Thesis

The average enterprise has over 1K applications, only 29% of which actively talk with one another and share data. This trend will likely accelerate, as end-user spending on public cloud services is estimated to reach $679 billion in 2024 and exceed $1 trillion in 2027. With this scale comes information fragmentation among different applications, making searching for and finding relevant information a significant problem.

The average worker in the US used 11 different applications in their day-to-day work as of May 2023, spending an average of 13 minutes searching for information before asking for help. On average, workers spent ~20% of their workweek trying to understand the documents, information, or people they need to do their jobs, leading to $1 trillion in total productivity lost per year as of April 2023. Some estimates indicate this inefficiency could cost Fortune 500 companies over $12 billion per year.

In addition to information fragmentation, the shift to distributed work environments has made it crucial for companies to provide employees with efficient tools for self-serving, onboarding, and finding information. The need to streamline employee onboarding creates an opportunity for software to help new workers feel like they are thriving in their new jobs. Progress in the capability of AI to understand natural language has led to improved search functionality, which could improve employee collaboration and information sharing.

That’s where Glean comes in. Glean is a productivity startup that has developed a smart enterprise search assistant by indexing and understanding the context of documents from dozens of products through the use of 100+ APIs. As information complexity increases, Glean gives knowledge workers a Google-like experience to more efficiently search through content and employee capabilities.

Founding Story

Source: Glean

Glean was founded in 2019 by Arvind Jain (CEO), T.R. Vishwanath (Infrastructure Lead), Tony Gentilcore (Product Engineering Lead), and Piyush Prahladka (former Head of Search & AI).

Prior to founding Glean, Jain had co-founded Rubrik* in 2014, a data security business that reached a $1 billion valuation within just over a year of emerging from stealth. While leading Rubrik, Jain and his team utilized a tech stack made up of 300+ cloud applications. With data scattered across so many pieces of software, Jain found his own productivity stunted by time spent locating the right information.

During a survey at Rubrik, he observed that finding information was the “single biggest employee environment issue”. Jain realized that no product existed in the market that was solving the problem of knowledge fragmentation within enterprises.Prior to Rubrik, Jain spent more than a decade (2003-2014) working at Google and previously held leadership positions at Akamai and Microsoft. When he later encountered the problem of knowledge fragmentation within enterprises, his idea to solve it drew on his past: building a Google-like search engine for business content by assembling a team of Google and Facebook veterans.

Prior to co-founding Glean, Vishwanath had experience as a principal software engineer at Facebook from 2010 to 2019, working on areas like News Feed ranking, ads, and Facebook’s developer platform. Co-founders Gentilcore and Prahladka, meanwhile, both spent almost a decade at Google as Senior Staff Software Engineers. Prahladka served as the technical and engineering lead in the Google Maps and Search Quality Ranking teams from 2005 to 2017, Gentilcore had previous experience in modernizing the web search interface and leading Chrome’s Speed Team between 2006 and 2016.

Given their backgrounds, the co-founding team was able to understand how ubiquitous the enterprise search problem was, and what differentiated it from consumer search. Unlike webpages linked together, enterprise search involves challenges such as data governance and linking between custom APIs for SaaS applications. To make the product useful for workers across an enterprise, Glean used large language models to perform semantic matching. This allowed users to ask a question in natural language, receive results from across all the applications the business uses, and tailor responses according to the user’s job function.

In March 2019, Glean raised a $15 million Series A and was launched out of an incubation space in Kleiner Perkins’ Menlo Park office, choosing to build in stealth for several years before officially launching in 2021. The company’s initial target customers were technology companies, and as of March 2024, the company was looking to expand to financial services, retail, and manufacturing.

Product

Source: Glean

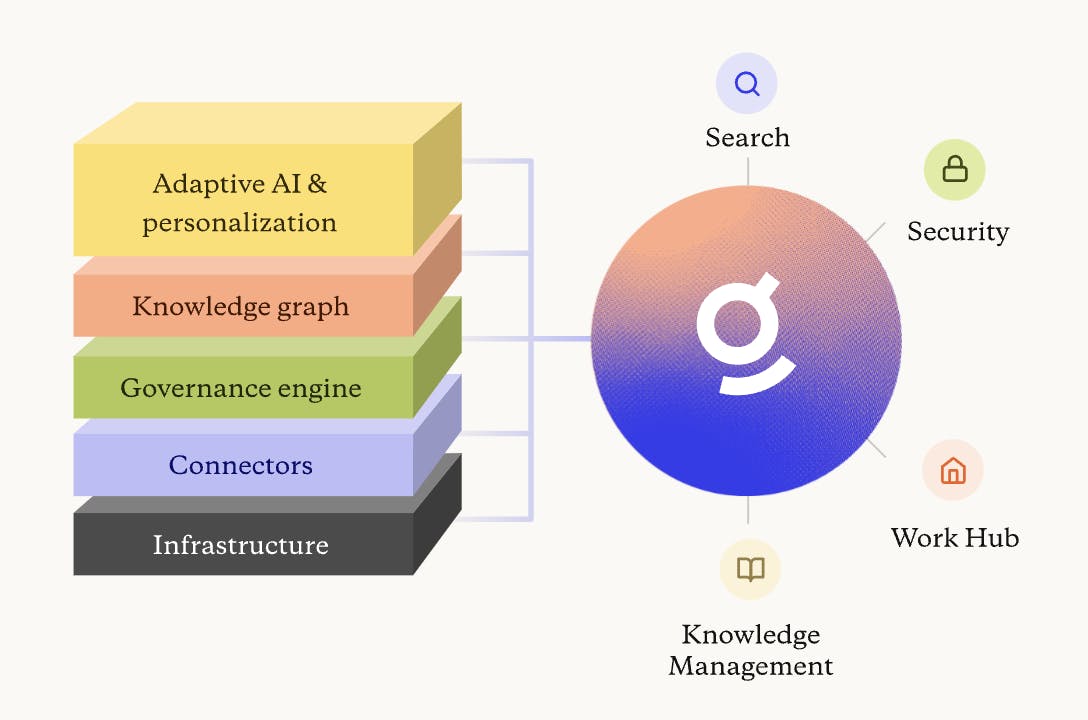

Glean is a unified search product that indexes dozens of applications, understanding context, language, behavior, and employee relationships, to find personalized answers to questions. The product is built on company knowledge and content, with a focus on permissioning and data governance in mind. Glean is a layer on top of a company’s software applications that users can engage with through a web app, new tab page, sidebar search, native search, or Slack demand.

To provide its core features, Glean retrains language models on a company’s unique knowledge base to develop a thorough understanding of content, language, people, and relationships. It operates based on the enterprise knowledge graph, a real-time model of all the indexed information within a company.

Connectors

Source: Glean

A critical piece of Glean’s ability to integrate across an organization's various sources of knowledge is its ability to connect with the disparate applications being used. Glean has built over 100 connectors to different systems that customers rely on. Glean’s ability to expand into larger organizations is significantly limited if the product is unable to ingest knowledge information from a particular core system.

These applications are connected via native, push API, and web history-based connectors. In addition to combining content from these sources, it also takes into account the metadata, identity data, permissions data, and activity data to provide secure and personalized responses to different users.

Workplace Search

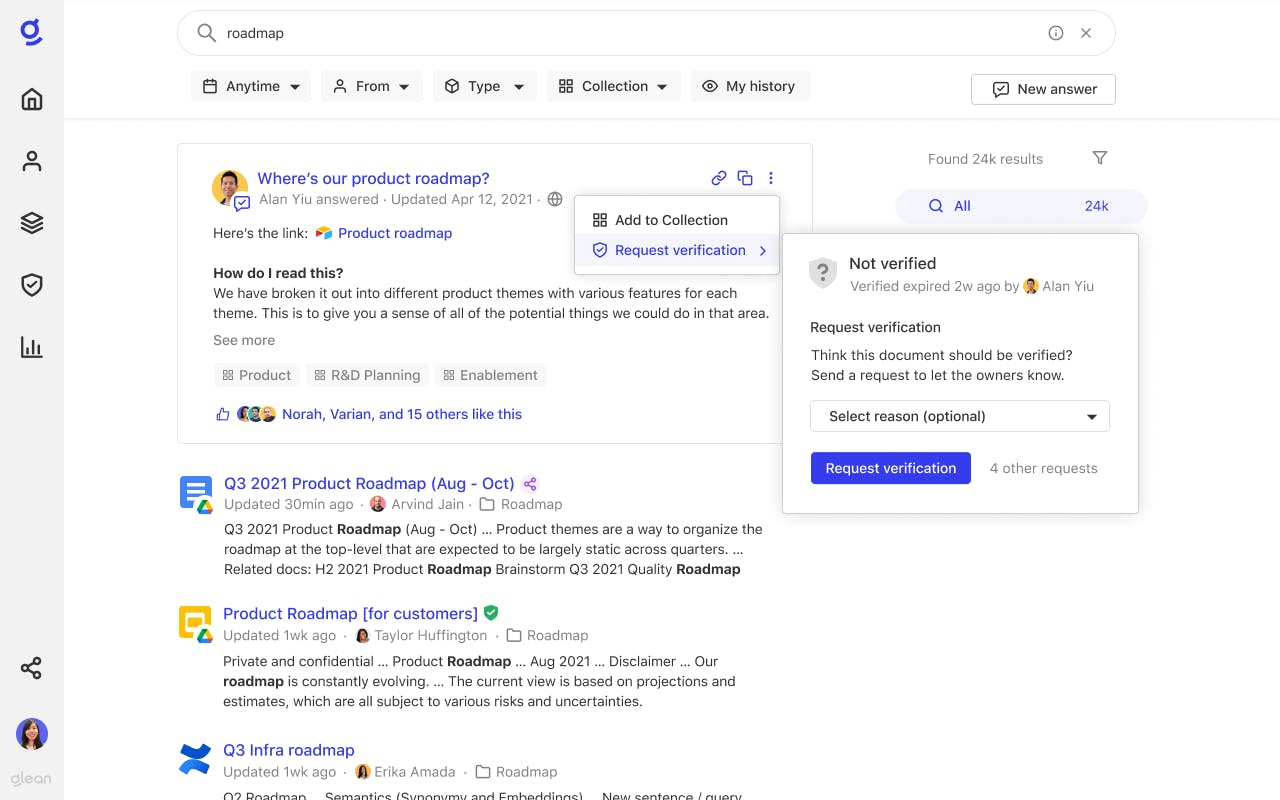

With Workplace Search, a user submits a query in a standard search bar as they would in Google. Contextually relevant documents from across disparate business apps within the enterprise’s knowledge base are retrieved and comprise the search results. As seen below, documents from Google Docs, Google Slides, and Atlassian that contain information relevant to the user’s query for ‘roadmap’ are displayed.

Source: Lightspeed

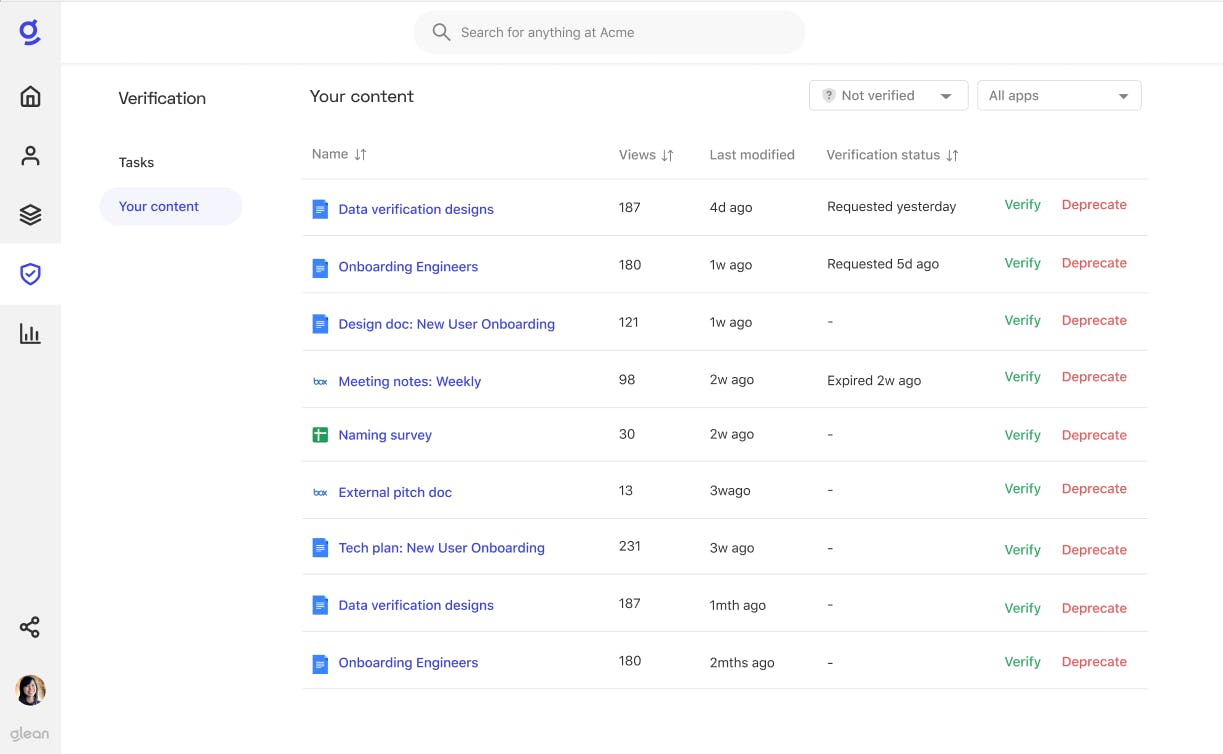

Users also “own” documents or resources that they’ve created. They can see all documents that they have ownership status of in a unified interface. Additionally, the user can verify that a given document is up-to-date. When a document is verified by its owner a green check mark is shown to the right of the document name in the search results page.

Source: Glean

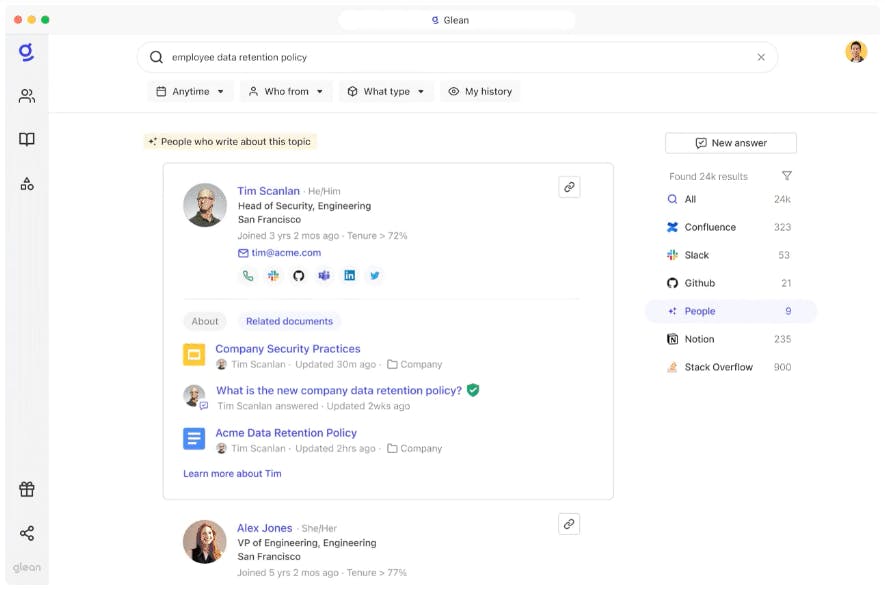

In April 2023, the company released Expert Detection, a feature that enables users to filter their search by “people” to view colleagues within the organization who have unique knowledge pertinent to their query. This is done by “mapping subject matters to people” based on Glean’s understanding of an enterprise’s content, employees, and the activities that employees display.

Source: Glean

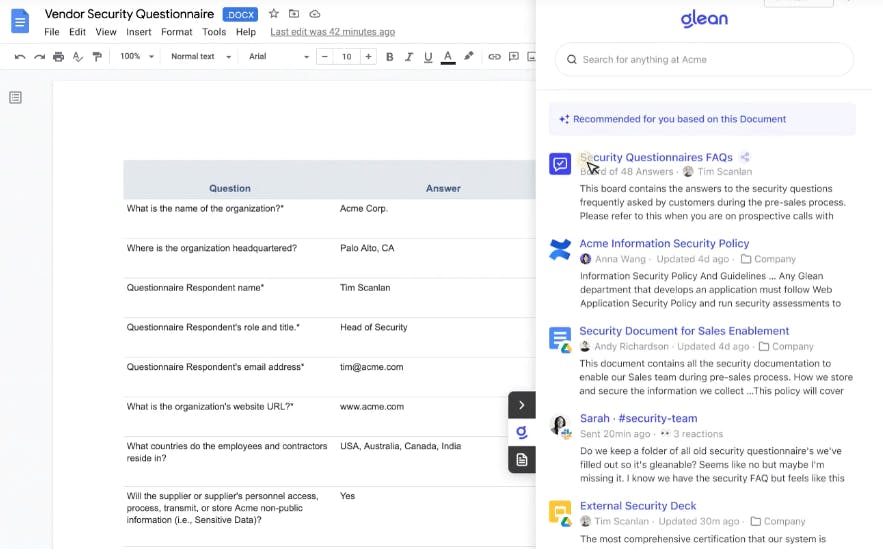

In-Context Recommendations was also released in April 2023. When a user clicks on a populated document on the Workplace Search results page, they can CTRL-J to “surface clickable recommendations for related or relevant content from across the company in a companion window”.

Source: Glean

Glean Assist

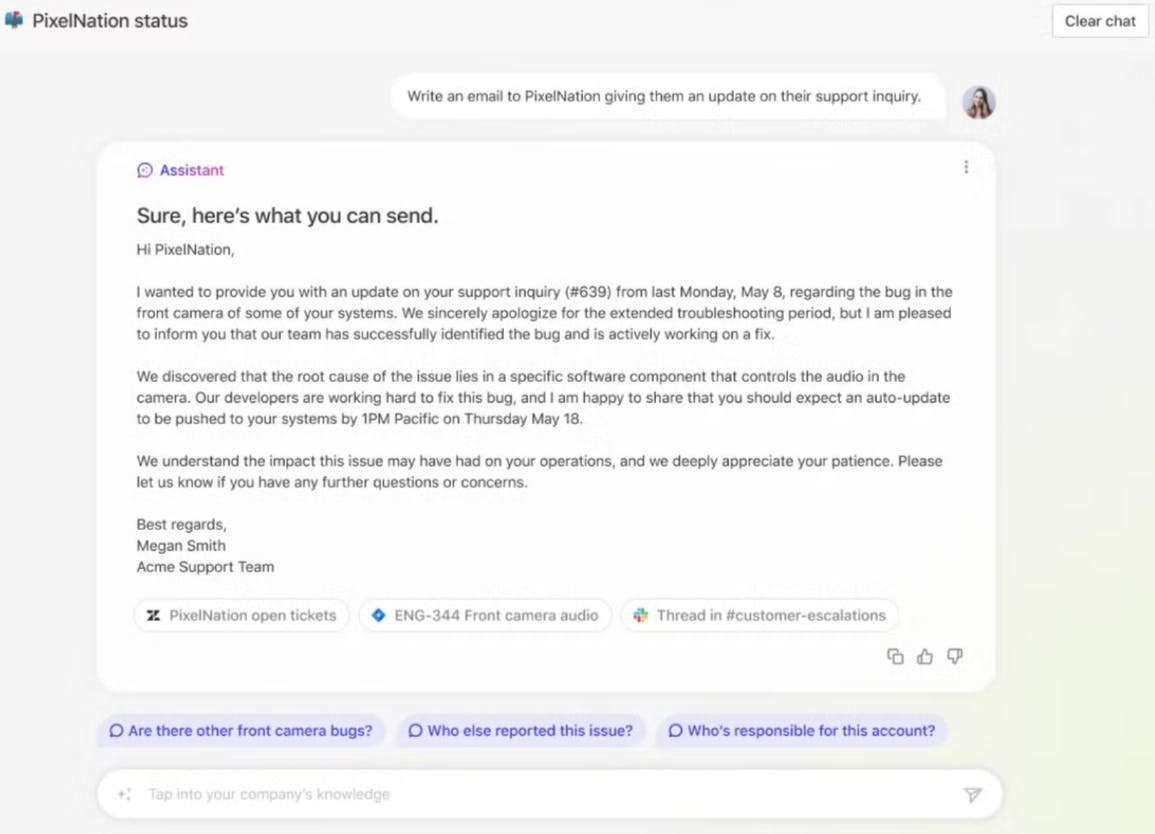

In June 2023, Glean launched Glean Assist, a chatbot that is powered by and functions like ChatGPT, but also has contextual understanding of your enterprise’s knowledge base. The core difference between Glean Assistant and Workplace Search is that Glean Assistant “summarizes, analyzes, creates, and executes work alongside you”, while Workplace Search is intended to retrieve the most contextually relevant documents that already exist from within an enterprise’s knowledge base.

After the user submits a query in natural language the chatbot pulls contextually relevant information from documents contained in applications within the enterprise’s knowledge base. It then incorporates pertinent information into its response. For example, a user can ask Glean Chat to write an email to a customer based on information sourced from their submitted ticket that resides within Zendesk.

Source: Glean

Sources that were used within a query response are documented below the chatbot’s output, as the product comes with “full referenceability for all results generated”.

As of September 2024, the company announced that it had “embedded its AI assistant into major customer service platforms like Zendesk and Salesforce Service Cloud, enabling seamless workflow integration for customer support teams”. This brought Glean’s search capabilities directly within these applications’ interfaces, “enabling support agents to find the knowledge they need to deliver better customer experiences and cut down on resolution times”.

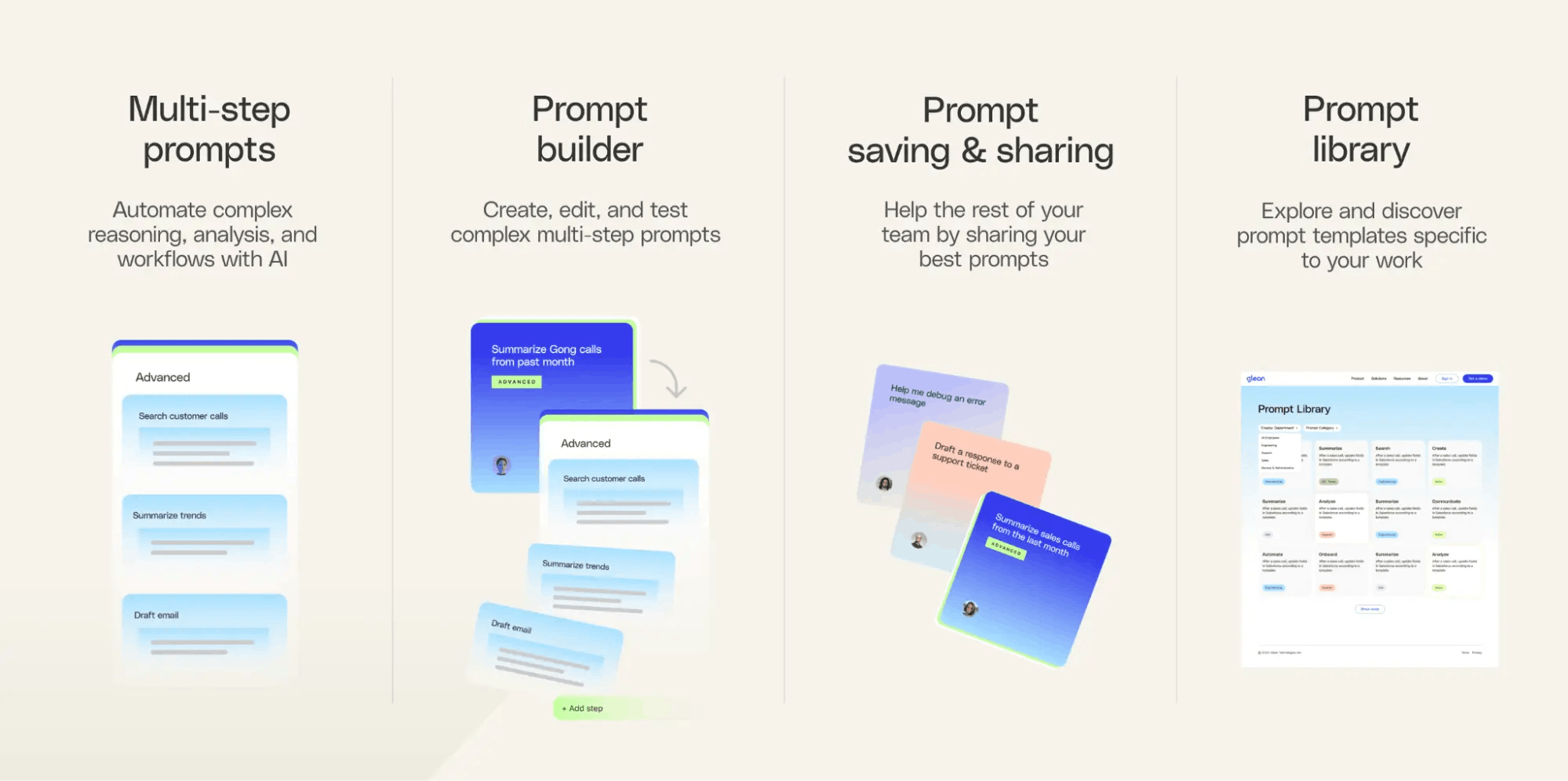

Prompt Builder

Source: Glean

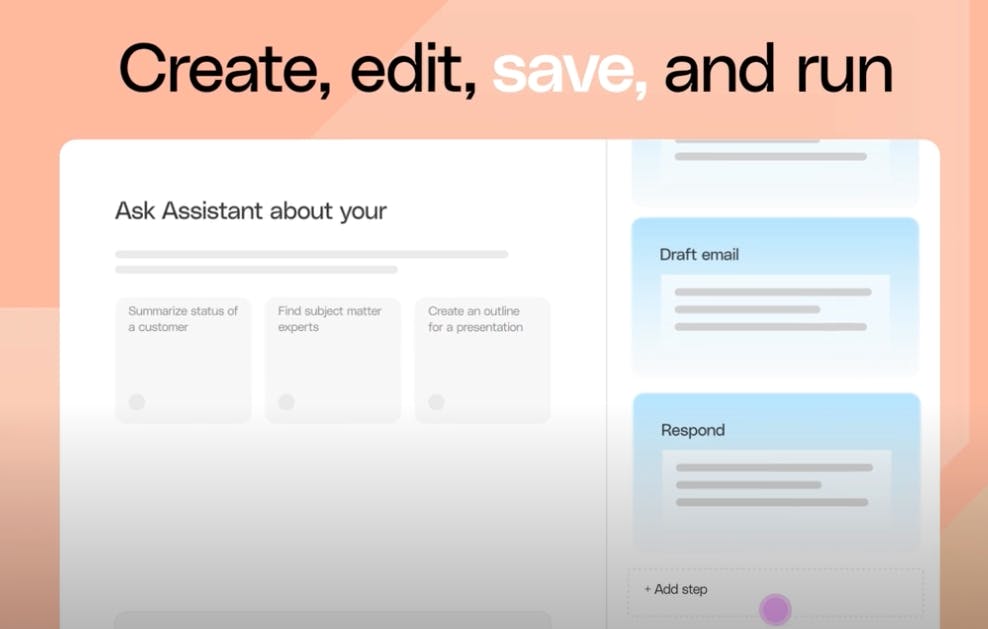

In September 2024, Glean announced Next-Generation Prompting, a major enhancement to its prompting interface and technology for its Assist chatbot product designed to empower anyone to prompt with confidence. It was noted by Jain that Chief Information Officers are under immense pressure to quickly adopt AI while also ensuring employees are comfortable using such tools.

Further, Glean has recognized that AI adoption within the enterprise commonly hinges on employees’ level of comfort with using newly implemented tools. The company demonstrated this through a September 2024 report indicating that only a small portion of enterprise employees know how to effectively prompt engineer and that its mission is to enable everyone to utilize AI at work.

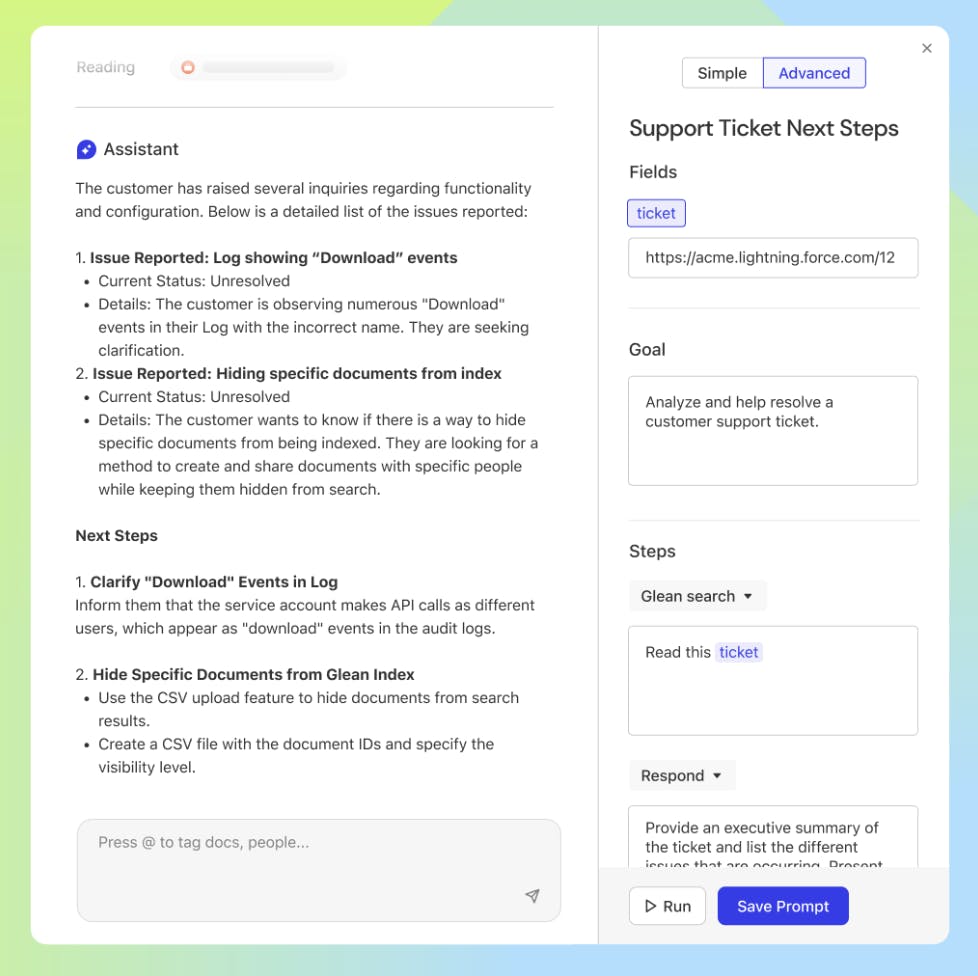

With Prompt Builder, users can more easily create simple and complex prompts. A simple prompt “performs single retrieval actions”, such as searching for documents and returning relevant text snippets or drafting content. However, advanced prompts require multiple steps. Users can now build multi-step prompts in a user-friendly interface with zero code. For example, a user in customer support can simply paste a link to a support ticket, specify the objective of the prompt, and specify the multiple steps that should be taken. In this example, the specified ticket will be read and an executive summary of the ticket will be generated.

Source: Glean

Separately, a product manager may want to extract key pain points from calls with customers. They can create an advanced query that retrieves specified customer calls, summarizes key pain points, drafts an email with this output, and automatically sends it once approved by the user. In addition, users can share links for a prompt with coworkers who can then iterate upon their own copies of it.

Source: Glean

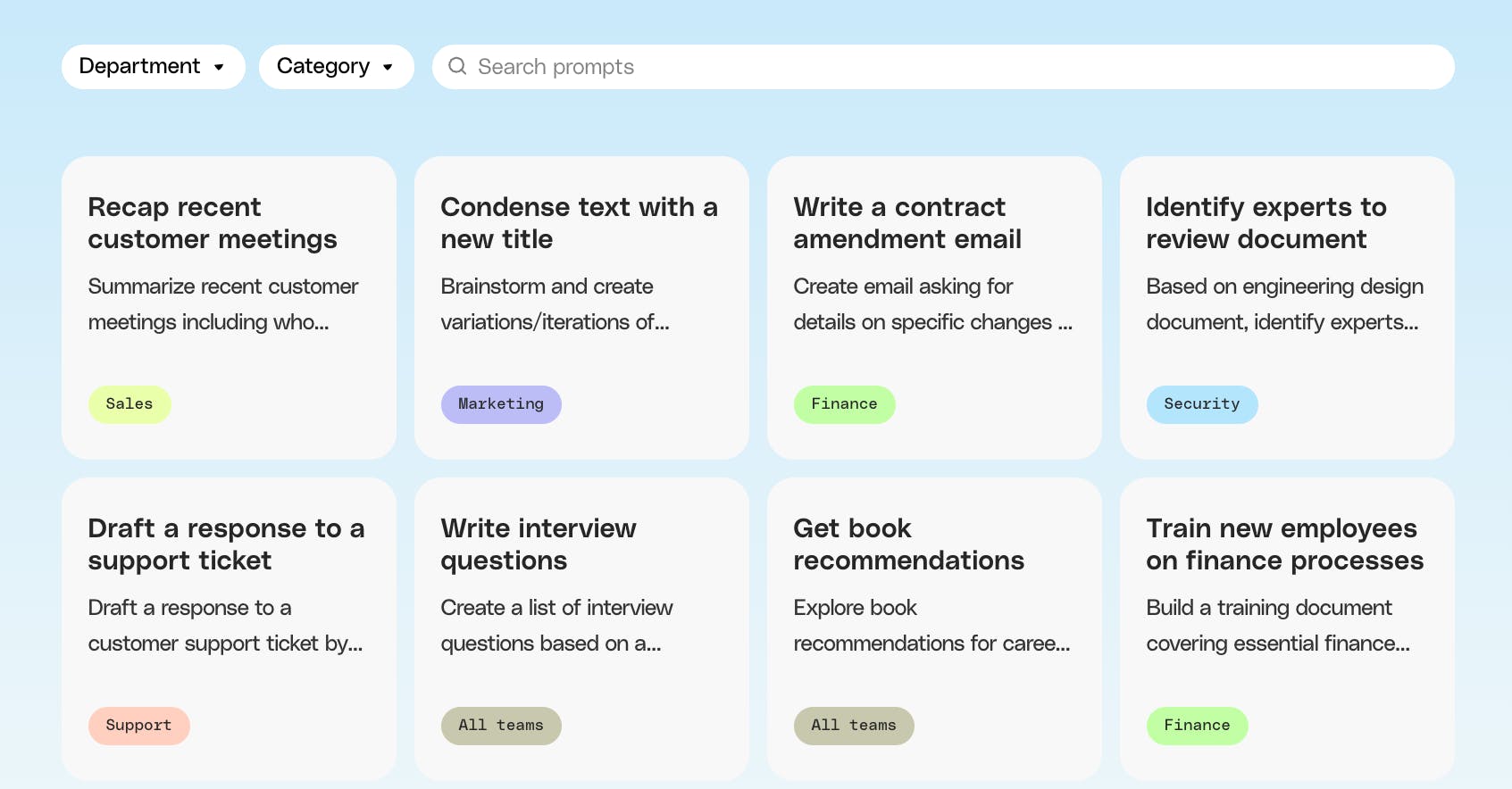

Prompt Library

Also released in September 2024 was Prompt Library, an offering viewable by a customer’s entire organization. It enables prompts to be “readily distributed, experimented with, and discovered by everyone.” This eliminates the need for users to manually produce their own prompts, as they can now utilize those already completed by coworkers. Users can filter prompts by department (e.g. marketing, engineering, design, product, IT, etc.) and category (e.g. search, create, summarize, analyze, onboard, explore, and research).

Source: Glean

Apps & Actions

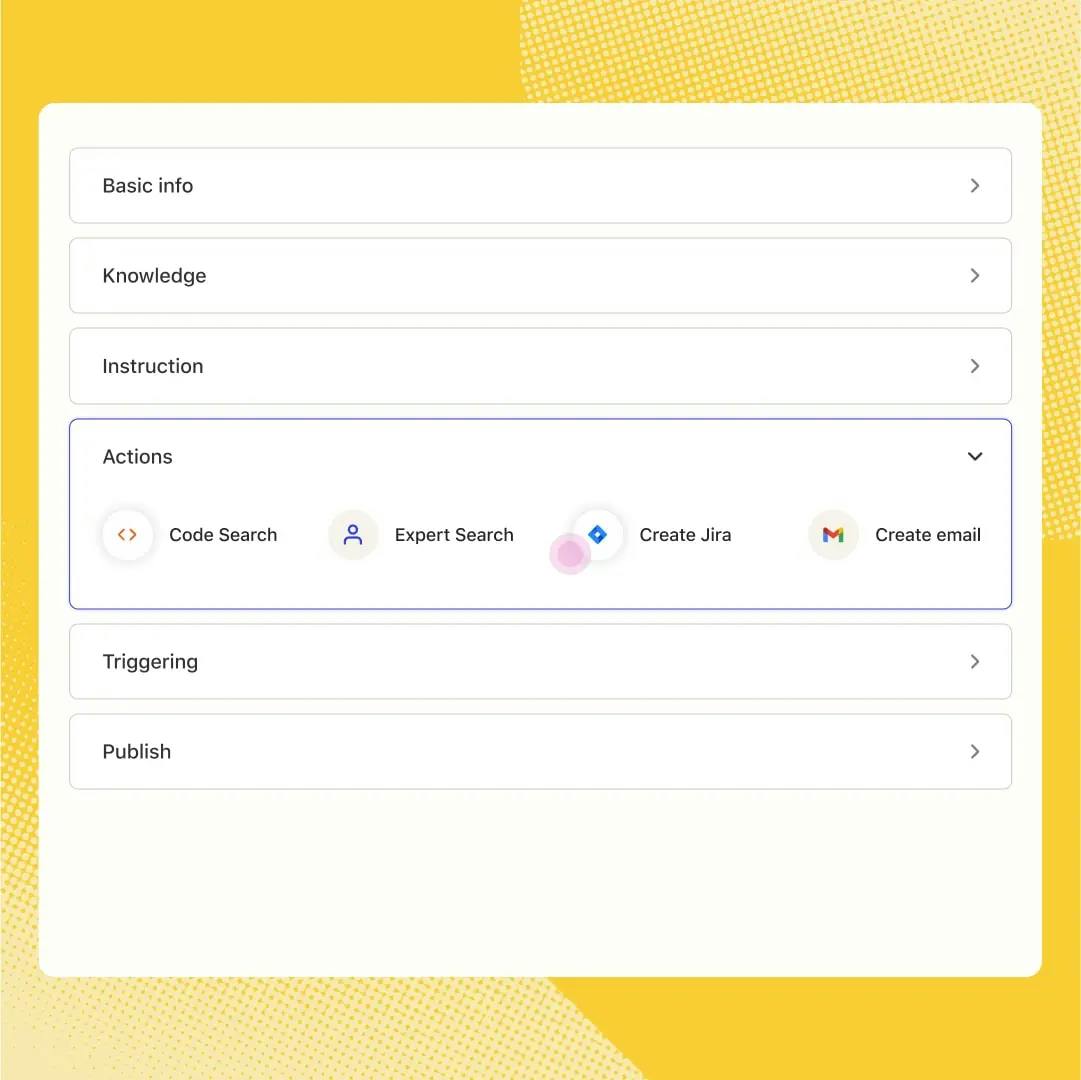

In June 2024, Glean announced the release of Glean Apps. This product enables users to easily create “custom generative AI agents, assistants, copilots, and chatbots created and deployed by everyday users in a no-code environment.”

Users are provided a simple interface, shown below. The user provides basic information including the name of the app along with a basic description. Apps can be constrained by which platforms they can retrieve information from which can be specified under “Knowledge”. Then, the user instructs the app what to do, providing key context such as the type of tasks the app should perform, how its response should be structured, and the desired action that should be taken if the task can be completed.

After that, the user can specify the “actions the app can take on a user’s behalf within a company’s connected applications” such as building code in Jira or creating an email. Lastly, access permission is determined by either an individual or by a team. The trigger that initiates the app’s steps is also provided.

Source: Glean

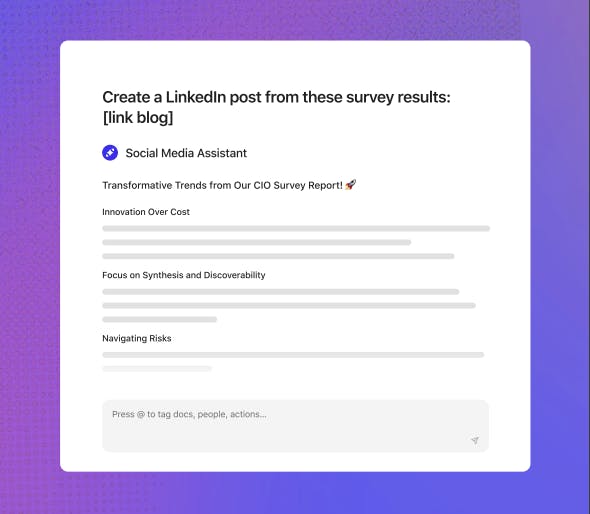

For example, a marketer can create an app that produces LinkedIn post copy based on an uploaded document. The output can follow a desired tone of voice based on the instructions specified by the user. Once the user approves of the copy, Glean Actions takes over and publishes the post directly to LinkedIn. The app can be reused with different documents, drastically reducing the time required for the marketer to produce LinkedIn posts.

Source: Glean

Similar to the Prompt Library offering, Glean Apps are published in the Glean App Library for simple discovery by others within the enterprise.

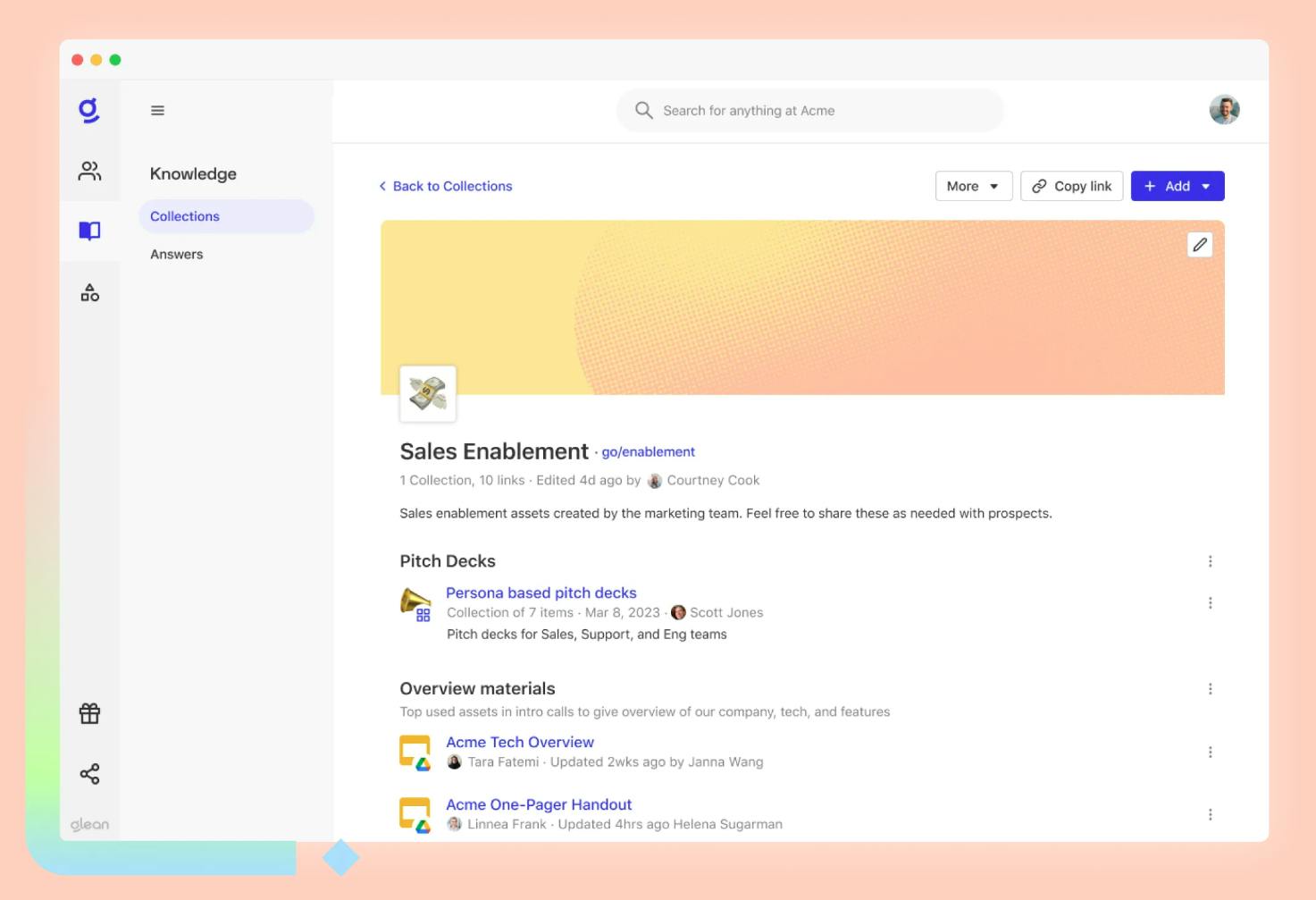

Knowledge Management

With Glean’s Knowledge Management product, users can compile and organize a set of links and documents from disparate platforms into a unified collection. This enables employees to conveniently locate a collection of resources that otherwise would have required manually visiting each respective platform such as Google Slides, Atlassian, or Salesforce, to find desired documents.

Source: Glean

A feature that displays the interconnectedness of Glean’s offering portfolio is shown below. If a document that is populated in a Workplace Search results page is relevant to an existing collection, the user can quickly add it from the search results page.

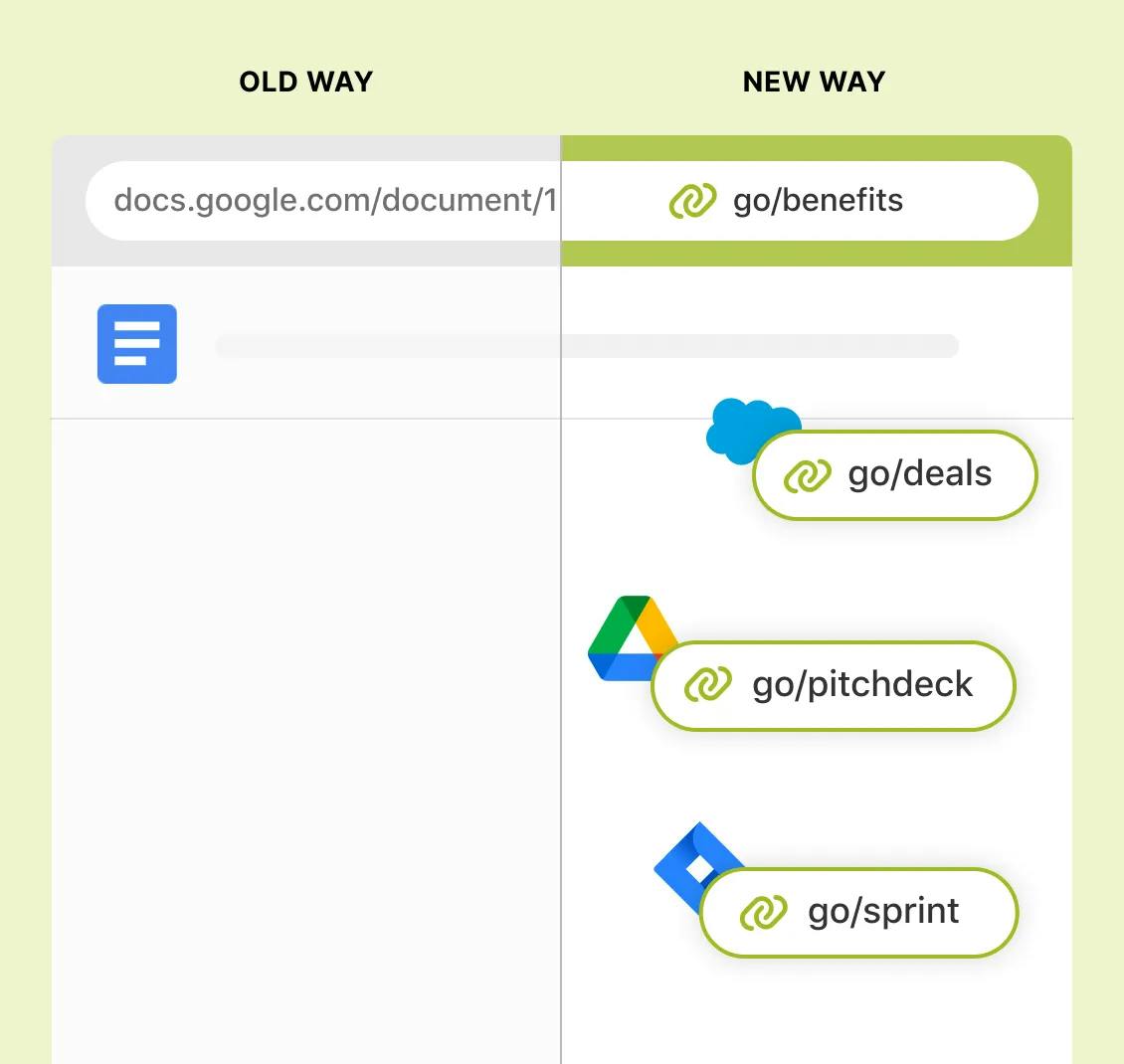

To further streamline a user’s ability to access a document collection, users can create and share Go Links to help employees quickly navigate to common collections of resources. For example, a company can create the Go Link “go/pitchdeck to arrive on a Google Slides deck within Google Drive. Alternatively, the Go Link “go/deals” could be created that directs users to Salesforce.

Source: Glean

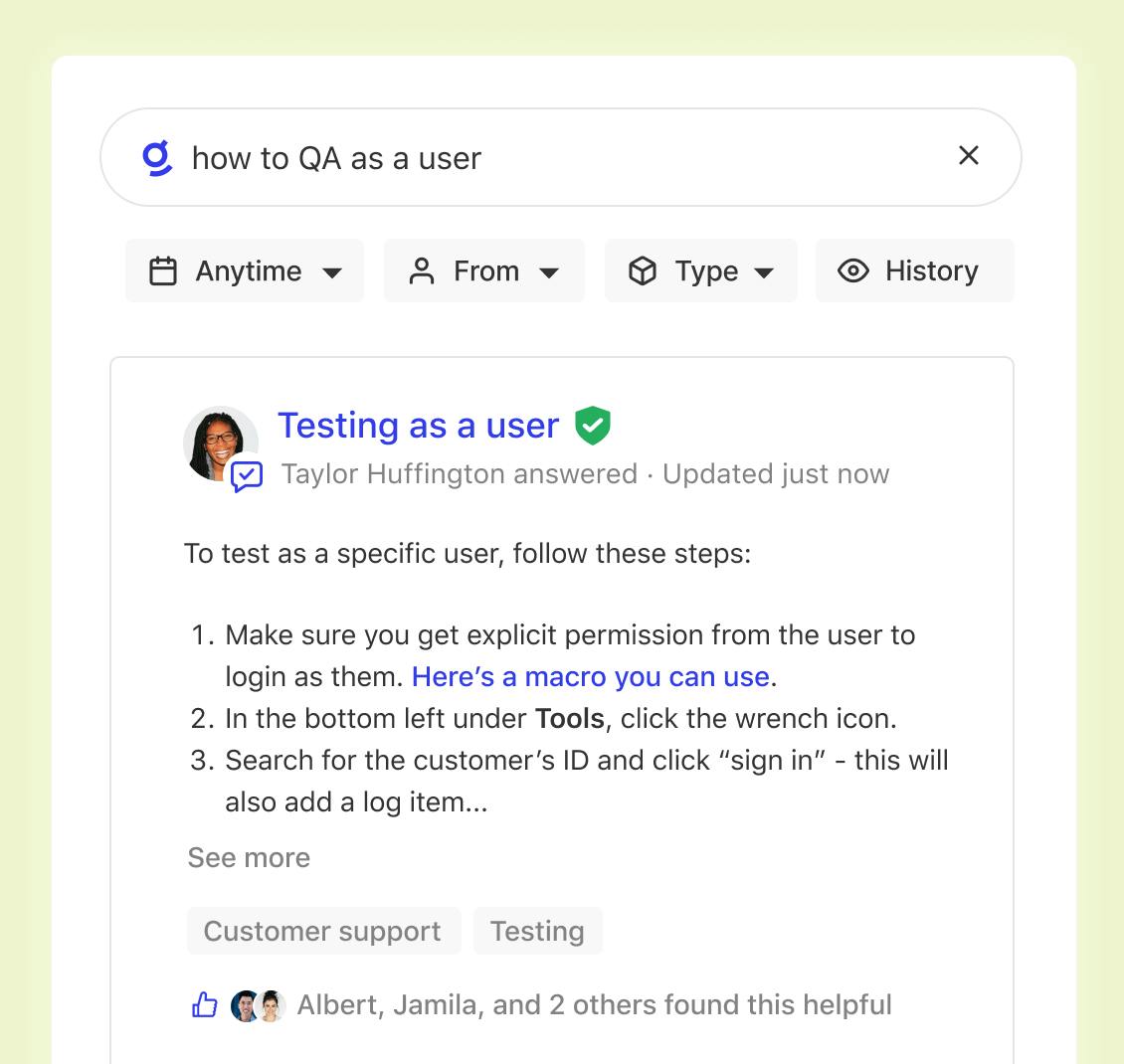

An additional feature within Knowledge Management is Answers. Employees within an organization often ask similar or identical questions. With Answers, employees can answer colleagues’ questions. When a user asks a question within Knowledge Management, a relevant answer is provided.

Source: Glean

Work Hub

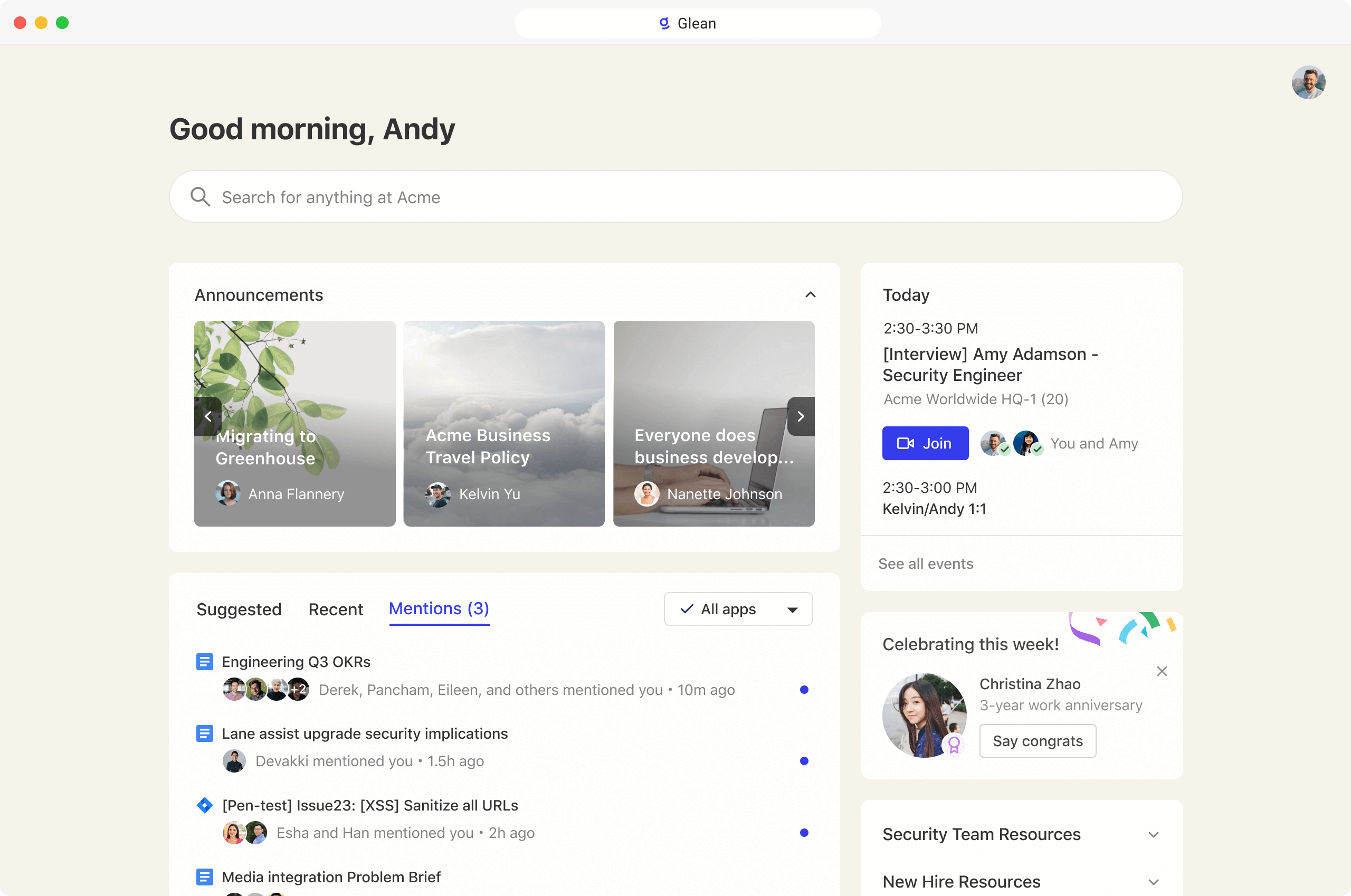

Source: Glean

Glean has built out a “home page” that serves as the go-to spot for employees to find AI-generated recommendations for documents to read through or people with relevant knowledge. This home page includes company announcements, employee directories, a calendar, and multiple widgets to help supercharge employee collaboration like related people, recent work, and availability to meet.

APIs

In June 2024, the company announced the release of two APIs that enable developers to incorporate Glean’s technology into their organization’s products. Chat API can be used to bring Glean Assist’s functionality within other companies’ applications. Search API provides Glean’s proprietary RAG models for best-in-class search functionality in custom generative AI applications. According to Manu Narayan, an executive at Glean customer Confluent:

“With Glean Apps and Glean APIs, we’ve been able to securely build and deploy generative AI applications that would have taken months and significant resources for us to develop on our own.”

Market

Customer

Source: Glean

Glean began by targeting fast-growing technology companies, based on the founding team’s previous experiences. This initial customer segment of companies with a workforce of 500 to 2K employees was chosen because of their propensity to move fast and be “willing to experiment”, according to Jain.

According to an interview with Outreach, a customer of Glean, Glean adds the most value to organizations that have passed an initial setup phase and are now entering into a growth phase with ~100 employees and more. The product is used by end users like engineers, account executives, support agents, and sales engineers.

As of September 2024, Glean served 200 enterprise customers including Duolingo, Grammarly, Webflow, Confluent, and Sony. As of March 2024, Glean was seeking to expand its customer base in industries like financial services, retail, and manufacturing. In February 2024, Citi Ventures confirmed that the bank “will do a pilot evaluation and might end up as a customer.”

Market Size

The global enterprise search market is projected to grow at a CAGR of 9.6% from $5.6 billion in 2023 to $13 billion in 2032. This growth can be attributed to growing data volumes and advanced data complexity within organizations. Along with the data itself, the average number of applications used by a desk worker at an enterprise has also increased. Employees are increasingly spending more time searching for information, with 47% of desk workers struggling to find necessary data for their jobs.

Within the global search market, the multimedia search segment is expected to account for the highest CAGR of 12% from 2023 to 2032, ahead of conversational and multilingual search. This provides an opportunity for Glean to expand from conversational and semantic search solutions as well.

The incorporation of AI-based tools has seen support from organizations and CIOs globally. Generative AI as a percentage of IT budgets is projected to increase from 1.5% in 2023 to 4.3% in 2025. 43% of IT leaders consider customer chat to be the most crucial generative AI capability for making a business impact.

Competition

Enterprise search has been a well-established problem that a number of companies have tried to solve. In 2007, a company called Powerset raised $12.5 million from investors like Peter Thiel and Luke Nosek, founders of PayPal, and Reid Hoffman, founder of Linkedin. In 2008, the company was acquired by Microsoft for $100 million.

Originally, technology like Powerset was expected to become an enterprise search juggernaut built around Microsoft’s SharePoint collaboration platform. However, Barney Pell, the founder of Powerset, focused primarily on Bing, and much of the excitement around search in the early 2010s was more focused on consumer use cases, rather than enterprise.

As a result, Glean still considers the status quo of employees having to search through various systems to be the most likely alternative that people might choose in lieu of Glean. As Arvind Jain, Glean’s CEO, explained in one interview:

“Glean’s biggest competitor is the status quo: employees continuing to deal with the complexity of finding the information and people they need at work. In a typical sales process, potential customers often require Glean to first start with a pilot to demonstrate how much value implementing Glean can provide.”

Of the solutions that do exist in this space, the majority are aligned to one of the large tech companies, such as Microsoft and Amazon.

Source: Gartner

Established Tech Companies

Microsoft: Microsoft has multiple solutions in the enterprise search space. SharePoint Syntex was launched in 2020 and made available to all Microsoft 365 users in 2022. The product offers content storage with AI integrated into user workflows in order to automatically add tags, and index high volumes of content, so users can search effectively.

Unlike Glean, SharePoint doesn’t connect with every information source within a company, limiting its access to Office 365. Within Microsoft’s Azure cloud service, the company provides Azure Cognitive Search, an information retrieval system within a customer’s web applications and data, both for internal enterprise use cases and external website or ecommerce search.

Google Cloud Search: Google announced Google Cloud Search in 2017 as a search platform spread “across G Suite products, including Drive, Gmail, Sites, Calendar, Docs, Contacts and more.” Originally, the product was focused on being seamlessly integrated across Google Workspace apps, but increasingly Google has launched similar connections to external platforms as other enterprise search offerings. The product includes connections to GitHub, Confluence, Jira, and Slack among others.

Amazon: In 2020, Amazon announced the release of Amazon Kendra, an enterprise search platform that enables users to ask contextual questions and search across silos for relevant information, both within Amazon’s ecosystem (e.g., S3) and external (Salesforce, Slack, etc.) Amazon also offers Amazon CloudSearch, a cloud-based search service that is primarily focused on external use cases like a website or ecommerce store, and Amazon OpenSearch Service, derived from Elasticsearch, which is primarily for application performance review, rather than knowledge management.

Elastic: Founded in 2012 by the creators of the popular open-source project Elasticsearch, Elastic provides software products for developers, startups, and enterprises to make massive amounts of complex structured and unstructured data usable. By focusing on scalability, ease-of-use, and ease of integration, Elastic’s products are used for real-time search, logging, analytics, and security to power internal and external applications for organizations like Cisco, eBay, Goldman Sachs, and Groupon.

Elastic went public in June 2018 after raising a total of $162 million from investors like Benchmark, Index, and NEA. Elastic mostly works on the back end of enterprises, powering external application interfaces without users ever realizing how their searches are being executed, and has not shown a desire yet to compete with Glean’s vision to become the Google of internal company data search.

Newer Entrants

Coveo: Founded in 2005 in Canada, Coveo is an AI search solution for ecommerce, websites, customer service, and workplaces. The company went public in November 2021, raising $158.3 million (CAD 215 million) for its IPO. Coveo reported a revenue of $112 million in 2023, up by 30% from 2022. As of September 2024, Coveo had 700+ enterprise customers, including Adobe, Formica, Salesforce, and Manulife. Unlike Glean, which solely focuses on internal enterprise search, Coveo’s product suite includes ecommerce and website offerings as well.

Sinequa: Founded in 2002, Sinequa is an enterprise search company, headquartered in France. The company has raised a total of $28.3 million in funding as of April 2024. It raised a $23 million Series B at an undisclosed valuation in July 2019 led by Jolt Capital. The company expanded to the United States in 2014 and mainly serves industries like healthcare, life sciences, manufacturing, financial services, law firms, and government and defense. As of September 2024, its customers include Pfizer, NASA, BASF, Siemens, and TotalEnergies. While both Sinequa and Glean offer AI-powered search and generative AI capabilities to their customers, the biggest differentiator between the two is the target customer segment.

Lucidworks: Lucidworks is an AI-powered search and product discovery company, founded in 2007. The company has raised a total of $209 million in funding as of September 2024. In August 2019, it raised a $100 million Series F at a $370 million valuation, led by Francisco Partners. Lucidworks offers solutions for both a company’s internal use as well as external-facing roles like customer service and ecommerce search. As of September 2024, its customers include Crate & Barrel, Morgan Stanley, Northwell Health, Cisco, and REI. Compared to Glean’s focus on technology companies, Lucidworks serves retail, healthcare, manufacturing, B2B commerce, and public sector industries.

Vectara: Founded in 2022 in Palo Alto, Vectara is a generative conversational search platform that seeks to provide a ChatGPT-like experience for business users looking to engage with their internal data. The company raised a $28.5 million seed round in June 2023, led by Race Capital. In February 2024, Vectara launched a new module Vectara Chat, that allows users to create their own chatbots using domain-specific data. The company positions itself as a “developer-friendly, API-first search platform”.

Neeva: Neeva, founded in 2019, was launched as a rival to Google’s consumer search business. The company raised a $40 million Series B in March 2021, bringing its total funding amount to $77.5 million. By 2022, Neeva had grown to one million monthly users and was expanding to Canada. After facing challenges in creating a sustainable user acquisition funnel, it announced a pivot to AI-powered enterprise search in May 2023. Just three days after the announced pivot, Snowflake announced that it had acquired Neeva for an undisclosed amount.

Traditionally, enterprise search companies are focused on enabling users to search for information across their employer’s internal knowledge databases. Some products, like Azure Cognitive Search or Amazon CloudSearch, are focused on enabling search functionality within an existing cloud ecosystem. With the acquisition, Neeva is expected to provide a higher-quality search capability within Snowflake’s cloud ecosystem.

Moveworks: Founded in 2016, Moveworks offers an AI chatbot purpose-built for the enterprise that pulls in data from hundreds of business apps. The company raised $200 million in a June 2021 Series C financing led by Tiger Global Management. It has raised approximately $315 million as of September 2024. Moveworks features a proprietary LLM trained on over six years of proprietary data. Moveworks’ product portfolio seems to be more centrally focused on its Copilot chatbot product, while Glean appears to offer a more comprehensive offering set consisting of a proprietary search engine, a chatbot, prompt builder, no-code app developers, and more.

Hebbia: Founded in August 2020, Hebbia’s core product, Matrix, is an enterprise search product specifically designed for knowledge workers within industries such as financial services and law. It raised $130 million in July 2024 in a Series B funding round led by Andreessen Horowitz. The company has experienced significant adoption within the asset management industry, with its product currently being used by 30% of the top 50 asset managers by AUM as of July 2024.

Hebbia’s product enables knowledge workers to upload any form of document and specify questions to be answered across each of them. It then returns answers to these questions in a format similar to Microsoft Excel. The product was also designed to handle the more ambiguous, complex questions that analysts within investment banking, private equity, and law are often required to answer. In contrast, Glean provides a more comprehensive suite of search products, including a proprietary search engine and no-code app developer.

Business Model

Glean earns its revenue through a per-user monthly fee, based on annual subscription contracts. The company has not made its pricing model public. As of February 2024, Jain said the custom pricing is dependent on the number of employees using the product each month. One interview indicated that early customers of Glean like Outreach paid a flat rate of ~$50K per year, regardless of the number of employees using the software.

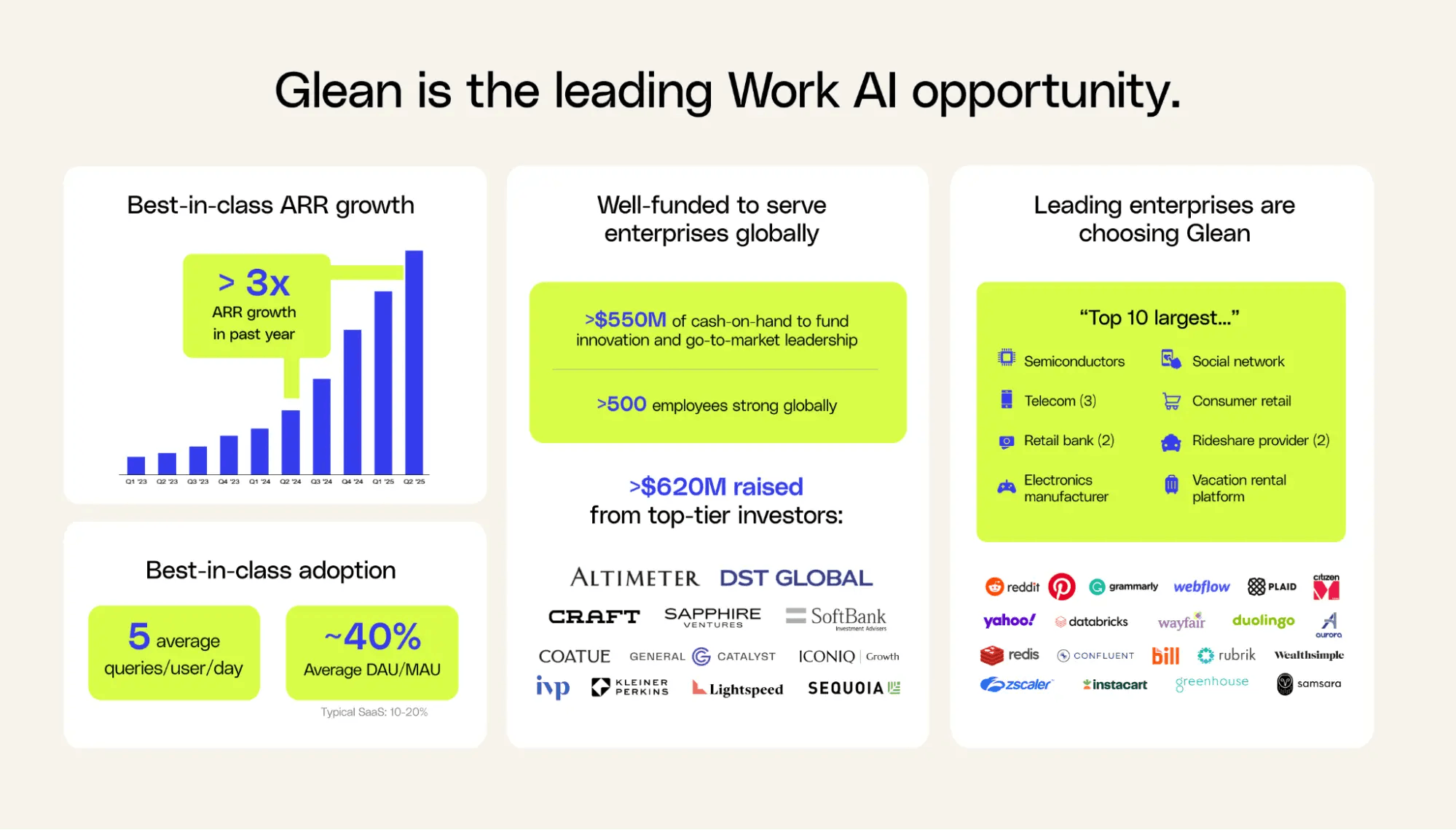

Traction

Glean's annualized revenue grew to $39 million in January 2024, marking a 4x growth from the $10 million recorded in 2023. Notably, it was indicated that between Q2 FY2024 to Q2 FY2025, the company saw a 3x increase in ARR. This is likely due to Glean’s customer base spanning into a broader range of industries and geographies. The company has successfully secured contracts with “many of the ‘top 10’ largest” companies across telecommunications, banking, retail, travel, social networking, manufacturing, semiconductors, and electronics. Of the company’s 200+ enterprise customers as of September 2024, notable names include Duolingo, Amplitude, Instacart, Databricks, Plaid, and Vanta.

Glean's workforce also expanded significantly in 2024. As of September 2024, the company had 614 employees, nearly doubling its size from 337 in March 2024. When the company announced its Series E in September 2024, Jain indicated its new funding would primarily be used to “accelerate AI innovation, customer acquisition, and global expansion”.

User engagement as of September 2024 has been strong across Glean's customer base, with an average daily active user (DAU) to monthly active user (MAU) ratio of ~40%, well above the 10-20% typical for enterprise SaaS platforms. Glean Assistant, in particular, has seen rapid adoption, with users querying the tool an average of five times per day — comparable to Google search activity. Many customers have cited Glean Assistant as the first new tool in years to be added to their everyday tech stack for work, joining core systems like Slack, Teams, email, and calendar tools.

Source: Glean

Valuation

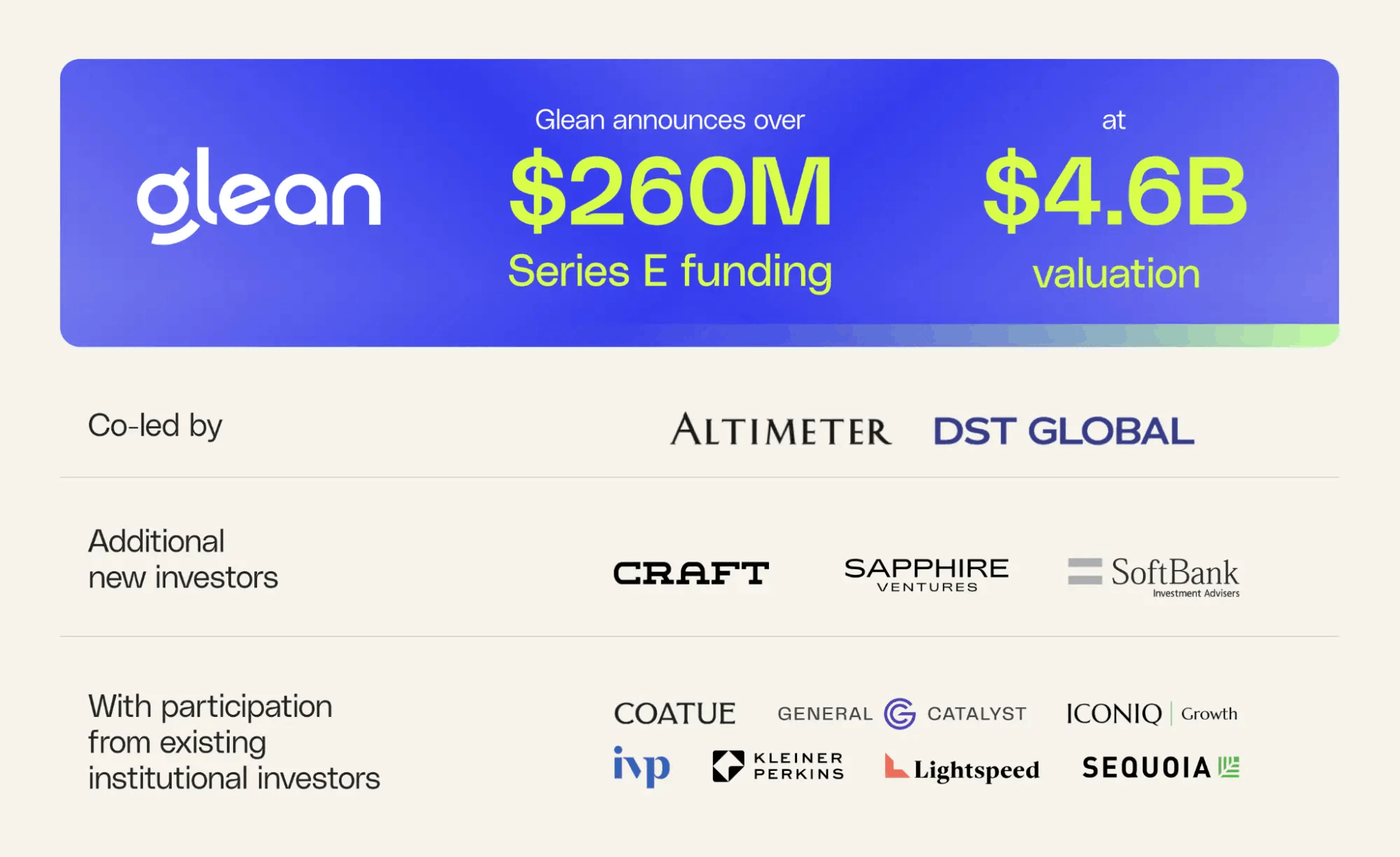

In September 2024, Glean announced a $260 million Series E financing at a $4.6 billion valuation, with Jain indicating that the most recent financing wasn’t required but was raised to meet rapidly growing demand for its offerings. As of its Series E, the company had $550 million in cash on hand and had raised a total of $615.3 million in funding.

The Series E was co-led by new investors Altimeter and DST Growth, alongside participation from existing investors Craft Ventures, Coatue, General Catalyst, ICONIQ Growth, IVP, Kleiner Perkins, Latitude Capital, Lightspeed, and Sequoia. The round came quickly after the company closed a $200 million Series D at a $2.2 billion valuation just a few months earlier February 2024, representing a 1.9x increase in valuation in less than a year. Its Series D valuation itself represented a 2.2x step up from its $1 billion valuation in May 2022.

source: Glean

Key Opportunities

AI Assistant for the Enterprise

With rapid advancement in LLMs like GPT-4, the practicality of an enterprise AI assistant becomes more probable. The vision for this kind of product would be an AI assistant that takes goals or tasks and leverages AI to find answers, or even progress towards completing tasks. In one estimate, the market for business process automation technologies — technologies that streamline enterprise customer-facing and back-office workloads — will grow from $9.8 billion in 2020 to $19.6 billion by 2026. In addition to analyzing, extracting, and synthesizing information, Glean can add task completion features to the Glean Chat AI assistant.

Employee Data Graph

Glean is uniquely positioned because it has access to the entire corpus of a company’s internal data. Having built out the employee knowledge graph, Glean now knows how every employee is connected to each other. Similar to how Rippling has built out a suite of tools from its employee knowledge graph, Glean can leverage its platform position and source of truth within an enterprise to potentially build out knowledge products in specific use cases like HR, payroll, app management, device management, and other tools, expanding its potential market size.

Global Expansion

The Asia-Pacific region is anticipated to be the fastest-growing market for enterprise search solutions, with a projected CAGR of 13.8% from 2023 to 2032. The region is also the fastest-growing financial services application market, projected to reach $271.7 billion by 2029. Expansion into this geography can serve Glean well, especially as it ventures into industries like financial services.

Key Risks

Unproven Market

Enterprise search is a difficult market. Consumer search has been able to succeed largely because of the massive amount of data on the public internet these types of products have to work with. Other companies, like Elastic and Algolia, have found some success enabling search capabilities for developers.

Regulation

Increasing privacy concerns and frequently changing policies around data and compliance pose obstacles for Glean. Since the platform connects the proprietary data of an organization, including internal chat data, data security risks are a challenge, especially with Glean seeking to expand into more regulated industries like financial services. Additionally, problems like hallucinations – where an underlying LLM generates grammatically correct but factually inaccurate data – are a serious concern, and products like Glean need to continue enforcing mitigation techniques to ensure reliable responses.

Adoption and Retention

Enterprises cannot draw any inferences for users or items if it hasn’t gathered enough information, and this can limit the size of customers Glean can target. In one interview, a Glean customer indicated that even post-launch for Glean, adoption among employees could be as low as 20-40%. Adoption can also be relatively uneven across different teams. Glean’s initial target buyers were companies with 500 to 2K employees, which are in their experimental, fast-moving stage. With fewer employees and thus a lesser need for knowledge management capabilities, Glean could find it challenging to market to SMEs.

Summary

As an enterprise grows, so does the volume and complexity of its information. Being able to structure existing content across diverse repositories and surface relevant information quickly yields benefits like increased productivity and enhanced collaboration. Glean is attempting to reform the way knowledge workers find and consume information. By integrating with as many knowledge databases within an enterprise, Glean can build a contextual knowledge graph to understand what information is critical, where it’s stored, and who at the company has any possible additional context on that information. As Glean continues to expand into larger enterprises, the company will have to demonstrate the ability to handle an increasingly complex knowledge graph to continue to serve customers effectively.

*Contrary is an investor in Rubrik through one or more affiliates.