Thesis

The rise of e-commerce has led to significant growth in the light industrial sector, with businesses such as warehouses, distribution centers, and production facilities forming the logistics backbone of online retail. However, this growth has brought challenges, as these businesses must adapt to the volatile demand patterns inherent to e-commerce. With monthly purchase volumes fluctuating due to seasonal trends, light industrial companies often rely on a small base of regular employees supplemented by temporary workers to fulfill short-term spikes in labor demand. That said, the staffing process today is outdated, slow and ineffective, making labor constraints the top bottleneck in logistics.

Simultaneously, the U.S. workforce has experienced a shift in preferences, with workers increasingly prioritizing flexibility and alternative forms of employment. The Great Resignation, a trend that saw a record 4.5 million workers quit their jobs every month in 2022, reflects widespread dissatisfaction with traditional employment models. A 2024 survey revealed that nearly 50% of people are considering leaving their careers in the following year, while a 2021 study found that 56% of U.S. job-seekers view flexibility as the primary reason for seeking new opportunities. Consequently, more workers are turning to gig work and temporary employment, with 44% of gig workers saying they make more money from temporary employment vs. traditional work as of March 2024.

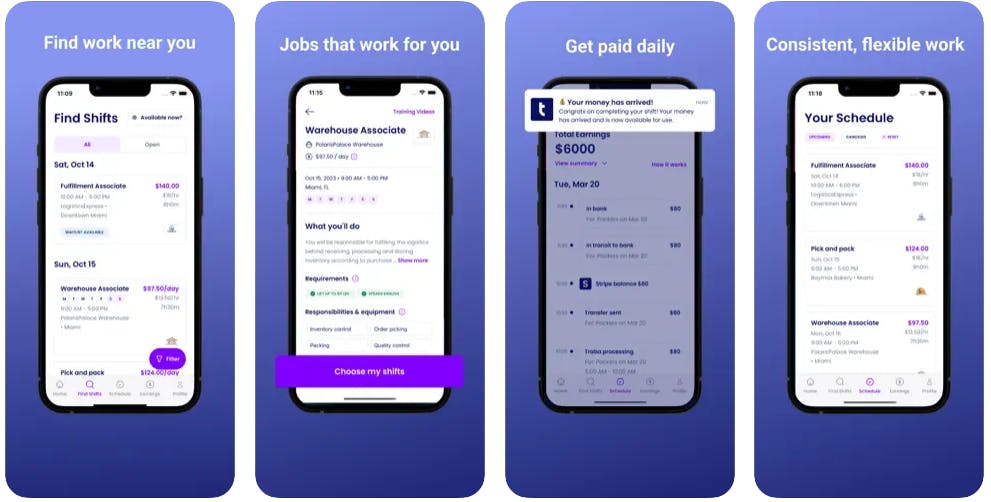

Traba, a labor marketplace founded in 2021, aims to bridge the gap between these two trends by connecting light industrial businesses with temporary workers seeking flexible employment. The company's platform provides a range of features, including a shift management system for businesses, a mobile app for workers to find and accept jobs, and operational tools to vet and coordinate workers. By leveraging technology to streamline the temporary staffing process, Traba seeks to address the challenges faced by light industrial businesses, such as high employee turnover rates of 75-95% and low fill rates of 46% on average for requests handled by traditional staffing companies.

As ecommerce continues to grow, with worldwide B2C sales projected to increase from $3.6 trillion to $5.5 trillion between 2023 and 2027, the demand for flexible staffing solutions in the light industrial sector is expected to rise. Traba is positioned to capitalize on this opportunity by providing a platform that benefits both businesses and workers. For businesses, Traba offers the ability to quickly find workers, manage shifts, and rehire high-quality candidates, enabling them to adapt to variable demand. For workers, the platform provides access to flexible, well-paying temporary jobs that align with their skills and schedules. By addressing the needs of both sides of the market, Traba aims to establish itself as a leading player in the light industrial staffing space.

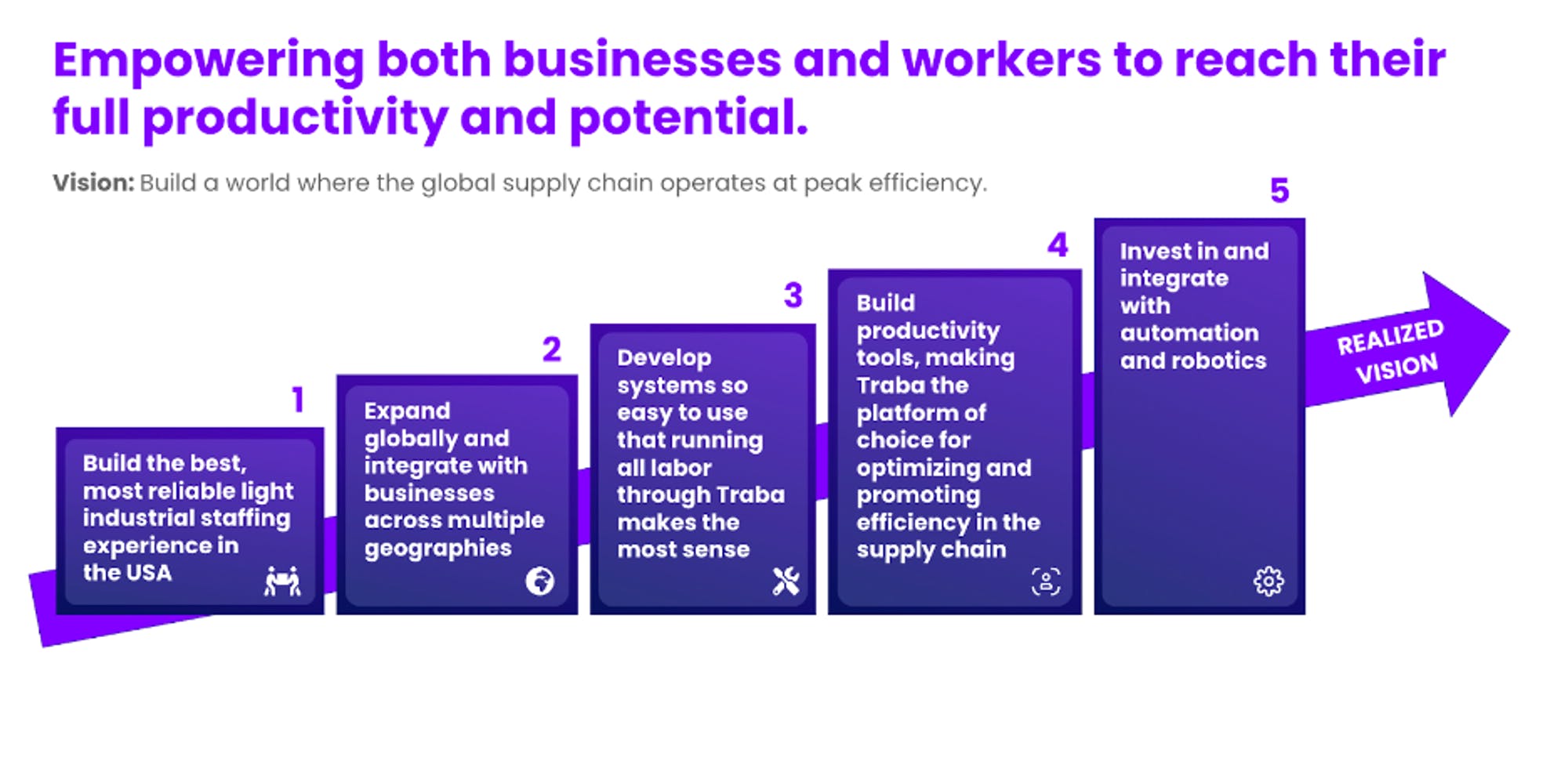

Traba’s overarching purpose is to address and solve the critical issues that arise from labor shortages and inefficiencies. In addition to creating a more meritocratic staffing platform, Traba plans to build interconnected systems and software that drive productivity and efficiency across supply chain operations globally. The goal for Traba customers is to enable faster delivery of goods, more efficient food and product manufacturing, and timely and effective matching of labor supply to workforce needs. In a September 2024 interview with Contrary Research, Traba CEO Mike Shebat said that “Traba is a technology company that increases the productivity and potential of the global supply chain – and staffing is just the beginning.”

Source: Traba

Founding Story

Source: Traba

Traba was founded in 2021 by Mike Shebat (CEO) and Akshay Buddiga (CTO).

After working at Goldman Sachs and Blackstone from 2013 to 2014, Shebat joined McMaster-Carr, a supplier of hardware, tools, and raw materials, where he discovered the complexities of temporary staffing in warehouses, factories, and fulfillment centers. When customers placed orders with McMaster-Carr, the company relied on staffing agencies to build temporary teams to handle packing, labeling, and loading packages. Shebat found that calling multiple staffing firms was time-consuming and laborious, especially because less than half of the assigned temporary workers would show up.

Shebat joined Uber in 2016, where he worked on launching Uber Eats in sixteen different markets. While at Uber, Shebat continued researching the problem he observed at McMaster. He discovered that staffing for light industries, such as warehousing, distribution, and events was challenging. In 2021 annual worker warehouse turnover rates were 49%, agencies would take up to seven days to hire a team, and usually, these teams were understaffed with an average industry fill rate of 46%. Shebat realized that these issues stemmed from a lack of a system of record as there was no way to vet workers’ skills and invite back productive workers.

Buddiga joined Zenefits in 2014 after their $66.5 million Series B round and spent 16 months at the company working on product operations. His experience left him with an appreciation for startups and the intensity required to succeed in company-building. After Zenefits, Buddiga became an engineer at Fanatics in 2016. Buddiga spent five years at the company scaling its products globally, and implementing multi-language and multi-currency features in Europe and Japan.

Shebat and Buddiga met through On Deck, a startup accelerator. Shebat joined On Deck in 2021, during the COVID-19 pandemic, to work on an idea for a tech-forward light industrial staffing platform and find a CTO. Buddiga discovered Shebat through On Deck’s intro Slack channel. The founders approached their partnership with intentionality. They discussed their ambitions, working styles, and decision-making processes, even addressing potentially challenging scenarios. Both agreed that building the business would be the primary focus of their lives, demonstrating a strong commitment to the venture.

As Shebat prepared to leave Uber, he began reaching out to potential investors in Miami, where he had relocated. Despite some initial unproductive meetings, the founders persevered in their fundraising efforts, and Traba raised a $3.6 million seed round co-led by Founders Fund and General Catalyst one month after being founded.

Product

Traba is a two-sided marketplace that connects light industrial businesses, such as distribution centers, warehouses, and event venues, to people looking for temporary work. Traba’s product offerings can be segmented into the following categories:

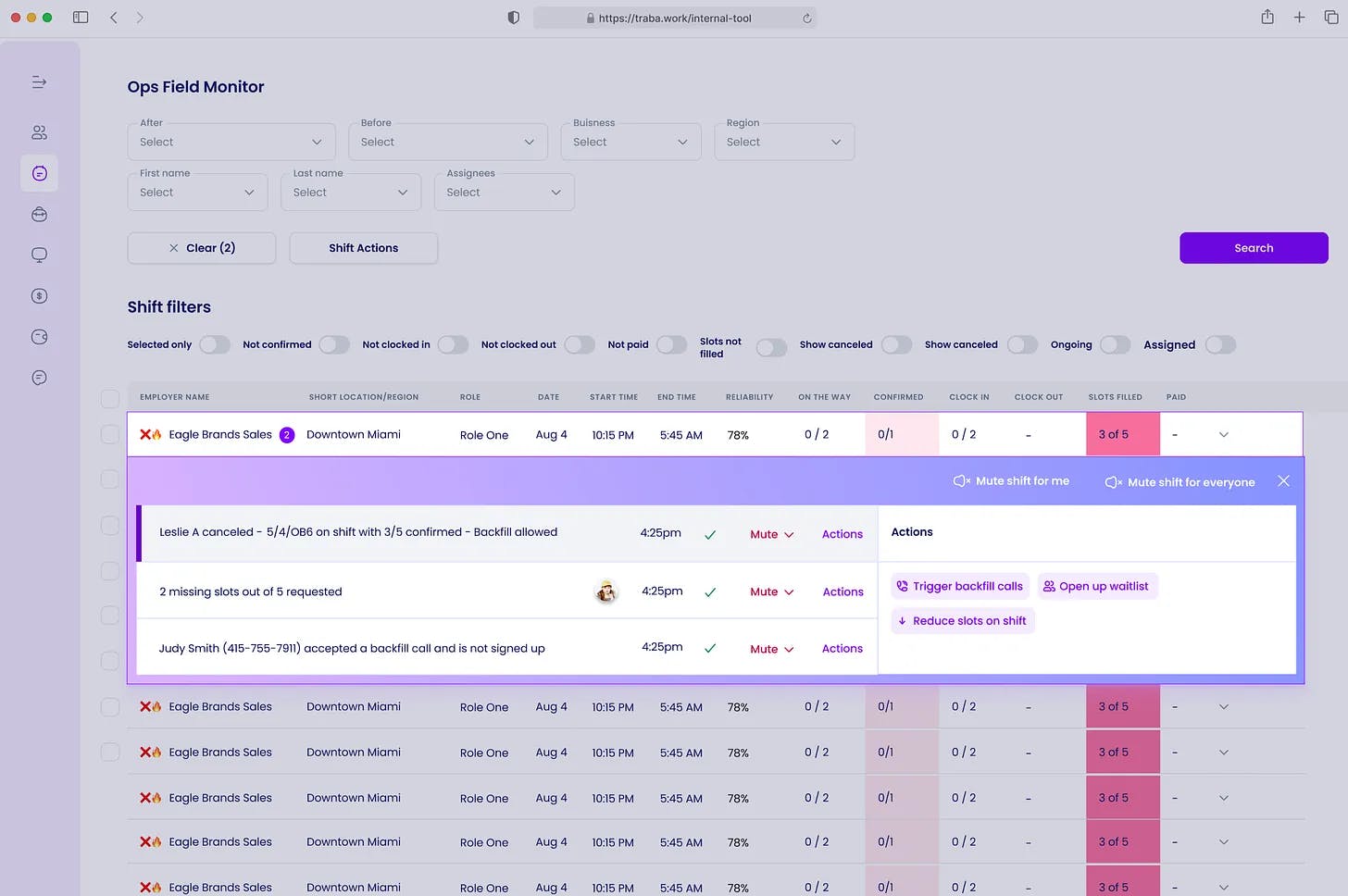

Operations Console: Traba’s internal “air traffic control center,” which allows the Traba team to programmatically contact, vet, and schedule workers while also serving as a dynamic system of record for labor.

For Businesses: A portal that gives businesses control and visibility into their labor – with tools to identify and contact workers, schedule shifts, provide worker feedback, manage their spend, and more.

For Workers: A mobile app that allows workers to accept shifts, track earnings, and set work schedules, all while building a real-world resume.

Operations Console

Source: The Generalist

Traba provides several operational tools to manage workers. It uses an AI chatbot to communicate with workers to ensure they meet the requirements of a given job. It also segments worker types and sends SMS blasts, push notifications, and automated phone calls to the most suitable candidates, continually building and enriching a proprietary worker data pool.

Traba follows a three-shift schedule to build its worker pool for any given customer. First, Traba conducts site visits to understand customer operations, business needs, and culture. Second, Traba interviews each worker before every shift assignment to identify valuable skills and potential red flags. Only the top 15% of applicants join Traba’s worker pool through this process. Third, Traba communicates role details, responsibilities, and shift information to workers matched to temporary jobs.

Traba also maintains a local and national operations team to maintain reliability among its workers. The Local Operations Team is reachable from 7:30 AM to 10 PM local time to ensure that every worker is vetted and prepared for the posted job. The National Operations Team is reachable 24/7 and monitors active shifts, deploying paid backups as replacements when necessary.

Business Portal

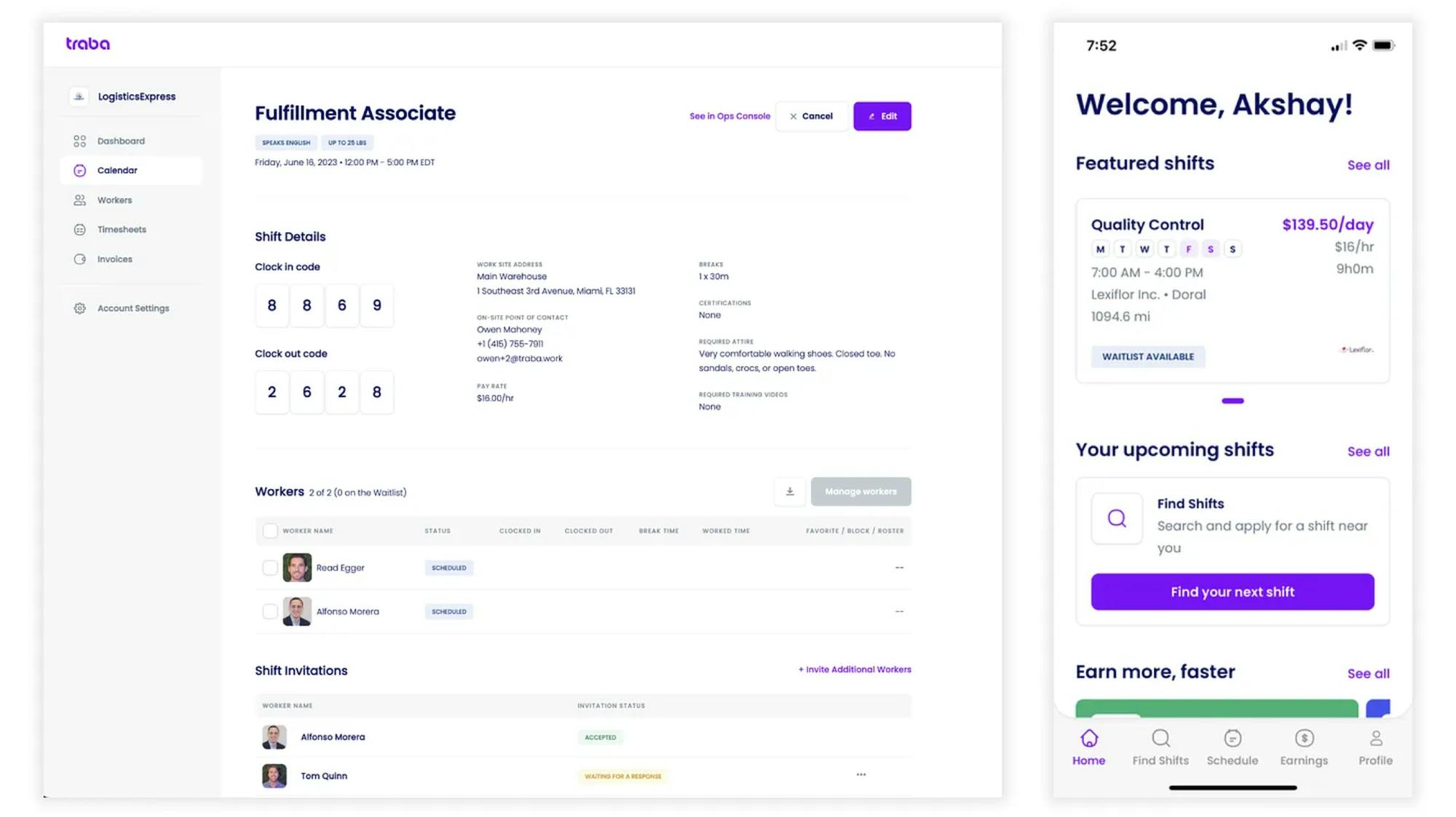

Source: Why You Should Join

Traba’s business portal is a shift management platform and two-sided marketplace that enables enterprise customers to post jobs to Traba’s worker base to identify and contact suitable workers. Through the marketplace, businesses can identify suitable workers, send announcements and training videos, and contact workers directly.

On the day of a shift, the business portal provides key functionality to help manage the workforce. Before the shift, businesses can monitor the number and location of confirmed workers. This allows them to ensure adequate staffing and send last-minute requests for replacements if needed.

As workers arrive on-site, they can check in via a kiosk, the Traba app, or with a supervisor. During the shift, the business portal allows businesses and supervisors to track worker locations within the facility. This visibility aims to minimize worker truancy.

After a shift ends, supervisors can use the portal to rate each worker's performance and provide qualitative feedback. Traba leverages this data to improve its intelligent role matching algorithm. The portal also provides analytics on key metrics like number of shifts per worker, aggregate worker ratings, and total hours worked by each staff member.

Traba automates the billing process, eliminating the need for businesses to manually generate timesheets and instead focus on reviewing, approving, or disputing shifts. Traba employs computer vision to automatically pull data from timesheets directly into the portal. The system detects any discrepancies, which are then surfaced to the business for review.

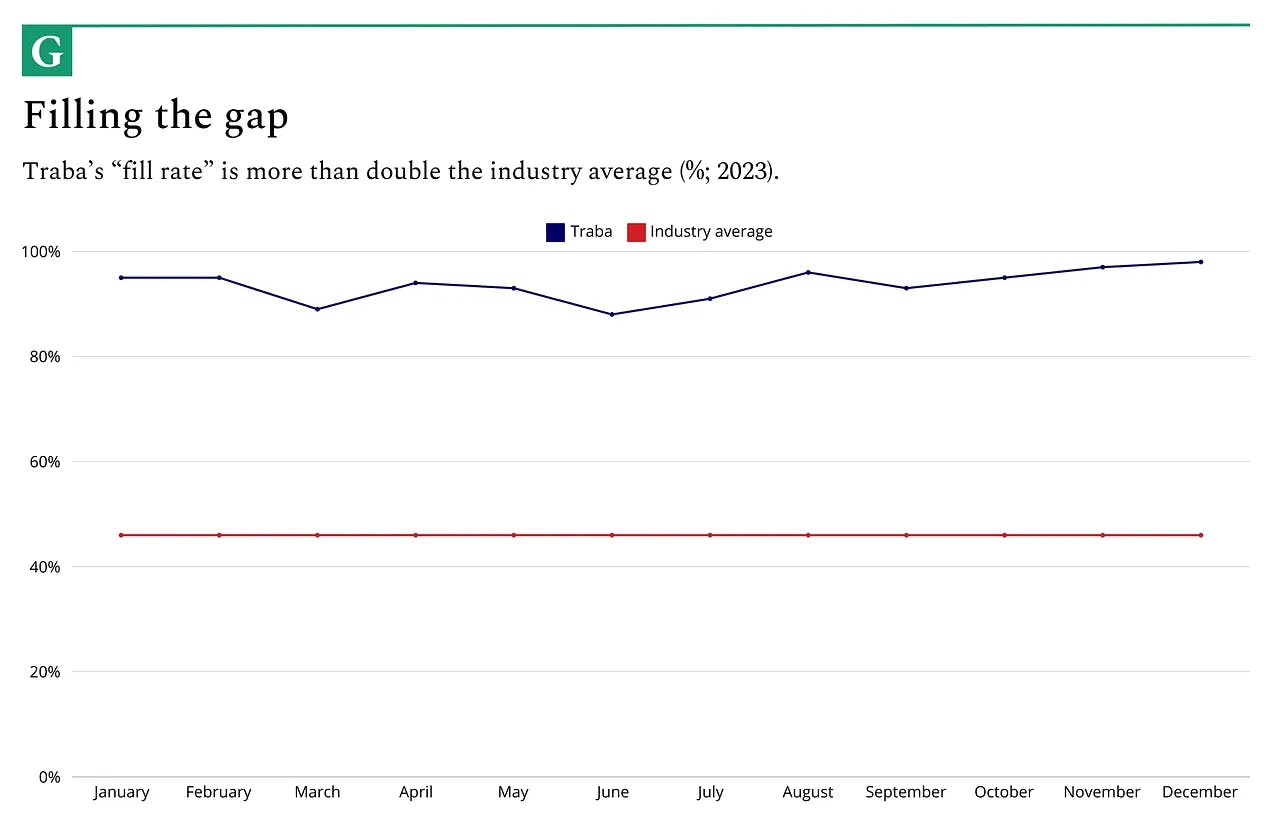

The industry average to fill an open role in light industrial staffing in 2021 was seven days, with a 46% fill rate. By leveraging paid backups, notification alerts, and live shift monitoring, Traba aims to fill open positions within a day and achieve a 99% fill rate as of 2023. The platform also sees 18x fewer no-shows compared to industry benchmarks as of September 2024.

Source: The Generalist

Worker Application

Source: Traba

Traba provides a mobile application that allows workers to accept work, track earnings, and set work schedules. Traba turns away companies that fail to comply with proper wage and environmental standards, such as the lack of AC in hot warehouses, to attract workers.

Traba provides Instant Pay, allowing workers to receive payment within 30 minutes of completing a shift. In a September 2024 interview with Contrary Research, Traba CEO Mike Shebat explained that “Traba has developed an advanced machine-learning model to enhance security that detects and prevents fraudulent activity.” Access to Instant Pay is restricted to workers in good standing as an incentive for quality work. Workers who are late, receive poor reviews, or leave the job site without authorization temporarily lose access to Instant Pay but can regain the privilege through improved performance. All workers on Traba are classified as independent contractors.

Market

Customer

As a marketplace, Traba has two primary customers: businesses and workers.

Traba targets businesses in light industries, which are typically less capital-intensive and more consumer-oriented compared to heavy industries like aerospace manufacturing, shipbuilding, and steel production. Examples of light industries include kitchen and dining products, beauty and personal care, home textiles, cleaning and storage, and packaging.

More specifically, Traba focuses on businesses such as warehouses, distribution centers, and manufacturing and production facilities. These companies often experience fluctuations in staffing needs due to seasonal demand volumes. For instance, consumer retail experiences peaks during the holidays, requiring additional workers to process higher order volumes. As a result, many of these businesses rely heavily on temporary staffing to meet short-term demand spikes. In the ecommerce sector as of 2023, 40% of annual sales occur during holiday periods, leading warehouses to depend on variable staffing.

Many of these businesses use antiquated processes to fill temporary work requirements. Reliance on paper timesheets, manual reconciliation against agency invoices, and cumbersome accounting procedures are common.

Consequently, the industry has slow average fill rates, with staffing requests taking days to complete. To mitigate the risk of understaffing, warehouses, and distribution centers often request more workers than needed. Despite 84% of businesses using two or more staffing vendors, only 6% consistently succeed in obtaining the required number of workers in 2022. Traba aims to bridge this gap by connecting the 73% of warehouse operators struggling to find sufficient labor with workers capable of handling tasks.

On the worker side of its marketplace, Traba serves a diverse pool of light industrial workers seeking flexible employment opportunities. Common roles filled by Traba workers include forklift operators, material movers, and manufacturing assemblers. The company attracts workers by offering a $13 hourly minimum wage, which is higher than the federal minimum of $7.25 per hour as of September 2024.

By leveraging technology to connect businesses with qualified workers on demand, Traba seeks to streamline the temporary staffing process for both sides of its marketplace. For businesses, Traba offers a solution for meeting variable labor needs. For workers, Traba provides access to a steady stream of job opportunities with higher wages and greater flexibility than traditional staffing agencies.

Market Size

The US staffing market size was estimated at $201.7 billion in 2023, with the global staffing market valued at $593 billion. The temporary staffing segment, a subset of the total US staffing industry, is projected to grow by 5% and account for 89% of the US recruitment market in 2024. According to Traba, the light industrial staffing market, which is the company’s primary focus, was a $50 billion industry as of 2021.

Several factors are driving growth in the light industrial staffing market. Manufacturing, assembly, and warehousing demands are key contributors. However, the sector has seen a 60% increase in worker resignations post-pandemic, largely due to low wages and limited opportunities for advancement.

The rise of e-commerce has also fueled demand for warehouse space and labor. As of September 2024, the US experienced historically low warehouse vacancy rates and high levels of new warehouse construction. Between July 2014 and July 2023, warehouse employment in the US more than doubled, growing from 760K to 1.8 million workers.

In the broader US staffing market, there were 12.7 million temporary and contract employees in 2023, with 36% working in industrial roles. The US also had 80.5 million hourly workers in 2023 and 76.4 million gig workers as of 2024.

Warehouse staffing challenges and fluctuations have had significant impacts on businesses. For instance, in 2022 34% of warehouse operators had to turn down business due to insufficient labor, up from 31% in 2021. Among those that missed out on revenue, 64% of warehouses forwent what would’ve amounted to more than 25% of their total business.

Competition

Direct Competitors

Traba has several direct competitors seeking to address similar issues in industrial staffing. These include the following:

Wonolo: Founded in 2014, Wonolo is an on-demand staffing marketplace for light industrial businesses, such as warehousing, event staffing, and delivery to fill immediate labor needs. As of September 2024, Wonolo had more than 1 million users on its platform. Wonolo raised a $140 million Series D led by Leeds Illuminate in October 2021 at an undisclosed valuation that brought its total amount raised to $190.9 million. Wonolo’s investors include Sequoia Capital, Bain Capital Ventures, and G2 Venture Partners. Unlike Traba’s vertical marketplace, Wonolo’s horizontal labor marketplace extends beyond light industrial workers and businesses to support opportunities in areas such as retail, delivery, administrative clerking, and teaching.

Shiftsmart: Shiftsmart is a labor-management marketplace that connects part-time workers with open shifts listed by businesses. Shiftsmart was founded in 2015. As of September 2024, Shiftsmart had more than 3 million workers registered across more than 50 countries on its platform with a customer list that includes companies like Circle K, Humana, Deloitte, and Airbnb. In December 2021, Shiftsmart raised a $95 million Series B led by D1 Capital Partners, bringing its total funding amount to $120.6 million. Shiftsmart investors include OakRidge Management Group, Imaginary Ventures, and Mark Cuban. Compared to Traba, Shfitsmart’s horizontal marketplace provides staffing solutions for warehousing as well as quality management, emergency management, real estate, healthcare, and logistics.

Instawork: Instawork is a two-sided labor marketplace for temporary and permanent workers focusing on hospitality, food service, cleaning, retail, events, and warehousing industries. Founded in 2015, Instawork generated an estimated $100 million in revenue in 2021. In May 2023, Instawork raised a $60 million Series D led by TCV at a $700 million pre-money valuation. The company’s investors include Benchmark, Greylock, and Spark Capital. Instawork’s product targets a similar customer segment as Traba with similar performance benchmarks of 97% fill rates within 24 hours.

Incumbents

The legacy industrial staffing market is highly fragmented. In 2023, the five largest industrial staffing firms accounted for 36% of the US industrial staffing market, up from 24% in 2008. Incumbent staffing firms are primarily brick-and-mortar offices that rely on human recruiters to find and match workers.

Randstad: Randstad was founded in 1960 and operates in 39 countries as the world’s largest global staffing firm. Randstad specializes in providing HR services for temporary and permanent jobs, including contractual staffing of senior managers. The company generated $26.4 billion in revenue in 2024 and has a market cap of $8.4 billion as of September 2024. Randstad has dedicated teams that help businesses find and hire employees for both temporary and permanent positions across industries such as accounting and finance, engineering, healthcare, legal, life sciences, sales and marketing, and technology. Randstad also offers talent solutions, like talent assessment and development, and HR consulting on matters ranging from organizational design to talent strategies, and change management.

Adecco: Founded in 1996, The Adecco Group is the world’s second-largest human resources provider and temporary staffing firm. Adecco’s services include temporary staffing, permanent job placement, career transition, and talent development across multiple industries. Adecco placed 474K individuals in flexible jobs and generated $24 billion in revenue in 2023. The company’s market cap as of September 2024 is $5.7 billion.

EmployBridge: Founded in 1997, EmployBridge is the largest light industrial staffing provider in the United States. In 2021, EmployBridge’s worker network consists of more than 400K temporary associates who work across 365 offices in 48 states. In June 2021, Apollo acquired EmployBridge for approximately $1.2 billion. In 2023, EmployBridge generated $3 billion in revenue. While EmployBridge focuses primarily on light industrial jobs like Traba, its services are administered through specialty divisions such as ResourceMFG, ProLogistix, ProDrivers, and Intelligent Staffing rather than marketplace software.

Differentiation

According to the company, Traba differentiates itself from direct competitors with a more comprehensive product suite tailored to the supply chain industry. Its internal operations console, or "air traffic control center," integrates technology with human oversight to provide customers with a more “white-glove experience.” Additionally, by focusing on the industrial sector, Traba works to ensure industry-specific worker quality, such as adherence to Good Manufacturing Practices (GMP) or verifying worker attributes and skills. Their tools built for businesses include systems that are specifically tailored to warehouses.

In terms of incumbents, Traba provides a fundamentally different model from the dated approach to manually recruiting, vetting, and managing temporary labor.

Business Model

Traba operates as a two-sided marketplace, generating revenue by charging a percentage cut of each worker contract they facilitate through the platform. Traba typically charges a premium of around 37% of the total payment as of April 2024.

Companies using Traba can set the hourly wage they are willing to pay temporary workers, subject to a minimum wage requirement of $13 per hour imposed by Traba. As of July 2022, the average wage on the platform was $16 per hour. The range is between $13 per hour to $38 per hour. Shifts booked through Traba have a minimum duration of four hours, and companies are charged the full four-hour rate even if the actual shift runs shorter. Cancellations are allowed up until 18 hours before the scheduled start time of a shift.

Shifts booked through Traba have a minimum duration of four hours, and companies are charged the full four-hour rate even if the actual shift runs shorter. Cancellations are allowed up until 18 hours before the scheduled start time of a shift.

For workers, Traba is free to use. They are paid based on the hourly rate set by the customer and only receive compensation for the hours worked. Traba offers an Instant Pay feature, allowing workers to access their earnings within 30 minutes of completing a shift. All workers on the platform are covered by occupational accident insurance and liability insurance up to $1 million as of September 2024.

In addition to its marketplace functionality, Traba provides a business portal for managing shifts. Some enterprise customers may prefer to use Traba's shift management software while sourcing their own hires. To accommodate this use case, Traba applies a 15% markup on outside hires for clients who wish to use the software platform with workers sourced from external light industrial staffing firms as of 2024.

Traction

Source: The Generalist

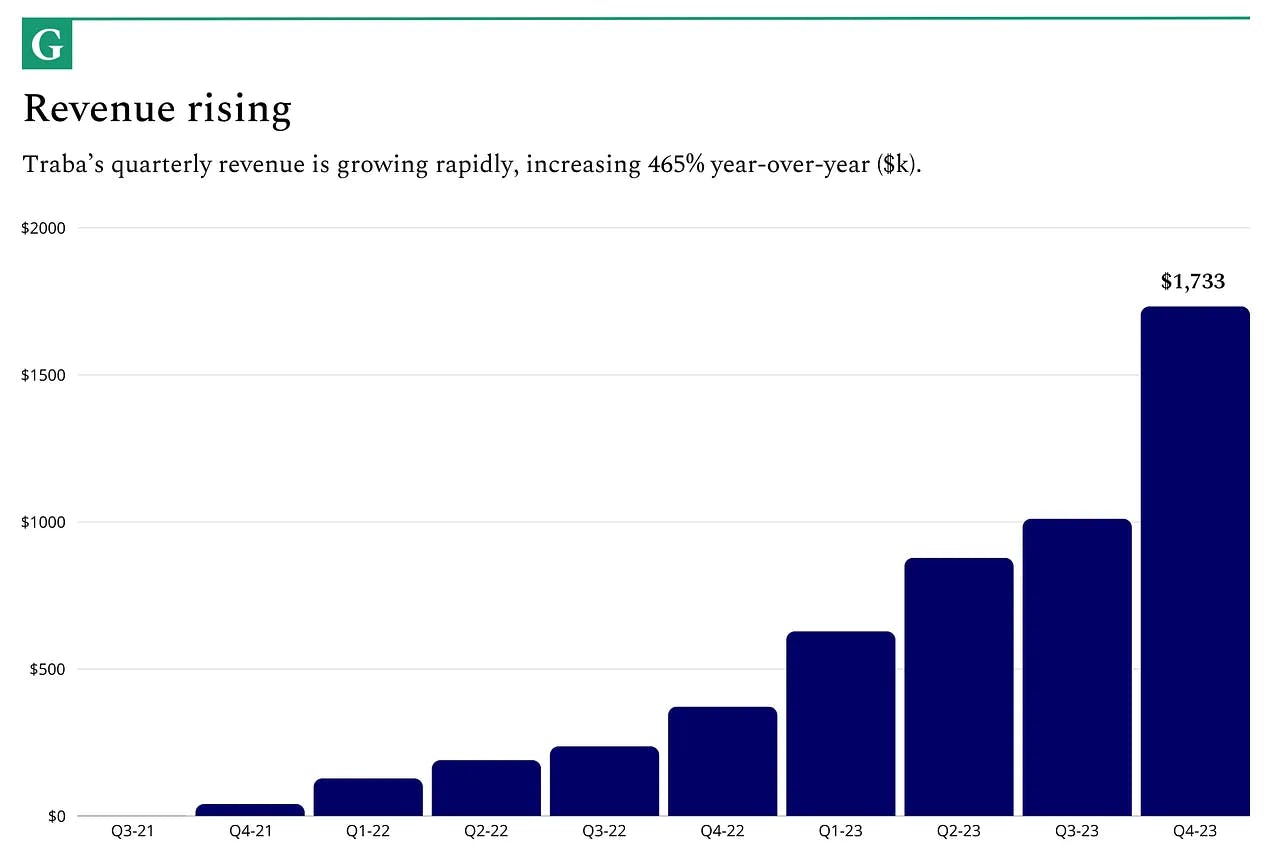

In July 2022, eight months after launch, Traba reported $1 million in annualized revenue and 12K workers on the Traba platform. In October 2023, the startup had more than 100 business customers in the light industrial industry and expanded out of Florida to seven states. At that time, the company grew to more than 50 employees across engineering, design, marketing, sales, and finance.

In October 2023, Traba raised a Series A2 round from Founders Fund which described Traba as its “highest-potential startup” at the time of the raise. In April 2024, Traba had nearly $7 million in annualized revenue, growing 465% year-over-year. Traba reported $1.7 million of revenue in Q4 of 2023, representing a 72% growth rate quarter-over-quarter. Concurrently, Traba improved its contribution margins from below 0% to 66% in 18 months.

Valuation

In July 2022, Traba raised a $20 million Series A at $120 million post-money valuation led by Khosla Ventures with participation from Founders Fund, General Catalyst, SciFi VC, and Atomic. Traba was valued after their Series A in July 2022. Other notable investors include Lux Capital and Village Global.

In October 2023, Traba raised $22 million Series A2 at an undisclosed valuation from Founders Fund and Khosla Ventures, bringing their total funding to $45.6 million as of September 2024.

“At Founders Fund there’s a tradition of investing in a signature company right out of the gate, finding the best, most important company on the planet, and then putting our first check into it. Peter [Thiel] asked, ‘what's going to be the best possible investment?’ and after going through the entire portfolio, the universal consensus among the GPs was to preemptively offer to lead a round into Traba because it was the best in the portfolio.”

Key Opportunities

Growth of E-Commerce

The continued expansion of e-commerce presents a significant opportunity for Traba. Morgan Stanley projects that global e-commerce volume will grow by 63% from $3.1 trillion in 2022 to $5.4 trillion in 2026. This rapid growth in online sales will likely exacerbate demand spikes and increase the need for warehouse staffing.

The relationship between e-commerce growth and warehouse space demand is well-established. One survey indicated that every $1 billion increase in e-commerce sales requires an additional 1.3 million square feet of distribution space. This trend was evident in 2024 when the US experienced historically low warehouse vacancy rates alongside record-high levels of warehouse construction.

For Traba, the sustained growth of e-commerce represents a tailwind that could drive increased adoption of its temporary staffing marketplace. As online sales continue to rise, warehouses and distribution centers will face mounting pressure to scale their operations quickly to meet peak demand. Traba's on-demand labor platform can help these businesses flex their workforce in response to changing market conditions.

Gen-Z Workforce Preferences

Shifting preferences among Gen Z workers presents an opportunity for Traba. This generation is increasingly questioning the value of traditional four-year degrees, becoming more concerned about student debt, and showing greater interest in skilled trades and technical schools. Simultaneously, workers across all age groups are placing a higher premium on flexibility, with 56% of US workers ranking it as their top priority and projections suggesting that 85.5 million Americans could become gig workers by 2027. As the supply pool massively increases, Traba fills the gap for skilled hourly jobs where a physical presence is required.

Embedded Financial Services

Traba's position at the center of the worker-business relationship presents an opportunity to expand into embedded financial services. By facilitating payments between businesses and workers, Traba sits in the flow of funds and has access to granular data on the behaviors and needs of both sides of its marketplace. The company has already demonstrated its ability to leverage this position with its Instant Pay feature, which allows workers to access their earnings within 30 minutes of completing a shift. For businesses, Traba streamlines the payroll process by automatically generating invoices and aiming to enable easy review and approval of timesheets through its platform.

Key Risks

Market Volatility

Traba's business is closely tied to the health of light industry businesses, which are sensitive to economic downturns and industry volatility. In the event of a recession or market downturn, reduced industrial spending and worker demand could negatively impact Traba's operations and growth prospects. As a company focused on providing temporary staffing solutions, Traba is particularly vulnerable to cyclical fluctuations in economic activity and the resulting changes in hiring patterns among its client base.

Regulatory and Compliance

Changes in labor laws, classification of contract workers, unionization, and workers' rights can impact Traba's business model and operations. As of September 2024, workers on Traba are classified as independent contractors, but legal changes may force the company to readjust its business processes, systems, and financial resources to comply with new regulations. Operating in multiple jurisdictions, each with unique labor laws and regulations poses additional operational challenges for Traba.

Job Automation

Increased adoption of automation in light industrial businesses could reduce demand for temporary staffing, posing a risk to Traba's long-term growth prospects. In 2021, global warehouses planned to invest $36 billion in automation, with more than half aiming to automate parts of their facilities over the next five years. More than 26% of warehouses are expected to be automated by 2027. Major players in the industry, such as Amazon, are already heavily investing in automation. As of July 2023, Amazon utilizes more than 750K robots in over 300 fulfillment centers to automate tasks previously performed by human workers, such as moving individual products from storage cubbies into specific bins and carrying packages to trucks in loading bays. As automation technologies continue to advance and become more widely adopted, Traba may face a shrinking market for its temporary staffing services in the light industrial sector.

In a September 2024 interview with Contrary Research, Traba CEO Mike Shebat emphasized the company’s focus on being able to mitigate that risk, saying “as an ambitious tech company, we plan on leading the charge into robotics and automation as we scale our operations.”

Summary

Traba is a two-sided marketplace that connects light industrial businesses with temporary workers, aiming to streamline the often inefficient temporary staffing process in industries such as warehousing, distribution, and event services. The company's platform includes a shift management system for businesses, a mobile app for workers to find and accept jobs, and operational tools to vet and coordinate workers.

By offering well-paying shifts that match workers' abilities and schedules, Traba caters to the growing demand for flexible gig work. Businesses benefit from improved fill rates, faster fill times, and platform incentives that encourage worker quality, while automating time-consuming processes like sourcing, vetting, and managing contracted individuals. Despite facing risks such as industry volatility, job automation, and regulatory changes, Traba has opportunities for further expansion through embedded financial services and exposure to the ongoing development of e-commerce.