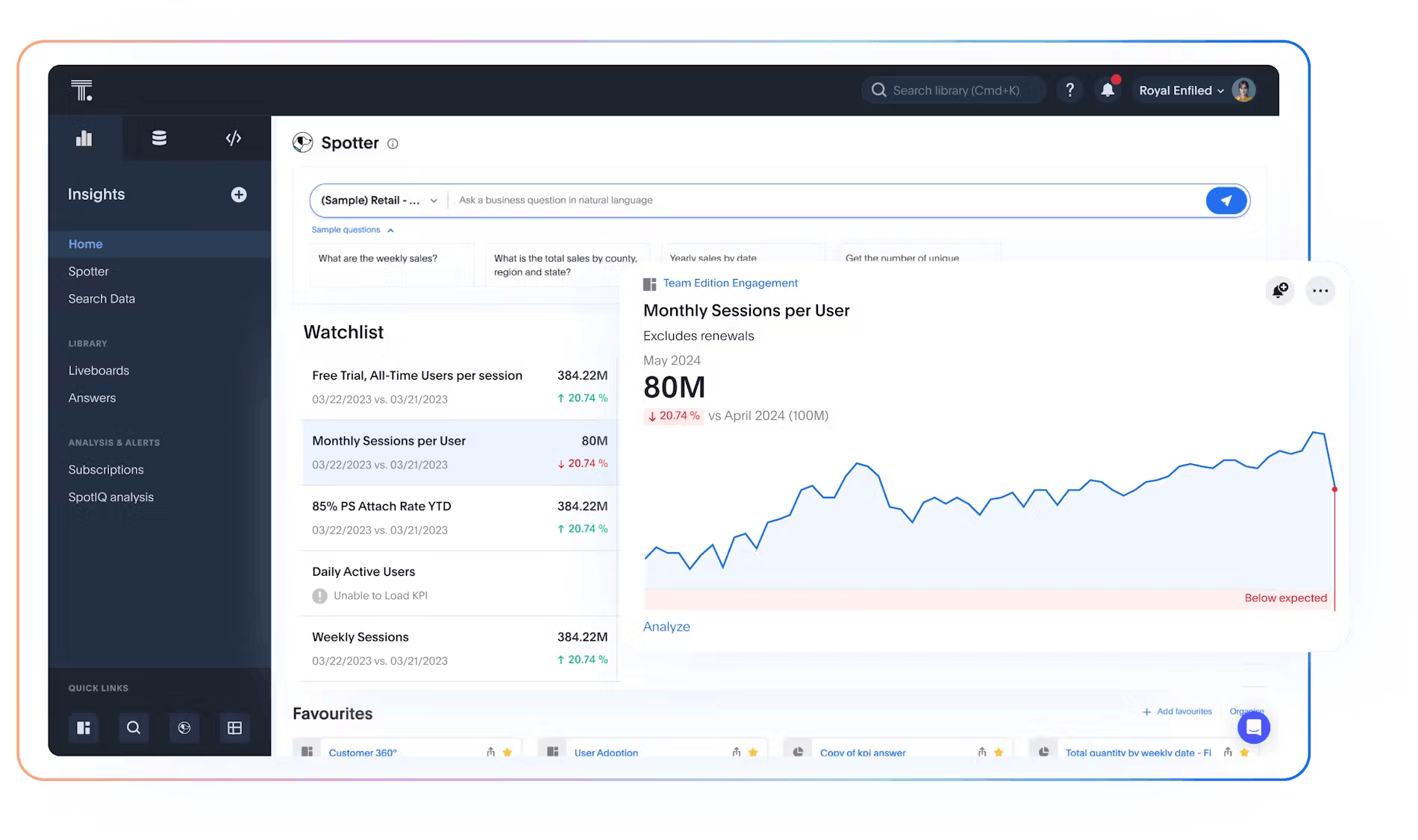

ThoughtSpot Analytics is the company’s core self-service BI platform, built to help users query and analyze live data using natural language. It was designed with both technical and non-technical users in mind and connects directly to cloud data warehouses such as Snowflake, Databricks, and Google BigQuery. This architecture allows users to interact with real-time data without relying on extract-based pipelines or scheduled batch refreshes.

A central component of the platform is the use of Liveboards. These are interactive dashboards that remain connected to live datasets and update in real-time. Unlike traditional dashboards that require predefined drill paths, Liveboards enable users to investigate metrics more freely. A user might begin with a top-line revenue figure and navigate deeper into product-level or geographic data with only a few clicks. Built-in tools such as anomaly detection, change analysis, and AI-generated highlights help surface patterns or disruptions in performance without requiring manual setup.

To enhance accessibility, the platform features an AI agent named Spotter. Instead of using filters or dropdown menus, users can type questions in natural language. Spotter returns responses that are designed to be both interpretable and modifiable. Users can refine their inputs by adjusting editable search tokens without needing to write SQL queries. Spotter draws on a semantic understanding of enterprise data and incorporates human feedback to improve over time, offering a more transparent and interactive experience than many black-box AI systems.

The platform also includes relational search functionality, which allows users to work across datasets with complex joins and schema structures. This is particularly useful in enterprise environments where data is often distributed across multiple systems. Rather than requiring users to understand those relationships in advance, relational search provides a way to navigate them through guided search inputs that can be adjusted during analysis.

Lastly, ThoughtSpot Analytics also includes AI-driven features such as predictive forecasting. Powered by the SpotIQ engine, these tools surface forward-looking insights based on patterns in historical data. It supports a wide range of users, including analysts, developers, product managers, and business executives, and is designed to meet the security and compliance requirements of enterprise environments.

ThoughtSpot Embedded

Source: ThoughtSpot

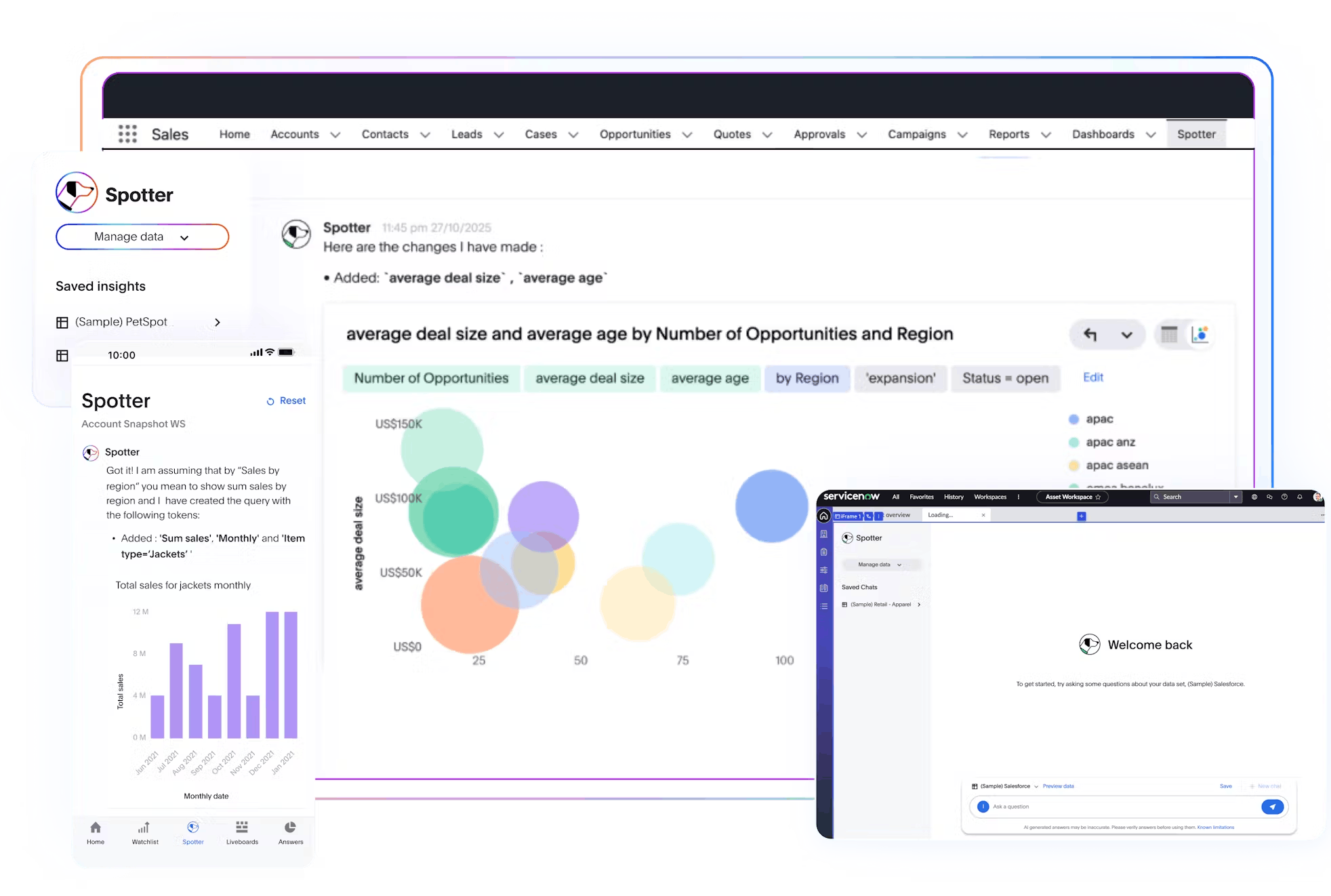

While ThoughtSpot Analytics brings data access to internal teams, ThoughtSpot Embedded extends those capabilities into external products and business applications. It is designed for developers and product managers who want to integrate analytics into the tools their customers and users already use. Rather than sending users to standalone dashboards or BI portals, ThoughtSpot Embedded enables insights to appear directly within operational workflows.

To support this integration, the platform offers a range of developer tools that reduce implementation time and lower the technical barrier. Teams can use low-code options like software development kits and configuration templates, or take a more hands-on approach through a REST API framework. A dedicated Developer Portal provides access to interactive demos, implementation guides, and workflow previews, making it easier to test configurations before deploying them. In some cases, customers have moved from early prototypes to public beta in under a month.

The platform supports full customization through white-labeling. Developers can adapt visual elements such as search inputs and charts to match existing interfaces, creating a consistent experience for end users. Branding elements, custom metrics, interaction logic, and styling options can all be defined to align analytics with product-specific requirements.

Embedded deployments also support automation through event listeners and webhook integrations. When metrics cross thresholds or trends emerge, teams can trigger notifications or downstream actions. These alerts can be sent to collaboration tools like Slack or integrated into business systems such as Salesforce or Google Docs, enabling follow-up steps without switching platforms.

Companies across healthcare, retail, financial services, manufacturing, and education have used embedded analytics to improve customer engagement and expand product offerings. In a 2024 survey conducted by Product-Led Alliance and ThoughtSpot, over half of product leaders reported revenue gains tied to embedded analytics. A similar share cited increased user engagement, pointing to the growing importance of in-app insights as part of the broader product experience.

Analyst Studio

Source: ThoughtSpot

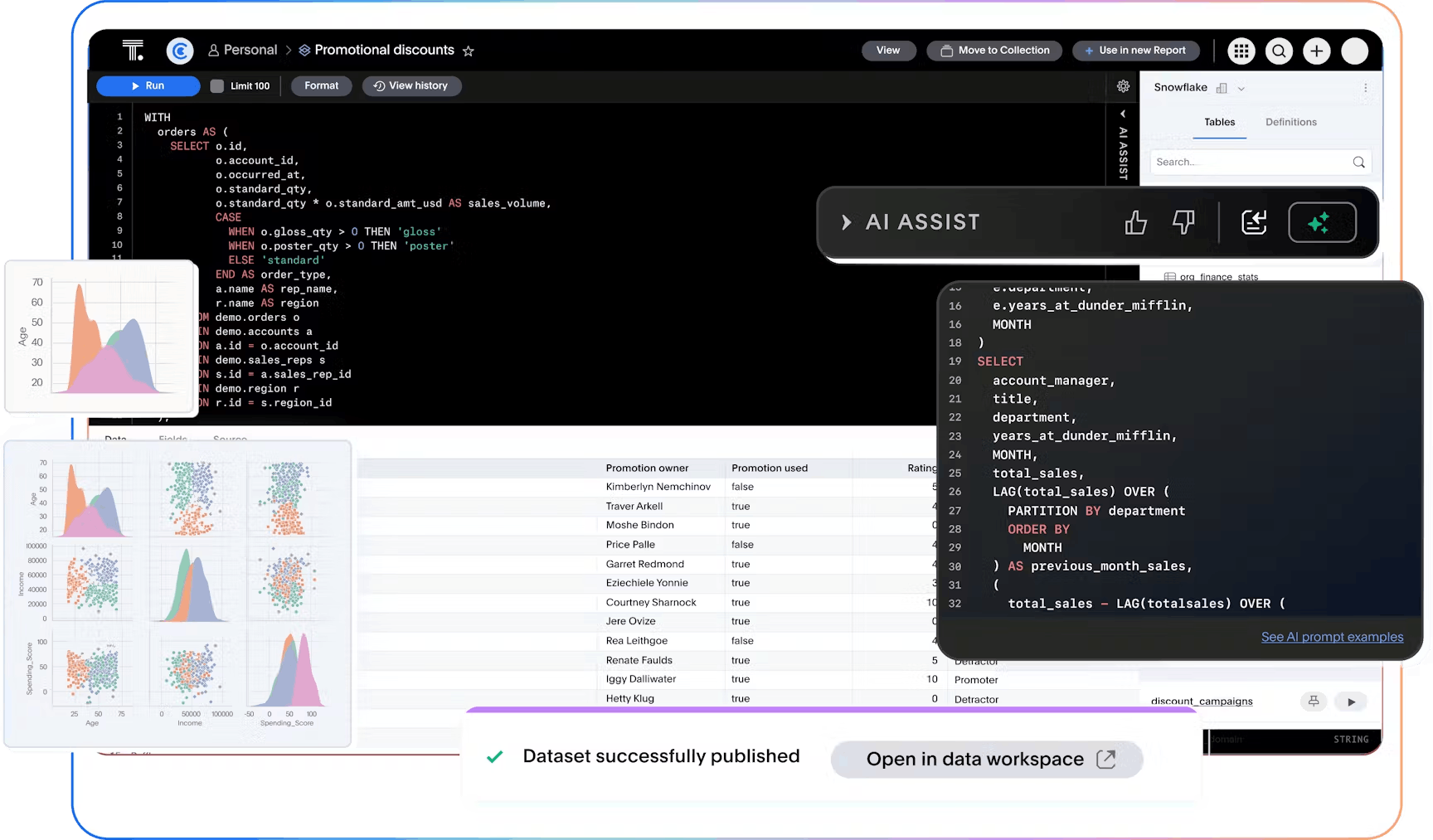

For teams that want to go beyond dashboards and reporting, Thoughtspot offers a product named Analyst Studio, which lets users do deeper, code-first analytics. It is designed for technical users who need more than just access to data. Analysts, analytics engineers, and data scientists use it to prepare, transform, and analyze data across large and often fragmented systems.

Built for compatibility with major cloud data platforms, including Snowflake, Google BigQuery, and Databricks, Analyst Studio brings code and visual workflows together within a single environment. Users can write SQL, develop Python and R notebooks, and automate data pipelines directly inside the platform. A native SQL editor supports natural language input through AI Assist, which helps translate plain-text questions into structured queries. For more advanced work, built-in notebooks provide access to commonly used statistical libraries, enabling custom modeling and forecasting within the same space.

To balance performance with cost, users can choose between live data connections and cached snapshots using a feature called Datasets. These snapshots are configured with custom refresh schedules and are often used to prototype analytics workflows or validate logic before scaling them to production systems.

The platform also supports connectivity across a variety of systems. Using native connectors, teams can pull data from cloud data warehouses, spreadsheets such as Google Sheets, and third-party software platforms. This flexibility allows users to join and analyze data from environments that are often siloed, enabling more comprehensive analysis without the need for separate tools.

For users who prefer visual exploration, the platform includes an interactive chart builder and a grammar-of-graphics framework. These tools support iterative analysis while still allowing users to control how the data is processed and displayed. This combination of flexibility and transparency makes it easier to move between exploratory and production workflows.

Analyst Studio became generally available in early 2025 for ThoughtSpot Cloud customers. It incorporates capabilities from ThoughtSpot’s 2023 acquisition of Mode, blending self-service BI with more robust tools for data engineering and modeling. As organizations increase their reliance on operational analytics, the need for trusted data pipelines and scalable modeling has grown. Analyst Studio was developed in response to that shift, giving technical teams the infrastructure to support more complex questions and faster decisions.

Market

Customer

According to ThoughtSpot CEO Karkhanis, speaking in October 2024:

“We’ve got a large number of customers knocking on our door right now. And they want to know, ‘What does the future of AI and analytics look like?’ They want to know how they can get all their data in an experience that actually helps them get actionable insights, but more importantly, drives business outcomes"

ThoughtSpot primarily serves mid-sized to large enterprises across a range of industries, including financial services, healthcare, retail and e-commerce, procurement, manufacturing, and telecommunications. While the company’s roots are in making analytics more accessible to business users, its customer base today spans both traditional enterprises and digital-native startups, reflecting a broad set of deployment needs and use cases.

Source: ThoughtSpot

As of 2024, ThoughtSpot reports over 1K customers globally, including a notable presence across the Fortune 100. Notable customers include Capital One, Lululemon, Nasdaq, Unilever, Nvidia, Comcast, OpenTable, Klaviyo, and Albertsons.

In many cases, organizations have adopted ThoughtSpot as a replacement for legacy BI platforms. Odido, the largest mobile operator in the Netherlands, replaced its use of Tableau and Qlik with ThoughtSpot to give frontline teams real-time access to customer and performance data. This shift reduced dependence on analysts and led to IT cost savings of €1 million annually.

Other companies have used ThoughtSpot to improve the reach and impact of existing data infrastructure. Snowflake enabled over 350+ employees to analyze ServiceNow data through ThoughtSpot’s interface, improving IT productivity by 20% and helping teams meet 99% of operational goals. HP saw a similar shift after adopting ThoughtSpot in place of older BI tools. In the first six months, over 155K+ queries were run by 350 users, and data turnaround for global partners dropped to under 24 hours.

In product-led and embedded use cases, customers have integrated ThoughtSpot into their own offerings to deliver insights to end users. Accern, an AI platform focused on ESG and crypto sentiment data, embedded ThoughtSpot to allow non-technical users to navigate complex datasets. The company projected a 20-fold increase in adoption as a result. Chick-fil-A adopted ThoughtSpot alongside AWS to address bottlenecks in supply chain analytics, allowing business teams to analyze delivery and invoice data directly. The change restored an estimated 100K hours of productivity by reducing the time spent waiting on centralized analyst support.

Market Size

ThoughtSpot operates within the broader BI and analytics market, which was valued at $29.4 billion in 2023 and is projected to reach $63.8 billion by 2032. This represents a compound annual growth rate of 9.0%, reflecting a shift in enterprise priorities toward real-time access to data and the adoption of AI-powered decision-making tools. As companies face pressure to move faster and make better-informed decisions, traditional, static reporting tools are being replaced by platforms that enable more dynamic exploration of data across departments.

One of the fastest-growing segments within this space is embedded analytics, where ThoughtSpot has seen rising demand through its low-code developer tools. This market was valued at $19.8 billion in 2024 and is projected to grow at an 18% CAGR, reaching $22.9 billion by 2025.. As more enterprise software vendors look to bring intelligence directly into their applications, demand is increasing for analytics platforms that can be tailored and integrated into existing products. By supporting interactive search, AI-driven summaries, and white-labeled interfaces, ThoughtSpot has become a compelling option for companies embedding analytics in client-facing applications.

The analytics landscape is also being reshaped by generative AI. The generative AI in analytics market is projected to grow at a CAGR of 26.4%, reaching $12.5 billion by 2034. Much of this momentum is tied to the growing use of natural language interfaces and agentic workflows within analytics tools. With built-in support for large language models from OpenAI and Google Gemini, ThoughtSpot’s Spotter assistant allows business users to interact with data more intuitively. This opens up new use cases across industries where traditional BI tools have struggled to gain widespread adoption due to complexity or skill barriers.

ThoughtSpot’s position within the broader analytics ecosystem is further strengthened by its partnerships with companies like Snowflake, dbt, ServiceNow, and Google Cloud. As more organizations adopt cloud-native architectures and modern data stacks, platforms that can interoperate with upstream data tools and downstream applications are well-situated to gain traction.

Competition

Competitive Landscape

ThoughtSpot competes across a broad landscape of business intelligence providers that serve enterprise and departmental analytics needs. Its public competitors include Microsoft Power BI, Salesforce’s Tableau, and Google's Looker — platforms that offer varying levels of data integration, visualization tools, and AI-enabled features. These solutions are widely adopted across industries and cater to a range of users, from individual analysts to large, distributed teams.

In the private market, Alteryx and Sisense also represent key challengers. Alteryx is known for its strengths in data preparation and workflow automation, while Sisense emphasizes embedded analytics and developer flexibility. Each competitor brings a distinct approach to enabling data-driven decision-making, and overlaps exist in both product functionality and target customer segments. ThoughtSpot competes by offering differentiated capabilities in search-driven analytics, natural language interfaces, and live cloud data exploration.

Incumbents

Tableau: Tableau, founded in 2003, is a business intelligence platform bought by Salesforce in August 2019 for $15.7 billion. The last time Tableau’s revenue was separately disclosed, it totaled about $2.1 billion for Salesforce’s fiscal year 2022.

Tableau lets users connect to a wide range of data sources, explore them through drag-and-drop workflows, and share interactive dashboards across web and mobile. Compared to Tableau, ThoughtSpot argues its platform is more flexible, has more self-service features, and increases the speed to insight.

Microsoft Power BI: Originally launched in 2013 and bundled with Microsoft 365, Power BI is the market leader among business intelligence platforms with over 375K customers and 30 million monthly active users as of April 2025. Power BI benefits from its Microsoft 365, Azure, and Teams integrations, comparatively low pricing, and strong functionality. Copilot for Power BI launched in 2024, expanding Power BI’s AI capabilities. In contrast, ThoughtSpot bills itself as a more flexible platform that doesn’t rely on steep learning curves and allows for more self-serve options.

Looker: Looker is a business intelligence platform founded in 2012 and acquired by Google Cloud for $2.6 billion in 2020. Looker is part of Google’s BI product suite, with Google Data Studio rebranded into Looker Studio (free) and Looker Studio Pro (enterprise tier). The product lineup spans ad-hoc dashboarding, governed modeling, and embedded analytics, and leverages a tight integration with Google’s BigQuery and the wider Google Cloud Platform.

The main difference in Looker’s product compared to ThoughtSpot is its semantic model first philosophy. Metrics are defined once in LookML and reused everywhere, ensuring consistency in customer metrics and allowing for non-technical users to easily spin up analyses. It also creates a new querying language for customers to learn and, unlike Thoughtspot, de-emphasizes the ability for users to query for answers in SQL or Python.

Other Competitors

Alteryx: Alteryx, founded in 1997, has long been a fixture in the data analytics landscape, offering a platform tailored to business users and analysts for data preparation, workflow automation, and advanced analytics. The company went public in 2017 under the ticker AYX on the New York Stock Exchange (NYSE), after raising over $163 million in venture funding. In March 2024, Alteryx was taken private in a $4.4 billion acquisition by Clearlake Capital and Insight Partners, signaling a new chapter focused on transformation and repositioning in a fast-evolving market.

Alteryx built its reputation by offering no-code and low-code tools that enable users to blend, cleanse, and transform data without extensive programming knowledge. The platform is known for helping analysts create repeatable data workflows and streamline ETL processes, making it a go-to solution for upstream data preparation tasks. This emphasis on automation and transformation has allowed Alteryx to serve a broad range of users, from business analysts to data engineers, across industries such as financial services, healthcare, and retail.

While both Alteryx and ThoughtSpot seek to make data more accessible, their approaches reflect different focal points. Alteryx is centered on enabling users to manipulate and structure raw data, often before it reaches a BI layer. In contrast, ThoughtSpot focuses on downstream analytics by allowing users to generate insights from live cloud data using natural language queries and AI-assisted search. This distinction has made the two platforms complementary in some organizations, where Alteryx handles data preparation and ThoughtSpot enables self-service insight delivery.

However, as both companies respond to shifting market dynamics, competitive overlap is growing. Alteryx has increasingly embraced cloud-native capabilities and AI-driven features that bring it closer to the value propositions long championed by ThoughtSpot. Its Fall 2024 release introduced tools for hybrid analytics workflows, accommodating both on-premises and cloud environments. These updates aim to support flexible deployment needs while advancing the platform’s capacity for real-time, AI-enhanced analytics.

Sisense: Sisense, founded in 2004, has positioned itself as a BI platform focused on flexible deployment and extensibility. As of June 2023, the company had raised $356.5 million in venture funding from backers including Insight Partners, Bessemer Venture Partners, and Battery Ventures. Following a $100 million Series F funding round in 2020, Sisense surpassed a $1 billion valuation, joining the ranks of analytics-focused unicorns. Its platform is built to support a wide range of analytics use cases, with tools for data integration, custom dashboards, and embedded analytics.

One of Sisense’s distinguishing features is its developer-oriented architecture. The platform provides APIs, SDKs, and a set of customization tools that allow product and engineering teams to embed analytics into third-party applications and internal business systems. This extensibility has made Sisense appealing to companies that require tight control over their analytics environments and want to tailor workflows to specific organizational needs. The platform also supports hybrid deployment across on-premises infrastructure, private cloud, and public cloud environments, offering flexibility in how data is accessed and analyzed.

While Sisense and ThoughtSpot both aim to make data more actionable, they differ significantly in technical orientation and user experience. Sisense is more developer-centric, designed to integrate into existing applications with configurable interfaces. ThoughtSpot, by contrast, is built around a search-based interface that allows users to ask natural language questions and receive AI-generated responses from live data. It is a cloud-native platform optimized for use with modern data warehouse providers like Snowflake and Databricks.

These divergent approaches reflect different priorities. Sisense emphasizes customization, control, and infrastructure flexibility, catering to technical users who manage embedded analytics and complex data environments. ThoughtSpot focuses on lowering the barrier to entry for data exploration, prioritizing ease of use for non-technical stakeholders through natural language interfaces and real-time search.

Business Model

ThoughtSpot operates under a cloud-based Software-as-a-Service (SaaS) model, earning the majority of its revenue through tiered subscription pricing. The company’s core self-service analytics platform is sold via multiple pricing plans, starting with the Essentials tier at $1,250 per month when billed annually. More advanced Pro and Enterprise plans follow custom pricing structures, which are adjusted based on variables such as the number of users, data volume, and specific requirements around security, governance, or compliance.

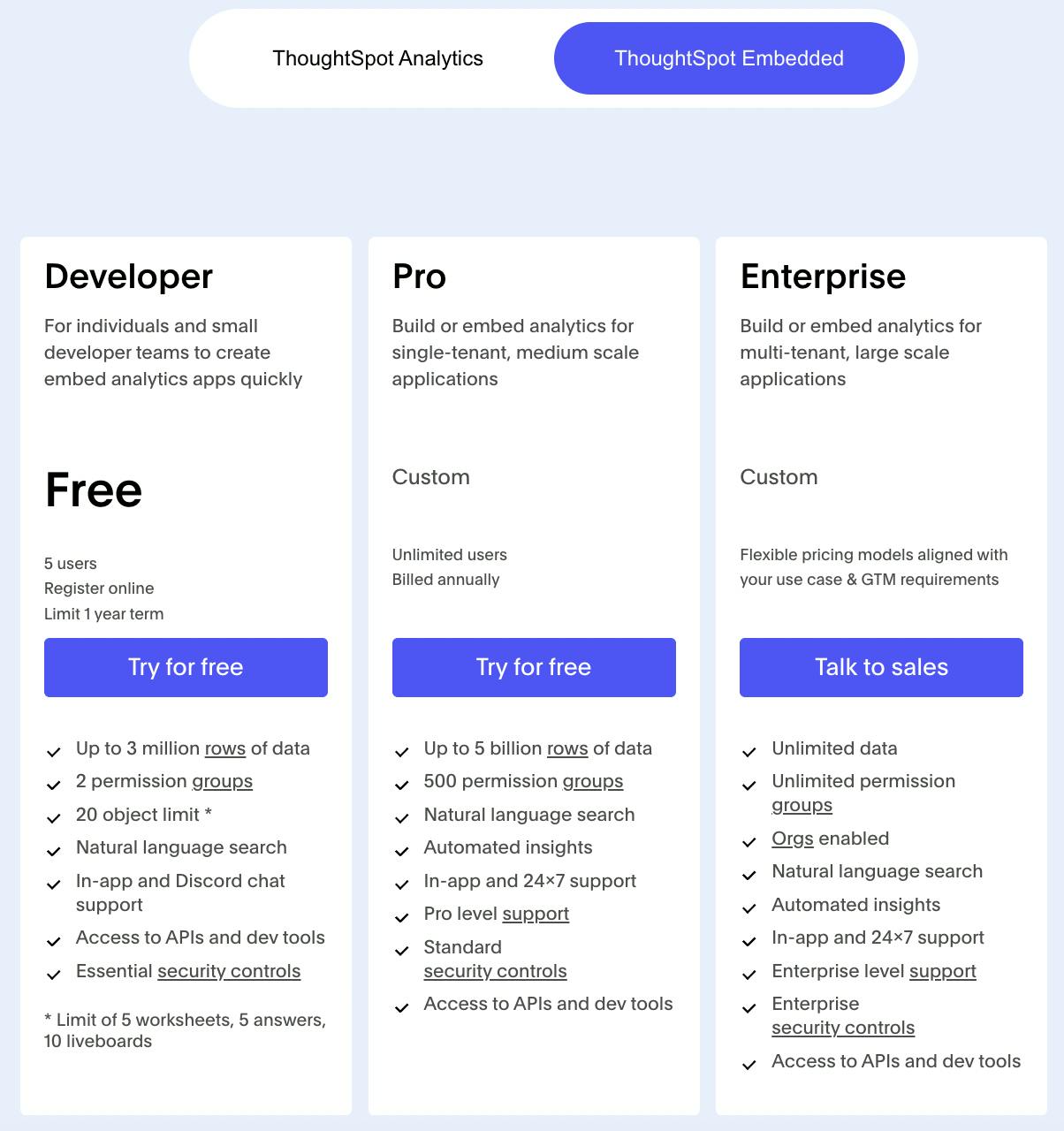

Source: ThoughtSpot

For ThoughtSpot Embedded — its product line focused on integrating analytics into third-party software — the company offers a free Developer tier aimed at individuals or small teams. Higher tiers are priced according to custom metrics such as the number of concurrent users, API usage, and service-level expectations. As with its core platform, Pro and Enterprise Embedded tiers are structured around annual or multi-year agreements, often including negotiated bundles that reflect a client’s broader deployment goals.

Enterprise contracts often go beyond licensing fees, incorporating add-ons like advanced administrative features, customer success support, and white-glove professional services. These services can include implementation, technical training, and ongoing support during data stack transitions or modernization efforts. Such offerings not only generate incremental revenue but also play a strategic role in deepening customer engagement, particularly during complex migrations to cloud-native environments.

While ThoughtSpot’s integrations with cloud data platforms such as Snowflake, Google BigQuery, and Amazon Redshift do not serve as direct revenue sources, they are key to the company’s go-to-market strategy. These partnerships help embed ThoughtSpot within existing enterprise data ecosystems and improve retention by making it easier for clients to centralize and analyze their data. Over time, these integrations can facilitate expansion opportunities through upsells or additional product deployments.

The company’s cost structure is typical of a modern SaaS business and includes recurring cloud infrastructure expenses for compute, storage, and API services. Engineering and product development represent ongoing investments to maintain competitiveness in a fast-evolving analytics landscape. Other major expenses include customer success and technical support personnel, as well as sales and marketing to drive growth across enterprise and mid-market segments. Additionally, ThoughtSpot allocates resources toward maintaining and improving third-party platform integrations, which are foundational to the customer experience but add technical and operational complexity.

Traction

Customer & Revenue Growth

Since its founding in 2012, ThoughtSpot has demonstrated consistent customer expansion and revenue growth, driven by both strategic acquisitions and organic momentum. The company’s trajectory reflects increasing enterprise adoption of self-service and embedded analytics, alongside a broader shift to cloud-native platforms. In 2015, ThoughtSpot reported an 810% year-over-year (YoY) increase in sales. That same year, it surpassed one million user searches and secured its first $1 million customer. The company also doubled average deal sizes across industries, with 25% of customers making repeat purchases within a year of their initial engagement. This momentum accelerated in 2016 as the customer base expanded by 270%. Of those, 28% came from Fortune 500 companies. Users conducted over 3 million ad hoc searches, resulting in an estimated savings of 5 million analyst hours and $250 million in labor costs. During this period, 40% of customers increased their investment by more than 220% within the first year.

In Q4 of fiscal year 2018, the company reported 180% YoY revenue growth. More than 80% of new customers made initial purchases in the six-figure range, and many scaled their deployments into $1 million+ contracts. To support this growth, ThoughtSpot opened new offices in Bangalore and Seattle to expand its engineering and go-to-market capabilities. By 2020, the company’s annualized bookings run rate had exceeded $100 million. Average first-sale size grew to $300K, with expansion deals averaging $700K. That year, ThoughtSpot closed approximately ~20 seven-figure enterprise agreements, reflecting rising demand for large-scale BI deployments.

A significant shift came in 2021 with the launch of ThoughtSpot’s cloud-based SaaS platform. Within six months, the company signed its first 100 enterprise SaaS customers. Cloud products quickly gained traction, accounting for more than half of annual recurring revenue (ARR) and growing over 250% YoY. Notably, 85% of new customers purchased cloud offerings, and a quarter of all transactions reached six figures. Following its acquisition of Mode Analytics in July 2023, ThoughtSpot’s total customer count exceeded 1K. ARR reached $150 million, with its embedded analytics product, then named ThoughtSpot Everywhere, doubling ARR YoY. Monthly active users more than doubled, while customer query volume nearly tripled.

In 2024, SaaS revenue grew over 40% YoY. Embedded analytics continued to drive adoption across industries, with use cases expanding in retail, telecom, and healthcare. By this time, the company counted five of the top ten healthcare firms and six of the top ten technology firms among its customers. As Singh reflected in 2024,

“I feel like we are at, I would say, our perfect inflection point in the industry where the market is looking for the next, new, big thing. And we have that opportunity, we have the product, we have the customers, and we have the team and technology to really build upon. So I am pretty thrilled.”

Notable Acquisitions

In March 2021, ThoughtSpot acquired SeekWell, a company that enabled users to push data insights directly into operational business applications like Salesforce and Google Sheets. This acquisition enhanced ThoughtSpot’s ability to operationalize analytics by integrating real-time insights into day-to-day workflows. Two months later, in May 2021, ThoughtSpot acquired Diyotta, a cloud-native data integration platform. Diyotta expanded ThoughtSpot’s data connectivity across hybrid and multi-cloud environments, reinforcing its position as a modern analytics cloud provider. In July 2023, ThoughtSpot completed its largest acquisition to date with the purchase of Mode Analytics for $200 million in cash and stock. The acquisition significantly broadened its appeal to data analysts and large enterprise clients, doubling its customer base and helping drive annual recurring revenue (ARR) past $150 million.

Industry Awards and Recognitions

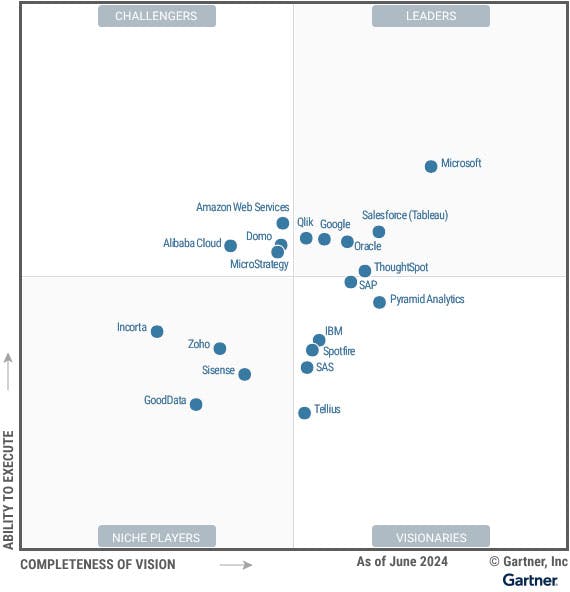

ThoughtSpot has received multiple industry recognitions that underscore its growing influence in the analytics and business intelligence space. In 2024, it was named Google Cloud’s Global Technology Partner of the Year for Data & Analytics, a reflection of its expanding role within the modern data stack and its strong integration with Google Cloud services. In 2024, ThoughtSpot was positioned in the Leaders quadrant of the Gartner Magic Quadrant for Analytics and BI Platforms, recognized for both the completeness of its vision and its ability to execute. Most recently, in 2025, the company was included on the CRN Cloud 100 list, an acknowledgment of its leadership and innovation in delivering enterprise-grade cloud software solutions.

Valuation

ThoughtSpot has followed a consistent upward trajectory in valuation since its founding in 2012, culminating in a Series F extension in July 2023 that brought the company’s total equity funding to approximately $801 million. The July 2023 round raised an estimated $124 million at a post-money valuation of $4.4 billion. The round was led by REV Venture Partners, Fabrica Ventures, and Unity Growth Fund, with additional participation from Golden Falcon Capital, Capital Advantage Ventures, Reimagined Ventures, Humla Ventures, Washington Harbour, and other undisclosed investors.

This marked ThoughtSpot’s ninth equity financing round and followed a $100 million Series F raise in November 2021 led by March Capital at a $4.2 billion valuation. Earlier, in August 2019, the company raised $248 million in a Series E led by Silver Lake at a $1.9 billion valuation—more than doubling its Series D valuation. That Series D round, closed in 2018, brought in $145 million from Lightspeed Venture Partners and Sapphire Ventures.

Key Opportunities

Increasing Demand for AI-Augmented Analytics Workflows

As ThoughtSpot CEO Karkhanis stated in 2024:

“They really want simplicity of experience. They do not want partial analytics. They want complete analytics. And by that, what I mean is, they just do not want to know what happened in their business. They want AI to help them understand how they can make things better in their business, what happened in their business.”

The enterprise analytics space is rapidly evolving as organizations transition toward AI-native workflows. ThoughtSpot is well-positioned to capture this momentum through its Analyst Studio, which consolidates AI-augmented SQL, R, and Python tools into a unified environment. This all-in-one workspace enables analysts to ingest, model, and analyze data seamlessly, reducing the inefficiencies caused by using fragmented toolsets such as Tableau, Alteryx, and Jupyter notebooks. By eliminating toggling across platforms, ThoughtSpot streamlines insight generation and positions itself as a system of record for advanced analytics workflows.

Expansion of Agentic AI in Business Applications

With the launch of Spotter, ThoughtSpot has embedded large language models (LLMs) into enterprise workflows, allowing users to query data using natural language directly within platforms like Salesforce and ServiceNow. Unlike generic LLM wrappers that convert text to SQL with limited context, Spotter leverages ThoughtSpot’s proprietary BARQ (Business Augmented Reasoning for Questions) technology to interpret and execute queries with explainable and actionable outputs. It handles row-level security, supports complex joins, and enables advanced visualizations via grammar-of-graphics. This creates a closed-loop system where curated datasets from Analyst Studio feed into Spotter, empowering business users to generate insights with minimal analyst support. As ThoughtSpot CEO Karkhanis said in November 2024:

“Across the world, customers are looking at their BI stack and realize that this is not meant to solve problems in the future. It is hard for them to bolt AI to that stack; they can not simply put AI on it. They need an analytics platform that’s built ground up for AI – and that is driving ThoughtSpot’s growth.”

The resulting workflow reduces dashboard bottlenecks and drives faster, more informed decision-making across departments.

Cost-Optimized, Flexible Data Preparation and Exploration

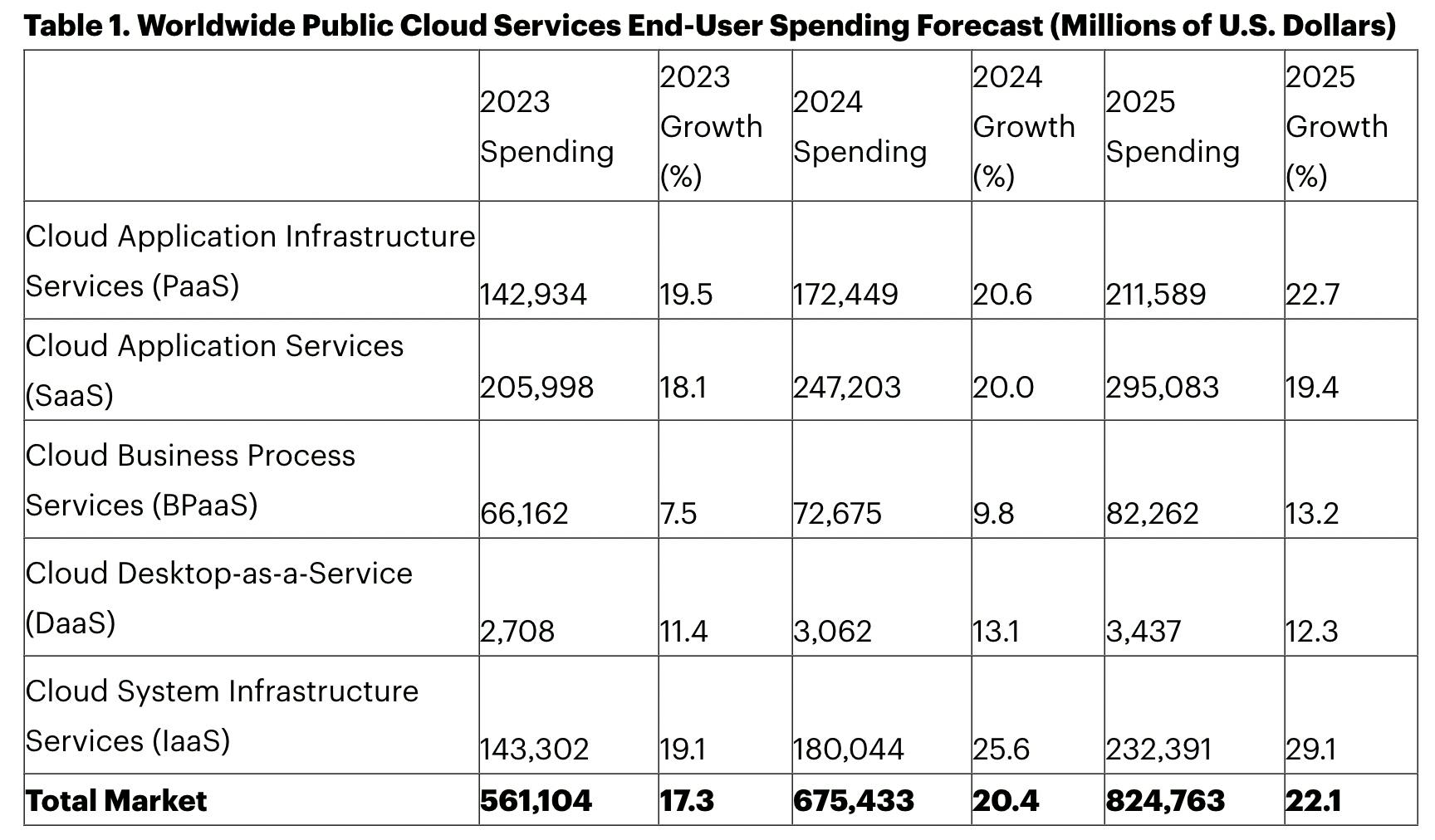

Source: Gartner

With cloud infrastructure spending projected to reach $675 billion in 2024, cost-efficient data exploration has become a key concern. ThoughtSpot addresses this with its Datasets feature, enabling analysts to work off cached data snapshots rather than constant live queries, significantly reducing strain on cloud warehouses like Snowflake and BigQuery. Additionally, Analyst Studio supports iterative development through schema browsing, built-in Python and R notebooks, and native DDL integration across leading cloud platforms. This balance of performance, flexibility, and cost control makes ThoughtSpot’s offering particularly appealing for enterprise teams managing both scale and budget constraints.

Strategic Expansion of Global R&D Capabilities in India

Source: Forbes India

In 2023, ThoughtSpot committed $150 million to expanding its India operations, which now comprise over 500 employees, approximately 70% of the company’s global engineering team. The Bengaluru office, along with hubs in Hyderabad and Thiruvananthapuram (acquired through a prior deal), has evolved into a strategic innovation hub. The Spotter product itself was largely built by the India-based team, underscoring their central role in ThoughtSpot’s product development. According to CEO Karkhanis, India is now a "powerhouse of innovation," functioning alongside Mountain View as a dual headquarters. The India operations also encompass go-to-market, legal, HR, and support functions, allowing for continuous customer engagement and operational efficiency. With future hiring focused heavily in India and plans to develop Bengaluru as an AI Center of Excellence, ThoughtSpot is poised to accelerate R&D and scale delivery in high-growth international markets.

Key Risks

Intense Competition from Established BI and Analytics Vendors

Source: Gartner

ThoughtSpot competes in a mature and crowded business intelligence (BI) market dominated by long-standing incumbents such as Microsoft Power BI, Tableau (Salesforce), Looker (Google Cloud), and Qlik. Many of these platforms are deeply embedded in enterprise environments and are tightly integrated into broader productivity ecosystems. Microsoft Power BI, for instance, is bundled with Office 365, granting it seamless distribution across enterprise users and reinforcing its role in daily workflows. In Gartner’s 2024 Magic Quadrant for Analytics and BI Platforms, Power BI and Tableau were again positioned as Leaders, whereas ThoughtSpot was categorized as a Visionary. This distinction reflects both ThoughtSpot’s innovation and its relatively limited penetration among the largest enterprise buyers.

Replacing or displacing incumbent tools presents significant challenges due to switching costs, long-term vendor contracts, and entrenched user behaviors. Enterprises frequently prioritize ease of integration and existing vendor relationships when evaluating new tools, which may constrain ThoughtSpot’s ability to win net-new accounts, particularly among large, risk-averse organizations that have standardized on established platforms.

Dependence on Cloud Data Warehouses and Associated Cost Structures

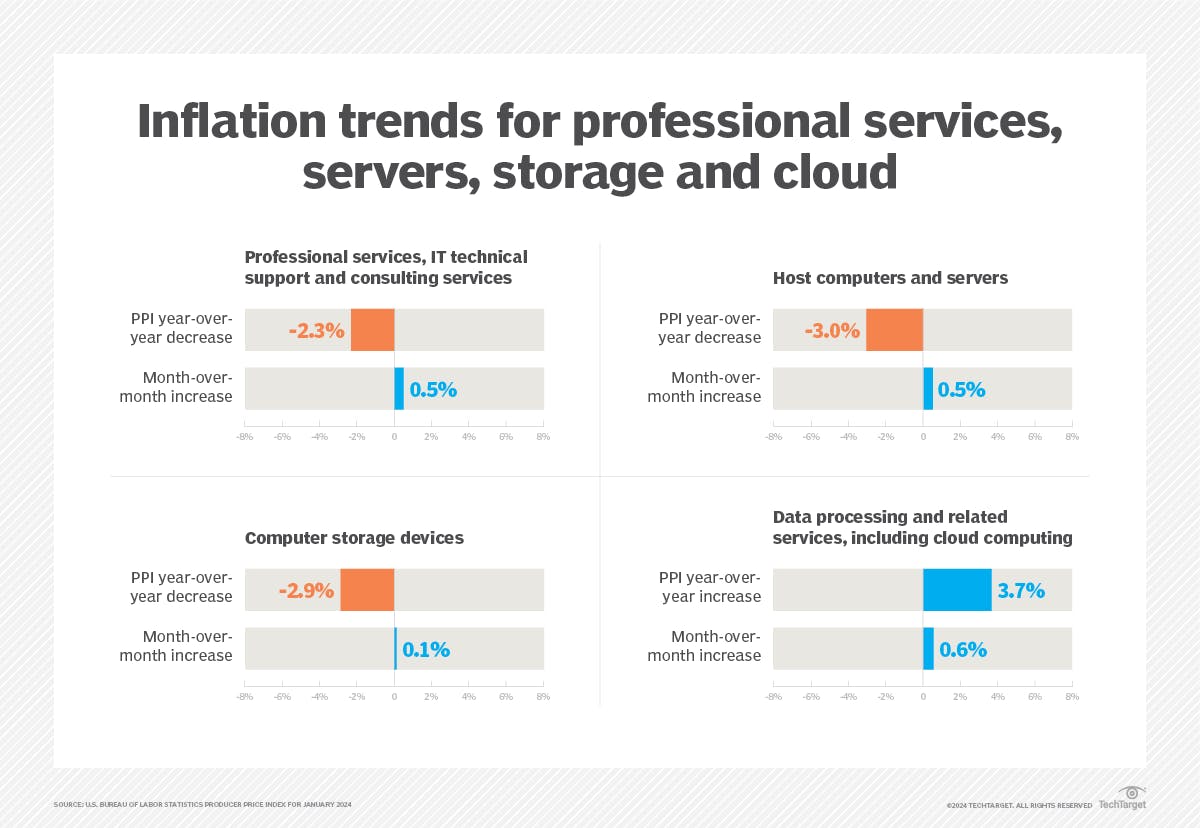

Source: TechTarget

A cornerstone of ThoughtSpot’s Live Analytics experience is its ability to deliver real-time query results by pushing workloads directly to cloud data warehouses such as Snowflake, Databricks, Google BigQuery, and Amazon Redshift. While this architecture supports up-to-date insights, it also exposes the company to broader concerns around cloud computing costs.

As enterprises seek to manage rising cloud expenditures, ThoughtSpot’s reliance on external compute platforms may draw increased scrutiny from procurement and IT teams, particularly in data-intensive environments. Organizations aiming to minimize data egress fees and reduce query load may favor solutions that cache data, run in-database processing, or offer more granular control over compute utilization. Without a clear and transparent TCO (Total Cost of Ownership) value proposition, ThoughtSpot may face headwinds during procurement cycles, especially in budget-constrained settings.

Challenges in Driving Broad Organizational Adoption

One of ThoughtSpot’s key differentiators is its ability to democratize data access through natural language querying and generative AI tools like Spotter and Sage. While this self-service model offers clear advantages in theory, enterprise-wide adoption of augmented analytics platforms remains challenging in practice. According to a 2023 Forrester report, 68% of data and analytics leaders cited “lack of data literacy across the organization” as a major barrier to the adoption of self-service BI tools.

Driving consistent usage among non-technical users often requires significant cultural and procedural change. Without robust enablement, training programs, and change management strategies, organizations may struggle to translate ThoughtSpot’s interface into meaningful day-to-day usage. In turn, low engagement levels among business users could limit product stickiness, reduce expansion opportunities, and increase the risk of churn. These dynamics are especially important in usage-based pricing models, where monetization is closely tied to platform adoption and active usage rates.

Summary

ThoughtSpot has shifted from being a search-focused BI provider to offering a broader analytics platform that supports both business users and technical analysts. Its current product suite includes ThoughtSpot Analytics, ThoughtSpot Embedded, and Analyst Studio. These tools are built to address different stages of the analytics workflow. The platform now supports natural language queries, dashboard creation, embedded analytics, and technical workflows through support for SQL, Python, and R. This marks a shift toward accommodating a wider range of users within enterprise environments.

Recent product updates have focused on addressing limitations in earlier versions of the platform. These updates include the addition of code-first environments, improved data preparation tools, and workflow automation features. Analyst Studio is designed to help analysts manage data engineering tasks, perform analysis, and prepare data for AI applications without switching between tools. ThoughtSpot Embedded supports teams that want to integrate analytics into customer-facing products and includes a configurable interface and integration with large language model tools like Spotter.

As the enterprise analytics market continues to move toward consolidated platforms that support end-to-end workflows, ThoughtSpot’s ability to serve different user roles and deployment contexts will play a key role in its ability to grow and maintain relevance in a competitive landscape.