Thesis

The COVID-19 pandemic turned the hospitality market upside down. The global travel booking market saw a 60% drawdown from $1.4 trillion in 2019 to $600 billion in 2020 and it's estimated that it won’t recover its 2019 volume until 2024. Moreover, the pandemic changed customers’ expectations around hospitality, with an increased expectation for travel arrangements to be more flexible. Customers are also combining leisure and work in their travel, causing them to stay longer at their travel destinations. They’re looking for a rich experience in their accommodations with access to services like restaurants, workspace, and entertainment.

In addition to this, hospitality organizations worldwide have seen rapid digital change, spurred on by increasing demand during the pandemic for digital options like an in-room QR-code or self-check-in. Surviving the COVID-19 pandemic was only the beginning, and now these businesses must face a return of customers who have heightened expectations. To meet these needs, organizations must supply property managers and frontline staff with efficient tools to give guests and offer customers the ability to self-service when possible. The property management system (PMS) has been a cornerstone of hospitality enterprise software and plays a crucial role in meeting customer demands. Hotels have a PMS to manage bookings, allocate guests to rooms, manage check-in and check-out, oversee housekeeping, and manage the back office.

Mews is a hotel property management system that helps simplify hotel operations so properties can focus on their guests. Founded by ex-hoteliers, Mews is an operating system for hotels, hostels, apartments, and more. Mews enables hospitality providers to offer a better guest experience while improving the operations and performance of their properties. It positions itself as an alternative to incumbent players in the space like Oracle Opera or Protel by offering large hotels and hotel chains the ability to transition their historical PMS to the cloud.

Founding Story

Richard Valtr started Mews in 2012 in Prague. Prior to Mews, Valtr studied and worked in the film industry in the UK. His mother operated a real-estate group that included hotels, and he spent several summers as a night receptionist in hotels owned by his family. One day, his mother asked him to return to the Czech Republic to operate a new hotel. It was in the course of working on this hotel when he came up with the idea for Mews, as he stated in a podcast interview:

“I started Mews back in 2012 while I was building a hotel in the center of Prague which is where I'm from. I thought that creating this entire operating system for hotels would be as easy as building a hotel without a reception desk like I was building at the time. I thought the PMS part of it would take about a year to do and nine years later, I’m still struggling to do it.”

With Mews, Valtr aimed to remove the reception desk so that it wouldn't be a barrier between guests and the hotel. This way, guests could feel more at ease, and the hotel staff could focus on providing an exceptional guest experience. Mews was initially designed as an app for receptionists with iPads to check in guests and interact with them since there was limited space for workstations without a reception desk. When Valtr met with Oracle to discuss his idea, he discovered a major issue in the industry: a legacy system that made integrating new technology solutions nearly impossible.

It took the company four months to create a product to be tested at its first hotel customer. Mews was a bootstrapped company for four years, which forced the company to be agile. In 2016, Mews eventually raised a seed round.

In January 2017, Matthijs Welle became Mews’s CEO, replacing Richard Valtr who remains active in the company. Welle was an early employee at Mews, having joined in 2013.

Prior to joining Mews, Welle had worked at Hilton for 10 years across various departments and was unhappy with the lack of technology that caused a fragmented guest experience. When Valtr told him he wanted to change that by creating an entirely different approach, Welle was eager to join. Welle joined in 2013 and eventually became the CEO in 2017.

Product

Mews Operations

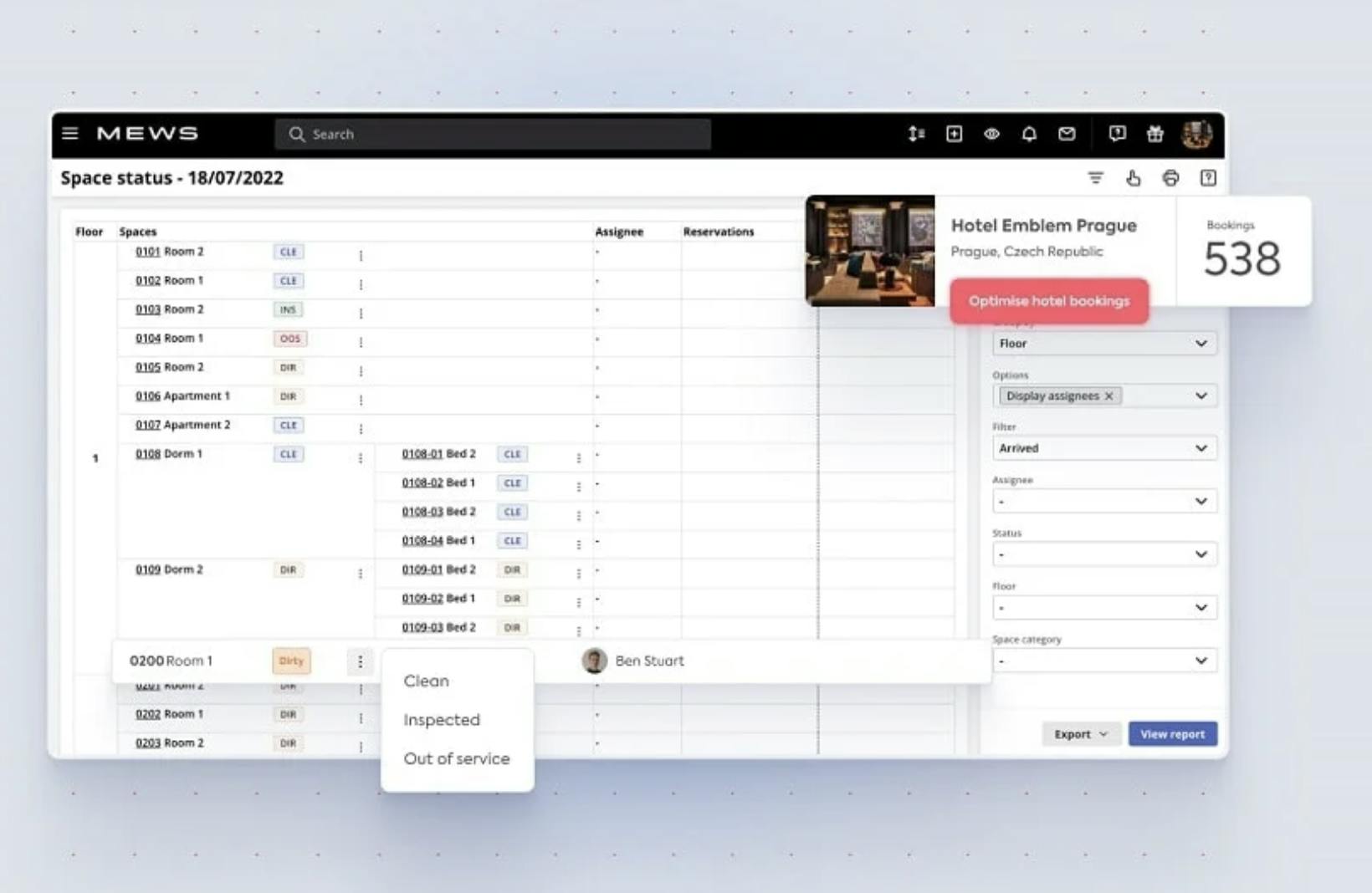

The Mews Operations PMS has five main modules: reservation management for individuals and groups, housekeeping (room cleaning), front-office management (check-ins, checkouts, ancillaries), rate management, and accounting.

Users can handle all bookings, track availability, and access different views from a real-time dashboard. Mews supports specialized group management features and assignments as well. The company offers a mobile app for all housekeeping employees working in the hotel to streamline communication, get status updates, and manage schedules. On front-office operations, the desk team can access guest profiles, issue payment requests, communicate with guests, and generate new tasks for their colleagues.

Mews also allows hotels to create customized packages (e.g. a room with or without a view, breakfast included or not, activities included or not) and to set up room pricing rules (e.g. based on seasonality or expected occupancy).

Source: Mews

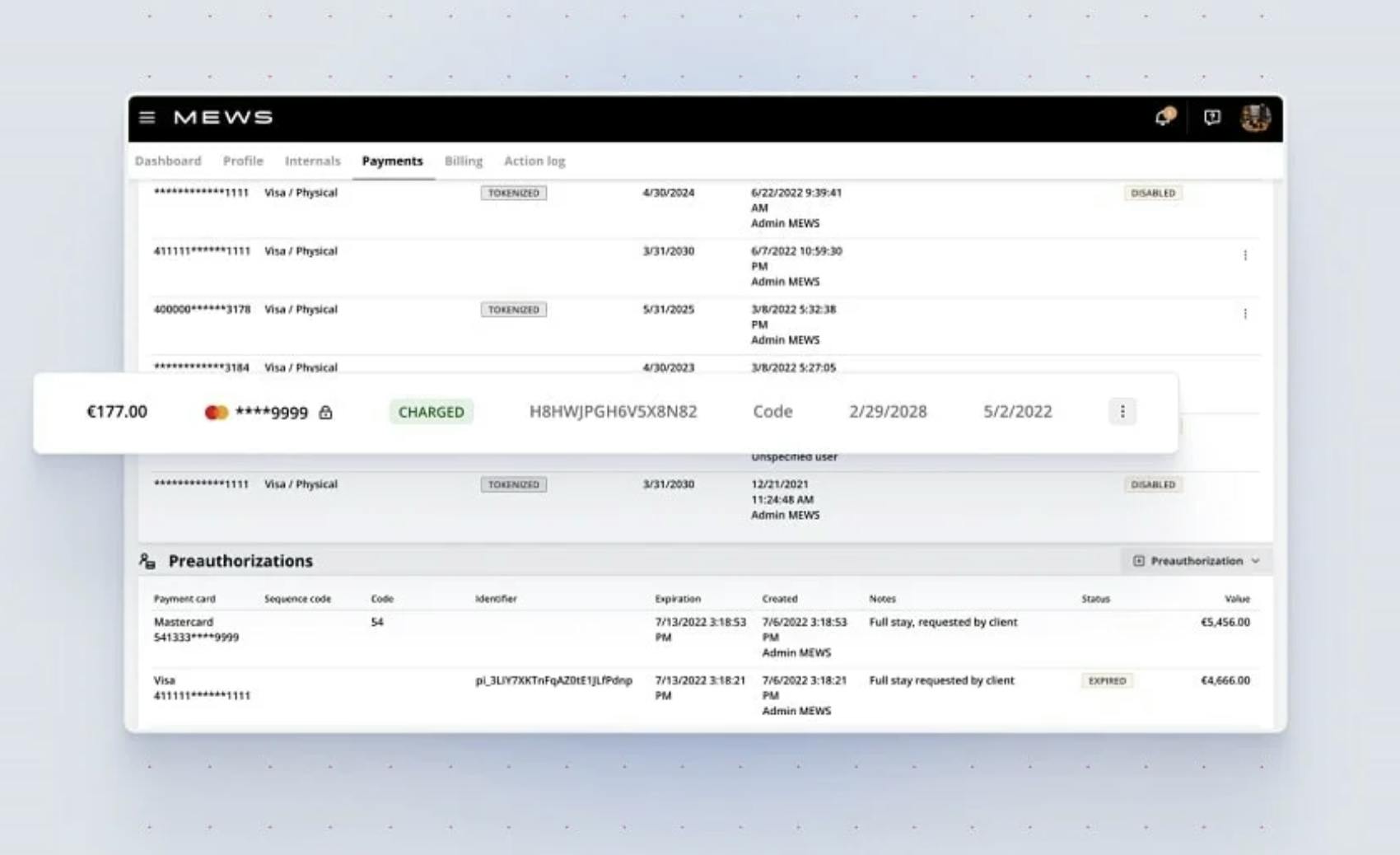

Mews Payments

Mews Payments is a payment gateway integrated into the PMS to process online and offline payments. It supports 10+ payment methods in 40+ countries, and offers one-click payments, transactions overview, settlement rules, virtual card detection, kiosk payments, and central reconciliation.

Hotels can also use Mews Payments to configure their payment schedule for their guests to know when they will be charged (e.g., upon arrival, at checkout) and how they will be charged (percentage paid or pre-authorized at confirmation vs. percentage paid at check-in).

Source: Mews

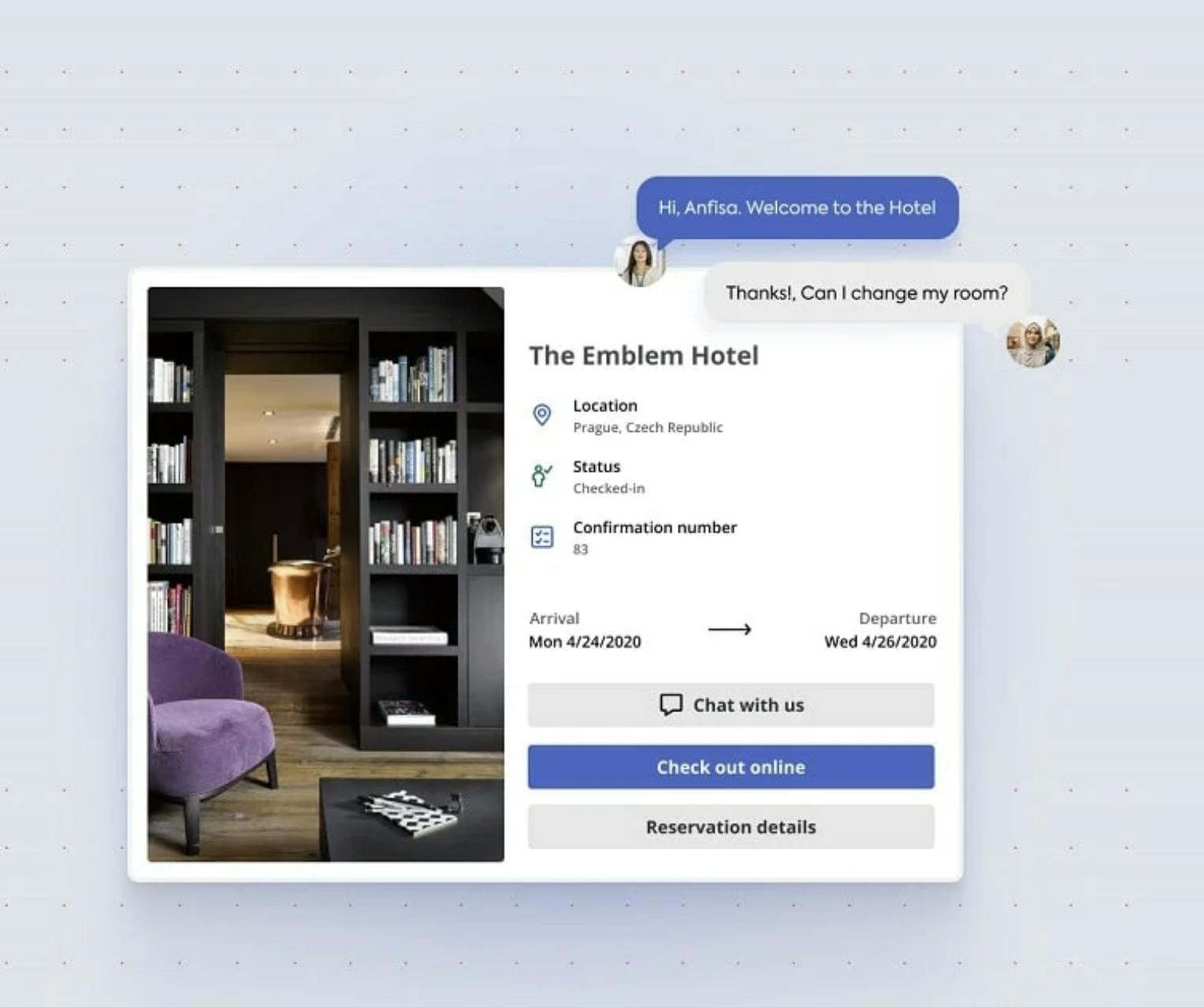

Mews Guest Journey

Mews Guest Journey is a guest management solution meant to enhance the guest experience throughout their stay at a hotel. It includes a booking engine to make a reservation directly via the hotel’s website, online guest services to let guests purchase ancillary services during their stay, and a self-service kiosk to cut waiting time by doing check-ins or check outs online.

Source: Mews

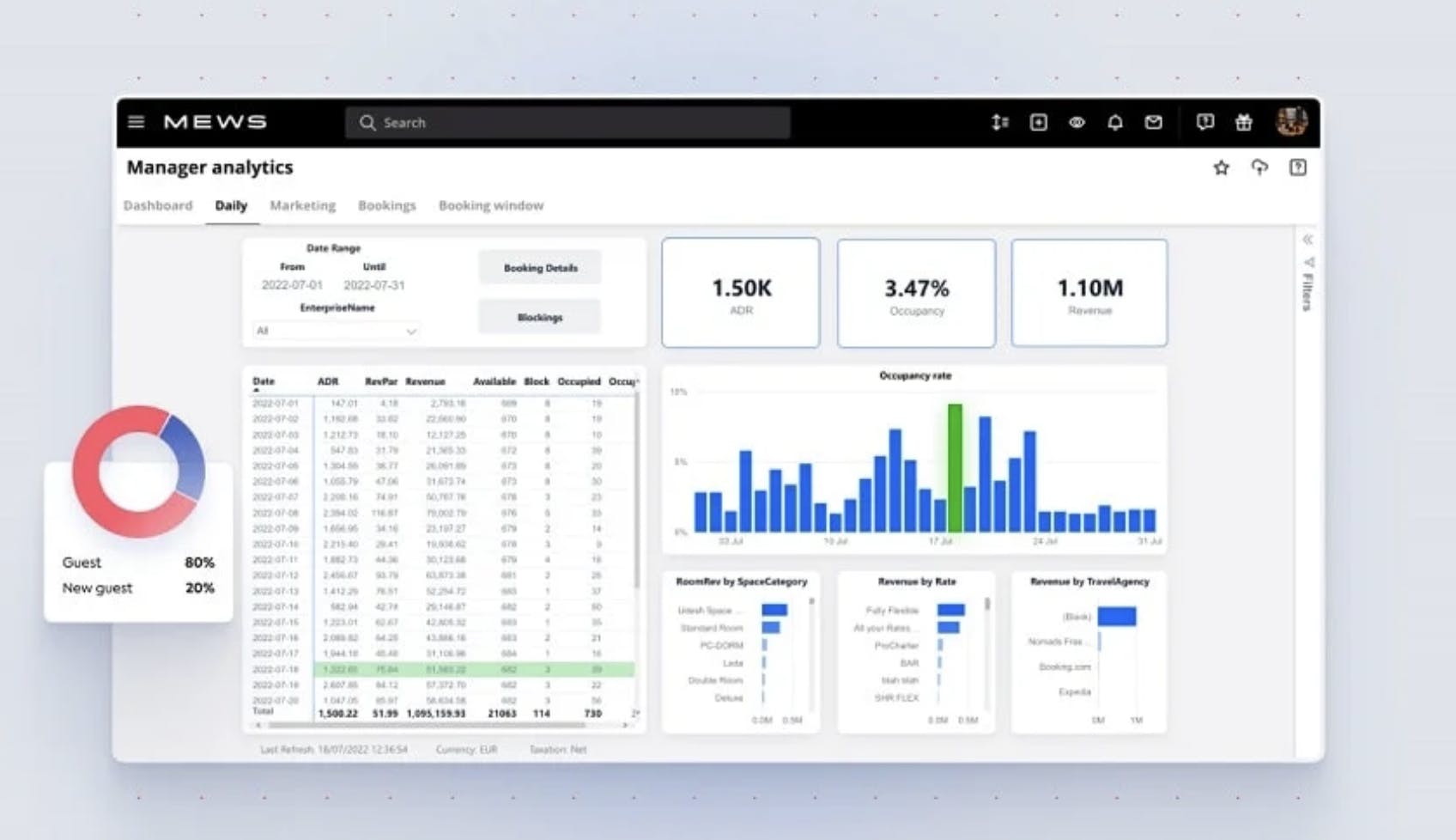

Mews Business Intelligence

Mews also offers a business intelligence solution with analytics and reporting capabilities specifically built for the hotel industry. Mews allows its hotels to compare their performance with others using Mews’s anonymized data. Users can view historical data, current performance, and target figures across operations, finance, and guests. It supports manager reports, reservation reports, accounting reports, bills and invoice summaries, and occupancy reports.

Source: Mews

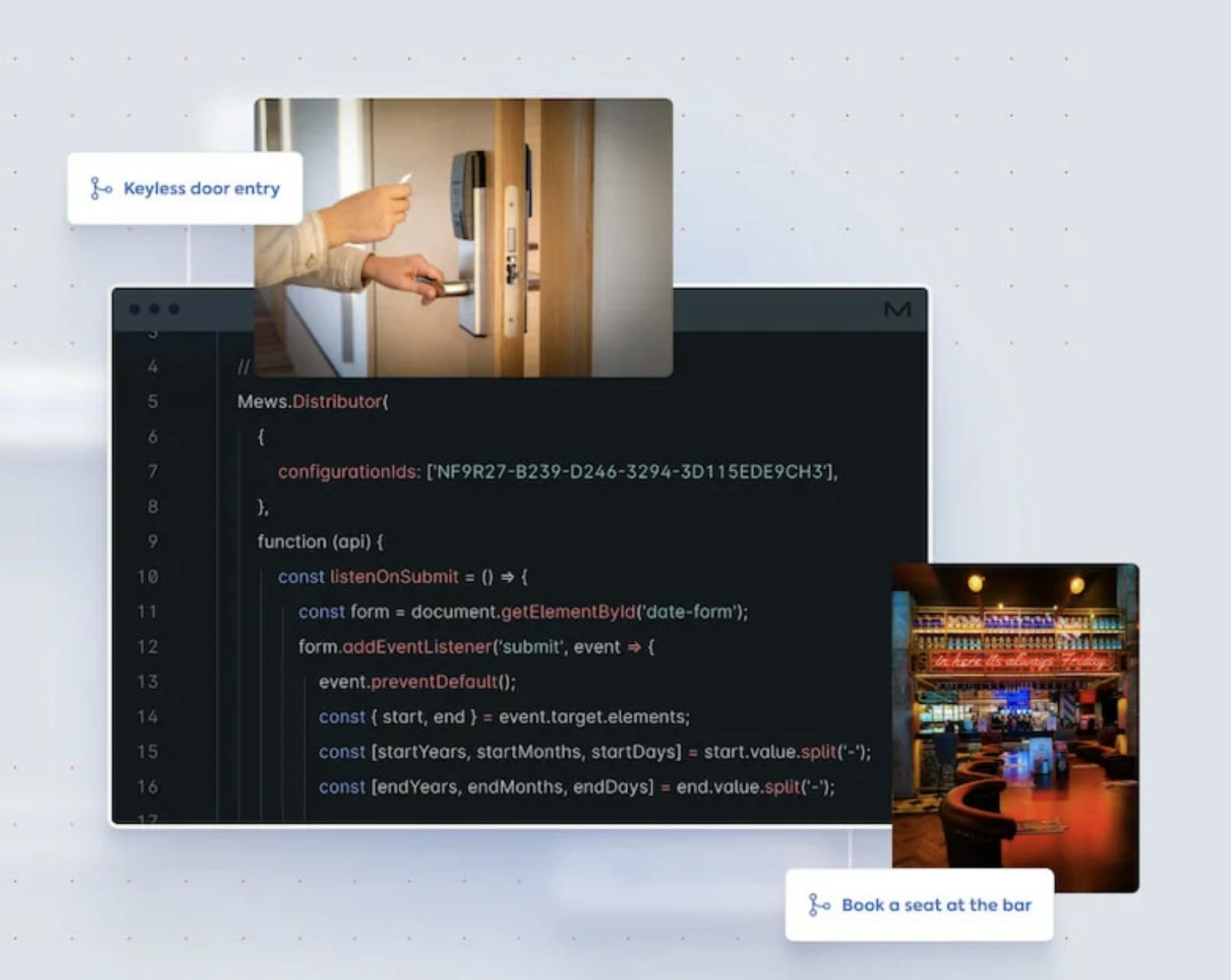

Mews Open API

The Mews API connects Mews to in-house tooling or third-party applications not on Mews’s marketplace. It facilitates communication between Mews and external applications or systems and connects with other services that work with property data, such as revenue management and POS systems. It can also be used with onsite solutions and local devices like printers and kiosks.

Source: Mews

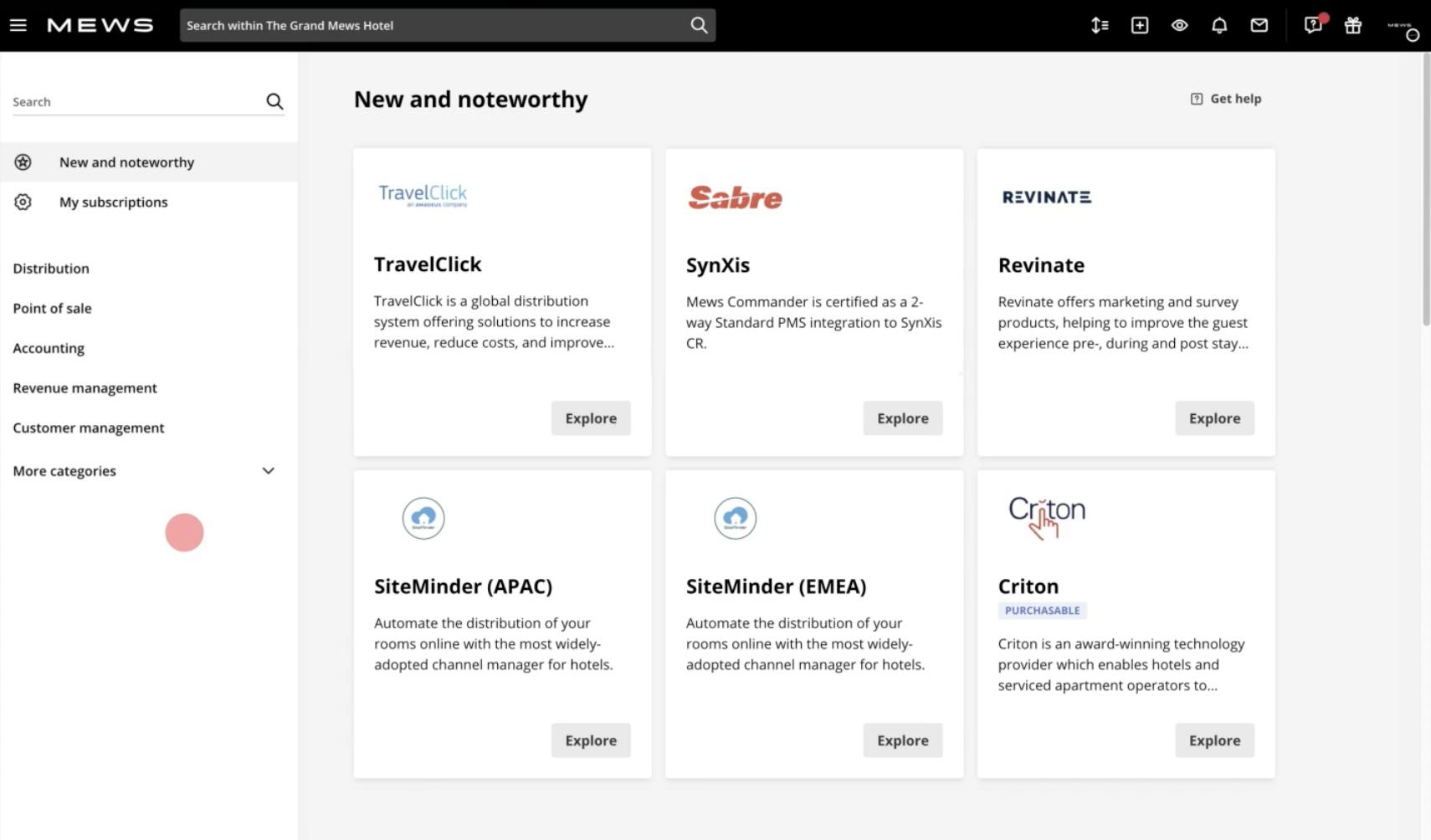

Mews Marketplace

Mews has a marketplace with 750+ solutions connected to the Mews platform. On its marketplace, Mews offers integrations in categories like accounting, customer management, business intelligence, revenue management (Smartpricing, RoomPriceGenie, Pace), reputation management (GuestRevu, Qualitelis, ReviewFilter), or distribution with channel managers (SiteMinder, D-Edge, Booking.com). On average, Mews customers take advantage of eight integrations via its marketplace.

Source: Mews

Market

Customer

Mews’s ideal customers are hotels with more than 50 rooms, including both independent properties and chains of all sizes. Mews started with independent properties and small chains with less than 10 properties, and has since progressively moved upmarket. For instance, it has a partnership with Accor, a hotel chain with a market capitalization of $8.9 billion as of June 2023. Mews has group-specific features such as a multi-property booking engine and a central reservation management system for hotel groups. In June 2023, Mews works with over 3.2K hotels in 84 countries.

As Mews is the system of records of a hotel, it’s a product used by every employee working on-site daily (the general manager, events manager, restaurant manager, waiters, housekeeper, porter, and front desk clerk). In chains, Mews is also used at the headquarter by cross-properties roles like the revenue manager in charge of maximizing revenues per hotel or by tech leads in charge of digitizing the IT stack of a hotel chain. Over time, it has expanded to hostels, apartments, and resorts.

Market Size

In 2015, the global hospitality market was worth $29.7 billion and hotels allocated 4.9% of their revenues to IT. The global hotel property management software market was estimated at $6.5 billion in 2022, and $7.2 billion in 2023. It is projected to grow at a CAGR of 10.8% to reach $14.7 billion by 2030.

The vast majority of hotels use a PMS. For instance, in the UK, 85% of hotels have a PMS and in the US, 80% of hotels have a PMS. Historically, PMS were on-premise solutions but there is an ongoing transition in the hospitality market from on-premise to cloud-based PMS.

On average, a hotel changes its PMS every seven years. The hospitality market is digitizing at an unprecedented rate as the hospitality market recovers from the COVID-19 pandemic, with 21% of hotels upgrading or changing their PMS in 2022 and a further 27% having reported that they planned to follow suit.

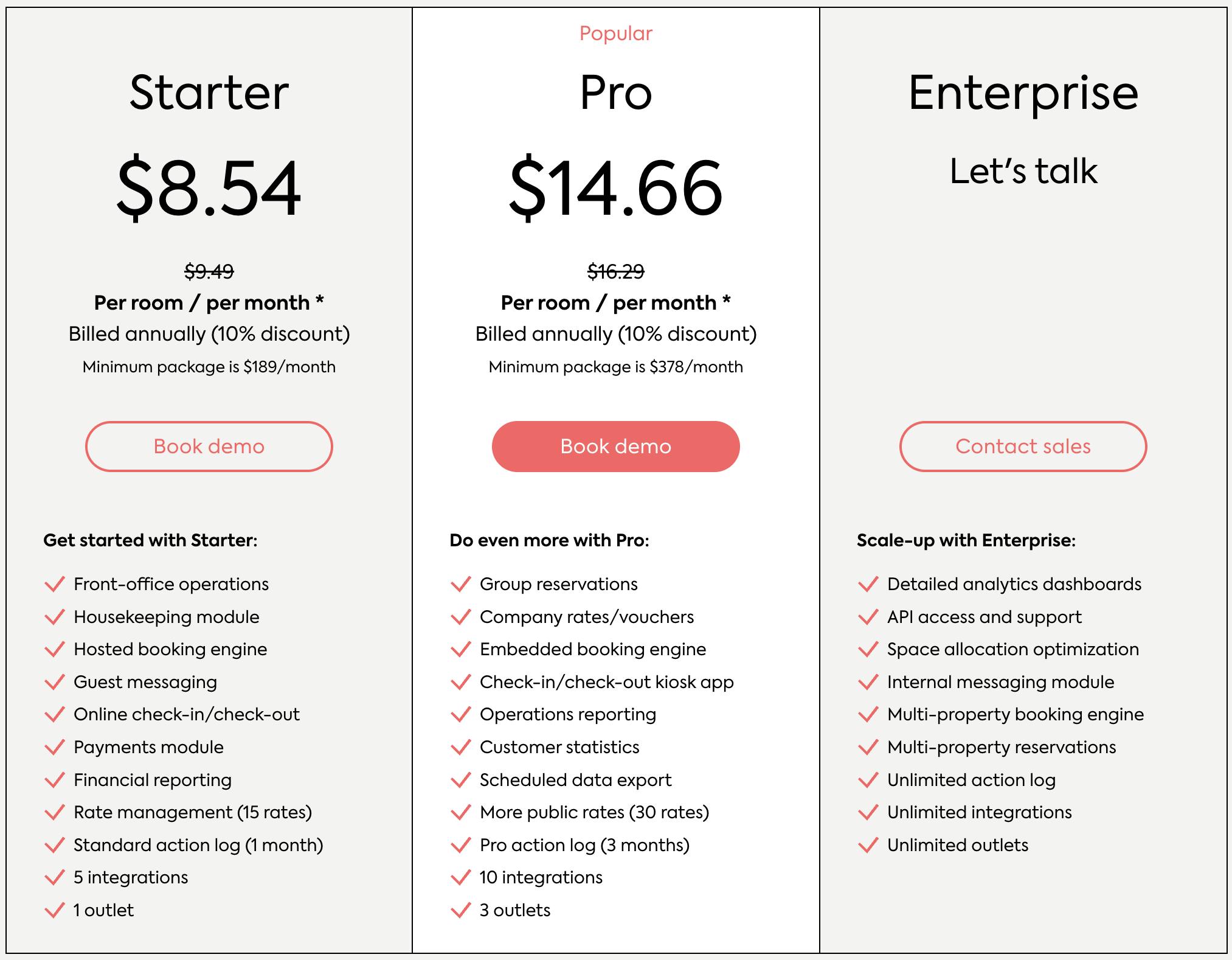

Hotels spent $4.5 billion on PMS in 2019. Estimating Mews's market size can be estimated from the bottom up by focusing on SaaS revenues (excluding payment revenues) and taking Mews Pro’s pricing at $15 per month. This leads to an estimated $4.8 billion addressable market ($15 per month and 28.7 million rooms).

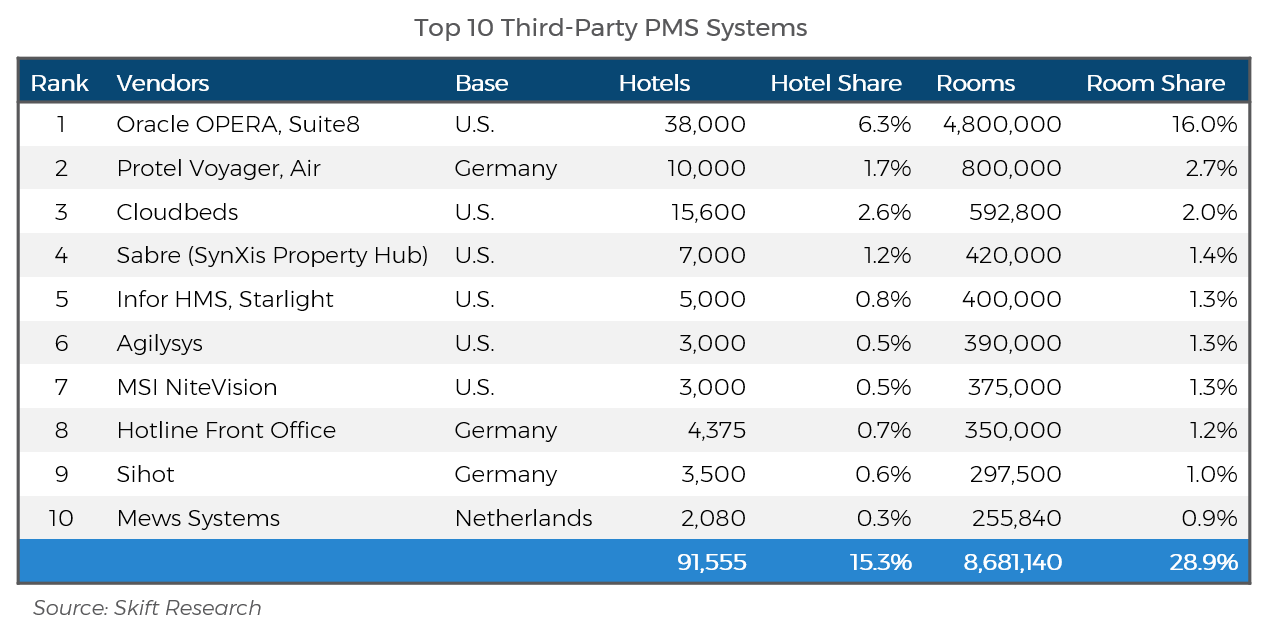

The PMS market is also very fragmented with between 700-1.3K different providers across the world and with the leading player controlling only 6% of hotels. This is because many local and regional regulations need to be embedded into the PMS, which makes it hard for providers to offer a global solution.

Competition

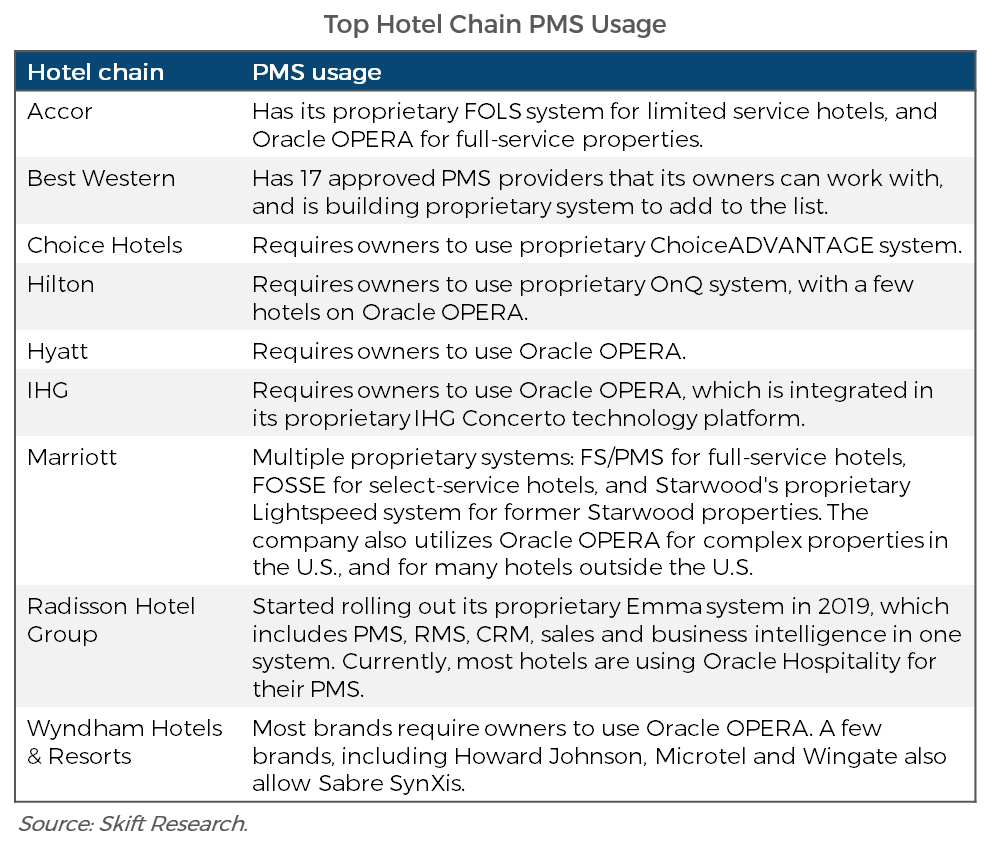

Source: Skift

Oracle Opera: Oracle Opera is the leading incumbent in the market. It works with 38K hotels (6.3% market share) and 4.8 million rooms (16% market share). Oracle bought a PMS called Micros Systems for $5.3 billion in 2014, which became Oracle Opera. Like Mews, it has a strong focus on the mid-market and enterprise segment of the hospitality industry, working mostly with multi-property chains and large hotels. Opera has launched a cloud offering and is progressively transitioning its customer base to its cloud product, but the transition is not happening quickly. As of January 2020, only 100 hotels (vs. 38K on Opera) are on Opera’s cloud product. Commenting on Oracle, Mews CEO Matthijs Welle stated in a March 2023 interview:

“Oracle was the number one [in the midmarket/enterprise segment]. We’re there to take them out because they’re not doing a good job and they’re doing a disservice to hotels. I’m a hotelier, and I deeply care about hotel experiences, they’re just holding our industry back. They’re holding it hostage almost.”

Protel: Protel is a technology provider to the hotel industry and was founded in 1994 in Dortmund, Germany. It works with 14K hotels as of May 2023. It offers a PMS (on-premise or cloud base), a booking engine, and a product for events and conferences. Protel was acquired in March 2022 by Planet, a payment platform owned by private equity funds Eurazeo and Advent, to embed financial services into Protel’s product suite.

Cloudbeds: Cloudbeds is an all-in-one solution for independent hoteliers. Its platform includes a PMS, a channel manager, and a booking engine. On top of this, it offers complementary products including payments, revenue management, demand marketing and guest management. It was founded in 2012 in California and raised $248 million in total funding, including a $150 million Series D led by Softbank in November 2021. It has 20K customers as of March 2023. Contrary to Mews, Cloudbeds is more focused on independent hotels and has an all-in-one value proposition beyond the PMS.

Amenitiz: Amenitiz is an all-in-one solution for independent hoteliers. Its platform offering includes a PMS, a payment solution, a booking engine, a channel manager, a website builder, and a revenue management system. It was founded in 2018 in Barcelona in Spain and has raised a total of $38 million in funding. It has 8K customers as of May 2023. Contrary to Mews, Amenitiz is more focused on B&Bs and small independent hotels with less than 50 rooms.

Incumbents like Oracle Opera and Protel used to be on-premise, but are transitioning their customer base to the cloud. Newer players mostly target independent and small hotels but could move upmarket over time. Mews also competes with in-house solutions. Many top hotel chains are known for having developed their own PMS.

Source: Skift

Business Model

Mews has two main revenue streams.

It charges a SaaS fee based on the number of rooms the hotel has. For instance, a hotel with 50 rooms on the Pro Plan will pay $8.8K annually.

It also has a payment fee on transactions processed by Mews. A former Mews employee stated in an interview that “Mews makes 25% of its revenue through its monthly SaaS fee and 75% of its revenue through transaction volumes.”

Source: Mews

Traction

Mews signed its first property in 2013. In 2015, it had 30 properties across nine countries. In 2016, it had 276 properties in 30 countries. In December 2022, its revenue was reported to be 174% higher year-over-year, and gross payment volume increased 227% year-over-year to $2.3 billion. Over 3K properties in 70 countries used Mews as of December 2022. Mews’s customers include Accor, Nordic Choice Hotels, The Social Hub, Life House, and Les Airelles.

Most of its properties are in Belgium, Luxembourg, and the Netherlands. Going forward, the company is focusing on acquiring properties in Europe, APAC, and North America. Mews generates more than $25 million in annual revenues.

Valuation

In December 2022, Mews announced a $185 million Series C led by Kinnevik and Goldman Sachs at an $865 million post-money valuation. Mews has raised a total of $232.2 million in funding as of June 2023, with other notable investors including firms like Battery Ventures and Notion Capital.

Key Opportunities

Expanding Beyond Europe

Mews started in Europe and has the largest part of its customer base there, with 6 million rooms. Going forward, it can accelerate its international expansion (with an addressable market of 1 million hotels and 26.7 million rooms across the world), especially in the US (5.3 million rooms) and in APAC (3.7 million rooms).

Signing Top Hotel Brands

Mews started with mid-market independent hotels with over 50 rooms and small chains with less than 10 properties. In the hotel market, the top 15 companies (Marriott, Hilton, IHG, Wyndham, Choice, Accor, or Best Western) control an important part of the market. For Mews, signing these accounts and rolling out its solution across its portfolio can be a game changer. Mews has already signed a deal with Accor to be referenced as an authorized PMS for their hotels. Nonetheless, it can go beyond Accor and try to sign deals with other top global hotel brands.

M&A

Mews acquired several small and local PMS (Hotello in Canada in April 2023 and Hotel Perfect in the UK in August 2021) to transfer their customer base to Mews. Many small PMS are local, old, and obsolete that Mews can purchase in order to fuel its growth. Going forward this continue to be a growth lever to substitute sales acquisition costs with M&A costs, and Mews could extract additional value from each property from payments.

Monetizing Mews Marketplace

Mews has built a rich marketplace with over 750 integrations. At some point, it could open an additional monetization opportunity in which Mews will be able to take a cut on revenues generated by solutions that are growing on top of the Mews marketplace.

Key Risks

Switching Costs

The PMS is a hotel’s core system used by everyone at the hotel on a daily basis, and it’s the system of records for both rooms and customers. Transitioning to a new PMS is risky and can kill a hotel if improperly executed. As a result, many hotels have been reluctant to shift PMS even if they’re dissatisfied with the solution they use.

Competition from Low-End Disrupters

Today, Cloudbeds and Amenitiz mostly focus on small independent hotels with less than 50 rooms, but as they saturate their initial ICP and mature their product, they may move upmarket. This could put them in competition with Mews for both larger hotels chains or small chains with between 2-10 hotels. This could hurt Mews because these companies have an all-in-one approach combining the PMS with the other tools a hotel needs to operate its business (e.g. a channel manager or a revenue management system) whereas Mews is selling the PMS as a standalone product, and hotels need to purchase other tools independently. As a result, a hotel may have a more expensive and less integrated tech stack using Mews compared to low-end disrupters.

Summary

Mews is a modern PMS that is cloud-based, open to third-party applications, and guest-centric. It counterpositions incumbents in the PMS industry like Oracle Opera or Protel, which are mostly on-premise, closed ecosystems and room-centric. The PMS is the largest piece of software in the hotel tech stack. The PMS market is fragmented and many solutions are starting to be obsolete. This creates a unique opportunity for Mews to become the next Oracle Opera for the mid-market and enterprise segments of the market. Mews is working with 3.2K hotels across the world. Going forward, Mews is expanding commercially beyond Europe, going upmarket, and rolling-up small PMS to transition their customer base on its own PMS.