Thesis

The Great Resignation, a period during which many Americans quit their jobs, reflected widespread worker dissatisfaction in the US following the COVID-19 pandemic. A record 47 million Americans quit their jobs by choice in 2021, and this record was broken by the ~50.5 million people who quit their jobs in 2022, compared to 42 million who quit in 2019. This rate of employee turnover is likely to persist; 56% of workers surveyed in April 2023 said that they planned to look for a new job within the next year.

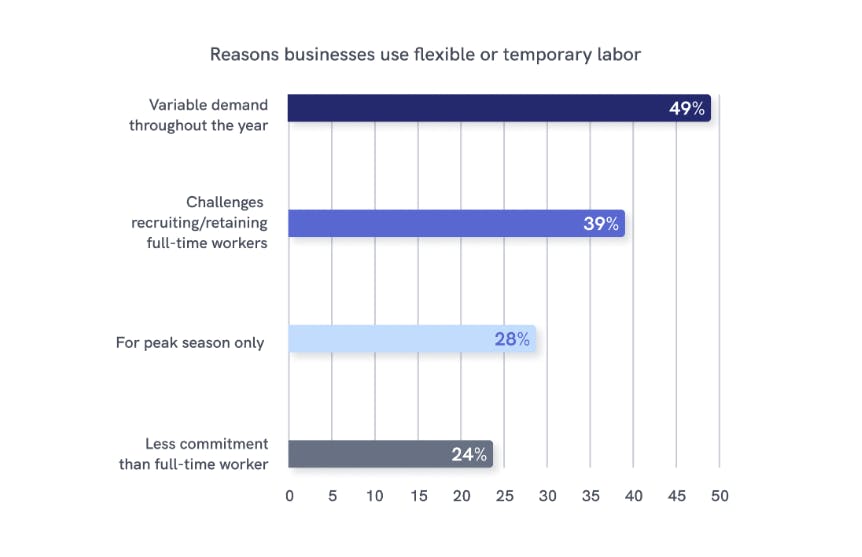

A separate survey from August 2021 found that over half of US job-seekers rank flexibility as the top reason for seeking alternative job opportunities. Workers are increasingly turning to untraditional employment options like gig work and temporary work to find this flexibility. As of the end of 2021, about one-sixth of American adults had already earned money through the gig economy.

Instawork is a labor marketplace that matches businesses with short-term, seasonal, temp-to-hire, and full-time workers. It aims to help businesses quickly and easily find the workers they need to scale their workforce based on customer demand — flexibility which is especially important given the high turnover rates of 50%-80% in industries like hospitality and warehousing. For workers, it provides an app to find and book shifts based on flexible work schedules, along with access to training and development resources.

Founding Story

Instawork was founded in 2015 by Saureen Shah (former CTO) and Sumir Meghani (CEO). Growing up, Meghani had witnessed his parents struggle to hire the employees necessary to manage sudden bursts in demand. Later in life, while Meghani was working at Groupon, a restaurant owner he spoke with faced similar issues. When Meghani delivered a pitch on how Groupon could get more customers into the restaurant, the owner expressed that the real issue was a lack of dishwashers to handle more diners, and the owner’s sign in the window saying “We need dishwashers” in Spanish had been ineffective.

To solve this pain point, Meghani (CEO) partnered with Saureen Shah (former CTO) and participated in Y Combinator’s Summer 2015 batch. They started building a restaurant job board, manually matching restaurants with workers. Inspired by Uber, they later pivoted to a flexible labor marketplace with a mobile-first focus, resulting in Instawork. As of November 2023, Meghani remained the CEO of Instawork. Debarshi Kar joined as CTO in 2017, replacing Shah.

Product

Instawork offers a mobile-first labor marketplace for both temporary and full-time workers with a focus on the hospitality, food service, cleaning, retail, events, and warehousing industries. As a two-sided marketplace, the company’s product offerings can be segmented into the following categories:

For Businesses: A marketplace platform that provides businesses (referred to as Partners) with quick access to workers.

For Workers: A work management platform that allows workers (referred to as Professionals or “Pros”) to accept work, track earnings, and set their schedule.

Resources: Information and data on the labor market.

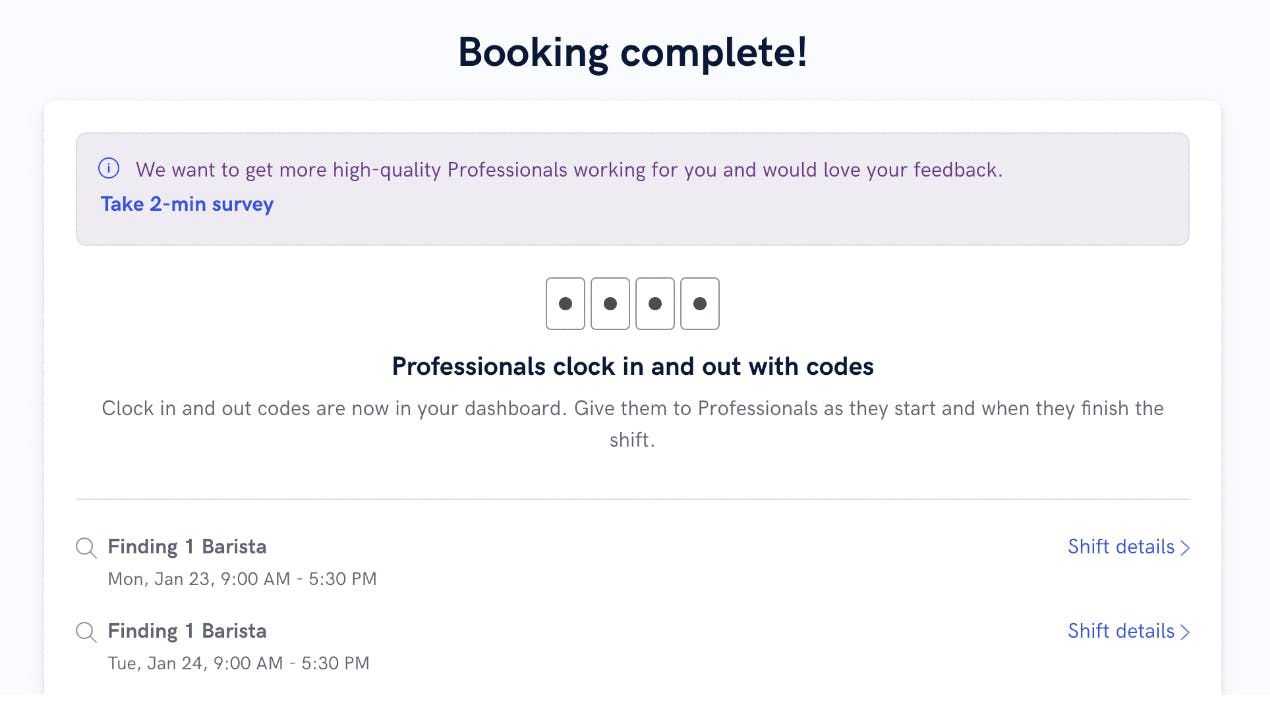

For Businesses: Temporary Workers

Instawork offers an app for businesses that allows them to find temporary workers on-demand for shifts. As with ridesharing apps like Uber, businesses and workers can rate each other. Partners post shifts, and Instawork uses a machine learning algorithm to match those shifts with temporary workers, considering numerous data points including past employment, training, and connections.

According to Instawork, the automated matching process results in an average time-to-fill of under 12 hours and a 97% fill rate within 24 hours. Despite this speed, Instawork claims “90% worker quality and less than 2% no show.”

Source: Instawork

Businesses also use Instawork’s app to communicate with workers, track their locations on their way to shifts, and manage schedules for their temporary staff. Instawork’s app can also be used by companies to manage their own staff who are not employed or contracted by Instawork.

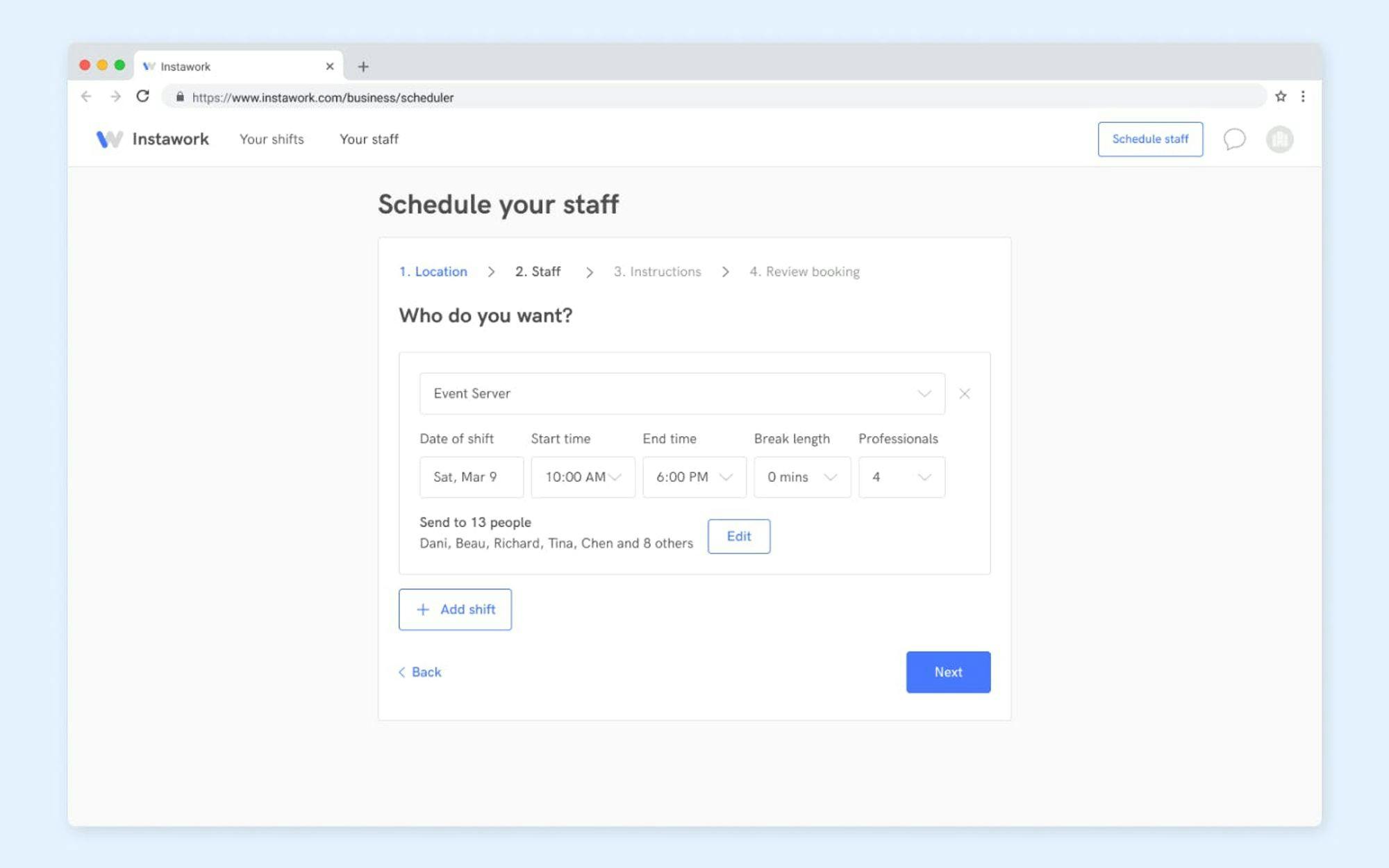

Using the app, Partners can send out shifts, specifying the location, time, and positions they need filled. They can also provide instructions on things like attire and who to report to on arrival at the event. Workers receive links to the shift requests through emails and texts. They can view information about the shift and then decide whether to accept or decline the shift.

Source: Instawork

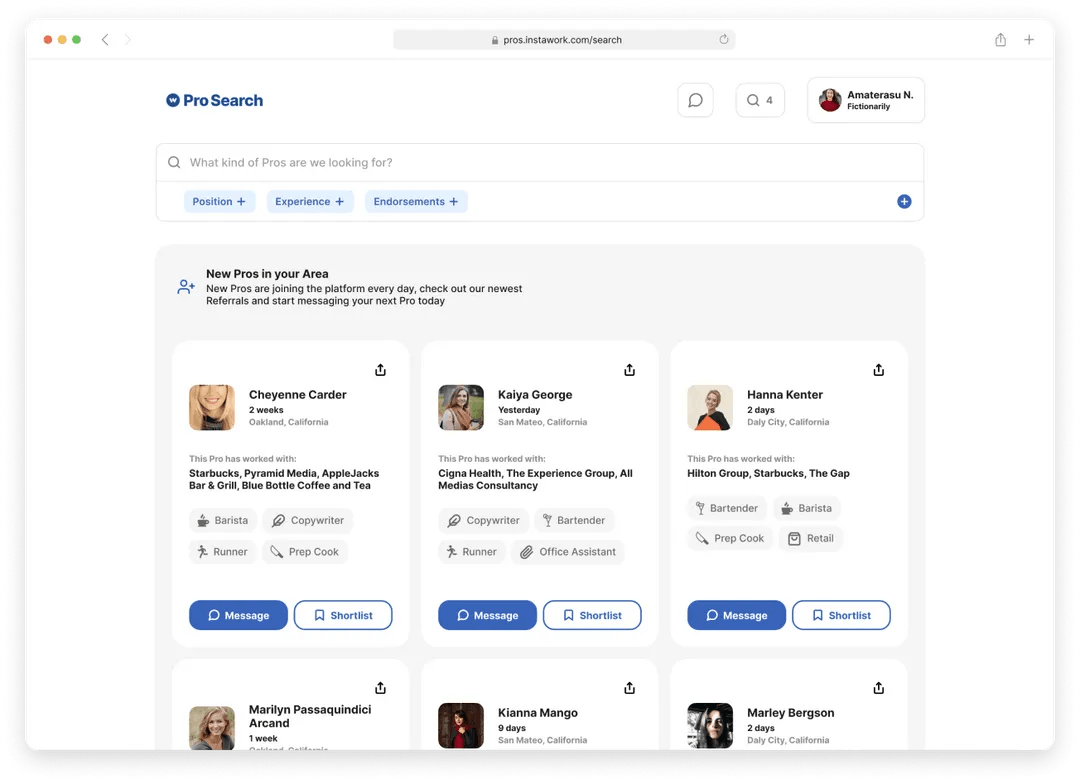

For Businesses: Full-time Workers

Instawork also enables businesses to hire full-time workers for roles that require more permanent staffing compared to a temporary, hourly position. Partners can access a Pro Search, a marketplace that shows available full-time workers, Pros, who are qualified and seeking work. Instawork claims over 5 million Pros on the platform as of November 2023. The company ensures a quality pool of workers by collecting past work experience and recommendations, conducting a background check, and requiring a quiz for some positions.

Source: Instawork

Partners can add Pros they have previously enjoyed working with to rosters. Using these rosters, Partners can open shifts only to these Pros or give them priority access. Partners largely lack control of wages, although they can offer a bonus to top Pros when posting a shift. Instead, Instawork automatically prices shifts based on local market conditions.

When hired through Instawork, Pros are employees or independent contractors of Instawork itself, as opposed to the Instawork Partners they are hired for. Instawork handles all administrative and legal work to make hiring Pros as frictionless as possible for Partners. This includes taking care of tax withholding for W-2 gigs and payments to Pros. The company also includes Occupational Accident Insurance for 1099 shifts and Workers’ Compensation Insurance for W-2 shifts. W-2 and 1099 refer to IRS tax forms for employees and independent contractors, respectively.

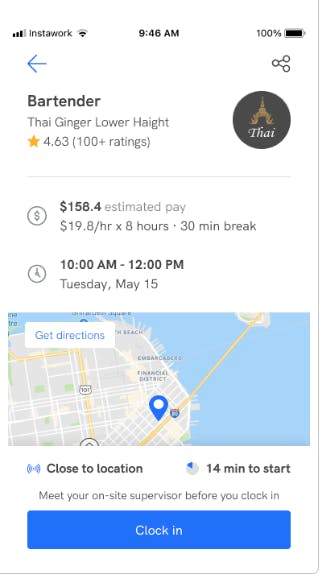

For Workers

For workers, Instawork provides an app that allows them to view and accept shifts, track their earnings, and set their schedules. Pros receive the flexibility that surveys show is increasingly important to workers, while enabling them to make more money.

The Instawork app clearly displays the amount Pros will take home from a shift. Hourly wages on Instawork average about $20/hour, significantly more than the minimum wage in any state. In fact. Pros average a 25% higher hourly wage compared to workers represented in the Bureau of Labor Statistics’ data. Partners can hire Pros into full-time jobs even for gigs not labeled as temp-to-hire.

Source: Instawork

Pros can complete additional paperwork and verification steps, including meeting with an authorized representative, to unlock W-2 opportunities. For W-2 opportunities, Pros are legally classified as employees of Advantage Workforce Services, an Instawork affiliate. In contrast, for 1099 gigs, they are classified as independent contractors of Instawork. Instawork pays pros weekly for both W-2 and 1099 shifts.

Instawork’s Top Pro program rewards high-quality work with various tiers of rewards. Top Pros can receive bonuses and up to 25% higher wages, early access to shifts, leadership opportunities, and faster payments through Instapay. Earning Top Pro status involves working many shifts, showing up, and maintaining a high rating.

With Instapay, Top Pros receive their money within hours after their shift directly to their debit cards. Leadership positions include Shift Lead and Onsite Captain. A Shift Lead is a member of the team selected by the Partner. They are the same as other Pros but also oversee the clock in - clock out process for large shifts. An Onsite Captain, on the other hand, is specifically directed by Partners to manage the staff and event.

Resources

Instawork launched its Economic Research division, led by Chief Economist Daniel Altman in January 2022. Every month, this division publishes labor market data from Instawork’s platform about each of the metro areas Instawork operates in. This first-hand data complements official surveys like those at the Bureau of Labor Statistics. The Economic Research division also analyzes this data in monthly and annual reports. Past reports have analyzed the overall hourly workforce, business costs for workers, trends in pay, and the state of particular industries.

Source: Instawork

Market

Customer

Instawork’s on-demand staffing service is most beneficial for businesses that need to flex their workforce up and down in response to demand. Companies in seasonal industries are more likely to experience fluctuating demand, but event-based companies like Encore Catering, and companies that manage their own logistics like Gift Six the Wrappery also experience it. Enterprise Partners such as Marriott, and Delaware North, which manage concessions at sports events, also face volatile demand.

Prior to Instawork, companies used traditional staffing agencies for temp labor. But many businesses, like Boley (toy company) and Half Moon Bay Golf Links (resort), turned to Instawork after being dissatisfied with staffing agencies. Other notable companies that have worked with Instawork include Google, Stanford University, Warby Parker, and Target.

Source: Instawork

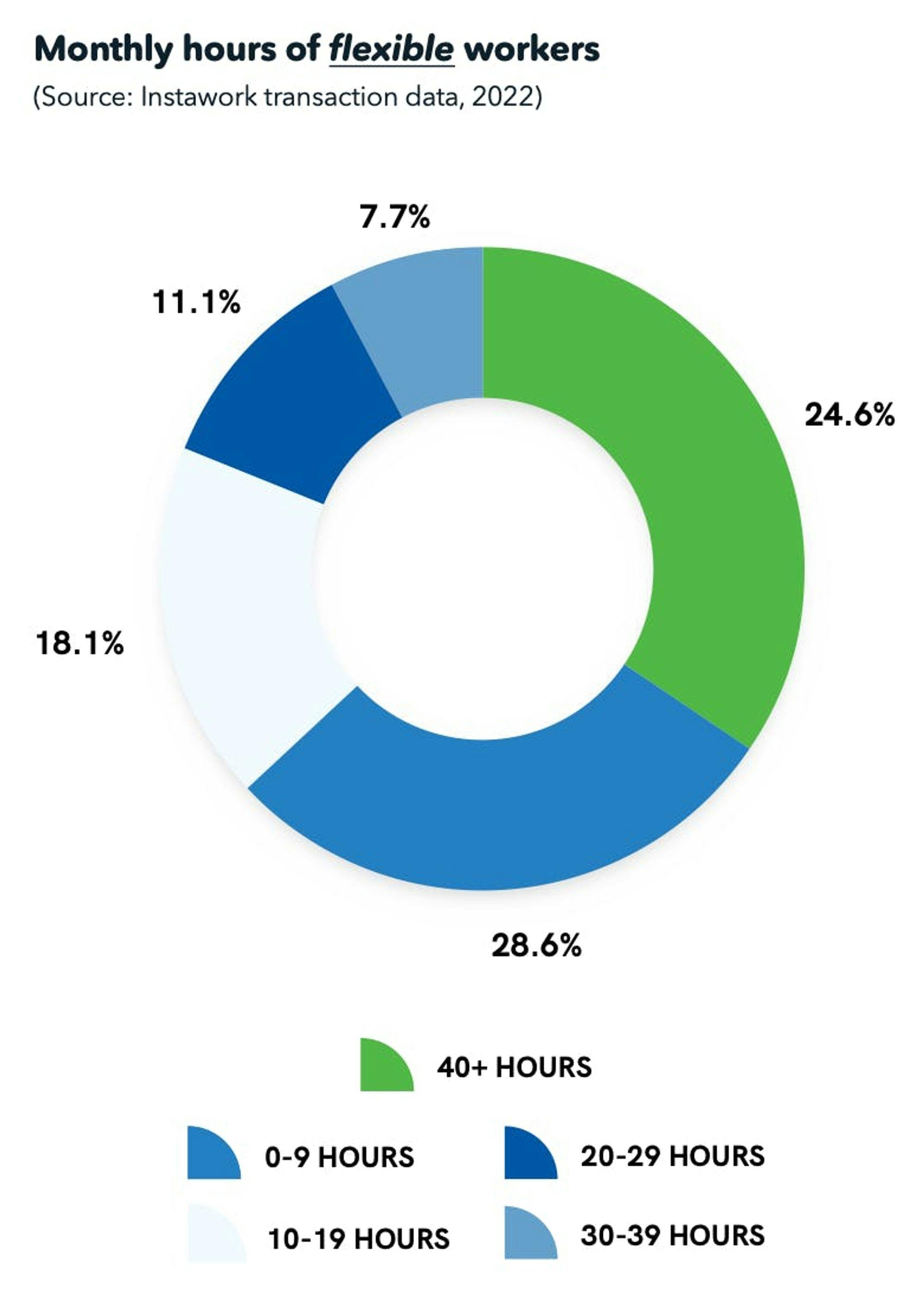

On the worker side, Instawork prefers workers with previous experience to maintain high quality. Compared to the overall hourly workforce in the US, as of 2022, about half of Pros earned 20% or more of their income through Instawork, and about three-fourths used Instawork to help pay for essentials. Nearly a quarter of Instawork Pros work 40 or more hours per week.

Source: Instawork

Market Size

The US alone had 78.7 million hourly workers as of January 2023. In 2022, there were around 58 million gig workers, representing 36% of Americans — up from just 27% in 2016. The flexibility of gig work is increasingly appealing to workers. Traditional staffing agencies saw an estimated $186 billion in sales in 2022, and tech-enabled labor marketplaces such as Instawork are poised to capture more of this market over time.

Globally, the temporary labor market was valued at $511.7 billion in 2022 and is projected to reach $930.7 billion by 2032, growing at a 6.3% CAGR. This market includes hourly workers, temporary workers, and seasonal workers. Within this, the global gig economy was estimated to have been worth $355 billion in 2021 and was expected to grow at a CAGR of 16.2% to almost $1.9 trillion by 2031.

Competition

Wonolo: Established in 2014, Wonolo is an on-demand staffing marketplace for businesses to fill immediate labor needs. Wonolo primarily serves blue-collar sectors, such as warehousing, event staffing, and delivery with a focus on underutilized workers.

As of November 2023, Wonolo had over 1 million users on its platform. Its most recent round of funding as of November 2023 was a $140 million Series D in October 2021 at an undisclosed valuation that brought its total funding to $190.9 million. Wonolo's broad reach and direct focus on providing on-demand workers to business competes directly with Instawork’s core product offering

Shiftsmart: Launched in 2015, Shiftsmart is a marketplace that connects workers with shifts across various industries, from retail to call centers. It emphasizes flexibility and worker empowerment by enabling users to pick shifts that suit their schedules across multiple work providers. By offering cross-industry job options and worker-focused features, Shiftsmart represents direct competition for Instawork in providing on-demand workers for businesses.

As of November 2023, Shiftsmart claimed it had over 3 million workers on its platform in over 50 countries. Shiftsmart raised a $95 million Series B in December 2021 which brought its total funding to $120.6 million.

ShiftPixy: Similar to Instawork, ShiftPixy has acted as jobs marketplace since its founding in 2015. ShiftPixy provides a platform for part-time workers to find, apply for, and manage gigs. As of August 2020, ShiftPixy had 28 million workers on its platform with $20K yearly in expected billings per worker per its website. ShiftPixy’s business model directly competes with Instawork in the on-demand worker space. As of November 2023, ShiftPixy had a market cap of $4.7 million.

Business Model

As a marketplace, Instawork charges a take rate, i.e. a percentage of the transaction that Partners pay for temporary workers. Instawork does not publicly disclose the take rate, but competitor Wonolo charges 45% of wages, and traditional staffing agencies typically charge over 25% of workers’ wages.

By setting the wage for each shift based on the local market, Instawork acts as a market maker. The company can calibrate this rate based on data from other shifts to maximize transaction volume on its platform. Although Partners receive less control than through traditional hiring processes, automated pricing smooths the hiring process for both sides by eliminating negotiation.

Instawork’s full-time staffing service also charges a fee when a Partner hires a Pro for a permanent role. This $2.5K fee drops to $1K when the Pro has previously worked 320+ hours with the Partner through Instawork.

Two-sided marketplaces like Instawork benefit from network effects. The company largely grew through word-of-mouth. Its August 2021 acquisition of Drafted, a startup using AI/ML to leverage workers’ networks for referrals, was intended to further boost organic marketing. It now also has a dedicated go-to-market team. The company focused on building high marketplace liquidity in the markets it started in before expanding to new cities.

Traction

Instawork generated an estimated $100 million in revenue in 2021. As of November 2023, Instawork is largely focused on North America and operates in over 48 markets across the United States and Canada with over 5 million hourly workers within its network. The company had a growth spurt in the six months preceding October 2022 when the company added more than 1 million Pros. Available shifts grew over 8x in the two years preceding July 2021 (dating back to pre-COVID times) alongside a 6x increase in gross transaction value.

Valuation

In May 2023, Instawork raised a $60 million Series D led by TCV. The round valued the company at $760 million and brought its total funding to $160 million. Notable investors from previous rounds included Benchmark, Greylock, and Craft Ventures. Although CEO Sumir Meghani stated that the company had no need to fundraise because of its $60 million Series C from two years prior in July 2021, the company wanted to fundraise to accelerate its use of AI in its product.

Key Opportunities

Flexible Work

As workers increasingly prefer flexible work arrangements, online gig platforms like Instawork stand to benefit. 56% of US workers ranked flexibility as their top priority when looking for a new job in 2021 and by 2027 86.5 million Americans could become gig workers.

Today, anyone with a driver’s license can become a rideshare or restaurant delivery driver, but platforms like Uber don’t allow workers to exercise specialized skills. Remote digital workers can find work suited to their skillset on freelancer platforms like Upwork and Fiverr. Instawork fills the gap for skilled hourly jobs where a physical presence is required, like warehousing, food service, and hospitality.

Financial Services for Pros

Instawork could naturally extend to offering financial services for its Professionals. Meghani has expressed interest in expanding to this area before, specifically mentioning loans backed by Instawork’s data. Loans could be particularly beneficial for Pros with extensive experience working on Instawork but limited or poor credit history.

Instawork already offers Instapay. Pros eligible for Instapay receive their shift payments within hours after their shift ends. However, Instapay only works with debit cards because bank account payments take too long. Instawork could solve this issue by offering its own white-labeled banking platform, allowing it to transfer money into Pros’ accounts directly after shifts.

Pros would then have a clear incentive to use Instawork’s bank accounts. When they spend money on debit cards from those bank accounts, Instawork could monetize through card interchange. On the $1 trillion in annual wages hourly workers earn, ~1% interchange on an Instawork card would represent a $10 billion market annually. This revenue stream would come at no cost to Pros or Partners. Instead, Instawork would just be taking a portion of the interchange fees that currently flow to financial institutions.

Key Risks

Job Automation

Automation could significantly reduce the demand for Instawork’s staffing service. Many of the jobs Instawork supports involve routine, physical work at risk of automation. Warehouses were projected to invest $36 billion in automation in 2021, and those investments have already resulted in robots that can handle simple tasks like boxing orders. One warehouse already used automation to reduce human labor needs by one third, and another warehouse company expects 60% to 70% of its warehouses to be majority-automated by 2027. In the food service industry, one report found that over 80% of restaurant jobs could be automated. This includes 21% of cooks and over half of fast-food and counter workers. Fully automated restaurants, like Mezli in San Francisco, already exist.

Regulation

Governments could pass regulations to set minimum pay and benefit standards for online gig platforms. For example, in June 2022, Seattle passed a law requiring gig apps with over 250 contractors to pay their contractors at least the city’s minimum wage of $17.27. New York City passed a similar regulation for Uber and Lyft drivers in 2019. Brent Goldfarb, a professor of entrepreneurship at the University of Maryland School of Business, summarized that situation:

“Two things could happen if you increase wages for the gig worker in Uber or Lyft: The company eats the difference or they raise the cost of rides. If the company raises the cost of rides, then fewer people may take rides at the higher prices and then there would be less work to go around.”

In Instawork’s case, although shifts would be filled at higher hourly rates, Partners would likely post a lower number of shifts. To compensate for lower shift openings, the company could be forced to reduce the number of Pros, as Uber did in response to the New York City law. This would further reduce revenue opportunities by providing a smaller base for Instawork’s potential expansion into financial services for Pros.

Multi-Tenanting

Uber and Lyft offer very similar products. Nearly 1 in 4 rideshare drivers in the US work for both companies and nearly 1 in 8 rideshare passengers use both platforms. Drivers can choose based on the service that provides the higher payout, and riders can hunt for the lower ride price. Uber and Lyft’s fight for market share led to a price war, and as of June 2022, neither company is profitable. A similar situation could arise between Instawork and direct competitors like Wonolo and Traba, leading to a lack of profits despite the promising market opportunity.

Summary

Workers want flexibility, and they often find it through gig work. Skilled hourly workers in warehousing, food service, and hospitality turn to Instawork for well-paying shifts suitable for their skills and on their schedule. Businesses also benefit from Instawork’s flexibility. They use Instawork to rapidly scale their workforces up and down as needed and to skip time-consuming processes like sourcing job candidates, interviewing, issuing paychecks, and training. Although job automation, regulation, and lack of differentiation pose risks to Instawork, the company can further capitalize on its network of gig workers by offering them financial services.