Thesis

In 2022, the market for cloud infrastructure was valued at $480 billion globally and at ~$97.4 billion in the US alone. It is projected to increase at a 17% CAGR to hit ~$2.3 trillion by 2032, driven by increased cloud adoption as the economy continues to digitize. Within this, the global GPU cloud market was valued at $3.2 billion in 2023 and is expected to grow to $25.5 billion by 2030, growing at an even faster CAGR of 34.8%.

A major driver of GPU cloud adoption is the AI/ML market, because generative AI products are compute-bound, meaning adding more compute resources often directly results in a better product. As of April 2023, some AI companies were spending as much as 80% of their total capital raised on compute resources. Google, Amazon, and Microsoft collectively spent $42 billion in Q3 2023 on cloud computing to meet the demand for generative AI systems. The majority of AI/ML applications have been trained on GPUs over the past five years, which has led to a sudden near-universal need for processing power.

CoreWeave is a cloud infrastructure provider focused on GPU workloads. Legacy providers are not designed to handle the advanced workloads that the AI/ML, tech, entertainment, and life sciences sectors, are increasingly demanding. Because of its specialization, CoreWeave claims it can provide its service up to 35x faster and 80% less expensive than legacy providers. CoreWeave’s CEO Michael Intrator said in an April 2023 interview that the company believes that it is playing an important role in the progress of the AI/ML industry, stating that “democratizing access to GPUs will continue pushing the AI/ML industry forward."

Founding Story

CoreWeave was founded in 2017 with the original name of Atlantic Crypto by Michael Intrator (CEO), Brian Venturo (CTO), and Brannin McBee (CSO). None of the founders came from the cloud space before starting CoreWeave. Rather, all came from trading energy futures. While Venturo and Intrator were working together at their hedge fund, Hudson Ridge Asset Management LLC, they accidentally stumbled into a new market: leasing GPUs.

They purchased their first GPU to experiment with cryptocurrency mining in 2016. They began buying GPUs for this purpose at a time when crypto prices were rising quickly. Soon they realized they could buy a GPU and it would pay for itself within a matter of days. Around the same time they found this opportunity, Hudson Ridge Asset Management LLC started to underperform the S&P 500. As a result, they closed down their hedge fund and started Atlantic Crypto in September 2017. They set up shop in Venturo's grandfather’s garage in New Jersey to focus on renting GPUs for crypto mining.

The new company raised a $1.2 million seed round in February 2019. At that time, it diversified from its business of renting chips for mining Ethereum to other less volatile markets that also required lots of GPUs. They pivoted to cloud infrastructure that year. The cloud business grew 271% within the first three months, and after seeing continued growth in this side of the business, the company renamed itself from Atlantic Crypto to CoreWeave in October 2021.

Product

CoreWeave specializes in GPU-accelerated compute in the cloud. GPUs were initially designed to render graphics in video games, but it was soon understood that processing computational tasks at the same time could drastically increase speed and efficiency in other applications. As a result, the use case for GPUs broadened to include workloads that require processing vast amounts of data.

GPU acceleration offloads highly intensive compute or data-parallel portions of a computational task to a GPU. End customers tend to pair legacy providers that offer more optimized CPU workloads with CoreWeave because CoreWeave is optimized for GPU processes to increase efficiency, cost savings, and scalability. CoreWeave provides a broad range of compute options, including 10+ Nvidia GPUs, so customers can tailor the product down to the hardware level to the specific use case they need.

Customers use CoreWeave to lease compute power, usually an Nvidia GPU, to accomplish the various workloads they need to run. This eliminates the need for them to have their own dedicated hardware to run the applications they need to run, and can instead rely on CoreWeave’s back-end cloud infrastructure.

Infrastructure Support System

The compute CoreWeave delivers to customers is supported by bare metal serverless Kubernetes infrastructure fully managed by CoreWeave. Kubernetes is an open-sourced infrastructure to manage and automate workloads in the cloud. CoreWeave uses Kubernetes to ensure fast, reliable service.

CoreWeave is serverless so clients can run their own code, manage data, and integrate applications without having to manage infrastructure. Kubernetes can deploy workloads through a virtual machine or on bare metal. A virtual machine is built on top of the existing architecture while bare metal is built directly on the server’s physical resources. Bare metal is deployed directly from the hardware level without any layer built on top.

CoreWeave uses Kubevirt, which leverages bare metal to deploy virtual servers. Virtual servers are the best of both worlds combining a virtual machine's ease of use and bare metal’s performance. The result is that customers can customize servers to the hardware level and spin up new virtual servers quickly and in a cost-effective way.

To facilitate the connection, communication, and interaction of devices from CoreWeave to customers, CoreWeave uses its own Cloud Native Networking system. For nearly all GPU applications, customers use HPC Interconnect on CoreWeave Cloud. There are two different types of HPC interconnect depending on the degree of compute needed. For the most intense workloads, CoreWeave partnered with Nvidia to offer Infiniband for the fastest and lowest latency, providing up to 400 gigabytes per second of throughput.

Customers like Inflection AI use Infiniband to build Pi on Nvidia’s H100 GPUs. For slightly less demanding throughput, CoreWeave uses HPC over Ethernet which still provides sub-microsecond switching. Bit192 built a 20 billion parameter Japanese model from scratch using CoreWeave Ethernet’s networking. For other niche use cases such as connecting an on-premise environment, specific firewall requirements, or storage-intensive workloads, CoreWeave uses an L2VPC networking system to deliver compute to its customers.

CoreWeave also offers block, file system, and object storage options. Its storage system is distributed for fault tolerance, meaning that it spreads data across multiple servers and data center racks. When one part of the storage infrastructure fails, the data remains accessible and intact from other locations, which can be important for customers who need to minimize data loss and downtime. CoreWeave’s storage system allows customers to manage storage volumes independently of the compute resources. Lastly, its storage system can scale from one gigabyte to petabytes (1 million gigabytes), ensuring that CoreWeave can support a business of almost any size and scale with them.

Cloud UI

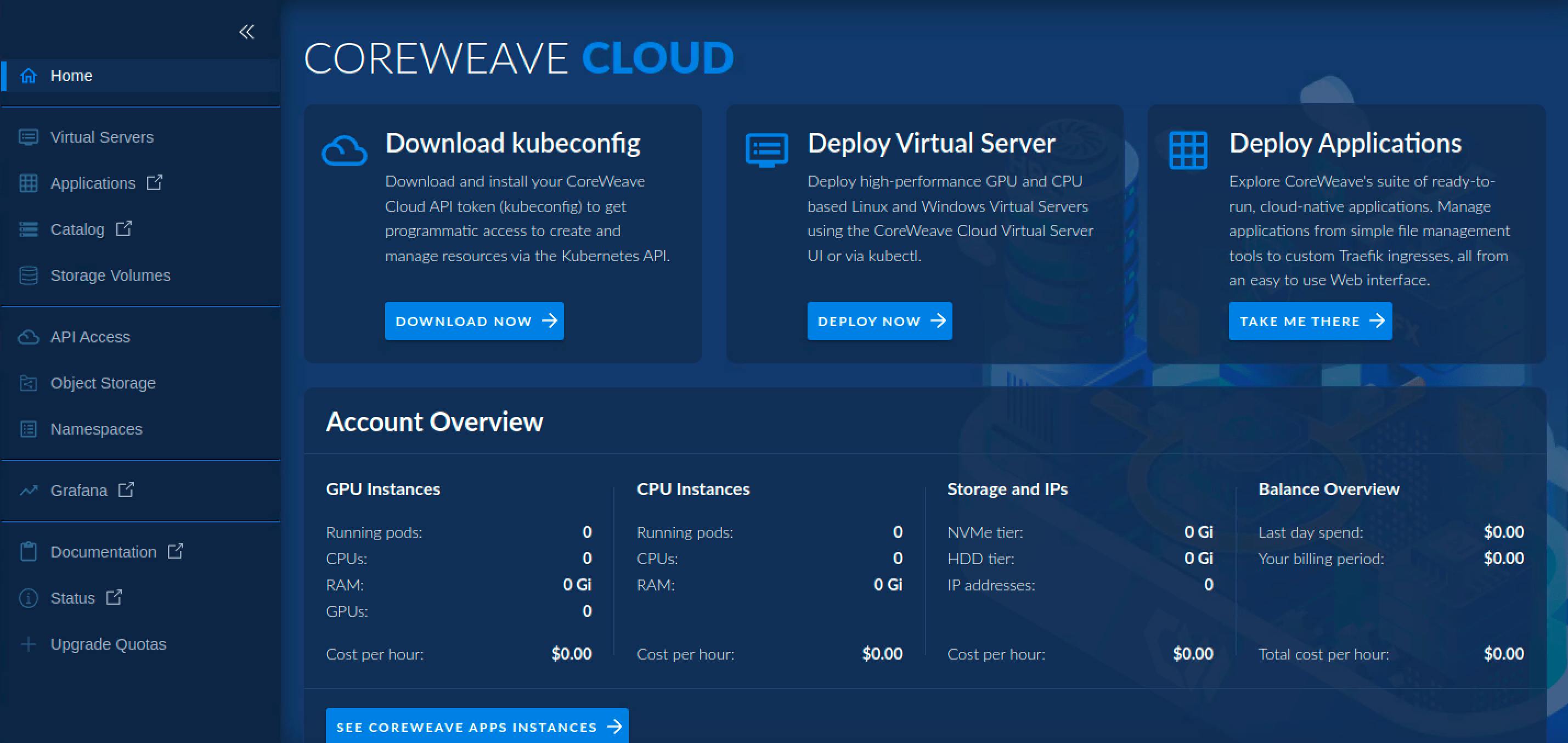

Source: CoreWeave

The CoreWeave Cloud UI is CoreWeave’s web management platform. The Cloud UI is where users deploy, manage, and make changes to their accounts. There are four main functions users can access within Cloud UI.

Deploying virtual servers that deliver compute to customers. Example: spinning up a Nvidia A100 to handle fine-tuning an AI model.

Deploy applications: built-in applications CoreWeave has designed for typical use cases in partnership with Argo-Workflows.

A storage interface where users can increase, decrease, and view the storage of virtual servers, applications, and files.

GPU Compute

Compute is CoreWeave’s core product offering. CoreWeave has been leasing GPUs to customers since its launch in 2017 and has optimized this product line for several types of customer needs since that time. The first type of workload CoreWeave GPUs are used for is model training, considered the center of CoreWeave cloud’s architecture. CoreWeave partners with Determined AI to help end-users build their models, leasing end-users various options for GPUs to get the job done including the HGX H100, A100 NVLINK, and the V100 NVLINK.

CPU Compute

In May 2022, CPU compute was introduced to make CoreWeave a cloud provider for any workload not just GPU-accelerated ones. In theory, this allows customers to access any semiconductor they need for their specific use case. However, in practice, customers tend to use legacy providers for CPU compute and pair CoreWeave for GPU compute. The main use cases for CPUs on CoreWeave include latency-sensitive applications and technical computing.

Market

Customer

CoreWeave serves companies ranging from small companies to large enterprises. According to one unverified source, Microsoft was CoreWeave’s largest customer as of September 2023. Microsoft signed a deal with CoreWeave in June 2023 that “could be worth billions of dollars."

Smaller customers of CoreWeave include pixel streaming platforms, VFX companies, and more. In an April 2023 interview, CoreWeave CEO Michael Intrator said:

“Our clients include generative AI companies, like Tarteel AI and Anlatan, the creators of NovelAI, and we’ve supported a range of open source AI and machine learning projects like EleutherAI and Stability AI’s Stable Diffusion… We also work with a number of notable VFX and animation studios such as Spire Animation, and partner closely with 3D streaming and ‘metaverse’ companies such as PureWeb."

Market Size

In 2022, the market for cloud infrastructure was valued at $480 billion globally and was projected to increase at a 17% CAGR to hit ~$2.3 trillion by 2032. Within this, the global GPU cloud market was valued at $3.2 billion in 2023 and is expected to grow to $25.5 billion by 2030 at an estimated CAGR of 34.8%.

A major source of the rapid expected growth of the GPU cloud market is the AI/ML market, which is growing rapidly. Some AI startups were spending as much as 80% of their total capital raised on compute resources by April 2023. Google, Amazon, and Microsoft collectively spent $42 billion in Q3 2023 on cloud computing to meet the demand for generative AI systems. The majority of AI/ML applications have been trained on GPUs over the past five years, which has led to a sudden near-universal need for processing power.

Competition

Legacy Providers

Amazon Web Services: Amazon Web Services (AWS), launched in 2006, is a subsidiary of Amazon that provides on-demand cloud computing platforms and APIs to individuals, companies, and governments, on a metered pay-as-you-go basis. As a leader in the cloud infrastructure market, AWS offers a broad set of global cloud-based products including compute, storage, databases, analytics, networking, mobile, developer tools, management tools, IoT, security, and enterprise applications.

AWS's scale and breadth of services have attracted a wide array of customers from startups to large enterprises and public sector organizations, enabling it to maintain a dominant position in the cloud market. Unlike CoreWeave, which specializes in GPU-accelerated computing services for specific industries like machine learning and visual effects, AWS provides a more generalized cloud service portfolio. AWS's roughly 33% market share as of Q3 2023 and comprehensive service offerings give it a competitive advantage in terms of scalability, reliability, and global reach.

Microsoft Azure: Founded in 2008, Microsoft Azure is the cloud computing service created by Microsoft for building, testing, deploying, and managing applications and services through Microsoft-managed data centers. It provides software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS), and supports many different programming languages, tools, and frameworks, including both Microsoft-specific and third-party software and systems. Azure has rapidly grown into one of the largest cloud platforms, representing 22% of the cloud infrastructure market share.

Microsoft has made strides as a compute provider in the AI space, including hosting all of OpenAI’s compute needs and partnering with Mistral AI to exclusively host its Mistral-Large model on Azure. Azure's emphasis on hybrid cloud environments offers a potential advantage over CoreWeave's more specialized, high-performance computing focus, appealing to businesses seeking a bridge between their on-premises infrastructure and the cloud.

Google Cloud Platform (GCP): Launched in 2008, Google Cloud Platform is a suite of cloud computing services that runs on the same infrastructure that Google uses internally for its end-user products, such as Google Search, Gmail, file storage, and YouTube. Alongside a set of management tools, it offers a series of modular cloud services including computing, data storage, data analytics, and machine learning. GCP has offerings across data analytics, machine learning, and open-source technologies, catering to industries that require high-compute offerings. Compared to CoreWeave, GCP's global infrastructure and deep investment in AI and machine learning tools present a complementary blend of services for clients needing both specialized and general cloud solutions.

GPU-Specific Providers

Lambda Labs: Founded in 2012, Lambda Labs specializes in providing GPU cloud solutions tailored for machine learning and AI research. Lambda's offerings include powerful GPU workstations, servers, and cloud services designed to accelerate compute-intensive applications, such as deep learning model training and inference. This focus places Lambda in direct competition with CoreWeave in the niche market of GPU-accelerated cloud computing. Both companies cater to a similar customer base that requires high-performance computing resources for AI and machine learning workloads, but Lambda distinguishes itself with a strong emphasis on research and development in AI. The company has raised a total of $432.2 million in funding as of March 2024, reaching a $1.5 billion valuation at the time of its $320 million Series C in February 2024.

Together AI: Together AI was founded in 2022 and focuses on providing AI-powered cloud solutions to businesses, emphasizing user-friendly interfaces and integration of AI functionalities into everyday business processes. Its services aim to democratize access to AI technologies, making it easier for non-specialists to deploy AI solutions. Together AI stands out for its flexibility in scalability, offering the ability to scale compute capacity from 16 to 2048 GPUs. This feature is particularly beneficial for businesses with fluctuating computational requirements.

Although TogetherAI offers scale, it is harder to access 2048 GPUs at a moment’s notice. This contrasts with CoreWeave's approach, which provides high-performance computing resources specifically designed for compute-intensive tasks. Together AI's emphasis on AI accessibility and ease of use presents a different value proposition from CoreWeave's specialized, performance-oriented offerings. Together AI has raised a total of $228.5 million and was valued at about $1.3 billion after a $106 million funding round in March 2024.

Paperspace: Established in 2014, Paperspace offers cloud computing services targeted at the machine learning and AI development sector. Paperspace has built out an IPU (Intelligence Processing Unit) cloud in partnership with Graphcore. IPUs are chips optimized for AI & ML workloads while GPUs are created for a broad range of parallel processing tasks. As a result, on the hardware level, Paperspace is better suited for complex AI training tasks.

Its products include GPU-accelerated virtual machines, a managed Kubernetes service, and Gradient, a suite of tools designed to simplify the process of training AI models in the cloud. Paperspace seeks to differentiate itself through its developer-centric approach and comprehensive suite of AI development tools, catering to a broad spectrum of users from hobbyists to large-scale enterprises. It has raised a total of $35 million in funding as of March 2024.

Business Model

CoreWeave sells time and space on its cloud to clients in need of compute power, with price depending on the type of chip needed. It is an infrastructure-as-a-service model where clients pay on a per-use basis, offering a scalable and flexible solution.

CoreWeave's pricing model encompasses a range of options tailored to various computing and storage needs. For GPU resources, the pricing spectrum starts at $.24 per hour for the Quadro RTX 4000, extending up to $4.25 per hour for the high-end Nvidia H100 PCIe. On the CPU front, customers can opt for the economical Intel Xeon v3 at $.0125 per hour, or choose the more powerful AMD EPYC Milan at a higher rate of $.035 per hour.

Storage solutions are offered with a range starting from $.03 per GB per month for both HDD and NVMe object storage, going up to $.10 per GB per month for premium NVMe file system storage. Additionally, networking services are priced at $4.00 per month for a public IP address, with the option to upgrade to a VPC at $20.00 per VPC per month, catering to diverse network connectivity requirements. All pricing is priced by the hour, but billed by the minute.

Traction

In 2022, CoreWeave reported $25 million in revenue. The following year, CoreWeave told investors it expected to generate $500 million for the fiscal year in June 2023, which would represent a 25x growth in revenue within a year. Further projections estimate revenue will reach $2.3 billion in 2024. Other major milestones include its June 2023 deal with Microsoft, in which Microsoft agreed to spend “billions of dollars” over multiple years, and its partnership with Nvidia, which CoreWeave described as follows:

“CoreWeave had joined the NVIDIA Partner Network (NPN) as a Preferred Cloud Services Provider (CSP). This was a meaningful first step in establishing CoreWeave’s place as the first specialized cloud provider."

Meanwhile, the company has expanded its physical infrastructure. Starting with three data centers at the beginning of 2023, CoreWeave expanded its footprint to between 14 and 18 data centers by the year's end. Each of these facilities houses approximately 20K GPUs, underscoring the company's commitment to scaling its high-performance computing capabilities.

Valuation

In December 2023, CoreWeave conducted a minority stake sale to investors led by Fidelity Management & Research Co. with participation from Jane Street, JP Morgan Asset Management, Nat Friedman, Daniel Gross, Goanna Capital, and Zoom Ventures which valued the company at $7 billion, and brought its total estimated funding to $3.5 billion including both equity and debt financing.

This was following a Series B extension in May 2023 which brought CoreWeave’s Series B funding to $421 million, and a $2.3 billion debt financing round led by Magnetar Capital and Blackstone in August 2023.

Key Opportunities

Nvidia Partnership

Nvidia was the first and remains an elite partner to CoreWeave for supplying chips. Similar to how TSMC specializes in creating fabs so as not to have conflicts of interest with chip designers like Nvidia or Apple, CoreWeave specializes in providing compute capacity to end users so as not to have a conflict of interest with Nvidia in designing their own chips. CoreWeave gets better deals from Nvidia, which allows CoreWeave to focus on providing the highest quality, cost-efficient GPU cloud to customers. CoreWeave executives believe they are two years ahead of competitors because of this. Looking ahead, CoreWeave has the opportunity to build a moat around a GPU cloud somewhat similar to how TSMC has built a moat around manufacturing fabs.

Riding AI Tailwinds

On the surface, the cloud service provider space looks saturated: a $480 billion industry with leading legacy providers sitting on lots of cash to finance expansion. However, the GPU compute industry is growing, propelled by the growth of AI. There were ~58K AI companies as of January 2024 that have received over $173 billion in total funding from 2021 to 2023. These companies need compute to perform applications that didn’t previously exist, which means that legacy providers haven’t optimized their services for such applications. CoreWeave has positioned itself as the GPU cloud to provide AI startups with the necessary compute.

Key Risks

CoreWeave Dependency on Nvidia

Amazon and Microsoft are dependent on Nvidia for cutting-edge compute power, so Nvidia can maintain a chokehold on the market giving CoreWeave special treatment. Amazon, Microsoft, and other large tech companies are trying to develop their own chips to compete. If there was a breakthrough by one of the legacy providers, CoreWeave could lose the competitive advantage that it currently holds with the help of Nvidia. Its dependency on its Nvidia partnership also poses a risk if Nvidia chooses to alter the terms of the partnership.

Geopolitical Risk

Every company that touches the semiconductor space is bottlenecked by TSMC, which produces more than 90% of the world’s high-end chips. TSMC is based in Taiwan, and geopolitical tensions between Taiwan and China put >90% of the supply for manufacturing high-end chips that CoreWeave buys at risk, endangering its supply chain. However, this may be ameliorated by the fact that its competitors are also largely vulnerable to the same risk.

Summary

CoreWeave describes itself as “a specialized cloud provider, delivering a massive scale of NVIDIA GPUs on top of the industry’s fastest and most flexible infrastructure." Originating from crypto mining, its founders pivoted towards a GPU cloud model and saw rapid growth, fueled by an early partnership with Nvidia. However, CoreWeave’s dependency on Nvidia and geopolitical risks related to semiconductor supply are notable risks. CoreWeave's growth trajectory is set against the backdrop of a fast-growing GPU cloud market because of strong tailwinds such as the emergence and rapid growth of the AI/ML industry.