Thesis

The COVID-19 pandemic caused the cancellation of hundreds of shows and live events, but the industry has bounced back in the post-pandemic period. In 2022, ticket sales for events and in-person gatherings increased rapidly. Live Nation, the world's largest venue operator, hosted 12.5K shows in Q2 of 2022, a 2.5K increase from 2019. In addition, from January through July 2022, Live Nation sold over 100 million tickets — 26 million more than the same period in 2019. While demand is rising, the live event ticket-buying experience for consumers is often frustrating. It has become a chaotic process characterized by limited ticket availability, exorbitant prices, and predatory reselling practices.

When tickets are released for highly anticipated concerts, sports events, or shows, they are quickly snapped up by bots and scalpers, leaving genuine fans empty-handed. The surge in online ticket sales has also led to technical glitches, crashed websites, and long virtual queues, exacerbating the frustration. Additionally, consumers are burdened with hidden fees, which inflate ticket prices. The secondary market, dominated by reselling platforms, allows scalpers to resell tickets at inflated prices, making it even more challenging for fans to attend their desired events. Tensions have escalated between Ticketmaster concertgoers and artists in recent years, with Bruce Springsteen, Taylor Swift, and Bad Bunny being just some of the names voicing their displeasure. The Department of Justice has an antitrust investigation into Live Nation, the parent company of Ticketmaster, following their 2010 merger. The global online event ticketing market was worth $28.5 billion in 2021 and is expected to reach $52 billion by 2030.

SeatGeek is a ticket search engine aggregating listings for live sports, concerts, and theater events. It combines a consumer ticket marketplace with primary ticketing technology. Its products include Deal Score, ticket rating technology; Rally, an event-day operating system; and SeatGeek Swaps, the first return policy offered by a major ticketing platform. It also offers enterprise ticketing software to help teams, venues, and promoters grow their businesses.

Founding Story

Source: GeekWire

SeatGeek was founded in 2009 by Jack Groetzinger (CEO) and Russell D’Souza, both graduates of Dartmouth College. Prior to SeatGeek, the pair had previously co-founded Scribnia, a web app that used collaborative filtering to recommend bloggers.

Growing up in Cleveland, Ohio, Groetzinger went to a lot of sports events. When he and his friend D’Souza started to buy and resell sports tickets on the secondary market to earn extra money, they noticed several glaring issues with the ticketing experience. One particular area that stood out was price transparency. As search companies emerged in other verticals, Groetzinger and D’Souza saw the opportunity to build a platform specializing in ticketing and helping customers determine whether they were getting good deals.

Groetzinger and D’Souza started SeatGeek as a mobile-based ticket platform that combined ticketing data from various sources to give customers a straightforward and clear pricing system. In May 2009, Groetzinger and D’Souza received $20K in seed funding from DreamIT Ventures, an early-stage startup accelerator program in Philadelphia. Their first hire was Eric Waller, who eventually became CTO. SeatGeek was launched in September 2009 at TechCrunch50, a conference for startups in San Francisco, and was one of 50 finalists out of 1K applicants.

D’Souza stated in 2014 that:

“When we founded SeatGeek in 2009, nobody was really building mobile apps. When we launched the app in 2012, we were one of the first ticketing companies to have one. Today, mobile is driving our company’s growth and it’s what we’re betting our future on.”

While SeatGeek began as a pure aggregator that allowed visitors to compare tickets offered on other reseller platforms, it has since expanded its products and services to include secondary and primary ticketing for sports teams and live event venues.

SeatGeek filed confidentially with regulators in April 2023 to go public. This follows its previous attempt to go public via a SPAC merger with RedBall Acquisition Corp in October 2021. Both parties agreed to terminate the deal in 2022 due to market conditions.

Product

SeatGeek Marketplace

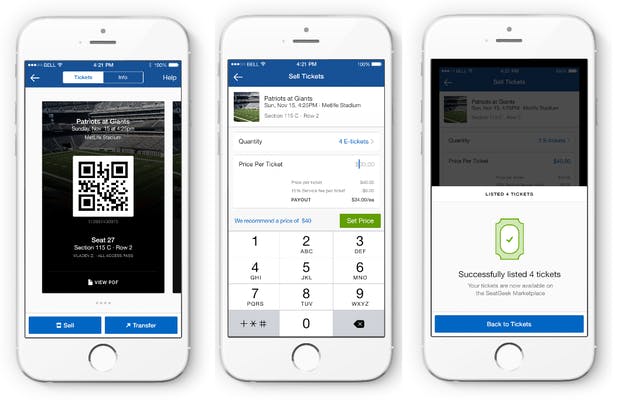

The SeatGeek Marketplace allows users to buy and sell tickets for live sports, concerts, and theater events. It operates as both a secondary and primary ticketing platform, meaning that users can buy tickets either from other fans who are reselling their tickets, or from venues and organizations selling tickets directly to customers. Users can browse events, evaluate seats through interactive color-coded seat maps, complete purchases, and receive print or electronic tickets on their mobile devices or desktop. Users can also list their tickets for sale on SeatGeek and gain access to millions of ticket shoppers.

Source: Forbes

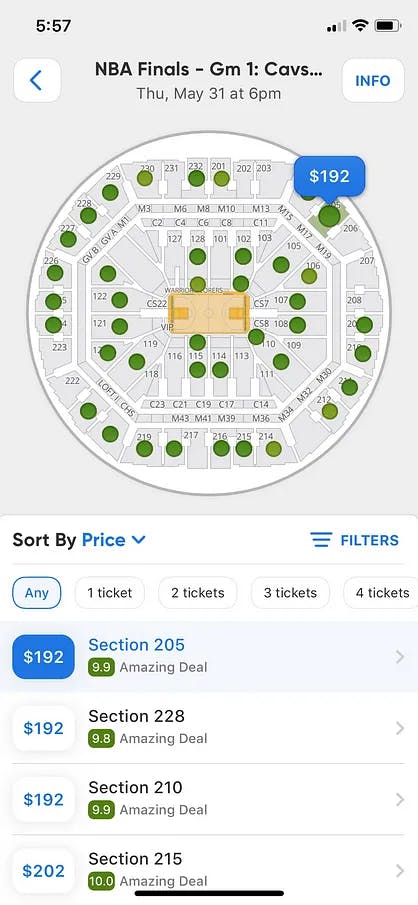

Deal Score

Deal Score helps ticket buyers determine whether a ticket seller’s offer was good value based on factors including historical ticket prices for the performer and the venue, seat location, expected sightline from the seats, and the quality of the other available tickets for the event. Deal scores range from 1 to 10. The closer a deal score is to 10, the better the deal. Deal scores are calculated by comparing each ticket’s expected price to its listed price.

Source: Vignesh Palaniappan

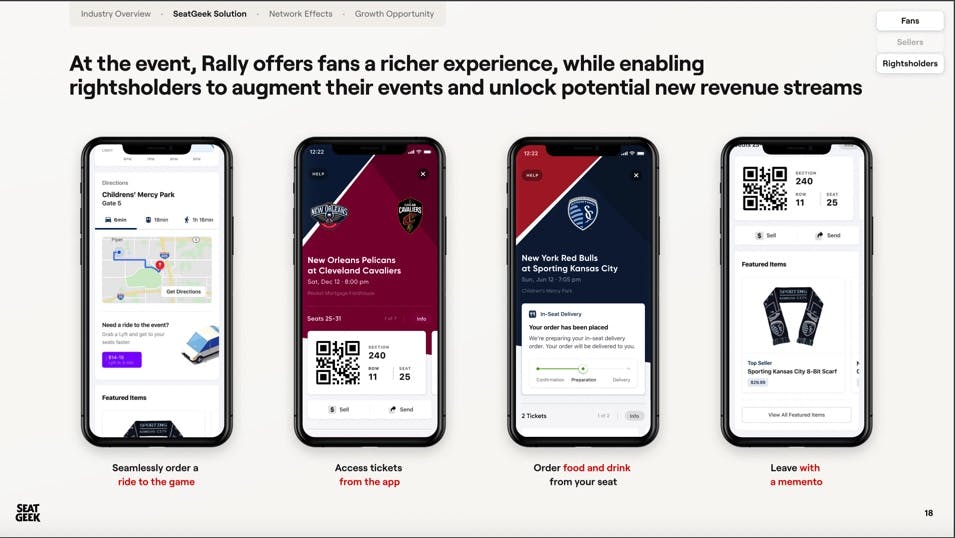

Rally

Rally provides fans with a personalized in-app experience customizable by venue. Rally's weather forecast widget informs fans about the weather conditions leading up to and during the event. Furthermore, fans can use Rally to secure parking passes in advance and reduce the stress of finding parking on the event day. Through Mobile Food and Beverage Ordering, Rally enables fans to skip lines by ordering food and drinks directly through their mobile tickets. Rally also offers Gameday Gear, allowing fans to browse and order team merchandise from the platform. After the event, Rally allows fans to book a Lyft ride home from the nearest gate.

Source: SeatGeek

SeatGeek Swaps

SeatGeek Swaps allows customers to return their tickets to a sports, concert, or other live event up to 72 hours prior to the event if they can no longer attend. Traditionally, when customers bought a ticket they could no longer use, their options were either to eat the ticket's cost or to try to resell it. Moreover, customers often had to pay additional fees to the marketplace where the tickets were sold. With SeatGeek Swaps, customers can return their tickets and receive 100% credit, including fees, through a 12-month promo code. This credit can be used to 'swap' their tickets for another event of their choice.

SeatGeek Enterprise

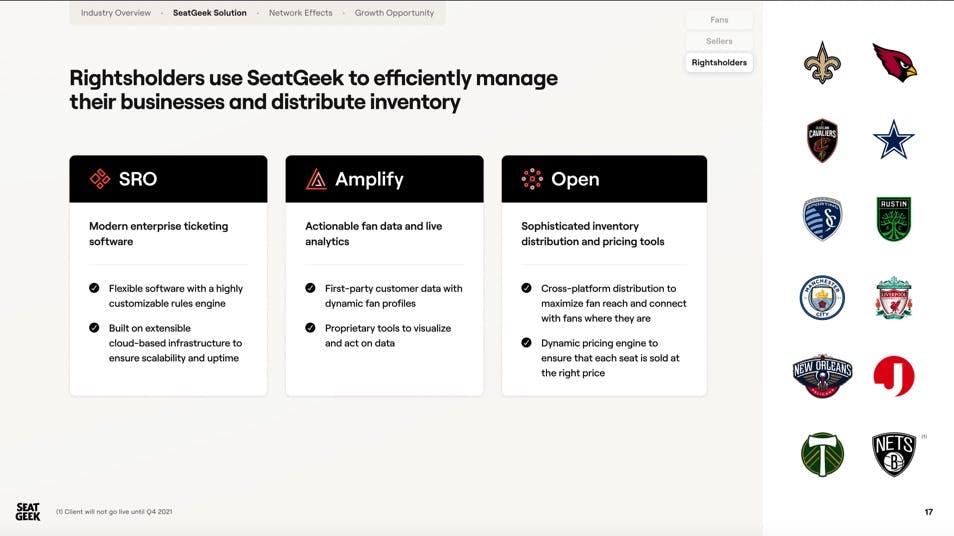

SeatGeek Enterprise is the company’s enterprise ticketing solution that allows teams, venues, and promoters to run various aspects of their business. Its offerings include:

SRO (standing room only), which is SeatGeek’s enterprise ticketing software.

Amplify, SeatGeek’s first-party customer data analytics tool that provides dynamic fan profiles and data visualization.

Open, SeatGeek’s ticket inventory distribution and pricing tool.

Furthermore, SeatGeek Enterprise has introduced a wide array of features to help teams and venues return to their businesses following the COVID-19-related shutdowns, including contactless entry, demand projections, and in-stadium social distancing.

Source: SeatGeek

Market

Customer

SeatGeek provides a platform for buying and selling tickets for live events, such as sports, concerts, and theater. Through its consumer business, SeatGeek helps event-goers find tickets to live events while offering a platform for ticket owners to sell their tickets through a secondary market. SeatGeek’s audience leans slightly male, with a composition of 53% male and 47% female. Its customer base also skews towards younger generations, with 70% of users below age 45.

In addition to its consumer business, SeatGeek provides enterprise ticketing software that helps teams, venues, and promoters to grow their businesses and engage fans. SeatGeek customers not only leverage SeatGeek’s platform to distribute tickets but also gain access to SeatGeek’s data to expand their fan bases further. Contracts usually last between five to seven years. Some of SeatGeek’s notable enterprise customers include the MLB, the NFL’s Arizona Cardinals, Baltimore Ravens, Dallas Cowboys, New Orleans Saints, and Washington Commanders.

Market Size

The global online event ticketing market had a revenue holding of $28.5 billion in 2021. It is expected to reach $52 billion by 2030, growing at a CAGR of 7.8% during the forecast period. In 2022, ticket sales for these gatherings increased rapidly as people eagerly sought entertainment. Live Nation, the world's largest venue operator, hosted 12.5K shows in Q2 of 2022, a 2.5K increase from the same period in 2019, before the COVID-19 pandemic.

Competition

Ticketmaster: Ticketmaster is a global ticketing services company. It was founded in Phoenix, Arizona, in 1976. The company originally licensed computer programs and sold hardware for ticketing systems. For a time, it struggled until it was acquired by Hyatt Hotels founder Jay Pritzker and had Fred Rosen installed as CEO. Under Rosen, Ticketmaster went from selling $1 million in tickets during his first year in 1982 to $600 million in 1990 and nearly $2.5 billion in 1998. Fast forward to 2023, Ticketmaster now sells over 500 million tickets annually. Ticketmaster merged with Live Nation, an American events promoter and venue operator, in 2010 to form Live Nation Entertainment. Compared to Ticketmaster, SeatGeek has a younger audience, with 36% classified as Gen Z (vs. 18% from Ticketmaster) and a higher Net Promoter Score of 45 (vs 6 from Ticketmaster). On the other hand, Ticketmaster has a stronger global presence with offerings in 35 countries while SeatGeek is only present in the United States, Canada, and the United Kingdom.

StubHub: StubHub is a ticket marketplace that allows people to buy and sell tickets for concerts, sports, theater, and other live entertainment events. It was founded in San Francisco in 2000 by Eric Baker and Jeff Fluhr, former Stanford Business School students and investment bankers. In 2007, StubHub was acquired by eBay for $310 million. In November 2019, Viagogo acquired StubHub for $4.1 billion. In contrast to SeatGeek, which offers both primary and secondary ticketing, StubHub focuses on secondary ticketing and does not provide primary ticketing. In addition, the two companies also differ in the way they navigated through the COVID-19 outbreak: while SeatGeek was able to grow its business and market share after the outbreak, growing its market share from 7.2% (2019) to 11.5% (2021) and doubling its sales from June 2021 compared to that of June 2019, StubHub experienced a much slower recovery in its business with its sales from June 2021 37% lower than they had been in June 2019.

Vivid Seats: Vivid Seats is another ticketing marketplace that allows fans to buy and sell tickets to sports, concerts, and theater events nationwide. The company was founded in Chicago, Illinois in 2001. The company went public in April 2021 through a SPAC transaction with Horizon Acquisition Corporation. While SeatGeek does not have loyalty programs for consumers, Vivid Seats has a rewards program called “Vivid Seats Rewards” that allows customers to earn credit on their purchases. Customers can obtain a free ticket from Vivid Seats for every 10 tickets they buy on the platform. Furthermore, SeatGeek has a younger user base than Vivid Seats, with 36% classified as Gen Z vs. 19% for Vivid Seats.

Business Model

SeatGeek generates revenue through a combination of revenue streams including referral fees, ticket transaction fees, advertising, and enterprise partnerships. SeatGeek built its initial business without its own inventory and by aggregating listings from other ticketing platforms. In exchange for traffic, SeatGeek would charge its partners a percentage of referred sales, usually around 10%. SeatGeek also allows users to list and sell their tickets in exchange for a 15% cut. In addition, SeatGeek charges its enterprise clients to advertise on the SeatGeek platform. Lastly, SeatGeek generates revenues through enterprise partnerships, offering its services such as distribution, ticketing, data analytics, and more. One notable example is its partnership with the MLB, which promised the MLB roughly $100 million per year over five years.

Traction

After seeing its revenue decline by over 70% in 2020, SeatGeek has rebuilt its business and expects to generate over $500 million in revenue in 2023, more than three times its revenue ($142 million) from 2019. SeatGeek’s revenue was $82.5 million in Q4 2021, $56.8 million in Q3 2021, and $4.8 million in Q4 2020.

As of January 2023, the company has over 33 million app downloads. The company also powers ticketing operations for 300 enterprise clients across the NFL, NBA, and premier leagues, including the Dallas Cowboys, New Orleans Saints, Liverpool F.C., Cleveland Cavaliers, and New Orleans Pelicans.

Source: SeatGeek

Valuation

SeatGeek has raised $400 million from investors including Accel, Arctos Sports Partners, and Qualtrics founder Ryan Smith. SeatGeek filed confidentially with regulators in April 2023 to go public. This follows its previous attempt to go public via a SPAC merger with RedBall Acquisition Corp in October 2021 at ~$1.4 billion. Both parties agreed to terminate the deal in 2022 due to market conditions. For comparison, as of May 2023, SeatGeek competitors Ticketmaster and Vivid Seats were valued at 1.1x and 2.9x revenue respectively.

Key Opportunities

Introduction of NFTs

The introduction of NFTs offers ticketing platforms such as SeatGeek the opportunity to improve the transaction process, increase the value of tickets for consumers, and help its partners capture more value beyond the initial ticket sale. With NFTs, customers can verify the authenticity of tickets before transactions. Furthermore, ticketing platforms may be able to leverage NFTs to increase the value of digital tickets as memorabilia or collectibles. People have historically collected ticket stubs before digital tickets to remember going to certain events, such as a championship game. NFTs offer the potential to reintroduce the element of memorabilia to digital tickets. Lastly, NFTs can help SeatGeek partners, such as artists and professional sports teams, continue to earn revenue from ticket resales. For instance, teams may pocket a percentage of each secondary ticket sale through contracts from NFTs.

International Expansion

As of May 2023, SeatGeek only lists events in the United States, United Kingdom, and Canada. Out of the 59 cities listed on SeatGeek, only six were located outside the US: Toronto, Vancouver, Edmonton, Calgary, Montreal, and London. While the US is the largest global live events ticketing industry market, responsible for $58 billion out of the $126 billion market, over 52% of the market exists outside the US and remains largely uncapitalized by SeatGeek. In contrast to SeatGeek’s US focus, Ticketmaster lists events from over 35 countries.

Accelerate Enterprise Client Signings

Since launching its primary ticketing offering in 2016, SeatGeek has signed nearly 300 enterprise clients, including professional sports teams from the NFL, NBA, and Premier League. Since it last disclosed the number of enterprise clients in 2021, over 85 rights holders from the NFL, NBA, MLB, NHL, and MLS either have been or will be up for contract until the end of 2023, presenting SeatGeek with the opportunity to accelerate its enterprise business further.

Key Risks

Regulation

Changes in laws or regulations could affect the business operations and profitability of ticketing companies such as SeatGeek. For instance, federal regulation to force all ticketing websites to show the total price of tickets, including all fees from the beginning of the purchase process, may impact the profitability of ticketing companies. Ticketing companies have long applied a strategy known as “drip pricing”, through which sellers advertise a deceptively low price that lures in consumers, revealing the full cost, including mandatory surcharges, only once the consumer is on the verge of completing the transaction. Drip pricing has been proved to lead consumers to spend more money than they would have if the full price were communicated upfront. Another risk area is potential regulation against multi-year exclusive enterprise contracts (as seen from the Unlock Ticketing Markets Act), which would prevent companies such as SeatGeek from using multi-year exclusive contracts to lock in enterprise customers.

Larger Competitors

The merger of Ticketmaster and Live Nation in 2010 united the world’s most powerful concert promoter and the biggest ticketing platform. Ticketmaster today controls ticketing for 70-80% of the major concert venues in the United States. Some senators have accused Ticketmaster of using monopoly power to dominate the ticketing and live events industry and to shut out rivals. SeatGeek CEO Jack Groetzinger has also accused Ticketmaster of leveraging its market power to sign venues because the venues fear losing Live Nation concerts if they don’t use Ticketmaster. Ticketing companies such as SeatGeek have to deal with Ticketmaster’s exclusive contracts with venues, artists, and other organizations, which limit their access to tickets and customers.

Summary

SeatGeek is a ticketing platform founded in 2009 by Jack Groetzinger and Russell D'Souza. The founders saw an opportunity to create a meta-search platform specializing in ticketing to help customers determine if they were getting good deals. Initially, SeatGeek was an aggregator, allowing users to compare tickets from various reseller platforms. Over time, the company expanded its services to include secondary and primary ticketing for sports teams and live event venues.

SeatGeek operates both a consumer-facing and an enterprise-facing business. On the consumer side, it helps users find tickets to live events and provides a platform for ticket owners to sell their tickets through a secondary market. The platform is popular among younger users, with 70% of its audience below 45. On the enterprise side, SeatGeek offers ticketing software that helps teams, venues, and promoters grow their businesses and engage fans. Customers gain access to SeatGeek's data to expand their fan bases. The company has secured contracts with several sports organizations, including the MLB and NFL teams such as the Arizona Cardinals, Baltimore Ravens, Dallas Cowboys, New Orleans Saints, and Washington Commanders.