Thesis

Every frontier technology depends on infrastructure, and today’s AI revolution is no exception. In just a few years, AI has shifted from niche R&D to a capital-intensive industrial category, with training runs for large-scale models requiring tens of thousands of high-performance GPUs, terawatt-hours of electricity, and hundreds of megawatts of dedicated power. The compute behind modern AI is no longer abstract, it is physical, expensive, and highly constrained.

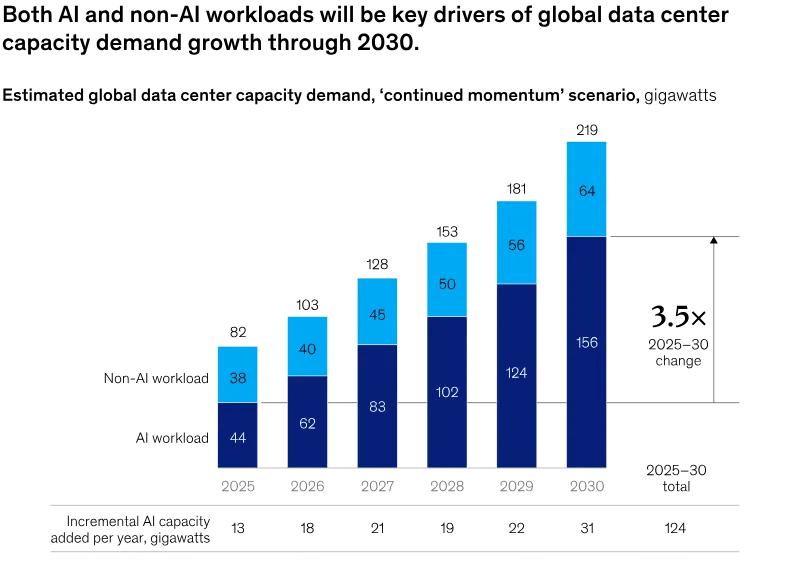

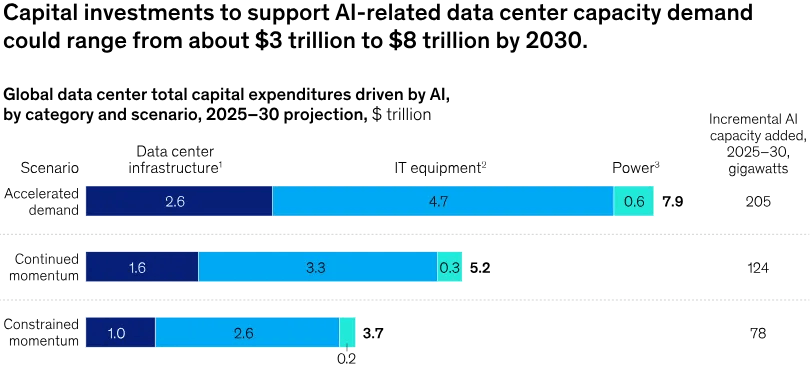

As demand surges, power, permitting, and hardware availability have become the new bottlenecks. AI will require $5.2 trillion in data center investment by 2030, with 156GW of AI-specific capacity needed globally. In a more aggressive scenario, that number rises to $7.9 trillion. In the first half of 2025, data center construction contributed more to US GDP than every other sector outside energy. Without it, GDP growth would have been just 0.1%.

Source: McKinsey

The cloud infrastructure built by today’s hyperscalers wasn’t designed with AI in mind. These providers optimized for serving digital content close to users, not for powering compute-intensive workloads in remote regions. Their data centers were built around legacy power constraints, long construction timelines, and rigid supply chains. But AI introduces entirely different requirements: far higher power densities, new cooling systems, and access to cheap, consistent energy, often far from population centers.

In January 2025, President Donald Trump announced Stargate, a $500 billion public-private initiative backed by OpenAI, Oracle, and SoftBank to build the physical and virtual infrastructure needed to secure American leadership in artificial intelligence. Framed as a project of national importance, Stargate aims to develop a new network of data centers optimized for AI, capable of supporting high-density compute and large-scale energy demand. Its first site, a 1 million sq foot campus in Abilene, Texas, broke ground within weeks.

Source: Bloomberg

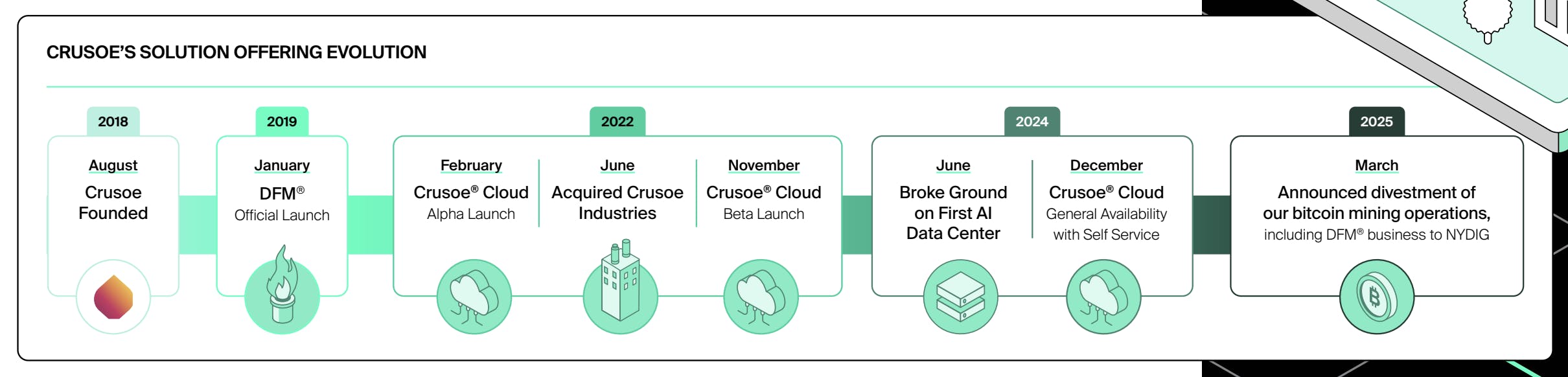

The company developing this site was Crusoe, a seven-year-old startup. Founded in 2018 to convert methane flares from oilfields into usable electricity, Crusoe began as a climate-focused infrastructure company, deploying modular data centers at remote energy sites to reduce emissions. But as demand for AI compute accelerated, the company evolved.

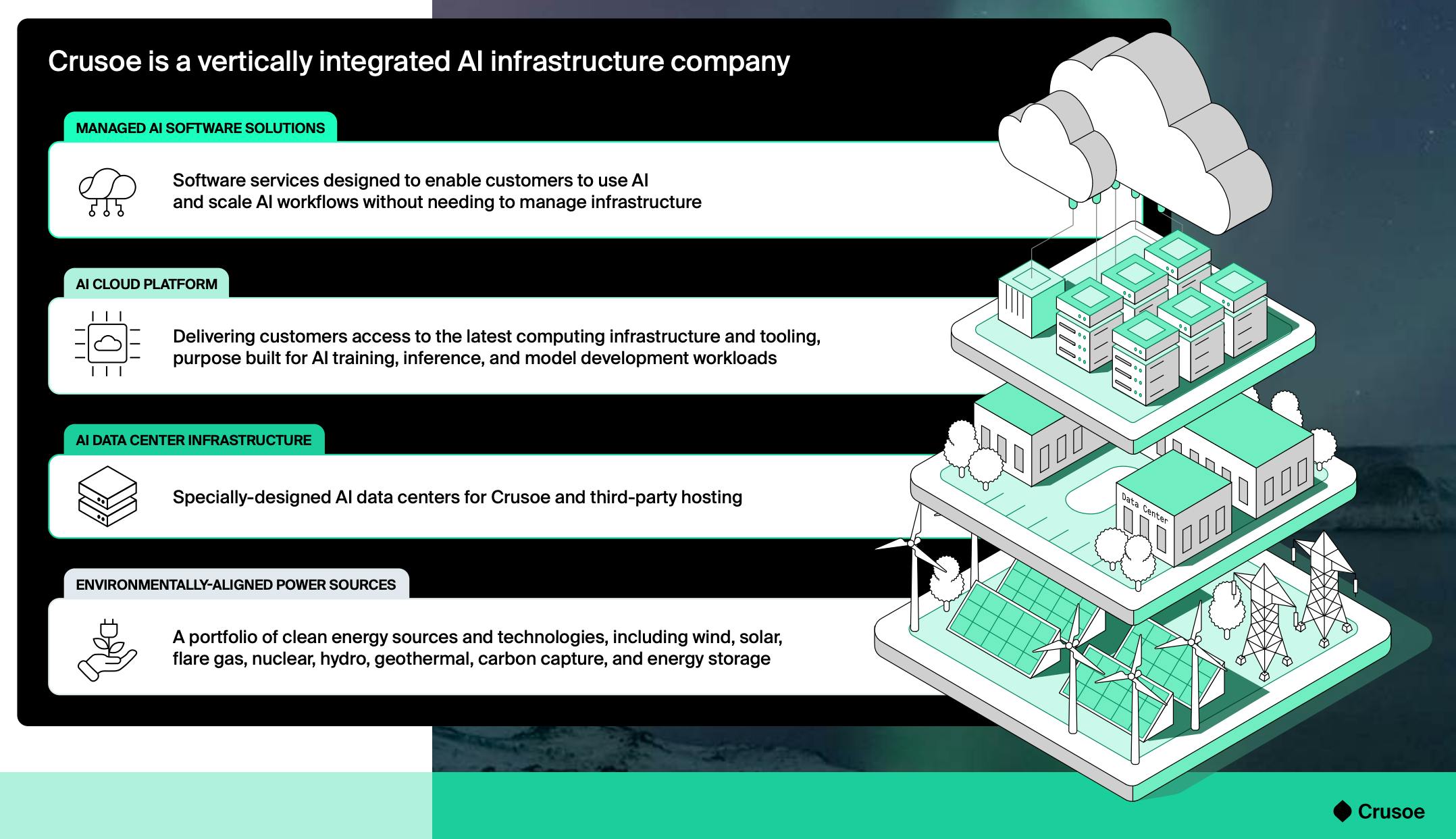

Crusoe now operates as a vertically integrated AI infrastructure provider, with capabilities spanning energy procurement, hardware manufacturing, and GPU virtualization. Its platform is built for speed and scale, bringing high-performance AI clusters online in a fraction of traditional development timelines. With a 45GW pipeline of energy-aligned data center projects across North America and Europe, Crusoe is becoming a core enabler of the AI era’s physical foundation.

Founding Story

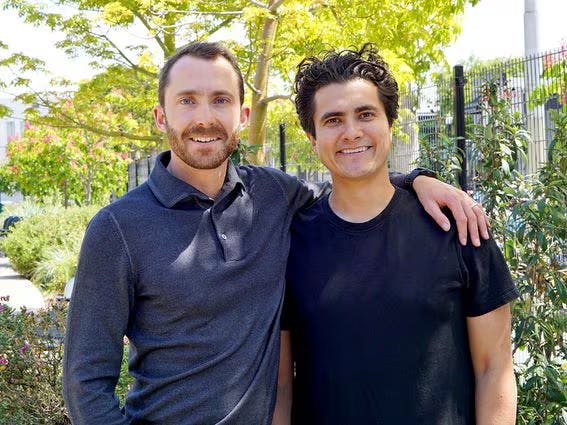

Source: CoinDesk

Crusoe was founded by Chase Lochmiller (CEO) and Cully Cavness (COO) in 2018 in Denver, Colorado.

Lochmiller received his bachelor’s degree in math and physics from MIT in 2008, and his master’s in computer science from Stanford in 2016, where he specialized in artificial intelligence. He began his career as a quantitative trader at Jump Trading, then left the finance industry to spend six months climbing five of the world’s seven tallest summits. He cites this experience as formative in his entrepreneurial thinking. After returning to Colorado from mountain climbing, Lochmiller went on a trip with his high school classmate, Cully Cavness.

Cavness graduated in 2010 from Middlebury College, a school famous for its emphasis on sustainability and environmental activism, with a bachelor’s in geology. Furthermore, in 2010, he was awarded the Thomas J. Watson Fellowship, through which he completed a year of study abroad regarding energy economics in Europe. From 2010 to 2013, he worked for Recurrent Engineering where he was involved in the development of geothermal, solar thermal, and industrial waste heat power projects. Afterward, from 2015 to 2016, Cavness was an associate in energy investment banking.

On a hiking trip in 2017, Lochmiller and Cavness decided to join forces to establish a company that would tap stranded energy sources, and use them to power computing. They named their company ‘Crusoe’, after Robinson Crusoe, a character from Daniel Defoe’s 18th century novel, who got stranded on an island near the Venezuelan coast and used his adaptability to survive.

Together, Lochmiller and Cavness set out to solve the problem of gas “flaring”, a harmful industry practice of burning excess natural gas emitted in the oil drilling process. The process of drilling for oil yields three outputs: oil, natural gas, and water. After separation, the water and oil can easily be transported to treatment facilities or refineries, as they are liquids. Managing natural gas, however, is not as simple. Being vaporous, it is hard to capture and expensive to transport. As a result, for decades, most oil companies have opted to simply “flare” or burn it.

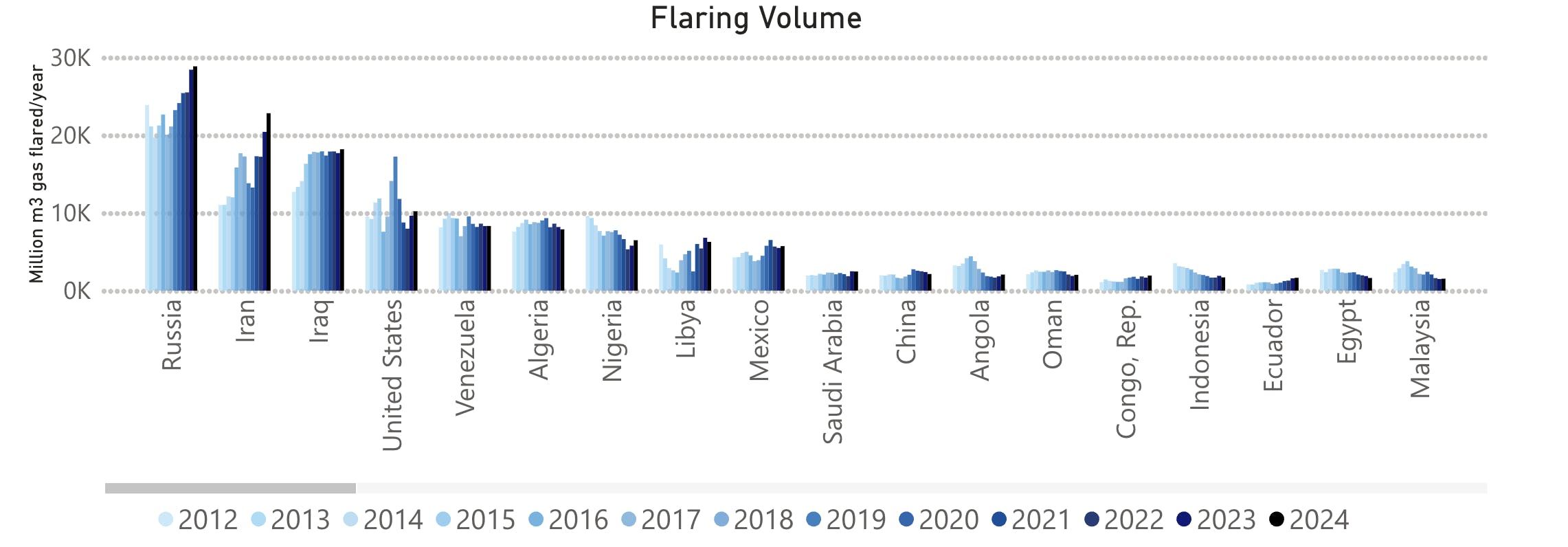

Source: Ars Technica

Gas flaring releases large amounts of carbon dioxide and methane gas into the atmosphere and contributes to nearly 2% of total global greenhouse gas emissions. Moreover, as of 2024, over 150 billion cubic metres of gas is flared (wasted) globally each year, a volume that could power Sub-Saharan Africa for a year.

Source: World Bank

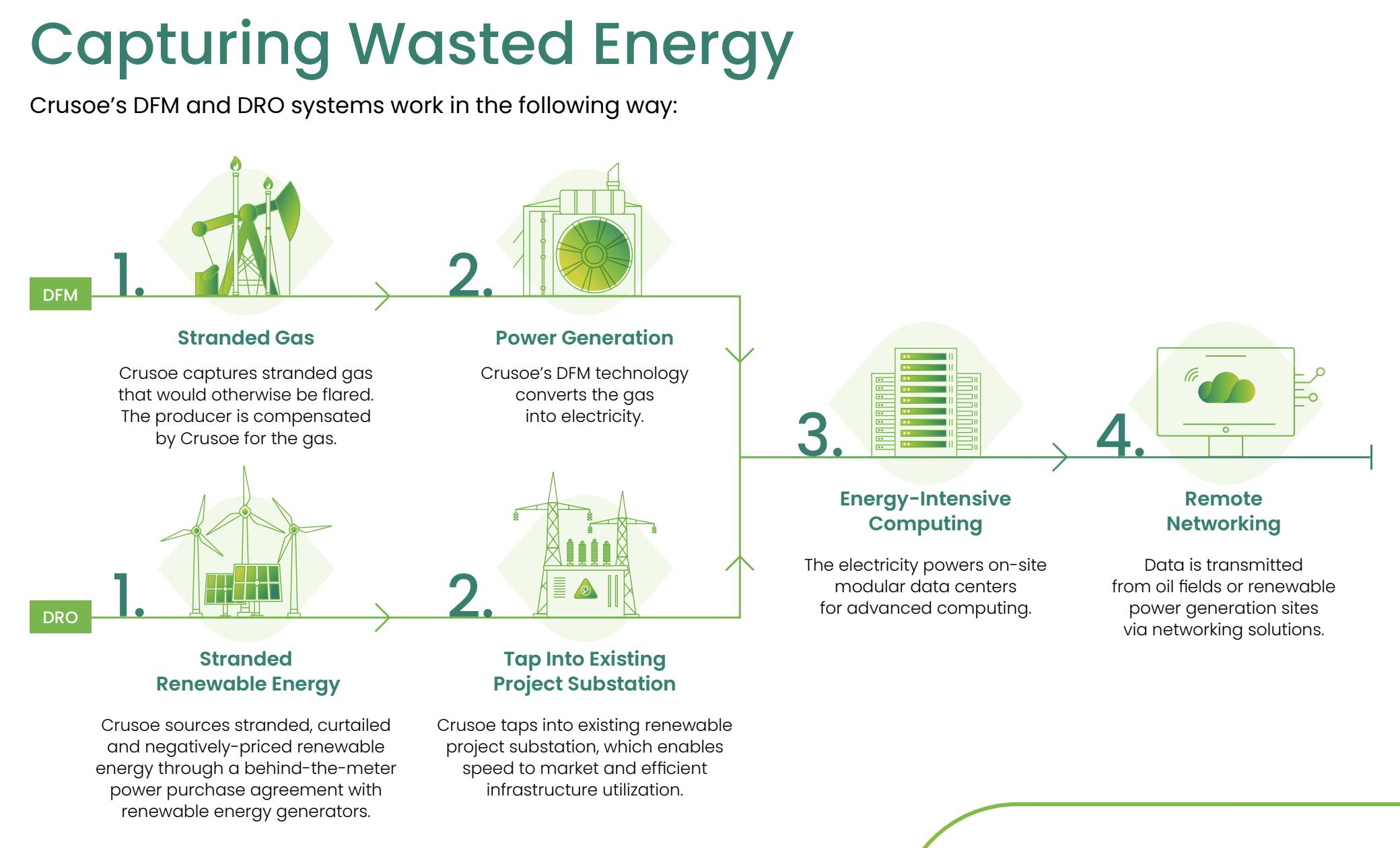

This gas, Lochmiller and Cavness realized, was wasted primarily because of the prohibitive costs of transporting it from oil fields to places of energy demand. It's often the most economical solution for oil companies to simply throw out this natural gas, despite the damage and cost. The team realized that if this resource could be captured, it could provide a viable source of energy. With this insight, Crusoe Energy developed a now-patented Digital Flare Mitigation (DFM) System that could absorb this natural gas and convert it into usable energy. Crusoe could then use this captured power to fuel data centers that could support Bitcoin mining ecosystems. In a proof of concept, the company’s early mobile data centers reduced greenhouse gas emissions at select oil fields by 70%.

In addition to its DFM technology, Crusoe developed a complementary approach called Digital Renewable Optimization (DRO) to harness power from stranded and curtailed renewable energy sources, such as wind, solar, and geothermal. By colocating data centers at renewable project substations, Crusoe reduced curtailment and accelerated deployment.

Source: Crusoe

In the initial years of Crusoe, the founding team sent a video to potential investors of a gas flare getting smaller as a Bitcoin wallet grew in size. In 2022, Crusoe launched its high-performance compute platform, Crusoe Cloud, starting with a small deployment of GPUs in a remote Montana data center. Demand quickly outpaced expectations, prompting the company to scale and establish additional sites in Virginia and Texas.

To support its infrastructure buildout and vertically integrate core operations, Crusoe acquired Easter-Owens Electric Co in 2022, rebranding it as Crusoe Industries. The acquisition brought in an 87K sq foot facility and a team of engineers, electricians, and welders capable of building custom modular data centers and power systems. This in-house manufacturing capability enabled Crusoe to accelerate deployment, reduce reliance on third parties, and scale more efficiently across its clean energy and computing initiatives.

Source: Crusoe

As Crusoe became one of the largest off-grid Bitcoin miners in the world, the team saw an emerging opportunity in AI infrastructure. Lochmiller had early conviction that GPUs for machine learning would become a massive market, and Crusoe was uniquely positioned to serve it. Unlike Bitcoin ASICs, which are single-purpose chips, GPUs could be monetized flexibly across training and inference workloads. In the years prior to ChatGPT’s explosion, Crusoe began deploying GPU clusters directly in the oil fields, effectively converting waste energy into AI compute.

In 2023, the team pivoted from a focus on Bitcoin mining to supporting all HPC workloads, in particular, AI and large language models. To that end, it secured a $200 million loan from investment firm Upper90 in late 2023, with stated plans to use the money to purchase NVIDIA H100 Tensor Core GPUs as well as the previous A100 version. Involvement in the fast-growing demand for energy from AI was a strategic move, believing that the pivot came “at a time when the entire compute infrastructure market is constrained due to burgeoning demand from AI/ML workloads.”

Crusoe officially entered the hyperscale data center business in June 2024 with the announcement of its Abilene, Texas data center, at the Lancium Clean Campus. Initially presented as a major expansion of Crusoe’s AI infrastructure strategy, the project took on broader national significance in January 2025, when President Donald Trump announced the $500 billion Stargate AI infrastructure initiative, led by OpenAI, Oracle, and SoftBank to advance America’s leadership in AI. In April 2025, it was revealed that Crusoe is the lead developer behind Stargate’s flagship site in Abilene, positioning the company at the center of one of the largest AI infrastructure efforts in the world.

Source: Chase Lochmiller via X

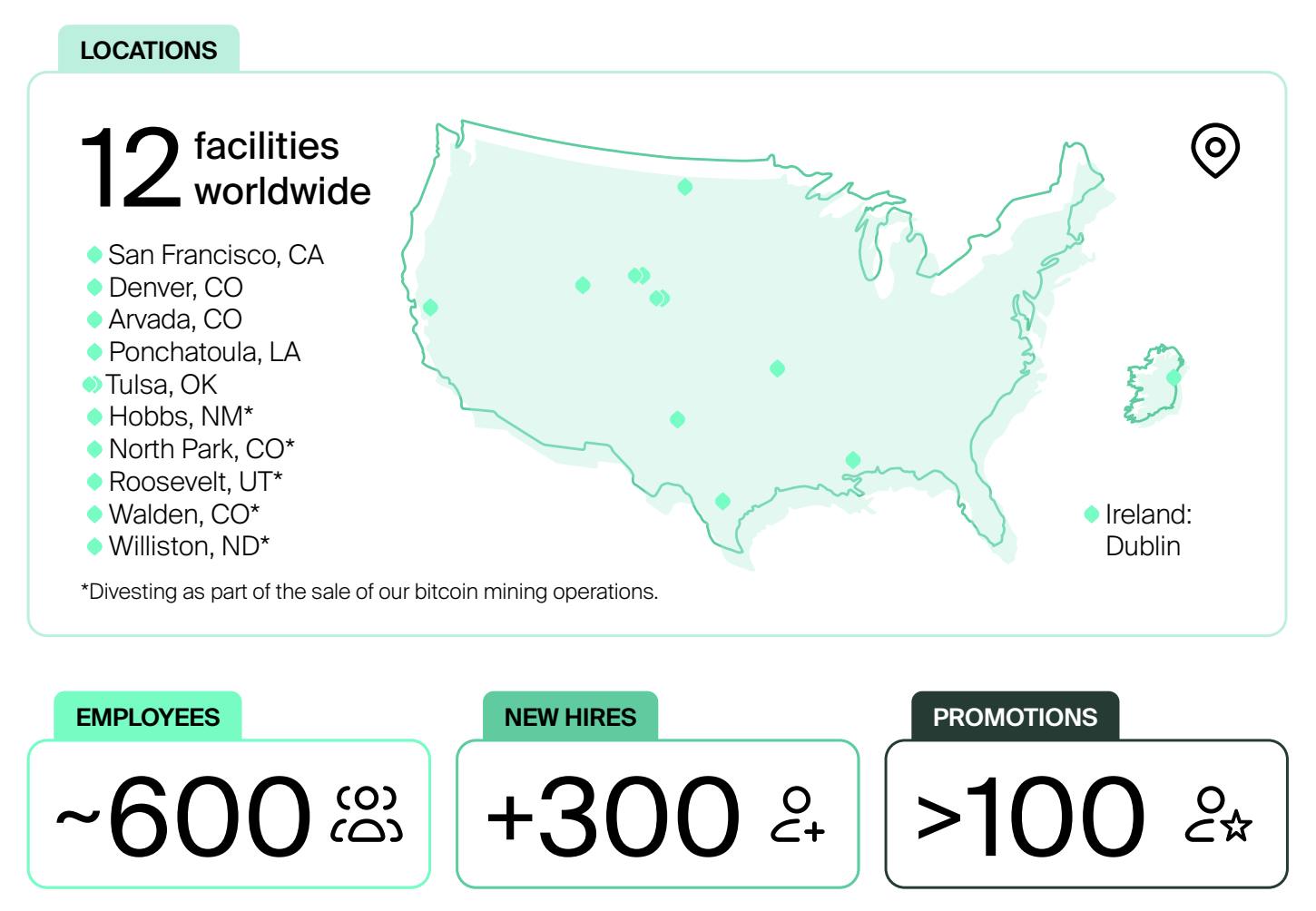

By 2025, Crusoe scaled its DFM operations to over 250 megawatts across seven US states and Argentina. The company deployed more than 110 mobile generation systems and abated over 39 billion cubic feet of gas, equivalent to removing over 300K cars from the road.

In March 2025, Crusoe announced the sale of its entire Digital Flare Mitigation and Bitcoin mining division to NYDIG (New York Digital Investment Group). The deal included all flare gas operations, 135 employees, and renewable-powered Bitcoin sites. This allowed the company to go all-in on its new focus as a vertically integrated AI infrastructure provider.

Source: Crusoe

Product

Crusoe is a vertically integrated AI infrastructure company, designing and delivering high performance compute capacity. The company identifies low-cost, underutilized energy and co-locates data centers directly at these sites. Its in-house manufacturing arm accelerates deployment, while its cloud platform offers customers direct access to energy-efficient GPU compute. This allows Crusoe to build AI-optimized infrastructure on faster timelines and at lower cost than traditional providers, while enabling the transition to cleaner energy systems by monetizing stranded and intermittent power.

Source: Crusoe

Crusoe Cloud

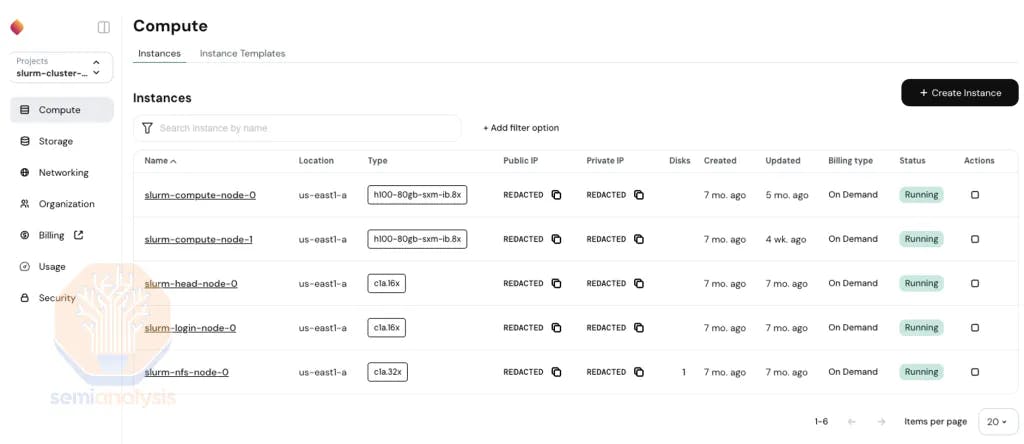

Crusoe’s primary client-facing product is Crusoe Cloud, a cloud infrastructure platform powered by its data centers. Crusoe Cloud is a scalable, cost-efficient and sustainable platform for businesses designed specifically to meet the unique demands of AI. Unlike traditional hyperscaler cloud providers that retrofit legacy systems for machine learning workloads, Crusoe has built an entirely new architecture, optimized for performance, cost, energy efficiency, and environmental alignment.

Source: SemiAnalysis

The company launched its first containerized GPU cluster in Montana in 2022, starting with a small deployment of A100s. Demand quickly outpaced supply, prompting Crusoe to expand into larger facilities in Texas and Virginia by 2023, and to launch its first fully renewable-powered data center in Iceland by 2025.

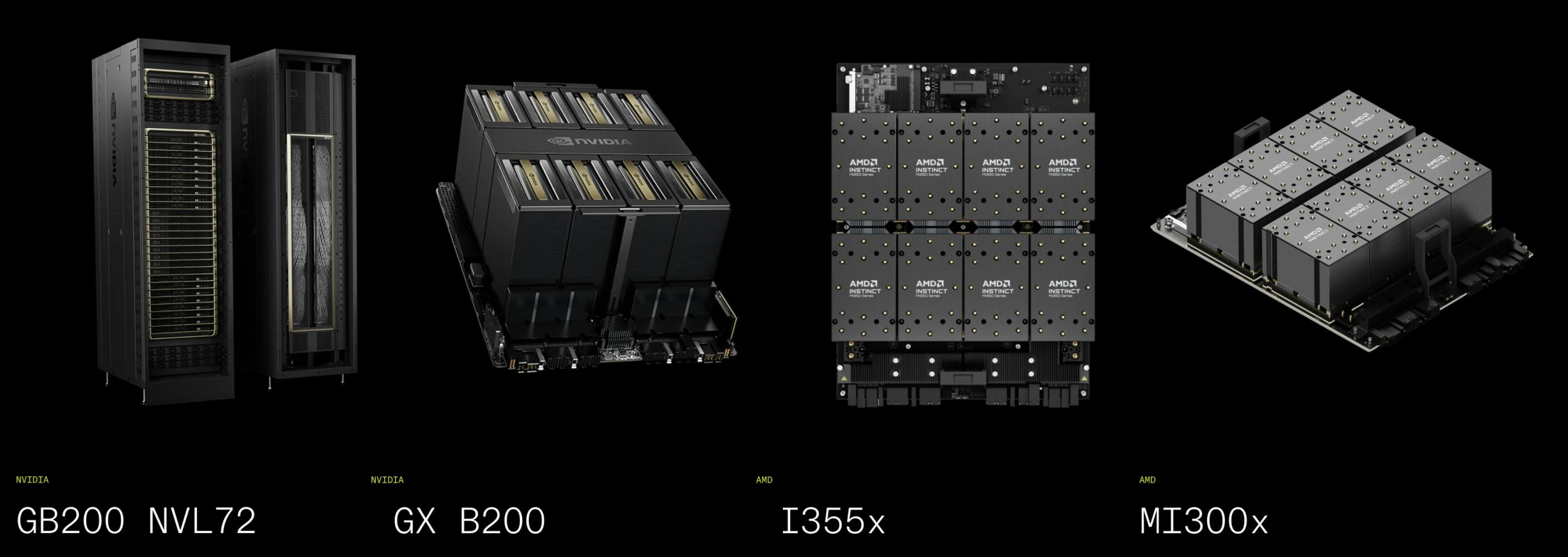

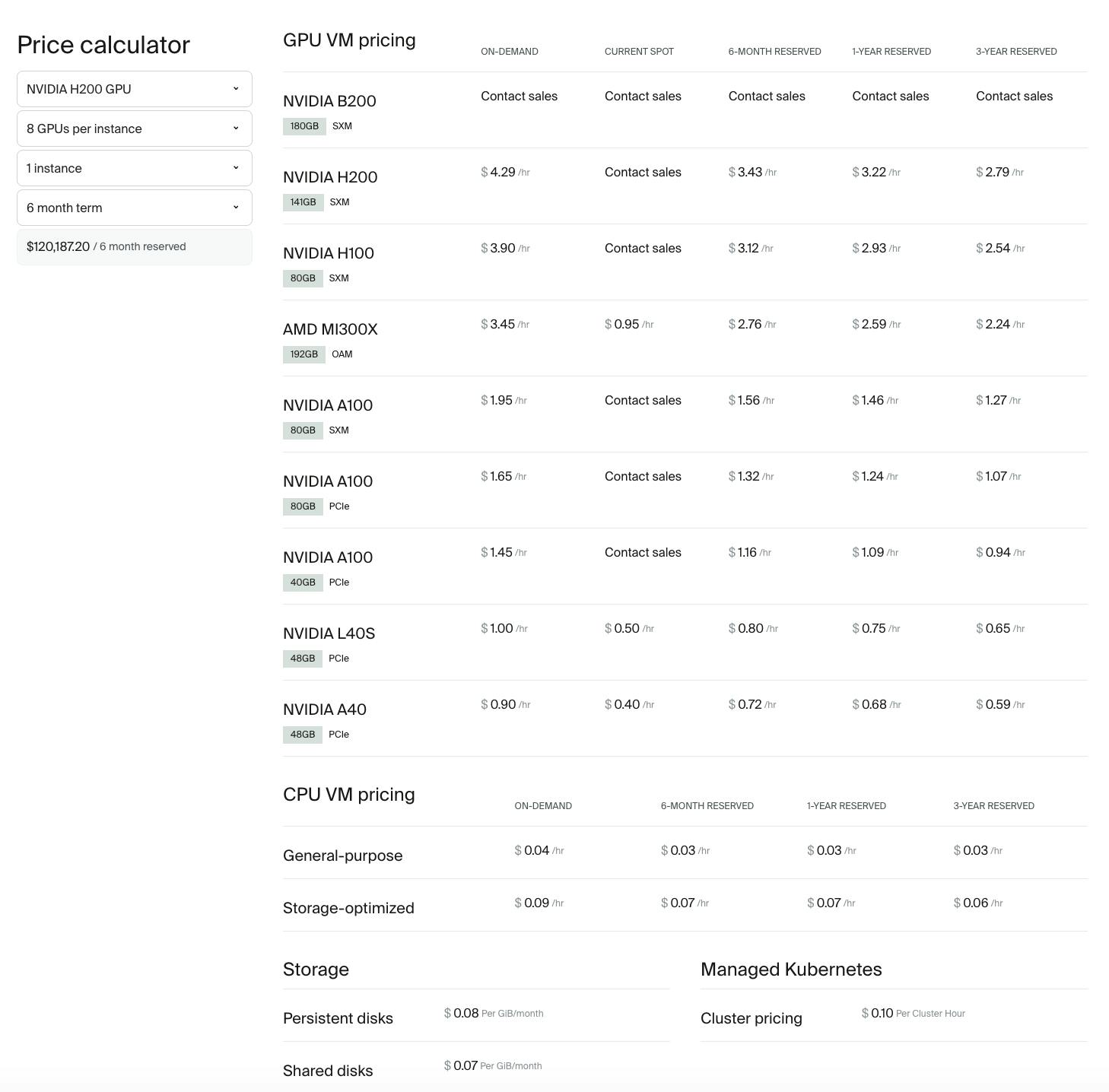

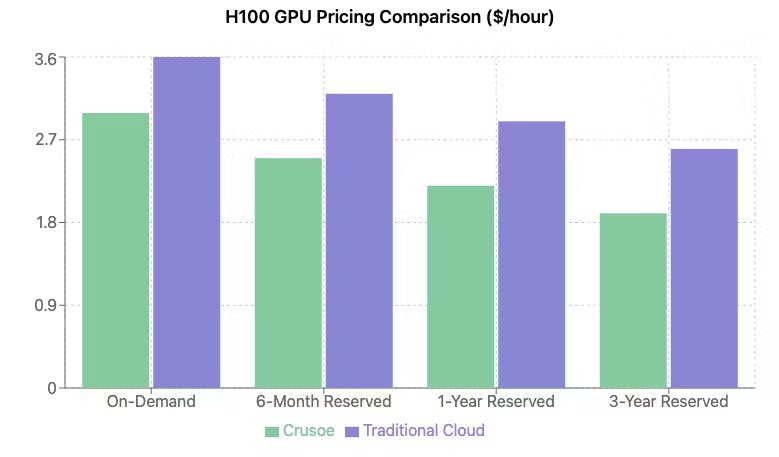

Crusoe Cloud offers a broad portfolio of the latest GPU infrastructure optimized for AI workloads, including NVIDIA’s GB200 NVL72, B200, H200, H100, and A100 chips, as well as AMD’s MI300X and MI355x. Customers can choose from on-demand, spot, or multi-year reserved options, and Crusoe offers a self-serve pricing calculator to estimate total cost based on GPU type, instance size, and contract length.

Source: Crusoe

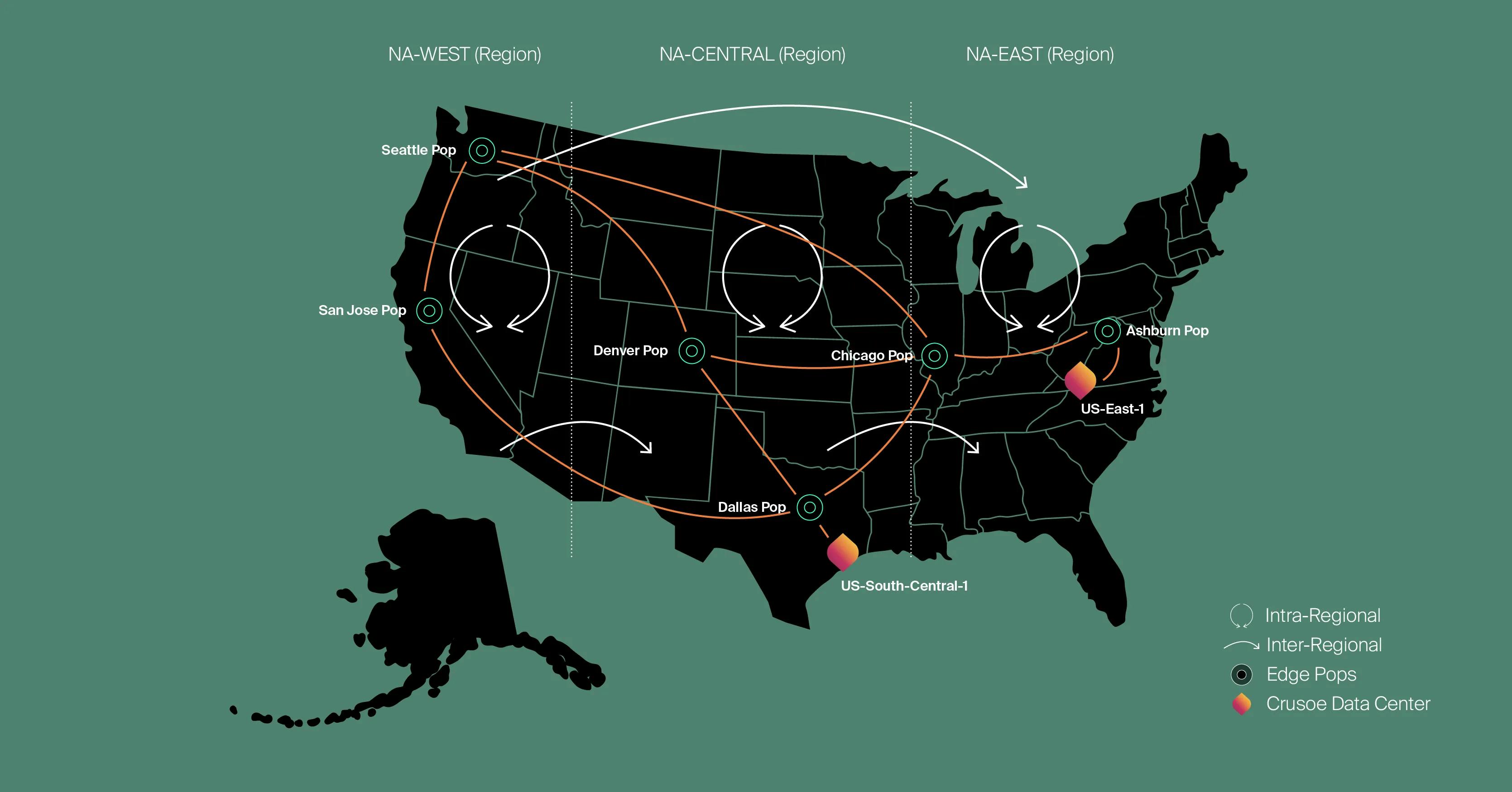

Crusoe Cloud’s backbone is engineered specifically for distributed AI workloads. It combines intelligent routing protocols, dynamic traffic shaping, and end-to-end observability powered by machine learning. These features ensure low-latency, high-reliability performance across workloads like multi-node training or cross-region inference.

Crusoe’s physical infrastructure also reflects its AI-first design. Rather than concentrating compute in a few centralized campuses, Crusoe deploys modular data centers across geographically distributed sites. This decentralized approach allows the company to take advantage of stranded or non-rival energy sources without compromising uptime. If one site experiences a power drop, workloads can be shifted across Crusoe’s broader network, enabling fault tolerance and load balancing by design.

Source: Crusoe

In contrast to hyperscalers like AWS, Azure or GCP, Crusoe passes along a structural cost advantage to its customers. Because it co-locates compute directly at energy sources, it avoids grid pricing, transmission costs, and peak pricing variability. This allows Crusoe Cloud to offer lower prices, more consistent performance, and reduced carbon intensity, without compromising on speed or reliability.

Crusoe describes this approach as a “Neocloud”, purpose-built for the AI era, tightly integrated across power, hardware, and network layers. With rising demand for specialized AI infrastructure, Crusoe Cloud is positioning itself as a high-performance, lower-cost alternative to general purpose compute providers.

Data Centers

Crusoe designs, builds and operates a range of data centers purpose-built for AI workloads. Whether modular or monolithic, every facility is integrated with Crusoe’s energy systems and designed to meet the speed and density demands of modern compute. The company’s infrastructure spans from mobile flare-site deployments to hyperscale AI campuses. As of October 2025, Crusoe’s data center footprint extends to 9.8 million sq feet, with capacity of up to 946K GPUs and powered by 3.4GW of electricity.

Modular Data Centers

Crusoe’s modular data centers, branded as Crusoe Spark, are turnkey AI “factories” designed to bring high-performance compute to the edge. These units integrate everything required to operate AI workloads at scale, including GPU racks, advanced cooling, remote monitoring, fire suppression, and power distribution, all housed in a transportable chassis.

Source: Crusoe

Crusoe Spark was launched in June 2025 to address surging demand for localized, low-latency AI infrastructure. The units are optimized for applications where real-time inference is critical, such as autonomous vehicles, healthcare monitoring, predictive maintenance, and smart cities. Because they can operate independently from grid constraints, Spark units are deployable in remote locations or industrial settings where centralized cloud compute isn’t viable.

Each Spark unit is built to support the latest generation of AI chips and is engineered for rapid deployment, with lead times as short as three months. Customers can deploy single units for targeted workloads or combine multiple units to create scalable clusters. As of June 2025, Crusoe has deployed over 400 modular data centers globally.

Crusoe officially entered the hyperscale data center business in June 2024 with the announcement of its Abilene, Texas data center, at the Lancium Clean Campus. Initially presented as a major expansion of Crusoe’s AI infrastructure strategy, the project took on broader national significance in January 2025, when President Donald Trump announced the $500 billion Stargate AI infrastructure initiative, led by OpenAI, Oracle, and SoftBank to advance America’s leadership in AI. In April 2025, it was revealed that Crusoe is the lead developer behind Stargate’s flagship site in Abilene, positioning the company at the center of one of the largest AI infrastructure efforts in the world.

Custom Data Centers

Crusoe builds large-scale, custom data centers designed specifically for high-density AI workloads. These facilities are engineered to support modern training and inference requirements, with high-throughput networking, large-scale power availability, and chip-specific thermal and hardware configurations.

Crusoe’s efforts as the lead developer on the Stargate project includes capacity planned to scale to over 1.2GW and over 450K GPU chips, making it one of the largest AI data centers in the world. The first two buildings, spanning 980K sq feet, went live in September 2025.

Source: Data Center Dynamics

In addition to its Abilene, Texas campus, Crusoe is expanding its custom data center footprint across multiple geographies. In Norway, the company is developing a 12MW facility in partnership with Polar, powered entirely by hydroelectric energy and expandable to 52MW. In Iceland, Crusoe has expanded capacity at the ICE02 data center operated by atNorth, integrating NVIDIA Blackwell hardware and liquid chip cooling, all powered by geothermal and hydro energy.

In July 2025, Crusoe announced its partnership with Tallgrass to develop a 1.8GW AI campus in southeast Wyoming, with plans to scale up to 10GW, marking one of the most ambitious AI infrastructure projects in North America.

Source: Crusoe

Crusoe’s advantage in custom development comes from its vertical integration. The company manufactures key electrical components through its Crusoe Industries division, reducing dependence on third-party vendors and enabling faster build times. It also colocates data centers near low-cost, underutilized energy sources, to reduce operating costs and improve power availability.

Energy Solutions

Crusoe takes an energy-first approach to powering AI infrastructure. The company integrates power planning directly into data center design, selecting sites near abundant or underutilized energy, and building proprietary utility networks to manage supply. This allows Crusoe to deploy compute at lower cost and with greater control over environmental impact. Crusoe’s data centers operate on a diverse mix of energy sources, including natural gas, wind, solar, battery storage, hydro, and geothermal. These sources are unified through Crusoe’s internal energy management systems, which dynamically balance cost, availability, and carbon intensity across sites.

The company’s energy strategy began with DFM, capturing stranded gas from oil fields and converting it into on-site power. At its peak in 2024, DFM accounted for 87% of Crusoe’s energy mix. In March 2025, Crusoe divested its DFM operations to refocus on clean, scalable compute infrastructure.

Crusoe’s track record of power delivery includes building and energizing a full on-site power plant and substation in Abilene, Texas in under six months. In June 2025, it partnered with Redwood Materials to deploy a Crusoe Spark unit at Redwood’s Tahoe campus, powered entirely by solar and second-life EV batteries; the largest solar microgrid of its kind in North America.

Source: Bloomberg

Looking ahead, Crusoe is actively pursuing next-generation clean energy technologies. The company has signed development agreements for carbon capture and sequestration (CCUS), small modular nuclear reactors (SMRs), and grid-scale battery storage. With over 45GW of energy projects in development as of October 2025, Crusoe is building the power capacity required to support large-scale AI infrastructure over the long term.

Manufacturing

Crusoe’s ability to deploy infrastructure at speed is supported by its in-house manufacturing division, Crusoe Industries. Established in 2022 through the acquisition of modular data center manufacturer Easter-Owens, Crusoe Industries operates facilities near its Denver headquarters in Arvada, Colorado, as well as in Tulsa, Oklahoma and Ponchatoula, Louisiana.

Source: Crusoe

The division produces a wide range of data center components and systems, including Crusoe Spark modular units, metal structures, electrical enclosures, industrial control systems, and power distribution equipment. It also provides end-to-end engineering services, from custom design to welding, fabrication, and painting, ensuring every unit meets local code requirements and is ready for deployment.

Vertical integration in manufacturing has allowed Crusoe to overcome industry bottlenecks and control critical infrastructure timelines. As CEO Chase Lochmiller put it:

“We got quotes for low voltage switch gear, which is basically the electrical control room for the data center. These quotes were up to 100 weeks. So we stood up a factory and started making switch gear ourselves, now it takes us 22 weeks.”

In August 2024, Crusoe announced a $10 million investment in a new 120K sq foot facility in Tulsa, focused on scaling production of core data center systems like switchgear, expecting to create 100 new jobs and playing a key role in supporting Crusoe’s growing deployment pipeline.

Source: Crusoe

Market

Customer

Crusoe’s ability to rapidly deploy large-scale GPU clusters has become a key differentiator in the AI infrastructure market. Crusoe ensures that the lifetime costs of owning its data centers are primarily driven by energy expenditure, rather than hardware or software costs. As of January 2024, the average AI data center spent as much as 60% of its total budget on power and energy. The company’s vertically integrated approach, spanning energy procurement, data center design, and in-house manufacturing, allows it to bring sites online in a matter of months, creating a meaningful competitive edge for its customers.

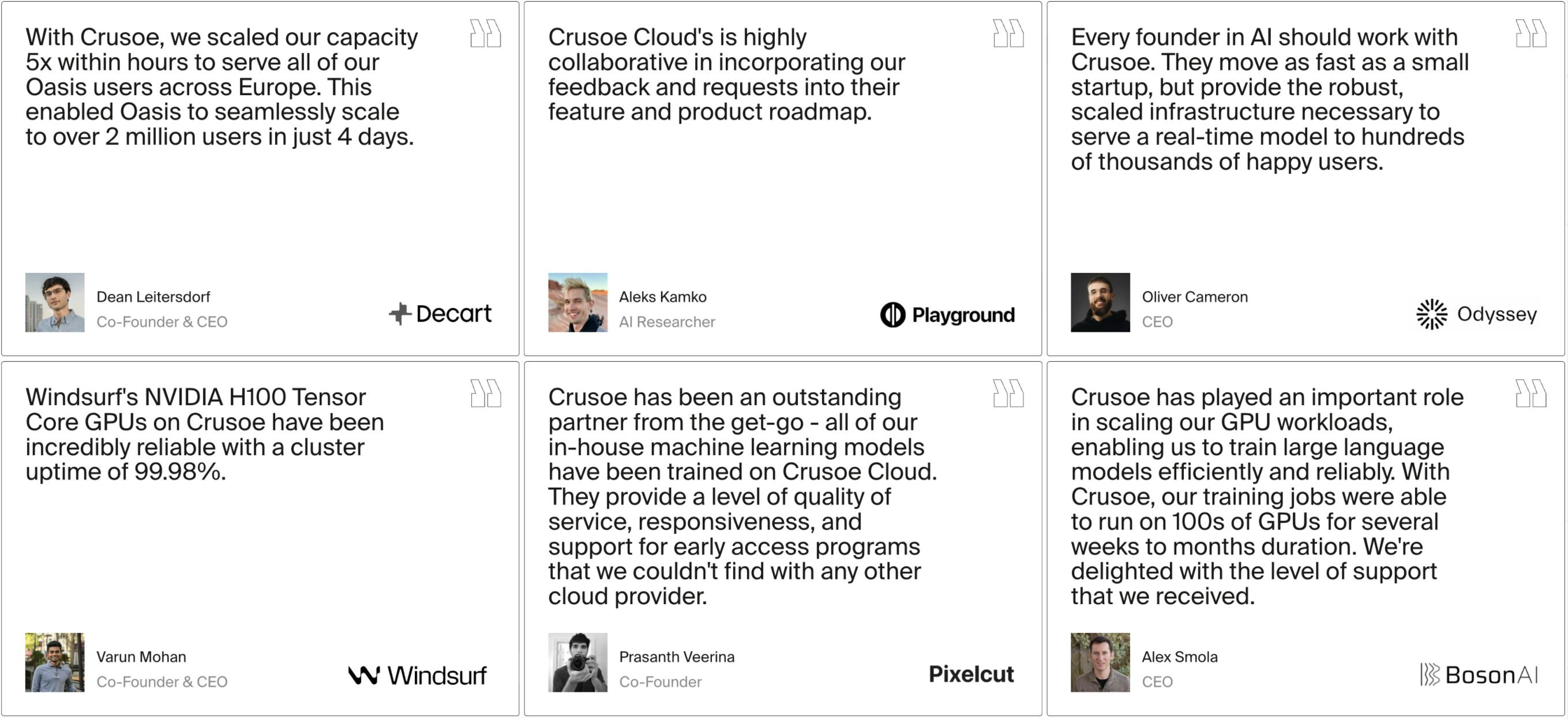

Crusoe primarily serves three types of customers, with AI startups as a core part of Crusoe’s customer base. These teams are building and fine-tuning large language models, generative AI tools, and other high-intensity applications. For companies like Anysphere (Cursor), Together AI, Windsurf, Decart, and Playground, Crusoe Cloud offers access to clean, cost-efficient compute for model training and inference workloads, with flexibility on scale and procurement structure.

Source: Crusoe

Enterprise technology teams also use Crusoe Cloud to support internal AI research and product development. These customers often prioritize transparency in pricing, strong reliability, and sustainability credentials. Notable adopters include Sony, Databricks and MIT, who have used Crusoe infrastructure for a mix of production workloads and experimental compute.

Crusoe also supports large cloud providers and hyperscalers through infrastructure partnerships. In Abilene, Texas, Crusoe developed the Stargate site at the Lancium Clean Campus, a high-capacity data center leased to Oracle and used by OpenAI.

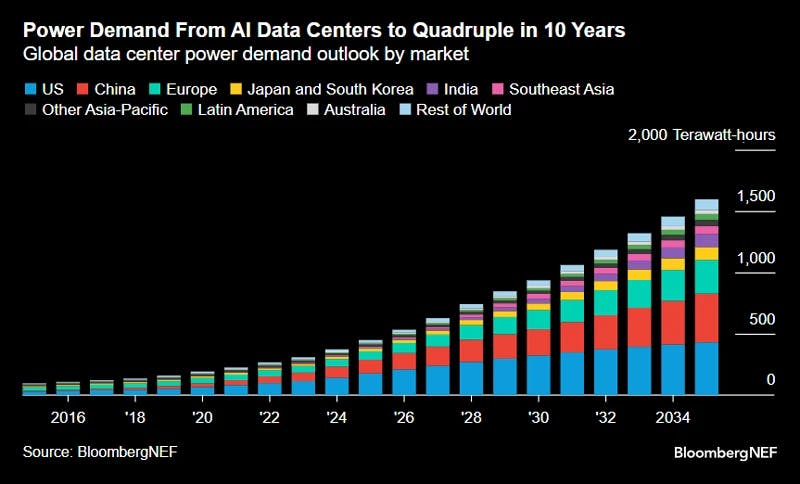

Market Size

The rise of AI is triggering a shift in both the data center and energy industries, as AI infrastructure is now one of the largest and fastest growing drivers of global electricity demand. According to Bloomberg, data centers could consume 1.6K terawatt-hours of electricity annually by 2035, roughly 4.4% of all global energy use, placing them behind only China, the US, and India in national consumption terms.

Source: Bloomberg

At the center of this transformation is a new generation of hyperscale and high-performance compute facilities built specifically for AI workloads. In the early 2010s, most data centers operated at 5MW. Today, developers are routinely planning sites in the hundreds of megawatts, with gigawatt-scale projects already underway.

Crusoe is among a handful of companies at the forefront of this shift, with 2GW of capacity under construction and a long-term pipeline of 45GW, 10 times larger than the entire 2024 capacity of Northern Virginia at 4.5GW, the biggest data center region in the world. Estimates from McKinsey suggest that AI alone will require $5.2 trillion in data center investment by 2030, with 156GW of AI-specific capacity needed globally. In a more aggressive scenario, that number rises to $7.9 trillion.

Source: McKinsey

However, this data center growth is sometimes considered unsustainable. AI searches require 10 times the electricity of traditional Google search queries. A single NVIDIA H100 server (8 H100 carts) running at full load takes the equivalent of 10 US homes worth of power.

Furthermore, clustered data center growth has led to increased electrical grid pressure in areas already operating at-capacity and/or prone to instability, and growing the power grid is impractical: new power takes a minimum of four years to build, creating a substantial lag between computing growth and grid growth.

Thus, sustainable, alternative avenues for power and cloud computing services will benefit from significant industry tailwinds between 2025 and 2030. And by providing an alternative avenue for power without compromising on environmental safety or placing additional pressure on already over-burdened scarcity constraints, Crusoe counter-positions itself against traditional technology companies who are trying to enter the AI and cloud computing space.

The global cloud computing market was valued at $912 billion in 2024 and is projected to grow to $2.3 trillion by 2030, with GPU-as-a-service and other neocloud offerings expected to account for approximately $180 billion of that total.

Competition

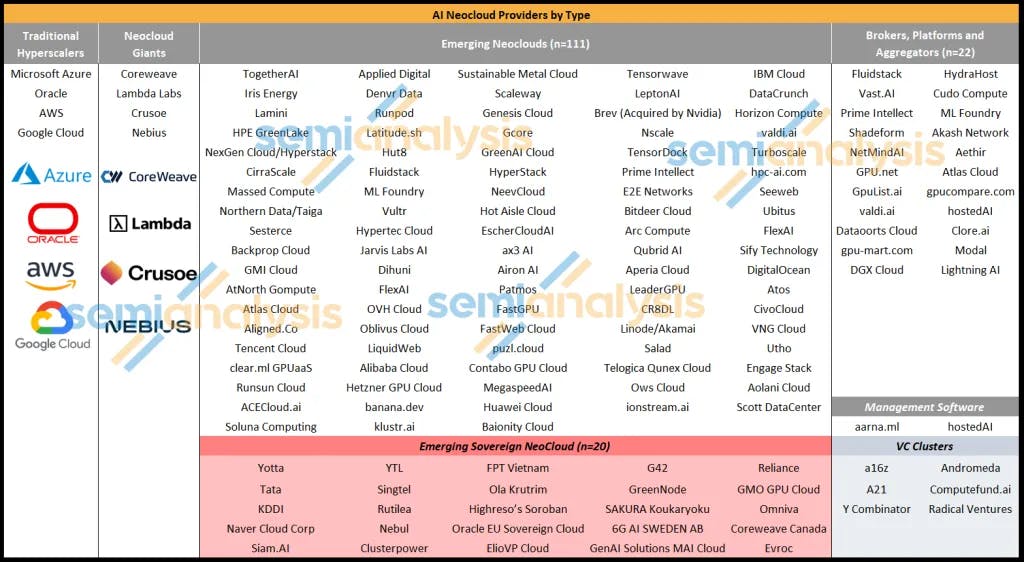

Crusoe faces competition from three major sectors: traditional hyperscalers and neocloud companies, which provide cloud computing infrastructure to AI groups, as well as data center development companies.

Source: SemiAnalysis

Incumbents

AWS, Google Cloud, & Microsoft Azure:

The cloud computing market is dominated by AWS, Azure, and Google Cloud, three companies that combined accounted for 63% of the $99 billion global cloud market in Q2 2025.

AWS began offering cloud computing services to businesses in 2006 and by 2024 had grown to offer over 200 fully featured services from data centers around the globe. Its parent company, Amazon, is a publicly traded company with a $2.3 trillion market cap as of October 2025. Like Crusoe, AWS has launched several meaningful sustainability initiatives since 2020. For example, the company now uses advanced cooling techniques to lower the power demands of its data centers.

Similarly, Google and Microsoft are publicly traded companies that launched cloud computing services platforms Google Cloud and Microsoft Azure in 2008. They, too, have explicit sustainability goals regarding their power consumption, with Google attempting to reach carbon neutrality by 2030.

Source: Visual Capitalist

Neoclouds

CoreWeave: Founded in 2017, CoreWeave is a cloud infrastructure company that delivers computing resources tailored for AI, featuring a cloud-based production pipeline that allows clients to meet their flexible, scalable compute demands. The company had raised over $13.4 billion through twelve funding rounds as of April 2025, including a debt financing round for $650 million in October 2024 led by Goldman Sachs, JP Morgan, and Morgan Stanley. Other notable investors include Fidelity and Magnetar Capital.

CoreWeave went public in March 2025, raising $1.5 billion at $40 per share. By October 2025, the share price has surged by over 250%, trading at a market cap of $65 billion. Much like Crusoe, CoreWeave benefits from a close partnership with NVIDIA. As one analyst explained in 2023: “Since supply has been limited for a long time, and [CEO of NVIDIA] Jensen is allocating so as to not concentrate all the buying power on a few hyper-scalers, there’s a margin to be made in reselling capacity.” This margin is expected to enable CoreWeave to quadruple its sales in 2025, to around $8 billion.

Lambda Labs: Founded in 2012, Lambda Labs specializes in providing GPU cloud solutions tailored for machine learning and AI research. Lambda's offerings include powerful GPU workstations, servers, and cloud services designed to accelerate compute-intensive applications, such as deep learning model training and inference. This focus places Lambda in direct competition with Crusoe in the niche market of GPU-accelerated cloud computing. Both companies cater to a similar customer base that requires high-performance computing resources for AI and machine learning workloads, but Lambda distinguishes itself with a strong emphasis on research and development in AI. The company has raised a total of $1.7 billion in funding as of October 2025, reaching a $2.5 billion valuation at the time of its $480 million Series D in February 2025.

Nebius: Founded by Arkady Volozh in 1989 as Yandex NV, to serve as the parent company of Russia’s leading internet company Yandex. Nebius went public on the Nasdaq in May 2011, raising $1.3 billion. In February 2022, trading of its shares was suspended due to sanctions related to the Russian invasion of Ukraine. By July 2024, the company had divested its Russian operations and rebranded as Nebius Group, shifting its focus towards AI.

Nebius resumed trading in October 2024 and had a market cap of $24.3 billion as of October 2025. The company provides a cloud platform offering scalable and flexible tools for developing, deploying, and managing AI models and machine learning workflows. Similar to Crusoe, it offers GPU instances for utilizing L40s, H100, and H200 compute. According to Nebius CEO Arkady Volozh, the company has a “great cloud partner in NVIDIA” as it has access to the latest of NVIDIA’s GPUs. The Netherlands-based firm operates in a nearly identical niche to Crusoe, posing direct competition.

Core Scientific: Founded in 2017, Core Scientific operates bitcoin mining data centers and manufactures crypto mining servers, utilizing its compute capacity to support these power-intensive tasks. The company went public through a $4.3 billion SPAC in January 2022. Like Crusoe, Core Scientific invested heavily in data center buildouts throughout 2023 and 2024, the largest of which is expected to provide a total contract value of over $8.7 billion by 2026. In July 2025, CoreWeave bid to acquire Core Scientific for $9 billion in a deal that would give it control of 1.3GW of Core Scientific’s data center capacity. In October 2025, influential proxy advisors ISS and Glass Lewis urged investors to reject the deal, arguing it undervalued Core Scientific and exposed shareholders to volatility. As of October 2025, Core Scientific was trading at a market cap of $5.4 billion.

Data Center Developers & Colocation Providers

Digital Realty: Digital Realty is a publicly traded data center REIT with over 300 facilities across six continents, serving enterprises, hyperscalers, and cloud platforms through its offerings. In December 2023, the company partnered with Blackstone on a $7 billion joint venture to develop AI-optimized campuses in Frankfurt, Paris and Northern Virginia. Although it does not offer a cloud computing services like Crusoe, Digital Realty competes on hyperscale buildouts, power delivery, and strategic AI partnerships, especially in Europe, where Crusoe recently announced its first site in Norway. As of October 2025, Digital Realty was trading at a market cap of $60 billion.

Equinix: Founded in 1998, Equinix is one of the world’s largest colocation and interconnection providers, operating over 270 data centers worldwide, and has been one of Crusoe’s co-location partners. The company offers infrastructure for hybrid cloud, edge deployments, and digital ecosystems through its flagship product, Equinix Fabric, which connects enterprises, cloud providers, and networks globally. In response to growing sustainability demands, Equinix has made significant investments in advanced cooling and sovereign cloud strategies. While Equinix traditionally serves enterprises and hyperscalers through shared colocation space, its aggressive expansion into high-density AI-ready capacity and global connectivity makes it an indirect competitor to Crusoe. As of October 2025, Equinix was trading at a market cap of $81 billion.

Vertiv: Vertiv is a global provider of critical digital infrastructure and modular data center solutions, serving edge, enterprise, and hyperscale markets. Its SmartMod and OneCore prefabricated data centers integrate power distribution, liquid cooling, and IT enclosures to support rapid deployment of high-density AI workloads. In 2025, Vertiv partnered with Polar for a modular AI-ready deployment in Norway, and signed deals with Chemours and DataVolt to advance scalable energy-integrated infrastructure. While Vertiv does not operate its own cloud platform, it competes directly with Crusoe’s in-house modular data center product. As of October 2025, Vertiv was trading at a market cap of $65 billion.

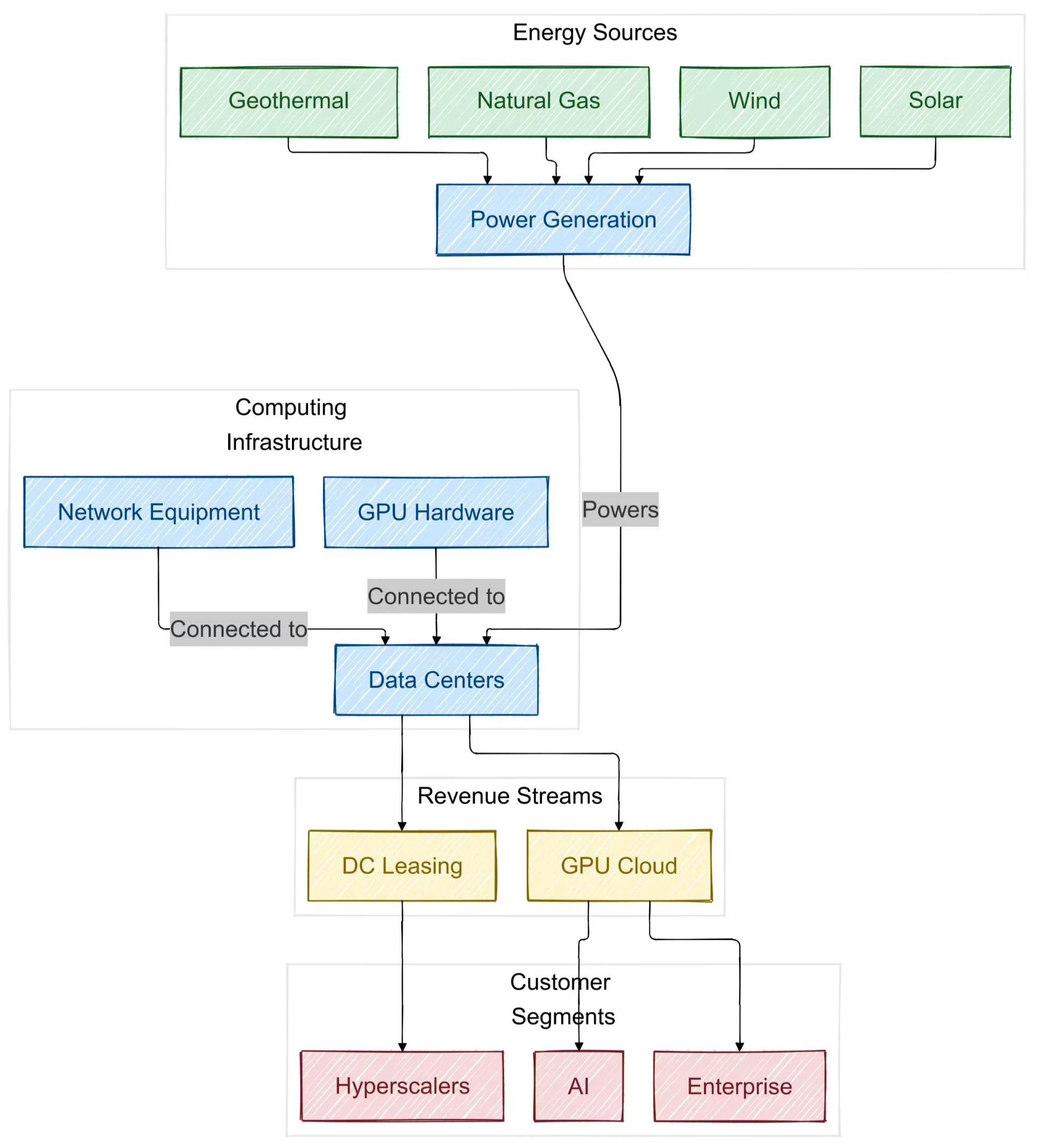

Business Model

Crusoe combines energy sources, networking equipment, and GPUs into its own data centers, which serve two types of customers: those renting compute through Crusoe Cloud, and those leasing physical capacity through hyperscale partnerships. This integration allows Crusoe to manage costs, improve deployment speed, and align with sustainability goals more directly than traditional providers.

Source: Crusoe Energy

Crusoe’s core revenue stream comes from Crusoe Cloud, offering on-demand and reserved compute access for AI training and inference. Customers pay rates of $2-3/hour for a variety of instances, from NVIDIA’s A100s and H100s to B200s and GB200s, as well as AMD’s MI300X chips. Crusoe offers discounted multi-month and multi-year reservation contracts, supported by a pricing calculator that adjusts based on GPU model, cluster size, and term length.

Source: Crusoe

Beyond its cloud platform, Crusoe earns revenue by building and leasing physical data center infrastructure to hyperscalers. These large-scale deployments typically involve custom sites built near clean energy sources or stranded energy assets. The flagship example is Stargate. Crusoe developed the facility and leased it to Oracle, who in turn leases compute to OpenAI. These infrastructure deals generate long-term contracted revenue while allowing Crusoe to scale its footprint.

Crusoe’s third business line is Crusoe Industries, its in-house manufacturing division formed through the 2022 acquisition of Easter-Owens. Crusoe Industries fabricates the electrical and physical components required for modular and hyperscale data centers, including switchgear, electrical enclosures, power distribution systems, and Crusoe’s proprietary modular units. By manufacturing in-house, Crusoe shortens build timelines, reduces supply chain bottlenecks, and earns margin on infrastructure it might otherwise outsource.

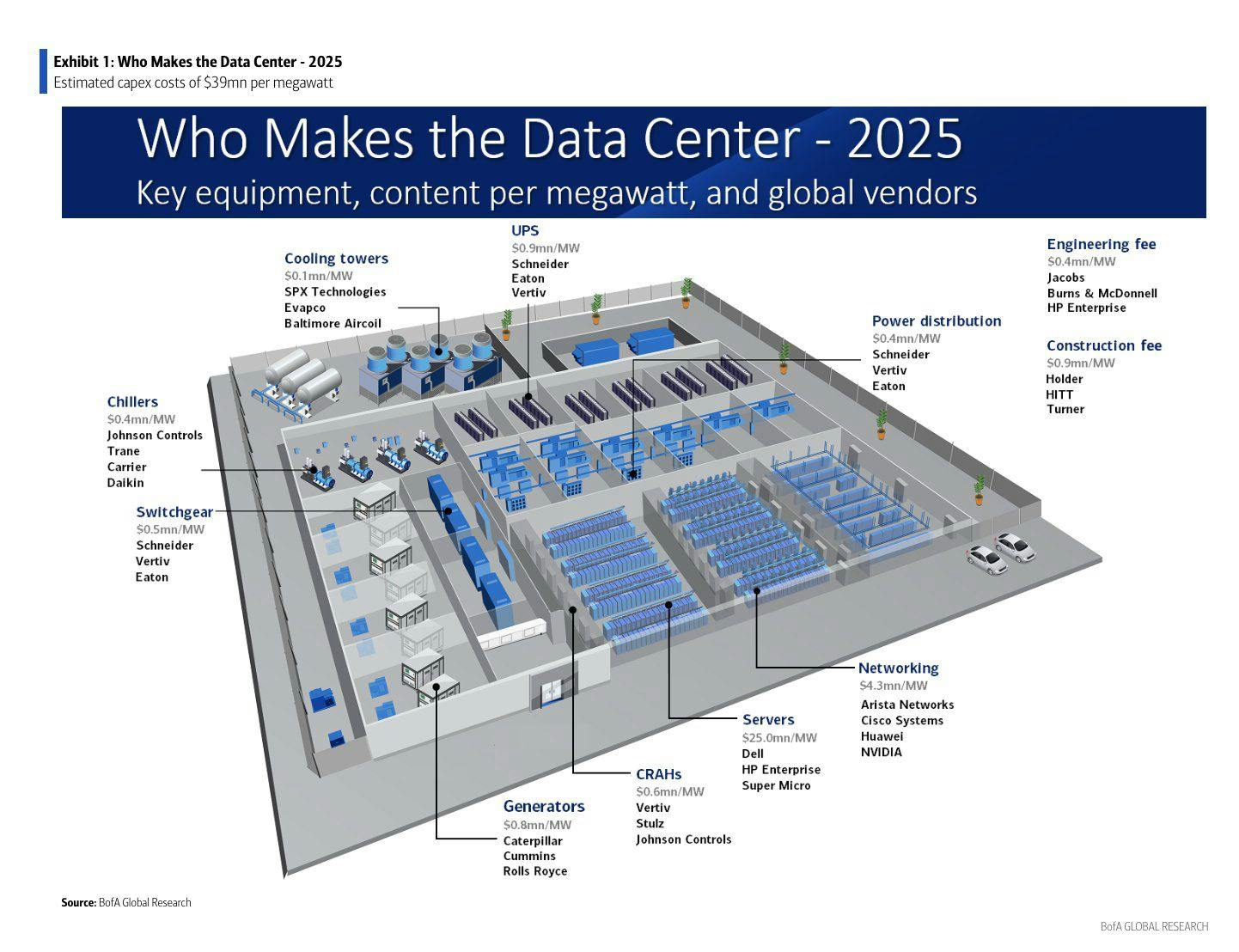

Source: Bank of America

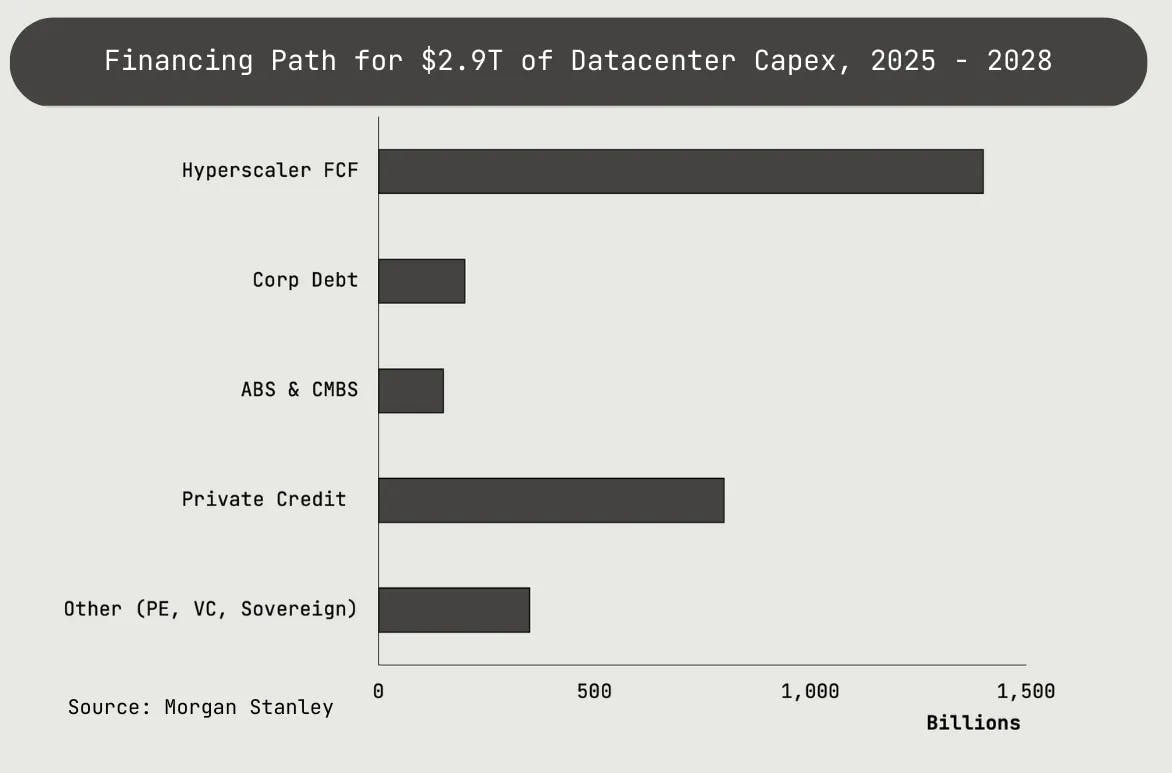

Building and operating data centers is highly capital-intensive, with capex requirements of roughly $10 million per 1MW of capacity, depending on density and redundancy. With the rise of AI workloads, many operators are now planning gigawatt-scale campuses, pushing project budgets into the billions.

Financing for this infrastructure typically comes from a mix of sources, including hyperscaler investments, private credit, corporate debt, and asset-backed securities. Increasingly, private investors such as private equity funds, sovereign wealth funds, and venture capital are also stepping in to fund compute infrastructure.

Source: Crucible Capital

Traction

Crusoe has evolved from its early days of gas flaring mitigation into one of the fastest scaling infrastructure providers in the AI era. Between 2018 and 2025, the company’s Digital Flare Mitigation systems have repurposed over 21 billion cubic feet of stranded natural gas, enough to generate 2.5TWh of electricity and avoid 2.7 million metric tons of CO2 emissions. In 2024 alone, Crusoe captured over 10bcf of gas, converting it into 1.3TWh of power.

In 2024, Crusoe broke ground on a 1.2 GW AI data center campus in Abilene, Texas, expected to become the world’s most powerful once fully built. The site combines closed-loop liquid cooling systems with a 350MW on-site natural gas plant to speed up energization, replace diesel backup, and lower lifetime emissions. The data center’s first phase went live in September 2025 and is expected to generate over $1 billion in local economic impact over 20 years. This data center will be leased to Oracle, which will rent the compute to OpenAI.

Additionally, Crusoe is expanding its footprint globally, with new facilities underway in Iceland, Norway, and Wyoming. As of October 2025, Crusoe employs over 1K full-time employees, with over 5K contractors on site at Abilene. Recent hires include Matt Field as Chief Real Estate Officer and the addition of former Google Cloud SVP Erwan Menard to lead Crusoe Cloud platform development.

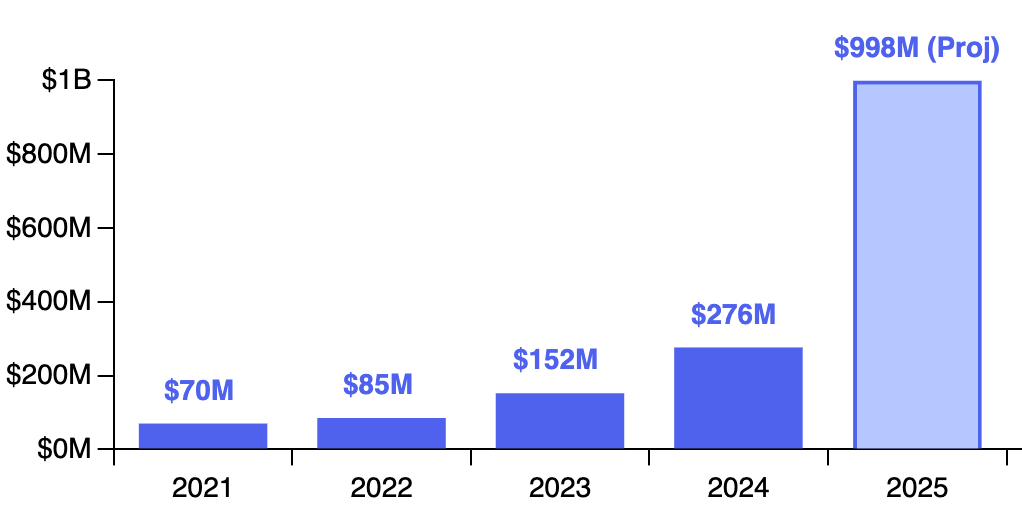

Source: Crusoe

The company forecasts $998 million in 2025 revenue, a 262% increase year-over-year, driven in part by its involvement in the $500 billion Stargate project, where Crusoe is co-developing the first hyperscale sites with an estimated $12 billion in capital spend through 2026. In August 2025, Crusoe acquired Israeli GPU orchestration startup Atero for $150 million, establishing an R&D hub in Tel Aviv.

Source: Sacra

Operationally, Crusoe maintains 24/7 support across four time zones, with a <6-minute average response time, 24-hour resolution time, and a 99.5% SLA guarantee. Its customer satisfaction score has remained at 100% as of October 2025. Crusoe’s vertically integrated infrastructure and energy access allow it to undercut traditional cloud pricing on H100s and other high-performance GPU SKUs, offering a meaningful cost advantage. Crusoe is an NVIDIA Preferred Partner and was named to the 2025 Forbes AI 50 and TIME100AI lists.

Source: Sacra

Valuation

As of October 2025, Crusoe had raised a total of $3.9 billion in debt and equity financing. In October 2025, the company raised $1.38 billion at a $10 billion valuation, led by Valor Equity Partners and Mubadala Capital, with participation from Nvidia, Altimeter Capital, BAM, Founders Fund, Fidelity and Salesforce.

Prior to this, the company raised a $600 million Series D round at a valuation of $2.8 billion in December 2024, led by Founders Fund. Notable credit facilities include a $750 million loan from Brookfield in June 2025, $225 million from Upper90 in March 2025 and $175 million from Victory Park Capital in August 2025.

Crusoe has also secured $11.6 billion towards its Stargate effort in Abilene Texas, with the funds managed by Blue Owl Capital, Crusoe’s construction partner, and Primary Digital Infrastructure. This loan was secured against the Abilene data center and Crusoe’s 15-year lease with Oracle. The company has also turned to asset-backed financing to cover CapEx requirements such as GPU procurement, as explained by CEO Chase Lochmiller:

“We’ve certainly done a lot of equity, but on the CapEx side, we’ve done a bunch of very interesting things around how to scale the business without just plowing equity dollars into CapEx. We essentially have four big pieces of CapEx: we have generators and electrical infrastructure supporting the power generation side, we have GPUs and associated networking equipment and servers, we have bitcoin mining hardware, and then we have data center infrastructure, the physical boxes or buildings that we build to house the actual equipment. Our belief is that the best way to structure financing is to have each of those individually with different asset-backed loan facilities, and then we use equity capital to continue to grow, invest in technology and hire the team.”

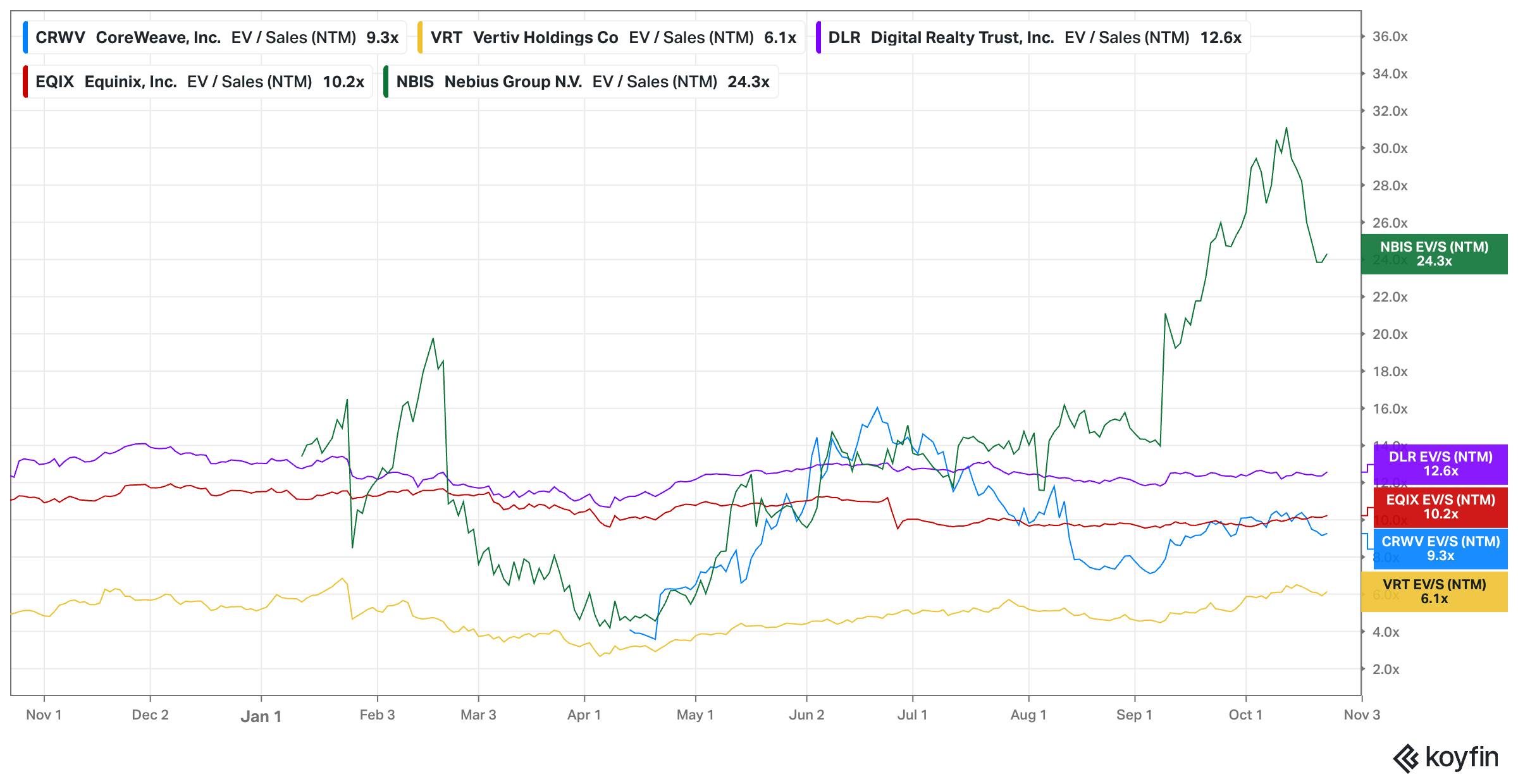

Crusoe projected $998 million in 2025 revenue, which implies a 10x EV/Sales multiple to its $10 billion valuation in October 2025. As a proxy, CoreWeave, Nebius, Vertiv, Digital Realty and Equinix are comparable companies that are publicly traded.

Source: Koyfin

CoreWeave (9.3x), Equinix (10.2x), and Digital Realty (12.6x) fall within a similar range to Crusoe, while Vertiv trades at a lower multiple (6.1x), and Nebius commands a premium at 24.3x. This highlights how Crusoe’s valuation sits near the midpoint of the broader neocloud and infrastructure peer set, suggesting its positioning as a hybrid between capital-intensive infrastructure players and fast-growing AI native platforms.

Key Opportunities

Capturing Cloud Share

As the GPU cloud market expands, Crusoe is well-positioned to capture meaningful share of what is projected to become a $180 billion neocloud and GPU-as-a-service market by 2030. With a lower cost base, competitive pricing, and infrastructure tailored specifically for AI workloads, Crusoe has an opportunity to serve a growing number of AI companies, enterprise teams, and hyperscalers seeking alternatives to traditional cloud providers. The shift from general-purpose cloud to specialized infrastructure is already underway, and Crusoe’s vertical integration and energy-first model provide structural advantages as that transition accelerates.

Data Center Buildout Frenzy

Demand for AI infrastructure is driving record level capital deployment into data centers. With over 45GW of projects in development and multiple hyperscale sites already underway, Crusoe is building at a pace that outstrips many traditional operators. Its ability to identify remote land, secure power, manufacture hardware in-house, and energize facilities quickly has become a core differentiator. In an environment where compute access is constrained by power, steel, and permitting, Crusoe’s speed and control over the stack represent a durable edge.

Pioneering Novel Energy Sources

Crusoe’s vertically integrated model opens the door to exploring energy technologies that most peers cannot support. Its Digital Renewable Optimization systems allow mobile data centers to operate entirely off-grid, co-locating with stranded or curtailed renewable energy in remote areas. Through partnerships like the one with Redwood Materials, using second-life EV batteries in modular microgrids, and exploratory work with startups in nuclear, battery storage, and carbon capture, Crusoe is creating new energy pathways to serve AI workloads sustainably. As power availability becomes the defining constraint on AI infrastructure, Crusoe’s willingness to fund and adopt novel energy sources may unlock long-term strategic upside. As COO Cully Cavness put it:

“When we're spending $15 billion dollars at a data center campus, there's a lot of opportunity to invest in SMRs (small modular reactors), to try to be the first to have a PPA with an SMR, to invest in innovative approaches to batteries and solar.”

Global Expansion

In 2024, Crusoe announced its data center expansion to Iceland, a country that has 13 data centers in use as of October 2025. Iceland is home to abundant geothermal and hydroelectric energy, providing a sustainable and cost-efficient solution for HPC needs. Thus, by building here, Crusoe is able to capture significant amounts of stranded natural gas at reduced cost while also establishing key footholds in an international market.

Iceland isn’t unique in this regard. Crusoe has stated goals to continue its expansion in Argentina and the Middle East. By pioneering outside of the traditional hubs for AI and technology, like California, Crusoe is able to create environments in which it does not face as much competition from established players like AWS, Azure, and Google. Furthermore, Crusoe is able to benefit from a first-mover advantage and create key partnerships with oil, gas, and AI companies in these emerging markets.

Key Risks

GPU Pricing Compression & Debt Exposure

Crusoe has built its business around high-performance GPUs, investing heavily in infrastructure during a period of elevated market prices. But GPU rental rates have dropped sharply, from $8/hour to $2/hour in some cases, as supply constraints have eased and new providers have entered the market. If rates continue to fall after existing customer contracts expire, Crusoe’s unit economics could compress significantly.

This risk is magnified by Crusoe’s growing debt burden. Interest expense is projected to reach nearly $300 million annually by the end of 2025. Servicing that debt depends on high utilization and healthy margins. Any sustained dip in GPU pricing or customer demand could put pressure on Crusoe’s ability to meet those obligations.

AI Bubble Speculations

Crusoe’s growth is deeply tied to the current AI infrastructure boom, but questions are emerging about how sustainable that boom really is. Industry leaders have sounded the alarm: Sam Altman warned of speculative excess in August 2025, and Mark Zuckerberg expressed similar concerns in September. These statements have added weight to the idea that AI investment may be outpacing real-world adoption.

Macroeconomic data reinforces the concern. According to Harvard economist Jason Furman, US GDP growth in the first half of 2025 was just 0.1% excluding data center construction, suggesting that AI infrastructure is carrying a disproportionate share of economic momentum. If AI workloads and commercial value don’t materialize at expected scale, the market could face a sharp correction. That would directly affect Crusoe’s core business: GPU leasing, hyperscale deals, and large-scale buildouts. A downturn could reduce demand, compress margins, and constrain access to capital just as Crusoe ramps up its infrastructure spend.

Competition

Crusoe operates in a highly competitive market with established players like AWS, Azure, and Google Cloud. These companies have massive resources and are investing heavily in sustainability initiatives, which could challenge Crusoe's market position. Furthermore, switching costs for cloud computing services are high. There are major migration costs for businesses and enterprises to shift from one cloud computing service to another, so those customers already secured by the industry behemoths may be inaccessible to Crusoe as customers.

Additionally, given that this market requires meaningful capital expenditures, and building data centers is an incredibly expensive undertaking, it follows that Crusoe is less well-positioned to expand as rapidly as larger companies with more cash, such as Google, Amazon, and Microsoft. Furthermore, these competitors also have outsized influence on the strategic direction of policy and legislative decisions made regarding AI.

Summary

Crusoe is a vertically integrated AI infrastructure company founded in 2018 to convert stranded energy into useful compute. Originally focused on reducing methane emissions from oilfield gas flaring through its patented Digital Flare Mitigation (DFM) technology, Crusoe pivoted into high-performance computing as demand for AI workloads surged. The company has since built a full-stack platform that includes custom-designed data centers, an energy-first deployment model, and Crusoe Cloud. Crusoe operates across the US and internationally, and is the lead developer of the Abilene, Texas site for Stargate, a $500 billion initiative led by OpenAI, Oracle and Softbank.

Crusoe’s business spans three revenue lines: cloud-based GPU rentals, hyperscale infrastructure leasing, and hardware manufacturing via its Crusoe Industries division. With over 45GW of projects in development and modular products like Crusoe Spark enabling off-grid deployments, the company is well-positioned to meet growing global demand for compute while promoting cleaner energy adoption. As it scales, Crusoe aims to turn its speed, vertical integration, and energy advantage into long-term defensibility.