Thesis

As of 2021, 10 billion IoT devices were active globally across smart home devices, industrial sensors, industrial robots, healthcare devices, smart city sensors, and connected cars. The number of IoT devices may grow to 30 billion by 2025 and produce 79 million petabytes of data.

Capitalizing on the rapid growth of IoT, Nova Labs (formerly Helium) is a decentralized telecommunication infrastructure provider that uses software, blockchain, and specialized routers to connect IoT devices to the internet. Nova Labs uses decentralized hotspots owned by individuals (e.g., “hotspot operators”) which allow Nova Labs to scale infrastructure at a lower cost compared to centralized networks and telecommunication companies. Its platform also shares revenue with its blockchain participants. Helium’s low radio frequency network (LoRaWan) allows devices to send simple and small data sets. As of September 2022, Nova Labs is one of the largest LoRaWAN networks in the world with over 900K hotspots.

Nova Labs aspires to expand beyond LoRaWAN to be a “network of networks” disruptor to telecommunications and internet services. As of August 2022, Nova Labs planned to bring ~1.9K 5G nodes online across 700 cities in the US. Providing 5G networks increases the potential market size to $25 billion. As Nova Lab matures, the company’s CEO, Amir Haleem, aspires to utilize blockchain and decentralized infrastructure to revolutionize other network protocols like Wifi and VPN.

Initially, Nova Labs used crypto tokens (HNT) issued to hotspot operators for “coverage” to incentivize buying and operating the hotspots. In the early days before 2021, the price for the tokens and the rate of token issuing could make an operator attractive returns. However, in 2022, the incentive structure has unraveled; the overall crypto market decline put downward pressure on HNT ($2.20 as of November 21, 2022 down from a high of $50.77 a year before) and lagging demand for the Nova Lab infrastructure slowed token issuing. It remains to be seen if Nova Labs can sell its infrastructure in a way that makes money or if the token economics are viable for operators that provide the infrastructure.

Founding Story

Nova Labs is a San Francisco-based company founded in 2013 by Amir Haleem, its CEO and founder. Previous to Nova Labs, he built online gaming businesses, having co-founded a social gaming startup, Diversion, from 2010 to 2013.

In 2012, Amir and his investor Shawn Fanning (co-founder of Napster) noticed the growing trend of IoT. They came together to figure out how to solve IoT’s data cost and battery cost issues. Amir Haleem, Shawn Fanning, and Sean Carey co-founded Helium focusing on IoT sensors and networks. However, Sean Carey left in 2015, and Shawn Fanning has no public record of his involvement with Helium. Amir was the main founder who raised funding and pivoted the company towards blockchain.

As the company became a decentralized IoT network, Amir brought on Frank Mong as COO. Frank has ten years of tech experience with HP Security, Palo Alto Networks, and HackerOne. Together Amir and Frank used their expertise to create the hardware, software, and blockchain underpinning Helium

Nova Labs initially built IoT sensors before pivoting in 2018 to be a blockchain-based IoT wireless network provider. Node operators receive cryptocurrency rewards for owning and maintaining hotspots. The hotspots use specialized routers for non-licensed radio frequency and wifi data transmission.

For instance, if an IoT refrigerator shared information like remote temperature reading, it would be able to send specialized small, low-energy packets of data through the Helium network. Bypassing the more expensive and energy-intensive 5G network provided by a traditional telecoms like AT&T or Verizon.

In 2020 and 2021, some node operators began earning up to thousands of dollars a month in the Helium network token (HNT). When crypto markets skyrocketed in 2021, HNT economics drove thousands to buy Helium routers to earn passive income. In 2021, the number of Helium hot spots grew 3,100% from 14K to 450K. By August 2022, this figure had doubled to 916K hotspots.

Nova Labs’ community-based governance structure uses a “Decentralized Autonomous Organizations” (DAO). DAO governance allows HNT owners to vote on company initiatives known as “Helium Improvement Proposals” (HIPs). In Feb 2021, Helium participants passed HIP 27, permitting Nova Labs to explore 5G and LTE wireless coverage. By August 2022, Nova Labs was preparing to bring ~1.9K 5G nodes online across 700 cities in the US. Each expansion leads to new sub-DAOs governing protocols specific to new networks.

Product

Nova Lab’s core service connects IoT devices to the internet through its wireless network. Nova Lab’s “service” is an ecosystem involving hardware, blockchain, and a native economy.

Hardware Hotspots

Specialized Helium routers are “miners” because they “mine” HNT by providing a node of network coverage. Like a wifi router, the miners process packets of data wirelessly. The main difference is they use radio frequency antennae to broadcast small packets of data much farther, allowing miners to pick up data from various IoT devices and transfer the data across a city to specialized routers that upload the information.

The company does not sell the miner hardware itself. Although the miners have relatively simple computing components, Hotspot operators buy miners and router equipment like antennae from certified third parties that register the hotspot and allow it to participate in the blockchain; DIY hotspots cannot participate in receiving blockchain rewards. RAK Wireless and Bobcat Miners are examples of certified providers selling the hardware for ~$400-600.

The miners use a LoRaWAN for long-range and low-energy data transfers. Operators must buy new hardware to support Nova Labs’ expansion into other wireless protocols, like 5G.

Proof of Coverage & Blockchain

Blockchain technology enables decentralized network nodes. The LoRaWAN Helium network uses a “Proof of Coverage” consensus mechanism for nodes to verify network activity.

Node operators earn HNT for providing hotspot coverage. Rewards increase if the hotspot connects to several other network nodes. For example, it is on high ground with a line of sight to a large area and can transfer data faster across the network.

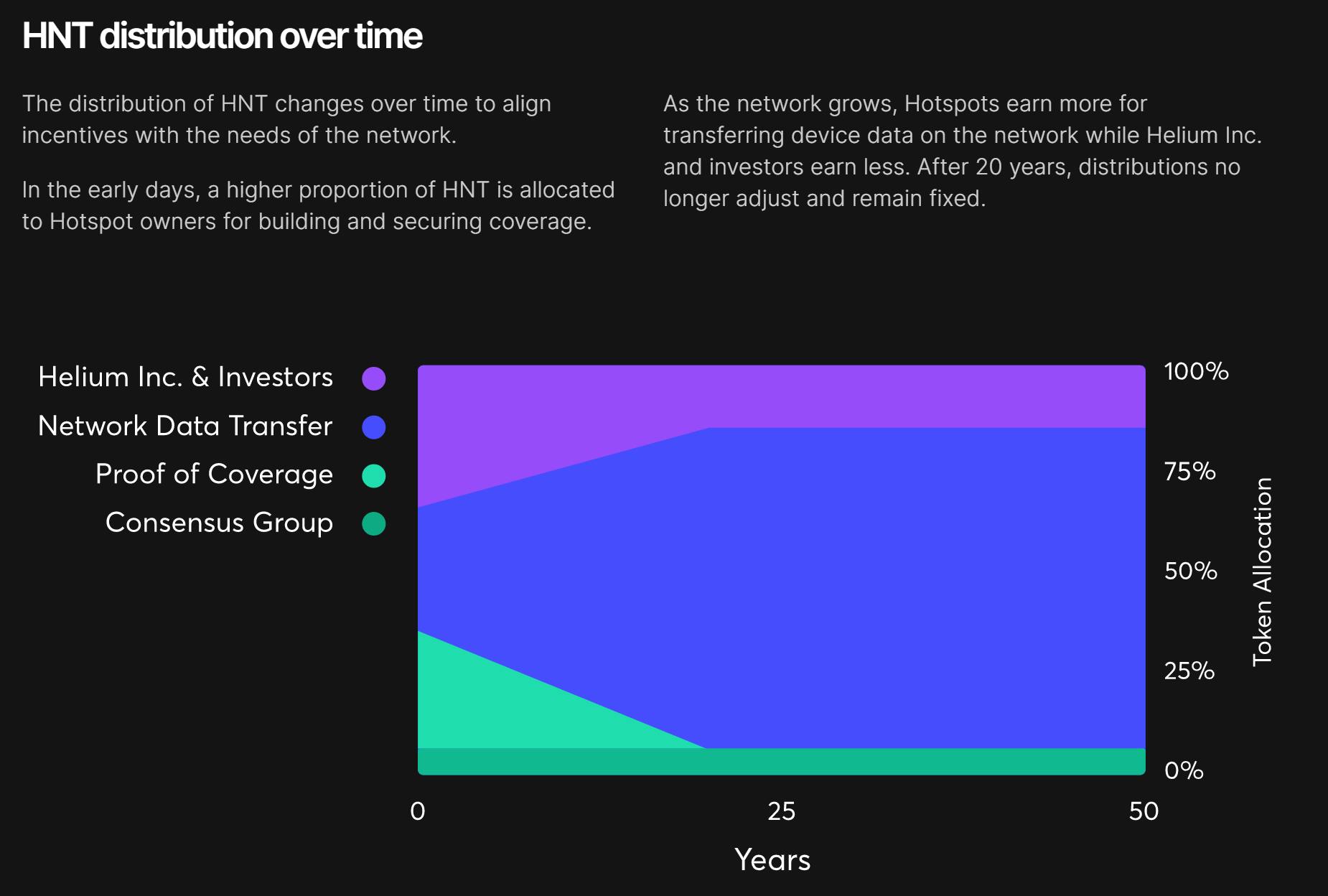

Once an area saturates with enough coverage, each hotspot earns less HNT as more hotspots come online. The network rewards operators most for increasing the size and strength of the network. Over time, hotspots get fewer coverage rewards and more rewards for transferring data.

As Nova Labs expands into new networks, the company will mint new blockchain coins for each network. For example, 5G miners earn MOBILE coins for 5G coverage.

Source: Nova Labs

HNT Tokenomics and Data Credits

Customers use the network based on the number of data credits they buy. Customers buy HNT and “burn” them into credits to buy data credits. Data credits cost $0.00001. If the price of HNT is $1, one HNT will convert into 100K data credits (~2.4MB of data). If the price of HNT is $2, it will burn into 200K data credits.

For example, a GPS tracker designed for LoRaWAN consumes 350KB of monthly data, equating to $0.14 per month in data credits. In the long term, HNT burned and minted should reach equilibrium and stabilize the price of HNT.

In August 2021, the number of HNTs minted halved from 5M/month to 2.5M/month. Less HNT payouts across the network mean more hotspots have fewer coins, increasing HNT scarcity for data credits. However, it also reduces the payout per node.

Ecosystem Dynamics & Pricing

The price of HNT is a key component of the ecosystem’s incentive structure. In theory, the demand for data credits will prop up the HNT price. However, as of June 2022, Nova Labs had very few paying customers, and speculators driving HNT price fluctuations. In the second half of 2021, HNT rose from ~$15 to $58 when 3rd party speculators piled into HNT. When the crypto market cooled in March 2022, the HNT token dropped and stabilized around ~$8-9. By November 2022, the price had dropped even further to $2.20.

Source: Coin Market Cap as of January 27, 2023

By late summer and fall of 2022, consumers reported in media sources such as Forbes, Fortune, and Reddit that they might leave the platform because they had no chance of earning back their investments.

Market

Market Size

Helium’s core LoRaWAN customer is a business with IoT devices such as air quality monitors or mice traps. As of 2021, 10 billion IoT devices were active globally across smart home devices, industrial sensors, industrial robots, healthcare devices, smart city sensors, and connected cars. The number of IoT devices may grow to 30 billion by 2025 and produce 79 million petabytes of data.

Helium’s LoRaWan “consumer grade” network allows devices to send simple and small data sets. Helium’s potential IoT devices exclude many healthcare, industrial, or automotive applications sending large, complex data requiring different wireless protocols. For instance, a medical accelerometer generating 8+ GB of data a month would be better off using wifi or 5G than Helium LoRaWAN.

Even without connecting most devices, the sheer volume of IoT data still creates an attractive market for Nova Labs. If Nova Labs’ can serve 1% of 79M petabytes for $0.0001 per data credit, they will make a $330 trillion market by 2025.

The size of IoT represents an immense market potential for Nova Labs. More conservative estimates place LoRaWAN device and networking solutions at around $5.5 billion by 2026. Nova Lab’s expansion into 5G lets them compete in the $21 billion 5G network infrastructure market. Between 5G and IoT, Nova Labs’ market is over $25 billion.

Competition

Nova Lab’s Helium network size has surpassed LoRaWAN competitors like Senet and Everynet by using blockchain incentives to build consumer-grade networks hosted by third-party hotspot owners. By contrast, Senet and Everynet focused on enterprise-grade networks for cities and businesses. While smaller, they made networks with customer demand already secured.

Infrastructure competitors can also be partners. Senet partnered with Nova Labs in April 2022 to supplement its network. Using Helium’s network footprint and cheap data rates, Senet could expand its customer base, address lower-cost applications without incurring infrastructure costs, and build marginal enterprise-grade infrastructure to service enterprise-level SLA agreements. Meanwhile, Nova Labs created a demand for its services. Similarly, Dish wireless paired with Nova Labs to use Helium hotspots to supplement its 5G infrastructure.

Business Model

Nova Labs’ business model is not public. They do not disclose how hotspot owners and data users burning HNT for data credits earn revenue. However, in response to Twitter skeptics tearing down Nova Lab’s revenue numbers, CEO Amir Haleem confirmed that the company earns revenue on fees and data credit sales.

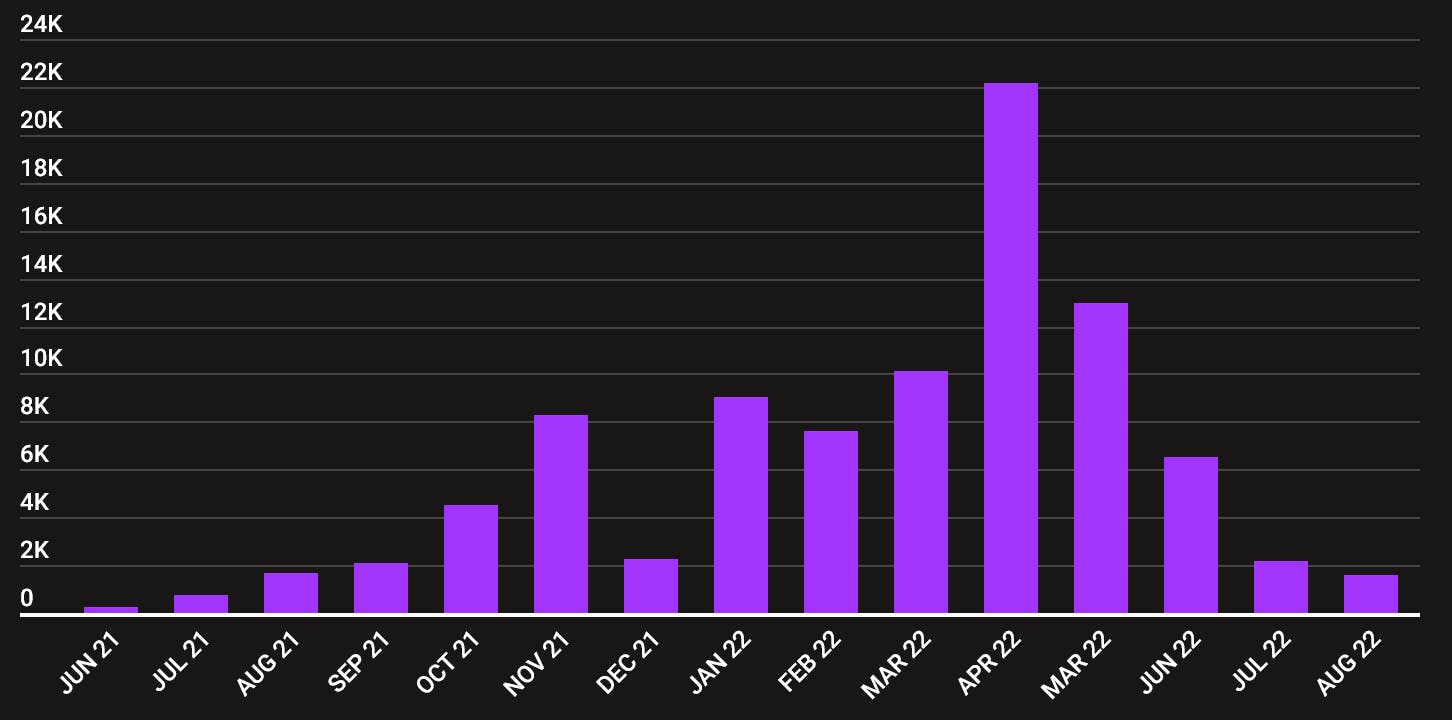

When setting up a hotspot, a Helium owner buys 1.05 million data credits (~$10) to establish the hotspot’s location. If the hotspot location changes, the owner must pay the fee again. Transferring hotspots to a new owner is a 0.05M data credit fee. Total fees and data sales generated $5.5 million in April 2022, but this decreased to $2.6 million in June as the poor economics slowed the number of setups.

Setup fees comprised most of the company revenue. Only $6,551 came from network users buying data in June 2022 and this decreased to less than $2K in August. The company said it would announce additional monetization initiatives in the fall of 2022 but had not done so by late 2022.

Source: Forbes; Monthly USD revenue from data credit purchases

Although the revenue is low, Nova Labs operates an asset-light business given that it outsourced infrastructure hardware, servers, and maintenance to other parties. Nova Lab’s costs reside primarily in developer and business development headcount costs.

Traction

From 2018 to 2022, Nova Labs gained traction quickly on the hotspot supply side. In 2021, Helium hot spots grew 3,100% from 14K to 450K hotspots. By August 2022, the company had doubled this to reach 916K hotspots.

From the demand side, Nova Labs does not announce its total number of customers. Featured user stories on its webpage show 75 IoT customers in industries like agriculture, healthcare, and location services.

Valuation

Since its founding in 2013, Nova Labs has raised $365 million from investors, including Tiger Global, Khosla Ventures. In December 2020 and August 2021, it raised $111 million in two Initial Coin Offerings (ICO), selling HNT to private investors. The terms of the ICO are not public and add nuance to Nova Lab’s valuation if the ICO’s HNT were pegged to public market value.

Nova Labs followed their ICOs with a $200 million Series D in February 2022 at a $1.2 billion valuation, led by Tiger Global and Andreessen Horowitz. The company plans on using its Series D funding to hire development resources, support wireless protocols, and build new applications. Although cryptocurrency is a key part of Nova Lab’s incentive structure, it is unclear if crypto market caps play a direct role in Nova Lab’s valuation.

Key Opportunities

IoT Expansion

IoT deployments grew from 2.1 billion devices in 2013 to ~11 billion by 2020. Most growth came from devices with enough monetary value to justify a high-cost cellular network connection or to build out the small networking infrastructure costs (e.g., manufacturing sensors). However, many IoT devices are never developed and do not justify the costs. LoRaWAN infrastructure enables innovation in low-energy, high-distance sensors not possible on other networks.

In a rebuttal to Nova Lab skeptics, CEO Amir Haleem claims network demand will rise because innovation is only viable after the network is in place. As an example company, he pointed to Nano Things, a temperature-sensing sticker manufacturer. Nano Things uses Helium and Senet networks to track the temperature of packages moving across the country. Their low-cost sticker sensor is valuable but not valuable enough to justify building its own network like manufacturing or healthcare IoT does. After building low-cost LoRaWAN infrastructure, Nova Labs expects innovative companies to drive demand.

Telecom Partnerships

In Jan 2022, COO Frank Mong stated Nova Labs is educating Tier 1 and Tier 2 telecom providers about their 5G infrastructure capabilities. However, telecoms are still deciding if Nova Labs is “a potential leverage point or existential threat in the short and long term.”

By August 2022, Dish announced a partnership with Nova Labs. Pairing with established telecom providers accelerates Helium’s 5G network’s demand. Partnerships are helping Nova Labs build a more robust path to monetization.

Key Risks

Low Demand / Unknown Monetization Strategy

In June 2022, the company confirmed customers buying data coverage produced less than $6,651. Helium infrastructure growth greatly outstripped demand. Lime and Salesforce, featured on Nova Lab’s website, announced in July 2022 that they do not have business relations with Nova Labs. Other than a small pilot before 2020, Lime was never a Nova Labs customer. VC investor Josh Rosenthal responded to concerns about the business model by stating that the company is focusing on providing infrastructure before the potential to monetize the infrastructure. However, without demand for data credits and hotspot growth fueling speculation on HNT, the token economics for users fall precipitously.

Blockchain Economics

Hotspot operators were increasingly vocal and nervous about their revenue through the summer of 2022. Operators joining in 2021 earned thousands of dollars a month based on the high price of HNT (high of $58) and the rate of 50-200 HNT mined each month.

During the 2021 to early 2022 period of extreme growth, hotspots sellers like Bobcat Miner were on backorder for 20-30 weeks, and $430 miners sold for $1,400 on eBay. By the summer of 2022, revenue fell to $16-40/month as HNT prices plummeted to $8 and hotspots mined 2-5 HNT/month. As of November, the HNT prices was as low as $2.20 and miners had slowed to less than a HNT a month. Hotspot miner resales dropped to $100 on eBay in November 2022.

With poor economics, node operators may lose money participating in the chain and leave, threatening Nova Lab’s infrastructure reliability and growth. In the long term, data users’ demand for HNT will theoretically prop up the price as they buy HNT to get data credits. However, in the short term, crypto speculation will drive the price of HNT. HNT buyers may become more skeptical of Nova Lab’s monetization strategy if the crypto market cap continues to decline. If users leave the networks, the instability may threaten their ability to sell data credits and cause further decay in the network.

Summary

Nova Labs is one of the largest LoRaWAN networks in the world, with over 900K hotspots in September 2022. They scaled quickly by using decentralized blockchain protocols to lower infrastructure costs while riding favorable cryptocurrency conditions from 2019 to early 2022. However, the company still needs to prove it can generate demand from LoRaWAN IoT device users. Expanding into 5G may increase revenue if they can form the right partnerships. The company can potentially serve IoT and 5G connectivity markets worth $25 billion, but commercialization plans remain unclear.