Thesis

Every company represents a complex web of inflows and outflows. Managing a company’s expense account can be death by a thousand cuts for many businesses. For example, the average company spent $9.6K per employee annually just on SaaS subscriptions in 2023. As an industry, global software-as-a-service spend is projected to grow to $295 billion by the end of 2025, a 44% increase from $205 billion in 2023.

The average US business runs on an 8.5% profit margin, meaning that to generate a dollar in profit, a company can either grow revenue by $12 or reduce costs by just one dollar. In this context, every dollar saved is equivalent to 12 dollars earned. It’s a principle well understood by history’s most effective operators: Sam Walton, for example, simplified Walmart’s supply chain from five layers to three, and Henry Ford cut car assembly time from 12 hours to 93 minutes, both with the effect of substantively reducing costs.

Expense management is one factor that can contribute to lowering a business’s costs. While managing tens of thousands in expenses may be mundane, it's an ever-present part of any business that has to be managed. A lot of inefficient costs, both in time and money, can arise from the complexity of expense management. Many businesses still use paper receipts or spreadsheets to manage their expenses. These methods are inefficient, expensive, and error-prone. In 2022, it was found that one in five expense reports contained errors, and it cost $52 to fix each expense report.

Software has become an integral part of managing financial services. In a 2021 survey, 88% of US respondents said they use technology to manage their finances, a notable increase from the 58% who responded the same way in 2020. Meanwhile, the market for expense management software was valued at $6 billion in 2021, and $1.5 trillion was spent on corporate cards in 2022, with an increase to $1.9 trillion in 2023. In 2020, the global corporate card market was valued at $32.3 billion and was expected to grow 7.3% through 2026.

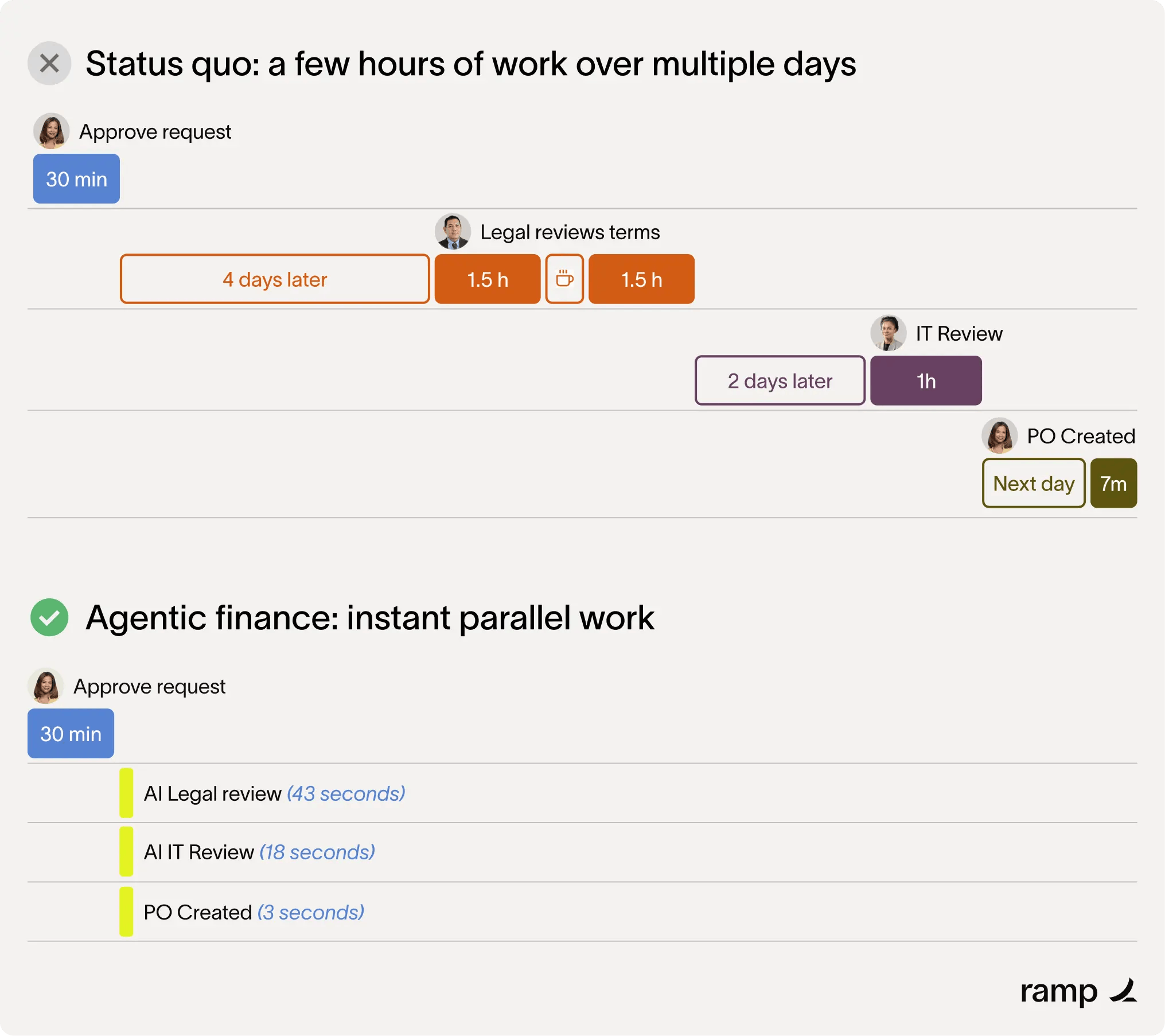

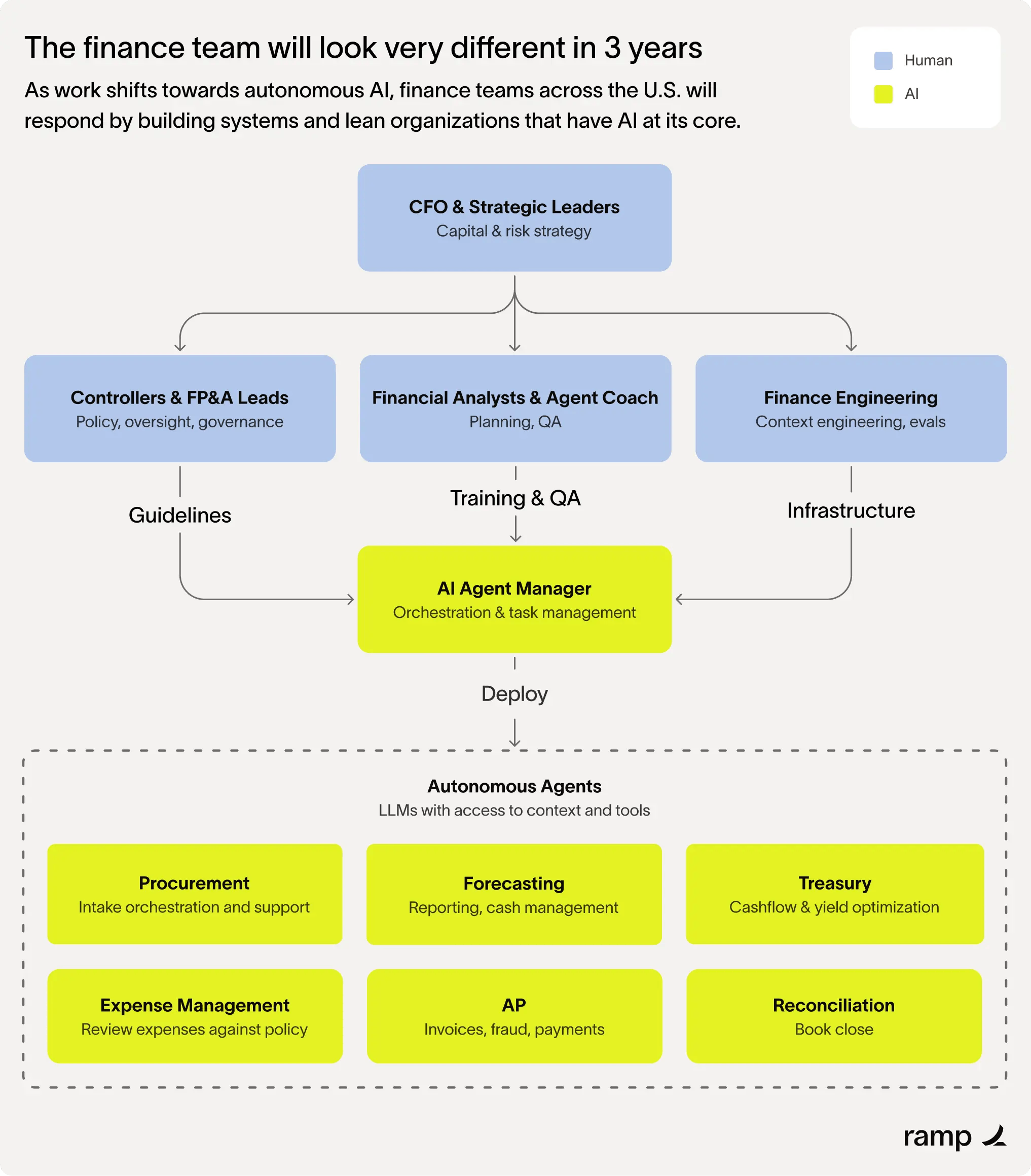

As AI tools mature and finance workflows become increasingly digitized, we’re seeing a shift from passive visibility to active intervention. Finance teams are no longer just tracking spend –they’re automating decisions, enforcing policy in real-time, and accelerating routine processes with AI. The next phase of expense and spend management will be defined not just by software adoption, but by systems that can reason, act, and adapt at scale.

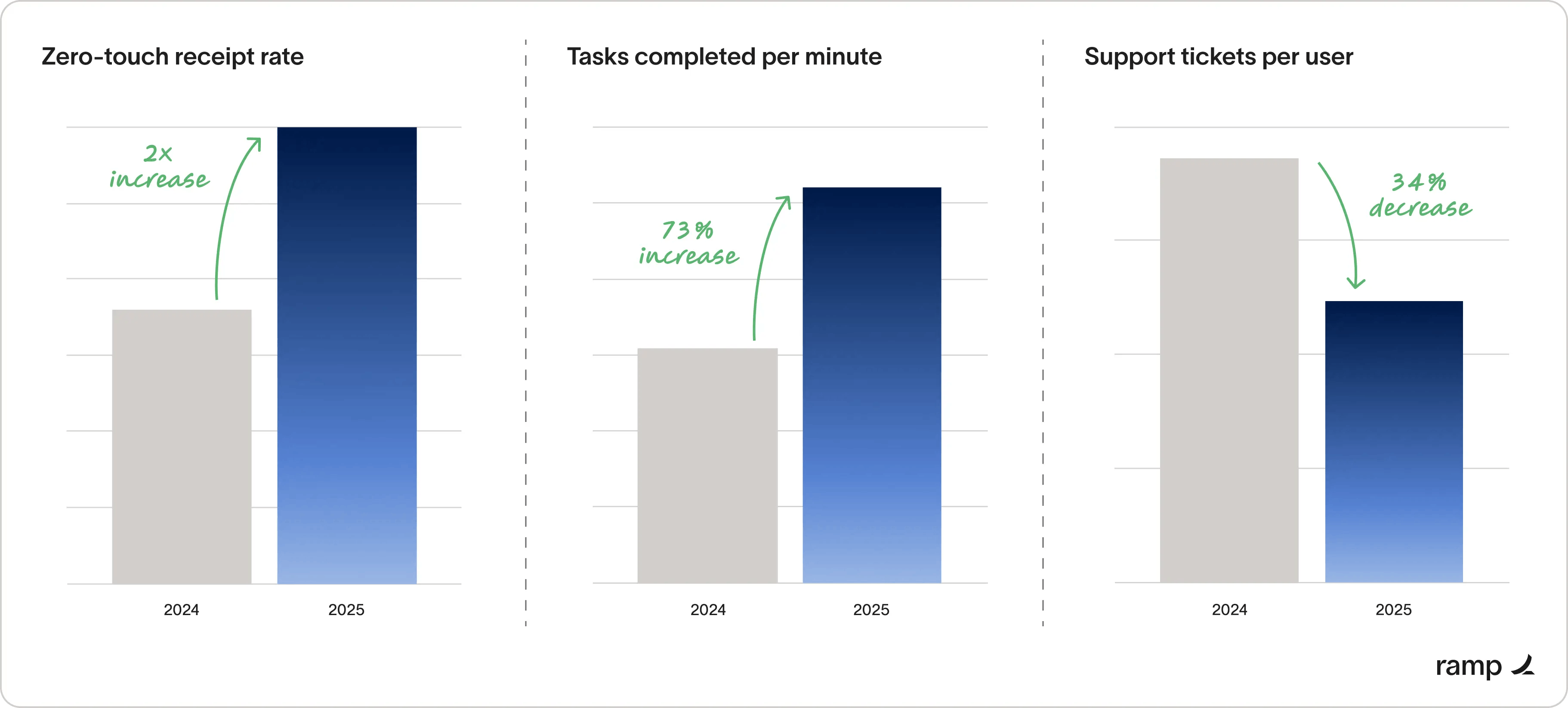

Source: Ramp

The future of finance operations will be defined by AI agents operating in parallel across workflows that have historically been manual and sequential. Rather than waiting days for legal, IT, and procurement reviews to happen one after another, AI agents enable these reviews to occur instantly and in parallel. Early deployments show significant time savings and lower error rates, helping companies move faster while maintaining compliance and control.

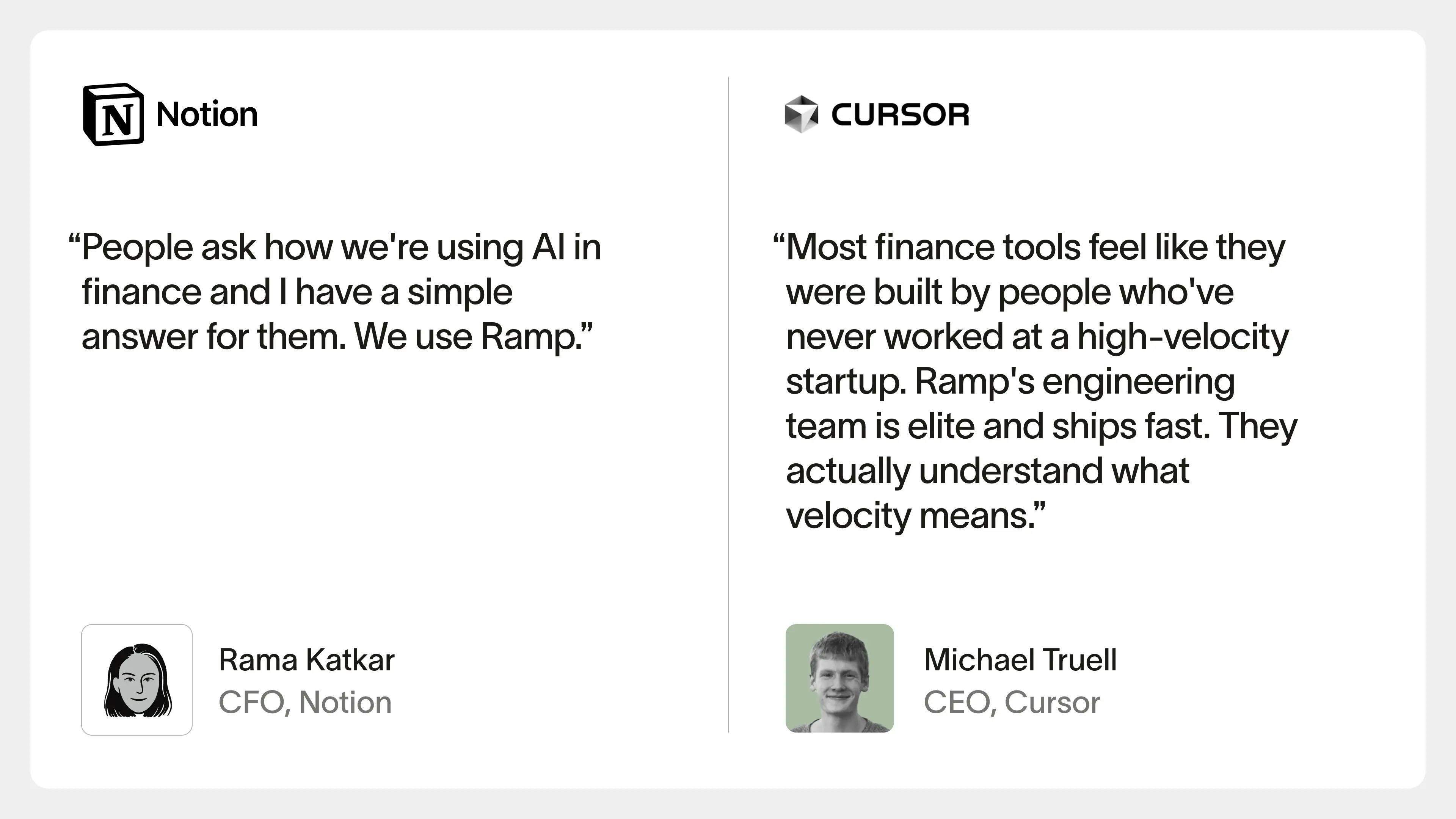

Ramp* is at the forefront of this transition, providing a suite of products designed to automate companies’ finance operations. Ramp’s expense management software automates receipt capture and reporting, eliminating manual tracking. It also provides corporate cards and offers agentic solutions for bill payments, vendor management, and procurement operations. Its products are intended to increase spending policy compliance and allow businesses to adopt smarter spending policies while cutting down on waste from manual expense management.

Ramp is building toward a future where AI is embedded at every layer of finance, from transaction review and fraud detection to forecasting, reconciliation, and cash flow management. Human teams are still responsible for setting policy and making strategic decisions, but the execution is increasingly automated. As of October 2025, Ramp was used by over 45K businesses, leading them to save $10 billion and 27.5 million hours of labor. With copilots already deployed across customers like Webflow and Notion, Ramp’s agents are now handling approvals, flagging fraud, reviewing policy violations, and syncing data without human touch, shaping what a lean, AI-native finance organization looks like in practice.

Source: Ramp

Founding Story

Ramp was founded in 2019 by Eric Glyman (CEO), Karim Atiyeh (CTO), and Gene Lee. Ramp co-founders Glyman and Atiyeh first met as classmates at Harvard and then launched their first company, Paribus, out of school. Paribus, co-founded by Glyman and Karim Atiyeh in 2014, aimed to help regular folks find and make use of better deals they might have missed out on. They got the idea from Glyman's time working at Express, where prices kept changing (a dress shirt could be 20% off one day and 50% off the next day), and from a time when he felt annoyed after booking plane tickets and then realizing the price dropped later. Paribus allowed users to track prices and get refunds automatically.

Source: Forbes

Not long after Paribus had been founded, Capital One showed interest in the company. Capital One’s credit card division acquired the company in 2016, just months after it had completed YC. At the time, the company had roughly 700K users and had saved consumers over $100 million. While Glyman and Atiyeh were at Capital One, they worked closely with Gene Lee, who had been one of their software engineers at Paribus. Lee would become Ramp’s third co-founder.

In March 2019, Glymen and Atiyeh left Capital One to start a new venture. In an interview, Glyman described the origin of Ramp, saying: "We had this idea of, ‘What if your credit card could help your business spend less money?’”. The two of them reportedly spoke to 100 entrepreneurs and finance experts before launching such a card and found that clients were even more interested in saving time than money because the process of expensing was so broken and inefficient. This realization gave rise to the idea for Ramp, a product to both make the expensing process more efficient and a corporate card tailored to provide perks that businesses want.

From its founding in 2019 to July 2023, Ramp scaled its team to over 400 employees; by April 2024, this had risen to 730 employees. The company built its early team with the mindset that everyone ought to think like a founder: out of the first 60 employees, one in every three people was a former founder. The founders took debt at first to help early hires buy founder shares, and always emphasized the long-term relationship they would have with their team members. Eric Glyman, Ramp’s CEO, put it this way:

“It's possible that we'll all work together for 20-plus years building this company. That'd be great. But it's possible some want to go there, see what it's like, and go and start their company later. And when I look at some of the first 22 have gone on to do that, and we've been there to support them. Not just having a relationship building the company, but helping them actualize what they care about and believe in over the course of their life.”

Early on, Ramp attracted top executive fintech talent, former founders, and award-winning programmers. It also became a landing spot for young talent in or out of university. The founders have described their aspirations for the company to be a learning ground for a future generation of founders. That culture is one aspect of the company that the founders have ascribed to contributing to the company's product velocity:

“We tried to have a team that was extraordinary in capabilities from the get go, that would attract other people who wanted to work with other great people, wanted to build and create processes that for areas of engineering, we needed to go super fast. We would do this and operate and ship consistently. And for parts of the infrastructure that needed to go slow, and never be taken down? Do that, but isolate them and have separate processes around and make sure the engine around talent was really a forefront focus of the company.”

Product

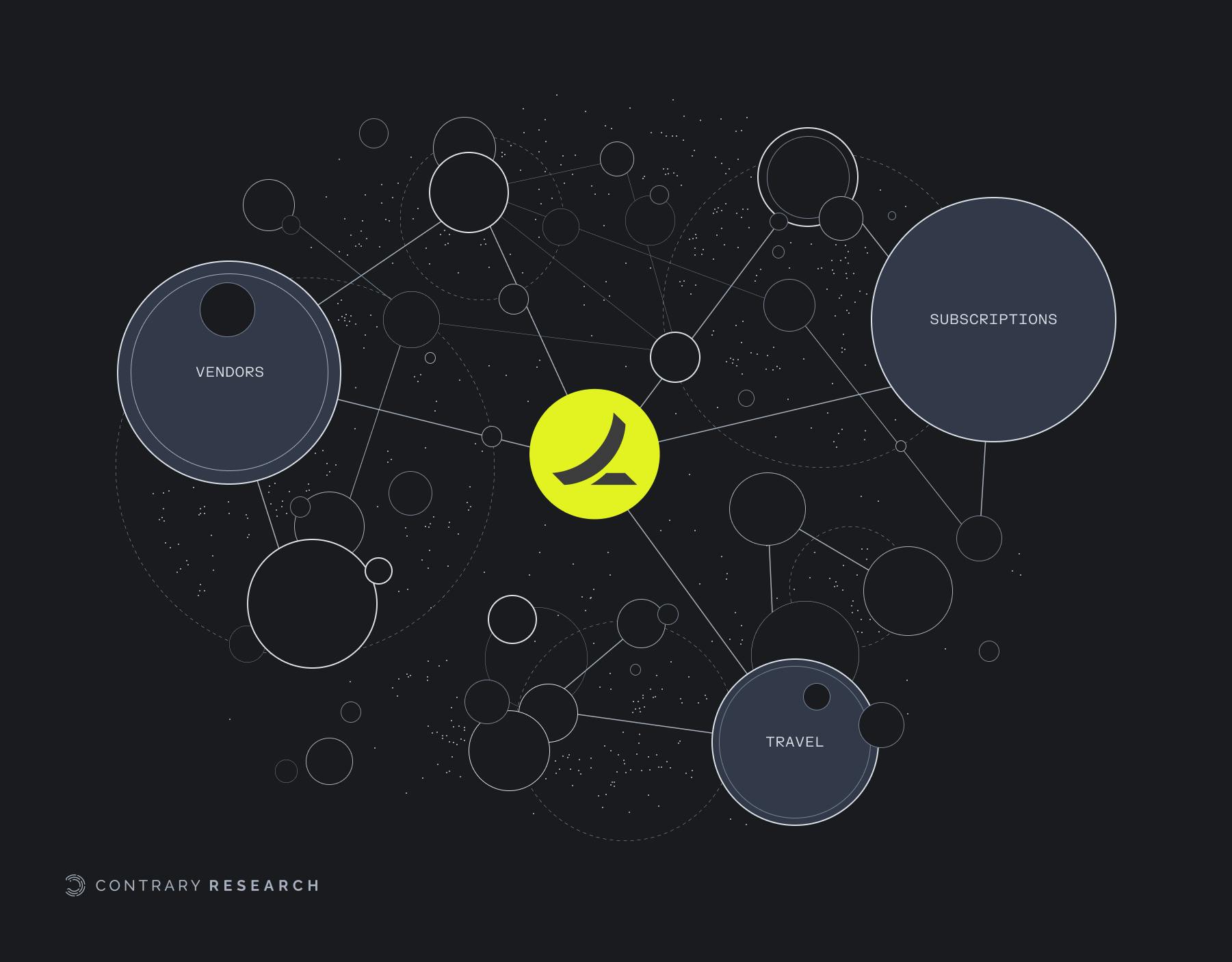

Every transaction over the course of a company’s life represents a massive web, from paying for the smallest box of paper clips to multimillion-dollar vendor deals. When thinking about Ramp’s product vision, it's necessary to go deeper than simply looking at the Ramp card through which some of those transactions flow. Ramp's vision is to become the center of gravity in a company’s transaction layer and leverage that position to identify every meaningful node within each customer.

Source: Contrary Research

While the initial vision is to extend into several areas of the finance stack and tackle processes like travel or expense management, the long-term vision is focused on automation. As CEO Eric Glyman put it:

“What if your card, your bill payments, your software [were] quite literally so smart that… what used to take days [or] hours could be totally automated away. Some of the manifestations of that have started to become clear. Fully automated expense management, where 6% of our companies that enable all of our integrations with Gmail, Amazon for business, Lyft and 90% of all their receipts are fully automated, no human touch at all.”

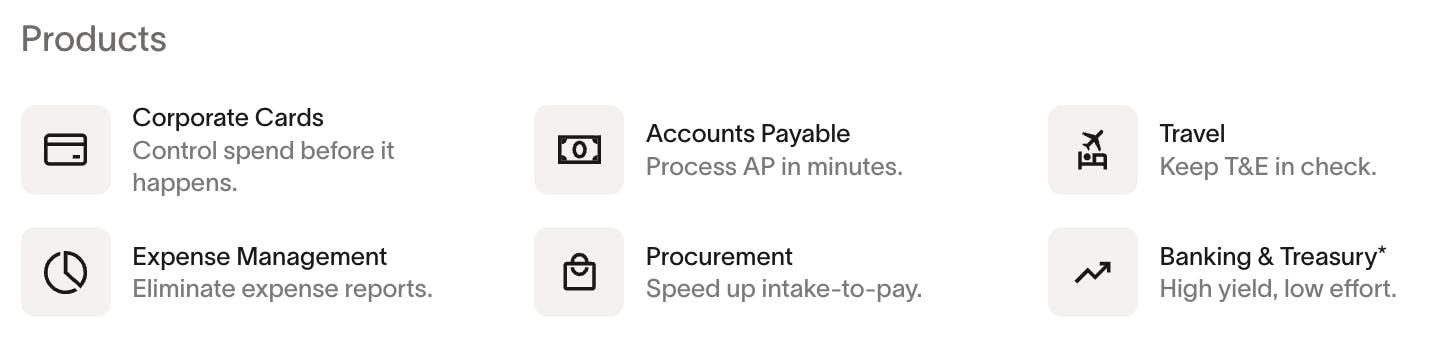

Keith Rabois, who invested in DoorDash, Affirm, and Stripe, and led several funding rounds for Ramp, said in March 2022 that “Ramp’s product velocity is absolutely unprecedented in my 21 years working with technology businesses.” That product velocity funnels into a suite of products Ramp describes as helping companies (1) start (cards, expense management, and bill pay), (2) scale (manage expenses policies and visibility), (3) streamline (accounting automation and integration), and (4) save (both time and money).

Source: Ramp

Corporate Cards

On average, companies spend $80 per employee per year ordering business cards. If a company has 150 employees, this would add up to over $12K per year. Ramp’s first product was a simple Visa corporate card with unlimited 1.5% cash back on all transactions. The Ramp card is free to use and does not charge any card replacement fees, late fees, or interest. As of October 2025, alongside the 1.5% cash back, Ramp customers have access to $350K in perks as a result of partnering with the platform. Ramp does not charge interest on balances, because the issued corporate cards are charge cards.

Source: Ramp

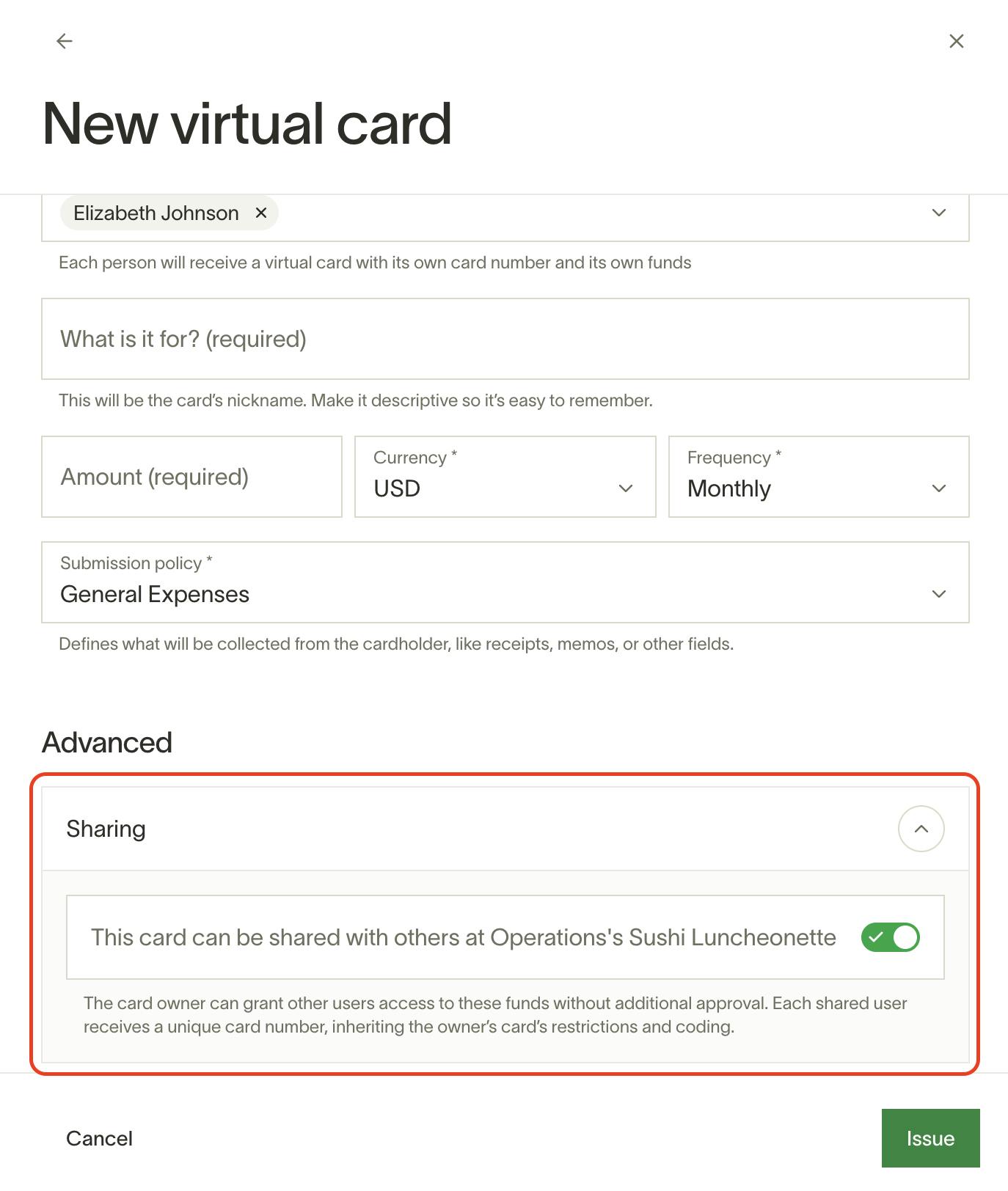

Ramp customers can issue virtual cards or physical cards. Virtual cards can be issued in unlimited quantities and are easy to transfer between users. These virtual cards can also be added to Apple Pay or Google Pay for in-store purchases. Physical cards are individual to a user, and at any time, only one can be active.

Most corporate cards are enrolled in 3D Secure (3DS) payment. 3DS is a common credit card authentication method that's used for Strong Customer Authentication (SCA). SCA is a European regulatory requirement to reduce fraud and improve security for online and contactless payments. This means Ramp’s physical card can be used internationally without worry.

Ramp allows businesses to block or restrict spend by specific vendors or categories and allows businesses to enact precise controls, including spend limits by frequency and auto-lock dates for every card. As of May 2024, Ramp was also beta testing shared limits for tracking group spend. As Ramp described it:

“This feature allows admins to issue or employees to request limits that multiple employees spend towards for a specific purpose with their own cards.”

The feature allows authorized employees to spend from the same pool of funds, with visibility on who is spending on what. For example, a head of marketing can allocate a budget to plan an event that can be shared amongst multiple employees.

The inspiration for Ramp's card offering came out of Glyman and Atiyeh's experience working at Capital One:

“The traditional corporate card world was all about excess. When I asked people what they wanted? It wasn’t points. It wasn’t cash back. It was money in their bank account. They wanted more control and the ability to be more profitable.”

As a result, Ramp aimed to build an easy-to-use card, and over time, extended its platform to include software that would focus on helping companies spend less and keep more money in their bank accounts.

In May 2025, Ramp announced it would be partnering with Stripe to launch corporate cards backed by stablecoins aimed at streamlining cross-border business transactions. Starting with select markets in Latin America, and expanding to Europe, Africa, and Asia, the new card program is designed to eliminate many of the frictions with international payments, such as long settlement times, high fees, and currency volatility. By allowing businesses to fund wallets in local currency and transact globally as if they were making local payments, Ramp’s stablecoin-backed cards offer a faster, cheaper, and more stable alternative to traditional cross-border payment rails.

Expense Management

With Ramp’s expense management platform, companies can effectively manage employee spending in one centralized dashboard. Each component of the product is built to save both time and money. With the combination of both its card and software products, Ramp is more deeply integrated into the financial rails of its customers.

As part of its base product offerings, Ramp offers customers the ability to build out complex and flexible approval chains for different conditions under expense approvals. The workflow approval building is initialized using one of a number of requirements that can be layered and nested to create the desired approval routing. Amount and employee role-based routing is available to all customers. However, there are several unique fields offered solely to Ramp Plus customers.

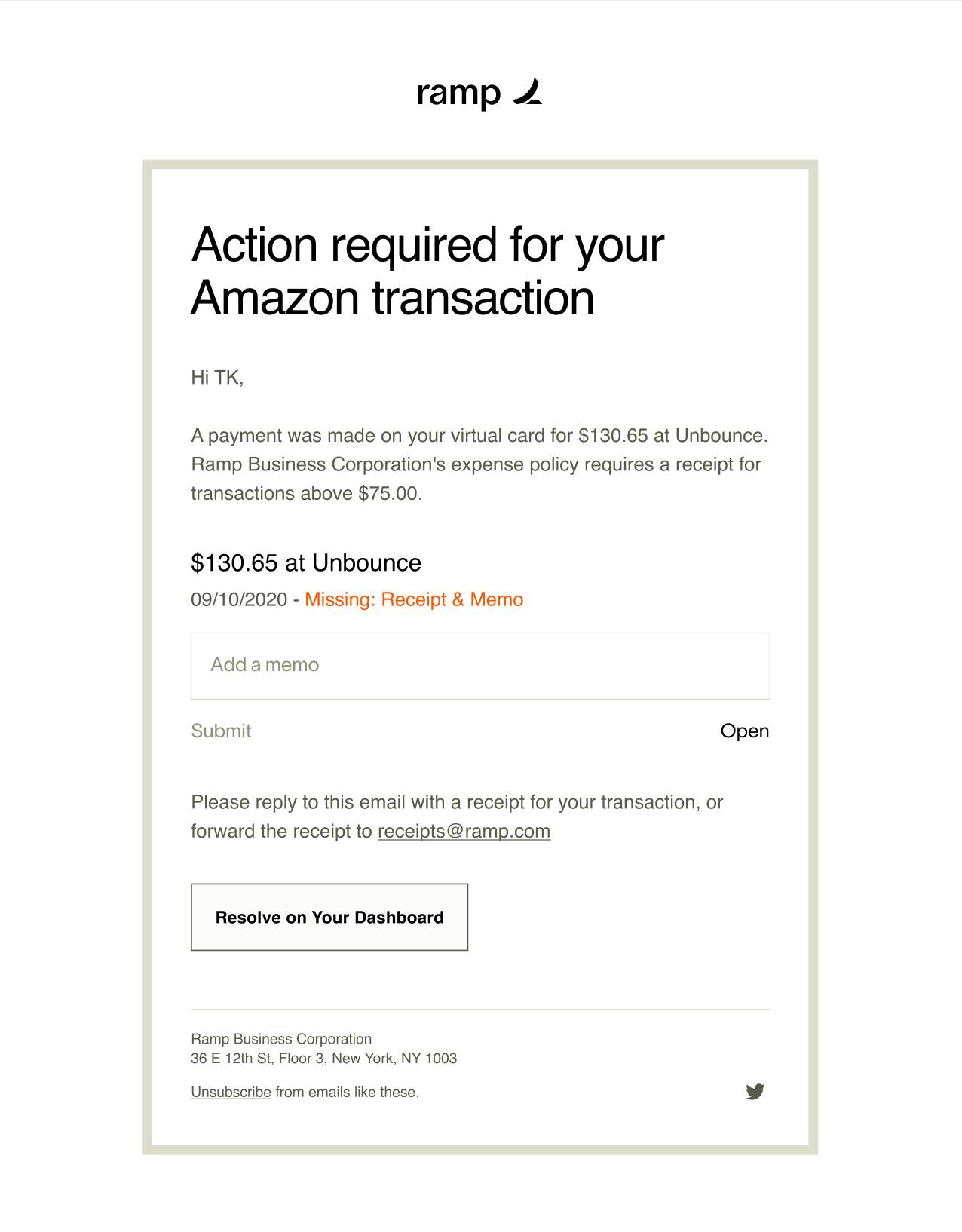

Receipt Matching

Source: Ramp

Often, when expense management software is divorced from transactions themselves, users find themselves with a pile of receipts each month that need to be input into the software manually. To prevent this, Ramp focused on building more robust optical character recognition (OCR) to automatically ingest even the hardest-to-read receipts to achieve over 90% accuracy.

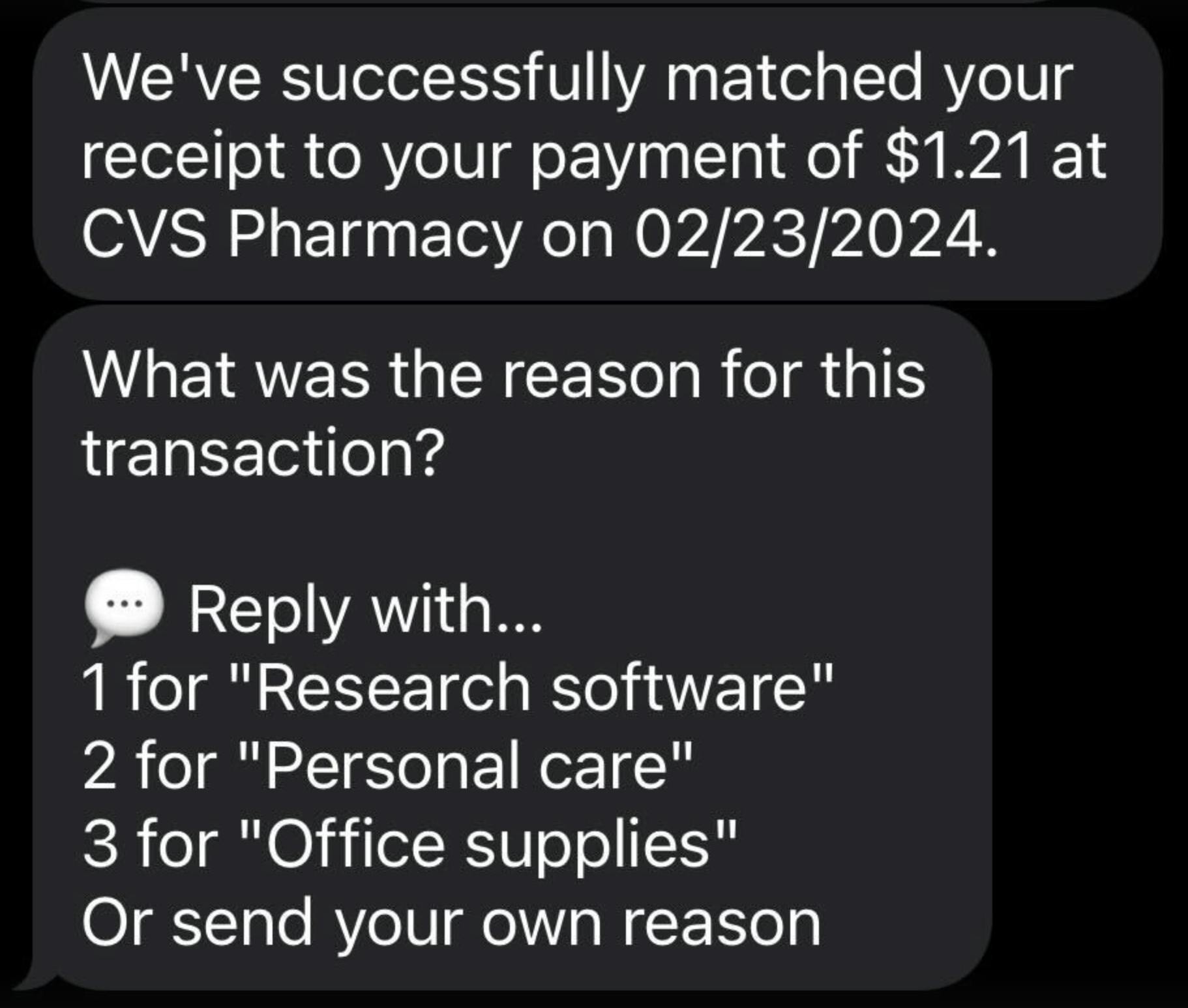

It also aims to send triggers right at the time following a transaction, which is intended to ensure easier and more timely transaction logging. Ramp's software is therefore intended to make expense management as simple as it can for the individual user. Further, when a user spends with their Ramp card, if a receipt is required, they can attach it alongside any relevant notes or categorizations as a memo via several different options like SMS, email, Ramp.com, mobile app, or Slack integration.

A feature launched in Q1 2024 and in beta as of May 2025 is that, using Ramp Intelligence, Ramp will automatically suggest a few memos via SMS that users can select from under specific conditions.

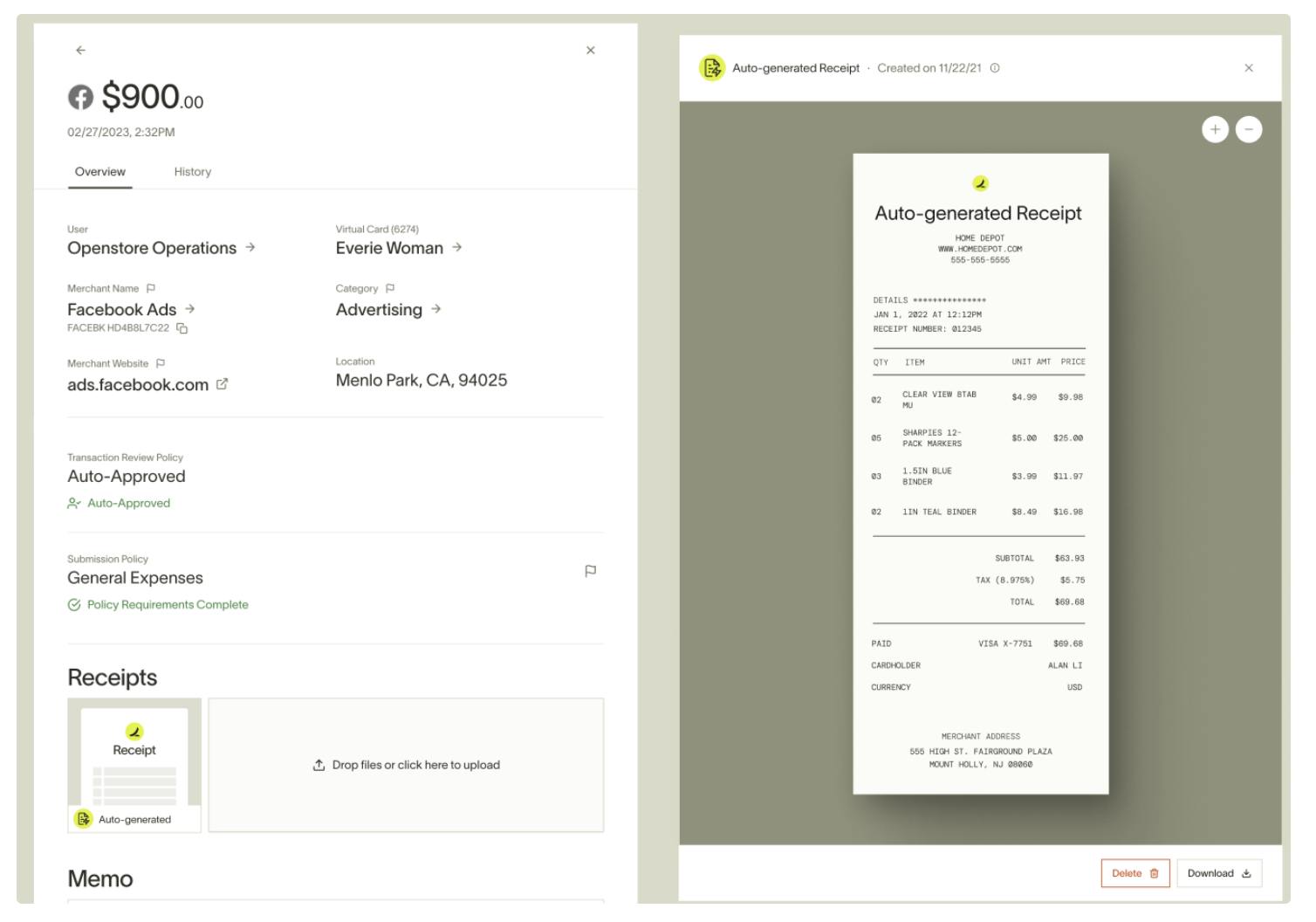

Source: Ramp

As another time-saving feature, Ramp also enables customers to create auto-generated receipts and digital versions of paper receipts for card transactions under $75 (the threshold for IRS compliance). The information for the receipt is sourced via information captured at the point of sale (POS) or payment. For example, when a customer purchases at a retail store, the POS system captures transaction data such as the date and time, items purchased, prices, discounts, and payment method. This information is then sent to the merchant's payment processor, which may generate an automated receipt.

Source: Ramp

As part of compliance and receipt matching, Ramp prevents finance teams from having to verify receipts manually. If a transaction and its fields pass at least two out of three checks for the amount, date, and merchant, Ramp will “auto-verify” the receipt.

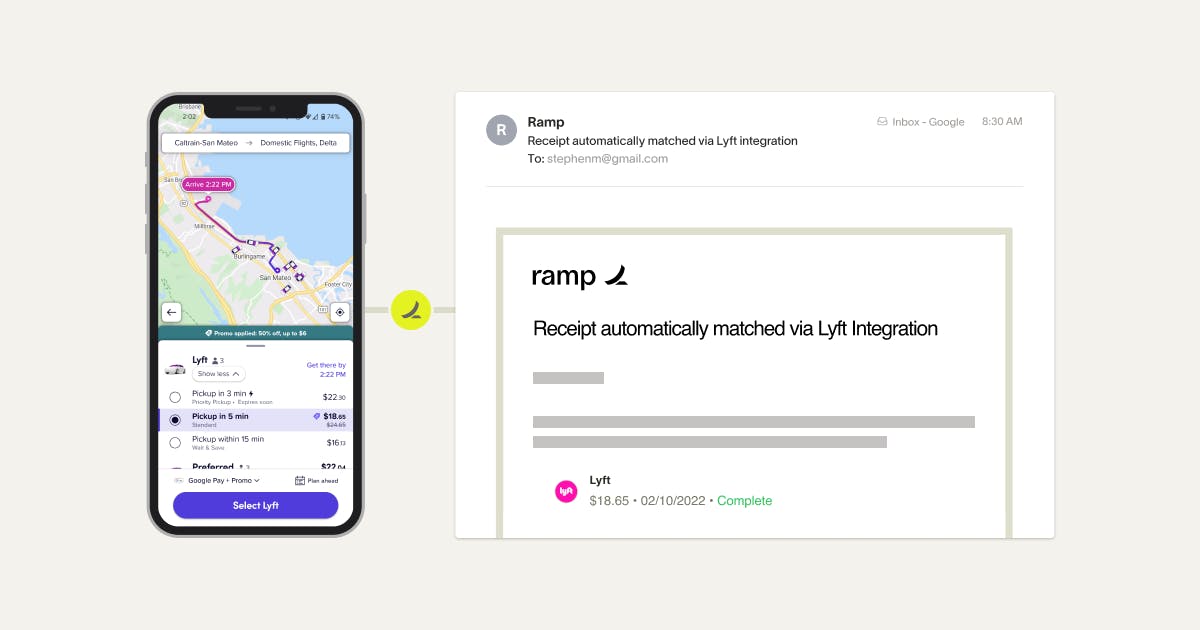

Source: Ramp

Ramp also enables users to automatically send receipts via integrations with Gmail, Outlook, Amazon Business, Lyft, and Uber that allow for automatic receipt collection, a feature that Ramp claimed in June 2022 had saved customers “more than 1 million hours.” This feature works by using image recognition technology on receipts in Microsoft Outlook or Gmail inboxes. Once it does this, the transaction is automatically coded, and the finance team of the company using this feature can verify the coding is correct and sync the transaction with its accounting provider.

Ramp’s software is designed to deliver on the founders' original vision of creating a place for central oversight over spending. Within Ramp’s expense management software, administrators can automatically set policies, make approvals, and enforce spending limits in real time, deciding when and how much money can be spent. Ramp reduces friction between managers and employees by automatically sending reminders for missing items, requesting repayments, and auto-lock cards for non-compliant employees.

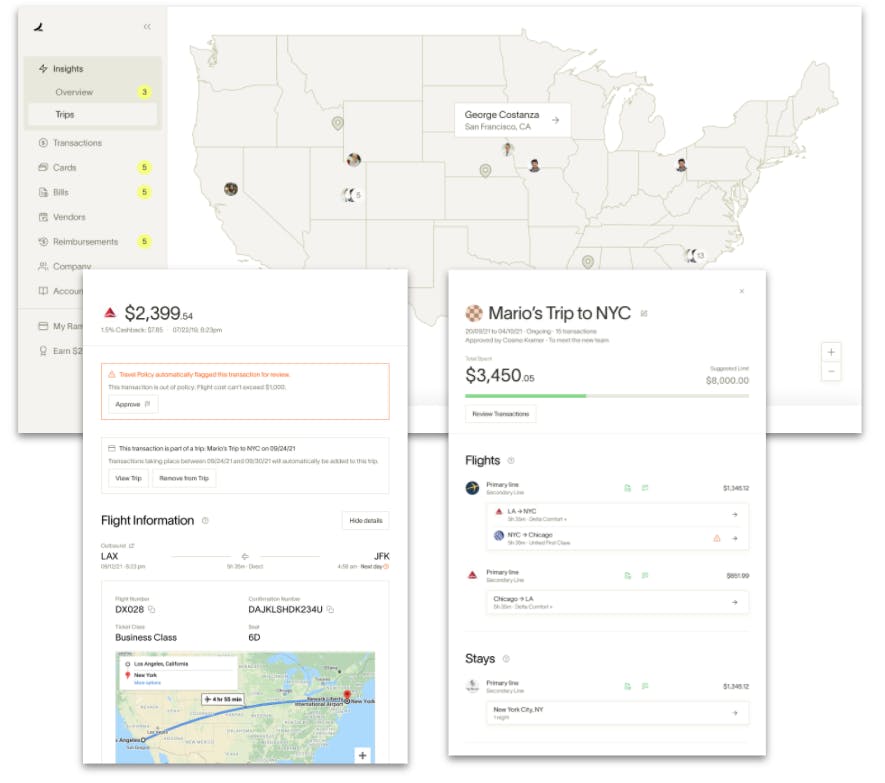

Corporate Travel

Source: Ramp

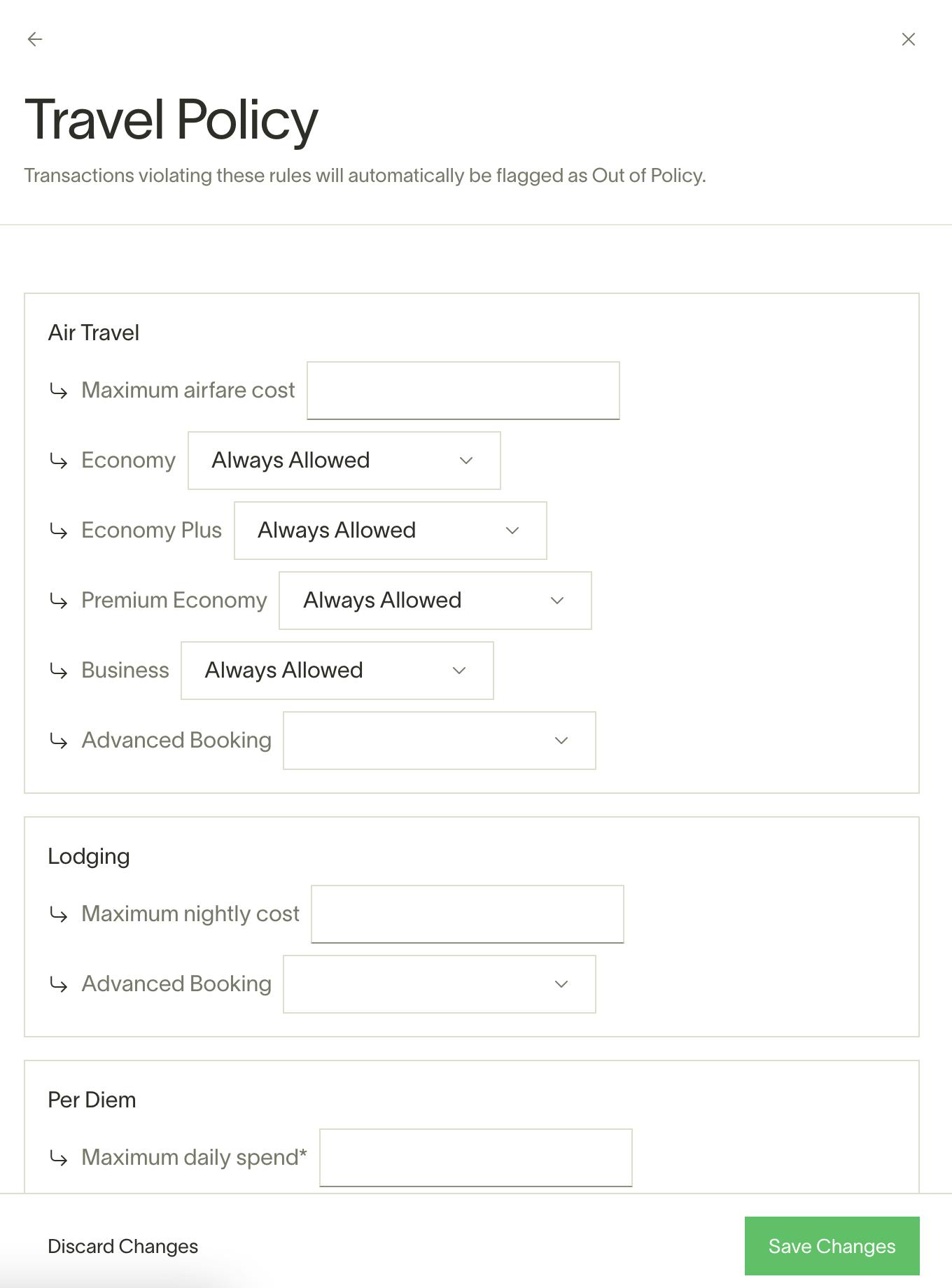

In February 2022, Ramp launched its corporate travel tool. In line with the company's north star of saving users time and money, Ramp allows users to book travel from whatever platform they prefer and, because they have control of the card, can enforce travel expense policies before any travel gets booked.

Source: Ramp

Some examples of travel policies that can be set include the following:

Maximum airfare cost and hotel nightly rate

Flight booking class allowed based on flight time

How long in advance booking must occur

Maximum daily spend on meals (per diem)

Traditional corporate travel management platforms require users to use a separate interface to ensure policies are followed. One way of thinking about Ramp’s approach is that it treats the transaction as the interface. As Packy McCormick explains:

“Instead of forcing employees to log into a specific site to do a thing, companies can set rules, and the card can enforce those rules depending on the context. The transaction itself becomes a mini-app - understanding the context, approving or denying, and even routing to a better solution. No dedicated website needed.”

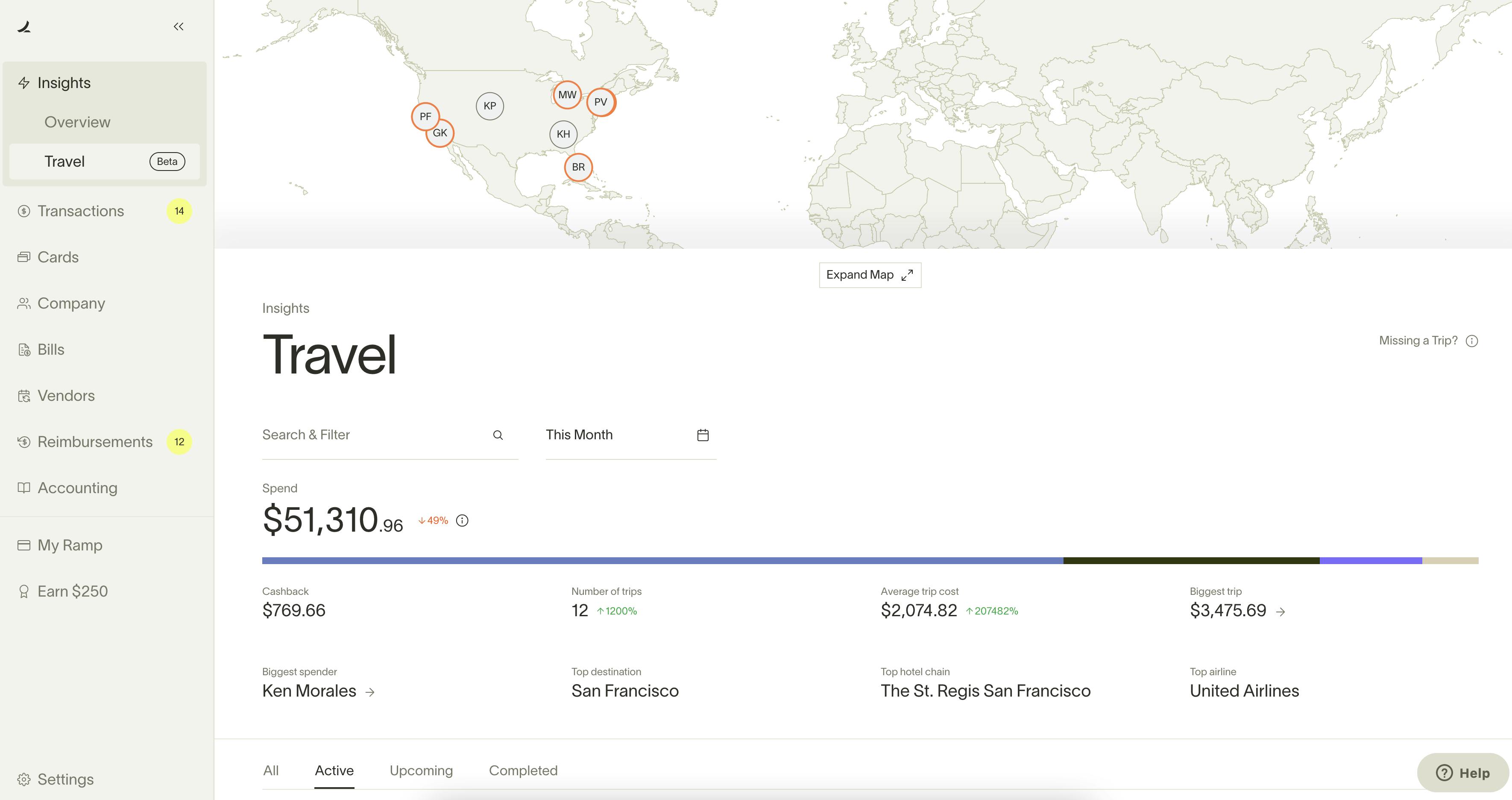

Source: Ramp

Ramp’s Travel Dashboard enables customers to see company travel spend and details live. There are three main sections:

Map view: active and upcoming trips can be seen on the world map, with bubbles that can be clicked on to provide trip details.

Metrics view: a summary of travel spending over a period of time, including a breakdown by categories (flights, hotels, per diems, transit), top spenders, merchants, largest trip expenses, and more.

Trips view: a bird’s eye view of active, upcoming, and completed trips.

For companies that require managed travel solutions, Ramp has partnered with Melon and TravelPerk to automatically send a receipt and itinerary information directly into the Ramp platform once travel is booked. In April 2025, Ramp expanded its travel offering by introducing car rentals to Ramp Travel.

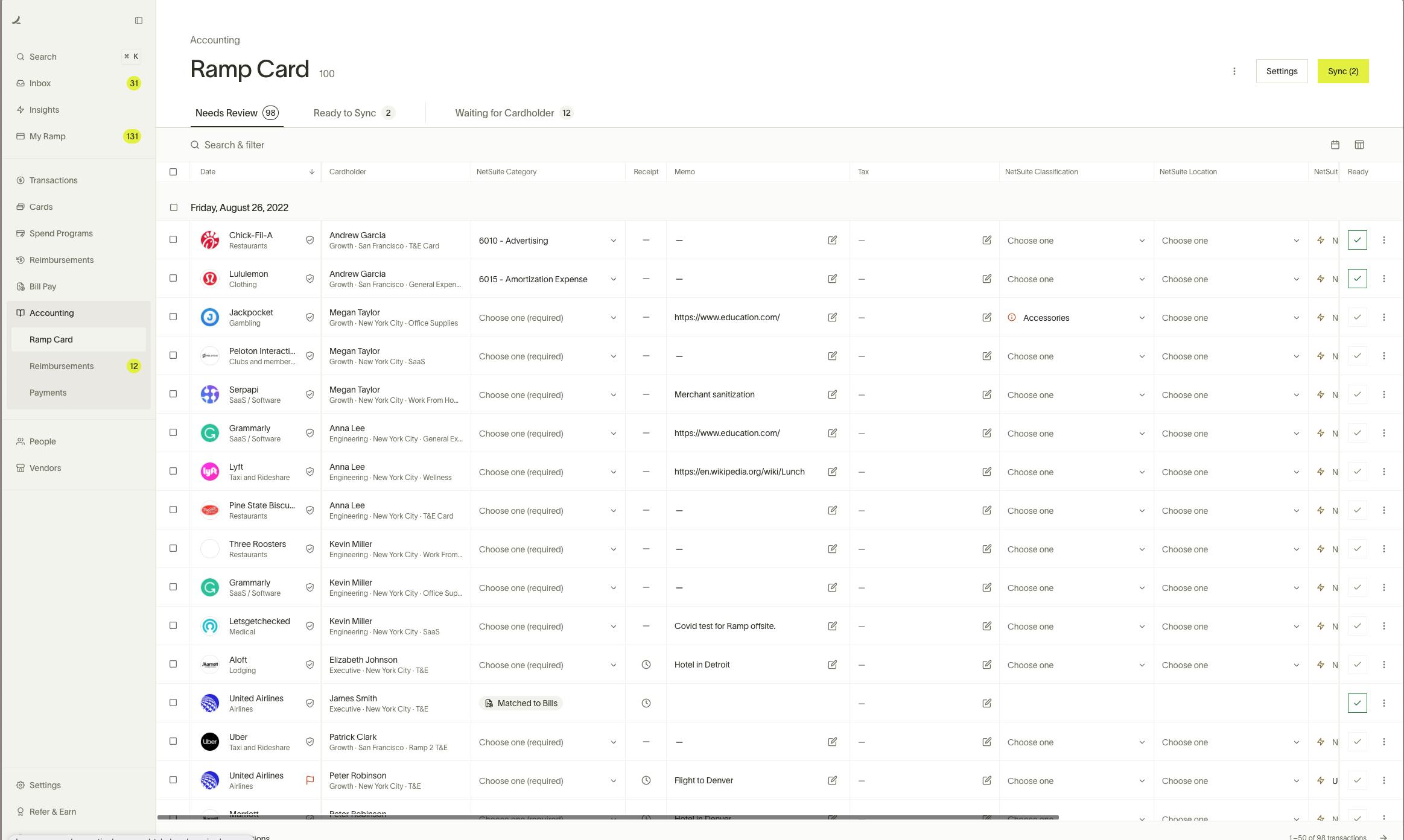

Accounting

Source: Ramp

With the core guiding ethos of Ramp’s product, the focus on saving time and money extends not only to when the money is spent but to the accounting process on the back end as well. Ramp has claimed that, on average, companies close their books five times faster with Ramp, going from a process that can take 2-3 weeks and shrinking it down to about an hour. It also says it saves finance teams 5.4 days per month and can save over $100K per company.

The product includes automated policy enforcement, invoice management, and accounting connections to platforms like QuickBooks and Xero, and for Ramp Plus customers, such as NetSuite and Sage Intacct. For all other providers that Ramp does not yet have a native integration with, Ramp offers a universal CSV.

Once a customer is connected to accounting, Ramp pulls in cleared transactions and approved reimbursements. A transaction can then be coded and exported to a desired format. Universal CSV offers the ability to import any field from an accounting provider to be coded within Ramp, an open text field that allows bookkeepers to fill in according to company policies, and a “required field for syncing,” which ensures that data can be reconciled between platforms.

Beyond streamlining the accounting process, Ramp also emphasizes integrations to make the overall process as easy as possible. Some of those integrations are as simple as connecting to a Gmail or Outlook account to automatically identify invoices and receipts. Ramp also partnered with Amazon for Business, allowing customers to connect their Amazon Business account to Ramp. Anytime an employee uses one of their cards to make a purchase, Ramp automatically pulls the receipt.

Bill Pay

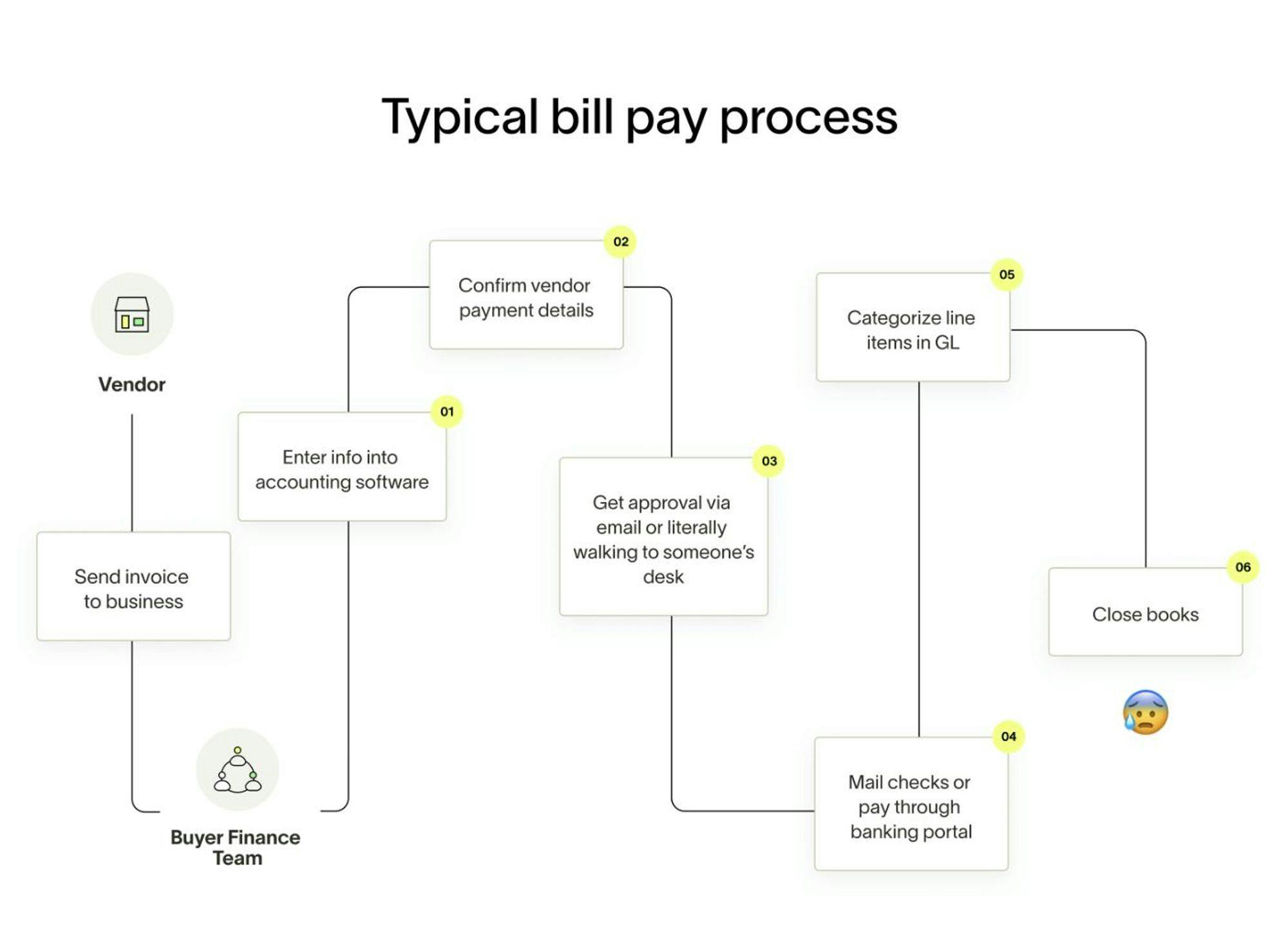

In October 2021, Ramp launched its Bill Pay module. The majority of Ramp’s existing product suite revolves around individual employee card spend, such as subscriptions, travel, etc. Bill Pay is one of Ramp’s first products to extend to the broader portfolio of spend. Bills are typically paid through a very manual accounts payable (AP) process.

Source: Ramp

For businesses, bill payments represented 75% of discretionary spend, on average, as of 2021. Ramp has taken a 15-minute manual process and automated everything from the point the finance team receives the invoice through closing the books, resulting in an automated 60-second process.

Pushing beyond the automation of the Bill Pay process, Ramp also broadened the flexibility with which customers pay those bills. Bill Pay provides automatic syncing of bills and payments between Ramp and a customer’s choice of accounting software. This occurs whenever a bill is created, after every update, and when the payment has been made.

Bill Pay can be set up in the same way as standard reimbursement and transactions in the expense management product can. The difference lies in setting conditions. Mount-based routing is available to all Ramp customers, and other, more specific conditions are only available to Ramp Plus customers. To make this process simpler, as of October 2025, Ramp had two pre-configured approval templates based on common approval flows:

Bill Pay vendor and department owner approval: This template is available to all Ramp customers, and allows customers to require the vendor owner, department owner, and then an amount trigger that will require an admin to approve.

Bill Pay approvals by departments: This template is only available to Ramp Plus customers as it uses the Ramp department condition to route approvals.

Ramp provides vendor tax support as well. Bill Pay users can add and store their vendors’ W9 information directly in Ramp and export that information for easier 1099 processing at year-end.

In August 2022, the company launched Ramp Flex, where users can elect to have Ramp pay their bills up-front and can choose when to pay Ramp back (30, 60, or 90 days later). That flexibility is intended to create additional breathing room for companies that are trying to manage their working capital between what bills are due and what cash they need to run their business day-to-day.

In response to its customers having increased international spend by 5.6x year-over-year in 2022, Ramp started supporting cross-border bill payments, flexible financing, and employee reimbursements globally across more than 190 countries and a number of local currencies as of October 2025. Ramp also supported same-day ACH bill payments for a $10 flat fee as of October 2025. For vendor payment using Bill Pay, there is a $20 flat fee on international payments made via SWIFT USD. While it takes between one to five days for a vendor to receive payment, international payment timelines are more variable.

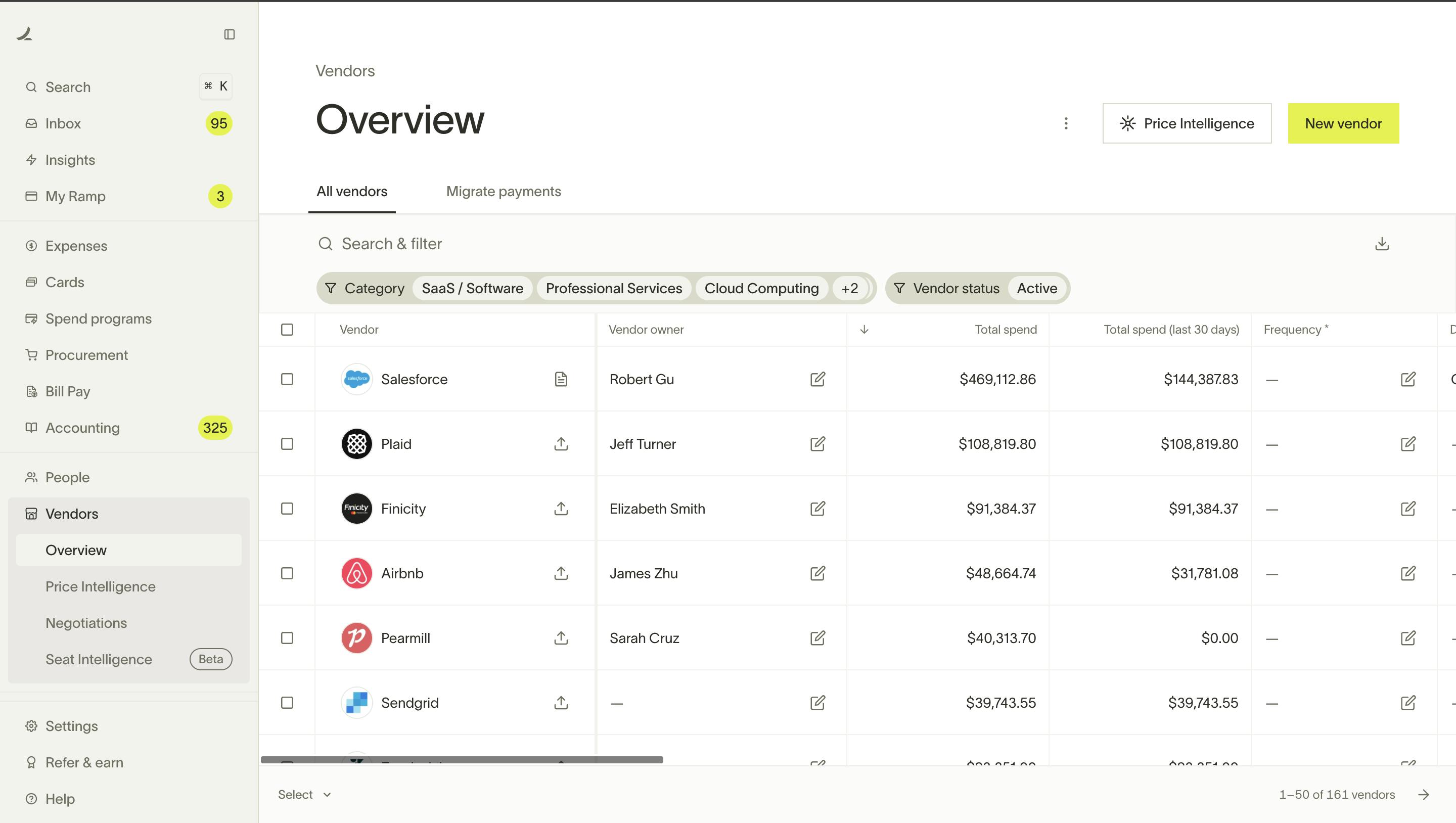

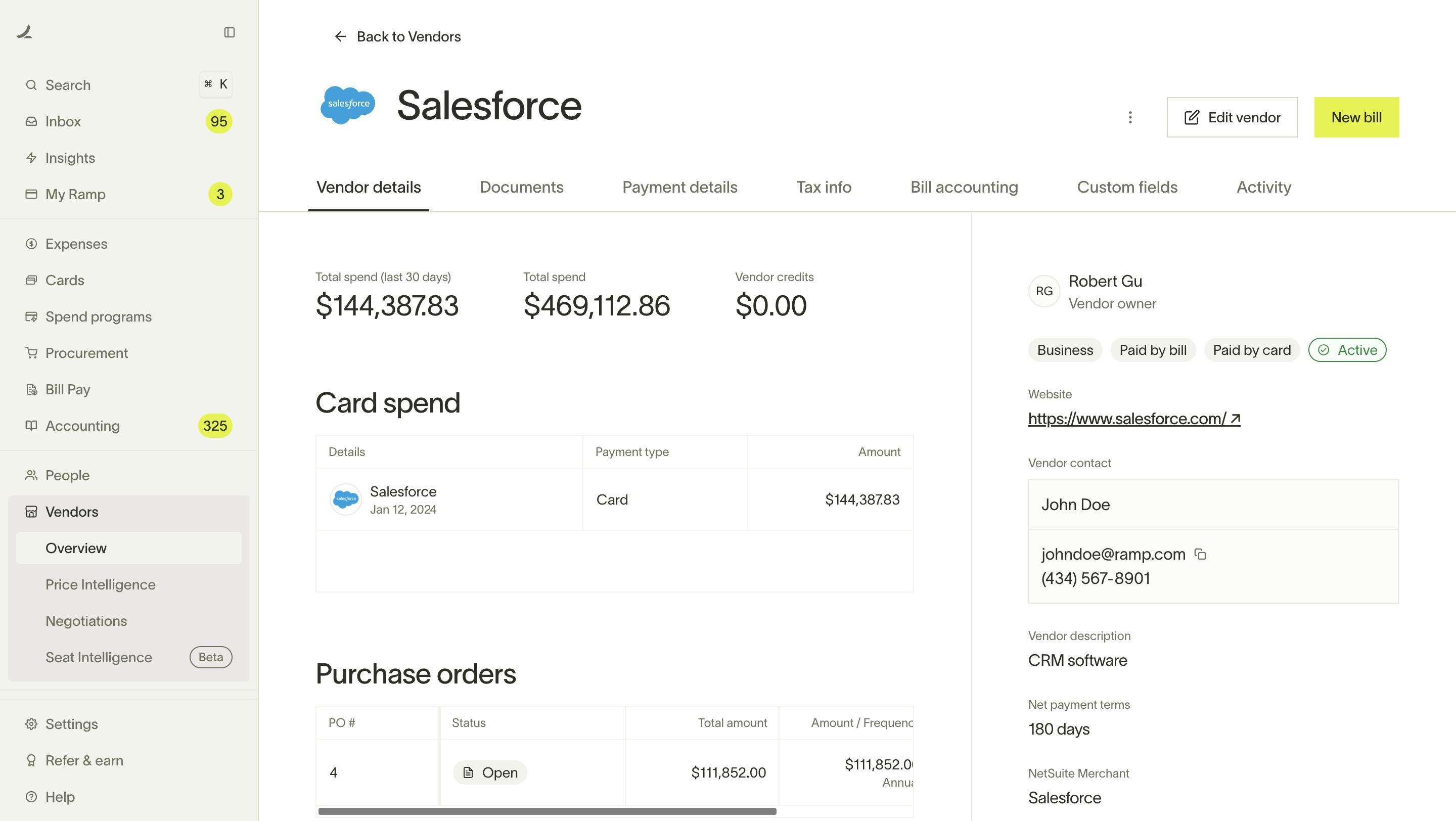

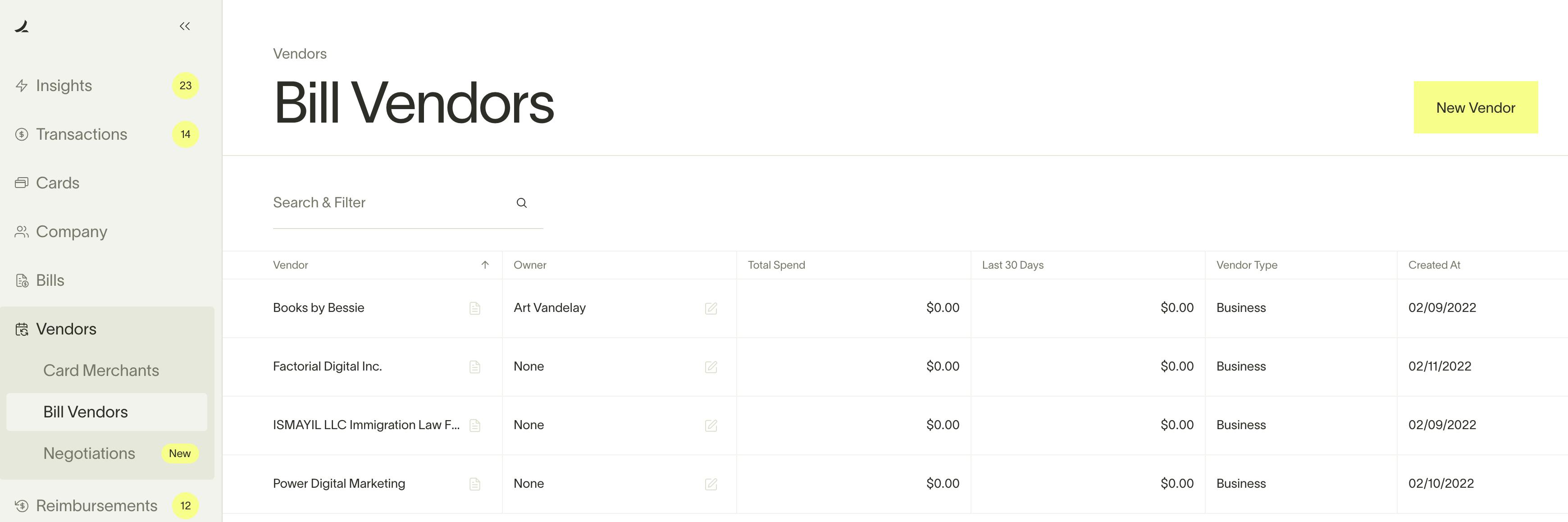

Vendor Management

Ramp provides a platform for users to manage vendor records in Ramp. Vendors paid via Ramp card or Ramp Bill Pay are recorded here. This tab simplifies storing, analyzing, and discovering vendor records and data.

Source: Ramp

When a transaction to a vendor occurs, it is added to the vendor management tab, which provides an overview of spend. Clicking on a specific vendor will provide more details, like recent bills or card transactions.

Source: Ramp

Ramp also allows customers to upload key documents associated with the vendor, like contracts, Form W-9s, and other tax information, payment instructions, and more. For Ramp Plus customers, admins or bookkeepers can add custom fields to build a source of truth for vendors on Ramp.

Source: Ramp

Vendors can be created either during the bill creation process or on the vendor management page. The “Vendor Owners” feature is an important part of the process; it represents a way to assign responsibility and pay to a particular vendor. This view highlights this relationship and allows users to manage and create vendors. There is also an ability to bulk upload vendors using a CSV template provided by Ramp.

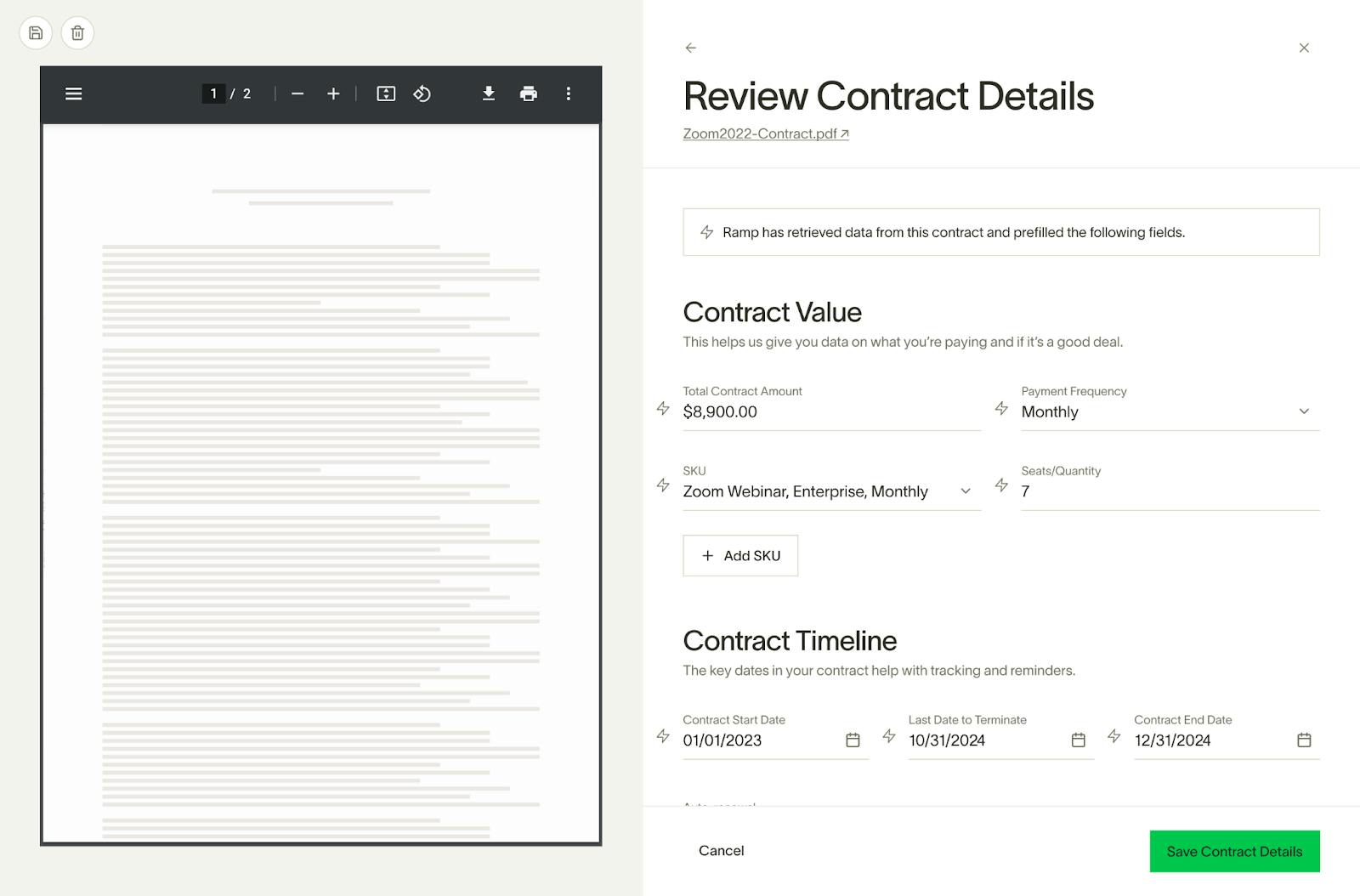

Contract Parsing

If the selected file is a contract, Ramp has the ability to parse the contract and extract key details like contract amount, payment frequency, and contract start or end dates. Users also have the ability to set reminders to the vendor owner 30 or 60 days prior to the last day to terminate or the contract end date (whichever may come first). This is being released in a phased approach.

Source: Ramp

Price Intelligence

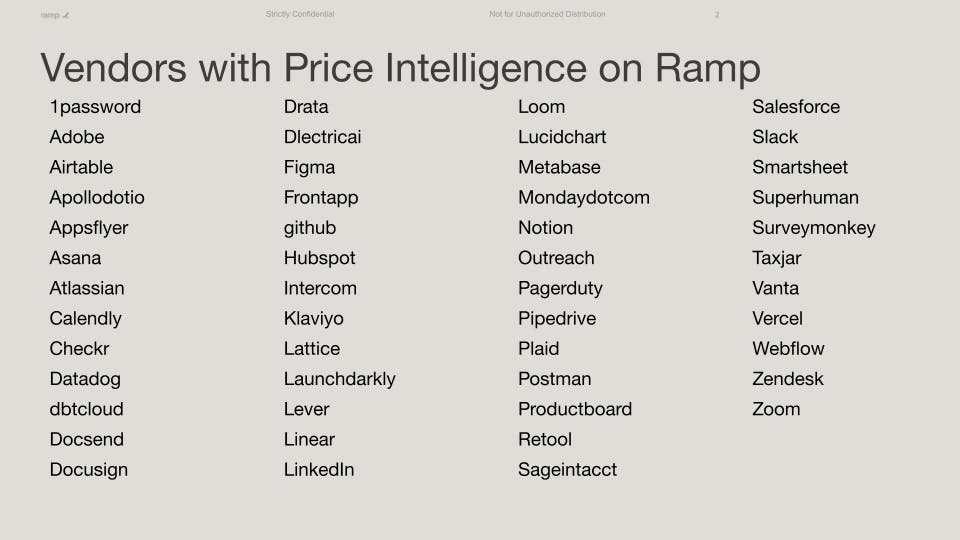

Ramp also has a Price Intelligence feature that is accessible through the Vendor Management Tab. It uses “spend data from thousands of Ramp customers and millions of Ramp transactions” to give users the ability to compare what they’re paying for software against others.

When users upload contracts, invoices, and receipts or transact payments, Ramp processes the associated data and applies a variety of analyses to the data, including LLMs developed by OpenAI to generate its intelligence. As of October 2025, Ramp supports price intelligence for the following vendors:

Source: Ramp

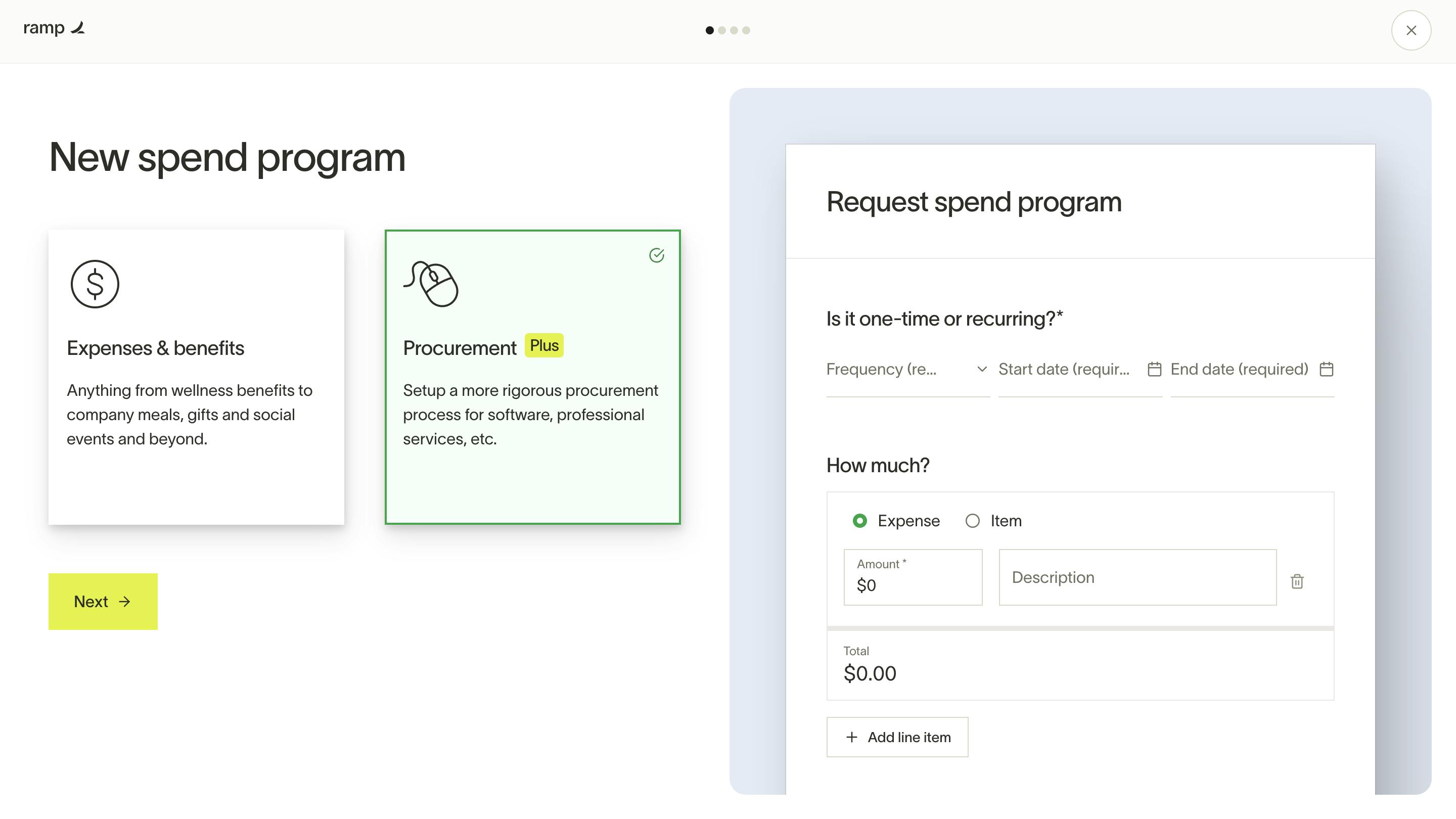

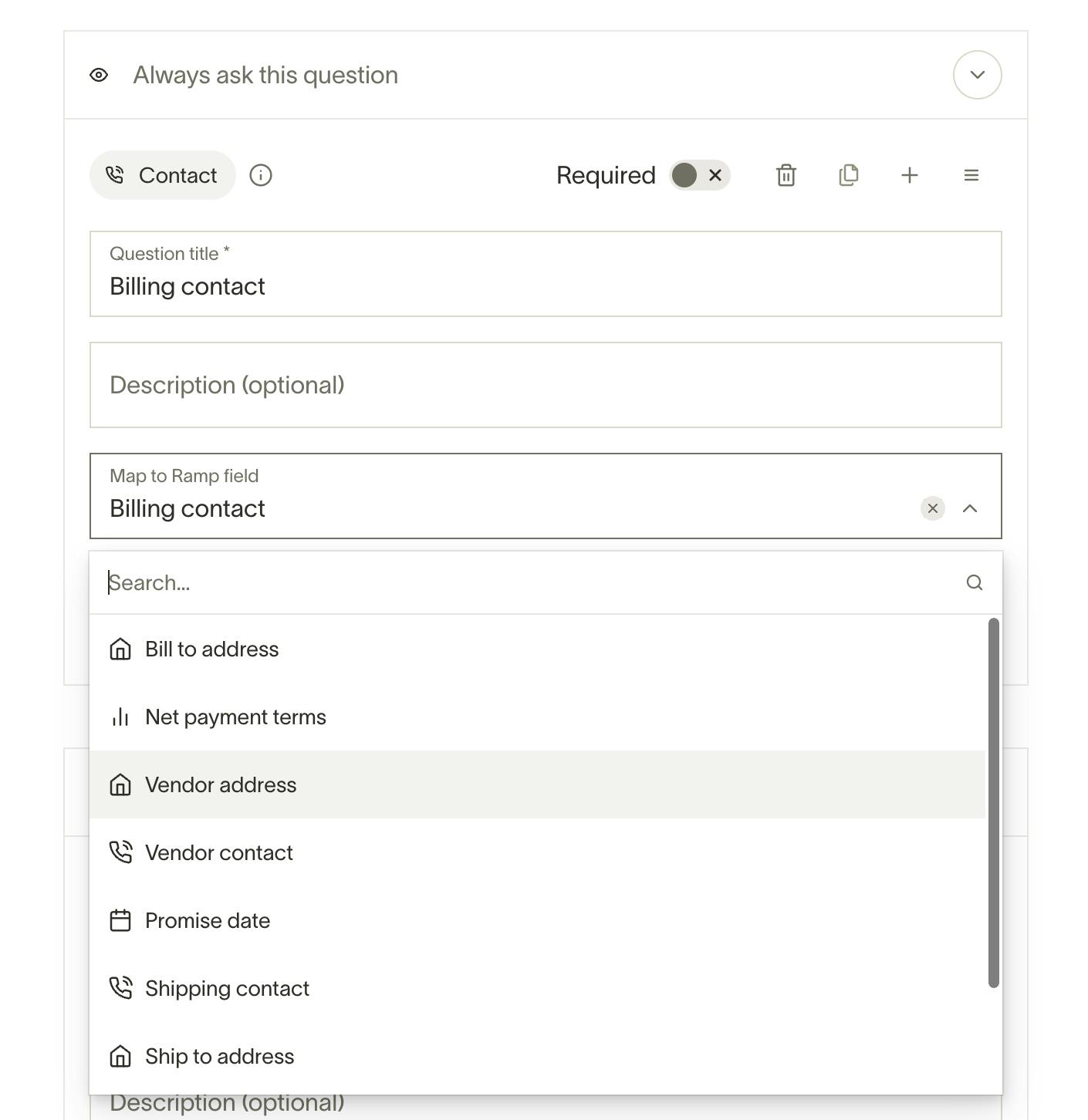

Procurement

In August 2023, Ramp acquired AI-powered startup Venue to expand into the procurement space in an attempt to focus on more complex enterprise customers. Commenting on the acquisition, Ramp said that it believed that back-end business processes like procurement were “ripe for practical automation and AI implementations”.

Available to Ramp Plus customers, Ramp procurement lets users capture purchase requests in one place, loop in approvers, and manage purchase orders (POs) within a unified platform.

Source: Ramp

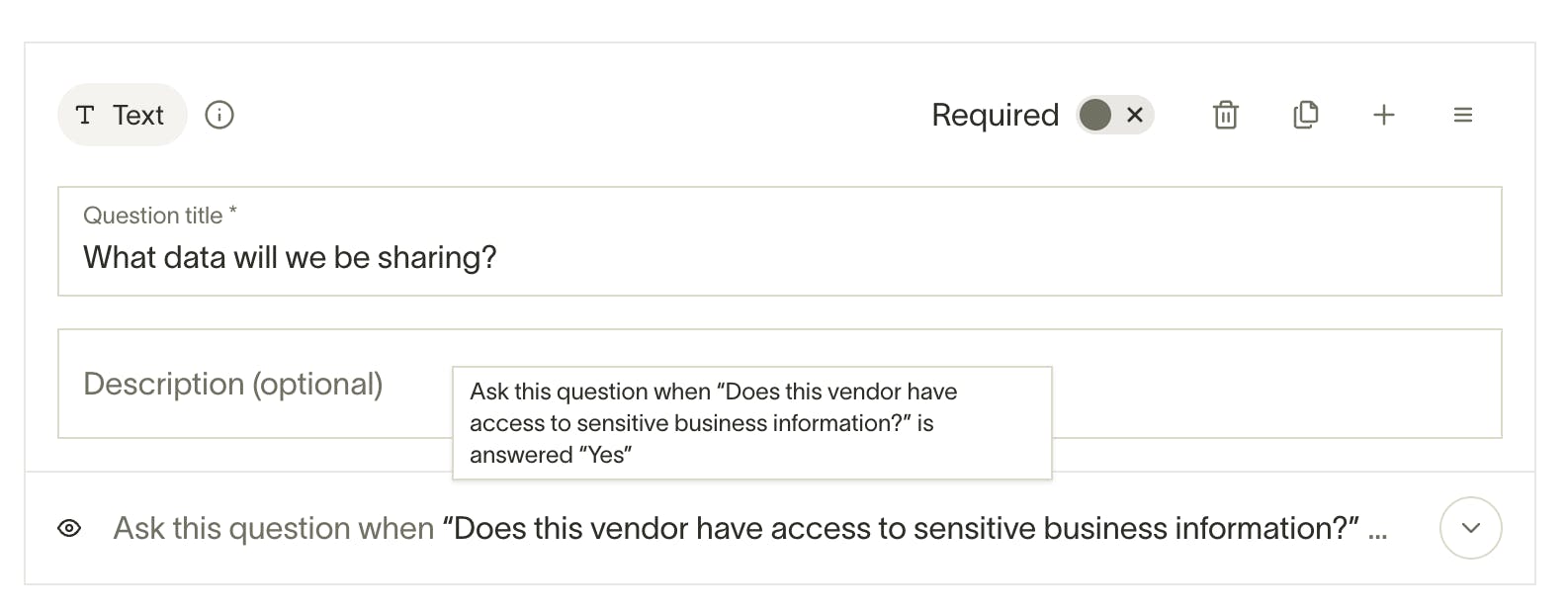

Admin users can also customize their procurement forms and specify question types from a given list of options.

Source: Ramp

To streamline the intake process, questions can be conditionally asked, and eventually, the form responses can be mapped to purchase order fields.

Source: Ramp

Further, the visibility, approval policy, and payment method of a procurement spend program can be customized.

Source: Ramp

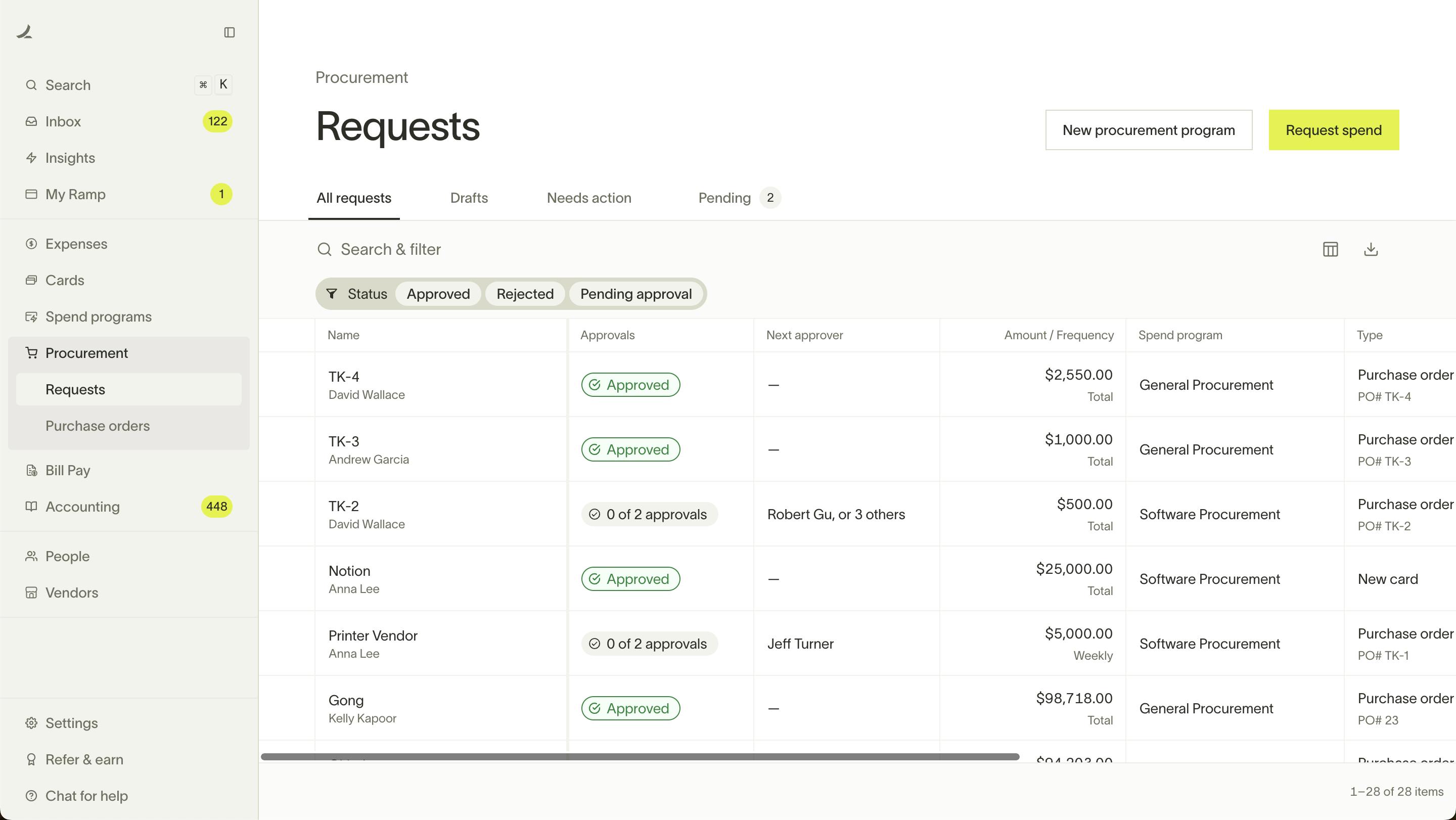

Once a procurement program is created, a new view exists in the main navigation of the dashboard. In this tab, an admin can:

View all requests, drafts, and requests that need approval, and pending requests

View all open, partially billed, fully billed, and closed purchase orders (PO)

These POs can be synced into a customer’s accounting system from within the POs tab. These POs can be customized as per a customer’s needs as well.

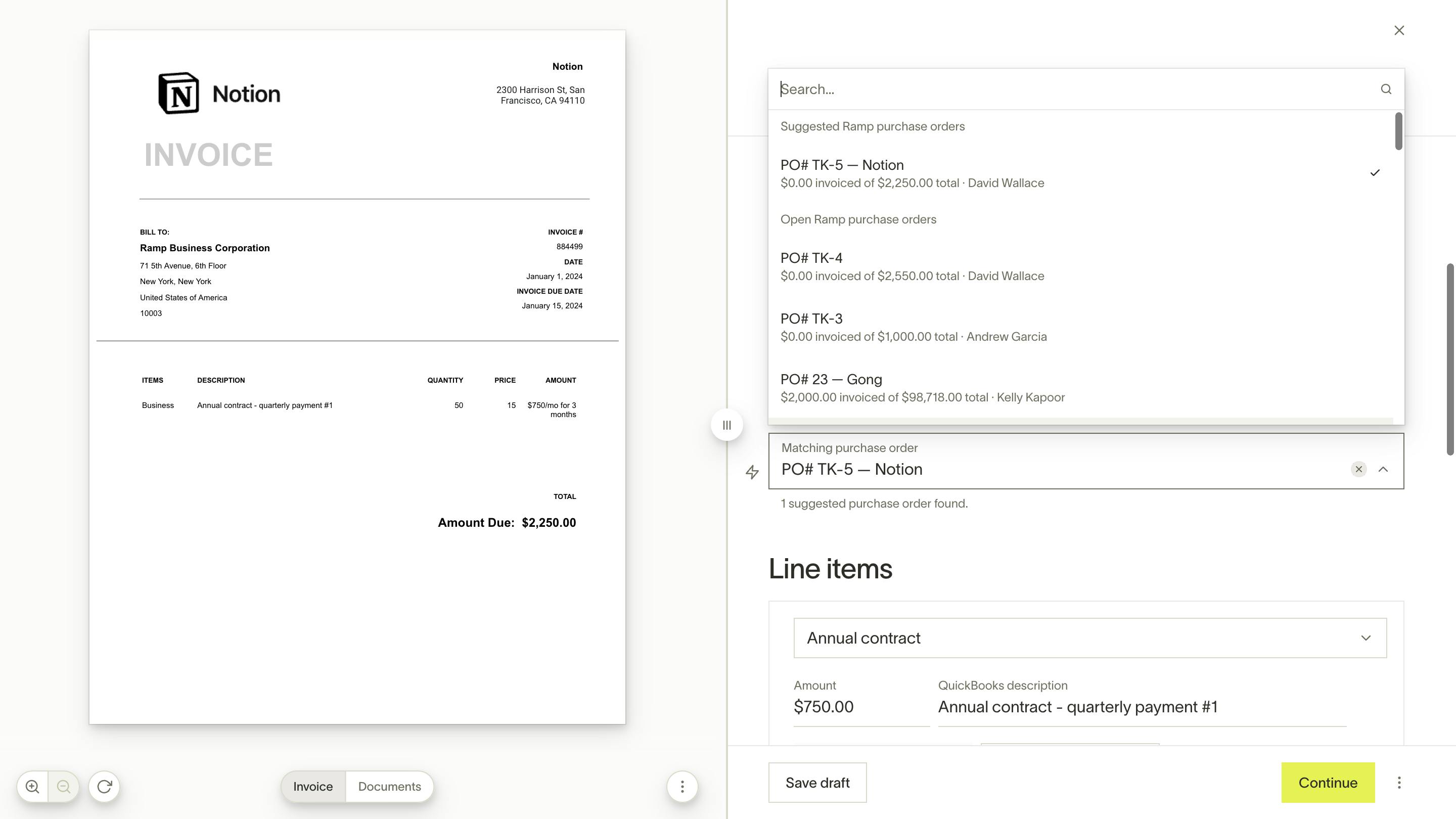

Source: Ramp

Ramp also allows customers to match invoices between Ramp Bill Pay to POs created in Ramp. If there’s an exact match for the Ramp, it will be automatically matched; otherwise, options will be suggested. This matching then cascades down to invoice line items with PO line items.

Source: Ramp

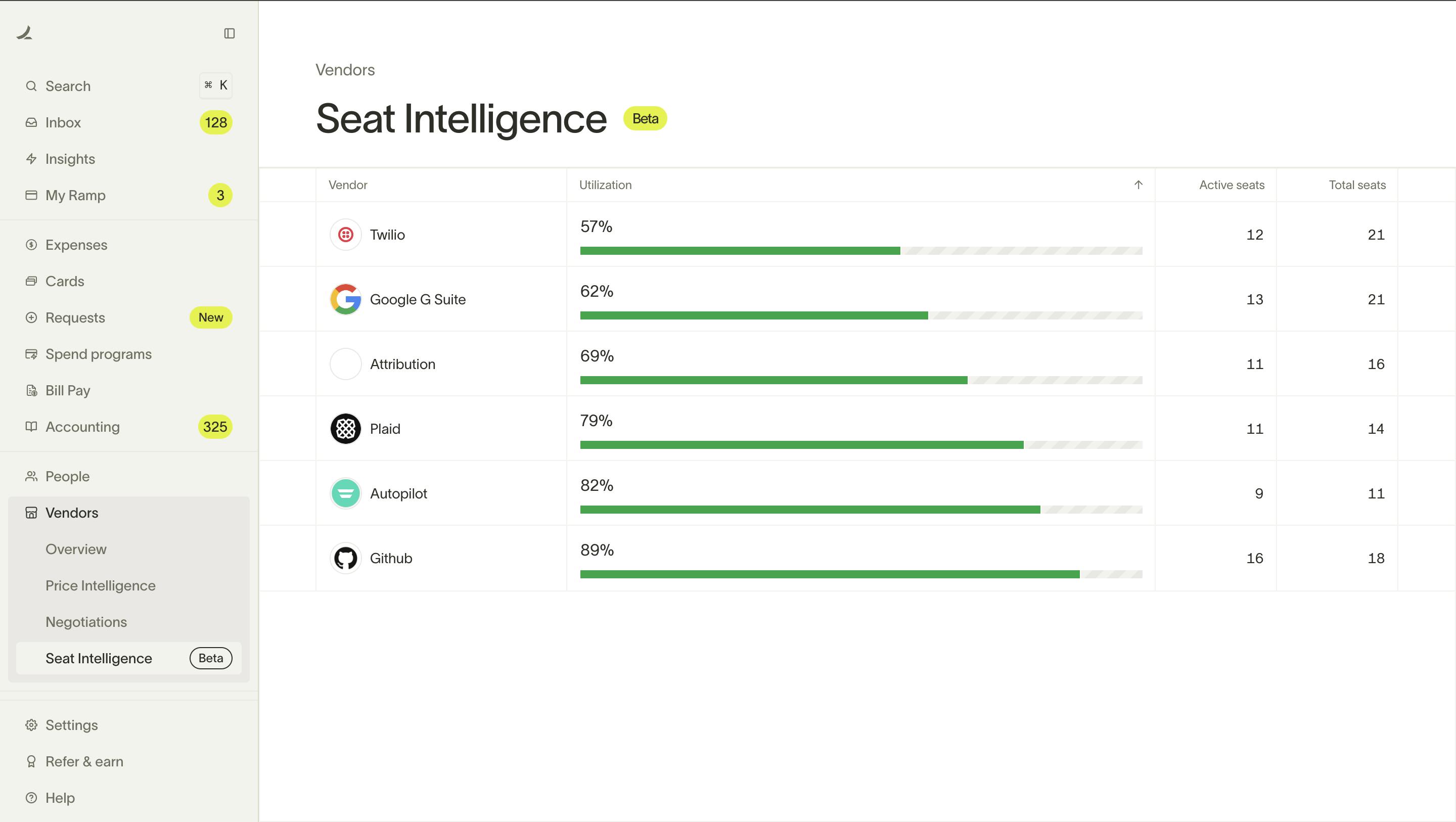

In January 2024, Ramp released Seat Intelligence. Seat Intelligence tracks software usage against the number of seats businesses are getting billed for through its Okta integration to ensure that businesses are getting the desired value from SaaS contracts.

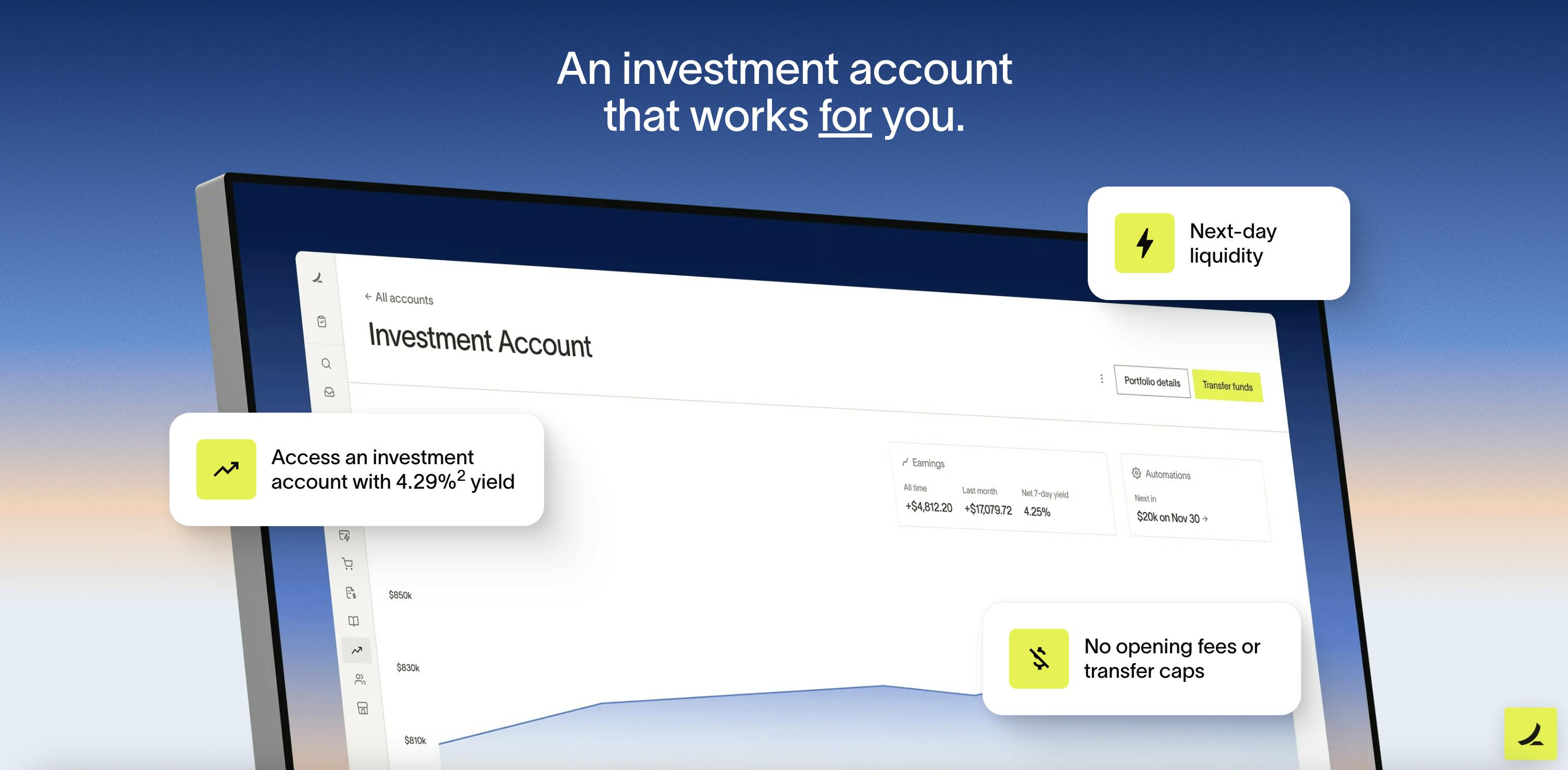

Banking and Treasury

In January 2025, Ramp launched Ramp Treasury, a fully integrated cash management product that helps businesses earn meaningful yield on their operating cash while keeping it liquid. Traditionally, finance teams have kept cash in non-interest-bearing accounts to pay bills on time or locked it away in separate brokerage accounts with restrictions, transfer delays, or hidden fees. Ramp aims to remove this tradeoff with its Treasury product.

As of October 2025, through its partnership with First Internet Bank of Indiana, Ramp Business Accounts offer customers 2.25% interest on FDIC-insured deposits with no minimums, fees, or transfer limits. For excess cash, businesses can allocate funds to a Ramp Investment Account, which provides access to money market yields as high as 4.09% as of October 2025 through a brokerage partnership with Apex Clearing. Funds can be moved freely between accounts, and cash remains accessible until the moment it’s needed, maximizing returns without disrupting daily operations.

Treasury workflows are embedded directly into accounts payable, so businesses can manage cash, payments, and approval flows from a single system. Money stays invested until bills are due, vendors are paid on time, and same-day settlements ensure that every available dollar continues earning until the last possible moment. Access is tightly controlled, and every transaction syncs automatically with the company’s ERP.

Source: Ramp

Integrations

Ramp integrates with a wide range of apps to streamline customers’ finance operations. Ramp has over 1K integrations, including apps like Gusto, Microsoft Teams, Slack, Okta, 1Password, and Google SSO.

Ramp’s priority referrals program also lets customers quickly open new accounts with banks in its network of 80+ partners. These connections allow customers to diversify their funds across multiple bank accounts while centralizing payments and enabling real-time visibility into their cash flows.

Visibility

Part of Ramp’s flywheel includes driving customer growth, which leads to more insights with the goal of making Ramp’s products notably faster, more user-friendly, and better at saving money than a typical expense management tool that mostly only addresses the customer’s need to save time.

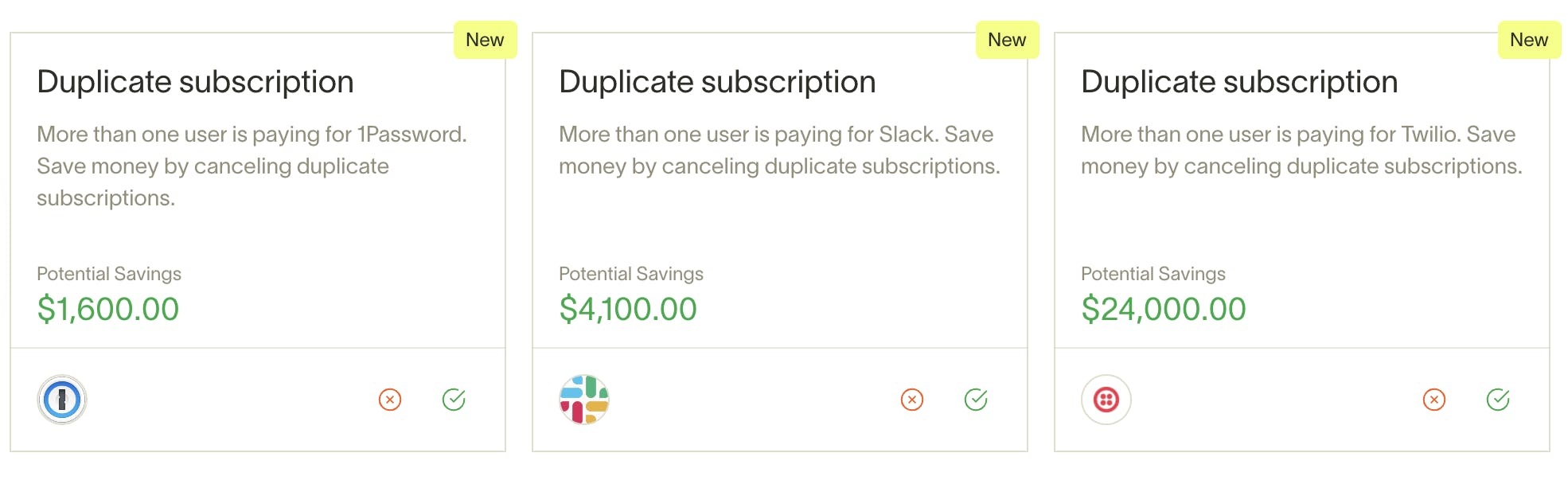

Source: Ramp

Ramp can also identify duplicate and unused subscriptions, as well as partner rewards that aren’t being taken advantage of. Overall, this is intended to provide a sense of how spend behavior is trending. In August 2021, after raising its Series C, Ramp announced that it had acquired Buyer, a negotiation-as-a-service startup. According to Ramp, customers working with Buyer “saves clients an average of 27.3% on big-ticket purchases like annual software contracts.”

Ramp Plus

In August 2023, Ramp announced the launch of Ramp Plus, which is intended to help "growing companies with their most complex financial operations" with an "all-in-one functionality" with several offerings.

The company stated in its launch announcement that the product would be available as an optional, paid plan starting in September 2023, but that "as a thank you to our early customers", existing SMBs and mid-market business customers will receive a free upgrade to Ramp Plus for one year. The company also stated that Ramp's core product offering (the card and bill payment software) would remain free. As of October 2025, Ramp Plus features include:

Procure-to-pay: This offering is an automated, customizable procurement solution intended to allow customers to "control spend and manage the full procure-to-pay process". It enables customers to have all spend requests in one centralized location, which can be approved by the appropriate teams, and also to track purchase orders until they're paid.

Global expenses: Ramp Plus allows users to consolidate both domestic and international spend with support for a range of currencies, tax reporting systems, and debit systems.

Workflow builder: This offering allows users to build customizable, rules-based workflows for use cases such as automated employee onboarding, procurement, and payment approvals.

Self-enforcing smart policies: Ramp Plus is further designed to allow for automated controls and policy enforcement; for example, employee cards can become auto-locked when they have failed to submit receipts. Another example is "smart transaction reviews", which will automatically flag expenses that are outside policy.

Market

Customer

Ramp began with a focus on small-to-medium-sized businesses (SMBs) but grew to work with companies of all sizes, from farming businesses to multi-billion-dollar enterprises. Ramp also cuts across industries, working with those in fashion, ecommerce, defense, transportation, healthcare, software, creative services sectors, and more.

For most financial products, breaking into larger enterprises is often the most challenging thing to do, given the complexity of their financial processes. In October 2021, Ramp CEO Eric Glyman was asked during a podcast episode whether Ramp’s product could serve “large corporations like Microsoft, Amazon, IBM…?” Glyman's response was, “we do have one of the companies you mentioned there using it.”

Source: Ramp

Ramp’s product has become increasingly modular. With the launch of its bill pay product, it even has some customers who start using Ramp not for the corporate card, but just for bill pay. The combination of easy-to-use software for SMBs, integrations with an existing tech stack for startups, and enterprise integrations with tools like NetSuite and Workday enables Ramp to flex up and down in terms of customer size. An example of this flexibility and ability to support large-scale organizations is that, as of August 2023, Ramp became the sole expense management provider for Shopify.

Notable customers of Ramp as of October 2025 included Shopify, TaskRabbit, Webflow, Glossier, Barry's, Eventbrite, Discord, Anduril*, and Stripe.

Market Size

Software has become an integral part of managing financial services. In a 2021 survey, 88% of US respondents said they use technology to manage their finances, a notable increase from the 58% who responded the same way in 2020. When discussing Ramp’s addressable market size, a key focus is on business spend. Businesses spend over $120 trillion each year globally as of 2022, but only $1.5 trillion was spent on corporate cards, which is expected to grow to over $6.8 trillion by 2026.

While there are a number of pockets of business spend that Ramp continues to build its platform towards, its existing suite addresses a large swath of expenses. Corporate cards like AmEx, for example, generated $60.5 billion in annual revenue in 2023. Meanwhile, the global business travel market was valued at $901.5 billion in 2022 and was expected to grow to $2.5 trillion by 2032, a 10.8% CAGR. Meanwhile, BILL (formerly Bill.com) processed $69.1 billion in transaction volume in Q4 2023 alone.

In June 2025, Ramp announced that its products were used by 1.5% of US businesses. Across corporate cards, business travel, and bill pay, Ramp is tapped into several trillion dollars worth of spend. The question now is one of execution. Most of the incumbent providers in these categories are fairly entrenched. Ramp’s product flywheel will have to continue to spin to effectively penetrate these large existing pools of spend.

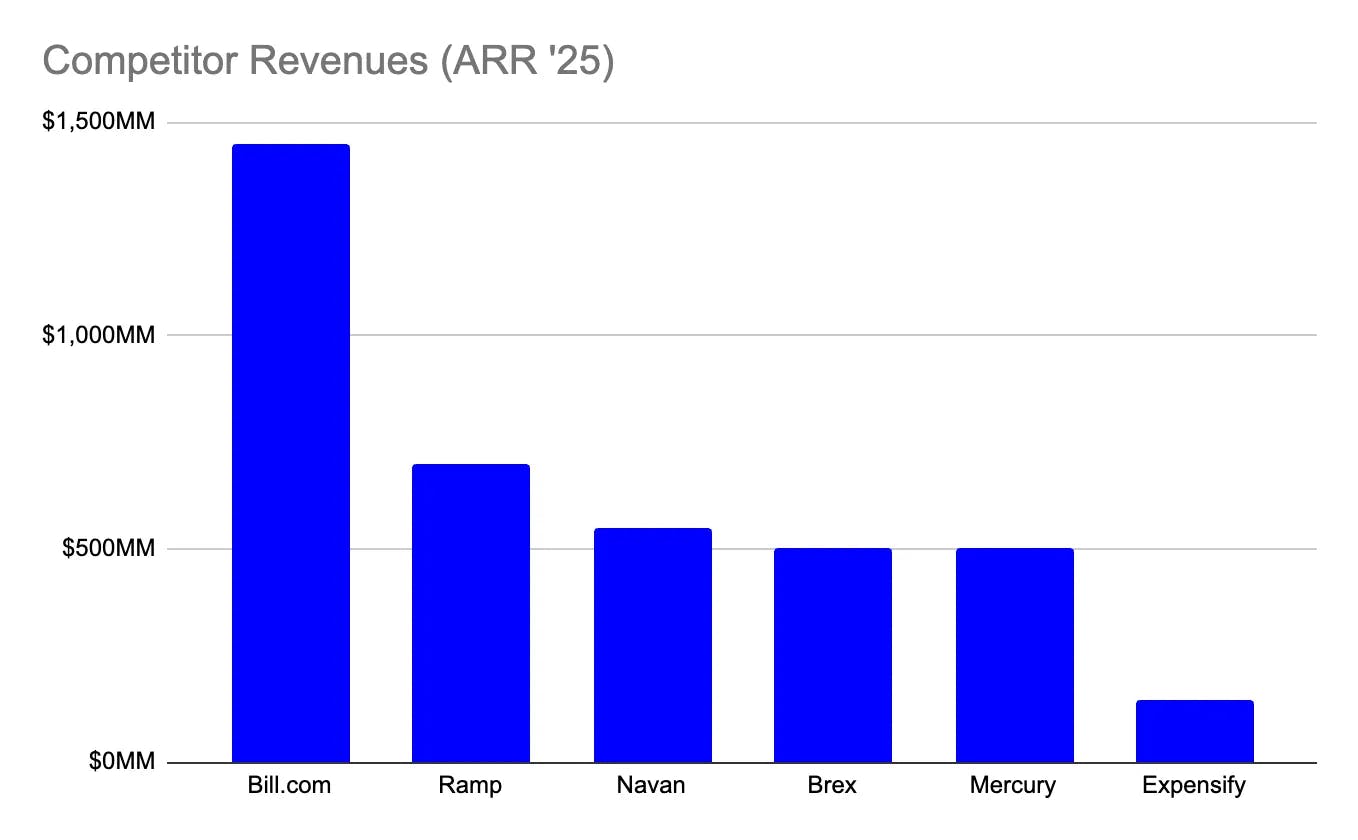

Competition

Ramp competes across multiple fronts, with legacy incumbents like AmEx and SAP Concur, modern fintech challengers like Brex, Mercury, Airbase, and Rho, and emerging solutions like Navan and TravelPerk. Each of these players is aiming to become the financial operating system for businesses, combining cards, spend management, payments, and software into a unified platform. With the 2025 launch of Treasury and stablecoin-backed cards for global expansion, Ramp is pushing further into adjacent categories, increasingly going head-to-head with both vertical specialists and full-stack financial platforms.

Ramp leads most of its direct competitors in revenue in 2025, surpassing both Brex and Mercury in annual run rate. However, it still lags behind BILL, which has established a dominant position in invoice automation. In August 2025, BILL reported $1.5 billion in total revenue for FY 2025.

“[BILL] has incredibly strong distribution and network effects – as evidenced by the fact that I still use it because the companies who pay me use it – and Ramp’s product isn’t fully developed yet. For example, it handles the Accounts Payable side but not the Accounts Receivable side which means I could use it to pay bills but not to send invoices.”

Ramp’s ability to differentiate will depend not only on continuing to launch high-quality products but products that are feature-rich enough to attract customers away from some well-established network effects within their existing vendors.

Ramp's Differentiation

Early on, Ramp saw the advantage of having an integrated card program and expense management software. In early 2021, Ramp saw more than 90% of its customers start using their cards and completely switch over to their software as well. CEO Eric Glyman described the benefit of centralization this way:

Source: Fintech Blueprint

Corporate Cards

AmEx: American Express, or AmEx for short, is a public company traded on the NYSE (AXP), and as of October 2025, it has a market cap of $225 billion. It was founded in 1850 and competes with Ramp’s corporate card. By comparison, Ramp’s corporate card product offering could be seen as more diverse and thorough. Although AmEx cards tend to have lower spending limits, they require personal guarantees and have $100+ annual fees, whereas Ramp does not charge fees. As of October 2025, AmEx and Ramp both offer physical cards. Ramp says its differentiation from AmEx stems from the fact that it provides unlimited virtual cards, 1.5% cash back, integrations, free expense management software, expense and accounting automation, and automatic onboarding.

Brex: Brex is an expense management platform that combines corporate cards, expense management, travel, and business accounts. Founded in 2017, Brex has raised a total of $1.5 billion as of October 2025, with its most recent round having been a $725 million Series D round ($425 million in a Series D-1 in April 2021 and $300 million Series D-2 in May 2022) at a valuation of $12.3 billion. As of October 2025, Brex had an estimated valuation of $12.3 billion in secondary markets.

Like Ramp, Brex provides syncing with modern ERP systems, physical, and unlimited virtual cards. Ramp claims it differs from Brex in that it offers procurement, price intelligence, guest roles for temporary users, and flat fees for advanced user functionality independent of location. Ramp also says it offers a 5% average savings with cashback and savings insight that Brex does not provide. Earlier on, Brex claimed that its offering is differentiated from Ramp in that it offers a cash account with FDIC and treasury, in-app travel booking, and cards without foreign transaction fees. As of October 2025, Ramp has introduced all of these offerings to its platform.

Mercury: Mercury is a digital banking platform built for startups and small businesses, offering business bank accounts, corporate cards, treasury, and spend management tools. Founded in 2017, Mercury has raised over $450 million in equity funding as of October 2025, with backers including Coatue, Andreessen Horowitz, and Sequoia Capital.

The company saw a surge in adoption following the collapse of Silicon Valley Bank in early 2023, positioning itself as a trusted alternative for startup banking. Like Ramp, Mercury offers virtual and physical corporate cards, multi-entity support, and integrations with major accounting platforms. Its core differentiation has historically been its sleek banking interface, customizable treasury options, and deep focus on early-stage companies. In August 2024, Mercury has also announced it would be launching a personal banking offering. While Mercury continues to lead in deposit infrastructure and cash management, their competitive gap has narrowed as Ramp builds a broader financial stack, with the introduction of the Treasury module.

Spendesk: Spendesk provides company cards and software to help companies manage approvals, budgets, and accounting automation. Founded in 2016, Spendesk has raised a total of $311.8 million as of October 2025, including a $232 million Series C round ($118 million in a Series C-1 in July 2021 and $114 million in a Series C-2 in January 2022) at a post-money valuation of $1.2 billion, with Tiger Global leading the round. Both Spendesk and Ramp offer cards and integrate with existing financial and accounting systems to speed up visibility and management. However, Spendesk offers comprehensive spend management with a strong emphasis on automation and employee expense tracking. Ramp offers this with a bigger focus on providing advanced analytics and insights into spending patterns alongside automation.

Extend: Extend provides virtual company cards and software to help companies manage payments and expense processes. Founded in 2017, Extend has raised a total of $74 million as of October 2025, with its latest round being a $20 million venture round in September 2025. As of October 2025, Extend supports integrations with nine banks, compared to Ramp’s 80+. Its focus is to build upon existing corporate credit cards, without needing additional bank-issued cards. Ramp does the same but has a broader scope with features in areas like accounts payable, procurement, and vendor management. In 2021, American Express also announced a partnership with Extend to offer SMB business card customers access to virtual cards.

Rho: Rho offers corporate cards, expense management, AP automation, business banking, accounting automation, and treasury management. Founded in 2018, Rho has raised $195 million in total funding as of October 2025, with a $75 million Series B round in December 2021 led by Dragoneer Investment Group. Rho claims that it differs from Ramp in that it offers a Treasury solution that helps customers invest excess cash in short-dated government securities. This comes with a Treasury Management Account that provides $75 million in FDIC deposit insurance per entity.

Expense Management Software

SAP Concur: SAP Concur is an expense management platform for managing travel, expenses, and invoicing. Founded in 1993 and previously known as Concur Technologies, SAP bought Concur in 2014 for approximately $8.3 billion and renamed it to SAP Concur. As of October 2025, it does not provide a consolidated offering for corporate cards, spend management, and accounts payable like Ramp does, nor is there real-time finance reporting with streamlined search and filtering. Ramp also provides its customers with an automated employee reminder for receipts and instant receipt matching, in contrast to SAP Concur. SAP traded at a market cap of $324 billion as of October 2025.

Expensify: Expensify provides expense management to automate accounting processes for expenses, bills, and invoices. It was founded in 2008 and had a market cap of $160 million as of October 2025, down substantially from a peak of almost $4 billion in November 2021. Ramp and Expensify share similarities in product offerings. Ramp claims that it is differentiated from Expensify in that it automates receipt capture to replace email forwarding and has free expense reimbursements, whereas Expensify claims to have more flexibility when it comes to expense approvals, delegated access, and integrations at an individual per-card export.

Airbase: Airbase provides an expense management platform to manage non-payroll spending. Founded in 2017, Airbase raised a total of $251.5 million prior to being acquired by Paylocity for $325 million in September 2024. While Airbase claims that it excels in detailed control and advanced features, Ramp sees itself as being at an advantage for its ease of use and focus on automating financial tasks to save time and reduce costs. Airbase seems to go deeper into the expense management categories, while Ramp seems to be more breadth-focused and covers common high-level functionality at companies.

Bill Payments

BILL: BILL is a platform that provides a way to create, pay bills, send invoices, manage expenses, control budgets, and access credit for business growth. Founded in 2006, BILL (NYSE: BILL) had a market cap of $5.3 billion as of October 2025. Ramp contrasts its bill payment product to BILL in that it offers the ability to seek financing with extended payment terms of 30, 60, or 90 days, and the ability to manage a full procure-to-pay process with central intake.

AvidXchange: AvidXchange (NASDAQ: AVDX) serves middle-market businesses by providing accounts payable automation software. Founded in 2000, as of October 2025, AvidXchange had a market cap of $2 billion. An important difference between the two platforms is that AvidXchange runs a quote-based system, whereas Ramp provides transparent pricing.

Stampli: Stampli’s platform allows finance teams to access accounts payable communications, documentation, and payments in a single solution. Founded in 2015, Stampli has raised a total of $145.7 million as of October 2025, with notable investors including Blackstone, Insight Partners, and others. As of October 2025, Ramp offers same-day ACH payments, whereas Stampli processes ACH payments between 1-3 days, and international payments on Stampli are difficult to process, whereas Ramp makes it very simple.

Corporate Travel

Navan (formerly TripActions): Navan is an end-to-end travel management platform for corporations with booking, tracking, reporting, and expensing tools. Founded in 2015, Navan has raised $2.2 billion in funding as of October 2025, and the company raised a Series G round at a $9.2 billion valuation in December 2022. Navan competes against Ramp’s product offerings that help customers book and manage spend on travel. In September 2025, Navan filed to go public on the Nasdaq. The company disclosed year-over-year growth of 33% in 2025, with revenues climbing from $402 million in fiscal 2024 to $537 million in fiscal 2025.

TravelPerk: TravelPerk is a travel management company that provides business travel solutions for companies. As of October2025, TravelPerk has raised $864.7 million in funding from investors, having raised a $200 million Series E at a $2.7 billion valuation in January 2025, with participation from SoftBank, Sequoia Capital, General Catalyst, and Blackstone. TravelPerk reported that it booked $2 billion in revenue in 2023 and grew revenue by 70% YoY in travel spend under management.

Some of these products have extended into other categories as well, as was the case with Navan launching expense management or Airbase launching corporate cards. Ramp has some customers who have replaced several tools (i.e., BILL, Expensify, AmEx) in favor of centralizing on Ramp’s platform.

Expanding further into the Bill Pay market could prove a formidable battle for Ramp. Corporate cards are more commoditized, especially since different cards' rewards programs represent a race to the bottom as companies try to compete for customers. Bill Pay, on the other hand, has a push-and-pull relationship. While users can decide what card they use to pay for things by themselves, Accounts Payable and Accounts Receivable have other parties involved. Packy McCormick described that dynamic in March 2022 as follows:

“[BILL] has incredibly strong distribution and network effects – as evidenced by the fact that I still use it because the companies who pay me use it – and Ramp’s product isn’t fully developed yet. For example, it handles the Accounts Payable side but not the Accounts Receivable side which means I could use it to pay bills but not to send invoices.”

Ramp’s ability to differentiate will depend not only on continuing to launch high-quality products, but products that are feature-rich enough to attract customers away from some well-established network effects within their existing vendors.

Ramp's Differentiation

Early on, Ramp saw the advantage of having an integrated card program and expense management software. In early 2021, Ramp saw more than 90% of its customers start using their cards and completely switch over to their software as well. CEO Eric Glyman described the benefit of centralization this way:

“When using a standalone solution like BILL a user has to connect that product to accounting software, and then connect their credit card to the reimbursement software so you could continue to operate your accounting software on it. Versus with Ramp, being able to manage it all in one platform with automated accounting, expense management and invoice processing.”

Card-driven models will focus on extensive programs to increase card spend and more effectively monetize. Software-driven models are fairly sales and marketing-heavy, requiring a higher sticker price to justify the acquisition cost of those customers. Ramp’s competitive positioning has been to offer both the card and the software for free.

Business Model

Source: Ramp

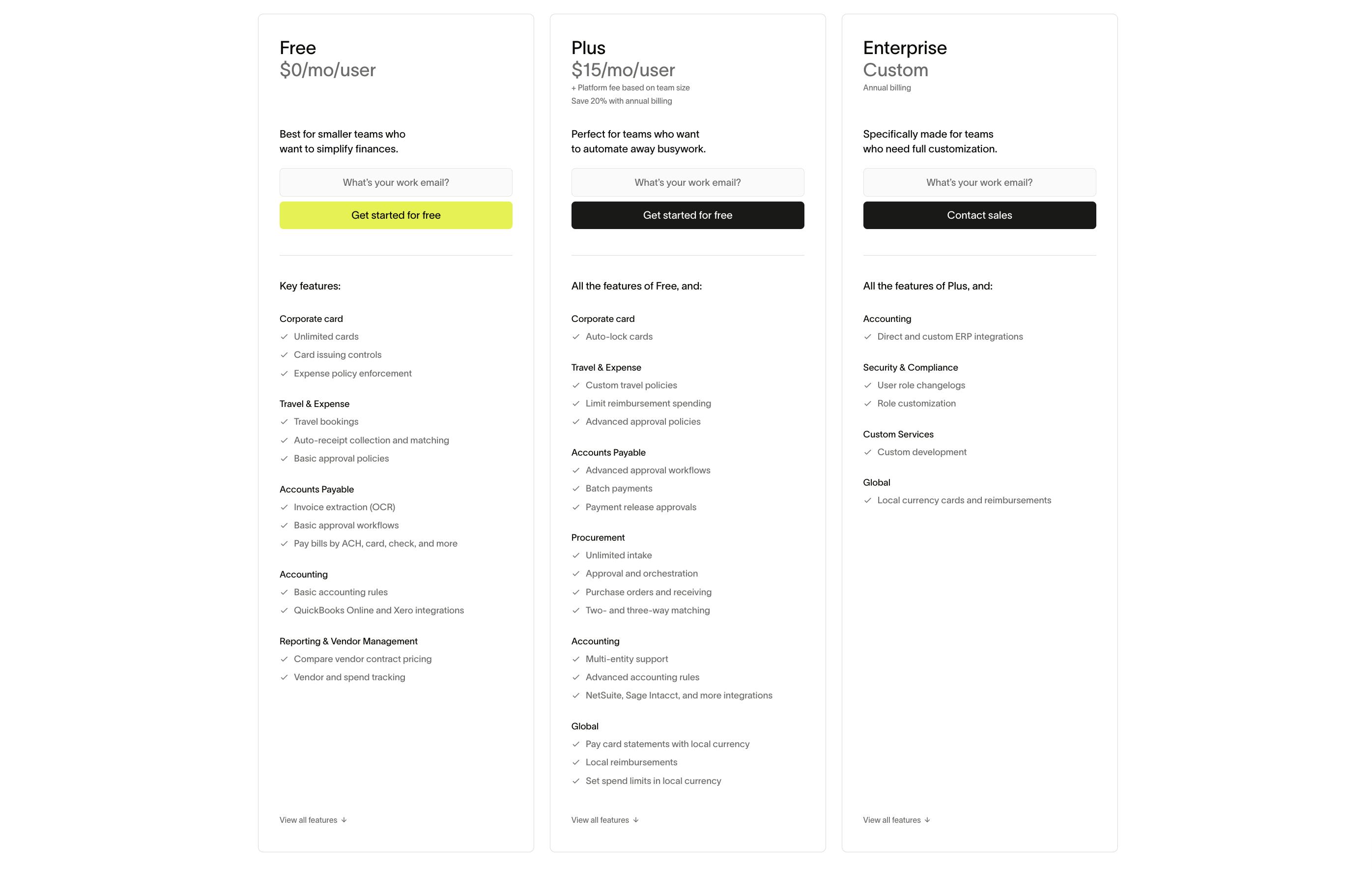

As of October 2025, Ramp has three pricing tiers:

Ramp (no cost): This plan offers unlimited cards and smart controls, access to automated expense management, travel and expenses, vendor management and accounts payable, accounting software sync, and real-time saving insights.

Ramp Plus ($15 per user/month - billed annually): This plan offers everything that Ramp offers with custom controls and advanced user roles, unlimited customizable workflows, procurement automation and PO management, advanced ERP integrations with multi-entity support, and international capabilities, with multi-currency card limits and spend programs.

Enterprise: It offers everything the previous tiers have, with custom dedicated implementations, premium support, enterprise ERP integrations, local card issuance, SOX compliance customizations, and more.

Ramp provides its base products for free without any subscription or annual fees. Besides the subscription for Ramp Plus, Ramp monetizes with interchange fees. Ramp takes a cut from merchants for every transaction made using a Ramp card. That cut is then divided between the card network (like Visa) and the merchant’s bank. In addition, the company states that it "may also make money from other features and services, like international bill payments, negotiations and Flex."

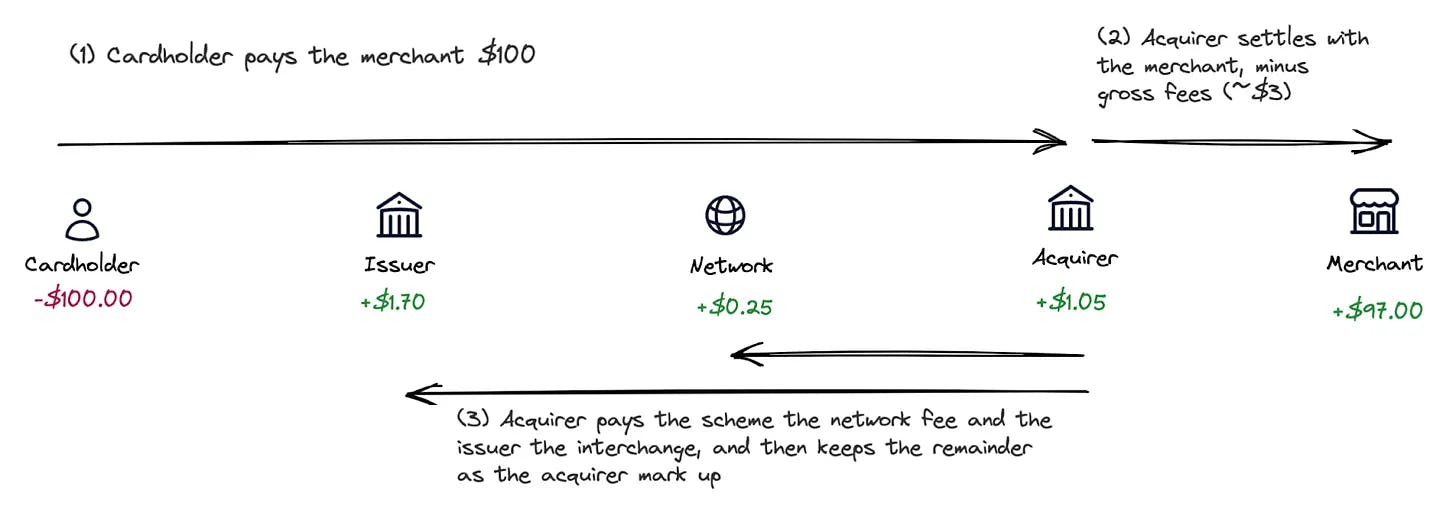

The status quo for most cards involves taking various pieces from each transaction. Each cut goes to a variety of players in this process, and every card swipe involves requests passed to a card network (e.g., Visa, Mastercard) through to the issuer (i.e., the bank that’s funding the consumer’s transaction).

The issuer of the card will then either approve or decline the transaction based on the availability of funding. Issuers therefore bear the brunt of the risk, because if something is wrong and the consumer ends up not paying, then the issuer is on the hook with the merchant. The issuer “credits” the merchant for a percentage of the original transaction request, but not the full amount. Each transaction takes into account a number of fees, like interchange and network fees. Credit card processing fees (which encompass interchange fees) are usually in the range of 1.5%-3.5%, which means that for a $100 transaction, fees can range between $1.50-$3.50.

Source: Matt Brown

Some of the participants taking a cut in that transaction include the merchant bank and the card network, but the majority goes to the issuer because they’re taking the risk. Ramp’s model is fairly simple. It partners with Sutton Bank (which issues the Ramp Visa Commercial Card) and Celtic Bank (which issues the Ramp Visa Corporate Card) as its “acquiring bank” to manage transactions.

Generally, banks expect ~1.5 - 2.5% (i.e., 150-250 bps) in interchange, so hypothetically Ramp would collect ~250 bps (2.5%) per transaction, give 200 bps back to the bank, and keep 50 bps as revenue. Many companies further complicate the transaction with other fees and rewards on either side of the transaction. Ramp, however, takes a simple approach to interchange so that it can instead focus on product innovation to place it in a more central role within each customer’s financial stack. Eric Glyman puts it this way:

“One of the things that we felt was, back to that original premise, people aren't looking for more cash back or points. They're looking for more in their bank account. When you follow that through, you realize that 1% back, 2% back, whatever it could be, sounds great, but not spending that dollar in that first place for the end consumer is 50 to 100 times as powerful.”

In March 2025, CEO Eric Glyman shared that nearly a third of Ramp’s growth was coming from word of mouth. Beyond organic adoption, Ramp also operates a wide-ranging partnership program that includes accounting firms, private equity and venture capital funds, solution integrators, and affiliate partners. These channels help Ramp tap into embedded trust and expand into new segments efficiently.

On the marketing front, Ramp has consistently distinguished itself from competitors through unconventional and brand-forward campaigns. Its initiatives range from direct mail kits and live sports events to influencer partnerships and data-driven content like the Ramp AI Index. In one of its most attention-grabbing moments in February 2025, Ramp partnered with NFL star and investor Saquon Barkley for a Super Bowl commercial, which was reportedly conceived, shot, and produced in just seven days. Ramp also promoted the January 2025 launch of its Treasury product by demolishing a sports car with a Ramp-branded wrecking ball in a New York City parking lot, underneath a billboard saying “Ramp Treasury has landed”.

Source: LinkedIn

Traction

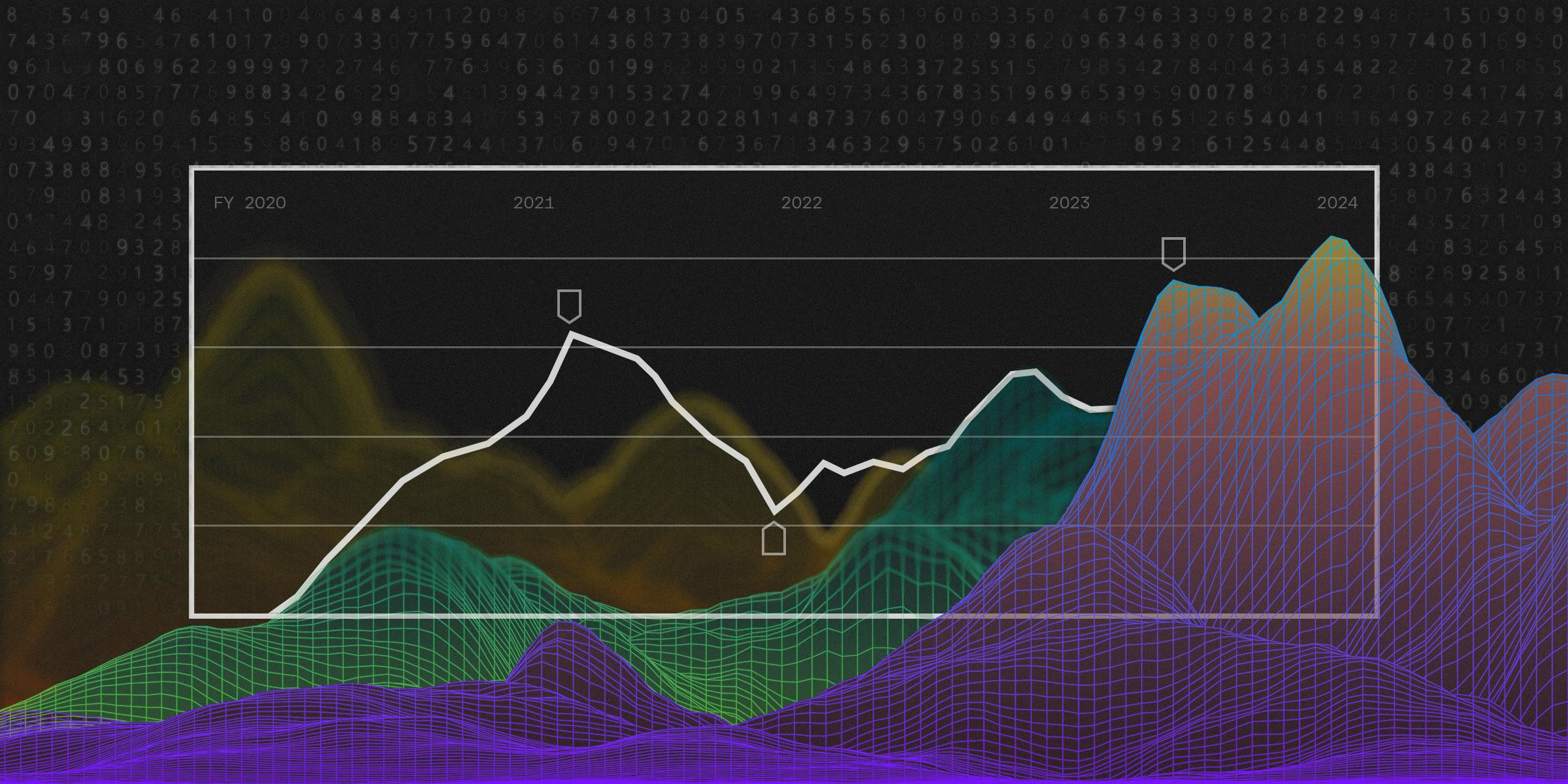

In January 2024, Ramp claimed to power $10 billion in accounts payable spend each year, a 10x increase in its preceding two years. In April 2024, CEO Eric Glyman stated that Ramp’s total purchase volume and revenue growth increased “faster quarter over quarter than it did over the same period in 2023, on a much larger base.”

As of October 2025, Ramp has over 40K companies as customers, up from 15K in August 2023 and 5K in March 2022. From a company perspective, Ramp has grown from 495 employees in 2023 to ~1.2K as of October 2025. Ramp has not reported any layoffs in 2023 and 2024, during a 1.5-year period that saw over 300K tech workers being laid off. Ramp has been efficient with its human capital, achieving over $300 million in annualized revenue with just ~500 employees.

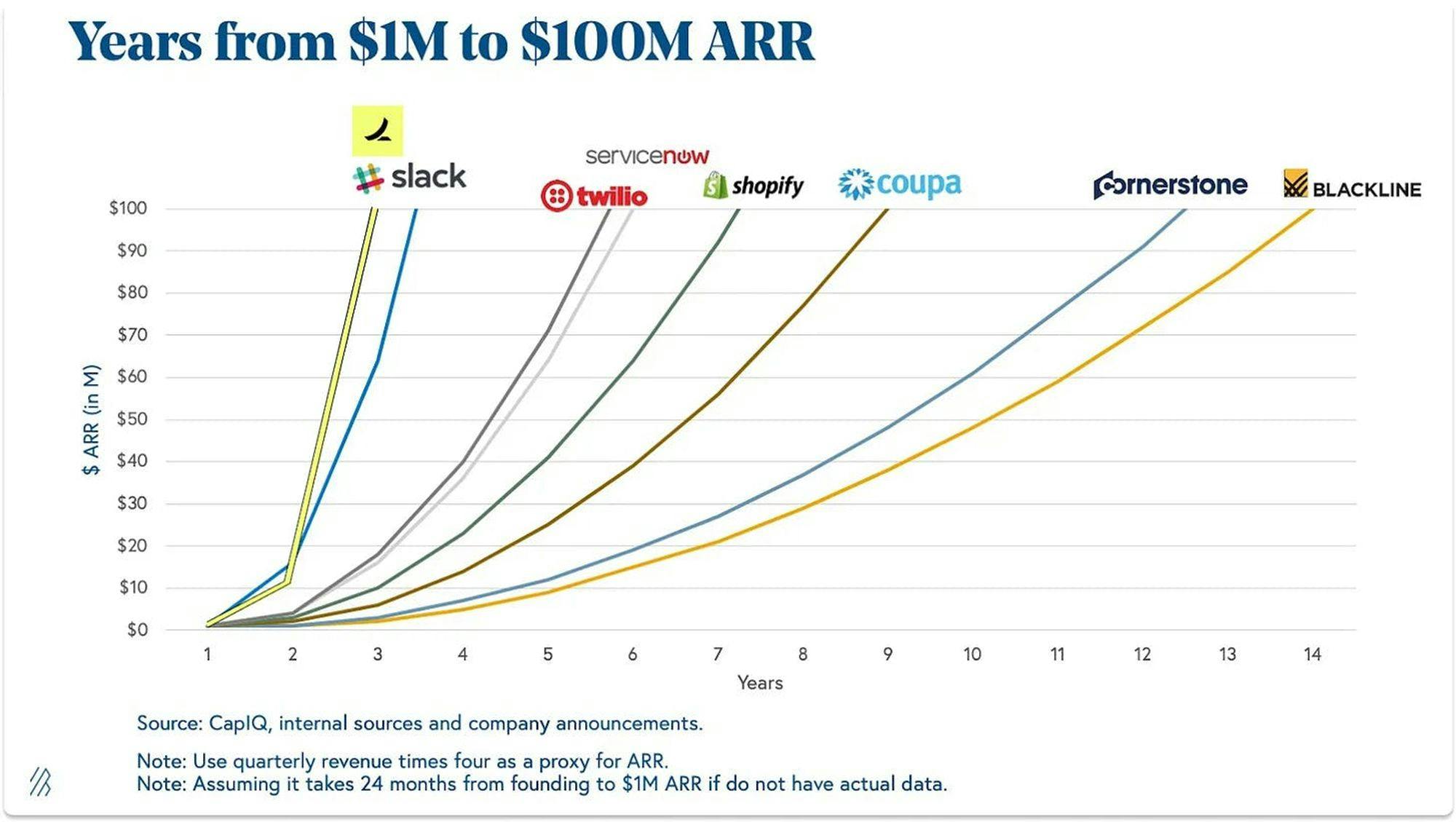

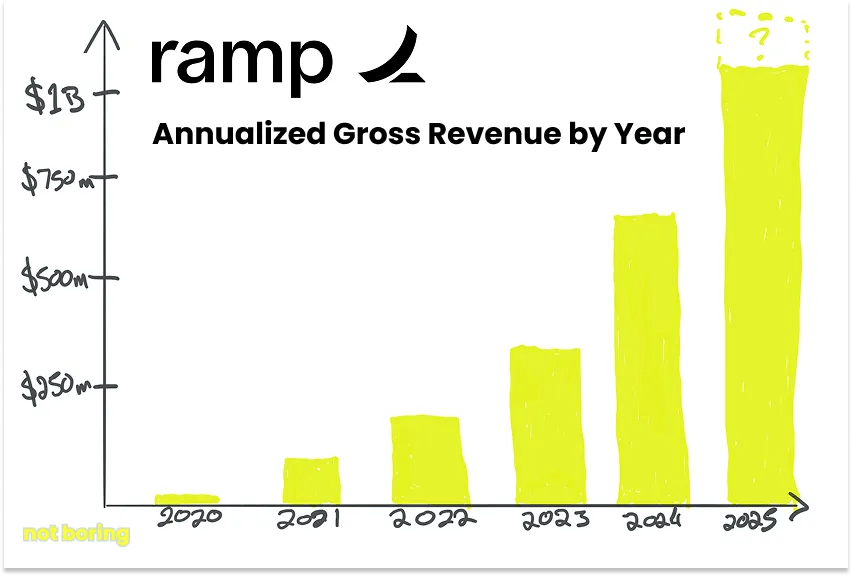

Ramp reported reaching this $300 million figure at the end of 2023. This came after a March 2023 announcement that Ramp had seen 4x revenue growth in the previous year alone, after having crossed a $100 million revenue run rate in March 2022, making it among the fastest startups to achieve this particular milestone (although describing interchange revenue as ARR is not strictly accurate, as it is not contractual revenue).

Source: Not Boring

A January 2024 estimate by a third-party source projected that Ramp overtook older competitor Brex in total payment volume (TPV). By the end of 2023, Ramp reached an estimated $30 billion annualized TPV, growing 209% YoY. In September 2025, Ramp announced it crossed $1 billion in annualized revenue and became cash-flow positive in 2025.

Source: Not Boring

In March 2022, Ramp raised a $200 million Series C at an $8.1 billion valuation. At that time, it had 5K businesses as customers, and Ramp was powering over $5 billion in annualized payment volume for those businesses. In the year leading up to its Series C announcement, Ramp's customer base grew 7x year over year, cardholder growth was up 15x, and its largest customers were spending $10 million a month through Ramp. As CEO Eric Glyman put it, “It took us over two years to reach 10K cumulative cardholders, and now we are adding that many in a month.”

While Ramp’s corporate card product has scaled quickly, Bill Pay has grown even faster. Eric Glyman described the rapid adoption of Ramp's Bill Pay product as follows:

"Ramp's Bill Pay platform has had extraordinary customer adoption. Within six months of its public launch, customers were using Ramp to power over $1 billion in annualized volume. It's our fastest growing product, exceeding the growth of even our corporate card, which is the fastest growing in the U.S.”

The combination of growth in underlying customer spend and the launch of additional products that bring more customers onto the Ramp platform has enabled the company to achieve over 200% net dollar retention as of March 2022.

As of June 2025, Ramp was used by roughly 1.5% of US businesses and continued to expand rapidly across both product and customer dimensions. Glyman stated in March 2025 that Ramp’s Net Promoter Score is on par with Apple’s, likely indicating product-market fit and customer satisfaction. That loyalty is reinforced by the company’s shipping velocity. Ramp launched 270 new features in the first six months of 2025. This velocity, combined with its expanding platform surface area and consistently high customer satisfaction, has helped Ramp maintain growth momentum and deepen its footprint in financial operations.

Source: Ramp

Valuation

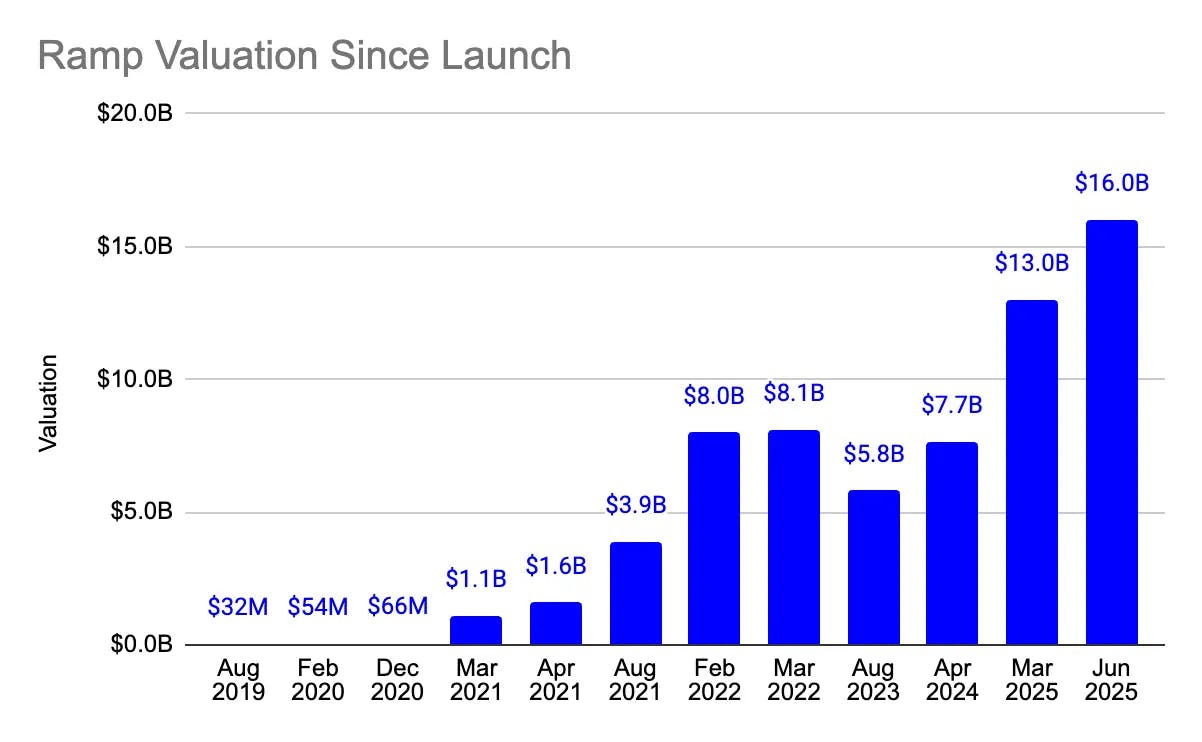

In July 2025, Ramp raised a $500 million Series E led by ICONIQ, with participation from Founders Fund and D1 Capital Partners. The raise came 45 days after its previous round, a $200 million Series E led by Founders Fund in June 2025, which valued Ramp at $16 billion, more than double its $7.7 billion valuation just fourteen months earlier in April 2024. Notably, this jump came only three months after Ramp announced a $150 million secondary share sale in March 2025 at a $13 billion valuation, marking a $3 billion increase in less than a quarter.

Source: Fintech Blueprint

Prior to this, in April 2024, Ramp raised a $150 million Series D-2 round at a valuation of $7.7 billion. The Series D extension was co-led by a new investor Khosla Ventures, and existing backers Founders Fund, with participation from existing investors Sequoia Capital, Greylock, and 8VC.

This extension round followed Ramp’s initial Series D raise of $300 million in August 2023, which occurred at a valuation of $5.8 billion. This was 28% lower than its valuation of $8.1 billion at the time of its Series C. Ramp was not the only fintech startup to see its valuation drop in the 18 months leading to its initial Series D raise; Stripe and Klarna, among others, saw steep declines as the market as a whole saw a drop in revenue multiples. In July 2023, Ramp was estimated to be worth $4.8 billion on the secondary markets. Its Series D extension valuation of $7.7 billion in April 2024 brought it closer to the $8.1 billion valuation at the time of its Series C.

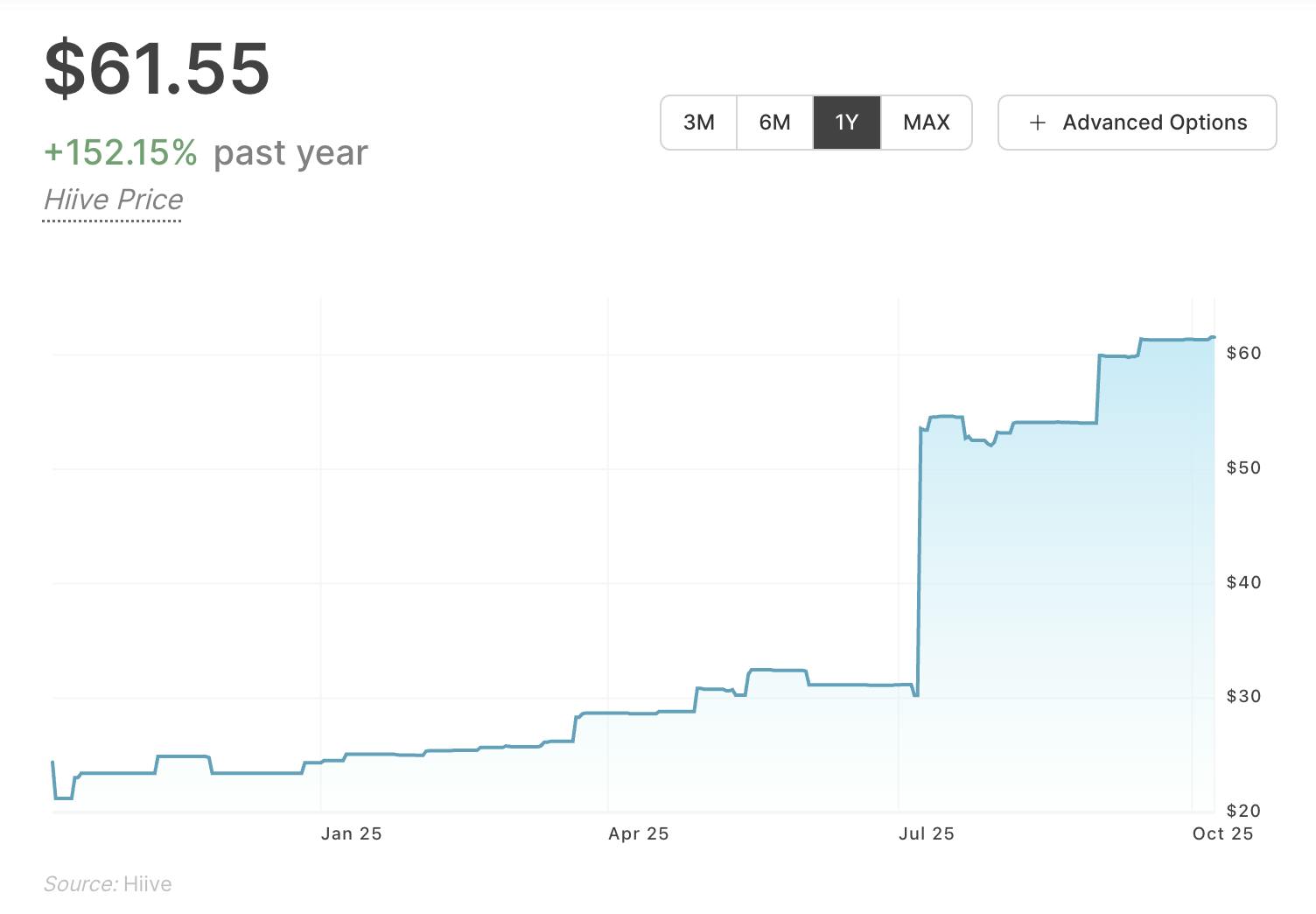

In March 2022, Ramp announced a $200 million Series C at an $8.1 billion valuation. Over the preceding few years, Ramp’s valuation had grown rapidly; in August 2021, for instance, the company had been valued at $3.9 billion, less than half of its March 2022 valuation. The Series C round was led by Founders Fund (marking the third time the firm had led one of Ramp’s funding rounds). Other notable investors in Ramp include Contrary, D1, Coatue, Stripe, and Redpoint. As of October 2025, Ramp’s stock was valued at $61.55/share on the secondary markets, an almost 2x jump from July 2025.

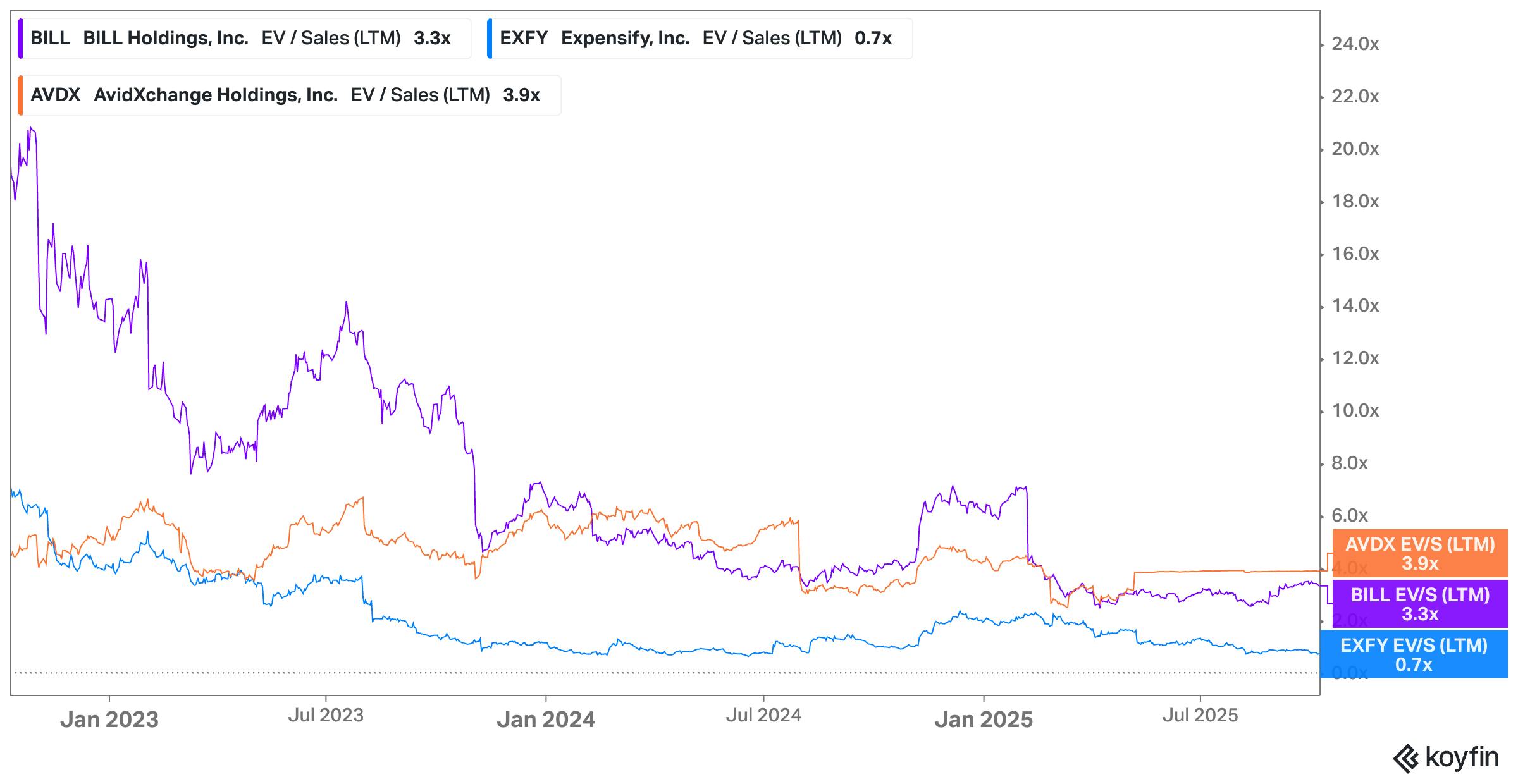

Source: Hiive

Ramp reached $1 billion in annualized revenue in September 2025, and was valued at $22.5 billion in July 2025, implying a 22.5x revenue multiple. Meanwhile, comparable public companies had a range of revenue multiples, from 0.7x for Expensify on the low end to 3.3x for BILL and 3.9x for AvidXchange on the high end. The premium on Ramp’s multiple may be due to its sustained 38% average annual revenue growth over the past six years and the size of its market opportunity. Ramp estimated in June 2025 that it had penetrated just 1.5% of the US expense management market, a segment still dominated by legacy players like AMEX and JPMorgan.

Source: Koyfin

Key Opportunities

Automating the Buying Experience

The complex inflows and outflows within each company require significant human involvement and are typically under-optimized in terms of cost savings. The opportunity for Ramp to leverage its suite of products to automate customer spend more effectively is significant. The company has already mentioned that it has automated 90% of the expense management process for the 6% of its customers using all of its integrations. With things like bill pay logic and its acquisition of Buyer, Ramp has the ability to further automate the negotiation, purchase, and payment processes for its customers.

Leveraging AI to Expand the Product Stack

Ramp has made progress in the use of AI with products like Ramp Intelligence and its customer service chat assistant. As of October 2025, Ramp had over 45K customers and has developed a detailed platform capable of analyzing spend management, whether it be contracts, fraud detection, or financial forecasting. This was based on its diverse and large datasets. Ramp could leverage AI integrations further to move more ERP functionality to the platform. One example is continuing to expand its bill pay module so that it not only manages paying bills (accounts payable) but also collects payments as well (accounts receivable). That existing limitation is one reason why some customers cite remaining with BILL.

As of October 2025, Ramp says that it monetizes primarily based on interchange revenue, and "may also make money from other features and services" such as international bill payments, negotiations, Flex, and Ramp Plus. Aspects of a company’s financial stack that Ramp still hasn’t touched include areas like payroll (labor is 50-60% of a typical company’s spend), and deeper accounting functionality (features that are still being served by integrations with tools like NetSuite.) With around $50 billion being spent annually on ERP software as of 2023, extending the platform to account for managing spend on employee salaries and analyzing data in this way can be an effective way of moving past competitors. As costs for using large language models and ingesting and understanding data decline amid high competition in the AI space, Ramp has an opportunity to extend its margins alongside refining its already present and new AI features to be even more effective.

As Ramp innovates by releasing more features and products, better cost savings, and insights for customers, a natural flywheel is generated. More data means better cost savings and insights for the AI models, which leads to more companies’ onboarding and consistent growth.

Expansion via Acquisition

Ramp can continue to acquire companies to efficiently and effectively expand its product offerings. In August 2021, for example, Ramp acquired Buyer as a “negotiation-as-a-service” platform that claims to save clients money on large purchases like annual software contracts. In 2023, Ramp acquired Cohere.io, a startup predicated on AI-powered customer support, already releasing products under Ramp Intelligence, Ramp’s Teams Integration, and internal use cases. Ramp also acquired Venue in 2023 to enter the procurement space to address more “complex” enterprises, and in January 2024, released Procurement and Vendor Management product offerings.

In September 2025, Ramp acquired Jolt, a software engineering productivity startup specializing in tools that help large organizations build and deploy AI systems at scale. Jolt’s team has developed systems that can understand complex codebases and generate context‑aware code, capabilities that will be applied to Ramp’s internal developer environment. By improving how Ramp engineers prototype, test, and ship new AI features, the acquisition could strengthen the company’s ability to deliver agentic products more quickly and reliably.

Key Risks

Product Differentiation

Selling technology to a finance organization is uniquely difficult, both because the systems are critical and can’t fail, and because the space is surrounded by different regulatory and auditing requirements. Different tools are preferred by different stakeholders: finance leaders want as much control as possible, business line managers want as many rewards as possible, and employees want as simple an experience as possible.

Ramp’s emphasis has been on (1) alignment of its incentives with its customers by helping to minimize spend, (2) the quality of the product and user experience, and (3) broadening the number of functional areas to which its platform extends. While those things have resonated with customers and have driven exceptional growth, they may be less effective in the long run as they may prove difficult to articulate and communicate to prospective customers.

Packy McCormick describes it this way:

“Actually differentiating on product – offering something different than competitors – is one thing, and Ramp’s really good at that. The company was built to build better financial software than anyone else in the industry. Communicating that differentiation to customers is a completely different challenge.”

Being able to effectively maintain product-led growth while also building out a robust enterprise engine is never easy. While Ramp’s products have demonstrated clear differentiation, it's going up against established incumbents. As one example, as of October 2025, Ramp had ~2.1K reviews on G2 at 4.8 stars, compared to competitors with a larger number of total reviews, such as Navan (8.5K reviews, 4.7 stars), Expensify (5.4K reviews, 4.5 stars) and SAP Concur (6.2K reviews, 4.0 stars) With a 4.8-star rating, however, Ramp may be ahead of its competitors in terms of product experience.

Loss and Fraud Potential

Like any financial platform, Ramp is always at risk of fraud and has to maintain a robust know-your-customer (KYC) and anti-money laundering (AML) platform. Beyond typical threats to its corporate spending business, its Bill Pay (specifically, the Ramp Flex product offering) introduces additional risk. Companies like Affirm, Klarna, and Afterpay extend “buy now, pay later” credit to consumers. Ramp is effectively doing the same for companies, so it can delay paying their bills. Affirm’s exposure to consumer lending is more volatile depending on consumer spending. For example, from Q1 2022 to Q2 2022, Affirm saw a 38% increase in its charge-offs (basically estimated debt losses). Depending on the quality of the risks Ramp is taking, it could expose them to similar potential losses down the road.

Competitive Landscape

The competitive landscape for fintech is tough. As of October 2025, there are several startups like Brex, Airbase, Rho, and more that compete against Ramp, in addition to incumbents like AmEx. Each startup is making similar moves towards integrating AI and consolidating functions into a single platform. Investment in the space continues to grow, with $35 billion from VCs going into fintech in 2023. Ramp must seek to differentiate itself and drive specific wedges within broad areas of B2B payments. It must do so with speed and quality, as competitors are expected to achieve similar functionality in products.

Summary

Ramp has grown into one of the leading companies in business finance software by aligning with customer incentives, focusing on product quality, and expanding its platform into adjacent workflows. Its push into AI-native infrastructure suggests a long-term bet on automation as a source of efficiency and differentiation. With $1 billion in annualized revenue, 45K customers, and significant whitespace, Ramp has the potential to become a central system for managing business finances – if it can maintain its execution speed and navigate growing competition.

* Contrary is an investor in Ramp and Anduril through one or more affiliates.