Thesis

Warehouses are the physical backbone of the global supply chain. Due to the growth of ecommerce and increasing pressure from Amazon, Walmart, and other retail giants striving to meet rising consumer expectations, warehouses are facing rapid change. There are over 100K warehouses globally which help fulfill 20 billion square feet of demand, but 95% of warehouse space is currently not automated. Warehouses and third-party logistic providers store, pack, and ship items that consumers order online. As ecommerce accelerates, so does the demand for its underlying infrastructure. However, traditional warehousing must be revamped and automated to meet that demand.

Most distribution centers still rely on manual processes and workers walking around to locate items that must be shipped. The average turnover rate across all industries in one year is 3.6%, but the average turnover rate for warehouse workers is 37%. This makes the constant recruiting and training of warehouse workers more and more unfeasible. Because Amazon Prime can deliver packages in less than an hour in some cities, customer expectations have risen dramatically. Fulfillment centers won't be able to process and ship packages fast enough without automation to meet customer expectations. Most warehouses generally do not have enough capital to make a multi-million dollar investment upfront or do not want to spend up to a year setting up an automation system to find out it does not work. The global warehouse automation market was valued at $13.6 billion in 2021 and is projected to reach $57.6 billion by 2031.

Locus Robotics is a flexible robotic warehouse automation company that provides autonomous mobile robots that work directly with warehouse associates by assisting in locating, identifying, and picking items during the fulfillment process, reducing the time each task requires. It provides a lower-cost alternative to large-scale industrial conveyors and retrieval systems and can be deployed in a matter of days without requiring changes to the existing warehouse footprint. Locus Robotics helps retailers, 3PLs, and specialty warehouses efficiently meet and exceed the increasingly complex and demanding requirements of fulfillment environments.

Founding Story

Bruce Welty (ex-CEO & Chairman) and Mike Johnson (President/COO) founded Locus Robotics in 2014. Rick Faulk is currently the CEO of Locus Robotics. Welty and Johnson founded a company that sold warehouse management systems (WMS) called AllPoints Systems in 1987. They sold the company in 2001, when the company had made about $10 million in revenue. Welty became an executive-in-residence at Great Hill Partners in the early 2000s. Following this, Welty purchased a WMS company which became the platform upon which he cofounded a different business called Quiet Logistics, a third-party logistics company focused on picking ecommerce orders with robotic technology, along with Johnson. By 2012 Quiet Logistics had revenues of $37 million, was profitable, and did not need any more investment.

In 2012, Amazon bought Kiva Systems, securing for itself a large portion of the large-scale robotic logistics market. Quiet Logistics used Kiva robots to support centralized warehouse operations for various clients. Once Quiet Logistics’ contract with Kiva ran out, they needed to find some new robots. That was the genesis of Locus Robotics: the founders recognized a need for a company that makes its own autonomous mobile robots. Locus Robotics was spun off from Quiet Logistics in 2016 and became its own company. Quiet Logistics was able to buy Locus Robotics robots and continue operating as a fulfillment service provider that relies on robots. Quiet Logistics was sold in late 2018 to a new ownership group and then sold again by that ownership group in late 2021 to American Eagle Outfitters for $350 million.

Product

Locus Robotics has a fleet of robots that works alongside warehouse workers, helping to quickly locate the right items for improved throughput. With Locus Robotics, workers spend more time on task and less time walking around the warehouse. Since robots transport the items, workers don’t have to push carts or carry bins, allowing them to become more productive and less fatigued. That translates to lower labor costs and higher employee morale.

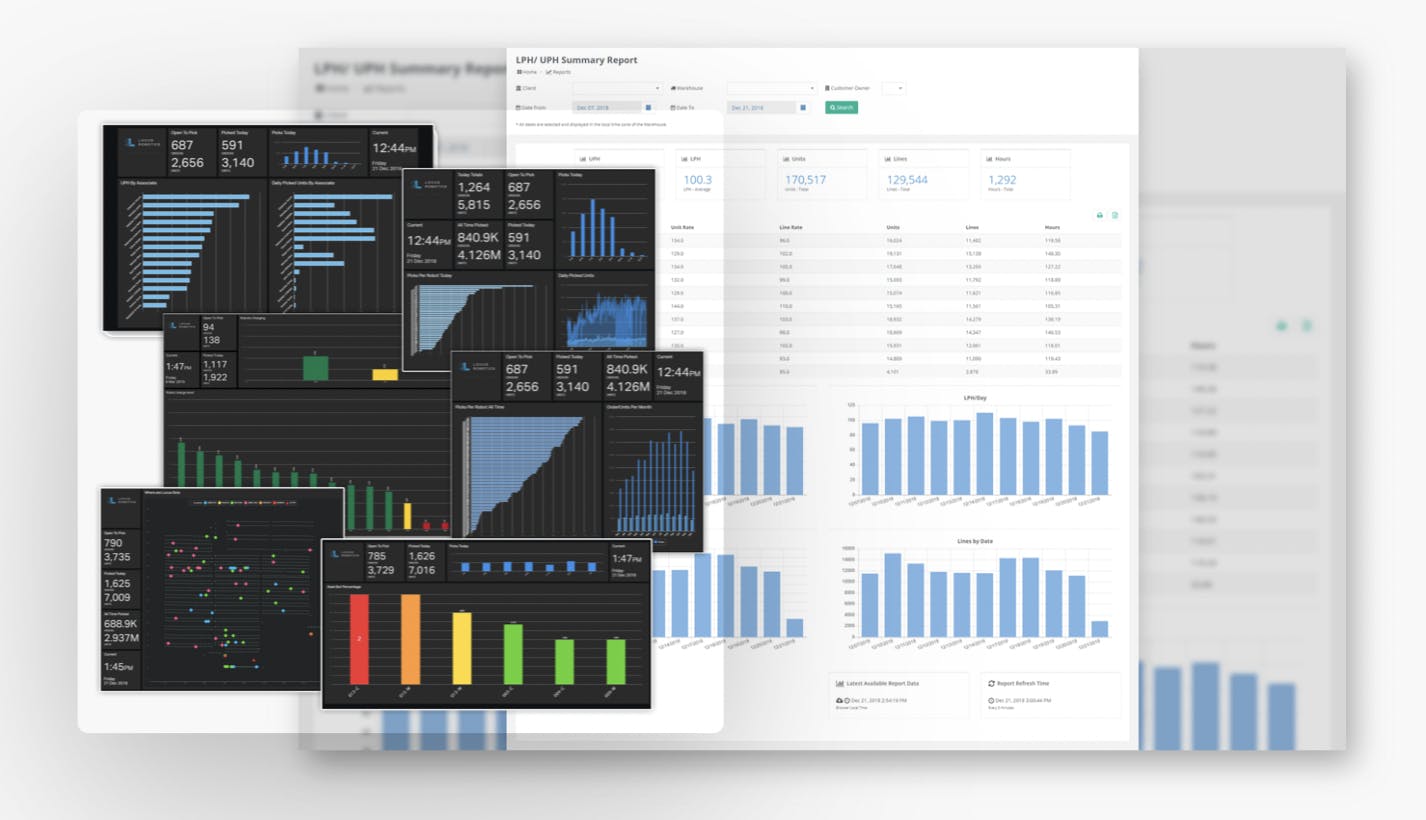

Locus Robotics scales as warehouse operations grow and lets customers manage peak periods and volume increases without major capital expenditures or infrastructure changes. The robots deploy within a warehouse’s existing infrastructure without disrupting operations. Since it is able to fully integrate with warehouse management systems, Locus Robotics can receive orders, optimize them for picking, and then transmit back confirmations. The warehouse management team gets real-time operational performance data such as robot productivity and status, worker productivity, etc. The Locus Management Portal helps the warehouse management team manage day-to-day operations in real time through reports and graphics showing the operation details. Customers can see hourly, daily, and monthly performance metrics, individual worker performance, inventory flow, slotting optimization, workflows, and more.

Source: Locus Robotics

Locus Robotics offers three types of robots: Locus Origin, Locus Vector, and Locus Max.

Locus Origin

Source: Locus Origin

Locus Origin is Locus Robotics’ flagship product. It s the autonomous mobile robot (AMR) that’s designed for collaborative, high-volume order fulfillment. These robots are meant to handle many containers like tote arrays, bulk bins, and shipping boxes so that warehouses can utilize the Locus Origin fleet for multiple product types. It supports dynamic task-interleaving, letting workers complete pick and putaway or replenishment tasks with the same labor force.

Source: Locus Robotics

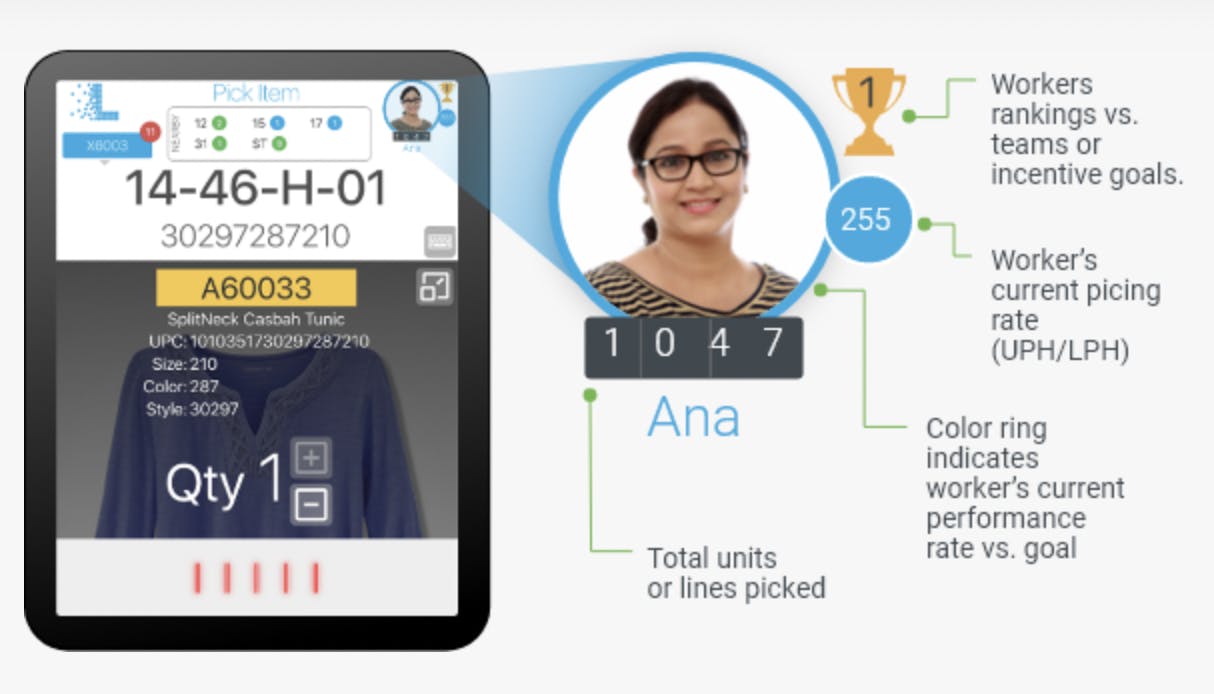

With the Locus Origin tablet, pickers will be visually guided to the next item they should pick in a particular area with the specific bar code they should be scanning and an idea of the product. The tablet also switches display languages to match the picker’s preference.

Locus Vector

Source: Locus Robotics

Locus Vector is a flexible, autonomous mobile robot (AMR) designed for high-productivity material handling and logistics applications. Built with an industrial strength chassis, omnidirectional mobility, and compact design, Locus Vector can be deployed in various environments, tackling material handling tasks. In addition to handling up to 600 pounds, it is optimized for moving racks, shelves, and material handling. Its top is configured to integrate with conveyors, sortation, and other mechanized automation workflows for different use cases. Locus Vector’s 3D LiDAR 90-meter range adds an additional layer of safety and navigation accuracy for demanding warehouse environments.

Locus Max

Source: Locus Robotics

Locus Max is a heavyweight, autonomous mobile robot (AMR) designed to transport large and heavy payloads throughout the facility safely. It has a carrying capacity of 3K lbs.

Market

Customer

Locus Robotics was founded to replace Kiva Robotics, a key Quiet Logistics' 3PL offering. As such, Locus Robotics' first customer was Quiet Logistics, which utilized the robots to improve warehouse operations for its 3PL customers. As it expanded, it began providing autonomous mobile robots to all types of fulfillment warehouses and distribution centers. These included third-party logistics providers, e-commerce retailers, medical device company distribution centers, automotive/electrical parts distribution centers, and other businesses managing large inventories and processing high order volumes.

Locus Robotics has an advantage in selling to larger Warehouse Management Systems (WMS) that often run fulfillment warehouses and distribution centers. WMS usually takes a while to implement, costing millions in capital expenditures upfront. Locus Robotics offers its robots as a service under a subscription model, meaning its customers can access its robots without making a large upfront capital investment. This can make it easier for businesses to adopt and integrate technology into their operations. They can start with just a few robots at one site and then scale up gradually as needed. It also keeps its customer acquisition cost low. Some of Locus Robotics' customers include companies like Material Bank, DHL, GEODIS, CEVA Logistics, and Radial.

Market Size

The global warehouse robotics market is projected to grow at a 9-year CAGR of 8.9%, from $12.2 billion in 2022 to over $27.9 billion in 2031. Growth in this market will be mainly driven by the rise of e-commerce fulfillment centers, the declining availability and retention of human workers, and the declining price of robots relative to human labor. The global ecommerce fulfillment services market is anticipated to reach $168.7 billion by 2028, growing at a CAGR of 10% from 2021 to 2028. This increased need for fulfillment means more warehouse space is needed to collect and ship these packages. According to Locus Robotics CEO Rick Faulk, this will cause an additional 3 billion square feet of warehouses to be built (on top of the 20 billion square feet already in existence), which will, in part, need to be automated.

While retention of warehouse workers has become more difficult, over the past 30 years the average robot price has fallen by 50%; it has fallen even further when measured relative to labor costs. As this trend continues, it will become more and more of a financial necessity to use robots instead of human labor.

Competition

Most companies with a Robotics as a Service (RaaS) service model converge on the same AMR products, differentiating on how much weight they can carry, their battery lives, customer support, and their offerings beyond the AMRs.

Geek+:Geek+ is a Chinese flexible AMR company with the largest global autonomous mobile robots market share. It introduced its U.S. Robotics as Service operations in February 2020 competing with Locus Robotics’ entire fleet. The Geek+ robots are used for sorting and collaborative picking, moving bins or inventory storage to the picking station for manual picking. The company offers robots in different sizes and shapes, depending on need. Geek+ was founded in 2015. It has raised $539.4 million in funding over nine rounds. Its latest funding round was a $100 million Series E led by Vertex Growth Fund.

6 River Systems: 6 River creates flexible, autonomous mobile warehouse robots. It was founded in 2015 by former Kiva Systems and Mimio executives and is based in Boston. It has raised $46 million in funding. Its latest funding round was a $25 million Series B led by Menlo Ventures. Its flagship product, Chuck, is a direct competitor to Locus Origin, but 6 River does not have competing products for Locus’ Vector and Max robots, so larger warehouses with more diverse needs might go with Locus Robotics for an all-in-one solution. Smaller warehouses with fewer needs might be incentivized to go with Chuck for the 200-pound payload for 16 hours vs. the 80-pound payload Locus Origin can carry for 14 hours. Shopify acquired 6 River Systems in 2019 to increase its warehouse productivity.

Fetch Robotics: Fetch Robotics produces a cloud-driven flexible and collaborative autonomous mobile robot with multiple platforms for different payloads. Fetch was founded in 2014 by Melonee Wise, a robotics pioneer and alumnus of Willow Garage's famed robotics research lab. It has raised $94 million in funding. Its latest funding round was a $46 million Series C led by Fort Ross Ventures. With a comparable fleet of AMRs as Locus Robotics, Fetch has a drag-and-drop workflow automation tool that decreases deployment time significantly with no third-party software developers necessary.

GreyOrange: GreyOrange is a company that provides fulfillment automation solutions for warehouses and retail stores. GreyOrange was founded in 2011 in India but moved its headquarters to Atlanta, Georgia in April 2021. GreyOrange has raised $293.1 million in funding. Its latest funding round was a $123.1 million bridge round split between debt and equity financing. GreyOrange competes with all Locus Robotics products but offers much more, like sorting and fork lifting AMRs.

ABB’s AMR Unit: ABB is a publicly traded automation company based in Switzerland. In 2021 it acquired ASTI Mobile Robotics Group to start selling flexible AMRs. It competes on most products (although do not explicitly compete with Locus Robotics’ Origin product). ABB’s main advantage over Locus Robotics is its distribution power and scale.

Business Model

Locus Robotics’ business model is based on Robotics as a Service (RaaS). This means that its clients pay for the service delivered by the robots (operating expense budget) instead of buying them as capital assets (capital expense budgets). This way, the clients can save on upfront costs, maintenance fees, and depreciation expenses. It can also scale up or down its robot fleet according to its needs and demand.

Traction

As of March 2023, Locus Robotics has more than 250 sites under contract worldwide from over 90 customers — with some having as many as 500 LocusBots per site — operating more than 10K autonomous mobile robots. Customers include CEVA Logistics, DHL, Material Bank, Boots UK, GEODIS, Whiplash, Verst Logistics, Radial, and others who state that the solution doubles or triples their productivity with near-100% order-picking accuracy.

In September 2022, Locus Robotics achieved a significant milestone by picking its 1 billionth industry-first item. It took Locus Robotics over 1.5K days to pick its first 100 million items but only 59 days to pick the last 100 million items. Locus Robotics robots now pick an average of more than 3 million items per day worldwide.

Valuation

Locus Robotics has raised $416 million in funding over 7 rounds. It announced a $117 million Series F round led by G2 Venture Partners and Goldman Sachs at a $2 billion post-money valuation in November 2022. Other notable investors include Tiger Global Management, BOND, Scale Venture Partners, and Prologis Ventures.

Key Opportunities

Product Expansion

One of the deciding factors for warehouses and fulfillment centers deciding where to purchase their robots from is which provider can get them set up the fastest and support the warehouse’s needs if and when they expand. Because of Locus Robotics’ limited product offering, it cannot allow the same software implementation as fast or as seamlessly as Fetch Robotics. It is not offering any other AMR tools like SmartForklifts from Geek+. By building competitive products for both and leveraging its existing brand, it would have a much easier time expanding.

Increasing Presence in Asia Pacific

While the warehouse robotics market CAGR globally from 2021-2028 is 10%, the projected CAGR for Asia Pacific for the same market during the same time period is closer to 15%. That is largely because the Asia Pacific region for ecommerce is projected to hit 25% year-on-year growth, representing 64.3% of global ecommerce spending. Locus Robotics already has a couple of partnerships there, starting with Cohesio Group based in Australia, but if it moves fast, it can become one of the core players there and increase its global footprint.

Key Risks

Cybersecurity and Injury

Despite Locus Robotics being NIST and GDPR compliant, a cybersecurity hack could accidentally kill or badly injure a worker because its software physically interacts with the real world through its AMRs. If this happens for whatever reason (even if it was the warehousing company that did not update its versions), Locus Robotics could potentially be liable. This might make some companies stay away to avoid accidental injuries or lawsuits from their workers.

Platform Bundling

Amazon acquired Kiva Robotics to improve its order fulfillment operation's efficiency drastically. Shopify acquired Fetch robotics to help with warehousing for the same reasons. Although Fetch is still available to the public, it is possible that Shopify also makes the AMRs only available to Shopify fulfillment centers in the near future. Amazon and Shopify already represent over 50% of sales of e-commerce. The more fulfillment both begin to do for third-party sellers, the harder it becomes for smaller fulfillment centers (customers of Locus Robotics) to compete. If those customers are driven out of business more frequently, Locus Robotics will have someone to sell to.

Summary

The surge in ecommerce has created immense pressure on fulfillment centers, but most still need to be automated to compete with the speed and accuracy of Amazon fulfillment centers. With a warehouse robotics market projected to be worth $27.9 billion in 2031 up from $12.2 billion in 2022, adopting these robots will likely increase significantly. Over the past few years, Locus Robotics has entered a relatively crowded market to offer its collaborative fleet of robots on the RaaS model. It has been successful so far, but because of increasing global competition and the looming threat of Amazon taking away customers, it must execute well to maintain its positioning.