Thesis

The construction industry accounts for approximately 7% of the global workforce and $10 trillion in annual expenditure. Despite this substantial footprint, it remains one of the world’s least digitalized industries and has lagged in terms of growth and innovation. Productivity growth in the construction industry averages 1% YoY compared to 2.8% for the global economy as a whole. Were the construction sector to catch up, it would be able to generate an additional $1.6 trillion of economic value globally.

One contributor to construction under-productivity is poor utilization of equipment. By some estimates, an average-sized fleet of machines experiences idle time ranging from 28% to 30%. This idle time has substantial cost implications for construction contractors given the high expenses associated with equipment. For example, a midsized piece of equipment like a bulldozer or excavator can result in yearly unrecovered costs of $10.8K due to downtime. The problem is exacerbated in construction thanks to its laggard performance in digitalization — with many operators and contractors still using manual processes to track performance and manage their equipment.

EquipmentShare aims to digitalize and increase productivity across the construction industry with a unified hardware and software solution coupled with a rental and purchasing platform for construction equipment. With the inclusion of EquipmentShare's telematics solutions on every piece of equipment rented or sold, it gives its customers full visibility into their fleet. By providing contractors with this visibility into equipment usage, EquipmentShare intends to provide them the ability to improve efficiency, save time, and reduce costs.

Founding Story

Source: EquipmentShare

EquipmentShare was founded in Columbia, Missouri in 2015 by brothers and co-CEOs William Schlacks and Jabbok Schlacks, along with Brad Siegler, Jeffrey Lowe, and Matthew McDonald. The Schlacks brothers, the only founders who still have active roles with the company, began their entrepreneurial journey early. Having grown up on a socialist commune in rural Missouri, they started their first business — which built and rented sheds — as teenagers.

Over the years, the brothers started various businesses, both individually and as a pair. William has started more than nine companies, including an ecommerce equipment wholesaler and a Japanese-inspired karaoke bar. Together, the brothers started a commercial and industrial contracting business named Schlacks Construction. While working in construction, the founders observed the challenges contractors faced in obtaining equipment, with many unused machines sitting idle while other contractors incurred significant expenses to lease or purchase equipment from rental companies.

The concept of EquipmentShare was born in 2014 during a Startup Weekend event in Columbia. In its original conception, EquipmentShare was a peer-to-peer marketplace allowing contractors to rent equipment like boom lifts and excavators from one another. The brothers participated in a Startup Weekend competition and emerged as winners.

As the company grew, it developed beyond its origins as a simple web and mobile marketplace for construction equipment. It expanded into a full asset handling and distribution network which gives its customers access to a range of construction machines and equipment. Concurrently, it developed a telematics operating system named T3 to capture utilization data from each machine, assisting contractors in making more informed operational decisions. It also expanded its leadership team, bringing in new executives including Paul Rogers (CTO) and Trevor Schauenberg (CFO).

Product

EquipmentShare’s product digitalizes a number of common construction workflows, with a view toward bringing largely manual, pen-and-paper processes into a single solution. It offers a cloud-based software platform named T3 OS, a marketplace for leasing and purchasing construction equipment, and a telematics solution for extracting data from equipment.

T3 OS

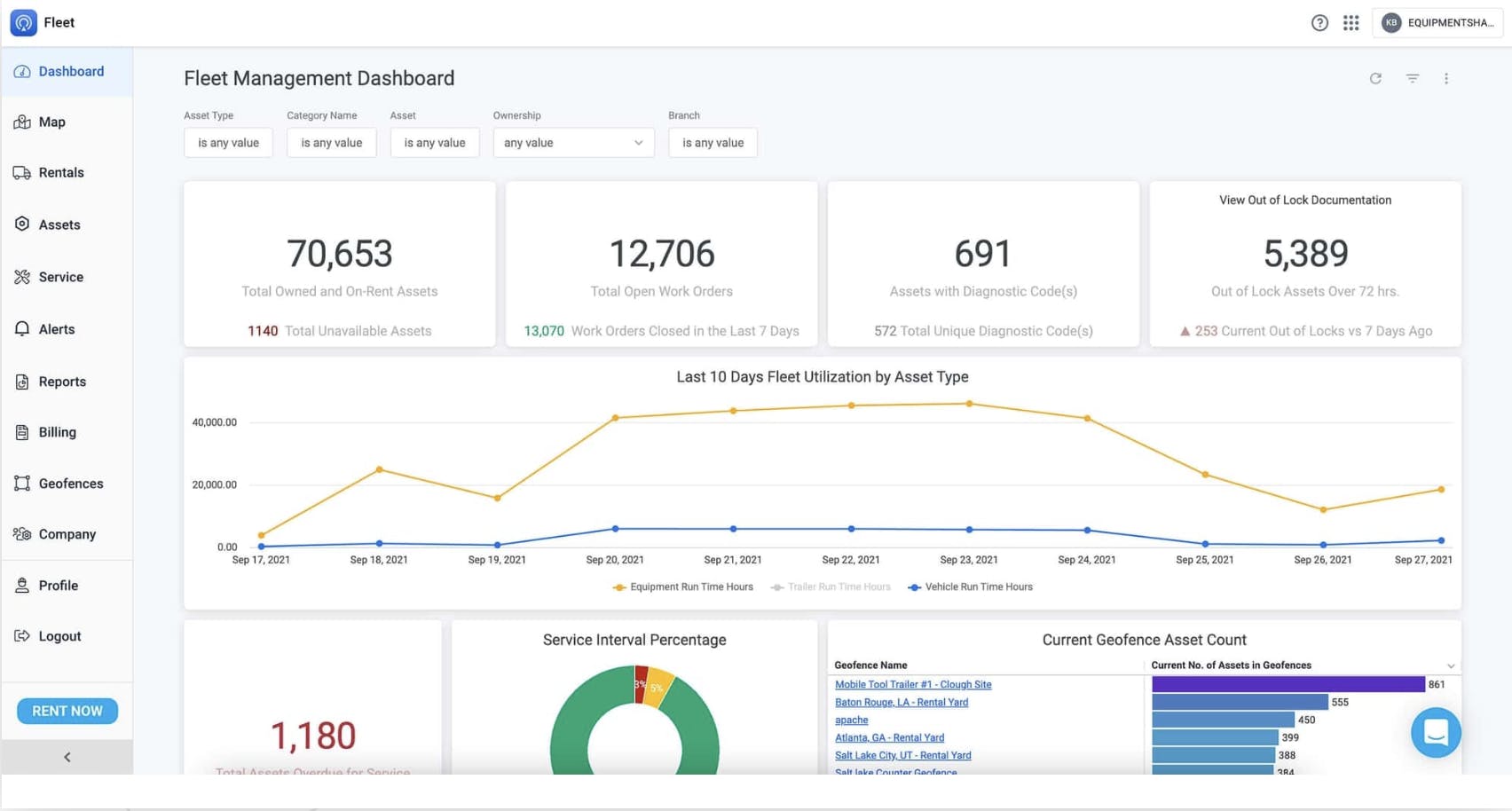

The cloud-based T3 operating system is at the heart of EquipmentShare’s product. The T3 OS serves as a foundation connecting all the data collected from telematics, hardware, and mobile applications, bringing a variety of construction workflows into a single platform. Using the platform, customers gain visibility over day-to-day construction workflows. It has the capability to integrate with existing software solutions in order to digitalize manual processes.

Through a suite of applications, contractors can effectively monitor the three core components of construction productivity:

Assets: T3 allows for the tracking of equipment, vehicles, and tools, providing real-time location information. It also facilitates the monitoring of fleet health through diagnostics and preventive care measures. Contractors can access important data regarding asset utilization, enabling them to optimize their fleet operations.

Materials: T3 provides functionality for invoice generation and monitoring spending on materials. This feature ensures contractors have a clear understanding of their material costs, improving financial management and streamlining the invoicing process.

People: With T3, contractors can manage personnel-related aspects. The system allows for staff scheduling, monitoring labor utilization, ensuring regulatory compliance, and meeting safety requirements. T3 also integrates with other systems to streamline workflows.

Hardware

Source: EquipmentShare

EquipmentShare offers a range of telematics hardware technologies that can integrate with a range of construction equipment from different manufacturers and providers. These solutions feed data into T3 OS, giving customers an up-to-date picture of their construction hardware.

These technologies include machine tracers, Bluetooth tags, jobsite and vehicle cameras, and cloud-connected keypads. Machine tracers and trackers are designed to collect data from various sources such as vehicles, machines, trailers, and fuel tanks, providing insights into equipment performance and utilization. Cloud-connected keypads replace traditional universal keys, allowing customers to control equipment access and monitor usage, as well as preventing unauthorized use or theft.

EquipmentShare offers jobsite and vehicle cameras to enhance safety both on the project site and during transportation. These cameras provide real-time visual monitoring, detect dangerous driving, and improve overall site security. Additionally, Bluetooth tags can be placed on valuable jobsite components, enabling enhanced tracking and monitoring capabilities. This allows for better visibility and management of critical assets.

Apps

Source: EquipmentShare

EquipmentShare uses the data collected from its hardware products to provide insights and visibility for customers through a suite of web and mobile applications.

Fleet enables the organization and tracking of various tools, trailers, machines, and vehicles, regardless of make or model. It provides real-time visibility into each machine, including health and usage information. This health data aids in conducting preventive maintenance, thereby increasing equipment utilization. Fleet has the capability to digitize data from both rented and owned assets, and it can be accessed through desktop or mobile devices.

Time Cards is a fully integrated time-card solution that tracks and records the hours worked by contractors on each project. It syncs directly into ERP software, simplifying the payroll process. Employees can easily check in and out and assign hours to specific projects using the mobile app.

E-Logs serves as a hub for ELD (Electronic Logging Device) compliance and driver tracking. It replaces paper logbooks with an app that automatically records drivers’ hours and creates timecards, daily logs, and more. Drivers can use the mobile app to clock in and out of trips, monitor their time behind the wheel, and ensure compliance with hours-of-service limits.

The Analytics application aggregates data from other applications to generate various reports, including billing reports, fleet care reports, geofence reports, fleet usage reports, rental reports, service reports, and purchase order reports.

Work Orders is an application that automates workflows related to fleet service requirements. Users can open work orders through the app when issues are identified. At the shop, a manager reviews the order and assigns a technician to the task. Technicians receive notifications on their phones, containing all necessary information about the required maintenance. The app allows technicians to locate the machine, follow an inspection checklist, and complete the servicing.

In addition to these applications, EquipmentShare plans to launch CRM, cost capture, and inventory tracking functionality in the future.

Rent

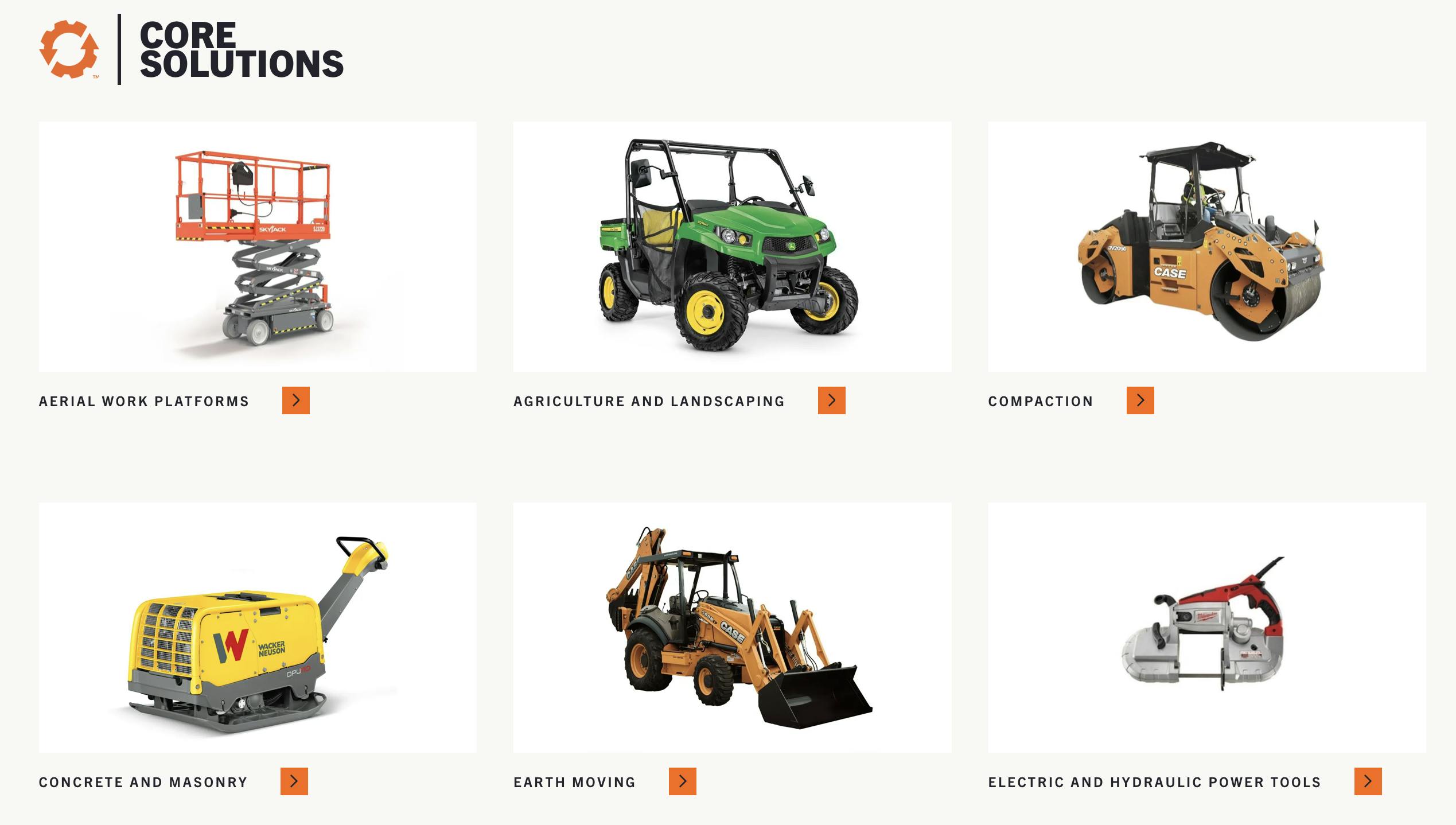

Source: EquipmentShare

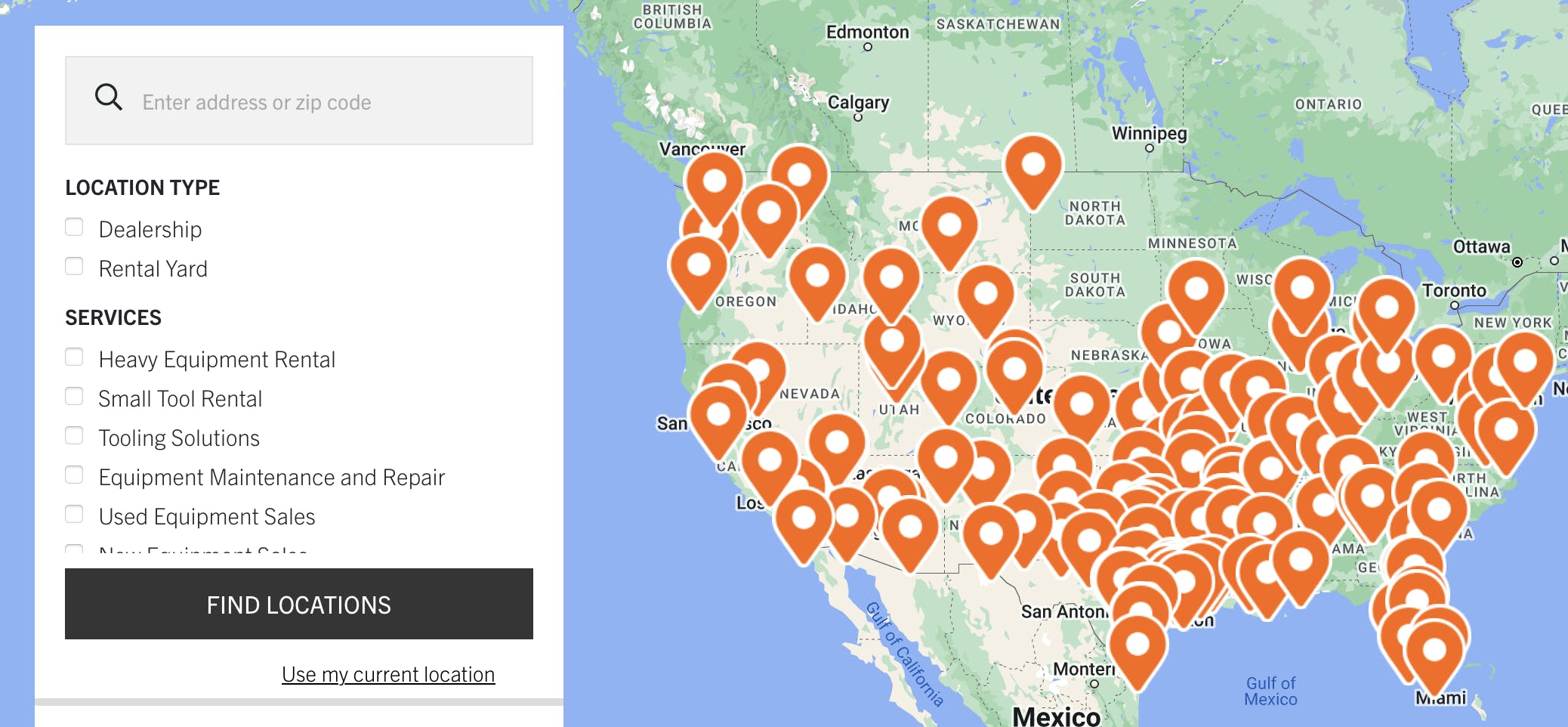

EquipmentShare’s Rent solution enables contractors to access and rent construction equipment through a network of local rental yards using an app or web interface. Using the EquipmentShare Rent app, available via the web or on iOS and Android, customers can handle every aspect of the rental process, from scheduling bookings to reviewing contracts and submitting service requests. Every machine in EquipmentShare's fleet is equipped with T3 technology, providing renters with access to the full range of benefits and insights generated by telematics hardware and software. EquipmentShare offers a wide range of rentals from many brands, including Genie, Takeuchi, and Doosan. Equipment offered includes aerial work platforms, storage tanks, bulldozers, forklifts, as well as advanced solutions like power and climate control.

Buy

Source: EquipmentShare

EquipmentShare’s Buy solution provides customers the opportunity to purchase both used and new equipment and parts. The company has established a network of dealerships where a wide range of equipment is available for purchase, all set up with telematics hardware and ready for integration into T3 OS. Equipment purchased from EquipmentShare is eligible for lifetime service from the company, which includes tasks such as oil filter changes, tuneups, damage repairs, and more. Leveraging predictive analytics, EquipmentShare assists contractors in optimizing equipment maintenance and identifying potential issues, with the goal of generating cost savings.

Market

Customer

EquipmentShare's target customers range from individuals and small-scale contractors to medium and large contractors. Individual and small contractors benefit mostly from EquipmentShare's rental and purchase offering, through which they can access the equipment they need for their projects via EquipmentShare’s network of suppliers and sellers.

However, the T3 and telematics insights provided by EquipmentShare are particularly suited for larger-scale operations. The T3 OS and its suite of apps are designed for managing extensive fleets which are challenging to track with manual processes or multiple software solutions. By leveraging T3 and telematics insights, contractors operating at a larger scale can enhance their fleet management capabilities and monitor their workforce.

The company says its full solution becomes viable for customers with $5 million of annual revenue and can scale to the largest enterprise-level contractors. As EquipmentShare William Schlacks put it:

“The best fit contractors that can get the most out of T3 include mid-sized to enterprise-size contractors who need to manage assets and are at that point where they can’t just run around in their truck and look after everything….As soon as it gets to that point, T3 becomes a good tool. Some of our customers have one to two pieces of equipment and trucks and then also use our timecards for their employees and other management tools.”

Market Size

As of 2021, the construction equipment rental market was valued at approximately $42 billion, while the internet of things (IoT) market within construction specifically reached a valuation of roughly $12 billion in 2022. In 2022 the total value of the US construction market amounted to $2.1 trillion. Furthermore, the construction industry employed nearly 10 million individuals in the United States in 2023.

Despite its substantial size, the equipment rental market is highly fragmented. The top 10 rental companies make up 35% of the total market share, meaning the vast majority of sales are generated by small and medium-sized rental companies with a much smaller share of the total market.

Competition

EquipmentShare offers two distinct service lines: equipment rental and purchase, and fleet management and telematics. It has a range of competitors across these two categories.

Equipment Rental and Purchase

United Rentals: One of the largest equipment rental companies in the US, United Rentals was founded in 1997. It operates in 49 states and has a network of ~1.5K rental locations in North America, along with 60 other locations worldwide. With approximately 25K employees, United Rentals offers around 4.6K different equipment classes for rent or purchase. Similar to EquipmentShare, United Rentals equips its rental equipment with telematics solutions, with over 335K units in its fleet being onboarded with tracking technology. The company provides rental, purchase, invoicing, and other digital services. United Rentals (URI) is a publicly traded company, with a market cap of $27.6 billion as of June 2023. United Rentals generated $11.5 billion in revenue in 2022.

Herc Rentals: Herc Rentals, founded in 1965, is a large equipment rental company with approximately 5.6K employees and 312 company-operated locations, primarily in the US and Canada. It serves various customers in sectors such as construction, industrial manufacturing, refining, transportation, and agricultural production. Herc Rentals offers a diverse range of equipment for rent. In addition to rentals, the company provides a fleet management system and a telematics platform. Herc Rentals is publicly traded as Herc Holdings (HRI), with a market cap of $3.6 billion as of June 2023. In 2022, the company reported revenues of $2.7 billion.

Sunbelt Rentals: Sunbelt Rentals is one of the largest equipment rental companies in the world. Founded in 1983, it has over 18K team members and 1.1K locations. It offers a wide variety of equipment, including over 14K product types. The company has over 800K customers across a range of industries, from marine and mining equipment to utility and healthcare. Sunbelt Rentals' parent company, Ashtead Group, is a publicly-traded company. In the fiscal year 2023, Sunbelt Rentals generated $9.7 billion in total revenue, up 24% from the previous year. As of June 2023, Ashtead Group's market cap was $23.9 billion.

IronPlanet: IronPlanet is an online marketplace for buying and selling used equipment and heavy assets. It was founded in 1999 and was later acquired by Ritchie Bros. in 2017 for $758.5 million. Before the acquisition, IronPlanet had raised a total of $148 million. With over 1.8 million registered users worldwide, IronPlanet competes with EquipmentShare in equipment purchasing. While IronPlanet has a larger catalog and offers a wide range of equipment, it lacks the digitalization and telematics solutions in EquipmentShare's platform.

Telematics and Fleet Management Solutions

Fleetio: Founded in 2012, Fleetio has raised $170 million in funding. Fleetio offers fleet management solutions for a wide range of industries, including construction, delivery, landscaping, trucking, and freighting. In the construction sector, Fleetio assists contractors with the evaluation of equipment and vehicle inspections, automates maintenance workflows, and offers insights into asset utilization. With a global presence, Fleetio serves approximately 529K vehicles and operators in over 80 countries. Notable customers of Fleetio include Snap Towing, Subaru, Stanley Steemer, and AAA.

Samsara: Samsara, founded in 2015, provides software and systems to help companies track and monitor physical assets. Samsara serves tens of thousands of customers and employs over 2.2K employees globally. Additionally, Samsara collaborates with more than 220 integration partners. Samsara’s platform encompasses vehicle telematics, equipment monitoring, site visibility, and apps and driver workflows. The telematics solution offered by Samsara shares similarities with EquipmentShare, such as geofencing and tracking, vehicle diagnostics, automated workflows, and centralized dashboards. Samsara caters to a diverse range of industries, including transportation and logistics, food and beverage, field services, construction, higher education, and more. Samsara is a publicly traded company with a market cap of $15 billion as of June 2023. In 2022 Samsara recorded $558 million in ARR, a 64% increase from the previous year.

Motive: Motive, founded in 2013, provides fleet management technology that serves businesses of all sizes. Their customer base exceeds 120K customers across various industries, such as oil and gas, construction, food and beverage, trucking and logistics, delivery, field service, agriculture, and more. Motive offers a range of products to assist fleets in managing multiple aspects of their operations, including compliance and driver safety, spend management, and telematics. While Motive provides telematics solutions for construction companies, it began with a focus on the trucking industry and is less tailored to the specific needs of construction compared with EquipmentShare. As of June 2023, Motive has raised $567 million in funding.

Business Model

EquipmentShare does not publicly disclose information about its business model or pricing, but reports indicate there are two main revenue streams for the company. The first stream is generated through rentals and sales of its equipment fleet, though specific pricing details are not readily available. Additionally, EquipmentShare generates revenue through its T3 offering, for which customers typically pay a one-time hardware fee and a subscription fee based on factors such as the type of device being tracked, data setup, and the number of total devices connected.

Traction

In December 2022, EquipmentShare reportedly had around $2 billion in annual revenue. The leadership team has indicated that the company was profitable from an early stage. EquipmentShare has over 4.1K employees and over 165 locations across the US as of August 2023. EquipmentShare is focused on growing its distribution network across the US by buying fleets and other rental companies. In January 2023, it acquired the equipment fleet and operations of six Trekker Tractor locations in Florida.

Valuation

EquipmentShare has raised a total of $2.4 billion through a combination of debt and equity. In May 2023, EquipmentShare completed its most recent round of debt financing, raising $640 million, with Capital One as the lender. Concurrently, EquipmentShare increased its borrowing capacity from $2.1 billion to $3 billion with Capital One. This builds upon two prior debt issuances in 2021 and 2022, both of which were also with Capital One. In April 2023, EquipmentShare conducted a separate capital raise, raising $290 million in equity.

Of the total financing obtained, 75% has come from debt sources, while the remaining 25% has been raised through equity investments. Noteworthy equity investors include Romulus Capital, Y Combinator, RedBird Capital Partners, Insight Partners, Great Oaks Venture Capital, and BDT Capital Partners. While the precise valuation of EquipmentShare is not explicitly disclosed, during its equity round in April 2023, company management indicated that the valuation was 40% higher than the previous round.

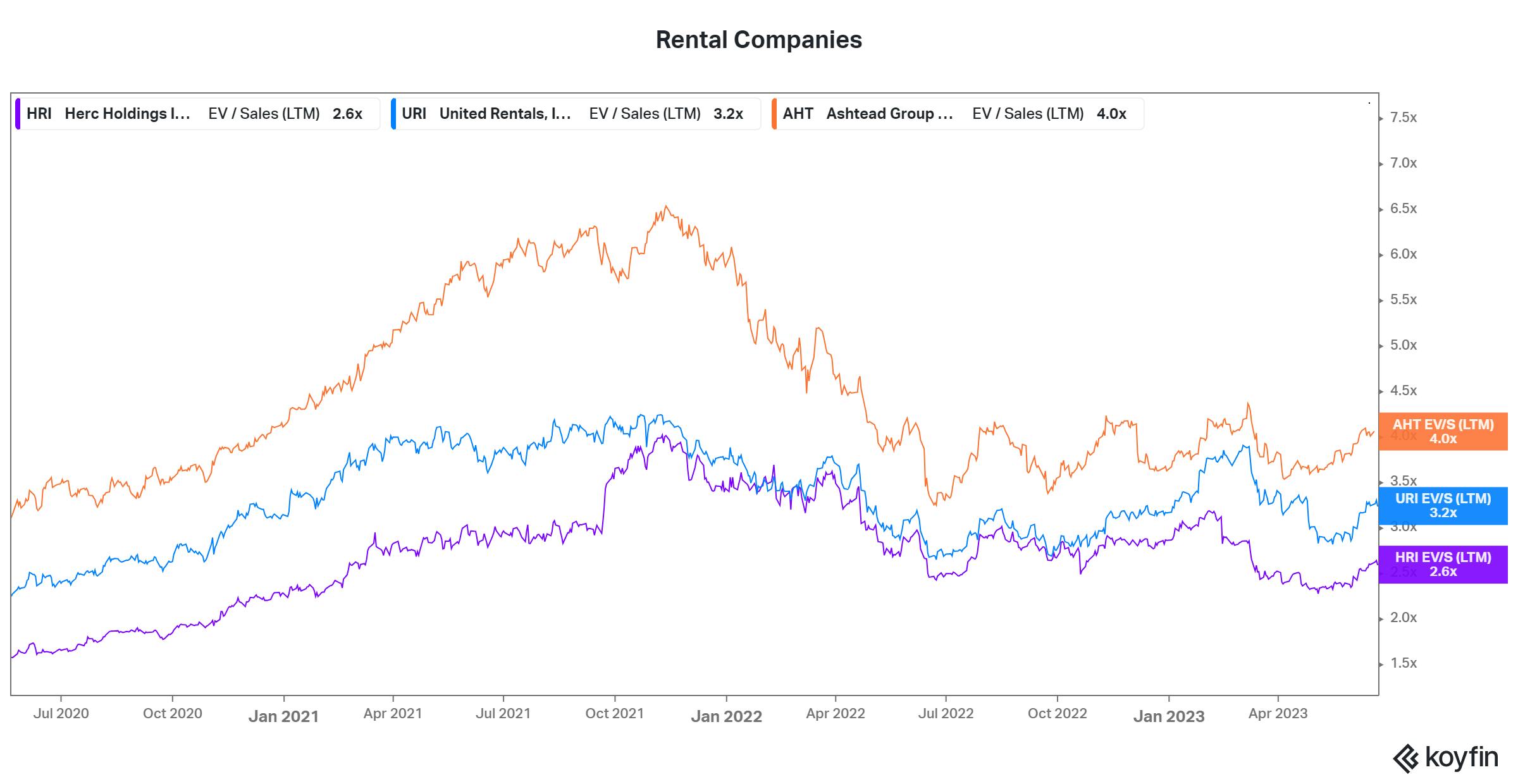

In terms of public company comparisons as a rental company, EquipmentShare can be compared to Herc Rentals, United Rentals, and The Ashtead Group. As of June 2023, these companies were trading at revenue multiples of 2.6x, 3.3x, and 4x, respectively. Using a ballpark revenue estimate of $2 billion for EquipmentShare, this would place its valuation between approximately $5.2 billion and $8 billion assuming a similar revenue multiple. Additionally, EquipmentShare could also be compared to technology-oriented telematics and fleet management companies like Samsara, which was trading at a revenue multiple of 19.9x as of June 2023. With this framework, EquipmentShare's valuation could potentially reach around $40 billion.

Source: Koyfin

Key Opportunities

Unifying A Fragmented Rental Market

EquipmentShare has the opportunity to seize a larger share of the fragmented rental market. With the growing demand for technology by contractors, there is a favorable environment for EquipmentShare to capitalize on and expand its market presence, potentially surpassing smaller competitors. Even if larger companies like United Rentals retain their market share, there is still a significant portion of the market, estimated to be upwards of 75%, that EquipmentShare could work to capture. This segment primarily consists of small and medium-sized rental yards and companies which lack the technological capabilities in telematics and digitalization that EquipmentShare offers.

Growing Global Construction Industry

EquipmentShare has the potential to benefit from an expansion in the construction market, which is anticipated to grow by $4.5 trillion globally from 2020 to 2030. As the industry grows, more projects will emerge demanding more labor, materials, and equipment. EquipmentShare benefits from this growth and has the ability to grow as a company as the market grows as well. Furthermore, EquipmentShare has the potential to extend its reach beyond its current market and explore opportunities in the European and Asian markets. These regions are expected to contribute more than half of the projected market growth. As developing countries undergo modernization and infrastructure development, the need for construction and related services will escalate. By expanding into these markets, EquipmentShare can tap into the increasing demand and establish a strong presence.

Expanding Offering

EquipmentShare aims to support contractors in managing their people, materials, and assets effectively. While its primary focus has been on optimizing equipment utilization, the company envisions a broader role in facilitating digitalization across all three pillars. Currently, EquipmentShare provides tools like Time Tracking and E-Logs for employee and labor management, but it has the potential to expand its offerings further. Moreover, there is an opportunity for EquipmentShare to enhance the digitalization of material management, especially in industries like steel that have yet to adopt digital solutions. By leveraging its expertise and technology, EquipmentShare can bridge the gap in digital solutions and streamline manual processes in various industries.

Key Risks

Competitors

As larger equipment rental companies such as Herc Rentals, United Rentals, and Sunbelt Rentals begin to embrace technology and digitalize their fleets, they pose a potential threat to EquipmentShare. The extensive distribution networks of larger equipment rental combined with the integration of telematics into their fleets pose a potential threat to EquipmentShare's competitive edge. While EquipmentShare currently stands out for its technology offerings, the adoption of telematics and software solutions by rental market competitors could potentially erode its unique selling proposition. This makes it crucial for EquipmentShare to continue innovating and differentiating itself to maintain its competitive position in the market against larger-scale, publicly-traded competitors.

Cybersecurity and Data

EquipmentShare stores and aggregates a significant volume of sensitive data, including financial information, equipment keys, and other project and job-related details. It is crucial for EquipmentShare to prioritize the security and compliance of this data in accordance with relevant regulations. A potential attack that immobilizes a large fleet would not only cause significant harm to clients but also severely damage the reputation of EquipmentShare. As a business that relies on building relationships with clients, maintaining trust is paramount. It is essential for EquipmentShare to prioritize transparency, reliability, and data security to foster trust with clients.

Summary

EquipmentShare is an integrated software and hardware solution for the construction industry, providing equipment rental and purchase as well as a telematics platform for fleet tracking and utilization. Contractors have the option to rent or purchase both used and new equipment from EquipmentShare, which is equipped with the requisite hardware to integrate with the company’s T3 platform. With these tools, contractors can effectively track their assets, monitor equipment health, and optimize asset utilization. EquipmentShare generates revenue from equipment rental and sales, as well as through subscription fees for its software and telematics services. With the construction industry facing challenges in digitalizing and achieving productivity gains commensurate with the rest of the global economy, EquipmentShare aims to capitalize on this market opportunity and drive change.