Thesis

In the 2021 “Report Card for America's Infrastructure”, an evaluation of infrastructure every four years conducted by the American Society of Civil Engineers (ASCE), the US received a 'C-' grade. This report also found that the US was investing only half of what would be needed to sustain the economic infrastructure of the United States. The same report assessed 17 categories of infrastructure, with grades ranging from ‘B’ (Rail) to ‘D-’ (Transit). For the first time in two decades, the country's overall infrastructure was graded 'C-', indicating that the nation's infrastructure is in mediocre condition and requires attention.

Modern infrastructure inspections mostly involve human visual checks. Traditionally, humans dangle from harnesses or crawl around dangerous areas to inspect infrastructure. There are two deaths per week involving the inspection of confined spaces in the United States. These dangerous manual inspections are also unreliable due to the difficulty in accurately measuring the size and quantity of defects across large areas, which leads to mounting costs. Instead, robots or drones used for inspection can be a better alternative to manual investigations, especially in hazardous settings, due to their accuracy, safety, and endurance. As a result, the global inspection robot market is expected to reach $4.2 billion by 2028.

Gecko Robotics builds wall-climbing robots and enterprise software to protect the physical infrastructure that underpins the economy. Its combination of robotics and software aims to improve the ability to inspect, protect, and efficiently maintain critical infrastructure. Its software processes the data the robots capture and enables human experts to contextualize that data and translate it into action and insights. Using robots, Gecko Robotics performs inspections 10 times faster than traditional methods and collects 1K times more data, providing accurate measurements on the state of key assets while eliminating the risk of fatality or injury for human inspectors.

Founding Story

Gecko Robotics was founded in 2013 by two college friends, Jake Loosararian (CEO) and Troy Demmer (CPO). At Grove City College, Loosararian pursued his bachelor's degree in electrical engineering, and Demmer studied finance and economics.

After visiting a nuclear power plant in college, Loosararian realized the need for technology that provides critical infrastructure information to prevent failures and shutdowns. He learned that such failures happen frequently in industries other than power plants, like refineries and airlines. Loosararian realized that the main issue with the frequent failure of a relatively new power plant was the structural integrity of its boilers. To inspect the interior of the boilers, the plant manager had to shut down the plant and send in human inspectors. These inspectors had to write on notepads while dangling from ropes in the air, posing a great risk to their safety and leading to lengthy, costly shutdowns. Each hour of downtime costs the plant over $1 million.

In college, he built a robot that prevented a few outages at the plant he had visited, saving between $10 million and $20 million. He figured out that other power plants could benefit from this and started the company that would ultimately become Gecko Robotics. He invested his savings into creating the robot, which, by 2015, had left him bankrupt. Then came an acquisition offer, but he decided to turn it down and join YC in the winter 2016 batch. He recruited Demmer as Chief Product Officer to start building Gecko Robotics together.

Product

Robots

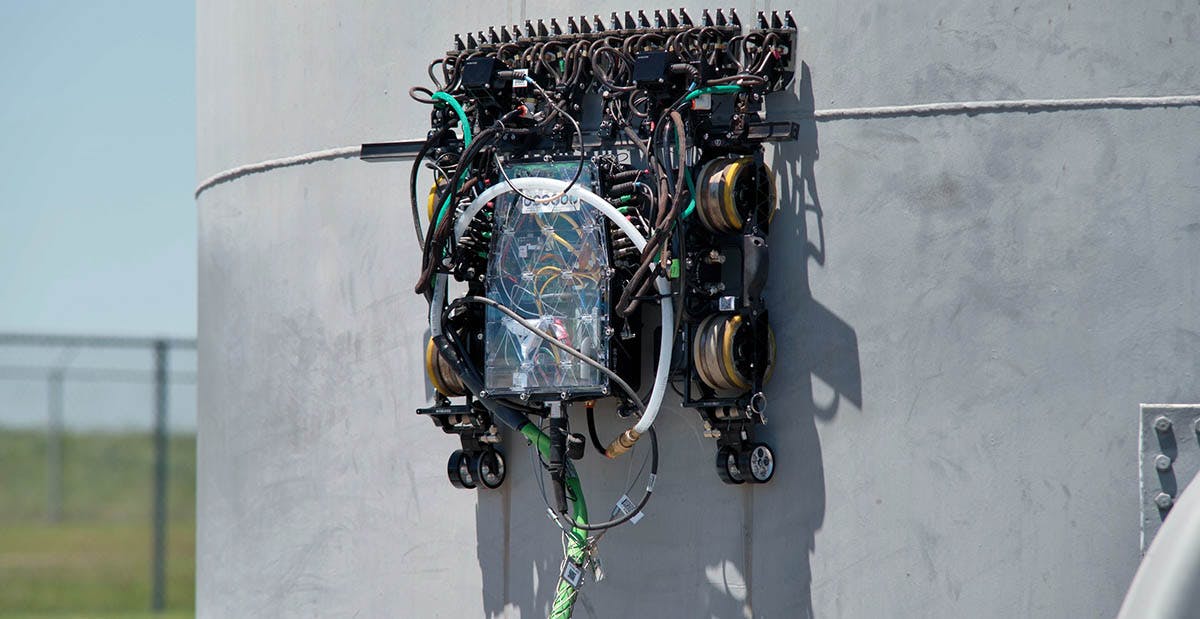

Gecko Robotics offers four types of wall-climbing robots, each equipped with sensors to collect 1K times more data at 10 times the rate of previous inspection methods for tanks, boilers, scrubbers, piping, and more.

TOKA 3: A wall-climbing robot specialized in medium-sized piping and high-temperature areas, equipped with eight sensors and one 720p camera. The TOKA 3 gathers more than 39 samples per meter at a speed of 18 meters per minute.

TOKA 4: Gecko Robotics's most popular robot, designed for boiler walls and curved surfaces, the TOKA 4 includes 24-32 sensors and a higher-quality 1080p camera. With a speed of nine meters per minute, TOKA 4 provides more precise samples more quickly than TOKA 3.

TOKA 4 GZ: Created for flat surfaces like tank floors, this robot has 96 sensors and two 1080p cameras, taking even more precise samples than TOKA 4 at the same speed of nine meters per minute.

TOKA Flex: With 12-18 sensors, the TOKA Flex is designed for small-diameter piping and features two 1080p cameras with the same precision as TOKA 3. It's designed to bend and be flexible, inspecting places previously difficult to reach.

Source: Robotics 24/7

Inspection Services

Gecko Robotics also provides clients with traditional non-destructive testing (NDT), assisted by the power of its wall-climbing ultrasonic robots. The company has a team of inspectors who execute the inspection plan according to the client's requirements on-site and deliver a final report within approximately 48 hours after leaving the site.

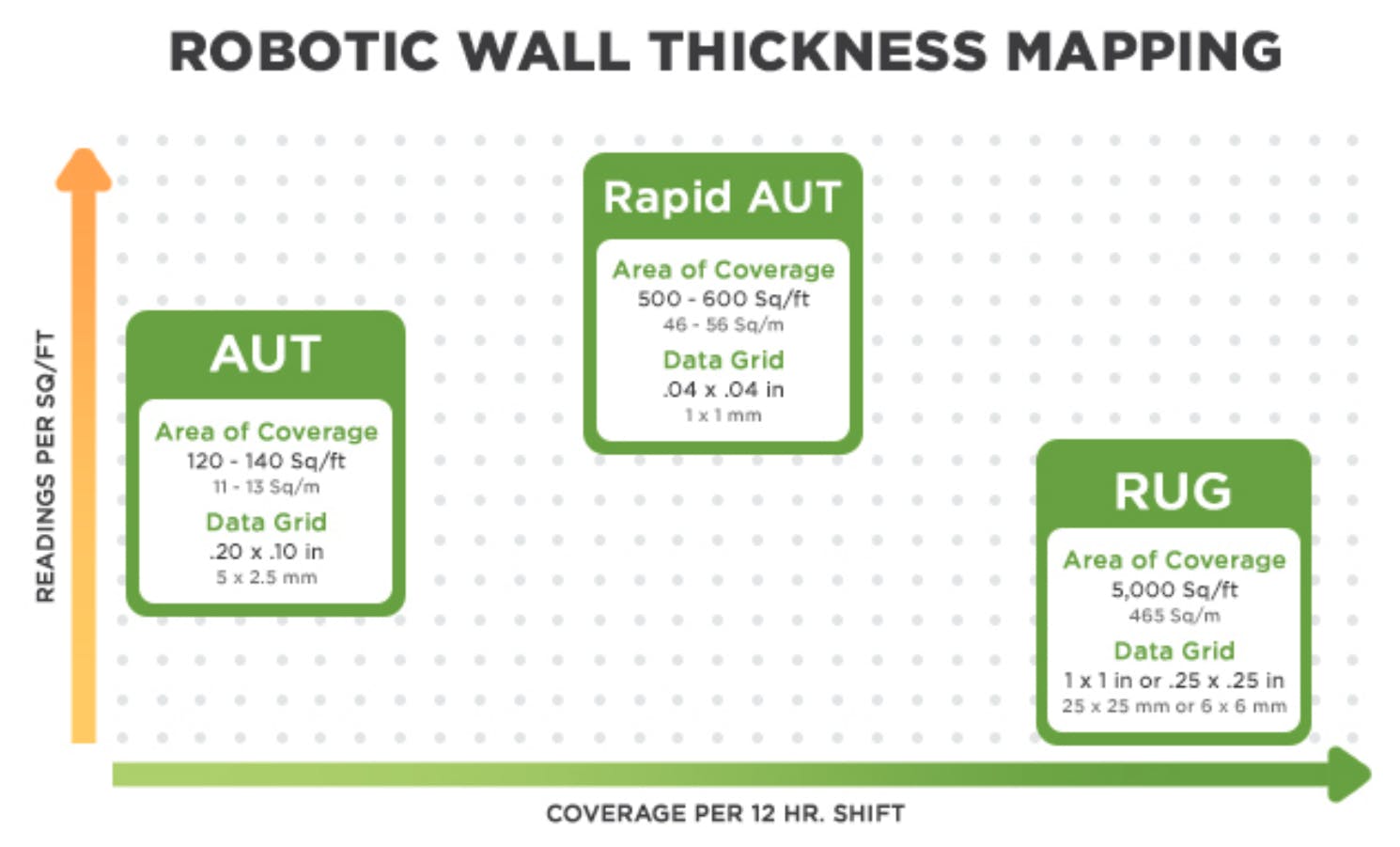

Rapid Ultrasonic Gridding: Ultrasonic inspection provides clients with a grid map of the inspected wall's thickness to identify areas where corrosion or damage has caused wall thinning. Traditionally, this process would be done with a handheld device, while Gecko Robotics can cover an entire asset in one shift.

Rapid Automated Ultrasonic Testing: Automated ultrasonic testing helps clients understand damaged areas of assets. Traditionally, this process would take days, but Gecko Robotics developed rapid automated ultrasonic testing to make this process five times faster. It covers up to 600 square feet in a single 12-hour shift with millimeter resolution.

Tri-Lateral Phased Array: Gecko Robotics also provides on-stream inspection of fixed equipment to identify damages caused by chemicals or stress in carbon and low alloy steel.

Phased Array Ultrasonic Testing: Inspection of areas such as weld seams and heat-affected zones, which are in constant danger of cracking or suffering damage. This service is provided manually and through robots to ensure inspectors identify existing damage.

Source: Gecko Robotics

Gecko Portal

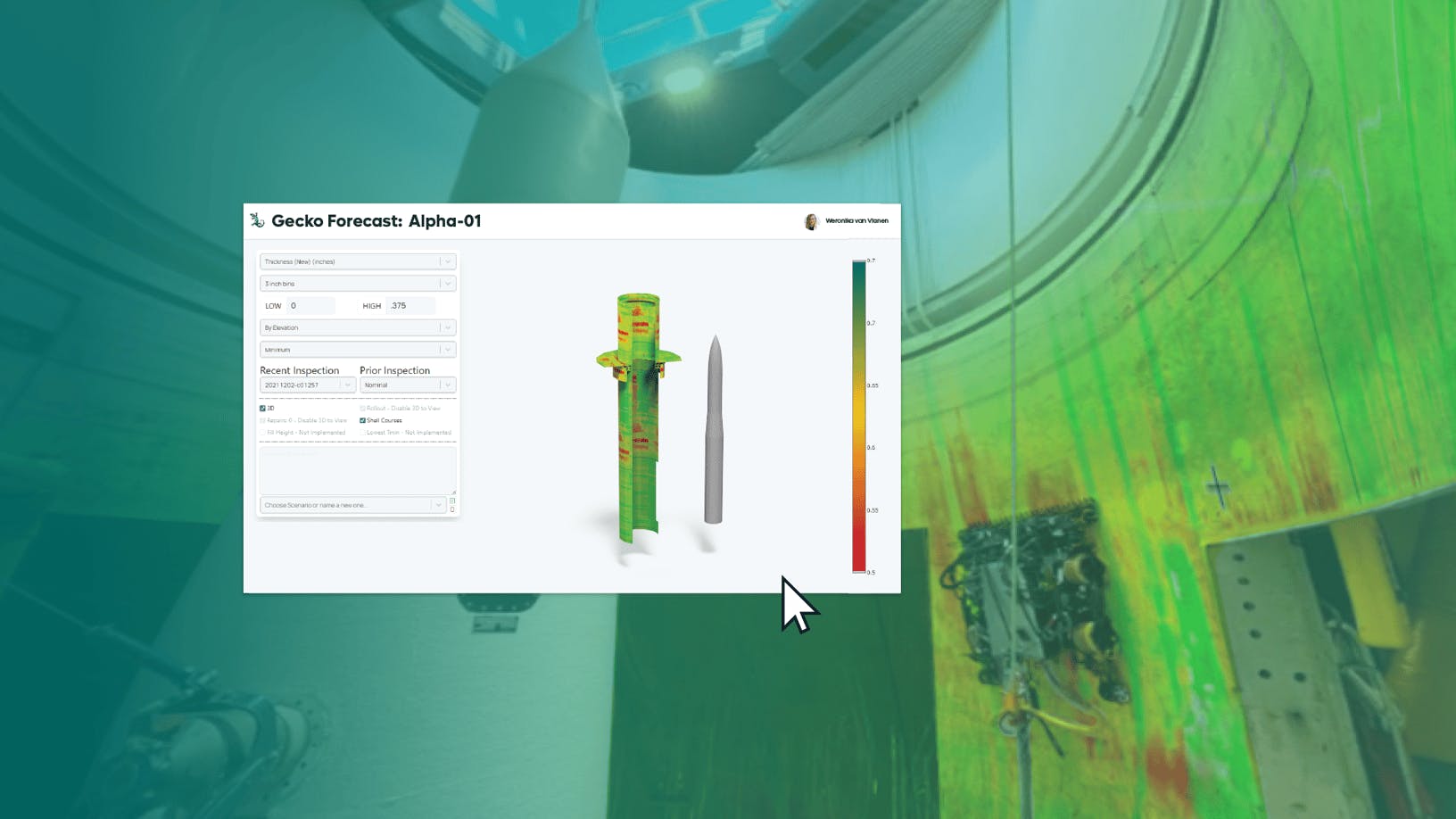

Clients can manage and observe all their asset data through the Gecko Portal. On the Gecko Portal, clients can access a 3D render of the asset through Gecko Vision 3D, gain insights on key metrics like wall thickness, apply filters, create thickness maps to identify which areas need maintenance and make annotations on relevant data points of the asset. Within 24 hours of the inspections, clients can log in to the Gecko Portal and explore an interactive map of its asset, filled with heat maps and precise measurements.

Source: Gecko Robotics

Market

Customer

Gecko Robotics services industrial sectors such as power, oil & gas, pulp & paper, and the defense industry. The power sector uses Gecko Robotics's services to inspect boilers, silos, scrubbers, and tanks. Corrosion in the walls of these assets can lead to failure if the inspection is not done correctly. The oil & gas sector utilizes Gecko Robotics's services to help prevent the malfunctioning of piping, pressure vessels, and tanks, potentially preventing environmental disasters such as petroleum leaks. In the pulp & paper sector, frequent inspection is essential for the paper-making process due to the intense use of chemicals and high temperatures. Another significant customer of Gecko Robotics is the US Department of Defense, which uses its inspection services to modernize the intercontinental ballistic missile leg of the US nuclear triad.

Market Size

The global market for inspection robots is expected to grow at a CAGR of 30.9% from 2021 to 2030, reaching $13.9 billion in 2030. Global corporate spending on industrial asset management software will reach $11 billion by 2026.

Oil and gas companies spend only $37 billion on inspection services in North America. An average US refinery spends around $9 million on maintenance annually. There were over 11K power plants and 130 oil refineries in the US alone as of January 2022.

Competition

The market for inspection services is growing, with various companies providing different inspection methods and technologies. Gecko Robotics's focus on ultrasonic testing and wall-climbing robots sets it apart in the market, but it does have notable competitors in the space.

Invert Robotics: Founded in 2011 in the Netherlands, Invert Robotics offers inspection solutions using ultrasonic robots, laser mapping, and visual inspection techniques to help clients protect their assets from imperfections. The company has raised $15.9 million in funding and has clients in the food production, pharmaceutical, oil and gas, and aerospace industries. Invert Robotics sets itself apart by offering a complete suite of services, including repairing assets and making them ready to resume operations within 24 hours. This approach reduces asset downtime by handling all tasks at once. Additionally, Invert Robotics develops detailed inspection reports within 3 days. Reports include data and mapping on the inspected asset and insights delivered through the customer portal.

Eddyfi: Founded in 2009, Eddyfi provides non-destructive testing inspection services, generating $10-50 million in revenue. Inuktun, a subsidiary of Eddyfi, competes with Gecko Robotics by building inspection robots and scanners. Most Inuktun products are dedicated to piping inspection, but the company also provides magnetic wall climbers for examining steel structures. Inuktun robots provide only a visual inspection and laser measurement, lacking Gecko Robotics’s rapid ultrasonic gridding technology. This technological gap could limit Inuktun's competitiveness in the inspection robotics market compared to Gecko Robotics.

Easy-Sight: A publicly-traded, Wuhan-based company founded in 2000, Easy-Sight provides companies with inspection, cleaning, and rehabilitation services for pipes. Easy-Sight's business model differs from Gecko Robotics in that it sells individual robots instead of offering robots as a service. However, due to its focus on piping inspection services, Easy-Sight competes with Gecko Robotics over a limited surface area and is playing for a smaller total addressable market as of 2023. In 2019, Easy-Sight sold more than 800 inspection robots.

Droneify: Droneify is a Canadian startup founded in 2015 that provides asset inspection services to companies such as GM, Shell, Samsung, and Deloitte. The key differentiator of Droneify is that it uses drones and unmanned helicopters that fly around clients' assets, gathering data through various sensors to assess the assets' health. Droneify's approach allows them to serve the telecom market by inspecting phone service towers and wind turbines, two sectors that fall outside of Gecko Robotics’s focus. Droneify has over $200 billion in inspected assets in more than 35 countries, and raised $250K in venture funding.

Business Model

Traditionally, robotics companies serving industrial and defense institutions would lease or sell robots, leading to higher acquisition costs and disincentivizing the use of robots. Additionally, the traditional model would abandon clients to their own use of the product after closing the sale, leaving them with difficult-to-use technology and specialized maintenance requirements. Contrasting with this, Gecko Robotics has positioned itself as a service provider rather than an equipment manufacturer, owning the entire customer experience through the Gecko Portal.

The company generates revenue by offering inspection services, with costs ranging from $50K and $100K per robot deployed. This robots-as-a-service is a relatively asset-light business model which is advantageous for clients and benefits Gecko Robotics's economics. The company can easily rotate the same asset among different clients, saving on production costs and moving into profitability much faster.

Traction

Gecko Robotics has signed contracts with energy and manufacturing leaders including BP, Dow, Marathon, Duke Energy, and International Paper. The company has also been awarded more than $1.6 million in government contracts with the US Department of Defense (DoD), the US Department of Interior, and the US Department of Veterans Affairs. In November 2022, the company announced a $1.5 million contract with the Air Force to conduct the inspection and digital analysis for the Air Force Nuclear Weapons Center. In October 2022, it announced a partnership with Siemens Energy’s European Field Service organization to deploy its robots for inspection and maintenance on critical infrastructure throughout Europe.

Valuation

In March 2022, the company announced a Series C round of $73 million at a $533 million post-money valuation, bringing its total funding raised to $122 million. Its Series C was led by XN, a New York-based hedge fund, and had the participation of venture funds like Founders Fund, XYZ, Drive Capital, and Snowpoint Ventures. The round also included participation from Mark Cuban, Joe Lonsdale, and Gokul Rajaram.

Key Opportunities

New Asset Types

In the US, 1 in 5 miles of road and 45K bridges are in poor condition. With the passing of the infrastructure bill by the US Congress, the country will invest $110 billion in renovating transportation infrastructure. This investment also includes repairing railroads, creating an opportunity for Gecko Robotics to expand into inspection services for new asset classes such as highways, roads, bridges, and railroads. There are also opportunities for Gecko Robotics to expand into underwater inspection services for assets such as pipelines, wind farms, and offshore oil rigs. The global offshore inspection, repair, and maintenance market is projected to reach $18 billion by 2028, representing a growth opportunity for the company's total addressable market.

Robot Lineup Expansion

To compete and grow in the inspection robotics market, Gecko Robotics has to continue innovating and expanding its robot lineup to stay ahead of the competition and address as many clients' needs as possible. Offering drones or underwater robots could enable the company to meet different client requirements and even expand into new types of assets. By diversifying its product offerings and targeting various industry sectors, Gecko Robotics can establish itself as a complete solution provider for inspection and maintenance services.

Advancements in Machine Learning

Gecko Robotics could benefit from incorporating machine learning to improve the Gecko Portal, allowing for more efficient and accurate inspection robots that beat competitors and capture market share. By integrating machine learning, the Gecko Portal could also provide insights and suggest improvements to clients, and the company could offer predictive and preventive maintenance solutions, helping clients reduce downtime, minimize costs, and extend the lifespan of their assets.

Business Model Flexibility

Gecko Robotics can offer training and certification programs for companies that buy or lease their inspection robots to scale faster and reach more clients around the globe. By providing these programs, Gecko Robotics can maintain control over the customer experience while allowing clients to operate the robots in different parts of the world. Additionally, it can continue to sell access to the Gecko Portal through a monthly subscription, ensuring a consistent revenue stream. This approach would allow Gecko Robotics to expand its global reach and outsource skilled and certified operators, ensuring the highest quality inspection services across various industries and regions.

Key Risks

Liability Risks

As a company responsible for inspecting critical assets, any failure in Gecko Robotics's software or hardware could have significant consequences for its clients and its public reputation. Pausing a plant or asset due to a bad inspection report could result in monetary losses for the client and even cause public harm if something were to fail. In the event of an erroneous inspection due to software or hardware issues, Gecko Robotics could potentially lose clients and face legal action that could harm the company. This risk comes with its business model of providing services directly rather than selling the robots to companies, meaning that the responsibility for any inspection errors would fall partially on Gecko Robotics, increasing its exposure to potential risks and liabilities.

Cost-Limited Scalability

One notable risk for Gecko Robotics is whether it will be able to scale and achieve market expansion. The company faces limitations in its ability to create innovative new robots, which is a capital-intensive endeavor requiring investment in research and development as well as production. This constraint could hurt the company's growth by forcing them to maintain a limited robot lineup, catering only to specific and niche applications.

Business Model Limitations

In terms of global expansion, Gecko Robotics's business model presents challenges. The company offers its services through in-house certified inspectors and robot operators rather than selling robots for clients to manage independently. This approach may make international growth more difficult, as it relies on finding and deploying skilled and certified personnel on the ground to manage inspections.

Summary

Advancements in technology have significantly transformed consumer products, but the real-life infrastructure that provides critical resources for the economy has been left to corrode and deteriorate over time. With the US scoring a "C-" across all infrastructure categories, there is a need for tech-enabled solutions to address key infrastructure and ensure the uninterrupted supply of essential resources. Gecko Robotics provides a part of this solution by lowering costs and automating inspection services through ultrasonic wall-climbing robots and data analytics tools that minimize downtime. The company has secured deals with multiple companies and has landed a $1.5 million contract with the US Department of Defense. However, there is still plenty of room for growth in the inspection robotics market, and Gecko Robotics must continue to innovate.