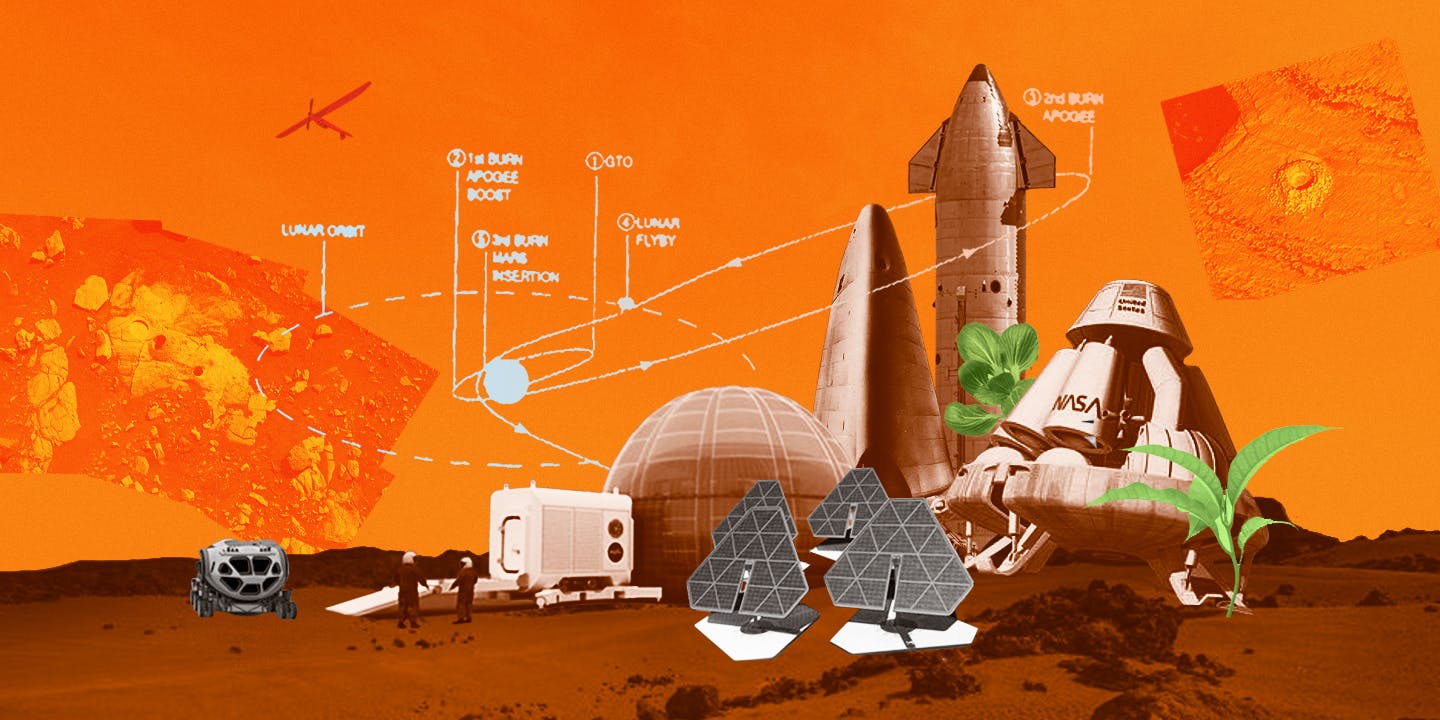

Thesis

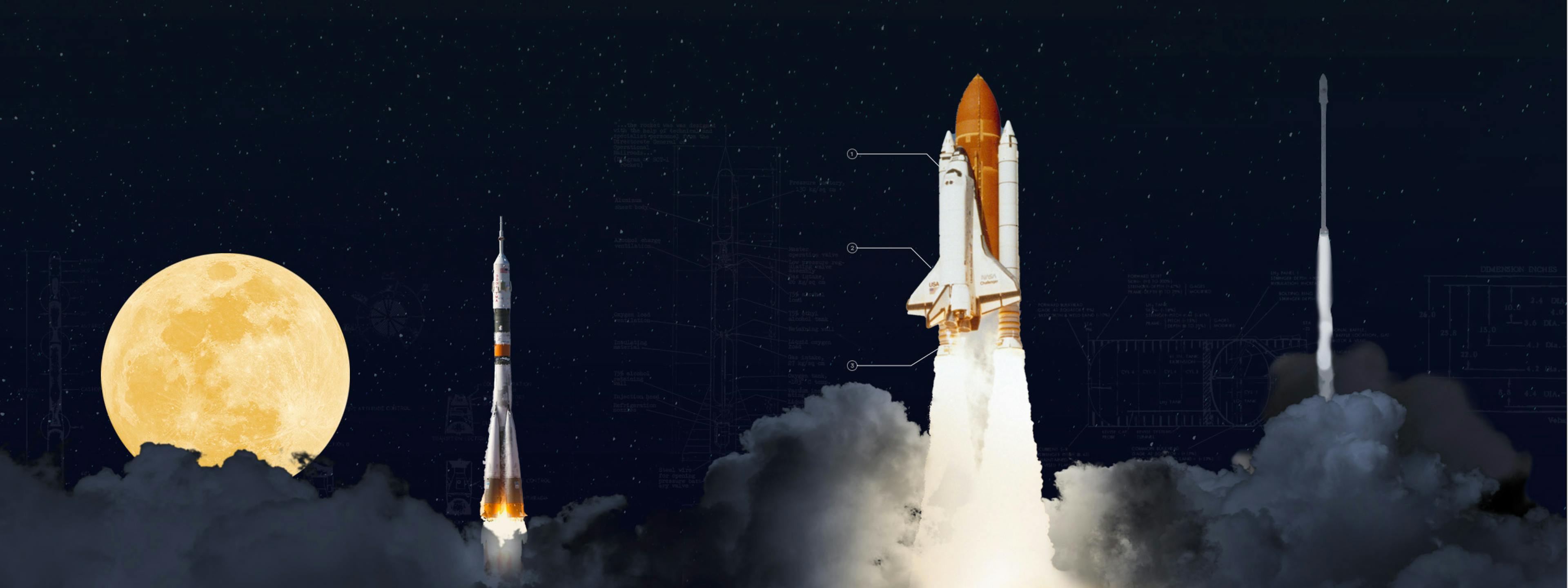

Although 58% of Americans in 2015 believed it was “essential” that the United States continues to be a world leader in space exploration, NASA’s annual budget has dropped by roughly 53% since the space race era of the 1960s. While the space race notably put the first humans in space and on the moon, historically, space exploration has also catalyzed various innovations like GPS, cameras, and improved weather tracking systems. Additionally, space has become increasingly critical for military applications, with most countries relying on space technology for communications, munition guidance, and reconnaissance.

The reduction in NASA's budget led to a deceleration in space exploration and technology. The last time NASA built its own spacecraft to venture into space was in 2011. SpaceX was founded to address this gap by providing the space sector with more regular and cost-effective launches. Traditional rockets were destroyed after a single mission and required rebuilding after each flight, making launches both infrequent and costly. SpaceX approaches this problem with reusable rockets, such as the Falcon 9, enabling more frequent launches for various purposes like restocking the International Space Station (ISS) or launching Starlink satellites. In fact, the rapid increase in satellite fleets enabled by SpaceX has led to a new satellite renaissance.

SpaceX's ambitious long-term vision is establishing a permanent settlement on Mars to transform humanity into a multi-planetary species. In the meantime, SpaceX has grown to dominate most rocket flights, with about two-thirds of NASA's launches being handled by SpaceX in 2020, and has become the backbone of a second space race and the emerging space economy.

Founding Story

SpaceX was founded in 2002 by Elon Musk (CEO), a serial entrepreneur who also founded Tesla, Neuralink, The Boring Company, and OpenAI. When Musk was younger, he read and was inspired by Isaac Asimov's Foundation series. As he said in a 2017 interview:

"Asimov certainly was influential because he was seriously paralleling Gibbon’s Decline and Fall of the Roman Empire, but he applied that to a sort of modern galactic empire... The lesson I drew from that is you should try to take the set of actions that are likely to prolong civilization, minimize the probability of a dark age, and reduce the length of a dark age if there is one.”

He later tweeted that the Foundation series was "fundamental to the creation of SpaceX.” Additionally, in 2001, one year before founding SpaceX, Musk joined the Mars Society, a society of enthusiasts for colonizing Mars. He later donated $100K to fund a research station in the desert. Mars Society member Dr. Robert Zubrin has claimed that he was "among those who helped convinced [Musk] to make Mars his calling."

Having been convinced of the importance of Mars colonization, Musk's initial idea was to propose a mission to send a greenhouse to Mars. In late 2001, Musk traveled to Moscow with Jim Cantrell and his college friend Adeo Ressi to attempt to buy an intercontinental ballistic missile (ICBM) to be used as a rocket that would send a greenhouse into space. Despite repeated attempts to purchase ICBMs, the Russians would not sell him a rocket. He therefore decided to build one himself.

In 2002, eBay acquired PayPal for $1.5 billion, leading to Musk receiving $175.8 million from the sale. Using $100 million of the money he made from the sale of PayPal, Musk founded SpaceX and brought on founding aerospace engineers Tom Mueller (former Propulsion CTO, now CEO of Impulse Space) and Chris Thompson (former V.P. of Operations, now CTO of Phantom Space). One of SpaceX’s early hires also included Gwynne Shotwell (COO) to work on business development.

Starlink, a subsidiary of SpaceX, was publicly announced in January 2015 during a press conference held by Musk. The decision to enter the satellite production business was motivated by the belief in the considerable financial potential of satellite internet services compared to space-launched services. Musk stated that the venture’s goal was to generate a significant revenue stream to fund a city on Mars, underpinning SpaceX’s ambition to make humanity an interplanetary species by creating a self-sustaining colony on Mars.

Beyond providing global internet coverage on Earth, SpaceX has long-term plans to develop and deploy an internet constellation around Mars. In 2016, the company filed with the FCC to operationalize the new satellite system and trademarked the name “Starlink,” a name inspired by John Green's novel, The Fault In Our Stars.

Product

Falcon 1

Source: Historic Spacecraft, Contrary Research

SpaceX’s first launch vehicle was the Falcon 1, designed to be a low-cost alternative to existing small satellite launch vehicles from public companies, such as Lockheed Martin and Boeing. SpaceX achieved major cost reductions by developing its Merlin engine, a cheaper alternative to those used by other companies. With a single Merlin engine, the Falcon 1 launched in 2006, but its three initial unsuccessful launches led to increased skepticism about the company’s capabilities.

Luckily, in September 2008, Falcon 1’s fourth launch successfully carried a dummy payload (the Ratsat) into low Earth orbit and became the first privately funded and developed launch vehicle to go into orbit. Falcon 1’s fifth and final mission was launched in 2009, where it successfully launched the Malaysian satellite RazakSAT into low Earth orbit. This was the first time a privately funded company launched a commercial satellite and helped solidify SpaceX’s presence in the commercial launch market. The Falcon 1 was then retired later in 2009. Despite its short operational life, the Falcon 1 provided crucial experience and data that informed the development of SpaceX's later, more successful rockets like the Falcon 9. Notably, the success of the partly recoverable Falcon 1 enabled SpaceX to focus on reusable rockets.

Falcon 9

Source: SpaceX

Following the retirement of Falcon 1 in 2009, SpaceX redirected its focus to the Falcon 9 rocket, which houses nine of SpaceX’s in-house designed Merlin engines. Although SpaceX had been developing the Falcon 9 as early as 2006 after winning a contract from NASA to send cargo and crew to the ISS and planned to launch the Falcon 9 in 2007, the initial launch would not occur until June 2010.

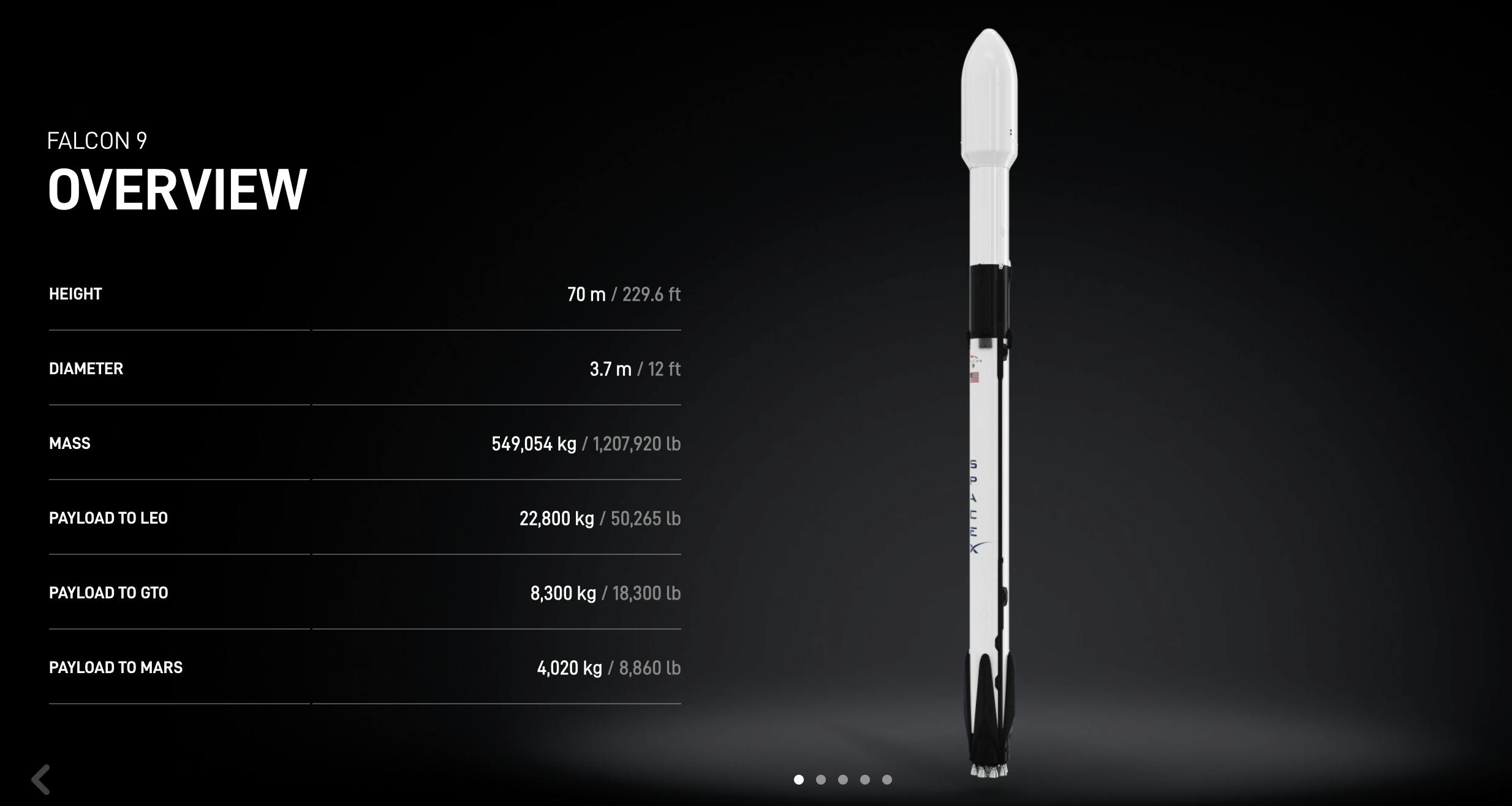

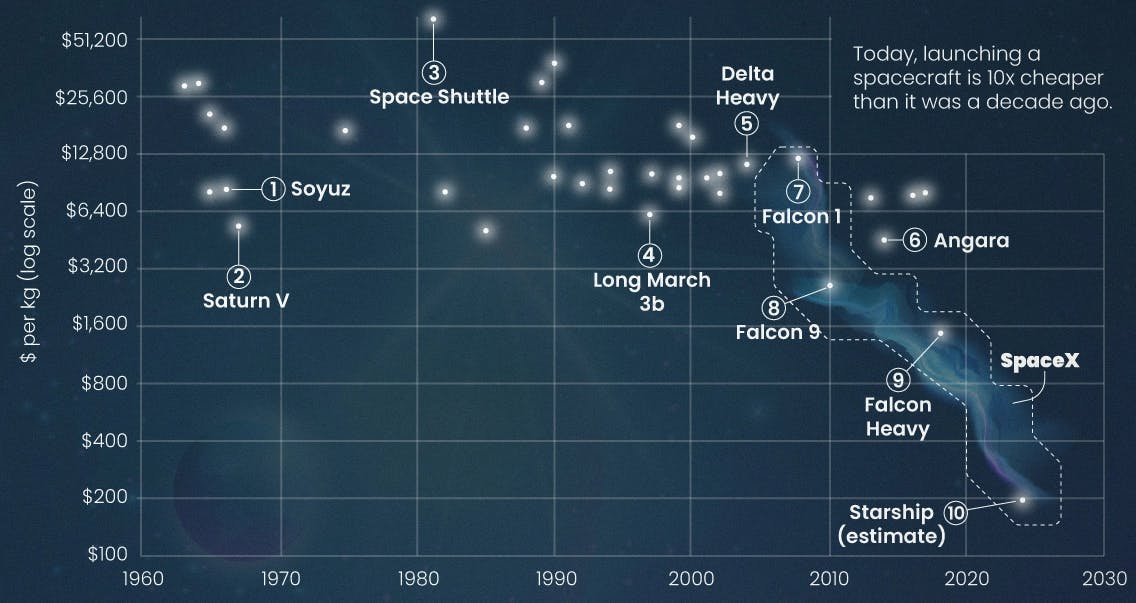

While SpaceX describes the Falcon 9 as "the first orbital class rocket capable of reflight,” it is only partially reusable as its second stage is single-use. Regardless, this has allowed SpaceX the unique opportunity to reduce the traditionally exorbitant costs of rocket launches from up to $30K per pound of payload (on NASA’s space shuttles) to as low as $1.2K per pound.

With its low cost, SpaceX has attracted sizable contracts from both private companies and federal agencies, including missions for Amazon’s Project Kuiper, SpaceX’s own Starlink, and NASA’s ISS resupply missions. In 2022, Falcon 9 had been launched 61 times, making up 70% of all rockets launched from the United States that year. As of August 2024, the Falcon 9 had launched over 362 times with only three failures and one partial failure.

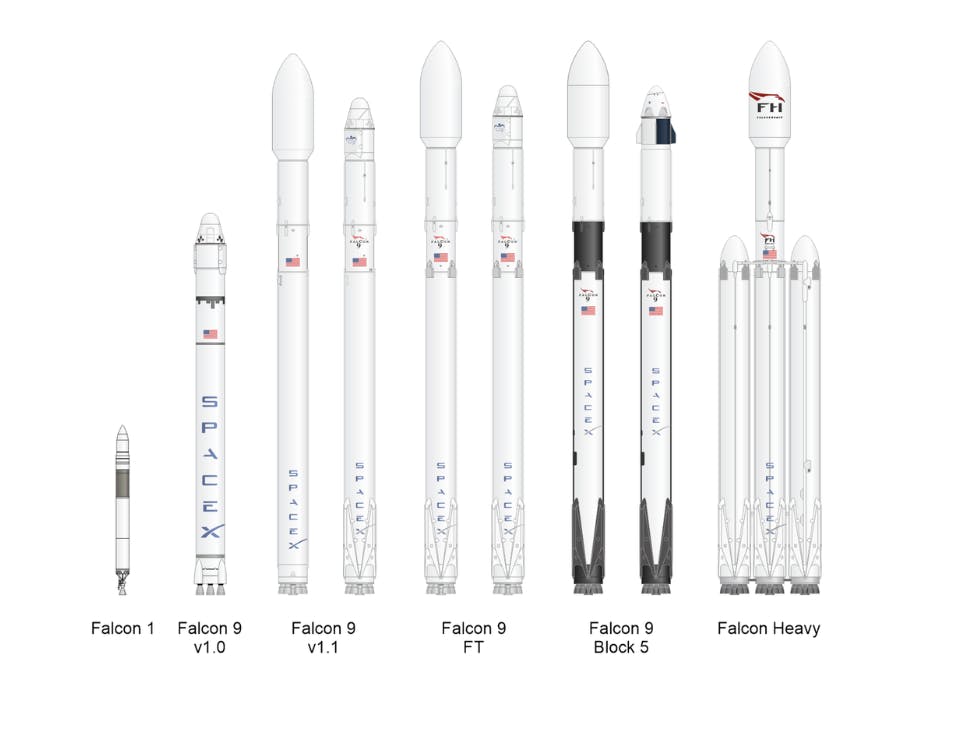

SpaceX has built five versions of the Falcon 9, ranging from the Falcon 9 Block 1 to the Falcon 9 Block 5. The Block 5 is considered the most reliable launch vehicle in history, boasting 303 successful launches and just one failed launch as of August 2024 (a 99.7% success rate) since its debut in May 2018. This includes one launch with astronauts onboard in May 2020 – becoming the first crewed orbital spaceflight launched from the United States since 2011.

The success of Falcon 9 marked a significant technological milestone in the space industry. SpaceX proved that the development costs of rockets could be amortized across multiple missions, enhancing the financial viability of space launches.

Falcon Heavy

Source: SpaceX

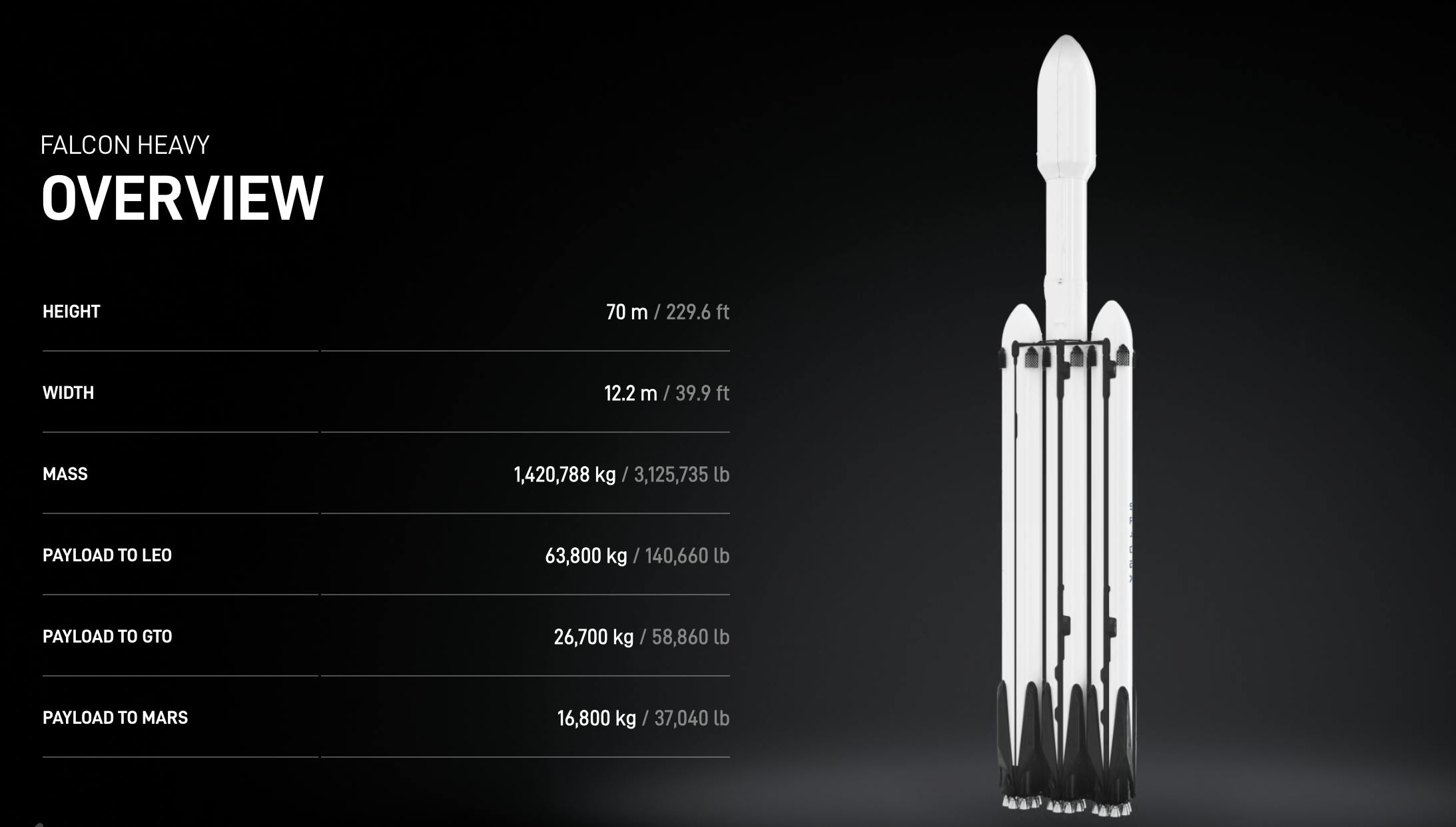

The Falcon Heavy is a more robust rocket than the Falcon 9 and was designed to lift heavier payloads. As of January 2022, the Falcon Heavy had the second-highest payload capacity of any currently operational launch vehicle and the third-highest of any launch vehicle ever to reach orbit. The Falcon Heavy consists of three reusable Falcon 9 engine cores powered by 27 Merlin engines. Together, these engines generate a combined 5 million pounds of liftoff thrust, giving the Falcon Heavy the capacity to lift nearly 64 metric tons into orbit, which SpaceX points out is the equivalent of a fully loaded 737.

SpaceX conducted Falcon Heavy’s maiden launch in February 2018, which carried a Tesla Roadster to orbit the sun. For Falcon Heavy’s second launch in April 2019, SpaceX successfully recovered all three booster rockets after deploying the Arabsat-6A satellite. In July 2023, the Falcon Heavy launched the Jupiter 3 satellite, the largest and heaviest communications satellite ever built, weighing over 20K pounds.

Dragon

Source: SpaceX

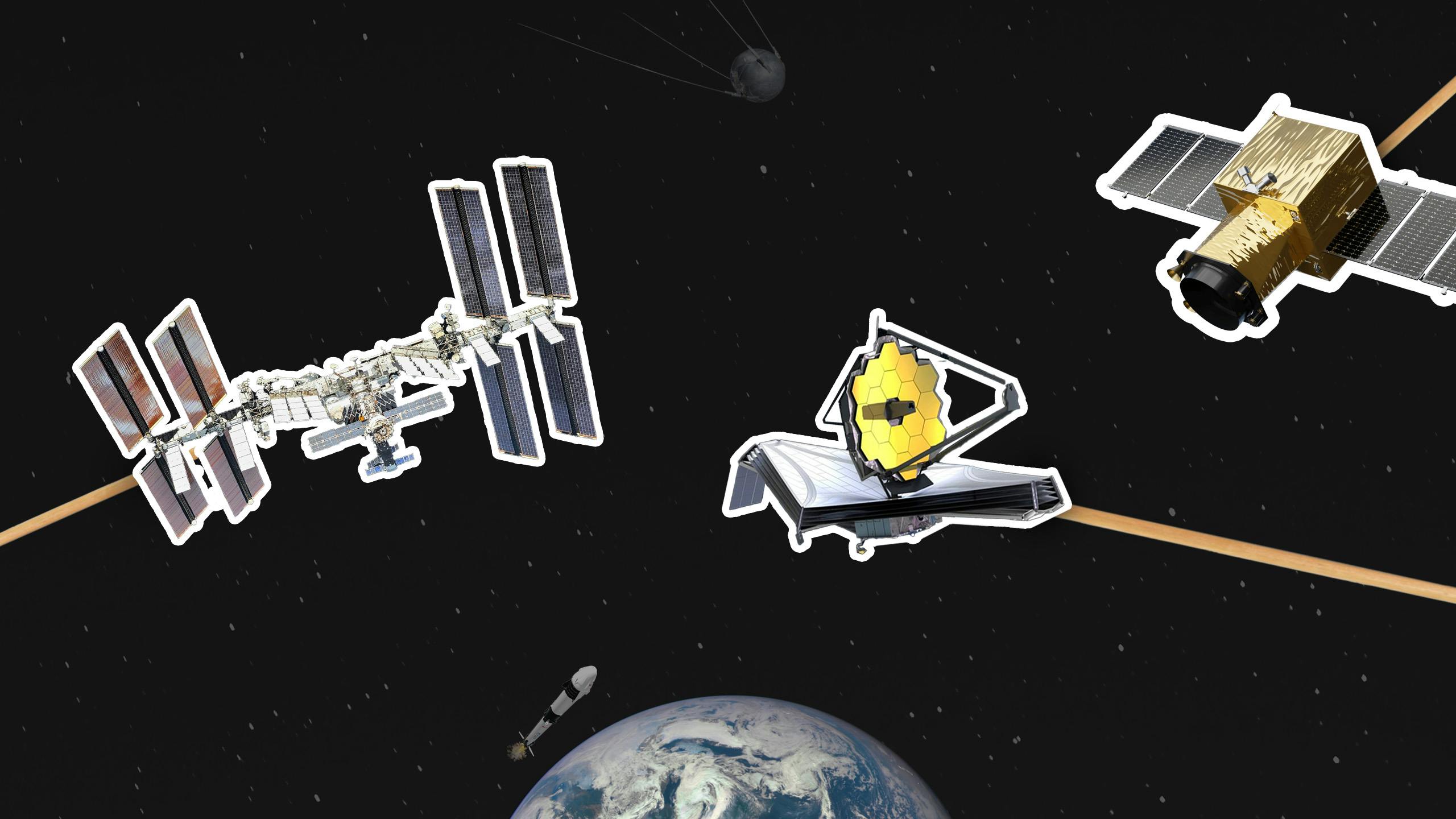

SpaceX’s first foray beyond launch rockets was its Dragon capsule using SuperDraco thrusters in 2005. By December 2010, the first operational Dragon spacecraft was launched on Falcon 9's second flight. In 2012, the Dragon-1 became the first commercial spacecraft to dock with the ISS and deliver cargo and continued to do so for 20 more cargo missions to the ISS between 2010 and 2020. Dragon-1 was replaced with an improved Dragon-2, which had two configurations: Crew Dragon and Cargo Dragon. SpaceX’s May 2020 Crew Dragon flight was not only the first time the US had been able to deliver astronauts to the ISS since 2011 but also the first time a private company launched astronauts into orbit. The Dragon was also the first spacecraft to bring tourists to the International Space Station in April 2022 (each passenger paid $55 million for the trip).

According to SpaceX, the Crew Dragon can carry up to seven passengers to and from Earth orbit. By March 2024, SpaceX had successfully sent more than 50 humans to space since it began doing so in May 2020 – 30 more than China’s entire space program. The Dragon has had 46 total launches, 42 visits to the ISS, and 25 total reflights as of August 2024.

Starship

Source: SpaceX

SpaceX's Starship system consists of its Starship spacecraft and Super Heavy rocket powered by 33 Raptor engines. According to SpaceX, Starship is designed to be a "fully reusable transportation system designed to carry both crew and cargo to Earth orbit, the moon, Mars and beyond" and will be the "most powerful launch vehicle ever developed,” with the ability to carry up to 250 metric tons of payload into space. As of September 2017, SpaceX intended to finish developing and testing Starship, and then replace Falcon 9 and the Falcon Heavy for future launches.

Capable of carrying up to 100 people on interplanetary flights, Starship is intended to serve multiple purposes, including satellite delivery, establishing a base on the moon, and point-to-point transport on Earth. Regarding payload delivery, Starship is designed to transport payloads "farther and at a lower marginal cost per launch" than its Falcon vehicles. This cost-effectiveness is particularly crucial for establishing bases on the moon and beyond, which will require transporting substantial amounts of cargo. Some estimates predict costs could decline to just $200 per kilogram of payload. In addition, the company intends to use Starship for fast Earth transport; by enabling travelers to leave orbit, most international trips could take place in under 30 minutes.

Construction of initial prototypes, like a test vehicle named Starhopper, began in early 2019. The first near-orbital test flight of the Starship took place on April 20, 2023. The rockets rose about 24 miles from the ground before falling six miles and self-destructing due to the loss of multiple engines. Since then, Starship has followed up with three increasingly successful tests in November 2023, March 2024, and June 2024. A fifth launch took place in October 2024 when Starship’s Super Heavy booster was caught using a pair of “chopsticks” from SpaceX’s launch tower, known as Mechazilla. The successful test was described as an "unprecedented feat of engineering"

One of the first scheduled missions on the Starship is to take Japanese billionaire Yusaku Maezawa and a small crew on a trip around the moon. Transporting Maezawa around the moon would be quite different from SpaceX’s previous missions, which revolved around sending payloads and a few astronauts to the ISS. Other missions include NASA’s Artemis program, which will utilize Starship to land astronauts on the moon. Including more crewed flights will continue to push SpaceX toward its goal of sending humans to Mars, which Musk has said will occur no earlier than 2029.

Super Heavy

The Super Heavy booster is the first stage of SpaceX’s fully reusable Starship system, designed to provide the thrust needed to launch Starship into orbit. Standing at 233 feet tall, it is the largest rocket booster ever built as of October 2024. Powered by 33 Raptor engines, the Super Heavy generates more than 16 million pounds of thrust at liftoff, surpassing NASA’s Saturn V in power. Its primary role is to carry the Starship spacecraft (which handles the payload and mission objectives) into low Earth orbit before detaching and returning to Earth for reuse, either landing on an ocean platform or near the launch site. This reusability is key to reducing launch costs and enabling high-frequency, affordable missions for cargo, crewed missions, and future travel to Mars.

The Super Heavy booster was manufactured using 300-series stainless steel. Originally intended to be made from carbon fiber, the switch to stainless steel allowed SpaceX to cut material costs while enhancing the durability and thermal resistance of the booster. Stainless steel can endure both extremely high temperatures (up to 870 degrees Celsius) and the cryogenic cold of space (-270 degrees Celsius). Additionally, its high ductility and toughness make it less prone to fracturing in harsh environments like space or planetary re-entry. SpaceX has also developed a new alloy, 304L, with higher chromium content to boost corrosion resistance, ensuring the booster’s longevity for multiple reuses. This design enables the booster to better withstand the challenges of interplanetary travel and repeated launches.

Mechazilla

Mechazilla is a 400-foot launch tower system designed to catch and recover the Super Heavy booster mid-air after it returns from space, eliminating the need for traditional landing legs. The structure consists of two mechanical arms, dubbed "chopsticks", which can move both vertically and horizontally. These arms are tasked with stabilizing and guiding the booster as it descends toward the launch pad. Mechazilla reduces turnaround time between launches because the boosters can be refurbished and reused, contributing to SpaceX’s goal of making space travel more efficient and cost-effective through reusability.

Mechazilla was designed to handle the immense weight and precision required to catch a falling rocket with high accuracy. Musk described Mechazilla as “a custom-built tower with arms that are designed to catch the largest flying and heaviest flying object ever made and pluck it out of the air. It'll weigh about 250 tons. We'll make that lighter over time" Mechazilla itself stands next to the launch pad at SpaceX's Boca Chica site in Texas, where engineers spent “tens of thousands of hours” constructing and testing the infrastructure. By incorporating this mechanism, SpaceX can avoid adding the weight of landing legs to its Super Heavy boosters, further optimizing payload capacity and minimizing the wear and tear on the rocket hardware.

Starlink

Source: SpaceX Starlink, Contrary Research

Starlink is a satellite constellation system developed by SpaceX starting in 2018. The system’s primary focus is democratizing high-speed and low-cost internet access to locations where traditional ground infrastructure has been economically or logistically challenging to implement, such as rural and remote areas, oceans, and skies. In an August 2024 interview with Gwynne Shotwell, she reinforced this advantage:

“Currently, the [Starlink] beam projection on the ground is about 22 km. We’ll keep shrinking that. But if you put a 22 km beam down in the middle of Manhattan you get a couple hundred users. But there’s 10 million people in Manhattan. So Starlink can serve people in cities, but fiber is much better suited to highly populated areas. It takes, depending on where you are, between $10K and $30K per mile of fiber. I can bridge that gap with one Starlink kit which is $500… So yeah, we can serve cities. But we can’t serve everybody in cities. But we can serve everybody in rural and semi-rural [areas].”

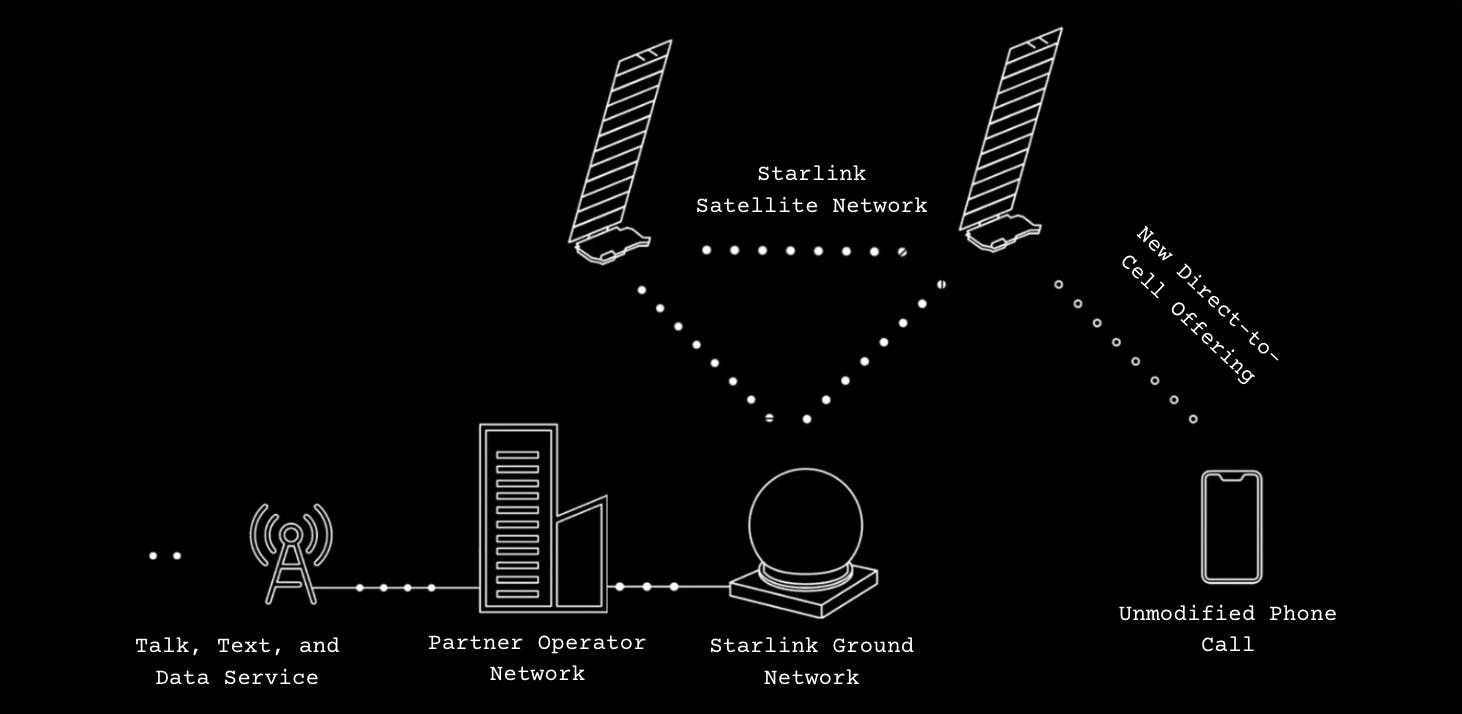

Unlike traditional internet services that rely on ground cables, Starlink satellites communicate through space, beaming information between satellites and user-installed devices on Earth. This system enables internet access virtually anywhere on the planet. As of July 2024, SpaceX hoped to eventually have a fleet size of over 42K satellites at low Earth orbit (LEO). At 342 miles above the Earth, the system is intended to provide low-latency internet and improve the speed and quality of connectivity. Starlink satellites pass through a SpaceX ground system to be distributed to consumers through residential, portable, maritime, aviation systems, and more. In January 2024, SpaceX launched a new batch of Starlink satellites that can connect directly to a user’s cell phone. With partnerships with T-Mobile and other regional providers, this direct-to-cell Starlink system will support texting in 2024, while voice and data services will start in 2025.

In December 2022, SpaceX also announced Starshield, a defense-focused version of its Starlink satellite internet service. The US Space Force awarded SpaceX its first Starshield contract, a one-year agreement with a maximum value of $70 million. This contract aims to provide end-to-end service via the Starlink constellation, including user terminals, ancillary equipment, network management, and other related services. The development of Starshield followed the high-profile use of Starlink in Ukraine during the early months of Russia's invasion in 2022. At that time, SpaceX activated the Starlink service in Ukraine and sent large shipments of terminals for both civilian and Ukrainian military use. By July 2022, more than 42K Starlink terminals were in use by the Ukrainian army, showcasing the application of satellite-based communications systems in defense and national security.

As of August 2024, over 6.6K Starlink satellites were in orbit, with more than 3 million customers across 100 countries. Over the course of Starlink’s life, SpaceX has invested $10 billion in the project.

Market

Customer

Launch Customers

SpaceX's earliest source of external funding was NASA, which awarded SpaceX a $396 million contract to develop its Dragon spacecraft to fly resupply missions for the ISS in 2006. NASA was also SpaceX's first customer for the Falcon 9 after its initial flight in 2010 and has continued to be one of SpaceX's largest sources of funding throughout the company's life.

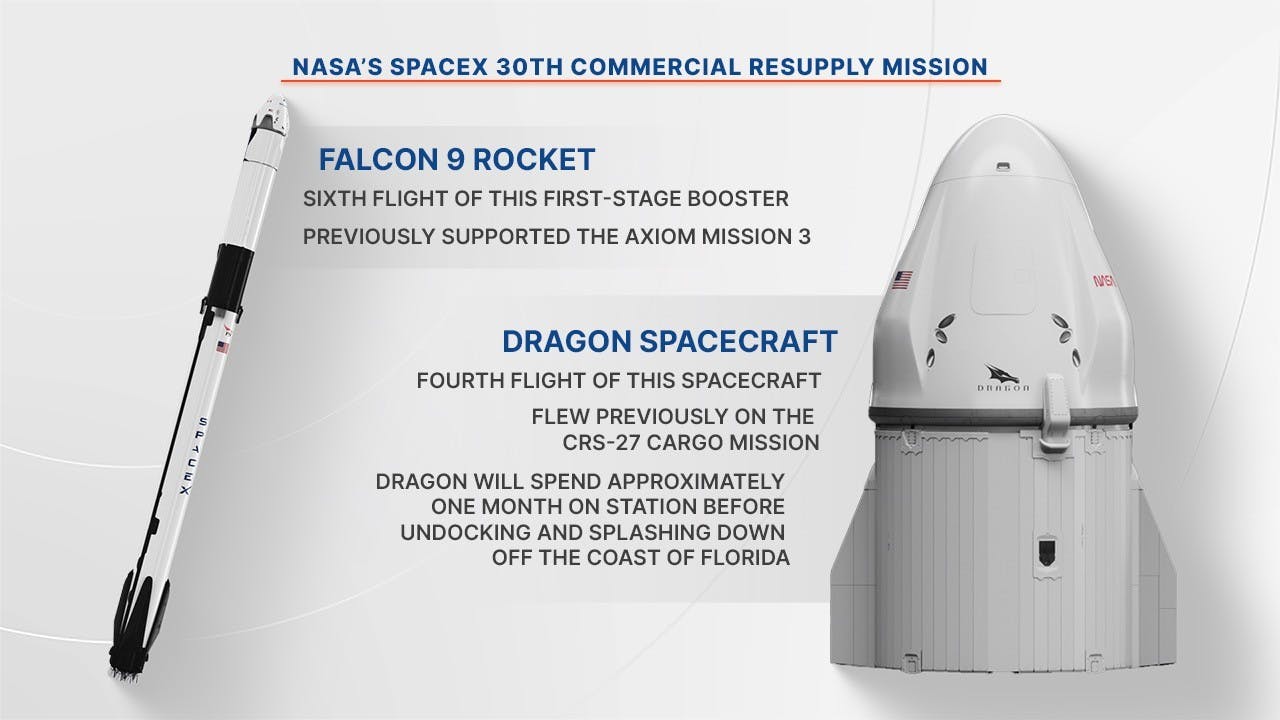

In August 2022, for instance, NASA awarded SpaceX a contract worth $1.4 billion under its Commercial Crew program to deliver astronauts and cargo to and from the ISS. In November 2022, it also awarded a contract modification worth roughly $1.2 billion to SpaceX for Starship under its lunar landing program Artemis. This follows an initial $2.9 billion contract NASA awarded to SpaceX in August 2021 to use Starship to take astronauts to the moon for its Artemis III mission. Additionally, in February 2023, SpaceX was included in a NASA payload contract of $100 million. In March 2024, NASA used SpaceX for the 30th time to resupply the ISS with over 6K pounds of materials and scientific equipment. In June 2024, NASA awarded SpaceX a $843 million contract to develop a spacecraft that will deorbit the ISS in 2030.

Source: NASA

Other SpaceX customers include commercial satellite operators such as SES, which began a contract to use the Falcon 9 to launch its satellites in 2016. Satellite operator Telesat made a launch agreement with SpaceX in the same year. Another operator that uses SpaceX is Intelsat, which SpaceX was launching satellites for in August 2023 as part of a push by the FCC for a "fleet-wide refresh" to clear the way for 5G networks. Two months later, SpaceX and the European Space Agency signed an agreement for two Falcon 9 launches in 2024, each carrying two Galileo satellites.

SpaceX is also a major customer for private spaceflight companies, such as Axiom Space, which signed a deal with SpaceX in 2021 for three private Dragon flights to the ISS, including a successful flight in April 2022 where three multimillionaires visited the ISS aboard a Dragon capsule for $55 million each. Space Adventures is another customer; it signed a contract with SpaceX for a Dragon mission in February 2020. In December 2023, Amazon purchased three Falcon 9 launches to support the deployment of its Project Kuiper satellite constellation.

Starlink Customers

An estimated 37% of the world’s population lacks access to the internet, amounting to 2.9 billion people who are offline. Of the 2.9 billion, 96% live in developing countries with severely limited internet infrastructure. Starlink primarily aims to serve people in these areas and in remote or rural locations where internet connectivity poses a challenge. About 3.4 billion people, approximately 43% of the global population, live in rural locations. In addition to individual consumers, small businesses operating in these rural or remote regions can significantly benefit from Starlink's service.

Starlink’s offering extends to government and emergency services. In natural disasters or situations where internet services are disrupted, Starlink can provide resilient connectivity. This was highlighted in the example of Ukraine during its crisis marked by conflict with Russia. Starlink ensured reliable internet connectivity and helped the country withstand electrical and communication infrastructure attacks. SpaceX also secured a contract with the US Department of Defense in June 2023 to provide Starlink internet for Ukraine's military.

The travel industry, including cruise ships, airplanes, and boats, is a growing sector within Starlink's customer base. Starlink's ability to provide internet connectivity virtually anywhere on Earth has made it an attractive solution for industries and customers that require mobility and remote connectivity. Hawaiian Airlines, Royal Caribbean, and Carnival Corporation are among its customers.

Market Size

Space is a rapidly emerging industry. In January 2023, it was valued at $447 billion, up from $280 billion in 2010. By 2030, the space industry is projected to grow to a $1 trillion market size and could reach as much as $1 trillion in revenue by 2040. SpaceX is both a pioneer in private space and a leading player, with a well-established market position in satellite and payload launch services, satellite internet, and space tourism.

Launch and Payload Delivery

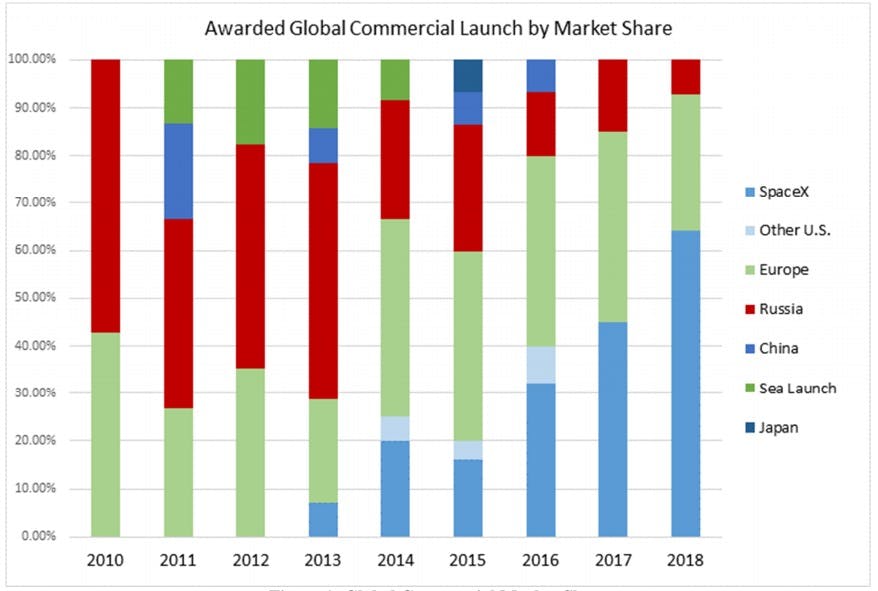

SpaceX's initial focus was on serving the launch industry. SpaceX had 65% of the global satellite launch market by 2018. Its customers include private companies, military agencies, and government-sponsored projects. Many of its contracts are from NASA to deliver cargo and astronauts to the ISS. The satellite launch vehicle market size alone was valued at $14.4 billion in 2022 and is expected to grow at a CAGR of more than 12.5% over the ensuing decade.

The launch industry is capital-intensive with long lead times. Only a few companies in the space industry have the resources to compete with SpaceX. Notable competitors include Blue Origin and United Launch Alliance (ULA).

Source: Arstechnica

One of the critical enablers for a low-cost competitor such as SpaceX to enter the space industry was NASA’s switch to a fixed-price contracting program called COTS (Commercial Orbital Transportation System) in the 2000s. COTS incentivizes lower-cost structures and innovations. NASA estimated it would cost roughly $1.4 billion to develop the Falcon 9 under its typical cost-plus contract. By contrast, SpaceX’s development costs for Falcon 9 would be $443 million under a fixed-price model.

Internet

In 2019, SpaceX began operating in the satellite internet market with the launch of its Starlink satellites. Starlink serves private sector and military customers in remote locations looking for reliable internet access.

The global market for internet service providers is substantial. It was estimated to be valued at around $419.4 billion in 2022 and was expected to grow at a 9.7% compound annual growth rate until 2030. However, Starlink will likely remain slower than other internet options, such as fiber. Starlink’s market will be constrained to more remote areas without fiber connections.

Starlink’s subscriber base stood at roughly 400K as of May 2022 and surpassed the milestone of 1 million subscribers in February 2023. In 2017, it was reported that SpaceX's goal was to reach 40 million subscribers and more than $30 billion in revenue by 2025, which would require considerable acceleration in Starlink's growth.

Space Tourism

SpaceX also operates in the space tourism market as it works toward its goal of enabling humans to colonize Mars. Its customer base will likely be limited to high-net-worth individuals in the near term, such as those who completed a trip to the ISS in April 2022. The space tourism market size was estimated at $869.2 million in 2022 and is projected to grow at a 16.2% CAGR for the ensuing decade to reach $3.9 billion by 2032.

Additional Markets

In the future, if the Starship program proves successful, SpaceX may also be able to enter existing markets such as travel (competing with the airline industry as a faster form of international travel) or become a category creator for markets such as Lunar transport or Mars colonization. However, reaching commercial scale in those industries will take significant time.

Competition

Blue Origin: Founded in 2000 by Jeff Bezos, Blue Origin is one of SpaceX's primary competitors across launch services and space tourism. In May 2023, for example, Blue Origin won a NASA contract to develop a crewed lunar lander worth more than $3.4 billion after having previously been beaten out by SpaceX for a lunar lander contract worth $2.9 billion in 2021.

Its products include a reusable suborbital rocket system (New Shepard), a reusable first-stage heavy launch vehicle (New Glenn), and a lunar lander (Blue Moon). Blue Origin offers people a seat to space aboard the New Shepard for $200K. The New Glenn is expected to launch by late 2024 under NASA’s ESCAPADE mission and will serve both crewed and non-crewed missions. Its lunar lander, which competes with SpaceX’s, is scheduled for a test mission to the moon in 2024.

United Launch Alliance (ULA): Before SpaceX’s first successful launches, Boeing and Lockheed Martin held a duopoly on U.S. launches through their joint venture, ULA, which was founded in 2006. ULA provides launch services on its expendable Delta IV Heavy and Atlas V systems for customers like NASA and the Department of Defense. The company has successfully delivered non-reusable rockets for more than 155 missions, including a June 2024 mission when ULA’s Atlas V rocket launched NASA crews to the ISS with Boeing’s Starliner capsule.

However, in 2016, one ULA executive openly acknowledged that the company’s expendable and cost-inefficient rockets can’t compete with SpaceX on costs. While the Atlas V rocket can carry up to 18K kilograms to LEO at $109 million per launch (roughly $6.1K per kilogram), SpaceX’s reusable Starship is predicted to cost just $200 per kilogram. This has motivated ULA to replace its older rockets with the Vulcan Centaur, which can carry a payload of 10K kilograms to LEO. The Vulcan Centaur had its maiden flight in January 2024 following a test failure in March 2023. In June 2024, ULA planned a second launch of its Vulcan Centaur by September to press ahead with achieving US national security goals in partnership with the DoD. A third launch was also announced for the end of 2024. However, the Vulcan Centaur is only partially reusable, which makes it challenging for ULA to challenge SpaceX’s launch dominance.

Relativity Space: Founded in 2015, Relativity Space is a California-based company that builds reusable, 3D-printed rockets. In April 2023, following a failed launch of its expendable two-stage rocket, the Terran 1, Relativity Space decided to retire its Terran 1 small launch vehicle in favor of its larger and partially reusable Terran R rocket (which is also 3D-printed). The upgraded Terran R is expected to launch in 2026 with the capability to launch over 33K kilograms to LEO. Relativity Space has raised $1.3 billion in total funding from investors, including Mark Cuban, Tiger Global, Lux Capital, Fidelity, and Y Combinator. It raised a $650 million Series E in June 2021, bringing its valuation to $4.2 billion.

Rocket Lab: Rocket Lab (NASDAQ: RKLB) was founded in 2006 and went public via SPAC in August 2021. As of August 2024, Rocket Lab has a market cap of $2.3 billion. The company provides satellite launch services with its Photon spacecraft and its small, reusable launch vehicle, the Electron, which is capable of carrying 320 kilograms of payload. In August 2023, NASA awarded it a contract to launch a pair of two small climate satellites "the size of a bread loaf." Although Electron is claimed to be “the world’s most frequently launched small rocket,” Rocket Labs aims to build a larger reusable launch vehicle, the Neutron, with an expected first flight date of mid-2025. The company’s new medium-lift rocket will be powered using nine of its newly designed Archimedes engines, which successfully fired in August 2024.

Boeing: Boeing (NYSE: BA), founded in 1916, has expanded beyond its traditional commercial airplane manufacturing to include space exploration services. Boeing's Starliner capsule competes with SpaceX’s Crew Dragon for NASA's Commercial Crew program contracts. While both Boeing and SpaceX have been awarded nearly $5 billion to develop their capsules, SpaceX has won 14 mission contracts over Boeing’s six.

In June 2024, Boeing launched its first “successful” crewed mission of Starliner to the ISS, which marked Boeing’s final test required by NASA before certification for routine astronaut flights to and from the ISS. The mission, originally planned for eight days, has been extended as Boeing’s Starliner capsule suffered multiple malfunctions.

As of August 2024, NASA announced that the two astronauts stranded on the ISS for over two months will have to return on SpaceX’s Crew Dragon in February 2025 if Boeing is unable to fix its Starliner capsule. Following a “damning assessment” of Boeing’s poor quality control by NASA’s Office of Inspector General, Boeing’s failed Starliner mission has severely damaged the company’s space efforts. The situation could culminate in SpaceX rescuing the astronauts eight months later than planned, or, in a worst-case scenario, could result in the death of two American astronauts if NASA chooses to have the two astronauts return on Boeing’s malfunctioning Starliner.

Starlink Competitors

Amazon: Initiated in 2018, Amazon’s Project Kuiper is planning to deploy a constellation of 3.2K satellites in low Earth orbit to increase global broadband access. The Federal Communications Commission (FCC) granted Amazon the license to operate these satellites in July 2020. As of June 2024, more than 2K people are involved in developing Project Kuiper. Amazon has arranged for 77 heavy lift launches through commercial providers, with potential additional options with Blue Origin, to send these satellites into space. The first two prototype satellites — KuiperSat-1 and KuiperSat-2 — were launched in October 2023 and achieved a 100% success rate across key mission objectives. As a final test, Amazon is deorbiting the two satellites starting in May 2024. Although the satellites were originally planned to provide service to customers by 2024, this has since been pushed back to 2025.

OneWeb: Founded in 2012 by Greg Wyler, OneWeb, formerly WorldVu Satellites Ltd, aims to build broadband satellite internet services through a constellation of satellites in low Earth orbit, similar to Starlink’s ambitions. OneWeb differentiates itself by primarily targeting businesses, governments, and airlines, partnering with local ISPs and mobile network operators to reach consumers. In 2020, OneWeb faced bankruptcy but was saved by investments from the UK government and an Indian conglomerate, which collectively invested $1 billion into the project. Since then, OneWeb has reemerged as a strong player in the race to create a satellite internet constellation with global coverage, sending over 630 satellites as of August 2024.

Astra: Astra (formerly NASDAQ: ASTR) is a low-cost launch service company founded in 2016. It provides orbital launches for small satellites on its Rocket 4.0 rocket, which costs roughly $4 million to launch a total payload capacity of 600 kilograms. Astra also builds electric propulsion systems for in-space navigation for satellites. In 2021, Astra went public through a SPAC deal at a $2.1 billion valuation. However, Astra has stopped trading on the NASDAQ as part of a take-private deal in July 2024, which valued the company at around $12 million.

Business Model

SpaceX has several different revenue streams, including satellite launch contracts and other payload contracts with NASA, Starlink subscriptions, and space tourism. Launches provide long-term contracts from organizations such as NASA. For example, in April 2021, NASA awarded SpaceX a $2.9 billion contract to transport astronauts to the moon in 2024. Winning large, long-term contracts allows SpaceX to dedicate resources to execute its vision of multi-planetary life.

Starlink also generates revenue through individual subscriptions to the Starlink internet service. This a capital-intensive business on the front end, as SpaceX has had to launch thousands of satellites into orbit. However, the satellites will reach a saturation point where Starlink becomes self-sustaining and can earn subscription revenue without launching new satellites. Several components of SpaceX’s business model contributed to its ability to scale, such as reusability, cost-efficient reliability, and vertical integration.

Reusability

Source: Visual Capitalist

SpaceX builds its rockets with reusability in mind. The marginal cost to launch a newly built Falcon 9 is around $50 million. Musk claimed In May 2020 that the marginal cost to launch a reused Falcon 9 was $15 million. Each reused Falcon 9 might save around $30-40 million while charging $10 million less for a reused Falcon 9 compared to a new one. The Falcon 9 reusability amortizes a rocket’s cost across multiple launches and creates better overall profitability. The Falcon 9 is credited with a large reduction in launch costs, as it can provide a payload cost per kilogram of roughly $2.7K; by comparison, the Space Shuttle program, which preceded it cost almost $55K per kilogram.

Cost Efficiency

SpaceX’s early reliability strategy contributed to its cost efficiency. Musk made a comparison between a Honda and a Ferrari to illustrate that a cheaper rocket does not necessarily need to be less reliable:

“A Ferrari is a very expensive car. It is not reliable. But I would bet you 1,000-to-1 that if you bought a Honda Civic that sucker will not break down in the first year of operation. You can have a cheap car that’s reliable, and the same applies to rockets.”

Vertical Integration

SpaceX has continued to pursue vertical integration to bring costs down through economies of scale. The status quo for launch companies such as ULA has been to source components from disaggregated supplier networks, limiting their ability to reach economies of scale. SpaceX’s vertical integration, however, allows it to eliminate transaction costs with suppliers while spreading its fixed costs over a more extensive production base. That includes manufacturing with SpaceX doing 80% of its production in-house.

The combination of reusability, cost efficiency, and vertical integration leads to a virtuous cycle capable of producing cheaper launches. Cheaper launches increase the demand for launches, giving SpaceX more opportunities to improve its technology. Starlink’s business experiences a similar virtuous cycle — economies of scale drive down the cost of launching Starlink satellites, improving the economics of Starlink. That enables the launch of even more Starlink satellites until they reach a saturation point.

Starlink Subscriptions

Starlink’s business model includes a subscription-based internet service and hardware sales. For residential customers, Starlink offers a standard plan that provides unlimited data designed for fixed, land-based locations like homes. The plan costs $130/month in most locations and $90/month for high-availability locations, including a $599 one-time hardware cost for the satellite dish. For nomads, Starlink offers the mobile (Roam) plan, which provides unlimited mobile data and is designed for portable, land-based use, such as for camping or RVs. Starlink has also released a direct-to-cell plan, although details are unknown as of August 2024.

For higher-demand users, such as businesses, governments, and institutions, a priority (Business) plan offers 1TB, 2TB, and 6TB Priority Data plans with a $2.5K one-time hardware cost. Priority data users experience faster and more consistent download and upload speeds, especially during peak times. Additional Priority data can be purchased per GB, or the service plan can be upgraded.

The mobile priority plan offers data in 50Gb, 1Tb, and 5Tb plans. The plan is designed for high-demand, maritime, and in-motion users needing global access across land and oceans, such as cruises, cargo ships, sailing, emergency responders, and mobile businesses. This plan is given network precedence over the Standard and Mobile data plans, giving users faster and more consistent speeds. Since October 2022, Starlink has offered aviation internet ranging from $12.5K to $25K a month with a one-time hardware cost of $150K.

Traction

Launch Traction

SpaceX saw significant traction in its Falcon launch products starting in the early 2010s. It went from only two launches in 2012 to 96 launches in 2023. In 2024, Starlink launched a total of 138 rockets, including 132 Falcon 9 launches, two Falcon Heavy launches, and four Starship launches.

SpaceX had 65% of the global satellite launch market by 2018. Given estimates that SpaceX’s revenue per Falcon 9 launch is $60 million (or $50 million for a reused booster), the company may have grown from around $120 million in revenue in 2012 to over $5.8 billion in 2023. As demand increases, SpaceX seeks to launch up to 120 times a year. The company has subsequently started building new launch sites in Florida and Texas.

The relationship between SpaceX, NASA, and the US military has improved over dozens of launches. Trusting SpaceX to launch astronauts also indicates continued trust in SpaceX. In an industry where human lives are on the line, trust and reliability are critical factors in deciding who receives a contract. SpaceX has also continued to attract high-quality talent as the most ambitious platform for engineers, rocket scientists, and physicists. In 2021, the company was named the most desirable company for engineering students to work at.

In October 2024, SpaceX’s Super Heavy booster achieved a milestone in reusable rocket technology during its fifth test flight. In an unprecedented and historic feat, the 233-foot booster separated from the Starship rocket and returned to the launch site, where it was captured midair by Mechazilla. This maneuver demonstrated progress toward SpaceX's goal of creating a fully reusable rocket system for Starship, which is intended to be an interplanetary transportation system.

The Super Heavy booster’s successful return marks a critical advancement in SpaceX's quest to advance space travel. This breakthrough not only paves the way for more cost-effective launches but also showcases the viability of SpaceX’s reusability model. Proving the booster can be retrieved and reused was the next step in potentially bringing launch costs down to around $10 million per launch. Lowering costs is critical to Musk’s long-term vision of making human settlement on Mars feasible. As he put it the day after the launch:

“... if rocket technology can be improved by 1000X, then the cost of becoming sustainably multiplanetary would drop to ~$1T, which could be spread out over 40 or more years, so <$25B/year. At that cost, it becomes possible to make life multiplanetary, ensuring the long-term survival of life as we know it, without materially affecting people’s standard of living on Earth.”

Starlink Traction

Since Starlink released its beta service to the public in 2020, it has garnered over 3 million subscribers across 100 countries. Since its debut, Starlink has experienced rapid growth in members, rising from an initial base of 10K subscribers in 2021 to 145K at the start of 2022 to 1 million in December 2022 to 3 million by June 2024. To provide global internet coverage, Starlink has deployed nearly 6.6K satellites into orbit, covering more than 80 countries worldwide. In March 2023, it was reported that over half of all active satellites in orbit belong to Starlink’s constellation. In November 2023, Musk announced that Starlink had achieved breakeven cash flow. This milestone raises questions about the potential for SpaceX to take Starlink public via IPO. Musk had previously indicated that the company would consider an IPO for Starlink once its cash flow became more predictable.

Valuation

SpaceX raised a $1.7 billion funding round at a $127 billion valuation in May 2022 and achieved a nearly $150 billion valuation in July 2023 following a share sale by existing investors. In July 2025, a secondary sale valued the company at $400 billion.Its total funding across grants, secondary sales, and private equity financing is $9.8 billion as of August 2024, which rose to $11.8 billion by September 2025.

In 2021, SpaceX’s revenue of $1.6 billion implies a revenue multiple of ~80x at its May 2022 valuation of $127 billion. One unverified source estimated that SpaceX generated $8.7 billion in revenue in 2023, an 89% growth from its 2022 revenue. Based on SpaceX's June 2024 valuation of $200 billion, the company's revenue multiple decreased to approximately 23x. Since then, SpaceX struck a $1 billion contract with NASA to deorbit the ISS.

A meaningful portion of SpaceX’s valuation likely comes as the result of assumptions about Starlink. Starlink has low variable costs and enormous revenue potential. With Starlink’s 3 million subscribers, Starlink’s basic plan of $130/month implies revenue of over $4.7 billion. If SpaceX and Starlink can reach the goal of 40 million subscribers by 2025, Starlink could reach over $62 billion in revenue, which alone implies a much larger valuation than the $150 billion valuation it reached in July 2023.

Key Opportunities

Starlink

Starlink presents a sizable opportunity for SpaceX to grow its top line. The small number of Starlink satellites in orbit may limit internet coverage and speed, but as SpaceX launches more satellites into orbit, the performance will increase. As Starlink’s entire constellation of satellites becomes operational, the marginal cost of adding a new subscriber is negligible. New subscription revenue will fall almost directly to the bottom line, turning Starlink into a profit engine for SpaceX.

Talent

SpaceX has a robust talent pipeline that takes advantage of great branding, given the company’s grand vision to make life multi-planetary. The company attracts some of the brightest rocket scientists and engineers from the best schools in the world. SpaceX needs to attract and retain top talent to continue its grand vision.

Cost Efficiency

Cost efficiency is one of SpaceX’s core strengths. If the Starship launch system is fully reusable, some estimate the cost per launch could decline to $200 per kilogram or lower. Starship could have a launch cost of less than 2% of SpaceX’s first launch vehicle, Falcon 1, in the mid-2000s. With such substantial reductions in cost, SpaceX could unlock even more launch demand. In an industry with high barriers to entry, due in part to the high upfront investment requirements, economies of scale can lead to a sustainable competitive advantage against new entrants.

Key Risks

Space Debris

Space debris, comprising defunct satellites, spent rocket stages, and fragments from collisions, poses a significant and growing threat to SpaceX's operations. As of April 2024, the US Space Surveillance Network was tracking over 16K pieces of space junk larger than 10 cm, along with over 120 million smaller and untrackable pieces. This debris field creates a hazardous environment for SpaceX's satellites and spacecraft, as collisions with debris the size of a paint chip can cause catastrophic damage. There are already several notable examples of space debris destroying functional satellites, which creates even more space debris – often thousands of new pieces.

If space debris continues to increase, a theoretical “Kessler Syndrome” is likely to occur. This is a scenario where the density of objects in LEO becomes high enough to cause a cascading effect of collisions, rendering entire orbital regions around Earth unusable, or, in the best-case scenario, more expensive to navigate through. Moreover, the increasing debris field complicates launch windows and trajectory planning for SpaceX's rockets, which could lead to more frequent launch delays.

Environmental Concerns

In July 2024, SpaceX has been seeking approval for up to 120 launches a year in Florida. This substantial increase in launch frequency has raised concerns among nearby residents and competing companies about long-term effects on the region's ecosystem and local industries.

Environmental groups have expressed worries about launch pad cooling water's potential impacts on nearby ecosystems, affecting shorebird and turtle populations. Noise pollution from increased launches is another concern among residents. Additionally, commercial fishing operations may be affected by frequent closures of ocean areas during launches and booster re-entries. At the same time, the air travel industry would need to reroute flights around the launch zone, leading to increased fuel consumption and emissions.

These environmental concerns have led to several regulatory and legal challenges for SpaceX, including lawsuits against the FAA regarding environmental reviews of Starship launches. Other launch companies at Cape Canaveral have also challenged SpaceX’s Starship launch license in Florida over environmental and safety concerns. Blue Origin has submitted a three-page letter to the FAA to cap SpaceX’s annual launches, while ULA submitted a 22-page document accusing SpaceX of fabricating environmental impact statements.

Geopolitical Issues

The geopolitical implication of Starlink, which can extend internet access across large parts of the globe, could put SpaceX in risky situations where it runs across the competing interests of various state actors. Heightened tensions could escalate dramatically over time for SpaceX, especially given SpaceX's use of Starlink to support Ukraine during its conflict with Russia. In August 2023, it was reported that Starlink restricted the Ukrainian military's access with ramifications for its military operations. In the same month, a group of hackers, ostensibly from the Sudan, attacked Starlink, causing it to go offline in "more than a dozen countries" as part of a bid to pressure SpaceX to extend Starlink service to the Sudan.

On SpaceX’s launch provision and space side, tensions between the U.S., China, and Russia create additional risks. Since the early days of space exploration, geopolitical competition has been a large impetus (initially between the U.S. and the Soviet Union. This continues to be a factor in humanity's space effort in the post-Cold War period. For example, in late 2021, Russia destroyed its own defunct satellite with a missile to prove its anti-satellite capabilities.

Meanwhile, China's development of its own satellite internet networks poses a significant state actor risk to SpaceX. As of August 2024, China has launched the first 18 satellites of its "Thousand Sails" constellation, with plans for potentially thousands more. This network, along with another planned Chinese constellation called Guowang (”national network”), aims to rival Starlink's capabilities.

China's efforts could lead to increased competition in the global satellite internet market, limiting Starlink's expansion in the Asia market and possibly elsewhere. Furthermore, China may leverage these networks as diplomatic tools in developing countries, potentially out-competing Western providers in areas where China has already established infrastructure partnerships. This geopolitical maneuvering could restrict SpaceX's market access for its Starlink subsidiary.

Summary

SpaceX, founded by Elon Musk in 2002, aims to transform humanity into a multi-planetary species. The company focuses on two core areas: cost-effective launches and revenue-generating satellite systems. SpaceX's launch efficiency stems from vertical integration and rocket reusability. Its current product line includes the Falcon 9 and Falcon Heavy rockets, Dragon spacecraft, and the developing Starship system, all of which have significantly reduced launch costs while increasing payload capacity.

By 2025, Starship will send astronauts to the moon under NASA's Artemis program, advancing Musk's Mars colonization vision. Simultaneously, SpaceX's Starlink subsidiary provides global satellite internet to over 3 million subscribers across 100 countries as of July 2024. SpaceX's future hinges on maintaining cost efficiency, attracting top talent, and Starlink's profitability. If successfully done, SpaceX will become not only a dominant force in commercial space launches, satellite internet, and space exploration but may also bring the first humans to Mars.