Thesis

The rise of social media has democratized content creation and consumption, leading to a rapidly expanding digital creative economy. This rapidly growing sector is projected to make up 10% of global GDP by 2030, and platforms at the core of direct-to-fan monetization have already scaled.

Creators no longer rely on traditional media corporations to distribute and monetize content. Instead, they can directly connect with audiences across digital platforms like YouTube, Instagram, and TikTok. The audience for such content has grown rapidly. Consumption of digital content doubled in 2020, driven by the COVID-19 pandemic and global lockdowns. This increase persisted into the post-pandemic period through 2024, with 55% of people spending more time each day consuming digital content than they did pre-pandemic. As of 2025, adult internet users spend about 6h 38m online per day and over two hours on social media, with in-person social time down from two years ago.

Despite the growing demand for digital content and the ability to leverage social media platforms for reach, creators struggle to monetize their content and build stable careers, with over half of influencers making less than $15K per year as of June 2025. The reliance on ad-based revenue from social media platforms can lead to unpredictable and often insufficient income due to fluctuating engagement, changes in ad rates, and dependence on the platform. Creators who had a large TikTok following were both enraged and distraught during the looming ban last January. In addition, creator funds provided by social media platforms are viewed as ineffective and unreliable. Clearly, competitiveness, uncertainty, and monetization issues create challenges for creators seeking to make content creation a full-time career.

While the term “creator” might bring to mind household names like Mr. Beast, most creators have much smaller followings. Fewer than 1% of content creators have over one million followers. These micro-creators are especially common on platforms like TikTok and Instagram and fuel the creator economy. Their niche content attracts dedicated followers who are more likely to engage with and purchase product recommendations, merchandise, or educational materials. Interestingly, these creators receive 47% more engagement on posts compared to larger influencers as of September 2024. This had led to a new marketing approach: User-generated content (UGC), where micro-influencers with high conversion rates work directly with brands to produce content. These smaller creators, who were once overlooked, now drive tremendous value.

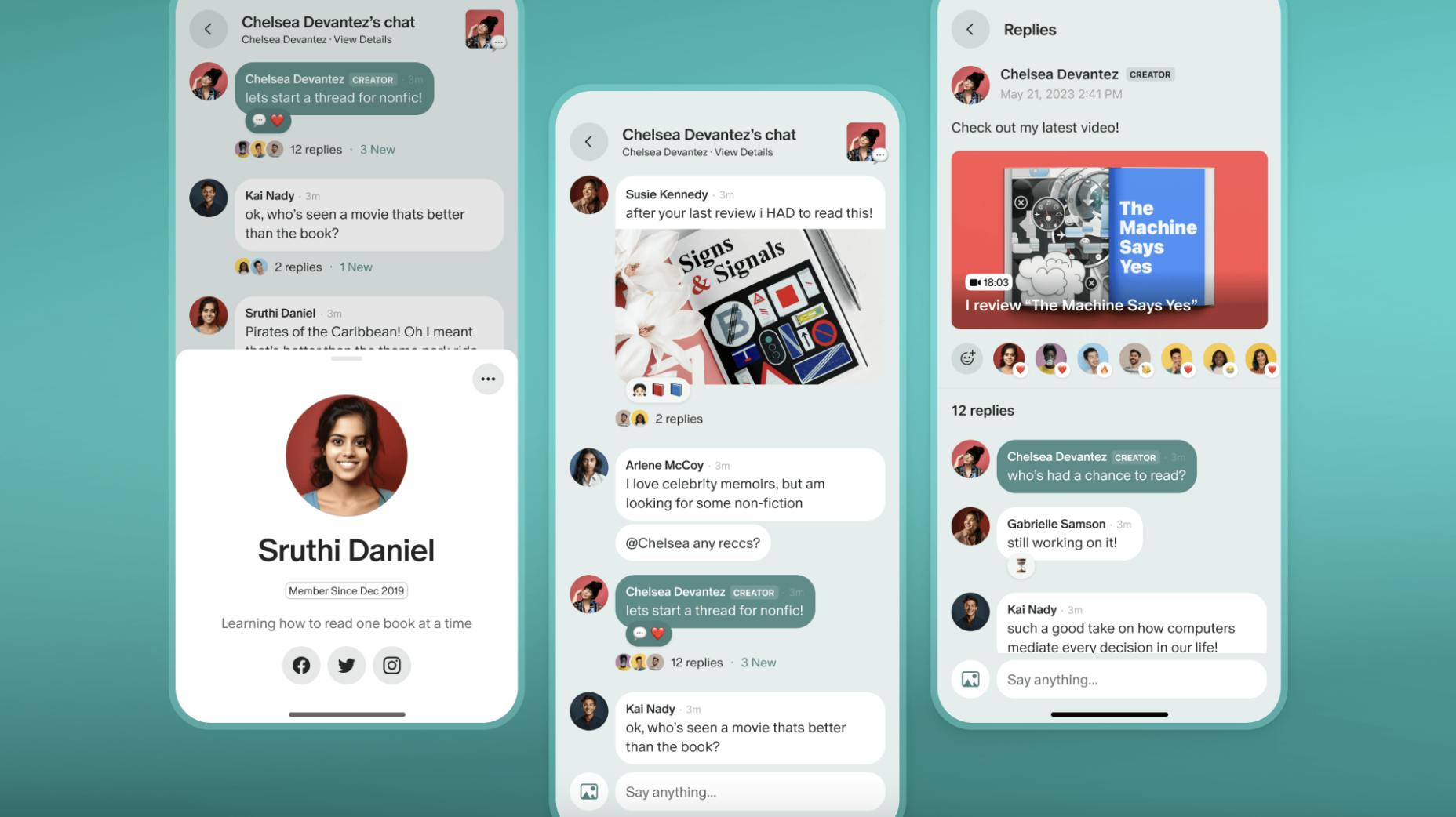

In response to content overload and declining organic reach on public feeds, audiences and creators are moving into private, high-intent communities (newsletters, Discords, Substack-like spaces) where trust and conversion are higher and algorithms matter less. Patreon is a critical part of these “gated” corners of the internet.

Patreon is a platform for digital content creators with loyal fanbases. By offering a membership platform that enables creators to monetize their work directly via subscriptions from their audience, Patreon allows creators to focus on their creativity without worrying about unpredictable ad revenue or platform policies. Creators can have various membership tiers with exclusive content, early access, and other benefits, fostering a sense of community and direct engagement with their audience. Patreon has been boosted by the increasing value of smaller creators and the growth of private communities. In 2025, creators on Patreon alone have surpassed $10 billion in cumulative payouts and over 25 million paid memberships.

Founding Story

Source: TechCrunch

Patreon was founded in May 2013 by Jack Conte (CEO) and Sam Yam (CTO).

While studying for a master’s degree in computer science at Stanford in 2006, Yam took a leave of absence to become one of the first engineers at social-mapping startup Loopt. He later founded AdWhirl in February 2009, enabling iPhone developers to choose ad networks dynamically. AdMob acquired AdWhirl in September 2009, before AdMob itself was purchased by Google. After a four-month stint at Google, Yam explored startup ideas for three years while working out of Dogpatch Labs, an incubator where Kevin Systrom and Mike Krieger developed Instagram.

In 2013, Conte, a producer, songwriter, and filmmaker, faced a funding shortfall for a music video he expected to cost $10K. Ad revenue from YouTube would not cover the expense. At the time, Conte had a YouTube following of about 100K subscribers and believed that a subset of fans might directly fund his creative work. He contacted Yam, his former college roommate, to develop a platform where subscribers could support creators.

The two met for coffee to discuss the idea. Yam, who was launching a freelance photographer marketplace named OurSpot, decided to begin developing Patreon while still managing OurSpot until the new venture secured seed funding.

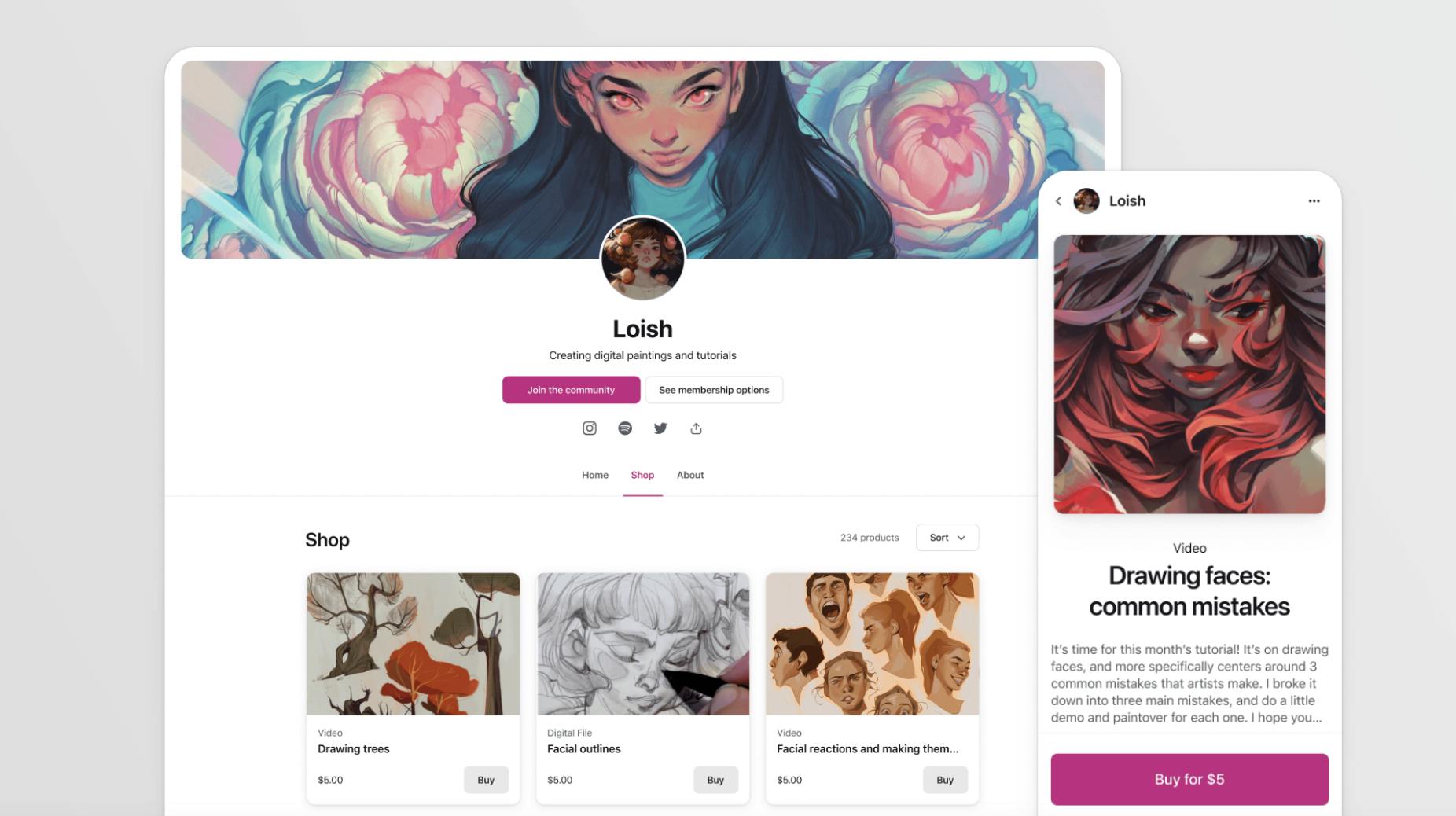

Product

Patreon’s product is a membership platform designed to help creators manage, grow, and monetize their audience. At its core, Patreon allows creators to offer exclusive content, perks, and experiences to paying subscribers, known as "patrons." These patrons provide a recurring revenue stream, supporting creators monthly or per creation. Patreon bundles its services into three distinct membership plans.

Creators can develop direct relationships with their patrons through exclusive posts, messages, emails, and fan profiles, which patrons can set up upon joining. Built-in polling in community chats allows creators to gauge what excites their patrons most and adjust their content accordingly. Business tools are provided so creators can track and manage patron payments, lifetime value, and personal notes, while also accessing data to monitor overall page and post-performance.

Patreon also makes payouts flexible, enabling creators to get paid whenever they want and to receive monthly automatic payouts from their creator balance via direct deposit, PayPal, or Payoneer. Membership tiers allow creators to structure their pages with different price points and benefits, giving patrons options depending on their level of interest. Patrons can even try out creator pages for free for a limited time before committing to a paid membership.

Beyond core functionality, Patreon handles patron support on behalf of creators by managing questions, payments, and concerns, ensuring that creators can remain focused on their work rather than administrative issues. The platform provides educational resources and workshops designed to help creators learn how to run their creative businesses more effectively. Finally, Patreon’s mobile app gives creators the ability to message their patrons directly and monitor their business in real time, while patrons see their homepages organized by creator, keeping each creator’s latest work and community chats visible and easy to access.

Source: Patreon

Historically, Patreon bundled its services into three distinct membership plans: Founders, Pro, and Premium. Each had its own fee structure and feature set. Prior to May 2019, Founders carried a 5% platform fee, Pro members carried an 8% fee with customization and analytics, and Premium members paid 12% for partner management and merch. These remain legacy plans, available only to creators who published before August 5, 2025, and kept their pages continuously active.

For all new creators after that date, Patreon introduced a single standard plan with a 10% fee. This plan consolidates nearly all Pro and Premium features, which include custom pages, analytics, shop for one-time sales, native video hosting, livestreaming, podcast RSS, community chats, and promotional tools like trials and gifting. Merch fulfillment is available as a separate 3% add-on, giving creators flexibility to run digital-only or physical-reward businesses.

In practice, this means new creators onboarded in 2025 have access to the full toolkit without needing to weigh Pro vs. Premium, while long-time creators retain their legacy fee rates but enjoy feature parity. The shift reflects Patreon’s attempt to simplify the business model while keeping early adopters whole. As of August 2025, the platform reported surpassing $10 billion in cumulative payouts and over 25 million paid memberships, underscoring the scale of this new unified approach.

Legacy Plans

The Founders plan was a legacy option available to creators who joined Patreon before May 2019. This plan offered a unique set of services and features at the original pricing, preserving the benefits for early adopters. Unlike the Pro and Premium plans introduced later, the Founders plan included three key components. First, a hosted creator page on Patreon where creators could invite fans to become patrons, post exclusive content, and curate collections tailored to specific audiences. Second, unique creator tools that allowed direct communication with their patrons, including email, posts on the page, and direct messaging through Patreon’s platform. Third, access to resources from Patreon’s Creator Success team, including workshops and personalized guidance to help creators maximize their use of the platform, expand their audience, and enhance monetization strategies.

Patreon Pro, the next tier of Patreon's platform, was designed for creators who wanted more control over their relationships with their patrons. It offered greater flexibility with branding, business analytics, and promotions, enabling deeper engagement with dedicated supporters through exclusive content, merchandise, and other perks. This plan included all of the services included in the Founders plan along with:

Customizable page: Creators have extensive options to personalize the look and layout of their landing page, where supporters can connect in community chats, browse digital products, and explore recent updates.

Enhanced analytics and insights: Tools that give creators detailed views of patron behavior and page performance, including in-depth member data to understand audiences. This helps identify what resonates with patrons, guiding creators on where to focus for increasing impact.

Special offers promo tool: Enables creators to offer promotional offers, pricing, or benefits to grow their following on Patreon.

Creator-led workshops: Live stream workshops hosted by Patreon’s top creators who provide advice and guidance on building a sustainable career on Patreon.

App integrations: Native integrations with other applications and platforms, like Discord, Vimeo, and WordPress, allow creators to streamline their workflow and manage their community more effectively.

Priority customer support: Prioritized support from Patreon to assist with issues, questions, or inquiries that creators may have about the platform.

Patreon Premium was the most feature-rich tier of Patreon's platform, targeted at established creators and creative businesses who need a robust set of tools to manage their membership program. In addition to all the features offered by Patreon Pro, Patreon Premium provided users with dedicated partner support, team accounts, and a merch for membership feature, allowing creators to offer physical merchandise as part of a membership. The additional services included a dedicated partner manager who assisted a creator with growing their business, added merchandising service to support creators, and creator team accounts for other individuals to manage the creator page.

Source: Patreon

Many of these features, highly anticipated by creators on the platform, were introduced following Patreon’s 2023 rebrand, and are now available as part of the Standard Membership. The launch of free memberships and community chats has been particularly successful, with creators' communities on Patreon doubling and gaining over 30 million new free memberships in the first year alone.

Standard Plan

The Standard plan is the only option available to creators who joined after August 4, 2025, carrying a 10% platform fee on processed earnings. This plan consolidates nearly all of the functionality that had previously been split across Pro and Premium, offering a unified system while legacy creators retain their original rates. Under Standard, creators have access to a full suite of monetization tools, including monthly and annual memberships, multi-tiered pricing structures, and the ability to run a Shop for one-time digital sales and collections. Content can be shared through Patreon’s built-in editor with audio, images, and formatted text, or distributed via private podcast RSS feeds. Native video hosting supports up to 100 hours per month for qualifying creators, and Patreon Live integrates livestreaming directly into creator pages with chat and moderation tools.

Community engagement is central to the plan, with access to chats, polls, comments, direct messages, and email newsletters, alongside discovery features such as the Explore tab for fan outreach. Creators can export email lists, integrate with external apps like Discord or Vimeo, and use analytics dashboards to understand patron behavior and guide content strategy. Promotional features include free trials and gifting memberships, enabling creators to acquire new fans and grow communities. For those offering physical rewards, Merch for Membership is available as an optional 3% add-on, with automated fulfillment provided by Patreon.

Flexible payouts are another key component, as creators can withdraw earnings on demand or set up monthly automatic deposits through direct deposit, PayPal, or Payoneer. In addition to the platform fee, creators cover payment processing, currency conversion, and payout method fees. Special policies apply to Adult/18+ creators, who must complete identity verification and receive feature access in phases, including video hosting, commerce, and discounts. By bundling these services into a single plan, Patreon removes the need for creators to weigh plan types while ensuring they have access to the complete modern toolkit of monetization, media hosting, community management, analytics, and optional merchandising.

Patreon also launched a new feature where a patron can gift a membership to someone else in November 2024. Additionally, Patreon plans to integrate AI to automatically create clips of posts and previews of podcasts, which can be shared off-platform to attract new fans and drive non-paying users to creators’ pages as of July 2024.

Market

Customer

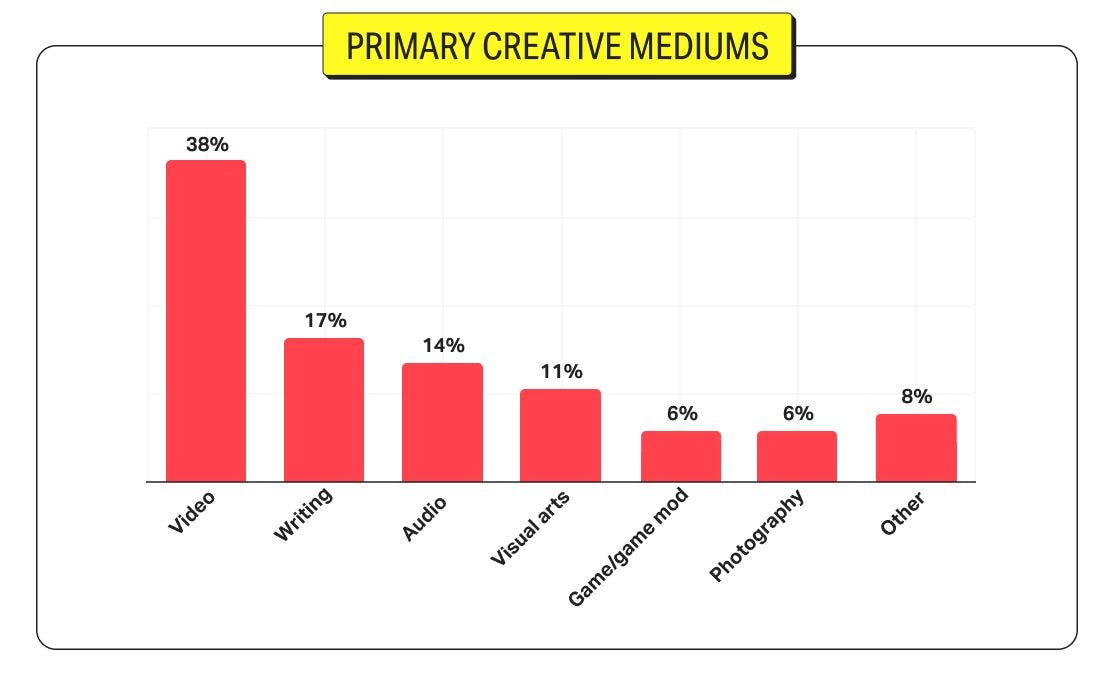

Patreon's customer base is comprised of two categories: creators who want an income from their work, and supporters willing to pay for exclusive content or to support the creators they love. The company's reach spans different industries, including music, podcasting, visual arts, writing, gaming, and more. A 2022 survey of Patreon creators revealed that videos are the most popular creative medium of creators on the platform, followed by writing and audio.

Source: Patreon

As of June 2025, podcasts were the highest-earning Patreon category, with 6.7 million paid podcast memberships in 2024, which earned $472 million for creators. Beyond video and podcasts, game modifiers or “modders” and indie devs have grown into a meaningful niche with recurring monthly drops and roadmaps. In addition, writers/comics/visual artists monetize through members-only posts, PDFs, and community features. Other segments include adult content, music, education, and many more. Across segments, creators in the survey said about 40% of their total income comes from Patreon.

Patron demographics are predominantly younger and male. Traffic/audience data indicate that 18 to 34 is the dominant age band (with 18 to 24 as the single largest cohort) and roughly 70% of visitors are male. Geography is similarly concentrated: the United States accounts for roughly 41% of traffic, followed by the United Kingdom (6.6%), Germany (4.9%), Japan (4.6%), and Canada (4.3%).

Customer acquisition leverages many different platforms, and relies primarily on creators. Most creators seed demand on YouTube, Spotify/Apple Podcasts, Twitch, TikTok, and newsletters, and convert fans on Patreon where they can own the relationship and bundle content with community. Leaderboards and category pages reflect those funnels across Podcasts, Games, and Video. Importantly, Patreon’s on-platform discovery has become a direct revenue driver too, with the company stating that internal discovery surfaces are now driving over $200 million per year to creators, and the over 60 million over free-membership layer acting as first-touch CRM for upsell.

YouTube, the go-to platform for many digital content creators and podcasters, is also where most Patreon creators first built their audience. The typical Patreon creator falls between a beginner and a seasoned professional, with Patreon representing 41% of their income. Well-established entities and influencers also use Patreon to offer premium content to their fans. Creators on Patreon tend to have a dedicated following, often cultivated through various social media or content platforms. They leverage Patreon as a means to monetize their following and offer additional value to their patrons.

As a result, patrons range from fans seeking additional content or closer engagement with their favorite creators to those who wish to support the arts or specific creators whose work they believe in. Patrons are generally characterized by their willingness to pay for digital content and their desire for exclusive or early access to content. Since 2020, TikTok's "For You" feed and its adoption by other social media platforms have shifted the focus from following creators to an algorithm-driven, highly personalized content experience, often overshadowing the creators themselves. This change has made it harder for creators to build tight-knit communities and sustainable businesses as the traditional “follower” has faded. Patreon aims to bridge this gap with new features focused on community connection and development.

Market Size

Patreon operates within the creator economy, a market segment comprised of artists, content creators, influencers, and anyone who monetizes directly through their audience. The global creator economy was valued at $250 billion in 2024 and was projected to grow to $480 billion in 2027. Drivers of expansion include more creators seeking monetization, rising internet penetration, and the emergence of platforms that support direct-to-audience business models.

Source: Epidemic Sound

The labor profile of creators has professionalized, with 54.9% of monetizing creators now working full-time. At the same time, income remains highly skewed: only 4% of creators earn more than $100K annually, while the vast majority earn substantially less. This highlights both the opportunity and the unmet need for sustainable monetization tools.

Within this larger ecosystem, Patreon operates in the direct-to-fan membership segment. Patreon has paid out more than $10 billion lifetime to creators, currently processes over $2 billion annually, and supports more than 25 million paid memberships. Adjacent platforms reinforce this momentum. Substack has surpassed 5 million paid subscriptions, with an estimated $450 million run-rate in gross writer revenue. Together, these datapoints (alongside other direct-to-fan services like OnlyFans, BuyMeACoffee, etc) imply that as of October 2025, direct fan-payment economy exceeds $10 billion and is only growing.

Competition

Content Creation Platforms with Monetization Features

YouTube: Founded in 2005, YouTube is the world's largest video-sharing platform, and the second-most visited website in the world. It was valued at approximately $455 billion as of July 2024 and was acquired by Google for $1.7 billion in October 2006. YouTube’s Partner Program, which allows creators to monetize their content through ads, channel memberships, and merchandise shelves, is a competitor to Patreon. YouTube's audience and content monetization options provide creators with an alternative to Patreon, particularly for video content creators. In particular, channel memberships on YouTube allow viewers to join a paid community, similar to Patreon, with perks, feedback options, and loyalty rewards. However, YouTube takes 30% of the revenue (more than Patreon) and has stricter terms of service and copyright policies. Furthermore, YouTube's expansion of its Super Chat and Super Sticker features, allowing fans to pay creators directly during live streams, has also increased its competitiveness in the creator economy.

TikTok: Since its global launch in 2018, TikTok was the most utilized social app by US adults as of April 2024. Its success has been driven by its focus on short-form video content, a large music library, and a powerful recommendation algorithm. As of October 2025, TikTok-maker ByteDance is valued at $330 billion. In 2022, TikTok introduced TikTok LIVE Subscription for creators with over 1K followers, allowing them to make money from live streaming. Subscribers gain exclusive benefits like badges, custom emotes, and subscriber-only chats, with pricing expected to start at $4.99 per month, similar to Twitch. In 2023, TikTok also launched TikTok Shop, enabling creators to sell merchandise and monetize through affiliate marketing. However, while TikTok offers emerging creators more exposure than other platforms, its emphasis on algorithm-driven content discovery makes it challenging for creators to build and maintain a loyal following. TikTok competes with Patreon by offering creators monetization options like fan memberships, gifts, and tipping features, allowing them to earn directly from their content and fan engagement on the platform.

Twitch: Founded in 2006 and acquired by Amazon in 2014 for $970 million, Twitch is one of the largest live-streaming platforms for gamers. It had an estimated valuation of $46 billion as of July 2024 and reported an average of 31 million daily visitors in March 2023. The Twitch Partner Program, which allows streamers to monetize their streams through subscriptions and ads, is a direct competitor to Patreon, particularly for creators in the gaming industry. While Patreon offers a more generalized platform for various types of creators, Twitch’s focus on live streaming and its integration with Amazon Prime via Twitch Prime gives it a unique position in the creator economy. As of March 2024, Twitch prioritizes helping creators grow their communities and earn more. Twitch also allows creators to start offering subscriptions relatively early, once they reach 50 followers and meet Twitch Affiliate criteria. After that, creators can offer subscription tiers at $4.99, $9.99, and $24.99 per month as of October 2025. Viewers can also support their favorite streamers by purchasing virtual currency to express excitement or gratitude during live streams.

Discord: Originally launched in 2015 as a communication platform for gamers, Discord reached over 200 million monthly active users and a valuation of $14.7 billion in 2024. In 2023, Discord improved its server subscriptions, allowing subscribers to access exclusive text or voice channels, premium emojis, and special or early content from creators. Creators receive 90% of the revenue from these subscriptions. In June 2024, it also introduced customizable tier pricing and premium roles on servers, which can be offered to subscribers or sold separately. Discord competes with Patreon by enabling creators to monetize their communities directly through subscription-based access to exclusive channels, content, and interactions.

Medium: Medium is an online publishing platform founded in 2011 by Twitter co-founder Evan Williams. Medium's Partner Program pays writers based on how much members engage with their articles and provides direct competition to Patreon for writing and blogging creators. Unlike Patreon's subscription model, Medium allows writers to earn money directly from their readers' engagement. It offers an alternative for writers to monetize their work without maintaining a subscription base. Medium's reader base and built-in distribution tools also give writers a larger audience than they might reach via Patreon. Medium has raised $163 million in funding as of October 2025. Its valuation has not been publicly disclosed.

X: Founded in 2006 as a microblogging service, X (formerly Twitter) has grown to become one of the world’s largest social media platforms, purchased by Elon Musk’s xAI in October 2022 for $44 billion. It has served as a distribution network and growth engine for content creators of all stripes, though it has historically struggled to enable them to monetize on the platform itself, with efforts like Super Follows seeing limited success. Musk emphasized creator monetization as a desirable substitute for advertising revenue, relaunching Super Follows as Subscriptions. Creators with over 500 followers can join Subscriptions on X, receiving 97% of the revenue until reaching $100K in lifetime earnings, after which their share drops to 90%. Similar to Patreon, subscribers can unlock exclusive posts, one-on-one communication with the creator, private discussion spaces, and badges.

Snapchat: Snapchat, founded in 2011 as a photo-sharing app, has evolved into a multimedia messaging platform for sharing pictures and videos with effects, with a market cap of $13.1 billion as of October 2025. Creators with over 50K subscribers who regularly post stories can qualify for the stories revenue share program, where ads are placed between their Snaps, and they earn a portion of the ad revenue. Like Patreon’s upcoming gifting feature, Snapchat allows users to send virtual gifts to creators using Snap Tokens as a way to show appreciation.

Meta: Formerly named Facebook and founded in 2004, Meta is a holding company for Facebook, Instagram, and other businesses, with a market cap of over $1.8 trillion as of October 2025. Facebook is a social media platform for connecting and sharing content. Facebook Subscriptions allow some creators with over 10K followers to offer exclusive content and perks. Creators also keep 100% of the subscription revenue after platform fees. Instagram is a photo-sharing app that lets users upload, edit, and share content. Instagram Subscriptions (similar to Facebook’s model) enable creators to offer exclusive content, including live streams, stories, badges, posts, reels, and social channels, where creators keep 100% of the subscription revenue, unlike Patreon.

Creator Monetization Platforms

Substack: Founded in 2017, Substack is a publishing platform that enables writers and podcasters to monetize their work directly from readers through paid subscriptions. Substack takes a 10% fee on paid revenue (plus Stripe fees), leaving creators with about 90% of earnings. The platform has grown quickly, scaling from 3 million paid subscriptions in February 2024 to 5 million by March 2025. Substack has raised over $100 million in venture funding, reaching a valuation of $1.1 billion in its July 2025 Series C, up from $650 million in 2021. Substack competes with Patreon by focusing on long-form written content and podcasts rather than multimedia or community-first creators. While Patreon spans art, gaming, and video, Substack is optimized for writers building direct relationships with their audiences through newsletters and serialized publishing. Its strong subscriber growth and creator-friendly revenue split position it as a leading Patreon alternative for journalists, essayists, and independent publishers.

Gumroad: Founded in 2012, Gumroad is a platform that enables creators to sell their work directly to their audience. Gumroad presents an alternative to Patreon for creators seeking to sell digital products, such as ebooks, courses, and music. Gumroad's pay-what-you-want model, which allows customers to set their prices for products, is popular among creators. Gumroad also charges no monthly subscription fees to creators, differentiating it from Patreon’s subscription model. It has raised $16.1 million in funding as of October 2025 and is valued at $100 million, with notable early investors including Naval Ravikant, Jason Fried, and Max Levchin.

Ko-Fi: Founded in 2012, Ko-Fi is a platform for creators to receive one-time donations and tips. With an estimated annual revenue of $14.1 million as of October 2025, Ko-Fi stands out for its simplicity and affordability compared to Patreon. Creators can use Ko-Fi to build memberships, receive donations, sell products, and offer commissions or requests from a single page. They can set their membership tiers with various benefits, such as exclusive content and Discord roles. On its free plan, creators keep 95% of their revenue with no flat fees, while the Gold plan charges a $6 monthly fee and allows creators to keep 100% of their earnings. Ko-Fi’s approach enables creators to manage one-time donations, store sales, and memberships all in one place.

Buy Me a Coffee: Founded in 2018 by Jijo Sunny, Joseph Sunny, and Aleesha John, Buy Me a Coffee simplifies monetization for creators with minimal setup. The platform allows creators to establish monthly or yearly subscriptions in exchange for exclusive content and includes a shop feature where creators can sell digital and physical products, like one-on-one calls, art commissions, and ebooks. Buy Me a Coffee takes a 5% fee from every transaction made on the platform. As of October 2025, it has an estimated annual revenue of $5.5 million and $150K in funding from Aaron Levie and Ankur Nagpal, among other angel investors.

Ghost: Launched in 2013, Ghost is an open-source, non-profit platform that offers an independent alternative to Patreon. It allows creators to run their websites, collect signups, publish private content, manage payments, and send newsletters. Unlike Patreon, which takes a percentage of earnings, Ghost operates on a subscription model starting at $9 per month, with the $25 per month creator plan offering unlimited theme access and custom integrations. Ghost appeals to creators who want more control and less interference from the platform they monetize on.

Business Model

As of October 2025, new creator pages use a single 10% platform fee. This fee is charged to creators on their earnings, deducted before payout, while patrons only pay the listed membership or product price plus any applicable taxes.

Creators who publish after August 4, 2025 are on the standard plan described above. Creators who published on or before August 4 keep legacy pricing unless they unpublish or republish (which migrates them to 10%). The standard plan includes the core toolkit (hosted page, monthly/annual memberships, digital product sales, community tools, insights) and Patreon Video/Live with an allowance of 100 hours/month for eligible creators. For one-time purchases, the platform fee now matches the creator’s plan rate in most situations. Early sellers may keep legacy treatment, and certain Patreon Shop surfaces may still show previous 5% fees.

Regardless of plan, creators pay payment processing on top of the platform fee, with standard vs. micropayment tiers by currency and method. Patreon applies a 2.5% currency-conversion fee when a member’s payment currency differs from the creator’s payout currency. Payout fees still apply. Where required, Patreon also applies VAT/sales tax to creator fees based on the creator’s location.

On iOS in-app purchases, Apple’s 30% App Store fee applies to eligible in-app transactions and replaces Patreon’s payment-processing fee for those transactions, while Patreon’s platform fee still applies; creators can choose to raise iOS prices to offset Apple’s fee or absorb it. After the April 30, 2025, Epic v. Apple ruling, Patreon paused the forced migration to subscription billing for 2025 and enabled U.S. users to complete purchases via mobile web.

Creators and patrons participate in different ways. Creators are Patreon’s paying customers: they set membership tiers and product prices; choose billing options (monthly/annual); publish posts, videos, and live streams; and receive their take-home after the platform fee (legacy rate or 10%), payment processing, foreign exchange when applicable, and payout fees. Patreon doesn’t withhold income tax for creators.

Patrons (the creators’ customers) pay the listed membership/product price plus any required VAT/sales tax based on their location. Patreon collects and remits consumer taxes, so the tax line is separate from creator earnings. Patrons can also buy in the iOS app, where Apple’s 30% App Store fee applies, and creators can choose to offset Apple’s fee via higher iOS pricing or absorb it. In the U.S., many transactions can now be completed via mobile web checkout following Epic v. Apple.

Patreon’s model, at its core, is a commission on sales plus processing, foreign exchange, payout, and tax on fees. Members/patrons pay the list price and any required consumer tax. This system creates a two-sided marketplace where Patreon monetizes by taking a percentage of creator earnings while enabling fans to directly support creators with transparent pricing and tax handling.

Traction

In 2018, Patreon facilitated income generation for creators from over three million active patrons, a 50% year-over-year increase from the two million patrons it processed payments for in 2017. In May 2018, Conte stated that it would process $300 million in payments that year, implying $30 million in revenue in 2018. By April 2021, the company stated that it hosted over 200K creators, earning over $100 million monthly from more than seven million patrons. Patreon said it added more than 30K creators during the pandemic in the first weeks of March 2020. According to an unverified source, Patreon had over 250K creators supported by eight million patrons as of September 2024.

In 2025, Patreon crossed $10 billion in lifetime payouts, with more than $2 billion per year flowing to creators and over 25 million paid memberships. The platform also counts over 100 million total memberships (free and paid) and supports over 300K active creators. Patreon highlights that over 700K free members convert to paid monthly, its discovery features drive over $200 million per year to creators, fans have watched over 80 million hours of video in 2024, and one-time purchases grew 4× year over year.

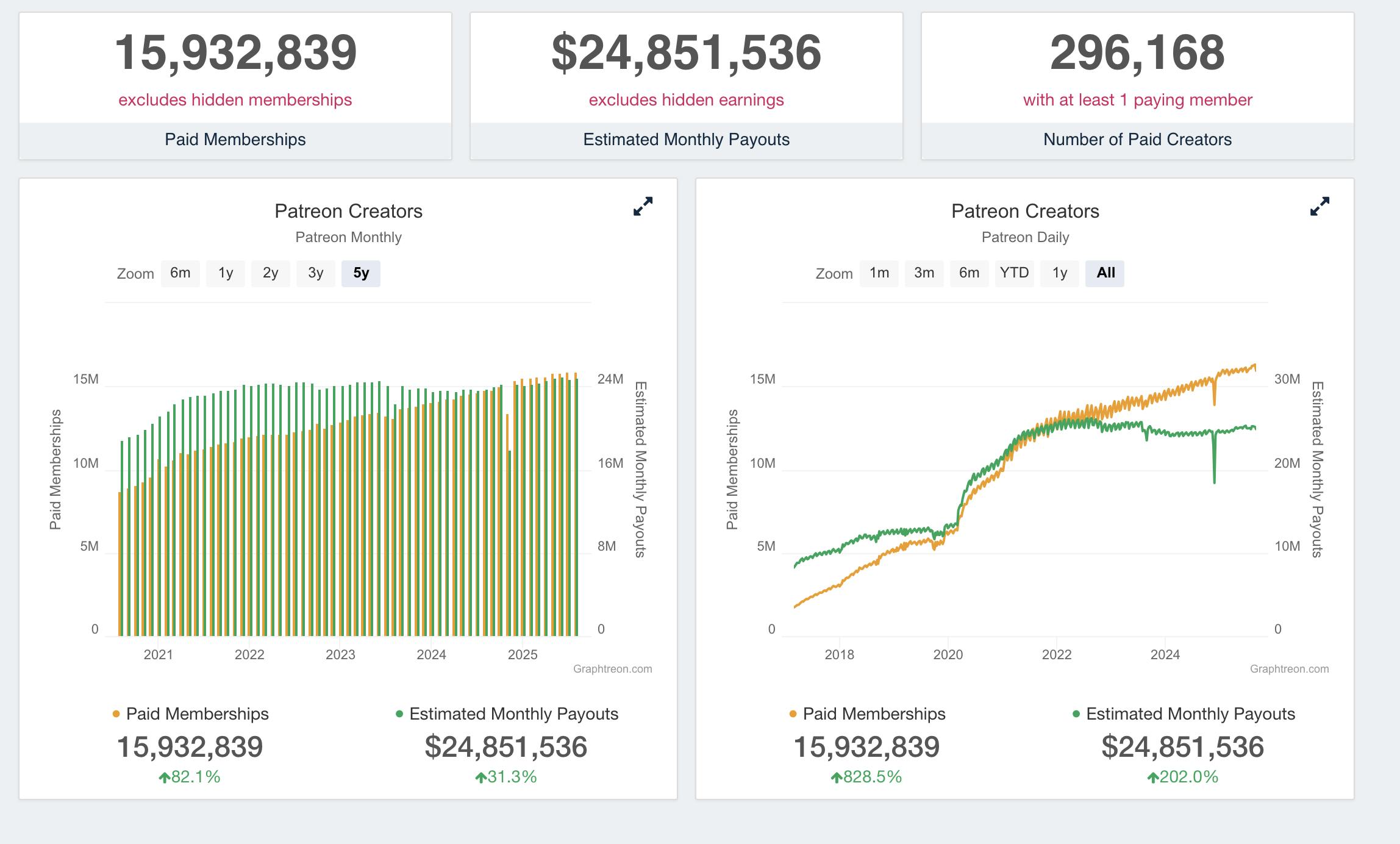

Graphtreon uses publicly available data from Patreon to estimate the total monthly payouts on the platform. While some creators elect not to make their monthly earnings public, and are therefore excluded from this total, the graph indicates a general growth trend, including a spike in the early months of the COVID-19 pandemic and less aggressive growth since 2021.

Source: Graphtreon

As of 2025, Graphtreon shows about 15.9 million paid memberships, 296K creators, and $24.9 million in visible monthly payouts. By category, video leads with 4.1 million memberships, peaking in 2022 before declining; podcasts hold 2.3 million, largely stagnant since 2022; and games have grown from 800K in 2023 to 975K in late 2024 and 1.0 million by 2025.

Acquisitions

Patreon has expanded its feature set through strategic acquisitions. In October 2023, Patreon acquired Moment, a digital ticketing experience platform. This acquisition enhanced Patreon's ability to offer interactive digital experiences and opened the door to new opportunities for creators to monetize and connect with patrons. Since then, Patreon has folded ticketing and live experiences into the core product by rolling out early-access Events and piloting native Live video (with OBS setup and Streamlabs support, including 24/7 streams), with a summer 2025 rollout and tests of ad-free live uploads.

Patreon’s prior acquisitions focused on subscription-related services. In August 2018, it acquired Memberful, a subscription platform that lets creators sell exclusive content through their sites, rather than on Patreon’s central platform. Then it acquired Kit in June 2018, which is a platform that helps creators bundle merchandise with their subscriptions, allowing them to offer physical products alongside digital content and membership perks. It also acquired Subbable in March 2015, which was a subscription-based funding platform for artists, which helped Patreon enhance its initial subscription model.

Valuation

In April 2021, Patreon announced a $155 million Series F round led by Tiger Global, which valued the company at $4 billion. Existing investors from prior rounds included New Enterprise Associates and Woodline Partners. As of October 2025, the company has raised a total of $413.3 million.

The company issued layoffs for 17% of its workforce and went through a 70% drop in its 409A valuation, which is an appraisal of value for a private company’s stock, in 2022. As a result, Patreon’s valuation as of September 2024 was estimated to be around $1.4 billion. In 2021, Patreon was considering going public and had been approached by special purpose acquisition companies (SPACs). As of October 2025, it has yet to go public.

Key Opportunities

Creator Sponsorships

Expanding to include corporate sponsorships for creators represents an opportunity for Patreon. By providing a platform for businesses to sponsor creators, Patreon could tap into a new revenue stream while facilitating direct, meaningful connections between brands and niche audiences. The global influencer marketing industry is expected to grow to $50.3 billion by 2028. This could be particularly appealing to businesses looking to reach specific demographics or engage with communities centered around particular interests or passions.

In 2025, high-profile figures like MrBeast began building a “creator marketplace” designed to directly match creators with sponsors, signaling the professionalization of sponsorship pipelines. Patreon could differentiate itself by leveraging its unique membership data, which includes conversion, retention, and live engagement, as a “sponsorship readiness score,” offering brands more predictive ROI than social follower counts. Unlike YouTube BrandConnect or TikTok Creator Marketplace, Patreon’s advantage lies in deeper fan insights tied to recurring payments, making it a stronger signal of long-term sponsor value.

Brands are also shifting their budgets toward UGC-style creator work, commissioning creators to produce native assets that can be used on brand channels rather than relying solely on influencer posts. Companies are raising their influencer budgets and prioritizing longer-term campaigns that mix micro- and macro-creators for reach and storytelling. Micro-influencers in particular continue to deliver the highest engagement rates. The value of Patreon’s base of niche creators may be an underutilized channel for brand partnerships.

Creator Financial Services

Patreon could expand by developing a financial services platform to further support its community of creators, adding value to its platform and generating additional revenue. The irregular income streams and unconventional business models of many creators can make it difficult for them to secure financing from traditional institutions, which may struggle to assess income from brand deals and social following, hindering creators’ ability to take on new projects. Patreon has unique insight into creators’ income and financial position based on their history and performance on the platform. This could allow Patreon to offer tailored loan products that consider the unique circumstances of creators, providing them with the funding they need to invest in their work and grow their businesses.

Additionally, as many Patreon creators are independent and may not have access to traditional employment-based benefits, health insurance is another potential area for expansion. Patreon could partner with insurance providers to offer health insurance plans tailored to the needs of self-employed individuals or small businesses. This could add an attractive benefit for creators and help to attract and retain users on the platform. Recent moves by firms like Viewture, which provides cash advances to YouTube creators, and Karat Financial’s creator-backed credit card validate this market appetite. As the creator economy expands and more monetization options arise, the demand for personalized financial services may increase as well. Patreon could go further by offering “membership-backed advances” tied to recurring subscription income, which can be considered more stable than ad revenue or follower counts, and support general employment-based benefits

Increased Patron Involvement

In 2024, Patreon’s introduction of free memberships and community chats has proven successful, with communities on the platform doubling and over 60% of free members joining to stay updated with creators’ work. This growth highlights the demand for closer connections between creators and patrons. Moreover, data shows that over 90% of Patreon creators with active communities earn $1K or more per month, underscoring the financial benefits of involved fanbases.

Gen Z spends the most time engaging with digital content on social media, with 65% identifying as content creators and 89% identifying as fans. This demographic follows more individual content creators than previous generations and seeks participatory experiences when continuing content trends. By giving patrons more agency to organize fan-led events and shape store inventories, Patreon can cater to its audience’s desire for personal connection and active participation.

In late 2024, Patreon also introduced gift memberships and discounts, while in April 2025, it began testing a native livestreaming feature with OBS/Streamlabs integration, scheduled for wider release in summer 2025. To maximize this, Patreon could build fan-led event features (watch parties, AMAs), collaborative commerce (fans voting on merch or perks), and patron governance tools, mapping directly onto Gen Z’s expectation for participatory fandom. By tying these participatory features directly to financial actions such as gifting, upsells, and store purchases, Patreon can out-differentiate Discord or Twitch, which offer community but not embedded monetization.

Key Risks

Native Platform Creator Tools

Patreon's business model could face risks as other platforms continue building their tools for creators. These platforms integrate monetization features directly into their product offerings, potentially reducing the need for creators to rely on Patreon for their income. Social media companies like YouTube, Facebook, Instagram, TikTok, and Twitter are developing monetization features, many of which have been rolled out. For example, YouTube has a channel membership feature, Instagram offers a "Badges" program for live videos, and TikTok has a creator fund. These platforms provide creators with ways to earn money directly from their platforms, creating a potential competitive risk for Patreon.

As these platforms continue to integrate monetization tools, they can offer a more seamless experience for creators and their fans. For instance, a YouTube creator can offer channel memberships directly within the YouTube ecosystem without directing fans to an external platform like Patreon. This integrated experience could be more attractive to creators and fans alike, potentially drawing users away from Patreon. Creators could migrate their fan base from Patreon to their respective platforms if they find the integrated tools more convenient or lucrative.

Content Moderation

Patreon's reputation and platform integrity are contingent upon its ability to moderate content and ensure adherence to platform guidelines effectively. However, content moderation is a complex and resource-intensive task. In 2018, Patreon suspended many adult content creators on its platform due to pressure from payment partners. If Patreon is perceived as too strict or inconsistent in its moderation policies, it could face backlash from creators who feel their freedom of expression is unduly limited. Creators Jordan Peterson and Dave Rubin announced they would leave Patreon in early 2019, citing perceived political bias in moderation decisions.

As of May 2024, Patreon required adult content creators to obtain and retain written consent from all participants in their content to comply with updated payment processor regulations. Additionally, Patreon joined the Tech Coalition, a global alliance committed to combating online child exploitation and abuse, in March 2023.

Future changes in laws and regulations around digital content could impose further obligations on Patreon, increasing the costs and complexities of content moderation. US regulators discussed repealing Section 230 in February 2023, a law that protects internet platforms from liability for what third parties say or do to them. Repealing Section 230 could require tech companies to moderate their platforms or face potential liability.

In March 2025, Patreon released its second Transparency Report covering 2024, confirming increased enforcement on age-restricted and adult content, including staggered feature access for 18+ creators. YouTube, Meta, and TikTok also expanded rules on “synthetic media,” which may indirectly pressure Patreon to tighten moderation around AI-generated content. This suggests Patreon will face higher compliance costs and a greater need for creator-facing risk maps and pre-publish compliance tools to maintain trust.

Creator Retention

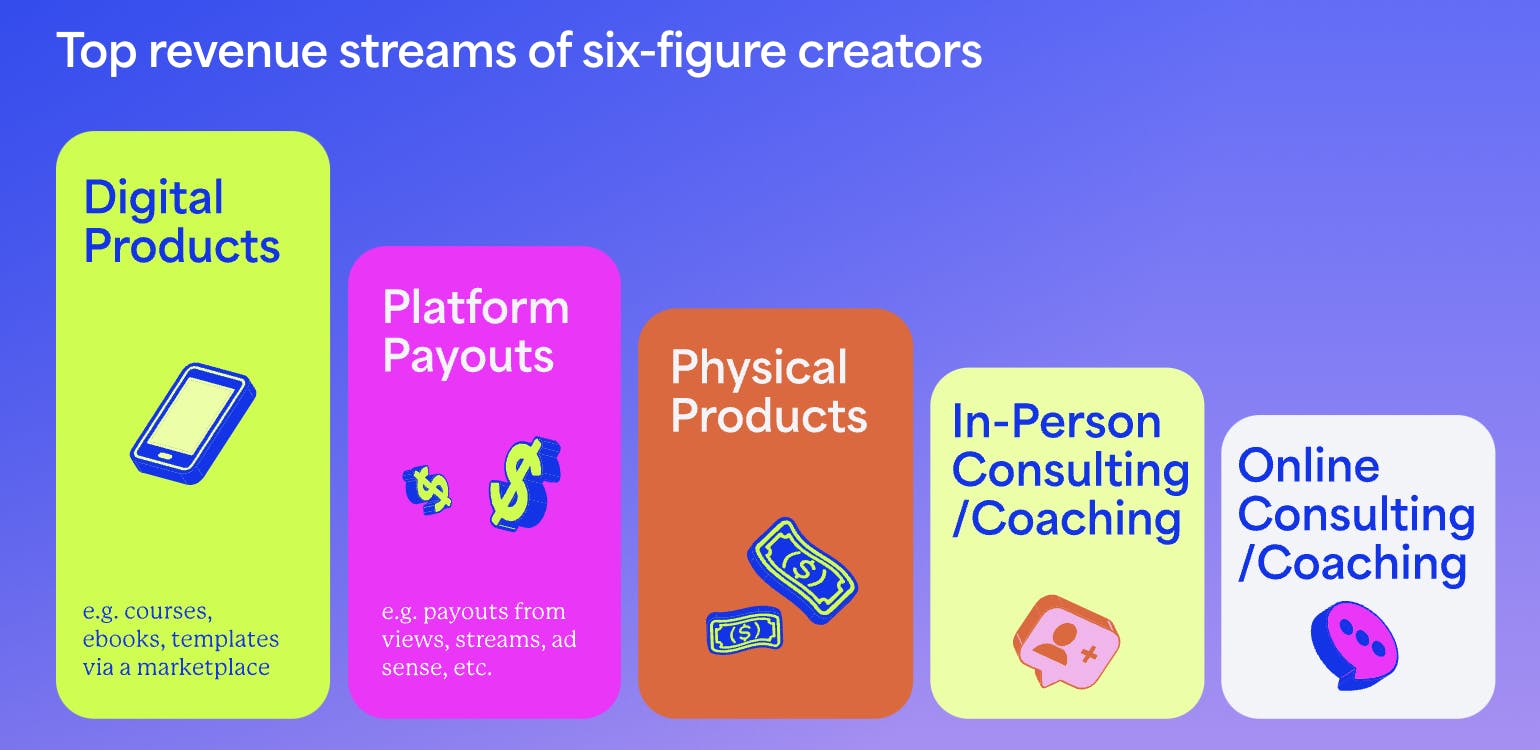

Patreon risks losing creators if it isn’t able to scale with its growing audiences. As the number of creators selling digital products has surged since COVID-19, these products have become a top revenue stream for creators earning $100K and over. While Patreon is initially attractive because of its easy setup, it’s less effective for selling products like online courses. Creators with dedicated followings may find greater success by establishing their membership sites or making use of platforms focused on course or merchandise creation and sales, allowing them to avoid sharing revenue with Patreon. This challenge is further compounded by ongoing frustrations among creators regarding financial stability and transparency of income streams, as discussed at the first White House Creator Economy conference. These factors suggest that while Patreon is seen as helpful for early and mid-career content creators to make a living, it may struggle to retain seasoned creators seeking more business-oriented monetization options.

A growing number of scaled creators are instead building all-in-one storefronts that bundle memberships with courses, software licenses, community access, and digital goods, and then drive discovery through marketplace channels. Whop is the clearest example: third-party estimates put it at $100M in monthly GMV with a rising take rate (5–6%) as more sales flow through its platform. The pitch to creators is simple: one storefront for everything, strong SEO discovery, flexible bundles and tiers, and commerce-first tools such as coupons, affiliates, and cohorts, all with no upfront costs and fast setup. This could allow creators to monetize their platforms better than Patreon, and could be detrimental to the platform.

Source: Kajabi

Platform Instability

Patreon's growth trajectory could face risks due to external platform instabilities, in turn affecting the business model and revenue streams. One major change comes from Apple's App Store policy, which is set to take effect by November 2025. Apple mandated that Patreon must adopt its subscription-only billing for iOS transactions to maintain App Store compliance, allowing Apple to claim a 30% commission on all in-app transactions, which could significantly reduce Patreon's share. Although as of October 2025, Patreon's mobile app ranks number 31 in the entertainment category on the App Store, this change may force Patreon to choose between covering the fee costs itself or passing it on to creators, risking dissatisfaction and potential distancing from the platform. Compounding this issue is the potential TikTok ban in the US. As of May 2024, 65% of creators expressed concern about how such a ban could impact their earnings, potentially prompting them to seek revenue diversification. This trend towards multiple income streams could dilute creator engagement on Patreon, potentially negatively impacting the platform's user base and revenue model.

Summary

Patreon has carved out a niche in the creator economy by enabling creators to monetize directly through recurring subscriptions, providing a predictable income stream compared to ad revenue or platform-controlled creator funds. With more than $10 billion in lifetime payouts and over 25 million paid memberships, the platform has scaled meaningfully, but its success has drawn intense competition from YouTube, TikTok, Twitch, and Substack, all of which now offer integrated subscription or tipping features that reduce the need for an external platform. At the same time, storefront marketplaces like Whop show that scaled creators increasingly demand commerce-first ecosystems with discovery, bundling, and SEO-driven reach. To maintain its leadership, Patreon must focus on its differentiators, such as community depth, fan-to-paid conversion, discovery-driven revenue, and niche creator data while also managing risks from content moderation, platform policy shifts like Apple’s App Store fees, and creator churn to rivals offering broader commerce or native monetization.