Thesis

The trucking industry represents a key pillar of economic activity in the US. In 2021, trucks moved 72.5% of America’s freight by weight, equating to 10.9 billion tons. In the same year, the industry earned $876 billion in revenue and employed 3.5 million truck drivers. That revenue figure represents a sharp 20% increase from 2020.

Trucking has undergone significant changes in recent years. In the past, the industry relied heavily on tedious, analog workflows. Fleet operators and managers had to deal with manual processes, paper-based record-keeping, and cumbersome administrative tasks. But by 2023, 97% of shipping and logistics companies had a digital transformation strategy in place or were actively contemplating one. In 2015, the Federal Motor Carrier Safety Administration passed a mandate that required all trucks to install an electronic logging device (ELD) in order to digitally record their hours of service. This led to a surge in demand nationwide for ELD units, with the market forecasted to increase by over $3 billion from 2022 to 2027.

Motive is a company that offers a full-suite, vertical-specific application that consolidates many software tools required for running a trucking and logistics business, including vehicle tracking, telematics, compliance, trucker safety, maintenance, spend management, and more. With this approach, Motive seeks to position itself as a mission-critical OS for trucking professionals.

Founding Story

Motive, formerly known as KeepTruckin, was founded in June 2013 by Shoaib Makani (CEO), Ryan Johns, and Obaid Khan (COO).

Prior to founding Motive, Johns, who serves as technical co-founder, was previously the VP of Engineering at Tapjoy, and Khan had spent time working in legislative affairs for a Washington DC nonprofit. Motive CEO Shoaib Makani had been an investor at Khosla Ventures, where he led investments in startups including Instacart and Yammer. Interested in building his own company, his attention was drawn to traditional industries outside the digital economy which were not fully explored by the startup ecosystem. He was particularly intrigued by trucking and logistics, and worked with Khan, his brother-in-law, to develop an understanding of the industry. In the process, he developed two key insights:

Automation and software could generate substantial improvements by replacing manual and paper-based workflows.

The industry was on the cusp of a major regulatory change that would accelerate digitalization efforts.

That regulatory change came in the form of a 2015 mandate passed by the Federal Motor Carrier Safety Administration (FMCSA) which required all trucks to install an electronic logging device (ELD) in their vehicles to automatically record data including location, engine hours, vehicle movement and miles driven. Though it did not fully come into effect until 2017, the groundwork was laid by the Moving Ahead for Progress in the 21st Century Act (MAP-21) signed into law in 2012, which called for the introduction of an ELD mandate.

With no knowledge of when exactly this requirement would go into effect, Makani and his team decided to focus on compliance, with its innate complexity and clear pain points, as a good entry point into the trucking industry. In July 2013, the team raised a $2.3 million seed round led by Google Ventures, with participation from Greenoaks Capital. Joe Kraus, a partner at Google Ventures, had sat on a board with Makani while Makani was an investor at Khosla, and he decided to lead the seed round when he heard that Makani was starting a new company. Makani credits the Google Ventures team with being particularly helpful in addressing some of Motive's initial usability challenges.

In December 2013, the company released a mobile app that allowed truckers to track and edit driving logs and communicate with dispatchers using their smartphones. Previously, drivers often relied on faxing written driving logs from truck stops to let dispatchers know where they were and where they had been. In the same month, Motive announced it had deployed the app to over 200 drivers.

The app, which was available for free, was intended first and foremost to develop trust with a base of truck drivers who would later be amenable to other product offerings. It was downloaded one million times in its first four years. As the app’s install base grew, the company worked on an ELD product, on the assumption that a mandate would pass. The product launched in 2015, ahead of the ELD mandate coming into effect, and integrated with the app.

With ELD sales growing, Makani saw two growth paths for Motive: either to become a jobs marketplace for truck drivers or focus on automation and software services for fleet managers. The company elected to pursue the latter path, and it has since expanded into offering products supporting driver safety, maintenance, spend management, and dispatch.

KeepTruckin changed its name to Motive in April 2022. Makani said the rebrand reflected the company’s planned growth beyond trucking into other parts of the physical economy requiring transportation and logistics, including construction, agriculture, manufacturing, and energy.

Product

Motive offers an integrated suite of hardware and software products that seek to cover all of a truck fleet’s needs, including compliance, tracking, maintenance, driver safety, and more. Together, the Motive suite aims to be the operating system for all commercial fleets. The freemium app and ELD drove initial adoption, and the company has since added many additional products, creating a more complete platform for its customers.

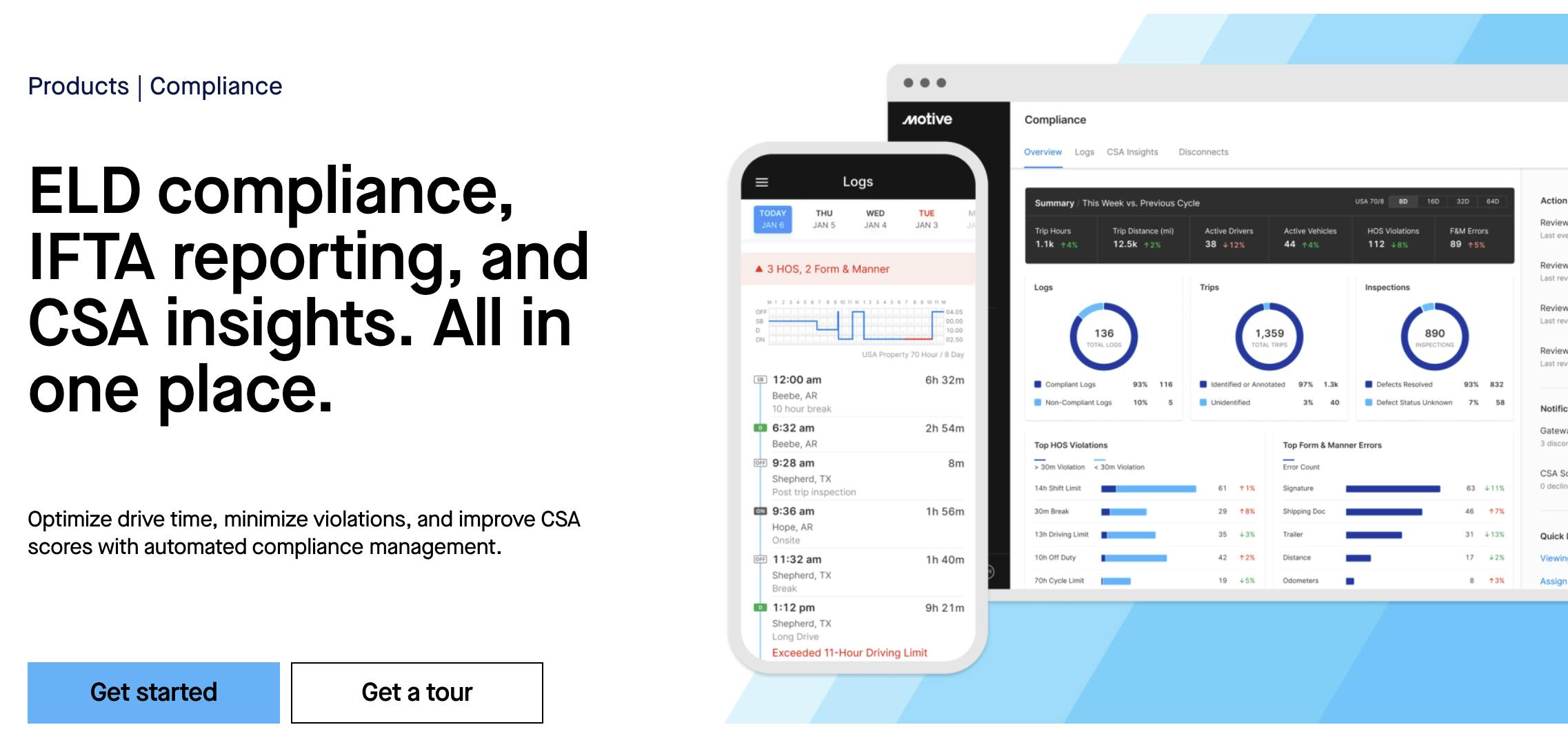

Compliance

Motive's compliance features help fleet operators meet regulatory requirements by providing features such as electronic logging devices (ELDs), hours-of-service (HOS) tracking, and driver qualification management. Companies can maintain regulatory compliance, avoid penalties and streamline administrative tasks related to reporting.

Together, Motive’s Driver App and the Compliance Hub and Fleet App provide fleets with full visibility into any given truck’s activities, allowing for real-time HOS violation alerts, Vehicle Gateway disconnects, unidentified trips, and more.

The Motive ELD is both FMCSA-registered and certified in Canada, meaning it supports drivers across North America. Motive claims that this feature reduces:

service violation hours by 50%

time spent on compliance tasks by 50%

insurance costs by 25%

Source: Motive

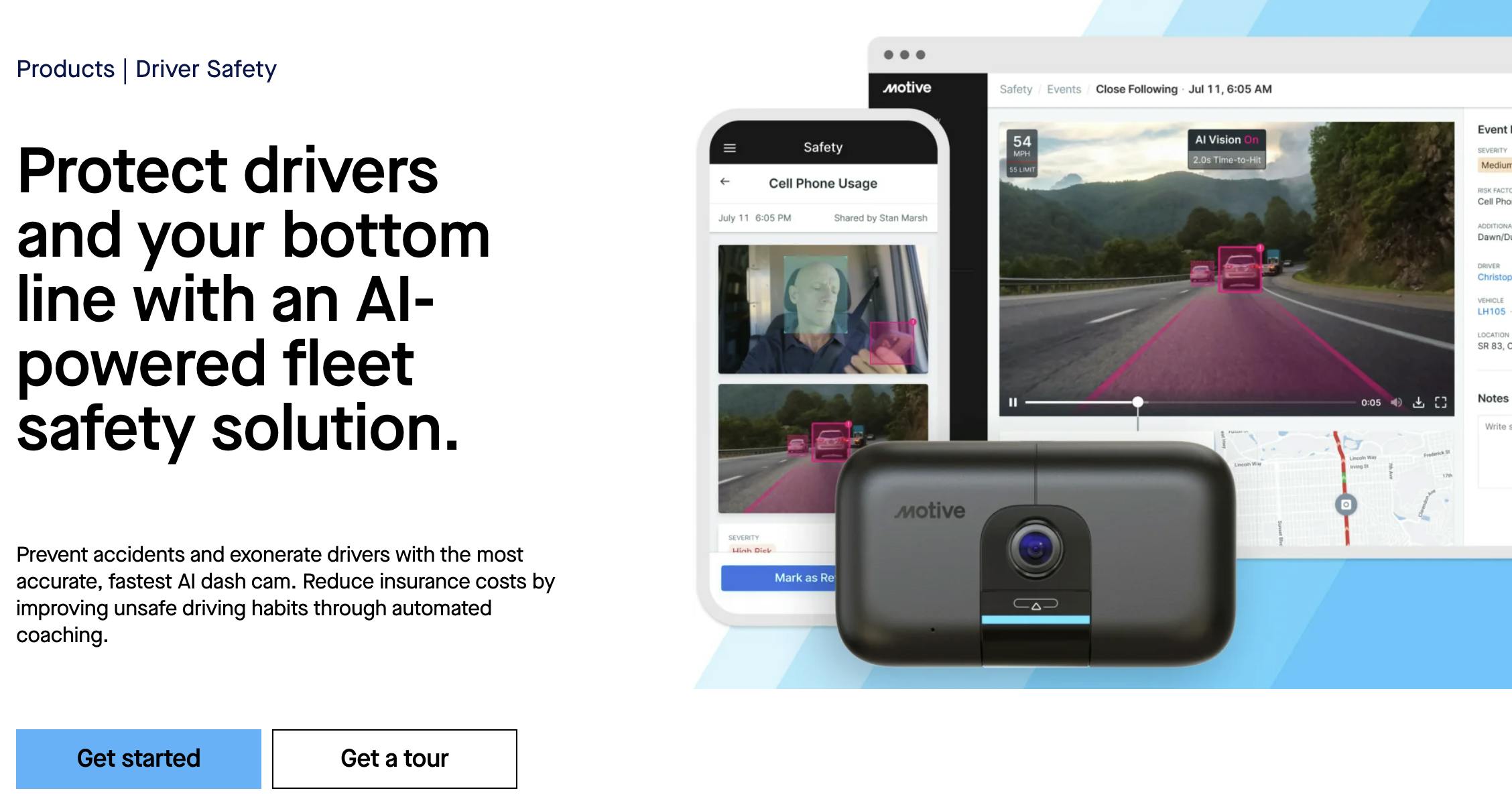

Driver Safety

Motive’s driver safety module includes features like real-time driver monitoring, behavior scoring, and coaching tools. By tracking driver behavior and providing data insights and reporting, the platform helps fleet managers identify and address risky driving habits, reduce accidents, and promote safer practices.

The company provides an AI dashcam that detects unsafe driving behavior both inside and outside the truck, including cell phone use. Additionally, Motive has an in-house Safety Team that reviews all dashcam videos to provide guidance and coaching. Motive generates a DRIVE risk score that quantifies the risk profile of any given truck driver.

Motive reports that its driver safety feature:

reduces the number of accidents by 22%

reduces the number of safety incidents by 56%

leads to 72% of drivers who face litigation being exonerated by footage from its dashcams

Source: Motive

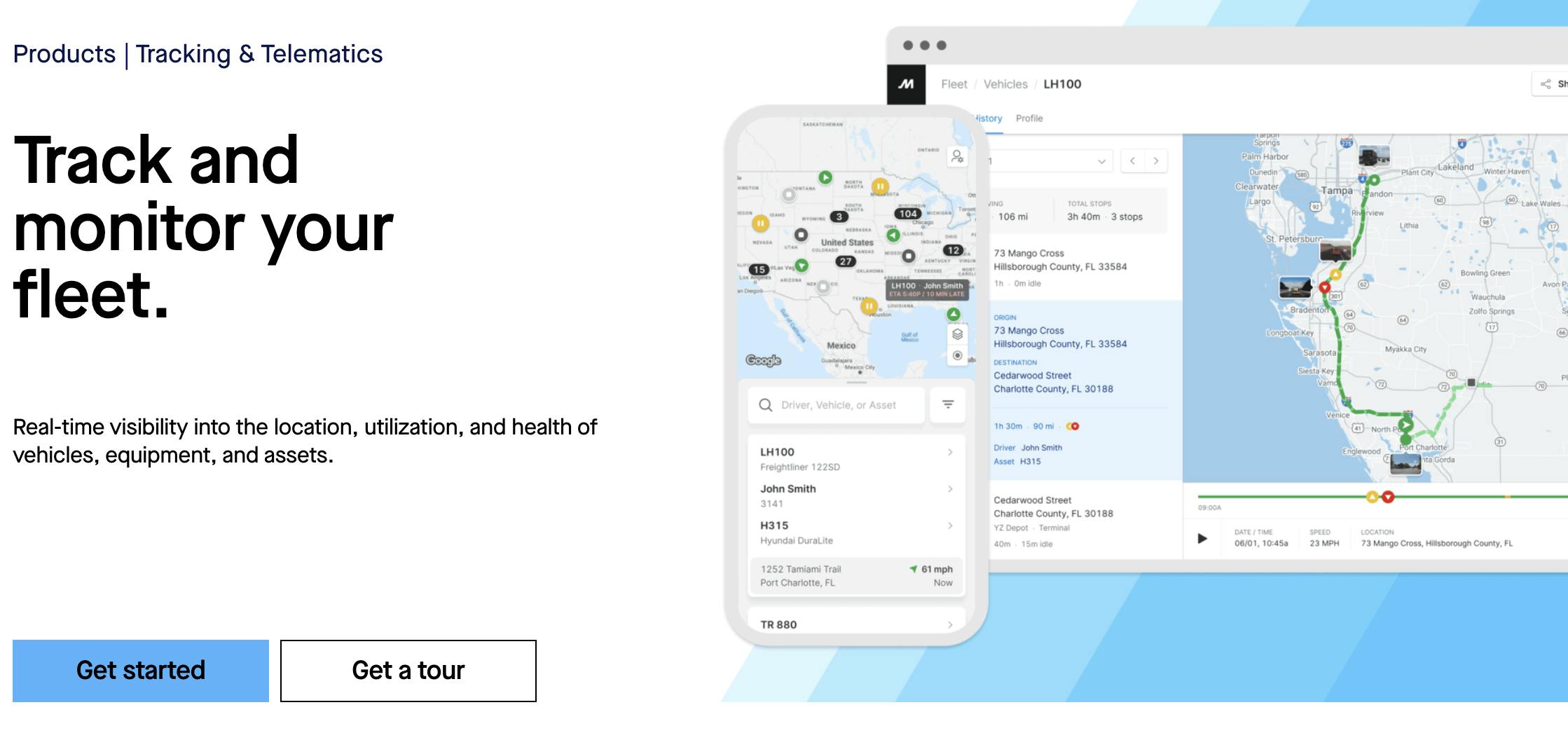

Tracking and Telematics

Motive's tracking and telematics product offers real-time visibility into vehicle location, speed, and other critical data. This enables fleet operators to optimize routes, improve dispatching, monitor vehicle health and performance, and track assets. The telematics data helps in identifying potential inefficiencies, reducing fuel consumption, and enhancing overall fleet productivity. Motive reports that these features:

track 1.8 billion miles per month from 700K connected vehicles

process 500 million data points every day

Source: Motive

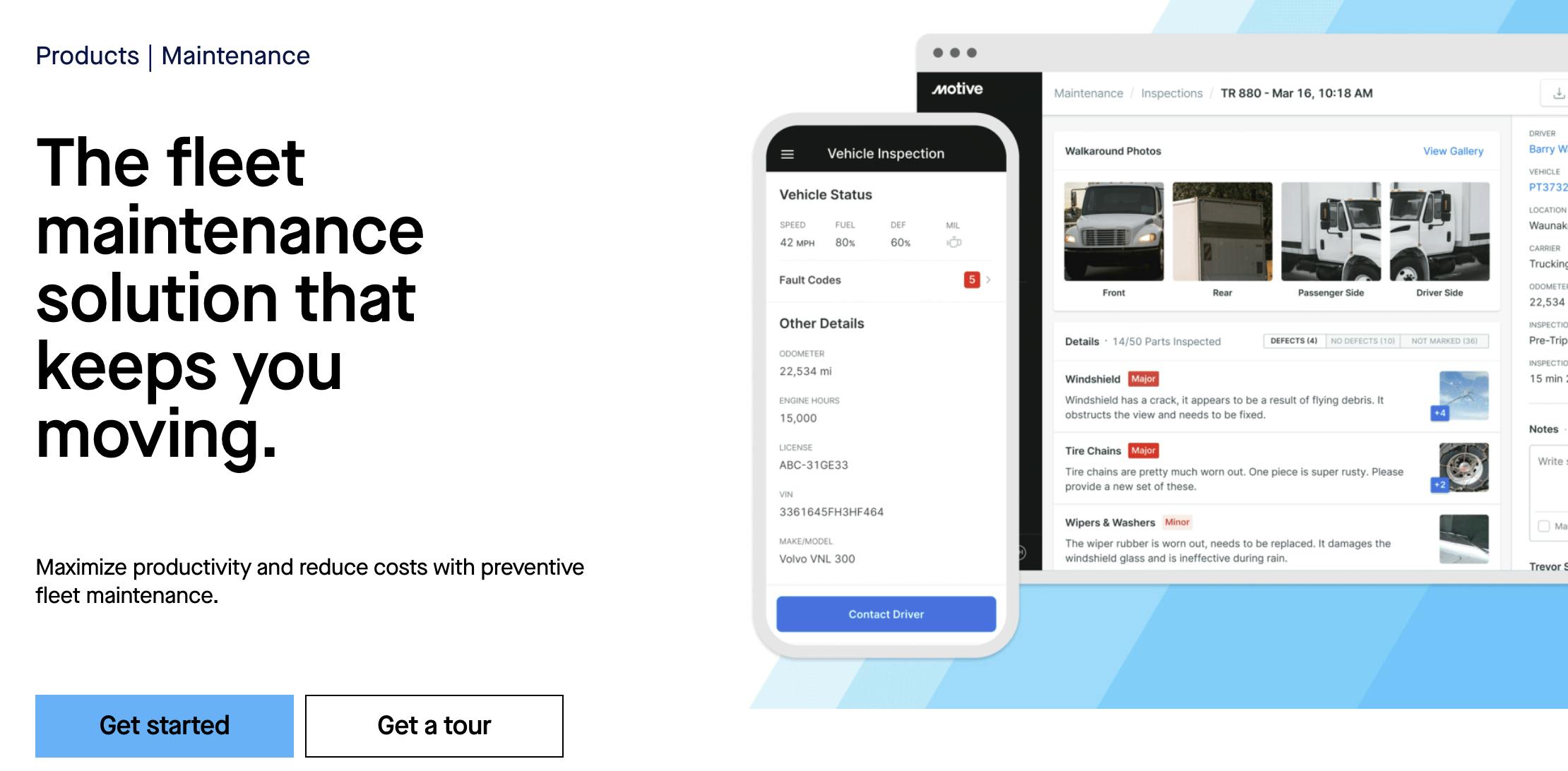

Maintenance

Motive's maintenance product assists fleet managers in scheduling and managing vehicle maintenance tasks. It provides alerts for maintenance requirements based on mileage, engine hours, and other parameters. By proactively addressing maintenance needs, fleet operators can reduce downtime, increase vehicle lifespan, and minimize costly repairs. It also allows for the creation of customized inspection forms, and all inspection records can be accessed and maintained electronically.

Source: Motive

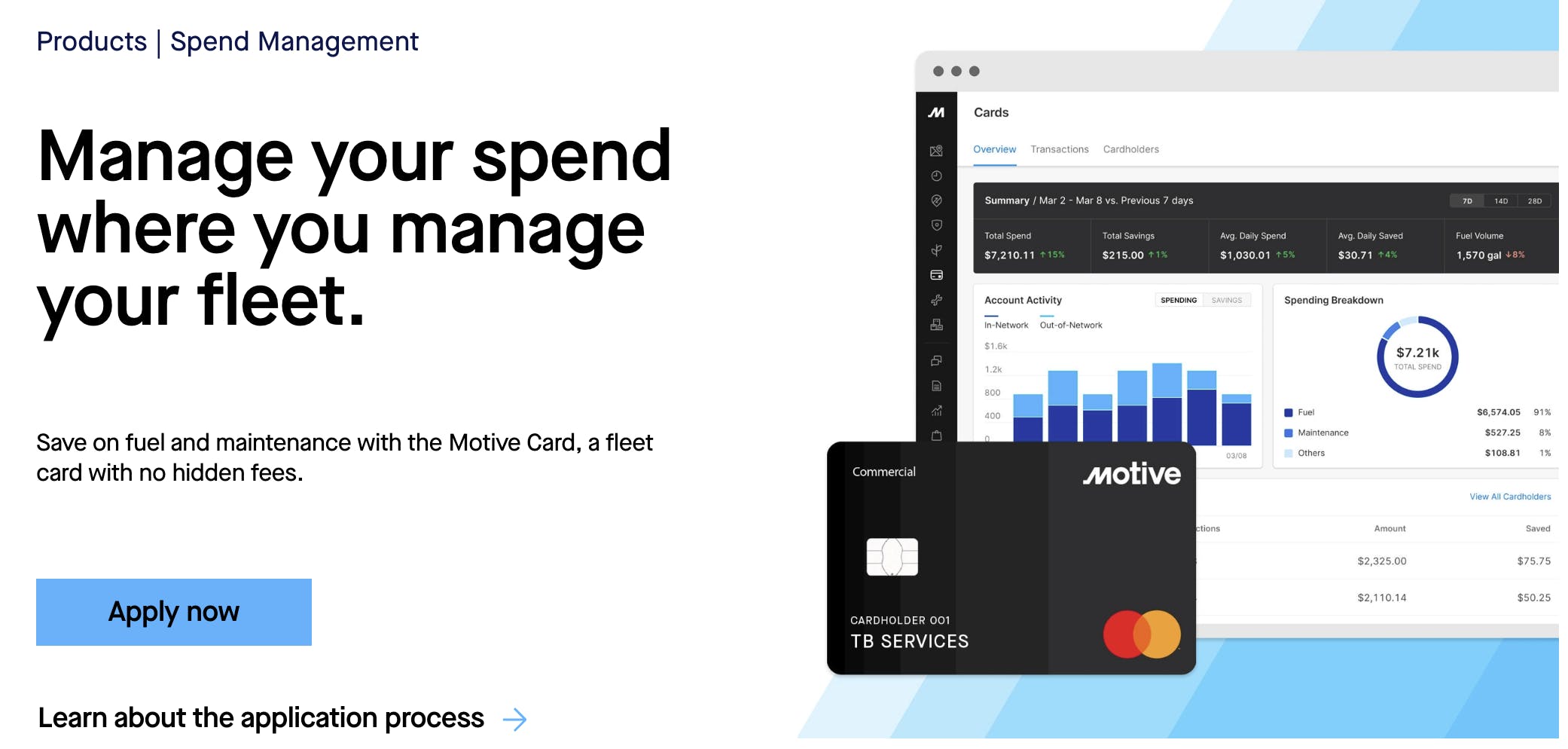

Spend Management

Source: Motive

Motive's spend management product helps fleet managers control and optimize expenses associated with their operations. It provides tools for monitoring fuel consumption, analyzing fuel efficiency, and identifying potential cost-saving opportunities. The Motive card also enables truckers to secure discounts and rewards on fuel, maintenance, and other trucking-related expenses. Fleet managers can also set spending limits for each cardholder by day and time, transaction, and product category.

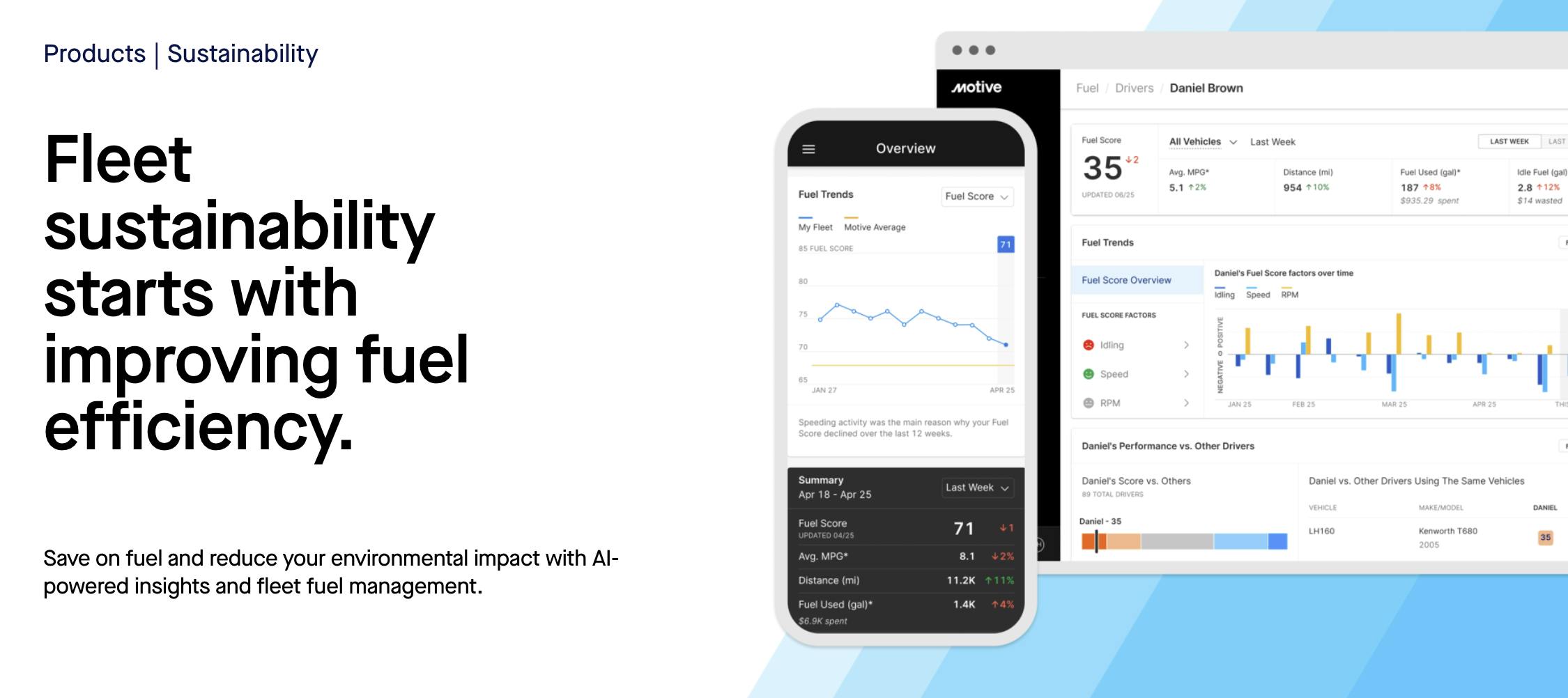

Sustainability

Motive's sustainability product supports fleet operators in meeting environmental and sustainability goals. The platform offers features like emissions tracking, fuel monitoring and efficiency analysis, and carbon footprint measurement. The system generates “fair and objective” reports tracking driver performance metrics that may impact fuel efficiency, such as idle time and hard braking.

Altogether, Motive reports that it has helped truckers achieve:

a 78% reduction in hard accelerations

a 40% reduction in hard braking

a 20% reduction in idling

Source: Motive

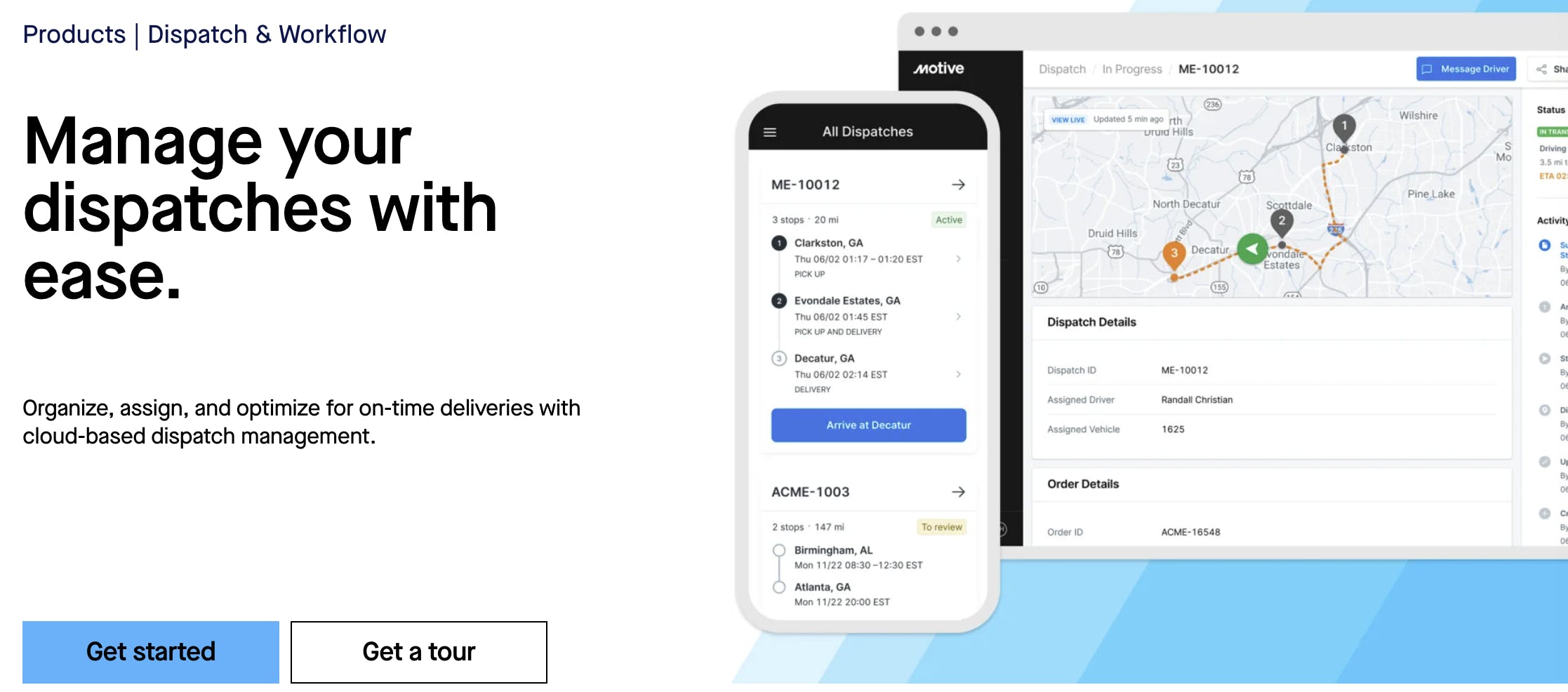

Dispatch

Motive’s dispatch product streamlines the dispatching process by enabling communication and coordination between fleet managers and drivers. It provides real-time visibility of vehicle availability, location, and load status, allowing for optimized routing and scheduling.

The dispatch module helps reduce response times, improve customer service, and enhance overall operational efficiency. Motive provides a Fleet View that allows for assigning dispatches and tracking the progress and location of each delivery. Order details can also be accessed in the Motive dashboard. In-built messaging tools help managers and drivers communicate via text.

On the driver side, the Motive Driver App allows drivers to manage inspections, dispatches, documents, and messaging on the go from their smartphones. It also auto-generates arrival and departure confirmations as drivers move, accounting for traffic and road conditions. Route optimization and dynamic ETAs also help ensure on-time arrivals.

Source: Motive

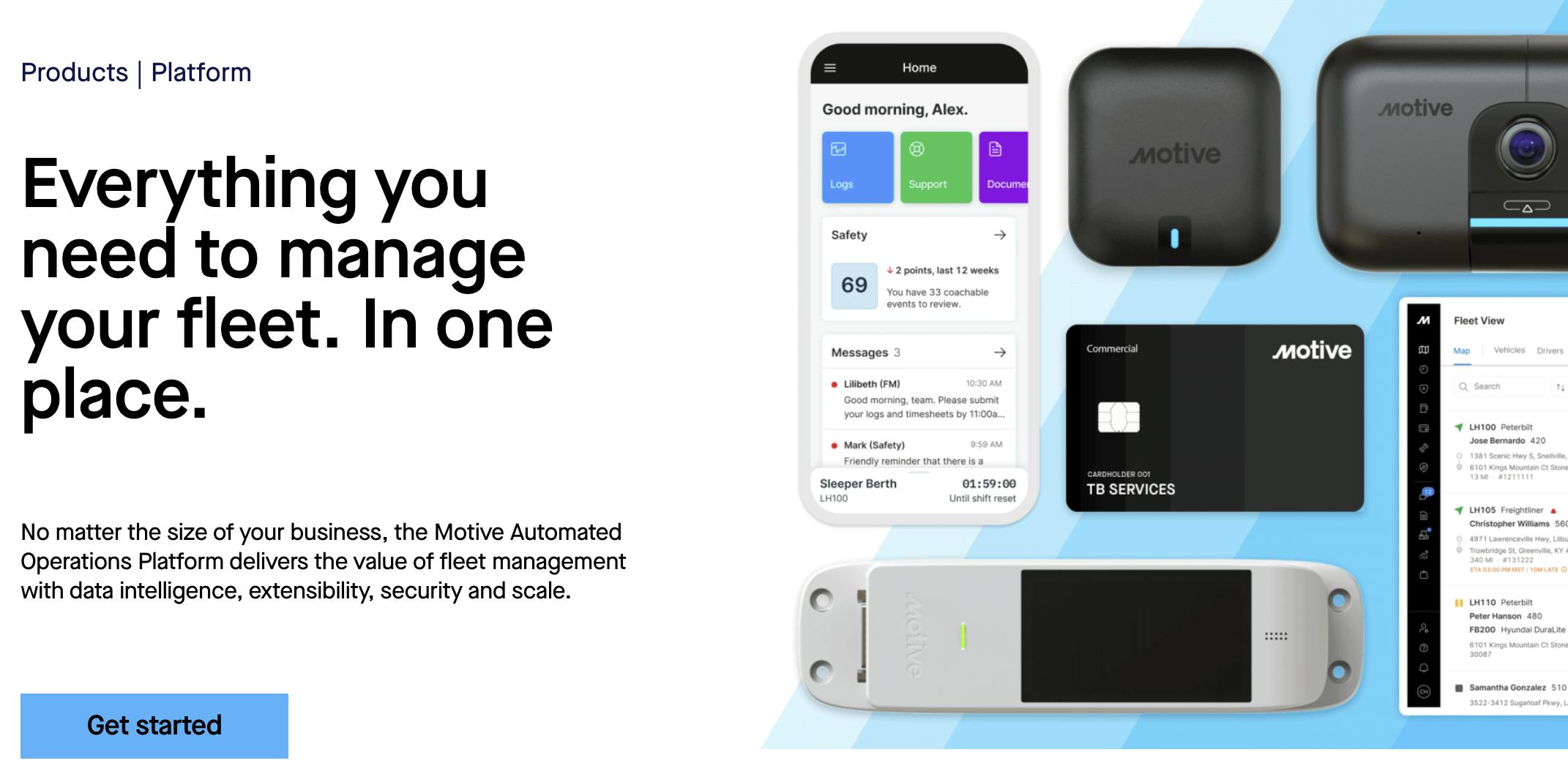

Platform

Motive's comprehensive platform integrates all the modules mentioned above, offering a centralized solution for fleet management. The platform provides a user-friendly interface that allows fleet managers to access and analyze data, generate reports, and make informed data-driven decisions. It integrates with other third-party platforms like transportation management systems (TMS), enabling operational efficiency and data portability.

Source: Motive

Market

Customer

Motive's target customers are primarily fleet operators and managers in the trucking industry. These customers range from small, owner-operator fleets to large, enterprise-level companies. Many of the clients highlighted on Motive’s website are small-to-medium, often family-owned businesses with dozens or hundreds of trucks directed from central offices.

Their needs revolve around improving fleet management, ensuring regulatory compliance, enhancing operational efficiency, and maximizing profitability. Motive's customers want a comprehensive solution that can track vehicles in real-time, monitor driver behavior and performance, streamline dispatching and routing, automate compliance processes, and optimize fuel consumption.

The trucking industry has historically relied on tedious analog workflows. Fleet operators and managers had to deal with manual processes, paper-based record-keeping, and cumbersome administrative tasks. This approach was time-consuming, prone to errors, and lacked real-time visibility into fleet operations. Motive identified a market opportunity to improve archaic practices through digitization and automation, aimed at streamlining operations, boosting efficiency, and enhancing overall productivity.

Motive's solution enables fleet operators to replace paper logbooks with electronic logging through integrated ELDs. This transition provides fleet managers with real-time insights into driver hours, therefore reducing manual data entry and mitigating the risk of errors.

While Motive's primary customers are in the trucking industry, it also serves a wide array of sectors that involve logistics and fleet management, from construction and transit to resources and agriculture.

Source: Motive

Market Size

The market for Motive in the trucking technology industry is substantial, encompassing a large number of truckers and fleets. In the United States alone, the trucking industry generated over $791 billion in revenue in 2019, indicating its significant size and economic impact. 8 million people work in trucking-related jobs, including 3.6 million professional truck drivers. This constitutes a large base of potential customers for Motive.

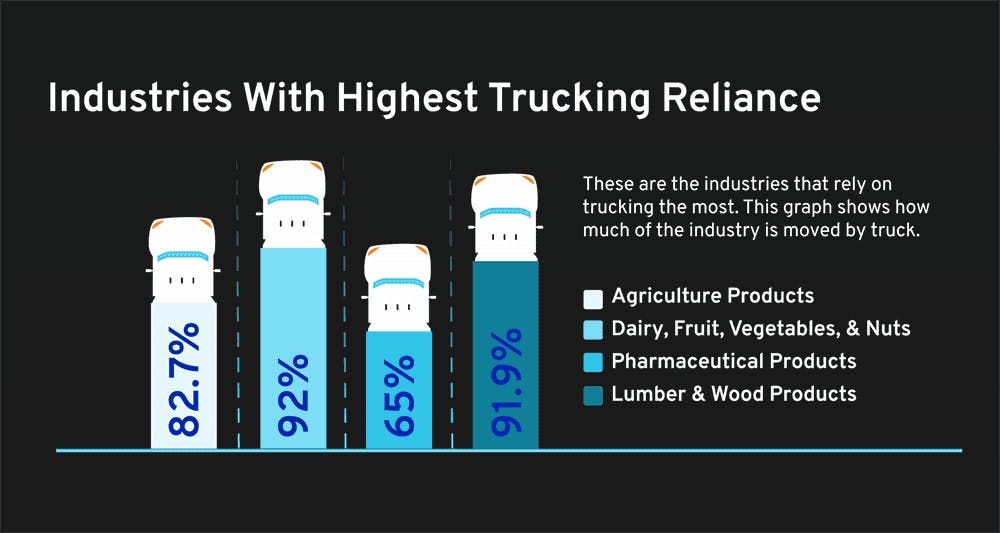

Industries with a high dependence on trucking — like agriculture, pharmaceuticals, and lumber — represent another key market. The percentage of goods transported by truck in these industries ranges from 65% to 92%.

Source: CloudTrucks

The implementation of the Electronic Logging Device (ELD) mandate by the United States in 2015 significantly reshaped the market. This mandate required digital recording of service hours through the installation of ELDs in millions of trucks. Motive built its business off the surge in demand for ELD units due to the mandate, providing a base for further digitization efforts.

Competition

There are a substantial number of players in the trucking SaaS and telematics industry, including legacy firms, which compete with Motive across part or all of its offering.

Samsara: Founded in 2015, Samsara offers an integrated platform for fleet management, safety, and compliance, providing solutions like vehicle tracking, ELDs, and AI-powered analytics. Samsara has raised $930 million in total, and the company went public via IPO in December 2021. Some industry analysts have noted that Samsara offers more features and more support than Motive, but is more expensive.

Verizon Connect: Originally founded as Fleetmatics in 2004, this company was acquired by Verizon for $2.4 billion in 2016 and subsequently rebranded as Verizon Connect. It offers fleet management solutions that include vehicle tracking, fuel monitoring, and route optimization using GPS and telematics technology. Being part of a much larger corporation gives Verizon Connect access to extensive resources, enabling them to leverage telecommunications expertise and cross-selling opportunities.

Omnitracs: Omnitracs, established in 1988, is a pioneer of the fleet management software industry. Its range of services includes fleet tracking, compliance, logistics support, and supply chain optimization. It offers an ELD and Hours of Service solution. Omnitracs was originally part of Qualcomm but was spun off and sold to Vista Equity Partners for $800 million in 2013.

Geotab: Founded in 2000, Geotab focuses on fleet telematics and connected vehicle solutions, including GPS tracking, driver behavior monitoring, and maintenance management. Some users report that Geotab has a clunky, unintuitive interface compared with other telematics and fleet management software.

Business Model

Motive charges both fees and ongoing subscriptions for the hardware and software packages it provides. Pricing is specifically tailored per solution, and prospective clients are required to go through an online form and speak to a sales representative to find out how much they will need to pay. Motive does not offer any public pricing on its website or elsewhere. Sources indicate a Motive ELD costs $150, and subscription fees start at $25/month. Fleets can pay additional fees for dashcams or other features like electronic logs.

Traction

As of May 2023, Motive serves 120K+ customers, 700K+ vehicles and assets, and over 1 million drivers.

In June 2021, the company reported it had experienced 70% annualized growth since the start of the COVID-19 pandemic, “in large part due to expansion into new markets like construction, oil and gas, food and beverage, field services, moving and storage and agriculture”. In April 2019, Motive reported having 55K+ customers. This means that in a span of four years, from 2019 to 2023, Motive increased its customer count by 13x.

In 2021, Motive was reported to have annual recurring revenue of $150 million.

Valuation

In May 2022, Motive announced it raised a $150 million Series F at a $2.9 billion valuation, co-led by Insight Partners and Kleiner Perkins. In total, the company has raised $567 million, with notable investors including Index Ventures, Scale Venture Partners, Greenoaks, Google Ventures, and IVP.

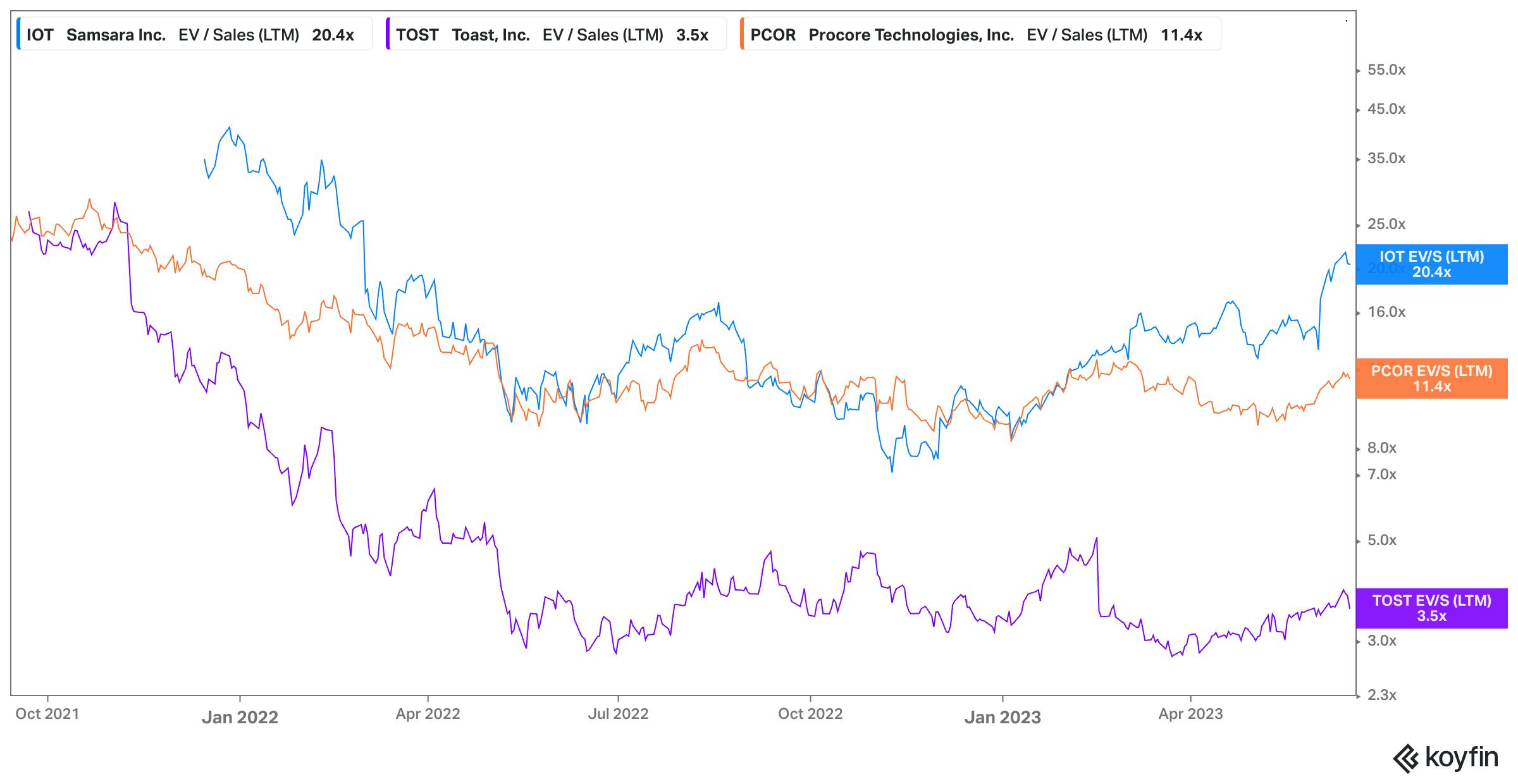

In 2021, Motive was reported to have annual recurring revenue of $150 million. Comparable vertical SaaS companies trade anywhere from a 3.5x to 20.4x revenue multiple. Samsara, the publicly traded company that most closely resembles Motive, trades at a 20.4x revenue multiple, and this multiple has been as high as ~45.0x and as low as ~7.0x from the time of Samsara’s IPO in December 2021 until June 2023.

Source: Koyfin

Key Opportunities

Moving Upmarket

Motive initially catered to smaller trucking companies. However, it has started to move upmarket to attract larger, enterprise-level customers. This segment presents opportunities for increased revenue due to the larger fleet sizes and greater and more complex operational requirements. The advantages of targeting enterprise-level customers include securing larger contracts, longer-term commitments, and higher pricing tiers.

Furthermore, enterprises often have wider geographic footprints, operating across multiple regions. This provides Motive an opportunity to broaden its market presence and establish a firmer footing in the industry. In its Series F funding announcement, Motive noted accelerated growth in the enterprise segment, citing significant new customer acquisitions including Rosendin, Select Energy, and Strike USA. It also indicated a continued investment strategy to expand its engineering, professional services, and support teams to better serve this growing customer base.

Extending Through the Value Chain

Motive has primarily focused on trucking businesses themselves, but it has the opportunity to extend its reach through the value chain and touch players including auto maintenance shops, parts suppliers, and insurers. Many trucking businesses require insurance for their trucks and the workers and also require regular purchasing of parts for maintenance of the trucks. By extending its reach to these stakeholders, Motive can replicate the success of companies like CCC Intelligent Solutions, which transitioned from offering software to auto repair shops to establishing a two-sided online parts marketplace, having identified that auto shop managers would spend much of their time ordering parts and reconciling invoices. By providing a streamlined solution for trucking businesses' workflow needs, Motive has the potential to increase its relevance and penetration of the broader trucking market.

Growth of Nearshoring

Nearshoring, the practice of moving business operations closer to the home market, has led to an increase in the demand for trucking and related solutions such as those offered by Motive. Companies increasingly prefer nearshoring over offshoring due to geopolitical factors and the wider trend of deglobalization. By establishing manufacturing and distribution facilities closer to target markets, there is a greater demand for efficient, local transportation of goods. Motive's comprehensive fleet management, compliance features, and optimization tools are well-positioned to cater to this increased demand. By facilitating smooth operations, real-time tracking, and cost-effective solutions, Motive enables businesses to manage logistics challenges associated with nearshoring effectively, resulting in streamlined supply chains and reduced lead times.

Key Risks

Competitive Market Environment

The market for fleet management solutions is intensely competitive. Numerous players, both established companies and new entrants, offer products and services similar to Motive's. This poses a challenge for Motive, as it needs to differentiate itself to capture a significant share of the market. There's the risk of a "race to the bottom," with competitors engaging in price wars and aggressive discounting to gain market share. This could potentially erode profit margins and devalue the industry's offerings. It remains unclear whether Motive can establish a dominant position in the trucking SaaS market amid stiff competition.

Summary

The trucking industry in the US is critical to national economic activity. The industry has experienced significant transformation in recent years, moving away from traditional analog workflows toward streamlined digital solutions, while also undergoing significant regulator changes like ELD mandates. With its suite of trucking and logistics applications, Motive aims to become the core operating system for the industry, offering features that cater to the diverse needs of trucking professionals such as tracking, telematics, compliance, safety, maintenance, and expense management. Motive can look to move upmarket and build new offerings that address additional parts of the value chain as it looks to drive growth.