Thesis

The implementation of the United States-Mexico-Canada Agreement (USMCA) in 2020 led to a significant increase in cross-border trade. In 2023, imports to the US from Mexico totaled $475.6 billion in value, and exports from the US to Mexico were $323.2 billion. Both figures had grown markedly from a decade earlier: in 2013, Mexican imports to the US were valued at $280.6 billion and US exports to Mexico were valued at $225.9 billion. This growth has made Mexico’s trade relationship with the US one of the most important; imports from Mexico to the US in 2023 exceeded those from China, which totaled $427.2 billion, for the first time in nearly two decades.

The flourishing trade relationship between the US and Mexico is facilitated by their geographic proximity and the extensive land border the two countries share, making land trade easier. Air freight can cost up to 20 times more than ocean or land transport, while ocean transport can be up to 10 times slower than air freight. Land freight, by comparison, is a good in-between option that offers a quick and cost-efficient way to deliver goods over short distances, which benefits shipping across the US-Mexico border.

Nuvocargo provides a US-Mexico cross-border freight solution that encompasses freight forwarding, customs brokerage, cargo insurance, and managed transportation. Nuvocargo allows business customers to centralize their vendors and provides “granular real-time visibility” on freight shipments with “6+ border-specific events, and 24/7 tracking across every leg”. As of April 2024, it leverages over 250 vetted carriers with a total fleet of over 20K trucks to provide this solution for customers, along with a bilingual team of Spanish and English speakers.

Founding Story

Nuvocargo was founded in 2018 by Deepak Chhugani (CEO). Sam Blackman (former CTO) joined the company in 2019 as an additional co-founder.

Chhugani, born in Kenya to Indian parents and raised in Ecuador, was intimately familiar with the logistics industry from a young age, thanks to his father's freight forwarding and logistics business. After graduating from Bentley University in 2014, Chhugani worked in Bank of America’s Latin America M&A division for two years. He left in 2017 to start The Lobby, designed to help people with atypical, non-Ivy league backgrounds get jobs in finance and tech. After struggling to grow that business at the rate that he wanted, Chhugani pivoted to an area in which he had personal life experience: the intersection of logistics and the LatAm economy.

When Chuggani founded Nuvocargo, he envisioned a company that would tackle the complexities of cross-border trade between the US and Mexico, a market fraught with challenges like language barriers, cumbersome paperwork, and complex regulations. Nuvocargo emerged as the first digital platform dedicated to this specific trade lane, offering an integrated suite of services. Chhugani joined Y Combinator’s winter 2018 batch as a solo non-technical founder and first native Ecuadorian and then went on to join Y Combinator Growth in 2021.

Chhugani found Nuvocargo’s former CTO and technical co-founder Sam Blackman through an online blog post in 2018. Blackman is from New Zealand and attended the University of Auckland. After graduation, he was a founding team member, instructor, and product manager for Dev Bootcamp in New York. He went on to become the Head of Engineering at Common, where he stayed until he met Chuggani and became a co-founder of Nuvocargo in 2019. Blackman left his role as CTO in February 2023 and as of April 2024, was still working as an advisor for the company.

Product

Nuvocargo is a digital freight forwarder that assists customers in managing shipments through software. This approach centralizes data from various parties, enabling streamlined management and tracking of shipments on a cloud-based system. Beyond its primary freight forwarding service, Nuvocargo also provides additional products like customs brokering, cargo insurance, and supply chain financing.

Freight Forwarding

Nuvocargo provides a Federal Motor Carrier Safety Administration (FMCSA)-licensed, door-to-door freight forwarding service between the US, Mexico, and Canada for both imports and exports in both directions. It does so through a network of carriers and a bilingual team.

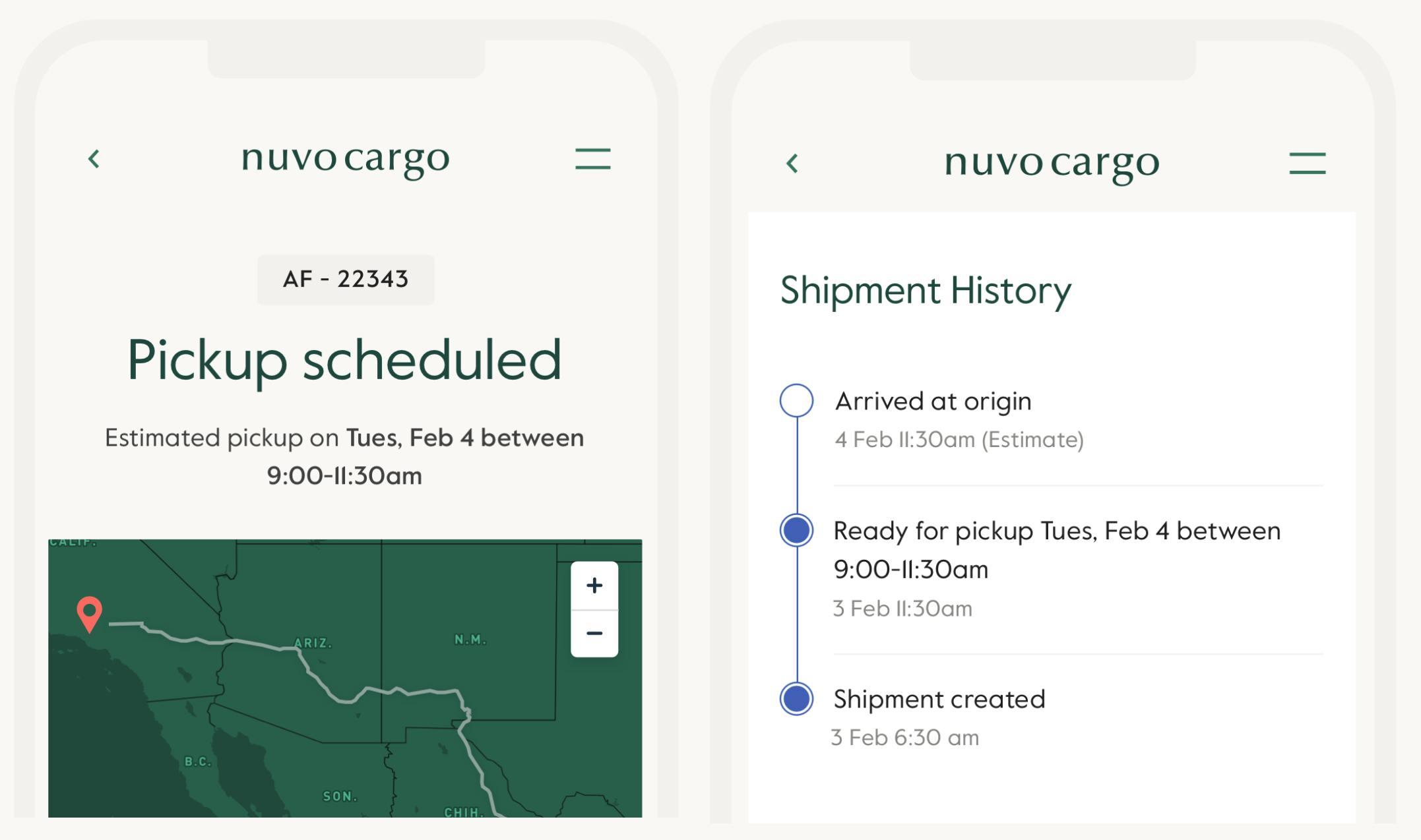

Source: Nuvocargo

Nuvocargo also provides a bilingual software platform, accessible on both desktop and mobile devices. It offers visibility on shipments, with live end-to-end tracking across borders with visibility into over six border-specific events, including critical stages such as arrival at origin, loading, paperwork processing, departure from origin, arrival at the border, border crossing, arrival at the destination, unloading, and ultimately, delivery at the final destination. The software platform also serves as a centralized solution for documents and paperwork, as well as reports intended to help customers optimize their supply chains.

Customs Brokerage

Nuvocargo offers a custom brokerage solution that helps clear shipments through customs. It classifies freight, assesses tariffs, and gathers and files paperwork with Customs and Border Patrol. While importers are not legally required to hire customs brokers, most do for the sake of efficiency and avoiding fees. Nuvocargo claims that its customs brokerage product helps companies clear customs faster by 33% and saves up to 20% in customs fees.

Trade Management

Nuvocargo augments its core freight forwarding services with complementary financial products. It offers import-export financing and inventory loans in multiple currencies. Additionally, Nuvocargo offers cargo insurance through third-party insurance providers, a mandatory requirement for carriers in the US. On top of cargo insurance, carriers must carry commercial risk insurance and insurance for civil responsibility, both of which are also offered by Nuvocargo.

Carrier Platform

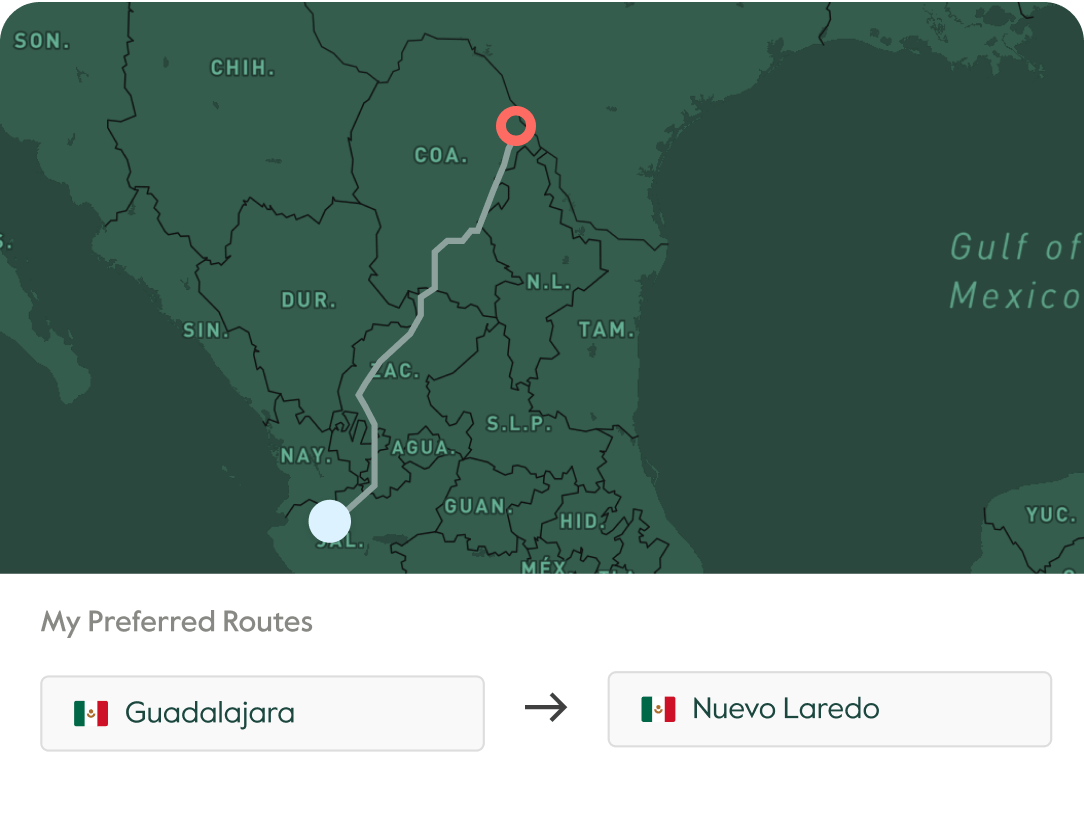

Source: Nuvocargo

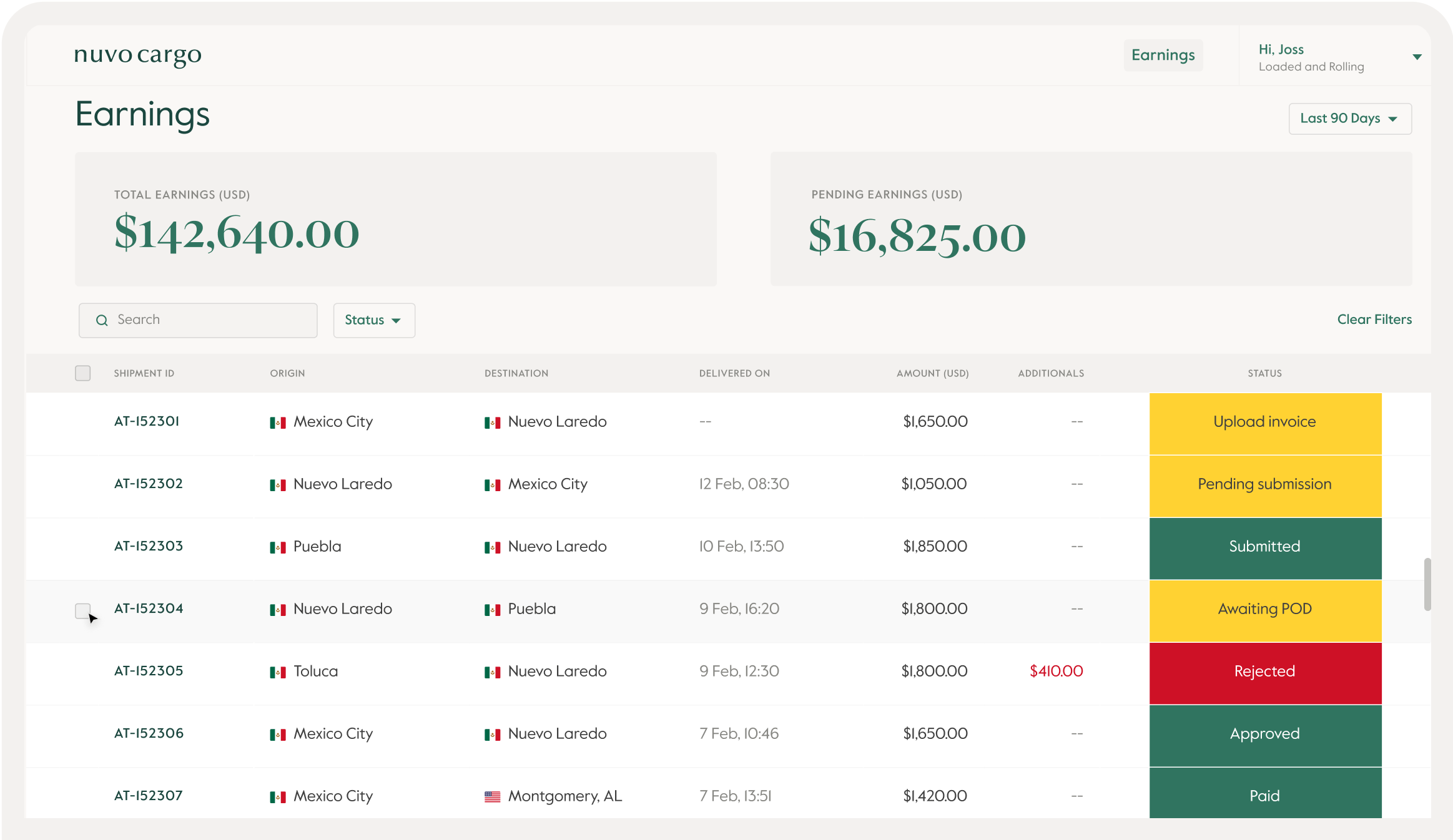

For carriers, Nuvocargo offers smart load matching. This allows carriers to haul on their preferred driving routes. It also offers an “all-in-one” software platform intended to help carriers streamline operations. In addition to visualizing all loads in one place, the platform allows carriers to upload invoices, proofs of delivery, and compliance documents.

Source: Nuvocargo

Carriers face high asset costs, low margins, and lengthy payment delays which range between 30-60 days. This raises cash flow management concerns, often causing carriers to turn to high-interest-rate loans. To address this problem, Nuvocargo offers QuickPay, a cash advance product allowing carriers to receive their payment in less than 48 hours based on their invoice value.

Market

Customer

Nuvocargo caters to shippers and carriers involved in cross-border trade between the United States and Mexico. Selling to these customers can be complex due to the intricacies of cross-border trade, including compliance with customs regulations, differing transportation standards, and language barriers. The last of these potential obstacles is why Nuvocargo emphasizes that its team is fully bilingual. As of April 2024, carriers using the Nuvocargo platform included Samax Express, Union Carriers, and Soluciones de Monterrey S.A. de C.V. Its shipping customers include Grupo Gondi, Howden Buffalo Forge, and Impulsora del Alambre SA de CV.

Market Size

The 2020 implementation of the USMCA led to a significant increase in trade between Mexico and the US, with a total of $798.8 billion in cross-border trade occurring in 2023, up from $506.5 billion in 2013. This represented an increase of $292.3 billion, a 4.7% CAGR for the decade. This growth has accelerated: from 2017 to 2022, trade between the two nations grew at a CAGR of 6.9%. Top Mexican exports include electronics, vehicles, and machinery while top US exports are agricultural products such as corn, soybeans, and dairy. US-Mexico trade is expected to hit $1 trillion by 2028.

As of 2020, logistics expenditure represented ~10% of global GDP at $9 trillion. Global road freight forwarding was estimated to be a $3.7 trillion market in 2022 and is projected to grow to $5.5 trillion by 2030. Freight forwarding in particular, a $182 billion market in 2022, is projected to grow to $221 billion by 2025 for a CAGR of ~5%. Across all regions, North America emerged as the largest global freight forwarding market with 37% of the global freight forwarding market revenue in 2021.

Nuvocargo’s product offerings beyond freight forwarding operate in modestly growing markets which add to its total addressable market. Cargo insurance was valued at $54 billion in 2022 and is projected to grow at a 3% CAGR until 2029 to reach $67.1 billion. Finally, the US customs brokerage market was estimated to be worth $5.2 billion in 2024 and is expected to grow to $6.6 billion by 2029, representing a 5% CAGR.

Competition

As of 2022, the freight forwarding market was highly fragmented with the top five firms capturing 20% of the market, the next 15 firms capturing another 20% of the market, and the rest of the market comprised of smaller providers with less than 2% market share.

Legacy Firms

Freight forwarding is subject to economies of scale. Consequently, larger, established companies that handle higher volumes have lower costs and higher margins. The gross margins of legacy firms range between 20-30%. In addition, legacy freight forwarders often receive net promoter scores in the teens but tech-enabled, digital-first freight forwarders can have scores in the 60s.

DHL: DHL, founded in 1969 and publicly listed in 2000, is a market leader with a 5% market share as of 2022. As of December 2023, Germany-based DHL is among the top three international package carriers, the world's largest air and ocean freight forwarder, and the second-largest overland freight broker in Europe. It has multiple lines of business, including international express shipping, air and ocean freight forwarding, contract logistics, and ecommerce solutions. DHL’s global freight forwarding solutions employ 30K+ employees and generated €28.7 billion in 2022, equating to 30.4% of its total revenue.

Similar to Nuvocargo, DHL provides customs brokerage services and cargo insurance along with its freight forwarding offering. While Nuvocargo’s focus is exclusively on overland, trucking shipments between US-Mexico, DHL has a global footprint, operating across air, ocean, road, and rail. As of April 2024, it has a market cap of $49.6 billion.

Kuehne+Nagel: Kuehne + Nagel (KN) is a global transportation and logistics company based in Switzerland and founded in 1890. It went public in 1994 and operates in 100 countries with over 81K employees as of April 2024. KN operates as a middleman between shippers and carriers, matching companies that wish to ship goods with carriers that have the capacity to transport the goods. By pooling demand, KN sells transportation capacity at more competitive rates than shippers could secure by dealing with the carriers directly.

As the largest customer for global container shippers, KN receives preferential treatment, such as guaranteed shipping capacity from leading shipping companies such as Maersk. Guaranteed capacity is a key differentiator for KN, attracting shippers drawn to its proven ability to secure space unavailable to smaller rivals, especially during peak seasons when shipping capacity tightens. As of April 2024, KN had a market cap of $31.5 billion.

Startups

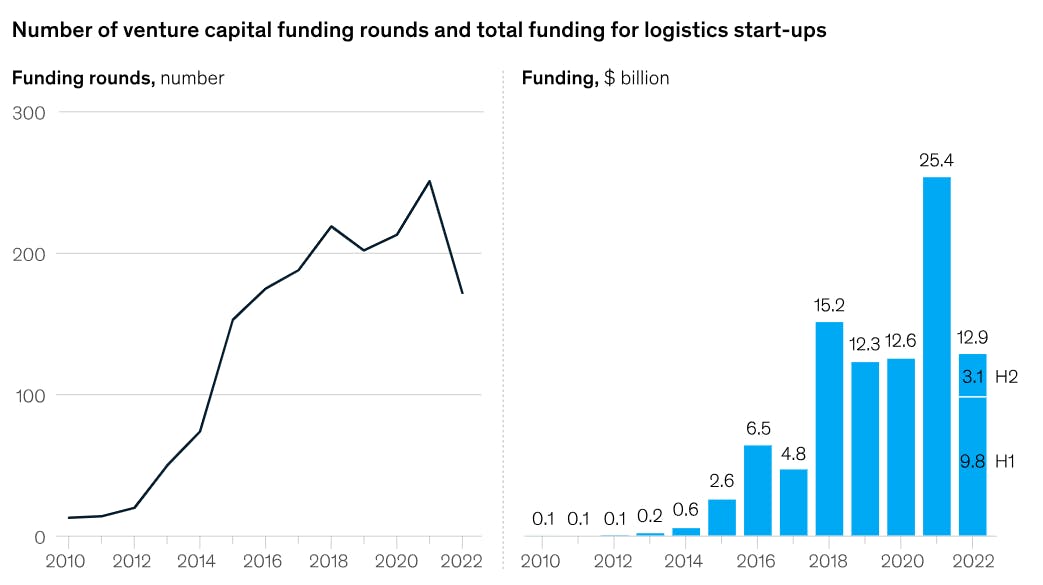

Source: McKinsey

Following a surge of investments in logistics startups in 2021, funding dropped by half in 2022. This precipitous drop outpaced the broader VC market, which declined by ~30%. Nevertheless, logistics startups have still seen significant long-term growth with 2022 funding levels exceeding years leading up to the COVID-19 pandemic.

Flexport: Flexport, founded in 2013, is a provider of logistics and supply chain solutions. The company’s services include air, ocean, and trucking freight forwarding, customs brokerage, warehousing, and trade finance. Moreover, through its cloud-based platform, Flexport connects importers, exporters, trucking companies, ocean carriers, airlines, customs agencies, and port terminals to create a supply chain analytics dashboard that sets it apart from other startups like Nuvocargo.

As of 2022, it has garnered more VC investments than any other startup in the digital freight forwarding space. In 2022, Flexport raised a $935 million Series E at a $8 billion valuation led by Andreessen Horowitz and MSD partners. In January 2024, Flexport raised an additional $260 million from Shopify. Flexport has raised a total of $2.7 billion in funding as of April 2024. Despite being a competitor, Flexport is also an investor in Nuvocargo.

Forto: Forto is a German company founded in 2016. It is a digital freight forwarder that employs 900+ employees and serves 2.5K+ customers as of April 2024. It offers services such as sea, air, and rail freight forwarding, customs clearance, and insurance. Forto also provides less-than-truckload services, offering greater flexibility for customers, while Nuvocargo only offers full-truck-load services.

Furthermore, Forto is dedicated to decreasing greenhouse gas emissions within the logistics sector and offers customers the use of biofuels for transportation and the option to purchase plastic credits, which fund the removal of plastic from the oceans. In 2022, Forto raised a $250 million Series D at a $2.1 billion valuation led by Disruptive with participation from Softbank and Northzone Ventures. In total, Forto has raised $593.4 million in funding as of April 2024.

Business Model

Freight Forwarding

Nuvocargo provides custom pricing based on the distance and route of the cargo being shipped. Freight forwarding margins are subject to economies of scale because freight forwarders can negotiate better pricing from carriers in exchange for giving them higher volume. Consequently, legacy competitors like KNl had gross margins of 34.4% in September 2023. Nuvocargo may not have the same margins, however, due to lower volume. Typically, net income margins in freight forwarding range from 3% to 8%. Despite low margins, return on capital can still be attractive in the freight forwarding business because it is asset-light.

Complementary Products

After successfully onboarding shippers and carriers to its platform, Nuvocargo cross-sells its financial products, such as cargo insurance and trade financing. Cargo insurance safeguards shipments on a per-load basis during cross-border transport, while trade financing supports businesses facing extended payment terms. This support includes financing against accounts receivable and offering lines of credit tied to inventory levels. Lastly, Nuvocargo offers 48-hour payment on the day of load delivery to carriers, who often have to wait 30-60 days for payment. Nuvocargo calls this service QuickPay. As of April 2024, it charged a 3% fee on the invoice value for its QuickPay service

Traction

Nuvocargo’s revenues grew by 25x in 2020. In April 2022, it reported that it had been able to grow its revenues at 30% or more month-over-month since its launch in 2018. Nuvocargo is on track to make “tens of millions” in revenue in 2023, on 200% year-over-year growth. During the same period, it cut its burn rate in half according to Chhugani.

Nuvocargo’s services were used to move one out of every thousand trucks that crossed the US-Mexico border in 2022. Its customers include Grupo Gondi, Howden Buffalo Forge, and Impulsora del Alambre SA de CV. Additionally, as of 2021, Nuvocargo’s QuickPay product was in use by 10% of the carriers on their platform. As Grupo Calidra’s Director of Innovation said:

“Nuvocargo is the first freight forwarder with a single dashboard to track everything end to end, and a fully bi-lingual team that can coordinate every detail from start to finish on both sides of the border. It’s a huge improvement on the old way of doing things.”

Valuation

Nuvocargo raised a $36.5 million Series B led by QED Investors in June 2023 at a more than $250 million valuation, a 40% increase from its $180 million valuation at its $20.5 million Series A in December 2021. As of April 2024, the company has raised a total of $74.4 million in funding. Notable investors include Tiger Global, NFX, Magma Partners, Flexport, and the founders of Ramp*, Deel, Rappi, and others.

Key Opportunities

Global Cross-Border Trade

Until January 2024, Nuvocargo only did business around one major US-Mexico crossing, but after raising its Series B, it started expanding to serve all major US-Mexico border crossings. In the short term, burgeoning US-Mexico GDP and trade, buttressed by nearshoring and deglobalization, could be a key source of growth for the company if it is able to maintain and expand its market position.

Product Expansion

Nuvocargo’s financial products as of April 2024 include cash advances, inventory loans, trade financing, and cargo insurance. Each product operates in a multi-billion dollar market of its own, adding to the addressable market of Nuvocargo’s core freight forwarding product. As Nuvocargo continues to expand its platform for both carriers and shippers with additional product offerings, it can continue to expand its addressable market while also improving its value proposition which could help it establish a moat against startup competitors and improve its ability to disrupt legacy players with a larger amount of market share.

Key Risks

Commoditization

As indicated by the highly fragmented nature of the industry, it is difficult to create a differentiated product in the freight forwarding space — which is one reason why product expansion and delivering on the company’s claim to provide an “all-in-one solution” is critical for its continued growth. If Nuvocargo is unable to deliver on that promise, it may find it difficult to differentiate from competitors and, as mentioned previously, this will make it difficult to gain traction against incumbents who benefit from economies of scale relative to Nuvocargo.

Execution Risk

Focusing on the US-Mexico border has required the Nuvocargo team to be fully bilingual. Similar structures will be required if the company wants to expand to new trade corridors, which could make the business difficult to scale globally. A logistics industry veteran explains that for a single shipment:

“You're going to have the origin warehouse. You're going to have the origin truck provider. You're going to have the origin customs agent based on the country. You're going to have the ocean shipping line. You're going to have the destination customs agent, the destination trucking company, the destination warehousing company. You're going to have insurance providers, trade finance providers, so on and so forth.”

Furthermore, freight forwarding, financing, and insurance are vastly different markets and the company will require human capital and infrastructure investment across its multiple product lines to benefit from its product expansion efforts.

Summary

Nuvocargo is a digital freight forwarding company founded in 2018 by Deepak Chhugani, focusing on cross-border trade between the US and Mexico. The company offers a suite of services including freight forwarding, customs brokerage, cargo insurance, and financial products like trade financing and inventory loans.

Nuvocargo's platform provides real-time visibility and tracking of shipments, with over 250 vetted carriers and a total fleet of 20K trucks as of April 2024. The company has experienced notable growth, and Nuvocargo has secured multiple rounds of funding, including a $36.5 million Series B round in June 2023. It is expanding its operations to serve all major US-Mexico border crossings, capitalizing on the trade growth facilitated by the USMCA and aiming to capture a larger share of the freight forwarding market.

*Contrary is an investor in Ramp through one or more affiliates.