Thesis

Over the course of a typical day, the average consumer is exposed to ~4-10K ads. Every day. That’s 2X the number of ads the average person saw in 2007. As more people spend time online, the amount of marketing noise they’re exposed to continues to increase. Meanwhile, higher touch sales, like business-to-business (B2B) sales, that have typically required contact from a sales rep are becoming less preferred. 43% of B2B buyers said they would prefer a rep-free sales experience.

As businesses are faced with potential customers that are more sensitive to marketing noise, they see sales cycles increase. More than 75% of B2B sales to new customers take at least 4 months to close, with almost 50% taking 7+ months. Sales professionals need to understand and identify buyers with intent more than ever. Account-based marketing (ABM) emerged in the early 2000s as a way to create hyper-personalized marketing and sales campaigns.

That’s where 6sense comes in. 6sense is an ABM platform that helps companies identify the purchase intent of their target customers, and enables them to reach those prospective customers with highly personalized campaigns. The company identifies top target accounts by aggregating buying signals such as company website visits, email opens, and product review site visits. 6sense leverages an AI-enabled predictive model to more accurately predict customer intent.

Founding Story

6sense was founded in 2013 by Amanda Kahlow, Dustin Chang, Viral Bajaria, Premal Shah, and Shane Moriah. Amanda Kahlow developed the idea for 6sense after completing a consulting project for Cisco to help them revamp their sales process. After presenting her findings, a Cisco marketing executive interrupted Kahlow:

“Suddenly one of them dramatically stopped the conversation, looked at me and said, ‘Amanda do you know what you are doing here?’ I responded, ‘No, what?’ And he said, ‘You know [what] our customers are going to buy before they even know they are going to buy.’ The room moved to discussion about sending customers a PO before the rep calls the customer. This was the moment I knew we had something game-changing. I knew I no longer could be a modest services business and that I needed to build a scaleable repeatable product. I knew there was a door open in front of me and I was going to walk through it.”

After building the business for ~7 years, Kahlow stepped away from 6sense. As of January 2023, only Viral Bajaria and Premal Shah are actively involved in the company of the original co-founders. As of January 2023, Jason Zintak was the CEO of 6sense, after joining in 2017. Before joining 6sense, Zintak was the former CEO and President of Platfora, a data analytics platform for business intelligence that was acquired by Workday in July 2016.

Product

Discover Buyer Intent

6sense uses an AI-powered predictive model to enable users to uncover top accounts that are likely to buy their products, predict the account’s readiness to purchase, and enable them to reach key customer stakeholders with targeted messaging throughout a B2B sales cycle. 6sense uses a combination of first-party, and third-party data to predict intent.

First-party data includes data on a customer’s own websites, and other engagement channels like marketing emails. 6sense is able to de-anonymizes website visitor data for clients using reverse IP lookups and cookies. One customer of 6sense indicated that the platform was able to identify 25% of their web traffic, compared to alternatives that could only identify ~10-15% of traffic. That unique data is valuable for users to understand which potential customers are spending time on their website, or engaging with their marketing materials.

Third-party intent data aggregates events and interactions outside the user’s owned marketing channels (like their website). 6sense buys data from a network of websites who historically have collected user data using cookies. Third-party data is valuable to 6sense’s users because it represents potential customer activity earlier in the funnel, before the potential customer even reaches the main company website.

In August 2022, Google announced they would stop enabling user tracking via cookies in their Chrome browser by the end of 2024. As a result, 6sense has adopted new third-party data tracking methods, including partnering with walled-garden publishers that track logged-in users, and then sell their engagement data, and using alternative identifiers for specific users.

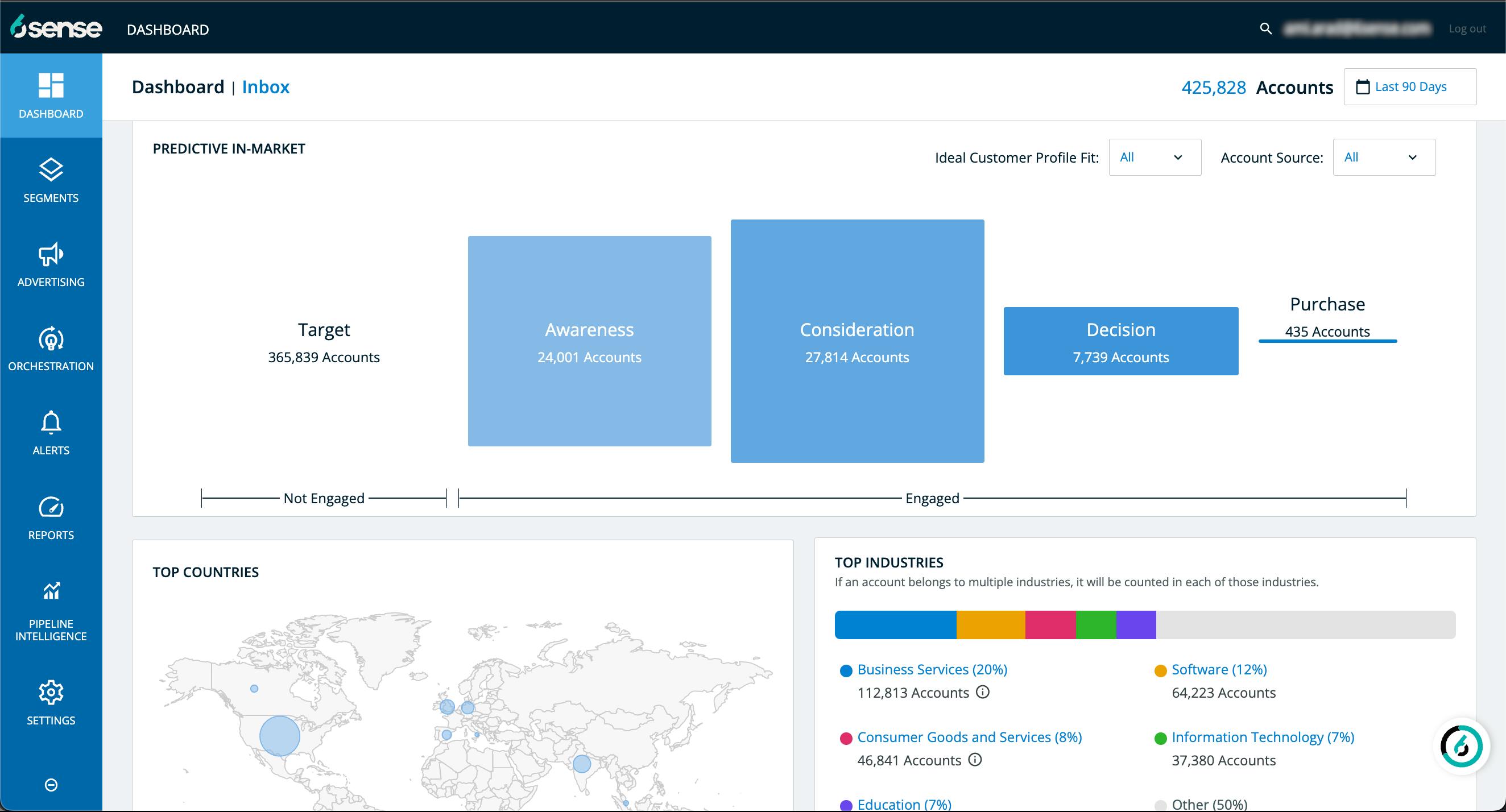

6sense is then able to pipe this intent data into a dashboard where users can leverage the platform view to visualize where in the buying journey certain customer accounts may be.

Source: Capterra

Prospect Targeting

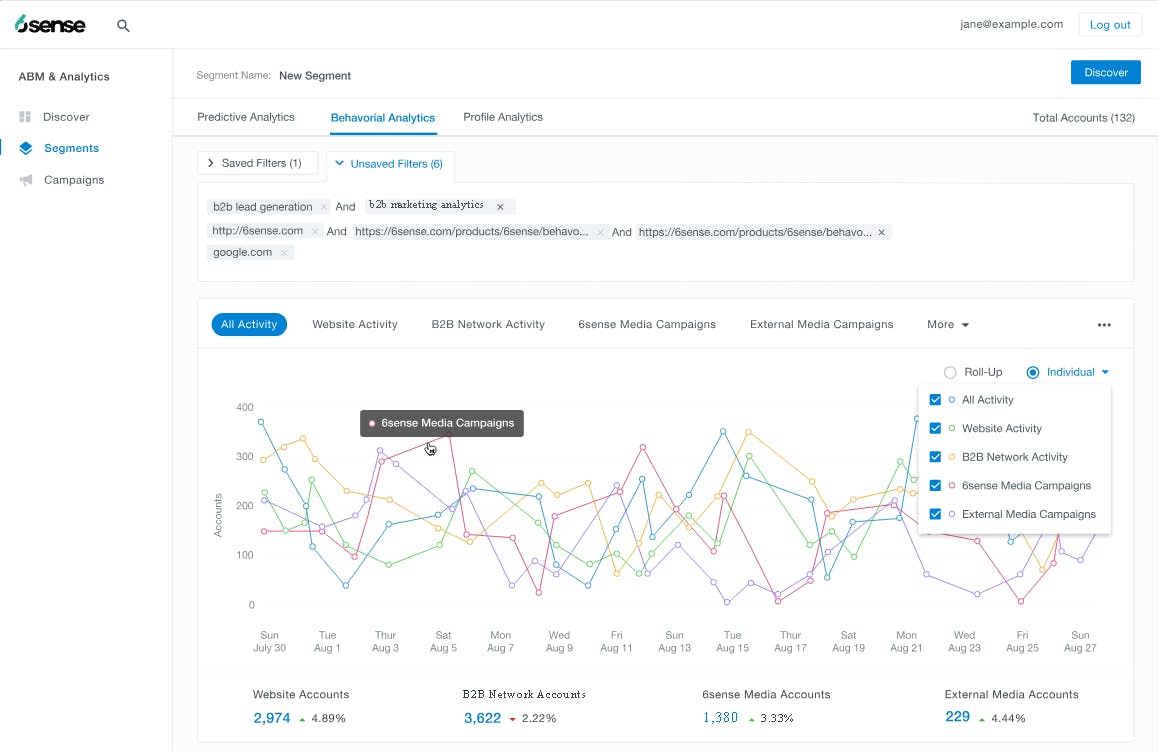

Using intent data, 6sense can then segment certain buyers based on where they are in the buying journey, which enables sales and marketing teams to engage buyers with highly targeted messaging in the most effective channels.

Source: SourceForge

6sense also has a demand-side platform (DSP) providing customers access to ad inventory across thousands of publisher sites. 6sense can connect to a number of websites, as well as large ad platforms like Facebook and LinkedIn, based on the channels and sites that are most likely to lead to high conversion for target buyers, and can then target those users with highly personalized campaigns.

In October 2021, 6sense acquired Slintel, a provider of technographic data, buyer insights, and professional contact information. The additional view of data provided by Slintel is integrated into 6sense, and provides a more complete picture on potential customers by tracking signals across “250M B2B profiles, 100M decision makers, 50M B2B emails, and 20M buyer direct dial numbers”

Platform Integrations

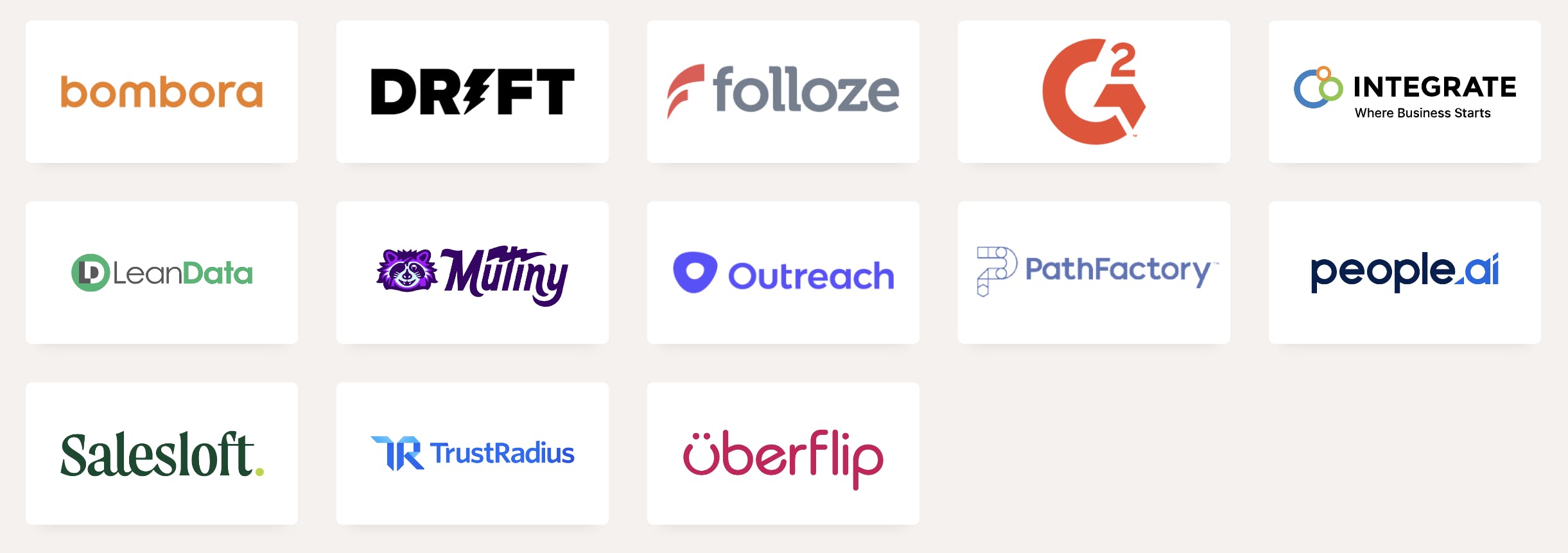

Source: 6sense

Operationalizing intent data to enable lead qualification and deeper targeting is another key part of the 6sense value proposition. Marketing and sales teams can access 6sense data within products like Salesforce, Outreach, and Drift to inform their sales and marketing outreach.

For example, marketing teams can segment their accounts based on 6sense data and run email marketing campaigns in Pardot, and then sales teams can see relevant conversion signals from 6sense in their Salesforce account.

Lead Qualification & Pipeline Management

Saleswhale

In January 2022, 6sense acquired Saleswhale. In April 2022, 6sense launched an AI-driven email marketing platform to increase personalization in email outreach using insights from 6sense’s data platform. Saleswhale’s platform helps to qualify leads brought in through marketing emails, and then facilitates lead delivery to sales reps.

Fortella

In August 2021, 6sense acquired Fortella and integrated the product into its platform. 6sense’s pipeline intelligence product enables marketers predict the quantity and quality of pipeline needed to hit revenue targets, track potential customer segments and campaign performance in real time, and make recommendations to manage revenue goals.

Market

Customer

6sense’s target customer is typically a medium to large B2B company with a sizable sales and marketing organization, high customer lifetime value, and a relatively long and complex sales cycle. Some of 6sense’s customers include Shell, Experian, Qualtrics, and Auth0. 6sense does not have a freemium tier to target smaller accounts.

Market Size

While account-based marketing rose to prominence in the early 2000s, the category is still relatively early. The market for ABM software is estimated at $750 million in 2021, expected to grow to $3.1 billion by 2030. From 2022 to 2030, the industries expected to see the most significant adoption of ABM software include telecommunication and IT, largely driven by high volumes of data and complex sales cycles.

As 6sense has broadened its focus with acquisitions like Slinetel, Saleswhale, and Fortella, the company has started addressing the broader market of sales intelligence. The global sales intelligence market is estimated at $2.7 billion, expected to grow to $4.8 billion in 2026. One driver of growth in the sales intelligence market is due to increased efficiency from process automation using ML and AI technologies. For example, Microsoft successfully quadrupled their sales effectiveness for their Dynamics 356 product after implementing ML and AI into their lead generation processes.

Competition

6sense has 2 key competitors—Demandbase and Terminus. Gartner and Forrester provide similar ratings for all three companies. All three players are attempting to extend their product functionality with the acquisitions of smaller players. Another notable potential competitive threat to 6sense is ZoomInfo given their prominence in providing high-level customer data.

Demandbase

Founded in 2007, Demandbase was one of the original players in the ABM category. They have acquired several companies and raised a $65 million Series H round in May 2017. In June 2020, Demandbase acquired Engagio, a competing ABM platform with marketing automation capabilities, and in May 2021, they acquired InsideView, a sales and marketing intelligence provider, and DemandMatrix, a provider of technographic data and intelligence.

Demandbase had $100 million in revenue as of June 2020. Customer feedback indicates that Demandbase has its own network on sites that they include in its DSP, which enables the product to reach a higher quality audience through display ads and generate better ad engagement and results. Demandbase is the most relevant competitor when it comes to serving customers with large display ad spends.

Terminus

Founded in 2014, Terminus provides both an ABM solution that includes sales intelligence and digital ad targeting, as well as the ability to run email and chatbot campaigns integrated with its ABM product. Terminus raised a $90 million Series C in February 2021 at a valuation of $400 million. In May 2022, Terminus laid off 15% of its staff before quietly raising an additional $24 million of capital in December 2022.

As of September 2022, Terminus had acquired five different companies. Zylotech (a B2B customer data platform) in September 2021, GrowFlare (an AI data intelligence platform) in November 2020, Ramble (a click-to-chat platform) in April 2020, Sigstr (a corporate email marketing platform) in December 2019, and BrightFunnel (a predictive revenue insights platform for B2B marketing) in January 2018.

ZoomInfo

In addition to established competitors, ZoomInfo launched a new ABM platform, MarketingOS, in February 2022. Given the quality of ZoomInfo’s B2B data and the existing customer base of over 20K customers, ZoomInfo could be a formidable competitor going forward. The founder and CEO of ZoomInfo, Henry Schuck, described the launch of MarketingOS this way:

“Our comprehensive B2B database is the key differentiator that sets MarketingOS apart from other ABM solutions. ZoomInfo’s unique data science algorithms allow marketers to connect with the right prospects at precisely the right time. No other solution on the market combines the power of data-driven insights and marketing-optimized workflows like ZoomInfo’s MarketingOS.”

Business Model

6sense uses a subscription-based pricing model with longer-term contracts (1-2 years). They also take a small cut of ad spend on their DSP, but ad spend is not a significant contributor to revenue. The platform takes a month or two to set up. Once accounts are set up, switching costs are relatively high due to the effort required to set up the product and the need to maintain advertising continuity and ad tracking.

Traction

As of January 2022, 6sense had a revenue run rate of $110 million, growing approximately 100% YoY with a net retention rate of 125%. The company also doubled their customer based from March 2021 to January 2022.

According to 6sense data, customers report a 100% increase in average deal size, 20% better conversions, 30% faster deal cycles, and a 120% improvement in revenue effectiveness. 6sense is listed by both Forrester and Gartner as a recommended leader in the ABM category in 2022.

In August 2022, 6sense was selected as the “Best Lead Management solution” in the fifth annual MarTech Breakthrough Awards. James Johnson, the managing director of MarTech Breakthrough, explained their perspective on 6sense this way.

“Today's B2B selling environment has evolved and purchase decisions are made by teams of stakeholders who prefer to remain anonymous until deep into the buying journey. 6sense's breakthrough platform is built for this new environment, putting rich insights at the fingertips of sales teams and helping them uncover more opportunities, accelerate deal cycles and optimize revenue efficiency.”

Valuation

In January 2022, 6sense raised a $200 million Series E co-led by new investors Blue Owl and MSD Partners, as well as existing investors including SoftBank Vision Fund 2, B Capital Group, Franklin Templeton, and Harmony Partners. Existing investors Insight Partners, Tiger Global, D1 Capital Partners, and Sapphire Ventures. That valuation was more than double the valuation of the company’s Series D in March 2021 at $2.1 billion.

6sense’s $5.2 billion valuation in January 2022 represented a 47X ARR multiple, based on January 2022 ARR of $110 million. Despite some very high revenue multiples during 2021, as of January 2023 other marketing software companies like Salesforce and HubSpot are trading at ~5-10x NTM revenue.

Source: Koyfin

Key Opportunities

Increased Utilization of AI

In April 2022, 6sense launched an AI-driven email marketing platform and an AI-driven pipeline intelligence products. 6sense plans to build out additional capabilities with a long-term goal of a unified go-to-market platform for the entire revenue team. For example, 6sense has a partnership with Drift where 6sense data enables Drift to drive highly personalized conversations in a chat with target accounts. As marketing becomes more focused on personalization, being able to leverage AI more effectively could increase the quality of the output from 6sense’s platform.

Growth Through Acquisitions

6sense has demonstrated the ability to acquire adjacent companies to broaden its product platform. Thus far, those products have also been effectively integrated to 6sense’s existing product. Given the number of vendors in the broader sales and marketing space, there is likely additional value to come from other acquisitions.

Key Risks

Online Privacy Trends

The prominence of GDPR, CCPA, Apple’s IDFA, Google’s removal of using cookies to track users and any future privacy-focused adjustments by large companies or specific governments could create additional risk to the structure behind gathering buyer intent data. The less 6sense can access particular pools of data, including third-party user tracking, the less effective the company’s platform becomes.

GDPR also leads to additional regulatory constrains around how user data is collected used in account-based marketing. Using data provided by third-party platforms who have used emails to get users to opt-in to data sharing could become illegal under GDPR.

Crowded Competitive Field

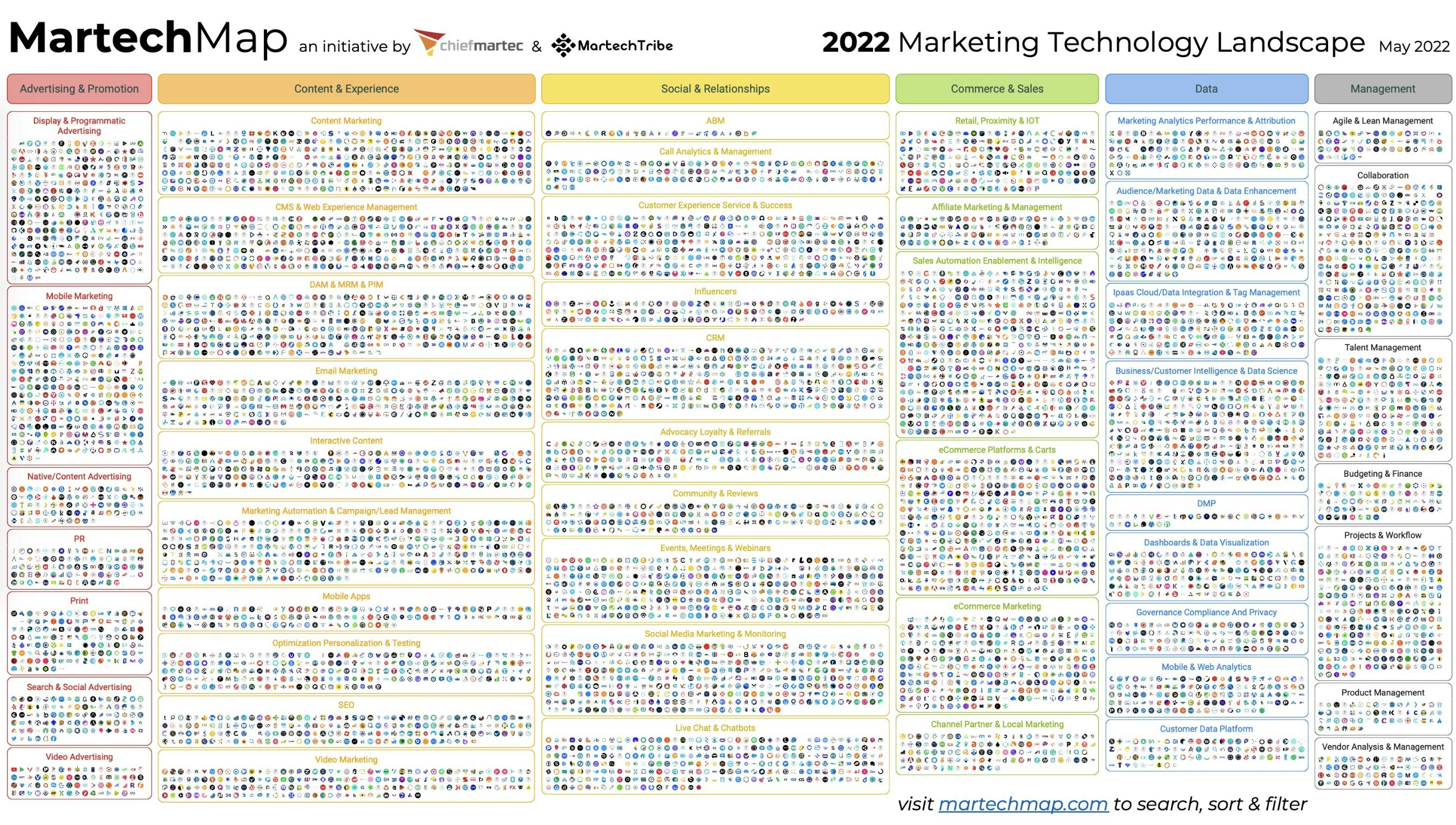

Marketing technology is a very crowded space, with over 9K different vendors. As companies look to provide more value to their customers, there is an increasing need to consolidate solutions. 6sense, Demandbase, and others have already started to consolidate. Across the broader MarTech category, there were 166 M&A deals in 2021 alone.

Source: MarTech 2022

Slowdown in Marketing Spend

Marketing spending tends to be cut during recessions. During the recession of 2008, marketing spending saw a reduction of over 27% across all channels. In 2022, multiple public companies like Spotify, Meta, and Snap have commented on a softening digital ad market due to economic uncertainty. If a recession occurs in 2023, it could adversely affect 6sense growth.

Summary

6sense is a leader in the ABM market and is focused on broadening its product suite to encompass more aspects within revenue generation. 6sense has built a multi-product offering, in part driven by acquisitions of adjacent products. There is significant competition in the ABM market and the broader revenue technology category. The introduction of more advanced AI features will also cause additional disruption in the category. 6sense is among a number of platforms that are attempting to own more of its customers wallet around the sales and marketing effort.