Thesis

Globally, the energy industry employs 65 million people, accounting for 2% of employment. In the US, in 2021, energy jobs grew 4% from the previous year. This outpaced growth in overall employment, which grew 2.8% in the same period. Additionally, the number of jobs in the energy sector increased from 7.5 million in 2020 to over 7.8 million in 2021 in the US. In 2020, it was projected that more than 80% of total upcoming new job opportunities in the oil, natural gas, and petrochemical industries would come from the retirements in the aging workforce. This presents an opportunity for future workers. At the same time, it creates a challenge for the industry to fill leadership and institutional knowledge gaps without disruption. Moreover, the demand for labor in renewable energy is poised to grow. For example, employment of wind turbine technicians is projected to grow 44% from 2021 to 2031.

Although there is an increasing need for workers in the energy sector, the nature of work in this industry creates recruiting challenges. Such work is often temporary, complex, and requires specialized skills. In addition, workers tend to work for multiple operators across different geographies. Invoices are submitted on paper, and payments are received only after the job is finished — often weeks later. Furthermore, independent contractors must maintain certification and insurance, which is costly without the help of a risk aggregator on behalf of the workers. Contractors have historically relied on fragmented agencies to find roles. The process is laden with high fees, a need for more transparency, and minimal information about available opportunities.

Workrise is a workforce management and vertical labor marketplace that makes it easier for skilled laborers to find work and companies to find in-demand, trained workers. It started with companies in the oil and gas industry and has since expanded to serve companies and trade workers in the solar, wind, commercial construction, and defense industries.

Founding Story

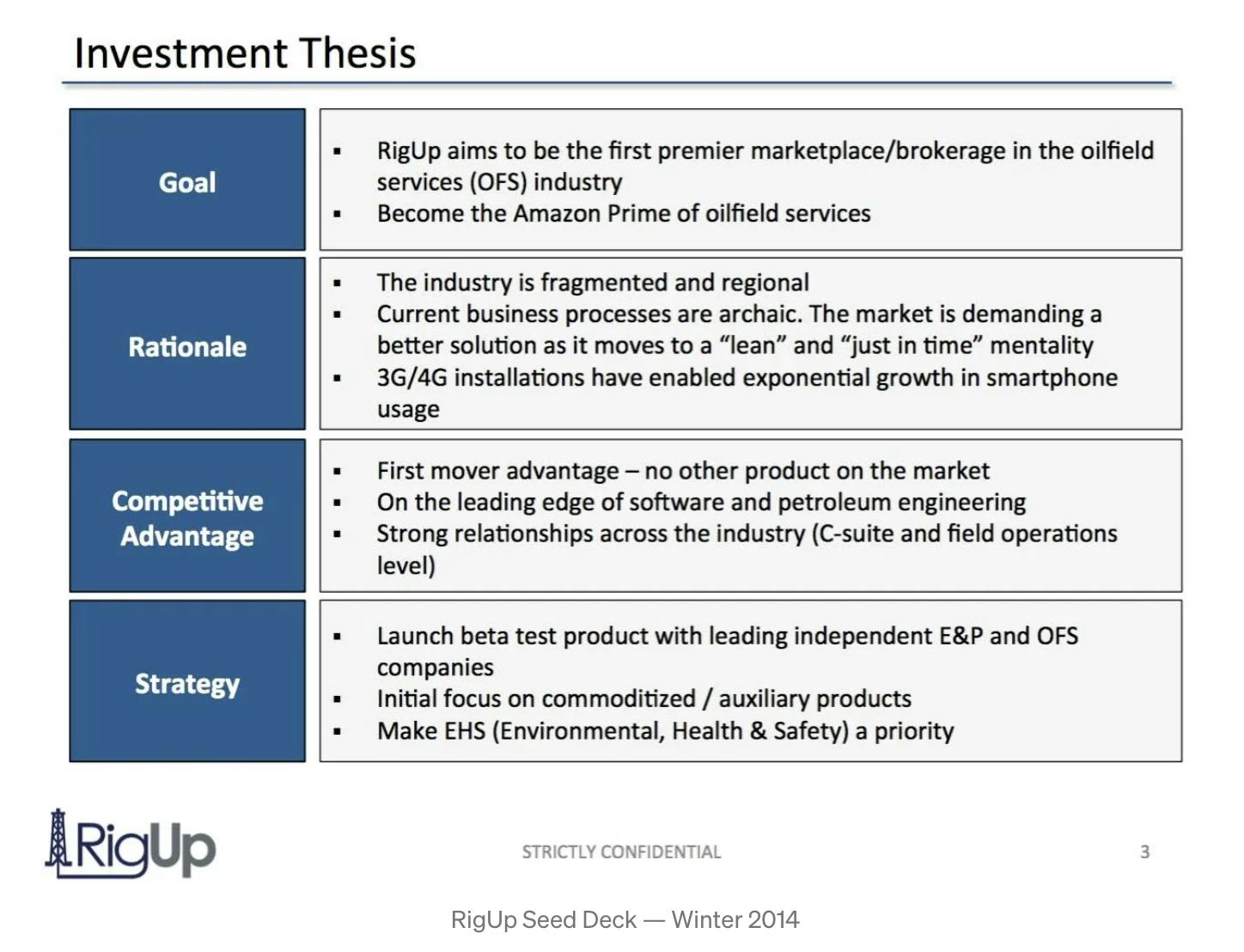

Workrise, formerly known as RigUp, was founded by Xuan Yong and Michael Witte in 2014. From 2014 to 2022, Witte was COO, and moved up to become CEO in February 2022 following Yong’s transition from CEO to Chairman in December 2022. Prior to founding RigUp (later Workrise), Yong previously worked at Goldman Sachs, D.E. Shaw & Co, and Citadel Investment Group. Witte, meanwhile, had worked as a petroleum engineer at Encana Corporation and then as a petroleum engineering consultant. Both Texas natives with roots in the energy sector, Yong observed that labor shortages were causing costly disruptions for companies across the industry. As a petroleum engineer, Witte saw a solution in implementing technology to manage labor in the industry.

Initially, RigUp operated a platform similar to Angi but for oil and gas professionals, offering a space where oil and gas companies could evaluate and hire project vendors and workers. RigUp initially struggled to gain traction in the market. Through their interactions with users, Yong and Witte realized that workers were using RigUp as a kind of LinkedIn for the energy industry — a place where they could showcase their backgrounds, skills, and experience to get hired for jobs. This revealed that matching workers with job opportunities was the most promising aspect of RigUp’s offering. Knowing that oil and gas companies had faced challenges finding workers, they recognized RigUp’s potential as a scalable talent pool for the sector.

Source: Geoff Lewis

As the company continued to evolve, its founders recognized the need for a name change to reflect better their broader ambitions to serve sectors beyond oil and gas within the energy and infrastructure industries, having observed that the workforce dynamics and challenges observed in the oil and gas were not unique to that sector alone. This realization opened doors for the company to start catering to a wider range of industries needing skilled labor. In 2021, RigUp rebranded as Workrise. The name Workrise symbolizes the company's dedication to empowering workers and represents its mission to modernize outdated labor staffing practices.

Product

Vendor Management

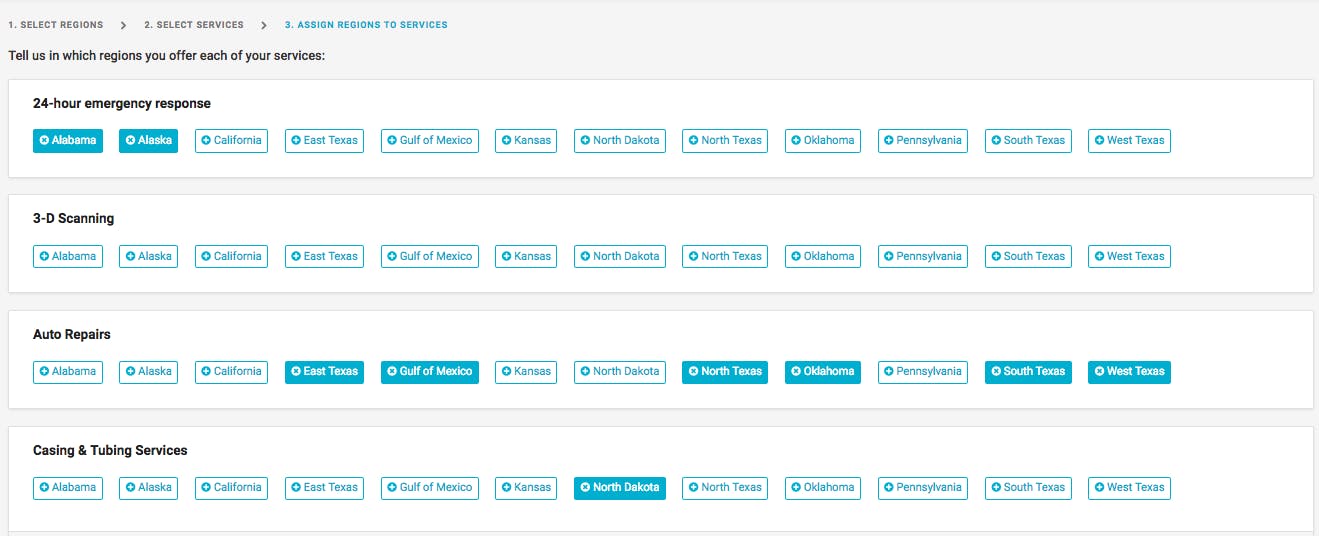

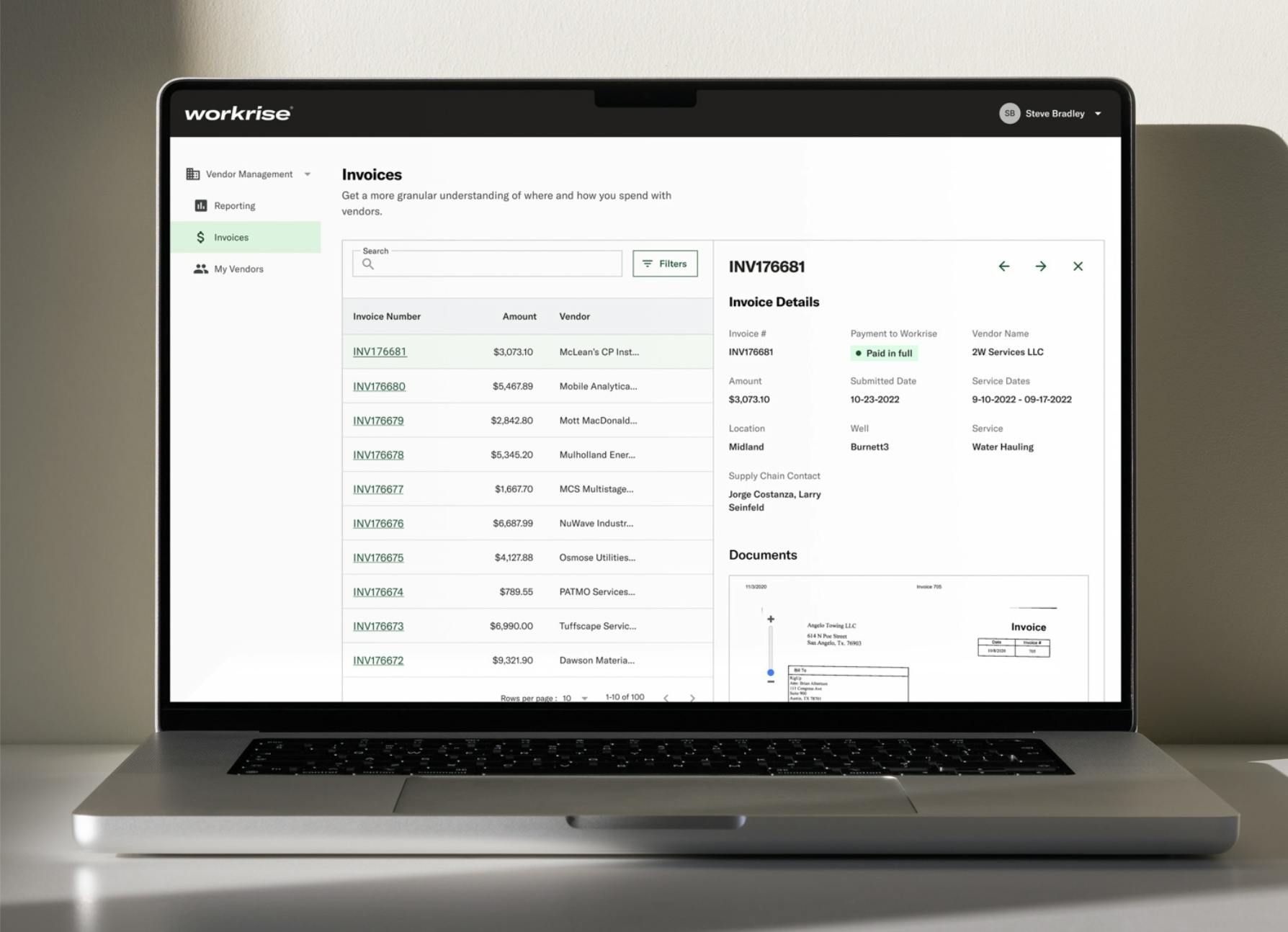

Workrise offers vendor management tooling to help make it easier for energy companies to identify and process the vendors and workers they need to complete their projects for the best price.

Source: Workrise

Additionally, Workrise offers streamlined managed billing and compliance to help companies pay vendors easily and on time, as well as data and reporting tools for companies to understand better how they are operating and how they can improve. Through Workrise’s Connect platform, companies can access dashboards about their vendor, spending, and invoicing data.

Source: Workrise

Workforce Management

Workrise facilitates a marketplace across more than 400 roles and skill levels for workers across the US. It provides workforce management tools for energy companies to facilitate worker management. Companies can use Workrise to approve timesheets and quickly submit work orders.

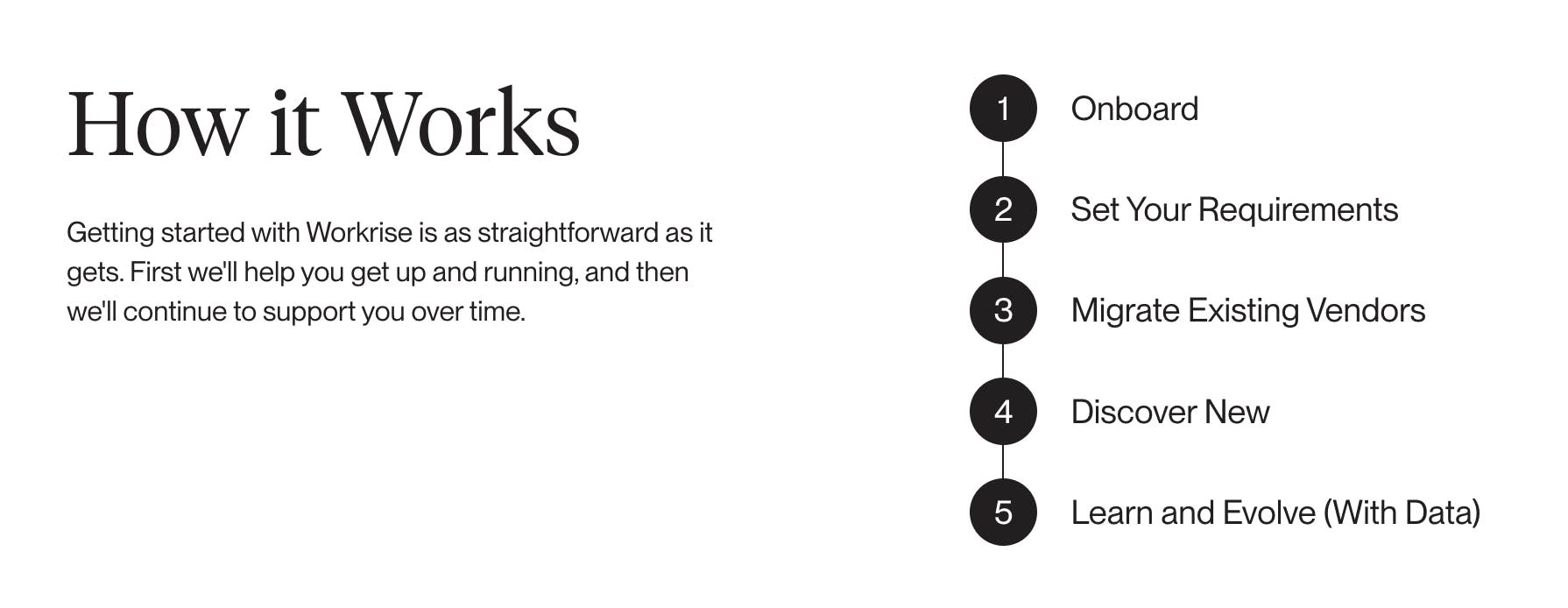

Client Engagement

Workrise allows energy services companies to join its network, build profiles, and set terms for new contracts. This means companies can open up new lines of business in weeks instead of negotiating on a master service agreement (MSA) for months. Workrise offers a speedy onboarding processes, automated health, safety, and environmental (HSE) tracking, and compliance tracking.

Workrise enables energy service companies to build a profile about themselves and their services. They can also manage and streamline invoicing operations into a single system for efficient approval processes and automated depositing and payment. In addition, Workrise enables document updates along with HSE and compliance tracking.

Source: Workrise

Billing and Compliance

Workrise offers billing and compliance tools for energy services companies to digitize and automate many of the industry’s manual tasks. It offers streamlined invoicing, approval, and deposit functions to consolidate all invoice processing under one roof. Workrise also offers payments services that work in line with preset agreements, HSE and compliance tracking, and the ability to opt into expedited payments. According to Workrise, these enable companies to get paid in as little as five days from invoice approval.

Source: Workrise

Bill Through Workrise

With Bill Through Workrise, energy workers can create a profile on the company’s marketplace, find work opportunities, and bill through it. Workers can access flexible medical, dental, and vision coverage, 401(k) savings plans, immediate vesting, and reimbursements for new certifications and PPE when they find jobs via Workrise.

Market

Customer

Workrise serves the needs of multiple stakeholders in the energy industry. For energy companies, Workrise offers a point of entry to access hundreds of vendors and thousands of skilled workers, faster onboarding, managed billing and compliance, and reporting tools. As of June 2023, Workrise lists customers like Gulport Energy, Civitas, and Kimmeridge on its website. For energy services companies, Workrise offers hundreds of vendors across its network, faster onboarding, flexible and faster payment options, and managed billing and compliance. For energy workers, Workrise offers opportunities for jobs with benefits.

Source: Workrise

Market Size

Globally, the energy industry employs 65 million people, accounting for 2% of employment worldwide. In the US, more than 7.8 million people were employed in the industry in 2021. The National Solar Jobs Census found that 26% of solar employers struggle to find qualified applicants. More than 80% of job opportunities in the oil, natural gas, and petrochemical industries will come from retirements in the aging workforce. This presents an opportunity for future workers. At the same time, it creates a challenge for the industry to fill leadership and institutional knowledge gaps without disruption. Moreover, the demand for labor in renewable energy is poised to grow. For example, employment of wind turbine technicians is projected to grow 44% from 2021 to 2031.

Competition

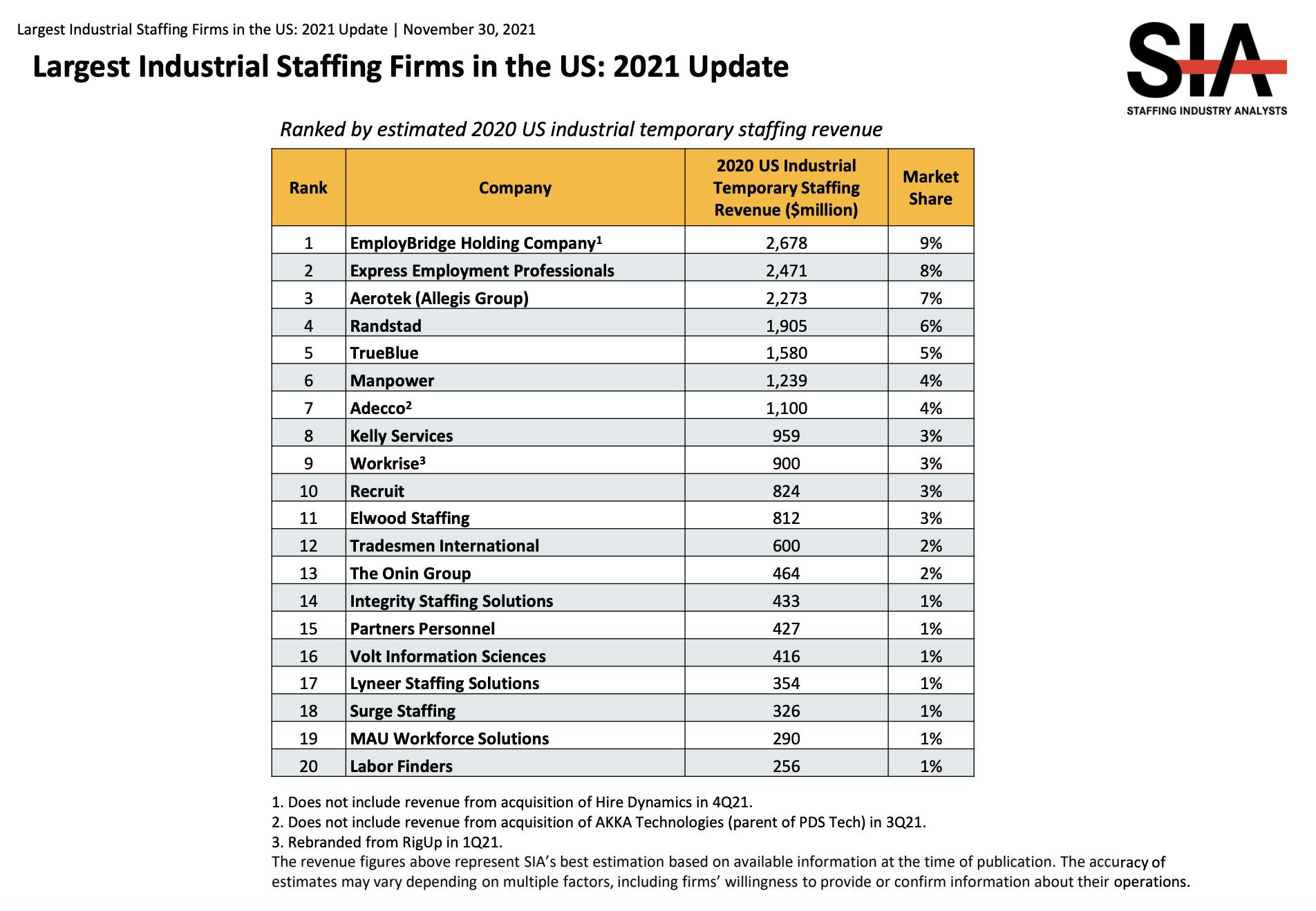

Workrise is a marketplace connecting workers, vendors, and energy companies. Many industrial, oil and gas, and other industry-specific staffing companies compete with Workrise for its user base and business.

Source: Staffing Industry Analysts

Petroplan: Founded in 1976, Petroplan is a global talent solutions partner for energy contractors. As of June 2023, it has made over 10K placements in more than 55 countries for over 550 clients across 65 disciplines. Around the world in the oil & gas and renewables fields, Petroplan offers services across talent sourcing, contractor management and payroll, workforce consultation, and more. For oil and gas, Petroplan sources talent across many specialties, including geoscience, drilling, production engineering and maintenance, HSE & quality, subsea & subsurface, quality assurance, construction and commissioning, refinery, and more. Petroplan sources wind, solar, hydro, and geothermal talent for renewables across design, construction, maintenance, commercial operations, installation, energy storage, and more.

Brunel: Brunel offers people and workforce services worldwide in the oil and gas and renewables industries. The company has over 45 years of experience in management recruiting services and workforce solutions across all oil & gas industry sectors, including downstream, midstream, upstream, chemicals, and liquefied natural gas (LNG). In 2022, the company saw revenue increase 31% to €1.2 billion. It is publicly traded on the Amsterdam Stock Exchange.

Indeed: Indeed is a subsidiary of Recruit Holdings, a human resources technology company that owns Glassdoor and has a market cap of over $53 billion as of early June 2023. While Indeed offers generalized tools and a search engine for employers and applicants, it is used to post jobs across the oil and gas industry and renewables. The company may leverage its existing technology to develop new offerings and services deeper into niche industries, including oil and gas.

Business Model

Workrise does not publicly disclose its pricing. It operates a labor marketplace, which differs from what has historically been a conventional freelance staffing firm model in the oil and gas industry. Additionally, Workrise operates as a vertically-integrated marketplace that integrates HR and payroll software. In addition to its marketplace fees, Workrise generates revenue through supplementary features such as next-day payments.

Traction

As of May 2021, Workrise served over 70 metro areas in the US and had 500 companies in its network. It placed 8K workers in jobs in 2019, with 13% in renewable, and 15K workers in 2020. In 2020, Workrise laid off a quarter of its staff in response to a downturn in oil and gas spurred by the pandemic. In 2022, Workrise decided to refocus on its core verticals and conducted further layoffs of its staff. As of March 2022, the company had over 25K workers in its marketplace. In January 2023, Workrise disclosed year-to-date its workforce had billed 14 million hours across oil & gas and renewables with placements in over 400 roles, and over 60% of the largest producers across upstream and midstream oil & gas were on its network.

Valuation

In May 2021, Workrise announced a $300 million Series E round at a $2.9 billion valuation led by Baillie Gifford. Franklin Templeton joined existing investors, including Founders Fund, Bedrock Capital, Andreessen Horowitz, 137 Ventures, and Brookfield Growth Partners. In total, the company has raised $752.5 million in funding as of June 2023.

Key Opportunities

Addressing the Gen-Z Workforce

Workrise has an opportunity to tap into younger workers. Gen-Z workers are increasingly questioning the prospect of a traditional four-year degree and the issue of student debt. As skilled trades and technical schools see growth in interest and enrollment, Workrise can accelerate this shift by providing education, training, technology, and job opportunities that attract a young, talented, and motivated workforce toward the energy sector.

The Evolution of Energy Companies

Workrise has the opportunity to provide its services to conventional energy companies as they continue to adapt to the future of sustainable energy. Major oil and gas players are actively working towards carbon neutrality and diversifying their energy portfolios. As these companies venture into new energy markets, challenges concerning identifying, hiring, and working with vendors and individuals may heighten. Workrise is positioning itself as a reliable partner for energy companies by working to offer them comprehensive vendor and worker management solutions. By leveraging its existing network, Workrise can help streamline the expansion of operations into new territories, reducing the friction associated with diversification efforts.

The Growth of Renewables

The Biden administration’s Inflation Reduction Act, which passed in August 2022 promised $370 billion in renewable energy tax credits, and has helped spur growth in the renewable job market, aligning with Workrise's focus on renewable energy and sustainable solutions. The International Renewable Energy Agency estimates 38 million people worldwide could work in the industry by the decade's end.

Key Risks

Industry Volatility

Workrise's business is closely tied to the overall health of the industries it serves, industries that are particularly susceptible to economic downturns and industry volatility. A significant risk for Workrise is the impact of a recession or market downturn, which can lead to reduced demand for workers and job opportunities in these industries. During an economic downturn, companies may delay or cancel projects. This can decrease the number of available job opportunities on the Workrise platform, leading to lower worker engagement and revenue generation.

Regulatory and Compliance Challenges

Changes in labor laws, the classification of contract workers, and workers' rights can impact Workrise's business model and operations. Compliance with new regulations may require substantial adjustments to the company's business processes, systems, and financial resources. Moreover, navigating the complex and evolving regulatory landscape poses operational challenges. Workrise operates in multiple jurisdictions, each with its unique labor laws and regulations. Ensuring compliance with these diverse regulations, staying updated on changes, and adapting the business model can be demanding and time-consuming. Failure to comply with regulatory requirements could result in legal penalties, reputational damage, and potential disruptions to Workrise's operations.

Summary

Today, the US is experiencing skilled labor shortages that could result in a $2.5 trillion loss for the country’s economy by 2028. Even for today’s needs, the demand for labor in energy, especially renewables, is growing. To address these issues and meet the energy demands of tomorrow, solutions are needed to help companies across the energy sectors drive efficiency and modernize back-office business operations. Workrise’s marketplace of energy workers, vendors, and companies, as well as integrated benefits plans, HR and billing software, and more, aims to facilitate better and faster matching of labor supply and demand in energy. In doing so, Workrise can support the growth and sustainability of the skilled labor workforce while addressing the needs of the energy industry and the broader economy.