Thesis

Men are increasingly taking care of themselves. In 2021, American men spent over $40 billion on grooming products, and the global men’s grooming market is expected to grow 8% annually until 2030. This trend is driven by several factors including changing social attitudes towards male grooming, a wider range of grooming products specifically targeting men, a general increase in disposable income, and growth of ecommerce platforms making grooming products more accessible.

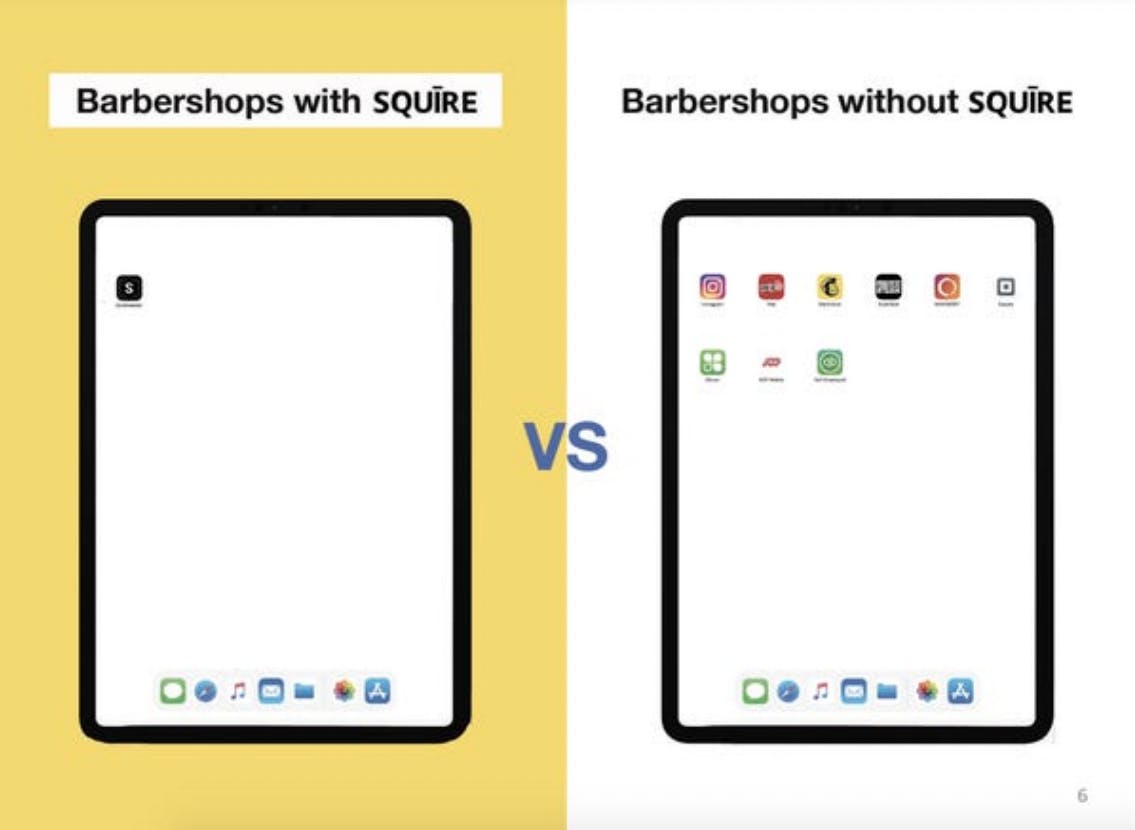

The barbershop is at the center of the male grooming experience. Most men go to the barbershop every three to six weeks, with some men going even more frequently depending on their hairstyle preferences. While the relationship of men to grooming has evolved over the past few decades, the barbershop experience has remained essentially static. They are disproportionately traditional businesses operating with phone, pen and paper, with customers who walk in, wait their turn and pay in cash. When barbershops look to digitize their business, they are often forced to either use multiple point solutions or to rely on all-in-one beauty solutions that are a poor fit for their specific needs. As a new generation of digital-native barbershops emerges and the industry adapts to the disruptive effect of the COVID pandemic, operators crave a vertical platform specifically built for barbershops.

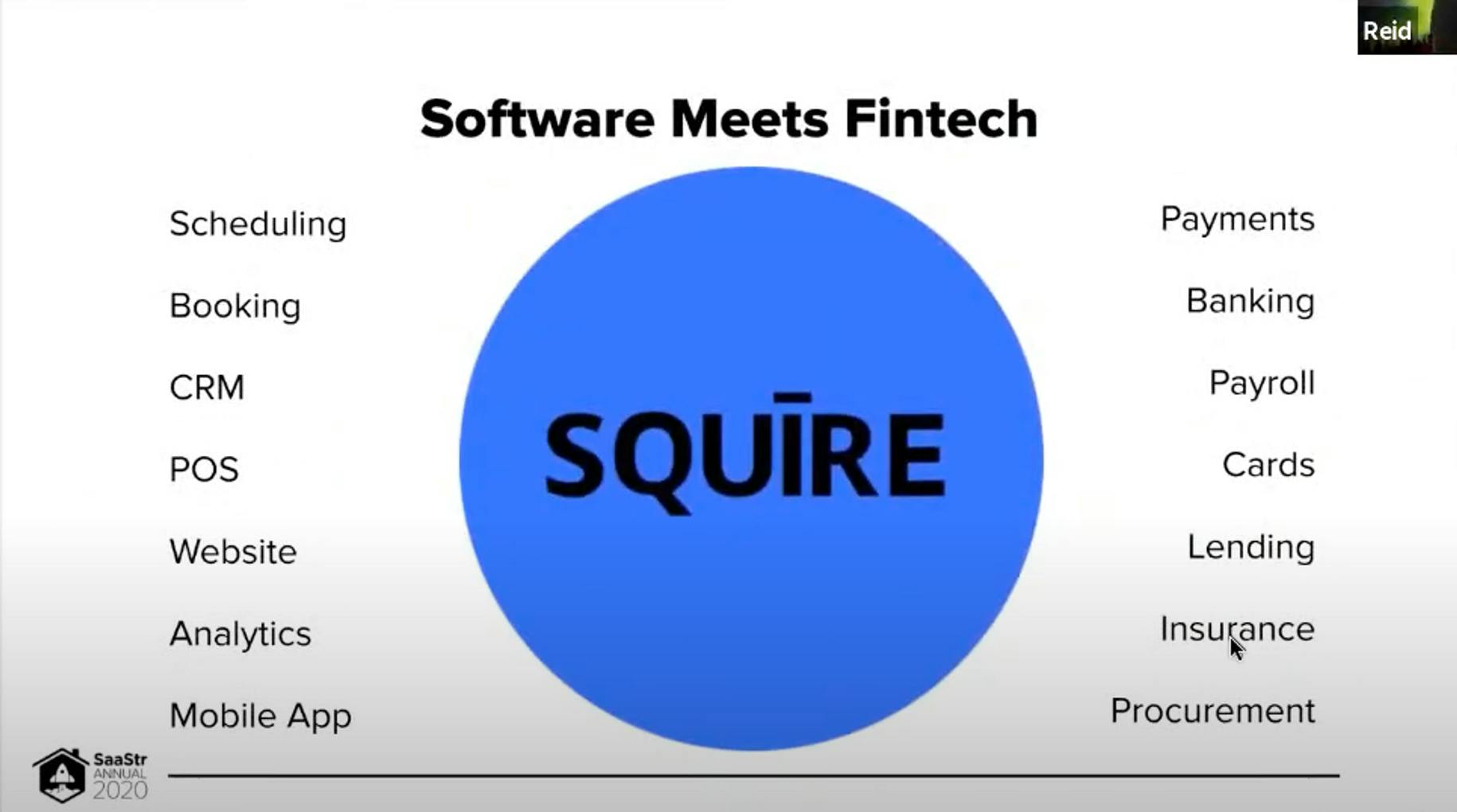

Squire is building an all-in-one platform tailored to barbershops. Beginning with a booking management system coupled with a point of sales system, Squire has evolved into an end-to-end solution including other products like inventory management, CRM, and finance.

Founding Story

Songe LaRon (CEO) and Dave Salvant (President) cofounded Squire in January 2015.

Neither founder had previous experience in tech or in the barbershop industry. LaRon had graduated with degrees from UCLA in philosophy and Yale in Law, and was working as a corporate lawyer at Skadden with a focus on mergers and acquisitions. Salvant had graduated from the State University of New York and was working as a sales associate at AXA after having worked as private banker at JP Morgan. They met in New York in their twenties and quickly became friends. Both wanted to build a startup as a means to exit the corporate world. They brainstormed ideas before landing on the barbershop industry as a target ripe for disruption. They felt that the experience for both operators and customers had not evolved much since their youth, with lengthy wait times and cash transactions being the norm.

Source: Squire

They first launched an ‘Uber for barbershops’ in New York, which enabled customers to book appointments at their favorite barbershops. They recruited Yas Tabasam as cofounder and CTO to build the first iteration of the app. They managed to onboard 50 barbers, but it quickly became apparent the app was not helping barbers generate new business, while also integrating poorly with existing manual booking workflows. This led to double bookings and other poor customer experiences.

At this point, LaRon and Salvant decided to use a third of their savings to buy and run a barbershop in Chelsea Market in New York. They wanted to personally experience the pain points related to operating a barbershop in order to build more relevant solutions to serve them. The pair discovered many barbers are independent workers renting chairs from a barbershop, and that each barber can have their own prices and scheduling systems.

As the team gained industry experience they relaunched a booking management system handling industry specifics for barbershops. Squire was rejected two times by Y Combinator before being accepted in the Summer 2016 batch when they had gained industry expertise and that they had relaunched a booking management system handling the industry specificities of barbershops. In 2017, Tabasam left the company and was replaced as head of engineering by Troy Payne, who had worked at companies like Gilt.com and TripAdvisor.

In 2018, Squire launched a POS system as their second product, having discovered that it made little sense for a barbershop to have sales and scheduling systems that did not interact. It then launched analytics and a CRM to provide tooling for barbershops to engage with their customers.

Squire had a difficult journey raising money, and it took them a long time to secure additional funding. Nearly three years after participating in YC, the company was able to raise an $8 million Series A from Trinity Ventures in June 2019. The COVID-19 pandemic heavily impacted the business for several months. In March 2020, Squire raised $34 million Series B led by CRV immediately prior to the lockdowns which forced all barbershops to temporarily close their businesses. Squire reacted by waiving its service fee for nine months. It also built an array of new features like gift cards, virtual waiting rooms, and contactless payments.

In September 2020, it launched a procurement marketplace to help barbers source the products they use in their shops. Today, it has expanded into an all-in-one platform for barbershops, including additional products including lending, payroll, and a website builder.

Source: SaaStr

Product

Squire is an all-in-one solution for barbershops. Its platform can be understood as five products: (1) a booking management system, (2) a workforce management system, (3) a customer relationship management (CRM) system, (4) inventory management, and (5) financial services centered around a point of sale (POS) system.

Source: Squire

As CEO Songe LaRon put it in an episode of This Week in Startups:

“We handle everything that a barbershop needs to run its business from the booking to online payments to the point of sales in the shop and all the back-end activities like paying out the barbers, CRM, and marketing. It’s really a full end-to-end system focused specifically on the vertical of barbershops. We like to think of ourselves as providing everything that they need to run their business so they don’t have to look outside of Squire for anything. We’re very selfish about our customers and we don’t want to work with anyone if we can avoid it. We try to replace everything and do everything.”

Booking Management

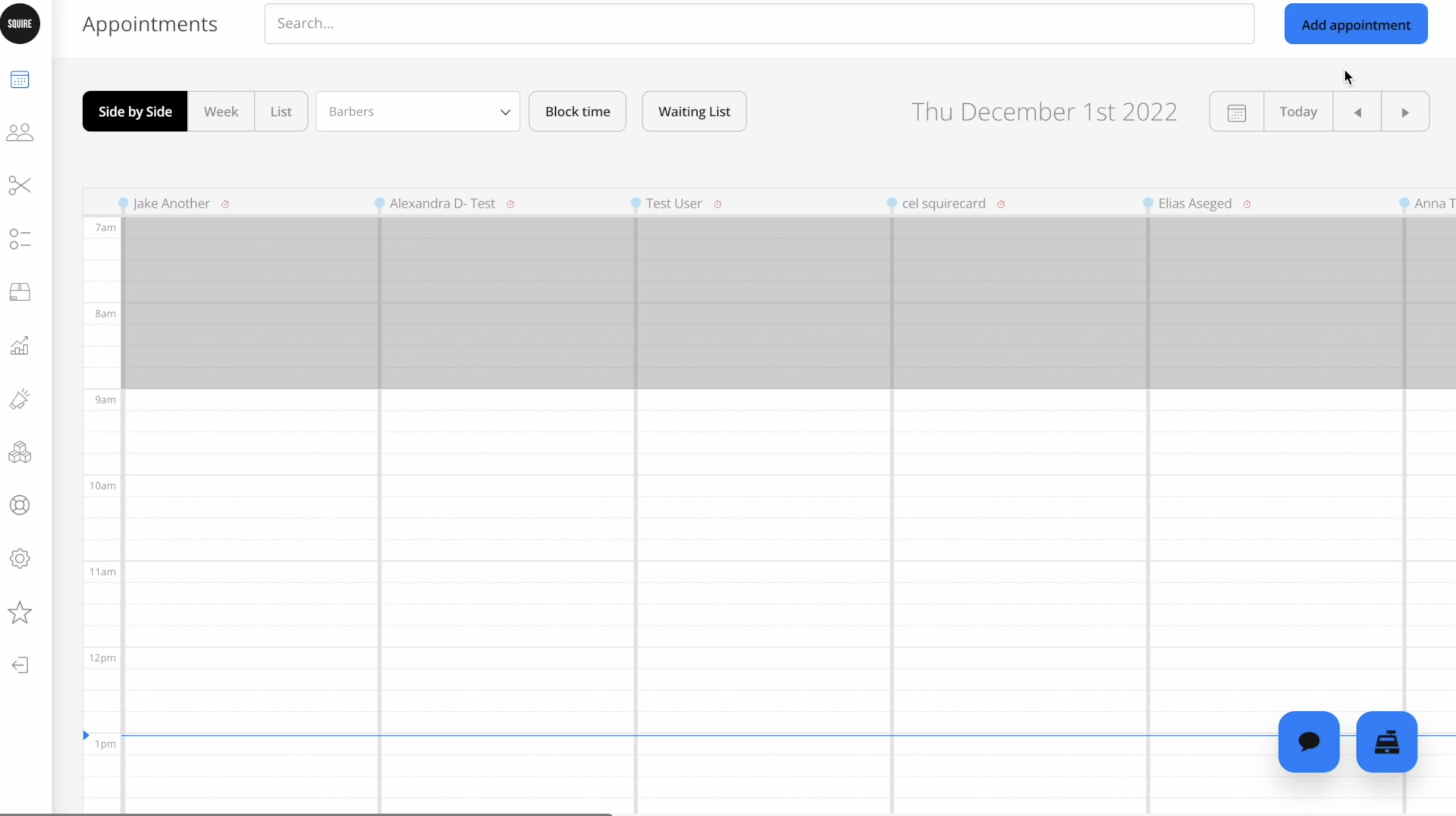

With Squire, barbershops can manage online bookings across multiple channels, like Google, Instagram, and their own website. The system allows for easy integration with the often informal processes which power barbershop scheduling, like Instagram DMs. Each barber can have their own individual booking link, allowing customers to see the availability of their preferred staff member.

Squire offers features to maximize occupancy rate, including emails, text reminders, and a waitlist that can automatically fill bookings when a customer cancels. Squire can auto-charge customers who do not show up for their bookings.

Source: Squire

Workforce Management

Barbers can either be employed by barbershops or act independently by renting a seat in one. In both case, barbershops rely on Squire to organise barbers’ schedules and payments. When a barber is an independent worker, Squire can automate both the booth rental payment and the payouts from the barbershop to the barber based on their activity. Barbers can clock in and clock out according to their schedules. They also have access to a leaderboard to compare performance with their peers.

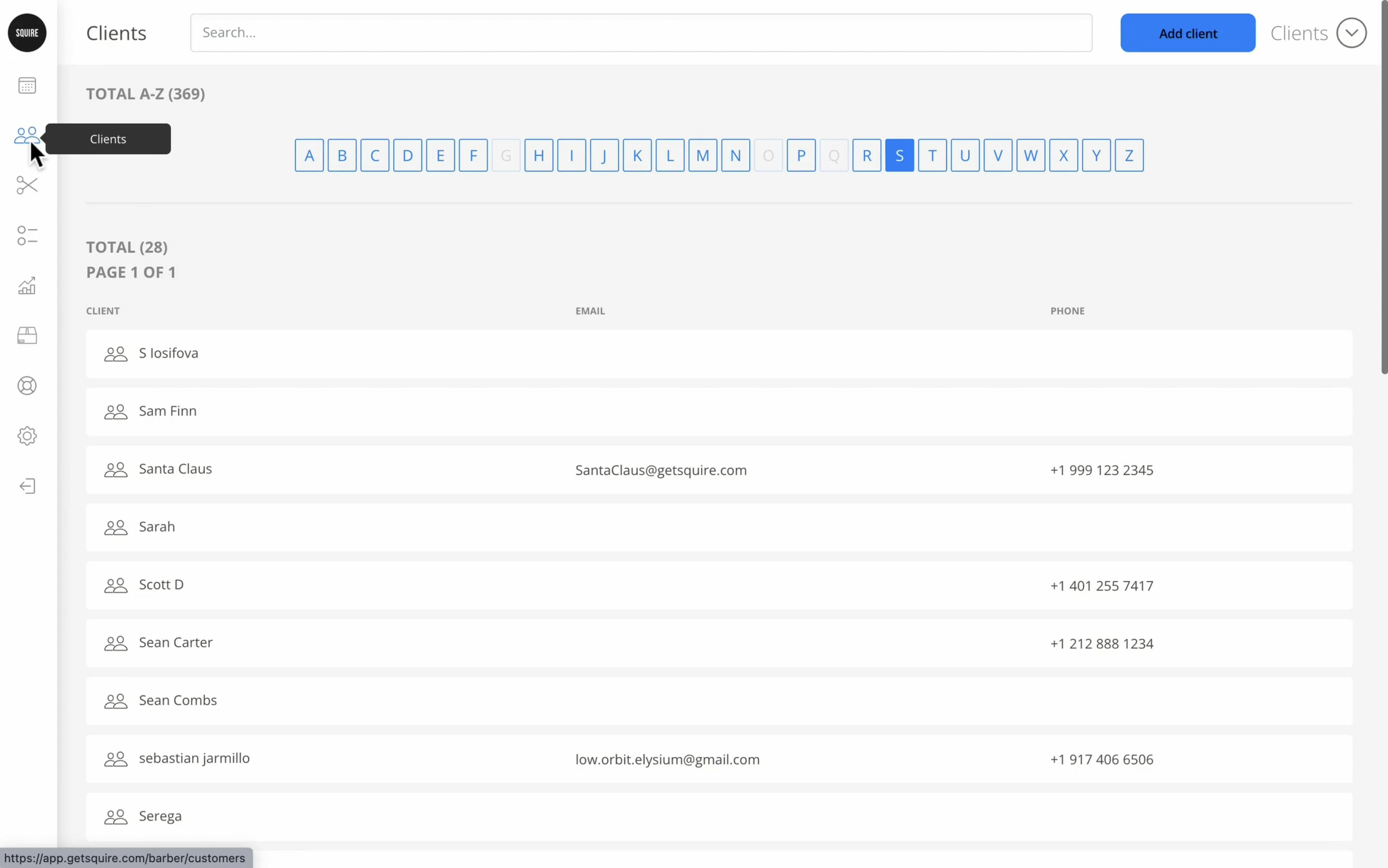

Customer Relationship Management & Marketing

Squire stores customer information and activity, enabling barbershops to activate their data with marketing tools such as emailing, client chat, loyalty programs and memberships, promo codes and recurring appointments. Squire offers a simple website and app builder to help barbershops build an online presence and generate direct bookings outside of manual channels.

Source: Squire

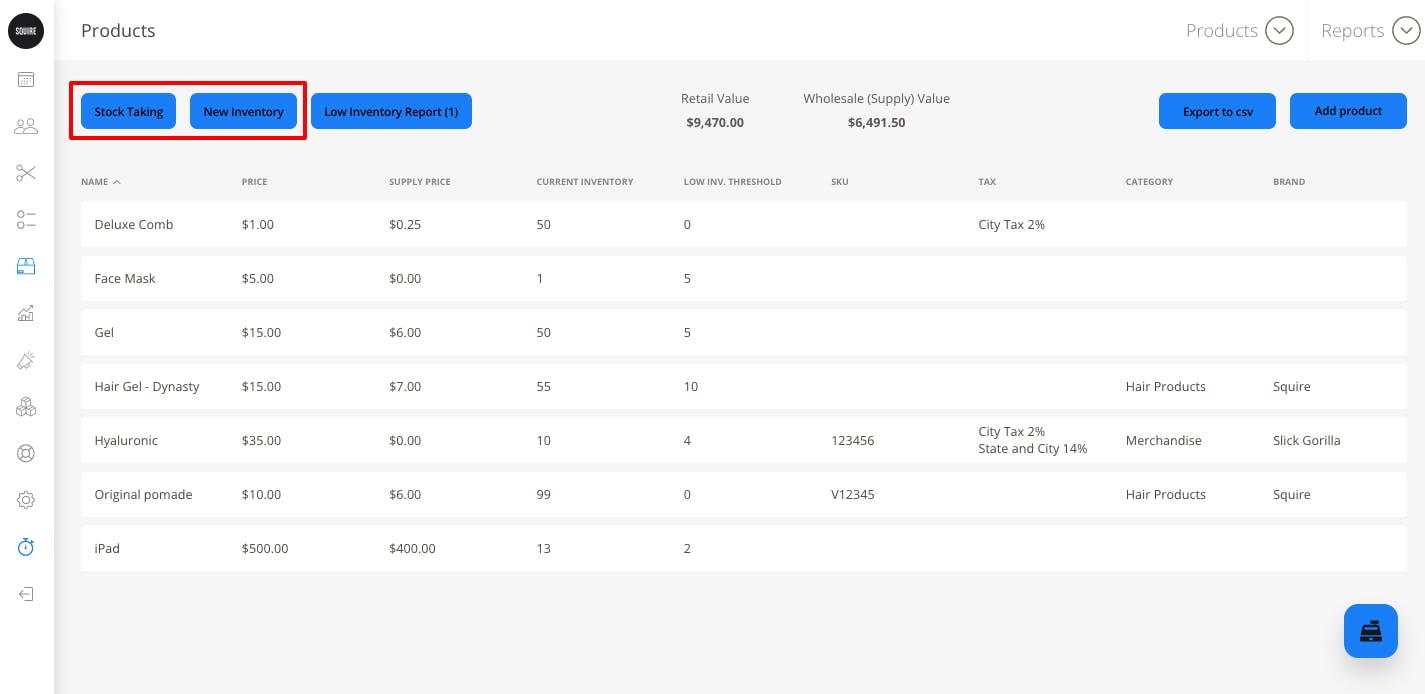

Inventory Management

Squire offers an inventory management module that allows barbershops to add and remove products in their inventory and track the inventory they sell or use. They can audit their inventory for shrinkage. Squire features a marketplace for barbershops to buy common supplies they need to operate their business, as well as to upsell grooming products to consumers after a shave or a haircut.

Source: Squire

Financial Services

Barbers and barbershops have historically been underserved by traditional financial institutions. It is challenging for them to access financial services due to the unique structure of their business and it is frequently more expensive when they do.

Squire offers a POS platform to process transactions both online and onsite. Beyond payments, Squire has begun to offer other financial services, such as a debit card for barbers in partnership with Bond alongside a lending offering called Squire Capital to fund the working capital needs of the business.

Market

Customer

Squire targets barbershops, a segment of the beauty industry providing cutting, trimming, shampooing, and shaving for men. The average barbershop has 5-6 chairs, and most barbers are independent workers.

There are two primary business models for barbershops. First is the booth rental model, where a barber rents a seat in a barbershop, generally paying $200-300 per week. The barber has a fully flexible schedule and they keep 100% of the revenues they generate. Then there is a commission-based model, where the barber does not pay rent but shares between 40%-60% of their revenue with the barbershop. In this case, the barber has a more rigid schedule, as with any regular employee.

The average barber makes a $39K annual salary, and the average barbershop makes $250K per year. A typical career path for a barber is to start with a barbershop to develop skills, build savings and grow their book of clients before potentially opening their own shop. Most barbershops are independent businesses, but there also exist chains operating multiple locations, such as Supercuts.

Tech adoption across the industry varies strongly. Some barbershops — largely newer businesses and chains — are already digitized. They tend to use multiple systems to operate their shop, whereas Squire’s value proposition is to replace these point solutions with an all-in-one platform. More traditional barbershops operate with pen and paper and largely (or exclusively) take cash. It has historically been a major challenge for Squire to acquire these customers. However, the COVID pandemic helped accelerate barbershop digitization efforts, as shops had to adopt software to offer contactless payments and alternative booking options when walk-ins were no longer possible.

Squire is available to barbershops in the United States, the United Kingdom, and Canada.

Market Size

There are approximately 109K barbershops in the United States. Squire argues that market studies underestimate the actual number of US barbershops and that the figure is between 250K and 400K. The justification for this evaluation, according to LaRon, is that these studies often only count barbershops that are officially registered or have a physical storefront, whereas the barbershop industry includes many informal or unregistered businesses, including those operating out of homes, garages, or other non-traditional spaces.

If one accepts the lower-end Squire estimate of 250K barbershops in the US is accurate and that Squire can generate $1.6K in monthly ARPU (vs. $700-800 ARPU as of today), it indicates the company is going after a $4.8 billion total addressable market in the United States.

Competition

Squire’s competition largely exists in the form of horizontal solutions which target the entire beauty industry.

Mindbody: Mindbody, founded in the United States in 2001, is a SaaS-enabled marketplace for the fitness and wellness industry. It went public in 2015 and was acquired by private equity firm Vista in 2019 for $1.9 billion. It operates as an all-in-one solution with modules for customer management, workforce management, booking management, payment processing, AI-based customer support, and marketing. It sees strong network effects with its marketplace, which is able to both bring new clients to its customers and maximize utilization of the space its customers operate in thanks to an acquisition of ClassPass in 2021.

Booksy: Booksy was founded in Poland in 2014. It is a SaaS platform targeting the beauty industry which offers booking management, payment processing, marketing, workforce management, revenue stream diversification (e.g. offering memberships or retail products), and inventory management. It raised $119 million in total funding from investors like Cat Rock Capital, Sprints, and Piton. It has 13 million users and 500+ employees. It entered the US market in 2017 and serves multiple international markets including Poland, Spain, Brazil, South Africa, and France. Compared to Squire, Booksy serves a much wider array of clients, including hairstylists, nail artists, and massage therapists.

Boulevard: Boulevard is an all-in-one SaaS for the beauty industry founded in the United States in 2016. It offers booking management, client management, payment processing, and marketing services. It raised $108 million in total funding from investors including Index and Point72. It works with 2K businesses and 25K professionals. In 2022, it grew its ARR by 122%, doubled its customer base, and processed $1.5 billion in payments. It targets a broader scope in the beauty industry. It works with barbershops, as well as hair salons, spas, nail artists, spas, and massage shops.

Business Model

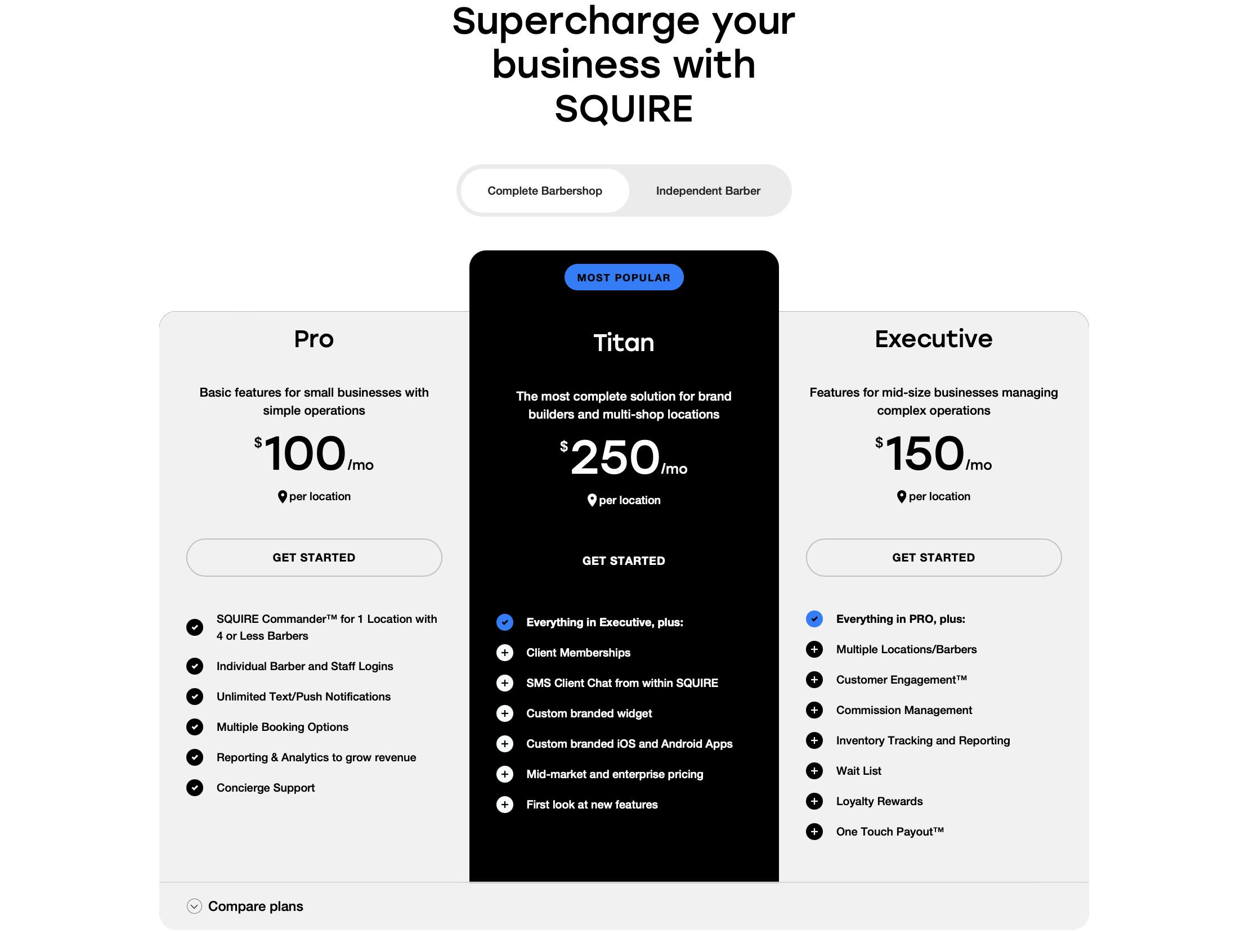

Squire has two primary revenue streams. It offers a SaaS subscription priced at $30 a month for independent barbers, and between $100 to $250 per month per location for barbershops.

Source: Squire

It also monetizes with a take rate from its financial services and payments offering. This takes the form of a 2.9% take-rate and 30 cents per transaction on the POS system, and $1 paid by customers if they book and pay online.

Traction

In November 2021, Squire said it had signed 2.8K barbershops, amounting to 400 new barbershop signups per year since inception. Today, it claims it over 3K barbershops use its platform. In 2020, Squire generated $4 million in revenue. In October 2021, it claimed to be nearing $12 million in revenue. In June 2023, Squire shared that it had processed over $1 billion in total payments.

Squire started with a $150 monthly ARPU. In September 2020, it claimed to generate a $700-800 monthly ARPU and to be in a position to reach $1.6K in monthly ARPU in the mid-term.

Valuation

In July 2021, Squire raised a $60 million Series D led by Tiger Global at a $750 million valuation. In total, it has raised over $167 million in funding from investors including Iconiq, CRV, Trinity Ventures, and 645 Ventures.

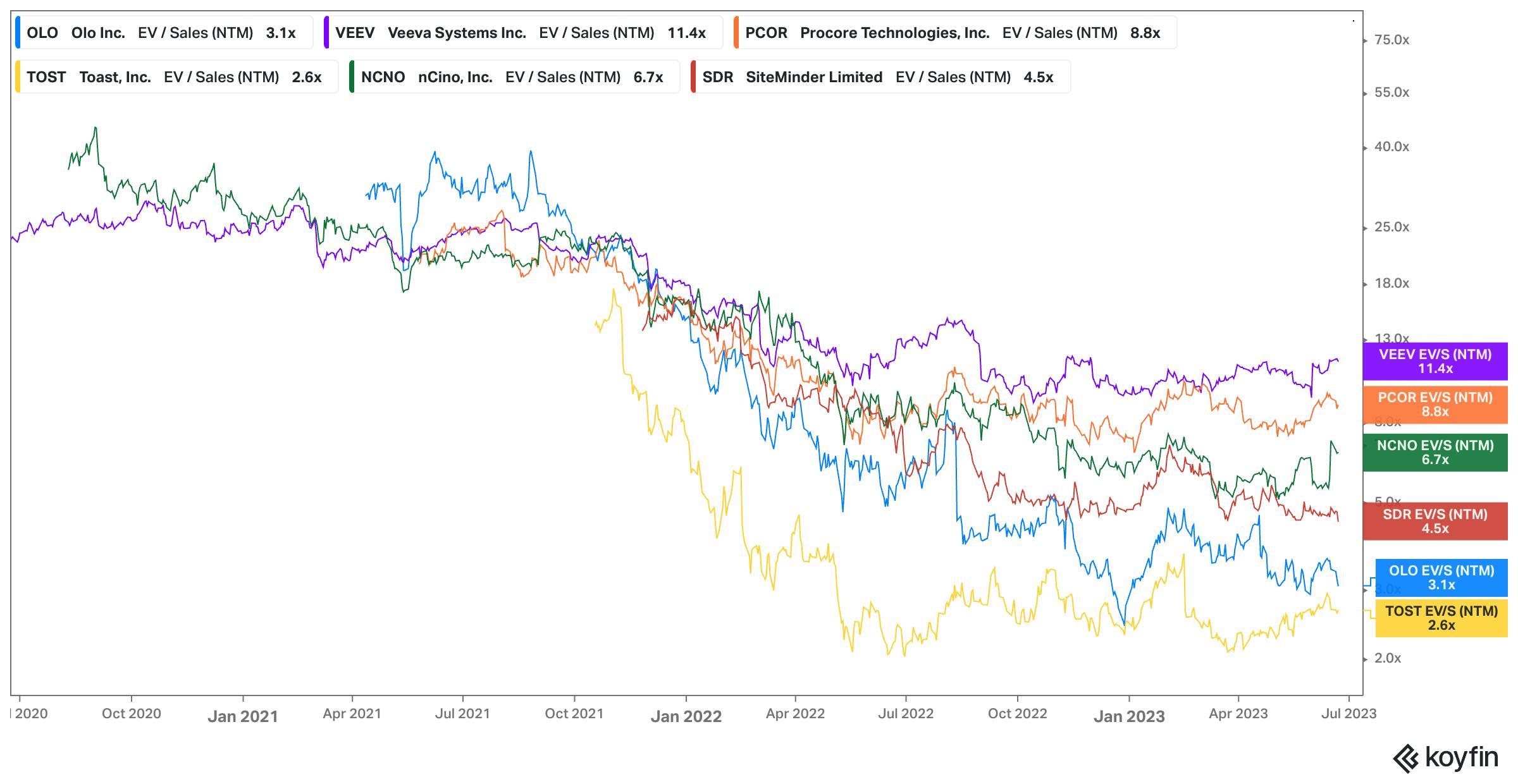

Squire’s last round valuation was done at a 62.5x multiple on the $12 million in revenues that Squire was planning to generate in 2021. In comparison, public vertical SaaS companies trade at a revenue multiple between 2.6x and 11.4x with a 6.2x average multiple. It implies Squire would need to 10x its revenue to grow into its valuation compared to equivalent public peers.

Source: Koyfin

Key Opportunities

Becoming an All-in-One System for Barbershops

Squire’s product vision is to be the only platform used by barbershops to fulfill their software, commerce, and financial needs. It has made strong progress in this direction, but there still exist other areas that Squire can add to its platform like insurance, benefits , or accounting. These services will be key for Squire to double its monthly ARPU as it hopes to do.

Payment Facilitation

Payment processing is an essential revenue stream for Squire. It started by using third-party partners like Stripe to process online and onsite payments, relying on a revenue share model with Stripe to capture a percentage of the 2.9% take rate and 30 cents per transaction. After a certain volume threshold, it will make sense for Squire to become a Payment Facilitator (PayFac) to directly process financial transactions in order to capture a higher percentage of payments processed on its platform and to make financial services even more integrated into its offering.

International Expansion

Today, Squire is present in the United States, the United Kingdom, and Canada. It can expand in other geographies starting with Europe, where the beauty software market is already well-developed with players like Booksy, Planity, or Treatwell.

Beauty Industry Expansion

Squire’s main differentiation in the beauty software market is to be fully focused on the barbershop segment. This focus gives Squire the ability to support unique barbershop workflows and to build a go-to-market strategy fully dedicated to this niche. If Squires successfully owns this market, it will have the option to expand to other beauty segments, because its product suite can be easily adaptable. Squire could do so by either expanding the remit of its core brand or building new brands tailored to other segments, such as hairdressers or nail technicians.

Key Risks

Competition from Horizontal Players

Squire faces intense competition and is being squeezed from two sides. On the one hand, they are challenged by all-in-one beauty industry solutions with broader customer scope and relatively similar feature sets. On the other hand, they are challenged by solutions like Square or Lightspeed for their point-of-sale system offering. This intense competition could impact Squire’s business by putting pressure on prices and increasing churn.

Sustaining Growth Without Increasing CAC

Squire is mostly targeting SMBs, as most barbershops are independent shops. For vertical SaaS targeting SMBs, it is challenging to maintain a reasonable CAC and payback period as they scale. The initial cohorts of customers are easier to acquire because there are more willing to digitize their operations. Moreover, most go-to-market motions serving local businesses are hard to scale because they are human-intensive with field sales, telesales, and customer success staff to enable onboarding.

Summary

Squire is an end-to-end platform for barbershops that began as a booking management system coupled with a POS. It has 2.8K barbershops as customers in the United States, Canada, and in the UK. It provides a compelling alternative to wider competitors because of its all-in-one value proposition and because it is built for the unique features of the barbershop industry. Going forward, it aims to expand internationally and add new products to its platform to serve all the software, commercial, and financial needs of barbers and barbershops.