Thesis

In 2022, over 6 million Americans were working in the home services industry, and the home service market reached a size of $657 billion in the US alone. There were roughly 2.5 million home service companies in the US, and they completed over 500 million home service jobs each year as of 2022. In 2023, homeowners spent $13.7K on home services on average, which represented a slight uptick from 2022. Overall, the increase in home services spend, which grew rapidly during the COVID-19 pandemic, has persisted into the post-pandemic period: in 2023, homeowners spent 51% more on home projects than they did in 2019.

During the COVID-19 pandemic, the industry saw an acceleration of growth as homeownership reached a 10-year high in 2020, accompanied by a boom in home services spend. It also accelerated the adoption of software tools by small and medium-sized businesses (SMBs). In the past, many home services SMBs relied on pen and paper or spreadsheets to manage operations and customers. After the pandemic, more and more SMBs are adopting digital solutions to run their businesses — in September 2021, 77% of SMBs said that they increased their reliance on technology because of COVID-19.

ServiceTitan lies at the intersection of these two tailwinds. Founded by the children of home services contractors, the company provides a set of software tools that blue-collar businesses and contractors can use to manage and grow their businesses. Importantly, ServiceTitan offers a full-suite, vertical-specific application that consolidates many software tools needed for running a home services business, including accounting, scheduling, marketing tools, payroll management, payments, and more. In a world full of software vendors offering point solutions, this consolidation is intended to make it easier for small business owners to buy and manage the software they rely on to run their businesses. With this approach, ServiceTitan seeks to position itself as a mission-critical OS for home service professionals.

Founding Story

Source: ServiceTitan

ServiceTitan was founded in 2012 by Ara Mahdessian (CEO) and Vahe Kuzoyan (President), although the pair had begun working on the concept as early as 2007. Mahdessian and Kuzoyan met on a college ski trip for Armenian students in 2004. Mahdessian was studying software engineering at Stanford at the time, and Kuzoyan was at USC also studying software engineering.

They connected over their shared experience of being Armenian immigrants to southern California. Both of their fathers were home-service contractors in building and plumbing, and both were having issues with the logistics of running their successful and growing companies. After college, the pair decided that before going to Silicon Valley for coding jobs, they would work on a summer project together building a software tool to help their dads’ businesses.

Originally, the project was a simple desktop program. In 2012, however, they launched a cloud-based platform which formed the basis for what has grown into ServiceTitan, a home-services platform that offers a suite of products.

Product

Source: ServiceTitan

ServiceTitan has built a suite of products that seek to cover the workflows involved with running a home services business. Its main product is the ServiceTitan platform, which provides “solutions built for commercial and residential contractors” to help contractors scale their businesses, improve revenue, and increase efficiency.

Its product lines are broken down into four major categories: front office, field operations, client experience, and management insights which are overviewed below. ServiceTitan provides a full list of features provided by its platform on its features page.

Front Office

Source: ServiceTitan

ServiceTitan provides front-office tools intended to optimize an office team and help them more easily communicate with field teams and customers. These include tools to create “branded, professional-looking” proposals and quotes, service agreement tools that automate recurring services, scheduling tools, dispatch tools, lead capture, and lead management tools, and call recording tools to help analyze and improve staff interactions with customers.

Field Operations

Source: ServiceTitan

ServiceTitan also provides tools for field teams. These include a technician app that can be used by contractors while on the job, an inventory app for the management of daily tasks and workflows in warehouses, a tool for tracking equipment detail and history, crew management tools, dynamic digital forms for use by contractors in the field, and a tool for restocking truck inventory.

Client Experience

Source: ServiceTitan

ServiceTitan offers tools to help contractors improve client experiences with a personalized client portal, a technician tracking tool, a pricing tool that dynamically updates downstream variable costs based on pre-built rules, an SMS tool to send and receive notifications to and from customers, a scheduling and payments tool that enables new work requests and simplifies payment processes, and a CRM that tracks equipment, customer insights, and invoices.

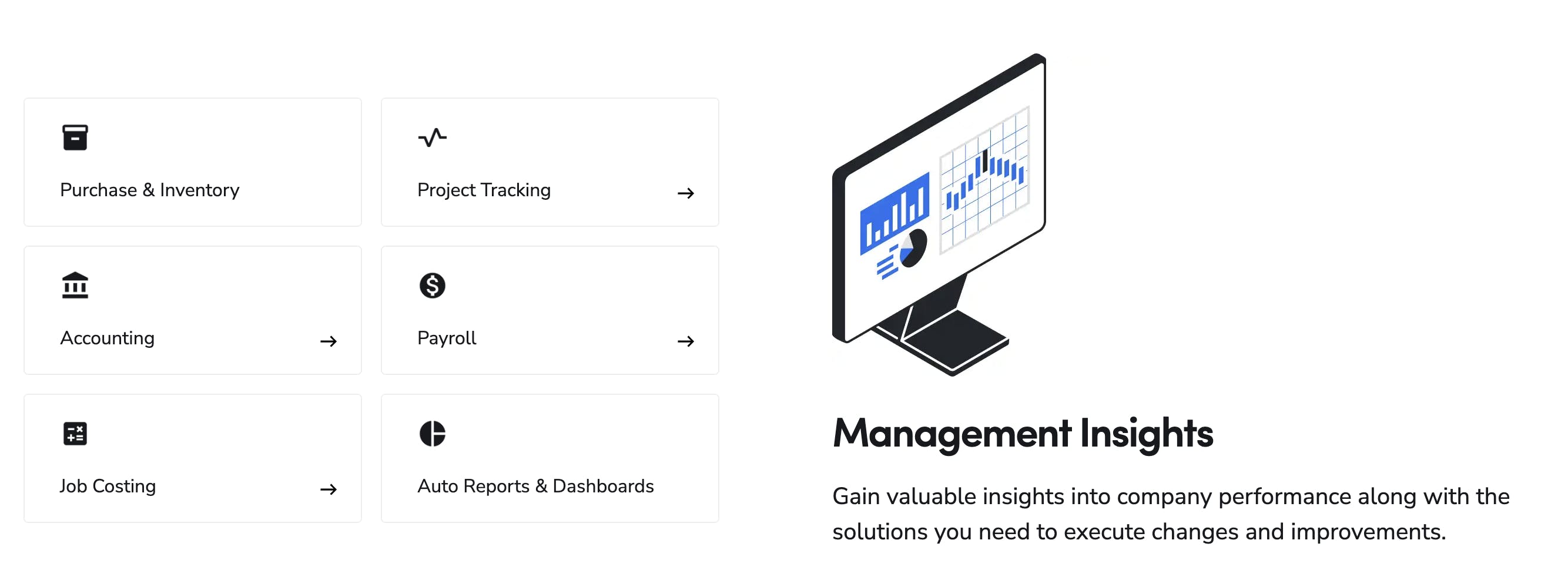

Management Insights

Source: ServiceTitan

ServiceTitan’s platform allows customers to gain insights into company performance via its management insights tools. These include automations that track materials across a user’s business, project tracking that provides real-time progress and profit tracking across projects, accounting task automation and financial insights, payroll features, real-time insights into the expenses and profit margins involved with a specific job, and customizable dashboards to visualize data.

Overarching Value Proposition

ServiceTitan’s product suite is focused on serving its customer base in two main ways:

Reducing the time, effort, and complexity involved with managing a home services operation

Increasing the revenue that a home services operation can generate.

For example, financing is a particularly relevant product for helping customers increase their revenue — ServiceTitan advertises that customers using its financing product see a 17% increase in revenue. This is because financing can unlock an end customer’s buying power, allowing them to afford larger projects over time, which in the end means the contractor makes more money per project.

ServiceTitan has put a clear focus on addressing as many business needs as possible within its platform and seeks to be the one-stop shop for contractor business operations. An advantage of having all these solutions in one platform is that customers don’t have to deal with the headache of managing separate apps for each part of their operations workflow, nor do they have to spend time and money on figuring out how to integrate all of those apps together. This type of bundling improves the customer support experience as well — instead of having to contact different support for different features, ServiceTitan can act as the one place to go for support across all its products.

ServiceTitan’s product strategy is similar to many other vertical software companies: it worked to create a dominant position in its category by becoming the system of record for all transactions and customer interactions. Once it established that position, it began to layer on more products to cover more pain points and expand its offering. This approach enables ServiceTitan to upsell its existing user base in the hopes of driving up average revenue per user, net revenue retention, and customer lifetime value.

ServiceTitan prioritized the buildout of each of these new products by paying close attention to the customer workflow. It looked at its customers’ main areas of spend and explored where it could add value and capture a share of the economics. After doing so, ServiceTitan saw that marketing, inbound and outbound communications, dispatching, payments, and financing were key pain points in a home service professional’s journey to acquire a customer and close a job, so it based its product roadmap on building out solutions in those areas.

Market

Customer

ServiceTitan’s initial target customers were home service contractors working in repair and maintenance. starting with categories like garage door repair and residential plumbing, before moving into other categories within home maintenance including heating and cooling (HVAC), electrical contractors, chimney sweeping, pool service, and garage door maintenance. It has since further expanded to servicing more specialized professional contractors in pest control, landscaping, snow and ice management, and construction. A majority of ServiceTitan customers are small businesses with less than 100 employees (an estimated 97.3% as of 2023) and the vast majority (92.5%) were US-based as of 2023.

Market Size

The home service market grew to over $657 billion in size as of 2022, at which time there were ~2.5 million businesses in the space employing over 6 million people, suggesting an average business size of between 2-3 people. In 2023, homeowners spent $13.7K on home services on average (with “home services” encompassing improvement, maintenance, and emergency repairs. Home services spend, which grew rapidly during the COVID-19 pandemic, has continued to grow into the post-pandemic period: in 2023, homeowners spent 51% more on home projects than they did in 2019, while 30% of homeowners in 2023 planned to undertake more work in the following year.

The vast majority of the home services market is comprised of home improvement, with maintenance and emergency repair work making up other parts. Higher incomes and higher homeownership rates have also contributed to growth in home service spending. The home services industry includes occupations like masons, carpenters, construction laborers, carpet and floor installers, roofers, and plumbers.

Source: Angi

Competition

Housecall Pro: Housecall Pro was founded in 2013 and has raised $175 million in funding, with its latest round of funding consisting of a $125 million Series D of combined debt and equity funding at an undisclosed valuation in July 2022. Housecall Pro offers many similar features to ServiceTitan, and it has a particular emphasis on community, with over 11K users who share best practices, answer each other's questions, and exchange ideas. For service providers, getting a glimpse of what peers are doing can be very informative, and the feeling of being part of a community is another intangible perk.

Jobber: Jobber was founded in 2011 and has raised a total of $183.5 million in funding as of December 2023. It is more focused on offering dispatching functionality and has a simpler interface that can be more suitable for smaller businesses. It seeks to focus on a few customer pain points, as opposed to the more broad approach that ServiceTitan has taken in trying to cover as many pain points as possible.

Workiz: Workiz specializes in providing businesses with field and home service management solutions. The company was founded in 2015 and has raised $60.3 million as of December 2023. The company offers a comprehensive suite of tools designed to streamline and optimize various aspects of job management. Workiz's features include job scheduling, dispatching, invoicing, customer relationship management, online payment tools, and real-time communication capabilities. It targets a range of service-oriented sectors, such as plumbing, electrical, HVAC, and cleaning, catering to small and larger enterprises. Over 100K business professionals used it as of November 2021.

Aside from these direct competitors, ServiceTitan also faces competition from players that focus on specific parts of a contractor’s workflow. For instance, Hearth is seeking to establish itself as the leading solution for financing in-home services. If it succeeds, ServiceTitan could see decreased usage of its financing product.

Another source of competition is the category of marketplaces that pair consumers with contractors for home service jobs, such as Pro.com, Angie’s List, and Yelp. However, these players only serve to connect consumers and service providers, and unlike ServiceTitan, often do not provide the full suite of software tools to help service providers manage their businesses. Finally, ServiceTitan faces competition upmarket, with players like ServiceMax specializing in field service management software for large enterprises, while ServiceTitan focuses on SMBs.

Business Model

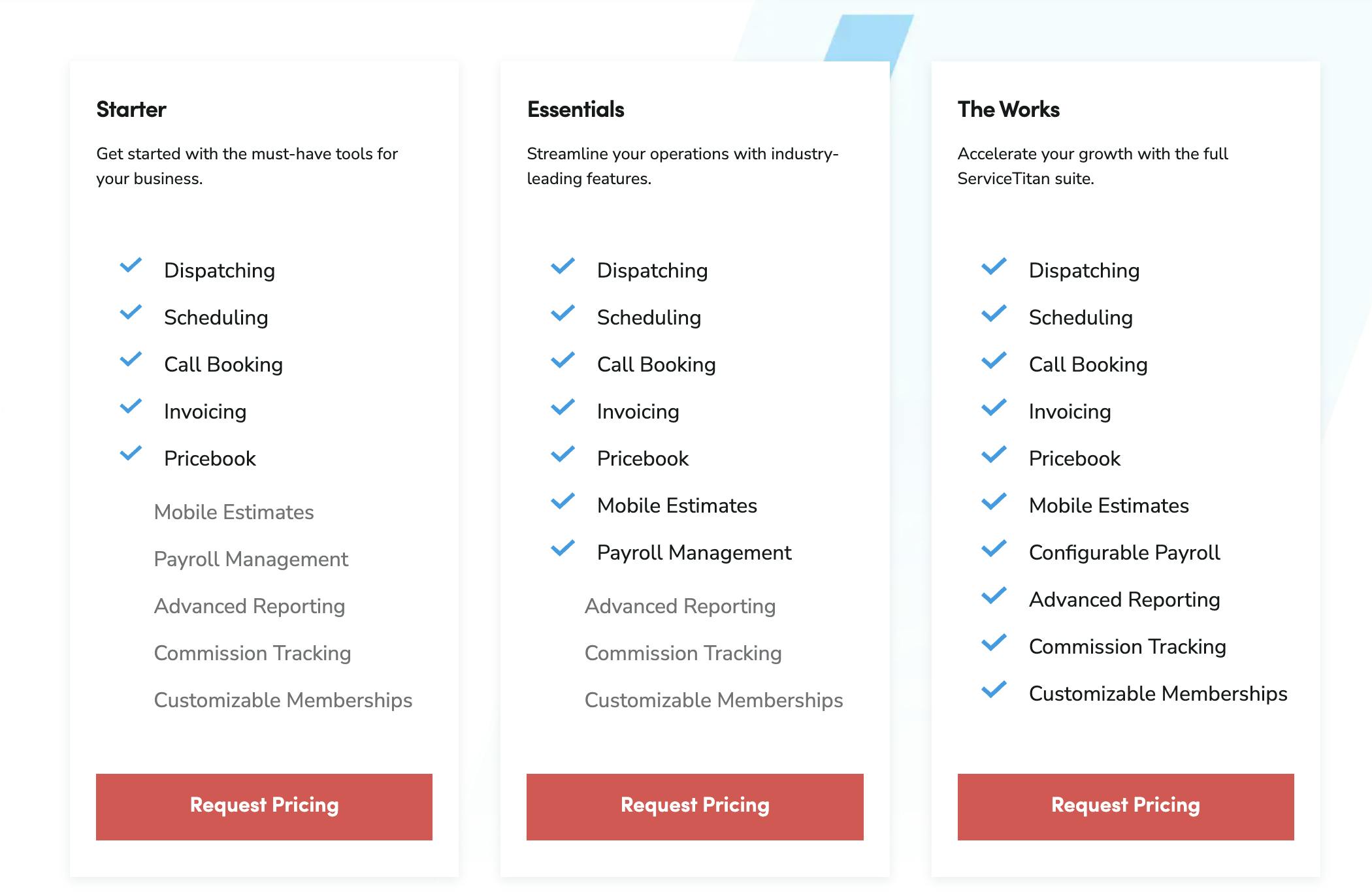

Source: ServiceTitan

ServiceTitan pricing varies based on the features included, but the software product pricing starts at $398 per month, paid as an annual contract, and increases based on how many features are used. ServiceTitan also likely monetizes on payment flow and financing volume. The company offers three pricing tiers: “Starter”, “Essentials”, and “The Works”.

Traction

ServiceTitan first crossed $100 million in ARR in 2018, six years after the platform launched, and hit $200 million two years later in December 2020. In March 2021, ServiceTitan reported that it had crossed $250 million in ARR, with over 7.5K customers that employed over 100K technicians. It also reported that its customers “conduct nearly $20 billion worth of transactions across services like plumbing, air conditioning, electrical work, chimney, pest services, and lawn care”. Between January 2022 and January 2023, the company realized $460 million in revenue, but reportedly had $170 million in losses in 2022.

Valuation

ServiceTitan’s most recent round of funding as of December 2023 was a $200 million Series G raised in June 2021 that valued the company at $9.5 billion. The round, which was led by Thoma Bravo, brought its total capital raised to $1.1 billion. Other notable investors in ServiceTitan include Sequoia, Tiger Global, Index Ventures, Dragoneer, Battery Ventures, Bessemer Venture Partners, and ICONIQ.

In January 2022, ServiceTitan had filed confidentially to go public with an $18 billion IPO, but this planned IPO did not come to fruition, likely due to adverse macroeconomic developments leading to a poor market for IPOs at the time. In November 2022, it was reported that ServiceTitan had held talks to raise $600 million at a valuation about 20% lower than the $9.5 billion figure it had raised its Series G at. The company had already raised $250 million in debt financing in October — this debt carried fairly onerous terms, including a 10% interest rate with warrants covering ~1.5% of the company’s equity. However, this did not occur.

Instead, in December 2023, it was reported that ServiceTitan was working with Goldman Sachs and Morgan Stanley in making preparations to go public, in a revival of its IPO plans from 2022. The company could IPO as early as Q2 2024.

Key Opportunities

New Verticals

In 2013, ServiceTitan launched its initial product with verticals like garage door repair and plumbing. Since then, it has expanded into adjacent verticals, such as HVAC, electrical, landscaping, and more. There are several adjacent verticals that the company could expand into. For instance, in June 2021, ServiceTitan announced that it had acquired Aspire Software, a leading software provider for the commercial landscaping industry, a $100 billion market. In addition to HVAC, plumbing, and electrical, ServiceTitan also already has separate pages for several specific verticals. ServiceTitan has a demonstrated opportunity to continue expanding its target verticals by serving more and more adjacent home services and thereby expanding its position in the market.

New Product Lines

Source: Bessemer

ServiceTitan has already covered a large surface area with its suite of different products. It can continue new product development and solve additional problems for its customers. For example, a relatively nascent business line for ServiceTitan is Payroll. ServiceTitan saw that its customers had been using third-party tools to process payroll for their workforces, but these third-party tools often struggled with wage calculations for standard field service requirements.

By building a payroll tool tailored to its customers’ vertical-specific use cases, ServiceTitan could solve a pain point and further entrench itself as the all-in-one platform to manage its customers’ business operations. Other possible products include AI and automation tools, such as the suite of AI-powered products based on its AI solution Titan Intelligence that it launched in September 2023. One June 2023 survey found that 24% of contracting businesses are already incorporating AI, which has had a positive impact on workflows such as call booking, invoicing, dispatching, and customer experience.

Extending Through the Value Chain

ServiceTitan has built a large user base comprised of contracting businesses themselves, but it has an opportunity to extend through the value chain and touch players like parts suppliers as well. Many home improvement and maintenance jobs require hardware and parts to complete jobs, and oftentimes the home services contractor is responsible for sourcing these parts. ServiceTitan could follow the example of CCC Intelligent Solutions, which offered software to auto repair shops before it discovered that auto repair shop managers would spend large chunks of their day ordering parts and reconciling invoices to those orders. As a result, CCC decided to build out a two-sided online parts marketplace to streamline this key part of the auto repair workflow. ServiceTitan has the opportunity to do something similar for the home services workflow.

Moving Upmarket

While ServiceTitan started by serving SMBs, there is a large portion of the field service management software market that is geared toward serving enterprises. For example, ServiceMax serves enterprise customers that have an average technician headcount of ~900 people (think of the team of technicians that companies like GE or Schneider Electric have to service the industrial technology and equipment that they sell). This part of the market has been largely untouched by ServiceTitan but represented a $9 billion market that employed ~8 million technicians globally as of July 2021. Though not the same as home services, many of the workflows are similar, and ServiceTitan could build enterprise-grade versions of its existing product to help it move into this market.

Key Risks

Adverse Macroeconomic Environment

Home services is an industry that is particularly vulnerable to a macroeconomic downturn. Businesswire found that in 2022, 70% of contractors did not see an increase in revenue compared to the previous year. Spending on home services is largely discretionary with 80% of it spent on home improvement. In a worse economic environment, consumer discretionary spending could decrease as a result of lower incomes and rising unemployment rates. Home buying and the rate at which people move into new homes can be expected to decrease as well, which negatively impacts the demand for home services. This impact on consumer demand can lead to fewer customers and fewer jobs for ServiceTitan’s users.

Questions about Profitability

Despite having already raised over $1 billion in capital, ServiceTitan still hasn’t achieved positive cash flow. In 2022, the company burned through $170 million in cash, which was more than a third of the company’s revenue for that year. As public markets shift to prioritize profitability over growth at all costs, ServiceTitan could face skepticism from the market which could present significant challenges as it prepares to IPO in the first half of 2024.

Summary

ServiceTitan is tackling an underserved market, representing millions of workers. By building software that addresses all the pain points and complexities involved with running a home services business, ServiceTitan seeks to create an all-in-one platform for contractors. There are many large opportunities ServiceTitan can choose to pursue, from new verticals to new product lines to moving upmarket, but it remains to be seen if it can continue to drive growth in these areas as it prepares for its IPO.