Thesis

Companies are increasingly offering embedded financial products in existing interfaces. Online retailers offer financing at the point of sale (via companies like Afterpay, Klarna, or Affirm), coffee shops or restaurants offer loyalty programs through dedicated apps (Chipotle, Starbucks), and businesses offer their employees branded corporate cards (Ramp*, Brex).

The market for integrated financial services in non-financial products is expanding. Embedded finance in the US reached $20 billion in revenue in 2021, and according to a February 2024 report, the global embedded finance market is expected to reach $384.8 billion by 2029, growing at a CAGR of 30% during the 2023-2029 forecast period. This growth is being driven by changing consumer expectations for frictionless, on-demand financial services, as well as growth in adjacent categories like buy now, pay later (BNPL), neobanks, and digital payments.

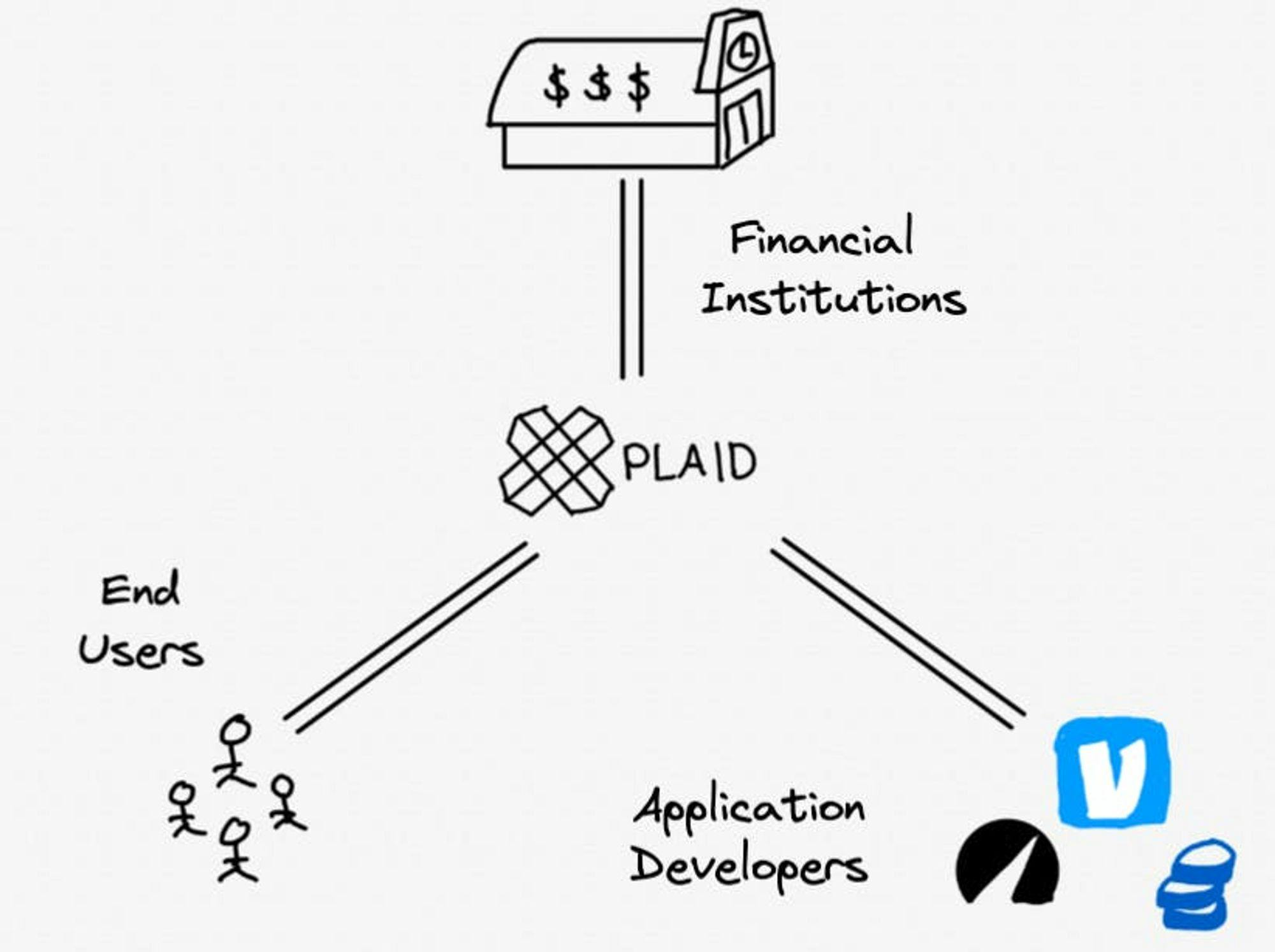

Plaid is well-positioned to benefit from the growth of embedded finance. It has built a widely-used abstraction layer that provides integration between financial applications, banks, and other financial service providers. Acting as an intermediary between the growing field of finance apps (Venmo, Robinhood, Wealthfront, or Coinbase), Plaid functions as a connection layer for developers of financial apps to interface with banks on behalf of their end customers.

As of March 2024, Plaid has over 100 million users and connects over 8K apps and services with over 12K financial institutions across 17 countries. According to the company, one in three US adults have used Plaid’s customer onboarding flow as of March 2024. Additionally, Plaid has expanded its product offering beyond a connection layer, and as of March 2024 offers a suite of solutions across payments, fraud & compliance, financial data analysis, credit underwriting, and open finance.

Founding Story

Plaid was founded by Zach Perret (CEO) and William Hockey (Former CTO and Board Director) in 2013. Perret and Hockey met as consultants at Bain & Co’s Atlanta office. The two set out to build a consumer-facing financial planning app after experiencing a lack of transparency in the bills they paid. However, the pair would quickly hit a roadblock: developing custom integrations for each financial institution was difficult. In a 2018 interview, Hockey stated:

“We started to realize we were struggling so much of the time because we couldn’t connect anything to financial services. The fundamental building blocks that make it really easy to build an application, we just couldn’t find.”

This roadblock gave them the idea to build an API to simplify the process of linking users’ bank accounts to fintech apps. They pitched the idea to 70 investors, but none were interested. To prove the idea’s viability, Perret and Hockey entered the 2013 TechCrunch Disrupt hackathon in Manhattan. The pair built an app called Rambler that mapped out consumers’ banking activity. They ended up winning the hackathon. Rambler’s underlying technology served as the foundation of what would become Plaid. In the fall of 2013, the co-founders moved their company to San Francisco to expand and find engineers.

One early fintech adopter of Plaid’s API was Venmo. The head of engineering at Venmo, who happened to be a friend of Perrett and Hockey, wanted a more efficient way to connect Venmo to a user’s bank account. At the time, Venmo relied on settling transactions in large batches, which meant that, while Venmo users would transact instantly, the settlement of those transactions didn’t occur until the next day. Using Plaid, Venmo could verify in real time whether a sender had a sufficient bank balance. In a 2018 interview, Perret said:

“It was a great proof-point to see tons of people using Plaid at scale inside of Venmo, which then helped launch us into a lot of other applications.”

In June 2019, Hockey stepped down from his role as CTO into an advisory role. In a post shared with Plaid employees, Hockey described his departure as “neither a rash nor a recent decision”, stating that “I am now at a place where I have a personal desire to take a step back and breathe.” In May 2021, Jean-Denis Greze, Head of Engineering at the time, was promoted to CTO.

Former Expedia CFO Eric Hart joined Plaid as CFO in October 2023. In February 2024, the company hired former Cloudflare CPO Jennifer Taylor as President. These two additions were seen as a potential move by Plaid to ready itself for IPO. Following Hart’s hiring, a Plaid spokesperson stated “we do not have any plans to IPO at this time.” In February 2024, a company spokesperson confirmed “an eventual IPO is a milestone we’re tracking towards, but we don’t have any details or a timeline to share beyond that.”

Product

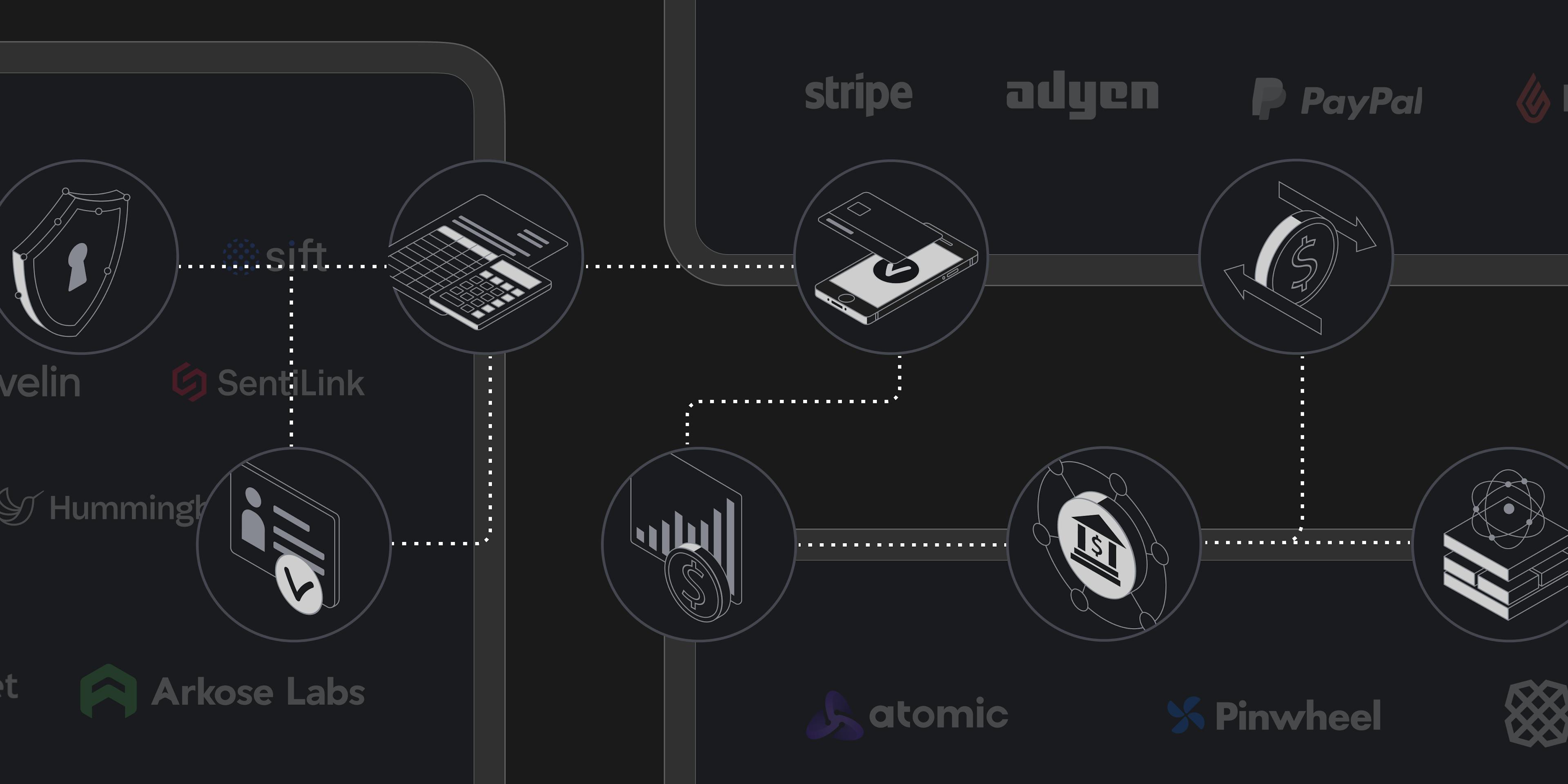

Source: Plaid

Plaid Link

Plaid’s core product is Link, an API that sits between a financial institution and an app or service needing to access relevant banking data. Built “with developers in mind”, companies can build apps on top of the Plaid API without having to devote time and money to figuring out how to integrate with financial institutions. Plaid assumes the weight of the complex integrations, allowing developers to focus on their main goal of building a useful financial application.

As of March 2024, Plaid has diversified beyond Link, offering several products across payments, fraud & compliance, personal finance insights, credit underwriting, and open finance.

Payments

Auth: The Auth API is a payments product that can instantly authenticate the existence of a user’s bank account, allowing payments to be initiated. When a user connects their checking or savings accounts to an application via Plaid Link, the Auth API will fetch the corresponding account and routing number. Once the account is authenticated, ACH payments are enabled, allowing users to move money from their bank account to a specific application, and vice versa.

Identity: The Identity API verifies a user's identity using personal information associated with their bank account. First, the API makes an Identity Request. After approval from the user, the Identity API retrieves personal data such as the user’s name, email, phone number, and address. Ultimately, this allows businesses to reduce the risk of fraud by verifying user information.

Balance: Where the Auth API verifies that a bank account exists for a given set of login credentials, Balance will then verify the amount of funds in the account. This protects users from overdraft and NSF fees by giving them visibility into available funds before they transfer. The Balance API provides real-time data.

Additionally, the Balance API distinguishes between available funds (i.e. amount of funds available to be withdrawn) and current funds (i.e. total amount of funds in the account). In particular, available funds factor in overdraft considerations, which helps companies reduce the risk of overdrafts.

Transfer: Plaid Transfer facilitates bank transfers using ACH, RTP, and FedNow, designed for high conversion and operational efficiency. It offers instant account verification, a Risk Engine to reduce NSF and return risks, and a dashboard for payment reconciliation, aimed at minimizing fees and providing real-time payment analytics. Transfer only works with US accounts as of March 2024

Transfer can also be used with Plaid’s built-in UI for transfer payments, Transfer UI. Through the Transfer UI, users can initiate two kinds of bank transfers: payments and disbursements. They can review key details of the transfer before confirmation, including the transfer amount and both the originating and receiving accounts. As of March 2024, Transfer UI does not support recurring transfers, RTP, or Platform Payments.

Signal: The Signal API provides ACH risk assessment and scoring. It offers predictive scores on the likelihood of ACH returns and refines risk models with over 60 attributes as of March 2024. Specifically, Signal categorizes ACH risk into two types: customer-initiated return risk, related to unauthorized returns, and bank-initiated return risk, mainly for NSFs and administrative returns. Each risk type is scored between 1-99, with corresponding risk tiers to clarify the level of return risk. Signal enhances this with predictive insights for deeper analysis into the factors influencing these scores and tiers, allowing for integration into customized risk models. This enables businesses to create dynamic payment flows tailored to different levels of risk, aiming to enhance transaction success while minimizing fraud.

Fraud and Compliance

Identity Verification: Not to be confused with the Identity API, Identity Verification was introduced to Plaid’s product suite in May 2022. Part of Plaid’s fraud & compliance offerings, Identity Verification helps customers verify identity data and authenticate IDs while ensuring the person’s face matches the image on the provided ID. Additionally, Identity Verification can help:

Monitor customer behavior to identify bad actors, fraud rings, and bots

Limit email and phone risk, checking whether the number or address is new, disposable, registered with external accounts, or compromised in breaches.

Limit device and network risk, detecting the use of VPNs, timezone mismatch, incognito browsers, or repeat sessions.

Identify synthetic and stolen identities.

This feature also helps with know your customer (KYC) through a no-code editor that allows users to create and change verification flows and customize risk rules and success criteria to meet their risk tolerance levels. It also allows compliance agents to override failures, manage exceptions, and record user and session information for record-keeping, future audits, and investigations.

As of March 2024, Identity Verification supports over 16K ID types across 200 countries and territories and is available in five languages.

Source: Plaid

Monitor: Since its founding in 2013, Plaid has encountered security concerns, resulting in a lawsuit settlement in 2022. To bolster its fraud prevention capabilities, Plaid introduced the Monitor API in May 2022. Monitor works in conjunction with governments to actively scan user activity to implement anti-money laundering (AML) rules, and compare them to politically exposed persons (PEP) lists. Monitor reduces the risk of fraud, and allows companies to onboard legitimate customers all while avoiding time spent on manual reviews. As of October 2022, within a few months of its release, the Monitor API had already screened over 700 million identities against government watchlists.

Beacon: Beacon is an anti-fraud network designed to prevent identity fraud across financial applications by allowing users to report and query fraud. It aggregates and encrypts reported data to protect sensitive information without sharing personally identifiable information (PII) with customers. Beacon enables the detection of stolen identity, synthetic, or account takeover fraud. Users can screen identity data against reports within the network and automatically generate internal blocklists to prevent repeat fraud and duplicate signup attempts.

Beacon was launched in June 2023 alongside ten founding members including Tally, Credit Genie, Promise Finance, and Veridian Credit Union. Head of Identity at Plaid Alain Meier spoke about the need for a cross-fintech fraud detection service in a June 2023 interview:

“The idea behind Beacon is that the vast majority of fraud that any one fintech sees has been seen by another fintech before. So essentially, what that means is that everyone is rebuilding the same anti-fraud mechanisms in order to try to catch what is frequently the exact same fraud, which means there’s a lot of wasted money and there’s a lot of wasted time.”

Personal Finance Insights

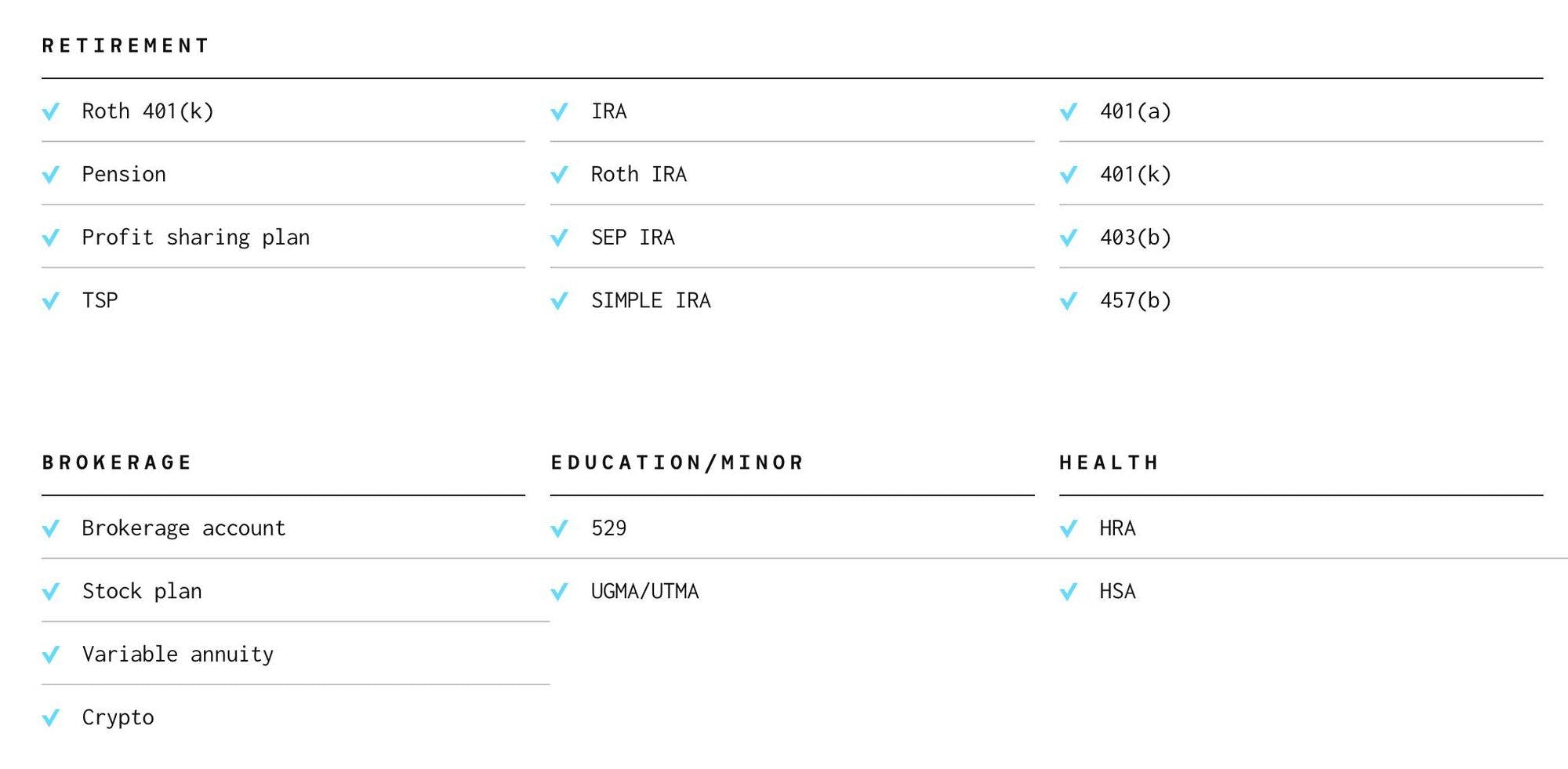

Investments: The Investments API is responsible for retrieving data related to a user’s investment holdings which can be incorporated into a personal finance or wealth management app. As of March 2024, users in the US and Canada can use the Investments API to obtain both general data related to a specific investment, and general user data based on their holdings. Holding data creates a holistic picture of a user’s investments by retrieving cost basis information, quantity of the security, purchase price, and total book value of the holding.

The Investments API offers connections to a “broad network” consisting of banks, brokerages, crypto exchanges, credit unions, and retirement plan providers. Additionally, the API can pull data from 20 account types, as depicted below.

Source: Plaid

Transactions: The Transactions API performs a similar function to the Investments API but covers a user’s general transaction history as opposed to just their investments. As of March 2024, data pulled by the Transactions API covers a 24-month period and includes details such as geolocation, merchant, and purchase category. Every transaction linked to a user’s bank account — including both pending and posted transactions — is continuously updated, and notifications are received through the use of a webhook. Applications for the Transactions API include personal finance management apps where users are provided with a real-time view of their spending habits, such as the money management app for couples Zeta.

Liabilities: The Liabilities API enables applications to retrieve a user’s liability data from their financial institution. For each type of liability or loan, Plaid extracts data, including next payment, interest rate, initial loan amount, and loan duration. As of March 2024, the Liabilities API provides credit card coverage, providing integrations with “the largest institutions including American Express, Wells Fargo, Bank of America, Citi, and more.”

Enrich: Enrich cleanses, categorizes, and enhances transaction data from card products, bank accounts, or non-Plaid sources. It standardizes merchant details for better user experience, utilizes machine learning for accurate spending categorization, and provides visibility into transaction parties. This service enables banks and fintechs to understand customer spending habits, improve user experiences, identify leads, reduce dispute costs, and make faster decisions by delivering personalized financial insights.

Credit Underwriting

Assets: The Assets API allows lenders to easily determine if a borrower has sufficient assets to be approved for a loan. Specifically, a lender can request to obtain an Asset Report from a borrower using the Assets API. To uphold security and user privacy, Plaid keeps the borrower in control of their asset information by allowing them to grant permission for the Asset Report and to revoke access to their data when information is no longer required. This API allows lenders to automate their loan application process and obtain more borrowers.

Income: The Income API verifies a user’s income and employment through three different methods: Payroll Income, Document Income, and Bank Income.

Payroll Income obtains information from a user’s payroll account. When a user agrees to a payroll request, Plaid can obtain payroll data including deductions, earnings, employer data, pay period frequency, and W2 information. As of March 2024, the payroll income feature supports approximately 80% of the US workforce, including gig economy workers.

Document Income retrieves information from any documents physically uploaded by the user, such as a pay stub, bank statement, 1099 form, or W-2. This method is meant to accommodate users whose payroll provider is not supported by Plaid.

The Bank Income method retrieves information directly from the bank account connected by the user. The Income API will notice recurring deposits from an employer and can extract information such as income category, income frequency, and total amount.

Source: Plaid

Open Finance

Core Exchange: Plaid built its reputation on the variety of APIs it offered, all of which were focused on helping developers access different pieces of financial information for users. Since then, Plaid has expanded to helping financial institutions implement APIs. In May 2020, Plaid released Plaid Exchange, which the company described as a way to provide banks with “API connectivity in a box.” As of March 2024, the service had been renamed Core Exchange.

Core Exchange facilitates the implementation of data access in compliance with the Financial Data Exchange (FDX) API specification. It provides guidelines for API integration within six to eight weeks as of March 2024, ensuring interoperability and industry-aligned data access. Core Exchange supports the development of APIs that enable institutions to connect both with Plaid and other aggregators. In its May 2020 release of Plaid Exchange, Plaid described the importance of advancing digital transformation for all sizes of banks by stating:

“We believe APIs are the future of open finance, and we want to make it as easy as possible for all financial institutions to incorporate APIs into their broader digital transformation agendas regardless of budget size and resources.”

Permissions Manager: Plaid's Permissions Manager is an API designed for data partners to create their own consumer permissions portal, allowing customers to control their data sharing. It offers real-time visibility into Plaid-connected apps, enabling customers to manage permissions and disconnect apps as needed. This tool aims to build customer trust, expand digital capabilities, and demonstrate data privacy leadership by integrating other data networks into the portal. As of March 2024, it is available at no cost to existing data partners on Plaid's Data Connectivity API solutions

Additional Products

Plaid Portal: Plaid Portal is a privacy tool that centralizes all the connections a user has made using Plaid across the entire fintech landscape. More importantly, it gives the user the ability to control which apps can have access to their financial data. Thus, if a user feels inclined to unlink a bank account from a specific app, or even delete information from Plaid’s database, they can do so via Plaid Portal.

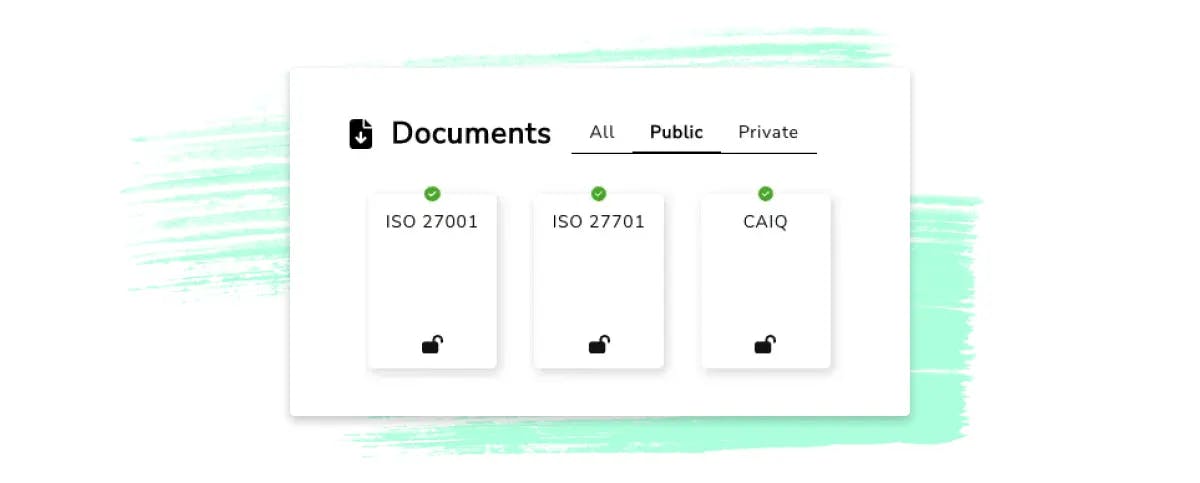

Security Portal: Security Portal is a public platform designed to distribute security-related documents needed for Cybersecurity Due Diligence. It allows for direct access to Plaid’s public security documents, like ISO certificates. For private documents, users can gain immediate access through auto-approval conditions or await manual approval if conditions aren't met. Additionally, it provides a knowledge base for FAQs, and users can subscribe to receive Plaid updates on security compliance documents and responses to significant security events.

Source: Plaid

Market

Customer

In its early years, Plaid was viewed as a product made by developers, for developers. However, developers are no longer fully representative of Plaid’s entire customer base, which as of March 2024 incorporated financial institutions and end-users in addition to developers. As COO Eric Sager put it in an October 2021 interview, Plaid can be described as the center of a “three-sided ecosystem that has consumers, developers, and then the institutions.”

Source: Stratechery

Developers: Perret and Hockey understood firsthand the difficulty fintech developers faced when, before founding Plaid, they set out to build their own financial planning app. This experience helped Plaid identify its first segment of customers to target: developers of fintech applications. As of January 2020, Plaid used a bottom-up strategy of “selling through the basement” which entails identifying low-level developers and creating the best possible experience for that individual, who will then advocate for the organization to adopt Plaid. CEO Zachary Perret described Plaid’s strategic emphasis on building for the developer from the bottom up in a January 2020 interview, stating:

“We’re trying to identify the lowest level engineer, [and] build a fantastic experience for them… Someone’s able to quickly build something in our sandbox. They’re able to quickly launch an application… They do it for free. And then the great thing is, over time, when their boss asks a question or if someone says, “Hey, how do I do that thing over there?” And then the developer saying, “Well, try this. Have you used Plaid?”

This bottom-up strategy has been successful for Plaid, allowing it to win over developers at some of the largest fintech apps in the industry including Venmo, Wise, and Acorns.

Source: Plaid

Financial Institutions: Plaid has expanded its product offering into different segments of the account-linking process. With the launch of Plaid Exchange in 2020, financial institutions became a primary customer group for Plaid. In an October 2021 interview, Plaid COO Eric Sager described Plaid’s customer relationship with financial institutions as follows:

“I think our partnerships with [financial] institutions have been evolving over the life of Plaid. Obviously, very recently, you’ve seen a lot of the data access agreements we’ve signed with the vast majority of large institutions in the US… Many of the institutions now are also customers. [Financial institutions] are both developers / customers, as we call them, and housing a lot of the data that consumers want to access.”

As of March 2024, Plaid worked with over 12K financial institutions across the US, Canada, and Europe.

End Users: Plaid’s relationship with the end user is more indirect than direct. While the end-user interacts with Plaid Link when inputting their bank account login information within an app, Plaid’s original intention was always to provide an outstanding developer experience. However, following a class action lawsuit filed in 2020, Plaid began to rethink its security and privacy policies. As the end user is the main concern regarding data privacy, Plaid began launching products that directly served the end user. In an October 2021 interview, Sager described how data privacy has driven the end-user into Plaid’s customer ecosystem, stating that:

“Our fundamental belief at the end of the day is that it’s the consumer’s data, so the consumer should have the choice to share that data for the use cases they want to pursue, as opposed to it being the bank’s data. It ultimately has to be in the best interest of the consumer.”

Plaid launched Plaid Portal in January 2022 to provide end users with a detailed snapshot of all the connections they have made via Plaid. By giving individuals control over where their data can and cannot be shared, Plaid aimed to enhance transparency and build greater trust to mitigate data privacy concerns.

Market Size

The global open finance market was estimated at $22.2 billion in 2024 and was projected to reach $133.5 billion by 2034. In 2023, the total value of open banking transactions was estimated at $57 billion and was projected to grow to $330 billion by 2027.

The proportion of banks and credit unions investing in APIs grew from 35% in 2019 to 47% in 2021. In 2023, 28% of banks planned to make use of APIs in addition to the 40% of banks who had already invested in or deployed APIs during 2022. 87% of credit unions launched a digital transformation strategy in 2023. Similarly, in 2023 over 60% of credit unions had implemented APIs to manage data connectivity.

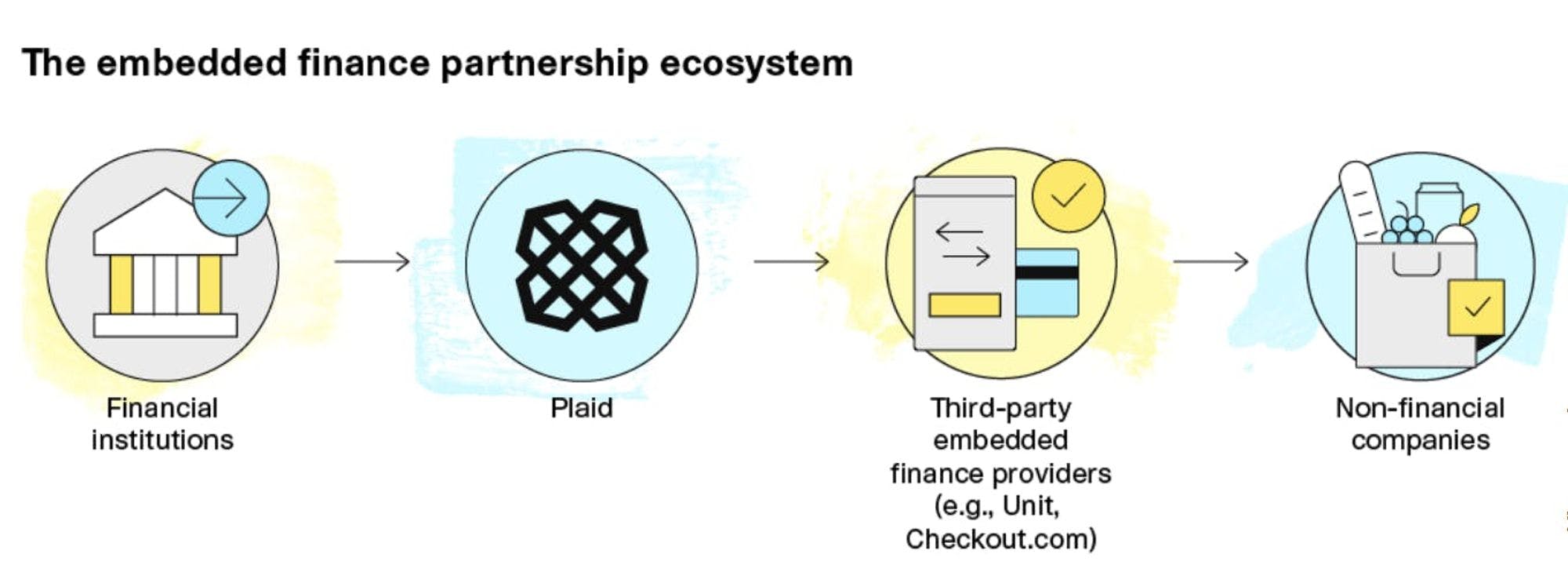

While the traditional finance landscape has been responsible for much of Plaid’s growth since its founding, Plaid’s market opportunity amplifies as more applications want to integrate directly with consumer bank accounts, even if their core use case isn’t financial. Known as embedded finance, it enables non-fintech companies to offer fintech capabilities. As depicted below, the embedded finance ecosystem flows from financial institutions to non-financial companies, flowing through Plaid and third-party embedded finance providers.

Source: Plaid

Embedded finance providers such as Unit work with their customers (non-financial companies) to quickly develop partnerships with banks and create APIs to help non-financial companies add financial services such as payment cards. Third-party embedded finance providers then use Plaid’s services to gain access to financial data to get insights into balances and transactions.

For example, for customers that offer branded payment cards such as Divvy, Plaid is used in the account funding step. It allows users to connect existing accounts via Plaid to fund their card accounts or make payments for a credit card. Plaid also offers embedded finance features of its own, such as Transfer. Companies looking to add a bank payment system into their services can embed Transfer to handle the entire payment process.

Competition

There are two types of competitors for Plaid: (1) direct competitors offering similar product suites to Plaid and competing with its Link API; and (2) companies that offer specific features that compete with some of Plaid’s products, but not with its overall product suite.

Direct Competitors

Tink: Tink is an open banking platform founded in 2012. It offers a similar product suite to Plaid including Account Check, Income Check, Payments, and Risk Signals. As of March 2024, it connects over 6K banks and has more than 10K developers using its platform across 18 markets. Tink had raised a total of $308.4 million across seven rounds of funding as of March 2024. Tink was acquired by Visa for $2.2 billion in June 2021, five months after Visa’s attempt to acquire Plaid was canceled due to regulatory concerns in January 2021.

MX Technologies: MX offers open finance APIs including financial insights, money management, and account verification. It was founded in 2010 and has a valuation of $1.9 billion as of its $300 million Series C in January 2021. As of March 2024, MX had raised a total of $450 million across four rounds. MX’s Account Aggregation product enables consumers to connect their financial accounts to financial apps or other online accounts.

Finicity: Finicity is an open banking platform focusing on lending, managing, and payment solutions. It provides FCRA-compliant data for decisions and verifications, including assets, income, employment, cash flow, and more. The platform also supports cleaned, categorized, and aggregated account data for better financial management. Finicity was founded in 1999. It had raised $79.9 million in funding across four rounds before being acquired by Mastercard in June 2020 for $825 million, plus an additional $160 million for existing shareholders if performance targets were met. Finicity’s Connect API competes directly with Plaid’s Link API.

Adjacent Competitors

Stripe: Stripe provides payment processing and financial solutions for businesses. It was founded in 2010 and had a $65 billion valuation as of a February 2024 share-sale deal with its employees. This is up from its $50 billion valuation as of Stripe’s $6.5 billion round in March 2023. As of March 2024, the company had raised a total of $8.7 billion. Stripe offers a suite of products including billing, invoicing, and payments, among others. However, some of Stripe’s services overlap with Plaid’s. Specifically, in May 2022 Stripe launched Financial Connections, an API for Stripe customers to connect to their customer’s bank accounts. This product competes directly with Plaid’s Link API. Another example of this overlap is Stripe Identity, which competes directly with Plaid’s Identity Verification API.

Yapily: Founded in 2017, Yapily is an open banking API platform designed to facilitate automated data insights, direct account-to-account payments, and customer account validation among other services. As of March 2024, Yapily operated in 19 countries, with over 95% account coverage in the UK and Germany and 2K banks and institutions able to integrate into its platform. The company had raised $69.4 million in total funding as of March 2024.

Persona: Persona provides identity verification and risk management solutions for businesses. It was founded in 2019 and has a $1.5 billion valuation as of its $150 million Series C round in September 2021. As of March 2024, Persona had raised a total of $217.5 million across five rounds. Generally, Persona and Plaid do not operate within the same market, as the Persona focuses on identity verification and risk management. However, Plaid has expanded its product suite into that identity verification and fraud risk space. Products such as Signal and Identity Verification compete directly with Persona’s offerings.

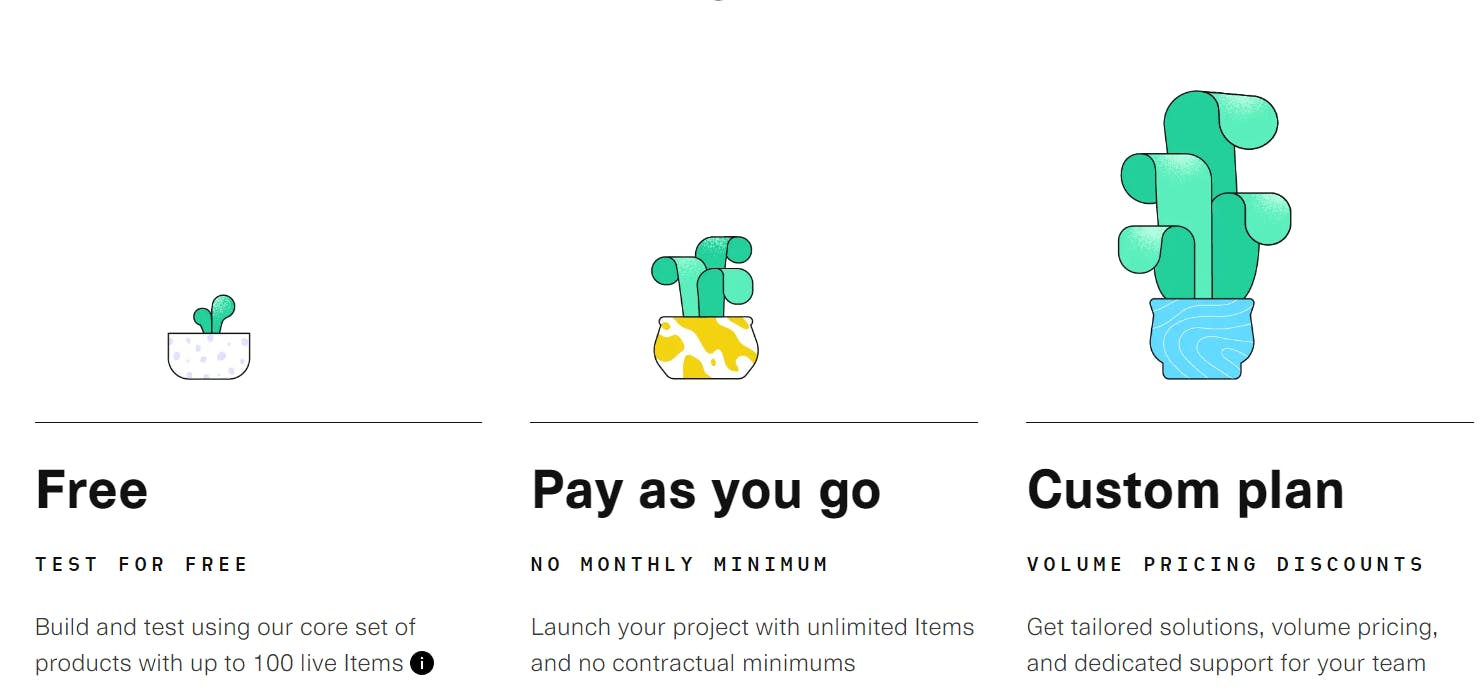

Business Model

Plaid operates under a freemium usage-based model, meaning that its core set of products can be tested for free with the possibility of upgrading to a paid plan with greater capabilities.

Source: Plaid

As of March 2024, Plaid had multiple pricing models that governed its products:

One-time fees are associated with one-time tasks. For Plaid, this pricing model governs products such as Auth, which authorizes a user’s account and verifies their identity and is typically a one-time occurrence.

Per Request fees are incurred for each successful API call (request) to a product endpoint asking to provide a specific service or piece of information. This type of fee governs Plaid’s products and services such as Asset Reports and Balance checks. These fees can be flat or flexible (varying by the amount of information requested), depending on the product or end-point used.

Subscription fees entail items that occur repeatedly and will incur a monthly fee as long as the item exists. For instance, Plaid’s Transactions product allows a company to check a user’s transactions, an action that is charged on a per connection, per month basis.

Per-payment fees are incurred for each payment initiated by a product. Payments are defined as an end user having reached the end of the payment flow and received confirmation of the payment’s success. Recurring payments are billed differently than one-time payments, with fees varying by the transfer network. Transfer transactions, including sweeps and movements to/from the Plaid Ledger, also incur a per-payment fee.

Monitor fees are specific to Plaid’s Monitor product. Monitor's pricing includes a base fee for the initial scan of a new user and a monthly rescanning fee, based on the number of users rescanned. The rescanning fee is calculated monthly, akin to a subscription model, with Plaid's billing cycle aligned with calendar months in UTC, starting anew each month. Mid-month changes in the rescanning roster don't affect fees.

Identity Verification fees are specific to Plaid’s Identity Verification product and vary based on user actions during setup. Initially, users are charged when they enter their phone number for SMS verification. If they skip this and choose another verification method, such as document verification, Plaid will charge for both the skipped SMS verification and the chosen method. The cost for Lighting verification varies by the user's location. Fees also apply for document and selfie checks. If a verification is retried, it's billed as a new attempt, including the initial verification and any additional steps taken.

Plaid is free to test. It allows developers to familiarize themselves with the different products and build unlimited test connections with financial institutions, and up to 100 live connections. Outside of its testing environment, Plaid offers three pricing plans:

Pay as you go

Growth

Custom (aka Scale)

The “Pay as you go” plan comes with no minimum spend or contractual commitment but has higher per-use costs than the “Growth” plan. The “Growth” plan, while cheaper, requires a minimum spend of $100/month and a three-month commitment. The “Scale” plan has a minimum spend of $500/month and requires an annual commitment, but has the lowest per-use cost out of the three plans. Additionally, users on the “Scale” plan get access to beta products, as well as help with integrations and premium support.

An advantage of Plaid having a usage-based business model is the potential to grow alongside some of its earliest customers. Specifically, Plaid’s revenue is a function of its API usage. By extension, its revenue is also a function of the number of developers or users using Plaid’s API in some way. As a result, the more users an app or service has, the more API calls that company will send, and the more revenue that Plaid will generate from a specific customer. For example, Plaid’s ability to capture customers such as Venmo and Robinhood, coupled with a usage-based pricing plan, has allowed Plaid to benefit from the growth of its customers. In 2022, a former Plaid employee described the company’s early outlook on a usage-based model as follows:

“The way we viewed our self-service product was, it's a way for us to capture as many lottery tickets as cheaply as possible … We don't know which early-stage company is going to get funding, which company has gotten into YC, or which companies are really going to break out and drive a lot of growth. But we do know we want those companies."

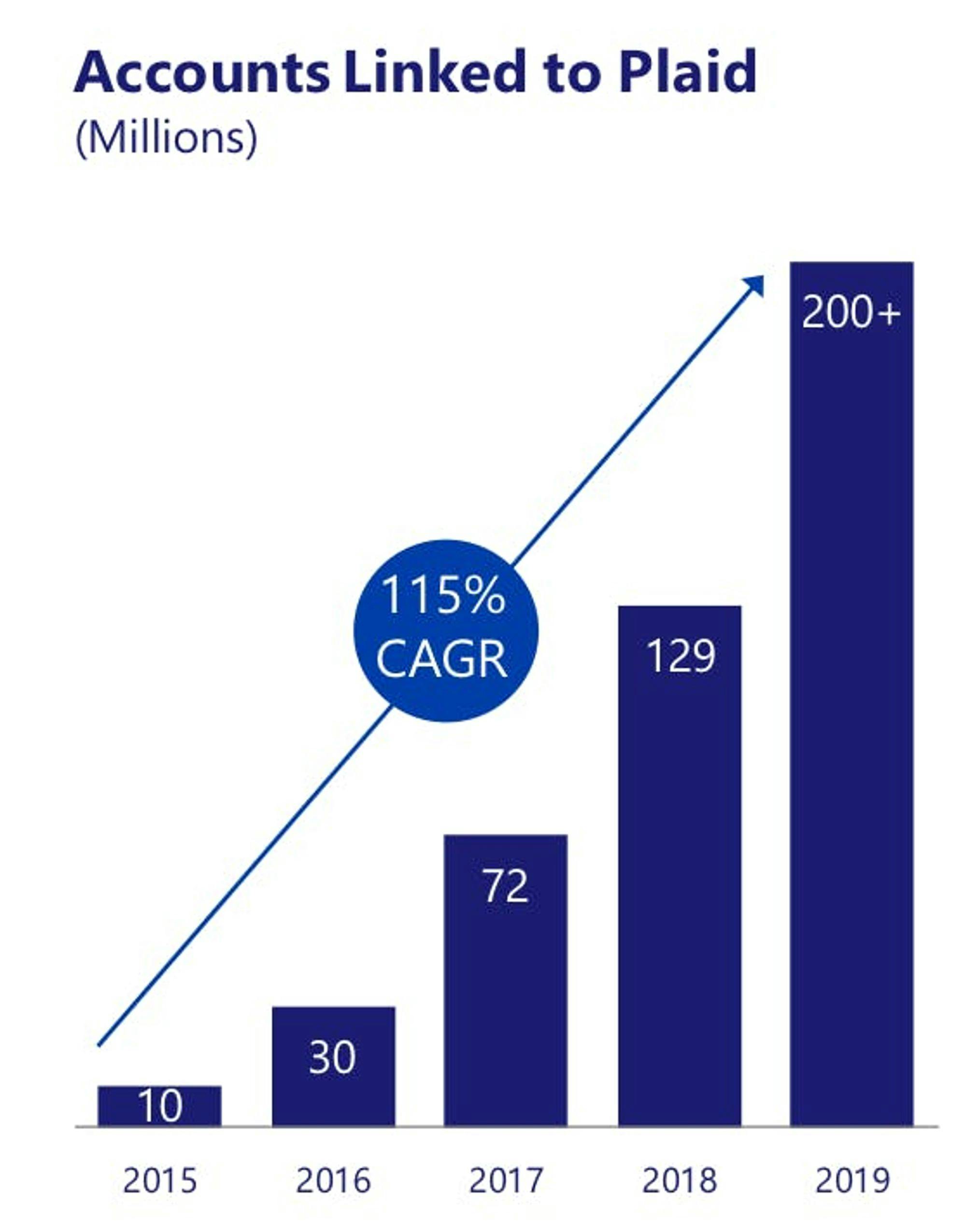

Traction

In 2017, the company reached 10 million consumer account connections, and, by 2018, that number had doubled. This growth was helped by its existing clients, such as Venmo and Chime, which matured and reached larger audiences. By the end of 2019, Plaid integrated with over 11K financial institutions, and over 5K fintech apps were using its products. In 2020, Plaid’s customer base grew by 60%, reportedly reaching around $170 million in annualized revenue by December of that year. As of March 2024, Plaid integrated with over 12K financial institutions, and over 8K digital financial services were built on Plaid’s offerings.

In terms of end users, according to the company, one in three adults in the US have used Plaid to connect their account to a fintech application as of March 2024. Another user-based metric is the number of bank accounts linked to Plaid. A January 2020 report by Visa stated that Plaid had linked over 200 million financial institution accounts in 2019, up from 10 million in 2015. An unverified source estimated that Plaid had linked 650 million accounts in 2022, up from 72 million in 2017.

Source: Visa

Valuation

As of March 2024, Plaid had raised a total of $734 million over five rounds of funding from investors including Index Ventures, Altimeter Capital, Andreessen Horowitz, and Coatue. In April 2021, Plaid raised a $425 million Series D funding round at a $13.4 billion valuation. Plaid’s Series D round came less than a year after the Department of Justice blocked Visa’s acquisition of Plaid in November 2020, which was set to close at a $5.3 billion price.

Following the April 2021 Series D, Plaid was rumored to be planning an IPO in 2022. The IPO did not happen that year. In October 2023, Plaid hired former Expedia CFO Eric Hart in what was seen as a move to work towards the possibility of an IPO, although at the time the company stated that it did not have plans to IPO. In February 2024, however, following the hiring of former Cloudflare CPO Jennifer Taylor as President, a Plaid spokesperson confirmed that an IPO was a milestone for the company.

Key Opportunities

Deepening Network Effects

Plaid’s products have benefited from network effects. For example, Plaid operates between financial institutions and financial applications. Initially, Plaid established these connections through direct efforts, but now it leverages APIs provided by financial institutions for smoother integration. This creates a two-sided network effect: as more banks integrate with Plaid, fintech apps can offer wider coverage and attract more customers. For banks, a higher number of apps using Plaid means more usage of their connections, justifying their investment and indirectly benefiting their customers.

As Plaid incorporates more integrations across more products and types of financial data, its network effects will only expand. Plaid’s layer of abstraction is a valuable asset that has allowed it to expand into adjacent areas of financial services including turning credit card history and account transfers into a loan decision to assist mortgage companies.

Plaid also has an opportunity to reach non-fintech applications and companies. In fact, as of August 2023, according to Plaid over 50% of its new deals since 2022 took place outside of traditional consumer fintech. Through features such as Transfer, Plaid can continue to broaden its scope to include any company that could benefit from integrating with a customer’s bank account. Plaid could help apps in sectors such as hospitality, travel, and shopping to better understand consumers’ spending and offer them personalized deals. In October 2018, Plaid CTO Jean-Denis Greze spoke about the potential of reaching non-fintech companies, stating that:

“Our philosophy is to provide the building blocks, and then we’re often surprised by how developers can use those building blocks to do something clever. We don’t know what that will look like. But we know that we make it easier for consumers to get started, make it easier for developers to build products full of insights, and we make it easier even for non-fintechs to start to offer things like payments or loans.“

Platform Expansions

Plaid’s mission is to “unlock financial freedom for everyone”, focusing on “democratizing financial services through technology”. In January 2022, Plaid acquired Cognito, a company that provides identity verification and compliance solutions. This acquisition highlights Plaid’s push to know your customer (KYC) to expand its offering and become a more comprehensive fintech platform. Similarly, Plaid has the opportunity to leverage its wealth of data to help financial companies with elements such as underwriting, thus developing a more holistic banking and payments offering. In May 2022, CEO Zack Perret described the importance of creating a more versatile product:

“Fintech is more mainstream than ever. Now is the time to build for what comes next—simple, secure, and easy ways for people to complete the majority of their financial tasks online.”

Fraud Prevention

The sensitive nature of the financial and banking data that Plaid deals with requires proactive fraud prevention measures. At the May 2022 Plaid Forum, the company introduced two fraud prevention tools to help companies better protect their customers: Signal and Guarantee. Signal is a tool that incorporates machine learning to analyze 1K risk factors and provide more certainty on which transactions will settle. As of March 2024, Guarantee is no longer a separate Plaid feature, but is instead part of its Transfers offering. In June 2023, Plaid released Beacon, a collaborative anti-fraud network allowing business partners and financial institutions to share security-related intelligence across the entire network. Given Plaid’s history with lawsuits, Plaid’s opportunity to prevent fraud by introducing tools like these three will be critical to the company’s long-term success.

Key Risks

Competing with Stripe

As the market for financial technology continues to grow, major players within the industry are expanding their capabilities and beginning to overlap with competitors. This was the case recently for Stripe and Plaid. In May 2022, Stripe launched a new product that gave Stripe’s clients a way to connect to a user’s bank account and access financial data. The product, called Financial Connections, has parallels to Plaid Link and puts Stripe in direct competition with Plaid. In May 2022, CEO Zachary Perret responded to a tweet from Jay Shah, the Stripe PM responsible for the launch of Financial Connections. In his now-deleted tweet, Perret said:

“Wow! Jay [Stripe PM], you took interviews with Plaid & asked probing questions multiple times over the past few years, and your team sent repeated RFP’s (under NDA!) to us asking for tons of detailed data. I wish y’all the best with these products [Financial Connections], but surprising to see the methods.”

Companies like Stripe continuing to branch out across different segments of fintech may be a threat to Plaid. Specifically, product expansions that encroach on Plaid’s core offering means competing for the same customers, which could translate to higher advertising spend, potentially lower sales conversion rates, and pressure to lower prices.

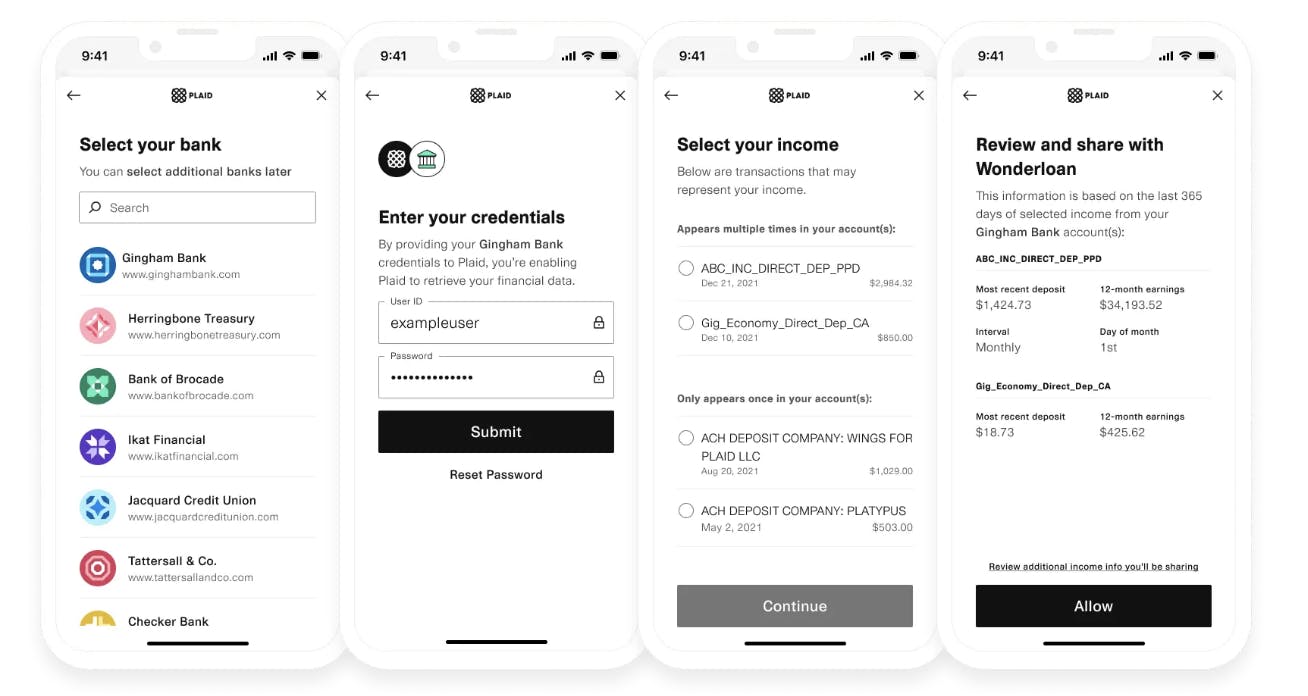

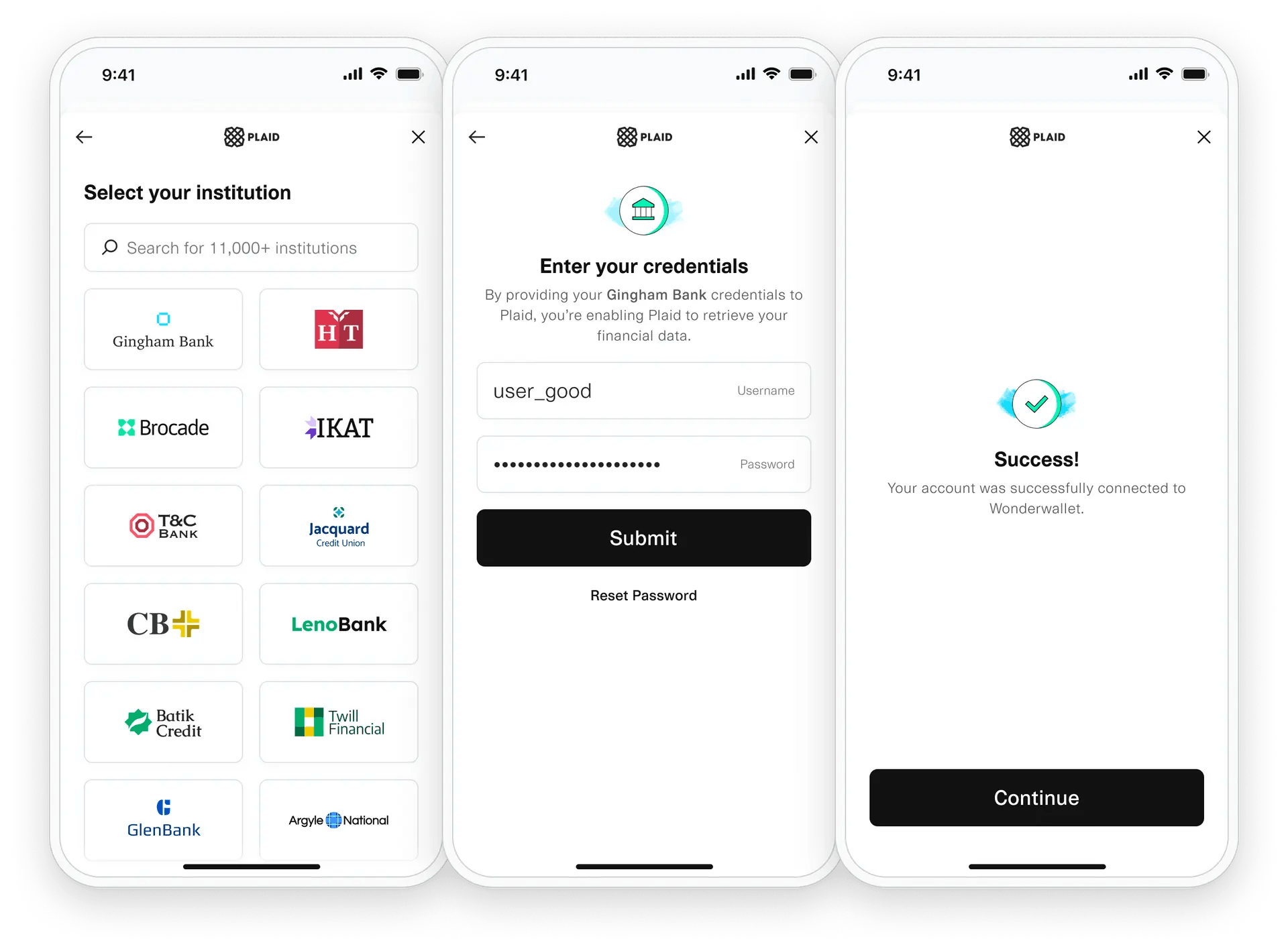

Privacy and Security Concerns

Privacy and security concerns have posed a threat to Plaid’s success. In 2021, Plaid faced a class action lawsuit from several customers who alleged that Plaid hid its role as the middleman in the account linking process. By designing the interface to look similar to a user’s bank account login, the lawsuit claimed that users were misled into sharing sensitive data with Plaid. In July 2022, the federal judge approved the settlement and Plaid was ordered to pay $58 million for “harvesting and selling users’ data.” The cash payment, stipulated at $35.97 per user, could be interpreted as a less significant concern than the negative brand sentiment, as privacy concerns could undermine established consumer trust.

Plaid was also ordered to implement several changes to its security policy to avoid future lawsuits. One of those changes was an update of Plaid Link, the client-facing component that allows users to input their financial information and connect a bank account to a fintech app. Prior to the lawsuit, the Plaid Link interface was designed to mimic a user’s bank account login screen.

Source: Plaid

To avoid future problems, in August 2021 Plaid agreed to alter its Plaid Link interface with the following stipulations in mind:

“Refer expressly to Plaid and explain that Plaid is used to link the user’s accounts.”

“Include a conspicuous link to the End User Privacy Policy.”

“Require the user to agree to Plaid’s privacy policy by taking clear affirmative action (e.g., by clicking Continue).”

“The credential pane for Plaid’s standard Link flow explains that the user’s credentials are being provided to Plaid.”

“The background color of the credential pane for Plaid’s standard Link flow does not utilize the color scheme associated with a specific financial institution for that financial institution.”

Following these stipulations, Plaid updated Link to be more transparent. The following image depicts the interface used by Plaid as of March 2024.

Source: Plaid

Plaid denied the allegations of the lawsuit, claiming to have never sold or harvested financial data. Nevertheless, the incident highlights the importance of having a sound privacy and security policy, especially for a company that deals with sensitive financial information. Moving forward, Plaid must continue to focus on providing a secure and transparent solution. Any future misstep could threaten the success of Plaid and put people’s finances at risk.

Summary

Driven by the general growth and complexity of the fintech ecosystem, and by the rapid growth within embedded finance specifically, there are significant tailwinds that favor Plaid moving forward. Plaid is the first mover in providing infrastructure that connects a large number of financial institutions and fintech apps and has built moats to solidify its market position. However, encroachment from other well-capitalized players like Stripe into its core market, as well as privacy and security concerns and the associated reputational consequences, remain significant risks going forward as Plaid looks towards an eventual IPO.

*Contrary is an investor in Ramp through one or more affiliates.