Thesis

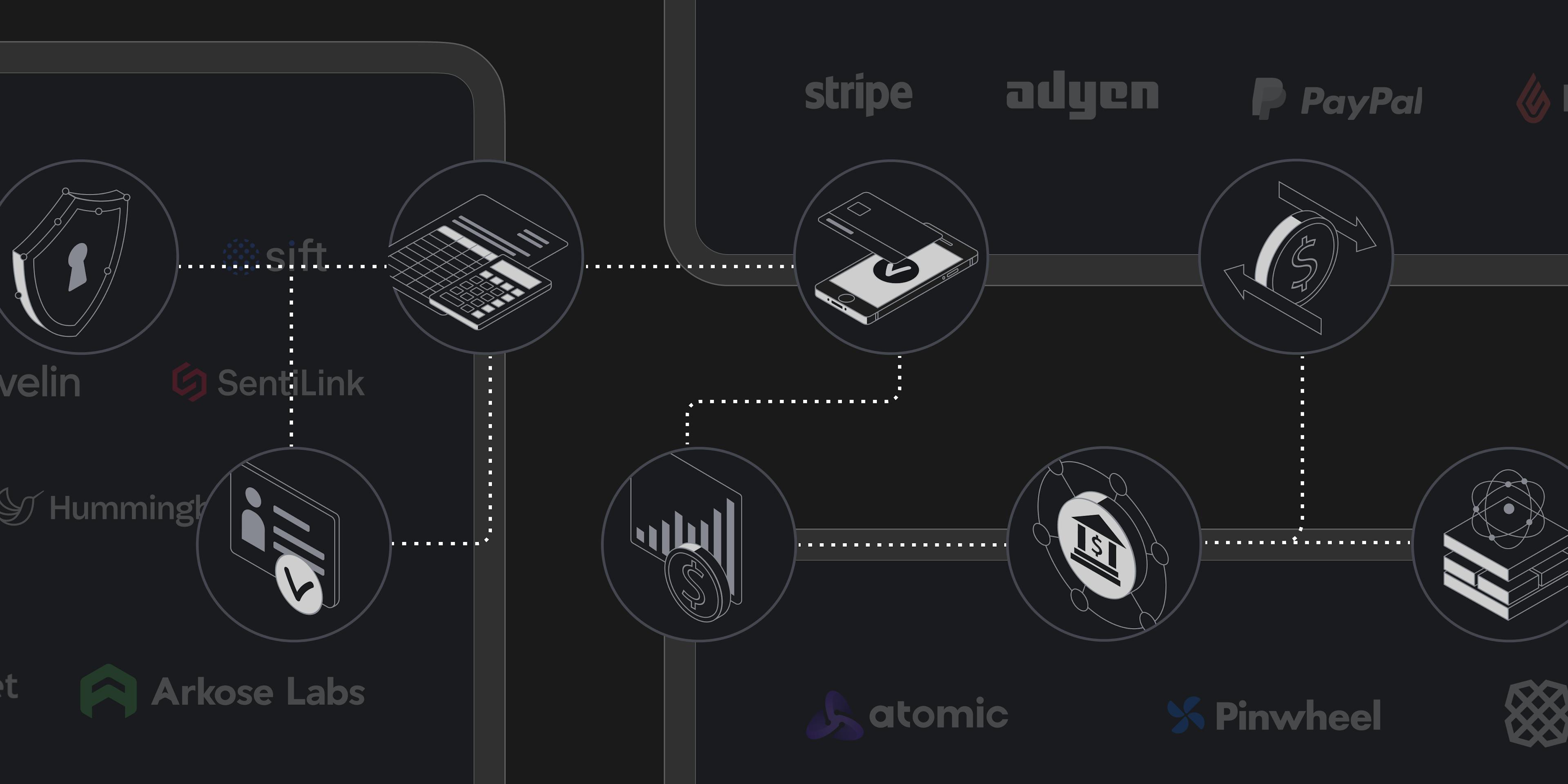

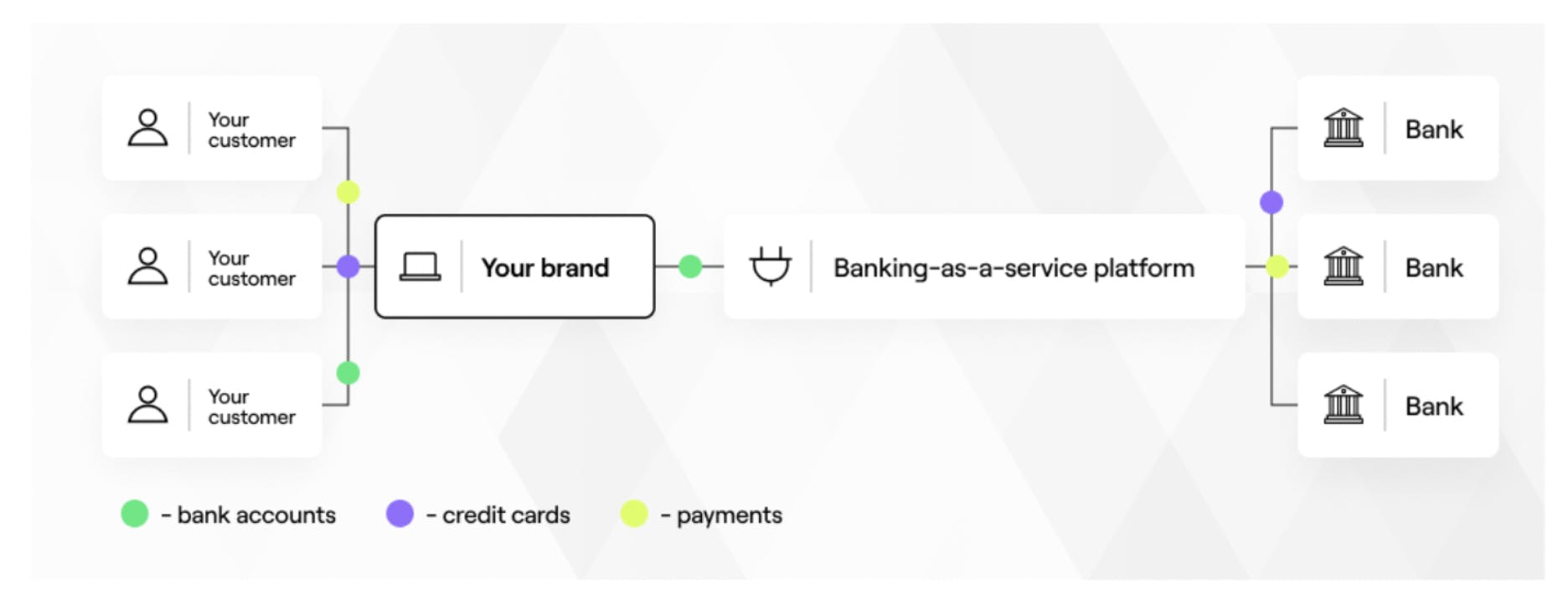

The first wave of successful fintech companies rebuilt single product lines without legacy systems and the technology of financial institutions like banks but had the same distribution and customer acquisition strategies as legacy options. Consumers had to search and select from similar options actively. This was followed by a second wave of fintech innovation called embedded finance, where non-fintech companies seek to provide financial offerings embedded within their products and services. However, it’s expensive, complicated, and time-consuming for non-financial services companies to build, launch, and grow compliant financial products. A catalyst of the growth of embedded finance has been the emergence of banking-as-a-service (BaaS) platforms, which provide the technical, operational, and legal layer between small banks wanting to lend their banking licenses and enable new offerings and non-fintech companies that want to find and integrate bank partner or sponsors.

Embedded finance reaches across many verticals, reflecting changing consumer expectations. A 2022 survey shows that three-fourths of gamers are interested in having an in-game account for money transactions on virtual items, two-thirds of home fitness enthusiasts would be receptive to health insurance from their providers, and almost two-thirds of fashion lovers would consider getting an investment account from luxury brands. The embedded finance market in the US is estimated at $75 billion in 2023 and is projected to reach $236 billion by 2029.

Unit is a BaaS platform that offers APIs, SDKs, and white-labeled UIs to enable companies to build financial features like accounts, cards, payments, and lending into their products. It also streamlines compliance and offers built-in bank relationships. Unit reduces the cost, time, and regulatory burden of building financial products from scratch for non-fintech companies.

Founding Story

Itai Damti (CEO) and Doron Somech (CTO) co-founded Unit in 2019. Damti had an early passion for software development starting at age 12. He worked as a developer in his teenage years, and when he turned 18 joined the Israel Defense Forces where he served as a software developer, while also studying mathematics as an undergrad through the Open University. In his last year at the IDF, he co-founded Tel Aviv-based Leverate, a technology provider for online brokers, with Somech. The company offered liquidity, risk management, compliance tools, and real-time market data. Leverate was able to grow without VC funding to 160 employees globally and $100 billion in monthly trading volume.

The pair left Leverate in 2015-16 and reconnected in 2019 to found Unit. In the interim, Damti was a Fintech Entrepreneur in Residence at 500 Startups, where he worked closely with startups in payments and blockchain. After a few months spent coming up with ideas “at the intersection of fintech and dev tools”, they decided to build a company that would help technology companies launch “rich, branded banking experiences”. They spent the first year stealthily building the product and officially launched the platform in late 2020, which Damti described as follows:

"We take what was once a very expensive and complex process of 18 months and turn it into one API and one dashboard that helps companies launch accounts, cards, payments, and lending within five weeks.”

Product

Unit provides businesses with an API layer to embed products across business banking, consumer banking, and freelance banking directly into its platform. This is valuable for businesses that do not have the resources to build their own infrastructure from scratch or navigate the complex financial regulatory environment. Its turnkey solution enables plug-and-play products like cards, accounts, payments, and lending.

In terms of technical architecture, Unit sits as an abstraction layer between its sponsor banks and its customers. Under this partnership model, the sponsor bank allows Unit’s customers to market the bank’s products under its own brand name.

Source: Unit Blog

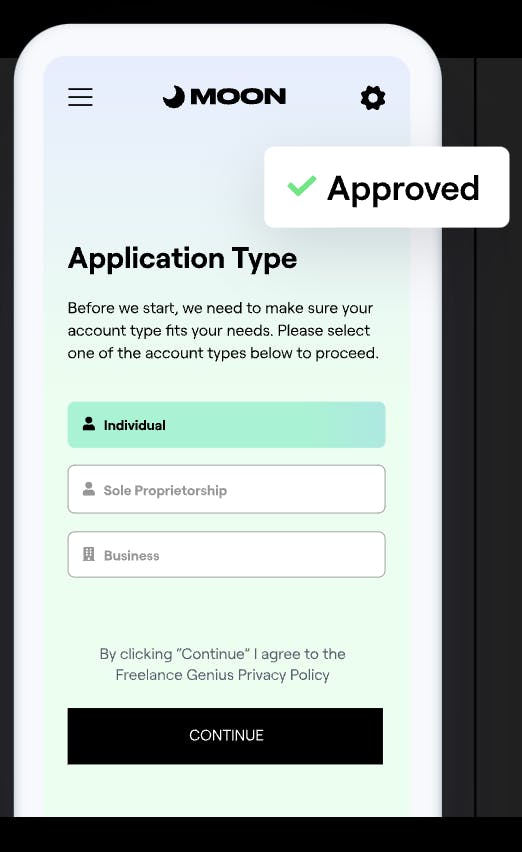

Accounts

Unit makes it simple to create accounts for businesses, sole proprietors, and individuals. Unit streamlines KYC/KYB, AML, fraud, application reviews, and other compliance and onboarding requirements.

Moreover, the product is white-labeled, meaning the application form can be customized to match the organization's branding using the platform. This provides a seamless onboarding experience for users as they can complete the application process without being redirected to a third-party site. Overall, Unit’s onboarding product streamlines the account opening process, reduces the risk of fraud, and delivers a consistent user experience.

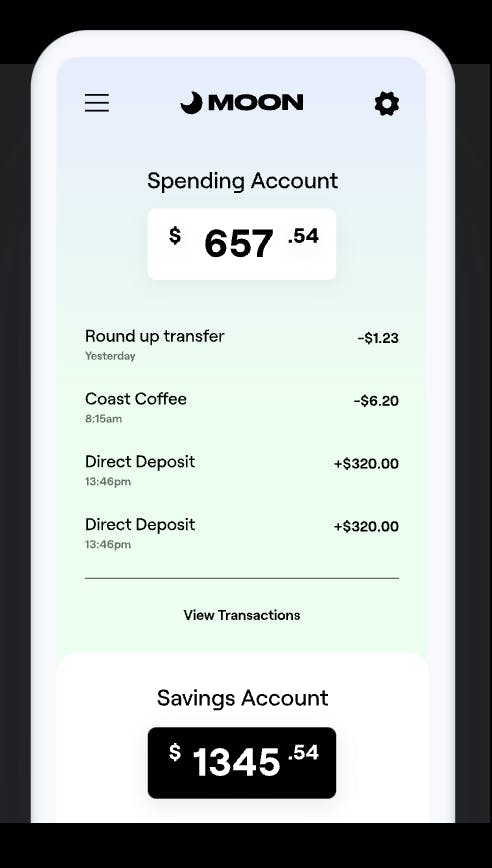

Source: Unit

The offering also allows businesses to create interest-earning FDIC-insured deposit accounts that support cards, money movement, bill pay, cash advances, ATMs, and more. Accounts can be used for different purposes, including checking, savings, or tax. All accounts are also FDIC-insured, providing customers with an extra layer of security.

Customers can create unlimited accounts per end-user, and Unit allows account holders to receive interest on their account balance. Businesses can optimize their customers’ income by allowing them to spend on certain items tax-free.

Source: Unit

Cards

Unit offers physical and virtual debit and credit cards that are fully programmable. The cards are on-demand or custom-designs created and shipped to the customer’s end users through an API call. Customers receive structured data for the merchant name, logo, website, location, and categories to create activity streams and for reporting. Unit’s customers can onboard users by allowing them to activate physical cards from within their products. Virtual cards are automatically activated. Customers can allow card users to activate, freeze, and unfreeze their cards with a branded user interface.

Unit also allows customers to offer flexible rewards based on card usage. These rewards can include cash back, points, or other incentives that can be redeemed for various benefits. The programmatic authorization feature enables businesses to set specific limits and controls on the card usage of their employees, providing an extra layer of security and preventing misuse. Unit’s card product is also mobile wallet ready, which means it can be used with popular mobile payment apps like Apple Pay, Google Pay, or Samsung Pay. It offers fee-free ATM access, which allows users to withdraw cash from ATMs without incurring additional fees.

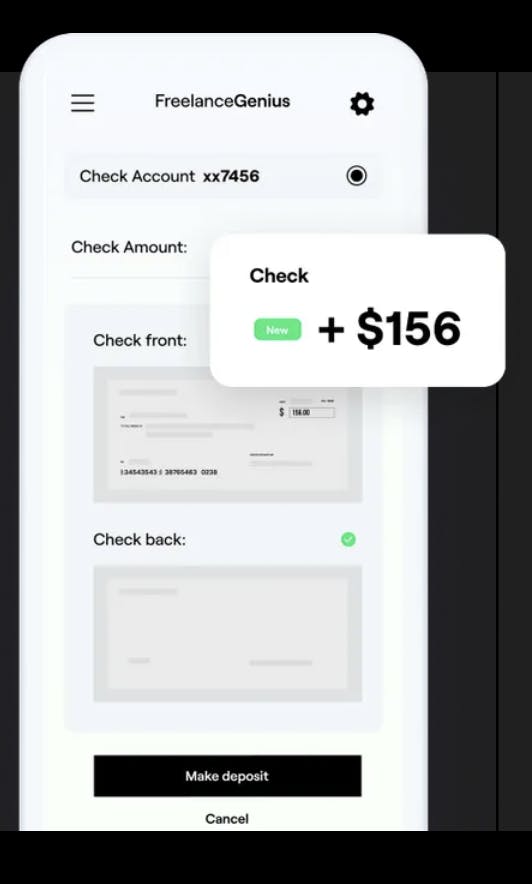

Payments

Unit's payment product provides users access to a suite of payment tools for moving money. These tools include ACH, wires, checks, ATMs, and card transfers. Unit enables customers to offer their users to receive money immediately for incoming ACH payments that have a settlement date in the future, such as paychecks.

It also supports bill pay, allowing users to schedule and pay bills online, eliminating the need for paper checks or in-person payments. Additionally, it enables ACH and wire payments across borders. Users can withdraw money with fee-free access to over 55K ATMs in the United States.

Source: Unit

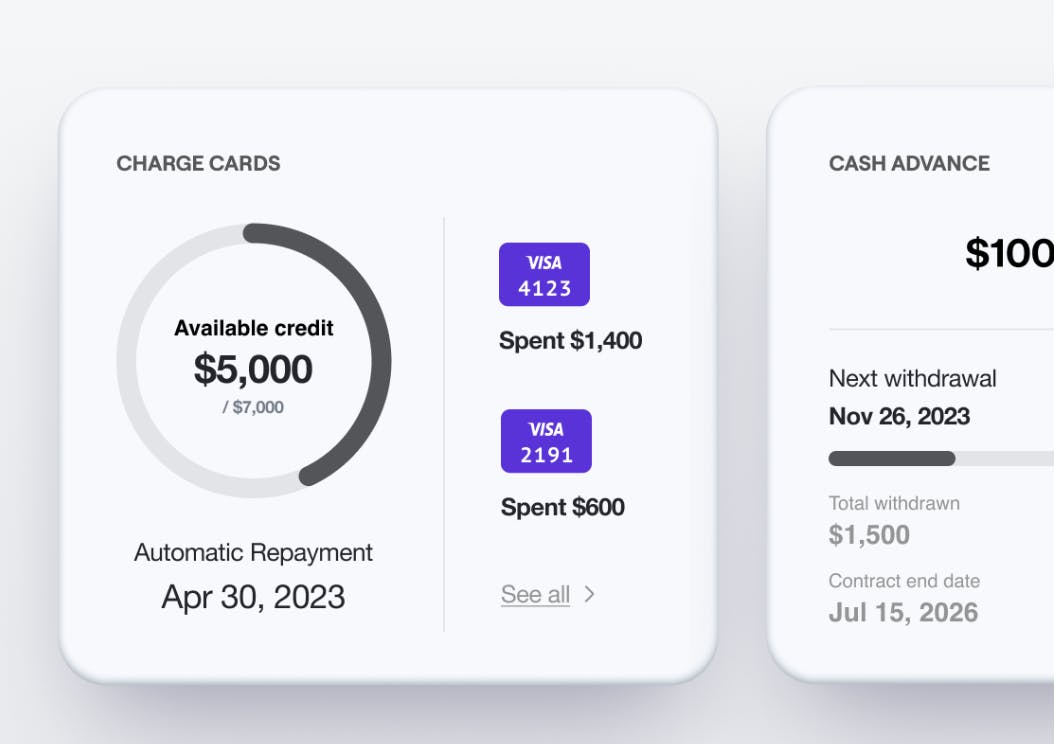

Lending

Unit's lending product offers users access to charge cards, cash advances, and factoring. Automatic repayment enables users to set up automatic payments for their loans, ensuring that payments are made on time and avoiding late fees. Programmable decisioning allows customers to customize their lending criteria based on their specific needs. This feature enables users to set up rules, such as credit score requirements or income verification, to ensure that only eligible borrowers receive loans or lines of credit.

Source: Unit

Dashboard

Customers can monitor and manage users’ accounts, cards, transactions, and activities from the Unit Dashboard. Using the dashboard, they can freeze accounts, add authorized users, and update account information.

Support

Customers get a dedicated account manager and technical support. Unit has a team of compliance experts available to help customers launch and scale. For applications that require additional documentation and a manual compliance review, Unit claims to review them within two business hours of receiving documentation.

Market

Customer

Unit works with vertical SaaS platforms, marketplaces, and ecommerce platforms that want to generate new revenue streams, as well as payments and payroll providers that already move money for customers and want to offer other financial services enabling more streamlined money management. Its customers include Forage, AngelList, Wethos, Invoice2go, Honebook, Tribevest, etc. Its use cases include business banking, consumer banking, and freelancer banking.

Market Size

The embedded finance market in the US is estimated at $75 billion in 2023 and is projected to reach $236 billion by 2029. This growth is driven by several factors, including the increasing demand for digital banking solutions, the rise of fintech startups, the increasing willingness of non-fintech brands to cater to the financial needs of users, and the need for banks to modernize their legacy systems. BaaS companies are well-positioned to capitalize on these trends by providing modular, customizable, and scalable solutions that enable businesses of all sizes to offer financial services to their customers.

Competition

Treasury Prime: Founded in 2017, Treasury Prime is an embedded banking platform that connects companies to a network of banks and partners. Companies can integrate directly with multiple banks, open bank accounts, issue cards, and launch payment rails. As of February 2023, it works with 16 banks. It has raised $71 million in funding. Like Unit, it supports ACH, wires, bill pay, debit cards, account management, and compliance. While Unit focuses on selling only to companies with its fully integrated platform, Treasury Prime has solutions for companies and banks. Its customers include Republic, Zeta, Alto, and Firstdollar.

Productfy: Founded in 2018, Productfy is another banking-as-a-service company. Like Unit, it facilitates branded banking and card programs. It supports virtual accounts, debit cards, compliance, ACH, statements, fraud monitoring, etc. Unlike Unit, it is not just focused on developers. It is more focused on brands that lack technical resources or domain expertise. Productfy’s partners include Equifax, card issuing platform Marqeta, card fulfillment partner Arroweye, and financial data provider Yodlee. It has raised $18 million in funding.

Galileo Financial Technologies: Founded in 2001, Galileo is a pioneer in enabling other companies to launch financial products. It started in the API-first card issuing and processing business and later became a full-fledged infrastructure platform to offer other financial products. SoFi bought it in 2020 for $1.2 billion. Like Unit, it supports cards, payments, deposits, accounts, lending, and compliance. Its customers include Tala, Monzo, Revolut, Aspiration, Wave, H&R Block, and BlueVine. In Q4 2022, Galileo signed 11 new clients, with 36% of new deals in B2B and 27% outside the United States.

Synapse: Founded in 2014, Synapse is a BaaS platform that facilitates modular banking. By having multiple sponsor banks connected to its platform, each bank provides overlapping services accessible to all fintech platform-wide. It has raised $51 million in funding. Its Deposit Hub, a deposit and payment platform, enables customers to build various account-centric product experiences. Like Unit, it also offers credit products through its Credit Hub, which enables customers to create various types of credit products for individuals or businesses.

Business Model

While Unit’s cost and pricing information is not publicly available, according to one Unit customer, Unit monetizes in three primary ways:

Platform fee: as with traditional SaaS businesses, Unit reportedly charges a monthly recurring subscription fee based on the specific services and features customers want to offer.

Transaction fees: Unit charges a small percentage fee on every transaction (e.g. an ACH payment).

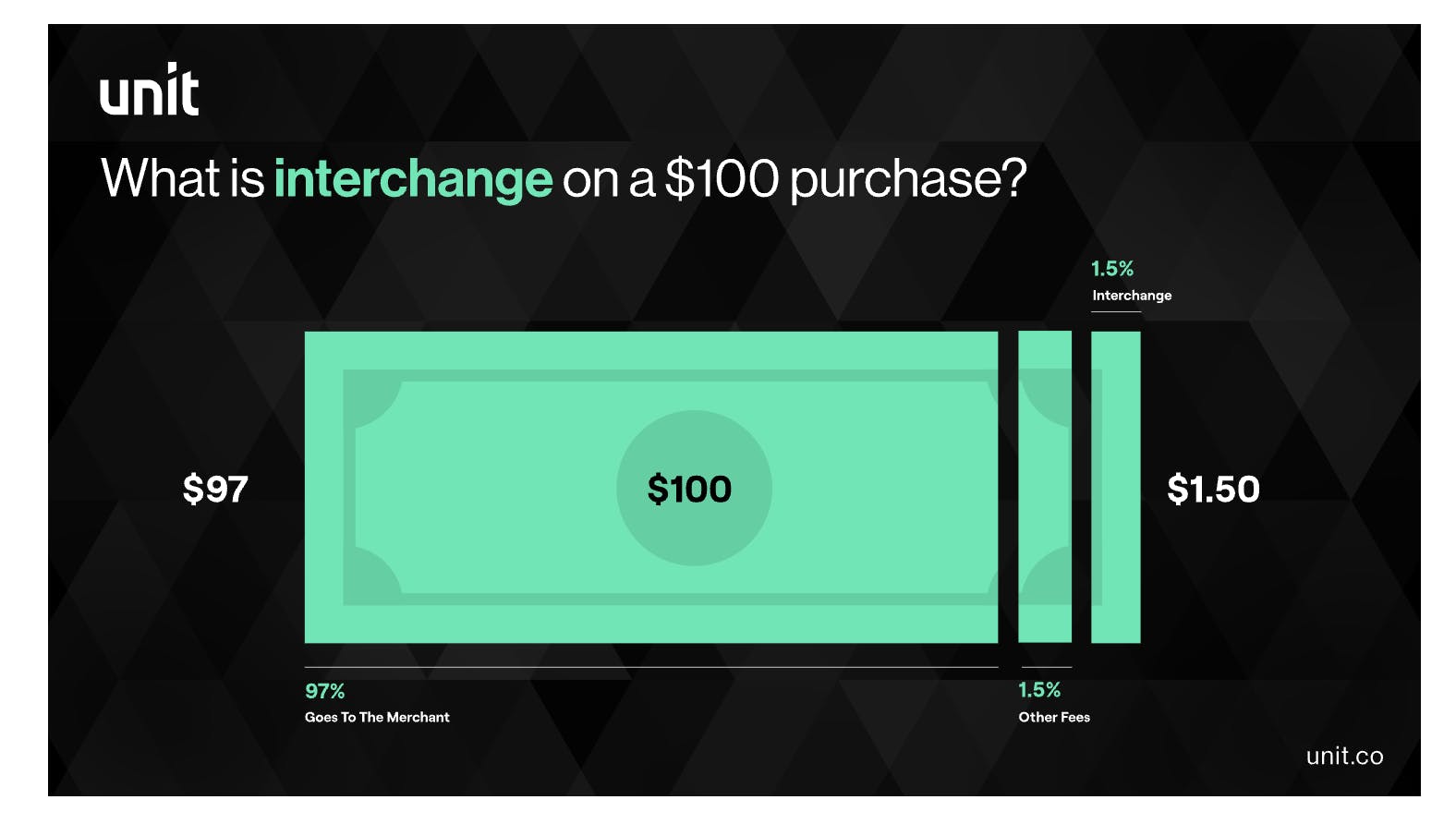

Interchange split: Interchange fees are paid to the card-issuing bank to cover handling costs, fraud, and the risk involved in approving the payment. Unit has a percentage of revenue share on the interchange fees.

Source: Unit

Traction

In May 2022, it was reported that Unit’s transaction volume had grown by 7x over the prior six months. As of May 2022, Unit had crossed an annualized transaction volume of $2.6 billion, issued over 430K cards to over 330K customers, and saw a 10x increase in deposit volumes. As of May 2023, Unit says it processes over $4 billion in payments per year and handled over 300 million API calls every month. It had also acquired notable customers including AngelList, HoneyBook, Homebase, Veryable, Roofstock, Hearth, and Benepass.

Valuation

Unit secured a $100 million Series C in May 2022 at a $1.2 billion valuation. The round was led by Insight Partners, with participation from existing investors, including Accel, Better Tomorrow Ventures, Aleph, Flourish Ventures, TLV Partners, and new investors Moving Capital and Stepstone. Unit has raised a total of $169.6 million in funding.

Key Opportunities

Open Banking

The increasing focus on openness in the financial industry, facilitated by regulatory initiatives like open banking, could be a source of opportunity for BaaS providers. These regulatory trends are likely to drive the development of banking APIs and promote universal access to financial services. Open banking is also likely to promote competition and innovation by encouraging financial institutions to share their data and infrastructure with third-party developers.

Customer Demand for Integrated Experiences

The rising customer demand for integrated experiences with streamlined, holistic, and embedded solutions, presents an opportunity for BaaS providers like Unit. As customers increasingly embrace ecosystem-driven platforms, BaaS providers can offer the necessary infrastructure and technology to enable businesses to integrate financial services into their offerings.

Search for New Revenue Models

Amid declining banking revenue and profitability projections, financial institutions are actively seeking new revenue models and avenues for product growth. This creates a favorable environment for Banking-as-a-Service (BaaS) providers who can offer ready-made infrastructure and enable financial institutions to tap into new revenue streams without significant additional IT investments.

Growing Gig Economy

As the gig economy expands, there is increasing demand for financial services catering to the requirements of freelancers, contractors, and small businesses. Platforms like Unit are positioned to meet this market segment's needs by offering tailored financial solutions integrated with other essential business tools and services.

Key Risks

Ensuring Regulatory Compliance

The increasing presence of banks utilizing BaaS models has garnered regulatory attention. While banks may not own the customer-facing experience, they are responsible for compliance in BaaS programs. Compliance functions such as onboarding, Know Your Customer (KYC), transaction monitoring, and customer complaint handling fall under the purview and risk of the licensed bank. Regulatory guidance, including a new due diligence guide from the OCC for community banks engaging with fintechs, underscores an increasing need for companies in this space to remain compliant with increasingly onerous regulation.

Security Fraud Prevention

Implementing robust fraud prevention features is paramount for BaaS providers like Unit, as is maintaining platform security. This is particularly critical in light of the increasing global rates of suspected digital fraud. As the adoption of digital financial services grows, so does the risk of fraudulent activities targeting these platforms.

Summary

Unit simplifies and streamlines the complex and costly process of managing a banking relationship, building a compliance team, and establishing a technology infrastructure. With its comprehensive API, Unit enables companies to swiftly launch accounts, cards, payments, and lending services within five weeks Unit attracts businesses seeking to differentiate their products, provide enhanced value to customers, and achieve revenue growth while reducing customer acquisition costs.