Thesis

The first two decades of the 2000s have seen significant growth in the use of agile and lean software development, which emphasizes rapid iteration and feedback loops. Product decision-making and execution often fall under the purview of product managers, who are increasingly important in driving revenue for software companies. Analysis from September 2022 found that “companies that excel in product management are over 40% more likely to beat the Rule of 40.” The Rule of 40 is the principle that a software company’s combined revenue growth rate and profit margin should be greater than or equal to 40% to be sustainable.

At the same time, product teams often struggle to meet their targets. For example, a 2019 survey found that 45% of product launches are delayed at least one month from internally targeted timelines. Issues with project management and planning are often a contributing factor in such delays. Other reasons for the gap between expectation and reality around product development include shortfalls in customer centricity, prioritization, cross-functional collaboration, and streamlined go-to-market process capabilities.

Productboard was created to help address this point. Productboard is a software platform that helps product managers gather customer feedback, prioritize features, and build roadmaps to create products. It brings insights, decisions, and execution together in one place, which is intended to streamline collaboration, create alignment across functions, and allow product teams to gain better visibility. It is designed to act as a central hub for everything related to product.

Founding Story

Productboard was founded in 2014 by Daniel Hejl (CTO) and Hubert Palan (CEO).

Prior to founding Productboard, Palan had obtained a master’s degree from Czech Technical University and an MBA from UC Berkeley Haas. He worked as VP of Product at GoodData for four years and also spent four years at Accenture. Hejl, meanwhile, had engineering expertise from early and growth-stage startups focused on developer tools and customer feedback. Hejl holds a degree from the Prague University of Economics and Business.

Palan was flying from Prague to New York in June 2011 when he began brainstorming ideas to make his life as a product manager easier. As he put it:

“I was trying to do my job, but there was no tool of my own… Jira, GitHub, and all the great software at the time worked for engineers but didn’t have what product managers needed: features for customer feedback and pain points. That made it difficult to build what mattered to customers.”

While he was brainstorming, he came up with an idea that would eventually become Productboard. He commemorated this eureka moment by writing down the words "I believe there is a better way of building great products and companies”, and he even took a selfie of himself on the flight to commemorate the idea for posterity, which was later posted on Productboard’s blog.

Source: Productboard

Due to visa issues, Palan began to work on what would become Productboard while still working at GoodData. In January 2013, he initially came up with the name Productboard. That same year, he began looking for a technical co-founder and began posting about it on social media. Hejl saw his posts and messaged Palan via LinkedIn. He soon came on as co-founder and CTO, and Palan left his job at GoodData in November 2013 to work on Productboard full-time.

In August 2022, Productboard hired CFO Sebastien Giroux, who had previously spent five years at Atlassian, one of Productboard’s competitors. The company announced this hire alongside the hire of Greg Strickland as COO, saying that the pair would “play a crucial role in helping scale the company.” However, Strickland left the company in October 2023.

Product

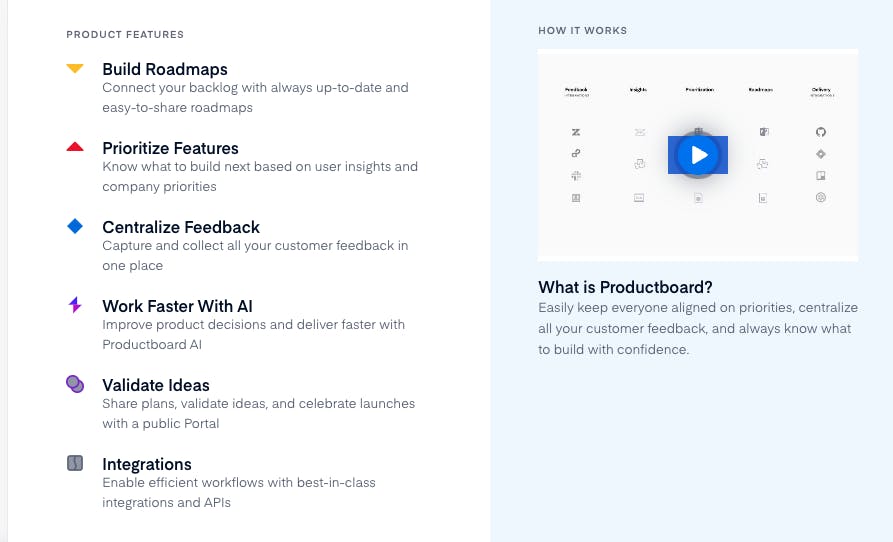

Source: Productboard

Productboard is a product management platform built to be a centralized source of truth for customer feedback to better inform product prioritization and roadmapping decisions. Productboard brands itself as a “one product system” that offers a holistic view encompassing product roadmaps, feature prioritization, centralized feedback, and idea validation capabilities. Palan has indicated that Productboard aspires to be the system of record for product teams, similar to what Salesforce has become for sales teams.

Build Roadmaps

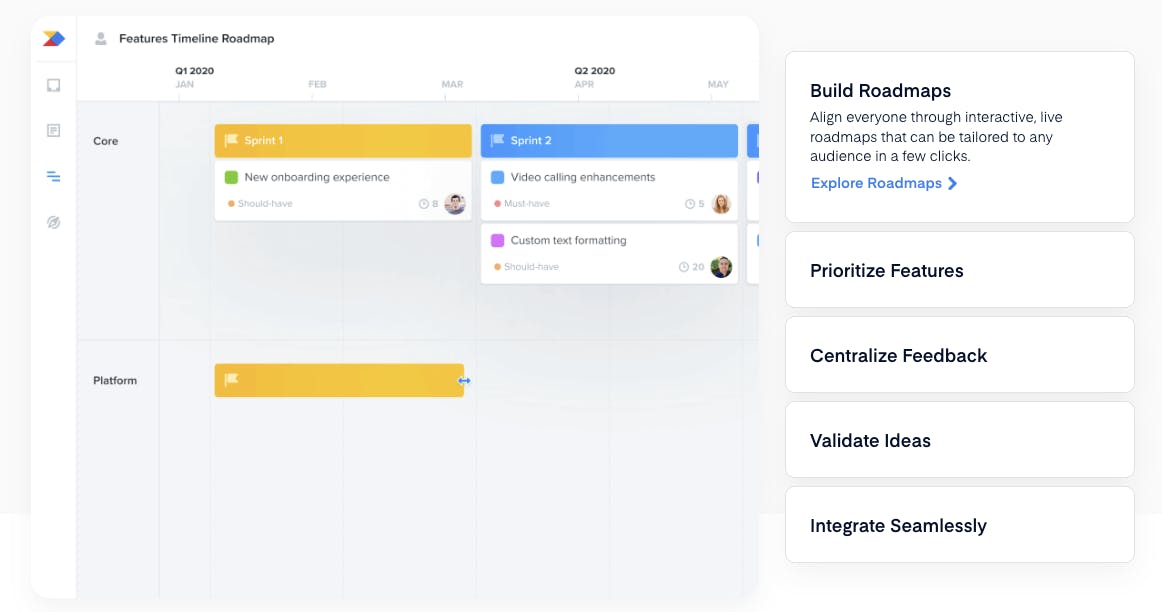

Source: Productboard

Roadmaps are Productboard’s core feature enabling product managers to select, customize, and share template roadmaps. Roadmaps are designed to be rooted in customer feedback, with options to build roadmaps around different product streams, timelines, and teams. The role-based visibility and ability to edit roadmaps offer flexibility in managing how roadmaps are communicated depending on the audience (C-suite to Go-to-Market to customer-facing).

Users can view Roadmaps to understand high-level prioritization and feature roll-ups within each product stream, offering transparency into the product development planning process across the business.

Prioritize Features

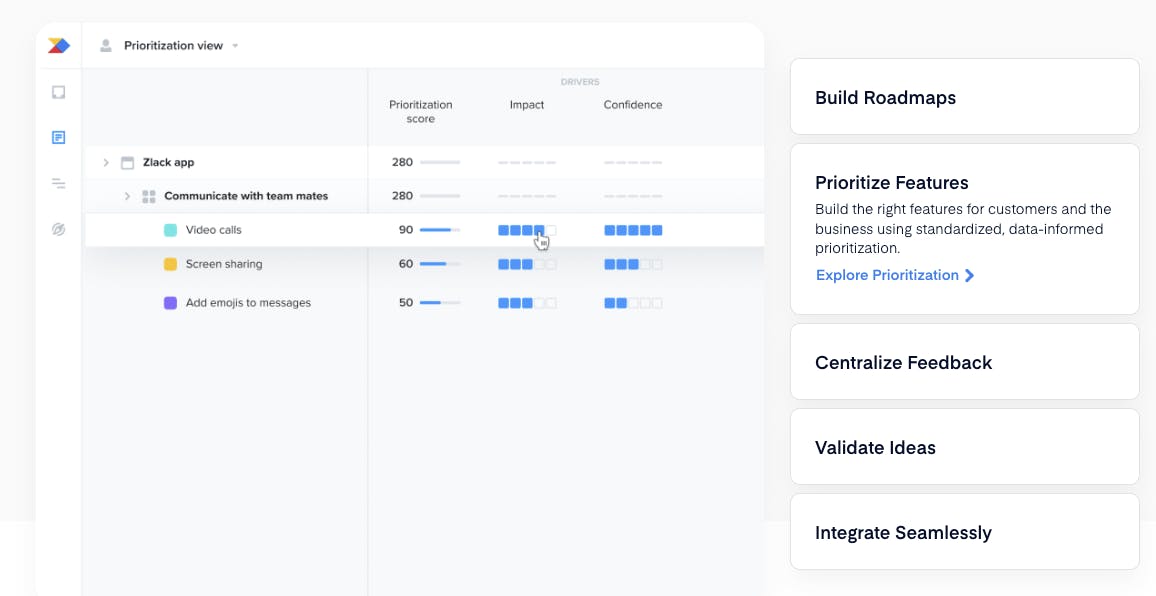

Source: Productboard

Productboard’s Prioritization tool allows users to see consolidated customer feedback and triage features for development with a standardized framework driven by a customized metrics framework. Its value proposition is to reduce the burden of consolidating multiple sources of truth when it comes to customer and internal feedback, giving stakeholders the ability to create and manage a centralized dashboard consolidating drivers, objectives, potential impact, and level of effort. Productboard also allows for prioritization with nuanced segmentation.

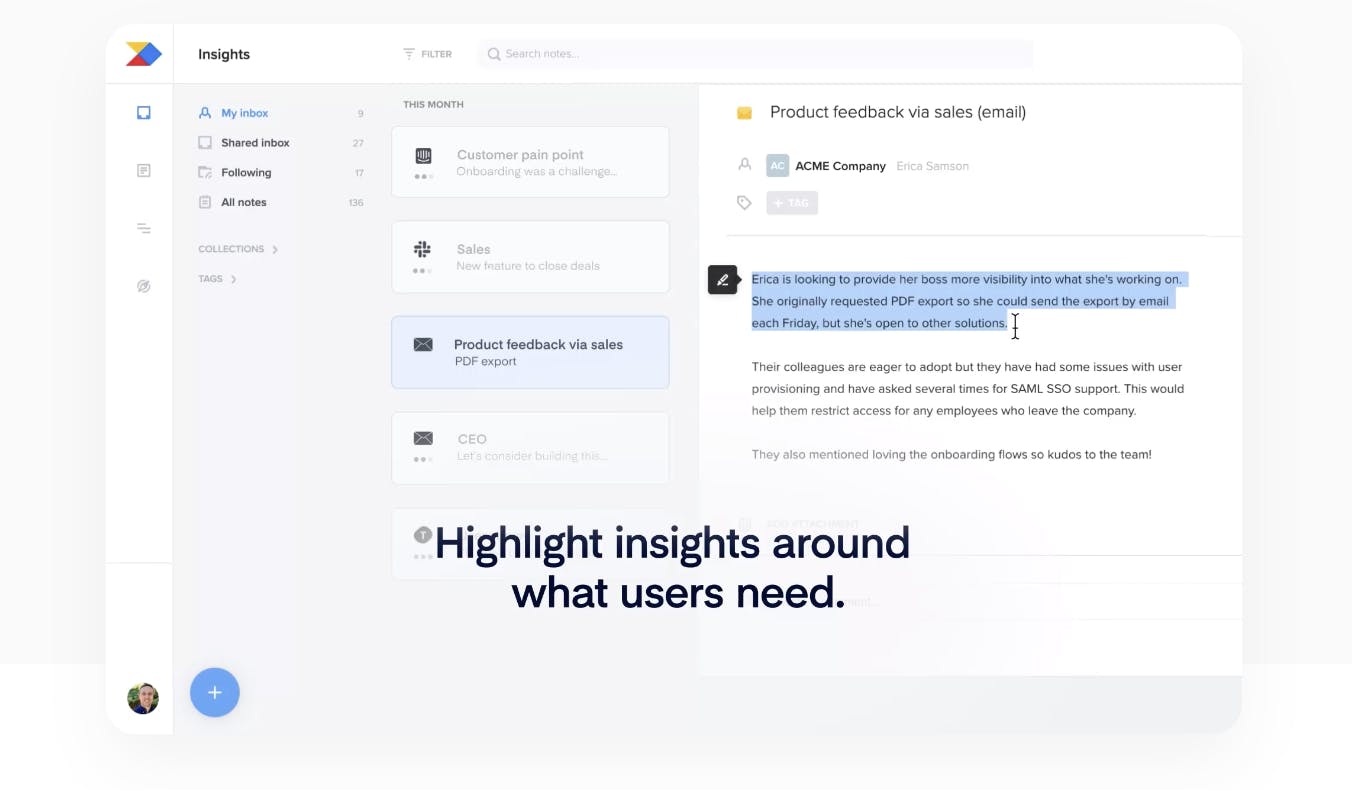

Centralize Feedback

Source: Productboard

Productboard’s customer feedback solution allows users to quickly collect customer feedback through notes. Augmented with machine learning, this tool is able to track trending features, tags, and segments parsed from qualitative notes over time, with clarity of customer attribution for each piece of feedback. In May 2022, Productboard acquired Satismeter, a feedback platform for product teams, to help power its customer feedback functionality.

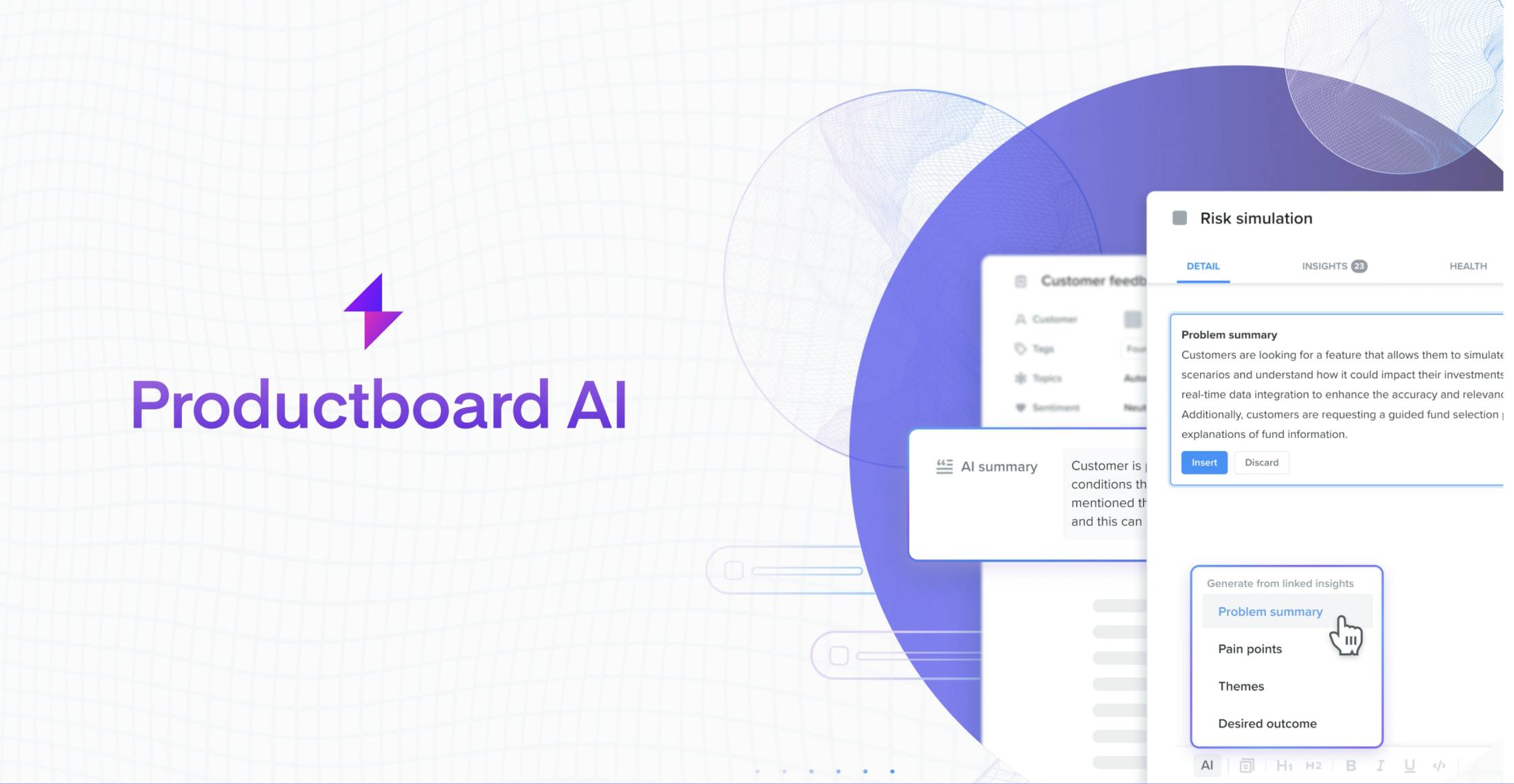

Productboard AI

Source: Productboard

Productboard’s AI tools draw on Productboard data with the intent of helping users work more quickly and “analyze feedback at scale.” It provides AI summaries of topics across all feedback, allows users to automatically draft specs based on existing customer requests, and helps users find “hidden gems” by summarizing support conversations, emails, and message threads with AI.

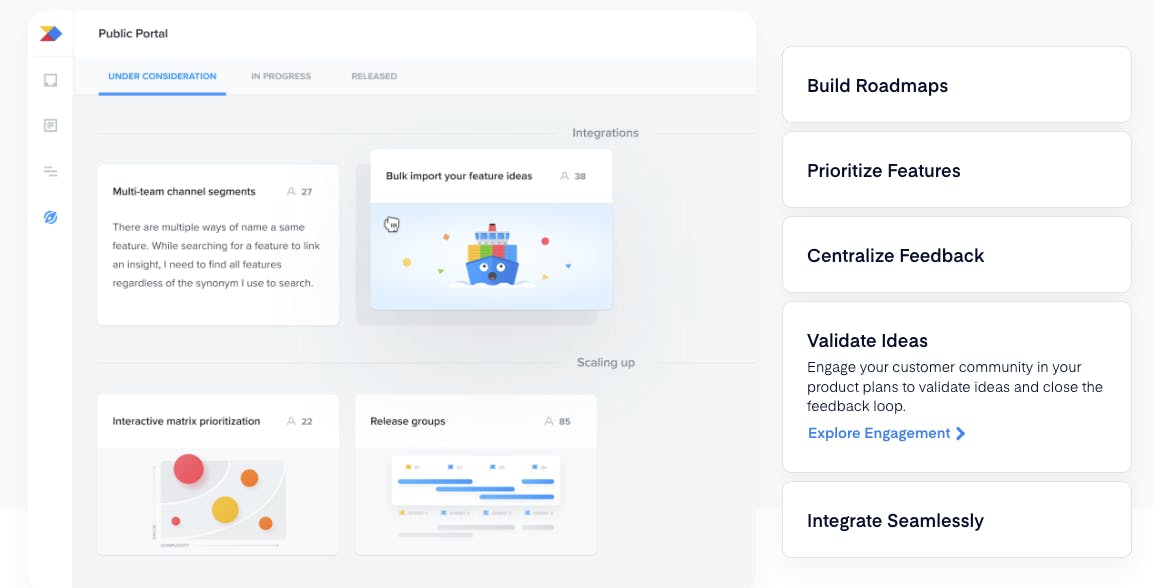

Validate Ideas

Source: Productboard

Productboard’s user engagement tool allows users to provide a customer-facing portal to quickly validate feature ideas and get feedback straight from customers. The feature is able to customize communication channels and feature views for customers depending on audience type while centralizing the intake of customer feedback within the Productboard platform.

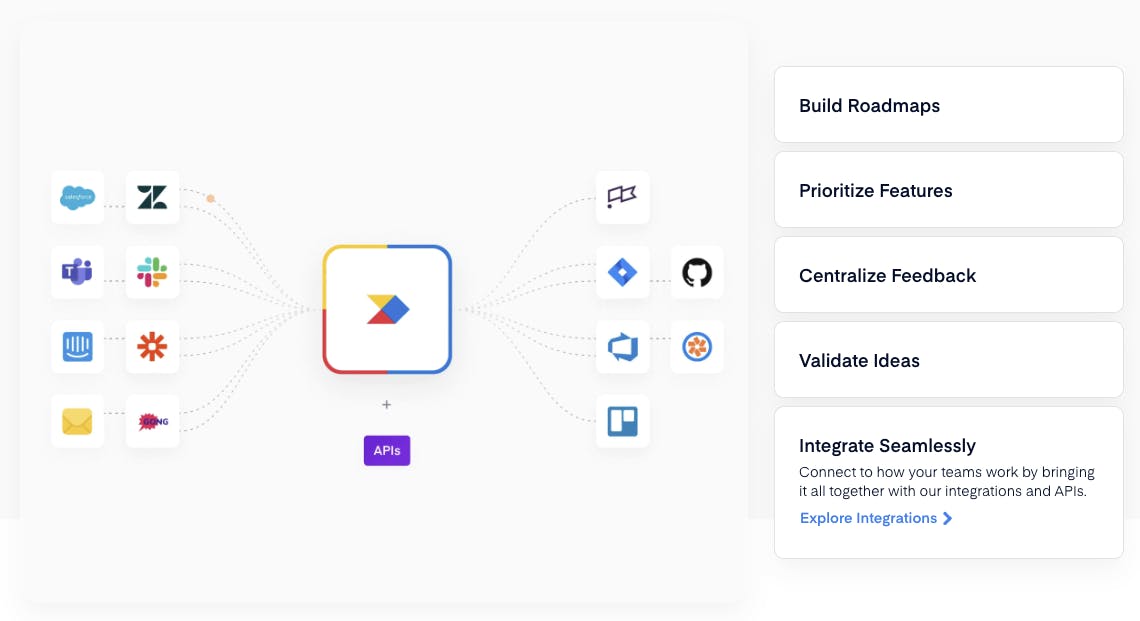

Integrations

Source: Productboard

Productboard supports a number of collaboration and delivery integrations, as well as open APIs. Notable integrations available as of January 2024 include Slack, Microsoft Teams, Salesforce, Zendesk, Intercom, Zapier, and Mixpanel, among others. By allowing users to import customer data from CRMs, issue resolution, support systems, and sales and customer tooling, Productboard’s platform aggregates external feedback for a full 360 picture of what each company and segment’s customers are looking for.

Market

Customer

Productboard’s main target segment has historically been tech-focused startups, but the platform serves multiple use cases central to supporting any product, regardless of where the product is in its lifecycle. Accordingly, Productboard’s customers span everything from product-led growth businesses to large enterprises. As of January 2024, notable Productboard customers include Salesforce, Zoom, Avast, JPMorgan Chase, Fastly, Flatiron, Axon, UiPath, and over 6K others.

Source: Productboard

While Microsoft Office has remained the dominant software suite for companies’ documentation and financial use cases, a product manager’s role involves communication with technical talent, nontechnical teams, leadership teams, and customers. Often, these different stakeholders require different tools for communication, documentation, and alignment. Productboard is used to act as the unifying software tool and product excellence framework to drive decision-making from product across the org.

Productboard empowers product managers at any stage company with any stage product to understand their customer needs and offer visibility to internal stakeholders. The platform’s templates do some of the work that would otherwise be needed to build repeatable frameworks in Microsoft Excel or Google Sheets. Those templates can then become a system that scales with the growth of products, customers, and the company itself.

Market Size

The global market for product management software was estimated at ~$24.7 billion in 2022 and is expected to grow to more than $43.1 billion by 2030. Product, as a category, has become more common in software development over the last decade, with ~26K product managers employed in the United States as of January 2024, and growing. In addition, as the rise of remote work becomes a more established trend with remote work accounting for 28% of workdays in early 2023, versus only 6% before 2019, the ability to collaborate on product roadmaps becomes increasingly important.

Competition

Atlassian: Atlassian is an Australia-based software platform providing collaboration, development, and issue tracking for teams. The company’s product offerings are used by software developers, project managers, and other software development teams. Atlassian was founded in 2002 and secured a total of $210 million in funding before going public in 2015. Its market cap as of January 2024 was $61.8 billion. Atlassian offers phone support, which Productboard did not as of December 2023. However, Productboard provides in-person training.

Asana: Asana is a San Francisco-based software company specializing in work management and productivity. The platform features a user-friendly interface, teamwork tools, reporting and analytics, and many more features. Asana was founded in 2008 and secured a total of $453.2 million in funding before going public in September 2020. As of January 2024, Asana’s market cap was $3.9 billion.

Monday.com: Monday.com is an Israel-based work OS that facilitates collaboration and can be used for project management, team management, and workflow management. The platform allows teams to manage tasks, projects, and processes to fuel collaboration and efficiency at scale. Monday.com was founded in 2012 and secured $384.1 million in total funding. The company went public in June 2021 and had a market cap of $9.3 billion as of January 2024.

Smartsheet: Smartsheet is a Washington-based cloud project and work management platform that enables teams to manage projects, automate processes, and scale programs on one platform. Features include project management, team collaboration, forms and data collection, task automation, content management, and more. Smartsheet was founded in 2005 and secured $152.2 million in funding before going public in April 2018. As of January 2024, its market cap is $6.2 billion. Smartsheet’s platform is supported on all mobile devices while Productboard’s offerings were limited to cloud and web as of December 2023.

Business Model

Source: Productboard

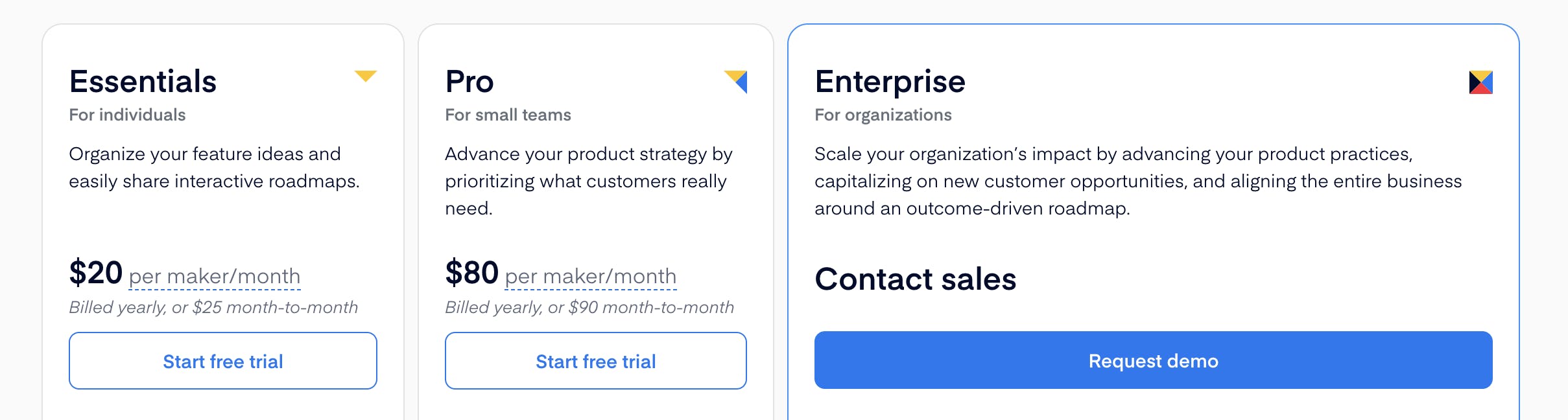

Productboard operates on a seat-based subscription pricing model, with a freemium component through three user roles:

Makers, who have full product access to “edit, update, add, create and prioritize feature ideas, insights, and roadmaps”.

Contributors, who can “share ideas, requests, and customer feedback and access feature data and roadmaps”.

Viewers, who can only see the roadmap.

Productboard only charges users for the number of “maker” seats and allows customers unlimited numbers of free contributors and viewers. Pricing is tiered according to Essentials, Pro, and Enterprise plans. The Essentials tier costs $20 per maker/month billed yearly. The Pro tier costs $80 per maker/month billed yearly. Enterprise pricing is custom and not publicly disclosed. Feature sets across the different tiers differ, with the company detailing them in its pricing plan comparison document.

Traction

At the time of its public debut at TechCrunch Disrupt San Francisco in 2016, three years after its founding, Productboard had 100 paying customers, and this grew to over 1K customers within the following two years. In July 2018, at the time of its Series A, it reported having 1.2K customers. This increased to 2.5K companies by the time of its Series B in January 2020, 4K companies at the time of its Series C in April 2022, and 5.5K companies at the time of its Series D in February 2022. The same year, one third-party source estimated that the company generated $22.2 million in annual revenue. Productboard reports having 6K+ customers as of January 2024.

Productboard grew to 500+ employees in early 2022 before laying off 20% of its employees in November, or about 100 people. This was likely due to the larger market downturn that occurred in 2022 which had a particularly large impact on SaaS companies.

Valuation

Productboard has raised a total of $261.7 million in funding as of January 2024. It raised a $125 million Series D in February 2022 at a valuation of $1.7 billion. The round was led by Dragoneer Investment Group and Tiger Global. Follow-on investors from earlier rounds included Bessemer Venture Partners, Sequoia Capital, Kleiner Perkins, Index Ventures, and Credo Ventures.

In 2022, at the time of Productboard’s Series D, one third-party source estimated that the company generated $22.2 million in annual revenue. If this estimate is accurate, a valuation of $1.7 billion would represent a ~77x revenue multiple. This is in contrast to competing public companies like Asana, Monday.com, and Atlassian, which ranged from 5.8x-16.4x revenue multiples as of January 2024.

Source: Koyfin

Key Opportunities

Continued Product-Led Growth

In September 2022, Productboard hosted its inaugural Product Excellence Summit where it announced several features including a digest to enable users to understand the spectrum of customer perspectives, faster validation of customer value via Satismeter, and an external-facing customer-specific consolidated view of feedback, unmet needs, feature requests, and progress to delivery. Additional net-new capabilities included OKR and measurement tooling. The company then announced the launch of its new AI tools in June 2022. Successfully broadening its product is an opportunity for additional upsell from new modules, and engaging different stakeholders, which would make the product more sticky.

Acquisitions

In May 2022, Productboard acquired fellow Prague-based startup Satismeter, a customer feedback platform. With 350+ customers, Satismeter provided complementary capabilities to Productboard’s native PM stack and an immediate channel for upsell and cross-sell opportunities. Satismeter enables better collection of customer feedback through embedded survey workflows quantifying Net Promoter Score, customer satisfaction, Customer Effort Score, and product-market fit. Users can easily export information collected to understand customer experience and satisfaction.

Expansion of revenue streams outside of Productboard itself marks a transition to multi-product growth. The continued use of strategic acquisitions could help Productboard continue to establish itself in the market and gain ground against incumbents. of record with a pipeline for organic customer data origination into that system of record.

Key Risks

Competitive Landscape

Strong competition from established, larger players like Monday.com and Asana for market share in product management software is a key risk for Productboard, which is now more than ten years old. Despite the fact that product management software is a growing space, startups continue to enter the market, making market saturation a risk to Productboard’s continued growth. To address this, the company will need to expand its competitive moat even as it continues to grow.

GTM Execution

Productboard’s continued emphasis on product-led growth, while sales-led growth continues to become more important for the company as it moves up the market, necessitates a balancing act of two separate go-to-market motions. Walking this tightrope could easily lead to a misstep, and the company needs to be careful to avoid a loss of execution on product even as it builds its sales engine.

Summary

Productboard is a software platform that helps product managers gather customer feedback, prioritize features, and build roadmaps to create successful products. Founded in 2014 by Hubert Palan and Daniel Hejl, it offers a centralized hub for customer insights, decisions, and execution. With its focus on streamlining collaboration and aligning teams, Productboard has attracted over 6K customers, including notable companies like Salesforce and Zoom. While facing competition from established players like Atlassian and Asana, Productboard stands out with its AI-powered tools and vision of becoming the "system of record" for product teams.