Thesis

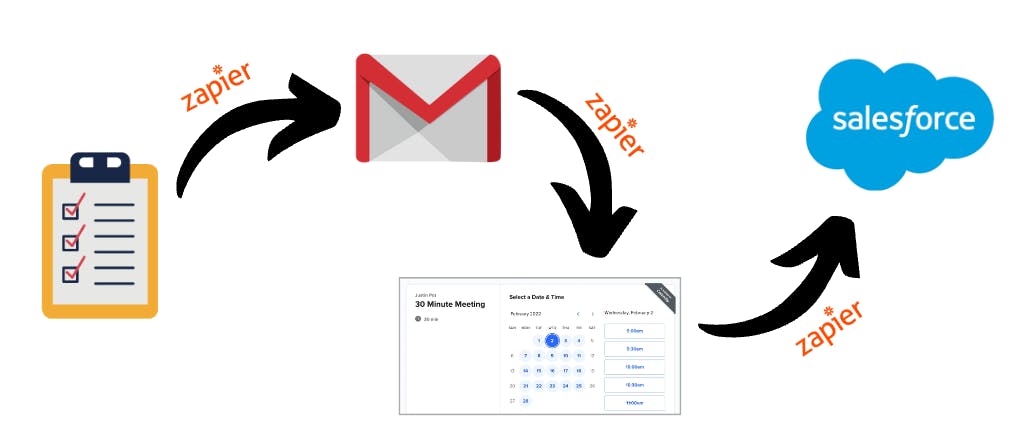

In 2021, the average business used a total of 88 applications, and knowledge workers used 9.4 applications per day, on average, to complete their work. The interplay of applications is typically a repetitive chain of actions following an initial trigger. For example, someone might fill out an Airtable interest form which then triggers an email being sent out. That email might then cause a meeting to be booked, and that meeting then populates a set of fields in a CRM.

Source: Contrary Research

Additionally, 88% of SMBs in a 2021 survey said business automation allows them to compete with larger companies, and 90% of knowledge workers claimed automation improved their productivity. Knowledge workers constitute the majority of the US labor force, representing over 100 million workers in the United States as of 2021. Of these, 82% either used or were planning to use automation software.

There are two ways that automation platforms can serve knowledge workers: (1) by building integrations between applications in-house, or (2) by connecting application triggers and actions to a central hub. With over 6K app integrations as of October 2023, Zapier is a central hub connecting triggers and actions that allows knowledge workers to automate workflows without writing code.

Founding Story

Wade Foster (CEO), Bryan Helmig (CTO), and Mike Knoop (Head of Zapier AI) founded Zapier in 2011. Interested in music throughout high school, Foster was unsure what to do after he graduated. After high school, Foster ended up studying industrial engineering at Mizzou because he was interested in productivity and creation.

Foster graduated college in 2008 but struggled to land a traditional manufacturing internship because this was in the midst of the financial crisis. Foster therefore decided to work in tech and got a summer internship at Idea Works, an early-stage software company. He became enamored with the startup space, remarking that:

“It was so cool to me that six or seven people could be in a house together making software and that people thousands of miles away could buy it. I knew immediately I wanted that as a career”

Foster joined Idea Works full-time in 2009 as the “Customer Development Lead”, picking up and implementing lean startup practices along with data-driven development. Then, in May 2011, Foster became an email marketing manager at Veterans United Home Loans, getting his first taste of dealing with unintegrated software, transitioning between email providers, managing 1 million+ emails, and syncing those emails with loan statuses to track the LTV of customers.

His role required him to constantly connect different software programs. Around the same time, Foster also re-connected with college jazz enthusiast, friend, and later co-founder, Bryan Helmig. Foster and Helmig began to freelance together, improving their technical skills, while constantly pitching each other ideas. After spending eight months manually forcing emails, databases, and customer loans to sync, Foster and Helmig came up with the idea of making it easier to get web apps to “talk to each other”. The duo then recruited Mike Knoop, another friend from college, and Zapier was born.

Building the MVP

For the next six months, the three co-founders balanced their day jobs and late-night coding sessions lasting as late as 3 AM. They built the first prototype in just two days during a Startup Weekend hackathon. They were encouraged by the feedback they got after this, and so they decided to move forward with the idea.

To land Zapier’s first customers, Foster visited the help forums of popular products like Evernote, Salesforce, and Dropbox to see what integrations customers were requesting. From there, Foster replied to each request, highlighting the technical option of using a service’s API and then introducing a link to Zapier’s first demo. With this method, Zapier was able to build trust and relationships with early adopters, but Foster knew this growth strategy would not scale forever.

“… those forum links, while they wouldn’t send a ton of traffic, we’d get 10, 15, 20 visitors from each one, but of those visitors, around 50% would convert and say ‘yes, I really want this.’”

Since Zapier’s integration features were not fully ready, Foster scheduled as many Skype calls as possible and asked customers which products they wanted to integrate and would manually assist with each one. As product development chugged along, Foster realized good software would just be the first step.

“We thought this idea had potential and people could really benefit from it. We’re good at building software, but there was lots we didn’t know about running a company”

The three co-founders applied to Y Combinator shortly after building the prototype at Startup Weekend. However, they were rejected, so they kept building. They focused on getting their first customers and ensuring the product experience was great. The team continued to get positive feedback from customers, developed a working version, and shipped bug fixes overnight when things did not work.

Zapier’s relationship-building with early customers allowed them to charge a $100 one-time fee during the beta which eventually dropped to $10 as the product got more attention. The team even connected with other promising early-stage startups, budding relationships that would later launch Zapier partnerships. By December 2011, Zapier had gained 10K users on the launch list and 25 integrations. Zapier, though still technically a side project, was starting to raise its profile in the startup world. After six months working on it, Foster noticed that:

“…we’d gone from three nobodies who had a pie-in-the-sky idea to three people who still don’t have a great resume, but who showed that they could actually get something done and build something.”

Early Traction

With Zapier’s improved traction and reputation, the team applied to Y Combinator again for the Summer 2012 batch. This time, Zapier was accepted, and the three co-founders quit their day jobs. For the next three months, the trio harnessed the focus of the batch experience, cramped into a tiny apartment, and did nothing other than write code, build products, and talk to users.

They found that Y Combinator’s acceptance helped improve response rates when they cold-emailed popular SaaS companies, opening the doors to more partnerships and even founder support. Reminiscent of Zapier’s first forum-based growth hack, the team found themselves googling popular companies and possible integrations to test demand. Soon, the team found a way to use SEO to capture traffic, setting up landing pages for as many app-to-app connections as possible so that Zapier would show up in search results as shown below:

Source: Groove HQ

As Zapier neared over 100 integrations and as organic channels looked good, the team decided it was time to actively promote the product. Since integrations bring value to the customers of popular SaaS apps, they promoted each integration’s release. Larger SaaS app partners would also support the launch of such integrations, funneling their larger audiences directly to Zapier.

Zapier’s growing reputation and traction within the startup world helped the team land a $1.3 million seed in October 2012. Still, awareness beyond a very technical audience was limited. Zapier was able to build trust with early customers but needed something more scaleable than hunting down niche support forums to increase that awareness.

They turned to long-form content marketing to tie their organic growth and SEO strategies together. Thus Zapier’s blog, which covered topics around apps, tools, and productivity, was born. Although the team did not see significant for the first six months, audience growth gradually compounded and the blog was able to build an audience of over 250K monthly readers by 2015.

Product

At its core, Zapier lets customers connect software applications with one another. Common use cases include, for example, saving a contact form submission to Google Sheets and then drafting an email in Gmail when a new Google Sheet row is created. The connected apps or flow of integrations that users make with Zapier are called “Zaps”.

Zaps

A Zapier integration, or “Zap” must connect at least two apps, but can create workflows encompassing multiple steps and integrating a wide variety of apps. Zaps are built using a trigger-action framework.

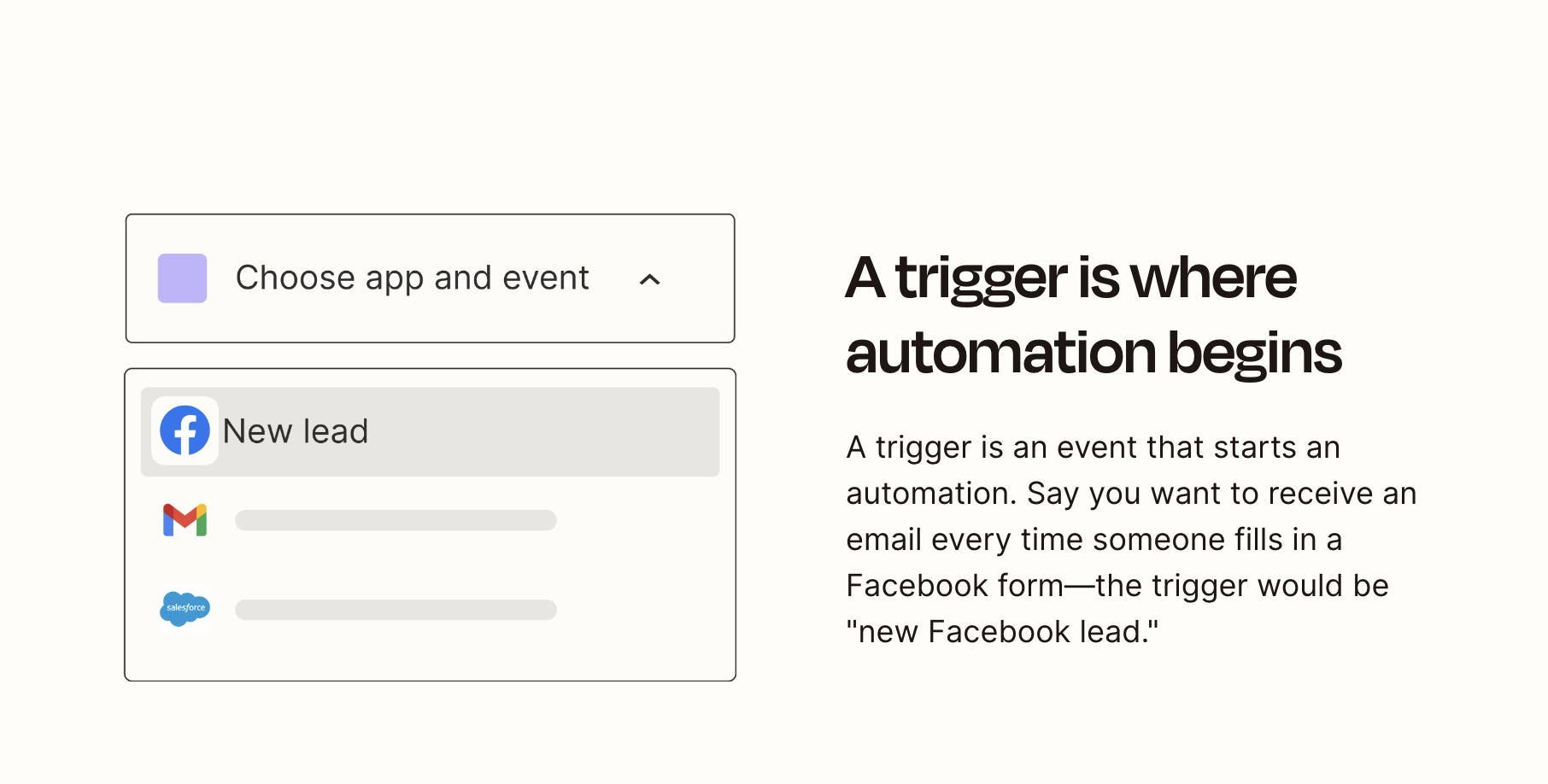

Trigger

Source: Zapier

First, a user is asked to select an app that will trigger a desired workflow. Then the user is asked to specify what event should cause the trigger. For example, if a user wanted a Zap to take effect whenever someone fills out a Facebook form, the trigger event would be the submission of a new lead via Facebook. For more complex services, like site-builders or even email, users can choose between new products, deleted products, or even data updates. Once the event is selected, users are asked to log into the desired app so that it can be implemented.

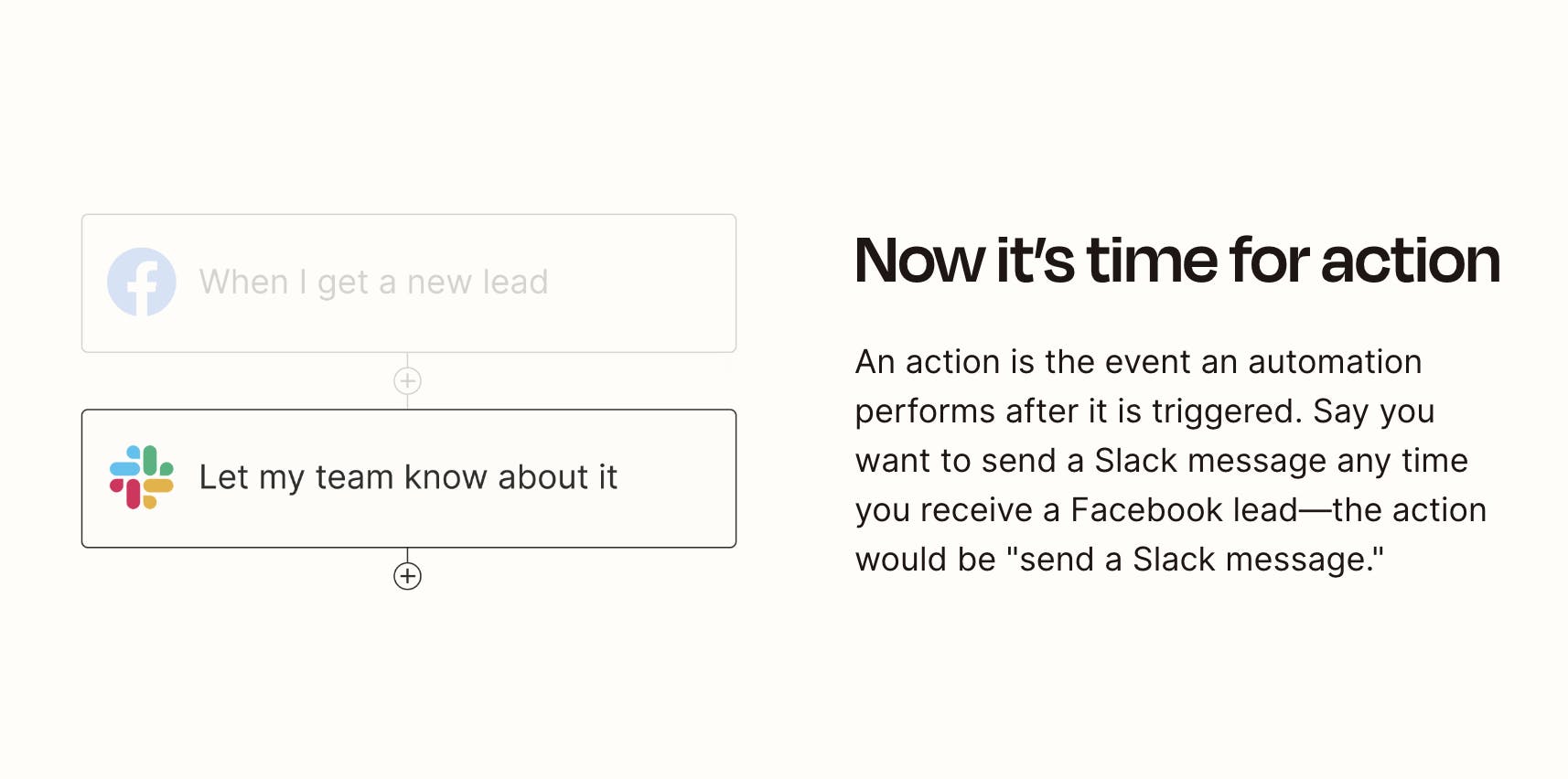

Action

Source: Zapier

Once a trigger has been set up and connected, the user is asked to connect a second app that will be completing an action. For example, a new Facebook lead can be used to automatically trigger a team-wide Slack message. When the user is ready, they can publish the Zap, so the integrations will run automatically going forward.

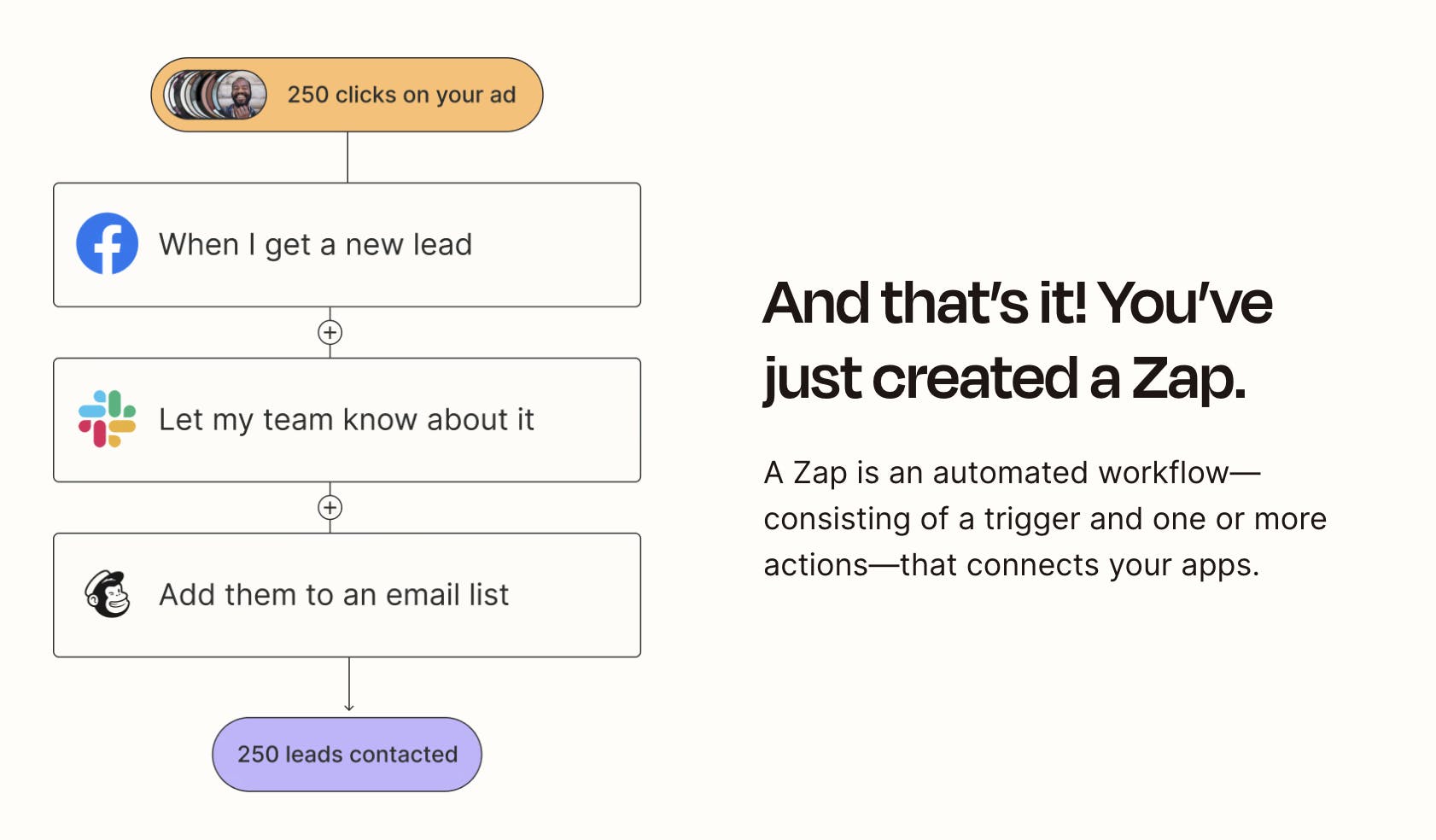

Multi-Step Zaps

Source: Zapier

Zaps can be set up so that the trigger leads to multiple steps. For example, the trigger of a new Facebook lead can lead to the addition of that lead to a Mailchimp list as well as an automated Slack notification.

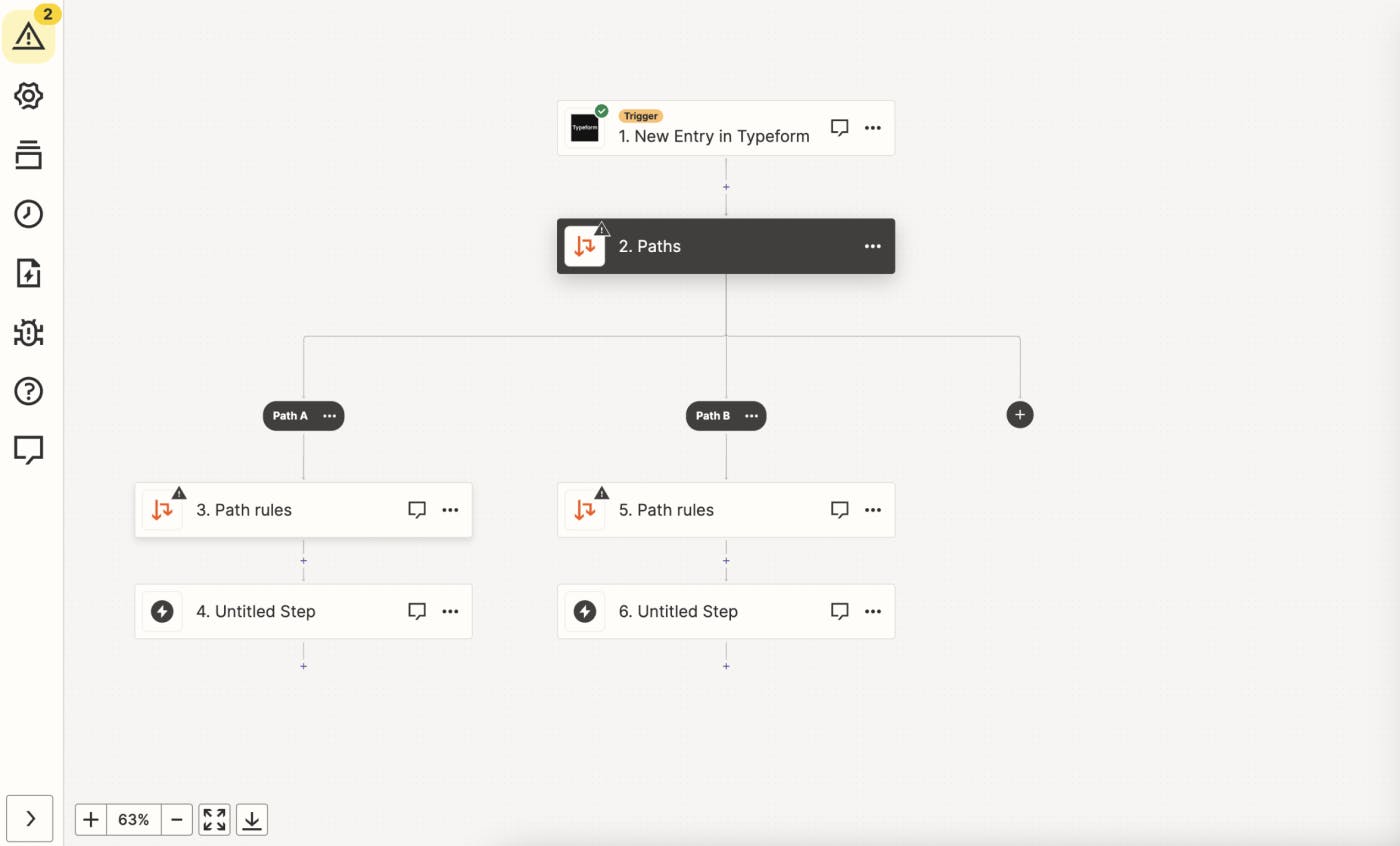

Paths

Source: Zapier

Paths are Zaps set up with conditional workflows based on if/then logic which allow for rules to be set at each step of a workflow. It follows the same trigger-action framework as other Zaps but allows for branching options based on conditions to be set at each step of a workflow. Paths can also be nested to help cover all possibilities.

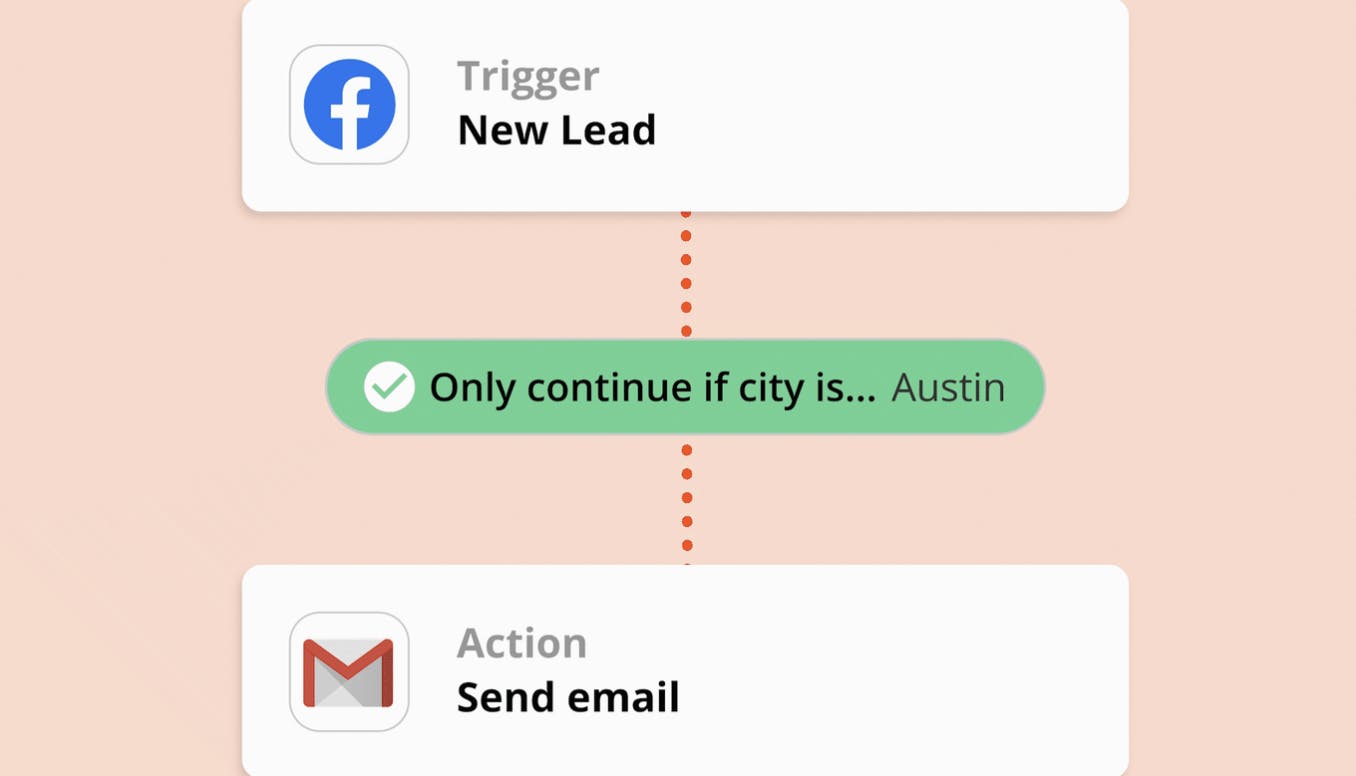

Filters

Source: Zapier

Filters allow Zaps to specify the conditions under which a trigger will lead to an action. For example, if the trigger event is a new lead on Facebook, and the consequent action of the workflow is to send an email (as illustrated above), filters can be imposed to narrow the range of trigger events that lead to the consequent action. Filters can be applied based on any kind of data provided. For example, instead of all Facebook leads constituting a trigger event for the workflow, filters allow users to narrow the trigger event to only Facebook leads from a particular location.

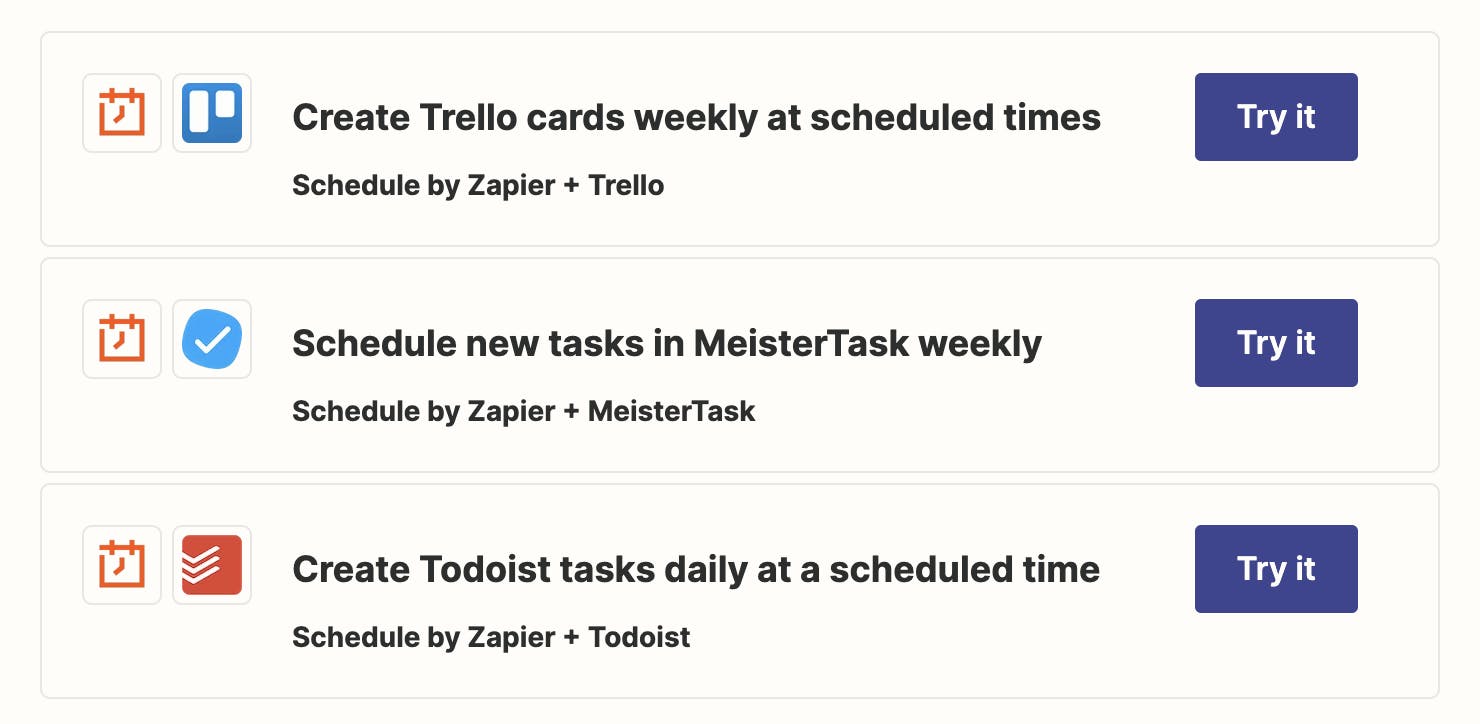

Schedule

Source: Zapier

Zapier’s schedule feature allows Zaps to be triggered or started on a recurring schedule. Users can schedule Zaps to run daily, weekly, or monthly on a specific hour, day of week, or day of the month, with the ability to turn weekends on or off.

Formatter

Formatter lets users change dates, currency, texts, and other types of data into a desired format when transferring data from one app to another. Formatter can split names, extract email addresses, website links, and numbers, capitalize text according to specific rules, find and replace text, format dates and times differently, and convert Markdown text to HTML or document text. Formatter can also trim whitespace, truncate text, pluralize English words, format currency and phone numbers, add or subtract time from dates, and run spreadsheet functions.

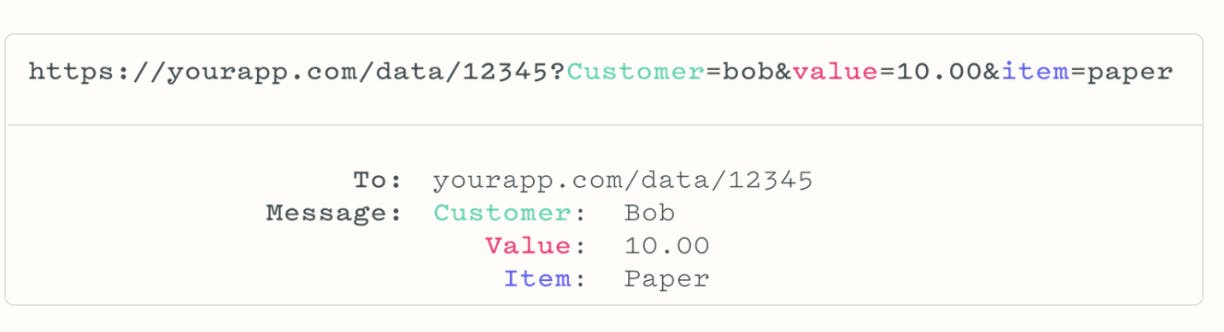

Webhooks

Source: Zapier

Webhooks allow Zaps to receive data from any service or send requests to URLs without writing code or running servers.

Templates

The Zap building experience is designed to be quick and eliminate repetitive work for users. Since it allows a wide range of apps to be connected without the use of codes, it allows users to set up automations that would otherwise need to be built internally by the engineering team. To increase the ease of use for common integration, Zapier offers a template library to help users with use cases such as AI chatbots, lead management, onboarding, client dashboards, and marketing operations.

Source: Zapier

Market

Customer

The traditional approach to task automation often involves custom coding, IT involvement, or manual labor, making it inaccessible or time-consuming for many businesses. Zapier’s code-free platform for automating tasks is meant to appeal to knowledge workers who find themselves completing systematic and repetitive tasks across software applications. Since reducing repetitive workflows is appealing to many, Zapier offers the following breakdown throughout its onboarding to help prospective customers envision specific use cases.

As of October 2023, Zapier claims it has had over 2.2 million customers, including both individual users and business users. Business customers listed on its website include Asana, Zendesk, Calendly, Lyft, Getaround, ServiceTitan, Dropbox, Hellofresh, and Miro.

Source: Zapier

Market Size

Driven by increasing cloud service and SaaS adoption, businesses have more apps to connect and more data to sync, resulting in a $5.3 billion global Integration Platform as a Service (iPaaS) market size in 2021, with growth estimates ranging from $14 billion by 2026 to as high as $62 billion by 2023. Zapier could also be considered to be in the hyper-automation market which was valued at $31 billion in 2021. Since the hyper-automation market is highly correlated with AI and ML, market growth estimations have increased rapidly in the early 2020s, with some estimates projecting a market size of $198 billion by 2023 growing at a CAGR of 18%.

Competition

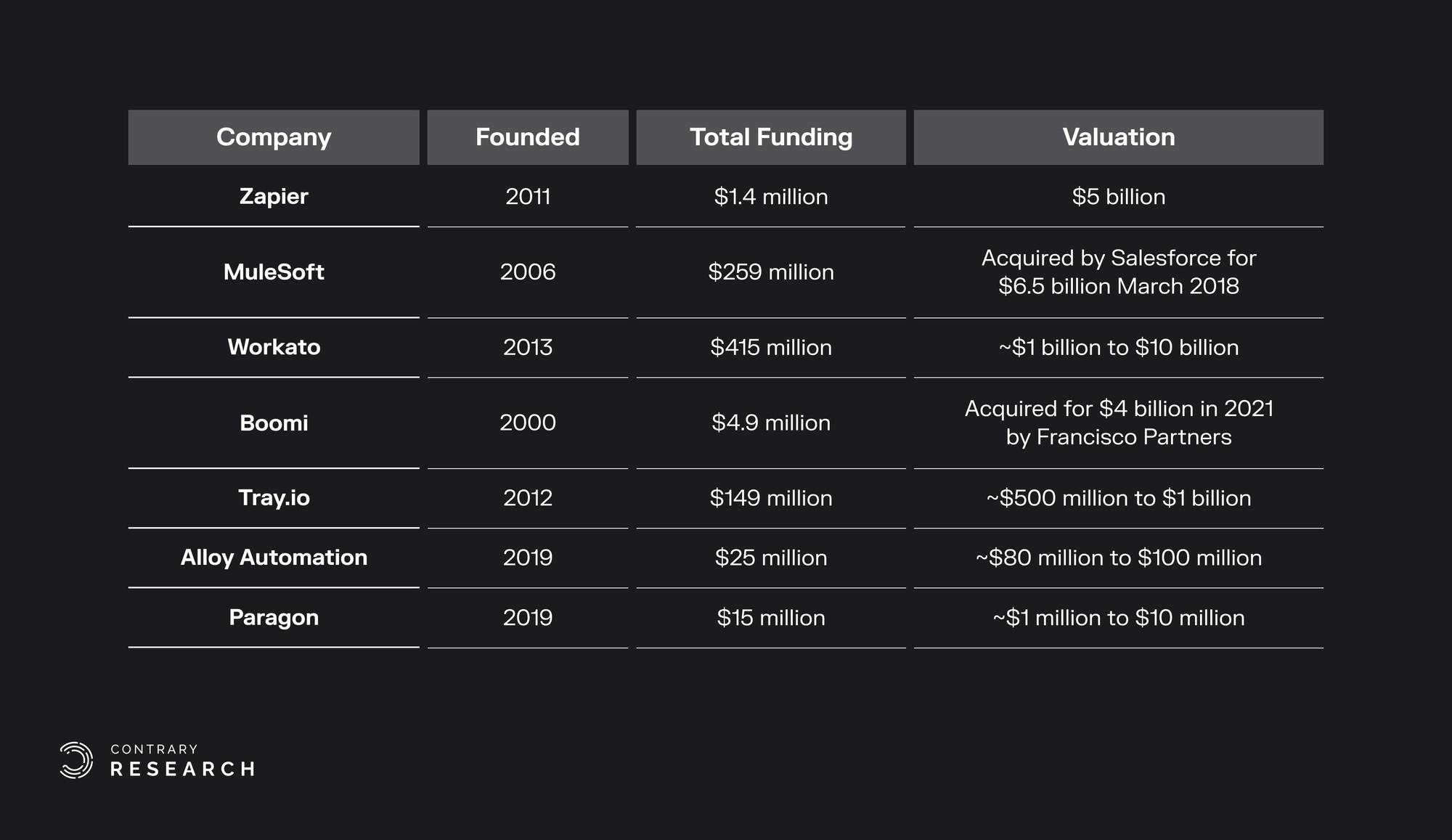

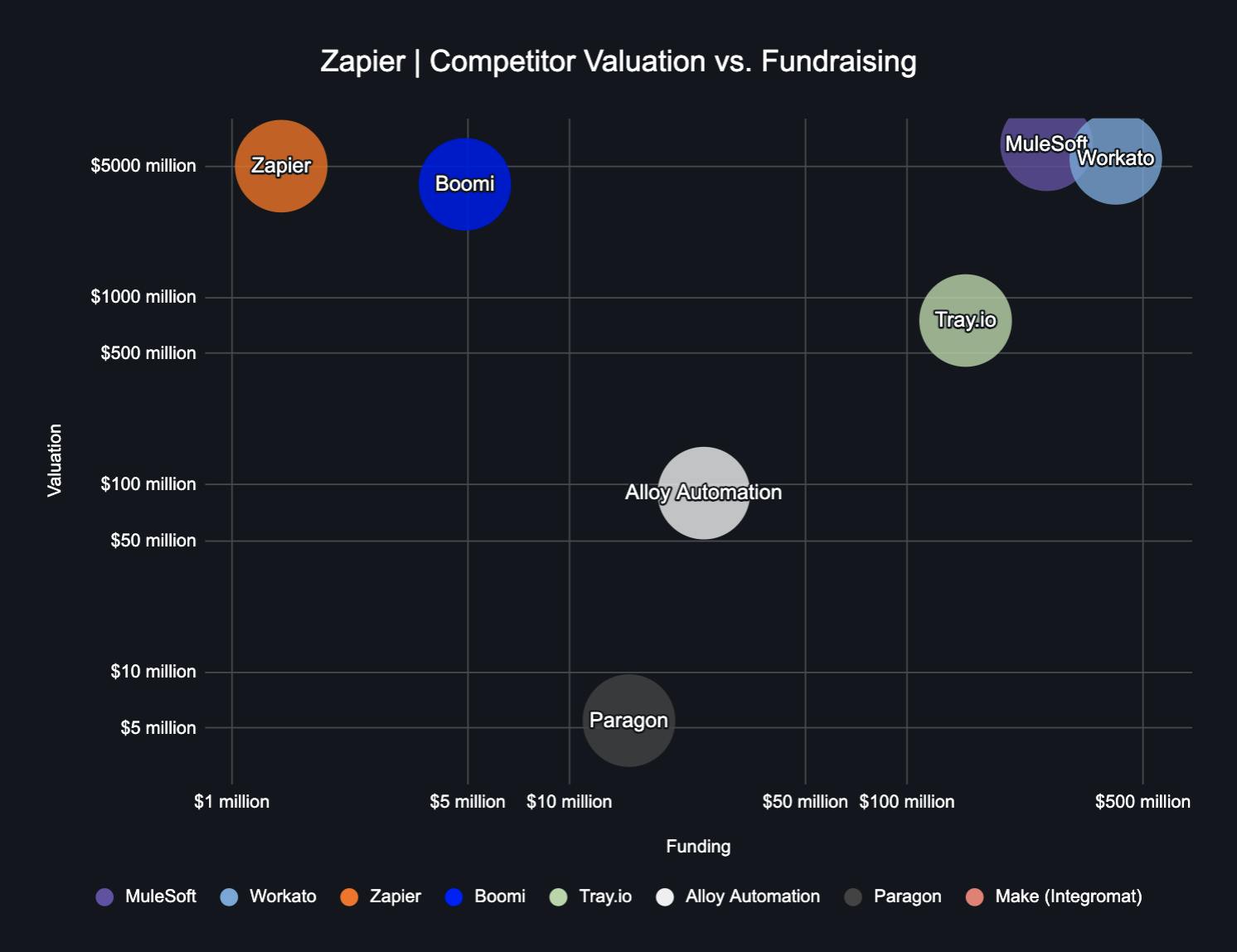

Source: Contrary Research; Crunchbase

Existing Platforms

There are a number of different tools that have built products to serve the integrations-platform-as-a-service (iPaaS) market. Most of them have primarily served enterprise use cases around building more deeply entrenched integrations within a company’s core systems (e.g. CRM, HRIS). First-generation tools included MuleSoft, which was acquired by Salesforce in 2018 for $6.5 billion, and Boomi, which was acquired by DELL in 2010 and then sold in 2021 to TPG and Francisco Partners for ~$4 billion. Other players in the enterprise iPaaS space include SnapLogic, which raised $165 million at a $1 billion valuation in December 2021, and Workato, which raised $200 million at a $5.7 billion valuation in November 2021.

Beyond broad enterprise iPaaS tools, Zapier also faces competition from tools such as Tray.io and Paragon that are offering embedded integrations within an application, rather than connecting two external applications. Tray.io and Paragon offer embedded integrations within an application, rather than connecting two external applications. Meanwhile, vertically-focused automation platforms like Alloy enable specific e-commerce integrations (e.g. order-based triggers and logic).

Native Integrations

Some of the most commonly connected tools on Zapier, like Slack, Salesforce, Google, and even Calendly, have announced workflow integration products within their existing platforms to upsell their customers and capture the value of integrations directly. Instead of having to rely on Zapier to connect Calendly to any other application, for example, users can build integrations natively without having to leave Calendly’s platform. This poses the risk of disintermediation to Zapier.

Business Model

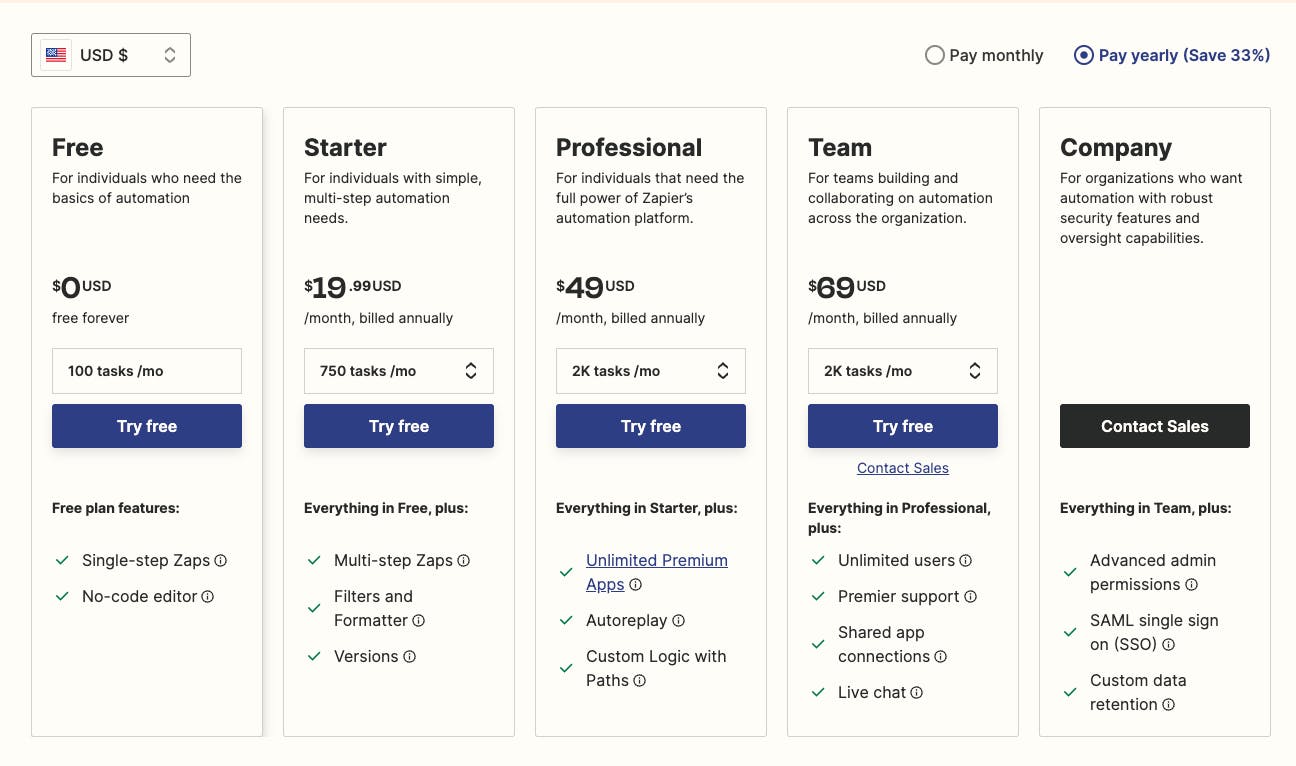

Source: Zapier

Zapier has five subscription pricing tiers, with its lowest paid plan starting at $19.99 per month, billed annually ranging, to as high as $599 per month. Subscription plans are differentiated by the number of tasks that can be performed per month using Zapier workflows.

Even though Zapier charges more for additional tasks per month, the company does not incur significant additional costs for providing these services, which are still based on its core Zap-building experience. The tasks increase as its customers scale, leading to the potential for favorable margins at scale. This has allowed Zapier to be profitable since 2014, and the company held no debt as of June 2022.

Traction

Zapier was an early pioneer of the product-led growth sales motion. It made it free for any user to get started without approval from their IT teams. That allowed the company to save on having a large sales team and helped it reach profitability two years after its founding. At its core, Zapier is positioned to make money only when users save time. The more time users save with zaps, the more likely they are to build other connections. The more connections, the more money Zapier makes.

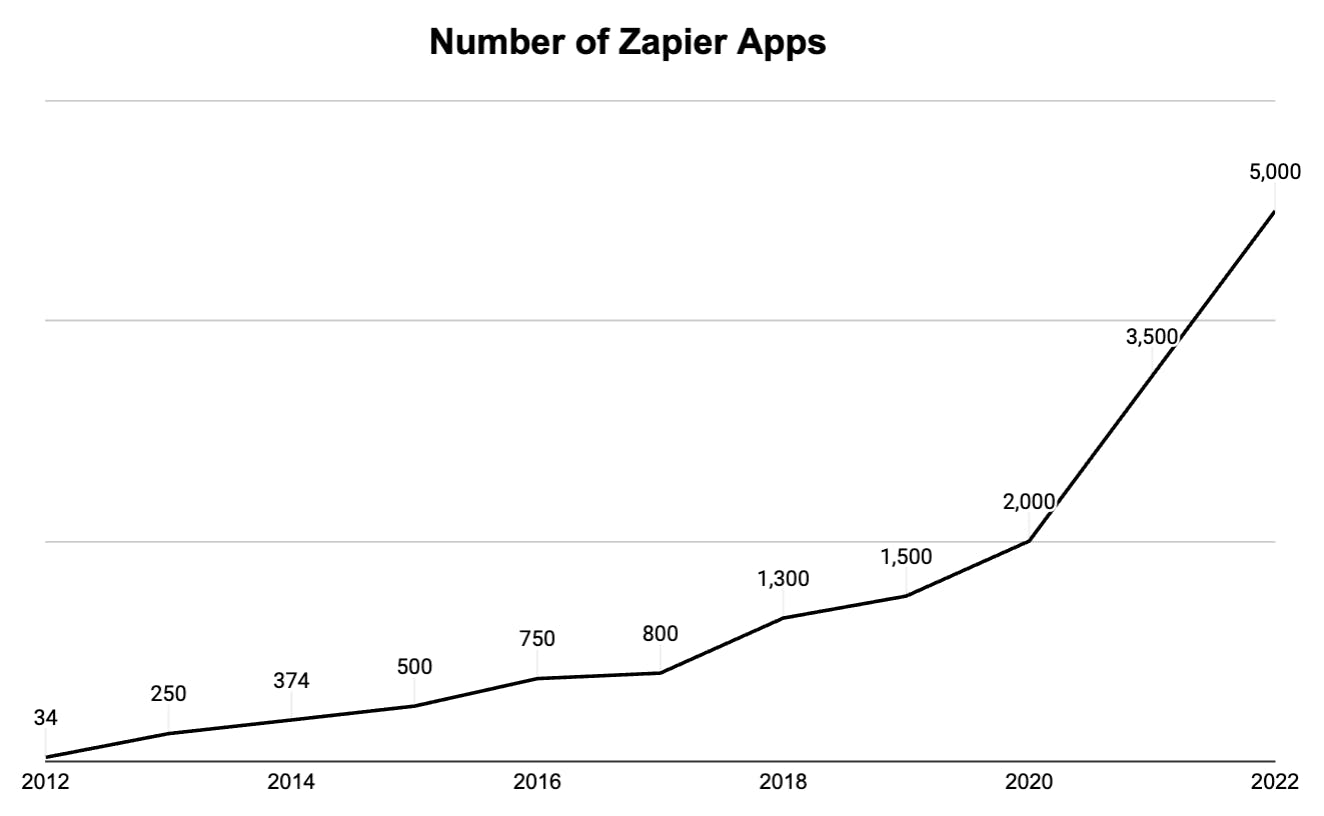

Between 2012 and 2015, Zapier scaled to 600K customers. As of September 2023, Zapier claims that it is the “automation platform of choice” for 99% of Forbes Cloud 100 companies, and for 69% of the Fortune 1000. Zapier’s landing page also highlights notable customers like Dropbox, Lyft, HelloFresh, Miro, Asana, Calendly, and Zendesk among its 2 million customers. The number of apps that Zapier integrates with has continued to grow, reaching more than 6.5K as of October 2023.

Source: Drift, Zapier, PR Newswire

Broad use cases and limited capital helped Zapier stay lean but made scaling slower. Some estimates believe that Zapier took nearly 10 years to achieve $100 million ARR which is slower in comparison to more capital-intensive B2B SaaS startups.

Valuation

Zapier established product market fit and profitability depleting the $1.4 million seed funding it raised in 2012, which remains the total amount of its venture funding as of 2023. Zapier’s founders are estimated to have retained 80% of their equity in the company as recently as 2021 and are proponents of avoiding venture investment that requires companies to continue raising more and more money. In early 2021, Sequoia purchased secondary shares of the company at a valuation of ~$5 billion. Around the time of that transaction, it was estimated that Zapier had ~$140 million in annual revenue, growing 50% year-over-year, and was profitable.

Zapier’s relative lack of venture funding makes its ARR per dollar raised relatively high, having raised $1.4 million and achieving $140 million in ARR, implying a 100x ARR to funding ratio. The company has also achieved a $5 billion valuation despite its lack of reliance on outside investment. Other companies in the integration space with similar valuations have either been acquired (Boomi) or raised much more, ranging from $259 million (MuleSoft) to $415 million (Workato).

Source: Contrary Research, Crunchbase

Key Opportunities

From Data Transfer to Data Pipelines

Transfer by Zapier enables customers to process batches of data too large for the traditional Zapier pipeline to process. Transfer, which Zapier launched in January 2023, has the potential to strengthen Zapier’s infrastructure to handle larger loads. The more data-centric companies become, the more they need systems to manage that data. Zapier’s expansion into Transfer places it in the data pipeline market along with companies like Fivetran.

Enterprise Expansion

While Zapier’s growth has been primarily product-led, there is an opportunity to leverage that install base to drive land-and-expand sales among enterprise customers. Users at enterprise companies can act as champions for a more direct expansion effort from Zapier to drive up usage. Zapier could build a traditional enterprise sales team to expand its focus on serving enterprise clients. As of October 2023, the company claims that 69% of Fortune 1,000 companies use Zapier, including Meta, Dropbox, and Shopify.

Source: Zapier

Embedded Integrations

Zapier has built out powerful rails to handle action-trigger workflow. More platforms are pushing for embedded functionality natively, as opposed to relying on external tooling like Zapier. The more Zapier is able to work with integration partners and enable embedded functionality, the more likely it can maintain its position in the market and continue to grow.

Key Risks

Competitive Pressure

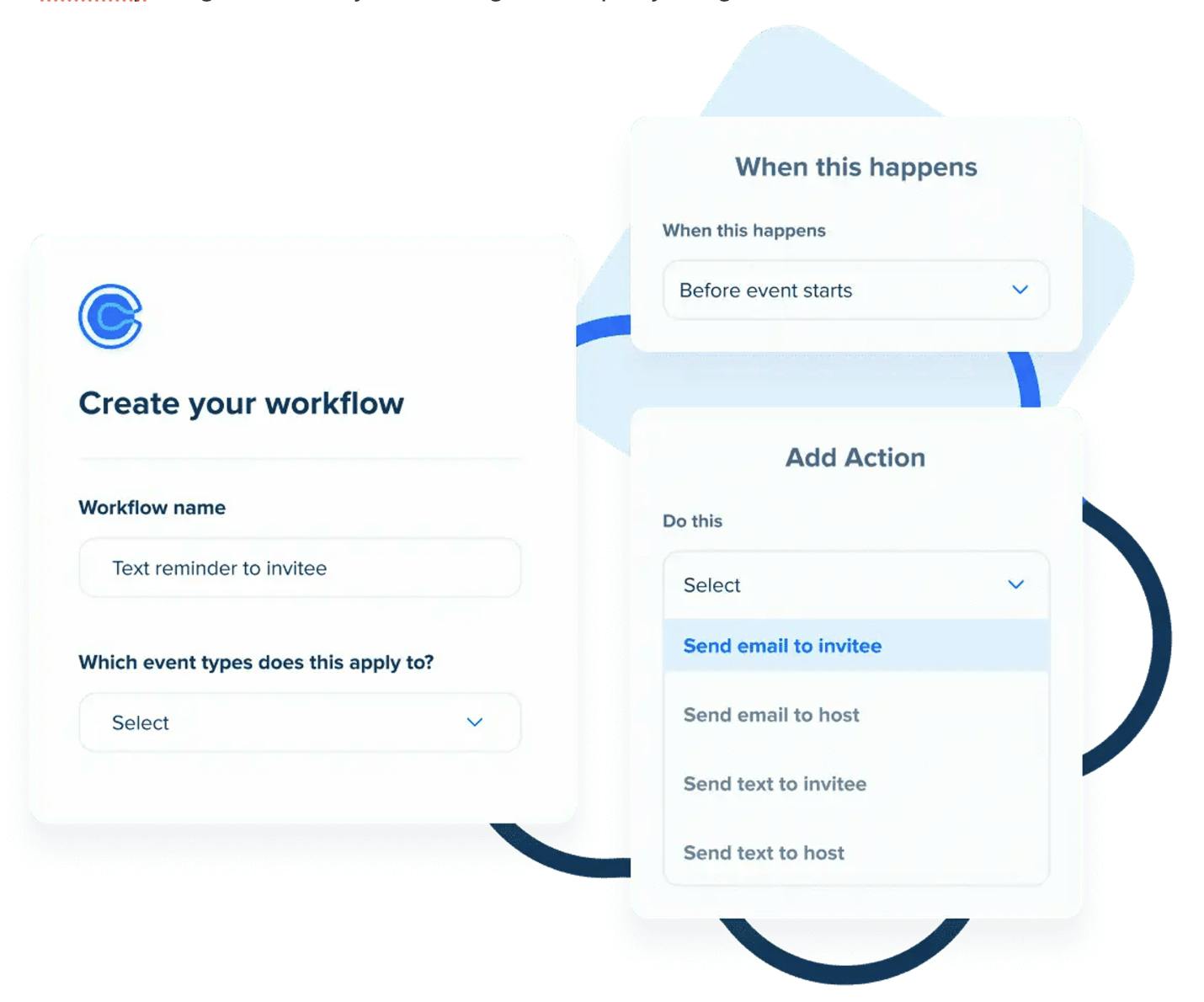

Competitors like Workato and Tray.io pose a risk for Zapier that is only compounded by the threat of disintermediation by native integrations. Companies like Calendly bundling workflow integrations into their product could move a significant number of potential Zapier users looking for Calendly integrations away from using a third-party integrations tool.

Source: Calendly

Pricing Model

Zapier’s pricing scales with usage. As a customer’s process grows in volume, the cost of using Zapier grows. Zapier’s most successful users may grow to sizable enough volumes that they move away from Zapier to build their own solutions. Most companies who lean on usage-based pricing have to enable additional functionality as their customers scale to avoid this pricing-related churn.

Platform Risk From Top Applications

Zapier’s top two integrations as of October 2023 remain Google Sheets and Gmail. Google announced the launch of Google Cloud Workflows in 2021, a product that can potentially reduce Zapier’s growth. Google also offers Apps Script for Google Sheets, a popular integration that could lower demand for Zapier. Microsoft also launched Power Automate in late 2021, which poses a similar risk over time.

Summary

To address the long-tail need for business automation and integrations, Zapier offers a user-friendly product. Zapier is sticky because, as business users build their essential business processes in Zapier, they become dependent on the platform. Zapier’s ease of use and SEO dominance for app connectivity have proven to be an advantage that has allowed the company to achieve traction without relying on outside funding. The growing number and complexity of applications used by knowledge workers is a continuing tailwind, but competition and disintermediation pose significant threats.