Thesis

As the world has adapted to a post-pandemic normal, ecommerce remains a mainstay in how people choose to shop. As of June 2022, 22% of sales are made online compared to just 15% in 2019. The shift to digital commerce has come with the growth of the number of brands and has also fueled the accessibility of consumers to search and discover new products, resulting in a paradox of choice.

Today, 72% of consumers expect companies to recognize interests and deliver personalized interactions, with personalization accounting for 10-15% of revenue lift. Even more paramount is how fast some of these interactions are delivered. In 2012, it was reported that Amazon found that one second of page load latency could account for $1.6 billion in lost sales revenue yearly. Now more than ever, with ecommerce projected to grow to $5.4 trillion by 2026, the paradox of choice necessitates personalization, and thereby, high-performance, relevant search.

Algolia is tackling that problem, in ecommerce and other verticals, with a set of APIs that enable developers and entire enterprises to embed search and discovery into their products and platforms. Algolia wants to be the API engine for B2B private search, just as Google has become for web search. Having become the second-largest search engine by query volume in 2021 with 1.75 trillion searches, the company is also positioned to take advantage of technical tailwinds like GPT-3, which is closing the gap between consumers and context in returning results.

Founding Story

Algolia was founded in 2012 by Nicolas Dessaigne and Julien Lemoine. Prior to founding Algolia, the pair worked together at Exalead, where they built and led engineering teams on web and enterprise search products. There, they observed that startups were building search features using Google App Engine’s indexing capabilities designed for document search. App Engine was not optimal for searching ‘as you type’ on smaller amounts of data stored in databases.

They then saw a need on StackOverflow from app developers wanting to embed Apache Lucene inside their own mobile apps. The team launched a mobile SDK search product, though their company was initially rejected by Y Combinator. Dessaigne and Lemoine then decided to pivot to a SaaS API product, choosing to differentiate search over databases instead of search over documents.

Algolia joined Y Combinator’s Winter 2014 cohort, where the founders rented a house in the Bay Area for their team of 6 as they worked on their MVP, setting the pace for an iterative culture. Dessaigne stepped down in 2020, moving to join Y Combinator as a Group Partner and appointing Bernadette Nixon as successor CEO. In December 2022, Algolia announced Lemoine would be transitioning to an adviser role.

Product

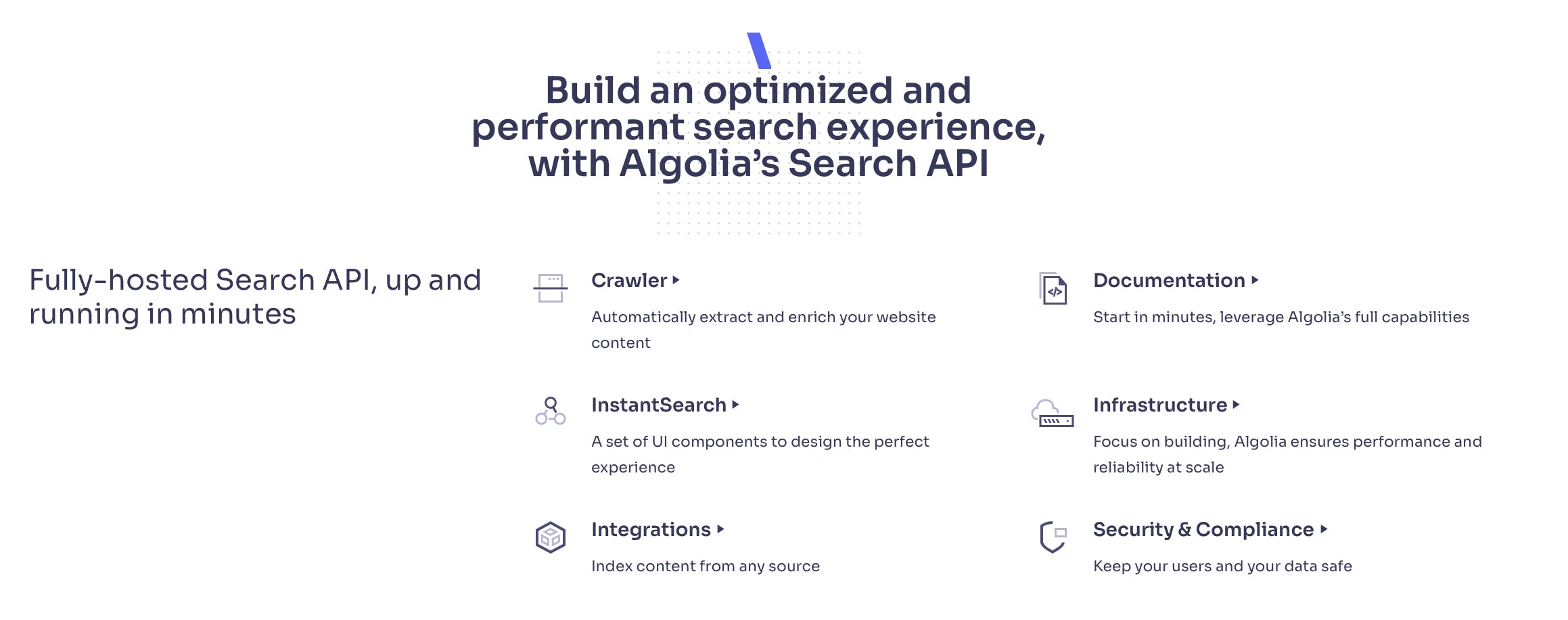

Algolia is a search and discovery platform consisting of two core APIs: Algolia Search and Algolia Recommend. Both APIs are designed to be fast, easy to implement, and scalable for websites and mobile applications. The company claims its APIs run with low latency, returning relevant results quickly and customized, which enables a better developer and user experience.

Search

Source: Algolia

Algolia Search is the company’s flagship product that enables developers to compose a search experience in their applications. It democratizes the development of any search capability. Algolia Search takes 1 to 20 milliseconds to process through its methodology of splitting indexing and searches across different application processes, using a distributed architecture and implementing an algorithm optimized for consumer-grade search. Implementation reportedly takes as little as 5 minutes.

Algolia Search will return results based on submitted data that the company hosts on its servers. This method conserves disk resources to ensure the search engine's speed. For customers that may not have that structured dataset on hand, Algolia has a crawler available as a paid add-on. Developers get access to pre-built frontend UI components, search analytics, event analytics, A/B testing tooling, dynamic reranking, NLP for multiple languages, autocomplete, security, and compliance.

Recommend

Source: Algolia

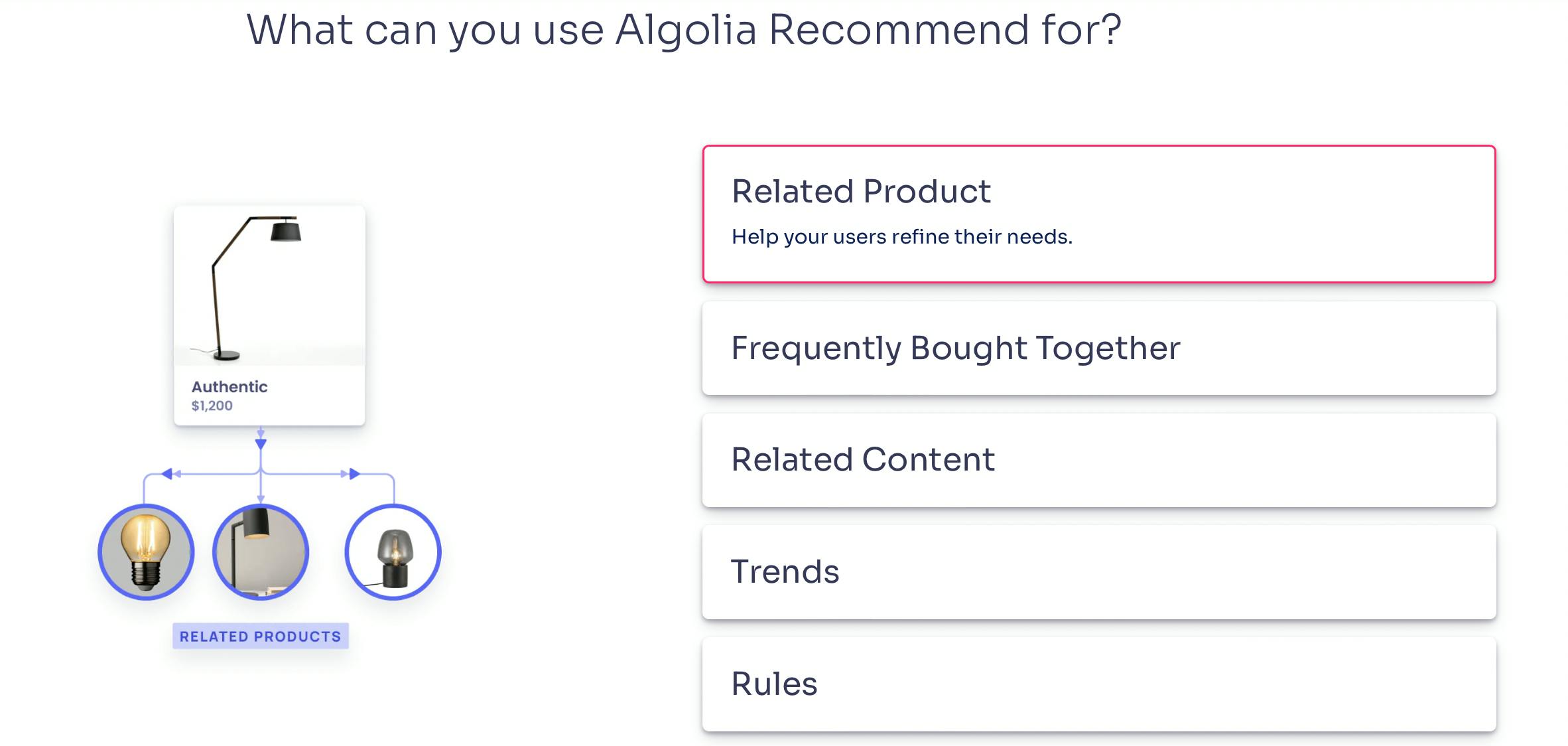

On the heels of Algolia’s acquisition of MorphL in January 2021, Algolia Recommend launched in May 2021. This is an API that enables businesses to deliver personalized recommendations to customers to improve user experience, increase repeat traffic, and maximize conversions. Using the Recommend product, developers can quickly build and offer recommendation carousels with related products, frequently bought together products, or related content dynamically on their websites and apps.

Market

Customer

Algolia’s composable APIs enable developers to use ready-to-implement code, accelerating time to market for their products. While it saw early product-led growth by the developer community, the company has shifted to a hybrid product and sales-led growth model for upmarket enterprises across several customer segments: B2C ecommerce, B2B ecommerce, marketplaces, media, and SaaS.

The company’s leading segment is ecommerce, where customers using Algolia see increased ROI via increased conversions to consumers buying products with relevant searches and recommendations. Gymshark reported an increase of 150% in mobile order rates after implementing Algolia Recommend. Algolia’s second-largest category is SaaS, where its main value prop is the speed of returning relevant results and ease of integration.

Market Size

The ecommerce market has grown to $5.7 trillion with the digital transformation of retail brands enabled by platforms like Shopify, which saw 200% growth in storefronts since the pandemic began in 2020. Since ecommerce companies are a big portion of Algolia’s core customer segment, they stand to benefit from this growth. In addition, $300 billion is lost in sales annually to search abandonment and the enterprise search market is projected to reach $7.8 billion by 2028.

Competition

Bloomreach connects customer and product data to bring personalization across every channel in ecommerce. It has raised $452 million in funding.

Elastic is a public company whose search product provides a standalone or embeddable search, regardless of data type, to power user experiences across commerce, websites, enterprise software, and customer support.

Yext is another public company that provides an API to create search and discovery experiences across the workplace and commerce to create personalized experiences.

Amazon’s AWS OpenSearch enables developers to easily ingest, secure, search, aggregate, and analyze data for application search, enterprise search, and more.

Business Model

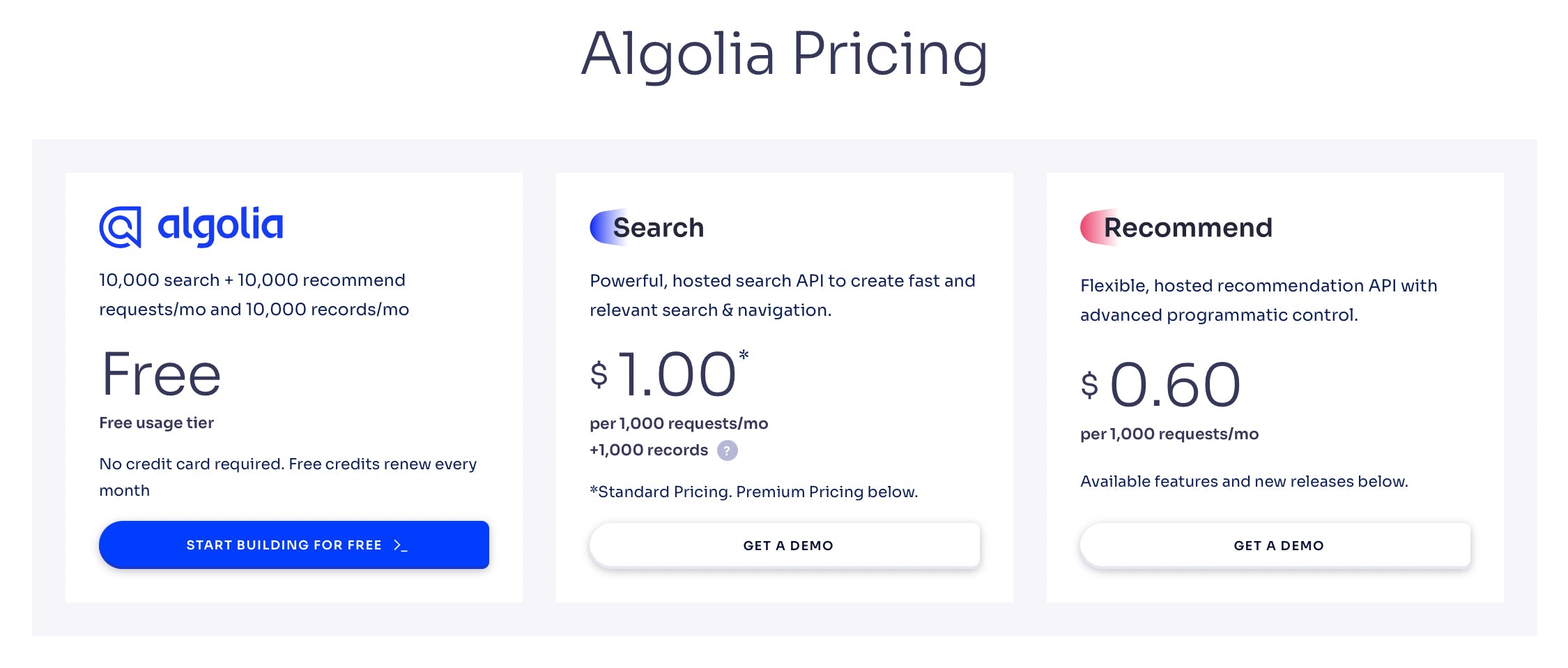

Algolia has a usage-based model where customers are charged based on the number of calls to an API rather than a recurring subscription. With a free tier enabling up to 10K searches and 10K recommend requests per month, the product has remained accessible to the developer community to maximize bottom-up adoption. The free tier includes basic search functionality such as typo-tolerant query suggestions while having caps on the amount of data that can be indexed and limits on query rules to push users onto paid usage as needs grow more complex.

Standard pricing for the Search API starts at $1 per 1K requests per month and 1K records retrieved. Premium pricing stands at $1.50 per 1K requests per month and 1K records retrieved. Pricing for Algolia Recommend is single-tiered at $0.60 per 1K requests per month.

Source: Algolia

Heavier usage triggers volume-based discounts, and custom pricing can be scoped based on committed volume over longer contracts and specific use cases that may require additional gated features.

Traction

In 2023, Algolia's revenue run rate hit $75 million in revenue. The company had over 10K customers, including Slack, Stripe, Medium, and Zendesk, and handled over 1.5 trillion search queries per year as of July 2021. Algolia was been named #39 on the Forbes 2022 Cloud 100 and has seen over 30 billion search requests per week as of August 2022. Its APIs have a 4.6 out of 5-star rating on G2, indicating high customer satisfaction based on speed and ease of use. Continued optimization of product offerings for its core ecommerce segment has contributed to customers realizing 382% in 3-year ROI.

Valuation

In July 2021, Algolia closed its Series D round, raising $150 million at a $2.25 billion valuation with 180% ARR growth year over year. The round was led by Lone Pine Capital, with participation from Fidelity, Steadfast Capital Ventures, Glynn Capital, and Twilio, alongside existing investors Accel and Salesforce Ventures.

Overall, the company has raised a total of $315 million in funding. In January 2023, investors Lone Pine Capital and Fidelity cut Algolia’s valuation by 9% and 39%, respectively, from July 2021 to June 2022. By September 2022, Fidelity had adjusted its valuation of the company down 43% (~$1.3 billion).

Public comps for the company include Yext, Elasticsearch, and Coveo. Coveo’s recent performance in late 2022 indicates a depressed multiple closer to what Algolia may trade upon initial entry into the public market. As of December 2022, Coveo traded at a $392 million market cap. Coveo’s Q2 earnings reported an expected FY23 ARR of $101.5-103 million, indicating a revenue multiple of just 3.8x. With current macroeconomic conditions, Algolia will need to continue to execute its top-line revenue growth with increased ARR and net dollar retention.

Key Opportunities

Enterprise Growth

While the search and recommendation API products serve a critical need for any business with a digital presence to continue its growth trajectory amid macro headwinds, Algolia will want to continue its pay-as-you-go momentum with SMBs and work to secure longer-term committed use contracts from its enterprise partners.

As consumer spending deteriorates, the number of searches made on ecommerce sites will presumably decline alongside the number of purchases. Algolia may look to augment its platform with additional observability and personalization tools tailored for customer retention, in the same vein as Twilio’s acquisition of Segment expanded its customer acquisition capabilities.

Product Expansion

In September 2022, Algolia acquired Search.io. Its product adds vector-based search capabilities to Algolia’s existing products, offering a complement to the latter’s keyword semantic search engine. Vector-based search enables unstructured data, such as text and images, to be queried using neural hashes.

The strategic transaction enables Algolia to evolve its platform with a hybrid search engine better positioned to “provide users with the ability to search as they think.” Integrating both processes that keyword and vector search engines employ into a single API call enables ecommerce businesses to use a single channel for multimedia search and discovery.

In August 2022, Algolia announced its new Merchandising Suite for ecommerce customers who require an end-to-end solution for managing product displays, inventory, promotion, and pricing in response to real-time customer behavior. It provides a specialized merchandising console, visual editor, and analytics feature.

Expanding AI capabilities trained on models specific to verticals can provide Algolia with additional second-order sales opportunities for enterprise businesses already consuming its APIs. Algolia’s Answers product, built on OpenAI’s GPT-3, is an example of specialized tooling that has yet to be integrated into the rest of the platform.

Key Risks

Security

In November 2022, security research firm CloudSEK flagged over 1.5K apps found to have been leaking Algolia API keys. Algolia will need to buttress its encryption to retain the trust of its tens of thousands of customers relying on the platform’s managed backend and keep developers from moving to competitors offering more control over security at a higher setup cost.

Customer Concentration

With macroeconomic headwinds, ecommerce may see a drawdown with consumers cutting spending. With less traffic to ecommerce platforms, Algolia may see less volume, which will translate to a revenue slowdown.

Third-Party Infrastructure

Algolia works with a number of third parties to support its global infrastructure. AWS, Google, Microsoft, and other vendors provide cloud services that host customer-submitted data for indexing. This presents a potential cost management concern as Algolia scales without an option for customers to run its API platform on-premise.

Summary

With composable enterprises and AI adoption continuing to grow, Algolia is well-positioned to serve a critical, usage-based search and discovery layer within a customer’s infrastructure stack. The company’s core APIs drive performance and allow for implementation within headless-commerce and enterprise search verticals. As Algolia continues to invest in optimizing its tooling off the tailwinds of large language models like GPT-3 and improving security, it will need to differentiate itself with more specialized API offerings for new workflows in its key customer segments. Meanwhile, if consumer spending deteriorates, the number of searches made on ecommerce sites will presumably decline alongside the number of purchases. Algolia may look to augment its platform with additional observability and personalization tools tailored for customer retention.