Thesis

The construction sector has consistently grappled with labor shortages, resulting in inefficiencies that prolong project timelines and increase costs. As of January 2024, there was an estimated shortfall of 501K workers in the construction industry. Building a home took an average of approximately 7.6 months in 2022, which excludes the time needed for pre-construction steps such as acquiring land, finalizing a design, and obtaining permits. In 2022, labor inefficiencies within the construction industry amounted to estimated losses ranging from $30 billion to $40 billion.

These inefficiencies have prompted a surge in the development and adoption of technologies that aim to enhance productivity within the sector. In 2023, there was $3 billion invested in construction tech. This was expected to grow at a CAGR of 9.4% to $7.5 billion by 2032. The ongoing scarcity of workers in the construction industry has caused construction companies to look for technological solutions to increase efficiency.

Kojo is a construction materials procurement platform that supports the process of researching, selecting, ordering, and paying for the raw materials required for a construction project. As of November 2023, Kojo had powered over 25K projects and had saved customers more than $30 million on materials orders. Kojo aims to help contractors “find the materials they need, at the fastest speed and at the best price exactly when they need them.”

Founding Story

Kojo was founded by Maria Davidson (CEO) alongside the founding team of Ryan Gibson (former CTO), Micah Rodman (COO), Adam Williams (Founding Engineer), and Michael Oliver (Founding Engineer), in 2018.

Davidson was born in Russia and was raised in Israel. She moved to London at the age of 13 and graduated from Oxford University where she studied philosophy, politics, and economics before joining Goldman Sachs where she worked as an investment banking analyst from 2014 to 2016. Towards the end of this period, 8VC founder Joe Lonsdale recruited her to move to the US and serve as his chief of staff for the new firm. Davidson moved to San Francisco in 2016 to join 8VC.

The seeds for Kojo were planted by Davidson’s observations of the construction industry in San Francisco. After having moved from London to San Francisco in 2016, Davidson was struck by the fact that a city renowned for innovation was plagued by a lack of affordable housing and very slow-moving construction projects. As Davidson put it:

“We were living in San Francisco and would constantly look around asking, ‘Why weren't we able to build more housing faster? Why it took months and, in some cases, years to fix a pothole? How is it possible then in a place that has such an amazing density of really smart people, and really ambitious people building technology products for every possible industry out there, why we were still so bad at building for the physical world?”

Davidson observed that construction projects experienced constant delays and frequently went over budget, making it difficult for cities to build the infrastructure they needed. Davidson and Gibson decided to found a company to address this problem. Davidson left her position at 8VC, Gibson departed from Microsoft, and Rodman left his position at Bridgewater to join them They then spent six months delving into the causes of construction inefficiencies.

Through interviews and talking to people in the industry, they discovered that labor expenses constituted 60% of building project costs, while materials accounted for the remaining 40%. They also found that better pricing transparency could lead to an average of 3%-5% in savings on materials. As a result, they began developing a materials management platform that aimed to connect teams and vendors and provide real-time visibility into materials spending and usage. In March 2020, the platform was launched initially with the name Agora. Within a year and a half of its launch, the company acquired its first 100 customers. In 2022, Agora rebranded as Kojo, expanding its focus from the electrical trade to include many major trades within construction.

Product

The Kojo platform is intended to help contractors to manage materials procurement and inventory. The company describes itself as a “one-stop shop for purchasing and inventory” that provides an “all-in-one system for contractors to handle all of their material and inventory needs.”

The Kojo platform is accessible through both its website and its mobile app which is available on Google Play and the Apple App Store. In September 2023, Kojo launched its AI-powered “Kojo Intelligence Layer” which Davidson described as follows:

"By adding this AI-powered layer to our platform, we've simplified materials sourcing for contractors by helping them answer questions like who has what they need in stock now, how much they've paid for an item in the past, and how much of an item did they buy last year, driving smarter decisions. The Kojo Intelligence Layer… [allows] contractors to make informed decisions about sourcing the right materials at the right time for the right price."

Purchasing

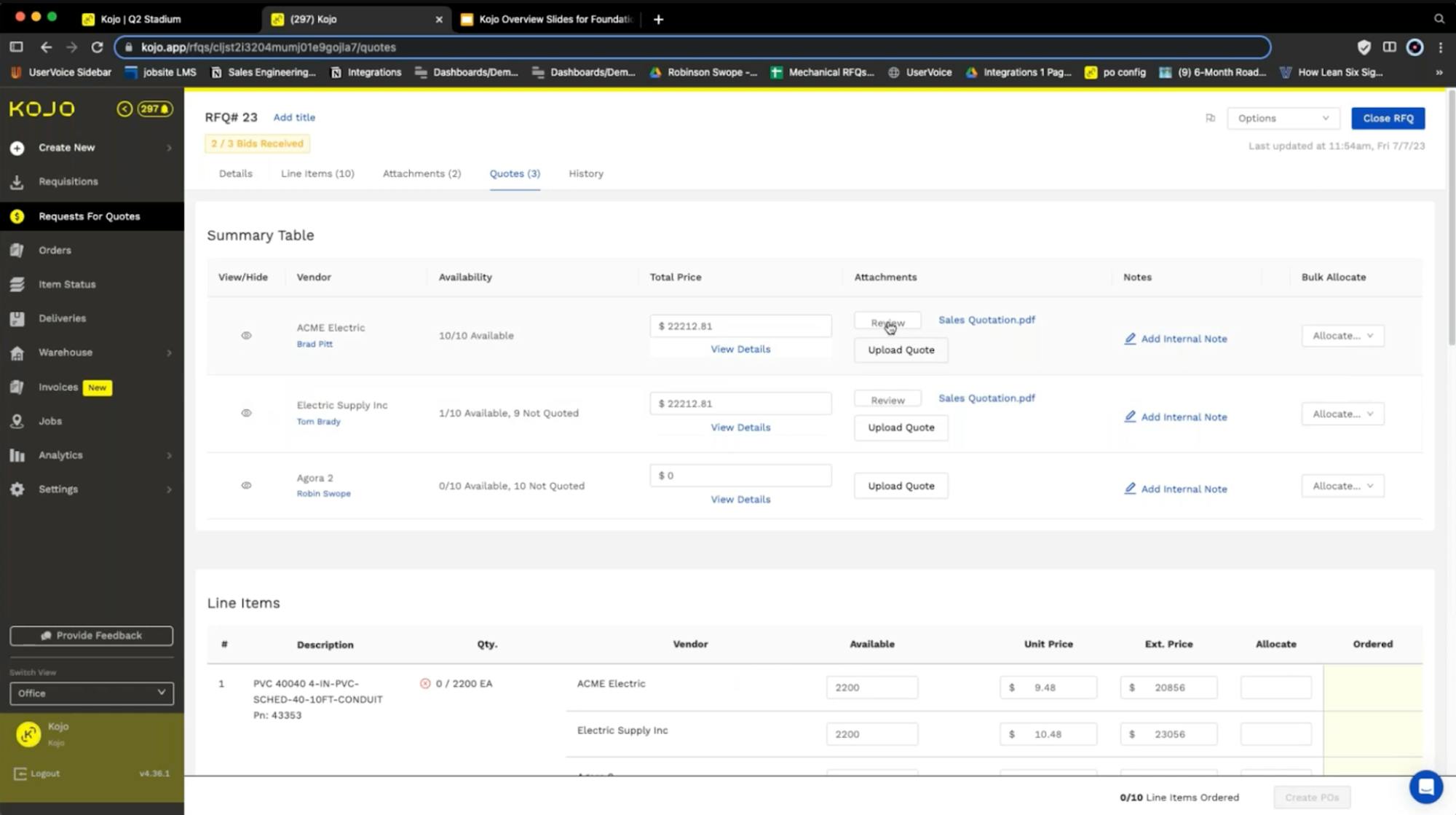

Source: Kojo

Kojo’s purchasing product automates the process of obtaining price quotes for materials, allowing users to send requests to multiple vendors simultaneously and see inventory and pricing for materials in real time via direct vendor integrations

Field

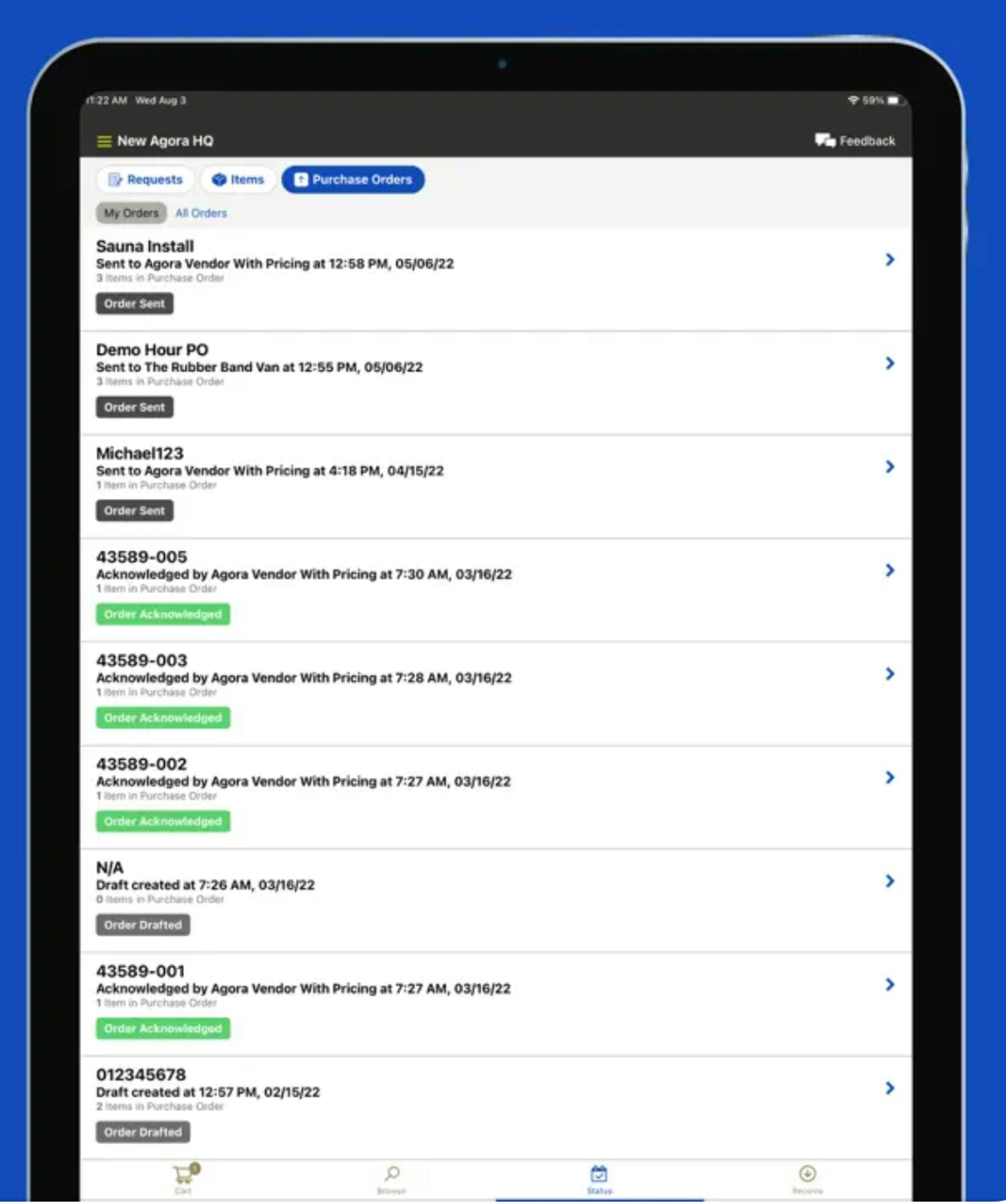

Source: Kojo

Kojo’s Field offering is a shopping feature within the platform that offers users an ‘Amazon-like’ shopping experience to purchase materials. Users can browse or search through a catalog of materials, select the items they need, create a shopping cart, and send material requests for purchase upon checkout. Once the material requests are submitted, users can track the status of the ordered materials.

When the materials arrive, users can easily locate the purchase order (PO) number linked with their order. They can then upload proof of delivery within the Kojo platform to confirm receipt of the materials or make notes regarding any problems encountered with the received materials.

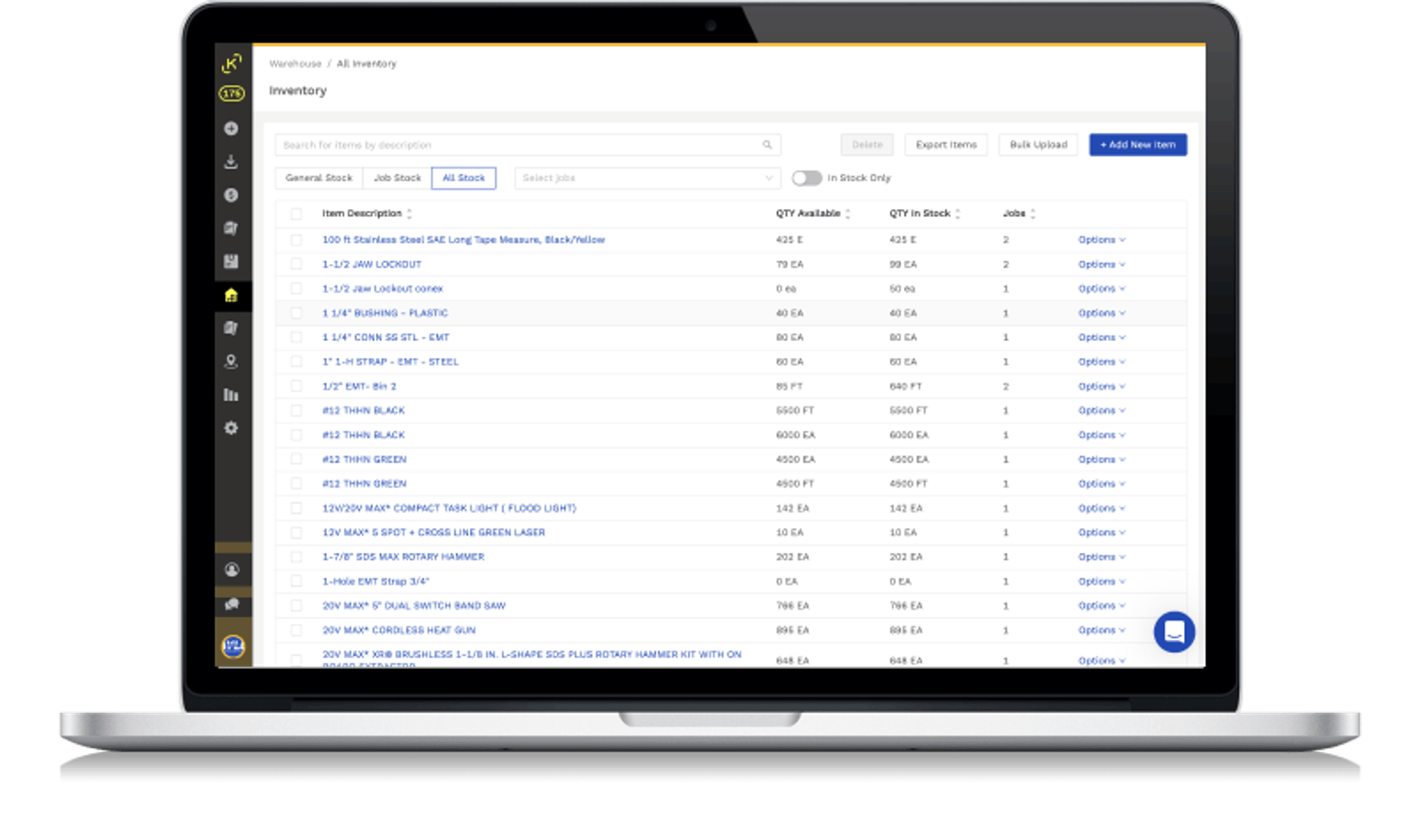

Warehouse

Source: Kojo

Kojo’s warehouse offering allows field personnel to access and request inventory through their mobile devices. This enables the inventory management team to receive field requests directly, eliminating the need for manual paperwork. Additionally, the platform provides all users, on-field or off-field, with visibility into warehouse inventory stock levels, reducing the need for lengthy communication and facilitating proactive restocking by purchasing teams.

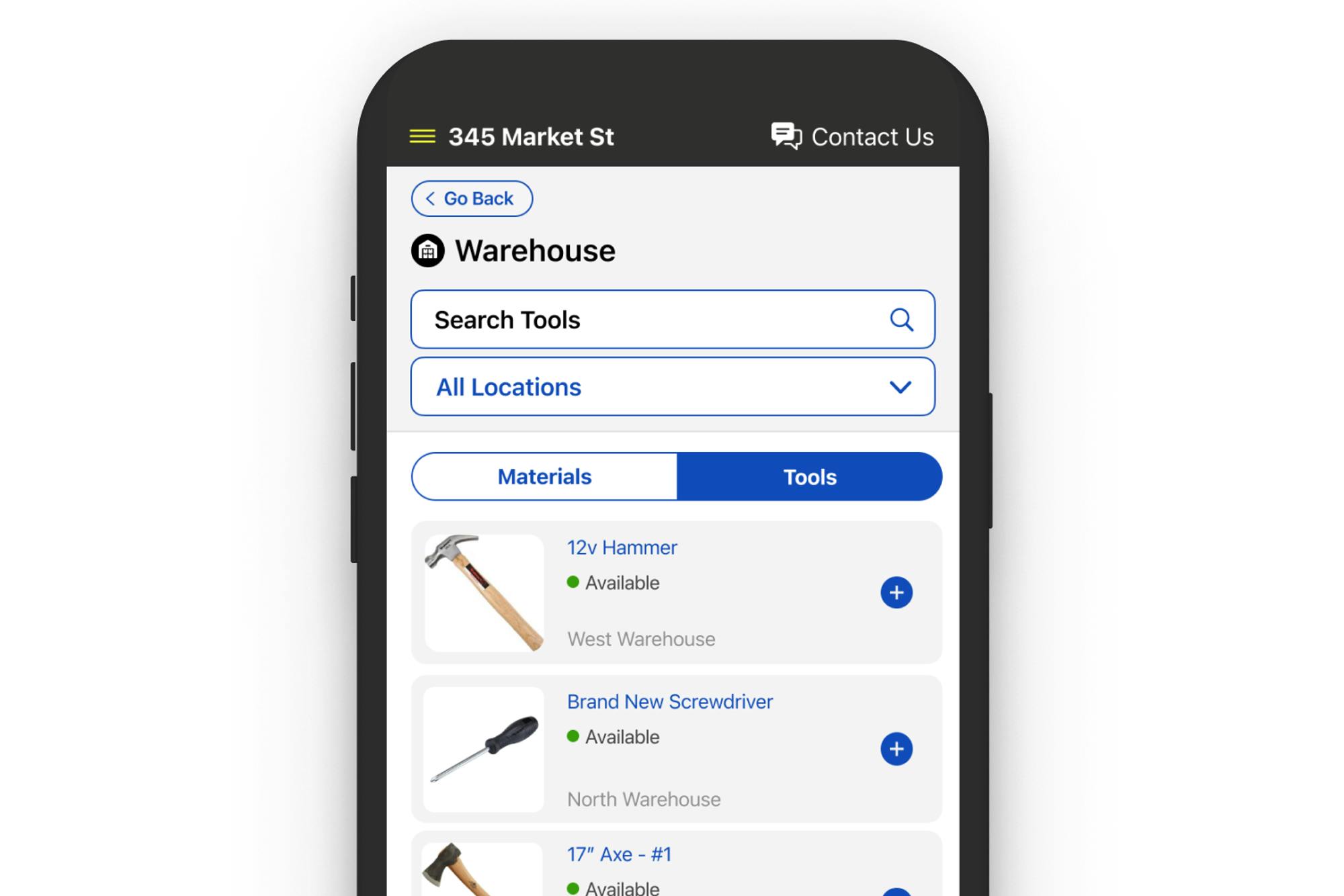

Tool Tracking

Source: Kojo

Kojo’s tool tracking solution offers users a centralized dashboard to manage their tool inventory, providing visibility into the current assignee, location, and condition of each tool. Through a “tools details” page, users can view and update pictures, statuses, and conditions, ensuring an accurate and up-to-date inventory. Users can easily mark tools as "service," "damaged," "lost," or "stolen". Additionally, field teams can use tool tracking to check in and check out tools, enabling users to track the tools present on their job site.

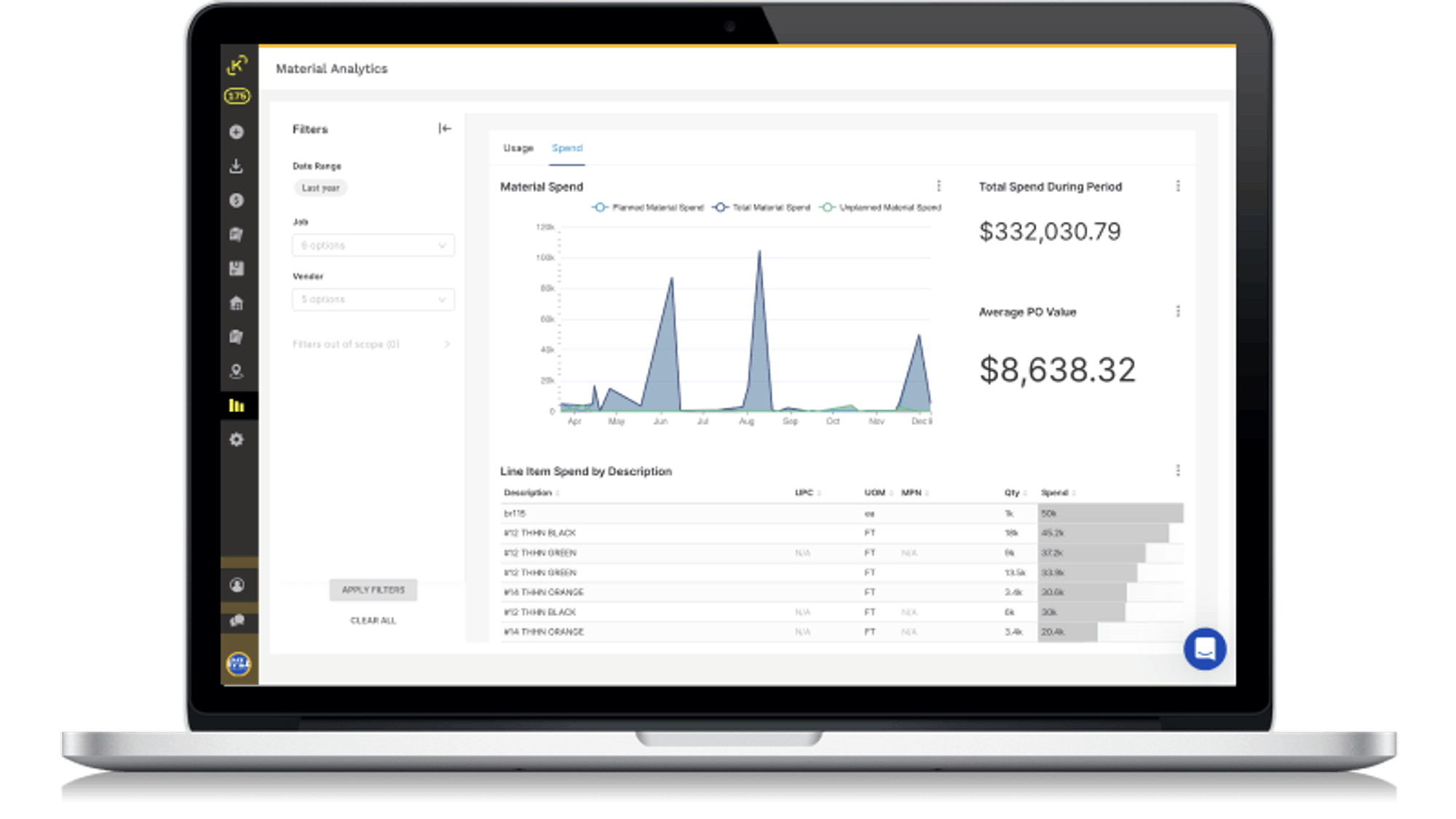

Operations

Source: Kojo

Kojo’s operations solution takes tracked data on team ordering behavior and material spending, and aggregates it into reports for users, streamlining the process of gathering and analyzing data. With these reports, users can identify the areas that significantly contribute to costs, enabling them to make well-informed purchasing and operational decisions.

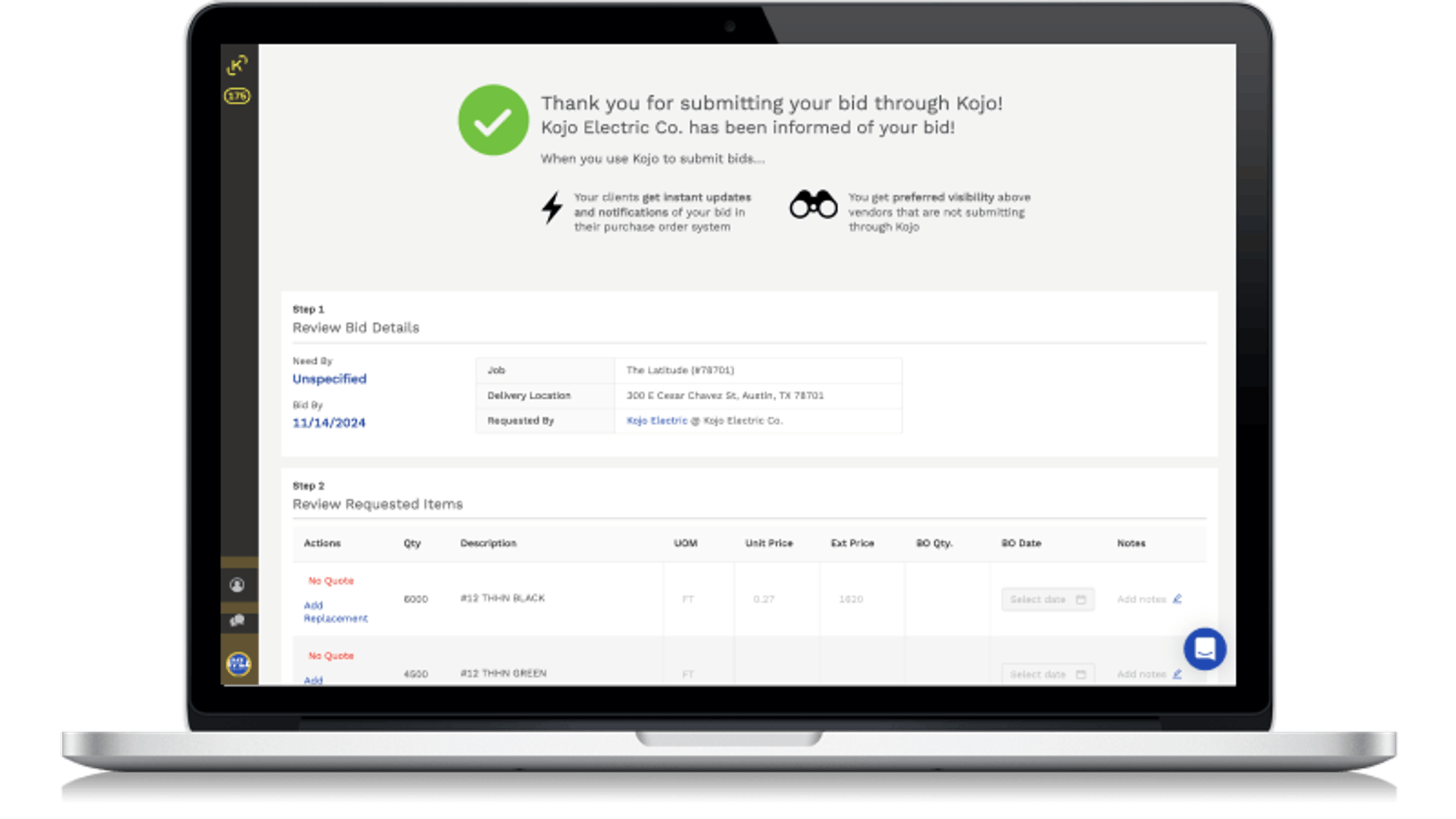

Vendor

Source: Kojo

Kojo’s vendor solution is intended to streamline transactions between contractors and vendors. Through direct EDI integrations, Kojo allows contractors to easily see price and availability for vendors they work with, as well as automate the exchange of key parts of the transaction flow including purchase orders (POs), order acknowledgements, shipping notices, and invoices

Accounting

Source: Kojo

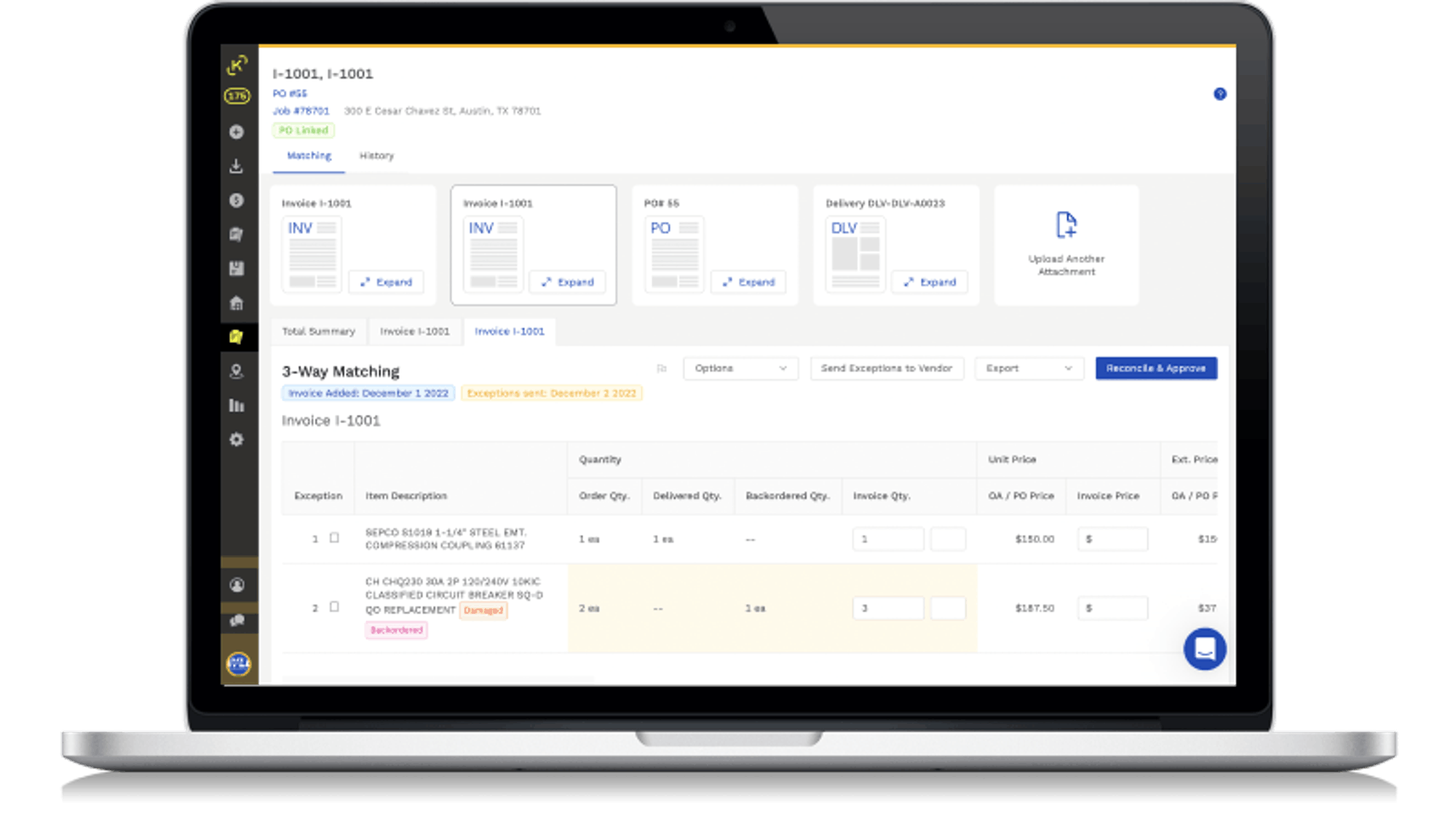

Kojo’s accounting solution automates the three-way matching process between PO, proof of delivery, and invoice documents that field personnel, purchasing teams, project managers (PMs), and vendors undergo when verifying material orders for accounting purposes. Kojo’s accounting tool also allows users to integrate the Kojo platform with their existing accounting systems. Completing the full procure to pay cycle, Kojo enables contractors to pay invoices directly through Kojo

The solution includes an invoice matching feature which presents users with a side-by-side view of the PO, proof of delivery, and invoice. Document comparison highlights discrepancies, making it easy for users to identify and resolve issues without having to reach out to purchasing or PM teams for additional information. As of June 2023, the Automated Invoice Matching feature had processed $9.2 million in invoices, catching mistakes on 27% of invoices processed.

Integrations

The Kojo platform allows for built-in connections with several construction enterprise resource planning (ERP) packages, which are commonly used by construction companies to manage their financial and operational processes. As of March 2024, Kojo supports integrations with software tools like Procore, Autodesk, Viewpoint Vista, and Viewpoint Spectrum and with supplier platforms including Ferguson, Mayer, and Rexel.

in November 2023, Kojo launched “Supplier Integrations”, which it described as “a new series of integrations with some of the leading electrical suppliers in the US” which was intended to create a “seamless, two-way flow of data between Kojo and the supplier.” The company stated that it already had 25 customers using this integration at the time of its launch, and expected to “open the integrations to hundreds of customers in the coming months”, and that it had 23 suppliers in beta with eight more to join over the course of the first quarter of 2024.

Market

Customer

Kojo's purchasing, field, warehouse, tool tracking, accounting, and operations solutions target contractors in the construction industry. These solutions can also be utilized by accounting, purchasing, field, or inventory management teams, depending on the organizational structure of a construction project. On the other hand, Kojo’s vendor solution is tailored specifically for materials suppliers. Kojo initially served only the electrical construction trade. However, in September 2022, it announced its expansion into eight construction trades. As of March 2024, Kojo serves the mechanical, electrical, plumbing, concrete, drywall, glazing, roofing, and flooring trades.

Kojo serves a diverse range of construction projects such as building hospitals, schools, stadiums, office buildings, and multifamily housing developments. In July 2022, Kojo announced a partnership with Concrete Foundations Association, an organization representing concrete contractors across the US and Canada, which made Kojo its preferred materials procurement platform. Additionally, in November 2023, Power Design Inc., one of the nation’s largest design-build multi-trade contractors with over 1.7K completed projects, selected Kojo as its procure-to-pay platform. As of March 2024, notable clients include Kleinknecht Electric, James Babcock, Inc., Arrow Electric Co., and Vertical Mechanical Group.

Market Size

The market for construction tech was estimated at $5 billion in 2023, up from $2.5 billion in 2018. This is expected to grow to $24.2 billion by 2033, growing at a CAGR of 16.9%. Growth is being driven by in part with ongoing labor shortages in the construction industry. Davidson acknowledged this problem during an interview in 2023, stating:

“There is a labor shortage. There are about 650K workers missing from the construction industry, and construction backlogs are now at a four-year high.”

Additionally, as of 2022, over 40% of the US construction workforce was expected to retire over the next decade, exacerbating the already persistent labor shortage. As of January 2024, the construction industry will need to attract an estimated 501K additional workers on top of the normal pace of hiring in 2024. With fewer workers, projects could take longer to complete and become more expensive as they drag on, therefore increasing the demand for construction technology tools to help increase the efficiency of the existing workforce.

Competition

StructShare

Launched in 2017, StructShare streamlines the purchasing of building materials by connecting field, accounting, and procurement teams through its platform. The company raised an $8 million seed round led by KOMPAS in March 2023 which accounts for its total funding raised as of March 2024. Its product shares similarities with Kojo, both in terms of trade coverage and the integration of AI into its platform. Like Kojo, StructShare serves trades such as mechanical (plumbing, HVAC), concrete, drywall, roofing, flooring, and electrical. However, StructShare also serves framing, which, as of March 2024, Kojo does not. Additionally, in October 2023, StructShare incorporated an AI-powered intelligence layer into its platform, similar to Kojo’s approach.

The main distinction between Kojo and StructShare lies in the support for inventory management and the level of integration with ERP systems. While StructShare's platform offers functions such as purchase order management, order delivery validation, project cost tracking, and three-way invoice matching, similar to Kojo's purchasing, field, operations, and accounting tools respectively, it lacks the inventory management support provided by Kojo's Warehouse and Tool Tracking features.

Additionally, in 2021, StructShare gained an initial advantage over Kojo by making its product compatible with Procore, a widely used ERP system with over 1.6 million users in more than 125 countries as of 2021. Kojo followed suit in 2022. The main distinction between Kojo and StructShare lies in the support for inventory management and the level of direct integration with ERP systems and vendors

Field Materials

Launched in 2022, Field Materials is a platform that streamlines materials procurement for contractors. In April 2023, the company raised a $4.7 million seed round led by Blumberg Capital, with participation from Zacua Ventures. As of March 2024, this accounts for the company’s total funding raised.

Field Materials offers a less comprehensive range of tools for the materials procurement process compared to Kojo. Field Materials’s platform supports functions such as quotes, orders, and invoices, which correspond to Kojo's purchasing, field, and accounting tools, respectively. However, similar to StructShare, Field Materials lacks inventory tracking support provided by Kojo's tool tracking and warehouse features. Additionally, Field Materials does not provide as much support for budget tracking compared to both StructShare and Kojo.

Procore

Procore is a cloud-based construction management software company founded in 2003. The company went public in May 2021 and had a market cap of $11.5 billion as of March 2024. The primary focus areas of Procore and Kojo differentiate them. Procore is primarily designed to facilitate comprehensive project management, encompassing budget management, subcontractor bidding and contract management, quality assurance, and safety standards. In contrast, Kojo specializes in materials procurement and management, catering specifically to the requirements of trade contractors and addressing challenges related to the materials supply chain.

However, Procore and Kojo both offer technologies that make Procore an adjacent competitor of Kojo. For instance, Procore features an invoice management function that consolidates all invoices onto a single platform for accounting purposes, with capabilities for integrating with accounting systems. This mirrors Kojo’s Accounting feature, highlighting the complementary nature of both platform’s technology.

Competitive aspects aside, Kojo is the only materials management platform that Procore now has a formal cross-selling agreement with. Procore Account Executives can sell Kojo, making the two companies partners.

Business Model

As of March 2024, Kojo generates revenue through custom SaaS subscriptions. Customers with a subscription are offered unlimited users and data, and are also given a dedicated account manager. The company does not publicly disclose its pricing.

Traction

In September 2022, at the time of its Series C, Kojo reported that it had grown its ARR 3.5x over the preceding year and had grown its team to 90 employees, which doubled its size from the previous year. By 2022, Kojo had processed materials orders worth over $1 billion for its customers. Kojo was also named the winner of the best “SaaS Product for the Construction Industry” by SaaS Awards in September 2022. As of November 2023, Kojo had powered over 25K construction projects across 47 states and was being used by more than 15K construction professionals. CEO Maria Davidson told Contrary Research that as of March 2024, Kojo had grown to process over $2 billion a year in annual materials orders for their customers.

Valuation

In September 2022, Kojo raised a $39 million Series C at an undisclosed valuation led by Battery Ventures and participated by Schneider Electric, RXR, and Bienville Capital. The round brought the company’s total funding to $83.6 million across four rounds of funding with notable investors including Battery Ventures, Tiger Global, and 8VC.

Key Opportunities

Increased Procurement Technology Adoption

In 2023, the construction industry ranked worse on procurement performance than many other industries, such as transportation and pharmaceuticals. Additionally, procurement constituted a substantial portion of a construction company's total spending, accounting for 40% or more of total costs as of 2023. Kojo's position in the market stems from its ability to offer a comprehensive procurement platform, which can help cut down on construction costs and help construction companies adopt more up-to-date procurement practices.

Large Addressable Market

Construction is a very large market, with an estimated $9.7 trillion spent on construction globally in 2022. Of this, construction materials account for 40% of construction costs. As a construction material management solution, Kojo’s solution is therefore applicable to a very large addressable market; if it can grow its market penetration and help deliver savings on even a small percentage of the nearly $4 trillion spent on construction materials every year, it has the potential for significant growth given the size of the market.

Key Risks

Price Sensitivity

Construction technology companies face the challenge of justifying software investments in a market with limited capacity for spending. Two primary factors contribute to this. Firstly, the construction industry is known for its low profit margins, with the average net margin ranging from 3-5% as of 2023. Secondly, construction companies tend to adopt IT infrastructure at a slower pace compared to other industries. In 2021, the typical IT spend for architecture, engineering, and construction (AEC) companies fell between 1-2% of revenue, compared with 3-5% percent on average across industries.

For Kojo, the risk lies in its pricing. According to an employee at a competing firm in September 2022, Kojo is perceived as up-market by customers. In an immature market, contractors often prioritize cost when selecting software solutions, similar to their approach to buying construction commodities.

Market Fragmentation

The construction industry operates within a market dynamic characterized by a high degree of customer fragmentation. As of 2023, the average construction company employs fewer than 10 people, indicating a decentralized market structure. At the same time, the average project involved more than 100 different suppliers and subcontractors, highlighting the complexity of the industry's network. The fragmented market structure poses a risk to Kojo as it requires engaging with a large number of contractors and vendors to drive growth. As a result, scaling the business may prove labor-intensive and slow.

Summary

Kojo, a construction materials procurement platform, was founded in 2018 by Maria Davidson. Kojo aims to streamline material procurement and inventory management for trade contractors. The platform offers various features such as purchasing, field, warehouse, tool tracking, accounting, and operations solutions, partnering with contractors and suppliers across different construction trades. With a growing market valued at $5 billion in 2023 and expected to reach $24.2 billion by 2033, Kojo's revenue model relies on custom SaaS subscriptions.