Thesis

Digital marketplaces are reshaping retail by pushing the luxury fashion industry into online sales. This is a trend that only grew during the COVID-19 pandemic. Online sales of luxury goods, such as apparel, footwear, accessories, jewelry, watches, leather goods, beauty products, and perfumes have increased 5x since 2009 to account for 8% of the global luxury market by 2018. At the same time, younger consumers are increasing their fashion expenditure and investing in distinctive, high-end streetwear. Additionally, sustainability is becoming an increasingly common consumer preference with the expanding movement toward a circular economy. A 2023 survey found 42% of consumers think secondhand shopping has become more accessible. 30% of Gen Z would choose secondhand to afford higher-end brands.

Related to this, streetwear is increasingly becoming a big part of mainstream fashion, merging high-end labels with youth culture. Celebrity influence, social media, and a desire for exclusivity and authenticity are contributing factors to its growth. By 2030, the resale market for authenticated sneakers and streetwear is expected to reach $30 billion. However, the sector's growth introduces a significant issue: counterfeits, posing a substantial challenge for consumers and brands. The growth in counterfeit has led to suits from luxury brands such as Louis Vuitton and Nike to reselling platforms such as eBay and StockX.

GOAT Group is a holding company that houses 4 luxury fashion platforms — GOAT, alias, Flight Club, and Grailed — for primary and secondary sales of sneakers, streetwear, apparel, and accessories online and offline through peer-to-peer and consignment-based marketplaces.

Founding Story

GOAT was founded in Los Angeles, California, by Eddy Lu (co-founder and CEO) and Daishin Sugano (co-founder and Chief Brand Officer) in 2015.

Lu, a computer science graduate from the University of California Berkeley, started his career at Deloitte as a consultant and later joined Lehman Brothers and worked in equity research. Sugano, who completed his master's and bachelor's degrees at the University of Southern California, embarked on his entrepreneurial journey alongside Lu during their college years. Both grew up in LA and launched several ventures before GOAT, including an import/export business, a golf apparel company, an online tea business, and multiple mobile apps.

In 2008, amidst a financial crisis, the two entrepreneurs visited a Beard Papa's restaurant in Los Angeles and liked the cream puffs they purchased there. Seeking "passive income", they decided to franchise the Japanese chain. Unfortunately, due to the economic downturn, they could not hire managers. In 2010, Lu and Sugano moved to Chicago to expand upon Beard Papa's presence. Meeting new people in this new city proved challenging, which led the duo to create GrubWithUs, an app that facilitated socializing by enabling users to arrange meals with strangers. GrubWithUs was accepted into Y Combinator's 2011 batch and raised a $5 million round in 2012. However, GrubWithUs failed to gain much traction.

Sugano has been a passionate sneaker and basketball fan since the age of 10 when his dad gifted him a pair of Air Jordan 5 Grapes. This iconic shoe was re-released in 2013 — 23 years after its debut — honoring Michael Jordan's jersey number. When Sugano told Lu he was displeased with the lack of authentication in the online sneaker market for purchasing such shoes, Lu was struck by the potential for a brand that would combat fraud between vendors and customers. Sugano stated that:

“I did my due diligence and came up with nobody. From that point on, we decided that this is something we could solve”.

In July 2015, GOAT was launched. In November 2015, after four months in operation, the company offered a Black Friday discount on the most popular products of the year, selling them at retail prices. Over 100K users installed the app to take advantage of the sale, resulting in repeated crashes and representing an inflection point in the company’s growth.

Product

GOAT Group operates four distinct products, including GOAT, its original consignment-based resale platform. Users submit their items to GOAT for authentication, and once approved and sold, GOAT sends the item to the buyer. The company also owns Grailed, a peer-to-peer resale marketplace for streetwear and luxury wear. With this marketplace, GOAT's team digitally authenticates the listed items. In addition, GOAT Group merged with Flight Club in February 2018. Their fourth offering, alias, is a unified platform for selling products like sneakers, apparel, and accessories, providing sellers with insight into pricing and other key metrics.

GOAT

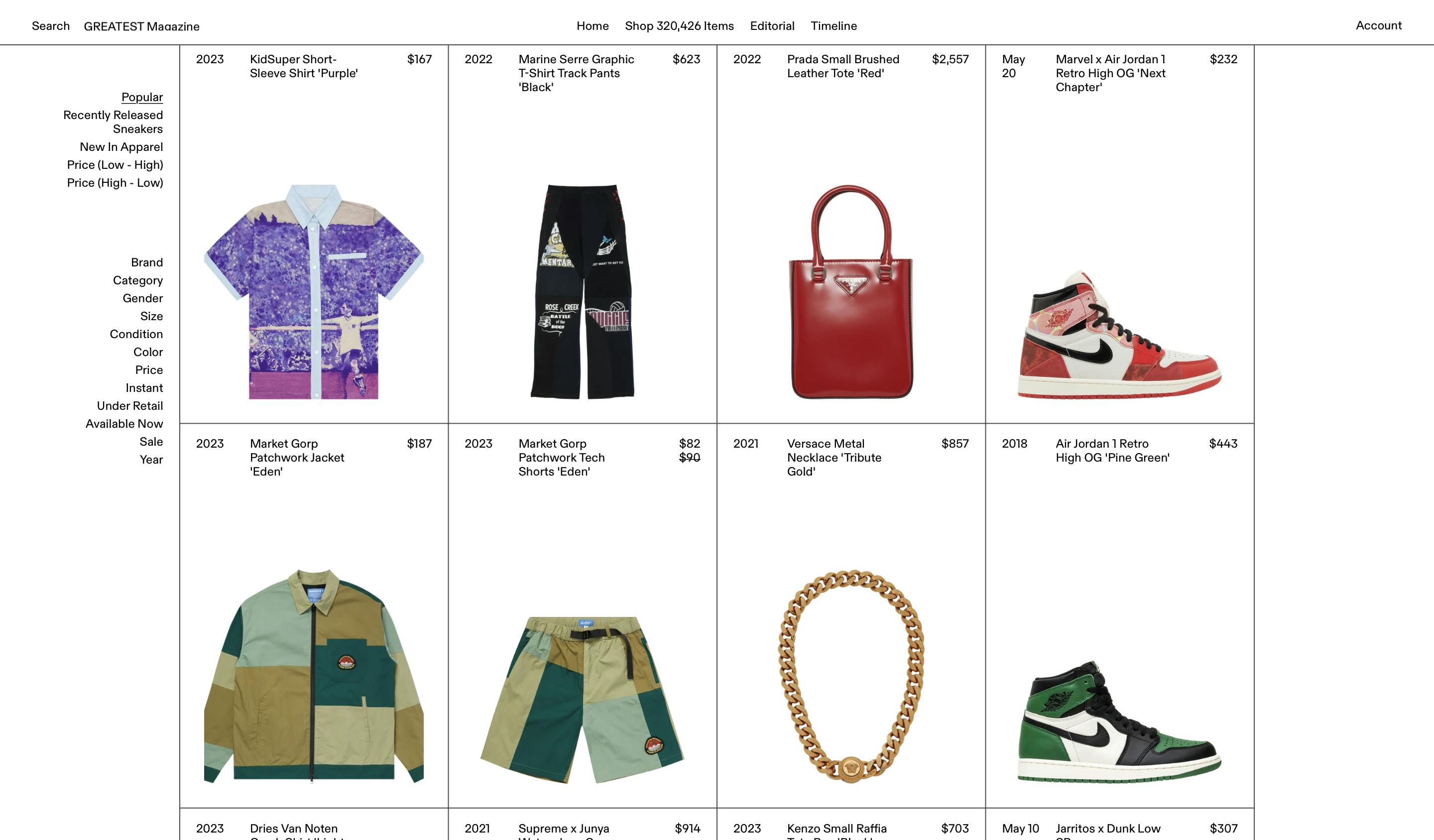

GOAT, launched in 2015, facilitates the trading of authentic new and used sneakers, luxury apparel, and accessories. The platform has a collection of over 320K items as of May 2023; GOAT’s marketplace features multiple popular brands like Air Jordan, Supreme, Gucci, and Saint Laurent.

GOAT is built around a consignment model, where sellers ship their items to the nearest GOAT fulfillment center for authentication and sale. GOAT's authentication procedure is a two-step screening process, initially using machine learning for digital authentication, followed by a physical inspection at their fulfillment centers.

GOAT collaborates with more than 350 high-fashion brands, including Gucci, Balenciaga, and Alexander McQueen, offering their products directly on the platform. GOAT has created a new editorial publication called Greatest to emphasize its commitment to community building. The magazine is a 150+ page publication on the stories of the creatives wearing the clothes, or as Sen Sugano, VP of Marketing at GOAT Group, says:

“With Greatest, we wanted to capture the industry's sense of community, while bringing together the spectrum of people who are inspired by sneakers”

Source: GOAT

Grailed

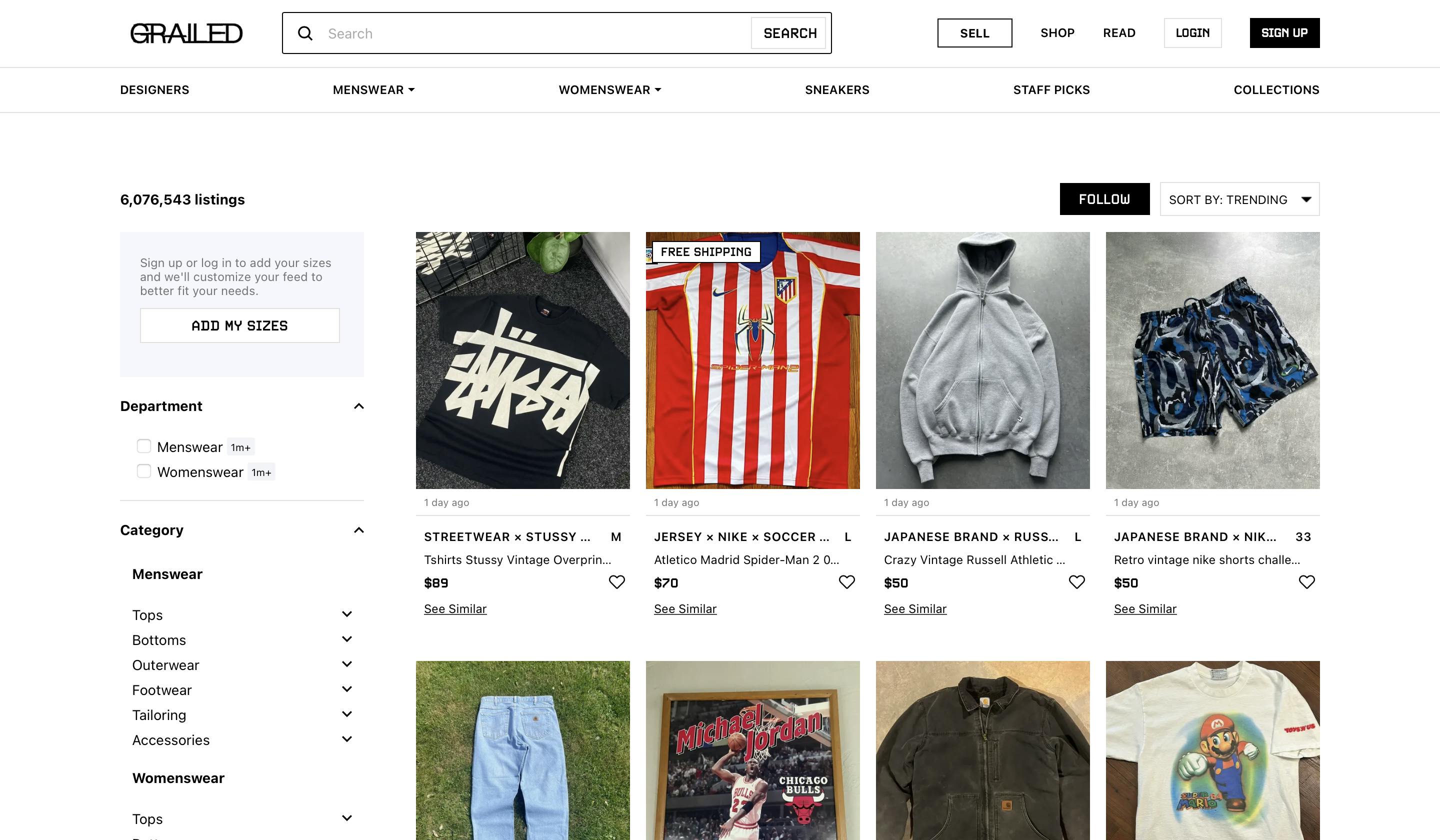

Grailed, founded in 2013 and later acquired by GOAT Group in October 2022, operates as a peer-to-peer marketplace for both menswear and womenswear. The platform, available on desktop and mobile, allows the easy direct sale of new and used clothing among users, backed by digital moderators, to ensure the authenticity of each listed item. It has smart pricing, allowing sellers to set a price reduction schedule that automatically lowers the price by 10% weekly until it reaches a predetermined floor price.

With Grailed, users can follow their favorite brands, designers, and sellers. Aside from the regular categories such as brands, menswear, womenswear, sneakers, or collection, Grailed’s team curates their favorite listings. GOAT's and Grailed’s business models are different. GOAT is a consignment reseller: sellers send products to GOAT, which authenticates them and sends them to buyers. Grailed, on the other hand, is a peer-to-peer marketplace. Customers buy and sell their products directly to and from each other.

Source: Grailed

Flight Club

Flight Club, founded in 2005 and later merged with GOAT in February 2018, serves as GOAT's physical retail business unit. Specializing exclusively in sneakers, Flight Club allows app users to physically interact with items before purchasing them and sells its items through its website.

Flight Club operates three stores in Miami, New York, and Los Angeles. Flight Club offers a broad range of sneakers from iconic brands such as Air Jordan, Nike, New Balance, and Yeezy alongside its line of branded apparel. Sellers can send in an online form to submit their sneakers for sale, after which they can be dropped off or shipped to a store. Once an item is sold, sellers can request payment through GOAT or Flight Club, providing flexibility and convenience.

Source: GOAT Group

alias

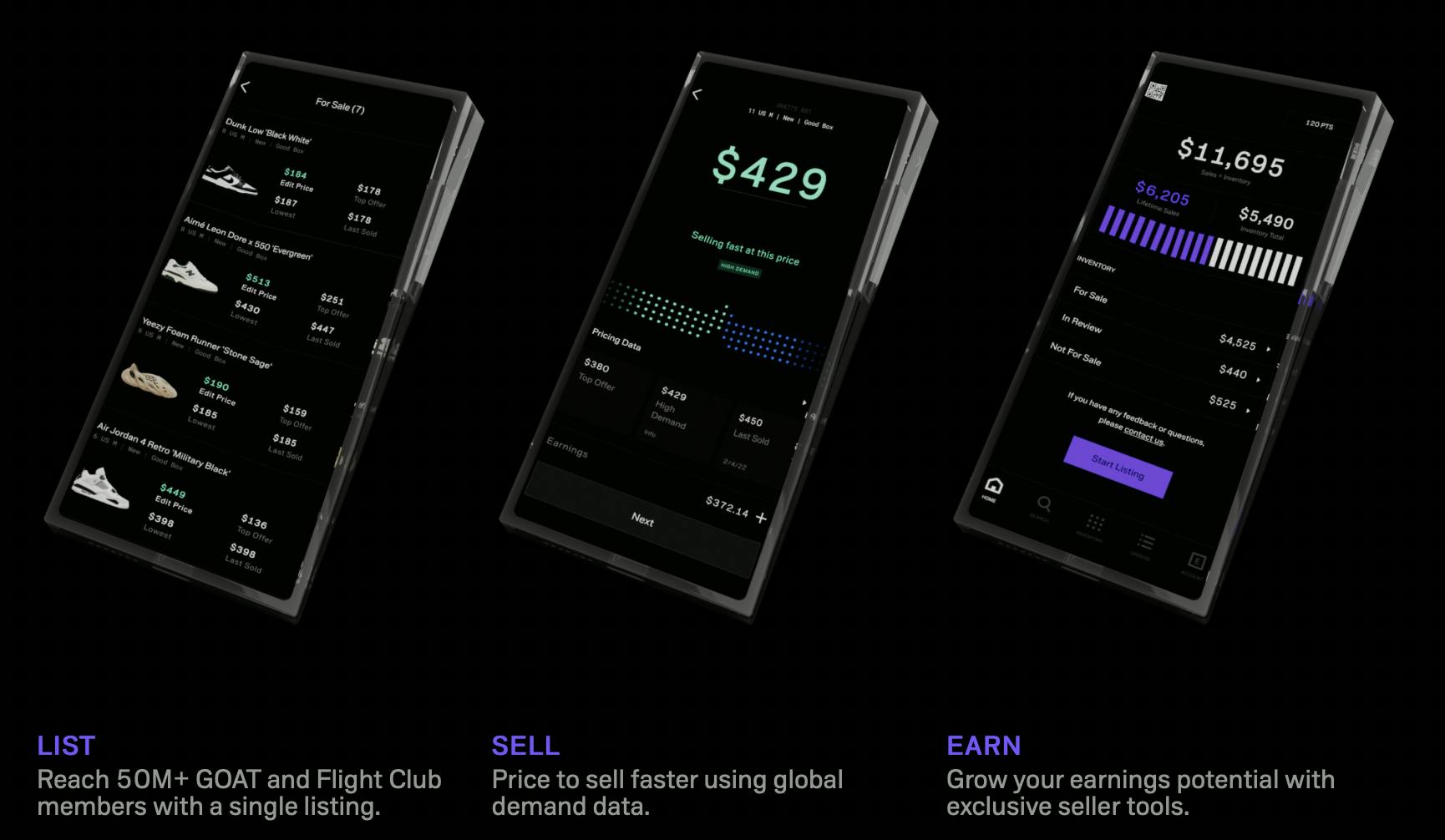

"alias" is a mobile-only application tailored specifically for global resellers. It was conceived to give them access to critical data, drive informed decision-making, and expand their reach to over 30 million buyers in 170 countries on both GOAT and Flight Club. Sellers can create a new account specifically for use on alias, or link to their GOAT profile. Sellers undergo an approval process before they are permitted to list their items on alias. The app provides sellers with real-time data on the resale market not available on GOAT. This data is designed to help sellers optimize their earnings through strategic, data-driven decisions.

One of the key data points provided by alias is its high demand indicator. This is a predictive pricing tool that leverages machine learning to anticipate an item's price based on market data, global demand, and buyer location. The “global indicator” feature shows the current lowest price of an item globally. The “lowest price” feature on alias allows sellers to view the current lowest price of a ship-to-verify item. Lastly, the “lowest consigned” tool shows the lowest price for consigned items, providing sellers with important pricing context for consigned goods. The data-driven tools provided by alias aims to position sellers to maximize their profits and succeed in the global resale market.

Source: alias

Market

Customer

GOAT Group caters to a global customer base comprising fashion-conscious consumers with a predilection for streetwear and sneakers. These consumers, primarily Millennials and Gen Z, prioritize sustainability and value access to luxury and exclusive items. With the advent of the fashion resale market, these items are no longer out of reach for many consumers who would otherwise be unable to access them.

Before GOAT, sneakerheads would typically have to go to physical stores or risk getting scammed online by purchasing items on horizontal marketplaces like eBay. By offering authenticated, pre-owned luxury goods, GOAT has allowed customers to shop from anywhere globally, replacing the need to navigate physical consignment stores or unauthenticated online listings.

Market Size

The growing acceptance and demand for pre-owned luxury goods, led by younger generations, is disrupting traditional retail models and creating new opportunities for businesses in the digital space. The online shopper count is expected to surpass 2.6 billion people in 2023. In 2023, the sneaker resale market in North America alone stands at $2 billion and is expected to reach $30 billion by 2030, showcasing the growing demand for premium, pre-owned sneakers. The global luxury resale market in 2021 was valued at $32.6 billion and is expected to reach $51.8 billion by 2026.

Competition

The RealReal: The RealReal, founded in San Francisco in 2011, is an online and physical retail marketplace specializing in authenticated, consigned luxury goods. The company focuses on fashion, fine jewelry, watches, home decor, and children’s clothing. In 2019 it became the first resale startup to go public on NASDAQ under the ticker $REAL. Although The RealReal and GOAT Group both concentrate on authenticating all items sold on their platforms, The RealReal's product range is broader, extending beyond sneakers and streetwear. As of May 2023, The RealReal is valued at $113 million, coming down from an all-time high of $2.5 billion in 2021.

Stadium Goods: Stadium Goods, founded in 2015, operates a marketplace for new and used sneakers and streetwear online and in its New York City store. Farfetch acquired it for $250 million in 2018. While it competes directly with Flight Club, its pricing model sets it apart from GOAT Group's platforms. Stadium Goods charges a flat fee of $2 per month per item listed, deducting this cost from the sale.

eBay: eBay, founded in 1995 originally as a bidding site, is one of the longest-running online marketplaces, enabling consumer-to-consumer (C2C) and business-to-consumer (B2C) sales globally. While it operates in a wide array of categories beyond fashion unlike GOAT Group, it does retain a significant presence in the resale of sneakers and streetwear. In 2019, it sold 6 million sneakers and offered authentication for watches sold on the platform that exceeded $2K in value. In 2020, it sought to bolster its position in the market by partnering with Sneaker Con as a third-party authenticator for shoes listed above $100.

StockX: StockX, founded in 2015, is a primarily sneaker-focused online marketplace and clothing reseller. Since its inception, it has raised $690 million in funding. By 2020, the company was generating $400 million in revenue. It raised $255 million in its Series E in 2021, led by Tiger Global, bringing its valuation to $3.8 billion. Like GOAT Group, StockX authenticates all items sold on its platform but utilizes a bid/ask marketplace model, contrasting with GOAT’s fee-price model. StockX also imposes higher selling fees, ranging from 10% to 8%, depending on the seller's sales volume.

SoleSavy: SoleSavy, founded in 2018, is a community designed to assist buyers in purchasing sneakers directly upon release, circumventing the higher prices of resale platforms. The challenge of buying at release is competition from bots and resellers, a problem that SoleSavy seeks to solve. Initially created as a Slack community for sneaker enthusiasts to strategize for new drops, by 2021, it had over 4K members in the US and Canada and was generating $1.5 million in annual recurring revenue. It has raised $14.5 million in funding. It operates as a membership-based community, offering a free tier with access to a marketplace that charges the lowest commissions (3% or $8 for trades). Its advanced tiers range from $11.99 to $33 per month.

Business Model

GOAT Group uses a percentage fee scheme across all its products. Both GOAT and alias have a commission fee that begins at 9.5% for new sellers and can increase to 25%, depending on their rating. Additionally, these platforms charge a fixed seller fee based on the user's location. Grailed charges a 9% fee on the listing when the item is sold. Flight Club also charges a 9.5% fee, but it imposes a flat $5 fee instead of a location-based seller fee. All GOAT Group entities benefit from their marketplace model, having no upfront stock costs. GOAT Group incurs maintenance costs from GOAT’s fulfillment centers for authenticity checks and real estate costs from Flight Club's retail locations.

Traction

As of May 2023, GOAT Group has a global community exceeding 50 million members across 170 countries. In 2021, GOAT Group disclosed its metrics, revealing over 700K sellers and over $2 billion in gross merchandise volume. GOAT lists over 320K items on its platform and has partnered with prestigious luxury brands such as Gucci, Balenciaga, and Alexander McQueen. In April 2022, GOAT Group signed a $55 million deal to sponsor the French soccer team, Paris Saint-Germain, for their 2022/23 campaign; it has also partnered up to create an exclusive collection. In 2021, the company said it had over 13 fulfillment centers worldwide but would expand to four more by the end of that same year, betting on the European and Asian markets as it looks to expand operations.

In 2021, StockX had $400 million in revenue and was valued at $3.8 billion (9.5x revenue) At the time, StockX was also generating $1.8 billion of gross merchandise value (GMV), which would represent a blended take rate of ~22% of StockX’s sales that turn into revenue. As a public company, The RealReal is trading at a $113 million market cap as of May 2023 (0.8x LTM revenue). GOAT had $2 billion of GMV in 2021. If we apply a similar take rate of 22%, we can assume the company had ~$396 million in revenue. At a $3.7 billion valuation, that would represent a similar 9.3x revenue multiple.

There are at least two likely drivers in the disparity between the valuations of companies like StockX or GOAT, and that of The RealReal. First, 2021 valuations have been massively corrected (for example, Etsy, eBay, and Shopify saw their revenue multiples drop from 20-40x LTM revenue to 2-12x).

Source: Koyfin

Second, The RealReal’s revenue growth has dropped from 55% YoY in 2021 when the company was also trading at 8x revenue, to 16% LTM revenue growth as of May 2023. In a highly competitive market for high-priced commodities, such as these companies compete in, a precipitous decline in revenue growth can also drive a significant decline in valuation.

Valuation

The GOAT Group has raised around $500 million in funding. This total includes its Series F round of $195 million, disclosed in June 2021, which led the company's valuation to go from $1.8 billion to $3.7 billion. Some of its investors include Y Combinator, Foot Locker (a traditional sportswear and footwear retailer), Accel, and Index Ventures.

In comparison, as of May 2023, StockX has raised $690 million and was last valued at $3.8 billion in 2021. The RealReal, meanwhile, as of May 2023, trades on NASDAQ with a market cap of $113 million.

Key Opportunities

Authentication Innovation

GOAT Group could explore innovative authentication methods, such as lidar scanning for phones equipped with the feature or blockchain technology for transparent traceability of an item's authenticity. While the company already employs AI to detect counterfeit shoes, further investments in AI tool development could enhance the detection of fraudulent activity on its various platforms.

Expanding Beyond Luxury

thredUP, a used clothing marketplace, forecasts that the secondhand clothing market will grow to $351 billion by 2027. GOAT Group might consider expanding into a new platform for reselling regular, non-luxury items to diversify its product lineup and reach a broader online shopper demographic. Maintaining the high quality associated with its existing platform, GOAT Group could leverage its current fulfillment centers for quality control rather than authenticity.

Global Expansion

Another important opportunity for GOAT Group lies in expanding its presence internationally, for example in the European Union and especially in China. In 2019 China's athletic footwear market was valued at $9.5 billion. The rising wealth of China is driving luxury purchases, with projections indicating that China will account for 44% of the global luxury goods market by 2025.

Key Risks

Luxury Goods Market

GOAT Group operates within the luxury goods market, making it vulnerable to economic fluctuations. Luxury goods sales are acutely responsive to economic conditions, often contracting during financial downturns or periods of economic uncertainty. For instance, during the 2008 financial crisis, the luxury goods market lost 9% of its value. This contraction was mainly due to consumers' shift towards more conscious spending in response to wage stagnation and inflation.

Counterfeit Threats

Despite GOAT Group's investment in filtering out fake products from its platforms, the risk of knock-off items slipping through the cracks persists. This issue could make the company lose its reputation and customer trust, harming the brand. In a worst-case scenario, this could result in lawsuits from original manufacturers for selling counterfeit goods, further damaging the company's standing and leading to financial losses.

Summary

With its four significant entities — GOAT, alias, Flight Club, and Grailed — GOAT Group has carved out a prominent place in the luxury clothing market. These platforms aim to provide customers with high-quality and authenticated streetwear and sneakers. Growth in demand for such products during and subsequent to the COVID-19 pandemic has enabled GOAT Group to expand into new markets and products. However, as market valuations adjust and consumers potentially tighten their spending, GOAT Group will likely face challenges. The founding team has experienced navigating economic downturns, which may prove useful in navigating these challenges.