Thesis

Decentralized exchanges (DEXs) are peer-to-peer marketplaces that use smart contracts to allow users to trade cryptocurrencies without the intermediation of a third-party custodian. In traditional finance, regulatory requirements and competitive barriers prevent individuals and small organizations from becoming market makers. DEXs provide direct market access to all participants. Individual traders have full access to the technology stack of DEXs, enabling them to provide quotes and trade using the same technology available to all users.

As of October 2022, DEXs were responsible for 18.2% of spot trading volume in crypto, with the majority of volume occurring on centralized exchanges (CEXs) like Binance and Coinbase. DEXs gained ground in the wake of the high-profile collapse of FTX, a centralized exchange; trading volume on DEXs reached $91 billion in November 2022, which represented a 79% increase over the previous month. DEXs reached a spot trading volume of $216 billion in the first quarter of 2023, which represented a 33.4% increase relative to the last quarter of 2022. DEXs continued to eat market share from CEXs well into 2023 even amidst a broader crypto winter, with the ratio of DEX to CEX spot trading volume reaching a high of 22% by June 2023.

Uniswap is the largest DEX by volume, recording $94.7 billion in spot trading volume in March 2023 alone, allowing it to surpass Coinbase’s trading volume for the first time. Uniswap is an on-chain DEX protocol built on top of Ethereum that enables users to exchange ERC-20 tokens. Users provide trading liquidity between ERC-20 asset pairs on Uniswap through liquidity pools (LPs). LPs earn fees from trades and distribute them to the liquidity providers and the Uniswap team. Uniswap is also one of the first automated market makers (AMMs), systems that use smart contracts to provide liquidity on an exchange using blockchain oracles and liquidity pools. The Uniswap Protocol and the Uniswap Interface were designed to be censorship-resistant and were developed by Uniswap Labs.

Founding Story

Uniswap Labs was founded in 2018 by Hayden Adams (CEO) who was also the inventor of the Uniswap Protocol. Adams studied to be a mechanical engineer in college, and his first job after graduating was at Siemens. He was laid off from that job in July 2017, after which he had a conversation with his friend Karl Floersch who told him:

“Congratulations, this is the best thing that could have happened to you!!! Mechanical Engineering is a dying field. Ethereum is the future and you’re still early. Your new destiny is to write smart contracts!”

According to Adams, Floersch caught him at a “low point” with this conversation and convinced him to get into Ethereum. Adams spent the following two months learning the basics of Ethereum and smart contract development. At this point, Floersch suggested Adams begin work on creating an AMM, the concept for which had been initially described by Vitalik Butherin, the inventor of Ethereum, in a 2017 blog post. He then built a proof-of-concept for what would become Uniswap from October to November 2017.

Adams had now been unemployed for five months and was living off cryptocurrency he had purchased earlier that year. It so happened that Floersch was giving a talk at Devcon 3 which occurred the same month, and he used Adams’ Uniswap demo as an example of crypto-economics. Following this, Pascal Van Hecke, an attendee at the talk, expressed interest in supporting Adams’ efforts and gave him a grant to fund his next month of research.

By April of the following year, Adams had been unemployed for 10 months and the crypto he was using as a source of funding was down 75%. Regardless, he decided to book a trip to a crypto conference in South Korea, Deconomy 2018, where he was introduced to Ethereum inventor Vitalik Buterin. Adams told Buterin about Uniswap, who read the entire smart contract on his phone on the spot and then advised Adams to apply for an Ethereum foundation grant.

The application was successful. Adams received a $100K grant from the Ethereum Foundation After Adams had worked on the project for over a year, Uniswap v1 was publicly announced and deployed to the Ethereum mainnet in November 2018 as a proof of concept. The second version of Uniswap, Uniswap v2, would officially deploy to the Ethereum mainnet in May 2020, and Uniswap v3 was deployed in May 2021. According to Uniswap’s GitHub page, there are 13 core contributors, to the Uniswap project, as well as 48 engineers employed by the company as of September 2023.

Product

Uniswap Protocol

Uniswap Labs’ main product is the Uniswap Protocol, a peer-to-peer system for exchanging ERC-20 tokens. Unlike centralized exchanges such as Binance or Coinbase, Uniswap functions without intermediaries. Trusted intermediaries cannot restrict access to Uniswap, because it is a decentralized protocol.

This is not the case for centralized exchanges; there are multiple examples of cases where centralized exchanges halted fund withdrawals by users such as when Celsius halted all withdrawals in June 2022 before filing for bankruptcy in July. FTX not only halted user funds but appears to have lost significant amounts of user deposits. Uniswap is designed to prevent scenarios like this. Decentralized exchanges are built with the intent of preventing any single entity from controlling the exchange.

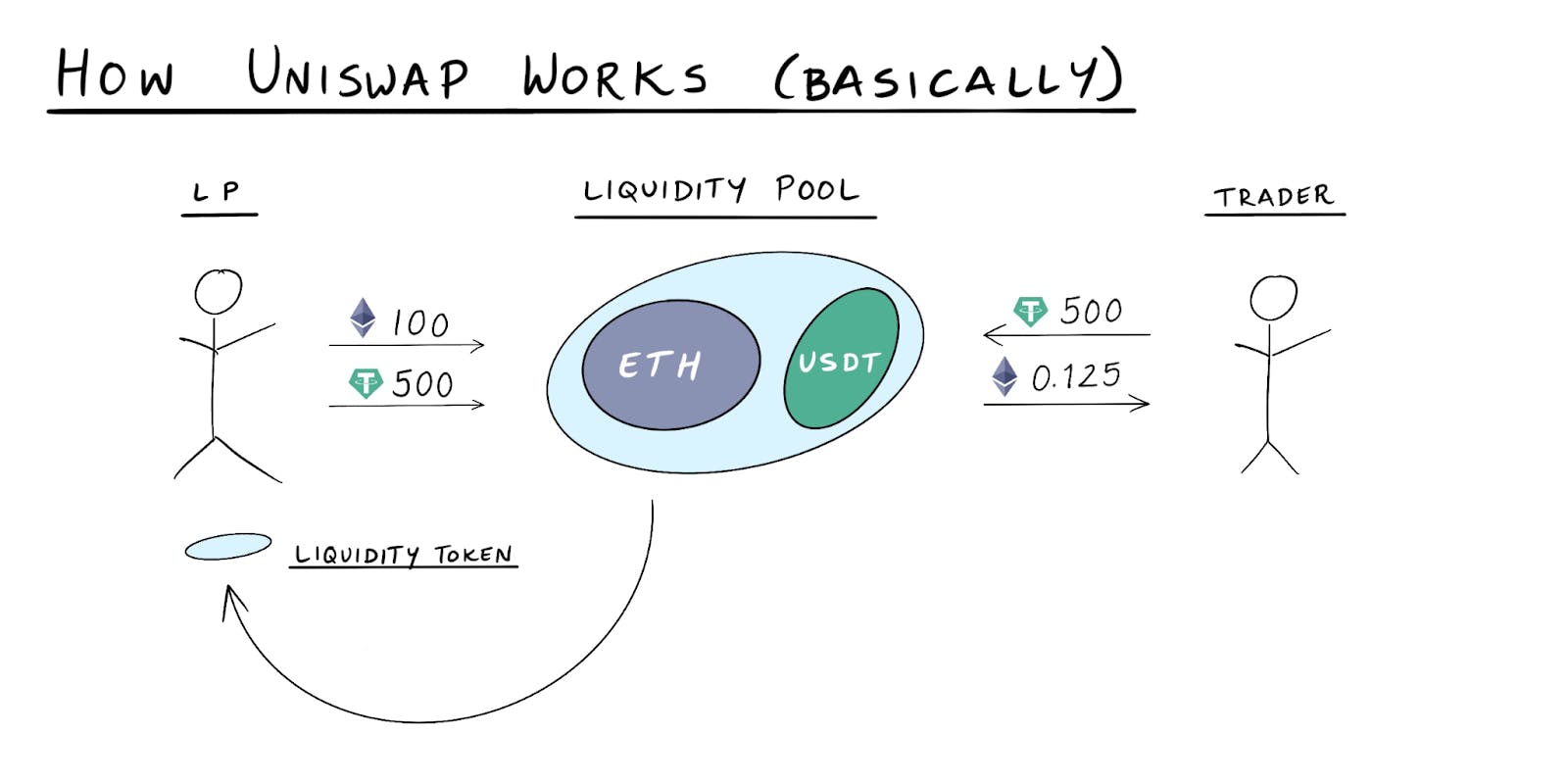

Uniswap is one of the first automated market makers(AMMs). AMMs allow users to trade against a pool of tokens known as a liquidity pool, instead of trading directly between the individual bids of buyers and sellers. In contrast to centralized exchanges using order books to trade between buyers and sellers, Uniswap uses liquidity pools. Liquidity providers (LPs) deposit tokens into a liquidity pool and are rewarded with the fees generated when other users make trades. Traders pay a fee to liquidity pool providers when executing trades. Uniswap does not charge fees for listing tokens and does not require user registration.

With liquidity pools, the constant product formula determines the price of assets in a trade based on the number of tokens in the relevant liquidity pool needed to route the trade. When tokens are purchased, a proportional amount of tokens on the other side of the liquidity pool are sold for the purchased asset and deposited back into the liquidity pool to maintain a constant price. The ratio of tokens within liquidity pools combined with the constant product formula determines the price trades execute at.

The Uniswap Protocol itself is a suite of smart contracts that together create an AMM. Uniswap also built a web interface connecting to the Uniswap Protocol and has a governance system based around the UNI token. UNI token holders have voting power for Uniswap distributed in proportion to a user’s UNI balances. Uniswap’s code is open source and can be forked to create new exchanges.

The Uniswap ecosystem has three types of users: liquidity providers, traders, and developers:

Source: The Generalist

LPs are incentivized to contribute ERC-20 tokens to common liquidity pools with the potential to earn fees and other liquidity incentives. They provide liquidity by staking or locking up tokens in Uniswap smart contracts and are rewarded with liquidity tokens representing their contribution to the liquidity pool.

Developers can use decentralized exchanges such as Uniswap to launch new tokens or automatically trade tokens while being decentralized. Uniswap may offer more products in the future, including lending platforms, coin launchers, and NFT platforms. In June 2022, Uniswap acquired Genie, an NFT marketplace aggregator. As stated in the Uniswap blog at that time:

“NFTs will be integrated into our products, starting with the Uniswap web app, where soon you’ll be able to buy and sell NFTs across all major marketplaces. We’ll also integrate NFTs into our developer APIs and widgets, making Uniswap a comprehensive platform for users and builders in web3.”

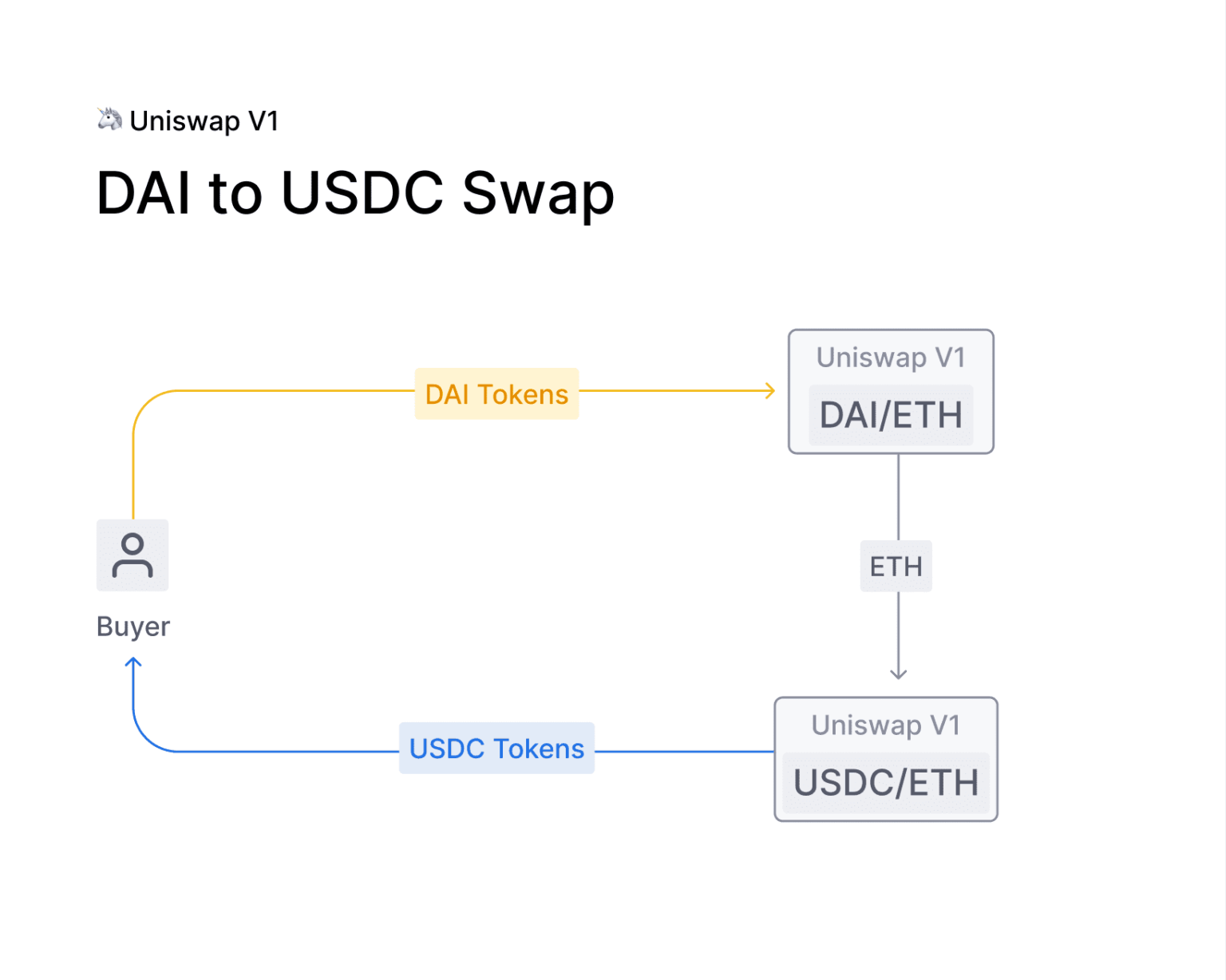

Uniswap v1

Uniswap v1 was first launched on the Ethereum mainnet in November 2018. Uniswap v1 supported only ETH-ERC20 trading pairs, so users could only swap ETH for a single ERC-20 token. For example, if someone wanted to swap USDC for DAI, they had to swap USDC for ETH and then go to the ETH-DAI pool to swap ETH for DAI. To place trades between two assets in Uniswap v1 usually two swaps would need to take place, leading to more fees and slippage for users compared to a single swap. Uniswap v2 allowed trades to be routed using one swap, eliminating the excessive slippage and gas fees paid by users in Uniswap v1.

Uniswap v1 also introduced the concept of liquidity provider tokens. Every liquidity provider would get an amount of LP tokens proportional to the percentage of liquidity they are adding to a liquidity pool. All LP tokens represent an asset that generates fees on Uniswap by facilitating trades on the protocol by providing liquidity. All LP tokens represent an LP’s contribution to the pool and could be sold, traded, or burned to redeem the deposited tokens. Additionally, every trade on Uniswap incurred a trading fee that was automatically sent as a reward to LPs providing liquidity.

Source: Uniswap

Uniswap v2

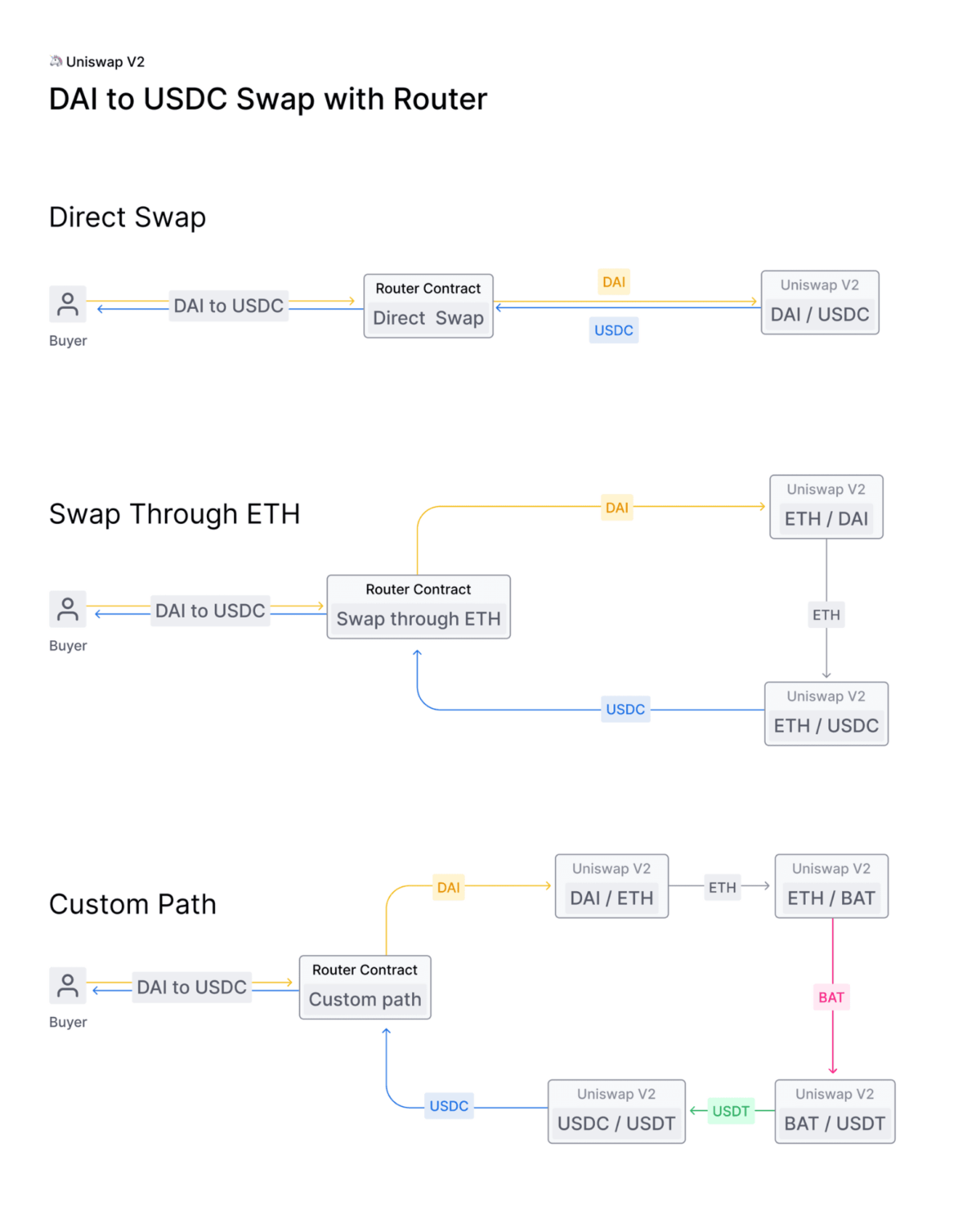

Uniswap v2 launched in May 2020. It improved on Uniswap v1 by introducing ERC20-ERC20 liquidity pools. After Uniswap v2 was launched, users wanting to swap USDC for DAI could swap USDC directly for DAI if a USDC-DAI pool exists, rather than executing two swaps from USDC-ETH then from ETH-DAI using Uniswap v1.

Additionally, Uniswap v2 introduced a price oracle, or a tool used to view price information about a given asset. It calculates the average price of an asset over a period of blocks ( referred to as ”time-weighted average price, or TWAP) by dividing the cumulative price by the timestamp duration. These price oracles are a critical component for many decentralized financial applications, including those related to derivatives, lending, margin trading, and prediction markets.

Uniswap v2 also introduced flash swaps that allow users to withdraw any amount of ERC20 tokens without having to pay upfront, provided that by the end of the transaction execution, the user either pays for all ERC20 tokens withdrawn, or pays for a percentage of ERC20 tokens and return the rest, or returns all ERC20 tokens withdrawn. An example of using flash swaps is being able to arbitrage with no upfront capital.

Uniswap v2 charges a 0.3% trading fee. However, Uniswap v2 also introduced a protocol fee switch. If the fee switch is flipped on, instead of 0.3% of all fees going to the LPs, 0.25% of the trading fees would go to LPs and the remaining .05% would be used to support contributions to Uniswap and its ecosystem.

Source: Uniswap

Uniswap v3

Uniswap v3 was launched in May 2021 and improves upon Uniswap v2 in several facets. Specifically, Uniswap v3 introduced:

Concentrated liquidity, giving individual LPs granular control over what price ranges their capital is allocated to, and

Multiple fee tiers, allowing LPs to be appropriately compensated for taking on varying degrees of risk.

Uniswap v3 also launched on layer 2 blockchains including Polygon, Arbitrum, and Optimism in addition to Ethereum. Uniswap V3 improved its price oracle, making it easier and cheaper to integrate it into apps and services.

Uniswap v3 offers LPs three separate fee tiers — 0.05%, 0.3%, and 1%. LPs using Uniswap v3 have more flexibility in their risk margins. Lower fee tiers are expected for less risky positions, such as stablecoins, and higher fee tiers are expected for more risky positions, like non-correlated token pairs. Uniswap v3 also has protocol fees similar to Uniswap v2. Fees will be off by default but can be turned on by governance on a per-pool basis and are set between 10% and 25% of LP fees.

Furthermore, Uniswap v3’s license was updated such that the code may not be forked for commercial use for two years in response to the Sushiswap fork. The Uniswap team made the following public statement about the decision to update their commercial license:

“We strongly believe decentralized financial infrastructure should ultimately be free, open-source software. At the same time, we think the Uniswap community should be the first to build an ecosystem around the Uniswap v3 Core codebase.”

Uniswap v4

The white paper for Uniswap v4 was released in June 2023, indicating that an official launch is imminent. The company stated that it released the draft code for Uniswap prior to launch so that “it can be built in public with open feedback and meaningful community contribution. The company expects that this will take several months.

One of the principal new features of Uniswap v4 will be “hooks”, which have been described as “programmable buttons that developers can customize to add new features to their liquidity pools.” Uniswap v4 will also introduce a singleton contract that manages token pairs in the protocol, increasing gas efficiency and lowering the cost of deploying new trading pairs significantly.

Uniswap Labs Ventures

In April 2022, Uniswap Labs announced the launch of Uniswap Labs Ventures, an organization investing in teams building web3 products. Uniswap LabsVentures invests in all technologies associated with web3, like infrastructure, developer tools, and consumer-facing applications.

Market

Customer

Uniswap customers include developers, traders, and liquidity providers. Developers develop DeFi apps and integrations built on the Uniswap Protocol, traders swap various cryptocurrencies using Uniswap, and liquidity providers earn fees generated trades on Uniswap. Beyond developers, traders, and liquidity providers, Uniswap also fosters a community of users, developers, designers, and educators through social media. They use Discord, Twitter (X), Reddit, and the Uniswap Governance Forum to drive the success of the Uniswap protocol.

Market Size

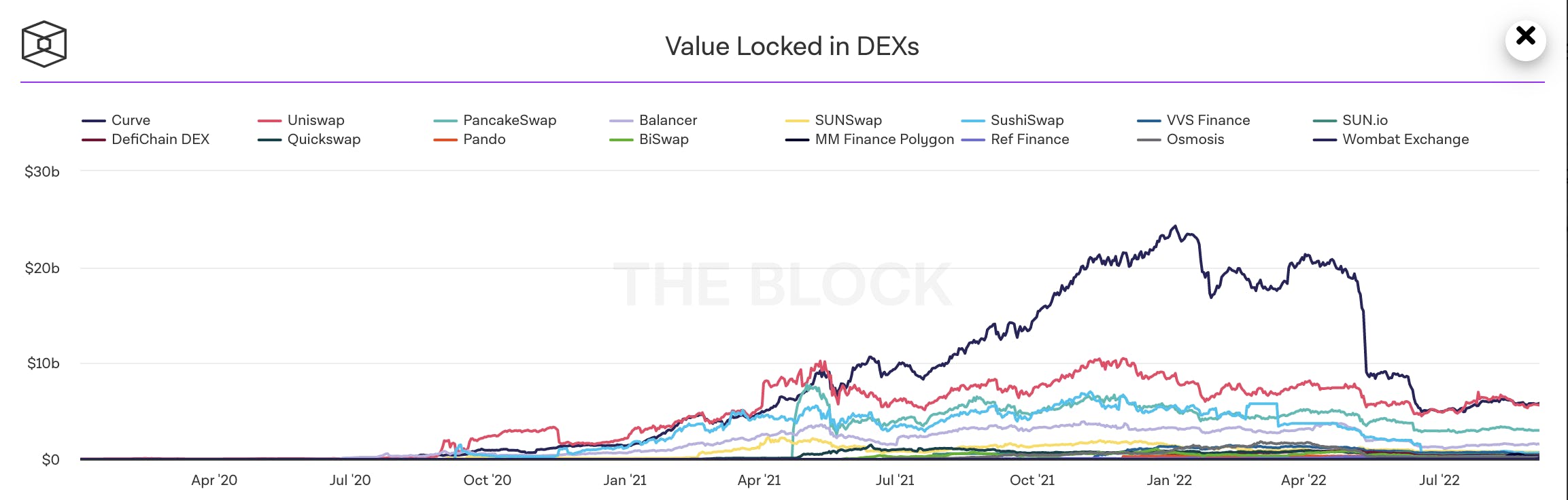

As of September 2023, the DeFi TVL was $37.7 billion; of this, the Ethereum blockchain’s TVL was $20.7 billion. The graph below shows the value locked inside of popular DEXs from July 2020 to September 2023.

Source: The Block

DeFi could potentially take market share from traditional finance as people begin to trust the safety of smart contracts. In 2021, the consumer banking industry was estimated to be worth $2.3 trillion globally, and capital markets were estimated to be worth $121 trillion. If the TVL of DeFi protocols continues to grow by taking market share away from traditional financial products, then Uniswap may see a significant rise in its addressable market.

Overall, the total cryptocurrency market cap is ~$1.1 trillion as of September 2023 (down from an ATH of $2.9 trillion in November 2021). Of this, a report from September 2023 valued the DeFi market at $13.6 billion as of 2022 and estimated that this would grow to $601 billion by 2032, representing a 46.1% CAGR.

Competition

Centralized Exchanges

Uniswap’s main competitors include CEXs such as Binance, Coinbase, and Kraken. Compared to DEXs, CEXs provide more due diligence in regulating tokens available to trade on their platforms and better support for converting cryptocurrencies to and from fiat. In contrast, tokens may be added by anyone on Uniswap, but trades cannot be converted to fiat using Uniswap.

CEXs also take the responsibility of key management away from their users, which might attract a broader customer base than is possible for Uniswap. By using a centralized exchange, users eliminate the risk of losing assets due to DeFi exploits or loss of private keys. However, as examples like FTX showed, centralized exchanges introduce the risk of mismanagement by the exchanges themselves.

Binance: Binance, the largest CEX, processed more than 50% of global spot trading volume between Q1 and Q2 2023. It was founded in 2017 and offers 385 tokens (compared to Uniswap’s 902 coins). Binance faces regulatory challenges in the US, with the SEC accusing it of running “an illegal exchange”.

Coinbase: Coinbase is a US-based centralized exchange that was founded in 2012. It went public in April 2021 at a market cap of over $100 billion, but its market cap has declined to $17 billion as of September 2023. Coinbase offers 241 tokens on its exchange versus 902 coins available on Uniswap V3 as of September 2023. Uniswap surpassed Coinbase’s trading volume for the first time in Q1 2023, with Uniswap recording $155 billion vs. Coinbase’s $145 billion.

Kraken: Kraken was founded in 2011 and has raised more than $130 million in total funding as of September 2023, with its latest round being a Series D of undisclosed size from 2021. Kraken supports 240 tokens, and its fee structure, like Coinbase’s varies according to volume incentives.

Decentralized Exchanges (DEXs)

Smart contract automation can make trading assets more efficient. Uniswap uses smart contracts to avoid liquidity issues that traditionally affect centralized exchanges. The elimination of any rent-seeking third party, such as a centralized exchange or financial institution, can also reduce transaction processing fees because transaction fees do not need to fund the daily operations of an entire company. The largest DEX competitors to Uniswap included dYdX, Kine Protocol, and Pancakeswap.

dYdX: dYdX was founded in 2017 by ex-Coinbase engineer Antonio Juliano. The dYdX protocol was built using Ethereum smart contracts and Starkware zero-knowledge cryptography. It is the top DEX by volume as of September 2023, having exceeded Uniswap’s trading volume for the first time in September 2021, with a 24-hour trading volume of ~$800 million. It has a six-tiered fee structure ranging from .02% to .07% (maker and taker fees combined) with volume incentives. It has raised $87 million in total funding as of September 2023, with its latest round being a $65 million Series C in June 2021 led by Paradigm.

Kine Protocol: Kine is a Singapore-based DEX which was founded in 2020. It raised $7 million in a March 2021 seed round led by Alexander Pack and Naval Ravikant. Its 24-hour trading volume as of September 2023 was around $260 million. The company claims to have the “lowest trading cost” with zero gas fees and a fixed trading fee of 0.1% per order. It was the third largest exchange by trading volume, after dYdX and Uniswap, as of September 2023.

PancakeSwap: PancakeSwap is a DEX that was first built on the Binance Smart Chain (BSC) by anonymous developers in September 2020. It offers four fee tiers: 0.01%, 0.05%, 0.25%, and 1%. It is the fourth-largest DEX by trading volume as of September 2023.

Business Model

Uniswap’s primary source of revenue is fees for processing trade orders. Uniswap v2 takes 0.3% on all trades, and Uniswap v3 has three fee tiers: 0.05%, 0.3%, and 1.0%. In August 2021, Uniswap officially distributed over $1 billion in fees since its creation in 2018 to users providing liquidity through Uniswap v2 and v3. Uniswap was the first DeFi protocol to surpass $1 billion in generated fees distributed to its users.

Although most of the fees are distributed to LPs, Uniswap keeps a portion of the fees in some trading pools. In 2021, Uniswap generated over $1 billion in fees for the year, and it’s estimated that about $40 million of that went directly to Uniswap. Since Uniswap uses smart contracts to execute trades, it doesn’t need to spend large amounts of capital to host servers or hire operational personnel like traditional exchanges. Once the smart contract code is launched, it cannot be changed or modified and is hosted directly on the blockchain instead of on centralized servers.

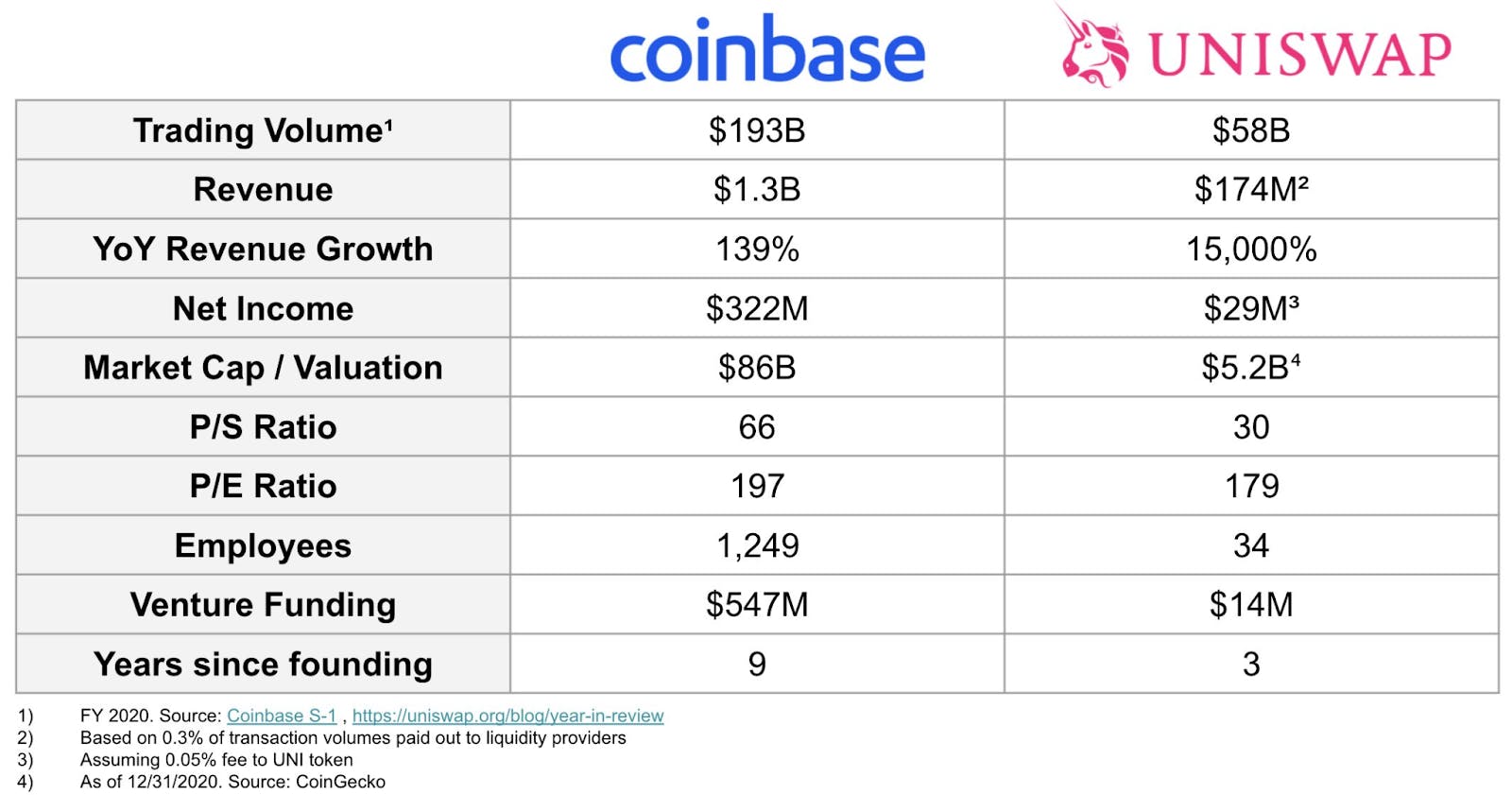

Uniswap’s staffing costs are comparatively low. Coinbase, which Uniswap exceeded in trading volume in early 2023, employs 4.3K people as of September 2023 versus Uniswap’s 138 employees. This indicates that Uniswap has comparatively good unit economics.

Source: Twitter @dberenzon

Traction

Uniswap is the largest DEX by volume, recording $94.7 billion in spot trading volume in March 2023 alone, allowing it to surpass Coinbase’s trading volume for the first time (with Uniswap recording $155 billion vs. Coinbase’s $145 billion in Q1 2023). This continued in the second quarter of 2023 with Uniswap reporting $110 billion in volume. Hundreds of decentralized finance (DeFi) apps, tools, and wallets utilize Uniswap, including projects like Aave, 1inch, and Compound Finance.

Source: Uniswap

Uniswap is one of the largest AMM DEXs in decentralized finance (DeFi). The TVL in the Uniswap protocol at its peak in November 2021 was over $10 billion. As of September 2023, the TVL of the Uniswap protocol is ~$4 billion, making it the fifth-largest DeFi protocol by TVL.

Valuation

Uniswap founder Hayden Adams initially received a $100K grant from the Ethereum Foundation in August 2018. In October 2022, Uniswap raised a $165 million Series B that valued the company at $1.7 billion. Additional investors participating in Uniswap’s Series B included a16z, USV, Paradigm, Version One, Variant, Parafi Capital, SV Angel, and A.Capital.

Using the traditional Gordon Growth Model to value Uniswap, Blockchain at Berkeley predicted a UNI price that was an average of 0.001X the token’s actual price based on the growth rate of LP fees in September 2022. The UNI token was worth $4.28 as of September 2023 with a market cap of $2.5 billion, down from an all-time high of $22.6 billion in May 2021. The Gordon Growth Model values UNI at around $4.6 billion. However, the Gordon Growth Model method fails to consider factors such as uncertainty around market prices, developing regulations, future governance decisions, and future projected growth.

Key Opportunities

Chain Expansion

Uniswap was one of the first DEXs and pioneered the idea of the Automated Market Maker (AMM) and Liquidity Pools. It is the second biggest DEX in terms of market share, having been beat out by dYdX which surpassed it in September 2021. It has consistently updated its protocol and expanded to new chains. Expanding to additional EVM-compatible L1 is a key opportunity for Uniswap, as many traders have moved to different blockchains due to high Ethereum gas fees.

New Product Offerings

Additional opportunities include expanding some features into the DeFi space. Uniswap could start offering lending and margin trading similar to competitors like Sushiswap. Uniswap may also expand to additional fee structures designed to compete with stablecoin trades and additional specialized AMMs such as Curve Finance. For example, in Q4 of 2021, Uniswap governance passed a fourth 0.01% fee tier specifically designed for stablecoin trades.

In June 2022, Uniswap acquired Genie, an NFT marketplace aggregator, and launched NFT trading on its platform in November 2022. Although NFTs have seen large price declines in 2023, they may represent a growth opportunity in the future.

Key Risks

Regulation

The changing environment of cryptocurrency regulations is a risk that may affect Uniswap. Uniswap does not require any identifying information of the trader (KYC) or require any background checks before listing a token on the exchange or facilitating a trade. Since they are decentralized, they’re not required to comply with the regulations for traditional companies.

Regulations required for Uniswap to potentially comply with are unclear. However, the SEC has investigated Uniswap to determine if the tokens listed on it should be considered securities. The SEC's decisions on how to regulate the cryptocurrency market may impact Uniswap’s position as a DEX. Uniswap may need to start collecting identifying information from its users. However, a federal judge dismissed the lawsuit against Uniswap in August 2023 while classifying ETH as a commodity.

Forks

Since Uniswap is open-source, it is possible for anyone to copy and fork its code. In fact, SushiSwap was a fork of Uniswap and conducted a vampire attack — a method where one protocol offers better incentives than another protocol, stealing their customers and investors. The Sushiswap vampire attack siphoned off almost $1 billion in TLV from Uniswap. In response, Uniswap introduced the governance token UNI, and Uniswap’s v3 license was updated such that the code may not be forked for commercial use for two years.

Gas Fees

Due to Ethereum’s high gas fees, some traders have moved to other L1 chains, such as Solana and Avalanche. The high gas fees may cause fewer people to use Uniswap on Ethereum as traders move to different chains to pay less fees. However, Uniswap is mitigating the risk associated with high gas fees by expanding its protocol to layer 1 solutions like Celo and layer 2 solutions such as Optimism, Arbitrum, and Polygon.

Summary

Uniswap provides value to traders and LPs by allowing traders to easily swap tokens and LPs to earn high fees in exchange for providing liquidity. It is among the biggest DEXs in terms of TVL and volume, and one of the oldest DeFi protocols. There are some opportunities for Uniswap to expand to additional blockchains and create new products. However, some key risks in the future include regulatory risk, copycat DEXs due to the open-source code, and whether people will continue to trade on Ethereum or move to a different blockchain due to the high gas fees on Ethereum.