Thesis

Livestream shopping is a fusion of online entertainment and ecommerce that experienced rapid growth in China after its emergence during Alibaba’s Taobao Live launch in May 2016. By 2021, livestream shopping accounted for 11.7% of all retail ecommerce sales in China, or about $366 billion. It continued to see growth in the post-pandemic period, with $520.5 billion in gross merchandise value by 2022. In November 2023, livestream shopping saw a 19% increase in sales in the Chinese Singles Day shopping festival over the previous year.

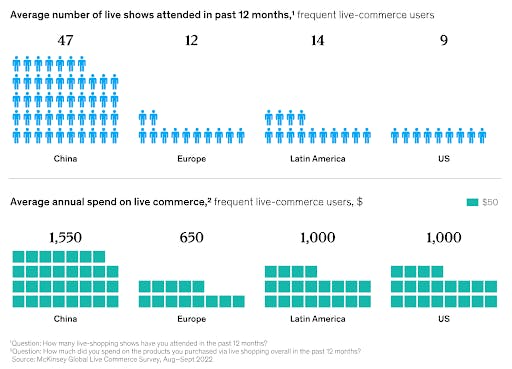

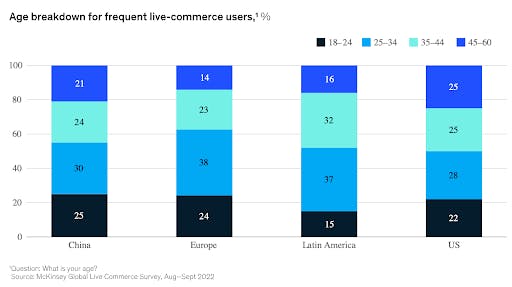

This trajectory could soon be paralleled in the US, where livestream shopping has not yet reached the same mainstream adoption as in China. Livestream shopping accounted for $20 billion in revenue in the US in 2022, while ecommerce sales as a whole were $7.1 trillion in the same year, meaning that livestream shopping accounted for just 2% of US retail ecommerce and 0.3% of total retail sales that year.

Source: McKinsey & Co.

One report from March 2023 estimated that livestream ecommerce in the US would reach a market size of $31.7 billion by 2023, and projected this to increase to $67.8 billion by 2026 when it would then account for 5% of ecommerce sales. If the growth of livestream shopping in China is an indicator of the potential for its growth in the US, livestream shopping could continue to see rapid growth throughout the decade.

Whatnot, which launched in December 2019, is a livestream shopping marketplace. Having launched with a focus on collectibles like Funko Pops and sneakers, Whatnot has since expanded into a wide variety of ecommerce categories including sports cards and memorabilia, comics, action figures, fashion, electronics, jewelry, and even perishables like food and pet supplies. By September 2021, it had become the most valuable independent livestream shopping company in the US, with 20x sales growth year-over-year in 2021 and 3x sales growth in the first half of 2022.

Founding Story

Whatnot was founded in December 2019 in Los Angeles by Grant LaFontaine (CEO) and Logan Head (CTO). Before founding the company, the pair had a history of selling collectibles. LaFontaine started selling Pokémon cards in middle school and sneakers later in his 20s, while Head had previously been a senior product manager at the sneaker marketplace GOAT.

Source: Los Angeles Business Journal

Before Whatnot, LaFontaine was a Product Manager for Facebook, co-founder of Kit (acquired by Patreon), and a Product Marketing Manager at Google. Head got a BS in Management Information Systems from The University of Montana. Before Whatnot, he was Senior Product Manager of GOAT after his previous company, Fight Club, was acquired by GOAT in 2018.

In April 2022, LaFontaine described Whatnot as having initially been a “high-end Craigslist-style platform” where anything could be bought and sold. The business then narrowed down to buying and reselling collectibles — starting with sneakers before branching out into Funko Pops (a type of vinyl collectible).

Whatnot then added a livestreaming element in the summer of 2020 after Head spent six weeks coding the app, not long after participating in YC W20’s Demo Day. During the first livestream on the app, Whatnot sold $5K worth of FunkoPops in a few hours.

Initially, investors were skeptical of a marketplace for resale collectibles utilizing live-streaming, causing the company to have difficulty fundraising. As LaFontaine put it in an interview:

"One of the challenges that we had when talking to people was that no one understood this world. No one understood why someone would collect, who would collect… When we spoke with people who did, it was much easier. But there's not that many of them who are investing.”

Whatnot completed its time at Y Combinator in 2020, and the program helped the team with their early fundraising efforts. Despite this, they had to talk to over 100 investors before they were able to secure their first $300K in pre-seed fundraising.

Product

Marketplace

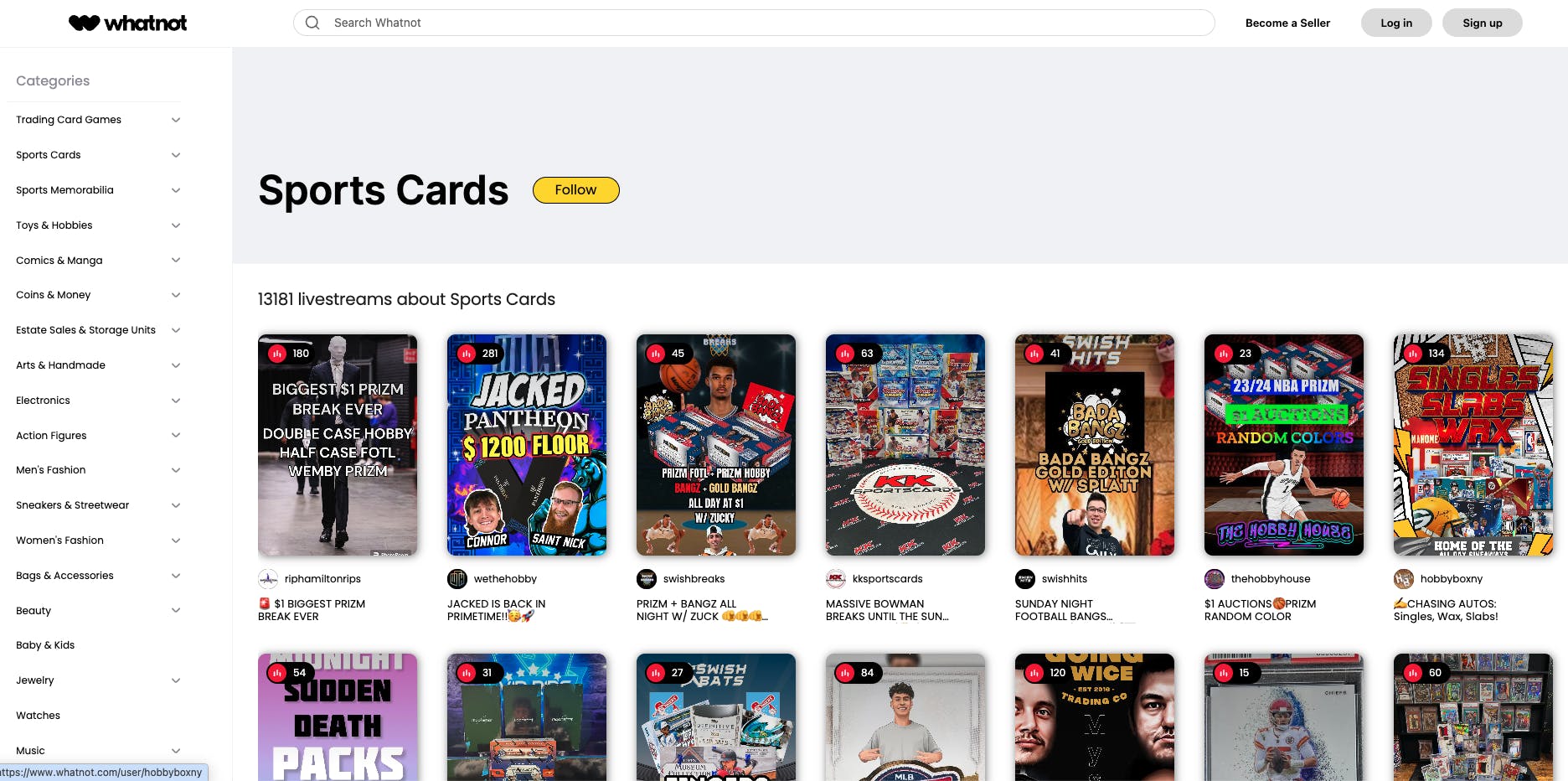

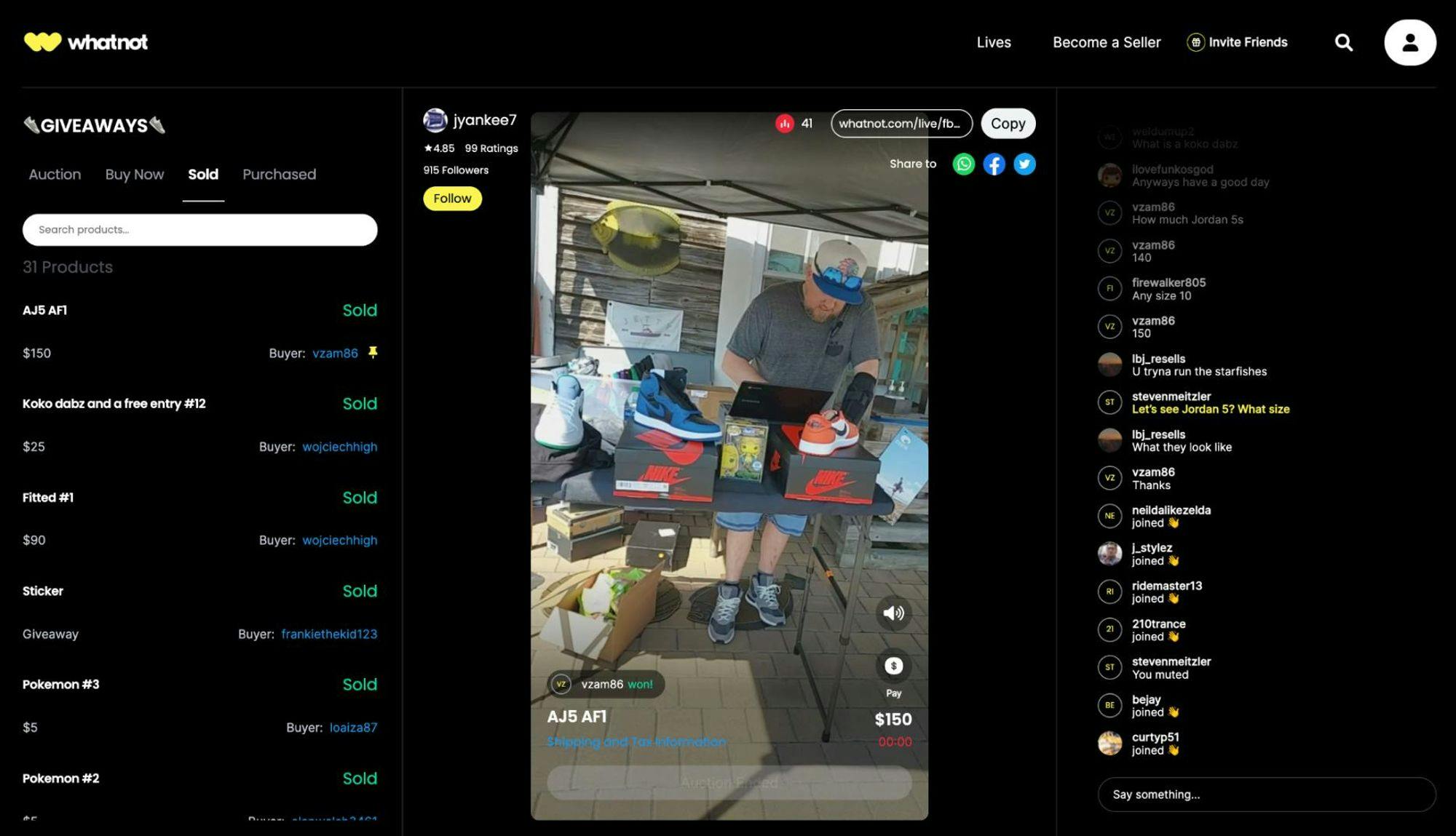

Source: Whatnot

Whatnot provides “experience-based shopping” for collectibles and other products through its livestream shopping marketplace. In describing why a16z invested in Whatnot’s Series A round, Connie Chan described the appeal of livestream shopping this way:

“Livestream shopping is entertaining and full of discovery, and it’s far more immersive than your typical eCommerce experience. It’s like a group treasure hunt where the hosts curate items and create a lively environment that makes shopping fun again. Similar to Pinterest, shopping becomes a byproduct of entertainment."

Whatnot combines aspects of traditional online shopping marketplaces like Craigslist or eBay with aspects of livestreaming platforms like Twitch — a place for enthusiasts of everything from watches to sneakers to go and, not only be entertained, but to discover and buy new products.

Source: Whatnot

Whatnot has a wide and growing variety of categories of resale products, including trading cards, clothing, and collectibles. All categories of seller streams can be accessed through the main app interface or the desktop website as a buyer/viewer. In contrast, sellers/influencers must submit an application before they can start hosting a stream.

Seller Experience

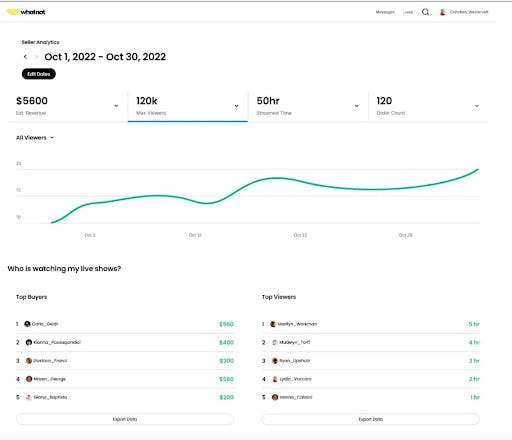

Source: Whatnot

For sellers, Whatnot provides the opportunity to earn revenue via sales while also building an audience as a creator. Influencers can monetize their following and become sellers, but sellers can also become influencers. Some sellers have built a big enough business and following using the Whatnot platform they were able to quit their jobs and work as sellers full time.

Sellers must apply to become sellers on Whatnot. According to an April 2023 interview with CEO Grant LaFontaine, less than 50% of applicants get approved to become sellers on Whatnot. However, as of March 2024, the company claimed that sellers on average sold over $6K per month on Whatnot.

Whatnot says it provides a “dedicated support staff” for sellers in order to facilitate customer support. After sellers are approved by Whatnot to join the platform, they can start a live stream where they can chat and interact with their live audience. Sellers set a starting price and time limit for the item they’re selling, which can be sold via auction to the highest bidder or can also be sold via a set price with a “Buy it Now” call to action. Sellers can also access a giveaway feature to help attract an audience.

Whatnot also provides a dashboard for its sellers where they can order pre-paid shipping labels to ship out their sales to their customers. Sellers can receive payment via PayPal or direct deposit from Whatnot as of March 2024.

Market

Customer

In a September 2021 interview with CEO Grant LaFontaine, Whatnot described its ideal customer profile this way:

“We’re focused on collectors and enthusiasts. We work backwards from what they want in terms of our product mix. Almost all of the things we have launched have been things that our audience wanted from us. Things like sports cards, comic books, action figures. That is really the driver of the categories. If they don’t love the products, then we don’t have anything to offer.”

Whatnot’s early users were therefore young (typically Gen Z), had plenty of disposable income, and were enthusiastic collectors of items like Pokémon cards, designer toys, and NFL/NBA trading cards. As of March 2024, 85% of Whatnot’s users were Americans, 65% were male, and 78% were younger than 44 years of age according to estimates from Similarweb.

Source: McKinsey & Co

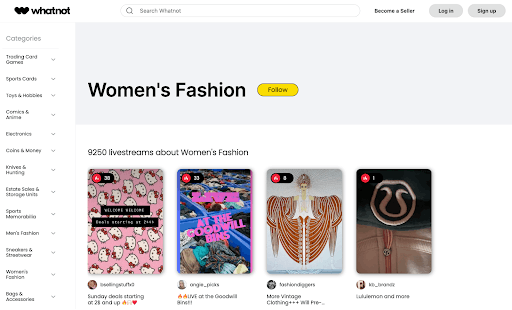

In May 2021, LaFontaine said the company sells millions of dollars of sports cards per month, making it the company’s most popular product category. However, the company has since expanded its categories and as a result, its target customer has broadened beyond its initial collector audience. In an April 2023 interview, LaFontaine said that fashion was Whatnot’s fastest-growing category and that within a year or two he expected it to grow to the company’s largest category.

Source: Whatnot

Market Size

In 2017, livestream shopping accounted for $2.9 billion in gross merchandise value (GMV) in China. By 2021, livestream shopping accounted for 11.7% of all retail ecommerce sales in China, or $366 billion. This increased to $520.5 billion by 2022 and was estimated to be $700 billion in 2023. In November 2023, it was reported that Goldman Sachs expected livestreaming ecommerce to grow 18% in China a year for the next two years, compared to 11% for ecommerce overall. The US has not seen the same level of adoption as yet, but it may follow a similar trajectory. CEO Grant LaFontaine predicted in 2021 that “in five to 10 years, the numbers (in the US) will look like they are in China today.”

Livestream shopping accounted for $20 billion in revenue in the US in 2022, while ecommerce sales as a whole were $7.1 trillion in the same year, meaning that livestream shopping accounted for just 2% of US retail ecommerce and 0.3% of total retail sales that year. One report from March 2023 estimated that livestream ecommerce in the US would reach a market size of $31.7 billion by 2023, and projected this to increase to $67.8 billion by 2026 when it would then account for 5% of ecommerce sales.

Competition

Startups

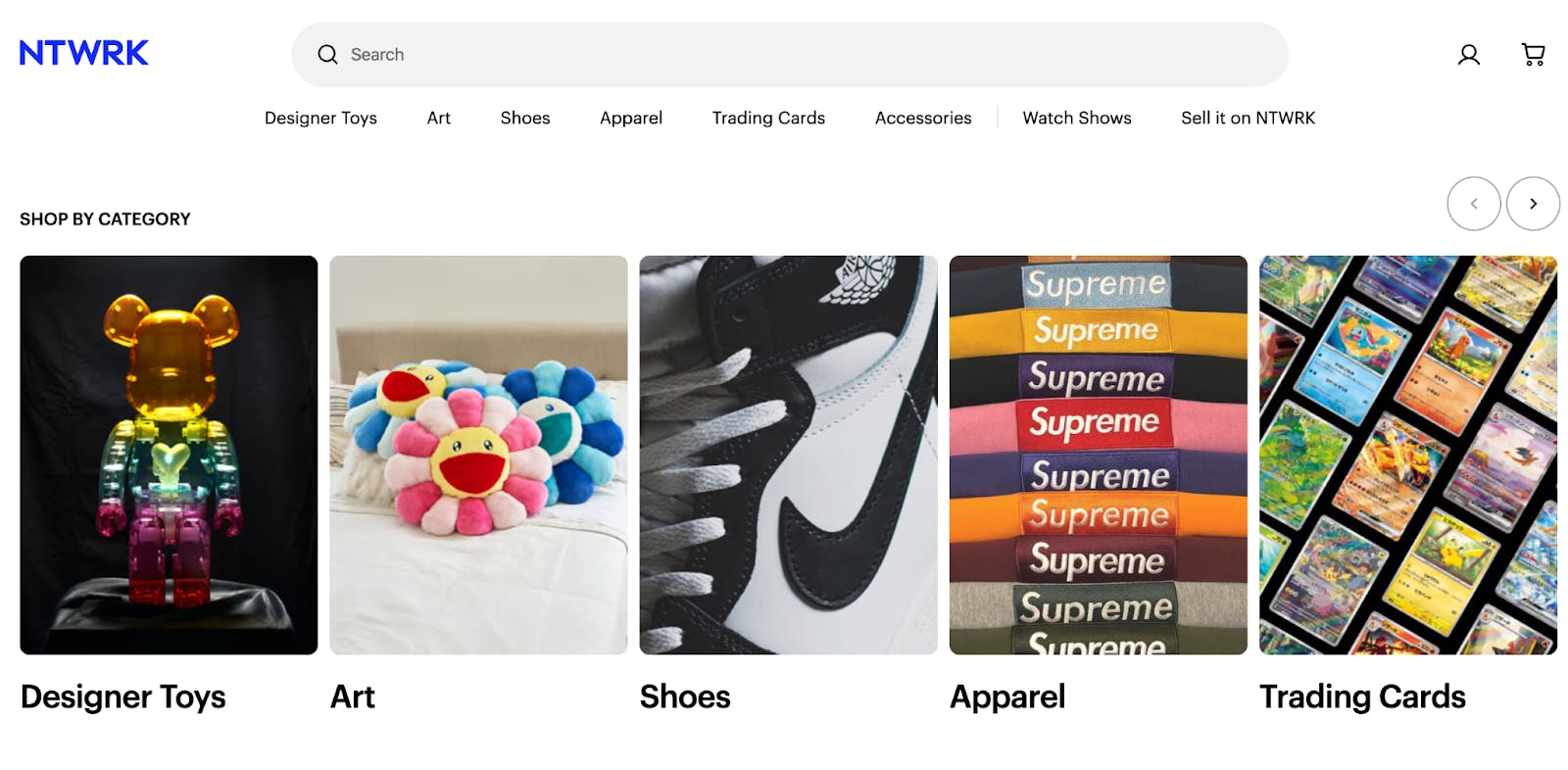

Ntwrk: Ntwrk is a company that describes itself as a “live video shopping” platform. It is targeted at Gen Z and Millennials. Ntwrk offers daily drops and allows users to shop for art, sneakers, fashion, trading cards, and more. The company had 2.2 million users as of July 2021 and had raised $60 million in total funding as of March 2024. It raised $50 million in September 2021 in a round led by Goldman Sachs Asset Management and Kering, a global luxury group that owns Gucci, Yves Saint Laurent, and other luxury brands. Ntwrk’s platform features more exclusive and limited edition products, while Whatnot’s marketplace features a wider range of goods.

Source: NTWRK

Firework: Firework, which launched in 2017, is a platform that offers video commerce solutions for brands and retailers. Brands can use Firework to create interactive video experiences for their apps and websites which are designed to allow customers to directly purchase products featured in videos without leaving a website, while also allowing viewers to interact with content via live chats, polls, and questions. As of March 2024, Firework had over 1K clients across 37 countries and had raised $269.3 million in total funding. In May 2022, it raised a $150 million Series B led by Softbank Vision Fund 2 which valued the company at $750 million.

Source: Firework

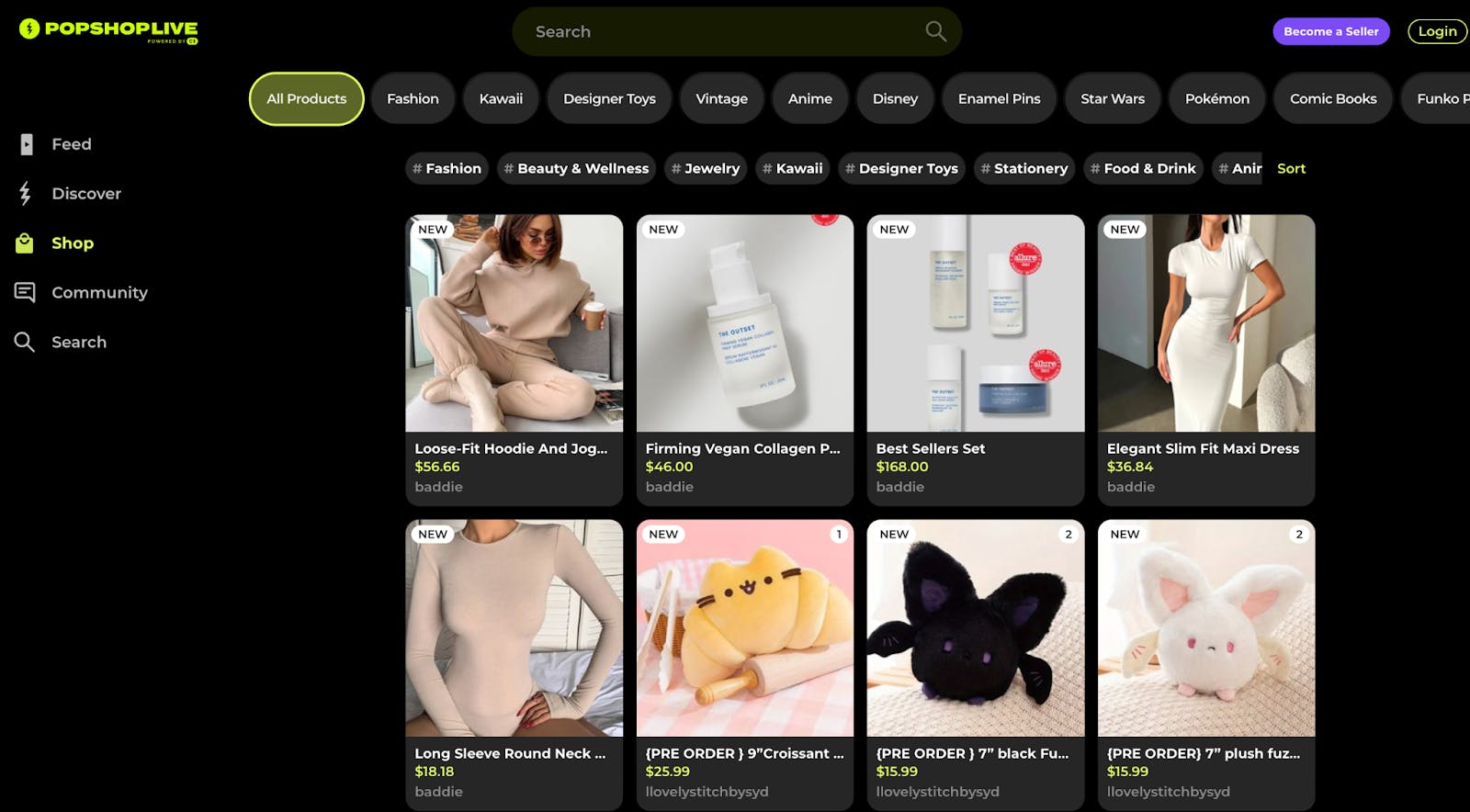

Popshoplive: Popshoplive is a mobile, live-streaming marketplace where brands and individuals can create and host their own pop-up shopping channels and sell products. The company has raised $23 million in total funding as of March 2024. It raised a $20 million Series A in July 2021 led by Benchmark which valued the company at $100 million. Other notable investors included SV Angel and Access Industries along with celebrities like the Chainsmokers, Kendall Jenner, Hailey Bieber, and others. As of February 2023, Popshoplive took nine percent commission on sales compared to Weight percent. It also features integrations with iPhone, iPad, and Android devices. In June 2022, the company laid off 18% of its staff, citing a shifting economic climate. It laid off a further 25% in August 2022.

Source: Popshoplive

Incumbents

Amazon: In August 2022, Amazon began testing livestream shopping in its app under the trial name “Inspire”. This feature was released to select customers in December 2022. As of March 2023, Amazon Inspire became available to all US customers. It can be accessed within the Amazon app.

TikTok: TikTok, which is owned by Chinese company ByteDance, launched TikTok shop in the US to its 150 million users in September 2023. It offers shoppable videos and live streams to users’ “For You” feeds. The company expected to see $20 billion in GMV in 2023, up from less than $5 billion in 2022.

Business Model

As of March 2024, Whatnot charges an 8% commission on the price of an item when it sells. in addition to this, it charges 2.9% + 30 cents as a processing fee for each transaction. The company occasionally runs promotional discounts on the amount of the fees it takes, such as a reduced 4% commission on vintage comics and coins that it ran from October 2023 through March 2024.

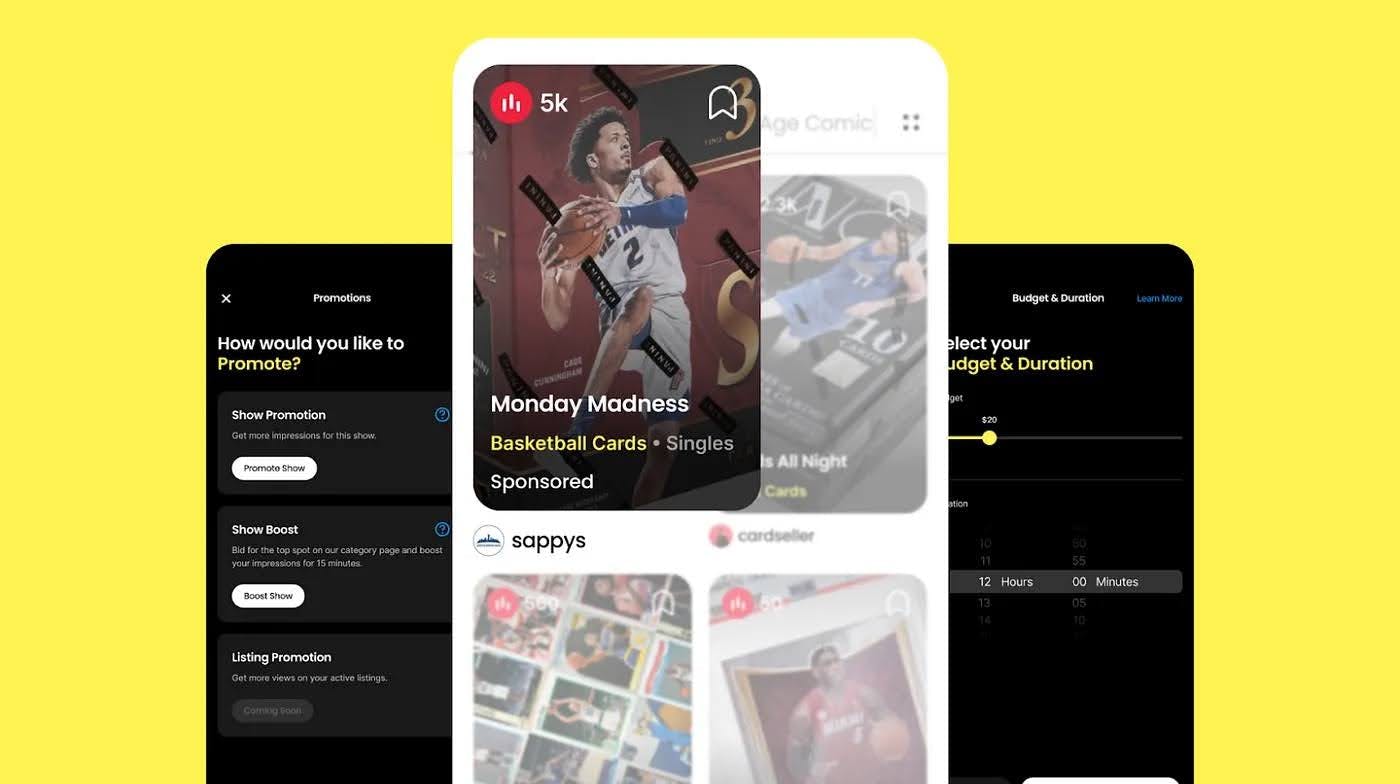

In a September 2021 Interview, Whatnot CEO Grant LaFontaine hinted at supplementing this take-rate business model, which is typical for marketplaces like Airbnb or eBay, with an additional ads business more typical of social media companies like Twitch:

“Right now, the business is supported by taking a cut, 8%, of every transaction. People do spend a lot of time in the app. On average, users are watching over an hour of video per day. With that much engagement, we could build an ad business.”

This vision was made a reality in May 2023, when Whatnot introduced its initial ads product: boosted livestreams. Boosted livestreams allow sellers to purchase the first position in their category feed for 15 minutes and serve as an additional revenue stream for the company.

Traction

By June 2022, the WhatNot app had 2 million installations between the App Store and Google Play, with US users accounting for 89% of this. In the months following its initial livestreaming launch on the app in 2020, Whatnot reportedly grew 120% month over month resulting in over 200x growth in gross sales from July 2020 to July 2021. In addition, Whatnot grew sales 20x (with a 30x increase in GMV) in the 2021 calendar year.

As of July 2022, WhatNot has its “sights set on expanding into more categories” according to CEO Grant LaFontaine. Whatnot was the largest livestream shopping platform in the US by July 2023 according to BusinessWire, and the company said it had not seen “any slowdown in business” in the wake of the COVID-19 pandemic. CEO Grant LaFontaine stated in April 2023 that:

“We’ve not seen any slowdown in the business whatsoever linked to before or after Covid. Our growth has and continues to be very good. Last year was our best year on record by a mile, last month was our highest ever month, to give you a sense of kind of our business trajectory.”

Furthermore, Whatnot was ranked at number nine on Andreessen Horowitz’s Top 100 Marketplaces of 2023 list, which is ranked on the annual GMV of the respective marketplaces. LaFontaine also stated that more than 100 Whatnot sellers sold $1 million or more in 2022. In November 2023, WhatNot signed a seven-year lease for 15K square feet of office space in a building in Manhattan.

Valuation

Whatnot raised $260 million in Series D funding at a $3.7 billion valuation in July 2022. The round was co-led by DST Global and CapitalG, with participation from past investors like Andreessen Horowitz and YC Continuity. This brought its total funding to $487 million. Less than a year prior to this, Whatnot raised a $150 million Series C in September 2021 which valued the company at $1.5 billion.

Key Opportunities

Product Expansion

Early on, Whatnot focused on selling collectibles such as sports cards, comic books, and action figures which made up the bulk of its early business. Since then, it has expanded to a wide variety of categories, from men’s fashion to books to electronics, as it increasingly comes to resemble the livestream shopping version of the “everything store”.

Among its product expansion, CEO Grant LaFontaine sees fashion in particular as one of Whatnot’s most important categories. In April 2023, he stated that fashion had become “our fastest growing segment by a pretty long shot” and that “within a year or two I wouldn’t be surprised if fashion is the biggest [category on Whatnot]”.

In the same interview, LaFontaine expressed plans to add new functionalities like tipping to the platform, as well as to invest in electronics and build out more fashion categories like luxury fashion. He also said hiring would increase by 40%-50% across the team in the ensuing year to support the expansion of the company.

Growth of Live Shopping

Live shopping’s interactive format enables merchants to present content and recreate the in-store experience in an online setting. Instead of relying on product descriptions and online reviews, customers can join digital live video broadcasts where they can engage in real-time conversations about products before making a direct purchase.

In September 2021, LaFontaine stated his belief that even amidst the crowded livestream shopping space, there are plenty of opportunities to continue to expand amidst a rapidly growing pie:

“To me, what’s clear is that livestream and social commerce is just going to be monstrous in the U.S. and the western world. The retail market for things that can be shipped in boxes is estimated to be $2.7 trillion, and only $500 billion of it is online. It’s really clear that ratio should probably switch with trillions of dollars of product sold online. And livestream shopping can tap into that through the fun side of shopping.”

The opportunity for Whatnot is to become the de facto method for US consumers to engage in livestream shopping, even as livestream shopping grows its share over the overall retail pie.

Key Risks

Uncertainty Around Livestream Shopping Adoption

One of the key potential drivers of Whatnot’s success would be if livestream shopping were to follow a similar growth trajectory in the US to that seen in China. However, there may be unique characteristics of the Chinese market that enabled such growth that may not translate fully to the US. A December 2022 survey found that 78% of US respondents had never joined a livestream shopping event, and if livestream shopping fails to continue to grow its share of the US retail pie, then Whatnot could experience difficulties continuing to grow.

Competition

Competition is coming from both well-capitalized startup peers such as Firework and Ntwrk and from large incumbents like Amazon or TikTok that entered the space in 2022-2023. LaFontaine described his perspective on competition this way:

“Everyone fears competition from big tech companies and bigger players. But, historically, they don’t destroy businesses like ours. There’s not a single fast-growing consumer startup that’s been destroyed by a big tech company. It boils down to the fact that building these businesses, getting livestream shopping to work, and all of the social commerce around that, is very difficult. It’s not as simple as adding a buy button to a livestream video.”

To remain competitive, Whatnot will need to attract and retain unique sellers with large followings, facilitate more user-generated content, and make it easy for buyers to purchase more goods. It can do this by continuing to expand the categories of products sold on the platform and creating new features that will engage sellers to produce more content and engage buyers.

Summary

While livestream shopping, a blend of entertainment and online sales, has flourished in China, it's still in its early stages in the US. Whatnot has emerged as the leading US player in this space, allowing users to buy and sell a variety of products through live streams. With the US livestream shopping market projected to reach $67.8 billion by 2026, Whatnot has a significant growth opportunity ahead. However, Whatnot faces challenges, including the uncertain adoption of livestream shopping in the US and competition from established players and startups. As the livestream shopping market evolves, Whatnot will need to navigate these challenges to capitalize on its potential.