Thesis

The first online transaction on the internet took place in August 1994, when Dan Kohn sold a CD of Sting’s “Ten Summoner’s Tales” for $12.48 to his friend via his website. In order to make this purchase, Dan’s friend used data encryption software to securely send his credit card number across the internet. 27 years later, the process of purchasing a CD via a website has never been easier. The core driver behind this improvement in online transactions has been the evolution of the digital payment stack. This evolution, led by companies like Stripe and PayPal, has resulted in a $6.5 trillion online transaction industry with billions of dollars being moved around the world each day. Yet, the online transaction market is still in its early innings, and while companies have disrupted the acquiring segment of the payment stack, the issuing segment remains untapped.

To understand why, it is necessary to unbundle the anatomy and evolution of the payment stack. Unlike when Dan Kohn sold a CD in 1994, nowadays, when a transaction occurs, customers and merchants see instant changes in their bank accounts. To get to this stage, a series of innovations have occurred in the acquiring portion of the payments stack, such as companies like Stripe making it easy for any merchant to process an online payment.

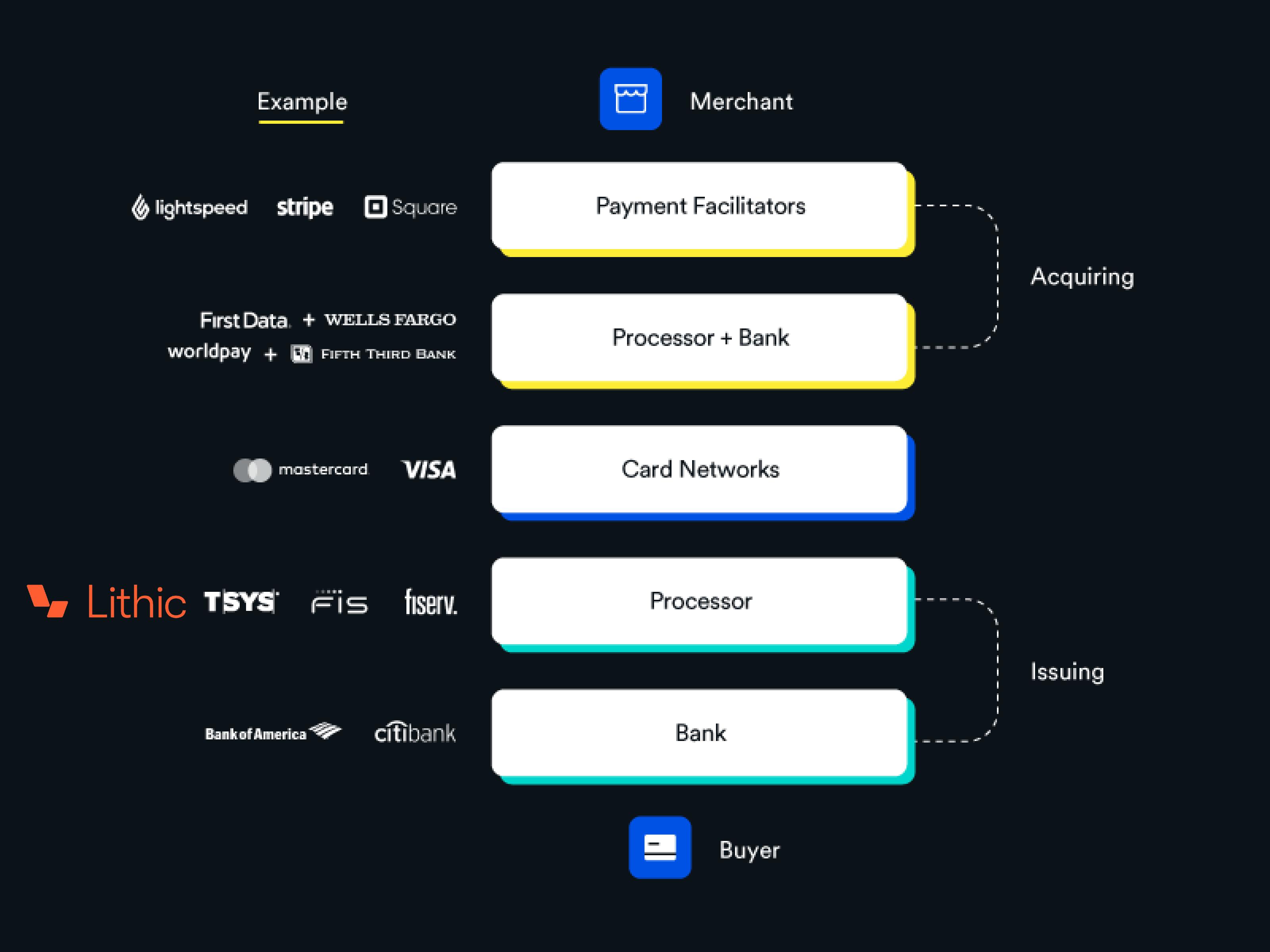

In its simplest form, the payment stack is divided into six core layers. All of these layers operate around a card network (such as Visa or MasterCard), which acts as the core connector between customers and merchants. They can be thought of as follows:

Payment Facilitator: An organization that processes payments on behalf of a merchant. For example, merchants can use Stripe to process their payments.

Acquiring Processor: Once a transaction occurs, the acquiring processor sends a message to check whether the customer’s transaction should be approved. Payment facilitators like Stripe can act as the acquiring processor, but there also exist specific acquiring processors like First Data.

Acquiring Bank: The acquiring bank is the provider of the bank account where a merchant’s money is stored. An example is Wells Fargo.

Card Network: Card network infrastructure facilitates the flow of payments between the merchant and the customer. The two largest are Visa and Mastercard. Essentially, the acquiring processor communicates with the issuing processor via the card network.

Issuing Processor: The issuing processor is asked by the acquiring processor to approve or deny a transaction on behalf of a customer. To do so, the issuing processor communicates with the customer’s bank.

Issuing Bank: The issuing bank houses the bank account of the customer. An example is Bank of America.

Source: Finix, Contrary Research

To understand how each component of the payment stack interacts, we can consider a simplified example of buying lunch at a taqueria that uses Stripe to process payments.

Once a customer taps their card to purchase lunch, Stripe (which acts as the taqueria’s payment facilitator in this example) sends a message to the acquiring processor to charge their card.

To confirm that this transaction can be authorized, the acquiring processor sends a message (via a card network such as Visa) to the issuing processor to analyze the customer’s bank funds.

The issuing processor then communicates with the customer’s issuing bank (the bank that issued the customer’s debit card) to confirm whether they have enough money in their bank account. If they do, the issuing processor authorizes the transaction.

In order for the taqueria to be paid, the issuing bank (which is the customer’s bank provider) transfers the funds to the acquiring bank (which is the merchant’s bank provider). The acquiring bank then deposits the money into the merchant’s bank account and completes the transaction lifecycle.

The majority of innovation in fintech has occurred in the acquiring portion of this payment stack –specifically, in the payment facilitation segment. For example, payment facilitation companies like Stripe, Paypal, Square, and Lightspeed have a combined market value of over $500 billion. In other words, these companies have powered the growth of the internet and enabled merchants to accept and process payments. Yet, the issuing portion of the payment stack has received significantly less attention and has “lagged the card acquiring side by five to seven years”.

The reason why is that large issuing banks have historically owned the customer relationship, thus receiving the majority of interchange value (i.e. the transaction fees that merchants pay). Customers normally transact with a debit card or credit card from these large banks, such as Chase. But the rise of embedded financial products has changed this.

Today, companies are able to offer financial products to customers, such as branded reward debit cards. This means that the cards being used by customers can now also be issued by fintech companies, marketplaces, vertical SaaS companies, main-street brands, and other non-banks in partnership with smaller regional and community-sponsored banks. Therefore, instead of just the country’s largest banks eating all of the interchange economics generated by debit and credit card spending, new players including merchants themselves are beginning to take more control over the customer relationships.

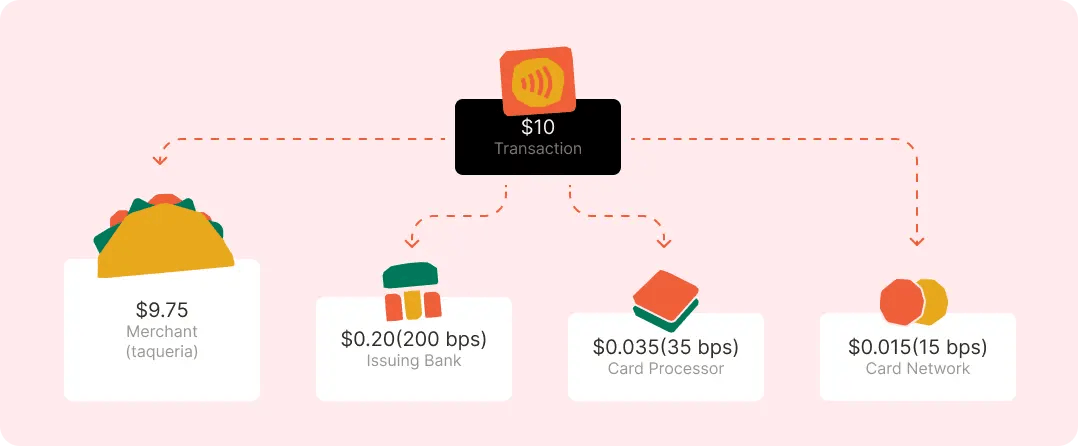

To explain why owning the customer relationship is so valuable for a company, we can again consider the example of a taqueria that sells $10 tacos. Of the $10 a customer pays, $9.75 goes to the taqueria, $0.20 to the traditional issuing bank, $0.035 to the issuing and acquirer processors, and $0.015 to the card network. While losing $0.20 to an issuing bank doesn’t appear to be a significant loss for the taqueria, the costs add up significantly over time. For example, it is estimated that Target’s net profit would increase by 65% if interchange fees were eliminated.

Source: Lithic

On the other hand, if the taqueria could launch its own card program for customers, it could own the customer relationship and not lose out on interchange revenue. This is because the card being used by the customer would now be the taqueria’s own debit card, reducing the leakage to the issuing banks of the various cards that the taqueria’s customers happen to use.

In this new scenario, the issuer bank’s primary role would be to provide the Bank Identification Number that is required to transact (any issuer who wants to launch a card program needs a BIN which must be sponsored by a chartered bank). As a result, regional and community banks are increasingly adopting the sponsor banking model to grow their fee-based revenues while leaving the customer-facing relationship management work to fintech companies and brands.

This means that the $0.20 interchange fee that large, legacy issuing banks previously took can instead be split between the taqueria and issuer processor, with a smaller portion going to the sponsor bank. Further, by implementing features such as reward points, companies can also benefit from indirect financial benefits like building loyalty among their customer base. Overall, the new model, powered by the rise of embedded financial products, has created a new payment stack with the client (e.g. the taqueria from the example) appearing in the issuing segment as well.

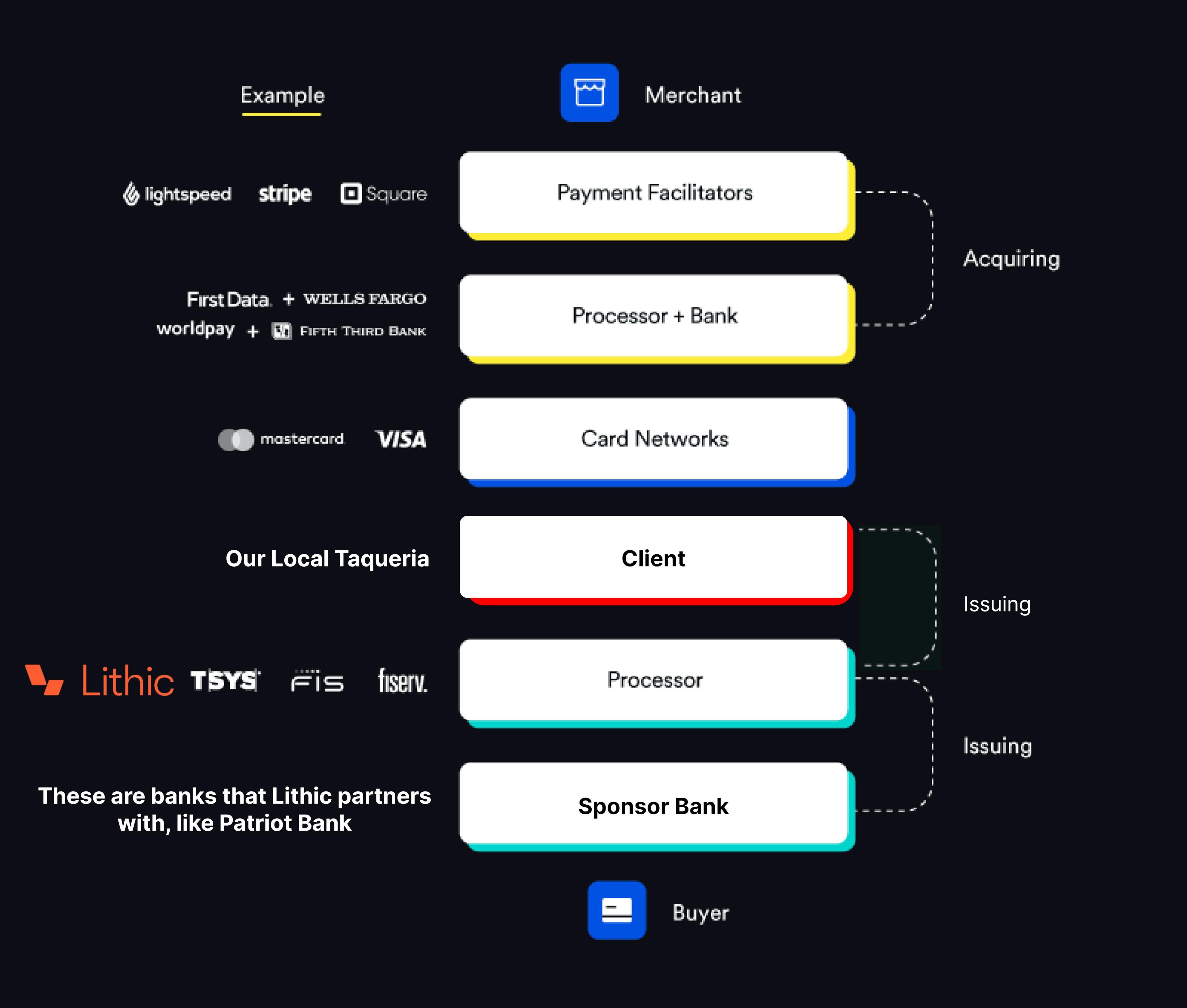

This is the new workflow for a customer purchasing lunch at the taqueria:

Once a customer taps their taqueria-issued card to purchase their lunch, Stripe (which acts as the payment facilitator for the taqueria) sends a message to the acquiring processor to charge the customer’s card.

To confirm that this transaction can be authorized, the acquiring processor sends a message (via a card network such as Visa) to the issuing processor to analyze the customer’s bank funds.

The issuing processor then communicates with the sponsor bank (the bank that the taqueria partnered with to create debit cards) to confirm whether the customer has enough money in their bank account. If they do, the issuing processor authorizes the transaction.

In order for the taqueria to be paid, the sponsor bank transfers the customer’s money to the acquiring bank (which is the merchant’s bank provider). The acquiring bank then deposits the money into the merchant’s bank and completes the transaction lifecycle.

Source: Finix, Contrary Research

This opportunity to innovate in the issuing segment of the payment stack has resulted in a new wave of modern issuer processors, like Lithic, to emerge.

Lithic provides the infrastructure to let companies issue physical, tokenized, and virtual cards to process transactions and ultimately own the customer relationship via a customized card program. Essentially, Lithic streamlines the card issuing process for companies like the taqueria from our example by managing tasks such as the configuration of cards, reconciliation, and card network integrations. As a result, these companies can access a greater share of the interchange fee and drive revenue.

Founding Story

Source: Lithic

Lithic (fka Privacy.com) was founded by Bo Jiang (CEO), Jason Kruse (CTO), and David Nichols (Head of Design) in 2014. The trio began working together at the age of 13, designing websites and working on various side projects such as an early competitor to Box that they sold before going to college. After developing an early interest in crypto, they built a Bitcoin-backed debit card in 2012, but all 50 banks they spoke to “hated the idea”. Though they decided not to pursue that idea, they became interested in the privacy aspect of virtual currencies, and eventually decide to build Privacy.com.

Privacy.com issues single-use virtual debit cards to everyday consumers to help them protect their card information online. Essentially, users connect a funding source (like a personal bank account), and Privacy.com generates virtual cards that mask the information of a customer’s debit card so that it is never revealed to a merchant. Thus, if a merchant’s security is compromised and card details are leaked, customers’ real card information would never be stolen if they transacted using a Privacy.com virtual card. Alongside the privacy component, users can set spending limits, close accounts, and prevent charges from unwanted subscriptions.

At the time of Privacy.com’s launch in 2014, virtual cards were relatively nonexistent, and the issuing infrastructure to power these single-use cards barely existed. Privacy.com initially used i2c (a legacy card issuing platform) to build its product. The process to onboard took 12+ months, cost Privacy.com $500K, and the infrastructure was not flexible enough to manage all of its needs as it scaled. Given this, the team decided to take two years to build its own issuer processor infrastructure to power the virtual cards on Privacy.com. In order to do this, the team built the infrastructure to, as Packy McCormick of Not Boring put it, “authorize transactions, route and orchestrate settlement and clearing messages, and handle reporting, reconciliation, and movement of funds between all relevant parties”.

By the time the infrastructure was built, Privacy.com was already generating millions of virtual cards and experiencing strong user growth, with 70-80% of its users learning about the product via organic marketing. Yet, as the team continued to scale the infrastructure, lots of developers began reaching out to ask for API access. One developer even reverse-engineered Privacy.com’s mobile application to find the card issuing and creation API that Lithic built.

As CEO Bo Jiang told Contrary Research in a July 2023 interview, the team soon realized the opportunity to make its card infrastructure available for developers:

"Over the course of four or five years, we had to build all this infrastructure around card issuing, transaction processing, PCI compliance, reporting, and reconciliation. And eventually, we realized, the broader world really needs this infrastructure that we built for ourselves."

In response, Privacy.com launched a beta program in 2019 where it gave developers access to its card-issuing API. After experiencing early product-market fit in the beta program, the founders raised a $10.2 million Series A round in July 2020 to enable them to publicly launch the API. Shortly after launch, demand skyrocketed which prompted Privacy.com to shift strategies, rebrand to Lithic, and raise a $43 million Series B in 2021 to scale its card-issuing infrastructure. Today, Lithic’s card-issuing API is its main focus, while Privacy.com continues to operate as a separate, smaller brand that is also powered by Lithic’s card-issuing API.

Product

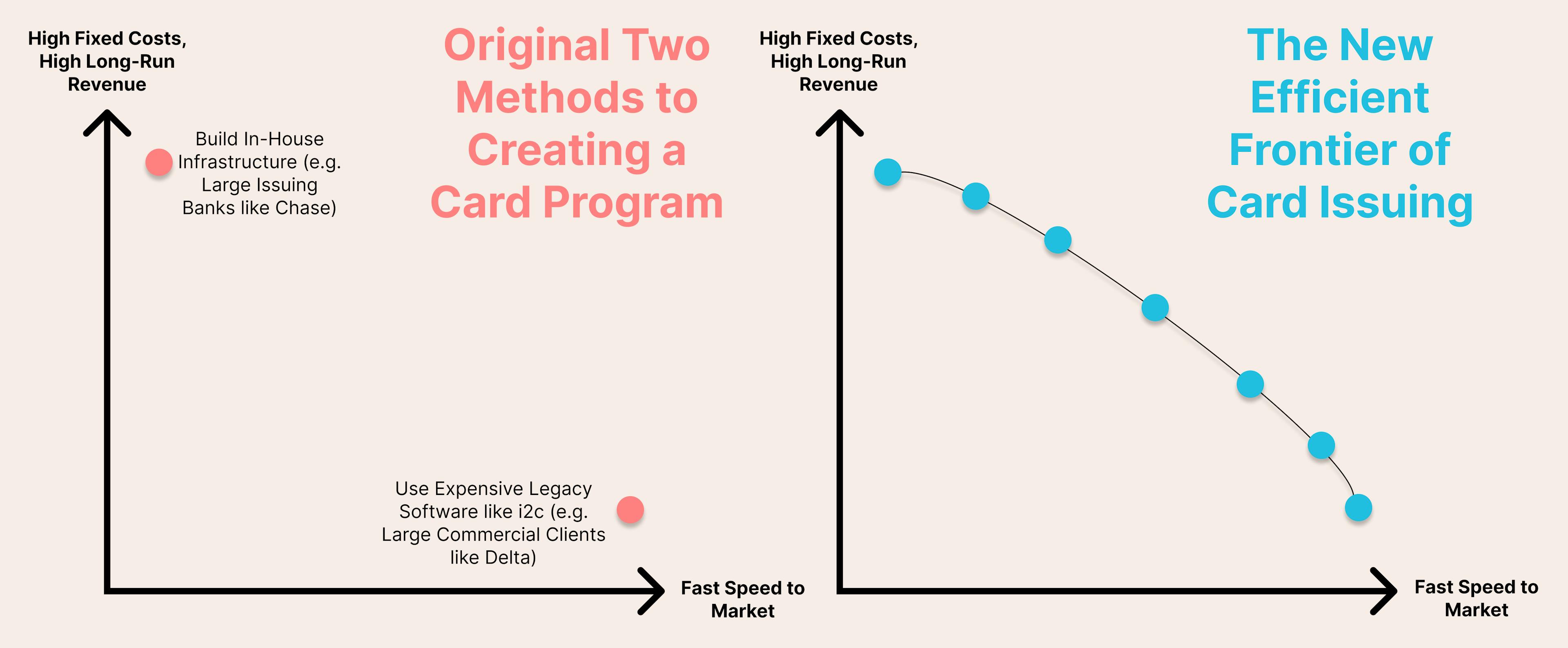

Until recently, companies only had two options if they wanted to launch a card program: use a productized, narrow offering that provides limited customizability, or create their own in-house card-issuing infrastructure. The former requires the use of legacy products built on outdated infrastructure that doesn’t scale well, while the latter requires investing in high-fixed costs over a period of 1-2 years. Neither solution works well for early-stage startups, and this is the problem Lithic’s product is attempting to solve.

Lithic’s API-first product provides an alternative solution that combines the infrastructure Lithic built for Privacy.com (card-issuing, processing, real-time authorization, and limits) with, as Not Boring puts it, “modularized components that [users] can get elsewhere, like sponsor banks, ledgers, card manufacturers, or KYC tools”. Given this, instead of having to build card issuing infrastructure, early-stage companies can utilize modern issuer processors like Lithic to create virtual and physical payment cards at a faster rate. Put simply, Lithic enables companies to launch their own card program within 1 week by managing complex and often messy back-office tasks.

Source: WorkWeek, Contrary Research

Lithic’s card-issuing API is designed to be modular, which means that companies can mix and match Lithic’s products with other APIs to suit their needs. For example, companies can bring in their own sponsor bank and combine it within their existing workflow in Lithic, or they can use Lithic’s existing sponsor banks.

Below is a detailed breakdown of the core features and products that Lithic offers.

BIN Sponsorship

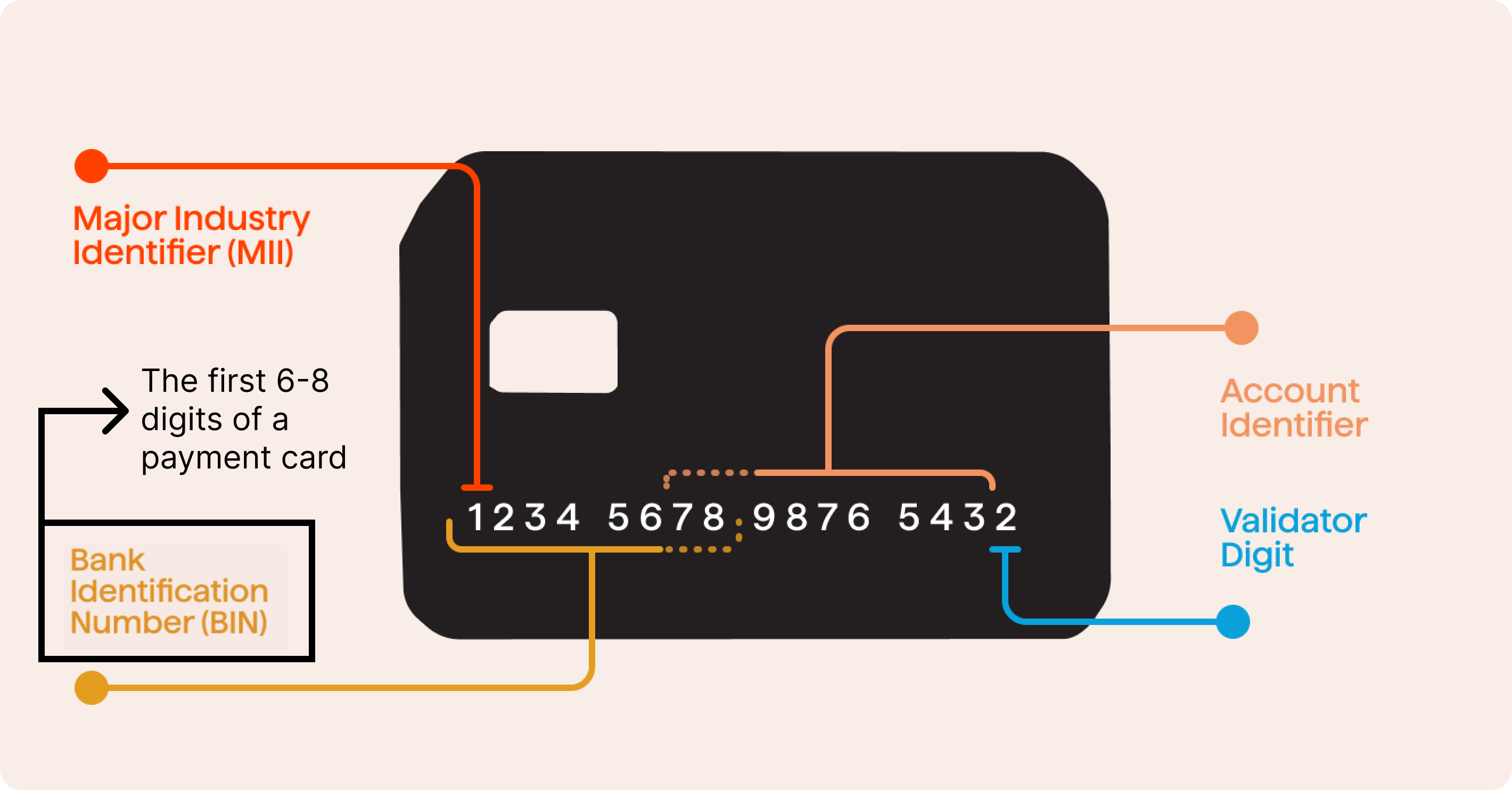

Every company that wants to launch its own card program must have a Bank Identification Number (BIN). A BIN is a unique sequence of numbers on a card that acts as an identifier to define which bank issued the card so that the other layers of the payment stack can process the transaction request accordingly. Originally, when customers paid with traditional debit cards (like a Chase card), the bank (in this case, Chase) would provide the BIN number.

However, with many modern card programs, the cards are no longer issued by these banks; rather, the companies that offer the cards are required to provide the BIN number on their cards. To do this, they have two options: develop a direct relationship with a sponsor bank such as Chase, or work with an issuer processor that offers program management capabilities. Lithic facilitates both options: it lets companies integrate their own sponsor bank or utilize relationships that Lithic has already built with partner banks, like Patriot Bank.

Source: Lithic, Contrary Research

Know Your Customer (KYC) and Know Your Business (KYB)

Lithic offers four workflows for KYC:

Basic KYC provides companies with identity verification with an immediate accepted or rejected decision and no remediation opportunity.

Advanced KYC provides companies with identity verification with a remediation path if the initially submitted information was not successfully verified.

BYO (bring your own) KYC provides companies with the opportunity to bypass the Lithic KYC process and create an individual account, however, this is only applicable for users who have pre-approved KYC processes.

KYC-Exempt allows certain programs to enroll users as KYC-exempt.

On the KYB side, Lithic offers two workflows:

Basic KYB lets companies complete identity verification with an immediate pending decision, with a final accepted or rejected decision provided within 2 business days.

BYO KYB lets companies bypass the Lithic KYB process. However, as for the BYO KYC module, this is only applicable to users who have pre-approved KYB processes.

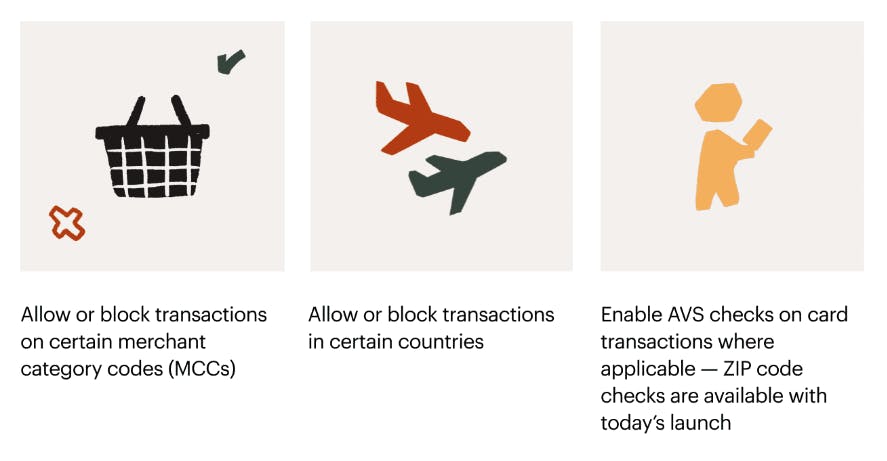

Spend Controls

Lithic lets companies apply spending controls at the transaction, cardholder, and account levels. This means that a company can restrict specific transaction volumes or restrict purchases from specific regions. Alongside establishing these controls, companies can also opt to issue single-use or merchant-locked cards, providing an additional layer of security by restricting the use of the cards with certain merchants or for a certain number of transactions.

Source: Lithic

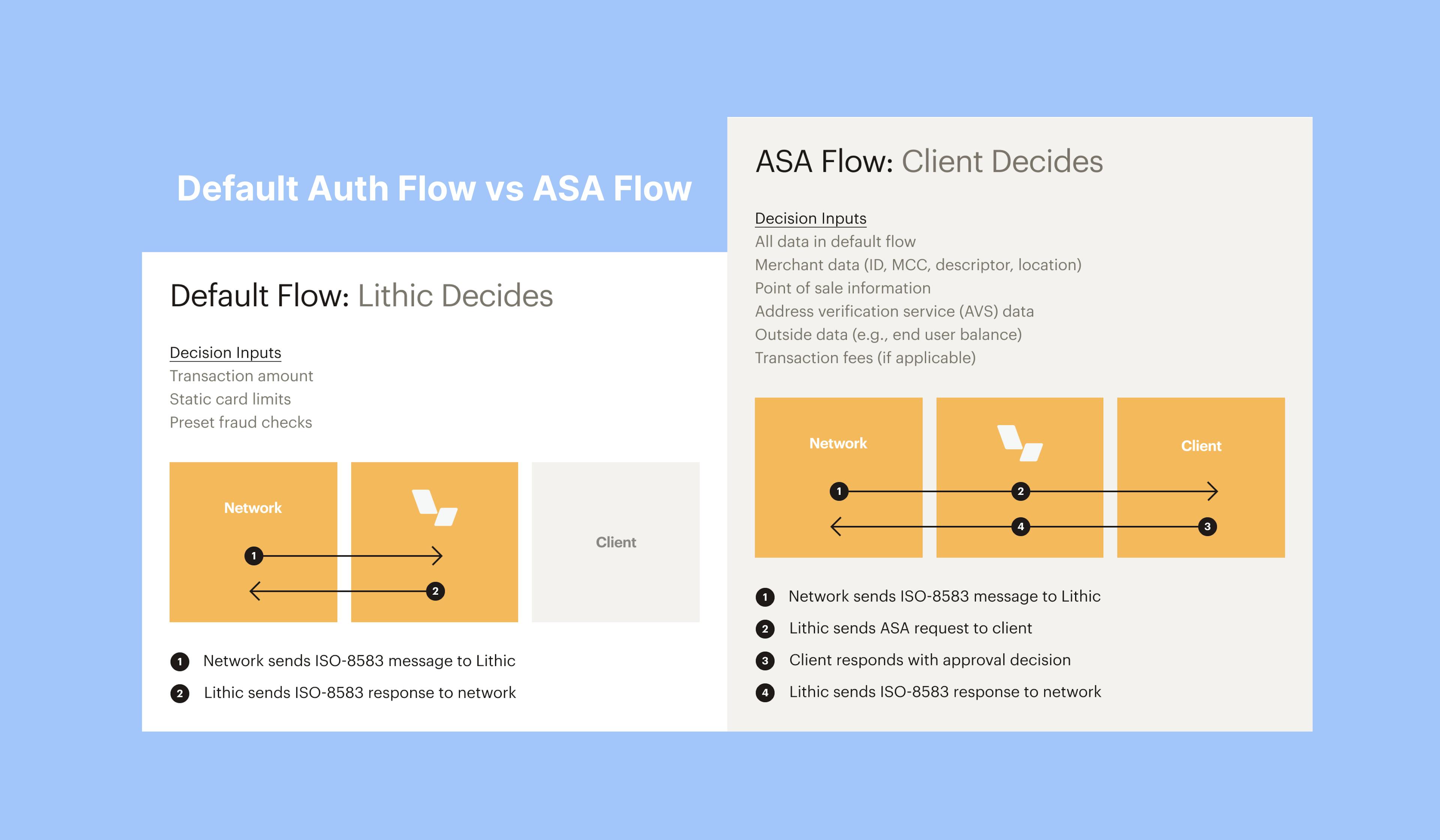

Authorization Stream Access

On top of spend controls, Lithic also offers a feature called Authorization Stream Access (ASA). This feature provides companies with transaction information in real time. For example, companies can access merchant data such as ID, descriptor, and merchant category code (MCC), as well as point of sale information and address verification service data. This lets companies create their own customized control flow logic for real-time authorization decisions, essentially taking on additional ownership over the transaction workflow.

Source: Lithic, Contrary Research

Disputes API

Lithic’s disputes API lets companies automatically file a dispute claim with Lithic. Once filed, Lithic’s disputes team reviews the submission, files the dispute with the card network, and manages the chargeback process on the customer’s behalf. The average chargeback success rate for Lithic is 96%.

Physical Card Creation

Lithic enables customers to utilize its existing manufacturing relationships to programmatically issue and ship custom physical cards to customers through an API call. The process to launch a physical card program can be achieved in under a week, which Lithic states is a “2-3x improvement over traditional templated setups”.

Other Features

Lithic also supports tokenization control to combat digital wallet fraud, real-time transaction data insights, and a PCI-compliant iframe solution. All of its API documentation can be found here.

Market

Customer

Lithic’s product is designed to be used by any company looking to launch a virtual or physical card program. Its customer demographic can be bucketed into two core groups:

The first bucket contains companies that have launched a financial product with a legacy provider (like i2c or TSYS) and are experiencing issues as they scale fast.

The second bucket contains companies that have what CEO Bo Jiang called “simple and productizable use cases”. For example, a vertical procurement platform that processes a significant amount of ACH or check payments is an ideal customer target.

Within these two buckets, Lithic’s core product targets early-stage companies, but the platform is still designed to be scalable so it suits companies of any size. This is evident through its payment plans, with options for companies creating MVPs as well as companies that are already generating millions in monthly payment volume.

Below is a breakdown of the typical use cases of Lithic’s card issuing and creation API:

Source: Not Boring

Further, as highlighted by Packy McCormick, Bo Jiang has also discussed other use cases:

“We’re seeing a proliferation of use cases in different industries that we couldn’t have anticipated even six to twelve months ago. We work with a commercial fleet warranty provider. Historically, if your truck breaks down, you take your truck to the mechanic, and you pay the mechanic out of pocket, it’s $10 or $20k, and you file the claim and get paid back 30 days later. With our API, the warranty provider is able to generate a card on the fly and pay the mechanic directly.”

On its website, Lithic highlights a number of its existing customers, including Mercury, Order, and Splitwise.

Source: Lithic

Market Size

In 2021, a report from Credit Suisse estimated that US payment card volumes were nearing $8 trillion, “with the vast majority touching Visa and/or Mastercard networks” (this figure had grown to $9 trillion by 2022). Interestingly, the report stated: "Visa and Mastercard are not the largest revenue beneficiaries though – banks are (the card issuers themselves), with card issuers earning interchange on each transaction equivalent to ~130bps on average (vs. Visa and MasterCard earning network yields that come to roughly~26bps)”.

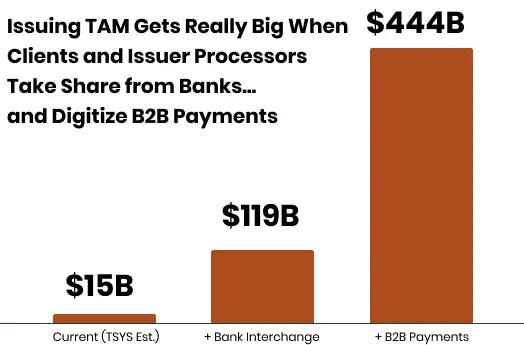

Under the new model, the card issuers as they are traditionally understood are no longer the issuer banks, but instead the merchants/clients and program managers/issuer processors. This indicates that they are the two segments that are the most likely to benefit from the growth of the online transaction industry. The report also estimates the size of the issuer processing market to be $15 billion based on TSYS’s market size. However, this estimate is likely to be lower than the true market that Lithic is competing in. This is because TSYS is a legacy issuer processor. Under the model in which it operates, the issuer bank captures the majority of interchange value while the issuer processor and merchant have little power.

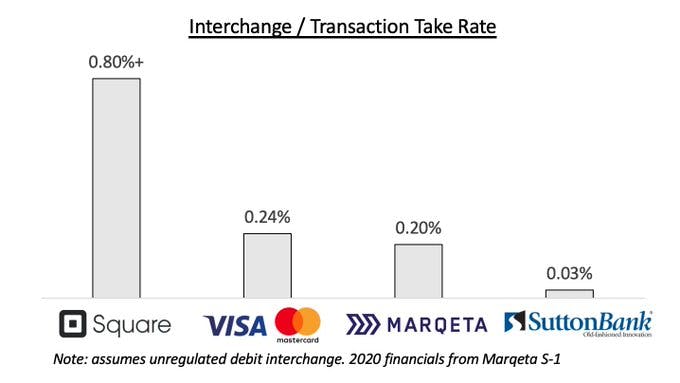

By contrast, in the new model, issuer processors like Lithic and Marqeta, alongside the merchants, capture a lot more interchange value than the sponsor banks as they own the customer relationship via embedded financial products. As a result, even though Marqeta has a less than 1% market share of the card issuing industry, it still has an market cap of $2.6 billion.

Other estimates suggest that the TAM could be between $100 billion and $450 billion based on an estimate of the new card issuers and their enabling technology vendors (issuer processors) taking ~130bps per transaction (with $8 trillion in payment volume).

Source: Not Boring

Competition

Marqeta: Marqeta offers modern card issuing solutions that are used by companies including Uber, DoorDash*, and Instacart. By contrast to Lithic, the majority of Marqeta’s transaction volume is from later-stage enterprise customers, as opposed to startups. For example, it was revealed that 73% of Marqeta’s revenue comes from Block (fka Square). In fact, Marqeta’s market cap took a hit in late 2022 as it faced questions over the renewal of its contract with Block which is set to expire in 2024.

In a July 2023 interview with Contrary Research, Lithic CEO Bo Jiang stated:

"Marqeta is a company that we get compared to, and it’s well known that 70%+ of their net revenue is from one customer (Block). That type of concentration obviously puts a lot of pressure on your product roadmap and makes prioritization of features for other customers challenging. When we started out, we looked at the most exciting companies in fintech over the last 15-20 years, and for us, these were companies like Stripe, Adyen, and Plaid. They serve different customers, but there is a unified philosophy of lowering the barrier to entry of launching new products vs. being solely focused on an enterprise motion.”

Given its focus on later-stage companies, Marqeta tends to offer better interchange rates for larger clients while Lithic provides better rates for earlier-stage startups. For example, this Twitter post highlights how Marqeta provides Square with a generous 80bps out of the total 128bps that are available. Further, Marqeta and Lithic differ in terms of product flexibility. Marqeta provides a full-suite solution that solves very specific use cases, whereas Lithic is more customizable. In terms of valuation, Marqeta had an IPO in 2021 at a $15.2 billion valuation. As of July 2023, its market cap has fallen to $2.8 billion following concerns about customer diversification.

Source: Twitter

Galileo: Galileo enables companies to launch financial products such as debit card programs. It mainly targets fintech companies, including Dave and MoneyLion, and offers unique solutions like cryptocurrency and investment tools. By contrast to the other issuer processors, Galileo partners with a wide range of sponsor banks, including Bancorp Bank, Stride Bank, Choice Financial Group, Evolve Bank, MetaBank, and Coastal Community Bank. Further, Galileo also differs from other modern issuer processors as its onboarding and maintenance costs are relatively high.

Despite that, Galileo offers the cheapest upfront solution for pay-as-you-go processing. Lithic CEO Bo Jiang has previously stated that “Galileo is interesting in that they're good if you're just looking for that processor and you want to bring in your own sponsor bank, and you want to pick and choose and do all your KYC, compliance, AML, and bank partner stuff. It's highly customizable, so you have to do everything in-house and ends up being pretty expensive and takes quite a long time to get to market”. To date, over 130 million accounts have been created with Galileo, and the company was acquired by SoFi in 2020 for $1.2 billion in stock and cash.

Stripe: Unlike the other competitors, Stripe is known for its payment facilitation product on the acquiring segment of the payment stack. However, in 2020, the company launched Stripe Issuing and expanded into the issuing segment of the payment stack. Like Lithic, Stripe Issuing is an API that lets customers create and control virtual and physical card programs. Stripe charges $0.10 per virtual card and $3 per physical card; similarly, Lithic charges $0.10 per virtual card for starter customers. Further, like Marqeta, Stripe tends to provide favorable interchange rates to larger companies. To date, over 100 million cards have been created with Stripe Issuing and the platform manages 500K transactions a day.

Highnote: Highnote enables small and medium-sized businesses to issue and launch physical and virtual cards via an API-first platform. Like Lithic, Highnote supports both commercial and consumer card programs as well as tokenized cards. Further, Highnote lets customers open bank accounts and manage how their cards are being used, providing useful insights into transaction data across networks. To date, Highnote has raised $104 million, with its latest round being a $25 million convertible note in June 2022. Prior to that, it raised a Series A round of $42.5 million in September 2021 led by Costanoa Ventures.

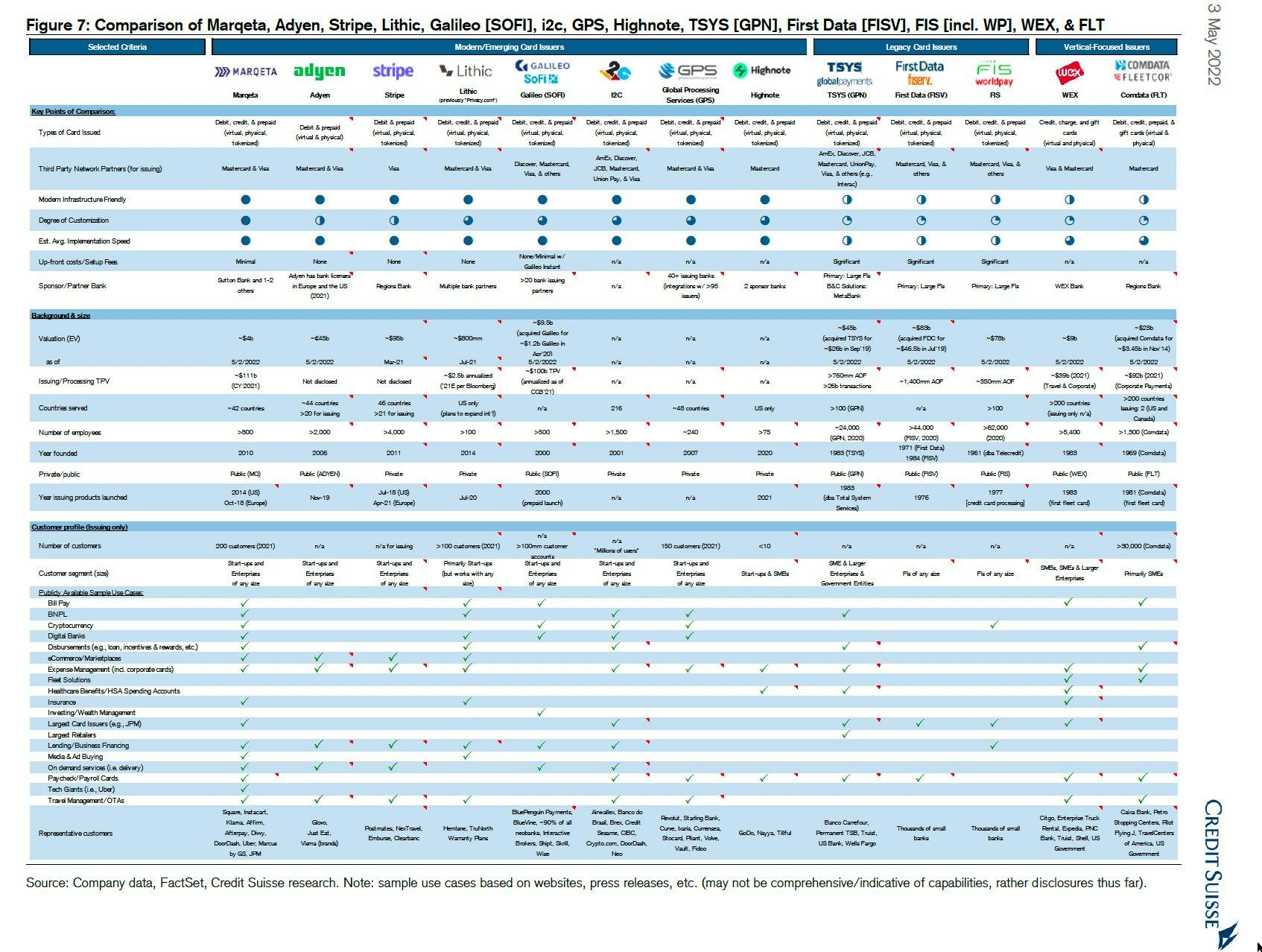

Alongside Marqeta, Galileo, Stripe Issuing, and Highnote exist a number of legacy card issuers like TSYS and FirstData, as well as vertical-specific issuers like Wex and Comdata. Below is a high-level market overview of the competition in the space.

Source: Twitter

Business Model

Lithic’s revenue is derived from two core sources: usage-based fees for things like creating virtual and physical cards, KYC, 3D Secure transaction authentications, etc., and interchange revenue. Lithic offers three different pricing models depending on the company size:

Starter: Lithic’s starter program is designed for companies building an MVP or piloting a card program. The starter program charges companies $0.10 per virtual card. Revenue share is based on total spend volume. Each month, companies in the starter program earn 0.2% on the first $100K in volume and 0.4% on all volume thereafter which comes with a standard fixed rebate.

Enterprise: Lithic’s enterprise program is designed for companies with $250K+ in monthly payment volume. Unlike the starter program, companies in this program can generate physical and tokenized cards (on top of the virtual cards). Lithic does not disclose the exact pricing of generating virtual cards for enterprise clients, but it states that “enterprise pricing is available” indicating that the cost is likely less than the $0.10 that is being charged to starter customers.

Processor Only: This program is intended for customers who already have their own sponsor bank and simply want to build a customized card program. There is minimal information on Lithic’s website, but it can be inferred that these clients keep the highest share of interchange revenue and have the lowest usage-based fees.

Traction

Lithic saw a 5x increase in processed transaction volume from 2021. Compared to Marqeta, Lithic handled “~20x the total payments volume (TPV) that incumbent Marqeta did in its first year with an API (2015)”. In terms of card generation, by May 2021, Lithic had issued 10 million cards. If we extrapolate its growth at 5x, it can be estimated that this number is now in the region of 50+ million cards as of July 2023.

While it is not clear how many customers Lithic has, in July 2022, it noted to the Department of Financial Protection and Innovation that it “enables more than 100 companies to use payment cards”. Its average customer revenue is likely lower than Marqeta, whose average customers generate $3 million. Interestingly, Marqeta only has 160 customers. However, this difference in average revenue generation, despite both companies having a similar number of customers, is likely understandable given Lithic’s focus on early-stage startups leading to lower average ACVs.

Despite its growth, Lithic was one of many companies to lay off employees in 2022. The company laid off 18% of its workforce, with 27 employees leaving the company. However, as of July 2023, Lithic is actively hiring for three positions on its LinkedIn.

When asked about Lithic’s recent growth in a July 2023 interview with Contrary Research, Lithic CEO Bo Jiang stated:

"For us, we continue to see really strong growth year-over-year. The mix of that growth has shifted in 2023 with less consumer, more commercial. Credit, even in the current environment, still has some exciting use cases. For example, we work with Imprint on their revolving credit products, Mercury on their IO card, Parker on their charge card product."

Valuation

Lithic has raised a total of $115.4 million across four funding rounds. Its most recent round, as of July 2023, was a $60 million Series C round led by Stripes in July 2021, with participation from Bessemer Venture Partners, Index Ventures, Exor, Rainfall, Tusk Venture Partners, and Commerce Ventures. The round brought Lithic’s total valuation to $800 million.

Key Opportunities

Continuing to Capture Early-Stage Companies

While Marqeta remains ahead of Lithic in terms of transaction volume and scale, the enterprise-focused strategy that enabled Marqeta to reach scale leaves early-stage companies, who are still looking to embed financial products into their core services, underserved. It is the customer demographic that Marqeta is no longer purpose-built for.

This creates an opportunity for issuers like Lithic to become the main player in the card issuing space for early-stage startups. While early-stage companies will inevitably have higher churn and lower ACVs than the companies that Marqeta is serving, all Lithic requires is for one of the companies it partners with to scale rapidly, allowing Lithic to move upmarket and capture larger transaction volumes.

In a discussion on this topic during a July 2023 interview with Contrary Research, Lithic CEO Bo Jiang stated:

"We think of ourselves like seed-stage investors. Our focus has been on building an offering that just works and a company that does what we say we’ll do. As a result of those efforts we’ve been fortunate to have a strong inbound pipe.”

Rising Card Adoption

The COVID-19 pandemic greatly accelerated the global transition to virtual payment methods including debit cards for both consumers and businesses. However, this shift is still in its early innings: while B2B payments are sized at $125 trillion, only $2 trillion of that is via card transactions. The pandemic-led trend of rising card adoption may soon trickle down to everyday companies.

As a16z partner Angela Strange described in her article titled, “Every Company Will Be a Fintech Company”, a significant portion of this shift will be driven by “existing companies that are adding financial services for the very first time”. As a result, companies like Lithic have an opportunity to take advantage of this growing market by partnering with companies early on and building strong client relationships that scale. This also means that the TAM for processors like Lithic is growing significantly, with every business becoming a viable customer target.

International Expansion

At this moment, Lithic cards are only issued to US cardholders who are US citizens or legal residents. While it does allow these cardholders to use their Lithic-issued cards overseas, it doesn’t issue cards to non-US residents or citizens. As a result, Lithic is currently losing out on a large customer demographic.

With that being said, Lithic’s CEO has previously discussed his desire to expand internationally, with Canada being the most-likely test candidate for Lithic’s international expansion. Though most international markets are considerably smaller than the US, there are still significant amounts of transaction volume up for grabs; for example, Canada processed $6.9 trillion in debit, credit, and prepaid transactions in 2021.

However, despite Lithic’s desire to expand into new markets, the current macro environment has impacted its planned timeline. In a July 2023 interview with Contrary Research, CEO Bo Jiang put it this way:

"International expansion is definitely interesting for us, but we’re focused on finding the right design partners to build with. So it's about aligning our road map with that of a design partner to pull those efforts forward. In the current environment, most folks are focusing more on their core. So that timeline is getting pushed out for a lot of companies."

Key Risks

High Competition

While Lithic has grown considerably, the card issuing industry is very competitive. Not only is Lithic competing with legacy issuer processors like TSYS as well as vertical players like WEX and Fleetcor, but it is also competing with the likes of Marqeta and Galileo – both of whom are multibillion-dollar companies operating in the space. As a result, Lithic must find ways to differentiate – from customer service to instant issuance – in order to remain competitive. However, differentiating in the issuing market is a difficult task as one anonymous founder of a neobank has already stated:

“I feel this will be a matter of who raises the most because there's so little and they can differentiate themselves on. Everyone is saying the same things: do you provide better ledgering? Dashboards? Better ancillary services? How much control do you let me have with the bank? Will you actually support me through the bank? Do you provide legal support? How do you handle disputes and resolutions? There are literally 200 to 300 things you need to consider.”

Further, there are a growing number of competitors emerging from the acquiring side, such as Stripe and Adyen. Both companies operate internationally and have 2K+ employees, thus operating at a much larger scale than Lithic. Given this high level of competition, as customers of Lithic scale themselves, it will be integral that Lithic’s infrastructure can scale accordingly and that it remains competitive in terms of interchange. This requirement could lead to higher costs and lower interchange for Lithic in the long run. This could become an issue for Lithic, especially as it is sometimes regarded as expensive.

When asked about Lithic’s ability to scale with clients during a July 2023 interview with Contrary Research, CEO Bo Jiang stated:

"As our customers have grown, we’ve definitely needed to continue to invest to ensure that we’re continuing to add leverage for larger customers. One thing that helps is we’ve built our own infrastructure completely from the ground up relatively recently, and we’ve done the heavy lifting of integrating directly with the major card networks. So being fast, responsive, and handling scaling challenges has been relatively more manageable.”

Regulation Risks

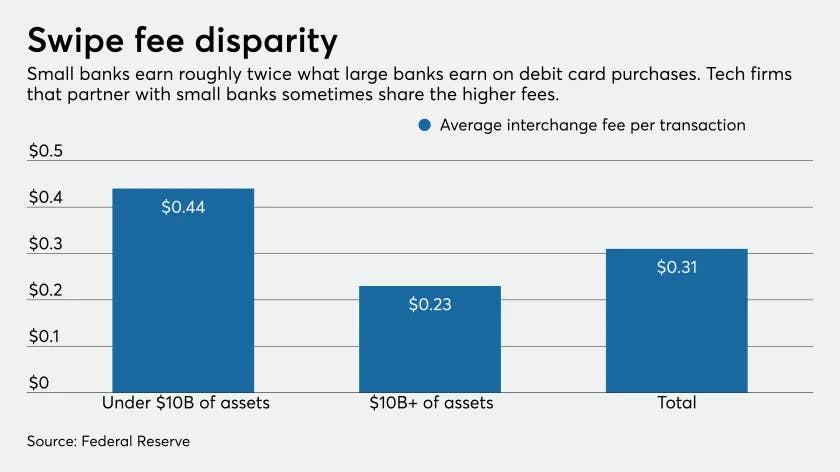

The reason why the unit economics behind issuer processors have become very compelling in the past decade is largely due to the Durbin Amendment of the Dodd-Frank Act in 2010. The amendment capped the interchange fees that banks could receive to $0.21 + 0.05% of the transaction, but it provided an exemption to banks with under $10 billion in assets, allowing them to charge $0.20 + 1.05% of the transaction. As a result, the new wave of issuer processors like Marqeta and Lithic have partnered with smaller banks as they receive higher interchange fees than large lenders, benefitting both the small banks and issuer processors.

Source: American Banker

This workaround has come under scrutiny. For example, in a prospectus, Marqeta warned investors that its interchange fees were subject to significant legal and regulatory scrutiny. Further, Jamie Dimon wrote in his annual shareholder letter that, “Neobanks, now with over 50 million accounts, bypass the Durbin Amendment and so earn higher revenue per debit swipe — and they don’t have to abide by certain other regulatory or social requirements”. While it is unlikely to change any time soon, this “regulatory arbitrage” still poses a long-term risk to companies like Lithic if the act is amended.

Customer Concentration Risks

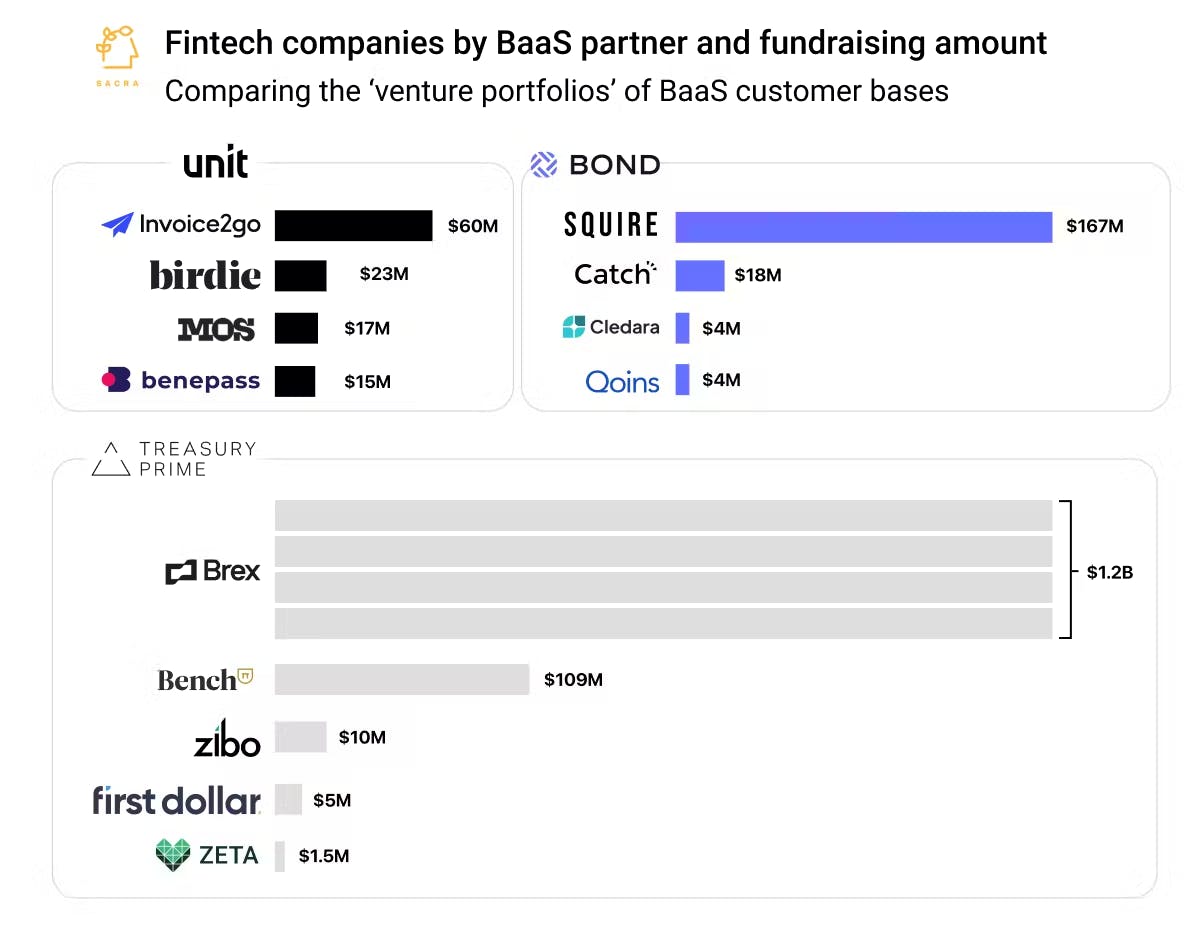

Like venture portfolios, the success of an issuer processor like Lithic is driven by a power law. For example, Square’s Cash App drives 73% of revenue for Marqeta. The power law is especially true for Lithic as it primarily focuses on early-stage companies. As a result, it needs to risk-rank all of its clients, and it is likely to experience high churn due to customers failing to scale and shutting down.

Lithic’s strategy of working with early-stage companies is intended to make the company less susceptible to customer concentration risks. In a July 2023 interview with Contrary Research, Lithic CEO Bo Jiang put it this way:

“We think one of the exciting parts of supporting companies doing something different and innovative is that you essentially wind up being an index on developer ingenuity across the board. It’s much more exciting to be enabling net new use cases vs. engaging in a zero-sum game. From a financial perspective, we have less revenue concentration. We have no customer that's greater than 15% of our revenue. More than anything it’s allowed us to take a longer-term outlook when it comes to product roadmap and investments in infrastructure.”

This poses another interesting dilemma: the success of Lithic is not solely driven by the quality of its product, but rather by the number of successful venture-like bets it is able to make. If the companies it partners with achieve significant growth, it exponentially grows Lithic’s transaction volume, and thus revenue. While finding the next Cash App is not an easy task, given Marqeta’s position of working with enterprise clients, there does exist a long tail of promising companies that may seek to embed a financial product into their service. This means that despite the risk of high churn, there is an opportunity for Lithic to find a portfolio-defining company to partner with.

Source: Sacra

Summary

Overall, the increasing adoption of cards, growth of embedded finance, and regulation such as the Durbin Amendment have created a new wave of modern issuing processors. While Marqeta has already emerged as an early winner, there still exists significant opportunity for companies to innovate. Lithic is well-positioned to win the early-stage market. Its quick-to-launch offering, coupled with its customizability and developer-centric focus, has enabled it to grow 2x faster than Marqeta did at its stage. As a result, Lithic already has 100 customers within three years of its founding.

However, its focus on early-stage companies does pose its own unique risks: Lithic not only needs to identify and then partner with generation-defining companies at the earliest stage, but it also needs to be able to scale with those companies and outcompete Marqeta as it moves upmarket. With big players like Marqeta focused on enterprise clients, the opportunity for Lithic to follow a similar strategy to Stripe and successfully move upmarket is there, and if executed successfully, this could enable it to become a leader in the payment space.

*Contrary is an investor in DoorDash through one or more affiliates.