Thesis

In 2014, the Indian government kicked off a campaign to democratize and modernize financial services in the country. In the months and years that followed, India’s biggest banks launched programs such as the Unified Payments Interface (UPI) and the Account Aggregator system which helped broaden access to financial services. These were buttressed by initiatives like Aadhaar, India’s digital proof of identity system, and the Open Network for Digital Commerce (ONDC). Modern identity verification standards were introduced, better financial infrastructure was established, and mandates around digitization and accessibility were enforced.

As a result, millions of Indians got access to financial services for the first time. Just 35% of Indian adults had a bank account in 2011; by 2021, this had grown to 80%. India’s digital economy grew in tandem; smartphone adoption rose from less than 20% in 2014 to more than 60% in 2022. This trend is ongoing, as digital payments enabled by programs such as the UPI are expected to make up nearly 65% of overall transactions in India by 2026, up from 40% in 2021.

Launched in 2015 on the back of these tailwinds, PhonePe, which is based in India, has built a digital wallet and financial services platform. For consumers, the company offers money transfer, insurance, investment, and shopping tools. For merchants, it provides a similarly diverse range of products, including payment acceptance, lending, and advertising solutions. Leveraging UPI and ONDC, it achieved significant traction, surpassing 500 million registered users in November 2023.

Founding Story

PhonePe was founded in 2015 by Sameer Nigam (CEO), Rahul Chari (CTO), and Burzin Engineer (Chief Reliability Officer). The founding team - and PhonePe itself - is the result of nearly two decades of friendship. In the 1990s, Rahul Chari and Sameer Nigam studied at the University of Mumbai together, becoming close friends and roommates. In turn, Nigam and CRO Burzin Engineer met in Los Angeles as they were beginning their careers.

These ties endured as they each began their professional lives. After spending the early part of their careers in a handful of programming and engineering roles, the trio reunited in 2009 to found Mime360, a digital media distribution platform. The company was acquired by Flipkart in 2011, and while Engineer soon departed to join another startup, Chari and Nigam remained at Flipkart to help build out the company’s infrastructure.

It was this shared experience at Flipkart that ultimately led to the founding of PhonePe. After witnessing the failure of payment systems during one of Flipkart’s major sales events in 2014, Chari and Nigam realized that there was a need for a platform that “made financial services and payments simple”. The idea for PhonePe was born a year later, and with Engineer back onboard the company was founded.

PhonePe and Flipkart were intertwined from the outset. Just a year after PhonePe was founded, Flipkart acquired PhonePe for less than $20 million. In 2018, Walmart acquired a majority stake in Flipkart, effectively placing PhonePe under its umbrella and overturning the company’s ownership structure once more. But in 2022, Flipkart and PhonePe completely severed ties in a move that Walmart described as “very analogous to eBay and PayPal, where each of them operating independently can pursue their own initiatives”.

Despite this turmoil, PhonePe has carved out its own identity. While it was still majority-owned by Walmart, PhonePe had become the most valuable payments company in India by January 2023, indicating that it had stepped out of the shadow of Flipkart. The three co-founders all remained at the helm as of November 2023.

Product

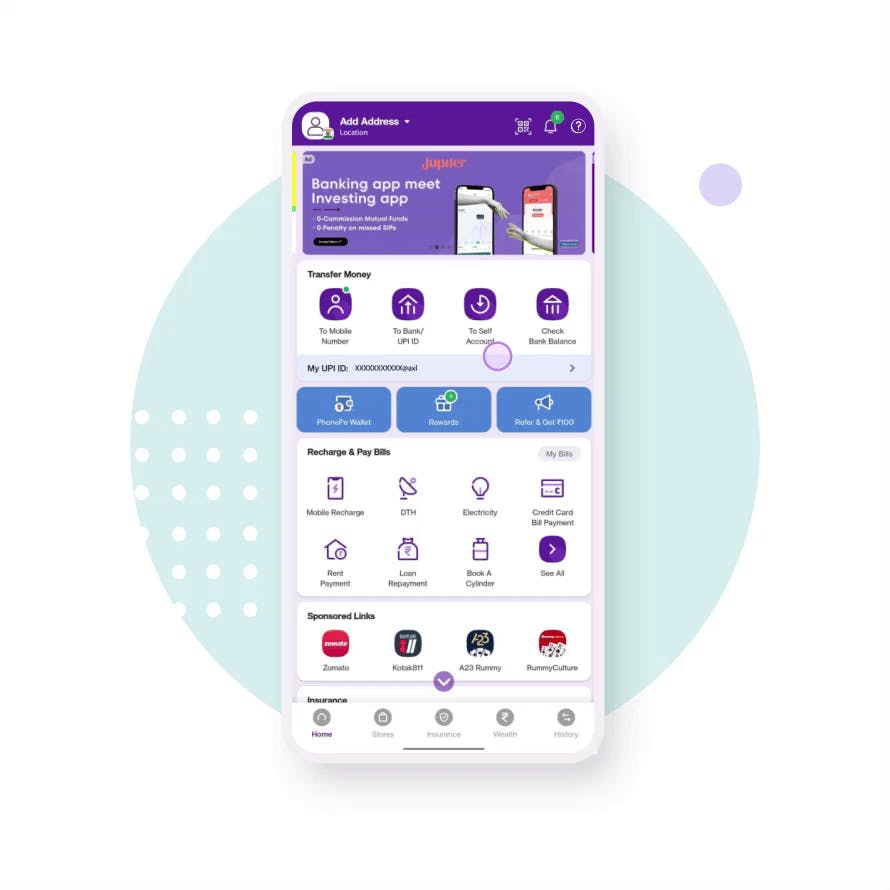

PhonePe is a two-sided platform that offers a suite of financial tools for consumers on the one hand and businesses on the other. While founded around its digital payments offering and its integrations with the UPI network, PhonePe has since expanded into insurance, investments, and lending, with the intent of creating a flywheel of financial services.

Source: PhonePe

Consumer Offering

Payments

PhonePe’s digital wallet and UPI payments tools are its core consumer-facing product offering. Through its mobile app, PhonePe allows users to send and receive money, pay bills, buy goods and services, top-up airtime, and more. While its integrations with UPI remain the most popular payment method, PhonePe also facilitates transfers via its closed-loop PhonePe wallet and debit and credit cards. Users can download the app, link their phone numbers, verify their bank accounts, and transact immediately. PhonePe also allows for cross-border UPI payments, which it launched in February 2023.

Insurance

PhonePe also provides a suite of insurance tools to consumers. Having acquired an insurance broking license in 2021, PhonePe’s app offers a variety of insurance plans across health, life, vehicle, and travel through a number of insurance partners while allowing users to pay insurance premiums on-platform. PhonePe had sold 5.6 million policies by July 2023, targeting the majority of Indians who remain uninsured.

Investments

PhonePe also cross-sells investment products to its user base. It offers mutual funds, equities, and other investment options alongside robo-advisory and PFM tools. To help bolster its efforts in these areas, PhonePe acquired two wealth management startups, Wealthdesk and OpenQ, in 2022.

Pincode

Launched in April 2023, Pincode is PhonePe’s hyperlocal commerce and shopping app. Pincode is built as a separate app on top of ONDC, a government-backed commerce network that allows buyers and sellers in India to transact directly regardless of whether they use Flipkart, Amazon, or some other service. It provides direct access to goods and services across food, grocery, home decor, pharma, electronics, and fashion, and crossed 50K downloads within its first month.

Business Offering

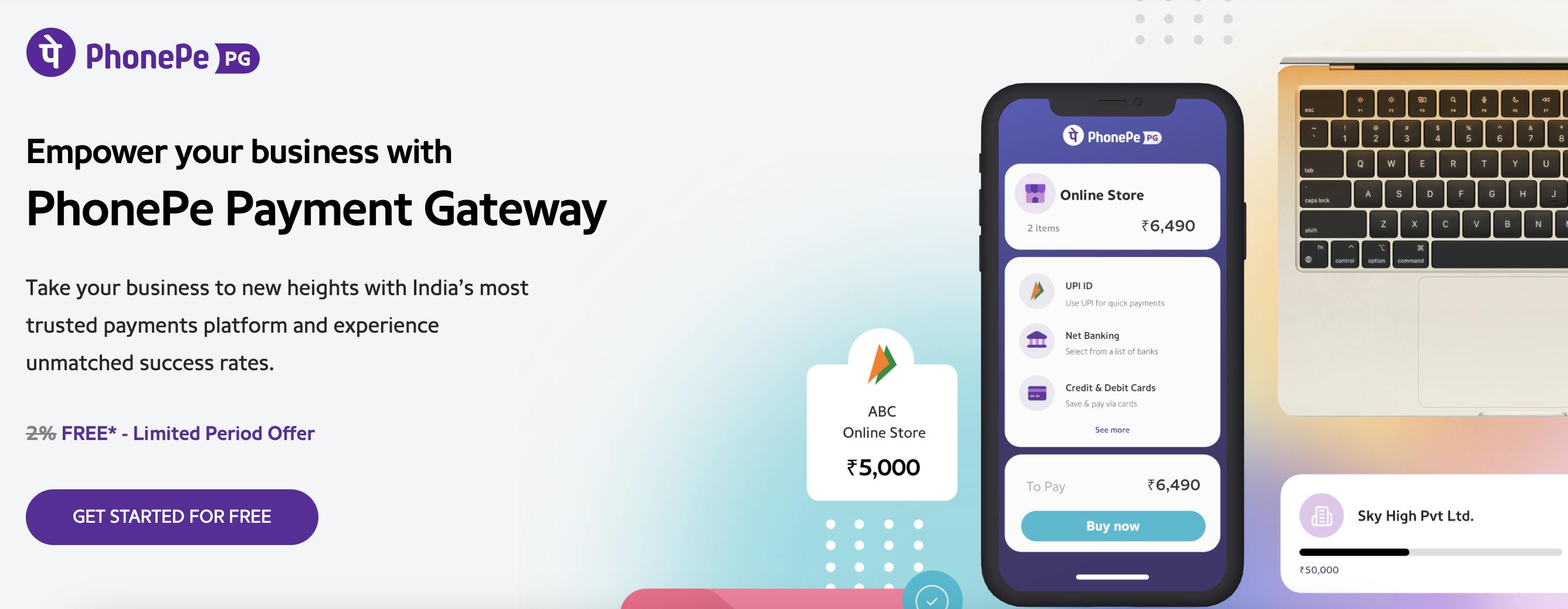

Payment Gateway

Source: PhonePe

PhonePe’s payment gateway allows merchants to accept online payments. While it was previously reliant on third-party gateways, PhonePe introduced its own in-house platform in June 2023 with fully digital onboarding, integrations with Shopify and other commerce providers, and modular checkout experiences.

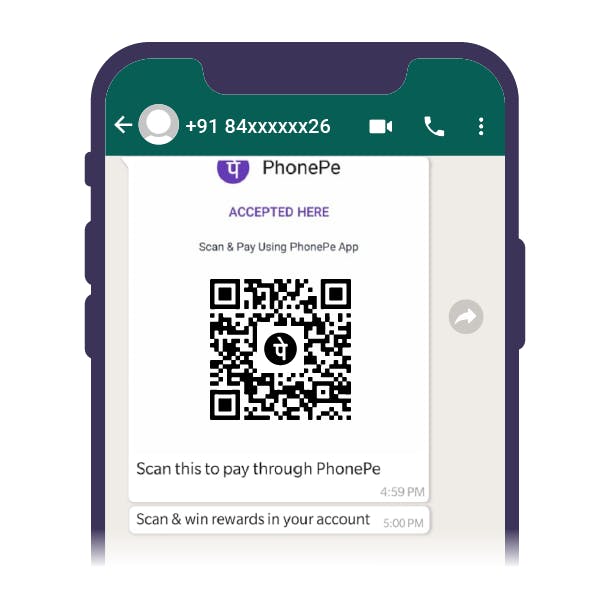

Offline Payments

Source: PhonePe

PhonePe offers an array of offline payments products to stores and businesses. These solutions include point-of-sale systems, QR codes, and reconciliation and tracking tools, allowing businesses to easily accept UPI, card, and digital payments. Through the PhonePe app, businesses can access a number of value-added services like the PhonePe ATM, a cash withdrawal service for customers.

In June 2023, PhonePe introduced its own “one-stop-shop” POS device that comes preloaded with the PhonePe app and handles a variety of payment methods, further consolidating the Company’s grip on the offline payments space.

PhonePe Switch

PhonePe Switch is a feature that allows users to browse merchants, order, and pay within the PhonePe mobile app. With this tool, businesses have a cost-efficient growth channel and direct access to PhonePe’s 450 million-plus users.

Advertising

Businesses can advertise directly on the PhonePe app to promote their goods and services. This product comes in two forms: Brand Ads, which are traditional advertisements displayed on the app homepage and other parts of the app, and Rewards, which are personalized offers and coupons for transacting customers.

Merchant Lending

Through a set of lending partners, PhonePe provides limited credit products to businesses across India. Announced in June 2023, these loans are approved and deployed directly through the PhonePe app, creating a fully digital experience for customers. In June 2023, PhonePe also announced that it was actively developing its own credit score to further streamline this process.

Market

Customer

PhonePe caters to both individuals and businesses. On the consumer side, PhonePe serves more than 500 million registered users across India. While PhonePe’s customer base spans income levels, age groups, and locations, it’s generally concentrated in smaller, less developed Tier II and III cities with the company stating that, over the course of 2020-2012:

“We have almost 13.3 Cr. monthly active users, and nearly 80% of our transactions come from tier 2, tier 3, tier 4 cities and beyond.”

The typical customer varies by product, too. PhonePe’s insurance offering, for example, is largely purchased from customers in smaller, more rural towns and villages.

For businesses, PhonePe primarily targets small and medium-sized merchants. In total, PhonePe serves more than 37 million merchants across India as of November 2023, helping grocery stores, restaurants, and other businesses accept digital payments or offline PhonePe payments, as well as advertise on the PhonePe platform or access business lending via PhonePe.

Market Size

PhonePe sits across multiple growing markets. Payments, through UPI and other channels, are the core of PhonePe’s offering: that segment in India is expected to be worth more than $1 trillion by 2024, up from just $200 billion in 2020. PhonePe and Google Pay dominate the landscape, together holding more than 80% of the UPI payments market.

Broader financial services in India are similarly seeing growth. The country’s insurance industry is growing at a CAGR of 12-15%, expected to reach $280 billion in market value by 2025 as plans become more accessible and Indian income levels increase. Digital lending will hit an estimated value of $1.3 trillion by 2030, up 400% from 2022 levels. Emergent players will drive much of this growth, with the fintech industry in India expected to earn more than $200 billion in total revenue by 2030. Finally, the Indian eCommerce market, dominated by Flipkart and Amazon, is also growing and is estimated to be worth $133 billion by 2025. While still a nascent part of PhonePe’s platform, ecommerce is an important part of its long-term addressable market.

Competition

Paytm: Paytm is a mobile payments and financial services platform for consumers and businesses in India. The company began as a mobile top-up service in 2009 but has since expanded into digital payments, ecommerce, merchant acquiring, and broader financial services, executing on the same ”super app” strategy that PhonePe is pursuing. On the back of its expansive merchant offering, Paytm recorded $978 million in total revenue while trimming its losses to $217 million during FY 2023, but it lags PhonePe and GooglePay in terms of digital payments, holding just over 10% of the UPI market.

After raising more than $3.3 billion in private capital, the company launched India’s largest-ever IPO in November 2021 to much fanfare, but its shares plummeted as much as 70% from its issuance price over concerns about profitability and competition. Paytm’s stock has since recovered somewhat as of November 2023 when its market cap was ~$6.7 billion (₹554.5 billion), but questions about the durability of its business model remain.

Google Pay: Google Pay is a digital payments service and mobile wallet. In India, Google Pay is built on top of UPI, allowing users to seamlessly send and receive money, pay bills, and make mobile top-ups. Originally launched under the name Tez in 2017, the product has become a stalwart in digital payments, controlling more than 30% of the UPI market.

In January 2023, Google Pay invested in its nascent merchant offering via its “Google Pay for Business” app to deepen its economics, but it has struggled to carve out a profitable business model amidst a challenging regulatory environment and heavy competition. The monetization of UPI payments remains difficult, and the platform, even with its millions of users, has been unable to effectively expand beyond its low-margin consumer payments business. The product is owned by Alphabet, which has a $1.7 billion market cap as of November 2023.

BharatPe: BharatPe Is a payments, banking, and lending platform that was founded in 2018. Focused on merchant acquiring, treasury management, and working capital solutions for small- and medium-sized merchants, the company also offers a limited set of financial tools for consumers, like PostPe, a BNPL product, and Zillion, a shopping rewards program. BharatPe has built a merchant base of over 10 million as of November 2023 and has raised a total of $680.5 million in funding. Its Series E in August 2021 valued the company at $2.9 billion.

Business Model

For consumers, the PhonePe app is free to download and use, and there are no charges associated with sending and receiving payments. For its insurance and investment plans, PhonePe receives commissions from its regulated partners.

For merchants, pricing is more complex. PhonePe typically charges 2% on each online transaction processed through the platform but it has subsidized this cost for merchants as of 2023. It also charges merchants for accepting payments through its POS product and receives affiliate commissions from partner offerings and advertising revenue from promotions it serves users of its platform.

Traction

PhonePe surpassed 10 million app downloads for the first time in 2017 and also achieved 1 million daily transactions that year. In 2018, it processed 1 billion transactions, which grew to 2 billion transactions by 2019. By 2020, the company reported having reached over 250 million registered users and had onboarded 25 million merchants by 2021.

In total, PhonePe serves more than 500 million consumers and 37 million merchants across India as of November 2023. It controlled more than 40% of the UPI market as of December 2023 and 45% of the popular Bharat Bill Pay System (BBPS) by June 2023.

The company recorded $234 million in revenue in the first nine months of 2022, and projected $504 million in revenue for CY 2023. But whereas its key rival Paytm is closing in on profitability, as of January 2023, PhonePe did not expect to turn EBITDA-positive until 2025.

Valuation

In May 2023, PhonePe raised $100 million of funding from General Atlantic as part of a broader $850 million fundraising round at a pre-money valuation of $12 billion. this valuation represented a 600x increase from the acquisition price Flipkart paid for the company in 2016, a nearly 2x increase over its August 2021 valuation. It also made PhonePe the most valuable fintech startup in India as of February 2023, compared to competitor Paytm’s $5 billion valuation.

This round brought PhonePe’s total funding to $2.6 billion as of November 2023. General Atlantic led its most recent round and Walmart maintains its majority stake, and other notable investors include Ribbit Capital and Tiger Global.

Key Opportunities

Product Adjacencies

PhonePe’s expansion into new product verticals represents a significant avenue for growth. While the company explicitly stated in May 2023 its intention to invest in new offerings like Pincode and wealth management, mortgages, crypto, and full-service stock trading all are potential add-ons as well. PhonePe’s CEO Rahul Chari himself acknowledges that the company has a “long way to go” when it comes to being the go-to Indian financial super app, but it is quickly developing a powerful ecosystem of financial services.

Growth of Digital and Real-Time Payments

India’s accelerated transition towards digital and real-time payments is likely to drive demand for accessible, app-based services like PhonePe well into the future. Introduced in 2016, the UPI payments system has transformed commerce in India, and in 2022 consumer digital payments users were expected to triple over the next five years while merchant digital payments were expected to double over that same period. PhonePe has positioned itself as the payments platform for a large swathe of Indians, and it is well positioned to capitalize on the rising tides pulling in the underbanked and underserved into the new Indian digital economy.

Consolidation and Integration

PhonePe has already completed several acquisitions (and called off the acquisition of BNPL ZestMoney) and disclosed its plans to invest in its data centers and other infrastructure, but creating a more cohesive stack, whether through M&A or internal channels, could improve the company’s economics and streamline the experience for end customers. Lending and other more nascent verticals for PhonePe are the obvious targets, but the Indian fintech ecosystem is growing quickly and opportunities exist across the industry.

Key Risks

Regulatory Uncertainty

Although all financial services have a degree of regulatory uncertainty, the banking and payments industry in India is particularly clouded. The National Payments Corporation of India (NPCI), the organization overseeing the UPI network, has delayed its intended caps on market share of participating players like PhonePe and GooglePay until 2025, but those restrictions still loom over the industry. Similarly, the Reserve Bank of India and other parties have contemplated building an alternative to UPI, a move that would undermine PhonePe’s positioning. PhonePe has capitalized on the wave of regulatory changes over the last decade in India, but those winds can shift quickly.

Competition

PhonePe is vulnerable to an increasingly competitive fintech and financial services landscape in India. Paytm and Google Pay are the most immediate threats, but particularly as PhonePe expands into ecommerce and other new verticals, banks, fintechs, and diversified technology players represent significant challenges as well. In 2021 and 2022 alone, Indian fintechs received more than $19 billion in financing, powering marketing spend and product development in every corner of financial services. PhonePe’s brand and footprint are significant, but it will have to fend off challenges from across the technology landscape in the years to come.

Path to Profitability

PhonePe’s path to profitability has been unclear for years. The company recorded a loss of nearly $25 million in the first 9 months of 2022 and does not expect to turn EBITDA-positive until 2025. PhonePe’s revenue is still dominated by low-margin payments products, and its ability to execute on lending, ecommerce, and other more profitable products is uncertain. In a macroeconomic environment where “growth at all costs” is no longer in vogue, PhonePe’s investors will likely demand profitability before any IPO.

Summary

PhonePe is a digital financial services platform for consumers and businesses across India. The company was founded around its core UPI payments offering, but it now offers a full suite of services across investments, insurance, lending, and ecommerce, all via its mobile app. The company was acquired by Flipkart for just $20 million in 2016 and is still majority-owned by Walmart, but it has now grown to a significant $12 billion company as of its last funding round.

In April 2023, PhonePe said it was aiming to IPO in 2024 or 2025 once its core businesses turn profitable and capital markets have stabilized, but with heavy competition and a precarious regulatory environment, that path is far from certain. Nevertheless, PhonePe has helped drive financial inclusion across India and pulled millions into the banking and payments system in the country.