Thesis

The world produces an immense amount of trash. In 2018, the US alone produced 292 million tons of waste. Total waste generation is growing steadily at around 3% per year as of 2022, despite efforts to reduce it. Recycling rates have plateaued between 30-35% since the 2010s, with only 32.1% of waste being recycled in the US as of May 2023. Outdated practices contribute towards this; regulations that govern solid waste management in the US were initially codified in the Resource Conservation and Recovery Act of 1976.

Some materials are less commonly recycled than others; one study found that of the estimated 44 metric tons of plastic waste managed in 2019 in the US, 86% was landfilled, 9% was combusted, and only 5% was recycled. The issue of low recycling rates stems from a lack of demand as well as recycling capacity. Demand for recycled materials has been capped by persistent purity issues with recycling outputs, and the cost of recycling has risen faster than prices in the last few years, restricting supply growth. Both supply and demand issues are driven by the reliance of recycling facilities on manual labor, which is both costly and error-prone.

AMP Robotics addresses this problem by replacing inaccurate, slow, and high-churn labor forces with more accurate, high-speed sorting robots to drive down operations costs for recyclers while also increasing the value of recycled materials. This allows recycles to tap into a potential $200 billion worth of unrecovered materials globally every year. From June 2019 to May 2023, AMP Robotics deployed 300+ robotics systems across one hundred US, Europe, and Asia facilities. The company claims to have the largest fleet of robots and AI training datasets for sorting recyclables. AMP Robotics’s dataset is generated from its global fleet, which is designed to create a data advantage with the intention of enabling AMP Robotics’ robots to be more accurate and efficient compared to competitors.

Founding Story

AMP Robotics was founded in 2014 by Matanya Horowitz (CEO). Horowitz was fascinated at a young age by the question of the origin of intelligence and human aptitude in things like reading, thinking, and analysis. Even as a kid, he took a liking to robots — things like Transformers, the Jetsons, and the work of Isaac Asimov, a science fiction author who notably also inspired Elon Musk to build SpaceX.

Horowitz excelled academically in his youth, completing college prerequisites while he was still in middle school and getting his bachelor’s degree in four different fields: mechanical engineering, computer science, mathematics, and economics. His early interest in robotics then led Horowitz to pursue a doctorate in Controls and Dynamic Systems at Caltech, focusing on the applications of robotics in outdated industries. While pursuing his doctorate, he worked at robotics labs and participated in DARPA challenges to develop better robotic arms and to improve robot performance on human-like tasks.

After graduating, Horowitz began to look for areas where he could apply his specialized knowledge, and he ultimately decided that recycling was the right fit, partially because no one else was working on it. He visited a materials recovery factory and found that working conditions were demanding and the processes in place were wasteful. It seemed clear that machine learning and robotics could have a big impact on an industry that relied on labor-intensive, costly manual work. This led him to found AMP Robotics the same year that he completed his doctorate.

Product

AMP Cortex

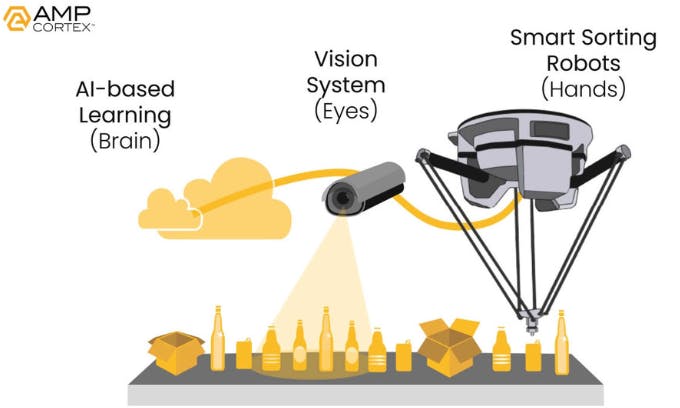

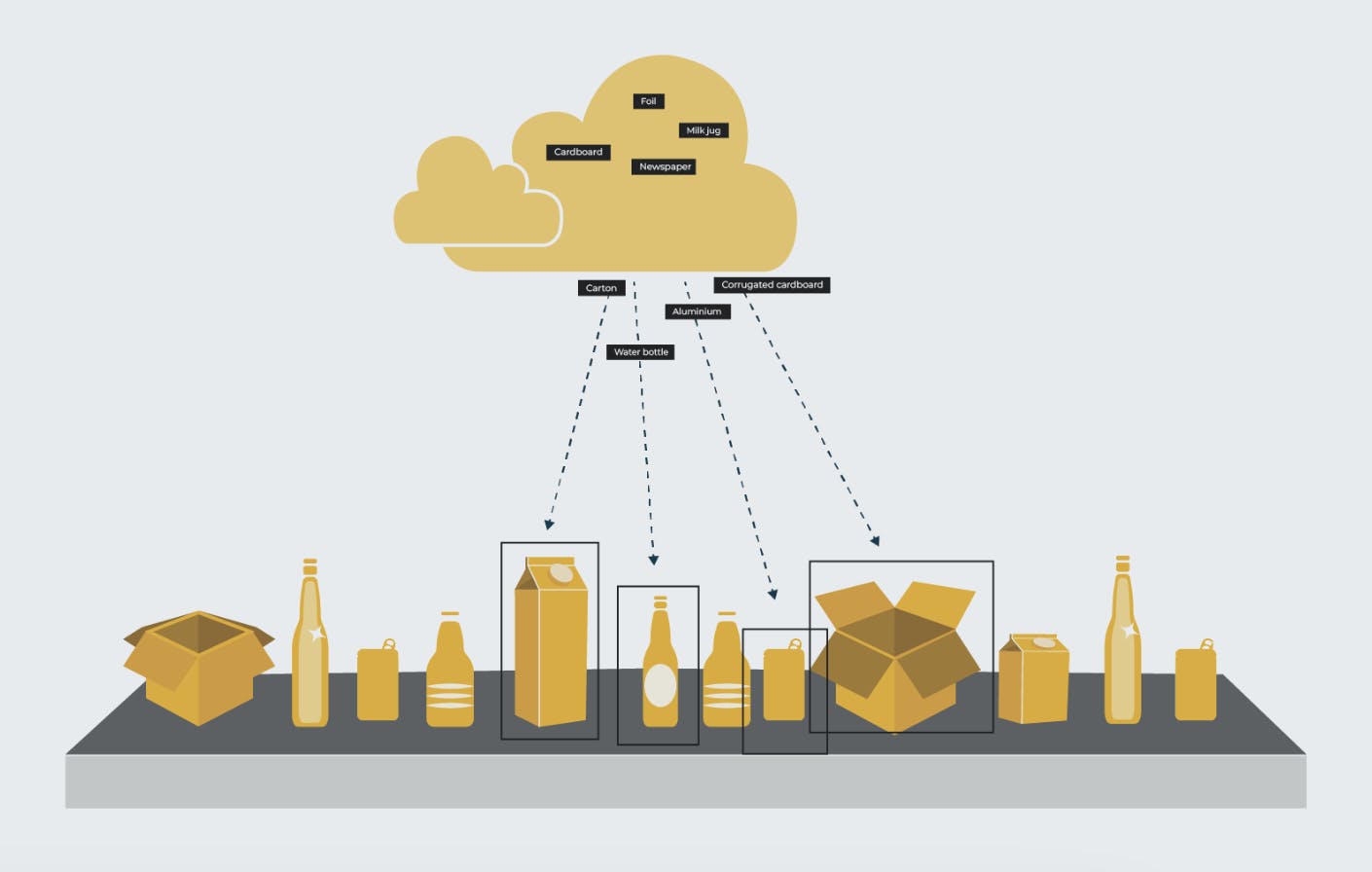

AMP Robotics’ flagship product is AMP Cortex, a high-speed robotic sorting system. AMP Cortex uses camera systems (”AMP Vision”) to feed video of conveyor belts into an AI platform (”AMP Neuron”). AMP Neuron identifies the materials and directs the robot arms to grab and sort the items.

Source: AMP Robotics

AMP Cortex uses robotics arms that are purchased off-the-shelf and built by ABB and Omron. Competitors use similar robots. The differentiating speed and accuracy of AMP Cortex robots, according to the company, comes from the AMP Neuron software.

The value proposition of AMP Robotics’ robots is to be cheaper and more accurate than manual recycling. Robots were priced at $300K per robot as of 2020. The average recycling facility worker works eight-hour shifts, picking 30-40 pieces a minute. AMP Robotics’ robots pick more than 80 pieces per minute and replace up to 4 humans over two shifts. A laborer costs ~$30-50K, so cost savings from offset labor is potentially ~$120-200K per year.

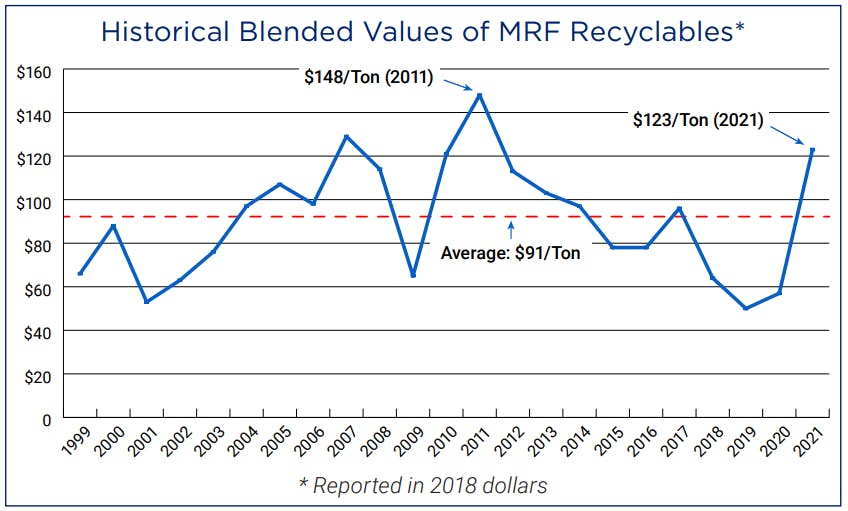

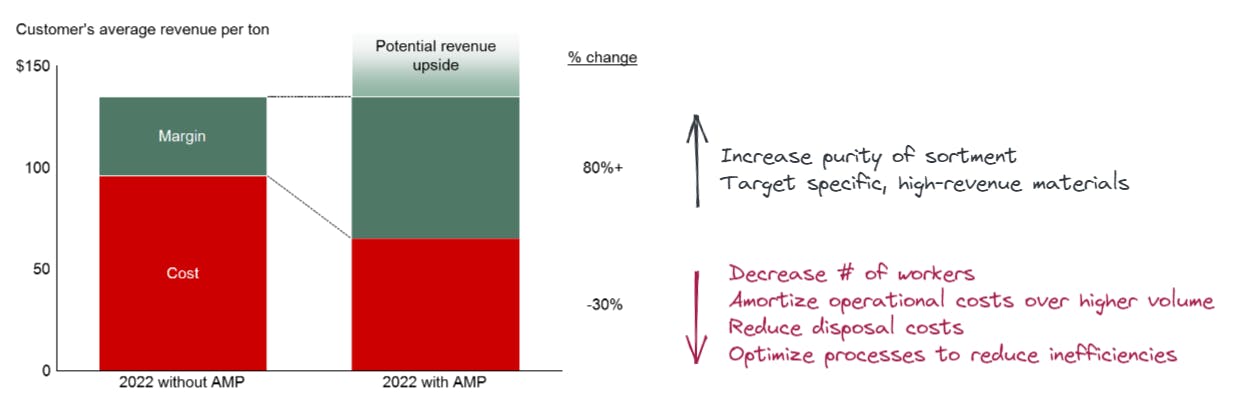

Source: Contrary Research; Note: The 2022 mixed average price for recyclables was ~$135/ton

Replacing humans also reduces hiring and injury liability costs. Recycling laborers have a ~50% turnover every three months. In a 2021 interview, Horowitz claimed his company reduced the cost per ton from an average of ~$95/ton to $65/ton.

AMP Robotics products could also improve the top line through increased pricing and volume. The company’s robots sort with higher accuracy than humans, allowing recyclers to sell purer bales of materials at higher prices. For example, co-mingled plastics are worthless, but pure when plastics are correctly baled into collections like #1 PET (bottles for soda and water) or #2 HDPE (milk jugs, cleaning product containers) are $546/ton and ~$2.3K/ton, respectively.

AMP Vision

Source: AMP Robotics

AMP Vision is a computer vision system that can be integrated into recycling operations to help users understand the flow of materials from inbound processing to the end of the line, within high-resolution imaging, monitoring, and waste auditing capabilities. AMP Robotics claims that it sees 70+ billion items annually and is able to recognize 50+ identifiable categories.

AMP Neuron

Source: AMP Robotics

AMP Neuron is AMP Robotics’s AI platform, which uses computer vision to recognize recyclable materials within complex streams of jumbled waste, quickly and at scale. It can distinguish between materials like types of paper, metal containers, and plastics and guide robots to sort and recover materials.

AMP Neuron aggregates fleet data and learns how to improve performance, creating a virtuous cycle that is designed to leverage AMP Robotics’ scale to differentiate its AI capabilities. By June 2023, AMP Neuron’s AI had recognized more than 70 billion items per year. It can identify more than one hundred materials in various crushed and disfigured conditions.

AMP Clarity

Source: AMP Robotics

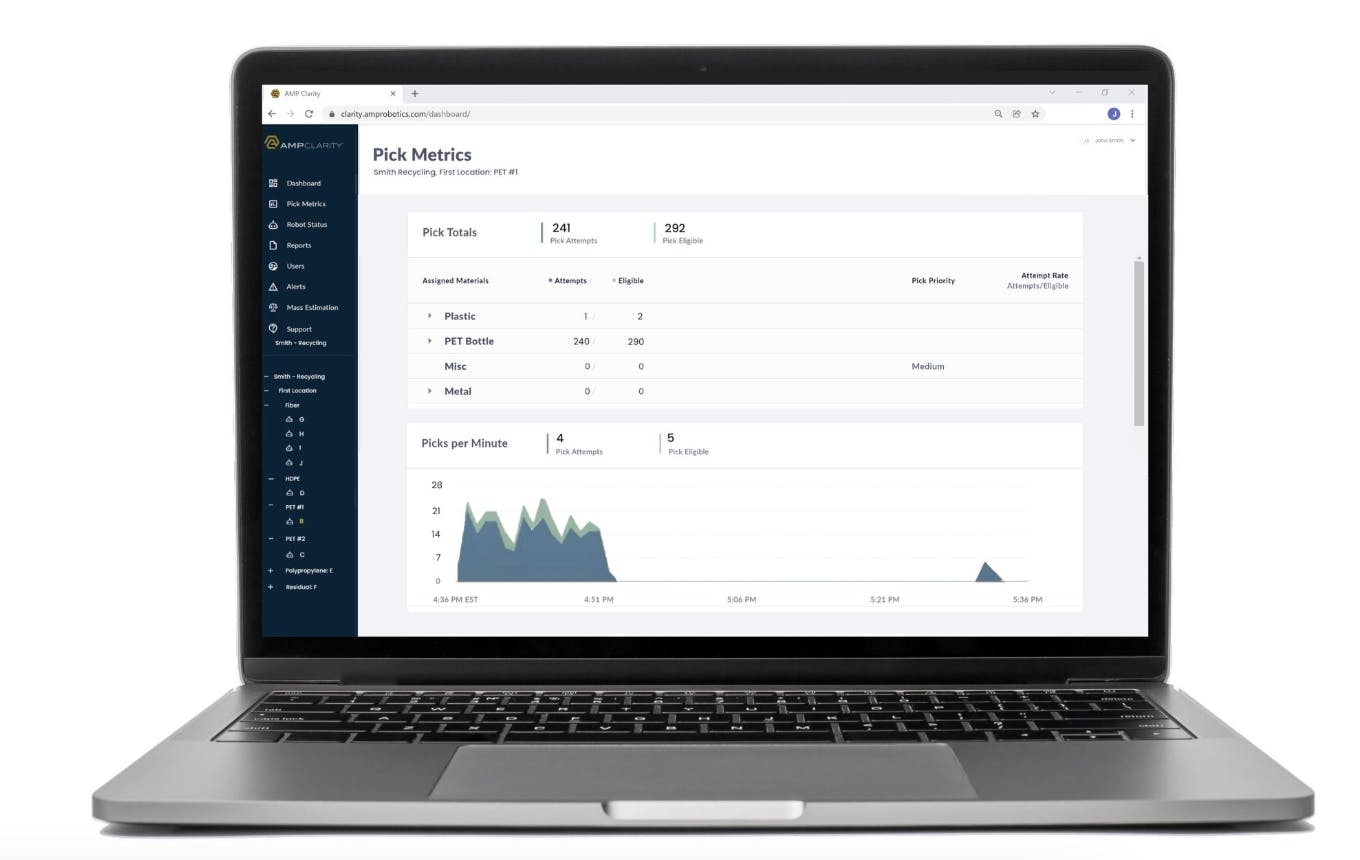

AMP Clarity is a material analysis platform that makes sense of data from AMP Vision and AMP Neuron. AMP Clarity can be accessed via a web-based portal that shows real-time material characterization and performance metrics. Customers use AMP Clarity to understand how to improve operations.

For instance, if AMP Clarity highlights a specific material appearing in higher quantities, the recycler may target sorting and selling pure bales of that material. The recycler can also track processing speed at different steps to understand bottlenecks, timing, and labor usage. According to customers, data insights are valuable to all stakeholders interested in waste reduction and the types of materials processed at recycling facilities.

AMP Vortex

Source: AMP Robotics

AMP Vortex is AMP Robotics’s automated film removal product, which allows users to automate film contamination removal. The company describes it as “the waste & recycling industry’s first automated AI solution”.

Market

Customer

AMP Robotics’ primary customers are recycling facility operators, such as Florida-based Single Stream Recyclers, that have historically relied on manual labor for materials sorting. Other notable customers of AMP Robotics include Waste Management, GFL Environmental, Evergreen, and Napa Recycling. As of May 2023, AMP Robotics has been deployed in more than one hundred recycling facilities across 3 continents.

Market Size

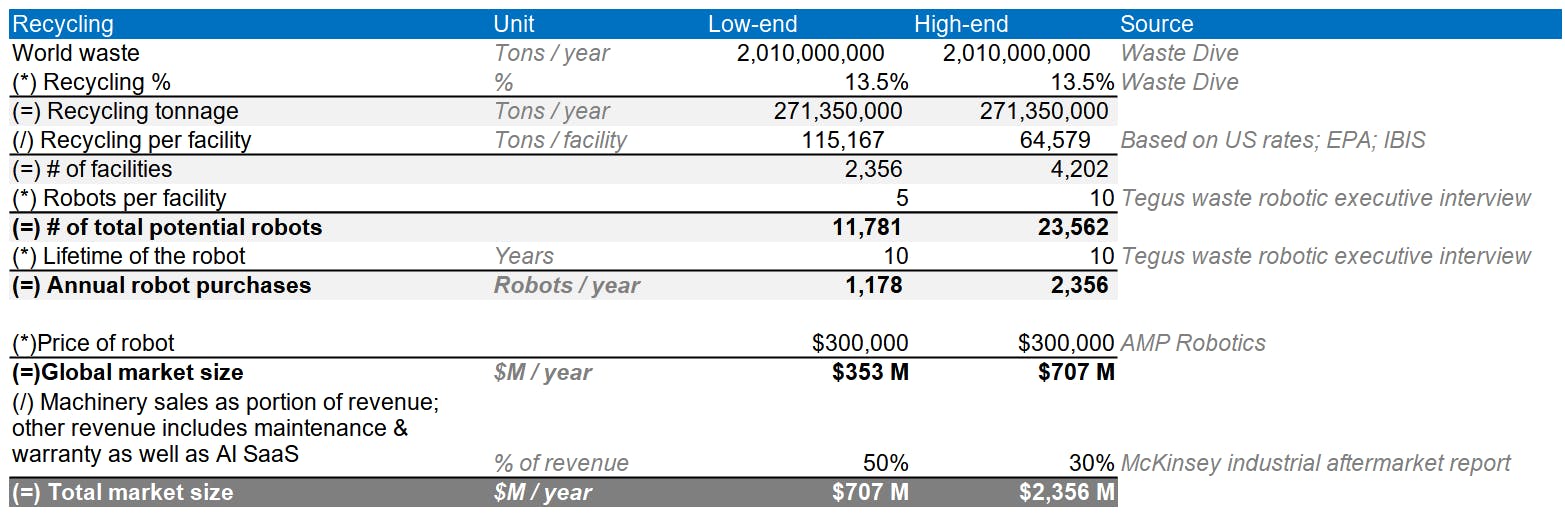

The number of global recycling facilities is unknown, but estimates use international recycling tonnage and US facility processing rates. Roughly 500-1K US facilities processed 69 million tons in 2022, averaging ~64-115K tons per facility. Applying the average US recycling rate against the 2018 global volume of 271 million tons reveals a potential fleet of 11-23K robots representing a $700 million - $2.3 billion market in 2022. As of June 2023, AMP Robotics’ worldwide fleet is ~300 robots, indicating the sorting robots market is under-penetrated.

Source: Various listed; Contrary Research

Some estimates indicate a ~$2 billion market for waste sorting robots in 2021, growing at a 19% CAGR from 2021 to 2030. By 2030, the market may top $10 billion, driven by increases in sold waste production, recycling rates, and robot penetration.

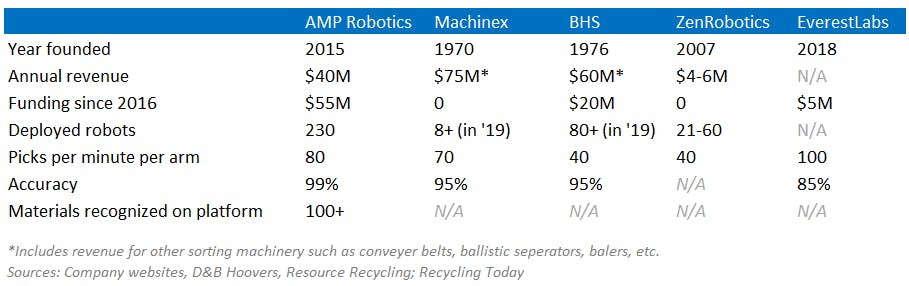

Competition

AMP Robotics competes against traditional recycling machinery sellers and robotic-focused startups. According to AMP Robotics, its core differentiating technology is its AI platform (AMP Neuron) which makes its robots more accurate and efficient than competitors by aggregating data from the AMP Robotics fleet across the globe to continuously improve the AI, creating a data network effect that could prove to be a durable advantage.

As a result, AMP Robotics aims to beat competitors on the speed and accuracy of its robots. Its AI also appears to be more sophisticated than competitors based on the number of materials recognized. As of May 2021, AMP Robotics’s fleet of 230+ robots likely represented half of all waste robots.

Source: Various listed; Contrary Research

Bulk Handling Systems (BHS): BHS is a recycling and environment company that offers legacy recycling conveyor belts along with more recent AI-powered robot sorters. BHS was founded in 1976 and is based in Oregon. The company last raised $20 million in April 2018 from private equity financing and operates with a similar range of 200 employees with a focus on R&D. Since AMP Robotics does not produce its own traditional conveyor belt filters, the company relies on existing manufacturing suppliers like BHS. After BHS launched its own “Max AI” for robotic material sorting in 2019, BHS’ existing clientele may be more willing to test out new AI products from a current provider instead of switching to AMP Robotics.

ZenRobotics: Founded in 2007, ZenRobotics offers AI sorting robots for waste management and specifically recycling. The company is based in Helsinki and serves a global market of 15+ countries as of June 2023. ZenRobotics last raised €1.3 million from grant funding in 2015, amounting to a total of €14 million in funding before being acquired by Terex for an undisclosed amount on August 11, 2022. Thanks to the Terex acquisition, ZenRobotics offers both AI robot sorters and new automated and sustainable recycling facilities. In addition to complete product offerings, ZenRobotics offers material recognition for over 350+ materials. ZenRobotics also promises a 99% accuracy rate just like AMP Robotics, but moves at half the speed of AMP Robotics’ sorters.

EverestLabs: Founded in 2018 and based in California, EverestLabs offers AI robots for waste management and sorting. The company raised a $16 million Series A in September 2022, amounting to $21 million in total funds raised from investors including Translink Capital and Sierra Ventures as of June 2023. In addition to robotic arms and AI-powered sorting, EverestLabs leans heavily into software with deep learning AI, operation analytics, and performance and sustainability reporting as core products. EverestLabs highlights its quick installation process, only requiring recycling centers to connect AC power. The company also claims it requires less than one minute of maintenance per day. EverestLabs’ robots are much smaller, and may even be the smallest according to EverestLabs, making them ideal for smaller waste management facilities that cannot afford retrofitting costs. AMP Robotics, on the other hand, aims to power the “fourth industrial revolution” and is targeting clients at the federal and enterprise levels.

Business Model

Customers buy AMP Cortex robots for $300K in a single lump sum, or lease robots for $6K monthly. AMP Robotics uses a SaaS model for their software, but it is unclear if the software is included in leasing agreements. The company outsources manufacturing and maintenance to Omron, allowing AMP Robotics to have a cost structure similar to a software company.

Traction

AMP Robotics sales doubled from 2019 to 2021, with third-party estimates putting revenue around $40 million for 2021. In 2021, AMP Robotics processed over 50 billion items. In 2022, AMP Robotics’ AI was able to identify over 100 distinct materials. As of November 2022, AMP Robotics had deployed 275 robots at over 40 recycling centers from 2017 through 2020. By 2022, this grew to 230 deployments in almost 80 facilities on three continents.

Notable recyclers using AMP Robotics include Waste Connections and Evergreen. Waste Connections’ purchase of 24 robots was AMP Robotics’ largest order as of January 2022. In May 2023, AMP Robotics received an honorable mention in Fast Company’s World Changing Ideas awards and was recognized as a pioneer in artificial intelligence and robotics.

Valuation

AMP Robotics raised a $55 million Series B funding round in January 2021. The Series B would have priced that company at $200 million, a valuation representing a ~10x revenue multiple on its estimated $20 million 2020 revenue. The company raised a $91 million Series C in November 2022, as well as a $8 million Series C bridge in May 2023. The valuation for AMP Robotics’ Series C was undisclosed. As of October 2023, AMP Robotics has raised a total of $175 million with notable investors including Microsoft’s Climate Innovation Fund, Congruent Ventures, XN, and Wellington Management.

Key Opportunities

Increased Sourcing From Recycling

In 2022, corporations began pledging to use more recycled materials. The push for recycled materials came as supply chains struggled to supply virgin materials. Unilever, Coca-Cola, and Walmart are examples of CPG companies moving towards 100% reusable or recyclable packaging by 2025. Increases in demand put upward pressure on recycled material prices when companies scrambled for suppliers. Limited recycled material supply drove 3x price growth from 2020 to 2022, creating a strong incentive for investment in recycling infrastructure. AMP Robotics’ growth will likely match, or exceed, the increases in recycled materials demand as recyclers look to reduce costs.

Operating Recycling Facilities

AMP Robotics’ AI and optimization software gives it an advantage in operating sorting facilities. In 2022, AMP Robotics built sorting facilities to recycle waste from other recyclers because their products have higher recovery rates. The company launched sorting facilities in Cleveland and Atlanta to test its operational capabilities. If AMP Robotics can stay ahead of MRFs’ innovations using AI-enabled tech to arbitrage the value of waste, AMP Robotics could tap into a $200 billion market for non-recycled materials.

Expanded Application Areas

AI for waste identification is upstream of disposal. The EPA funded a pilot program in 2022 for Clean Robotics to test AI-guided waste diversion at points of disposal in airports. Almost 50% of Americans don’t know if an item is recyclable and will throw it in a waste bin, bypassing the recycling process. Clean Robotics’ placed its AI system above disposal bins to scan items in someone’s hand. The AI would then guide them to the correct bin.

Cities like New York want to increase the diversion of recyclables and organic waste away from landfills and may start using AI-aided technology at the point of disposal to support their goals. AMP Robotics has built the largest related AI-training dataset in the world, which could allow cities to reduce the volume of recyclables and organic waste reaching their landfills using AMP Robotics’s AI.

Key Risks

Financing Environment

Unpredictable commodity prices and macroeconomic factors may dampen demand for robotic investments. Revenue derived from recycled commodity prices swing every year. For example, China declared its Great Sword policy in 2018, stopping imports of low-grade recycled materials. The Great Sword policy took the world’s largest recycling buyer off the market. In response, US recycling prices plummeted from almost $90/ton to $50/ton, creating negative margins for MRFs.

Low Maintenance Competitors

As more competitors enter the market, AMP Robotics’ speed and accuracy may not be unique. EverestLabs, only three years younger than AMP Robotics, has already matched its 99% accuracy. Other companies may be able to increase the speed of their products soon. AMP Robotics also has a large rig machine, versus a smaller and easier-to-install robotic arm. If cheaper, smaller, and near efficient products reach the market, clients may be less likely to use AMP Robotics’s machines.

Path to Profitability

Despite having deployed hundreds of robots, the company's $91+ million Series C and subsequent bridge round may suggest that AMP Robotics is reliant on external investment to fuel its growth and operations, which can potentially be an unsustainable source of capital in the long term. If revenue from sales and services alone is not enough to cover the company's operating expenses and investment in research and development, AMP Robotics may struggle to reach profitability. This could be especially challenging during rapid technological changes and potential economic downturns.

Summary

AMP Robotics addresses the global waste problem by utilizing high-speed sorting robots to replace manual labor in recycling facilities. This innovation aims to decrease operational costs for recyclers and enhance the value of recycled materials. AMP Robotics' flagship product, AMP Cortex, employs AI-driven vision systems to identify and sort recyclable materials. The company's AI platform, AMP Neuron, aids in recognizing recyclable materials within complex waste streams. Furthermore, AMP Clarity offers real-time material characterization and performance metrics via a web-based portal. By improving sorting efficiency and accuracy, AMP Robotics aims to revolutionize recycling operations, positioning it to establish itself within and help grow a multi-billion-dollar market.