Thesis

By 2032, the cross-border ecommerce market is expected to reach a market size of $1.5 trillion globally, propelled by an increase in online shopping, improvement in logistics and shipping methods, and continued adoption of digital payment methods. With 57% of online shoppers making international purchases when their needs aren’t met regionally, businesses aim to provide local payment methods to their users. Despite the fear of failed or late cross-border payments, 61% of small and medium enterprises increased sourcing from suppliers internationally in 2023. As of 2023, 75% of SMEs globally plan on conducting more business internationally in the future.

Integrating financial services into non-financial offerings, or embedded finance, is a way for these enterprises to streamline the payments and payout process for their customers as well as suppliers globally. Embedded finance includes services like direct payment processing, digital wallets, and currency exchange features to simplify cross-border transactions. The embedded finance market is projected to grow at a CAGR of 29% between 2023-2032 to reach $730.5 billion in size. Meanwhile, the B2B2X market (B2B to any end-user – customers, retailers, partners, or suppliers) is expected to reach $440 billion in annual revenues by 2030, bolstered by growth in embedded finance. Businesses are looking for a financial services provider that can offer secure, safe, and transparent payment solutions, resembling a super app.

Rapyd is a fintech company that enables businesses to collect payments in local currencies across the globe, conduct payouts, and maintain digital wallets globally. Operating as a fintech-as-a-service (FaaS) platform, it provides embedded finance capabilities through APIs to businesses like ecommerce websites, neobanks, and payroll companies, operating in 100+ jurisdictions. Along with integrated finance capabilities, it also offers card issuing, fraud protection, and identity management services. By providing full-stack financial services, Rapyd’s aim is to become the “AWS of fintech”.

Founding Story

Rapyd was founded in 2016 by Arik Shtilman (CEO), Arkady Karpman (Vice President), and Omer Priel (GM). The company was originally founded as a digital wallet called CashDash in 2015, aimed to serve as a PayPal competitor, with the goal of providing consumers ways to manage digital money, withdraw cash from any ATM without having a bank account, and make payments without fees.

The founders did not have any prior experience in the fintech or payments space but observed a slowdown in the global commerce industry due to a lack of unified payments infrastructure. Shtilman had focused on cloud computing early in his career, and after spending three years in the military, founded and bootstrapped a communications integrator company, ITNAVIGATOR in 2004. It was during his time here that he met Karpman and Priel. With a background in computer engineering and an MBA, Karpman joined ITNAVIGATOR in 2004 as a software manager. Priel joined ITNAVIGATOR IN 2010 as the Head of Presale Department, prior to which he was working as a presale engineer at a workforce management solutions company. The company generated “multimillion-dollars in revenue”, before being acquired in 2013 by a New Jersey-based cloud communications company Avaya.

Shtilman, Karpman, and Priel continued working at Avaya for two more years. In 2015, a trip to the Czech Republic drew the attention of the group to the FX fees charged to consumers. This propelled the original idea to create a consumer e-wallet built on alternative payment rails, based in the UK. The company started as a B2C product, but there were multiple layers to cut through: regulatory, acquiring, business, and partnership. This led the company to pivot to B2B, and create its own payment infrastructure for cross-border payments as an alternative to SWIFT, allowing businesses to collect payments, disburse payouts, maintain custodian wallets, and issue cards, all under the fintech-as-a-service (FaaS) umbrella.

Shtilman describes that this direction Rapyd took was like building “the AWS for fintech”, with the platform being targeted towards businesses that wanted to expand overseas but not invest in financial infrastructure from the ground up. Rapyd has capitalized on acquisition opportunities, having made three acquisitions as of May 2023. As of December 2023, the company has 850 employees across nine countries.

Product

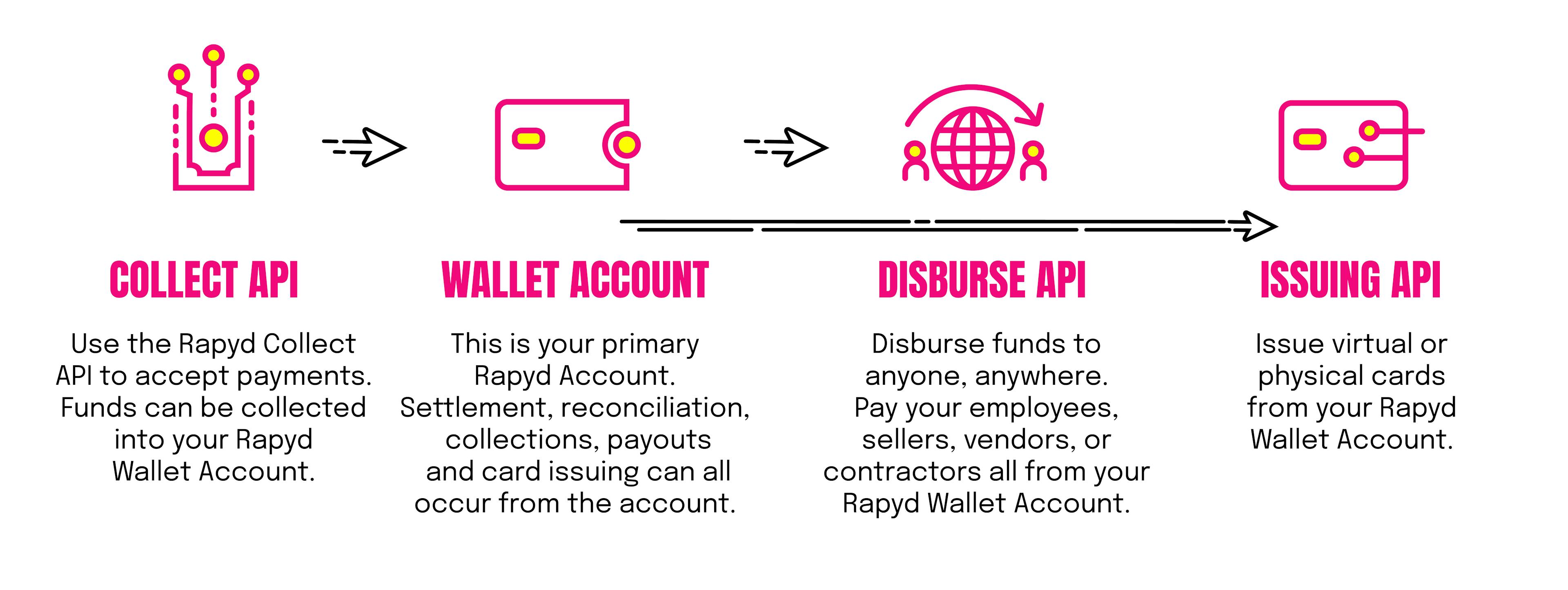

Rapyd provides an API-based platform that also offers card-acquiring, multi-currency treasury, cross-border payments, and embedded fintech solutions. Any client first has to make an account on the Rapyd Client Portal, where they can access the Collect, Disburse, Wallet, and Issuing products.

Source: Rapyd Docs

Rapyd Collect

Rapyd Collect is a global payment acceptance platform, that lets businesses offer locally-preferred methods like eWallets, local and international cards, bank transfers, and cash, payment methods to their consumers. Rapyd can accept payments in 100+ countries and offers a service to collect cash in 500K locations.

Global Payments API: Rapyd offers a REST API solution for businesses to embed online payment processing functionality directly into their applications. With features like next-day settlement, compliance, fraud protection, ability to split payments or set up recurring payments, Rapyd offers plugins, payment links, or customizable mobile-ready checkout variants.

Hosted Checkout: Customers can use a toolkit integration or a hosted page that lets businesses embed payment acceptance directly into their checkout page. Rapyd supports 900+ payment methods and more than 65 currencies.

Virtual Accounts: Each Rapyd wallet can have multiple virtual accounts, and these are helpful in identifying incoming payments and grouping them according to certain criteria. These also allow businesses to collect cross-border payments from their customers, and disburse funds repeatedly over time (for example to a beneficiary or for payroll)

Payment Links: Rapyd allows their customer businesses to accept payments in SMS, WhatsApp, invoices, and emails – all while re-using the same link.

Virtual Terminals: A Virtual Terminal solution allows businesses to convert their smartphone, tablet, or computer into a card machine and accept payments from their customers. This is a secure and compliant payment terminal hostel on a web page, where businesses get the same utility as a physical credit card terminal or POS system without an additional physical device.

Rapyd Disburse

Rapyd Disburse is a global payout platform that allows businesses to set up recurring or non-recurring payments in 190+ countries using bank transfers, eWallets, cards, and cash. Payouts are conducted between Rapyd Wallets and can be set up for one-to-one, B2B, or B2C transactions. This solution lets business pay their contractors, suppliers, or workers by either integrating Rapyd API into their existing treasury processes or through the Rapyd Client Portal. Businesses can start using Rapyd Disburse after setting up their Client accounts and completing a compliance questionnaire, with no limit on the amount of money that can be sent.

Rapyd Issuing

Rapyd enables its users to issue physical and virtual corporate cards funded by their Rapyd Wallets. Businesses can move funds to their connected wallet by transferring from another wallet or by transferring money to the virtual account connected to their wallet. Rapyd lets its clients issue cards using their APIs or by contacting sales representatives.

Rapyd Wallet

Rapyd Wallet is a ledger system, similar to a bank account, which is used for all other services like Collect, Disburse, and Issuing. Rapyd’s clients can accept payments, hold funds, and conduct transfers in more than 70 currencies. These clients can also create sub-wallets, allowing their own users to accept payments from the end customer, creating a ‘hierarchy’ of wallets.

Source: Rapyd Docs

Clients can use the Rapyd Wallet API to customize their accounts and build a white-label experience.

Plugins & Integrations

Rapyd lets its clients incorporate local payment methods on their checkout in 68 countries, along with credit cards, debit cards, eWallets, bank transfers, and cash. Payment plugins offered by Rapyd are available on multiple eCommerce websites, including WooCommerce, Wix, and Shopify. A seller using any of these eCommerce websites for their business can use the Rapyd plugin to start accepting payments by giving their customers a preferred checkout option.

Rapyd Ventures

In June 2021, the company announced the launch of the fintech venture arm of the company, Rapyd Ventures, investing in startups in early and growth stages, and working with them between their Seed and Series B rounds of funding. Rapyd Ventures focuses on two types of projects, including capability providers building core infrastructure in markets with limited financial services, and end-user platforms. As of December 2023, it has made 13 investments and led 6, including a $750K Venture Round for a Singapore-based HR platform Skuad, in February 2023. The venture arm has actively invested in startups based in Europe, the U.S., Southeast Asia, and East Asia.

Market

Customer

Rapyd’s target market includes companies in industries like ecommerce, logistics and distributors, financial services, online learning, and payroll. In ecommerce, the use case for Rapyd is both as a payment gateway and then as a payment facilitator. With Rapyd’s August 2023 acquisition of the Global Payments Organization (GPO) division of PayU, the payments group of Prosus, Rapyd is expanding operations globally and focusing on emerging markets. As of December 2023, Rapyd’s customers include enterprise-level customers like Meta, Netflix, Adidas, Rappi, and Uber.

Market Size

Rapyd operates in the FaaS and cross-border transaction domains of fintech. Within the global financial services market, fintech revenues are projected to grow from $245 billion to $1.5 trillion by 2030.

The FaaS market is expected to grow $1.4 trillion by 2032, compared to $268.4 billion in 2022 with a CAGR of 18.5% in a decade. This market includes fintech services offered through APIs that allow customers to integrate and offer financial services to their own users. As of 2022, 40% of large enterprises were using FaaS platforms to meet their real-time payments demand. Given that by 2026, 24% of retail purchases are expected to be online, compared to 21% in 2023, consumers will continue to demand integrated payment options. With an increase in ecommerce globally, payment processing fees are expected to increase from $82 billion to $138 billion between 2018 and 2024.

The cross-border payments flow is expected to reach $250 trillion by 2027, up $100 trillion from a decade prior in 2017. Payment ecosystems are usually molded to certain geographies, making it difficult for traditional infrastructure to expand globally and pass regulations, which creates an opportunity for fintech companies with their own infrastructure to offer cheaper, faster solutions.

The B2B2X market is growing at a 25% CAGR to reach $440 billion in annual revenue by 2030. With almost 400 million SMEs worldwide in 2023, Rapyd is positioned to capitalize on this growth, with its embedded finance offering.

By 2030, Asia-Pacific is on course to pass the US to become the top fintech market, growing 8.5x from 2021 to 2030 to reach $600 billion. Latin America and Africa are projected to be the fastest-growing regions, growing 13x and 12.5x respectively, between 2021 to 2030. This will be, in part, driven by an increase of institutional investors in LATAM, quicker adoption of technology in African markets, and SMEs in APAC looking for operational efficiency for facilitating cross-border payments.

Competition

As a company operating across fintech-as-a-service in several categories, Rapyd’s products and services can be classified into different categories: payment processing, payout solutions, card services, and cross-border payments. Some of its competitors across various parts of its business, followed by a more in-depth look into the main competitors:

Payment processing: Adyen, Stripe, Checkout.com

Payout solutions: Payoneer, Wise

Direct competitors

Adyen: Adyen is a Netherlands-based fintech company, founded in 2006, that offers payment processing, global payment acceptance, API integration, and point-of-sale solutions. The company went public in June 2018 via initial public offering (IPO), being valued at $8.3 billion, having raised a total of $1.1 billion in funding prior to that. With customers like Superdry, Linkedin, Spotify, and Etsy, the company reported $845 billion (€767.5 billion) in processed volume in 2022. In August 2023, the company reported revenue of $804.3 million for the first half of the year and an EBITDA of $348 million. As of February 2024, Adyen had a market cap of €46 billion. Adyen and Rapyd both operate in the global payment processing space, and as an incumbent Adyen’s main challenge is lower rates offered by the competition. Adyen is better known for its payment gateway offering, while Rapyd provides other adjacent services like disbursements as well.

Stripe: Founded in 2010 in San Francisco by brothers Patrick and John Collison, Stripe is a developer-oriented payments company, that lets businesses accept credit or debit card payments, send payouts, and automate operational financial processes. In March 2023, the company raised a Series I funding round of $6.5 billion, with a total of $8.7 billion raised, the company was valued at $50 billion as part of that round. As of December 2023, Stripe was available in 46 countries and has notable customers like Shopify, Google, Instacart, Notion, and Figma. Next only to Paypal, Stripe holds ~21% market share in the global online payment processing technologies. In 2023, Stripe acquired Okay, a low-code analytics software that helps build performance dashboards, signaling a focus on increasing in-house productivity for engineers. Stripe is an investor in Rapyd, having led the $40 million Series B round in 2019 along with General Catalyst. Stripe’s primary focus has been on developers, but with Stripe Issuing it also competes with Rapyd’s card-issuing product.

Checkout.com: Checkout.com is a global payment service provider that allows merchants to accept digital payments by offering payment processing, fraud detection, authentication, card issuing, and payment routing solutions. It was founded in 2012 in London and raised a $1 billion Series D in January 2022 at a valuation of $40 billion. In June 2023, the company reduced the internal tax value of its shares, leading to a new internal valuation of $9.3 billion, representing a 77% drop from its earlier valuation. Checkout.com has raised $1.8 billion in total funding as of February 2024, and earned revenue of $259.6 million in 2021 per its last reported revenue filing. With a focus on medium-to-large clients, Checkout.com serves customers like Shein, THG, Patreon, and Sainsbury. Both Rapyd and Checkout.com offer similar solutions like payment processing, payouts, and card issuing solutions, but Rapyd focuses on emerging markets. Checkout.com also has a bigger presence in markets like EMEA and APAC and wants to expand its reach in the US. As of August 2023, Rapyd’s growth strategy is more focused on Central Europe, Eastern Europe, and Latin America.

Adjacent competitors

Airwallex: Airwallex is a global payments and financial platform company, specializing in cross-border disbursement and collections. Founded in 2015, the company was valued at $5.5 billion in October 2022 and has raised $902 million in total funding amount as of February 2024. The company raised a $100 million Series E-2 extension in October 2022. Airwallex’s Singapore division reported a 13x growth in its YoY revenue as of November 2023. The company also recorded an annual recurring revenue of more than $200 million in September 2022. With customers from SMBs to high-growth technology companies, Airwallex serves Navan, Rippling, Brex, and Papaya Global. Both Airwallex and Rapyd offer cross-border payment solutions and API integrations, and are looking to expand into the same market – LATAM – with Rapyd’s acquisition of PayU and Airwallex’s acquisition of MexPago. Like Rapyd, Airwallex has built its own in-house payment rails for cross-border payments, as an alternative to SWIFT.

Railsr (previously Railsbank): Railsr is an embedded finance startup, founded in 2016 in London. The company offers embedded wallet, virtual and physical card, and loyalty card solutions to its customers. In March 2023, under bankruptcy concerns, the company got acquired by a shareholder consortium. The company, operating under D Squared Capital, raised a $24 million venture round in October 2023. The valuation of the company declined from $1 billion in 2021 to $250 million in October 2022 after raising a $46 million Series C. As of October 2022, the company has 330 customers using Rails APIs for their card and banking solutions. While Railsr and Rapyd both provide card issuing and API integration services, Rapyd has a greater focus on embedded finance solutions and payment processing solutions.

Business Model

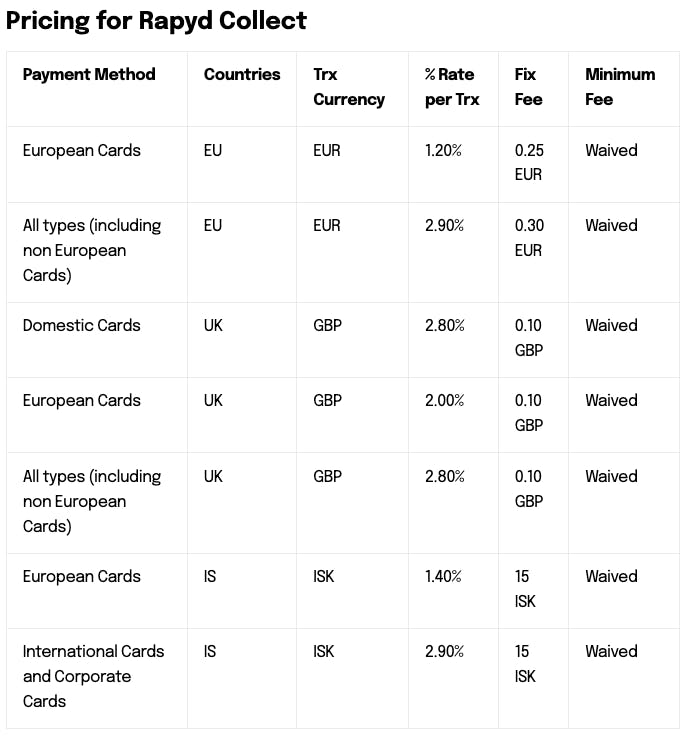

Like its competitors, Rapyd’s primary revenue is driven by its Rapyd Collect product, charging a percentage on each transaction and a foreign exchange fee. The fee charged is dependent on where the client’s business is domiciled and the payment method being used by the end-user on the platform.

Source: Rapyd Services Agreement

For each unsuccessfully defended and reversed chargeback for payment method a chargeback reversal fee of $15 is applied, and for Refunds by means of a bank transfer a Refund fee of $25 is applied.

To use the Rapyd Disburse service through which businesses can pay their contractors, suppliers, or workers, the customers need to complete a compliance questionnaire, perform at least 500 monthly payouts, and pay a minimum monthly fee of $5K.

Rapyd Business Account is a new account type available in Hong Kong and UK as of February 2024 which costs $99 monthly, and supports payouts into 100+ countries.

Traction

Rapyd recorded $50 million in revenue in the first three months of 2022, and after the acquisition of PayU, it recorded a combined 2023 revenue of $1 billion, with a YoY growth rate of 100%.

As of August 2023, Rapyd has more than 250K merchant clients across 41 regulated countries. 75% of Rapyd’s revenue is driven by enterprise level customers, including Adidas, Google, Rappi, Uber, and Netflix. In August 2023, Shtilman said Rapyd would achieve $2 billion in revenue and $400 million EBITDA by 2026. The company also expects $70 billion in processing flows in 2024, up to 60% of which is expected to be cross-border collections or disbursements.

Source: FXCIntelligence

In August 2023, Rapyd acquired PayU’s Global Payments Organization for $610 million. PayU is the payments group of Prosus, a technology investment company that focuses on emerging markets, and offers a global payment platform including payment processing, security, and routing solutions. Barring India, Turkey, and Southeast Asia, Rapyd has acquired PayU’s GPO operations globally, allowing it to accept local card-based payments and enterprise customers. This acquisition allows Rapyd to grow non-organically in markets where it doesn’t have a strong presence, such as Eastern Europe, Central Europe, Colombia, and Africa. At the time of the acquisition, Shtilman indicated that Rapyd is looking to IPO by 2026.

In May 2023, Rapyd partnered with General Catalyst and an Africa-based entertainment company MultiChoice Group to launch Moment, an integrated payments platform for African businesses. In the same month, Rapyd also partnered with Belvo, an open finance API platform, to expand into the LATAM market.

Valuation

In July 2023, Rapyd was valued at $8.7 billion, falling from its $15 billion valuation after its last secondary market round in March 2022. Prior to this round, Rapyd raised a $300 million Series E at an $8.7 billion valuation in August 2021, just seven months after a $300 million Series D at a $2.5 billion valuation in January 2021.

As of December 2023, the company has raised more than $806 million. Target Global led the Series E, and other repeat investors including General Catalyst, Tal Capital, Coatue, Avid Ventures, and Spark Capital. Another notable past investor was Stripe, which invested in a $40 million Series B along with General Catalyst in 2019.

Key Opportunities

Global Expansion Through Consolidation

In 2023, global fintech funding reached $10.5 billion compared to $26.8 billion in 2022. Despite a reduction in deal activity, more than half of over $500 million in M&A occurred in the second half of the year. As of May 2023, business model scaling was a challenge facing 59% of fintech CEOs over the next year.

Shtilman notes that the biggest opportunities in the market are in consolidation, mergers, and acquisitions. Rapyd made its biggest acquisition of PayU’s GPO in 2023, increasing the number of regulated countries it is operating to 41, and adding to its roster of 1.2K local payment methods. With Africa, APAC (excluding China), LATAM, and the Middle East projected to account for 29% of fintech revenues by 2028, Rapyd is positioning itself to take advantage through the acquisition of local players in these geographies.

Product Expansion

For 25% of fintech CEOs, product innovation is a top priority in 2024. Fintechs with single product lines are looking to expand into additional products and services, supporting the B2B2X and B2B enterprises in the US. Lending is projected to be the second largest fintech segment by revenue in 2030, reaching $400 billion. SMEs globally represent an underserved segment, with $5 trillion in unmet financial credit needs, representing 1.3 times the current level of SME lending.

In early 2024, Rapyd is set to launch a working capital lending product for its merchant clients. Operating as a marketplace, it will allow lenders to access Rapyd’s merchant database to provide working capital. The company will take a share of the revenue pie generated by the borrower merchant.

Key Risks

Slowdown of Investment in Fintech

Since the fourth quarter of 2022, the broader market correction has triggered a slowdown in investment activity in the fintech space. The effects continued into 2023, with the third quarter of 2023 seeing only $6 billion of venture capital investment in fintech companies, down by 36% YoY. Growth stage investments saw the biggest compression in funding compared to 2022, decreasing by 87% to $577 million in 2023.

In addition, competition from larger technology platforms could further stem interest in the category. Large tech companies have been integrating financial services into offerings, and can leverage strong financial foundations to deliver 'super-apps'.

Rapyd is preparing for an IPO in 2025, which among other things will be dependent upon “investor interest”. With the slowdown in fintech investment, expansion through acquisitions could be more appealing as other platforms struggle to access capital. However, this could also impact Rapyd’s ability to access that same capital.

Regulatory Compliance

For 41% of SMEs globally, being a victim of fraud is a major concern when choosing a cross-border payments solution. To this end, countries have introduced stricter regulatory guidelines around reporting and tax, among others, to combat cybersecurity and fraud associated with cross-border transactions. However, inconsistent regulations in different countries make the process more complex, especially in a B2B2X model.

To facilitate global cross-border transactions, fintech companies are expected to maintain strong anti-money laundering programs and follow compliance guidelines for every region they operate in. As of May 2023, implementing regulatory/compliance processes in the next 12-18 months is the top priority for 17% of fintech CEOs globally. Rapyd and PayU GPO combined are projected to have $120 billion in transaction processing volume by 2024, 60% of which will be driven by cross-border payments. By operating offices in different countries and teaming with local partners, Rapyd is navigating a myriad of complex regional regulations that could cause operational problems for the company.

Summary

Rapyd is a ‘fintech-as-a-service’ company, providing an API offering for payment collections, disbursements, storage, and card issuing. The company provides these products with foreign exchange capability, making it a cross-border transaction solution. It is looking to expand in geographies like Latin America, Central and Eastern Europe, and Africa through acquisitions. As of December 2023, Rapyd has raised $770 million, but saw its valuation fall from $15 billion in March 2022 to $8.7 billion in July 2023, amidst an industry-wide valuation dip. The company can capitalize on its wide geographic reach after the acquisition of PayU’s GPO, which has brought multiple enterprise clients in its roster. By offering both collection and disbursements in multiple jurisdictions, Rapyd has positioned itself as a unified service provider for clients needing multiple capabilities.