Thesis

Businesses are increasingly conducting financial transactions across borders. In 2023, global cross-border payments amounted to $190 trillion, and were projected to reach $290 trillion by 2030. B2B cross-border payments represented 98% of the total flow of financial transactions across borders as of January 2023. The global value of cross-border payments is expected to hit $250 trillion by 2027.

However, traditional cross-border financial transaction methods, such as bank transfers, foreign exchange brokers, and credit cards, come with significant pain points, including a lack of transparency, long wait periods, and high transaction costs. Transferring money internationally can cost an average of 11.7% of the transaction in fees. As of December 2024, 70% of US businesses indicated they had seen higher failed payment rates in cross-border transactions compared to domestic sales. As a result, 92% expected to make major investments in real-time cross-border payments starting in early 2025.

Airwallex is building the financial infrastructure and operating system for global businesses to transact internationally. Originally known for cross-border payments and FX, the company has expanded into a full-stack suite that includes global business accounts, corporate cards, treasury, embedded finance, and expense management. As of October 2025, Airwallex served over 150K customers, including Brex, Rippling, Deel, TikTok, and Canva, and has reached $800 million in ARR, processing over $130 billion in transactions annually.

While historically concentrated in the Asia-Pacific region (APAC), Airwallex’s fastest-growing markets are now North America and Europe, which are scaling at over 200% year-over-year as of July 2025, and are expected to surpass 40% of revenue by early 2026. Leadership continues to signal a public market path, with IPO readiness targeted for 2026.

Founding Story

Airwallex was founded in 2016 by Jack Zhang (CEO), Jacob (Xijing) Dai (CTO), Max Li (Head of Design), Lucy Liu (President), and Ki-lok Wong (Principal Architect).

Source: SmartCompany

Born in Qingdao, China, and raised in Australia from the age of 15, Zhang was forced to support himself by 16 after his family lost most of their money. To afford tuition at the University of Melbourne, he worked low-paying jobs in a lemon factory, as a dishwasher, and on overnight petrol station shifts.

After college, Zhang worked as an algorithmic trader and developer at Aviva and National Australia Bank and simultaneously ran multiple side businesses, including exporting olive oil and wine to China, importing textiles into Australia, and flipping real estate. By his late 20s, Zhang had earned over $10 million from his side businesses, but concluded that none of them excited him. “I started more than 10 businesses,” he said, “but I didn’t like any of them”. What excited Zhang was coding, and he had the ambition to build something meaningful at internet scale.

At the time, Max Li was a professional architect. Zhang and Li decided to start a specialty coffee shop, Tukk & Co., as a side project. In an attempt to keep the business cost-effective, the pair imported coffee cups and labels from China. However, they found that traditional methods of cross-border payments, like Western Union or bank transfers, were cutting into their profits with high foreign exchange (FX) rates and intermediary fees. In response, Zhang decided to develop a solution to make cross-country payments easier. In a 2019 interview, he spoke about this decision:

"We wanted to be able to build something a lot more robust, a lot more real time, cost-effective and as well as transparency in pricing to other customers so we could make the life of those businesses easier.”

Dai, who met Zhang while studying computer science at Melbourne University, joined the team to lead the technology stack. Another university friend, Liu, came on board after visiting Zhang and Li at their cafe while on a career break. Before Airwallex, Liu was an investment consultant at China International Capital Corporation. Along with Zhang and Li, each contributing $100K, Liu invested $1 million to bootstrap the development of Airwallex’s initial products. Zhang resigned from his job immediately. The founding team leased a 10-square-meter office room, sleeping in sleeping bags and coding 20 hours a day.

In September 2016, Airwallex became the first Australian startup to participate in Mastercard’s Start Path accelerator program. The program, aimed at startups supporting SMEs with digital needs, provided Airwallex with access to Mastercard’s innovation team and banking partners, as well as the opportunity to test its product-market fit. Within 18 months of launch, Airwallex secured a $13 million Series A led by Tencent, Sequoia Capital China, and Mastercard.

Product

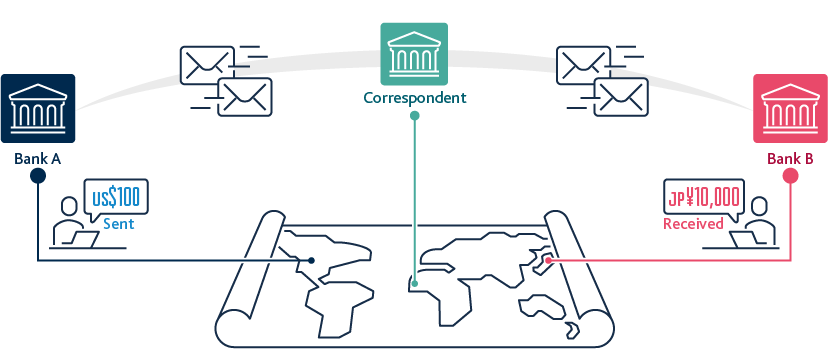

Typically, a country's payment systems aren't directly linked to those of other countries. Therefore, when transferring money internationally, the actual currency isn't directly moved abroad. Instead, international banks maintain reciprocal accounts with their foreign partners. Money doesn't cross borders; rather, accounts are credited in one country and debited an equivalent amount in another.

When banks don’t have direct connections with each other, they need to transact using one or multiple middlemen, called “correspondent banks,” which offer accounts to both banks. The more middlemen involved in an international transaction, the slower and costlier it becomes. Transactions between currencies with high volumes of interchange, like the US dollar to the Euro, typically have fewer steps.

However, for currency exchanges with a lower volume of exchange, more correspondent banks are needed. This means longer transaction times and higher costs at each step, particularly as every additional bank involved can charge fees of up to 3.5%, on top of their set foreign exchange (FX) rates.

Source: Bank of England

Airwallex built its own cross-border payments network to underpin all its product offerings. This network, founded on an infrastructure of over 60 banking licenses, is designed to offer faster and more cost-effective cross-border payments. As of October 2025, Airwallex’s payments network allowed customers to open accounts with local bank details in over 60 countries, hold funds in more than 20 currencies, accept payments in local currencies, and convert currencies at rates better than those of banks. Airwallex’s product suite is divided into four modules: (1) business accounts, (2) spend management, (3) payments, and (4) platform APIs and embedded finance.

Business Accounts

Source: Airwallex

Airwallex’s business accounts serve as a hub for receiving domestic and international funds, as well as collecting payments in the customers' preferred currencies. With a business account, customers can create Global Accounts (essentially local bank accounts, complete with bank and branch codes, and unique account numbers) in more than 60 banks. Customers can also accept payments from over 180 countries, and make transfers to over 200 countries at interbank rates, 95% of which arrive within 24 hours as of July 2025. As of July 2025, business accounts have no opening fees, monthly maintenance fees, or minimum transaction requirements.

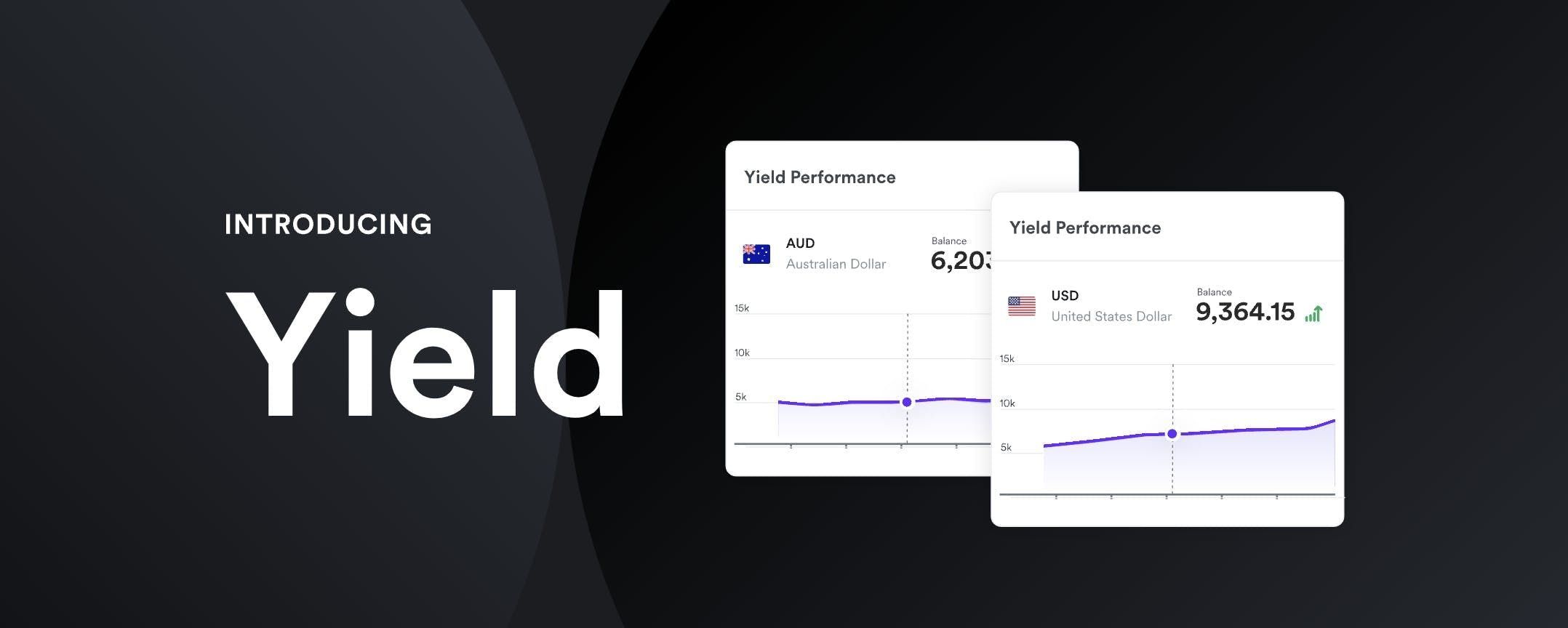

In November 2023, Airwallex introduced Yield, a new product that enables customers exclusively within the Australian market to invest their business account balances into an underlying fund, the JP Morgan Liquidity Fund. The account offers “a 3.67% return on AUD balances and 3.95% return on USD balances, compared to an average of 1.06 percent per annum” for business savings accounts with large banks in Australia.

The product had shown early traction as of August 2024, with $100 million in funds under management just six months after the product’s release. Luke Latham, Airwallex’s Australia and New Zealand Managing Director, stated: “Interest rates have picked up significantly, and we want to help our customers do more with funds that might be sitting idle in their accounts.”

Source: Airwallex

In July 2024, the company became the first payments company to be granted an Australian Financial Services License (AFSL), which unlocked the ability to “provide access to investment products to businesses regardless of size.” This license also allowed Airwallex to reduce the minimum initial investment size needed for Yield from $500K AUD to $10K AUD. The reduction in the minimum amount required to use Yield expands the spectrum of businesses that can utilize the offering, “from startups to larger enterprises, providing them with a business account that optimizes their cash management strategies.”

Spend

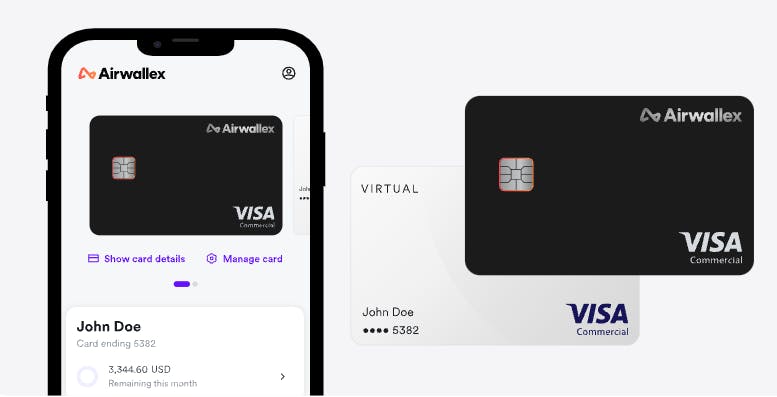

Source: Airwallex

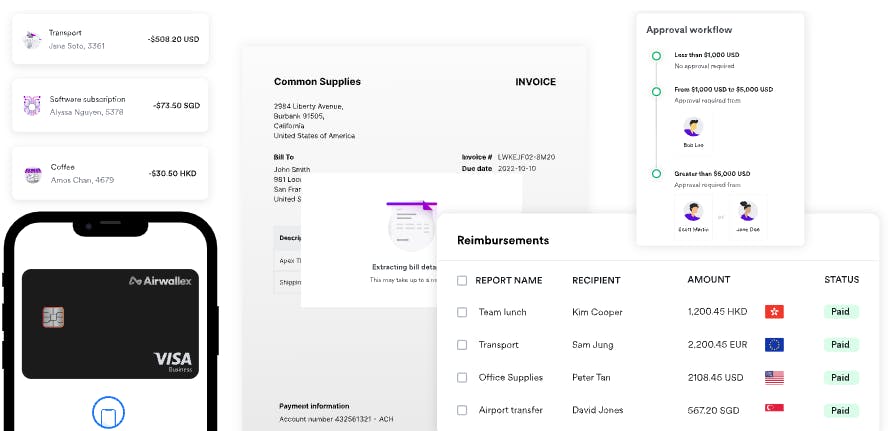

Business Accounts provide access to Spend, a unified product ecosystem that consists of cross-border business cards, an expense management platform, and bill payment functionality.

Borderless Cards: When customers sign up for a business account, they can issue physical and virtual wallet multi-currency Visa debit cards to their entire workforce. These cards are connected to the user’s Airwallex wallet and incur no international card transaction fees. This enables a company’s employees to make transactions in any currency supported by Visa. It was noted that “Airwallex Borderless Card gives customers the ability to pay their suppliers within seconds, thus saving business time and money. The collaboration with Visa offers secure, cross-border payments in multiple currencies.”

In 2020, this product collaboration with Visa was initially rolled out in the Australian market, but has since become available in over 50 countries. This geographic proliferation has continued as borderless cards became available to Canadian businesses in April 2024.

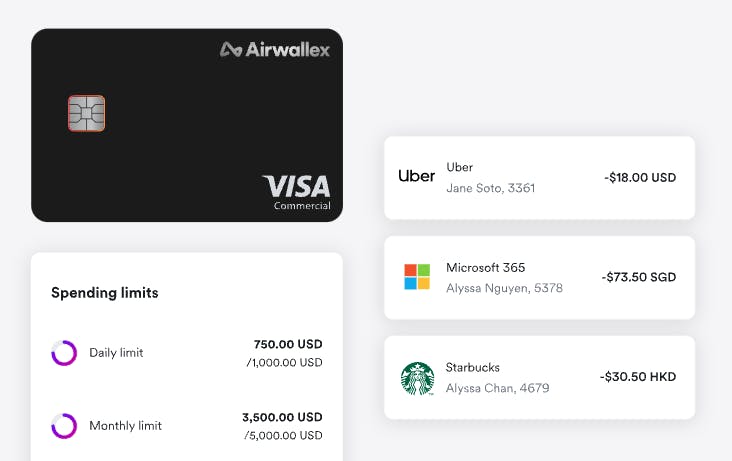

Source: Airwallex

Account administrators can also set a variety of spending limits on employee purchases, including daily and/or monthly limits, as well as the types of merchants that employees can transact with. This feature empowers companies to gain a precise view of exactly how much each employee is spending and with what types of businesses they are doing business with.

One Airwallex customer commented on the value of this offering in that the company “transformed the previously painful process of creating corporate cards and managing business accounts into something simple, convenient, and cost-effective.”

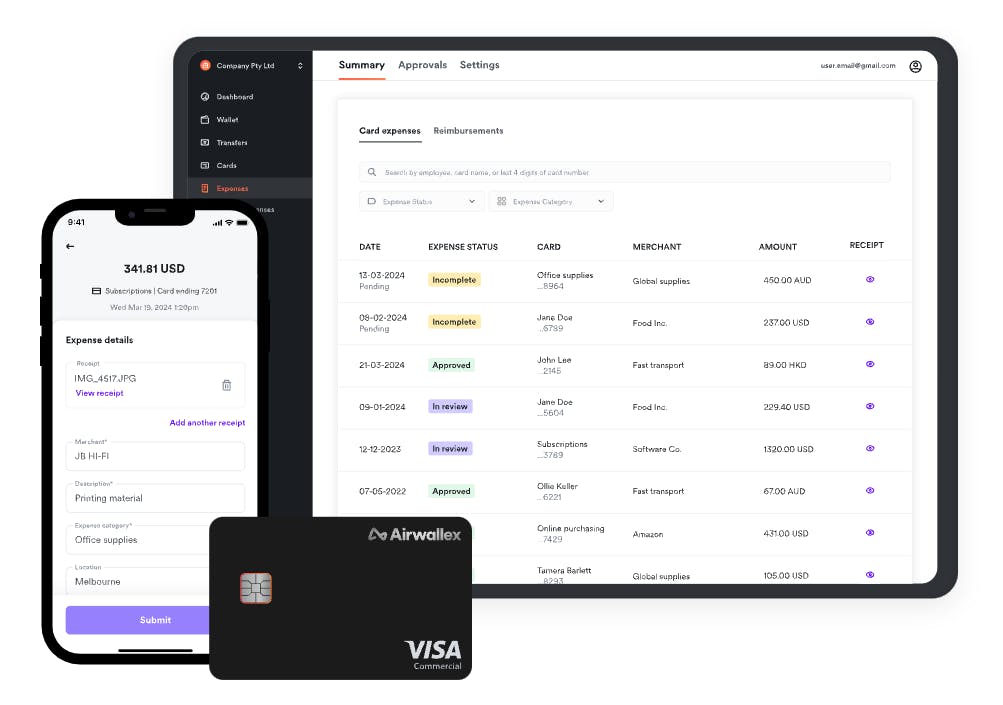

Source: Airwallex

Expense Management: Borderless Visa cards are integrated with Airwallex’s Expense Management offering, which enables businesses to “upload receipts, submit expense reports, and send through approval flows” and provides a unified view of incurred expenses across all currencies and employee accounts. The Expense Management also integrates with leading accounting platforms like Xero, Sage, NetSuite, and, as of June 2024, QuickBooks.

This further streamlines businesses’ expense reconciliation process while eliminating unnecessary data entry between disparate platforms. Further, users can easily upload receipts directly into the Expense Management product. OCR technology extracts all data, which further eliminates the need for manual data entry.

Source: Airwallex

Bill Pay: Business accounts also allow customers to automate domestic and international bill payments through Airwallex’s Bill Pay product. Businesses can pay invoices to vendors in over 200 countries.

In March 2024, Airwallex Reimbursements was announced. With this new feature, employees can submit out-of-pocket expenses for reimbursement within the Airwallex app. Businesses can then reimburse employees in their native currency. The uploaded receipt, along with payment details, is also synced to the business’s 3rd party accounting software (Xero, QuickBooks, etc.).

In February 2024, a newly released feature enabled users to forward vendor invoices to an email address that they self-specify to automatically generate a draft bill within the Airwallex platform.

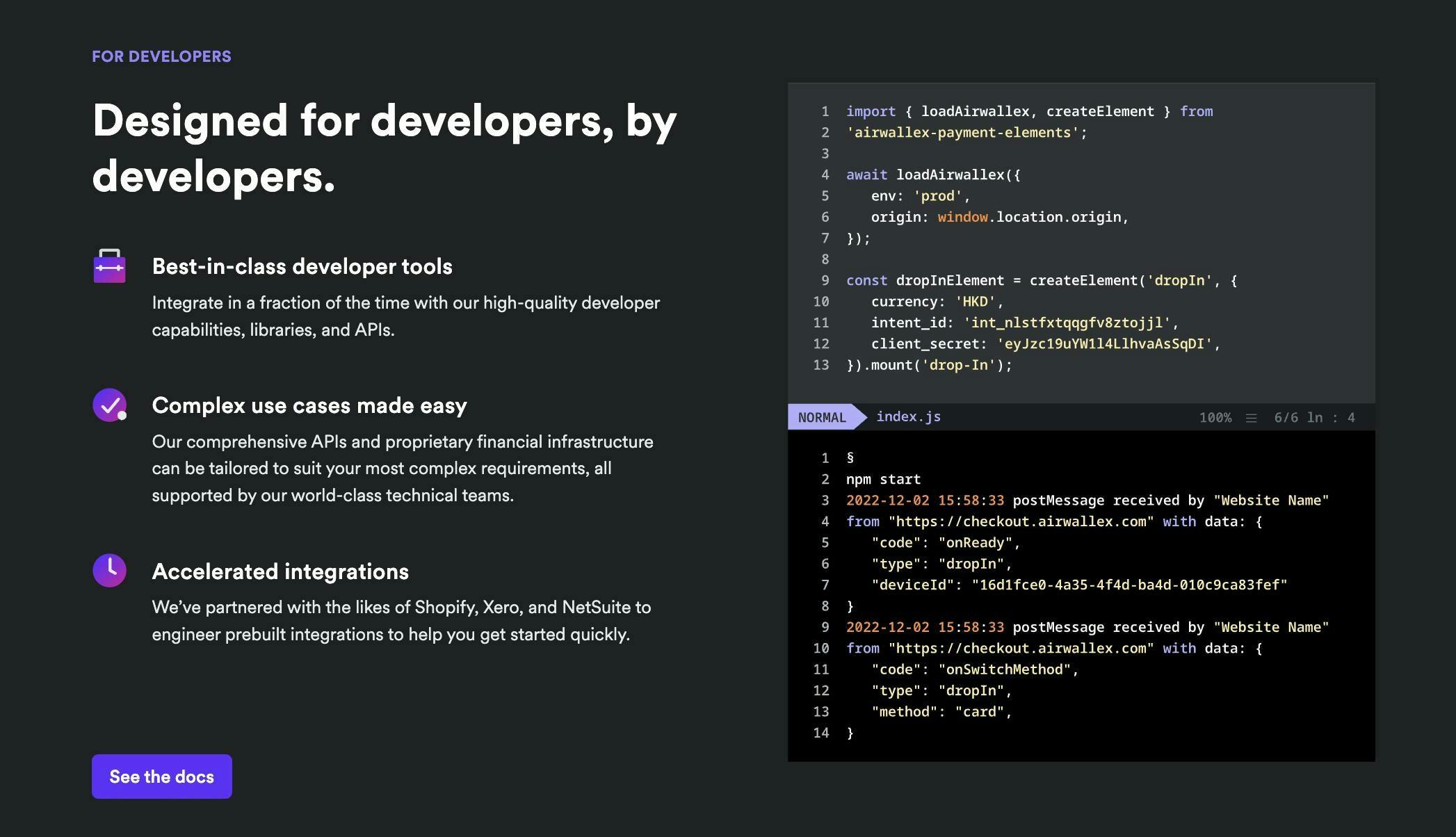

Core API

Source: Airwallex

Airwallex offers a set of APIs intended to integrate smoothly with customers’ existing workflows through developer tools that require no coding experience, clear documentation, and prebuilt integrations. These APIs can be used for payments, payouts, and issuing.

Payments: Users can integrate with Airwallex’s APIs to collect one-time or recurring payments from their customers in the customer’s preferred currency and local payment method. There are multiple integration paths available, including no-code ecommerce plugins, hosted payment pages, and pre-built UI components. Users can also choose to build directly via Airwallex’s API in the back end or accept payments in their iOS or Android app via Airwallex’s mobile SDKs.

Airwallex offers two kinds of foreign exchange (FX) services via API:

MarketFX: Allows users to conduct currency conversions at the prevailing market rate through a selection of global liquidity providers. This service is geared towards businesses that need to conduct multiple transactions in a short period at the best possible rate at the point of conversion.

LockFX: Allows users to lock conversion prices for a given period, mitigating the impact of market volatility on FX rates. Businesses can configure settlement times – same-day, immediate, or future – to determine when the currency conversion will be executed to and from their account.

Embedded Finance

Source: Airwallex

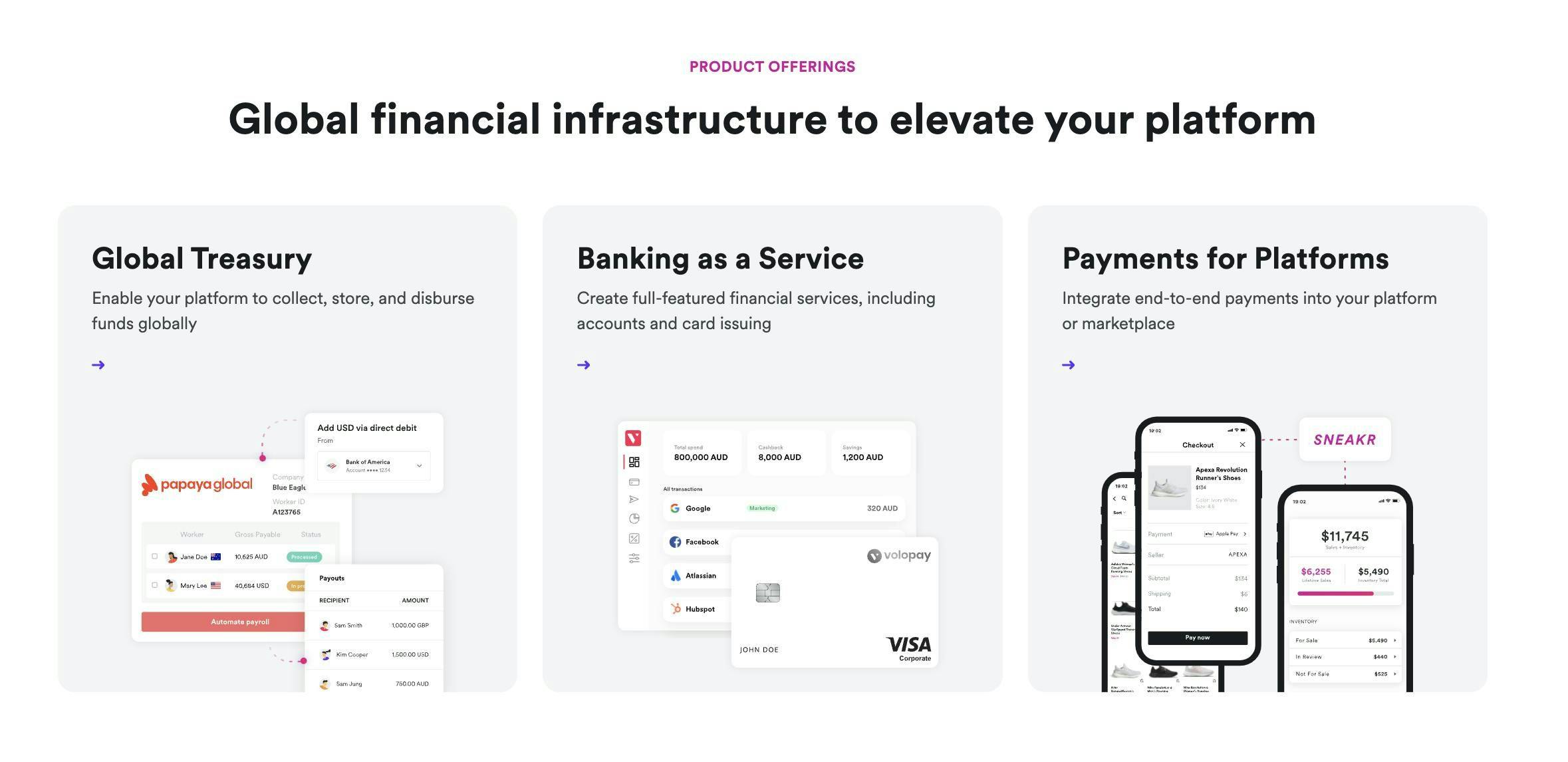

Airwallex offers a suite of embedded finance tools, enabling users to create customized payment and financial products for their customers. These tools include:

Global Treasury: This tool combines Airwallex’s Global Accounts and Payouts solutions. With it, customers can collect, store, and disburse funds internationally using Airwallex’s multi-currency wallet. Below are the features included in Global Treasury:

Collect Funds: Customers can receive funds globally and create Global Accounts in over 60 countries. They can do so via direct debits from verified external accounts, or receive bank transfers via local clearing systems or SWIFT.

Store and Convert Funds: As of July 2025, Airwallex’s Wallet allows customers to hold balances in 64 trade currencies, organize balances by currency, and convert currencies within the Wallet. All transactions are recorded in the Wallet. Through Airwallex’s API, customers can retrieve balances and generate financial statements and reports.

Process Payouts: As of July 2025, customers can programmatically conduct payouts to bank accounts in 200+ countries or set up direct debit payouts.

Banking-as-a-service (BaaS): This tool allows users to embed global banking capabilities into their products. These include Airwallex’s Global Account, Card Issuing, and Payout solutions. Additionally, users can extend lines of credit to their customers, assess customers’ creditworthiness on an ongoing basis, and set up programmatic debt collection.

Payments for Platforms: This solution allows users to integrate a payment system into their platform or marketplace. Payments for Platforms combines Airwallex’s Payment Links, Payouts, and Issuing products. It includes pre-built components for deployment and the ability to set pricing controls for end customers.

Airwallex handles compliance requirements for all its embedded finance products, including KYC, AML, sanctions screenings, and identity verification. Airwallex has 60 licenses and registrations globally.

Market

Customer

Airwallex primarily targets companies that conduct cross-border transactions as part of their operations. These range from SMBs and high-growth startups to enterprises. Airwallex’s core ICP includes global organizations with fewer than 1K employees, particularly those managing internationally distributed teams, customers, and vendor bases. As of October 2025, Airwallex had over 150K customers, including Brex, Rippling, Navan, Papaya Global, Afterpay, SHEIN, Deel, Canva, and TikTok.

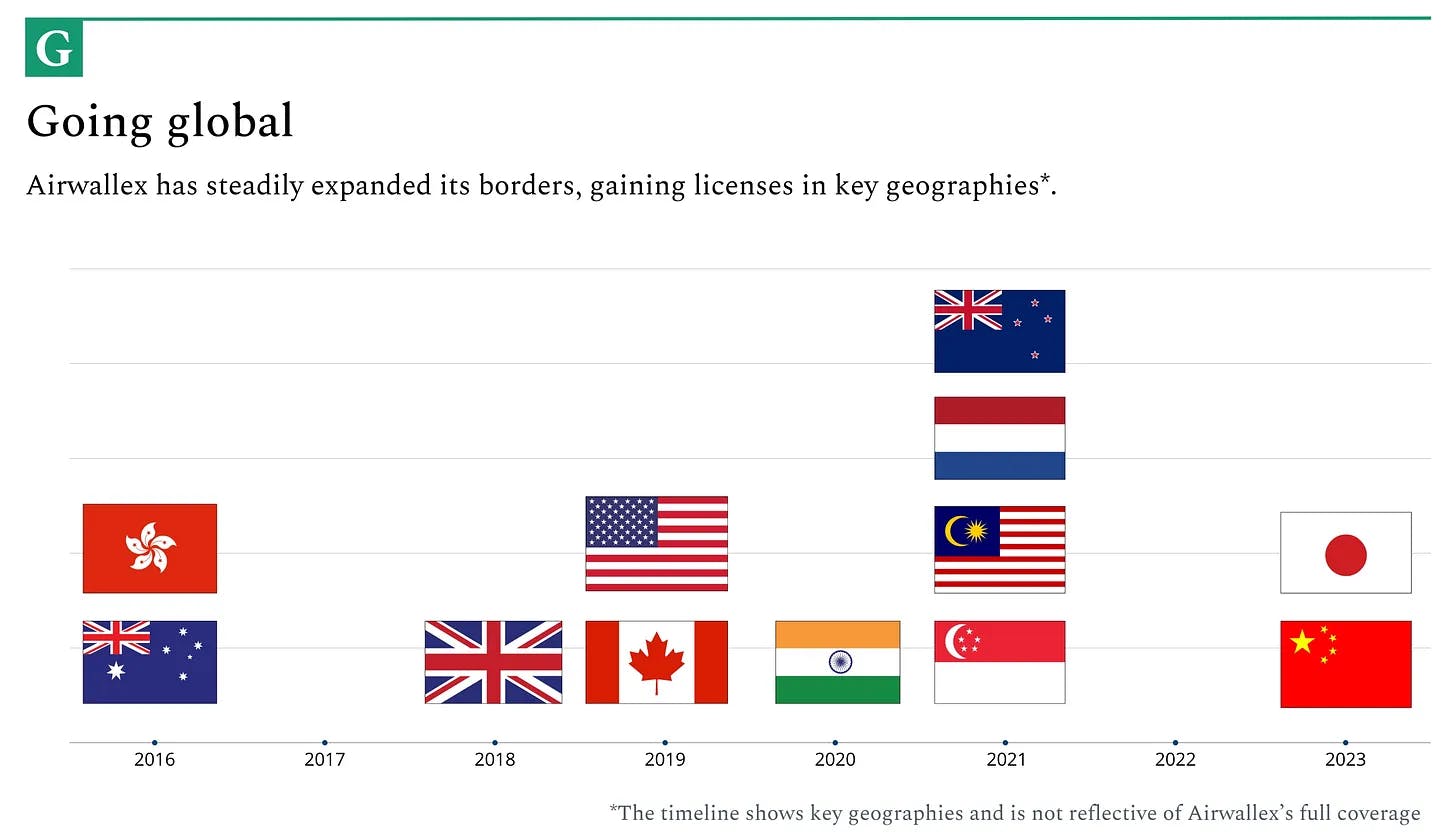

As of October 2025, Airwallex is licensed to operate in multiple geographies, including Australia, the United States, Canada, China, Hong Kong, the United Kingdom, and many others. In August 2024, Zhang emphasized the company’s focus on expansion to serve businesses within APAC and the Middle East.

Source: Generalist

The platform has historically been strongest in the Asia-Pacific region, which accounted for just under 70% of Airwallex’s revenue in July 2025. However, the North America and Europe businesses are growing over 200% year-over-year and are expected to represent over 40% of the company's revenue by 2026.

The businesses that use Airwallex often possess customer bases, employee bases, and/or vendors that are internationally based, which requires them to conduct cross-border transactions at a high volume. For example, the McLaren Formula 1 racing team partnered with Airwallex in February 2024. The United Kingdom-based team works with vendors (e.g., hotels and event space providers) from numerous countries, given the international nature of the sport. This required the team to adopt a financial payment infrastructure that would enable it to make multi-currency payments instantly.

Additionally, in June 2024, the global launch of Airwallex and Deel’s physical VISA spend card expands Airwallex’s customer base into the contractor vertical across 20 countries. Now, contractors can make purchases or payments in multiple currencies from anywhere in the world. This allows them to “gain instant access to their earnings, shop worldwide, pay securely, and hold their money in a more stable currency.”

Market Size

Airwallex operates primarily in two verticals: cross-border payments (through its Business Accounts) and embedded finance (through its Core API and Embedded Finance offerings).

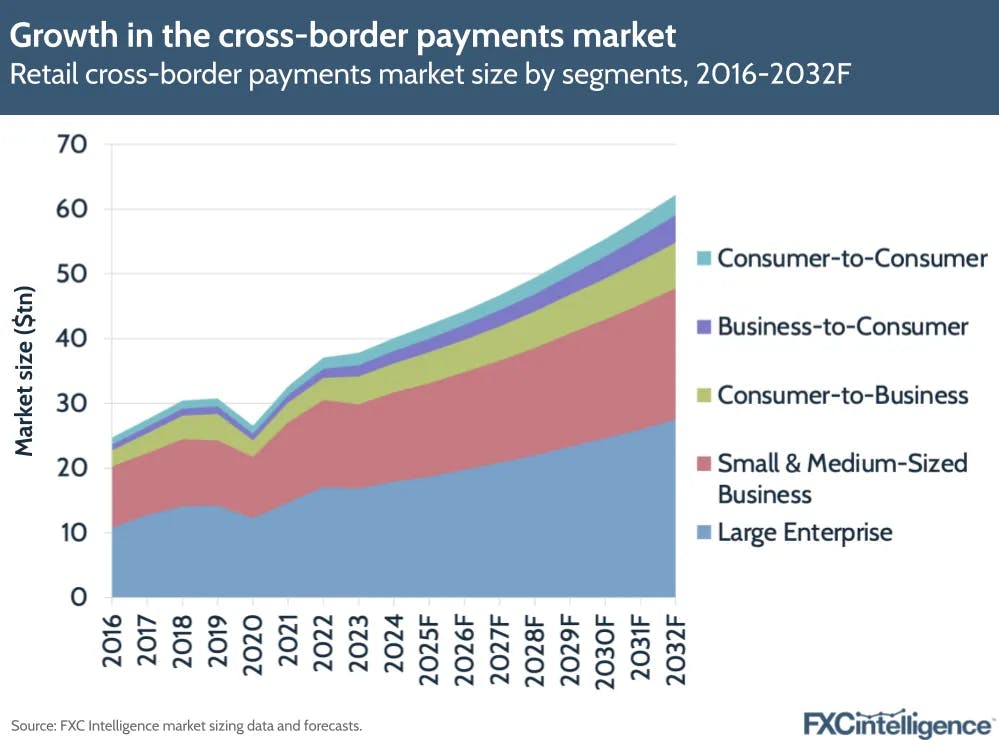

In 2023, worldwide cross-border payments amounted to $150 trillion, which is a 6x growth from $25 trillion in 2018. The market was estimated to reach $250 trillion by 2027. In 2022, B2B payments represented 98% of the total cross-border payment flow; global revenue for businesses facilitating cross-border payments was estimated at $165 billion, 69% of the total.

Source: FXC Intel

In 2023, the global embedded finance market was valued at $73.8 billion. One 2023 report projected the market would grow at a CAGR of 24.3% between 2024 and 2032, reaching around $523 billion by 2032. A 2022 report, however, estimated the embedded finance market would reach $291.3 billion by 2033.

Competition

Within each of the verticals Airwallex operates, its suite of products has distinct competitive dynamics and primary competitors. Below is an overview of the company’s competitors in different segments of its business, followed by an examination of its direct and adjacent competitors:

Global Treasury: HSBC Global Liquidity and Cash Management, Citi Treasury and Trade Solutions, J.P. Morgan Treasury Services, Mercury.

Payments for Platforms: Stripe Connect, Adyen MarketPay, PayPal for Marketplaces.

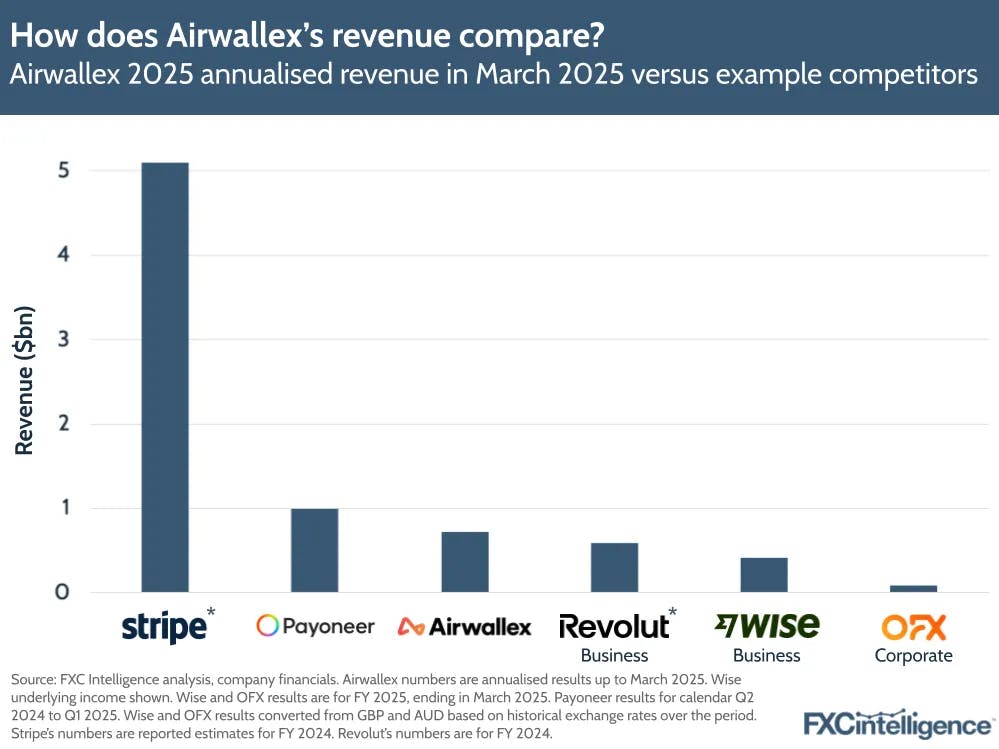

Source: FCX Intel

Direct Competitors

Wise: Wise is a UK-based fintech company specializing in cross-border financial services. Founded in 2011, Wise offers international money transfer services for individuals and businesses, facilitating both B2B and C2C transactions. The company went public in July 2021 via direct listing, being valued at $11 billion and having raised a total of $1.7 billion in funding before that. Wise indicated that it had 15.6 million active customers in the TTM to March 2025, 697K of which are business customers and 14.8 million are personal customers. This reflects a 23% year-over-year growth rate from Q4 FY23. As of October 2025, Wise operates in 160 countries and features 40 currencies on its platform.

Wise reported revenues of ~$1.6 billion between March 2024 to March 2025 and, as of October 2025, had a market cap of $13.4 billion. Like Airwallex, Wise built its own banking network. Both Wise and Airwallex offer cross-border payment solutions, but Wise is more focused on individual and small business customers through its Personal account. Wise Business directly competes with Airwallex’s Business Account product, offering global payments, expense cards, and platform API integrations.

Revolut: Revolut is a global neobank. It was founded in the UK in 2015 and had a post-money valuation of $45 billion after its employees sold $500 million worth of shares to new and existing investors in August 2024 in a round led by Coatue, D1 Capital Partners, and existing investor Tiger Global. As of July 2025, Revolut had raised a total of $1.83 billion. As of November 2024, the company had 50 million total customers, and it operated in 48 different countries as of October 2025. In calendar year 2024, it achieved $4.1 billion in revenue. While Revolut has a broader retail focus than Airwallex, its Revolut for Business service competes directly with Airwallex through features such as expense tracking, multi-currency accounts, and corporate cards.

Payoneer: Payoneer is an American financial services company. Founded in 2005, it specializes in cross-border payments and online money transfers. The company went public in 2021 after a SPAC merger, valued at $3.3 billion. It had raised a total of $570 million before that. As of October 2025, Payoneer had over 5 million users and operated in over 190 countries. In 2024, Payoneer reported annual revenue of $977 million, with a growth rate of 18%. Payoneer launched its cross-border receiving account in 2011 and launched a B2B cross-border payment platform in 2014.

Adjacent Competitors

Stripe: Stripe is a developer-focused financial services company. Founded in 2010, Stripe was valued at $85 billion in February 2025 after employees were enabled to sell shares. As of October 2025, the company had raised a total of $9.4 billion in funding. Its customers include both startups and Fortune 500s, such as Shopify, Instacart, Notion, and Figma.

Stripe’s offerings include payment processing, subscription management, fraud prevention, and developer tools. While the company mainly offers financial infrastructure products, it has expanded into the BaaS space and competes with a few of Airwallex’s products. These include Treasury, Card Issuing, and Payments for Platform. As of October 2025, Airwallex offers multi-currency business accounts, borderless debit cards, and expense management, while Stripe has more of a presence in the point-of-sale payments market.

Adyen: Adyen is a global payments company headquartered in the Netherlands. Founded in 2006, Adyen went public on the Euronext Amsterdam exchange in 2018 and had a market cap of $54.6 billion as of October 2025. Adyen’s customers include companies such as Spotify, Uber, Microsoft, and McDonald’s.

Adyen provides end-to-end payment infrastructure for both online and in-person commerce. Its offerings include payment processing, risk management, point-of-sale terminals, and acquiring licenses across major global markets. While Adyen primarily competes with Airwallex in global acquiring and card payments, its customer base is weighted more heavily toward enterprise retailers and omnichannel merchants. In contrast, Airwallex has deeper penetration in B2B platforms and digital-first businesses, and provides a broader suite of spend management, treasury, and multi-currency business account products.

Plaid: Plaid is a US-based financial technology platform that lets users connect their financial accounts and share data with other applications. It was founded in 2013 and raised $575 million at a post-money valuation of $6.75 billion in April 2025. Prior to this, Plaid raised $425 million in April 2021 at a valuation of $13.4 billion. As of October 2025, Plaid had raised a total of $1.3 billion in funding. The company has over 100 million end-users and works with over 8K fintechs globally, including Venmo, SoFi, Wise, and Betterment. The platform integrates with 12K+ financial institutions as of October 2025. In December 2022, Airwallex partnered with Plaid to offer faster and more secure ACH payments.

Plaid‘s main offering is its API, which connects consumers' bank accounts and financial institutions with various fintech applications, such as budgeting apps, personal finance tools, and investment platforms. While Plaid doesn't offer the same range of services as Airwallex, the two compete in the BaaS and financial infrastructure space. For example, Plaid Link, which allows businesses to connect with users' bank accounts to facilitate payments, competes with Airwallex's payment processing capabilities.

PayPal: PayPal is an online payment platform for individuals and businesses. It was founded in 1998 and IPO’d in 2002 at a valuation of $790 million. Shortly after this, PayPal was acquired by eBay for $1.5 billion in stock, then was spun out and re-listed as an independent company in 2015. As of October 2025, the company had a market capitalization of $73.8 billion.

PayPal offers online payment processing, credit service, POS system, business solutions, and cross-border payments, among other services. PayPal Payments and PayPal Checkout compete with Airwallex's payment processing solutions. Other PayPal for business products competing with Airwallex include card solutions, virtual wallets, and cross-border payment solutions.

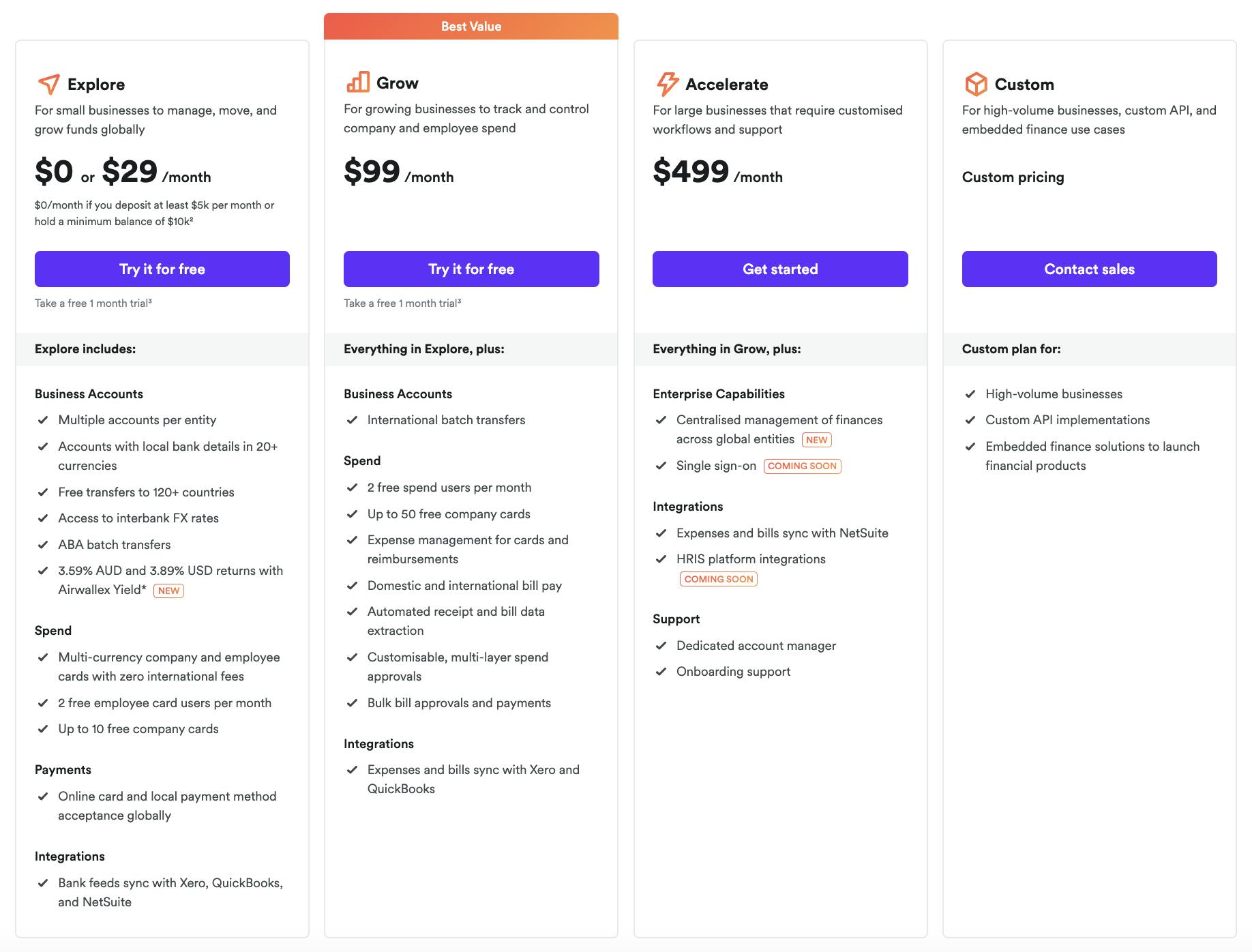

Business Model

Many of Airwallex’s products are free, such as Business Accounts, Company and Employee Cards, and Expense Management. However, the company charges percentage fees, fixed-charge fees, or a combination of both for specific usage of some of its products. As of August 2024, the company was working to streamline its pricing structure by piloting a three-tier SaaS pricing model in Australia that more effectively incentivizes business customers to use several products within a bundle instead of paying for individual products separately. Below is a feature overview of the three plans:

Source: Airwallex

Until the three-tier SaaS pricing model is applied to customers outside select markets, the company’s revenue model by product as of October 2025 is as follows:

Payments:

Domestic Cards (Visa, Mastercard, etc.): 2.80% + $0.30.

International Cards: 4.30% + $0.30.

Local Payment Methods (e.g., Klarna, 160+ other methods): $0.30 + Payment Method Fee.

Transfers & FX:

Transfers: Free (some regions may have additional fees).

SWIFT Transfers: $15-25 USD.

Check Issuance: $1.50 per check.

Direct Debit: Free for account top-up and direct debit payouts.

FX Conversions: 0.5% above interbank rates for major currencies, 1.0% for others.

Bill Pay & Software Integrations:

Free for services like Xero, QuickBooks, and various shopping plugins.

Airwallex is increasingly positioning itself as a full-stack global banking platform, not just a cross-border payout or FX provider. Despite its reputation for foreign exchange, CEO Jack Zhang disclosed that as of July 2025, only 20% of total transactions included an FX component. The company’s core offerings are becoming the primary revenue drivers.

As of July 2025, business accounts were accountable for 45% of total revenue. These accounts allow companies to open and operate local bank accounts globally, manage treasury functions, and execute vendor and payroll payouts in multiple currencies. In the same period, spend management and corporate cards accounted for another 25% of revenue, with more than half of all Airwallex customers adopting them. The remaining 30% comes from merchant acquiring, which includes domestic and international card payments. Additionally, 20% of business account customers use Airwallex’s acquiring product.

Airwallex’s Core API & Embedded Finance services have customized pricing based on transaction volume, multi-product discounts, and country-specific rates. In 2021, 40% of Airwallex’s revenue came from customers transacting while using the company’s Business Accounts, whereas the Core API and Embedded Finance products accounted for 60% of its revenues.

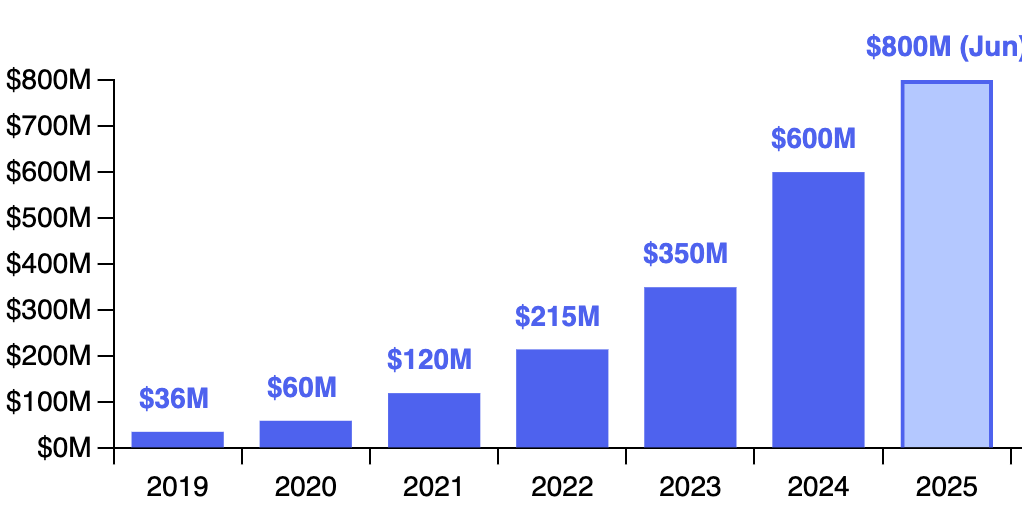

Traction

As of October 2025, Airwallex had over 150K customers, comprised of both SMBs and enterprise customers such as Brex, Navan, SHEIN, Rippling, and BILL. In fiscal year 2024, the company reported an 84% increase in global revenue, alongside a 68% year-over-year rise in transaction volumes. By August 2024, Airwallex processed over $100 billion in annual payments, representing a 73% increase from the previous August and a ~5x increase over the $20 billion transaction volume processed in 2021. Additionally, the company surpassed $500 million in ARR in July 2024, up from $200 million in 2022. In July 2025, CEO Jack Zhang mentioned the company was processing 180 billion global transactions annually, approaching $900 million in ARR, and was expecting to hit $1 billion by the end of 2025.

Source: Sacra

International expansion has been a primary driver of the company’s growth. In the Americas region, revenue grew over 300% year-over-year as of August 2024, supported by its continued expansion into the US, Canada, and Latin America. In the EMEA region, the company reported a 152% increase in revenue and a 125% rise in transaction volumes year-over-year. In the Asia-Pacific region, Airwallex reported a 71% year-over-year increase in revenue and a 53% rise in transaction volumes. To support this global expansion, as of October 2025, Airwallex had over 1.6K employees across 23 total offices spanning each of the previously specified regions.

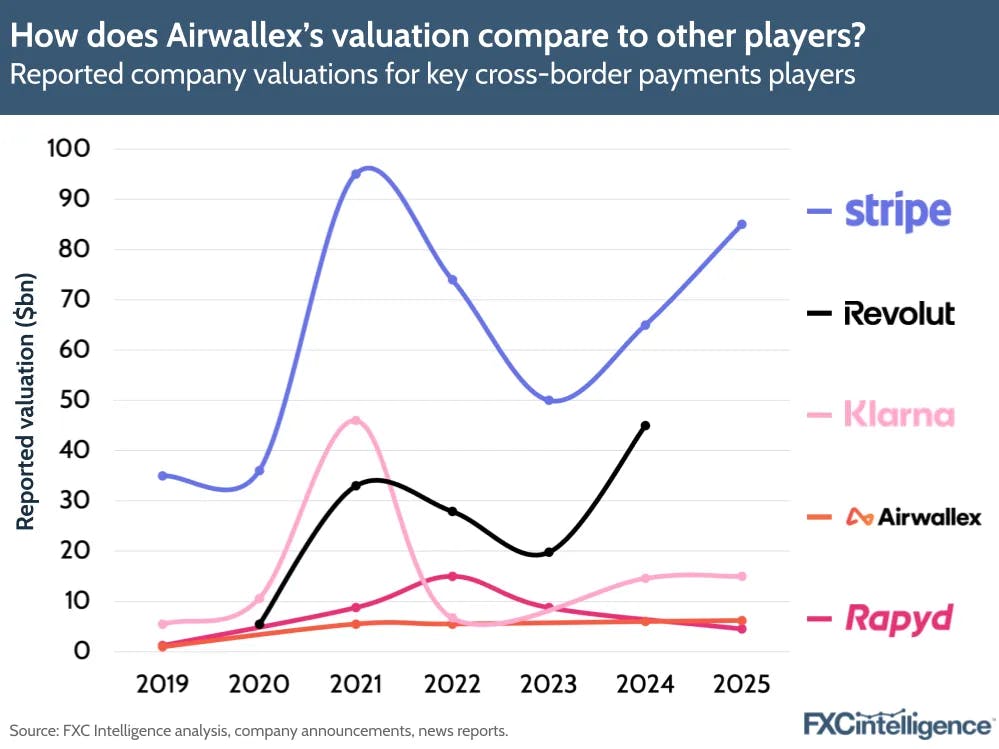

Valuation

As of October 2025, Airwallex had raised a total of $1.2 billion over 14 rounds of funding from investors including Sequoia Capital China, Square Peg Capital, Mastercard, ANZ, Tencent, and Salesforce Ventures. Airwallex’s latest round occurred in May 2025, comprising a $150 million Series F and a $150 million secondary market sale. Prior to this, in October 2022, Airwallex raised a $100 million Series E2 funding round at a $5.5 billion valuation. This round was preceded by a Series E1 round of $100 million in November 2021 and a $200 million Series E round in September 2021.

Airwallex’s valuation reached $6.2 billion in May 2025 following its Series F and secondary sale. While competitors Stripe and Revolut have rebounded after post-2021 dips, Klarna and Rapyd remain well below their 2021 peaks. Airwallex’s trajectory shows steady growth relative to peers, reflecting a more disciplined funding strategy.

Source: FCX Intel

The company received a takeover offer from Stripe in late 2018. The offer was composed of $860 million for Airwallex’s investors, plus $200 million for its founders. The founders rejected the deal, claiming it undervalued the company. Soon after, in March 2019, Airwallex raised a $100 million Series C at a $900 million valuation, led by DST Capital. In January 2024, Founder & CEO Jack Zhang announced that Airwallex planned to “get IPO ready in the next two years”. In August 2024, Zhang indicated the company has remained on the pre-IPO path, stating, “In 2025, we will prepare everything, and we can decide what to do after 2026.”

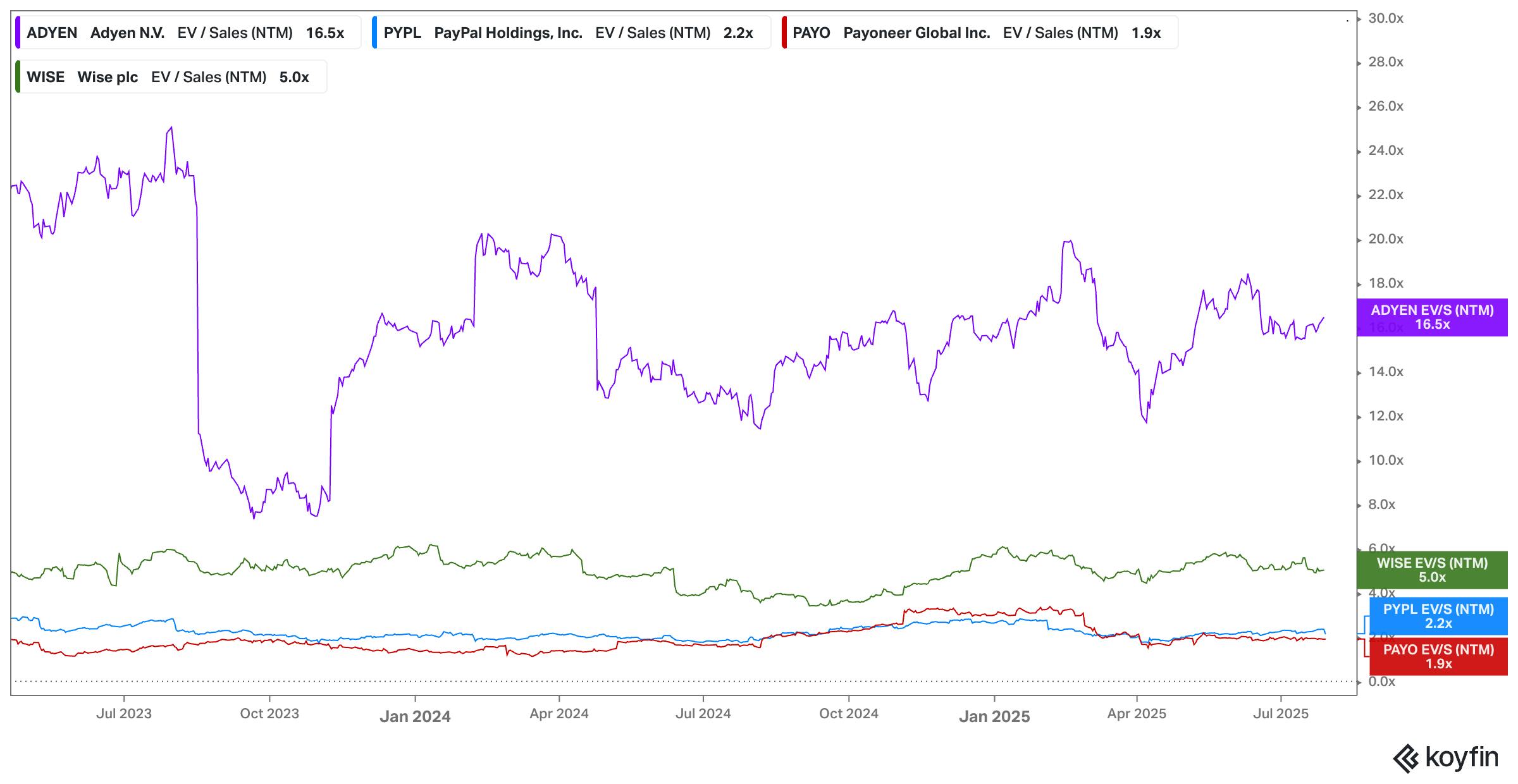

As of the end of June 2025, Airwallex had reached $800 million in annual recurring revenue and closed new funding in May at a $6.2 billion valuation, implying a forward revenue multiple of 7.8x. Over the same period, public comparables traded at notably varied revenue multiples: Adyen at 16.5x, Wise at 5.0x, PayPal at 2.2x, and Payoneer at 1.9x. These comps suggest potential upside for Airwallex in a public market scenario, particularly if it maintains its current pace of growth ahead of a potential 2026 IPO.

Source: Koyfin

Key Opportunities

Continued International Expansion

The total payment value (TPV) of cross-border payments was estimated to grow from $150 trillion in 2017 to $250 trillion by 2027. In March 2025, Airwallex processed just over $130 billion in cross-border transactions annually, a small fraction of this rapidly growing market. The company’s strategic expansion into new markets globally is indicative of this large market opportunity and has been a key driver of its revenue, surpassing $800 million in July 2025.

In the Americas, the company has scaled revenue by over 200% across the region as of July 2025. This follows a 2023 in which its revenue grew by 460% in the Americas. As Executive General Manager Ravi Adusumilli said in August 2024, “We knew from early conversations in the U.S. that we’d found strong product market fit”. The company continues to “see triple-digit revenue growth each quarter” in the region. This growth has been supported by the company securing Money Transmitter Licenses or exemptions in 49 US states. As Adusumilli put it:

“Unlike other markets, where we’re typically regulated by a single federal entity, in the U.S., you have to secure a money transfer license at the state level to operate independently. Each license is a major victory and grants us additional freedom to operate.”

Airwallex has also expanded its operations in Canada, officially entering the market in April 2023. By April 2024, the company launched its Borderless Visa Card, enabling Canadian businesses to make international payments seamlessly in multiple currencies.

In Latin America, Airwallex’s acquisition of MexPago in October 2023 was its first major step toward its expansion into this region. As Airwallex CEO Jack Zhang said at the time, “U.S. people export to Mexico to sell to the consumer there. Because of the supply chain, you can also export out of Mexico to other countries like the United States.” Brazil is an additional expansion target for Airwallex within LATAM, as its digital payments marketing is growing quickly. Adusumilli indicated that the company was in the early stages of obtaining a license to operate in Brazil in September 2024. By January 2025, Airwallex secured its Brazilian license.

The company has expanded to the EMEA region as well, having established its first office in the region in Tel Aviv in May 2023. Sood said, “Setting up local operations in Israel is just the first step in our ambitious plan for expansion across EMEA. Israel is at the forefront of tech innovation and a global hub for high-growth startups.” Additional offices have been opened across the region in Amsterdam, London, Paris, and Abu Dhabi. In July 2024, year-over-year revenue within the region grew by 152% and transaction volumes increased by 125% despite harsh macroeconomic fintech market conditions.

Lastly, the APAC region has seen similar scale. In Australia and New Zealand, revenue has grew 93% YoY in fiscal year 2024. This was driven by the launch of Airwallex Yield, which reportedly offers double the rates of big banks in the Australia and New Zealand region. If the company continues its expansion into new territories, be it via acquisitions or other means, Airwallex can increase its share of the global payments flow, further securing its position in the market.

AI-Powered Financial Suite

Airwallex is positioning itself not just as a financial infrastructure provider, but as a full-stack business operating system. With $300 million in funding secured in May 2025, the company is doubling down on artificial intelligence, building both foundation models and application-layer tools to power autonomous financial operations for global businesses.

CEO Jack Zhang described the company’s long-term ambition as becoming a vertically integrated platform that can “run, operate, and grow” a global business end-to-end. “We need to build an application layer, AI layer, or the ecosystem layer on top of our infrastructure,” he explained, signaling a shift from pure infrastructure to integrated software and intelligence layers. Airwallex is now developing its own large language model that will sit across its suite of business accounts, payments, cards, treasury, and spend management tools. As Zhang put it:

“AI will fundamentally change how companies run their businesses. We’re heading into a future where AI can run the entire finance function. We not only have the financial infrastructure, but we also build the business operating system. Now, we’re injecting an AI co-pilot to allow businesses to automate their business processes and have AI recommend decisions. The customer can interact with Airwallex infrastructure indirectly through either the workflow or through the AI. But either way, I don’t expect the user is going to be interacting with financial infrastructure directly anymore in the next decade.”

If successful, this transition would significantly reduce friction in global operations, enabling companies to automate treasury decisions, optimize cross-border payments, and manage expenses with minimal human input. With over 150K global customers and expanding product attach rates, Airwallex’s move into AI-powered financial management could allow it to claim a larger share of wallet, evolving from a payments provider into a strategic operating partner for companies scaling internationally.

Growth Through Partnerships

Airwallex can increase its customer base and expand into new sectors through partnerships. Given the complexities of multi-currency financial transactions as conducted by, for example, companies in the WealthTech sector, there’s a demand for ready-made payment rails on which to conduct these transactions.

Airwallex has seen the value in this strategy. In February 2024, the company became an official partner of the McLaren Formula 1 racing team. McLaren’s “existing payments infrastructure limits payments to suppliers, such as hotel and event space providers, to a singular currency account based in the UK, resulting in FX charges, slow transfer time and additional SWIFT fees.” Because F1 is a global sporting organization with races in 24 cities across the globe, Airwallex financial technology enables the racing team to “unlock multi-currency payment options”, “allowing the racing icon to hold core currencies and exchange with speed and ease at any point.”

Source: Fintech Magazine

In June 2024, Airwallex and Deel announced the worldwide launch of Deel’s physical VISA spend card that is accessible to contractors in 20 countries. Dan Westgarth, COO of Deel, commented: “Our focus at Deel is to offer contractors the best payments experience possible.” Contractors can now make purchases and payments wherever they are. They gain “immediate access to their earnings, can shop globally, and pay securely.” Additionally, contractors can receive and spend their funds in USD, which was previously challenging for those without a US-based bank.

In July 2024, a separate partnership was announced with GoCardless. Airwallex is leveraging GoCardless Embed via white-label integration designed to connect to GoCardless’ global bank payment network. With this integration, Airwallex can now offer direct debit options to its customers. Justin Leung, Financial Partnerships Manager at Airwallex, commented, “With direct debit continuing to be a trusted and popular way to pay, especially with the rise of the subscription economy, we felt it was the perfect time to strengthen our offering”, and that its collaboration with GoCardless was an ideal way to quickly provide direct debit via a single integration.

Strategic partnerships are an excellent vehicle for Airwallex to expand its offering portfolio, but also reach new consumer segments that were previously untouched by the company.

Ecommerce Embedded Solution

Airwallex is strategically positioned to capitalize on the growing demand for seamless cross-border ecommerce payments with its Payments for Platforms product. This white-label embedded solution is comparable to Stripe Connect and is designed for online businesses such as marketplaces, SaaS platforms, and on-demand service providers, allowing them to embed Airwallex’s financial payments infrastructure directly into their offerings.

Given that 93% of consumers report that seeing products priced in their local currency significantly influences their purchasing decisions, the ability to offer localized pricing at checkout is no longer a differentiator but a necessity.

Source: Airwallex

Moreover, transparency in payment fees is critical to consumer retention. Only 46% of consumers globally are likely to return to an international vendor if they encounter hidden costs such as currency conversion fees.

Further, in a June 2024 study, it was found that embedded finance solutions could contribute to a 4-7% lift in revenue, a 5-12% increase in conversion rates, and a 15-30% increase in average basket values. This makes Airwallex’s solution particularly valuable for retailers seeking enhanced outcomes and all types of ecommerce players looking to build long-term customer relationships.

With the total value of cross-border payments projected to reach $290.2 trillion by 2030, up from $190.1 trillion in 2023, the market opportunity for online businesses to embed a reliable and cost-effective international payments infrastructure is immense.

Key Risks

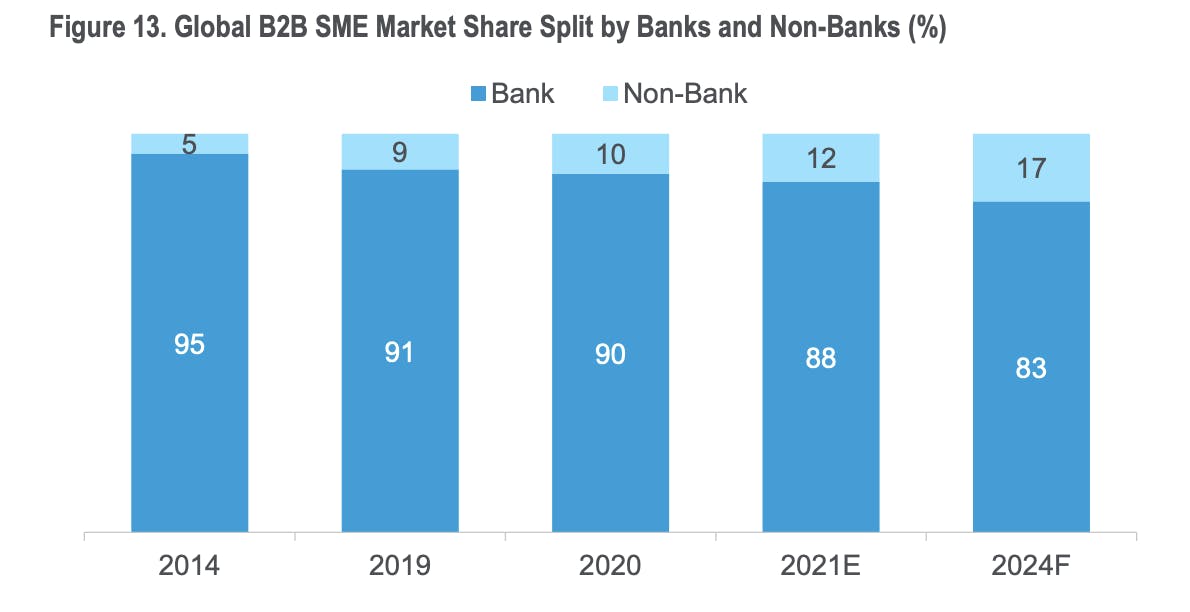

Legacy Banks

Despite the rise of fintech companies, traditional banks still processed 83% of SME-initiated cross-border transaction flow in September 2024, but that’s down from 88% in 2023. The continued decline indicates that while fintech companies are making inroads, traditional banks are expected to retain a substantial share of this market. This suggests that legacy banks remain strong competitors in the cross-border payments sector, posing a challenge to fintech companies like Airwallex.

Source: Citi

Moreover, legacy banks are actively modernizing to compete with fintech alternatives. For example, several banks have launched digital banking subsidiaries. Examples of these include HSBC’s First Direct, Scotia Bank’s Tangerine, and Cambridge Savings Bank’s Ivy Bank. By creating these digital-first platforms, traditional banks are not only retaining their existing customer base but also potentially attracting new customers who might otherwise turn to fintech alternatives. Similarly, a September 2023 survey reported that 50% of banks saw the need to update their front ends to improve client experience, and over 60% planned to update their core infrastructure to compete with new companies in the cross-border payments market.

Fraud and Cybercrime Potential

As a digital financial platform, Airwallex is vulnerable to cyber attacks such as hacking and phishing. For example, global payments processor Payoneer had several of its customers hacked through phishing links in January 2024. In early 2022, neobank Revolut had approximately $23 million stolen by hackers exploiting its Payment System. Of the $23 million stolen, Revolut was only able to recover $3 million.

Fraud is also a constant risk for all digital financial platforms; Airwallex itself had $18 million frozen by the Hong Kong police in a fraud probe in 2019. In 2022, PayPal admitted to having found 4.5 million illegitimate accounts on its platform. Speaking on this issue, former general manager at neobank N26 Georg Hauer said:

“[Challenger bank’s] anti-money laundering (AML) and financial crime detection systems are the same as traditional banks'… These engines are so inefficient that only 1% of suspicious activity is stopped. Overall, 95% of those [accounts or transactions] flagged are false positives.”

While Airwallex might not necessarily characterize itself as a challenger bank, it operates in the same space and is liable to the same risks, especially if its anti-money laundering (AML) and financial crime detection systems are not rigorously maintained and continuously updated. On this, Airwallex has made progress, however. The company announced in December 2023 that it had begun implementing generative AI to enhance the speed and efficiency of its know-your-client (KYC) system. The initiative reduced the rate of ‘false positives’ by around 50% on average.

Fraud is also a major concern when it comes to cross-border payments. A 2022 Mastercard survey highlighted that 45% of SMEs feared they might become victims of fraud while conducting international transactions. This fear is understandable; according to a 2021 report, cybercriminal organizations particularly target cross-border transactions due to their complex and obscure nature, which lacks uniformity and standardization.

Summary

Airwallex is building the financial infrastructure and operating system for global businesses. Originally known for cross-border payments and FX, the company has expanded into a full-stack suite that includes global business accounts, corporate cards, treasury, embedded finance, and expense management. The company has expanded its geographical reach through a series of acquisitions to obtain new banking licenses to operate in new geographies. It has also complemented its core offering of global business banking with Core API and Embedded Finance products, including banking-as-a-service.

As of July 2025, Airwallex serves over 150K customers, including Brex, Rippling, Deel, TikTok, and Canva, and has reached $800 million in ARR, processing over $130 billion in transactions annually. While historically concentrated in APAC, Airwallex’s fastest-growing markets are now North America and Europe, which are scaling at over 200% year-over-year and are expected to surpass 40% of revenue by early 2026. Leadership continues to signal a public market path, with IPO readiness targeted for 2026.