Thesis

The commercial real estate market is one of the largest markets in the US. In 2021, US commercial real estate was estimated to be $20.7 trillion in value. However, technology adoption in the real estate industry overall has been slow-moving. The industry's size, paired with the outdated nature of its processes, has left it ripe for technological disruption. Real estate companies are increasingly looking to adjust by offering digital services to meet market demands. While most commercial real estate (CRE) executives want to modernize, 60% of CRE executives in 2020 reported that progress towards greater technology adoption was being hindered by competing priorities, while 58% said difficulty integrating new systems into existing infrastructure and processes was preventing greater tech adoption.

One of the most inefficient processes in commercial real estate, and real estate as a whole, has been managing the end-to-end leasing process. In interviews with 50+ industry stakeholders, leasing agents were found to be using a variety of communication methods, including paper, to report viewings progress, term recommendations, and progress with viewings. Meanwhile, on the consumer side, expectations have shifted and a digitized experience is increasingly favored. Digital rent payments are now popular among both commercial and residential renters. As a result, 80% of CRE firms in a 2023 survey were planning to look at adopting new tech, while 75% of US CRE companies were planning to increase or maintain their tech spending.

VTS ("view the space") is a real estate software company bringing landlords, brokers, and tenants together to make deals. By centralizing all the data and workflows, the company enables landlords and brokers to better attract, convert, and retain assets and tenants. VTS enables owners and managers of commercial real estate to monitor the leasing process in real time by sharing information through a singular platform.

Founding Story

Source: The Real Deal

VTS was founded in 2012 by Nick Romito (CEO), Ryan Masiello, and Karl Baum (ex-CTO) in New York City.

Romito and Masiello were lifelong friends who grew up surfing in New Jersey. After graduating college, they both began working as agents in the commercial real estate industry. Romito got his start in commercial real estate at Murray Hill Properties and spent over six years in the industry across two firms. Masiello began his career at Cushman & Wakefield. He later worked at Jones Lang LaSalle, advising landlords and tenants in the Manhattan office market. Baum had a software engineer background and served as a Vice President at Goldman Sachs and as a CTO at WeShop.

The original idea for VTS came from a recognition that the amount of time wasted on identifying and closing commercial spaces was burdensome for all parties involved. VTS’s first product was a high-quality, steady cam video offering to show listings via email and online. It saw early traction by helping owners save time by qualifying leads before giving tours, and rates of potential clients into tenants. On the tenant rep side, the VTS product allowed agents to find spaces that fit specific customers' criteria more efficiently without the hassle of viewing any spaces in person. VTS signed the largest commercial real estate firm in NYC, SL Green, to its video platform early on.

The next phase came on the leasing side, which VTS is known for today. VTS had to make a decision between going in the direction of a video business or a software platform serving the leasing process and asset management. The company eventually decided on the latter option.

Product

The VTS platform enables portfolio management, leasing, marketing, and building operations for commercial real estate firms. VTS has also expanded its product offerings to include offerings for all sectors; office, retail, industrial, and even multi-family real estate.

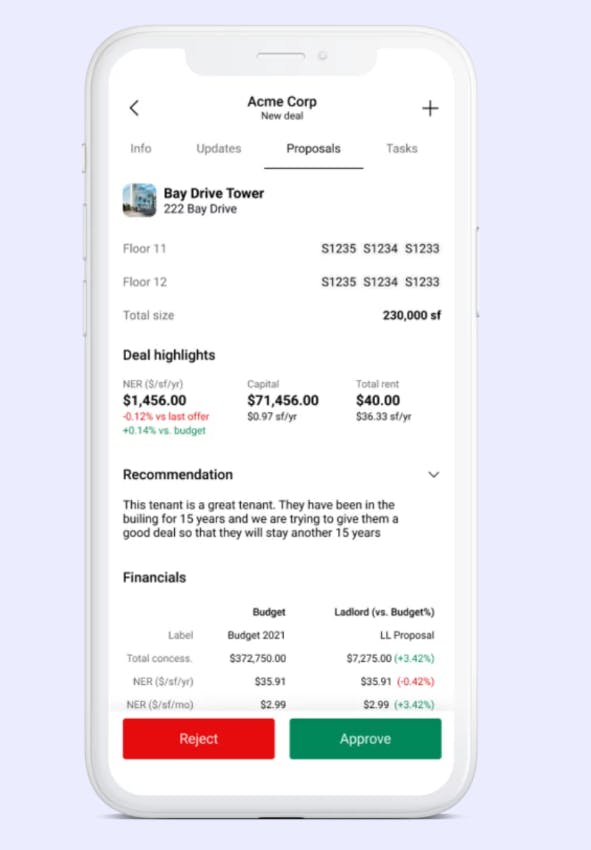

VTS Lease

VTS Lease allows users to manage deals, leases, and tenants online while providing “360-degree insights” into all portfolio activity. VTS Lease offers retention management, occupancy oversight, deal momentum tracking, deal approval management, and deal connection alerts, among other features.

Source: VTS Lease

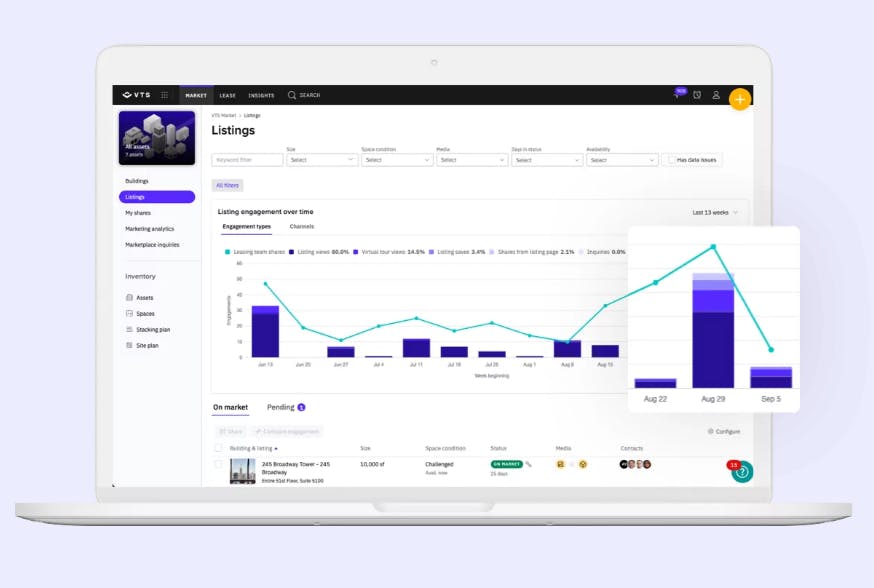

VTS Market

VTS Market is the digital marketing offering in the VTS product suite that streamlines marketing and leasing workflows from listing creation to executing the lease. From content creation and distribution to analytics and optimization, VTS Market helps marketing and leasing teams with their marketing campaigns. VTS offers listing pages, channel management, automated tactics, advanced analytics, a dedicated support team, and tenant engagement.

Source: VTS Market

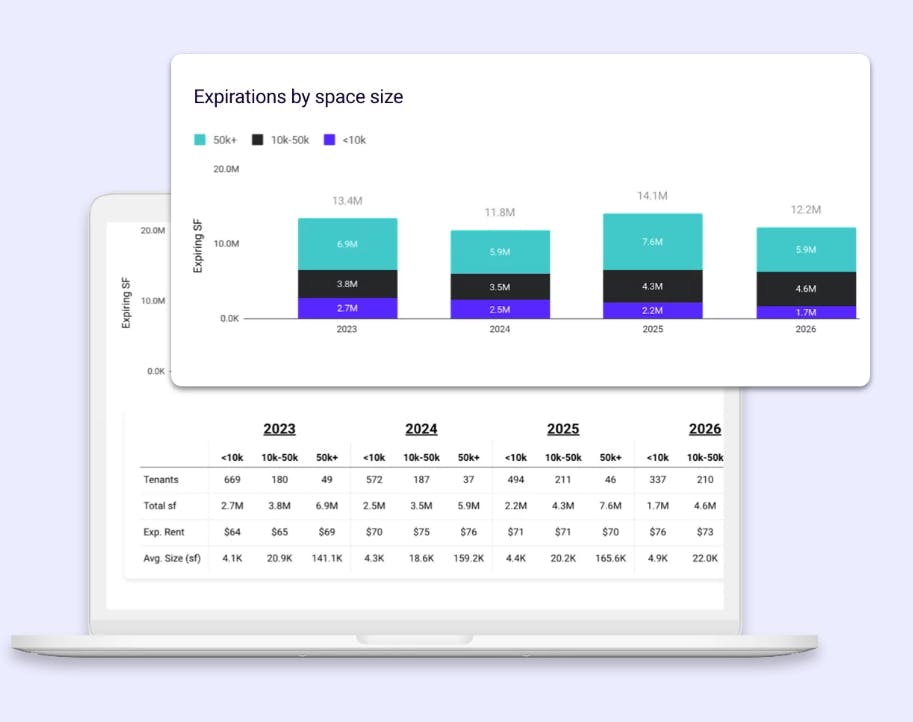

VTS Data

VTS Data is a market data platform powered by $200 billion in leasing transactions managed on VTS Lease. VTS Data is used by investment management and research teams to track market trends, identify opportunities, track portfolio performance, make strategic decisions about asset allocation, assess the value of properties, identify potential buyers, and more.

Source: VTS Data

VTS Activate

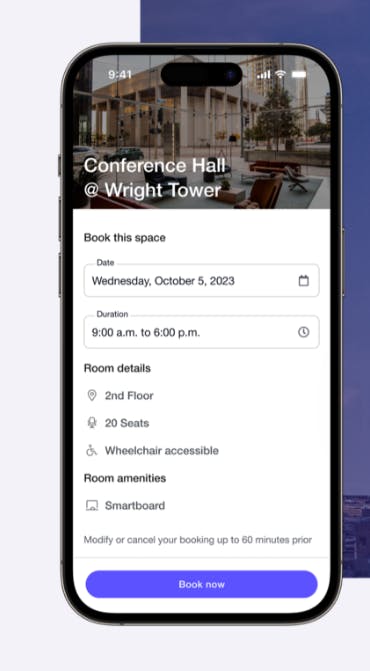

VTS Activate is a tenant experience platform that allows landlords and property managers to turn their portfolios into an interconnected branded ecosystem. It supports operations management, tenant engagement, work order management, communications management, flex space management, amenity booking, visitor management, and access control.

Source: VTS Activate

Market

Customer

VTS’s customer base spans landlords, property managers, and agents across office, retail, industrial, and multi-family real estate in over 38 countries. For agents, it provides streamlined deal execution, marketing content and analytics, and business insights. For landlords, it combines portfolio management, tenant relationships, and building operations. For property managers, it facilitates access control and property operations.

VTS’ customers include Blackstone, Brookfield Properties, LaSalle Investment Management, Hines, BXP, Oxford Properties, JLL, and CBRE. Since the company was one of the first to market, many of VTS’s customers migrated from legacy applications to using VTS.

Market Size

VTS’s addressable market consists of landlords, agencies, brokers, and tenant reps using competitor software or legacy, non-digital solutions. The global commercial real estate software market size was valued at $2.7 billion in 2021 and is projected to reach $4.6 billion by 2030, growing at a CAGR of 7.8% from 2023 to 2030. As of Q2 of 2021, commercial real estate property values were estimated to be worth $20.7 trillion. Although this value is established based on the worth of physical assets, it puts in context the scale of the value held by the customers of VTS and its competitors, indicating that there is room for continued market growth as digital penetration continues to increase.

Competition

Hightower (now merged with VTS): In the early to mid-2010s VTS was competing head-to-head with Hightower, a direct competitor also building a commercial leasing management platform for brokers and owners to manage their end-to-end leasing workflow. Hightower had raised $22 million in financing over the two years after its founding in 2013. The best example of its competition with VTS came during a very direct product trial by Blackstone which implemented both platforms from a finite trial period to a) decide which platform to migrate to and b) which companies to invest in. After winning this competition and the financial backing of Blackstone, VTS jumped into a leading position by garnering support for other large players in the space. In November 2016, VTS strategically merged with Hightower, ending its multi-year battle.

Yardi: Founded in 1984, Yardi is a software vendor for the real estate industry with end-to-end property and investment management software and services. Yardi’s suite of products is designed for office, industrial, and retail property management. An estimate put its annual revenue at $1.3 billion in 2022. Like VTS, Yardi supports asset management, tenant services, leasing, facilities management, deal management, and marketing.

HQO: Founded in 2018, HQO provides workplace experience technology that enhances how people connect and the places they work. HQO most closely competes with the newest VTS product VTS Activate as they both look to enable landlords and property management teams can now customize tenant engagement initiatives and workplace experiences. It has raised $106 million in funding.

Dottid: Founded in 2018, Dottid is another commercial real estate asset management platform. Like VTS, it helps landlords and property managers manage all deals in one place. Its Asset OS is an API Connector that allows third-party tools to integrate with Dottid and help asset managers keep all their data in one place. Features include a deals function that lets all team members stay on top of deal changes. Users can set approvals, assign tasks, communicate deadlines, and track financial negotiations. It also supports capital projects, dynamic projections, and property debt. It has raised $20 million in funding.

Occupier: Founded in 2018, Occupier is used by commercial tenants and brokers to maintain compliance with lease accounting standards, manage real estate leases, and execute lease transactions. Occupier is based in NYC and has raised $16.9 million in funding. Its lease management software enables tenants and brokers to collaborate on the entire lease life cycle, from site selection to critical date management and lease accounting. In February 2022, it announced it had seen over 200% year-over-year growth ARR and had over 130 customers, including Bluestone Lane Coffee, Afterpay, Shake Shake, DraftKings, and Bonobos. It operates across banking, healthcare, manufacturing, retail, and franchises.

Business Model

VTS generates revenue by charging subscription fees for its products and services. According to several sources, subscription prices start at $20K yearly, according to Capterra, Software Advice, and Trust Radius. VTS reportedly generated more than $100 million in 2022 in subscription revenue.

Traction

VTS has become the largest data source in the industry, with more than 60% of Class A office space in the U.S. being managed through their platform. As of May 2023, it has 12 billion square feet of office, retail, and industrial space managed through the platform worldwide. VTS’s user base includes over 45K commercial real estate professionals and customers such as Blackstone, Brookfield Properties, LaSalle Investment Management, Hines, BXP, Oxford Properties, JLL, and CBRE.

Valuation

VTS announced a $125 million Series E in September 2022 led by the CBRE group. This funding round valued the business at a $1.6 billion pre-money valuation and brought the company’s total amount of capital raised to $462.4 million, including debt financing.

In 2022, many real estate tech companies laid off staff to reduce costs and focus on their main services. An index of 17 public real estate technology firms lost more than 80% of their value since their peak, many achieving that high value through Special Purpose Acquisition Companies (SPACs).

Key Opportunities

Data-Driven Defensibility

VTS has access to a detailed picture of leasing activity in the industry with the unique data sets it has collected. VTS now captures over 75% of office building activity data in top US markets. In 2020 VTS began investing in and building its data science team to level up its data infrastructure. Moving forward, access to proprietary data sets will likely be instrumental in producing quality data models to power AI and ML applications. VTS has an opportunity to expand its predictive capabilities and create a data moat.

Credibility

47% of startup failures in 2022 were due to a lack of financing, nearly double the percentage that failed for the same reason in 2021. This greater uncertainty for newer startups could mean that the large, typically risk-averse customers will want to work with fewer and more established vendors on the technology front. This creates an opportunity for VTS to retain and upsell existing clients while even winning competitors' business.

M&A

There is an opportunity for VTS to go on the offensive, whether by acquiring complementary products or growing its existing product line. VTS, even as a startup, has been an active participant in M&A, as seen with its industry-defining strategic merger of Hightower in 2016 and its acquisitions of Property Capsule in 2019, Lane in 2021, and Rise Buildings in 2021. Additionally, the grounds for its $150 million debt financing in May 2022 was to accelerate investments in its strategic product roadmap, M&A, and global market expansion. With a portion of that financing allocated to M&A, it is likely to continue exploring M&A opportunities.

Key Risks

Slowing Market

With rising interest rates, mortgage rates moved back over 7% in 2022. This led to more residential properties sitting longer on the market and mortgage application rates dropping to a 28-year low. On the commercial side, the industry saw a 61% drop in tenant demand between 2019 and 2021. The macro headwinds on the residential side and record-high vacancy rates for commercial properties broadly create both medium and long-term risks to the real estate market. As a software provider and non-asset owner or broker, VTS is exposed to these macro factors.

Costs

Over half of American real estate companies report plans to stop or decrease their investment in new technologies in 2023. VTS’s starting subscription tier sits at a lofty $20K a year, which puts it at risk of being cut. If VTS doesn’t consider alternative pricing structures that may be more affordable for the 45K+ users on its platform, it may find itself losing both new and existing business.

Summary

As software adoption has increased within the commercial real estate market over the past decade, VTS has established itself as the de facto commercial real estate software: a multi-product platform serving every commercial real estate ecosystem player. Having started in 2012 by two surfers from New Jersey, VTS has grown to a 300+ person company that services greater than 45K commercial real estate professionals. VTS's early traction with key accounts in the NYC market propelled it to become a global leader in the historically slow-moving commercial real estate market. As new AI-focused market entrants attempt to win market share, VTS has some advantages given its year of proprietary real estate data. With that being said, to maintain its market position, VTS will have to continually iterate and expand its product offerings.