Thesis

The rise of ecommerce in the early 2000s led to the closure of many big-box retailers, with well-known examples like Circuit City in 2009 or Borders in 2011. Since then, many small independent retailers have risen to fill the void they left behind. As of November 2023, there were 2.7 million independent retailers in the US with an estimated $3.5 trillion in annual revenue, a figure that is projected to increase to $3.7 trillion by 2025. In comparison, Amazon’s revenue was $574.8 billion and Walmart’s revenue was $611.3 billion in 2023 for a total of $1.2 trillion, or about a third of the revenue of independent retail that same year.

The process of finding merchandise from millions of brands and wholesalers is called wholesaling, a market that was valued at more than $11 trillion in the US in 2022. Typically, independent retailers have to undergo a fairly manual wholesale process to be able to discover and purchase new merchandise. Retail owners travel to in-person trade shows and work with brokers to acquire new merchandise from brands. In addition, retailers buy a new product without really knowing whether it will end up driving new customers and revenue to their store. By comparison, big retailers such as Amazon and Walmart can more easily afford to experiment with new products.

Faire is a wholesale marketplace that connects independent retailers to small brands. It allows retailers to discover and purchase products at wholesale prices from small, independent brands around the world while giving those brands access to potential buyers. Faire’s founding vision was “to build a wholesale marketplace that would help small brands and retailers… compete on a more level playing field with Walmart and Amazon”. As a two-sided marketplace, it benefits from network effects where more retailers attract more brands and vice versa. In addition, as the marketplace grows, Faire has access to more data that it can use to better understand pricing, product success, and customer creditworthiness.

Founding Story

Faire was founded in 2017 by Max Rhodes (CEO), Marcelo Cortes (CTO), Daniele Perito (former Chief Data Officer), and Jeffrey Kolovson (COO). Before founding Faire, the founders all worked together at Square from 2013 to 2016. Rhodes had a product background and was a product leader for Square Capital and Square Cash. Cortes had many years of experience as an engineer, having been a senior software engineer at Google prior to Square. Perito had been a director of security and risk engineering at Square. Kolovson led the retail team at Square and led operations for Caviar.

During his time at Square, Rhodes realized “the power that technology could have in improving people’s lives, especially small business owners.” Before settling on a wholesale marketplace, the team brainstormed several ideas, from a car insurance company for low-income migrants to a dental drill. At one point, they were selling high-end umbrellas. While they didn’t have any issues selling it to department stores, they found that there was no way to sell to smaller retail shops online, even though that’s where the product sold best.

This gave the founders the idea of building an online wholesale marketplace, which didn’t exist at the time, with brands having to rely on offline methods such as trade shows to sell to retailers. Unlike their previous business ideas, Rhodes said that the idea of a wholesale marketplace “felt right instantly. We were solving a problem we understood really deeply”.

Faire initially struggled to gain traction despite positive reviews from early customers because of the intractable chicken-and-egg problem that new marketplaces often struggle with; without an existing demand from retailers on the platform, there is little incentive for small brands to join, and vice versa. To kickstart interest from early marketplace participants, Faire introduced net 60 payment terms, which allow retailers to test products at reduced risk — allowing them to trial new products and return any unsold merchandise after 60 days.

Faire’s launch of net 60 was the first time that small independent retailers were offered such terms and within three months of Faire introducing net 60 in late 2017, monthly gross merchandise value on the marketplace increased from $100K to $1 million. However, in January 2018, it became clear that retailers were returning an unsustainably high percentage of products and many accounts defaulted, leading the company to amend the rules to impose credit limits and create a ranking system of wholesalers and products. These changes were effective, with a 75% reduction in return rates within six months.

Product

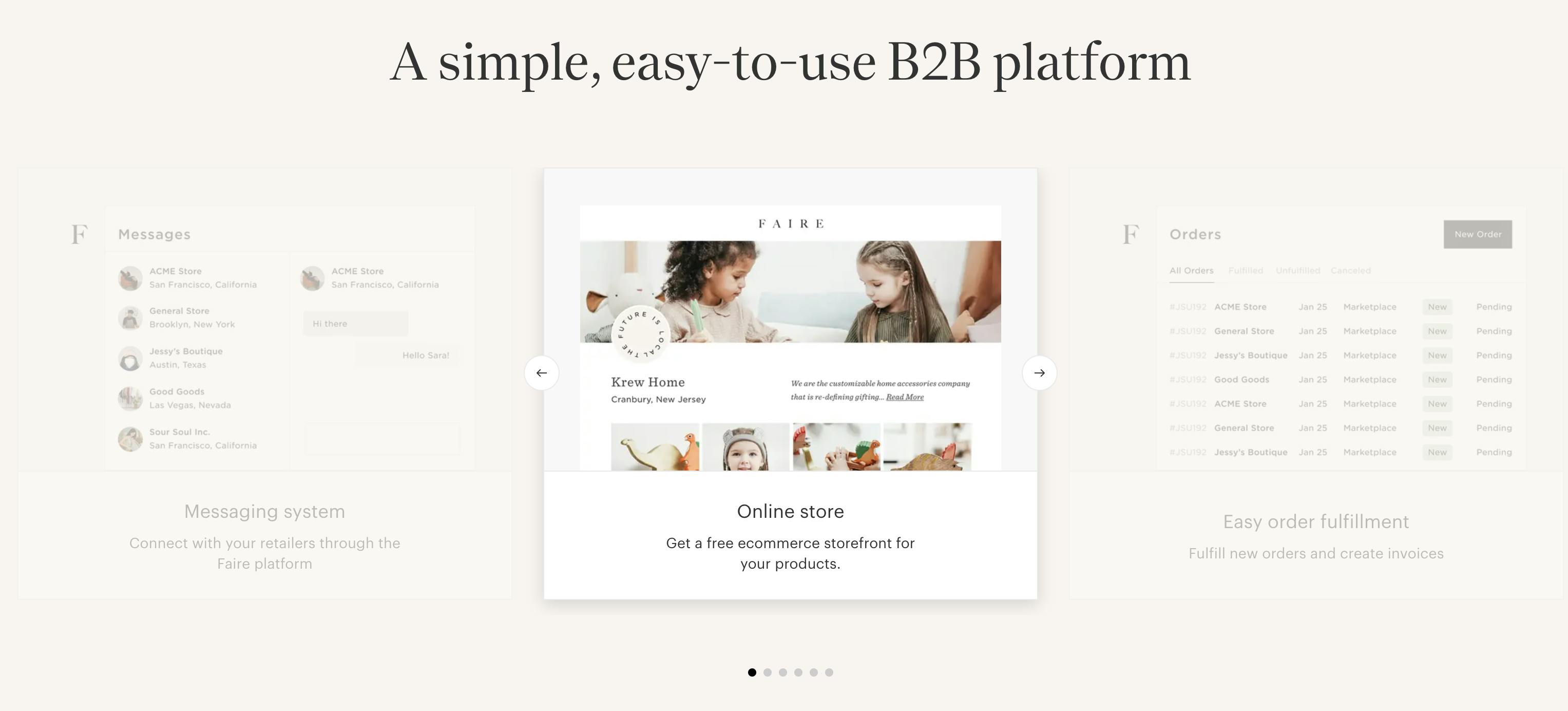

Faire is a B2B marketplace connecting independent retailers (i.e. “mom-and-pop shops”) and brands. It makes transacting easier by removing the risk for retailers of selling new products from small, unique brands and the complexity of in-person methods of wholesaling for brands, such as trade shows. Beyond its core marketplace offering, Faire also offers a suite of software tools and has two different product experiences for each side of the marketplace — one for retailers, and another for brands.

For Retailers

Source: Faire

Faire enables retailers to discover and buy new products from over 100K brands online as of March 2024. By having the purchasing process online, Faire also enables retailers to reduce the financial risk of experimenting with new products by allowing them to purchase them on credit. The terms of that credit allow retailers to buy inventory now and then pay for it 60 days later, i.e. net 60 payment terms.

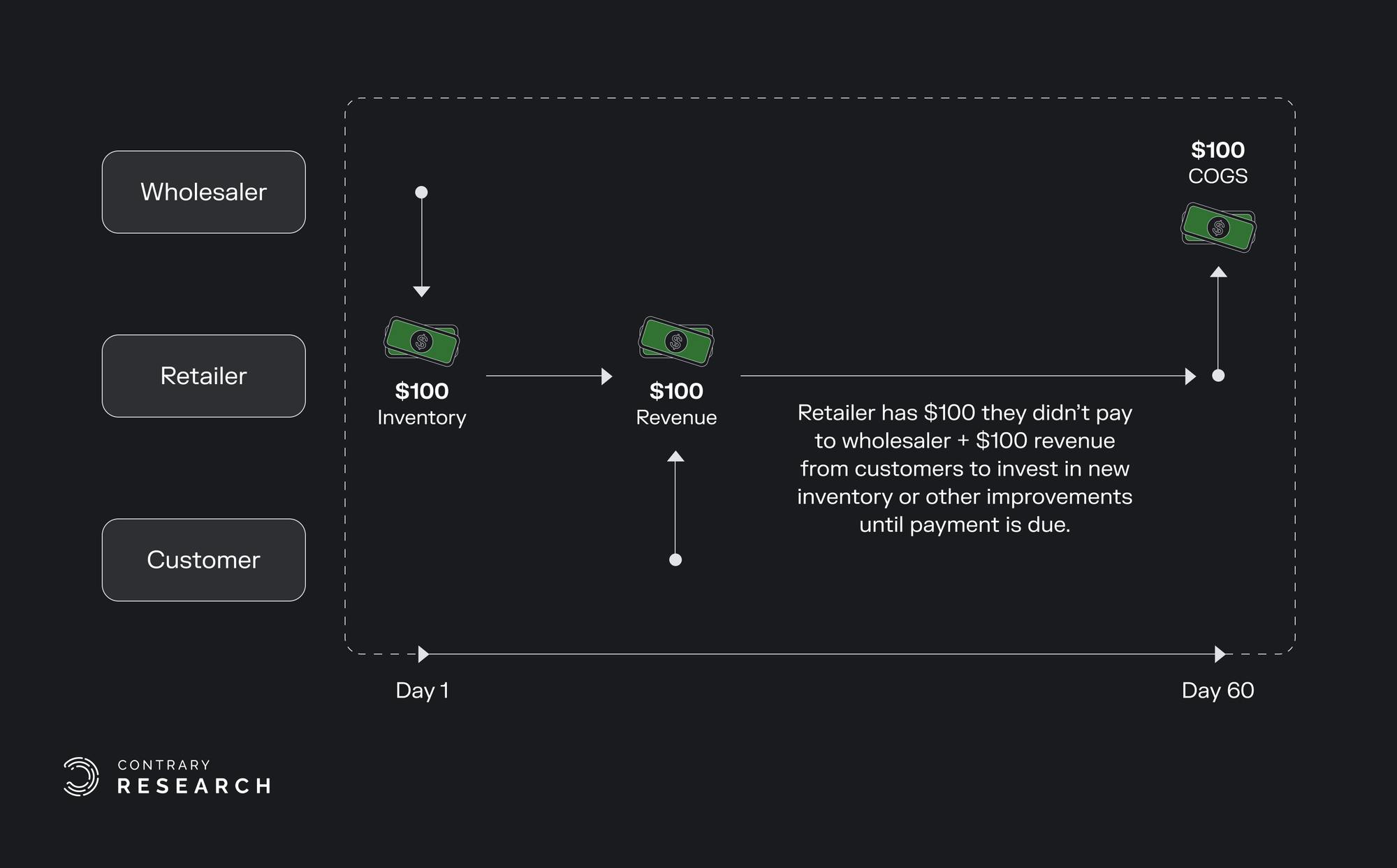

Independent retailers often have limited amounts of cash, so if they’re required to pay for inventory upfront they don’t have enough cash (e.g. working capital) to make other investments in their business. Faire covers the upfront cost of the inventory so the wholesaler gets paid immediately. The retailer is able to wait 60 days to make their payments. That means that if a retailer is able to sell its inventory during this 60-day period, it not only will have cash from the revenue of that sale, but cash that it didn’t pay the wholesaler before. That allows such retailers to more quickly experiment with other inventory and grow their businesses.

Source: Contrary Research

Faire provides the system through which retailers buy their merchandise, so Faire can make credit decisions (e.g. which customers should be able to borrow on net 60) based on past behavior, like paying invoices on time, maintaining healthy return rates, and linking their bank account to Faire. As of March 2024, the average monthly amount that retailers spend using net 60 terms was $1K.

For Wholesale Brands

Source: Faire

Wholesale brands are focused on finding retailers who want to carry their inventory. Faire offers these brands exposure to 700K (as of June 2023) verified independent retailers worldwide. Faire also offers a suite of software tools to make it easier for brands to discover, reach, and retain retailers. Through Faire’s software platform, brands can manage their digital ecommerce storefront for free, manage order fulfillment, customer relationships, and invoice creation, and analyze their transactions.

Brands also want to ensure they’re paid for their products. Faire’s net 60 arrangement with retailers means that brands get paid immediately, and the risk of any retailer not paying falls on Faire, not on the wholesale brand.

Source: Y Combinator

For any marketplace, one of the most significant risks is disintermediation, i.e. the risk of marketplace participants moving their transactions off-platform and doing business with each other directly. The ability to ensure payment helps disincentivize this by giving wholesalers a reason to purchase through Faire, rather than going directly to the retailers themselves, and giving retailers a reason to buy through Faire by allowing them to extend their payment terms.

Market

Customer

Faire appeals to two types of customers: independent retailers, and wholesale brands. Faire CEO, Max Rhodes, described Faire’s early target customers as follows in 2018:

“Local retailers today survive on their ability to find the best products for their stores and offer them at reasonable price points. After all, that’s what keeps customers coming back. Too many local retailers just buy the same stuff over and over again. Those that do experiment often end up marking up their best-selling items well over their suggested retail price to cover the costs of bringing in products that don’t sell. In a world where consumers have limitless options available at cutthroat prices online, that’s simply not sustainable.”

Small retailers have to experiment with new products to be able to grow their businesses, but this has historically been expensive and risky. Retailers might exert effort and spend money on inventory only to see a new item not sell. Meanwhile, small brands typically don’t have the scale or capital to offer favorable payment terms to retailers, which means that they can’t mitigate the risk that retailers would take on to buy their products. Faire satisfies both customers by reducing the risk to retailers and increasing the viability for wholesalers. As of June 2023, there were 700K independent retailers on the Faire marketplace. As of March 2024, it had over 100K independent small brands.

Market Size

Faire’s addressable market is quite large, even in comparison to other large markets such as B2C ecommerce and offline retail. As of November 2023, there were 2.7 million independent retailers in the US with an estimated $3.5 trillion in annual revenue, a figure that is projected to increase to $3.7 trillion by 2025. In comparison, Amazon’s revenue was $574.8 billion and Walmart’s revenue was $611.3 billion in 2023 for a total of $1.2 trillion, or about a third of the revenue of independent retail that same year. Meanwhile, the global B2B ecommerce market was valued at $18.7 trillion in 2023 and is forecast to increase to $56.6 trillion by 2030, growing at a CAGR of 18.2%.

Source: Morgan Stanley; Contrary Research

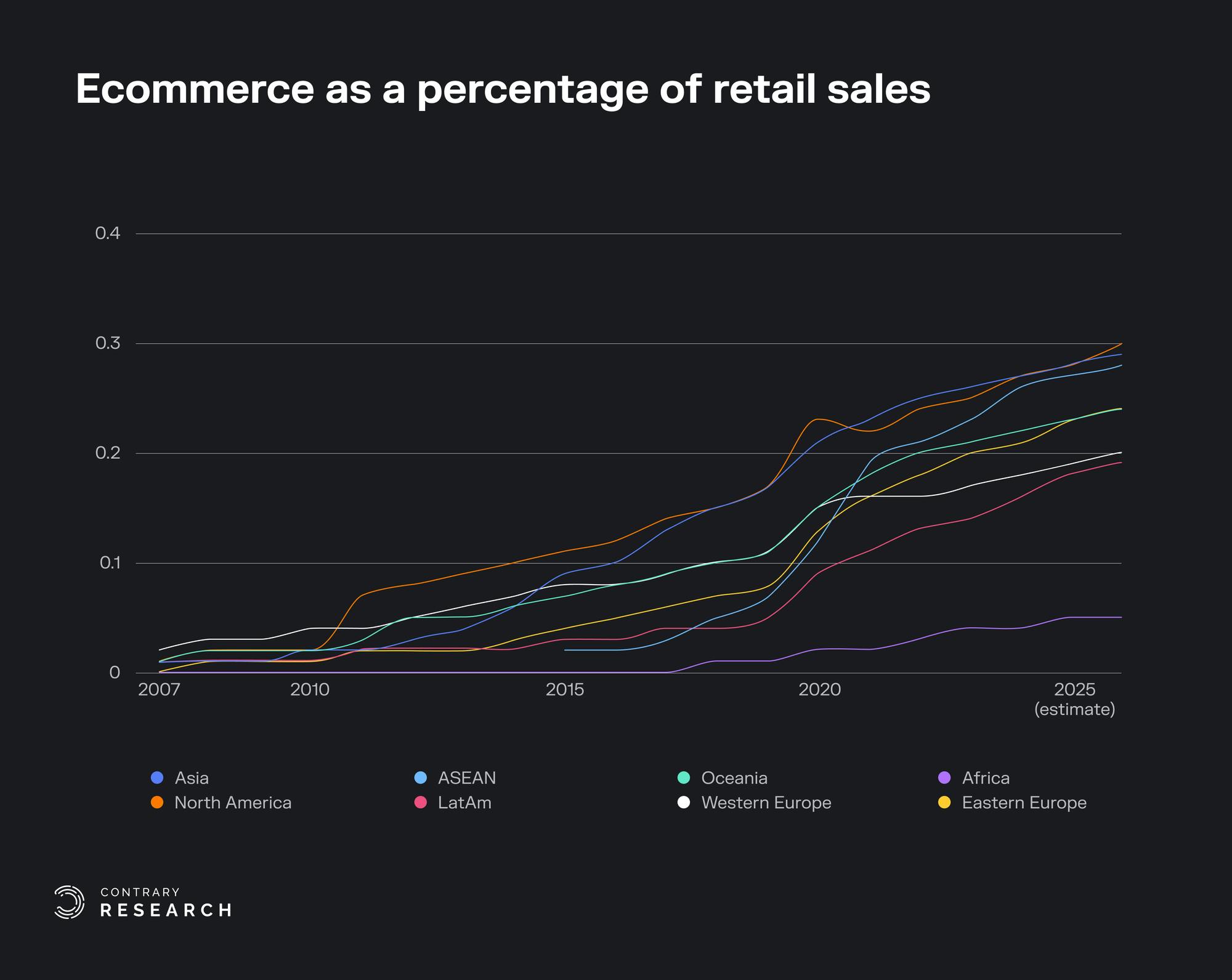

In the consumer market, ecommerce penetration has continued to grow steadily, reaching 23.5% in Q4 2023, up from just 5% back in 2010. B2B commerce lags behind on this digital growth curve, with only 4% penetration as of 2020, and only ~0.4% of B2B transactions happening via marketplaces like Faire as of June 2022. If ecommerce in the B2B market follows the same growth pattern as in B2C, then it will substantially increase Faire’s addressable market over time.

Competition

While Faire is one of the largest players focused on enabling B2B commerce (calling itself the world’s leading B2B retail marketplace in 2023), it faces threats both from other B2B marketplaces such as Ankorstore, as well as consumer ecommerce players that are expanding into B2B commerce such as Shopify and Alibaba.

Ankorstore: Ankorstore, a Paris-based wholesale marketplace, focuses primarily on the European market, providing a platform for independent retailers to source products directly from European makers. Founded in 2019, the company raised a $283 million Series C round in January 2022. As of March 2024, it had over 30K brands and more than 300K retailers on its platform. While Faire has focused on the US market and started expansion in European and Australian markets, Ankorstore's focus on the unique dynamics of the European market and position as a local company make it a strong competitor in that region.

Shopify Handshake: While Shopify is most well-known for enabling merchants to set up a storefront and sell directly to consumers, Handshake is its product for enabling businesses to transact with each other. Shopify acquired Handshake in 2019 and re-launched the product in late 2020. Shopify doesn’t share meaningful data on Handshake’s coverage, other than offering “tens of thousands of products from handpicked suppliers.” Handshake allows retailers to manage their wholesale purchasing within their existing Shopify ecosystem.

Alibaba: Founded in 1999, Alibaba is a China-based multinational conglomerate specializing in ecommerce. With a market cap of $183 billion as of March 2024, Alibaba operates one of the world's largest B2B marketplaces, connecting manufacturers, wholesalers, and retailers globally. While Faire targets small and medium-sized businesses with a curated selection of products, Alibaba's wholesale marketplace caters to a wider audience, providing a broad range of products from manufacturers across the globe. Alibaba's significant resources, established market presence, and scale pose a competitive threat to Faire. Moreover, Alibaba's extensive logistics network and established global supply chain could offer competitive prices and delivery times that are difficult for Faire to match.

Business Model

As with other marketplaces, Faire generates the majority of its revenue by charging commissions on transactions made on its platform, known as a take rate. Faire charges a 15% take rate on standard orders as of March 2024. It also charges a new customer fee of $10 on top of the standard commission fee to brands that attract a new retailer customer via Faire. The company says that this $10 fee is to compensate the company for the costs of driving retailers to discover shops on Faire, including incentives for first-time buyers, free returns on first orders, and marketing costs.

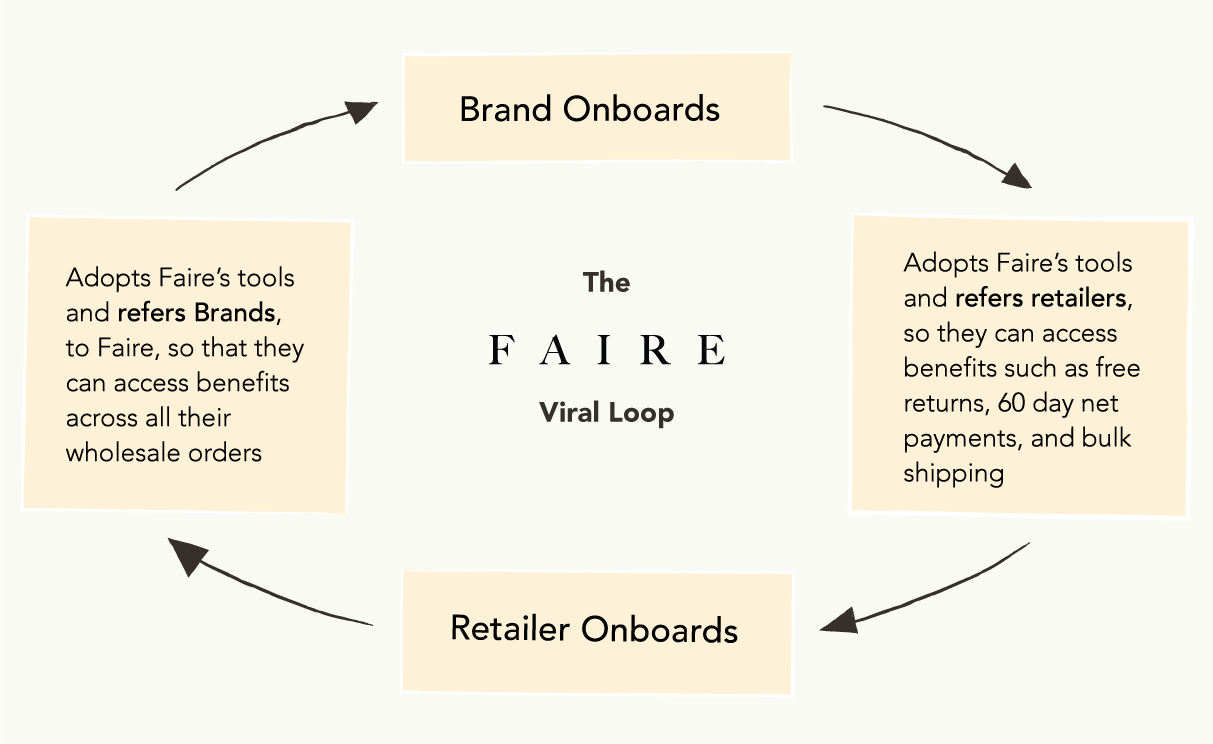

However, Faire does offer the ability for its brands to grow sales at a 0% commission via Faire Direct, which is a personalized link and supporting tool that it provides for brands. This 0% commission rate only applies to the first order of new customers, which is intended to incentivize brands to help Faire bring more retailers onto its marketplace. Finally, Faire does charge various payment processing fees depending on whether it is a next-day payout, 30-day payout, or 60-day payout.

On the cost side of the business, Faire takes on risk by offering net 60 credit terms. If retailers default on the credit that Faire extends, Faire is responsible for those credit losses, as it has already covered the payment to the brands. In early 2018, shortly after the company’s founding, Faire experienced a credit crisis. Retailers were returning a huge amount of purchased products, and many also defaulted, leading to unsustainable costs. Consequently, Faire rewrote its marketplace rules, imposed credit limits, and re-engineered its risk assessment engine. Faire has since invested in risk management to offer net 60 terms while maintaining reasonable costs.

Traction

In its first year of operation, Faire introduced net 60 terms for the first time for small independent retailers to help crack the cold start problem often faced by new marketplace businesses. Within three months, monthly gross merchandise value on the marketplace increased from $100K to $1 million. By November 2021, Faire reported that it served 300K retailers across North America and Europe, as well as over 40K brands from over 80 countries, and had reached $1 billion in annual GMV — implying revenue of at least $150 million at its current take rate of 15%.

By November 2022 there were 600K independent retailers on Faire, double the previous year, and 85K small brands. By June 2023, there were 700K independent retailers on the platform. In September 2023, Faire announced a partnership with Shopify, a competitor, which made it the company’s recommended wholesale marketplace in exchange for Shopify receiving equity in Faire. In March 2024, Faire reported having 50K retailers on its UK marketplace, which had been launched three years prior, and 100K small brands on its platform.

In October 2022, Faire laid off 7% of its workforce of 1.2K employees. A year later, in November 2023, Faire had a more significant layoff of 20% of its staff, or about 250 people, with the company’s given reason for the layoff being to create better alignment with its long-term vision.

Valuation

In May 2022, Faire raised a $416 million Series G extension which added to an initial $400 million it raised in November 2021, more than doubling the size of the round. The extension valued the company at $12.6 billion and brought the company’s total funding to $1.7 billion. Its first $400 million tranche of Series G financing was co-led by Durable Capital Partners, D1 Capital Partners, and Dragoneer Investment Group, and the $416 million extension was led by Sequoia and Y Combinator.

Key Opportunities

Continued Geographical Expansion

After scaling in North America and establishing an additional presence in Europe and Australia, Faire can continue to look to new markets to drive growth. Faire’s growth in Europe has been fairly rapid — in November 2021, Faire mentioned that six months after it expanded into 15 markets in Europe, it had already reached $150 million in annualized sales volume. Faire can continue to expand in Europe, and potentially move on to other geographies with large consumer retail sectors, such as Asia Pacific, and Latin America.

Expanding Upmarket

Expanding upmarket into serving larger retailers in addition to the existing small retailer base is also an area of opportunity for Faire. Historically, Faire has focused on serving smaller retailers. However, larger retailers could present a large opportunity. Larger retailers represent larger lifetime value (LTV) given their transaction volume.

Key Risks

Macroeconomic Volatility

Faire has operated in a strong macroeconomic environment for the company’s history. Decreased economic activity can jeopardize retail sales, which can hit smaller retailers and brands especially hard since they are less resilient to adverse conditions in comparison to their larger peers. Retailers and brands struggling could mean less transaction volume taking place on Faire’s marketplace. Retailers and brands going out of business would mean a weaker marketplace ecosystem, and retailers struggling in adverse macroeconomic conditions could lead to escalated levels of returns and credit defaults, which could negatively affect Faire’s unit economics.

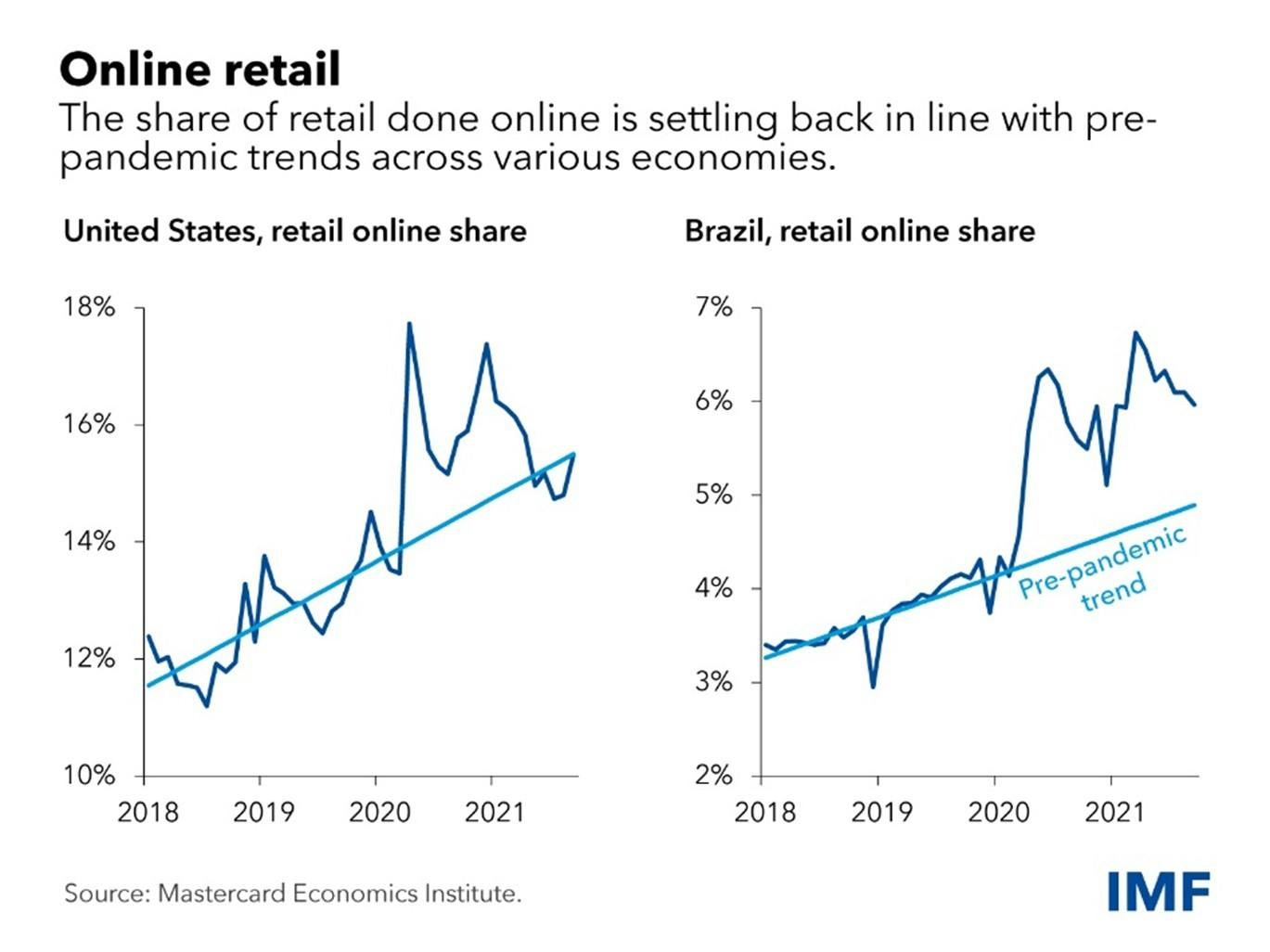

Return to In-Store Shopping

Faire’s business model, based on its online wholesale marketplace that connects makers and retailers, faces a risk with a return to in-person shopping post-COVID. Although the COVID-19 pandemic helped catalyze Faire’s growth, ecommerce habits formed during COVID have not shown to be wholly durable post-pandemic, with customers returning to stores in greater frequency and faster than the ecommerce industry anticipated.

Source: IMF

The resurgence of traditional shopping experiences could shift the demand back towards established supply chain relationships and diminish the perceived value of Faire's platform. This presents a challenge for Faire to sustain its rapid growth and continue to attract and retain users in a post-COVID retail environment.

Summary

Faire applies both software and economic incentives to improve the wholesaling process for both retailers and brands. The company was able to ride the wave of small independent retailers who needed the right tooling to compete with giants like Amazon and Walmart. As a two-sided marketplace, it benefits from a network effect that increases in value for both retailers and brands as it scales. It monetizes the transactions on its platforms with a standard take rate. The company stands to benefit from the growth of B2B commerce, which lags behind consumer ecommerce but may follow a similar trajectory if it can maintain and expand its market share.