Thesis

The increasing prevalence of remote work has had an impact on the American commute, but traffic congestion in downtown areas remains a problem. Traffic levels have risen significantly across US cities since hitting lows in 2020, and they are back to about 73% of pre-COVID levels across the US as of September 2022.

Traffic is more than an annoyance — it is a drag on urban economies and a significant source of mortality. Traffic deaths hit a 20-year high in 2022. Since 1980, commute time has increased 27% for the average American to about 55 minutes to and from work; as of 2022, 76% of Americans still commute to work despite the increase in WFH.

Back in the 1970s, a report on urban mobility by an Israeli transportation engineer found that people tend to be willing to spend 1 hour a day on travel at most, irrespective of the means of transport or distance travelled. This implies that an important constraint on the size of urban areas is the speed of travel, and traffic congestion is the primary constraint on speed for a car-first country like the US (66% of Americans commute via personal vehicle). Solving traffic congestion would likely be a major unlock for urban economies, in addition to saving time and potentially cutting down on traffic-related mortality.

The Boring Company says that its mission is to provide a solution by enabling rapid point-to-point transportation in a way that will solve traffic and beautify cities. As stated on The Boring Company website:

“To solve the problem of soul-destroying traffic, roads must go 3D, which means either flying cars or tunnels are needed… Tunnels minimize usage of valuable surface land and do not conflict with existing transportation systems. A large network of tunnels can alleviate congestion in any city; no matter how large a city grows, more levels of tunnels can be added."

While subways already exist in many major metros, The Boring Company claims that what differentiates its approach is speed and cost efficiency. For example, it says that its Prufrock product is “designed to construct mega-infrastructure projects in a matter of weeks instead of years”, and in April of this year laid out a roadmap to producing 600 miles/year in tunnel boring capacity. The Boring Company points out that, by contrast, less than 20 miles of underground subway tunnels have been built in the US in the last 20 years combined.

Founding Story

In 2013, Elon Musk — an early employee at PayPal and the founder of SpaceX and Tesla — put out a white paper detailing plans for a theoretical underground transport system titled “hyperloop” which he open-sourced for someone else to take on and build. The impetus for this was the realization that road infrastructure confined to a 2D plane (the earth’s surface) would never be able to keep up with the demand for thoroughfares created by 3D cities, which limits urban density and livability.

Although there were some subsequent attempts to put the hyperloop idea into practice, a working example never materialized. 3 years later, in late 2016, Elon was in LA and frustrated by traffic, when he tweeted:

“Traffic is driving me nuts. Am going to build a tunnel boring machine and just start digging…”

This ended up being the origin of the Boring Company, which was initially a subsidiary of SpaceX before separating into its own company in 2018. The ultimate goal of the company is to execute the Hyperloop concept, as he stated in April 2022:

"In the coming years, Boring Co will attempt to build a working Hyperloop. From a known physics standpoint, this is the fastest possible way of getting from one city center to another for distances less than ~2000 miles. Starship is faster for longer journeys."

Elon assigned Steve Davis, an early hire at SpaceX, to manage the nascent project in 2016. With masters degrees in both particle physics and aerospace engineering, during his tenure at SpaceX Steve developed a reputation for relentless hard-work, ingenuity, and being a little bit whacky (for example, opening a bar called “Thomas Foolery” which accepted Bitcoin and offered 10% discounts to people who dressed up as Carlton from Fresh Prince of Bel-Air). Steve became President of The Boring Company in 2019.

Products

The Boring Company’s description of its product lines is “creating safe, fast-to-dig, and low-cost transportation, utility, and freight tunnels.” The company offers five product lines of purpose-built tunnels for customers, which it will construct using its own proprietary line of tunnel-boring machinery. It also limited promotional products to raise awareness and capital for the company. At present, product pricing is not available, although the company has said that a price calculator will be forthcoming.

Loop

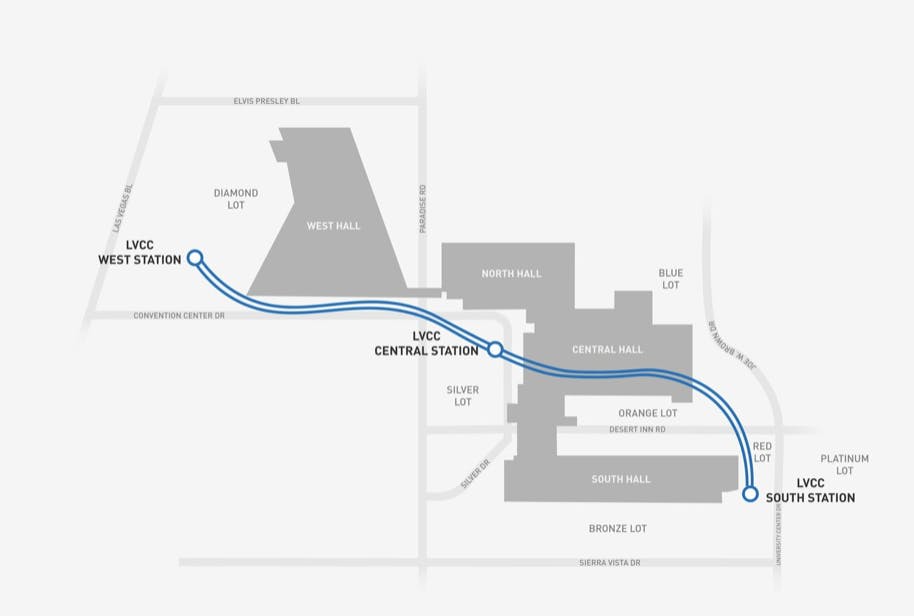

The Boring Company’s first and likely best-known tunnel product is called “Loop”. It is a high speed, all-electric underground public point-to-point transportation system intended for public transit with no intermediate stops. The first and only existing Loop project in Las Vegas was approved in October 2021; a 29-mile tunnel network with 51 stations and a target throughput of 57,000 passengers per hour, The Boring Company claims it is “the largest subsurface transportation project in the United States.”

Source: The Boring Company

The company says that Loop vehicles will use an express system allowing transport at 150 mph, which is more than 2x faster than conventional subway cars which travel at up to 65 mph. It also says that there is “no practical upper limit” to the number of stations that can be built along the tunnel route, which will lead to a great distribution of Loop vehicles and foot traffic across access points, both lowering congestion and increasing capacity.

Additional features advertised for the Loop product include LED lighting, emergency backup lighting, an embedded CCTV video system, secure wireless comms, blue light stations, passenger cell phone service, and a ventilation and fire safety system.

In addition to its core Loop product, which has an existing example in Las Vegas, The Boring Company website advertises 4 other product lines which seem to be forthcoming variations of the Loop tunnel purpose-built for different functions.

Utility: “Provides convenient access to multiple utilities without surface disruption.”

Freight: “Move freight underground. Fits a standard shipping container (barely!)”

Pedestrian: “Safe and fun way for pedestrians and cyclists to avoid surface road traffic”

Bare: “We build the tunnel, you put what you want in it.”

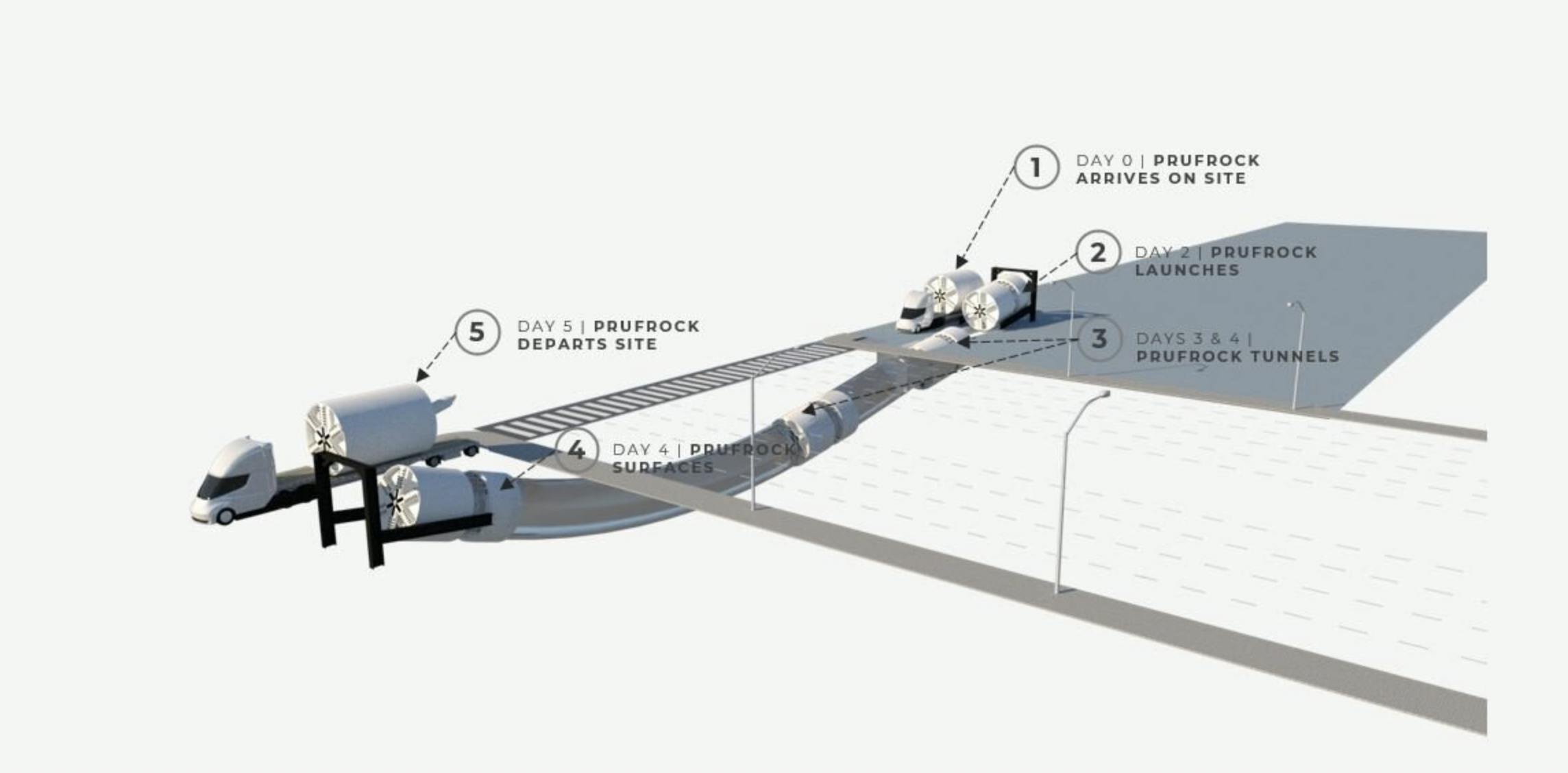

Prufrock

Aside from its tunnel products, The Boring Company’s other major offering is its tunnel boring machine, Prufrock. The current iteration of Prufrock, Prufrock-2, can mine up to 1 mile per week. The company claims its speed “is 6 times faster than The Boring Company's previous generation TBM (Godot+). This is still 4-5 times slower than a garden snail...but Prufrock is catching up!” The company’s medium-term goal is to improve this to 1/10 walking speed, or 7 miles a day.

Source: The Boring Company

Besides its speed, the machine has a major innovations aimed at cost-cutting: it is designed to “porpoise”, i.e. launch directly into the ground from a truck tiling down, and surfacing upon completion. This eliminates the need to dig expensive launch and end pits.

Source: The Boring Company

To increase tunneling speed, Prufrock is also designed with features like

Tripled power (higher power, better cooling systems)

Continuous mining (traditional soft soil boring machines stop every 5 feet)

Surface launch and porpoising

Elimination rail

To decrease the tunneling cost, The Boring Company has vertically integrated to allow for rapid iteration and standardized the offer for prospective customers.

Source: The Boring Company

Promotional Products

The Boring Company has a few different promotional products that they have offered in the past. These promotional items, while having little to do with the Boring Company’s core products and probably not a reliable source of revenue for the long term, have worked to create brand awareness through offering a limited pool of consumer products which have effectively generated buzz as the Boring Company works to secure and complete more projects.

The first is "Not a Flamethrower." This recreational device looks like a small flamethrower, branded with The Boring Company, and shoots flames less than 10 feet. The Boring company sold 20,000 units at $500 each in less than four days, for a total of $10 million.

Source: The Boring Company

The second is their branded hats. These are baseball hats with The Boring Company's logo on them. The company reportedly sold 50,000 hats at $20 each, for a total of $1 million.

Source: CNBC

Finally, the Boring Company recently announced a cologne called "Burnt Hair” — a reference to the Not a Flamethrower Product. The cologne is slated to be shipped in Q1 2023. The product is already sold out.

Source: The Boring Company

Market

Customer

The Boring Company’s current customers for tunnel projects include government agencies like the Las Vegas Convention and Visitors Authority, as well as Las Vegas strip hotels Encore and Resorts World Las Vegas, who have bought private tunnels. Going forward, The Boring Company is most likely to appeal to municipalities, local government agencies, or large businesses with an incentive to improve congestion and increase throughput of residents or customers beyond what is possible through 2D surface roads.

Market Size

In their Series C round announcement, The Boring Company noted that:

“In the short term, if each Prufrock-2 mines at 1 mile/week, and TBC produces 1 new Prufrock machine per month, then TBC will be introducing 600 miles/year of capacity. As a point of reference, less than 20 miles of underground subway tunnel has been constructed in the United States in the last 20 years.”

Using this premise as a starting point, it’s possible to estimate the size of the market opportunity. San Antonio bid for a Boring Company project runs 7.6 miles in length, for an estimated cost between $241 - $298 million. Funding for these projects typically come from government funding, and while The Boring Company’s revenue comes out of that funding, its likely that only a portion of it is recognized as revenue, as opposed to being passed on to other service providers.

The total cost per mile for a project is $31 - $39 million. This is consistent with The Boring Company’s first completed project in Las Vegas, which cost $47 million for 1.7 miles ($27 million per mile). Revenue per mile can vary dramatically based on capacity and usage, but as one estimate, the San Antonio bid is expected to generate $25 million in annual revenue for The Boring Company as they operate the tunnel. 0.5 - 5% of that is paid to the city as a franchise fee. Assuming The Boring Company nets ~$23 million in revenue for 7.6 miles of operated tunnels, that represents $3 million in annual revenue per mile.

Assuming there is capacity in the US for 600 miles of tunnel, that represents ~$18.6B - $23.4B of potential revenue in building costs, and ~$1.8B in potential operating revenue for The Boring Company’s tunnels. First, the validity of there actually being 600 miles of addressable demand is questionable given the highly politicized nature of making project decisions. In addition, to realize this opportunity, the company will need to scale to the point of producing a Prufrock each month and improve the machines’ speed to keep up with demand, while continuing to secure contracts to keep them at full capacity.

Competition

There are several companies in direct or indirect competition with the Boring Company, including traditional tunneling companies, public transportation agencies, and private transportation companies. Among direct competitors, legacy tunneling companies use boring technology that is slower to set up and has to stop every 5 feet, require more man power in the tunnels, and other higher costs.

Public transportation agencies are simultaneously a potential customer, regulator, and competitor to The Boring Company. Public transit projects like bus routes, above-ground trains and even subways are competitors to the Boring Company. The Biden Administration’s Infrastructure Bill, which was signed into law in November 2021, includes $39 billion of new investments to modernize public transit and $89.9 billion in funding for existing public transit, with the White House promising to “expand public transit options across every state in the country”. For the Boring Company, this could either result in a new source of competition or a new source of government funding.

Indirect competitors include private tech-enabled transportation companies innovating in methods of transport other than tunnels. For example, electric vertical takeoff and landing (eVTOL) companies like Joby Aviation and Lilium are well funded and have working prototypes; they have also landed deals, such as a $1 billion sale Lilium made in August 2021 with Brazilian commercial Airliner Azul.

Business Model

The primary business model of The Boring Company is selling its technology and services to government entities and businesses for mass transit projects. Another way the company will make money is directly financing the project (leaving money in tax payers’ hands) and charging fares for rides. The Boring Company can also generate revenue from operating the tunnels themselves, paying a 0.5-5% franchise fee to the government entity.

Traction

Since splitting off from SpaceX in 2018, the Boring Company has built a test tunnel and completed its first project, a tunnel network in Las Vegas. The first three Loop stations are built with another 51 planned. The Las Vegas Convention Center (LVCC) Loop system currently has 1.7 miles of tunnel, which took approximately a year to complete with the legacy Godot boring machine.

The cost of the project was $47 million and did not cause road closures or disturbances. The station page highlights several events that successfully used the Loop system to transport up to 26k people per day One event with 14,000-17,000 attendees which used Loop cited a ride time of less than 2 minutes and wait time of around 15 seconds.

Source: The Boring Company

In a video that Miami Mayor Francis Suarez posted last year, Suarez compared the competitive offer from The Boring Company at $30 million for a transit project to public pricing of over a billion dollars. While this price is an estimate, the video speaks to the magnitude of difference in costs and time frames between The Boring Company and its government competitors.

The Boring Company has won or been in the bidding process for several projects, but did not end up going through with them. The Boring Company had won the bid for a tunnel system in Chicago in 2018, but no longer lists the project due to political and civic groups’ criticism leading the Chicago Department of Transportation to drop the project. Similar Loops in Baltimore-Washington, Los Angeles westside, and Los Angeles Dodger Stadium have been inactive due to politics or regulatory review.

Valuation

The Boring Company raised its $675 million Series C round in April 2022 at a $5.7 billion valuation. The round was led by Vy Capital and Sequoia Capital, with participation from Valor Equity Partners, Founders Fund, 8VC, Craft Ventures, and DFJ Growth. In total, The Boring Company has raised $908 million in funding.

Key Opportunities

Expand To Other Metros

The biggest immediate opportunity for The Boring Company is to expand Loops and other tunnels to other major metros, where they could leverage the appeal of driving down costs for taxpayers and the speed of project completion versus alternatives.

Entering The Long-Distance Market

Another significant opportunity would be to connect metro areas, like Los Angeles and San Francisco, via something like the Hyperloop project originally proposed by Elon back in 2013. Although there would be significant regulatory, logistical, and fundraising hurdles, this could create significant economic value for regions with multiple high-traffic metro areas and allow the Boring Company to expand its market opportunity from short-distance intra-urban transit to longer distance inter-metro transit.

Key Risks

Execution Risk

One of the biggest risks facing The Boring Company is simply its ability to execute against its plans and deliver working products at the speed and cost efficiency it has estimated.

Regulatory Risk

Permitting, politics, and regulation have already caused several bids to be lost. If funding and regulatory hurdles continue to stop The Boring Company from being able to increase their capacity, that will significantly limit their growth.

Safety Issues and Legal Liability

An accident or injury during construction or operation of the tunnels would drastically hurt the reputation of The Boring Company. The Prufrock runs by itself underground and is expected to come back up to the surface. If there were hardware or software issues, it could present a significant safety and infrastructure risk, and be meaningfully damaging to The Boring Company’s reputation.

Summary

As the world continues to urbanize, there is long-term increasing demand for more efficient and convenient transportation. The Boring Company has a technological edge within the industry, access to a capital, and a technically proficient, experienced team. It is positioned to become a category creator for privatized underground transit, similar to how SpaceX was a category creator for privatized space travel.